Table of Contents

As filed with the Securities and Exchange Commission on June 10, 2004

Registration No. 333-114703

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

to

Form S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Xerium Technologies, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 2221 | 42-1558674 | ||

(Jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

One Technology Drive

Westborough Technology Park

Westborough, MA 01581

(508) 616-9468

(Address, including zip code, and telephone number, including

area code, of Registrant’s principal executive offices)

See Table of Additional Registrant Guarantors

Michael O’Donnell

Chief Financial Officer

One Technology Drive

Westborough Technology Park

Westborough, MA 01581

(508) 616-9468

(Name, address, including zip code, and telephone

number, including area code, of agent for service)

Copies to:

John B. Ayer, Esq. Ropes & Gray LLP One International Place Boston, Massachusetts 02110 (617) 951-7000 | David J. Goldschmidt, Esq. Skadden, Arps, Slate, Meagher & Flom LLP Four Times Square New York, New York 10036 (212) 735-3000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If delivery of the prospectus is expected to be made pursuant to Rule 434 under the Securities Act, please check the following box. ¨

Table of Contents

CALCULATION OF REGISTRATION FEE

TITLE OF EACH CLASS OF SECURITIES TO BE REGISTERED | PROPOSED MAXIMUM AGGREGATE OFFERING PRICE(1) | AMOUNT OF REGISTRATION | ||||

Income Deposit Securities (IDSs)(2) | ||||||

Shares of Class A Common Stock, par value $0.01 per share(3) | ||||||

% Senior Subordinated Notes(4) | ||||||

Subsidiary Guarantees of % Senior Subordinated Notes | ||||||

Total | $700,000,000 | $ | 88,690 | (6) | ||

| (1) | Estimated solely for the purpose of calculating the amount of the registration fee in accordance with Rule 457(o) under the Securities Act of 1933. Includes IDSs subject to the underwriters’ over-allotment option. |

| (2) | The IDSs represent shares of Class A common stock of Xerium Technologies, Inc. and $ million aggregate principal amount of % senior subordinated notes due 2019 of Xerium Technologies, Inc., including IDSs subject to the underwriters’ over-allotment option to purchase additional IDSs and an indeterminate number of IDSs of the same series as the IDSs offered hereby, which will be received on one or more occasions in the future in replacement of the IDSs offered hereby in the event of a subsequent issuance of IDSs or notes (not represented by IDSs) of the same series as the notes offered hereby upon an automatic exchange of a portion of the notes offered hereby for a portion of the additional notes. Assuming the underwriters’ over-allotment option is exercised in full, IDSs will be sold to the public in connection with this initial public offering and IDSs will be issued to our existing equity investors in connection with the transactions described in this registration statement under “The Transactions.” |

| (3) | Includes (a) shares of Class A common stock of Xerium Technologies, Inc. represented by IDSs to be sold to the public in connection with this initial public offering (which includes shares of Class A common stock represented by IDSs which are subject to the underwriters’ over-allotment option) and (b) shares of Class A common stock represented by IDSs to be issued to our existing equity investors in connection with the transactions described in this registration statement under “The Transactions.” |

| (4) | Includes (a) $ million principal amount of notes represented by IDSs to be sold to the public in connection with this initial public offering (which includes $ million principal amount of notes represented by IDSs which are subject to the underwriters’ over-allotment option), (b) $ million principal amount of notes represented by IDSs to be issued to our existing equity investors in connection with the transactions described in this registration statement under “The Transactions,” (c) $ million principal amount of notes sold separately (not represented by IDSs) and (d) an indeterminate principal amount of notes of the same series as the notes offered hereby, which will be received on one or more occasions in the future by holders of notes offered hereby (whether or not represented by IDSs) in the event of a subsequent issuance of IDSs or notes of the same series (not represented by IDSs) upon an automatic exchange of a portion of the notes offered hereby for a portion of the additional notes. |

| (5) | Pursuant to Rule 457(n) under the Securities Act of 1933, no separate fee for the guarantees is payable. |

| (6) | The registration fee was previously paid in connection with the initial filing of the Registration Statement on April 22, 2004. |

The Registrants hereby amend this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrants shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

Table of Additional Registrant Guarantors

Exact Name of Registrant Guarantor as Specified in its Charter | State or Other Jurisdiction of Incorporation or Organization | Primary Standard Industrial Classification Code Number | I.R.S. Employer Identification Number | |||

Huyck Argentina Sociedad Anonima | Argentina | 2221 | Not Applicable | |||

Huyck Australia Pty. Ltd | Australia | 2221 | Not Applicable | |||

Weavexx Corporation | Canada | 2221 | Not Applicable | |||

Stowe-Woodward/Mount Hope Inc. | Canada | 3559 | Not Applicable | |||

Huyck Japan Limited | Japan | 2221 | Not Applicable | |||

Stowe Woodward Mexico SA de CV | Mexico | 3559 | Not Applicable | |||

Huyck (UK) Limited | United Kingdom | 2221 | Not Applicable | |||

Huyck Limited | United Kingdom | 2221 | Not Applicable | |||

Stowe-Woodward (UK) Limited | United Kingdom | 3559 | Not Applicable | |||

Stowe-Woodward Limited | United Kingdom | 3559 | Not Applicable | |||

Xerium I (US) Limited | Delaware | 2221 | 51-0394458 | |||

Xerium Inc. | Delaware | 8741 | 51-0394459 | |||

Xerium III (US) Limited | Delaware | 2221 | 51-0394460 | |||

Weavexx Corporation | Delaware | 2221 | 05-0387869 | |||

Huyck Licensco Inc. | Delaware | 2221 | 06-1260434 | |||

Huyck Europe Inc. | Delaware | 2221 | 56-1222792 | |||

Stowe Woodward Licensco LLC | Delaware | 3559 | 51-0394459 | |||

Stowe Woodward LLC | Delaware | 3559 | 51-0394459 | |||

Xerium IV (US) Limited | Delaware | 3559 | 51-0394461 | |||

Xerium V (US) Limited | Delaware | 3559 | 51-0394462 | |||

The address, including zip code, of the principal offices of the additional registrant guarantors listed above is: c/o Xerium Technologies, Inc., One Technology Drive, Westborough Technology Park, Westborough, Massachusetts 01581 and the telephone number, including area code, of the additional registrant guarantors at that address is (508) 616-9468.

Table of Contents

Subject to Completion, Dated June 10, 2004

Income Deposit Securities (IDSs)

Representing

Shares of Class A Common Stock and

$ million % Senior Subordinated Notes due 2019

and

$ million % Senior Subordinated Notes due 2019

Xerium Technologies, Inc.

This offering consists in part of an offering of Income Deposit Securities, or IDSs, representing shares of our Class A common stock and $ million aggregate principal amount of our % senior subordinated notes due 2019. Each IDS represents:

| Ÿ | one share of our Class A common stock; and |

| Ÿ | a % senior subordinated note due 2019 with $ principal amount. |

We are also offering separately (not represented by IDSs) $ million aggregate principal amount of our % senior subordinated notes due 2019, which, along with the notes represented by IDSs, we refer to as the “notes.” The completion of the offering of the separate notes is a condition to our sale of IDSs.

This is the initial public offering of our IDSs, the shares of Class A common stock and notes represented thereby, and the notes being offered separately from the IDSs. We anticipate that the public offering price per IDS will be between $ and $ and the public offering price of the notes sold separately (not represented by IDSs) will be % of their stated principal amount.

Holders of IDSs will have the right to separate IDSs into the shares of Class A common stock and notes represented thereby at any time after the earlier of 45 days from the closing of this offering or the occurrence of a change of control. Similarly, holders of our Class A common stock and the notes, may, at any time, unless the IDSs have automatically separated, combine the applicable number of shares of Class A common stock and principal amount of notes to form IDSs. Separation of IDSs will occur automatically upon the continuance of a payment default on the notes for 90 days, or a redemption or maturity of the notes. Following any automatic separation, shares of Class A common stock and notes may no longer be combined to form IDSs.

We will be permitted to defer interest payments on our notes subject to the limitations described in “Description of Notes—Terms of the Notes—Interest Deferral” on page 133. The notes will be fully and unconditionally guaranteed, on an unsecured basis, by each of our direct and indirect wholly-owned United States domestic subsidiaries and certain of our direct and indirect wholly-owned foreign subsidiaries.

Upon a subsequent issuance by us of notes of the same series (whether or not represented by IDSs) with original issue discount and upon each subsequent issuance thereafter a portion of the notes owned by you either directly or represented by IDSs will be automatically exchanged for an identical principal amount of notes issued in such subsequent issuance and, in such event, your IDSs or notes will be replaced with new IDSs or a unit consisting of your notes and new notes, as the case may be. In addition to the notes offered hereby, the registration statement of which this prospectus is a part also registers the new notes and IDSs to be issued to you upon such subsequent issuance. For more information regarding these automatic exchanges and the effect they may have on your investment, see “Risk Factors—Risks Relating to our Capital Structure—Subsequent issuances of notes pursuant to an offering by us or exchange of Class B common stock may cause you to recognize original issue discount” on page , “Description of Notes—Covenants Relating to IDSs” on page , and “Material U.S. Federal Income Tax Consequences—Consequences to U.S. Holders— Notes—Additional Issuances” on page .

We will apply to list our IDSs on the New York Stock Exchange under the trading symbol “XRM”. Our shares of Class A common stock will not initially be listed for separate trading on the New York Stock Exchange or any other exchange or quotation system.

Investing in our IDSs, our Class A common stock and/or the notes involves risks. See “Risk Factors” beginning on page 25.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per IDS(1) | Total | Per Note | Total(2) | |||||||||

Public offering price | $ | $ | $ | $ | ||||||||

Underwriting discount | $ | $ | $ | $ | ||||||||

Proceeds to Xerium Technologies, Inc. (before expenses)(3) | $ | $ | $ | $ | ||||||||

Proceeds to selling stockholders | $ | $ | $ | $ | ||||||||

| (1) | The price per IDS is comprised of $ allocated to each note and $ allocated to each share of Class A common stock. |

| (2) | Relates to the $ million aggregate principal amount of the notes that we are selling separately (not represented by IDSs). |

| (3) | We will not receive any proceeds from the sale by the selling stockholders of shares of Class A common stock represented by IDSs being sold in this offering or from any exercise of the underwriters’ over-allotment option. In addition, we will use $ million of the proceeds we receive in connection with the offering to redeem shares of Class A common stock from the selling stockholders. |

The selling stockholders have granted the underwriters an option to purchase up to additional IDSs at the public offering price, less the underwriting discount, within 30 days from the date of this prospectus to cover over-allotments. This prospectus also relates to IDSs including shares of Class A common stock and $ million aggregate principal amount of notes being issued concurrently with this offering to certain of our current stockholders in exchange for a portion of their equity interests.

The underwriters expect to deliver the IDSs and the notes to purchasers on or about , 2004.

Sole Bookrunner

CIBC World Markets

| Citigroup | Merrill Lynch & Co. |

| Robert W. Baird & Co. | ||||||||

Calyon Securities (USA) Inc. | ||||||||

KeyBanc Capital Markets | ||||||||

| Legg Mason Wood Walker & Co. | ||||||||

, 2004

Table of Contents

| 1 | ||

| 27 | ||

| 43 | ||

| 44 | ||

| 46 | ||

| 48 | ||

| 49 | ||

| 51 | ||

| 58 | ||

Management’s Discussion and Analysis of Financial Condition and Results of Operations | 62 | |

| 81 | ||

| 85 | ||

| 96 | ||

| 108 | ||

| 110 | ||

| 116 | ||

| 120 | ||

| 122 | ||

| 127 | ||

| 133 | ||

| 176 | ||

| 177 | ||

| 187 | ||

| 190 | ||

| 194 | ||

| 194 | ||

| 195 | ||

| F-1 |

Table of Contents

The following is a summary of the principal features of this offering of IDSs and notes, and should be read together with the more detailed information and financial data and statements contained elsewhere in this prospectus.

Throughout this prospectus, we refer to Xerium Technologies, Inc., a Delaware corporation, together with its consolidated operations, as “we,” “our” and “us,” unless the context requires otherwise or otherwise indicated. We are a holding company and have no direct operations.

Our Company

Company Overview

We are a leading global manufacturer and supplier of two categories of consumable products used in the production of paper—clothing and roll covers. We have an extensive global footprint of 39 manufacturing facilities in 15 countries, strategically located in the major paper-producing regions of North America, Europe, South America and Asia-Pacific, and have approximately 4,000 employees worldwide. We market our products to the paper industry’s leading producers through several brands that are well known in the industry. In 2003, we generated net sales of $560.7 million.

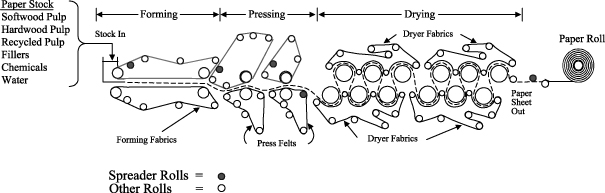

Our clothing and roll covers play key roles in the formation and processing of paper along the length of a paper-making machine. Our products are in constant contact with the paper and, as a result, they have a significant effect on paper quality and the ability of a paper producer to differentiate its products. In addition, while clothing and roll covers represent only approximately 3% of a paper producer’s production costs, they can help a paper producer reduce overall costs. Our clothing and roll covers allow paper producers to use less expensive raw materials (including recycled fiber), run paper-making machines faster and with fewer interruptions and decrease the amount of energy required in the expensive drying portion of the paper-making process. Accordingly, we believe our customers view us as a value-added supplier for their businesses.

Clothing and roll covers wear down over time and must be regularly replaced in order for paper producers to sustain high quality paper output and operate efficiently. Roll covers also require regular refurbishment, and we provide refurbishment services for previously installed roll covers. Paper producers must typically replace clothing multiple times per year, refurbish roll covers multiple times per year and replace roll covers every two to five years.

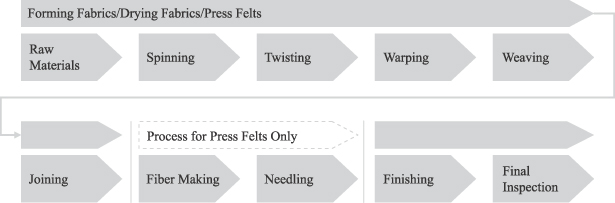

Our clothing and roll cover products are designed to withstand extreme temperature and pressure conditions, and are the result of considerable research and development and a sophisticated manufacturing process. Our clothing products are highly engineered synthetic textile belts that transport paper as it is processed along the length of a paper-making machine. Clothing plays a significant role in the forming, pressing and drying stages of paper production. Because paper-making machines vary widely in size and design, clothing is customized to each individual paper-making machine. Clothing can be in excess of 460 feet long and 30 feet wide.

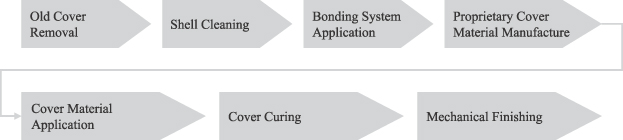

Our roll cover products provide a surface with the mechanical properties necessary to process the paper sheet in a cost-effective manner that delivers the sheet qualities desired by the paper producer. These products cover the rolls on a paper-making machine, which are the large steel cylinders over which clothing is mounted and between which the paper travels as it is processed. Like our clothing products, our roll cover products are customized to each individual paper-making machine.

1

Table of Contents

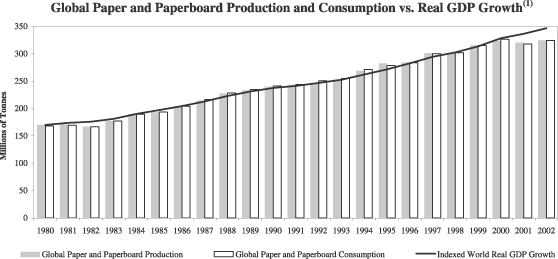

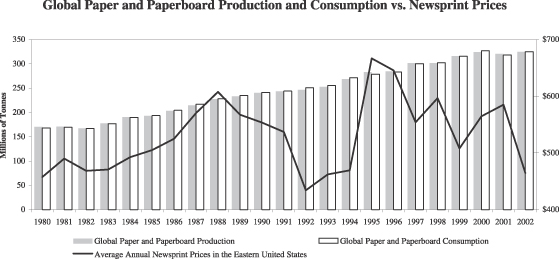

Demand for our products and services is driven primarily by the volume of global paper production, which, according to the Food and Agriculture Organization of the United Nations, increased at a compound annual growth rate of approximately 3.0% from 1980 to 2002, with growth in every year but two during this period. The stability in the global volume of paper production results in stable demand for our products and services and causes our business to be largely unaffected by the historical volatility of paper prices and the corresponding swings in the profitability of paper producers.

We estimate that there are approximately 7,800 paper-making machines worldwide, all of which require a regular supply of clothing and roll covers. Our experience is that our customers are typically reluctant to change suppliers of their clothing and roll covers, largely because these products must be customized to each individual paper-making machine and can significantly affect paper quality and production efficiency. We have found that our customers often believe that the risks to production associated with changing suppliers outweigh the potential benefits of the change.

Key Strengths

Global Market Leader with Well Known Brands

We believe that we are the leading global manufacturer and supplier of roll covers, with at least one-third of the global market share based on total sales (excluding Asia, where accurate data is not available), and are among the top three global manufacturers of clothing, with approximately a 15% global market share based on total volume of clothing sold. We are well known in the industry by the brands through which we market our products.

Stable Demand for Our Products

The steady growth in the volume of global paper production has resulted in stable demand for our products and services. Our business has been largely unaffected by the historical volatility of paper prices and the cyclicality of capital spending by paper producers.

Diversified Global Customer Base Including Leading Paper Producers

We have a diversified customer base that includes all of the leading paper producers in North America and Europe, including Abitibi-Consolidated, Inc., International Paper Company, Meadwestvaco Corporation, Smurfit-Stone Container Corporation, Stora Enso Oyj and UPM-Kymmene Corporation, as well as many others.

Our global presence also reduces the impact of regional economic downturns and geographic shifts in paper production.

Strong Pipeline of Technologically Advanced Product Upgrades and New Products

We believe that our customers value our ability to develop and incorporate technological advances into our products. We currently have an extensive pipeline of product upgrades and new products under development.

Strong Financial Performance

We have increased our revenues, net cash provided by operating activities and Adjusted EBITDA since 2000, despite adverse conditions in the paper industry and weak overall economic conditions in North America and Europe. For a discussion of the calculation of Adjusted EBITDA, see “Selected Historical Consolidated Financial Data.”

2

Table of Contents

Proven Management Team

We have a highly experienced management team that has successfully implemented operational changes enabling us to strengthen our market and competitive position in the face of adverse market conditions in the paper-making industry.

Business Strategy

The primary components of our strategy are to:

Deliver Value to Our Customers

We continually improve our existing products and introduce innovative new products and services that will help our customers: reduce operating costs; improve paper quality; and derive greater value from their existing paper-making machines, thereby reducing their need to invest capital in new machines.

Maintain Geographic Balance and Expand in High Growth Regions

In addition to maintaining our leadership positions in the mature paper markets of North America and Europe, we continue to expand our manufacturing presence in the higher growth regions of South America and Asia.

Continue to Improve our Productivity

We have a successful record of improving our productivity through cost reduction programs and other productivity initiatives, including closing underutilized plants, shifting manufacturing to lower cost locations and automating manufacturing processes.

Pursue Strategic Acquisitions

We will continue to selectively pursue strategic acquisitions that we believe have potential to expand our product offerings and improve our competitiveness.

New Credit Facility

Concurrently with the closing of this offering, we will enter into a new $ million senior secured credit facility with a syndicate of financial institutions, including CIBC World Markets Corp., which will act as lead arranger and sole bookrunner. In this prospectus, we refer to this credit facility as the “new credit facility.” The new credit facility will consist of a revolving credit facility in an aggregate principal amount of up to $ million and a $ million term loan facility. While the new credit facility will permit us to pay interest and dividends to our security holders, including IDS holders, it will contain significant restrictions on our ability to make such interest and dividend payments and on our subsidiaries’ ability to make payments or distributions to us. The revolving credit facility and the term loan facility will mature in . See “Description of Certain Indebtedness—New Credit Facility.”

Our Existing Equity Investors

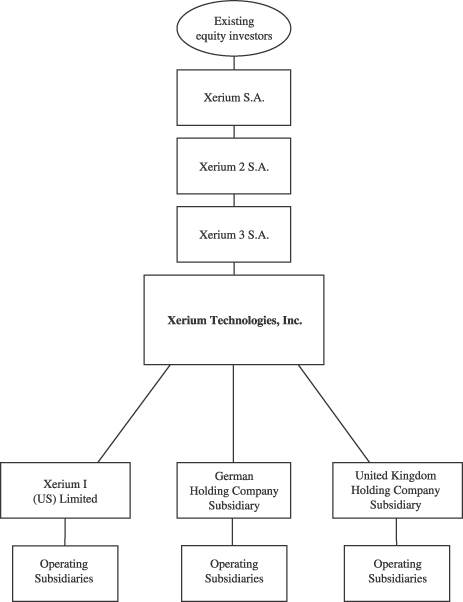

We are an indirect, wholly-owned subsidiary of Xerium S.A. prior to this offering. Apax Europe IV GP, L.P., which, together with its affiliates, we refer to as “Apax” in this prospectus, is manager, directly or indirectly, of investment funds holding the majority of the outstanding common stock of Xerium S.A. Affiliates of CIBC World Markets Corp., the lead managing underwriter for this offering, own approximately 5.6% of the common stock of Xerium S.A. prior to this offering. We refer to CIBC World Markets Corp. as “CIBC” in this prospectus. Our senior management, certain employees and certain other investors also own equity interests in Xerium S.A. We refer to Apax and these other investors in Xerium S.A. as our “existing equity investors” in this prospectus.

3

Table of Contents

Xerium 3 S.A. is our direct parent company and, prior to our recapitalization and the offering, owns 100% of our capital stock.

The Recapitalization and the Offering

This offering consists of an offering of IDSs, representing shares of Class A common stock and $ million aggregate principal amount of % senior subordinated notes due 2019, and an offering of $ million aggregate principal amount of % senior subordinated notes due 2019 sold separately (not represented by IDSs). We refer to the % senior subordinated notes due 2019 as the notes. The completion of the offering of the separate notes is a condition to the sale of the IDSs. All of the notes represented by IDSs and all of the notes sold separately are being sold by us. Of the shares of Class A common stock represented by IDSs, shares are being sold by us and shares are being sold by our current stockholders. We will combine the notes (other than the notes to be sold separately) and the shares of Class A common stock to form the IDSs sold to the public.

Prior to the closing of this offering, we will recapitalize our common stock into Class A common stock. The members of our senior management who own equity interest in Xerium S.A. will exchange such interests for our Class A common stock. Xerium 3 S.A. and members of our senior management will each sell a portion of their shares of Class A common stock to the underwriters for inclusion in the IDSs and will each sell a portion of their shares of Class A common stock to us, in each case for cash. They will also each exchange a portion of their shares of Class A common stock for IDSs and exchange the remainder of their shares of Class A common stock for Class B common stock. We expect that the members of our senior management will each sell the minimum number of shares of Class A common stock to the underwriters and to us that will provide them with cash proceeds sufficient to pay the estimated income taxes they will incur as a result of the vesting of their existing equity interests and the sale and exchange of their equity interests in connection with this offering.

Each share of Class B common stock will be automatically exchanged for one IDS on the second anniversary of this offering, subject to certain conditions. The exchange rate was set so that holders of Class B common stock will, upon such exchange, receive the same number of IDSs as they would have received if the shares of Class A common stock they exchanged for Class B common stock had instead been exchanged directly for IDSs at the time of the offering. If the IDSs have automatically separated or are otherwise not outstanding at the time of such exchange, each share of Class B common stock will be exchanged for one share of Class A common stock and a note having a principal amount equal to each note which was represented by an IDS. However, if the notes represented by IDSs are not outstanding at the time of such exchange, each share of Class B common stock will be exchanged for shares of Class A common stock. See “Description of Capital Stock—Class B Common Stock.”

The Class B common stock will have one vote per share but is initially expected to receive dividends at a higher rate than our Class A common stock. The initial dividend level on the Class B common stock is expected to be set so as to be equivalent on a pre-tax basis to the expected initial yield on the IDSs into which the Class B common stock will be exchanged. See “Description of Capital Stock—Class B Common Stock,” “Initial Dividend Policy and Restrictions” and “Related Party Transactions—Investor Rights Agreement.”

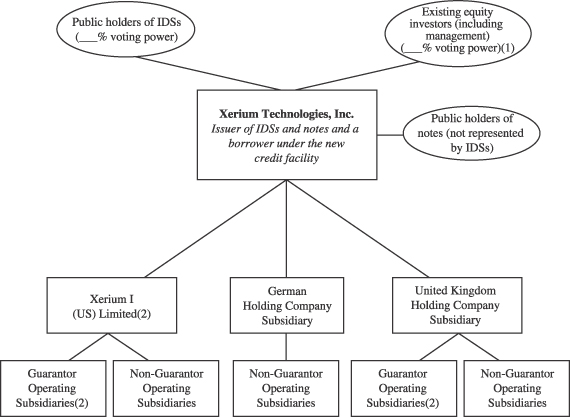

After giving effect to the offering and these transactions (assuming no exercise of the underwriters’ over-allotment option to purchase additional IDSs), the public IDS holders will hold approximately % of the voting power in us and our existing equity investors (including members of our senior management) will, directly or indirectly, collectively hold the remaining % through IDSs and shares of Class B common stock. See “The Transactions.”

4

Table of Contents

Use of Proceeds

We estimate that the offering will generate net proceeds of approximately $ million after deducting underwriting discounts and commissions and other estimated offering expenses payable by us, assuming an initial public offering price of $ per IDS, which represents the mid-point of the range set forth on the cover page of this prospectus and an initial public offering price of % of the stated principal amount for each note sold separately (not represented by IDSs). We will not receive any of the proceeds from the sale of our shares of Class A common stock to the underwriters by the selling stockholders, which we estimate to be $ million, or from the exercise of the underwriters’ over-allotment option. We estimate that we will receive net proceeds of $ million from our sale to the underwriters of Class A common stock and notes represented by IDSs and notes to be sold separately. We will use these net proceeds, together with $ million of borrowings under our new credit facility and cash on hand as follows:

| Ÿ | $ million to repay outstanding debt, including all outstanding borrowings under our existing senior and mezzanine credit facilities; |

| Ÿ | $ million to redeem a portion of the shares of Class A common stock held by the selling stockholders; and |

| Ÿ | $ million to pay transaction bonuses to certain of our officers and other members of senior management for completing this offering. |

If the underwriters exercise their over-allotment option in full, the selling stockholders will sell IDSs to the underwriters to cover over-allotments.

5

Table of Contents

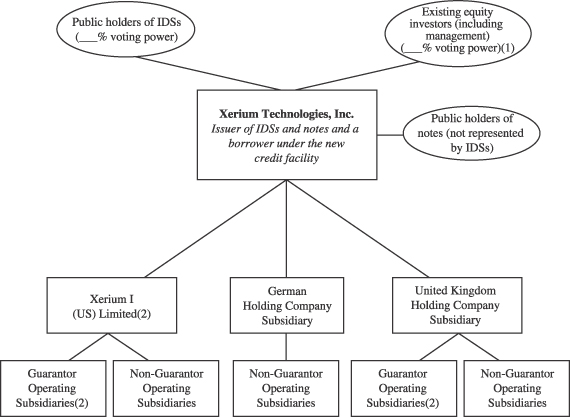

Our Organizational Structure After this Offering

The following diagram reflects our organizational structure immediately after the offering, including percentage of voting power (assuming no exercise of the underwriters’ over-allotment option to purchase additional IDSs):

| (1) | Includes Class A common stock represented by IDSs and Class B common stock. |

| (2) | The following direct and indirect subsidiaries of Xerium Technologies, Inc. will guarantee the notes: Huyck Argentina Sociedad Anonima, Huyck Australia Pty. Ltd, Weavexx Corporation, Stowe-Woodward/Mount Hope Inc., Huyck Japan Limited, Stowe Woodward Mexico SA de CV, Huyck (UK) Limited, Huyck Limited, Stowe-Woodward (UK) Limited, Stowe-Woodward Limited, Xerium I (US) Limited, Xerium III (US) Limited, Weavexx Corporation, Xerium Inc., Huyck Licensco Inc., Huyck Europe Inc., Xerium IV (US) Limited, Stowe Woodward Licensco LLC, Stowe Woodward LLC and Xerium V (US) Limited. |

Our Corporate Information

Our principal executive office is located at One Technology Drive, Westborough Technology Park, Westborough, Massachusetts 01581 and our telephone number is (508) 616-9468.

We were organized in 1999 in connection with the acquisition, sponsored by Apax, of the paper technology group of Invensys plc.

Huyck®, Mount Hope®,Robec®,Stowe Woodward®,Wangner®,Weavexx® andXerium® are trademarks of ours.

6

Table of Contents

The Offering

Summary of the IDSs and the Notes

We are offering IDSs at an initial public offering price of $ per IDS (comprised of $ allocated to each note and $ allocated to each share of Class A common stock), which represents the midpoint of the range set forth on the cover page of this prospectus, and $ million aggregate principal amount of notes sold separately (not represented by IDSs) at an initial public offering price of % of the stated principal amount for each note.

As described below, assuming we make our scheduled interest payments and pay dividends in the amount contemplated by our initial dividend policy we expect to be adopted by our board of directors, holders of IDSs will receive in the aggregate approximately $ in dividends and interest on the Class A common stock and notes represented by each IDS in the twelve month period ended September 15, 2005, and holders of our separate notes will receive $ in interest per note in the same period. The twelve month period ended September 15, 2005 is the first twelve month period following the completion of this offering during which IDSs will have been outstanding for the full quarter ending on each of the scheduled interest and dividend payment dates occurring during such twelve month period. Dividend payments, however, are not mandatory or guaranteed, and our board of directors may, in its discretion, amend, repeal or deviate from our initial dividend policy or otherwise decide not to declare one or more dividends or to declare dividends in different amounts. In addition, our ability to pay dividends will be restricted if we do not meet certain financial tests as set forth in the new credit facility and the indenture governing the notes. See “Risk Factors—Risks Relating to our Capital Structure.” Further, our ability to pay dividends is restricted by Delaware law. See “Initial Dividend Policy and Restrictions.” Holders of our common stock do not have any legal right to receive or require the payment of dividends.

What are IDSs?

IDSs are securities comprised of our Class A common stock and notes.

Each IDS initially represents:

| Ÿ | one share of our Class A common stock; and |

| Ÿ | a % note with $ principal amount. |

The ratio of Class A common stock to principal amount of notes represented by an IDS is subject to change in the event of a stock split, recombination or reclassification of our Class A common stock. For example, if we effect a two-for-one stock split of our Class A common stock, from and after the effective date of the stock split, each IDS will represent two shares of Class A common stock and the same principal amount of notes as it previously represented. Likewise, if we effect a recombination or reclassification of our Class A common stock, each IDS will thereafter represent the appropriate number of shares of Class A common stock on a recombined or reclassified basis, as applicable, and the same principal amount of notes as it previously represented.

What payments can I expect to receive as a holder of IDSs?

Assuming we make our scheduled interest payments on the notes, and pay dividends in the amount contemplated by our current dividend policy, you will receive in the aggregate approximately $ in interest on the notes and dividends on the Class A common stock represented by each IDS in the twelve month period ended September 15, 2005.

You will be entitled to receive quarterly interest payments at an annual rate of % of the aggregate principal amount of notes represented by your IDSs or approximately $ per IDS per year, subject to our

7

Table of Contents

right to defer interest payments on the notes, if we are not otherwise in default under the indenture, for an aggregate period not to exceed eight quarters prior to 2009, and up to four occasions after , 2009 for a period of up to two quarters per occasion. For a detailed description of these circumstances, see “Description of Notes—Terms of the Notes—Interest Deferral” and “Description of Certain Indebtedness—New Credit Facility.”

You will also be entitled to receive quarterly dividends on the shares of our Class A common stock represented by your IDSs, if and to the extent dividends are declared by our board of directors and are permitted by applicable law and the terms of the new credit facility, the indenture governing our notes and any other then-outstanding indebtedness of ours. Specifically, the indenture governing our notes restricts our ability to declare and pay dividends on our Class A common stock under certain circumstances as described under “Initial Dividend Policy and Restrictions” and “Description of the Notes—Certain Covenants—Limitation on Restricted Payments.” In addition, the new credit facility restricts our ability to declare and pay dividends on our Class A common stock under certain circumstances as described under “Initial Dividend Policy and Restrictions” and“Description of Certain Indebtedness—New Credit Facility—Covenants.”Upon the closing of this offering, our board of directors is expected to adopt an initial dividend policy which contemplates that, subject to applicable law and the terms of our then existing indebtedness, initial dividends will be $ per share of our Class A common stock for the twelve months ended September 15, 2005. However, our board of directors may, in its discretion, modify or repeal this dividend policy. We cannot assure you that we will pay dividends at this level, or at all. There is no requirement that we pay dividends, even if we have the means to do so.

We expect to make interest and dividend payments on the 15th day of each March, June, September and December to holders of record on the 5th day of each such month or the immediately preceding business day of such month if the 5th day is not a business day. The interest and dividend payment made on the first interest and dividend payment date following the completion of this offering will be a pro rata portion of the interest and dividend payment amount for a full quarter based upon the number of days elapsed following the completion of this offering and up to such interest and dividend payment date.

What instruments will govern my rights as an IDS holder?

Your rights as an IDS holder will be governed by a global IDS certificate which includes provisions with respect to the separation, combination and adjustment of the Class A common stock and notes represented by the IDSs. The Class A common stock represented by the IDSs will be governed by our restated certificate of incorporation and the global stock certificate for our Class A common stock. The notes represented by the IDSs will be governed by the indenture and the global note.

Will my rights as a holder of IDSs be any different than the rights of a beneficial owner of separately held Class A common stock and notes?

No. As a holder of IDSs you are the beneficial owner of the Class A common stock and notes represented by your IDSs. As such, you will have exactly the same rights, privileges and preferences, including voting rights, rights to receive distributions, rights and preferences in the event of a default under the indenture governing our notes, ranking upon bankruptcy and rights to receive communications and notices as a direct holder of separately held Class A common stock and notes, as applicable, would have.

Do I have voting rights as a holder of IDSs?

As a holder of IDSs, you will be able to vote with respect to the underlying shares of Class A common stock. IDSs have no voting rights separate and apart from the voting rights related to the underlying shares of Class A common stock. For a more detailed description of voting rights, see “Description of Capital Stock.”

8

Table of Contents

Will the terms of the notes represented by IDSs be the same as the terms of the notes sold separately (not represented by IDSs)?

Yes. The terms of the notes sold separately (not represented by IDSs) will be identical in all respects to the terms of the notes represented by IDSs and will be part of the same series of notes and issued under the same indenture. Accordingly, holders of notes sold separately and holders of notes represented by IDSs will vote together as a single class, in proportion to the aggregate principal amount of notes they hold, on all matters on which they are eligible to vote under the indenture.

Will the IDSs be listed on an exchange?

We will apply to list the IDSs for trading on the New York Stock Exchange under the trading symbol “XRM”.

Will the shares of our Class A common stock or notes be separately listed on an exchange?

Our shares of Class A common stock will not initially be listed for separate trading on the New York Stock Exchange or any other exchange or quotation system. If, for a period of 30 consecutive trading days, a sufficient number of shares of Class A common stock is held separately and not in the form of IDSs to satisfy applicable requirements for separate trading on the New York Stock Exchange, we will apply to list the shares of our Class A common stock for separate trading on the New York Stock Exchange. The notes will not be listed on any exchange or quotation system. The shares of our Class A common stock and notes will be freely tradable without restriction or further registration under the Securities Act of 1933, as amended, which we refer to as the “Securities Act,” unless they are purchased by “affiliates” as that term is defined in Rule 144 under the Securities Act.

In what form will IDSs and the shares of our Class A common stock and the notes represented by the IDSs be issued?

The IDSs and the shares of our Class A common stock and the notes represented by the IDSs will be issued in book-entry form only. This means that you will not be a registered holder of IDSs or the securities represented by the IDSs, and you will not receive a certificate for your IDSs or the securities represented by your IDSs. You must rely on your broker or other financial institution that will maintain your book-entry position to receive the benefits and exercise the rights of a holder of IDSs. In accordance with Delaware law, a registered holder of Class A common stock has the right to request a certificate representing its shares of Class A common stock. However, if a registered holder requests a certificated share on your behalf as a beneficial owner of IDSs, the IDSs beneficially owned by you must be separated into the Class A common stock and notes represented by such IDSs, and while the Class A common stock and the notes are separated your Class A common stock will not be eligible for inclusion in The Depository Trust Company’s, or DTC, book-entry settlement and clearance system described under “Description of IDSs—Book-Entry Settlement and Clearance.”

How can I separate my IDSs into shares of Class A common stock and notes or recombine shares of Class A common stock and notes to form IDSs?

Holders of IDSs, whether purchased in this offering or in a subsequent offering of IDSs of the same series may, at any time after the earlier of 45 days from the date of the closing of this offering or the occurrence of a change of control, through their broker or other financial institution, separate the IDSs into the shares of our Class A common stock and notes represented thereby. Any holder of shares of our Class A common stock and notes,

9

Table of Contents

whether represented by IDSs purchased in this offering or a subsequent offering and separated, or purchased separately in the secondary market, may, at any time, through his or her broker or other financial institution, combine the applicable number of shares of Class A common stock and notes to form IDSs unless the IDSs have previously been automatically separated as a result of the redemption or maturity of any notes or otherwise. Separation and combination of IDSs will occur promptly in accordance with procedures of DTC procedures upon receipt of instructions from your broker and may involve transaction fees charged by your broker and/or other financial intermediaries. Trading in the IDSs should not be affected as a result of any such separation or combination of IDSs unless a sufficient number of IDSs has separated so as to impair liquidity or result in delisting.See “Description of IDSs—Book-Entry Settlement and Clearance—Separation and Combination.”

Will my IDSs automatically separate into shares of Class A common stock and notes upon the occurrence of certain events?

Yes. Separation of all of the IDSs will occur automatically upon the continuance of a payment default on the notes for 90 days or the occurrence of any redemption, whether in whole or in part, of the notes, or upon the maturity of the notes.

What will happen if we issue additional IDSs or notes of the same series in the future?

Subsequently issued IDSs or notes will have terms that are identical to those of the IDSs and notes, respectively, sold in this offering, except that:

| Ÿ | if additional IDSs are issued 45 days or more from the closing of this offering, such IDSs will be immediately separable; and |

| Ÿ | if additional IDSs are issued less than 45 days from the closing of this offering, such IDSs will be separable on and after the same date the IDSs issued in this offering may separate. |

If we issue notes of the same series (whether or not represented by IDSs) in the future and either such notes are issued with original issue discount, or OID, for U.S. federal income tax purposes, or we previously issued notes of the same series with OID, holders of our notes outstanding prior to such issuance and purchasers of the newly issued notes will automatically exchange among themselves a portion of the notes they hold so that immediately following such automatic exchange, each holder will own a pro rata portion of the new notes and the old notes. The aggregate amount of new notes and old notes held by any holder prior to any such exchange will be the same as such holder holds subsequent to the exchange. Accordingly, following an automatic exchange of notes, each IDS will consist of Class A common stock and an inseparable note unit with an aggregate principal amount equal to the aggregate principal amount immediately prior to such exchange. This exchange will be effected automatically, without any action by the holders, through the facilities of DTC. DTC has advised us that the implementation of this automatic exchange may cause a delay in the settlement of trades of up to 24 hours. See “Description of IDSs—Book-Entry Settlement and Clearance—Procedures Relating to Subsequent Issuances.”

Other than potential tax and bankruptcy implications and subject to market perception, we do not believe that the automatic exchange will affect the economic attributes of your investment in our IDSs or notes. The tax and bankruptcy implications of an automatic exchange are described in more detail in “Risk Factors—Risks Relating to Our Capital Structure.”

This automatic exchange should not impair the rights you might otherwise have to assert a claim, under applicable securities laws, against us or the underwriters, with respect to the full amount of notes purchased by you.

10

Table of Contents

We will immediately file with the Securities and Exchange Commission, or SEC, a Current Report on Form 8-K (or any applicable form) to announce and quantify any changes in the ratio of IDS components or changes in OID attributed to notes.

What will be the U.S. federal income tax considerations in connection with an investment in the IDSs or notes?

Certain aspects of the U.S. federal income tax consequences of the purchase, ownership and disposition of IDSs or notes in this offering are not entirely clear. The purchase of IDSs in this offering should be treated as the purchase of shares of our Class A common stock and notes and, by purchasing IDSs, you agree to such treatment. However, there is no authority that directly addresses the tax treatment of securities with terms substantially similar to the IDSs, and it is possible the Internal Revenue Service, or IRS, could successfully challenge this treatment. IDS holders must allocate the purchase price of the IDSs between those shares of Class A common stock and notes in proportion to their respective initial fair market values, which will establish their initial tax basis. The values attributed to the shares of Class A common stock and notes represented by the IDSs are established based on the fair market value of such shares of Class A common stock and notes at the time of issuance. Assuming an initial public offering price of $ per IDS, which represents the mid-point of the range set forth on the cover page of this prospectus, we expect to report the initial fair market value of each share of Class A common stock as $ and the initial fair market value of each $ aggregate principal amount of notes as $ , and by purchasing IDSs, you agree to such allocation. Because the allocation between shares of Class A common stock and notes is based on a determination of fair market value, our counsel is unable to opine on this allocation, and it is possible the IRS will successfully challenge this allocation. See “Risk Factors—Risks Relating to Our Capital Structure.”

Based on the opinion of tax counsel, the notes should be treated as debt for U.S. federal income tax purposes. If the notes were treated as equity rather than debt for U.S. federal income tax purposes, then the stated interest on the notes could be treated as a dividend, and interest on the notes would not be deductible by us for U.S. federal income tax purposes, which could materially increase our taxable income and significantly reduce our future cash flow. Such dividends likely would not qualify for the reduced tax rate described below. In addition, payments on the notes to foreign holders would be subject to U.S. federal withholding taxes at rates of up to 30%. Payments to foreign holders would not be grossed-up on account of any such taxes.

Under recently-enacted legislation, which is scheduled to expire in 2008, dividends paid by us, to the extent paid out of our tax “earnings and profits,” will generally be taxable for U.S. federal income tax purposes to holders of IDSs at long-term capital gains rates. Interest income on the notes will generally be taxable to holders of IDSs at ordinary income rates.

For a more complete discussion of the material U.S. federal income tax considerations in connection with an investment in IDSs or notes, see “Material U.S. Federal Income Tax Consequences.”

What will be the U.S. federal income tax considerations in connection with a subsequent issuance of notes?

The U.S. federal income tax consequences to you of the subsequent issuance of notes with OID (or any issuance of notes thereafter) upon a subsequent sale of IDSs or notes pursuant to an offering by us or upon exchange of our Class B common stock are not entirely clear. The indenture governing our notes and the agreements with DTC, will provide that, in the event there is a subsequent issuance of notes with OID, and upon each issuance of notes thereafter, each holder of IDSs or notes, as the case may be, agrees that a portion of such holder’s notes will be exchanged for a portion of the notes acquired by the holders of such subsequently issued notes, as described above under “What will happen if we issue additional IDSs or notes of the same series in the future?”. As a result of these exchanges, any OID associated with the issuance of new notes effectively will be spread among all holders of notes on apro rata basis, which may adversely affect your tax

11

Table of Contents

treatment, as described below. OID generally is the excess, if any, of the stated redemption price at maturity of a note over its issue price. If the difference satisfies the statutory definition of being de minimis, there is no OID.

It is unclear, however, whether the exchange of notes for subsequently issued notes will result in a taxable exchange for U.S. federal income tax purposes and, accordingly, our counsel is unable to opine on this issue. It is possible that the IRS might successfully assert that such an exchange should be treated as a taxable exchange. In such case, a holder would recognize any gain realized on such exchange, but a loss realized might be disallowed. If the exchange of notes is treated as a taxable exchange, then your initial tax basis in the notes deemed to have been received in the exchange would be the fair market value of such notes on the date of the deemed exchange (adjusted to reflect any disallowed loss), and your holding period for such notes would begin on the day after the deemed exchange. Regardless of whether the exchange is treated as a taxable event, the exchange could result in holders having to include OID in taxable income prior to the receipt of cash and other potentially adverse U.S. federal income tax consequences.

Following any subsequent issuance of notes with OID (or any issuance of notes thereafter) and resulting exchange, we (and our agents) will report any OID on the subsequently issued notes ratably among all holders of IDSs and separately held notes, and each holder of IDSs and separately held notes will, by purchasing IDSs or notes, agree to report OID in a manner consistent with this approach. However, we cannot assure you that the IRS will not assert that any OID should be reported only to the persons that initially acquired such subsequently issued notes (and their transferees) and thus may challenge a holder’s reporting of OID on its tax returns. Such a challenge could create significant uncertainties in the pricing of IDSs and notes and could adversely affect the market for IDSs and notes.

Because there is no statutory, judicial or administrative authority directly addressing the tax treatment of the IDSs or notes or instruments similar to the IDSs or notes, we urge you to consult your own tax advisor concerning the tax consequences of an investment in the IDSs or notes. For additional information, see “Material U.S. Federal Income Tax Consequences.”

12

Table of Contents

Summary of the Common Stock

Issuer | Xerium Technologies, Inc. |

Shares of Class A common stock represented by IDSs being offered hereby | shares of Class A common stock, or shares if the underwriters’ over-allotment option is exercised in full. |

Shares of Class A common stock and Class B common stock outstanding following this offering | shares of Class A common stock, which includes shares represented by IDSs issued to the selling stockholders upon completion of this offering. |

shares of Class B common stock that will be automatically exchanged for IDSs, subject to certain conditions, upon the second anniversary of the closing of this offering at an exchange rate of one IDS for each share of Class B common stock. Upon such exchange, the holders of Class B common stock will receive an aggregate of IDSs. If the IDSs have automatically separated or are otherwise not outstanding at the time of such exchange, each share of Class B will be exchanged for one share of Class A common stock and a note having a principal amount equal to each note which was represented by an IDS. However, if the notes represented by IDSs are not outstanding at the time of such exchange, each share of Class B common stock will be exchanged for shares of Class A common stock. See “Description of Capital Stock—Class B Common Stock.” |

Our Class A common stock and Class B common stock are identical in all respects and are entitled to the same rights, preferences and privileges, and vote together as a single class on all matters upon which the common stock is entitled to vote, except (1) as to dividend rights as described under “Initial Dividend Policies and Restrictions,” (2) the Class B common stock will be exchanged for IDSs after the second anniversary of the closing of this offering, as described under “Related Party Transactions—Investor Rights Agreement” and (3) the Class B common stock may not be combined with notes to form IDSs. Furthermore, our by-laws provide that we may not issue Class A common stock as long as any IDSs are outstanding unless (i) such shares are issued as part of IDSs and pursuant to a registration statement that has been declared effective by the SEC or (ii) any IDSs that may result from the combination of such shares of Class A common stock and any notes have been issued in a registered transaction. |

Following the automatic separation of the IDSs as a result of the redemption or maturity of any notes, shares of Class A common stock and notes may no longer be combined to form IDSs.

Voting rights | Each outstanding share of our common stock will carry one vote per share and all classes of common stock will vote as a single class on all matters presented to the stockholders for a vote. |

13

Table of Contents

Dividends | We intend to pay quarterly dividends on the shares of our Class A common stock represented by IDSs and on the shares of our Class B common stock if and to the extent dividends are declared by our board of directors and permitted by applicable law and the terms of our then-outstanding indebtedness. Upon the closing of this offering, our board of directors is expected to adopt a dividend policy which contemplates that, subject to the foregoing, during the first year following completion of the offering we will pay dividends of $ per share on our Class A common stock and $ per share on our Class B common stock. However, our board of directors may, in its discretion, modify or repeal this dividend policy. We cannot assure that we will pay dividends at this level in the future or at all and there is no requirement for us to pay dividends. |

We expect the initial dividend policy on the Class B common stock to result in an overall dividend yield on the Class B common stock equivalent, on a pre-tax basis, to the initial yield on the IDSs into which the Class B common stock will eventually be exchanged. |

Under the indenture governing the notes, the dividends we may pay are, in general, limited to a basket of $ million plus our “Excess Cash.” Excess Cash is defined as our Adjusted EBITDA (as defined in the indenture) reduced by:

| Ÿ | cash interest expense, |

| Ÿ | deferred interest, if any, not included in cash interest expense, |

| Ÿ | cash income tax expense and capital expenditures (except to the extent financed through an incurrence of indebtedness), |

| Ÿ | certain non-recurring cash payments deducted in the calculation of Adjusted EBIDTA, and |

| Ÿ | certain amounts paid to permanently reduce senior indebtedness prior to scheduled maturity. |

Similar limitations on dividends and other distributions exist under the new credit facility. See “Description of Certain Indebtedness—New Credit Facility.” In addition, both the indenture and the new credit facility contain dividend suspension provisions under which we would be prohibited from paying dividends during any interest deferral period, at any time when any deferred interest or interest on deferred interest remains outstanding from a prior interest deferral period or if our interest coverage ratio fell below specified levels. There is no requirement that we use any Excess Cash to pay dividends.

14

Table of Contents

Dividend payment dates | If declared, dividends will be paid quarterly on the 15th day of each March, June, September and December to holders of record on the 5th day of such month or the immediately preceding business day of such month if the 5th day is not a business day. |

Listing | Our shares of Class A common stock will not initially be listed for separate trading on the New York Stock Exchange or any other exchange or quotation system. If, for a period of 30 consecutive trading days, a sufficient number of shares of Class A common stock is held separately and not in the form of IDSs to satisfy applicable requirements for separate trading on the New York Stock Exchange, we will apply to list the shares of our Class A common stock for separate trading on the New York Stock Exchange. Our Class A common stock will be freely tradable without restriction or further registration under the Securities Act, unless purchased by “affiliates” as that term is defined in Rule 144 under the Securities Act. |

15

Table of Contents

Summary of the Notes

Issuer | Xerium Technologies, Inc. |

Notes to be outstanding following the offering | $ million aggregate principal amount of % notes, which includes $ million aggregate principal amount of notes included in IDSs and $ million aggregate principal amount of notes sold separately (not represented by IDSs) (or $ million aggregate principal amount if the underwriters’ over-allotment option is exercised in full). Each offered note will have a principal amount of $ . |

Assuming the exchange of all of our outstanding Class B Common Stock for IDSs, $ million aggregate principal amount of notes will be outstanding |

Interest rate | % per year. |

Interest payment dates | Interest will be paid quarterly in arrears on the 15th day of each March, June, September, and December of each year commencing , 2004 to holders of record on the 5th day of such month, or the business day immediately following the 5th day if such interest payment date is not a business day. |

Interest deferral | Prior to , 2009, we may, under specified circumstances, defer interest payments on the notes on one or more occasions for up to an aggregate period of eight quarters. In addition, after , 2009, we may, under specified circumstances, defer interest payments on the notes on up to four occasions for up to two quarters per occasion. |

After the end of any deferral period occurring before , 2009 we will resume paying interest (including interest on deferred interest). No later than , 2009, we must pay in full all interest previously deferred (together with accrued interest thereon). We will repay all interest deferred after , 2009 on or before maturity, provided that we must pay all deferred interest and accrued interest on deferred interest in full prior to deferring interest for a second occasion or paying any dividends on our shares of common stock. |

During any interest deferral period and so long as any deferred interest or interest on deferred interest remains outstanding, we will not be permitted to make any payment of dividends on any class of our common stock. |

We may, at our election, defer interest payments on the notes if we determine in good faith that such deferral is reasonably necessary for bona fide cash management purposes, or to reduce the likelihood of, or avoid a default under, our senior indebtedness. We may not commence a deferral, and any on-going deferral will cease, if:

| Ÿ | a default in payment of principal or premium, if any, on the notes has occurred and is continuing, |

16

Table of Contents

| Ÿ | an event of default with respect to payment of interest on the notes has occurred and is continuing; or |

| Ÿ | another event of default with respect to the notes has occurred and is continuing and the notes have been accelerated as a result of the occurrence of such event of default. |

For a detailed description of interest deferral provisions of the indenture governing our notes, see “Description of Notes—Terms of the Notes—Interest Deferral.”

In the event that interest payments on the notes are deferred, you would be required to include accrued interest in your income for U.S. federal income tax purposes even if you do not receive any cash interest payments. See “Material U.S. Federal Income Tax Consequences—Notes—Deferral of Interest.” |

Maturity date | The notes will mature on , 2019. |

Optional redemption | The notes will be redeemable, in whole or in part, at our option, at any time on or after , 2011 at the redemption prices set forth in this prospectus, plus accrued but unpaid interest to the date of redemption. If the notes are redeemed in whole or in part, the notes and Class A common stock represented by each IDS will be automatically separated. See “Description of Notes—Optional Redemption.” |

We may, at our option, redeem all, but not less than all, of the notes if we receive an opinion of nationally recognized tax counsel that we would not be permitted to deduct all or a substantial portion of the interest payable on the notes from our income for U.S. federal income tax purposes, at a redemption price equal to 100% of the principal amount of the notes, plus accrued and unpaid interest, if any, to the redemption date. Other than as set forth above we may not redeem the notes prior to , 2011.

Change of control | Upon the occurrence of a change of control, as defined under “Description of Notes—Change of Control,” each holder of notes will have the right to require us to repurchase that holder’s notes at a price equal to 101% of the principal amount of the notes being repurchased, plus any accrued but unpaid interest to but not including the repurchase date. In order to exercise that right, a holder must separate its IDSs into the shares of Class A common stock and notes represented thereby and hold the notes separately. We may not have sufficient financial resources to purchase all of the notes that are tendered upon a change of control offer. Furthermore, our new credit facility, with certain limited exceptions, will prohibit the repurchase or redemption of the notes before their stated maturity. See “Risk Factors—Risks Related to our Capital Structure—We may not be able to repurchase the notes upon a change of control” and “Description of Notes—Change of Control.” |

17

Table of Contents

Guarantees of notes | The notes will be fully and unconditionally guaranteed, on an unsecured basis, by each of our direct and indirect wholly-owned U.S. subsidiaries existing on the closing of this offering and certain of our direct and indirect wholly-owned foreign subsidiaries existing on the closing of this offering, and all our future wholly-owned restricted subsidiaries (other than certain foreign subsidiaries that will not guarantee the notes) that incur indebtedness under our new credit facility. The guarantees will be joint and several. |

Procedures relating to subsequent issuances | The indenture governing our notes will provide that in the event we issue additional notes (whether or not represented by IDSs) with OID, and upon each issuance of notes thereafter, each holder of IDSs or separately held notes, as the case may be, agrees that a portion of such holder’s notes, whether or not represented by IDSs, will be automatically exchanged for a portion of the notes acquired by the holders of such subsequently issued notes, and the records of any record holders of notes will be revised to reflect such exchanges. Consequently, following each such subsequent issuance and automatic exchange, each holder of IDSs or separately held notes, as the case may be, will own notes of each separate issuance in the same proportion as each other holder. However, the aggregate principal amount of notes owned by each holder will not change as a result of such subsequent issuance and exchange. The indenture governing the notes will permit issuances of additional notes upon the exercise of the underwriters’ over-allotment option, in connection with the exchange of Class B common stock for IDSs and, subject to compliance with restrictive covenants contained in the indenture, for other permitted purposes. However, we may not issue additional notes if and for so long as an event of default with respect to the notes has occurred and is continuing. Any subsequent issuance of notes by us may adversely affect the tax treatment of the IDSs and notes. See “Material U.S. Federal Income Tax Consequences—Consequences to U.S. Holders—Notes—Additional Issuances.” |

Ranking of notes and guarantees | The notes will be unsecured and subordinated obligations, junior in right of payment to all of our existing and future senior indebtedness and effectively subordinated in right of payment to any future secured indebtedness. The notes will rank pari passu with all of our other indebtedness, including trade payables, except as discussed in “Risk Factors—Risks Related to our Capital Structure” and “Description of Notes—Ranking.” The guarantees will be unsecured and subordinated obligations, junior in right of payment to all existing and future senior indebtedness of our subsidiary guarantors, including all guarantees of our subsidiary guarantors under the new credit facility, and effectively subordinated in right of payment to any future secured indebtedness of our subsidiary guarantors. The guarantees will rank pari passu with all other indebtedness of the subsidiary guarantors, including trade payables, except as discussed in “Risk Factors—Risks |

18

Table of Contents

Related to our Capital Structure” and “Description of Notes—Ranking.” The notes will be structurally subordinated to all indebtedness of any of our subsidiaries which are not guarantors of the notes. We are a holding company and derive all of our operating income and cash flows from our subsidiaries. |

As of March 31, 2004, on a pro forma basis after giving effect to the transactions contemplated by this prospectus: |

| Ÿ | we would have had $ million aggregate principal amount of senior indebtedness outstanding, all of which would have been senior secured indebtedness to which the notes would be junior in right of payment; |

| Ÿ | we would have had $ million aggregate principal amount of other indebtedness outstanding, including trade payables, all of which would have ranked pari passu with the notes, except as discussed in “Risk Factors—Risks Related to our Capital Structure” and “Description of Notes—Ranking.” |

| Ÿ | the subsidiary guarantors would have had $ million aggregate principal amount of senior indebtedness outstanding, all of which would have been senior secured indebtedness to which the guarantees of the notes would be junior in right of payment; and |

| Ÿ | the subsidiary guarantors would have had $ million aggregate principal amount other indebtedness outstanding, including trade payables, all of which would have ranked pari passu with the guarantees, except as discussed in “Risk Factors—Risks Related to Capital Structure” and “Description of Notes—Ranking”. |

In addition, as of March 31, 2004, on a pro forma basis after giving effect to the transactions contemplated by this prospectus, based on the covenants in the indenture and our new credit facility: |

| Ÿ | we would have had the ability to incur an additional $ million aggregate principal amount of indebtedness, all of which could be senior in right of payment to the notes; and |

| Ÿ | the subsidiary guarantors would have had the ability to incur an additional $ million aggregate principal amount of indebtedness, all of which could be senior in right of payment to the guarantees of the notes. |

Restrictive covenants | The indenture governing the notes will contain covenants with respect to us and our restricted subsidiaries that will, among other things, restrict: |

| Ÿ | the incurrence of additional indebtedness and the issuance of preferred stock and certain redeemable capital stock; |

19

Table of Contents

| Ÿ | a number of restricted payments, including dividends, investments and acquisitions; |

| Ÿ | specified sales of assets; |

| Ÿ | specified transactions with affiliates; |

| Ÿ | the creation of liens on our assets; and |

| Ÿ | consolidations, mergers and transfers of all or substantially all of our assets. |

The indenture governing the Notes will also prohibit certain distributions from our restricted subsidiaries. In addition, all the limitations and prohibitions described above are subject to a number of other important qualifications and exceptions described under “Description of Notes—Certain Covenants.” |

Listing | We do not anticipate that our notes will be separately listed on any exchange or quotation system. |

Representation letter | None of the notes sold separately (not represented by IDSs) in this offering, which we refer to as the “separate notes” may be purchased, directly or indirectly, by persons who are also (1) purchasing IDSs in this offering or (2) holders of Class B common stock following our recapitalization. Furthermore, prior to the closing of this offering, each person purchasing separate notes in this offering will be asked to make certain representations to us in connection with these restrictions. See “Underwriting.” |

20

Table of Contents

Risk Factors

You should carefully consider the information under the heading “Risk Factors” and all other information in this prospectus before investing in the notes or IDSs.

General Information About This Prospectus

Throughout this prospectus, unless otherwise noted, we have assumed no exercise of the underwriters’ over-allotment option.

Unless the context otherwise requires, references in this prospectus to the “notes” refer collectively to the % senior subordinated notes due 2019 represented by IDSs and the % senior subordinated notes due 2019 sold separately, references to the “offering” refer collectively to the offering of IDSs to the public and IDSs to the selling stockholders, in each case, including the shares of Class A common stock and notes represented thereby, and the offering of $ million aggregate principal amount of notes to the public separately (not represented by IDSs). References to the “common stock” refers collectively to our Class A common stock, Class B common stock and Class C common stock.

In this prospectus, unless otherwise indicated, all references to dollars are to US Dollars, and all references to GAAP are to U.S. generally accepted accounting principles.

Xerium Technologies, Inc. will be the issuer of all of the securities offered by this prospectus. Prior to the offering, Xerium Technologies, Inc. is an indirect, wholly-owned subsidiary of Xerium S.A, a Luxembourg company. In connection with the offering, we will undergo a reorganization and, after the offering, we will, directly or indirectly, hold all of the equity interests of all of the current operating subsidiaries and related holding companies of our corporate group, excluding the current parent, Xerium S.A. and its two immediate subsidiaries — Xerium 2 S.A. and Xerium 3 S.A.

21

Table of Contents

Summary Historical Consolidated Financial Data

The following summary historical consolidated financial information as of and for the years ended December 31, 2001, 2002 and 2003 has been derived from our audited consolidated financial statements included elsewhere in this prospectus. The summary historical financial information as of March 31, 2004 and for the three month periods ended March 31, 2003 and 2004 has been derived from our unaudited consolidated financial statements included elsewhere in this prospectus.

This summary financial information should be read in conjunction with the information contained in “Selected Historical Consolidated Financial Information,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes included elsewhere in this prospectus. The figures in the table below reflect rounding adjustments.

| Year ended December 31 | Three months ended March 31 | |||||||||||||||||||

| 2001 | 2002 | 2003 | 2003 | 2004 | ||||||||||||||||

| (in thousands) | (unaudited) | |||||||||||||||||||

Statement of operations data: | ||||||||||||||||||||

Net sales | $ | 499,846 | $ | 514,945 | $ | 560,668 | $ | 130,378 | $ | 146,802 | ||||||||||

Income from operations | 89,264 | 101,667 | 108,994 | 20,538 | 29,615 | |||||||||||||||

Net income (loss) | (4,419 | ) | 470 | 3,036 | 1,331 | 9,173 | ||||||||||||||

Net income (loss) per share | (7.95 | ) | 0.85 | 5.46 | 2.40 | 16.11 | ||||||||||||||

Statement of cash flows data: | ||||||||||||||||||||

Net cash provided by operating activities | $ | 93,635 | $ | 124,415 | $ | 107,011 | $ | 12,961 | $ | 12,810 | ||||||||||

Net cash used in investing activities | (39,260 | ) | (31,903 | ) | (39,664 | ) | (7,062 | ) | (9,318 | ) | ||||||||||

Net cash used in financing activities | (64,915 | ) | (62,233 | ) | (82,656 | ) | (12,640 | ) | (439 | ) | ||||||||||

Other financial data: | ||||||||||||||||||||

Capital expenditures | $ | 32,658 | $ | 28,295 | $ | 44,423 | $ | 7,120 | $ | 9,661 | ||||||||||

Adjusted EBITDA(1) | 152,332 | 173,014 | 180,700 | 40,353 | 42,457 | |||||||||||||||

Ratio of earnings to fixed charges(2) | 1.3 | 1.2 | 1.6 | 1.1 | 1.9 | |||||||||||||||

Balance sheet data (at end of period): | ||||||||||||||||||||

Cash and cash equivalents | $ | 13,815 | $ | 32,834 | $ | 22,294 | $ | 25,757 | $ | 25,250 | ||||||||||

Total assets | 888,993 | 925,276 | 986,806 | 933,000 | 986,261 | |||||||||||||||

Senior debt | 446,993 | 611,960 | 611,670 | 624,995 | 604,934 | |||||||||||||||

Total debt | 748,907 | 796,201 | 823,617 | 820,320 | 815,697 | |||||||||||||||

Stockholders’ deficit | (39,160 | ) | (71,749 | ) | (52,645 | ) | (72,060 | ) | (48,571 | ) | ||||||||||

| (1) | Adjusted EBITDA, which is defined in the indenture governing the notes and the new credit facility, is calculated in part based upon the amount of EBITDA. EBITDA represents net income before interest expense, income tax provision (benefit) and depreciation and amortization. We consider EBITDA to be a measure of liquidity. Accordingly, EBITDA is reconciled to operating cash flows in the table below. |