UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-21563

Eaton Vance Short Duration Diversified Income Fund

(Exact Name of Registrant as Specified in Charter)

Two International Place, Boston, Massachusetts 02110

(Address of Principal Executive Offices)

Deidre E. Walsh

Two International Place, Boston, Massachusetts 02110

(Name and Address of Agent for Services)

(617) 482-8260

(Registrant’s Telephone Number)

October 31

Date of Fiscal Year End

October 31, 2023

Date of Reporting Period

Item 1. Reports to Stockholders

| % Average Annual Total Returns1,2 | Inception Date | One Year | Five Years | Ten Years |

| Fund at NAV | 02/28/2005 | 10.20% | 1.62% | 3.06% |

| Fund at Market Price | — | 2.86 | 3.59 | 3.58 |

| Bloomberg U.S. Aggregate Bond Index | — | 0.36% | (0.06)% | 0.88% |

| Blended Index | — | 7.08 | 1.48 | — |

| % Premium/Discount to NAV3 | |

| As of period end | (5.24)% |

| Distributions 4 | |

| Total Distributions per share for the period | $0.978 |

| Distribution Rate at NAV | 8.62% |

| Distribution Rate at Market Price | 9.09 |

| % Total Leverage5 | |

| Borrowings | 12.30% |

| Derivatives | 19.72 |

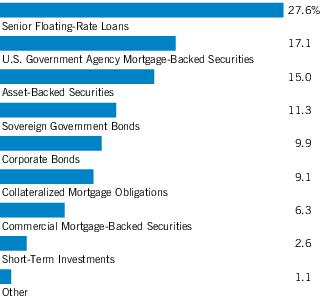

| Asset Allocation (% of total investments)1 |

| 1 | Including the Fund’s use of leverage, Asset Allocation as a percentage of the Fund’s net assets amounted to 128.7%. |

| † | The views expressed in this report are those of the portfolio manager(s) and are current only through the date stated at the top of this page. These views are subject to change at any time based upon market or other conditions, and Eaton Vance and the Fund(s) disclaim any responsibility to update such views. These views may not be relied upon as investment advice and, because investment decisions are based on many factors, may not be relied upon as an indication of trading intent on behalf of any Eaton Vance fund. This commentary may contain statements that are not historical facts, referred to as “forward-looking statements.” The Fund’s actual future results may differ significantly from those stated in any forward-looking statement, depending on factors such as changes in securities or financial markets or general economic conditions, the volume of sales and purchases of Fund shares, the continuation of investment advisory, administrative and service contracts, and other risks discussed from time to time in the Fund’s filings with the Securities and Exchange Commission. |

| ‡ | The information contained herein is provided for informational purposes only and does not constitute a solicitation of an offer to buy or sell Fund shares. Common shares of the Fund are available for purchase and sale only at current market prices in secondary market trading. |

| 1 | Bloomberg U.S. Aggregate Bond Index is an unmanaged index of domestic investment-grade bonds, including corporate, government and mortgage-backed securities. Morningstar® LSTA® US Leveraged Loan IndexSM is an unmanaged index of the institutional leveraged loan market. Morningstar® LSTA® Leveraged Loan indices are a product of Morningstar, Inc. (“Morningstar”) and have been licensed for use. Morningstar® is a registered trademark of Morningstar licensed for certain use. Loan Syndications and Trading Association® and LSTA® are trademarks of the LSTA licensed for certain use by Morningstar, and further sublicensed by Morningstar for certain use. Neither Morningstar nor LSTA guarantees the accuracy and/or completeness of the Morningstar® LSTA® US Leveraged Loan IndexSM or any data included therein, and shall have no liability for any errors, omissions, or interruptions therein. ICE BofA U.S. Mortgage-Backed Securities Index is an unmanaged index of fixed rate residential mortgage pass-through securities issued by U.S. agencies. ICE® BofA® indices are not for redistribution or other uses; provided “as is”, without warranties, and with no liability. Eaton Vance has prepared this report and ICE Data Indices, LLC does not endorse it, or guarantee, review, or endorse Eaton Vance’s products. BofA® is a licensed registered trademark of Bank of America Corporation in the United States and other countries. The J.P. Morgan Emerging Market Bond Index (EMBI) Global Diversified Spread Index is the spread component of the J.P. Morgan EMBI Global Diversified. J.P. Morgan EMBI Global Diversified is a market-cap weighted index that measures USD-denominated Brady Bonds, Eurobonds, and traded loans issued by sovereign entities. The J.P. Morgan EMBI Global Diversified Spread Index commenced on July 27, 2016; accordingly the Ten Years return is not available. Information has been obtained from sources believed to be reliable but J.P. Morgan does not warrant its completeness or accuracy. The Index is used with permission. The Index may not be copied, used, or distributed without J.P. Morgan’s prior written approval. Copyright 2021, J.P. Morgan Chase & Co. All rights reserved. The Blended Index consists of 33.33% Morningstar® LSTA® |

| US Leveraged Loan IndexSM, 33.33% ICE BofA U.S. Mortgage-Backed Securities Index and 33.34% J.P. Morgan EMBI Global Diversified Spread Index, rebalanced monthly. Unless otherwise stated, index returns do not reflect the effect of any applicable sales charges, commissions, expenses, taxes or leverage, as applicable. It is not possible to invest directly in an index. | |

| 2 | Performance results reflect the effects of leverage. Absent an expense waiver by the investment adviser, if applicable, the returns would be lower. |

| 3 | The shares of the Fund often trade at a discount or premium to their net asset value. The discount or premium may vary over time and may be higher or lower than what is quoted in this report. For up-to-date premium/discount information, please refer to https://funds.eatonvance.com/closed-end-fund-prices.php. |

| 4 | The Distribution Rate is based on the Fund’s last regular distribution per share in the period (annualized) divided by the Fund’s NAV or market price at the end of the period. The Fund’s distributions may be comprised of amounts characterized for federal income tax purposes as qualified and non-qualified ordinary dividends, capital gains and nondividend distributions, also known as return of capital. For additional information about nondividend distributions, please refer to Eaton Vance Closed-End Fund Distribution Notices (19a) posted on our website, eatonvance.com. The Fund will determine the federal income tax character of distributions paid to a shareholder after the end of the calendar year. This is reported on the IRS form 1099-DIV and provided to the shareholder shortly after each year-end. For information about the tax character of distributions made in prior calendar years, please refer to Performance-Tax Character of Distributions on the Fund’s webpage available at eatonvance.com. The Fund’s distributions are determined by the investment adviser. Fund distributions may be affected by numerous factors including changes in Fund performance, the cost of financing for leverage, portfolio holdings, realized and projected returns, and other factors. As portfolio and market conditions change, the rate of distributions paid by the Fund could change. |

| 5 | The Fund employs leverage through derivatives and borrowings. Total leverage is shown as a percentage of the Fund’s aggregate net assets plus the absolute notional value of long and short derivatives and borrowings outstanding. Use of leverage creates an opportunity for income, but creates risks including greater price volatility. The cost of borrowings rises and falls with changes in short-term interest rates. The Fund may be required to maintain prescribed asset coverage for its leverage and may be required to reduce its leverage at an inopportune time. |

| Fund profile subject to change due to active management. |

| Additional Information | |

| Bloomberg U.S. Treasury Index measures the performance of U.S. Treasuries with a maturity of one year or more. Bloomberg U.S. Corporate Bond Index measures the performance of investment-grade U.S. corporate securities with a maturity of one year or more. Bloomberg U.S. Corporate High Yield Index measures USD-denominated, non-investment grade corporate securities. Bloomberg U.S. Mortgage-Backed Securities Index measures agency mortgage-backed pass-through securities issued by Ginnie Mae (GNMA), Fannie Mae (FNMA), and Freddie Mac (FHLMC). Bloomberg U.S. Asset-Backed Securities Index tracks the performance of U.S. dollar denominated investment grade, fixed rate asset-backed securities publicly issued in the U.S. domestic market. | |

| Duration is a measure of the expected change in price of a bond — in percentage terms — given a one percent change in interest rates, all else being constant. Securities with lower durations tend to be less sensitive to interest rate changes. |

| Asset-Backed Securities — 19.3% |

| Security | Principal Amount (000's omitted) | Value | |

| AMMC CLO 15, Ltd., Series 2014-15A, Class ERR, 12.566%, (3 mo. SOFR + 7.172%), 1/15/32(1)(2) | $ | 2,000 | $ 1,757,694 |

| AMMC CLO XII, Ltd., Series 2013-12A, Class ER, 11.807%, (3 mo. SOFR + 6.442%), 11/10/30(1)(2) | 1,000 | 853,784 | |

| Ares XXXIIR CLO, Ltd., Series 2014-32RA, Class D, 11.476%, (3 mo. SOFR + 6.111%), 5/15/30(1)(2) | 1,000 | 856,831 | |

| Carlyle Global Market Strategies CLO, Ltd.: | |||

| Series 2012-3A, Class DR2, 12.156%, (3 mo. SOFR + 6.761%), 1/14/32(1)(2) | 2,000 | 1,668,694 | |

| Series 2014-4RA, Class D, 11.306%, (3 mo. SOFR + 5.912%), 7/15/30(1)(2) | 1,000 | 804,328 | |

| Series 2015-5A, Class DR, 12.377%, (3 mo. SOFR + 6.961%), 1/20/32(1)(2) | 1,000 | 817,725 | |

| Carlyle US CLO, Ltd., Series 2022-6A, Class DR, 10.13%, (3 mo. SOFR + 4.75%), 10/25/36(1)(2) | 1,000 | 1,003,401 | |

| Galaxy XV CLO, Ltd., Series 2013-15A, Class ER, 12.301%, (3 mo. SOFR + 6.906%), 10/15/30(1)(2) | 1,440 | 1,293,682 | |

| Galaxy XXI CLO, Ltd., Series 2015-21A, Class ER, 10.927%, (3 mo. SOFR + 5.511%), 4/20/31(1)(2) | 1,000 | 902,158 | |

| Galaxy XXV CLO, Ltd., Series 2018-25A, Class E, 11.59%, (3 mo. SOFR + 6.211%), 10/25/31(1)(2) | 1,250 | 1,106,564 | |

| Golub Capital Partners CLO 22B, Ltd., Series 2015-22A, Class ER, 11.677%, (3 mo. SOFR + 6.262%), 1/20/31(1)(2) | 2,000 | 1,872,446 | |

| Golub Capital Partners CLO 23M, Ltd., Series 2015-23A, Class ER, 11.427%, (3 mo. SOFR + 6.011%), 1/20/31(1)(2) | 2,000 | 1,853,692 | |

| Madison Park Funding XXV, Ltd., Series 2017-25A, Class D, 11.74%, (3 mo. SOFR + 6.362%), 4/25/29(1)(2) | 3,000 | 2,798,727 | |

| Neuberger Berman CLO XVIII, Ltd., Series 2014-18A, Class DR2, 11.594%, (3 mo. SOFR + 6.182%), 10/21/30(1)(2) | 3,000 | 2,786,799 | |

| NRZ Excess Spread-Collateralized Notes, Series 2021-GNT1, Class A, 3.474%, 11/25/26(1) | 637 | 574,273 | |

| Octagon 68, Ltd., Series 2023-1A, Class D, 10/20/36(1)(3) | 1,000 | 1,000,000 | |

| Palmer Square CLO, Ltd., Series 2013-2A, Class DRR, 11.514%, (3 mo. SOFR + 6.111%), 10/17/31(1)(2) | 2,000 | 1,873,650 | |

| Regatta IX Funding, Ltd., Series 2017-1A, Class E, 11.664%, (3 mo. SOFR + 6.262%), 4/17/30(1)(2) | 2,000 | 1,854,610 | |

| Voya CLO, Ltd., Series 2015-3A, Class DR, 11.877%, (3 mo. SOFR + 6.462%), 10/20/31(1)(2) | 2,000 | 1,601,934 | |

| Total Asset-Backed Securities (identified cost $29,893,316) | $ 27,280,992 | ||

| Collateralized Mortgage Obligations — 11.7% |

| Security | Principal Amount (000's omitted) | Value | |

| Cascade MH Asset Trust, Series 2022-MH1, Class A, 4.25% to 10/1/27, 8/25/54(1)(4) | $ | 471 | $ 412,386 |

| Federal Home Loan Mortgage Corp.: | |||

| Series 2113, Class QG, 6.00%, 1/15/29 | 133 | 131,510 | |

| Series 2167, Class BZ, 7.00%, 6/15/29 | 124 | 123,945 | |

| Series 2182, Class ZB, 8.00%, 9/15/29 | 197 | 200,402 | |

| Series 4273, Class PU, 4.00%, 11/15/43 | 420 | 357,972 | |

| Series 5035, Class AZ, 2.00%, 11/25/50 | 553 | 223,381 | |

| Series 5327, Class B, 6.00%, 8/25/53 | 1,000 | 954,179 | |

| Interest Only:(5) | |||

| Series 362, Class C7, 3.50%, 9/15/47 | 1,011 | 185,916 | |

| Series 2631, Class DS, 1.665%, (6.986% - 30-day average SOFR), 6/15/33(6) | 162 | 3,310 | |

| Series 2770, Class SH, 1.665%, (6.986% - 30-day average SOFR), 3/15/34(6) | 495 | 45,358 | |

| Series 2981, Class CS, 1.285%, (6.606% - 30-day average SOFR), 5/15/35(6) | 255 | 13,096 | |

| Series 3114, Class TS, 1.215%, (6.536% - 30-day average SOFR), 9/15/30(6) | 436 | 13,401 | |

| Series 3339, Class JI, 1.155%, (6.476% - 30-day average SOFR), 7/15/37(6) | 828 | 62,870 | |

| Series 4109, Class ES, 0.715%, (6.036% - 30-day average SOFR), 12/15/41(6) | 31 | 2,417 | |

| Series 4163, Class GS, 0.765%, (6.086% - 30-day average SOFR), 11/15/32(6) | 1,256 | 58,402 | |

| Series 4169, Class AS, 0.815%, (6.136% - 30-day average SOFR), 2/15/33(6) | 678 | 29,748 | |

| Series 4203, Class QS, 0.815%, (6.136% - 30-day average SOFR), 5/15/43(6) | 654 | 32,342 | |

| Series 4370, Class IO, 3.50%, 9/15/41 | 74 | 1,992 | |

| Series 4497, Class CS, 0.765%, (6.086% - 30-day average SOFR), 9/15/44(6) | 171 | 2,348 | |

| Series 4507, Class EI, 4.00%, 8/15/44 | 796 | 104,890 | |

| Series 4629, Class QI, 3.50%, 11/15/46 | 509 | 104,283 | |

| Series 4644, Class TI, 3.50%, 1/15/45 | 412 | 61,965 | |

| Series 4744, Class IO, 4.00%, 11/15/47 | 489 | 97,350 | |

| Series 4749, Class IL, 4.00%, 12/15/47 | 382 | 76,337 | |

| Series 4768, Class IO, 4.00%, 3/15/48 | 451 | 90,405 | |

| Series 4772, Class PI, 4.00%, 1/15/48 | 327 | 65,480 | |

| Series 4966, Class SY, 0.615%, (5.936% - 30-day average SOFR), 4/25/50(6) | 1,790 | 166,720 | |

| Principal Only:(7) | |||

| Series 3309, Class DO, 0.00%, 4/15/37 | 406 | 303,400 | |

| Series 4478, Class PO, 0.00%, 5/15/45 | 170 | 115,414 | |

| Federal National Mortgage Association: | |||

| Series 1994-42, Class K, 6.50%, 4/25/24 | 4 | 3,902 | |

| Series 1997-38, Class N, 8.00%, 5/20/27 | 57 | 58,169 | |

| Series 2007-74, Class AC, 5.00%, 8/25/37 | 462 | 450,269 | |

| Security | Principal Amount (000's omitted) | Value | |

| Federal National Mortgage Association: (continued) | |||

| Series 2011-49, Class NT, 6.00%, (64.855% - 30-day average SOFR x 10.00, Cap 6.00%), 6/25/41(6) | $ | 127 | $ 115,523 |

| Series 2012-134, Class ZT, 2.00%, 12/25/42 | 491 | 373,090 | |

| Series 2013-6, Class TA, 1.50%, 1/25/43 | 278 | 232,473 | |

| Series 2015-74, Class SL, 0.00%, (2.282% - 30-day average SOFR x 0.587, Floor 0.00%), 10/25/45(6) | 867 | 433,943 | |

| Series 2017-15, Class LE, 3.00%, 6/25/46 | 45 | 43,578 | |

| Interest Only:(5) | |||

| Series 2004-46, Class SI, 0.565%, (5.886% - 30-day average SOFR), 5/25/34(6) | 291 | 7,870 | |

| Series 2005-17, Class SA, 1.265%, (6.586% - 30-day average SOFR), 3/25/35(6) | 438 | 31,171 | |

| Series 2006-42, Class PI, 1.155%, (6.476% - 30-day Average SOFR), 6/25/36(6) | 599 | 43,594 | |

| Series 2006-44, Class IS, 1.165%, (6.486% - 30-day average SOFR), 6/25/36(6) | 540 | 36,065 | |

| Series 2007-50, Class LS, 1.015%, (6.336% - 30-day average SOFR), 6/25/37(6) | 446 | 30,216 | |

| Series 2008-26, Class SA, 0.765%, (6.086% - 30-day average SOFR), 4/25/38(6) | 563 | 41,616 | |

| Series 2008-61, Class S, 0.665%, (5.986% - 30-day average SOFR), 7/25/38(6) | 879 | 43,387 | |

| Series 2010-109, Class PS, 1.165%, (6.486% - 30-day average SOFR), 10/25/40(6) | 893 | 55,135 | |

| Series 2010-147, Class KS, 0.515%, (5.836% - 30-day Average SOFR), 1/25/41(6) | 1,070 | 31,038 | |

| Series 2012-52, Class AI, 3.50%, 8/25/26 | 87 | 2,166 | |

| Series 2012-118, Class IN, 3.50%, 11/25/42 | 1,166 | 230,245 | |

| Series 2012-150, Class PS, 0.715%, (6.036% - 30-day average SOFR), 1/25/43(6) | 1,822 | 136,022 | |

| Series 2012-150, Class SK, 0.715%, (6.036% - 30-day average SOFR), 1/25/43(6) | 768 | 60,149 | |

| Series 2013-23, Class CS, 0.815%, (6.136% - 30-day average SOFR), 3/25/33(6) | 689 | 29,931 | |

| Series 2014-32, Class EI, 4.00%, 6/25/44 | 187 | 33,229 | |

| Series 2014-55, Class IN, 3.50%, 7/25/44 | 428 | 87,074 | |

| Series 2014-80, Class BI, 3.00%, 12/25/44 | 1,001 | 177,513 | |

| Series 2014-89, Class IO, 3.50%, 1/25/45 | 354 | 75,581 | |

| Series 2015-14, Class KI, 3.00%, 3/25/45 | 782 | 128,617 | |

| Series 2015-52, Class MI, 3.50%, 7/25/45 | 416 | 83,510 | |

| Series 2015-57, Class IO, 3.00%, 8/25/45 | 1,824 | 320,999 | |

| Series 2015-93, Class BS, 0.715%, (6.036% - 30-day average SOFR), 8/25/45(6) | 450 | 18,010 | |

| Series 2018-21, Class IO, 3.00%, 4/25/48 | 792 | 140,872 | |

| Series 2020-23, Class SP, 0.615%, (5.936% - 30-day average SOFR), 2/25/50(6) | 1,411 | 132,952 | |

| Series 2020-45, Class IJ, 2.50%, 7/25/50 | 1,984 | 274,218 | |

| Principal Only:(7) Series 2006-8, Class WQ, 0.00%, 3/25/36 | 389 | 306,774 | |

| Security | Principal Amount (000's omitted) | Value | |

| Federal National Mortgage Association Multifamily Connecticut Avenue Securities Trust, Series 2020-01, Class M10, 9.185%, (30-day average SOFR + 3.864%), 3/25/50(1)(2) | $ | 998 | $ 958,647 |

| Government National Mortgage Association: | |||

| Series 2021-160, Class NZ, 3.00%, 9/20/51 | 304 | 147,138 | |

| Series 2022-189, Class US, 3.222%, (22.733% - 30-day average SOFR x 3.667), 11/20/52(6) | 280 | 253,598 | |

| Series 2023-56, Class ZE, 6.00%, 4/20/53 | 1,030 | 919,335 | |

| Series 2023-96, Class BL, 6.00%, 7/20/53 | 1,000 | 951,076 | |

| Series 2023-97, Class CB, 6.00%, 7/20/53 | 1,000 | 966,960 | |

| Series 2023-115, Class AL, 6.00%, 8/20/53 | 500 | 476,246 | |

| Series 2023-149, Class S, 5.505%, (21.45% - 30-day average SOFR x 3.00%), 10/20/53(6) | 1,000 | 969,327 | |

| Interest Only:(5) | |||

| Series 2017-121, Class DS, 0.00%, (4.386% - 1 mo. SOFR, Floor 0.00%), 8/20/47(6) | 809 | 22,894 | |

| Series 2020-146, Class IQ, 2.00%, 10/20/50 | 5,546 | 615,966 | |

| Series 2021-131, Class QI, 3.00%, 7/20/51 | 3,301 | 418,177 | |

| Series 2021-193, Class IU, 3.00%, 11/20/49 | 6,298 | 857,457 | |

| Series 2021-209, Class IW, 3.00%, 11/20/51 | 4,804 | 630,777 | |

| Total Collateralized Mortgage Obligations (identified cost $27,454,913) | $ 16,497,718 | ||

| Commercial Mortgage-Backed Securities — 8.1% |

| Security | Principal Amount (000's omitted) | Value | |

| BAMLL Commercial Mortgage Securities Trust: | |||

| Series 2019-BPR, Class ENM, 3.719%, 11/5/32(1)(8) | $ | 795 | $ 269,794 |

| Series 2019-BPR, Class FNM, 3.719%, 11/5/32(1)(8) | 1,605 | 369,682 | |

| BBCMS Mortgage Trust, Series 2017-C1, Class D, 3.541%, 2/15/50(1)(8) | 700 | 462,400 | |

| COMM Mortgage Trust, Series 2013-CR11, Class D, 4.54%, 8/10/50(1)(8) | 2,696 | 2,417,328 | |

| CSMC Trust, Series 2020-TMIC, Class A, 8.95%, (1 mo. SOFR + 3.614%), 12/15/35(1)(2) | 1,000 | 998,979 | |

| JPMBB Commercial Mortgage Securities Trust: | |||

| Series 2014-C22, Class D, 4.559%, 9/15/47(1)(8) | 1,850 | 1,211,602 | |

| Series 2014-C25, Class D, 3.933%, 11/15/47(1)(8) | 360 | 152,825 | |

| Morgan Stanley Bank of America Merrill Lynch Trust: | |||

| Series 2014-C16, Class B, 4.281%, 6/15/47(8)(9) | 240 | 219,763 | |

| Series 2016-C29, Class D, 3.00%, 5/15/49(1)(9) | 1,000 | 724,848 | |

| Series 2016-C32, Class D, 3.396%, 12/15/49(1)(8)(9) | 250 | 165,101 | |

| Morgan Stanley Capital I Trust, Series 2016-UBS12, Class D, 3.312%, 12/15/49(1)(9) | 1,000 | 523,854 | |

| UBS-Barclays Commercial Mortgage Trust, Series 2013-C6, Class D, 3.97%, 4/10/46(1)(8) | 988 | 819,152 | |

| Security | Principal Amount (000's omitted) | Value | |

| VMC Finance, LLC, Series 2021-HT1, Class B, 9.949%, (1 mo. SOFR + 4.614%), 1/18/37(1)(2) | $ | 1,000 | $ 950,022 |

| Wells Fargo Commercial Mortgage Trust: | |||

| Series 2013-LC12, Class D, 3.955%, 7/15/46(1)(8) | 2,000 | 395,794 | |

| Series 2015-C31, Class D, 3.852%, 11/15/48 | 922 | 701,242 | |

| Series 2016-C35, Class D, 3.142%, 7/15/48(1) | 1,000 | 710,071 | |

| Series 2016-C36, Class D, 2.942%, 11/15/59(1) | 500 | 290,646 | |

| Total Commercial Mortgage-Backed Securities (identified cost $15,456,506) | $ 11,383,103 | ||

| Common Stocks — 0.3% |

| Security | Shares | Value | |

| Commercial Services & Supplies — 0.1% | |||

| Monitronics International, Inc.(10)(11) | 2,596 | $ 54,516 | |

| Phoenix Services International, LLC(10)(11) | 2,365 | 22,467 | |

| Phoenix Services International, LLC(10)(11) | 216 | 2,052 | |

| $ 79,035 | |||

| Electronics/Electrical — 0.0%(12) | |||

| Skillsoft Corp.(10)(11) | 585 | $ 10,998 | |

| $ 10,998 | |||

| Entertainment — 0.0%(12) | |||

| New Cineworld, Ltd.(10)(11) | 2,436 | $ 52,070 | |

| $ 52,070 | |||

| Health Care — 0.0% | |||

| Akorn Holding Company, LLC, Class A(10)(11)(13) | 6,053 | $ 0 | |

| $ 0 | |||

| Household Durables — 0.2% | |||

| Serta Simmons Bedding, Inc.(10)(11) | 17,110 | $ 239,540 | |

| Serta SSB Equipment Co.(10)(11)(13) | 17,110 | 0 | |

| $ 239,540 | |||

| Investment Companies — 0.0% | |||

| Jubilee Topco, Ltd., Class A(10)(11)(13) | 79,130 | $ 0 | |

| $ 0 | |||

| Nonferrous Metals/Minerals — 0.0%(12) | |||

| ACNR Holdings, Inc., Class A(10)(11) | 587 | $ 50,189 | |

| $ 50,189 | |||

| Security | Shares | Value | |

| Oil and Gas — 0.0%(12) | |||

| AFG Holdings, Inc.(10)(11)(13) | 3,122 | $ 6,181 | |

| McDermott International, Ltd.(10)(11) | 12,407 | 3,350 | |

| $ 9,531 | |||

| Pharmaceuticals — 0.0%(12) | |||

| Covis Midco 1 S.a.r.l., Class A(10)(11) | 88 | $ 44 | |

| Covis Midco 1 S.a.r.l., Class B(10)(11) | 88 | 45 | |

| Covis Midco 1 S.a.r.l., Class C(10)(11) | 88 | 45 | |

| Covis Midco 1 S.a.r.l., Class D(10)(11) | 88 | 45 | |

| Covis Midco 1 S.a.r.l., Class E(10)(11) | 88 | 45 | |

| $ 224 | |||

| Telecommunications — 0.0% | |||

| Global Eagle Entertainment(10)(11)(13) | 3,588 | $ 0 | |

| $ 0 | |||

| Total Common Stocks (identified cost $796,849) | $ 441,587 | ||

| Corporate Bonds — 12.8% |

| Security | Principal Amount (000's omitted) | Value | |

| Aerospace and Defense — 0.5% | |||

| Bombardier, Inc., 7.875%, 4/15/27(1) | $ | 136 | $ 131,015 |

| Rolls-Royce PLC, 5.75%, 10/15/27(1) | 200 | 189,762 | |

| TransDigm, Inc.: | |||

| 4.625%, 1/15/29 | 100 | 86,337 | |

| 4.875%, 5/1/29 | 150 | 130,146 | |

| 6.25%, 3/15/26(1) | 179 | 175,045 | |

| $ 712,305 | |||

| Automotive — 0.6% | |||

| Clarios Global, L.P./Clarios US Finance Co.: | |||

| 6.25%, 5/15/26(1) | $ | 116 | $ 113,520 |

| 8.50%, 5/15/27(1) | 642 | 633,301 | |

| Ford Motor Co., 4.75%, 1/15/43 | 224 | 155,881 | |

| $ 902,702 | |||

| Building and Development — 0.4% | |||

| Builders FirstSource, Inc., 4.25%, 2/1/32(1) | $ | 500 | $ 398,526 |

| Smyrna Ready Mix Concrete, LLC, 6.00%, 11/1/28(1) | 192 | 177,701 | |

| $ 576,227 | |||

| Security | Principal Amount (000's omitted) | Value | |

| Business Equipment and Services — 0.6% | |||

| Adtalem Global Education, Inc., 5.50%, 3/1/28(1) | $ | 250 | $ 227,930 |

| Allied Universal Holdco, LLC/Allied Universal Finance Corp., 9.75%, 7/15/27(1) | 185 | 160,907 | |

| GEMS MENASA Cayman, Ltd./GEMS Education Delaware, LLC, 7.125%, 7/31/26(1) | 460 | 443,265 | |

| $ 832,102 | |||

| Cable and Satellite Television — 0.4% | |||

| CCO Holdings, LLC/CCO Holdings Capital Corp.: | |||

| 4.75%, 3/1/30(1) | $ | 75 | $ 61,976 |

| 5.50%, 5/1/26(1) | 500 | 477,331 | |

| $ 539,307 | |||

| Chemicals — 0.1% | |||

| W.R. Grace Holdings, LLC, 5.625%, 8/15/29(1) | $ | 100 | $ 77,596 |

| $ 77,596 | |||

| Commercial Services — 0.2% | |||

| APi Group DE, Inc., 4.75%, 10/15/29(1) | $ | 300 | $ 257,199 |

| $ 257,199 | |||

| Computers — 0.4% | |||

| McAfee Corp., 7.375%, 2/15/30(1) | $ | 200 | $ 160,174 |

| Presidio Holdings, Inc., 8.25%, 2/1/28(1) | 362 | 342,922 | |

| $ 503,096 | |||

| Distribution & Wholesale — 0.1% | |||

| Performance Food Group, Inc., 5.50%, 10/15/27(1) | $ | 172 | $ 161,013 |

| $ 161,013 | |||

| Diversified Financial Services — 0.2% | |||

| VistaJet Malta Finance PLC/Vista Management Holding, Inc., 7.875%, 5/1/27(1) | $ | 400 | $ 308,066 |

| $ 308,066 | |||

| Drugs — 0.2% | |||

| Endo DAC/Endo Finance, LLC/Endo Finco, Inc., 5.875%, 10/15/24(1)(14) | $ | 500 | $ 336,250 |

| $ 336,250 | |||

| Ecological Services and Equipment — 0.3% | |||

| Covanta Holding Corp., 5.00%, 9/1/30 | $ | 200 | $ 155,137 |

| GFL Environmental, Inc., 4.75%, 6/15/29(1) | 238 | 208,586 | |

| $ 363,723 | |||

| Security | Principal Amount (000's omitted) | Value | |

| Electronics/Electrical — 0.3% | |||

| Imola Merger Corp., 4.75%, 5/15/29(1) | $ | 291 | $ 253,943 |

| Sensata Technologies, Inc., 4.375%, 2/15/30(1) | 189 | 159,958 | |

| $ 413,901 | |||

| Engineering & Construction — 0.2% | |||

| VM Consolidated, Inc., 5.50%, 4/15/29(1) | $ | 370 | $ 328,018 |

| $ 328,018 | |||

| Entertainment — 0.5% | |||

| Allwyn Entertainment Financing UK PLC, 7.875%, 4/30/29(1) | $ | 200 | $ 198,192 |

| Caesars Entertainment, Inc., 8.125%, 7/1/27(1) | 325 | 322,296 | |

| CDI Escrow Issuer, Inc., 5.75%, 4/1/30(1) | 100 | 89,444 | |

| Jacobs Entertainment, Inc., 6.75%, 2/15/29(1) | 150 | 127,631 | |

| $ 737,563 | |||

| Financial Intermediaries — 0.3% | |||

| Ford Motor Credit Co., LLC: | |||

| 3.625%, 6/17/31 | $ | 206 | $ 162,956 |

| 4.125%, 8/17/27 | 300 | 272,691 | |

| $ 435,647 | |||

| Financial Services — 0.6% | |||

| Vietnam Debt and Asset Trading Corp., 1.00%, 10/10/25(15) | $ | 1,060 | $ 901,000 |

| $ 901,000 | |||

| Health Care — 1.2% | |||

| Fortrea Holdings, Inc., 7.50%, 7/1/30(1) | $ | 170 | $ 164,263 |

| LifePoint Health, Inc., 5.375%, 1/15/29(1) | 547 | 331,938 | |

| Medline Borrower, L.P., 5.25%, 10/1/29(1) | 500 | 426,103 | |

| Molina Healthcare, Inc., 3.875%, 11/15/30(1) | 296 | 241,771 | |

| Option Care Health, Inc., 4.375%, 10/31/29(1) | 400 | 334,751 | |

| US Acute Care Solutions, LLC, 6.375%, 3/1/26(1) | 150 | 127,762 | |

| $ 1,626,588 | |||

| Insurance — 0.7% | |||

| HUB International, Ltd., 7.00%, 5/1/26(1) | $ | 948 | $ 923,671 |

| $ 923,671 | |||

| Internet Software & Services — 0.2% | |||

| Arches Buyer, Inc., 4.25%, 6/1/28(1) | $ | 400 | $ 331,732 |

| $ 331,732 | |||

| Security | Principal Amount (000's omitted) | Value | |

| Leisure Goods/Activities/Movies — 0.7% | |||

| Lindblad Expeditions, LLC, 6.75%, 2/15/27(1) | $ | 200 | $ 182,436 |

| NCL Corp., Ltd., 5.875%, 2/15/27(1) | 375 | 345,553 | |

| Viking Cruises, Ltd., 5.875%, 9/15/27(1) | 540 | 486,974 | |

| $ 1,014,963 | |||

| Media — 0.0%(12) | |||

| iHeartCommunications, Inc.: | |||

| 6.375%, 5/1/26 | $ | 27 | $ 22,112 |

| 8.375%, 5/1/27 | 49 | 30,152 | |

| $ 52,264 | |||

| Metals/Mining — 0.3% | |||

| Cleveland-Cliffs, Inc., 6.75%, 3/15/26(1) | $ | 112 | $ 111,482 |

| Compass Minerals International, Inc., 6.75%, 12/1/27(1) | 200 | 188,580 | |

| Hudbay Minerals, Inc., 4.50%, 4/1/26(1) | 150 | 139,762 | |

| $ 439,824 | |||

| Nonferrous Metals/Minerals — 0.4% | |||

| First Quantum Minerals, Ltd., 7.50%, 4/1/25(1) | $ | 200 | $ 187,908 |

| New Gold, Inc., 7.50%, 7/15/27(1) | 381 | 357,875 | |

| $ 545,783 | |||

| Oil and Gas — 1.1% | |||

| Archrock Partners, L.P./Archrock Partners Finance Corp., 6.875%, 4/1/27(1) | $ | 250 | $ 240,584 |

| Permian Resources Operating, LLC, 7.75%, 2/15/26(1) | 750 | 750,137 | |

| Petroleos Mexicanos: | |||

| 5.35%, 2/12/28 | 30 | 24,234 | |

| 6.35%, 2/12/48 | 71 | 39,199 | |

| 6.50%, 3/13/27 | 101 | 89,180 | |

| 6.875%, 8/4/26 | 367 | 339,095 | |

| $ 1,482,429 | |||

| Pipelines — 0.2% | |||

| Antero Midstream Partners, L.P./Antero Midstream Finance Corp., 5.75%, 3/1/27(1) | $ | 100 | $ 95,673 |

| Cheniere Energy Partners, L.P., 4.50%, 10/1/29 | 71 | 63,628 | |

| Venture Global LNG, Inc., 8.125%, 6/1/28(1) | 150 | 145,738 | |

| $ 305,039 | |||

| Publishing — 0.1% | |||

| McGraw-Hill Education, Inc., 5.75%, 8/1/28(1) | $ | 134 | $ 113,083 |

| $ 113,083 | |||

| Security | Principal Amount (000's omitted) | Value | |

| Radio and Television — 0.1% | |||

| Outfront Media Capital, LLC/Outfront Media Capital Corp., 5.00%, 8/15/27(1) | $ | 150 | $ 133,371 |

| $ 133,371 | |||

| Real Estate Investment Trusts (REITs) — 0.0%(12) | |||

| VICI Properties, L.P./VICI Note Co., Inc., 5.75%, 2/1/27(1) | $ | 44 | $ 42,152 |

| $ 42,152 | |||

| Retail — 0.3% | |||

| Evergreen AcqCo 1, L.P./TVI, Inc., 9.75%, 4/26/28(1) | $ | 44 | $ 44,439 |

| Group 1 Automotive, Inc., 4.00%, 8/15/28(1) | 400 | 344,727 | |

| Kohl's Corp., 4.625%, 5/1/31 | 108 | 73,969 | |

| $ 463,135 | |||

| Retailers (Except Food and Drug) — 0.3% | |||

| PetSmart, Inc./PetSmart Finance Corp., 7.75%, 2/15/29(1) | $ | 500 | $ 460,804 |

| $ 460,804 | |||

| Software and Services — 0.2% | |||

| Fair Isaac Corp., 4.00%, 6/15/28(1) | $ | 250 | $ 222,905 |

| $ 222,905 | |||

| Technology — 0.1% | |||

| athenahealth Group, Inc., 6.50%, 2/15/30(1) | $ | 160 | $ 130,891 |

| $ 130,891 | |||

| Telecommunications — 0.5% | |||

| Ciena Corp., 4.00%, 1/31/30(1) | $ | 100 | $ 83,437 |

| Connect Finco S.a.r.l./Connect US Finco, LLC, 6.75%, 10/1/26(1) | 200 | 186,657 | |

| LCPR Senior Secured Financing DAC, 6.75%, 10/15/27(1) | 200 | 181,204 | |

| Sprint Capital Corp., 6.875%, 11/15/28 | 191 | 196,159 | |

| Viasat, Inc., 5.625%, 4/15/27(1) | 42 | 36,704 | |

| $ 684,161 | |||

| Utilities — 0.5% | |||

| Calpine Corp.: | |||

| 4.50%, 2/15/28(1) | $ | 250 | $ 225,657 |

| 4.625%, 2/1/29(1) | 250 | 211,359 | |

| 5.25%, 6/1/26(1) | 25 | 23,950 | |

| Security | Principal Amount (000's omitted) | Value | |

| Utilities (continued) | |||

| NRG Energy, Inc., 3.375%, 2/15/29(1) | $ | 200 | $ 163,015 |

| TerraForm Power Operating, LLC, 5.00%, 1/31/28(1) | 70 | 64,197 | |

| $ 688,178 | |||

| Total Corporate Bonds (identified cost $18,880,862) | $ 18,046,688 | ||

| Preferred Stocks — 0.1% |

| Security | Shares | Value | |

| Nonferrous Metals/Minerals — 0.1% | |||

| ACNR Holdings, Inc., 15.00% (PIK)(10)(11) | 277 | $ 142,470 | |

| Total Preferred Stocks (identified cost $0) | $ 142,470 | ||

| Senior Floating-Rate Loans — 35.5%(16) |

| Borrower/Description | Principal Amount* (000's omitted) | Value | |

| Aerospace and Defense — 0.2% | |||

| Dynasty Acquisition Co., Inc.: | |||

| Term Loan, 9.324%, (SOFR + 4.00%), 8/24/28 | 154 | $ 152,361 | |

| Term Loan, 9.324%, (SOFR + 4.00%), 8/24/28 | 66 | 65,297 | |

| $ 217,658 | |||

| Airlines — 0.2% | |||

| Mileage Plus Holdings, LLC, Term Loan, 10.798%, (SOFR + 5.25%), 6/21/27 | 94 | $ 96,719 | |

| SkyMiles IP, Ltd., Term Loan, 9.166%, (SOFR + 3.75%), 10/20/27 | 240 | 246,075 | |

| $ 342,794 | |||

| Auto Components — 0.9% | |||

| Adient US, LLC, Term Loan, 8.689%, (SOFR + 3.25%), 4/10/28 | 79 | $ 79,467 | |

| Autokiniton US Holdings, Inc., Term Loan, 9.939%, (SOFR + 4.50%), 4/6/28 | 171 | 167,997 | |

| Clarios Global, L.P., Term Loan, 9.074%, (SOFR + 3.75%), 5/6/30 | 325 | 324,899 | |

| DexKo Global, Inc., Term Loan, 9.402%, (SOFR + 3.75%), 10/4/28 | 123 | 118,181 | |

| Garrett LX I S.a.r.l., Term Loan, 8.895%, (SOFR + 3.25%), 4/30/28 | 98 | 97,347 | |

| Borrower/Description | Principal Amount* (000's omitted) | Value | |

| Auto Components (continued) | |||

| Garrett Motion, Inc., Term Loan, 9.883%, (SOFR + 4.50%), 4/30/28 | 107 | $ 107,411 | |

| LTI Holdings, Inc., Term Loan, 10.189%, (SOFR + 4.75%), 7/24/26 | 24 | 23,020 | |

| RealTruck Group, Inc.: | |||

| Term Loan, 9.189%, (SOFR + 3.75%), 1/31/28 | 195 | 186,332 | |

| Term Loan, 10.406%, (SOFR + 5.00%), 1/31/28 | 100 | 95,906 | |

| TI Group Automotive Systems, LLC, Term Loan, 8.689%, (SOFR + 3.25%), 12/16/26 | 62 | 61,679 | |

| $ 1,262,239 | |||

| Automobiles — 0.8% | |||

| Bombardier Recreational Products, Inc., Term Loan, 7.424%, (SOFR + 2.00%), 5/24/27 | 770 | $ 764,646 | |

| MajorDrive Holdings IV, LLC: | |||

| Term Loan, 9.652%, (SOFR + 4.00%), 6/1/28 | 73 | 71,418 | |

| Term Loan, 11.04%, (SOFR + 5.50%), 6/1/29 | 222 | 219,686 | |

| Thor Industries, Inc., Term Loan, 8.439%, (SOFR + 3.00%), 2/1/26 | 41 | 40,939 | |

| $ 1,096,689 | |||

| Beverages — 0.1% | |||

| Arterra Wines Canada, Inc., Term Loan, 9.152%, (SOFR + 3.50%), 11/24/27 | 146 | $ 138,085 | |

| City Brewing Company, LLC, Term Loan, 9.164%, (SOFR + 3.50%), 4/5/28 | 98 | 72,576 | |

| $ 210,661 | |||

| Biotechnology — 0.0%(12) | |||

| Alkermes, Inc., Term Loan, 7.949%, (SOFR + 2.50%), 3/12/26 | 68 | $ 67,043 | |

| $ 67,043 | |||

| Building Products — 0.4% | |||

| Gardner Denver, Inc., Term Loan, 7.174%, (SOFR + 1.75%), 3/1/27 | 163 | $ 163,870 | |

| Ingersoll-Rand Services Company, Term Loan, 7.174%, (SOFR + 1.75%), 3/1/27 | 37 | 37,225 | |

| LHS Borrower, LLC, Term Loan, 10.174%, (SOFR + 4.75%), 2/16/29 | 122 | 107,379 | |

| Oscar AcquisitionCo, LLC, Term Loan, 9.99%, (SOFR + 4.50%), 4/29/29 | 124 | 120,733 | |

| Standard Industries, Inc., Term Loan, 7.953%, (SOFR + 2.50%), 9/22/28 | 156 | 156,106 | |

| $ 585,313 | |||

| Borrower/Description | Principal Amount* (000's omitted) | Value | |

| Capital Markets — 1.1% | |||

| Advisor Group, Inc., Term Loan, 9.824%, (SOFR + 4.50%), 8/17/28 | 169 | $ 168,432 | |

| Aretec Group, Inc.: | |||

| Term Loan, 9.674%, (SOFR + 4.25%), 10/1/25 | 191 | 190,664 | |

| Term Loan, 9.924%, (SOFR + 4.50%), 8/9/30 | 100 | 97,131 | |

| Brookfield Property REIT, Inc., Term Loan, 7.924%, (SOFR + 2.50%), 8/27/25 | 104 | 102,985 | |

| EIG Management Company, LLC, Term Loan, 9.177%, (SOFR + 3.75%), 2/22/25 | 47 | 47,250 | |

| FinCo I, LLC, Term Loan, 8.383%, (SOFR + 3.00%), 6/27/29 | 175 | 174,650 | |

| Franklin Square Holdings, L.P., Term Loan, 7.674%, (SOFR + 2.25%), 8/1/25 | 71 | 71,339 | |

| Hudson River Trading, LLC, Term Loan, 8.439%, (SOFR + 3.00%), 3/20/28 | 342 | 337,215 | |

| LPL Holdings, Inc., Term Loan, 7.165%, (SOFR + 1.75%), 11/12/26 | 193 | 192,941 | |

| Victory Capital Holdings, Inc., Term Loan, 7.772%, (SOFR + 2.25%), 7/1/26 | 123 | 122,831 | |

| $ 1,505,438 | |||

| Chemicals — 1.8% | |||

| Aruba Investments, Inc., Term Loan, 9.424%, (SOFR + 4.00%), 11/24/27 | 98 | $ 96,017 | |

| CPC Acquisition Corp., Term Loan, 9.402%, (SOFR + 3.75%), 12/29/27 | 109 | 86,019 | |

| Gemini HDPE, LLC, Term Loan, 8.645%, (SOFR + 3.00%), 12/31/27 | 111 | 110,349 | |

| INEOS Enterprises Holdings II Limited, Term Loan, 7.783%, (3 mo. EURIBOR + 4.00%), 7/7/30 | EUR | 25 | 25,684 |

| INEOS Styrolution US Holding, LLC, Term Loan, 8.189%, (SOFR + 2.75%), 1/29/26 | 391 | 384,809 | |

| INEOS US Finance, LLC: | |||

| Term Loan, 8.924%, (SOFR + 3.50%), 2/18/30 | 125 | 122,623 | |

| Term Loan, 9.174%, (SOFR + 3.75%), 11/8/27 | 498 | 492,172 | |

| Lonza Group AG, Term Loan, 9.415%, (SOFR + 3.93%), 7/3/28 | 269 | 228,705 | |

| Momentive Performance Materials, Inc., Term Loan, 9.824%, (SOFR + 4.50%), 3/29/28 | 124 | 118,778 | |

| Nouryon Finance B.V., Term Loan, 9.434%, (SOFR + 4.00%), 4/3/28 | 164 | 160,109 | |

| Olympus Water US Holding Corporation, Term Loan, 10.39%, (SOFR + 5.00%), 11/9/28 | 350 | 348,163 | |

| Tronox Finance, LLC, Term Loan, 8.116%, (SOFR + 2.50%), 3/10/28(17) | 208 | 204,511 | |

| W.R. Grace & Co.-Conn., Term Loan, 9.402%, (SOFR + 3.75%), 9/22/28 | 147 | 145,095 | |

| $ 2,523,034 | |||

| Borrower/Description | Principal Amount* (000's omitted) | Value | |

| Commercial Services & Supplies — 1.0% | |||

| Allied Universal Holdco, LLC, Term Loan, 9.174%, (SOFR + 3.75%), 5/12/28 | 460 | $ 437,219 | |

| EnergySolutions, LLC, Term Loan, 9.382%, (SOFR + 4.00%), 9/20/30 | 147 | 146,317 | |

| Garda World Security Corporation, Term Loan, 9.746%, (SOFR + 4.25%), 10/30/26 | 170 | 169,970 | |

| GFL Environmental, Inc., Term Loan, 7.912%, (SOFR + 2.50%), 5/31/27 | 111 | 111,528 | |

| LABL, Inc., Term Loan, 10.424%, (SOFR + 5.00%), 10/29/28 | 98 | 92,828 | |

| Monitronics International, Inc., Term Loan, 13.145%, (SOFR + 7.50%), 6/30/28 | 143 | 144,739 | |

| Phoenix Services International, LLC, Term Loan, 11.427%, (SOFR + 6.10%), 6/30/28 | 28 | 26,513 | |

| Tempo Acquisition, LLC, Term Loan, 8.074%, (SOFR + 2.75%), 8/31/28 | 124 | 123,994 | |

| TruGreen Limited Partnership, Term Loan, 9.424%, (SOFR + 4.00%), 11/2/27 | 97 | 91,463 | |

| $ 1,344,571 | |||

| Communications Equipment — 0.2% | |||

| CommScope, Inc., Term Loan, 8.689%, (SOFR + 3.25%), 4/6/26 | 264 | $ 228,617 | |

| $ 228,617 | |||

| Consumer Staples Distribution & Retail — 0.1% | |||

| Peer Holding III B.V., Term Loan, 10/19/30(18) | 150 | $ 149,437 | |

| $ 149,437 | |||

| Containers & Packaging — 0.7% | |||

| Berlin Packaging, LLC, Term Loan, 9.189%, (SOFR + 3.75%), 3/11/28(17) | 172 | $ 167,840 | |

| Clydesdale Acquisition Holdings, Inc., Term Loan, 9.599%, (SOFR + 4.18%), 4/13/29 | 74 | 71,775 | |

| Pregis TopCo Corporation, Term Loan, 9.074%, (SOFR + 3.75%), 7/31/26 | 96 | 95,446 | |

| Pretium Packaging, LLC, Term Loan - Second Lien, 9.995%, (SOFR + 4.60%), 10/2/28 | 92 | 70,121 | |

| Proampac PG Borrower, LLC, Term Loan, 10.585%, (SOFR + 4.50%), 9/15/28 | 175 | 173,177 | |

| Reynolds Group Holdings, Inc.: | |||

| Term Loan, 8.689%, (SOFR + 3.25%), 2/5/26 | 128 | 127,762 | |

| Term Loan, 8.689%, (SOFR + 3.25%), 9/24/28 | 147 | 146,483 | |

| Trident TPI Holdings, Inc., Term Loan, 9.652%, (SOFR + 4.00%), 9/15/28 | 123 | 121,250 | |

| $ 973,854 | |||

| Borrower/Description | Principal Amount* (000's omitted) | Value | |

| Diversified Consumer Services — 0.2% | |||

| Belron Finance US, LLC, Term Loan, 8.057%, (SOFR + 2.43%), 4/13/28 | 122 | $ 122,012 | |

| KUEHG Corp., Term Loan, 10.39%, (SOFR + 5.00%), 6/12/30 | 200 | 200,089 | |

| $ 322,101 | |||

| Diversified Telecommunication Services — 0.3% | |||

| Altice France S.A., Term Loan, 10.894%, (SOFR + 5.50%), 8/15/28 | 205 | $ 182,764 | |

| GEE Holdings 2, LLC: | |||

| Term Loan, 13.50%, (SOFR + 8.00%), 3/24/25 | 32 | 28,816 | |

| Term Loan - Second Lien, 13.75%, (SOFR + 8.25%), 7.00% cash, 6.75% PIK, 3/23/26 | 71 | 42,821 | |

| Virgin Media Bristol, LLC, Term Loan, 8.699%, (SOFR + 3.25%), 1/31/29 | 175 | 171,924 | |

| $ 426,325 | |||

| Electrical Equipment — 0.2% | |||

| Brookfield WEC Holdings, Inc., Term Loan, 8.189%, (SOFR + 2.75%), 8/1/25 | 310 | $ 309,653 | |

| $ 309,653 | |||

| Electronic Equipment, Instruments & Components — 0.6% | |||

| Chamberlain Group, Inc., Term Loan, 8.674%, (SOFR + 3.25%), 11/3/28 | 221 | $ 215,052 | |

| Creation Technologies, Inc., Term Loan, 11.176%, (SOFR + 5.50%), 10/5/28 | 148 | 139,993 | |

| II-VI Incorporated, Term Loan, 8.189%, (SOFR + 2.75%), 7/2/29 | 137 | 137,016 | |

| Mirion Technologies, Inc., Term Loan, 8.402%, (SOFR + 2.75%), 10/20/28 | 84 | 83,556 | |

| Robertshaw US Holding Corp.: | |||

| Term Loan, 13.49%, (SOFR + 8.00%), 8.49% cash, 5.00% PIK, 2/28/27 | 34 | 33,909 | |

| Term Loan - Second Lien, 12.49%, (SOFR + 7.00%), 2/28/27 | 142 | 119,810 | |

| Verifone Systems, Inc., Term Loan, 9.653%, (SOFR + 4.00%), 8/20/25 | 166 | 155,117 | |

| $ 884,453 | |||

| Energy Equipment & Services — 0.1% | |||

| Ameriforge Group, Inc.: | |||

| Term Loan, 16.731%, (SOFR + 13.00%), 12/29/23(13)(19) | 11 | $ 9,159 | |

| Term Loan, 18.456%, (SOFR + 13.00%), 13.456% cash, 5.00% PIK, 12/29/23(13)(17) | 90 | 71,903 | |

| Borrower/Description | Principal Amount* (000's omitted) | Value | |

| Energy Equipment & Services (continued) | |||

| Lealand Finance Company B.V., Term Loan, 12.439%, (SOFR + 7.00%), 9.439% cash, 3.00% PIK, 6/30/25 | 31 | $ 17,180 | |

| $ 98,242 | |||

| Engineering & Construction — 0.4% | |||

| Aegion Corporation, Term Loan, 10.395%, (SOFR + 4.75%), 5/17/28 | 74 | $ 73,108 | |

| American Residential Services, LLC, Term Loan, 9.152%, (SOFR + 3.50%), 10/15/27 | 97 | 97,128 | |

| Northstar Group Services, Inc., Term Loan, 10.939%, (SOFR + 5.50%), 11/12/26 | 186 | 186,121 | |

| USIC Holdings, Inc., Term Loan, 8.939%, (SOFR + 3.50%), 5/12/28 | 166 | 160,998 | |

| $ 517,355 | |||

| Entertainment — 0.2% | |||

| Crown Finance US, Inc., Term Loan, 7.381%, (SOFR + 1.50%), 7/31/28 | 52 | $ 53,396 | |

| Renaissance Holding Corp., Term Loan, 10.074%, (SOFR + 4.75%), 4/5/30 | 150 | 148,156 | |

| Vue International Bidco PLC: | |||

| Term Loan, 12.13%, (6 mo. EURIBOR + 8.00%), 6/30/27 | EUR | 12 | 12,283 |

| Term Loan, 12.63%, (6 mo. EURIBOR + 8.50%), 6.13% cash, 6.50% PIK, 12/31/27 | EUR | 83 | 39,086 |

| $ 252,921 | |||

| Equity Real Estate Investment Trusts (REITs) — 0.1% | |||

| Iron Mountain, Inc., Term Loan, 7.189%, (1 mo. USD LIBOR + 1.75%), 1/2/26 | 118 | $ 118,014 | |

| $ 118,014 | |||

| Financial Services — 0.5% | |||

| Ditech Holding Corporation, Term Loan, 0.00%, 3/28/24(14) | 254 | $ 27,945 | |

| GTCR W Merger Sub, LLC, Term Loan, 9/20/30(18) | 425 | 422,420 | |

| NCR Atleos, LLC, Term Loan, 10.176%, (SOFR + 4.75%), 3/27/29 | 200 | 192,041 | |

| $ 642,406 | |||

| Food & Staples Retailing — 0.1% | |||

| US Foods, Inc., Term Loan, 7.439%, (SOFR + 2.00%), 9/13/26 | 187 | $ 186,875 | |

| $ 186,875 | |||

| Borrower/Description | Principal Amount* (000's omitted) | Value | |

| Food Products — 0.2% | |||

| Froneri International, Ltd., Term Loan, 7.674%, (SOFR + 2.25%), 1/29/27 | 290 | $ 288,648 | |

| $ 288,648 | |||

| Health Care Equipment & Supplies — 0.3% | |||

| Bayou Intermediate II, LLC, Term Loan, 10.128%, (SOFR + 4.50%), 8/2/28 | 123 | $ 117,900 | |

| Gloves Buyer, Inc., Term Loan, 10.439%, (SOFR + 5.00%), 12/29/27 | 100 | 96,259 | |

| Journey Personal Care Corp., Term Loan, 9.981%, (6 mo. USD LIBOR + 4.25%), 3/1/28 | 171 | 164,487 | |

| $ 378,646 | |||

| Health Care Providers & Services — 1.9% | |||

| AEA International Holdings (Lux) S.a.r.l., Term Loan, 9.402%, (SOFR + 3.75%), 9/7/28 | 147 | $ 147,006 | |

| BW NHHC Holdco, Inc., Term Loan - Second Lien, 13.39%, (SOFR + 8.00%), 1/15/26 | 145 | 124,050 | |

| Cano Health, LLC, Term Loan, 9.533%, (SOFR + 4.00%), 11/23/27(17) | 76 | 44,586 | |

| CHG Healthcare Services, Inc., Term Loan, 8.689%, (SOFR + 3.25%), 9/29/28 | 147 | 145,599 | |

| CNT Holdings I Corp., Term Loan, 8.926%, (SOFR + 3.50%), 11/8/27 | 98 | 97,134 | |

| Covis Finco S.a.r.l., Term Loan, 12.04%, (SOFR + 6.50%), 2/18/27 | 109 | 78,389 | |

| Electron BidCo, Inc., Term Loan, 8.439%, (SOFR + 3.00%), 11/1/28 | 123 | 122,038 | |

| Ensemble RCM, LLC, Term Loan, 9.233%, (SOFR + 3.75%), 8/3/26 | 243 | 243,450 | |

| Envision Healthcare Corporation: | |||

| Term Loan, 0.00%, 3/31/27(14) | 76 | 90,102 | |

| Term Loan - Second Lien, 0.00%, 3/31/27(14) | 534 | 93,527 | |

| Medical Solutions Holdings, Inc., Term Loan, 8.773%, (SOFR + 3.25%), 11/1/28 | 197 | 184,261 | |

| National Mentor Holdings, Inc.: | |||

| Term Loan, 9.187%, (SOFR + 3.75%), 3/2/28(17) | 319 | 279,078 | |

| Term Loan, 9.24%, (SOFR + 3.75%), 3/2/28 | 9 | 8,299 | |

| Phoenix Guarantor, Inc., Term Loan, 8.689%, (SOFR + 3.25%), 3/5/26 | 263 | 261,101 | |

| Radnet Management, Inc., Term Loan, 8.498%, (SOFR + 3.00%), 4/21/28 | 140 | 140,122 | |

| Select Medical Corporation, Term Loan, 8.324%, (SOFR + 3.00%), 3/6/27 | 373 | 372,048 | |

| Surgery Center Holdings, Inc., Term Loan, 9.203%, (SOFR + 3.75%), 8/31/26 | 195 | 195,212 | |

| $ 2,626,002 | |||

| Borrower/Description | Principal Amount* (000's omitted) | Value | |

| Health Care Technology — 0.9% | |||

| Imprivata, Inc., Term Loan, 9.189%, (SOFR + 3.75%), 12/1/27 | 171 | $ 170,198 | |

| MedAssets Software Intermediate Holdings, Inc., Term Loan, 9.439%, (SOFR + 4.00%), 12/18/28 | 148 | 117,276 | |

| Navicure, Inc., Term Loan, 9.439%, (SOFR + 4.00%), 10/22/26 | 242 | 242,132 | |

| PointClickCare Technologies, Inc., Term Loan, 8.765%, (SOFR + 3.00%), 12/29/27 | 98 | 97,378 | |

| Project Ruby Ultimate Parent Corp., Term Loan, 8.689%, (SOFR + 3.25%), 3/10/28 | 171 | 167,550 | |

| Symplr Software, Inc., Term Loan, 9.983%, (SOFR + 4.50%), 12/22/27 | 146 | 128,771 | |

| Verscend Holding Corp., Term Loan, 9.439%, (SOFR + 4.00%), 8/27/25 | 312 | 312,381 | |

| $ 1,235,686 | |||

| Hotels, Restaurants & Leisure — 1.8% | |||

| 1011778 B.C. Unlimited Liability Company, Term Loan, 7.574%, (SOFR + 2.25%), 9/20/30 | 844 | $ 839,520 | |

| Carnival Corporation, Term Loan, 8.689%, (SOFR + 3.25%), 10/18/28 | 368 | 362,296 | |

| ClubCorp Holdings, Inc., Term Loan, 8.181%, (1 mo. USD LIBOR + 2.75%), 9/18/26 | 247 | 241,812 | |

| Fertitta Entertainment, LLC, Term Loan, 9.324%, (SOFR + 4.00%), 1/27/29 | 226 | 221,111 | |

| IRB Holding Corp., Term Loan, 8.424%, (SOFR + 3.00%), 12/15/27 | 244 | 241,453 | |

| Playa Resorts Holding B.V., Term Loan, 9.585%, (SOFR + 4.25%), 1/5/29 | 199 | 198,128 | |

| SeaWorld Parks & Entertainment, Inc., Term Loan, 8.439%, (SOFR + 3.00%), 8/25/28 | 123 | 122,449 | |

| Stars Group Holdings B.V. (The), Term Loan, 7.902%, (SOFR + 2.25%), 7/21/26 | 343 | 343,195 | |

| $ 2,569,964 | |||

| Household Durables — 0.3% | |||

| ACProducts, Inc., Term Loan, 9.902%, (SOFR + 4.25%), 5/17/28 | 269 | $ 214,378 | |

| Serta Simmons Bedding, LLC, Term Loan, 12.90%, (SOFR + 7.50%), 6/29/28 | 252 | 249,662 | |

| $ 464,040 | |||

| Household Products — 0.1% | |||

| Kronos Acquisition Holdings, Inc., Term Loan, 9.402%, (SOFR + 3.75%), 12/22/26 | 195 | $ 190,961 | |

| $ 190,961 | |||

| Borrower/Description | Principal Amount* (000's omitted) | Value | |

| Independent Power and Renewable Electricity Producers — 0.1% | |||

| Calpine Construction Finance Company L.P., Term Loan, 7.574%, (SOFR + 2.25%), 7/31/30 | 160 | $ 158,598 | |

| $ 158,598 | |||

| Insurance — 1.4% | |||

| Alliant Holdings Intermediate, LLC, Term Loan, 8.835%, (SOFR + 3.50%), 11/5/27 | 149 | $ 148,433 | |

| AmWINS Group, Inc., Term Loan, 7.689%, (SOFR + 2.25%), 2/19/28 | 608 | 603,452 | |

| AssuredPartners, Inc., Term Loan, 8.939%, (SOFR + 3.50%), 2/12/27 | 24 | 23,895 | |

| HUB International Limited, Term Loan, 9.662%, (SOFR + 4.25%), 6/20/30 | 546 | 546,660 | |

| NFP Corp., Term Loan, 8.689%, (SOFR + 3.25%), 2/16/27 | 48 | 46,809 | |

| Ryan Specialty Group, LLC, Term Loan, 8.424%, (SOFR + 3.00%), 9/1/27 | 267 | 267,000 | |

| USI, Inc., Term Loan, 9.14%, (SOFR + 3.75%), 11/22/29 | 376 | 376,112 | |

| $ 2,012,361 | |||

| Interactive Media & Services — 0.1% | |||

| Getty Images, Inc., Term Loan, 9.99%, (SOFR + 4.50%), 2/19/26 | 92 | $ 92,567 | |

| Match Group, Inc., Term Loan, 7.298%, (SOFR + 1.75%), 2/13/27 | 100 | 99,719 | |

| $ 192,286 | |||

| IT Services — 2.4% | |||

| Asurion, LLC: | |||

| Term Loan, 8.689%, (SOFR + 3.25%), 12/23/26 | 486 | $ 470,675 | |

| Term Loan, 8.689%, (SOFR + 3.25%), 7/31/27 | 39 | 37,294 | |

| Term Loan, 9.424%, (SOFR + 4.00%), 8/19/28 | 220 | 210,553 | |

| Term Loan - Second Lien, 10.689%, (SOFR + 5.25%), 1/31/28 | 50 | 43,646 | |

| Endure Digital, Inc., Term Loan, 9.422%, (SOFR + 3.50%), 2/10/28 | 440 | 409,427 | |

| Gainwell Acquisition Corp., Term Loan, 9.49%, (SOFR + 4.00%), 10/1/27 | 828 | 793,175 | |

| Go Daddy Operating Company, LLC, Term Loan, 7.824%, (SOFR + 2.50%), 11/9/29 | 578 | 579,416 | |

| Informatica, LLC, Term Loan, 8.189%, (SOFR + 2.75%), 10/27/28 | 369 | 369,086 | |

| Rackspace Technology Global, Inc., Term Loan, 8.206%, (SOFR + 2.75%), 2/15/28 | 219 | 98,883 | |

| Borrower/Description | Principal Amount* (000's omitted) | Value | |

| IT Services (continued) | |||

| Sedgwick Claims Management Services, Inc., Term Loan, 9.074%, (SOFR + 3.75%), 2/24/28 | 167 | $ 166,799 | |

| Skopima Merger Sub, Inc., Term Loan, 9.439%, (SOFR + 4.00%), 5/12/28 | 221 | 213,924 | |

| $ 3,392,878 | |||

| Leisure Products — 0.2% | |||

| Amer Sports Oyj, Term Loan, 7.948%, (3 mo. EURIBOR + 4.00%), 3/30/26 | EUR | 263 | $ 275,842 |

| $ 275,842 | |||

| Life Sciences Tools & Services — 0.5% | |||

| Catalent Pharma Solutions, Inc., Term Loan, 7.453%, (SOFR + 2.00%), 2/22/28 | 144 | $ 140,514 | |

| Packaging Coordinators Midco, Inc., Term Loan, 9.152%, (SOFR + 3.50%), 11/30/27 | 220 | 217,378 | |

| Sotera Health Holdings, LLC, Term Loan, 8.395%, (SOFR + 2.75%), 12/11/26 | 100 | 99,600 | |

| Star Parent, Inc., Term Loan, 9.386%, (3 mo. USD LIBOR + 4.00%), 9/27/30 | 200 | 191,396 | |

| $ 648,888 | |||

| Machinery — 1.7% | |||

| Albion Financing 3 S.a.r.l., Term Loan, 10.924%, (SOFR + 5.25%), 8/17/26 | 221 | $ 221,062 | |

| Alliance Laundry Systems, LLC, Term Loan, 8.932%, (SOFR + 3.50%), 10/8/27 | 162 | 161,972 | |

| American Trailer World Corp., Term Loan, 9.174%, (SOFR + 3.75%), 3/3/28 | 34 | 32,089 | |

| Apex Tool Group, LLC, Term Loan, 10.689%, (SOFR + 5.25%), 2/8/29 | 264 | 225,264 | |

| Conair Holdings, LLC, Term Loan, 9.189%, (SOFR + 3.75%), 5/17/28 | 221 | 204,927 | |

| CPM Holdings, Inc., Term Loan, 9.827%, (SOFR + 4.50%), 9/28/28 | 47 | 46,561 | |

| EMRLD Borrower, L.P., Term Loan, 8.38%, (SOFR + 3.00%), 5/31/30 | 175 | 174,891 | |

| Filtration Group Corporation, Term Loan, 8.939%, (SOFR + 3.50%), 10/21/28 | 98 | 97,388 | |

| Gates Global, LLC, Term Loan, 7.924%, (SOFR + 2.50%), 3/31/27 | 287 | 287,296 | |

| Icebox Holdco III, Inc., Term Loan, 9.402%, (SOFR + 3.75%), 12/22/28 | 123 | 120,870 | |

| SPX Flow, Inc., Term Loan, 9.924%, (SOFR + 4.50%), 4/5/29 | 174 | 173,003 | |

| Borrower/Description | Principal Amount* (000's omitted) | Value | |

| Machinery (continued) | |||

| Titan Acquisition Limited, Term Loan, 8.731%, (3 mo. USD LIBOR + 3.00%), 3/28/25 | 402 | $ 395,979 | |

| Vertical US Newco, Inc., Term Loan, 9.381%, (SOFR + 3.50%), 7/30/27 | 194 | 193,017 | |

| $ 2,334,319 | |||

| Media — 0.8% | |||

| CSC Holdings, LLC: | |||

| Term Loan, 7.699%, (1 mo. USD LIBOR + 2.25%), 7/17/25 | 430 | $ 417,994 | |

| Term Loan, 7.699%, (1 mo. USD LIBOR + 2.25%), 1/15/26 | 143 | 137,803 | |

| Gray Television, Inc.: | |||

| Term Loan, 7.929%, (SOFR + 2.50%), 1/2/26 | 85 | 84,849 | |

| Term Loan, 8.429%, (SOFR + 3.00%), 12/1/28 | 147 | 141,736 | |

| Hubbard Radio, LLC, Term Loan, 9.69%, (1 mo. USD LIBOR + 4.25%), 3/28/25 | 72 | 60,756 | |

| iHeartCommunications, Inc., Term Loan, 8.439%, (SOFR + 3.00%), 5/1/26 | 67 | 56,987 | |

| Magnite, Inc., Term Loan, 10.538%, (SOFR + 5.00%), 4/28/28(17) | 98 | 98,300 | |

| Sinclair Television Group, Inc., Term Loan, 7.939%, (SOFR + 2.50%), 9/30/26 | 96 | 81,055 | |

| $ 1,079,480 | |||

| Metals/Mining — 0.2% | |||

| PMHC II, Inc., Term Loan, 9.807%, (SOFR + 4.25%), 4/23/29 | 199 | $ 181,536 | |

| Zekelman Industries, Inc., Term Loan, 7.449%, (SOFR + 2.00%), 1/24/27 | 119 | 119,387 | |

| $ 300,923 | |||

| Oil, Gas & Consumable Fuels — 0.5% | |||

| Freeport LNG Investments, LLP, Term Loan, 9.177%, (SOFR + 3.50%), 12/21/28 | 98 | $ 95,964 | |

| Matador Bidco S.a.r.l., Term Loan, 9.924%, (SOFR + 4.50%), 10/15/26 | 131 | 131,338 | |

| Oryx Midstream Services Permian Basin, LLC, Term Loan, 8.692%, (SOFR + 3.25%), 10/5/28 | 146 | 146,454 | |

| QuarterNorth Energy Holding, Inc., Term Loan - Second Lien, 13.439%, (SOFR + 8.00%), 8/27/26 | 55 | 55,160 | |

| UGI Energy Services, LLC, Term Loan, 8.674%, (SOFR + 3.25%), 2/22/30 | 218 | 218,221 | |

| $ 647,137 | |||

| Borrower/Description | Principal Amount* (000's omitted) | Value | |

| Personal Products — 0.2% | |||

| HLF Financing S.a.r.l., Term Loan, 7.939%, (SOFR + 2.50%), 8/18/25 | 131 | $ 129,456 | |

| Sunshine Luxembourg VII S.a.r.l., Term Loan, 9.24%, (SOFR + 3.75%), 10/1/26 | 146 | 146,240 | |

| $ 275,696 | |||

| Pharmaceuticals — 1.1% | |||

| Bausch Health Companies, Inc., Term Loan, 10.689%, (SOFR + 5.25%), 2/1/27 | 394 | $ 309,036 | |

| Elanco Animal Health Incorporated, Term Loan, 7.165%, (SOFR + 1.75%), 8/1/27 | 270 | 264,162 | |

| Jazz Financing Lux S.a.r.l., Term Loan, 8.939%, (SOFR + 3.50%), 5/5/28 | 220 | 220,426 | |

| Mallinckrodt International Finance S.A.: | |||

| DIP Loan, 13.439%, (SOFR + 8.00%), 8/28/24 | 30 | 30,769 | |

| DIP Loan, 13.451%, (SOFR + 8.00%), 8/28/24 | 56 | 58,315 | |

| Term Loan, 12.703%, (SOFR + 7.25%), 9/30/27 | 625 | 476,101 | |

| Term Loan, 12.953%, (SOFR + 7.50%), 9/30/27 | 209 | 159,405 | |

| $ 1,518,214 | |||

| Professional Services — 1.2% | |||

| AlixPartners, LLP, Term Loan, 8.189%, (SOFR + 2.75%), 2/4/28 | 219 | $ 219,390 | |

| Camelot U.S. Acquisition, LLC: | |||

| Term Loan, 8.439%, (SOFR + 3.00%), 10/30/26 | 224 | 224,440 | |

| Term Loan, 8.439%, (SOFR + 3.00%), 10/30/26 | 144 | 144,251 | |

| CoreLogic, Inc., Term Loan, 8.939%, (SOFR + 3.50%), 6/2/28 | 390 | 355,903 | |

| Deerfield Dakota Holding, LLC, Term Loan, 9.14%, (SOFR + 3.75%), 4/9/27 | 314 | 304,297 | |

| Employbridge Holding Company, Term Loan, 10.407%, (SOFR + 4.75%), 7/19/28 | 221 | 192,317 | |

| Techem Verwaltungsgesellschaft 675 mbH, Term Loan, 6.275%, (6 mo. EURIBOR + 2.38%), 7/15/25 | EUR | 111 | 116,916 |

| Trans Union, LLC, Term Loan, 7.689%, (SOFR + 2.25%), 12/1/28 | 186 | 185,834 | |

| $ 1,743,348 | |||

| Real Estate Management & Development — 0.4% | |||

| Cushman & Wakefield U.S. Borrower, LLC: | |||

| Term Loan, 8.189%, (SOFR + 2.75%), 8/21/25 | 19 | $ 19,213 | |

| Term Loan, 8.674%, (SOFR + 3.25%), 1/31/30 | 406 | 389,104 | |

| Term Loan, 9.324%, (SOFR + 4.00%), 1/31/30 | 167 | 159,586 | |

| $ 567,903 | |||

| Borrower/Description | Principal Amount* (000's omitted) | Value | |

| Road & Rail — 0.4% | |||

| Grab Holdings, Inc., Term Loan, 9.939%, (SOFR + 4.50%), 1/29/26 | 154 | $ 154,794 | |

| Kenan Advantage Group, Inc., Term Loan, 9.477%, (SOFR + 3.75%), 3/24/26 | 340 | 339,879 | |

| Uber Technologies, Inc., Term Loan, 8.159%, (SOFR + 2.75%), 3/3/30 | 110 | 110,322 | |

| $ 604,995 | |||

| Semiconductors & Semiconductor Equipment — 0.2% | |||

| Altar Bidco, Inc., Term Loan, 8.142%, (SOFR + 3.10%), 2/1/29(17) | 173 | $ 171,501 | |

| Ultra Clean Holdings, Inc., Term Loan, 9.191%, (SOFR + 3.75%), 8/27/25 | 152 | 152,366 | |

| $ 323,867 | |||

| Software — 6.3% | |||

| Applied Systems, Inc., Term Loan, 9.89%, (SOFR + 4.50%), 9/18/26 | 674 | $ 676,616 | |

| AppLovin Corporation, Term Loan, 8.424%, (SOFR + 3.10%), 8/16/30 | 208 | 207,538 | |

| AQA Acquisition Holding, Inc., Term Loan, 9.895%, (SOFR + 4.25%), 3/3/28 | 122 | 121,386 | |

| Astra Acquisition Corp.: | |||

| Term Loan, 10.902%, (SOFR + 5.25%), 10/25/28 | 148 | 101,808 | |

| Term Loan - Second Lien, 14.527%, (SOFR + 8.88%), 10/25/29 | 250 | 131,218 | |

| Banff Merger Sub, Inc.: | |||

| Term Loan, 9.189%, (SOFR + 3.75%), 10/2/25 | 342 | 341,704 | |

| Term Loan - Second Lien, 10.939%, (SOFR + 5.50%), 2/27/26 | 125 | 124,505 | |

| Central Parent, Inc., Term Loan, 9.406%, (SOFR + 4.00%), 7/6/29 | 323 | 321,225 | |

| CentralSquare Technologies, LLC, Term Loan, 9.29%, (SOFR + 3.75%), 8/29/25 | 194 | 183,419 | |

| Ceridian HCM Holding, Inc., Term Loan, 7.939%, (SOFR + 2.50%), 4/30/25 | 214 | 214,106 | |

| Cloud Software Group, Inc., Term Loan, 9.99%, (SOFR + 4.50%), 3/30/29(17) | 224 | 213,157 | |

| Cloudera, Inc., Term Loan, 9.174%, (SOFR + 3.75%), 10/8/28 | 393 | 379,081 | |

| Constant Contact, Inc., Term Loan, 9.687%, (SOFR + 4.00%), 2/10/28 | 270 | 251,158 | |

| Cornerstone OnDemand, Inc., Term Loan, 9.189%, (SOFR + 3.75%), 10/16/28 | 197 | 186,473 | |

| Delta TopCo, Inc.: | |||

| Term Loan, 9.069%, (SOFR + 3.75%), 12/1/27 | 219 | 216,301 | |

| Term Loan - Second Lien, 12.569%, (SOFR + 7.25%), 12/1/28 | 300 | 297,750 | |

| Borrower/Description | Principal Amount* (000's omitted) | Value | |

| Software (continued) | |||

| E2open, LLC, Term Loan, 8.939%, (SOFR + 3.50%), 2/4/28 | 122 | $ 120,739 | |

| ECI Macola Max Holding, LLC, Term Loan, 9.402%, (SOFR + 3.75%), 11/9/27 | 195 | 193,923 | |

| Epicor Software Corporation: | |||

| Term Loan, 8.689%, (SOFR + 3.25%), 7/30/27 | 96 | 96,018 | |

| Term Loan, 9.074%, (SOFR + 3.75%), 7/30/27 | 125 | 125,359 | |

| GoTo Group, Inc., Term Loan, 10.283%, (SOFR + 4.75%), 8/31/27 | 267 | 169,321 | |

| Greeneden U.S. Holdings II, LLC, Term Loan, 9.403%, (SOFR + 4.00%), 12/1/27 | 122 | 121,629 | |

| Imperva, Inc., Term Loan, 9.627%, (SOFR + 4.00%), 1/12/26 | 97 | 97,144 | |

| Ivanti Software, Inc., Term Loan, 9.907%, (SOFR + 4.25%), 12/1/27 | 214 | 190,638 | |

| Magenta Buyer, LLC: | |||

| Term Loan, 10.645%, (SOFR + 5.00%), 7/27/28 | 289 | 202,045 | |

| Term Loan - Second Lien, 13.895%, (SOFR + 8.25%), 7/27/29 | 75 | 32,475 | |

| Maverick Bidco, Inc., Term Loan, 9.283%, (SOFR + 3.75%), 5/18/28 | 123 | 119,930 | |

| McAfee, LLC, Term Loan, 9.165%, (SOFR + 3.75%), 3/1/29 | 395 | 378,295 | |

| Open Text Corporation, Term Loan, 8.174%, (SOFR + 2.75%), 1/31/30 | 194 | 194,524 | |

| Polaris Newco, LLC, Term Loan, 9.439%, (SOFR + 4.00%), 6/2/28 | 368 | 347,885 | |

| Proofpoint, Inc., Term Loan, 8.689%, (SOFR + 3.25%), 8/31/28 | 368 | 362,809 | |

| RealPage, Inc., Term Loan, 8.439%, (SOFR + 3.00%), 4/24/28 | 392 | 383,403 | |

| Sabre GLBL, Inc., Term Loan, 9.674%, (SOFR + 4.25%), 6/30/28 | 175 | 149,917 | |

| SolarWinds Holdings, Inc., Term Loan, 9.074%, (SOFR + 3.75%), 2/5/27 | 249 | 248,983 | |

| SS&C European Holdings S.a.r.l., Term Loan, 7.189%, (SOFR + 1.75%), 4/16/25 | 121 | 121,416 | |

| SS&C Technologies, Inc., Term Loan, 7.189%, (SOFR + 1.75%), 4/16/25 | 128 | 128,581 | |

| Ultimate Software Group, Inc. (The): | |||

| Term Loan, 8.764%, (SOFR + 3.25%), 5/4/26 | 608 | 605,539 | |

| Term Loan, 9.233%, (SOFR + 3.75%), 5/4/26 | 240 | 239,719 | |

| Veritas US, Inc., Term Loan, 10.439%, (SOFR + 5.11%), 9/1/25 | 388 | 329,459 | |

| $ 8,927,196 | |||

| Borrower/Description | Principal Amount* (000's omitted) | Value | |

| Specialty Retail — 0.9% | |||

| Great Outdoors Group, LLC, Term Loan, 9.402%, (SOFR + 3.75%), 3/6/28 | 389 | $ 386,750 | |

| Hoya Midco, LLC, Term Loan, 8.633%, (SOFR + 3.25%), 2/3/29 | 74 | 73,953 | |

| Les Schwab Tire Centers, Term Loan, 8.692%, (SOFR + 3.25%), 11/2/27 | 438 | 437,203 | |

| Mattress Firm, Inc., Term Loan, 9.95%, (6 mo. USD LIBOR + 4.25%), 9/25/28 | 165 | 163,576 | |

| PetSmart, Inc., Term Loan, 9.174%, (SOFR + 3.75%), 2/11/28 | 220 | 217,758 | |

| $ 1,279,240 | |||

| Trading Companies & Distributors — 1.0% | |||

| Electro Rent Corporation, Term Loan, 11.002%, (SOFR + 5.50%), 11/1/24 | 258 | $ 242,407 | |

| Park River Holdings, Inc., Term Loan, 8.907%, (SOFR + 3.25%), 12/28/27 | 97 | 92,415 | |

| Spin Holdco, Inc., Term Loan, 9.664%, (SOFR + 4.00%), 3/4/28 | 585 | 502,871 | |

| SRS Distribution, Inc., Term Loan, 8.939%, (SOFR + 3.50%), 6/2/28 | 147 | 143,564 | |

| White Cap Buyer, LLC, Term Loan, 9.074%, (SOFR + 3.75%), 10/19/27 | 315 | 313,619 | |

| Windsor Holdings III, LLC, Term Loan, 9.815%, (SOFR + 4.50%), 8/1/30 | 150 | 149,725 | |

| $ 1,444,601 | |||

| Transportation Infrastructure — 0.1% | |||

| Brown Group Holding, LLC, Term Loan, 8.174%, (SOFR + 2.75%), 6/7/28 | 184 | $ 181,402 | |

| $ 181,402 | |||

| Wireless Telecommunication Services — 0.1% | |||

| Digicel International Finance Limited, Term Loan, 8.902%, (3 mo. USD LIBOR + 3.25%), 5/28/24 | 118 | $ 108,199 | |

| $ 108,199 | |||

| Total Senior Floating-Rate Loans (identified cost $52,345,551) | $ 50,037,013 | ||

| Sovereign Government Bonds — 14.6% |

| Security | Principal Amount* (000's omitted) | Value | |

| Albania — 0.3% | |||

| Albania Government International Bond, 5.90%, 6/9/28(15) | EUR | 427 | $ 437,515 |

| $ 437,515 | |||

| Angola — 0.1% | |||

| Republic of Angola, 8.75%, 4/14/32(15) | 230 | $ 179,625 | |

| $ 179,625 | |||

| Argentina — 0.4% | |||

| Republic of Argentina: | |||

| 0.75% to 7/9/27, 7/9/30(4) | 194 | $ 54,467 | |

| 1.00%, 7/9/29 | 248 | 67,117 | |

| 3.50% to 7/9/29, 7/9/41(4) | 410 | 108,420 | |

| 3.625% to 7/9/24, 7/9/35(4) | 450 | 112,315 | |

| 4.25% to 7/9/24, 1/9/38(4) | 770 | 234,515 | |

| $ 576,834 | |||

| Bahrain — 0.5% | |||

| Kingdom of Bahrain: | |||

| 5.625%, 9/30/31(15) | 350 | $ 306,066 | |

| 6.75%, 9/20/29(15) | 200 | 193,535 | |

| 7.375%, 5/14/30(15) | 200 | 198,228 | |

| $ 697,829 | |||

| Barbados — 0.3% | |||

| Government of Barbados, 6.50%, 10/1/29(1) | 385 | $ 363,240 | |

| $ 363,240 | |||

| Benin — 0.4% | |||

| Benin Government International Bond: | |||

| 4.875%, 1/19/32(15) | EUR | 241 | $ 191,321 |

| 4.95%, 1/22/35(15) | EUR | 100 | 72,009 |

| 6.875%, 1/19/52(15) | EUR | 445 | 309,530 |

| $ 572,860 | |||

| Chile — 0.6% | |||

| Chile Government International Bond: | |||

| 2.45%, 1/31/31 | 200 | $ 161,637 | |

| 2.55%, 7/27/33 | 550 | 413,388 | |

| Security | Principal Amount* (000's omitted) | Value | |

| Chile (continued) | |||

| Chile Government International Bond: (continued) | |||

| 3.50%, 4/15/53 | 340 | $ 212,592 | |

| $ 787,617 | |||

| Costa Rica — 0.1% | |||

| Costa Rica Government International Bond, 6.55%, 4/3/34(15) | 200 | $ 190,833 | |

| $ 190,833 | |||

| Croatia — 0.1% | |||

| Croatia Government International Bond, 1.75%, 3/4/41(15) | EUR | 100 | $ 71,563 |

| $ 71,563 | |||

| Dominican Republic — 0.4% | |||

| Dominican Republic: | |||

| 5.875%, 1/30/60(15) | 191 | $ 136,372 | |

| 6.00%, 7/19/28(15) | 200 | 190,320 | |

| 6.40%, 6/5/49(15) | 160 | 126,142 | |

| 6.85%, 1/27/45(15) | 150 | 125,573 | |

| $ 578,407 | |||

| Ecuador — 0.2% | |||

| Republic of Ecuador, 2.50%, 7/31/40(15) | 1,260 | $ 311,865 | |

| $ 311,865 | |||

| Egypt — 0.3% | |||

| Arab Republic of Egypt: | |||

| 8.50%, 1/31/47(15) | 318 | $ 166,139 | |

| 8.70%, 3/1/49(15) | 200 | 106,000 | |

| 8.875%, 5/29/50(15) | 200 | 106,852 | |

| $ 378,991 | |||

| El Salvador — 0.3% | |||

| Republic of El Salvador: | |||

| 5.875%, 1/30/25(15) | 26 | $ 23,953 | |

| 6.375%, 1/18/27(15) | 173 | 142,314 | |

| 7.65%, 6/15/35(15) | 10 | 7,049 | |

| 8.25%, 4/10/32(15) | 242 | 191,110 | |

| $ 364,426 | |||

| Security | Principal Amount* (000's omitted) | Value | |

| Ethiopia — 0.2% | |||

| Ethiopia Government International Bond, 6.625%, 12/11/24(15) | 400 | $ 253,915 | |

| $ 253,915 | |||

| Ghana — 0.3% | |||

| Ghana Government International Bond: | |||

| 7.625%, 5/16/29(14)(15) | 200 | $ 85,706 | |

| 7.75%, 4/7/29(14)(15) | 290 | 124,726 | |

| 8.125%, 3/26/32(14)(15) | 290 | 122,986 | |

| 8.627%, 6/16/49(14)(15) | 320 | 134,024 | |

| $ 467,442 | |||

| Guatemala — 0.1% | |||

| Guatemala Government International Bond, 5.375%, 4/24/32(15) | 200 | $ 178,339 | |

| $ 178,339 | |||

| Hungary — 0.4% | |||

| Hungary Government International Bond: | |||

| 2.125%, 9/22/31(15) | 310 | $ 224,089 | |

| 6.25%, 9/22/32(1)(15) | 400 | 385,526 | |

| $ 609,615 | |||

| India — 0.2% | |||

| Export-Import Bank of India, 2.25%, 1/13/31(15) | 368 | $ 282,813 | |

| $ 282,813 | |||

| Indonesia — 0.9% | |||

| Indonesia Government International Bond: | |||

| 3.55%, 3/31/32 | 554 | $ 468,364 | |

| 4.65%, 9/20/32 | 400 | 367,212 | |

| 4.85%, 1/11/33 | 400 | 374,400 | |

| $ 1,209,976 | |||

| Ivory Coast — 0.4% | |||

| Ivory Coast Government International Bond: | |||

| 6.625%, 3/22/48(15) | EUR | 325 | $ 231,691 |

| 6.875%, 10/17/40(15) | EUR | 512 | 393,768 |

| $ 625,459 | |||

| Jordan — 0.1% | |||

| Kingdom of Jordan, 7.375%, 10/10/47(15) | 200 | $ 151,828 | |

| $ 151,828 | |||

| Security | Principal Amount* (000's omitted) | Value | |

| Kazakhstan — 0.2% | |||

| Kazakhstan Government International Bond, 6.50%, 7/21/45(15) | 210 | $ 206,816 | |

| $ 206,816 | |||

| Kenya — 0.1% | |||

| Government of Kenya, 7.25%, 2/28/28(15) | 200 | $ 162,910 | |

| $ 162,910 | |||

| Lebanon — 0.0%(12) | |||

| Lebanese Republic: | |||

| 5.80%, 4/14/20(14)(15) | 20 | $ 1,287 | |

| 6.10%, 10/4/22(14)(15) | 337 | 20,999 | |

| 6.15%, 6/19/20(14) | 26 | 1,673 | |

| 6.375%, 3/9/20(14) | 385 | 24,768 | |

| 6.40%, 5/26/23(14) | 6 | 375 | |

| 6.65%, 11/3/28(14)(15) | 65 | 4,274 | |

| 6.85%, 5/25/29(14) | 2 | 128 | |

| 8.20%, 5/17/33(14) | 70 | 4,548 | |

| 8.25%, 5/17/34(14) | 58 | 3,868 | |

| $ 61,920 | |||

| Mexico — 0.8% | |||

| Mexico Government International Bond: | |||

| 4.875%, 5/19/33 | 451 | $ 396,329 | |

| 5.00%, 4/27/51 | 400 | 296,495 | |

| 5.40%, 2/9/28 | 415 | 408,113 | |

| $ 1,100,937 | |||

| Nigeria — 0.5% | |||

| Republic of Nigeria: | |||

| 7.375%, 9/28/33(15) | 440 | $ 332,182 | |

| 7.625%, 11/28/47(15) | 200 | 135,546 | |

| 7.696%, 2/23/38(15) | 403 | 288,385 | |

| $ 756,113 | |||

| North Macedonia — 0.5% | |||

| North Macedonia Government International Bond: | |||

| 1.625%, 3/10/28(15) | EUR | 370 | $ 319,202 |

| 6.96%, 3/13/27(15) | EUR | 345 | 370,406 |

| $ 689,608 | |||

| Oman — 0.5% | |||

| Oman Government International Bond: | |||

| 5.375%, 3/8/27(15) | 200 | $ 193,921 | |

| Security | Principal Amount* (000's omitted) | Value | |

| Oman (continued) | |||

| Oman Government International Bond: (continued) | |||

| 6.25%, 1/25/31(15) | 200 | $ 194,719 | |

| 7.375%, 10/28/32(15) | 351 | 365,324 | |

| $ 753,964 | |||

| Panama — 0.4% | |||

| Panama Bonos del Tesoro, 6.375%, 7/25/33(1)(15) | 20 | $ 18,286 | |

| Panama Government International Bond, 6.70%, 1/26/36 | 622 | 584,868 | |

| $ 603,154 | |||

| Paraguay — 0.2% | |||

| Republic of Paraguay, 4.95%, 4/28/31(15) | 259 | $ 236,117 | |

| $ 236,117 | |||

| Peru — 0.4% | |||

| Peruvian Government International Bond: | |||

| 2.783%, 1/23/31 | 150 | $ 120,456 | |

| 3.00%, 1/15/34 | 360 | 273,455 | |

| 3.30%, 3/11/41 | 170 | 113,066 | |

| $ 506,977 | |||

| Romania — 0.9% | |||

| Romania Government International Bond: | |||

| 1.75%, 7/13/30(15) | EUR | 192 | $ 155,117 |

| 2.00%, 1/28/32(15) | EUR | 4 | 3,054 |

| 2.00%, 4/14/33(15) | EUR | 198 | 144,464 |

| 2.124%, 7/16/31(15) | EUR | 7 | 5,510 |

| 2.75%, 2/26/26(15) | EUR | 84 | 85,210 |

| 2.75%, 4/14/41(15) | EUR | 122 | 76,483 |

| 3.375%, 1/28/50(15) | EUR | 258 | 162,050 |

| 3.624%, 5/26/30(15) | EUR | 2 | 1,833 |

| 3.75%, 2/7/34(15) | EUR | 14 | 11,730 |

| 4.625%, 4/3/49(15) | EUR | 435 | 341,489 |

| 6.625%, 9/27/29(15) | EUR | 235 | 256,385 |

| $ 1,243,325 | |||

| Serbia — 0.3% | |||

| Serbia Government International Bond, 2.125%, 12/1/30(15) | 605 | $ 445,736 | |

| $ 445,736 | |||

| Sri Lanka — 0.5% | |||

| Sri Lanka Government International Bond: | |||

| 5.75%, 4/18/23(14)(15) | 370 | $ 194,216 | |

| Security | Principal Amount* (000's omitted) | Value | |

| Sri Lanka (continued) | |||

| Sri Lanka Government International Bond: (continued) | |||

| 6.20%, 5/11/27(14)(15) | 650 | $ 327,242 | |

| 6.85%, 11/3/25(14)(15) | 410 | 214,207 | |

| $ 735,665 | |||

| Suriname — 1.1% | |||

| Republic of Suriname, 9.25%, 10/26/26(14)(15) | 1,737 | $ 1,585,013 | |

| $ 1,585,013 | |||

| Ukraine — 0.2% | |||

| Ukraine Government International Bond: | |||

| 0.00%, GDP-Linked, 8/1/41(14)(15)(20) | 83 | $ 34,806 | |

| 7.75%, 9/1/24(14)(15) | 376 | 121,362 | |

| 7.75%, 9/1/25(14)(15) | 100 | 30,969 | |

| 7.75%, 9/1/28(14)(15) | 200 | 57,070 | |

| $ 244,207 | |||

| United Arab Emirates — 0.7% | |||

| Finance Department Government of Sharjah: | |||

| 4.375%, 3/10/51(15) | 670 | $ 408,238 | |

| 6.50%, 11/23/32(1)(15) | 540 | 524,323 | |

| $ 932,561 | |||

| Uruguay — 0.3% | |||

| Uruguay Government Bond: | |||

| 4.375%, 1/23/31 | 150 | $ 142,066 | |

| 5.10%, 6/18/50 | 210 | 182,463 | |

| 5.75%, 10/28/34 | 140 | 140,446 | |

| $ 464,975 | |||

| Uzbekistan — 0.3% | |||

| Republic of Uzbekistan: | |||

| 4.75%, 2/20/24(15) | 240 | $ 238,463 | |

| 5.375%, 2/20/29(15) | 200 | 178,254 | |

| $ 416,717 | |||

| Zambia — 0.1% | |||

| Zambia Government International Bond, 5.375%, 9/20/22(14)(15) | 200 | $ 110,011 | |

| $ 110,011 | |||

| Total Sovereign Government Bonds (identified cost $23,428,587) | $ 20,547,718 | ||

| Sovereign Loans — 0.9% |

| Borrower/Description | Principal Amount (000's omitted) | Value | |

| Tanzania — 0.9% | |||

| Government of the United Republic of Tanzania, Term Loan, 12.174%, (6 mo. USD LIBOR + 6.30%), 4/28/31(2) | $ | 1,288 | $ 1,257,494 |

| Total Sovereign Loans (identified cost $1,288,235) | $ 1,257,494 | ||

| U.S. Government Agency Mortgage-Backed Securities — 22.0% |

| Security | Principal Amount (000's omitted) | Value | |

| Federal Home Loan Mortgage Corp.: | |||

| 4.196%, (COF + 1.254%), 1/1/35(21) | $ | 189 | $ 184,714 |

| 5.00%, 8/1/52 | 2,446 | 2,258,491 | |

| 6.00%, 3/1/29 | 421 | 420,732 | |

| 6.15%, 7/20/27 | 43 | 42,483 | |

| 6.50%, 7/1/32 | 278 | 281,518 | |

| 7.00%, 4/1/36 | 322 | 331,013 | |

| 7.50%, 11/17/24 | 6 | 6,521 | |

| 9.00%, 3/1/31 | 3 | 2,891 | |

| Federal National Mortgage Association: | |||

| 4.44%, (6 mo. RFUCCT + 1.54%), 9/1/37(21) | 120 | 119,768 | |

| 5.00%, with various maturities to 2040 | 595 | 575,974 | |

| 5.50%, 30-Year, TBA(22) | 300 | 284,777 | |

| 5.50%, with various maturities to 2033 | 430 | 424,934 | |

| 6.00%, 11/1/23 | 1 | 1,039 | |

| 6.334%, (COF + 2.004%), 7/1/32(21) | 84 | 85,284 | |

| 6.50%, with various maturities to 2036 | 685 | 693,829 | |

| 7.00%, with various maturities to 2037 | 274 | 280,053 | |

| Government National Mortgage Association: | |||

| 4.50%, 10/15/47 | 117 | 106,897 | |

| 5.00%, 6/20/52 | 1,941 | 1,803,264 | |

| 5.50%, 30-Year, TBA(22) | 10,700 | 10,235,007 | |

| 5.50%, with various maturities to 2062 | 936 | 895,365 | |

| 6.00%, 30-Year, TBA(22) | 11,000 | 10,779,453 | |

| 6.00%, 7/20/53 | 249 | 245,531 | |

| 6.50%, 30-Year, TBA(22) | 800 | 798,516 | |

| 7.50%, 8/15/25 | 14 | 13,937 | |

| 8.00%, 3/15/34 | 215 | 219,391 | |

| 9.50%, 7/15/25 | 0 (23) | 56 | |

| Total U.S. Government Agency Mortgage-Backed Securities (identified cost $31,833,661) | $ 31,091,438 | ||

| Short-Term Investments — 3.4% |

| Affiliated Fund — 3.0% |

| Security | Shares | Value | |

| Morgan Stanley Institutional Liquidity Funds - Government Portfolio, Institutional Class, 5.25%(24) | 4,286,237 | $ 4,286,237 | |

| Total Affiliated Fund (identified cost $4,286,237) | $ 4,286,237 | ||

| U.S. Treasury Obligations — 0.4% |

| Security | Principal Amount (000's omitted) | Value | |

| U.S. Treasury Bills, 0.00%, 11/30/23(25) | $ | 500 | $ 497,872 |

| Total U.S. Treasury Obligations (identified cost $497,855) | $ 497,872 | ||

| Total Short-Term Investments (identified cost $4,784,092) | $ 4,784,109 | ||

| Total Investments — 128.7% (identified cost $206,162,572) | $181,510,330 | ||

| Less Unfunded Loan Commitments — (0.0)%(12) | $ (1,073) | ||

| Net Investments — 128.7% (identified cost $206,161,499) | $181,509,257 | ||

| Other Assets, Less Liabilities — (28.7)% | $ (40,467,506) | ||

| Net Assets — 100.0% | $141,041,751 | ||

| The percentage shown for each investment category in the Portfolio of Investments is based on net assets. | |

| * | In U.S. dollars unless otherwise indicated. |

| (1) | Security exempt from registration under Rule 144A of the Securities Act of 1933, as amended. These securities may be sold in certain transactions in reliance on an exemption from registration (normally to qualified institutional buyers). At October 31, 2023, the aggregate value of these securities is $55,323,353 or 39.2% of the Fund's net assets. |

| (2) | Variable rate security. The stated interest rate represents the rate in effect at October 31, 2023. |

| (3) | When-issued, variable rate security whose interest rate will be determined after October 31, 2023 |

| (4) | Step coupon security. Interest rate represents the rate in effect at October 31, 2023. |

| (5) | Interest only security that entitles the holder to receive only interest payments on the underlying mortgages. Principal amount shown is the notional amount of the underlying mortgages on which coupon interest is calculated. |

| (6) | Inverse floating-rate security whose coupon varies inversely with changes in the interest rate index. The stated interest rate represents the coupon rate in effect at October 31, 2023. |

| (7) | Principal only security that entitles the holder to receive only principal payments on the underlying mortgages. |

| (8) | Weighted average fixed-rate coupon that changes/updates monthly. Rate shown is the rate at October 31, 2023. |

| (9) | Represents an investment in an issuer that may be deemed to be an affiliate (see Note 8). |

| (10) | Non-income producing security. |

| (11) | Security was acquired in connection with a restructuring of a Senior Loan and may be subject to restrictions on resale. |

| (12) | Amount is less than 0.05% or (0.05)%, as applicable. |

| (13) | For fair value measurement disclosure purposes, security is categorized as Level 3 (see Note 9). |

| (14) | Issuer is in default with respect to interest and/or principal payments or has declared bankruptcy. For a variable rate security, interest rate has been adjusted to reflect non-accrual status. |

| (15) | Security exempt from registration under Regulation S of the Securities Act of 1933, as amended, which exempts from registration securities offered and sold outside the United States. Security may not be offered or sold in the United States except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act of 1933, as amended. At October 31, 2023, the aggregate value of these securities is $15,295,042 or 10.8% of the Fund's net assets. |

| (16) | Senior floating-rate loans (Senior Loans) often require prepayments from excess cash flows or permit the borrowers to repay at their election. The degree to which borrowers repay, whether as a contractual requirement or at their election, cannot be predicted with accuracy. As a result, the actual remaining maturity may be substantially less than the stated maturities shown. However, Senior Loans will typically have an expected average life of approximately two to four years. Senior Loans typically have rates of interest which are redetermined periodically by reference to a base lending rate, plus a spread. These base lending rates are primarily the Secured Overnight Financing Rate (“SOFR”) (or the London Interbank Offered Rate (“LIBOR”) for those loans whose rates reset prior to the discontinuance of LIBOR on June 30, 2023) and secondarily, the prime rate offered by one or more major United States banks (the “Prime Rate”). Base lending rates may be subject to a floor, or minimum rate. Rates for SOFR are generally 1 or 3-month tenors and may also be subject to a credit spread adjustment. Senior Loans are generally subject to contractual restrictions that must be satisfied before they can be bought or sold. |