As filed with the Securities and Exchange Commission on April 22, 2004

Registration No. 333-

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Xerium Technologies, Inc.

(Exact name of registrant as specified in its charter)

| | | | |

| Delaware | | 2221 | | 42-1558674 |

(Jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification Number) |

One Technology Drive

Westborough Technology Park

Westborough, MA 01581

(508) 616-9468

(Address, including zip code, and telephone number, including

area code, of Registrant’s principal executive offices)

See Table of Additional Registrant Guarantors

Michael O’Donnell

Chief Financial Officer

One Technology Drive

Westborough Technology Park

Westborough, MA 01581

(508) 616-9468

(Name, address, including zip code, and telephone

number, including area code, of agent for service)

Copies to:

| | |

John B. Ayer, Esq. Ropes & Gray LLP One International Place Boston, Massachusetts 02110 (617) 951-7000 | | David J. Goldschmidt, Esq. Skadden, Arps, Slate, Meagher & Flom LLP Four Times Square New York, New York 10036 (212) 735-3000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If delivery of the prospectus is expected to be made pursuant to Rule 434 under the Securities Act, please check the following box. ¨

CALCULATION OF REGISTRATION FEE

| | | | | |

TITLE OF EACH CLASS OF SECURITIES TO BE REGISTERED | | PROPOSED MAXIMUM AGGREGATE OFFERING PRICE(1) | | AMOUNT OF REGISTRATION

FEE(1) |

|

Income Deposit Securities (IDSs)(2) | | | | | |

|

Shares of Class A Common Stock, par value $0.01 per share(3) | | | | | |

|

% Senior Subordinated Notes(4)(5) | | | | | |

|

Subsidiary Guarantees of % Senior Subordinated Notes

due 2014(5) | | | | | |

|

Total | | $700,000,000 | | $ | 88,690 |

| (1) | Estimated solely for the purpose of calculating the amount of the registration fee in accordance with Rule 457(o) under the Securities Act of 1933. Includes IDSs subject to the underwriters’ over-allotment option. |

| (2) | The IDSs represent shares of Class A common stock of Xerium Technologies, Inc. and $ million aggregate principal amount of % senior subordinated notes due 2014 of Xerium Technologies, Inc., including IDSs subject to the underwriters’ over-allotment option to purchase additional IDSs and an indeterminate number of IDSs of the same series as the IDSs offered hereby, which will be received on one or more occasions in the future in replacement of the IDSs offered hereby in the event of a subsequent issuance of IDSs or notes (not represented by IDSs) of the same series as the notes offered hereby upon an automatic exchange of a portion of the notes offered hereby for a portion of the additional notes. Assuming the underwriters’ over-allotment option is exercised in full, IDSs will be sold to the public in connection with this initial public offering and IDSs will be issued to our existing equity investors in connection with the transactions described in this registration statement under “The Transactions.” |

| (3) | Includes (a) shares of Class A common stock of Xerium Technologies, Inc. represented by IDSs to be sold to the public in connection with this initial public offering (which includes shares of Class A common stock represented by IDSs which are subject to the underwriters’ over-allotment option) and (b) shares of Class A common stock represented by IDSs to be issued to our existing equity investors in connection with the transactions described in this registration statement under “The Transactions.” |

| (4) | Includes (a) $ million principal amount of notes represented by IDSs to be sold to the public in connection with this initial public offering (which includes $ million principal amount of notes represented by IDSs which are subject to the underwriters’ over-allotment option), (b) $ million principal amount of notes represented by IDSs to be issued to our existing equity investors in connection with the transactions described in this registration statement under “The Transactions,” (c) $ million principal amount of notes sold separately (not represented by IDSs) and (d) an indeterminate principal amount of notes of the same series as the notes offered hereby, which will be received on one or more occasions in the future by holders of notes offered hereby (whether or not represented by IDSs) in the event of a subsequent issuance of IDSs or notes of the same series (not represented by IDSs) upon an automatic exchange of a portion of the notes offered hereby for a portion of the additional notes. |

| (5) | Pursuant to Rule 457(n) under the Securities Act of 1933, no separate fee for the guarantees is payable. |

The Registrants hereby amend this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrants shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Additional Registrant Guarantors

| | | | | | |

Exact Name of Registrant Guarantor as Specified in its Charter

| | State or Other Jurisdiction of Incorporation or Organization

| | Primary Standard Industrial Classification Code Number

| | I.R.S. Employer Identification Number

|

| | | |

Huyck Argentina Sociedad Anonima | | Argentina | | 2221 | | Not Applicable |

Huyck Australia Pty. Limited | | Australia | | 2221 | | Not Applicable |

Weavexx Corporation | | Canada | | 2221 | | Not Applicable |

Stowe-Woodward Mount Hope Inc. | | Canada | | 3559 | | Not Applicable |

Huyck Japan Limited | | Japan | | 2221 | | Not Applicable |

Stowe Woodward Mexico SA de CV | | Mexico | | 3559 | | Not Applicable |

Huyck (UK) Limited | | United Kingdom | | 2221 | | Not Applicable |

Huyck Limited | | United Kingdom | | 2221 | | Not Applicable |

Stowe-Woodward (UK) Limited | | United Kingdom | | 3559 | | Not Applicable |

Stowe-Woodward Limited | | United Kingdom | | 3559 | | Not Applicable |

Xerium I (US) Limited | | Delaware | | 2221 | | 51-0394458 |

Xerium Inc. | | Delaware | | 8741 | | 51-0394459 |

Xerium III (US) Limited | | Delaware | | 2221 | | 51-0394460 |

Weavexx Corporation | | Delaware | | 2221 | | 05-0387869 |

Huyck Licensco Inc. | | Delaware | | 2221 | | 06-1260434 |

Huyck Europe Inc. | | Delaware | | 2221 | | 56-1222792 |

Stowe Woodward Licensco LLC | | Delaware | | 3559 | | 51-0394459 |

Stowe Woodward LLC | | Delaware | | 3559 | | 51-0394459 |

Xerium IV (US) Limited | | Delaware | | 3559 | | 51-0394461 |

Xerium V (US) Limited | | Delaware | | 3559 | | 51-0394462 |

The address, including zip code, of the principal offices of the additional registrant guarantors listed above is: c/o Xerium Technologies, Inc., One Technology Drive, Westborough Technology Park, Westborough, Massachusetts and the telephone number, including area code, of the additional registrant guarantors at that address is (508) 616-9468.

Subject to Completion, Dated April 22, 2004

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is declared effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Income Deposit Securities (IDSs)

Representing

Shares of Class A Common Stock and

$ million % Senior Subordinated Notes due 2014

and

$ million % Senior Subordinated Notes due 2014

Xerium Technologies, Inc.

We are selling IDSs in respect of shares of our Class A common stock and $ million aggregate principal amount of our % senior subordinated notes due 2014, subject to extension of maturity as described herein. Each IDS represents:

| | Ÿ | | one share of our Class A common stock; and |

| | Ÿ | | a % senior subordinated note due 2014 with $ principal amount. |

We are also selling separately (not represented by IDSs) $ million aggregate principal amount of our % senior subordinated notes due 2014, subject to extension of maturity as described herein, which, along with the notes represented by IDSs, we refer to as the “notes.” The completion of the offering of the separate notes is a condition to our sale of IDSs.

This is the initial public offering of our IDSs and the notes. We anticipate that the public offering price of the IDSs will be between $ and $ per IDS and the public offering price of the notes sold separately (not represented by IDSs) will be % of their stated principal amount.

Holders of IDSs will have the right to separate IDSs into the shares of Class A common stock and notes represented thereby at any time after the earlier of 45 days from the closing of this offering or the occurrence of a change of control. Similarly, holders of our Class A common stock and the notes, may, at any time, unless the IDSs have automatically separated, combine the applicable number of shares of Class A common stock and principal amount of notes to form IDSs. Separation of IDSs will occur automatically upon the continuance of a payment default on the notes for 90 days, or a redemption or maturity of the notes.

Upon a subsequent issuance by us of notes of the same series (whether as part of a new issuance of IDSs or otherwise), a portion of the notes owned by you either directly or represented by IDSs may be automatically exchanged for an identical principal amount of notes issued in such subsequent issuance and, in such event, your IDSs or notes will be replaced with new IDSs or a unit consisting of your notes and new notes, as the case may be. In addition to the notes offered hereby, the registration statement of which this prospectus is a part also registers the new notes and IDSs to be issued to you upon such subsequent issuance. For more information regarding these automatic exchanges and the effect they may have on your investment, see “Risk Factors—Subsequent issuances of notes pursuant to an offering by us or exchange of Class B common stock may cause you to recognize OID” on page , “Description of Notes—Covenants Relating to IDSs” on page , and “Material U.S. Federal Income Tax Consequences—Consequences to U.S. Holders— Notes—Additional Issuances” on page .

We will apply to list our IDSs on the under the trading symbol “ ”.

Investing in our IDSs or the notes involves risks. See “Risk Factors” beginning on page 23.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| | | | | | | | | | | | |

| | | Per IDS(1)

| | Total

| | Per Note

| | Total(2)

|

Public offering price | | $ | | | $ | | | $ | | | $ | |

Underwriting discount | | $ | | | $ | | | $ | | | $ | |

Proceeds to Xerium Technologies, Inc. (before expenses)(3) | | $ | | | $ | | | $ | | | $ | |

| (1) | Comprised of $ allocated to each note which represents % of its stated principal amount and $ allocated to each share of Class A common stock. |

| (2) | Amounts refer to notes sold separately (not represented by IDSs). |

| (3) | Approximately $ million of those proceeds will be paid to the current owners of our business before this offering. |

We have granted the underwriters an option to purchase up to additional IDSs at the public offering price, less the underwriting discount, within 30 days from the date of this prospectus to cover over-allotments.

The underwriters expect to deliver the IDSs and the notes to purchasers on or about , 2004.

CIBC World Markets

, 2004

Table Of Contents

Industry and Market Data

In this prospectus we rely on and refer to information regarding the paper-making industry and regarding the paper-making consumables industry. We obtained this information from various third-party sources, discussions with our customers and our own internal assumptions and estimates based on management knowledge and experience. We believe that these sources, assumptions and estimates are reliable, but we cannot guarantee their accuracy or completeness. Furthermore, information regarding our market positions and market shares within the clothing and roll covers segments of the paper-making consumables industry provides general guidance but is inherently imprecise. All of our assumptions and estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under “Risk Factors” and “Forward-Looking Statements” in this prospectus.

Trademarks

Huyck®, Mount Hope®,Robec®,Stowe Woodward®,Wangner®,Weavexx® andXerium® are trademarks of ours.

Prospectus Summary

The following is a summary of the principal features of this offering of IDSs and notes, and should be read together with the more detailed information and financial data and statements contained elsewhere in this prospectus.

Throughout this prospectus, we refer to Xerium Technologies, Inc., a Delaware corporation, together with its consolidated operations, as “we,” “our” and “us,” unless the context requires otherwise or otherwise indicated. We are a holding company and have no direct operations.

Our Company

Company Overview

We are a leading global manufacturer and supplier of two categories of consumable products used in the production of paper—clothing and roll covers. We have an extensive global footprint of 39 manufacturing facilities in 15 countries, strategically located in the major paper-producing regions of North America, Europe, South America and Asia, and have approximately 4,000 employees worldwide. We market our products to the paper industry’s leading producers through several highly regarded brands. In 2003, we generated net sales of $560.7 million.

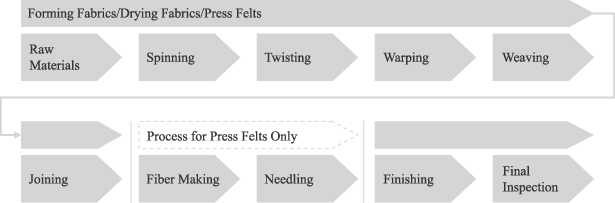

Our clothing and roll covers play key roles in the formation and processing of paper along the length of a paper-making machine. Our products are in constant contact with the paper and, as a result, they have a significant effect on paper quality and the ability of a paper producer to differentiate its products. In addition, while clothing and roll covers represent only approximately 2% of a paper producer’s production costs, they can help a paper producer reduce overall costs. Our clothing and roll covers allow paper producers to use less expensive raw materials (including recycled fiber), run paper-making machines faster and with fewer interruptions and decrease the amount of energy required in the expensive drying portion of the paper-making process. Accordingly, we believe our customers view us as a value-added supplier for their businesses.

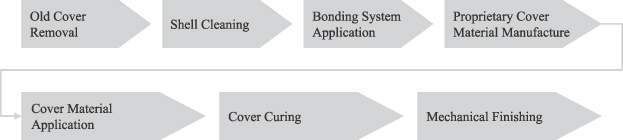

Clothing and roll covers wear down over time and must be regularly replaced in order for paper producers to sustain high quality paper output andoperate efficiently. Roll covers also require regular refurbishment, and we provide refurbishment services for previously installed roll covers. Paper producers must typically replace clothing multiple times per year, refurbish roll covers multiple times per year and replace roll covers every two to five years.

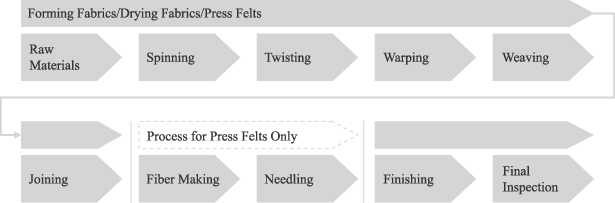

Our clothing and roll cover products are designed to withstand extreme temperature and pressure conditions, and are the result of considerable research and development and a sophisticated manufacturing process. Our clothing products are highly engineered synthetic textile belts that transport paper as it is processed along the length of a paper-making machine. Clothing plays a significant role in the forming, pressing and drying stages of paper production. Because paper-making machines vary widely in size and design, clothing is customized to each individual paper-making machine. Clothing can be in excess of 460 feet long and 30 feet wide.

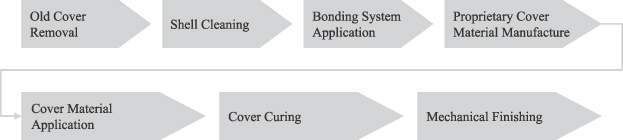

Our roll cover products provide a surface with the mechanical properties necessary to process the paper sheet in a cost-effective manner that delivers the sheet qualities desired by the paper producer. These products cover the rolls on a paper-making machine, which are the large steel cylinders over which clothing is mounted and between which the paper travels as it is processed. Like our clothing products, our roll cover products are customized to each individual paper-making machine.

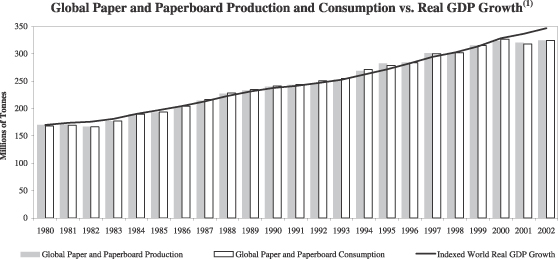

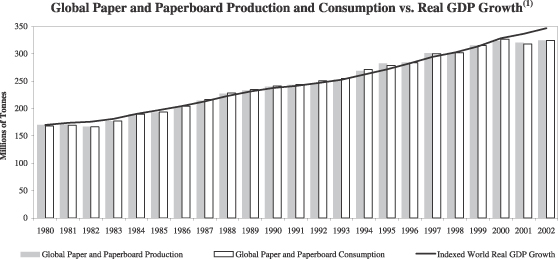

Demand for our products and services is driven primarily by the volume of global paper production,

1

which, according to the Food and Agriculture Organization of the United Nations, increased at a compound annual growth rate of approximately 3.0% from 1980 to 2002, with growth in every year but two during this period. The stability in the global volume of paper production results in stable demand for our products and services and causes our business to be largely unaffected by the historical volatility of paper prices and the corresponding swings in the profitability of paper producers.

We estimate that there are approximately 8,000 paper-making machines worldwide, all of which require a regular supply of clothing and roll covers. Our experience is that our customers are typically reluctant to change suppliers of their clothing and roll covers, largely because these products must be customized to each individual paper-making machine and can significantly affect paper quality and production efficiency. We have found that our customers often believe that the risks to production associated with changing suppliers outweigh the potential benefits of the change.

Key Strengths

Global Market Leader with Highly Regarded Brands

We believe that we are the leading global manufacturer and supplier of roll covers, with at least one-third of the global market share (excluding Asia, where accurate data is not available), and are among the top three global manufacturers of clothing, with approximately a 15% global market share. We are well known in the industry by the highly regarded brands through which we market our products, such asHuyck, Mount Hope, Robec, Stowe Woodward, Wangnerand Weavexx. We believe that the majority of our customers have a strong allegiance to our products and our brands, primarily because our products are highly reliable, cost effective and have a significant effect on paper quality and the overall efficiency of the production process.

Stable Demand for Our Products

The steady growth in the volume of global paper production has resulted in stable demand for our products and services. Our business has been largelyunaffected by the historical volatility of paper prices and the cyclicality of capital spending by paper producers, primarily because clothing and roll covers are fundamental to the paper production process, must be replaced or refurbished regularly and represent only a small fraction of paper production costs. Our products help paper producers increase production from their existing machines, which is especially important in periods of reduced capital spending for new paper-making machines.

Diversified Global Customer Base Including Leading Paper Producers

Our diversified customer base includes all of the leading paper producers in North America and Europe, including Abitibi-Consolidated, Inc., International Paper Company, Meadwestvaco Corporation, Smurfit-Stone Container Corporation, Stora Enso Oyj and UPM-Kymmene Corporation, as well as many others. As these paper producers, among others, continue to consolidate and expand their business throughout the world, we believe they increasingly value suppliers like us with a global presence and a strong track record of innovation.

Our global presence also reduces the impact of regional economic downturns and geographic shifts in paper production. In 2003, approximately 41% of our sales were in North America, 36% were in Europe, 10% were in South America and 13% were in Asia.

Technology Leader with a Strong Pipeline of Product Upgrades and New Products

We are known and valued by our customers as a technology leader in our industry and we currently have an extensive pipeline of product upgrades and new products under development. We continually enhance our existing products and introduce innovative new products that provide value for our customers. Our product innovations allow us to improve our competitive position and grow our business.

Strong Financial Performance

We have increased our revenues, net cash provided by operating activities and Adjusted EBITDA since 2000, despite adverse conditions in the paper industry and weak overall economic conditions in North America and Europe. Our revenues increased from

2

$504.9 million in 2000 to $560.7 million in 2003, an increase of 11.1%. Our net cash provided by operating activities increased from $69.1 million in 2000 to $107.0 million in 2003, an increase of 54.8%, and our Adjusted EBITDA increased from $163.5 million in 2000 to $180.7 million in 2003, an increase of 10.5%. For a discussion of the calculation of Adjusted EBITDA, see “Selected Consolidated Financial Data.”

Proven Management Team

We have a highly experienced management team. Their prudent investment of our resources and the operational changes they have implemented have resulted in productivity improvements and provided us with an efficient platform from which to develop and introduce value-added products and services for our customers. As a result, we have strengthened our market and competitive position in the face of adverse market conditions in the paper-making industry over the last several years.

Business Strategy

The primary components of our strategy are to:

Deliver Value to Our Customers

We continually improve our existing products and introduce innovative new products. We concentrate our efforts on the products and services that will yield the most value to our customers. We seek to develop new products and services that help our customers: reduce operating costs; improve paper quality; and derive greater value from their existing paper-making machines, thereby reducing their need to invest capital in new machines.

Maintain Geographic Balance and Expand in High Growth Regions

In addition to maintaining our leadership positions in the mature paper markets of North America and Europe, we continue to expand our manufacturing presence in the higher growth regions of South America and Asia. Our geographic balance reduces our exposure to regional economic downturns and leaves us well-positioned as paper production increases in both South America and Asia.

Continue to Improve our Productivity

We have a successful record of improving our productivity through cost reduction programs and other productivity initiatives, including closing underutilized plants, shifting manufacturing to lower cost locations and automating manufacturing processes. We maintain a lean, hands-on, productivity-focused management team that is structured to allow rapid decision-making and to react quickly to regional and industry changes.

Pursue Strategic Acquisitions

We have an established track record of strategic acquisitions and successful integration of acquired companies into our existing businesses. We will continue to selectively pursue strategic acquisitions that we believe have potential to expand our product offerings and improve our competitiveness.

The success of our strategy is demonstrated by our strong financial performance and stability despite adverse conditions in the paper-making industry and weak overall economic conditions in North America and Europe over the last several years.

3

New Credit Facility

Concurrently with the closing of this offering, we will enter into a new $ million senior secured credit facility with a syndicate of financial institutions, including CIBC World Markets Corp., which will act as lead arranger and sole bookrunner. In this prospectus, we refer to this credit facility as the “new credit facility.” The new credit facility will consist of a revolving credit facility in an aggregate principal amount of up to $ million and a $ million term loan facility. While the new credit facility will permit us to pay interest and dividends to our security holders, including IDS holders, it will contain significant restrictions on our ability to make such interest and dividend payments and on our subsidiaries’ ability to make interest and dividend payments to us. The revolving credit facility and the term loan facility will mature in . See “Description of Certain Indebtedness—New Credit Facility.”

Our Existing Equity Investors

We are an indirect, wholly-owned subsidiary of Xerium S.A. prior to this offering. Apax Europe IV GP, L.P., which, together with its affiliates, we refer to as “Apax” in this prospectus, is manager, directly or indirectly, of investment funds holding the majority of the outstanding common stock of Xerium S.A. Affiliates of CIBC World Markets Corp., the lead managing underwriter for this offering, own approximately 5.6% of the common stock of Xerium S.A. We refer to CIBC World Markets Corp. as “CIBC” in this prospectus. Our senior management, certain employees and certain other investors also own equity interests in Xerium S.A. We refer to Apax and these other investors in Xerium S.A. as our “existing equity investors” in this prospectus.

The Transactions

Prior to and in connection with this offering, we will recapitalize our capital stock into Class A common stock and Class B common stock. In this offering, we expect that we will sell IDSs (representing shares of Class A common stock and $ million aggregate principal amount of % notes)and $ million aggregate principal amount of % notes separately (not represented by IDSs) to the public. The completion of the offering of separate notes is a condition to our sale of IDSs.

In addition, we expect that we will issue IDSs (representing shares of Class A common stock and $ million aggregate principal amount of % notes), shares of Class B common stock and $ million in cash to Xerium S.A. in exchange for its ownership in us. Xerium S.A. will then distribute such IDSs, shares of Class B common stock and cash to our existing equity investors in exchange for their interests in Xerium S.A. In this exchange, we expect that Apax will receive IDSs, shares of Class B common stock and $ million in cash. No holder of equity interests other than Apax will receive Class B common stock in the exchange. In addition, we expect that members of our senior management will receive in the exchange an aggregate of IDSs and no cash, other than an amount of cash necessary to pay anticipated income taxes they will incur in connection with the vesting of equity interests and the exchange.

The Class B common stock will be exchangeable for IDSs at a fixed rate after the second anniversary of this offering, subject to restrictions. If all the Class B common stock were exchanged, the holders of our Class B common stock would receive an aggregate of IDSs representing shares of our Class A common stock and $ million aggregate principal amount of % notes. The Class B common stock will have one vote per share but will initially receive dividends at a higher rate than our Class A common stock. See “Description of Capital Stock—Class B Common Stock,” “Dividend Policy and Restrictions” and “Certain Transactions—Investor Rights Agreement.”

After giving effect to the offering and these transactions, the public IDS holders will hold approximately % of the economic interests in us and our existing equity investors will hold the remaining % through IDSs and shares of Class B common stock. See “The Transactions.”

4

Use of Proceeds

We estimate that we will receive net proceeds from this offering of approximately $ million after deducting underwriting discounts and commissions and other estimated offering expenses payable by us, assuming an initial public offering price of $ per IDS, which represents the mid-point of the range set forth on the cover page of this prospectus and an initial public offering price of % of the stated principal amount for each note sold separately (not represented by IDSs). We will use these net proceeds, together with $ million of borrowings under our new credit facility and cash on hand as follows:

| | Ÿ | | $ million to repay all outstanding debt, including all outstanding borrowings under our existing senior and mezzanine credit facilities; |

| | Ÿ | | $ million to pay transaction bonuses and make other payments to our senior management; and |

| | Ÿ | | $ million to make a distribution to Xerium S.A. in exchange for a portion of its equity interests in us, which Xerium S.A. will use to repay all outstanding debt to its shareholders and to make a distribution to its shareholders. |

If the underwriters exercise their over-allotment option in full, we will use all of the net proceeds we receive from the sale of additional IDSs under the over-allotment option ($ million) to make an additional distribution to our existing equity investors.

5

Our Organizational Structure After this Offering

The following diagram reflects our organizational structure immediately after the offering, including percentage of voting power (without giving effect to the underwriters’ over-allotment option to purchase additional IDSs):

| (1) | Includes Class A common stock represented by IDSs and Class B common stock. |

| (2) | The following direct and indirect subsidiaries of Xerium Technologies, Inc. will guarantee the new credit facility and notes: Huyck Argentina Sociedad Anonima, Huyck Australia Pty. Limited, Weavexx Corporation, Stowe-Woodward Mount Hope Inc., Huyck Japan Limited, Stowe Woodward Mexico SA de CV, Huyck (UK) Limited, Huyck Limited, Stowe-Woodward (UK) Limited, Stowe-Woodward Limited, Xerium I (US) Limited, Xerium III (US) Limited, Weavexx Corporation, Xerium Inc., Huyck Licensco Inc., Huyck Europe Inc., Xerium IV (US) Limited, Stowe Woodward Licensco LLC, Stowe Woodward LLC and Xerium V (US) Limited. |

Our Corporate Information

Our principal executive office is located at One Technology Drive, Westborough Technology Park, Westborough, Massachusetts 01581 and our telephone number is (508) 616-9468.

We were organized in 1999 in connection with the acquisition, sponsored by Apax, of the paper technology group of Invensys plc.

6

The Offering

Summary of the IDSs and the Notes

We are offering IDSs at an initial public offering price of $ per IDS (comprised of $ allocated to each note and $ allocated to each share of Class A common stock), which represents the midpoint of the range set forth on the cover page of this prospectus, and $ million aggregate principal amount of notes sold separately (not represented by IDSs) at an initial public offering price of % of the stated principal amount for each note.

As described below, assuming we make our scheduled interest payments and pay dividends in the amount contemplated by the dividend policy we expect to be adopted by our board of directors, holders of IDSs will receive in the aggregate approximately $ per year in dividends and interest on the Class A common stock and notes represented by each IDS, and holders of our separate notes will receive $ per year in interest per note.

What are IDSs?

IDSs are securities comprised of our Class A common stock and notes.

Each IDS initially represents:

| | Ÿ | | one share of our Class A common stock; and |

| | Ÿ | | a % note with $ principal amount. |

The ratio of Class A common stock to principal amount of notes represented by an IDS is subject to change in the event of a stock split, recombination or reclassification of our Class A common stock. For example, if we effect a two-for-one stock split of our Class A common stock, from and after the effective date of the stock split, each IDS will represent two shares of Class A common stock and the same principal amount of notes as it previously represented. Likewise, if we effect a recombination or reclassification of our Class A common stock, each IDS will thereafter represent the appropriate number of shares of Class A common stock on a recombined or reclassified basis, as applicable, and the same principal amount of notes as it previously represented.

What payments can I expect to receive as a holder of IDSs?

Assuming we make our scheduled interest payments on the notes, and pay dividends in the amount contemplated by our current dividend policy, you will receive in the aggregate approximately $ per year in interest on the notes and dividends on the Class A common stock represented by each IDS. We expect to make interest and dividend payments on the day of each , , and to holders of record on the day of each , , and , or the immediately preceding business day of such month if the day is not a business day.

You will be entitled to receive quarterly interest payments at an annual rate of % of the aggregate principal amount of notes represented by your IDSs or approximately $ per IDS per year, subject to our right, under specified circumstances, to defer interest payments on the notes so long as we are not in default in the payment of interest, principal or premium, if any, on such notes and no other default has occurred as a result of which such notes have been accelerated.

7

You will also receive quarterly dividends on the shares of our Class A common stock represented by your IDSs, if and to the extent dividends are declared by our board of directors and are permitted by applicable law and the terms of the new credit facility, the indenture governing our notes and any other then-outstanding indebtedness of ours. Specifically, the indenture governing our notes restricts our ability to declare and pay dividends on our Class A common stock under certain circumstances as described under “Dividend Policy and Restrictions.” In addition, the new credit facility restricts our ability to declare and pay dividends on our Class A common stock under certain circumstances as described under “Dividend Policy and Restrictions” and“Description of Certain Indebtedness—Covenants.”Upon the closing of this offering, our board of directors is expected to adopt a dividend policy which contemplates that, subject to applicable law and the terms of our then existing indebtedness, initial annual dividends will be $ per share of our Class A common stock. However, our board of directors may, in its discretion, modify or repeal this dividend policy. We cannot assure you that we will pay dividends at this level in the future or at all.

Will my rights as a holder of IDSs be any different than the rights of a beneficial owner of separately held Class A common stock and notes?

No. As a holder of IDSs you are the beneficial owner of the Class A common stock and notes represented by your IDSs. As such, you will have exactly the same rights, privileges and preferences, including voting rights, rights to receive distributions, rights and preferences in the event of a default under the indenture governing our notes, ranking upon bankruptcy and rights to receive communications and notices as a direct holder of separately held Class A common stock and notes, as applicable, would have.

Will the notes represented by IDSs be the same as the notes sold separately (not represented by IDSs)?

Yes. The notes sold separately (not represented by IDSs) will be identical in all respects to the notes represented by IDSs and will be part of the same series of notes and issued under the same indenture. Accordingly, holders of notes sold separately and holders of notes represented by IDSs will vote together as a single class, in proportion to the aggregate principal amount of notes they hold, on all matters on which they are eligible to vote under the indenture.

Will the IDSs be listed on an exchange?

We will apply to list the IDSs for trading on the under the trading symbol “ ”.

Will the shares of our Class A common stock and notes be separately listed on an exchange?

Our shares of Class A common stock will not be listed for separate trading on the or any other quotation system or exchange until a sufficient number of shares is held separately and not in the form of IDSs to satisfy applicable requirements for separate trading on such quotation system or exchange. If more than such number of our outstanding shares of Class A common stock is no longer held in the form of IDSs for a period of 30 consecutive trading days, we will apply to list the shares of our Class A common stock for separate trading on the or such other quotation system or exchange. The notes will not be listed on any quotation system or exchange. The shares of our Class A common stock and notes will be freely tradable without restriction or further registration under the Securities Act of 1933, as amended, which we refer to as the “Securities Act,” unless they are purchased by “affiliates” as that term is defined in Rule 144 under the Securities Act.

In what form will IDSs and the shares of our Class A common stock and the notes represented by the IDSs be issued?

The IDSs and the shares of our Class A common stock and the notes represented by the IDSs will be issued in book-entry form only. This means that you will not be a registered holder of IDSs or the securities represented by

8

the IDSs, and you will not receive a certificate for your IDSs or the securities represented by your IDSs. You must rely on your broker or other financial institution that will maintain your book-entry position to receive the benefits and exercise the rights of a holder of IDSs.

How can I separate my IDSs into shares of Class A common stock and notes or recombine shares of Class A common stock and notes to form IDSs?

Holders of IDSs, whether purchased in this offering or in a subsequent offering of IDSs of the same series may, at any time after the earlier of 45 days from the date of the closing of this offering or the occurrence of a change of control, through their broker or other financial institution, separate the IDSs into the shares of our Class A common stock and notes represented thereby. Any holder of shares of our Class A common stock and notes may, at any time, through his or her broker or other financial institution, combine the applicable number of shares of Class A common stock and notes to form IDSs unless the IDSs have previously been automatically separated as a result of the redemption or maturity of any notes or otherwise. Separation and recombination of IDSs may involve transaction fees charged by your broker and/or financial intermediary. See “Description of IDSs—Book-Entry Settlement and Clearance—Separation and Recombination.”

Will my IDSs automatically separate into shares of Class A common stock and notes upon the occurrence of certain events?

Yes. Separation of all of the IDSs will occur automatically upon the continuance of a payment default on the notes for 90 days or the occurrence of any redemption, whether in whole or in part, of the notes, or upon the maturity of the notes.

What will happen if we issue additional IDSs or notes of the same series in the future?

We may conduct future financings by selling additional IDSs of the same series. Additional IDSs will have terms that are identical to those of the IDSs being sold in this offering, except that if they are issued 45 days or more from the closing of this offering, they will be immediately separable, and if they are issued less than 45 days from the closing of this offering, they will be separable on the same date as the IDSs issued hereunder may separate. Additional IDSs will represent the same proportions of Class A common stock and notes as are represented by the then outstanding IDSs. In addition, we will be required to issue additional IDSs in the future upon exchange of our Class B common stock. Also, we may conduct future financings by selling additional notes of the same series (whether or not represented by IDSs). Although the notes that may be issued in the future (whether or not represented by IDSs) will have terms that are substantially identical (except for the issuance date) to the notes being sold in this offering and will be part of the same series of notes for all purposes under the indenture, it is possible that the new notes will be sold with original issue discount (referred to as OID) for U.S. federal income tax purposes. If such notes are issued with OID, all holders of IDSs of the same series (including the IDSs being offered hereby) and of outstanding notes (including the notes being offered hereby) not then represented by IDSs will automatically exchange a ratable portion of their outstanding notes for a portion of the new notes, whether held directly or represented by IDSs, and will thereafter hold a unit consisting of new notes and old notes with a new CUSIP number or a new IDS (consisting of such note unit and Class A common stock) with a new CUSIP number. As a result of such exchanges, we intend to allocate and report the OID associated with the sale of the new notes among all holders of notes on a pro rata basis, which may adversely affect your tax treatment. See below under “What will be the U.S. federal income tax considerations in connection with a subsequent issuance of notes?” In addition, if such notes are issued with OID, holders of such notes may not be able to recover the portion of their principal amount treated as unaccrued OID in the event of an acceleration of the notes or a bankruptcy by us prior to the maturity of the notes. See “Risk Factors—Subsequent issuances of notes pursuant to an offering by us or exchange of Class B common stock may cause you to recognize OID” and “Risk Factors—Holders of subsequently issued notes may not be able to collect their full stated principal amount prior to maturity.”

9

What will be the U.S. federal income tax considerations in connection with an investment in the IDSs?

The U.S. federal income tax consequences of the purchase, ownership and disposition of IDSs in this offering are not entirely clear. The purchase of IDSs in this offering should be treated as the purchase of shares of our Class A common stock and notes and, by purchasing IDSs, you agree to such treatment. IDS holders must allocate the purchase price of the IDSs between those shares of Class A common stock and notes in proportion to their respective initial fair market values, which will establish their initial tax basis. The values attributed to the shares of Class A common stock and notes represented by the IDSs are established based on the fair market value of such shares of Class A common stock and notes at the time of issuance. Assuming an initial public offering price of $ per IDS, which represents the mid-point of the range set forth on the cover page of this prospectus, we expect to report the initial fair market value of each share of Class A common stock as $ and the initial fair market value of each $ aggregate principal amount of notes as $ , and by purchasing IDSs, you agree to such allocation.

The notes should be treated as debt for U.S. federal income tax purposes. If the notes were treated as equity rather than debt for U.S. federal income tax purposes, then the stated interest on the notes could be treated as a dividend, and interest on the notes would not be deductible by us for U.S. federal income tax purposes, which could materially increase our taxable income and significantly reduce our future cash flow. In addition, payments on the notes to foreign holders would be subject to U.S. federal withholding taxes at rates of up to 30%. Payments to foreign holders would not be grossed-up on account of any such taxes.

Dividends paid by us, to the extent paid out of our tax “earnings and profits,” will generally be taxable for U.S. federal income tax purposes to holders of IDSs at long-term capital gains rates under recently-enacted legislation, which is scheduled to sunset in 2008. Interest income on the notes will generally be taxable to holders of IDSs at ordinary income rates. See “Material U.S. Federal Income Tax Considerations.”

What will be the U.S. federal income tax considerations in connection with a subsequent issuance of notes?

The U.S. federal income tax consequences to you of the subsequent issuance of notes with OID (or any issuance of notes thereafter) upon a subsequent sale of IDSs or notes pursuant to an offering by us or upon exchange of our Class B common stock are not entirely clear. In order to achieve fungibility of all of our IDSs and therefore ensure maximum trading liquidity, the indenture governing our notes and the agreements with the Depository Trust Company, or DTC, will provide that, in the event there is a subsequent issuance of notes with a new CUSIP number having substantially identical terms (other than issuance date) to the notes offered hereby, each holder of IDSs or notes, as the case may be, agrees that a portion of such holder’s notes will be exchanged for a portion of the notes acquired by the holders of such subsequently issued notes. Consequently, immediately following such subsequent issuance and exchange, each holder of subsequently issued notes, held either as part of IDSs or separately, and each holder of existing notes, held either as part of IDSs or separately, will own an inseparable unit composed of notes of each separate issuance in the same proportion as each other holder. The aggregate principal amount of notes owned by each holder will not change as a result of such subsequent issuance and exchange. Because a subsequent issuance will affect the notes in the same manner, regardless of whether these notes are held as part of IDSs or separately, the recombination of notes and shares of Class A common stock to form IDSs, or the separation of IDSs, should not affect your tax treatment.

It is unclear, however, whether the exchange of notes for subsequently issued notes results in a taxable exchange for U.S. federal income tax purposes, and it is possible that the Internal Revenue Service, or IRS, might successfully assert that such an exchange should be treated as a taxable exchange. In such case, a holder would recognize any gain realized on such exchange, but a loss realized might be disallowed. If the exchange of notes is treated as a taxable exchange, then your initial tax basis in the notes deemed to have been received in the exchange would be the fair market value of such notes on the date of the deemed exchange (adjusted to reflect

10

any disallowed loss), and your holding period for such notes would begin on the day after the deemed exchange. Regardless of whether the exchange is treated as a taxable event, the exchange could result in holders having to include OID in taxable income prior to the receipt of cash and other potentially adverse U.S. federal income tax consequences.

Following any subsequent issuance of notes with OID (or any issuance of notes thereafter) and resulting exchange, we (and our agents) will report any OID on the subsequently issued notes ratably among all holders of IDSs and separately held notes, and each holder of IDSs and separately held notes will, by purchasing IDSs or notes, agree to report OID in a manner consistent with this approach. However, we cannot assure you that the IRS will not assert that any OID should be reported only to the persons that initially acquired such subsequently issued notes (and their transferees) and thus may challenge a holder’s reporting of OID on its tax returns. Such a challenge could create significant uncertainties in the pricing of IDSs and notes and could adversely affect the market for IDSs and notes.

Because there is no statutory, judicial or administrative authority directly addressing the tax treatment of the IDSs or instruments similar to the IDSs, we urge you to consult your own tax advisor concerning the tax consequences of an investment in the IDSs. For additional information, see “Material U.S. Federal Income Tax Consequences.”

11

Summary of the Common Stock

Issuer | Xerium Technologies, Inc. |

Shares of Class A common stock represented by IDSs being offered hereby | shares of Class A common stock, or shares if the underwriters’ over-allotment option is exercised in full. |

Shares of Class A common stock and Class B common stock outstanding following this offering | shares of Class A common stock (or shares if the underwriters’ over-allotment option is exercised in full), which includes shares represented by IDSs issued to certain of our existing equity investors upon consummation of this offering. |

| | shares of Class B common stock that will be exchangeable for IDSs after the second anniversary of the closing of this offering at an exchange rate of one IDS for each shares of Class B common stock. If all such shares of Class B common stock were exchanged for IDSs, the holders of Class B common stock would receive an aggregate of IDSs. |

| | Our Class A common stock and Class B common stock are identical in all respects and are entitled to the same rights, preferences and privileges, and vote together as a single class on all matters upon which the common stock is entitled to vote, except as to dividend policies as described under “Dividend Policies and Restrictions.” Furthermore, our by-laws provide that we may only issue additional Class A common stock and IDSs pursuant to a registration statement that has been declared effective by the Securities and Exchange Commission, which we refer to as the “SEC.” In addition, our Class B common stock may not be combined with notes to form IDSs. |

Voting rights | Each outstanding share of our common stock will carry one vote per share and all classes of common stock will vote as a single class on all matters presented to the stockholders for a vote. |

Dividends | We will pay quarterly dividends on the shares of our Class A common stock represented by IDSs and on the shares of our Class B common stock if and to the extent dividends are declared by our board of directors and permitted by applicable law and the terms of our then-outstanding indebtedness. Upon the closing of this offering, our board of directors is expected to adopt a dividend policy which contemplates that, subject to applicable law and the terms of our then existing indebtedness, initial annual dividends will be $ per share of our Class A common stock and $ per share of our Class B common stock. However, our board of directors may, in its discretion, modify or repeal this dividend policy. We cannot assure that we will pay dividends at this level in the future or at all. |

12

| | We expect the initial dividend policy on the Class B common stock to result in an overall dividend yield on the Class B common stock equivalent to the initial yield on the IDSs into which the Class B common stock can eventually be exchanged. |

| | Our certificate of incorporation provides that as of 2006, which is the date two years following the closing of this offering, the per share dividend rate on the Class B common stock will thereafter not exceed the per share dividend rate of the Class A common stock under our dividend policy. |

Dividend payment dates | If declared, dividends will be paid quarterly on the day of each , , and to holders of record on the day or the immediately preceding business day of such month if the day is not a business day. |

Listing | Our shares of Class A common stock will not be listed for separate trading on the or any other quotation system or exchange until a sufficient number of shares is held separately and not in the form of IDSs to satisfy applicable requirements for separate trading on such quotation system or exchange. If more than such number of our outstanding shares of Class A common stock is no longer held in the form of IDSs for a period of 30 consecutive trading days, we will apply to list the shares of our common stock for separate trading on the or such other quotation system or exchange. Our Class A common stock will be freely tradable without restriction or further registration under the Securities Act, unless purchased by “affiliates” as that term is defined in Rule 144 under the Securities Act. |

13

Summary of the Notes

Issuer | Xerium Technologies, Inc. |

Notes to be outstanding following the offering | $ million aggregate principal amount of % notes, which includes $ million aggregate principal amount of notes included in IDSs and $ million aggregate principal amount of notes sold separately (not represented by IDSs) (or $ million aggregate principal amount if the underwriters’ over-allotment option is exercised in full). Each offered note will have a principal amount of $ . |

| | Assuming the exchange of all of our outstanding Class B Common Stock for IDSs, $ million aggregate principal amount of notes will be outstanding |

Interest rate | % per year. |

Interest payment dates | Interest will be paid quarterly in arrears on the day of each , , , and commencing , 2004 to holders of record on the day of such month, or the business day immediately following the day if such day is not a business day. |

Interest deferral | Prior to , 2009, we may, under specified circumstances, defer interest payments on the notes on one or more occasions for up to an aggregate period of eight quarters. In addition, after , 2009 but before , 2014, we may, under specified circumstances, defer interest payments on the notes on up to two occasions for up to three quarters per occasion. |

| | After the end of any deferral period occurring before , 2009 we will repay deferred interest (together with accrued interest thereon) in equal installments through , 2009. We will repay all interest deferred after , 2009 and prior to , 2014 on or before , 2014, provided that we must pay all deferred interest and accrued interest on deferred interest in full prior to deferring interest for a second occasion or paying any dividends on our shares of common stock. |

| | During any interest deferral period and so long as any deferred interest or interest on deferred interest remains outstanding, we will not be permitted to make any payment of dividends on any class of our common stock. |

| | For a detailed description of interest deferral provisions of the indenture governing our notes, see “Description of Notes—Interest Deferral.” |

14

| | In the event that interest payments on the notes are deferred, you would be required to include accrued interest in your income for U.S. federal income tax purposes even if you do not receive any cash interest payments. |

Maturity date | The notes will mature on , 2014. We may extend the maturity of the notes for two additional successive five-year terms if ourratio of net debt to Adjusted EBITDA for the twelve-month period ended on the last day of the fiscal quarter ending at least 45 days before the end of the then-current term is less than to one, and so long as no event of default has occurred under the indenture or any of our other outstanding indebtedness in excess of a certain aggregate amount or could occur as a result of the extension and there are no overdue payments in excess of a certain aggregate amount of interest on our notes or any other indebtedness for borrowed money of ours or any of our significant subsidiaries. |

Optional redemption | We intend to have an optional redemption feature in our indenture. |

Change of control | Upon the occurrence of a change of control, as defined under “Description of Notes—Change of Control,” each holder of notes will have the right to require us to repurchase that holder’s notes at a price equal to 101% of the principal amount of the notes being repurchased, plus any accrued but unpaid interest to but not including the repurchase date. In order to exercise that right, a holder must separate its IDSs into the shares of Class A common stock and notes represented thereby and hold the notes separately. |

Guarantees of notes | The notes will be fully guaranteed, on an unsecured basis, by each of our direct and indirect wholly-owned domestic subsidiaries existing on the closing of this offering and certain of our direct and indirect wholly-owned foreign subsidiaries existing on the closing of this offering, and all our future wholly-owned restricted subsidiaries (other than certain foreign subsidiaries that will not guarantee the notes) that incur indebtedness or issue shares of preferred stock or certain capital stock that is redeemable at the option of the holder. |

Procedures relating to subsequent issuances | The indenture governing our notes will provide that in the event we issue additional notes with a new CUSIP number (which will occur in connection with an issuance of notes with OID and any issuance of notes thereafter) having terms that are otherwise substantially identical (except for the issuance date) to the notes offered hereby, each holder of IDSs or notes, as the case may be, agrees that a portion of such holder’s notes, whether held directly in book-entry form or held as part of IDSs, will be automatically exchanged for a portion of the notes acquired by the holders of such subsequently issued notes, and the records of any record holders of notes will be revised to reflect such exchanges. Consequently, following each such subsequent issuance and automatic exchange, each holder of notes held either as part of IDSs or separately, as the case may be, will own |

15

| | an indivisible unit composed of notes of each separate issuance in the same proportion as each other holder. However, the aggregate principal amount of notes owned by each holder will not change as a result of such subsequent issuance and exchange. The indenture governing the notes will permit issuances of additional notes upon the exchange of Class B common stock into IDSs and, subject to compliance with restrictive covenants contained in the indenture, for other permitted purposes. However, we may not issue additional notes if and for so long as an event of default with respect to the notes has occurred and is continuing. Any subsequent issuance of notes by us may adversely affect the tax treatment of the IDSs and notes. See “Material U.S. Federal Income Tax Consequences—Consequences to U.S. Holders—Notes—Additional Issuances.” |

Ranking of notes and guarantees | The notes will be unsecured and subordinated obligations, junior in right of payment to all of our existing and future senior indebtedness and effectively subordinated in right of payment to any future secured indebtedness. The notes will rank pari passu with all of our other indebtedness, including trade payables, except as discussed in “Risk Factors - Your right to receive payments on the notes and the note guarantees is junior to all of our senior debt and the senior debt of our subsidiaries,” “Risk Factors - In the event of bankruptcy or insolvency, the notes could be equitably subordinated or recharacterized as equity” and “Description of Notes - Ranking.” The guarantees will be unsecured and will be subordinated obligations, junior in right of payment to all existing and future senior indebtedness of our subsidiary guarantors, including all guarantees of our subsidiary guarantors under the new credit facility, and effectively subordinated in right of payment to any future secured indebtedness of our subsidiary guarantors. The guarantees will rank pari passu with all other indebtedness of the subsidiary guarantors, including trade payables, except as discussed in “Risk Factors - Your right to receive payments on the notes and the note guarantees is junior to all of our senior debt and the senior debt of our subsidiaries,” “Risk Factors - In the event of bankruptcy or insolvency, the notes could be equitably subordinated or recharacterized as equity” and “Description of Notes - Ranking.” The notes will be structurally subordinated to all indebtedness of any of our subsidiaries which are not guarantors of the notes. We are a holding company and derive all of our operating income and cash flows from our subsidiaries. |

| | The indenture governing the notes will permit us and the subsidiary guarantors to incur additional indebtedness, including senior indebtedness, subject to specified limitations. On a pro forma basis after giving to the transactions contemplated by this prospectus we would have had $ million aggregate principal amount of senior secured indebtedness outstanding. |

16

Restrictive covenants | The indenture governing the notes will contain covenants with respect to us and our restricted subsidiaries that will restrict: |

| | Ÿ | | the incurrence of additional indebtedness and the issuance of preferred stock and certain redeemable capital stock; |

| | Ÿ | | a number of other restricted payments, including investments and acquisitions; |

| | Ÿ | | specified sales of assets; |

| | Ÿ | | specified transactions with affiliates; |

| | Ÿ | | the creation of liens on our assets; and |

| | Ÿ | | consolidations, mergers and transfers of all or substantially all of our assets. |

| | The indenture will also prohibit certain distributions from our restricted subsidiaries. However, there will be no restriction in the indenture governing our notes on our ability to incur indebtedness in connection with the issuance of additional IDSs so long as the ratio of the aggregate principal amount of the additional notes to the number of the additional shares of Class A common stock will not exceed the equivalent ratio represented by the then-existing IDSs. In addition, all the limitations and prohibitions described above are subject to a number of other important qualifications and exceptions described under “Description of Notes—Certain Covenants.” |

Listing | We do not anticipate that our notes will be separately listed on any exchange. |

17

Risk Factors

You should carefully consider the information under the heading “Risk Factors” and all other information in this prospectus before investing in the notes or IDSs.

General Information About This Prospectus

Throughout this prospectus, unless otherwise noted, we have assumed no exercise of the underwriters’ over-allotment option.

Unless the context otherwise requires, references in this prospectus to the “notes” refer collectively to the % senior subordinated notes due 2014 represented by IDSs and the % senior subordinated notes due 2014 sold separately, references to the “offering” refer collectively to the offering of IDSs to the public and IDSs to certain of our existing equity investors, in each case, including the shares of Class A common stock and notes represented thereby, and the offering of $ million aggregate principal amount of notes to the public separately (not represented by IDSs). References to the “common stock” refers collectively to our Class A common stock, Class B common stock and Class C common stock.

In this prospectus, unless otherwise indicated, all references to dollars are to US Dollars, and all references to GAAP are to U.S. generally accepted accounting principles.

Prior to the offering, Xerium Technologies, Inc. is an indirect, wholly-owned subsidiary of Xerium S.A. In connection with the offering, we will undergo a reorganization and, after the offering, we will, directly or indirectly, hold all of the equity interests of all of the current operating subsidiaries and related holding companies of our corporate group, excluding the current parent, Xerium S.A. (and its two immediate subsidiaries). Xerium Technologies, Inc. will be the issuer of the IDSs and notes.

18

Summary Consolidated Financial Data

The following summary consolidated financial data is derived from our audited consolidated financial statements for each of the fiscal years ended December 31, 2001, December 31, 2002, and December 31, 2003. The financial statements for fiscal 2001, 2002 and 2003 are included elsewhere in this prospectus. The information in the following table should be read together with our audited consolidated financial statements for fiscal 2001, 2002 and 2003 and the related notes, “Selected Consolidated Financial Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” included elsewhere in this prospectus. The figures in the table below reflect rounding adjustments.

| | | | | | | | | | | | |

| | | Year ended December 31,

| |

| | | 2001

| | | 2002

| | | 2003

| |

| | | (in thousands) | |

| | | |

Statement of operations data: | | | | | | | | | | | | |

Net sales | | $ | 499,846 | | | $ | 514,945 | | | $ | 560,668 | |

Income from operations | | | 89,264 | | | | 101,667 | | | | 108,994 | |

Net income (loss) | | | (4,419 | ) | | | 470 | | | | 3,036 | |

Statement of cash flows data: | | | | | | | | | | | | |

Net cash provided by operating activities | | $ | 93,635 | | | $ | 124,415 | | | $ | 107,011 | |

Net cash used in investing activities | | | (39,260 | ) | | | (31,903 | ) | | | (39,664 | ) |

Net cash used in financing activities | | | (64,915 | ) | | | (62,233 | ) | | | (82,656 | ) |

Other Financial Data: | | | | | | | | | | | | |

Capital expenditures | | $ | 32,658 | | | $ | 28,295 | | | $ | 44,423 | |

Adjusted EBITDA(1) | | | 152,332 | | | | 173,014 | | | | 180,700 | |

Balance sheet data (at end of year): | | | | | | | | | | | | |

Cash and cash equivalents | | $ | 13,815 | | | $ | 32,834 | | | $ | 22,294 | |

Total assets | | | 888,993 | | | | 925,276 | | | | 986,806 | |

Senior debt | | | 446,993 | | | | 611,960 | | | | 611,670 | |

Total debt | | | 748,907 | | | | 796,201 | | | | 823,617 | |

Stockholders’ deficit | | | (39,160 | ) | | | (71,749 | ) | | | (52,645 | ) |

| (1) | Adjusted EBITDA is calculated below and such calculation is based in part on the calculation of EBITDA. EBITDA represents net income before interest expense, income tax provision (benefit) and depreciation and amortization. EBITDA is not a measure of operating income, operating performance or liquidity under GAAP. We include EBITDA because we understand it is used by some investors to determine a company’s historical ability to service indebtedness and fund ongoing capital expenditures, and because certain covenants in our borrowing agreements are tied to similar measures. Nevertheless, this measure should not be considered in isolation or as a substitute for operating income (as determined in accordance with GAAP) as an indicator of our operating performance, or of net cash provided by operating activities (as determined in accordance with GAAP). |

We consider EBITDA to be a measure of liquidity. In the table below, EBITDA is reconciled to operating cash flows. EBITDA as calculated below differs from Adjusted EBITDA as defined in the indenture governing the notes and our new credit facility. Adjusted EBITDA as defined in the indenture governing the notes and our new credit facility means EBITDA plus (i) expenses related to refinancing, (ii) unrealized foreign exchange (gain) loss on indebtedness, net, (iii) certain transaction-related costs, (iv) stock-based compensation (net of the amount of actual cash paid), (v) expenses and losses associated with debt retirement, (vi) restructuring or impairment expenses (subject to certain limitations specified in the indenture governing the notes and our new credit facility) and (vii) non-recurring costs (subject to certain limitations specified in the indenture governing the notes and our new credit facility). If our Adjusted EBITDA were to decline below certain levels, covenants in our indebtedness that are based on Adjusted EBITDA, including our interest coverage ratio and leverage ratio covenants under our new credit facility, could result in, among other things, a default or mandatory prepayment under our new credit facility, our inability to pay dividends or a requirement that we defer interest payments on the notes. These covenants are summarized under “Description of Certain Indebtedness” and “Description of Notes—Certain Definitions.”

19

The following table contains a reconciliation of EBITDA to operating cash flow and a reconciliation of Adjusted EBITDA to EBITDA:

| | | | | | | | | | | | |

| | | Year ended December 31,

| |

| | | 2001

| | | 2002

| | | 2003

| |

| | | (in thousands) | |

| | | |

Net cash provided by operating activities | | $ | 93,635 | | | $ | 124,415 | | | $ | 107,011 | |

Interest expense, net | | | 69,912 | | | | 60,165 | | | | 63,290 | |

Net change in operating assets and liabilities | | | (20,677 | ) | | | (844 | ) | | | (6,644 | ) |

Income tax provision | | | 21,916 | | | | 13,317 | | | | 33,945 | |

Cumulative effect of change in accounting principle, net of income tax benefit | | | (835 | ) | | | — | | | | — | |

Stock-based compensation | | | — | | | | (2,560 | ) | | | — | |

Deferred financing cost amortization | | | (3,465 | ) | | | (3,146 | ) | | | (1,032 | ) |

Deferred income tax provision | | | 19,401 | | | | 4,027 | | | | (19,427 | ) |

Deferred interest | | | (27,555 | ) | | | (27,312 | ) | | | (11,314 | ) |

Asset impairment | | | — | | | | (8,384 | ) | | | (4,769 | ) |

Unrealized foreign exchange gain (loss) on indebtedness, net | | | 7,804 | | | | (1,989 | ) | | | (11,881 | ) |

Loss on early extinguishment of debt | | | (3,100 | ) | | | (36,158 | ) | | | (673 | ) |

| | |

|

|

| |

|

|

| |

|

|

|

EBITDA | | | 157,036 | | | | 121,531 | | | | 148,506 | |

Expenses related to refinancing | | | 3,100 | | | | 38,437 | | | | 3,166 | |

Unrealized foreign exchange (gain) loss on indebtedness, net | | | (7,804 | ) | | | 1,989 | | | | 11,881 | |

Stock-based compensation | | | — | | | | 2,560 | | | | — | |

Restructuring expenses(a) | | | — | | | | 8,497 | | | | 10,971 | |

Costs expensed—Weavexx(b) | | | — | | | | — | | | | 4,620 | |

—Stowe Woodward North America(b) | | | — | | | | — | | | | 1,556 | |

| | |

|

|

| |

|

|

| |

|

|

|

Adjusted EBITDA | | $ | 152,332 | | | $ | 173,014 | | | $ | 180,700 | |

| | |

|

|

| |

|

|

| |

|

|

|

| | (a) | As part of our long-term strategy to reduce our overall costs and improve our competitiveness, we have incurred restructuring charges to reduce the cost structure of our North American operations. The amounts reported reflect the amounts of these restructuring costs. |

| | (b) | Represents amounts expended in 2003 for employee-related costs connected with Weavexx and Stowe Woodward North America that are non-recurring in nature. |

20

Interest and Dividend Payments to IDS Holders

The tables below reflect the following:

| | Ÿ | | a reconciliation of our net cash provided by operating activities to Adjusted EBITDA for the twelve-month period ended December 31, 2003, as calculated in accordance with the indenture governing our notes and our new credit facility; |

| | Ÿ | | a reconciliation of our Adjusted EBITDA for the twelve-month period ended December 31, 2003 to our estimated remaining available cash as of December 31, 2003, after giving pro forma effect to this offering and the related transactions described elsewhere in this prospectus, in each case, as if such transactions had been completed on January 1, 2003; and |

| | Ÿ | | payments to IDS holders and holders of notes sold separately (not represented by IDSs) for the year ended December 31, 2003, after giving pro forma effect to this offering and the related transactions described elsewhere in this prospectus, in each case, as if such transactions had been completed on January 1, 2003 and based on the assumptions and estimates included in the above calculations. |

| | | | |

| | | Year Ended December 31, 2003

| |

| | | (in thousands) (unaudited) | |

| |

Net cash provided by operating activities | | $ | 107,011 | |

Adjustments: | | | | |

Interest expense, net | | | 63,290 | |

Net change in operating assets and liabilities | | | (6,644 | ) |

Income tax provision | | | 33,945 | |

Deferred financing cost amortization | | | (1,032 | ) |

Deferred income tax provision | | | (19,427 | ) |

Deferred interest | | | (11,314 | ) |

Asset impairment | | | (4,769 | ) |

Unrealized foreign exchange loss on indebtedness, net | | | (11,881 | ) |

Loss of early extinguishment of debt | | | (673 | ) |

| | |

|

|

|

EBITDA | | | 148,506 | |

Expenses related to refinancing | | | 3,166 | |

Unrealized foreign exchange loss on indebtedness, net | | | 11,881 | |

Restructuring expenses(1) | | | 10,971 | |

Costs Expensed—Weavexx(2) | | | 4,620 | |

—Stowe Woodward North America(2) | | | 1,556 | |

| | |

|

|

|

Adjusted EBITDA | | | 180,700 | |

Additions (deductions) to Adjusted EBITDA: | | | | |

Change in management incentive plans(3) | | | | |

Estimated annual public company administrative expenses(4) | | | | |

Income tax expense(5) | | | | |

Interest expense on new credit facility(6) | | | | |

Interest expense on notes(7) | | | | |

| | |

|

|

|

Increase in available cash for capital expenditures, dividends and

general corporate purposes | | | | |

Capital expenditures(8) | | | | |

Dividends on Class A common stock(9) | | | | |

Dividends on Class B common stock(9) | | | | |

| | |

|

|

|

Increase in available cash(10) | | $ | | |

| | |

|

|

|

21

| (1) | As part of our long-term strategy to reduce our overall costs and improve our competitiveness, we have incurred restructuring charges to reduce the cost structure in our North American operations. The amount reported reflects the amount of these restructuring costs incurred for 2003. |

| (2) | Represents amounts expended in 2003 for employee-related costs connected with Weavexx and Stowe Woodward North America that are non-recurring in nature. |

| (3) | Upon consummation of this offering, our existing management incentive compensation plan will be terminated and new management incentive plans will be adopted. The amount reported represents the reduction in compensation expense that would have occurred in 2003 if the new management incentive plans had been put into effect on January 1, 2003. |

| (4) | Consists of costs primarily attributable to additional internal audit, accounting and legal staff, additional fees for outside audit and legal services, an increase in premiums for directors’ and officers’ liability insurance and increased levels of compensation for our non-management directors. |

| (5) | Consists of federal, state and foreign income taxes resulting from our capitalization after this offering. |

| (6) | Assumes interest at current rates, estimated as % average interest on $ million outstanding borrowings under the new term loan facility, % interest on an estimated average balance of $ million under the new credit facility’s revolving loan facility and a % commitment fee on the average unused balance of $ million under the new credit facility’s revolving loan facility. |

| (7) | Represents % interest on $ million of notes represented by the IDSs and the $ million of % notes sold separately (not represented by of IDSs). |

| (8) | See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Capital Expenditures.” |

| (9) | Dividends will be paid on the Class A common stock and the Class B common stock in accordance with our dividend policy and restrictions described under “Dividend Policy and Restrictions.” |

| (10) | Remaining cash will be used for general corporate purposes. |

Based on the foregoing, aggregate payments to IDS holders and holders of notes sold separately (not represented by IDSs) for the year ended December 31, 2003 would have been as follows:

| | | | | | | | | |

| | | Aggregate

| | Per IDS

| | Per Note

|

| | | (in thousands) | | | | |

| | | |

Interest on notes | | $ | | | $ | | | $ | |

Dividends on shares of class A stock represented by IDSs | | | | | | | | | — |

| | |

|

| |

|

| |

|

|

Total | | $ | | | $ | | | $ | |

| | |

|

| |

|

| |

|

|

22

Risk Factors

An investment in the IDSs or our notes involves a number of risks. In addition to the other information contained in this prospectus, prospective investors should give careful consideration to the following factors.

Risks Relating to our Capital Structure