As filed with the Securities and Exchange Commission on July 26, 2004

Registration No. 333-115199

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 3

to

Form S-1

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

eCOST.COM, INC.

(Exact Name of Registrant as Specified in Its Charter)

| | | | |

| Delaware | | 5961 | | 33-0843777 |

(State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification No.) |

2555 West 190th Street, Suite 106

Torrance, California 90504

(310) 225-4044

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Adam W. Shaffer

Chief Executive Officer

2555 West 190th Street, Suite 106

Torrance, California 90504

(310) 225-4044

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| | |

Robert M. Mattson, Jr. Craig S. Mordock Bryan S. Gadol MORRISON & FOERSTER LLP 19900 MacArthur Boulevard, 12th Floor Irvine, California 92612 (949) 251-7500 | | Mark L. Dosier Paul D. Zier SONNENSCHEIN NATH & ROSENTHAL LLP 233 South Wacker Drive 8000 Sears Tower Chicago, Illinois 60606 (312) 876-8000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box. ¨

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment that specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission

becomes effective. This prospectus is not an offer to sell these securities and we are not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated July 26, 2004

PROSPECTUS

3,150,000 Shares

Common Stock

This is an initial public offering of 3,150,000 shares of common stock of eCOST.com, Inc. We are selling all of the shares of common stock offered by this prospectus. No public market currently exists for our common stock. We currently expect that the initial public offering price per share will be between $9.00 and $11.00. Our common stock has been approved for listing on the Nasdaq National Market under the symbol “ECST.”

We are currently a wholly-owned subsidiary of PC Mall, Inc. Upon completion of this offering, PC Mall will own approximately 81.6% of our outstanding common stock (80.2% if the underwriters’ over-allotment option is exercised in full).

Investing in our common stock involves a high degree of risk. Please see the section entitled “Risk Factors” starting on page 9 to read about risks you should consider carefully before buying shares of our common stock.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| | | | | | |

| | | Per Share

| | Total

|

Public Offering Price | | $ | | | $ | |

Underwriting Discounts and Commissions | | $ | | | $ | |

Proceeds, Before Expenses, to Us | | $ | | | $ | |

We have granted the underwriters a 30-day option to purchase up to an additional 315,000 shares of common stock from us at the initial public offering price, less the underwriting discount, to cover any over-allotments.

The underwriters expect to deliver the shares on or about , 2004.

William Blair & Company

ThinkEquity Partners LLC

Merriman Curhan Ford & Co.

Prospectus dated , 2004

Table of Contents

i

PROSPECTUS SUMMARY

This summary highlights information found in greater detail elsewhere in this prospectus. In addition to this summary, we urge you to read the entire prospectus carefully, particularly the risks of investing in our common stock discussed under the caption “Risk Factors” and the financial statements and accompanying notes before you decide to buy our common stock.

Our Business

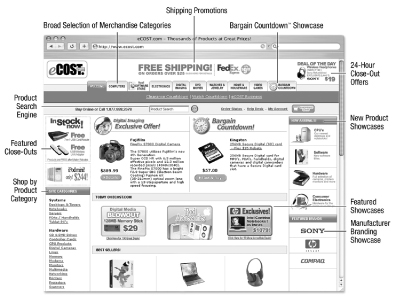

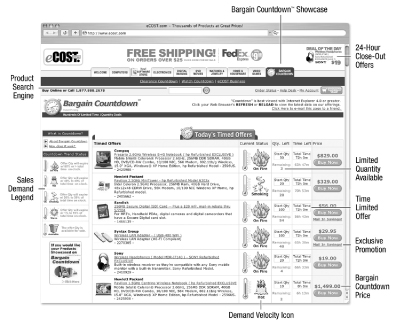

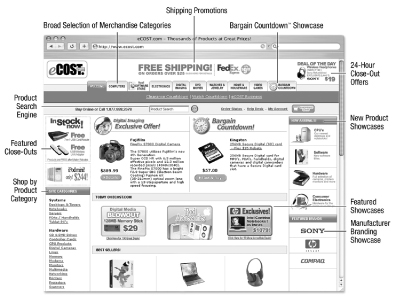

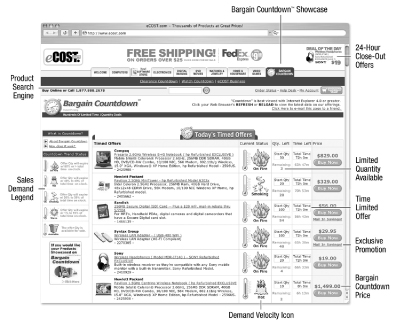

We are a multi-category online discount retailer of high quality new, “close-out” and refurbished brand-name merchandise. We currently offer over 100,000 products in seven merchandise categories, including computer hardware and software, home electronics, digital imaging, watches and jewelry, housewares, DVD movies, and video games. We appeal to a broad range of consumer and small business customers through what we believe is a unique and convenient buying experience offering two shopping formats: every day low price and our proprietary Bargain Countdown™. This combination of shopping formats helps attract value-conscious customers looking for high quality products at low prices to our eCOST.com website. We also provide rapid response customer service utilizing a strategically located distribution center and third-party fulfillment providers, as well as customer support from online and on-call sales representatives. We offer suppliers an efficient sales channel for merchandise in all stages of the product life cycle. We offer products from leading manufacturers such as Canon, Citizen, Denon, Hewlett-Packard, Nikon, Onkyo, Seiko and Toshiba and have access to a broad and deep selection of merchandise, including deeply discounted close-out and refurbished merchandise. We believe that our extensive selection of merchandise offered across a broad range of categories in a convenient shopping environment, combined with our rapid response service, creates customer loyalty and repeat customer orders. We were formed in February 1999 as a subsidiary of PC Mall, Inc.

We use a hybrid order fulfillment model that reduces inventory carrying cost while assuring that our customers experience rapid delivery and a high level of customer service. We use an outsourced distribution center, located near FedEx’s main hub in Memphis, Tennessee, which stocks faster selling products as well as special purchases of refurbished and close-out merchandise. For slower selling products not stocked in inventory, we have access to merchandise that can be sourced from 11 major distributors through our virtual warehouse technology.

We provide consumers and small businesses with quick and convenient access to high quality new, close-out and refurbished brand-name merchandise at discount prices similar to a traditional discount retailer. We offer the following key benefits to customers shopping on our website:

| | • | a broad and deep product selection of over 100,000 brand-name products primarily from well-known manufacturers; |

| | • | a compelling price-to-value proposition that offers low prices on new products and steeper discounts on close-out and refurbished merchandise; |

| | • | two shopping formats on our website that appeal to a broad customer base: every day low price and our proprietary Bargain Countdown™, a time- and quantity-limited format that is more deeply discounted; |

| | • | a rapid response order fulfillment model that allows us to ship substantially all orders in stock at the Memphis facility placed by 10:15 p.m. Eastern Time the same day they are placed and to deliver these orders at the customer’s request as early as 10:30 a.m. the next day for most domestic locations; |

| | • | a focus on responsive customer service and a positive shopping experience by our experienced team of customer service representatives; and |

| | • | appealing features for small business customers, including secure personalized websites, purchasing and payment history, software licensing, custom hardware configurations and flexible payment alternatives, and lease financing through third-party sources. |

1

We offer manufacturers and vendors the following key benefits:

| | • | a single point of distribution for new, refurbished and close-out products; |

| | • | an efficient distribution and sales channel through centralized distribution and product management capabilities, and an ability to rapidly sell inventory and quickly communicate feedback to vendors on product sell-through and inventory positions; |

| | • | customized manufacturer website stores to showcase the full assortment of a manufacturer’s products and accessories to customers we target through sophisticated marketing strategies; and |

| | • | speed to market for newly released products through quick postings and marketing of new products on our website. |

Our objective is to become a leading discount online retailer of nationally branded, high quality merchandise across multiple categories by providing a superior customer experience. Key elements of our growth strategy include:

| | • | expansion of product offerings and merchandise categories to attract new customers and offer a broader variety of merchandise to our existing customers; |

| | • | acquiring new customers through continued online campaigns as well as through new techniques involving online and traditional offline advertising, including print, media and direct mail; |

| | • | expansion of sales to existing customers by encouraging them to visit our website repeatedly to browse through additional merchandise categories and product offerings, new merchandise assortments, and new promotions; |

| | • | introduction of a fee-based membership program before the end of 2004 to provide participating customers with additional exclusive product and service offerings; and |

| | • | increasing eCOST.com brand awareness through strategic online and offline advertising programs. |

Risks Affecting our Company

Our business is subject to numerous risks as discussed more fully in the section entitled “Risk Factors” immediately following this prospectus summary. These risks include:

| | • | our limited operating history; |

| | • | our historical reliance on PC Mall for our operational and administrative infrastructure and our ability to develop our infrastructure quickly and cost effectively; |

| | • | our ability to successfully establish and manage our own inventory management and order fulfillment operations; |

| | • | our ability to establish and maintain relationships with key manufacturers and vendors as a stand-alone, independent company; |

| | • | costs or liabilities associated with intellectual property infringement claims; |

| | • | our ability to attract, retain and integrate key senior management and employees; |

| | • | our ability to raise capital in the future; |

| | • | our ability to successfully attract customers to our website through effective and efficient advertising and promotions and other strategic initiatives; and |

| | • | the effect of competition on our industry. |

2

Our Relationship with PC Mall

We are currently a wholly-owned subsidiary of PC Mall, Inc., which, through its subsidiaries, is a rapid response supplier of technology solutions for businesses and government and educational institutions, as well as consumers. Unless we indicate otherwise, references to “PC Mall” in this prospectus refer to our parent company PC Mall, Inc. and/or its subsidiaries excluding eCOST.com, Inc. After the completion of this offering, PC Mall will own approximately 81.6% of the outstanding shares of our common stock, or approximately 80.2% if the underwriters exercise their over-allotment option in full.

PC Mall has advised us that it intends to distribute its remaining ownership interest in our company to its common stockholders, which we refer to in this prospectus as the “distribution” or “spin-off.” PC Mall expects the distribution to take the form of a spin-off by means of a special dividend to its common stockholders of all of our common stock owned by PC Mall approximately six months after completion of this offering. Completion of the distribution is contingent upon the satisfaction or waiver of a variety of conditions described elsewhere in this prospectus, including the receipt of a favorable opinion of PC Mall’s tax counsel as to the tax-free nature of the distribution for U.S. federal income tax purposes. The distribution may not occur by the contemplated time or may not occur at all. For a discussion of the conditions to and the timing of the distribution, see “Certain Relationships and Related Transactions—Master Separation and Distribution Agreement” and “Shares Eligible for Future Sale.” This two-step process, consisting of the initial public offering described in this prospectus, including the repayment of a note in the amount of $10.0 million to PC Mall using a portion of the proceeds from this offering, followed by a distribution by PC Mall of our common stock to PC Mall stockholders, enables us to raise capital while at the same time achieving the benefits of our separation from PC Mall in a tax-efficient manner. For a description of use of the proceeds of this offering, please see “Use of Proceeds.”

We believe that our separation from PC Mall will enable us to realize the following benefits:

| | • | Strategic focus and business opportunities. Our separation from PC Mall will allow us to concentrate managerial attention on the needs of our business. As a separate company, we expect to be in a better position to grow our business and serve our customers more effectively through more efficient deployment of resources, increased operational flexibility and enhanced responsiveness to our customers and markets. In addition, we will no longer have to compete with other subsidiaries within the PC Mall organization for the allocation of resources and product supply. |

| | • | Incentives for employees more directly linked to our performance. We expect to enhance our employees’ motivation and to strengthen our management’s focus through incentive compensation programs tied to the market performance of our common stock. Our separation from PC Mall will enable us to offer our employees compensation more directly linked to the performance of our business than when we were a part of PC Mall. We believe that these incentives will also enhance our ability to attract and retain qualified personnel. |

| | • | Ability to grow our business through the reduction of perceived vendor conflicts. We believe that a number of our existing or targeted vendors may be reluctant to engage in significant business transactions with us while we are a subsidiary of PC Mall because these vendors may compete with or supply their products to other divisions of PC Mall. We believe that our separation from PC Mall will eliminate this perceived conflict, providing us the opportunity to broaden and deepen our vendor relationships and grow our business. |

| | • | Market recognition of the value of our business. As a separate, stand-alone company, we will offer a more focused investment opportunity than we have offered as part of the PC Mall organization. We expect that this will promote a more efficient equity valuation of our company. |

3

| | • | Direct access to capital markets. As a separate public company, we will have direct access to the capital markets to issue equity or debt securities. |

| | • | Increased ability to pursue strategic acquisitions. With the ability to issue our own stock as consideration for an acquisition, we expect to be better positioned to pursue strategic acquisitions to grow our business. However, our ability to use our equity securities to raise capital or engage in acquisition transactions will be restricted for a period of three years after the distribution. For a discussion of these limitations, please see “Risk Factors—Risks Related to Our Relationship with PC Mall—We may be required to indemnify PC Mall for taxes arising in connection with the spin-off, and the tax characteristics of the spin-off may interfere with our ability to engage in desirable strategic transactions and issue our equity securities.” |

As a subsidiary of PC Mall, we have received services provided by PC Mall, including administrative services (accounting, human resources, tax services, legal and treasury), inventory management and order fulfillment, credit card processing, information systems operation and administration, advertising services and use of office space. In consideration for these services, PC Mall has historically allocated and charged to us a portion of its related overhead costs. We expect that we will incur incremental additional operating expenses and capital expenses as a result of becoming a stand-alone public company. These stand-alone costs include certain administrative costs for services currently performed for us by PC Mall, costs to establish our own inventory management and order fulfillment capabilities, as well as other incremental costs we will incur.

Prior to the completion of this offering, we will enter into agreements with PC Mall related to the separation of our business operations from PC Mall. These agreements will provide for, among other things, administrative services, office space, inventory management and order fulfillment, information systems operation and administration, employee benefits, intellectual property matters, and other ongoing relationships. We expect to establish our own inventory management and order fulfillment capabilities prior to the completion of the distribution. With limited exceptions, the other services to be provided under our agreements with PC Mall are not expected to extend beyond 12 months from the completion of this offering. Each of these agreements with PC Mall have been or will be entered into while we are a wholly-owned subsidiary of PC Mall. All of the agreements relating to our separation from PC Mall will be made in the context of a parent-subsidiary relationship and will be entered into in the overall context of our separation from PC Mall. While we believe the agreements are fair to us, had these agreements been negotiated with unaffiliated third parties, they might have been more favorable to us. PC Mall currently offers many of the same products for sale as we offer, and PC Mall will not be restricted from competing with us in the future. See “Risk Factors—Risks Related to Our Relationship with PC Mall” and “Certain Relationships and Related Transactions” for a more detailed discussion of our relationship with PC Mall.

4

Recent Developments

The following are our expectations of our financial results for the second quarter of 2004. We have not finalized our financial statements for this period, however, and it is possible that the actual results may vary from our expectations set forth below.

We expect our net sales to be in the range of $38.7 million to $38.8 million for the second quarter of 2004, as compared to net sales of $23.9 million in the second quarter of 2003. In addition, we expect net income (loss) for the second quarter of 2004 to be in the range of $(0.1) million to $0.0 million, which includes $0.3 million of audit fee expense and $0.1 million of non-cash stock compensation expense. This compares with net income of $0.2 million in the second quarter of 2003.

This information should be read together with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the related notes included elsewhere in this prospectus.

Company Information

We were incorporated in Delaware in February 1999 as a wholly-owned subsidiary of PC Mall. Our principal executive offices are located at 2555 West 190th Street, Suite 106, Torrance, California 90504. Our telephone number at that location is (310) 225-4044. Our fiscal year ends December 31. Our website is www.ecost.com. The information and other content contained on our website are not part of this prospectus. As used in this prospectus, the terms “we,” “us,” “our,” the “company” and “eCOST.com” mean eCOST.com, Inc.

eCOST®, eCOST.com® and Bargain Countdown™ are our trademarks or registered trademarks. Other service marks, trademarks and trade names referred to in this prospectus are property of their respective owners.

5

The Offering

Common stock offered by us | 3,150,000 shares |

Common stock to be outstanding immediately after this offering | 17,150,000 shares |

Common stock to be held by PC Mall immediately after this offering | 14,000,000 shares |

Use of proceeds | We expect to receive approximately $26.6 million in net proceeds from this offering based on an assumed initial public offering price of $10.00 per share, after deducting underwriting discounts and estimated offering expenses. We expect to use $10.0 million of the net proceeds of this offering to repay a note payable to PC Mall and to use the balance for general corporate purposes, including working capital and capital expenditures. See “Use of Proceeds” on page 30 for more detailed information. |

Nasdaq National Market Symbol | ECST |

The number of shares of our common stock to be outstanding after this offering is based on 14,000,000 shares of our common stock outstanding as of June 30, 2004. This calculation:

| | • | excludes 918,400 shares of common stock issuable upon exercise of options outstanding as of that date that have a weighted average exercise price of $4.06 per share; and |

| | • | excludes an aggregate of 6,300,000 shares, plus annual increases, that will be reserved for future issuance under our 2004 Stock Incentive Plan upon completion of this offering. |

In connection with our spin-off from PC Mall, each outstanding option and warrant to purchase PC Mall common stock will be converted into an adjusted PC Mall option or warrant and an option or warrant to purchase a number of shares of eCOST.com common stock based on the distribution ratio. As of June 30, 2004 there were options and warrants to purchase an aggregate of 2,320,879 shares of PC Mall common stock outstanding. For a discussion of the treatment of outstanding PC Mall options and warrants, please see “Management—Employee Benefit Plans—Treatment of Outstanding PC Mall Options.”

For a more detailed discussion of our capital stock and stock option plans, please refer to note 6 to the financial statements, “Management—Employee Benefit Plans” on page 76 and “Description of Capital Stock” on page 96.

Unless we indicate otherwise, all information contained in this prospectus assumes:

| | • | a 1.4-for-1 split of our common stock to be completed immediately prior to this offering; |

| | • | that the underwriters have not exercised their over-allotment option; and |

| | • | that the agreements relating to our separation from PC Mall have been entered into by us and PC Mall or its affiliates. |

6

Summary Financial and Operating Data

(in thousands, except per share and operating data)

The following table sets forth our summary financial and operating data for the periods indicated. You should read this information together with our financial statements and related notes appearing elsewhere in this prospectus and the information under “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” The summary operating data for all periods presented are unaudited and have been derived from internal records of our operations. The historical financial information may not be indicative of our future performance and may not reflect what our financial position and results of operations would have been had we operated as a separate, stand-alone entity during the periods presented.

| | | | | | | | | | | | | | | | | | | | |

| | | Year Ended December 31,

| | | Three Months Ended

March 31,

| |

| | | 2001

| | | 2002

| | | 2003

| | | 2003

| | | 2004

| |

Statement of Operations Data: | | | | | | | | | | | | | | | | | | | | |

Net sales | | $ | 83,996 | | | $ | 89,009 | | | $ | 109,709 | | | $ | 23,890 | | | $ | 38,190 | |

Cost of goods sold | | | 75,057 | | | | 79,429 | | | | 99,409 | | | | 21,476 | | | | 34,732 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Gross profit | | | 8,939 | | | | 9,580 | | | | 10,300 | | | | 2,414 | | | | 3,458 | |

Selling, general and administrative expenses | | | 8,578 | | | | 8,945 | | | | 9,885 | | | | 2,106 | | | | 3,491 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Income (loss) from operations | | | 361 | | | | 635 | | | | 415 | | | | 308 | | | | (33 | ) |

Interest expense—PC Mall(1) | | | 675 | | | | 461 | | | | 76 | | | | 76 | | | | — | |

Interest expense—PC Mall commercial line of credit(2) | | | 709 | | | | 1,097 | | | | 1,476 | | | | 224 | | | | 401 | |

Interest income—PC Mall commercial line of credit(2) | | | (709 | ) | | | (1,097 | ) | | | (1,476 | ) | | | (224 | ) | | | (401 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Income (loss) before income taxes | | | (314 | ) | | | 174 | | | | 339 | | | | 232 | | | | (33 | ) |

Income tax provision (benefit)(3) | | | — | | | | 27 | | | | (5,872 | ) | | | — | | | | (13 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net income (loss) | | $ | (314 | ) | | $ | 147 | | | $ | 6,211 | | | $ | 232 | | | $ | (20 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | | |

Earnings (loss) per share: | | | | | | | | | | | | | | | | | | | | |

Basic | | $ | (0.02 | ) | | $ | 0.01 | | | $ | 0.44 | | | $ | 0.02 | | | $ | (0.00 | ) |

Diluted | | $ | (0.02 | ) | | $ | 0.01 | | | $ | 0.43 | | | $ | 0.02 | | | $ | (0.00 | ) |

| | | | | |

Weighted average number of shares(4): | | | | | | | | | | | | | | | | | | | | |

Basic | | | 14,000 | | | | 14,000 | | | | 14,000 | | | | 14,000 | | | | 14,000 | |

Diluted | | | 14,000 | | | | 14,422 | | | | 14,279 | | | | 14,426 | | | | 14,000 | |

| | | | | |

Unaudited pro forma earnings per share(5): | | | | | | | | | | | | | | | | | | | | |

Basic | | | | | | | | | | $ | 0.42 | | | | | | | $ | (0.00 | ) |

Diluted | | | | | | | | | | $ | 0.41 | | | | | | | $ | (0.00 | ) |

| | | | | |

Unaudited pro forma weighted average number of shares(4): | | | | | | | | | | | | | | | | | | | | |

Basic | | | | | | | | | | | 14,786 | | | | | | | | 14,786 | |

Diluted | | | | | | | | | | | 15,065 | | | | | | | | 14,786 | |

| | | | | | | | | | |

| | | Year Ended December 31,

| | Three Months Ended

March 31,

|

| | | 2001

| | 2002

| | 2003

| | 2003

| | 2004

|

Summary Operating Data (unaudited): | | | | | | | | | | |

Total customers(6) | | 398,948 | | 517,196 | | 720,422 | | 557,954 | | 793,808 |

Active customers(7) | | 156,871 | | 156,361 | | 261,493 | | 174,182 | | 300,914 |

New customers(8) | | 130,470 | | 118,248 | | 203,226 | | 40,758 | | 73,386 |

Number of orders(9) | | 155,700 | | 171,979 | | 330,983 | | 63,051 | | 119,192 |

Average order value(10) | | $564 | | $538 | | $345 | | $395 | | $333 |

Advertising expense(11) | | $2,849,000 | | $3,072,000 | | $3,609,000 | | $635,000 | | $1,306,000 |

7

| | | | | | | | | | | |

| | | As of March 31, 2004

|

| | | Actual

| | | Pro Forma(5)

| | | Pro Forma

As Adjusted(12)

|

Balance Sheet Data: | | | | | | | | | | | |

Cash and cash equivalents | | $ | — | | | $ | — | | | $ | 16,645 |

Working capital (deficiency) | | | (831 | ) | | | (10,831 | ) | | | 15,814 |

Total assets(13) | | | 41,577 | | | | 9,107 | | | | 25,752 |

Long-term obligations, less current portion | | | — | | | | — | | | | — |

Total liabilities(13) | | | 37,547 | | | | 15,077 | | | | 5,077 |

Stockholders’ equity | | | 4,030 | | | | (5,970 | ) | | | 20,675 |

| (1) | Interest expense related to net advances from PC Mall. See note 7 of the notes to financial statements. |

| (2) | Interest expense and interest income related to borrowings by PC Mall under its commercial line of credit and the related receivable from PC Mall. See note 3 of the notes to financial statements. |

| (3) | Results primarily from the reversal of a valuation allowance for the net deferred tax asset in 2003. See note 4 of the notes to financial statements for an explanation of the deferred tax asset. |

| (4) | See note 1 of the notes to financial statements for an explanation of the determination of the number of shares used to compute the basic and diluted per share amounts. See note 8 of the notes to financial statements for an explanation of the calculation of the number of shares used to determine pro forma earnings per share and pro forma weighted average number of shares. |

| (5) | The pro forma data above gives effect to our dividend to PC Mall of $12.5 million prior to completion of this offering, of which $10.0 million will be paid in the form of a promissory note, and the remaining $2.5 million will be paid by the settlement of the capital contribution due from PC Mall outstanding as of the date this offering is completed. In addition, the pro forma data above gives effect to our release as a co-borrower under PC Mall’s commercial line of credit facility with a third-party lender. |

| (6) | Total customers has been calculated as the cumulative number of customers for which orders have been taken from our inception to the end of the reported period. |

| (7) | Active customers consists of the number of customers who placed orders during the 12 months prior to the end of the reported period. |

| (8) | New customers represents the number of persons that established a new account and placed an order during the reported period. |

| (9) | Number of orders represents the total number of orders shipped during the reported period (not reflecting returns). |

| (10) | Average order value has been calculated as gross sales divided by the total number of orders during the period presented. The impact of returns is not reflected in average order value. |

| (11) | Advertising expense includes the total dollars spent on advertising during the reported period, including Internet, direct mail, print and e-mail advertising, as well as customer list enhancement services. |

| (12) | The pro forma as adjusted balance sheet data above reflects the application of the estimated net proceeds from the sale of 3,150,000 shares of common stock offered by us at an assumed initial public offering price of $10.00 per share, after deducting estimated underwriting discounts and commissions and estimated offering expenses, and the payment to PC Mall of $10.0 million upon completion of this offering in repayment of the promissory note payable to PC Mall. |

| (13) | Includes a liability related to borrowings by PC Mall under its commercial line of credit and the related receivable from PC Mall. See note 3 of the notes to financial statements. |

8

RISK FACTORS

Any investment in our common stock involves a high degree of risk. You should consider carefully the following information about these risks, together with the other information contained in this prospectus, before you decide to buy our common stock. If any of the following risks actually occur, our business, financial condition and results of operations would likely suffer. In these circumstances, the market price of our common stock could decline, and you may lose all or part of your investment.

Risks Relating to Our Business

Our limited operating history makes evaluation of our business difficult.

We were originally organized in February 1999 and launched our website in April 1999. Our limited operating history will make it difficult for investors to evaluate our business and future operating results. You must consider our business and prospects in light of the risks and difficulties we may face as an early stage company with limited operating history. These risks and difficulties include challenges in accurate financial planning as a result of limited historical data and the uncertainties resulting from having had a relatively limited time period in which to implement and evaluate our business strategies as compared to older companies with longer operating histories.

Our historical financial information may not be representative of what our actual results would have been if we were an independent company or indicative of what our future results may be.

Our financial results are presented in this prospectus on a stand-alone basis; however, PC Mall historically accounted for our business for financial reporting purposes as a segment within its consolidated financial statements. The historical financial information we have included in this prospectus does not necessarily reflect what our financial position, results of operations and cash flows would have been had we been a separate, stand-alone entity and not part of PC Mall’s consolidated group during the periods presented. The historical costs and expenses reflected in our financial statements include charges for certain corporate functions historically provided by PC Mall, including administrative services (accounting, human resources, tax services, legal and treasury), inventory management and order fulfillment, credit card processing, information systems operation and administration, advertising services and use of office space. These allocated charges were based on what we and PC Mall considered to be reasonable reflections of the historical utilization levels of these services required in support of our business; however, we have not made a determination of whether these expenses are comparable to those we could have obtained from an unrelated third party. The historical financial information is not necessarily indicative of what our results of operations, financial position and cash flows will be in the future and does not reflect many significant changes that will occur in our capital structure, funding and operations as a result of our separation from PC Mall. For example, we may face increased costs for leases, senior management, insurance, technology software and support, employee benefits, financing and increased costs associated with being a publicly traded, stand-alone company.

We may not be able to maintain profitability.

We have invested heavily in our website development, advertising, hiring of personnel and startup costs. We had significant operating losses in our first two years of operations and have only reported net profits in the past two fiscal years. As a result, we had an accumulated deficit of approximately $10.0 million at March 31, 2004. Our ability to establish and maintain profitability given our planned business strategy depends upon a number of factors, including our ability to maintain vendor relationships, procure merchandise and fulfill orders in an efficient manner, leverage our fixed cost structure, maintain adequate levels of vendor funding, and maintain customer acquisition costs at acceptable levels. Even though we have achieved profitability in the past two fiscal years, we may not be able to sustain or increase profitability on a quarterly or an annual basis.

9

Our profitability will also depend on our ability to manage and control operating expenses and to generate and sustain increased levels of revenue. We expect to incur significant operating expenses and capital expenditures to establish ourselves as an independent company, including increased general and administrative costs to support our operations and the increased costs of being a public company, and costs to transition from an outsourced inventory management and order fulfillment function provided by PC Mall to performing such functions on our own. We also expect to incur significant operating expenses and capital expenditures to:

| | • | increase our customer base; |

| | • | expand our marketing efforts to enhance our brand image; |

| | • | further improve our order processing systems and capabilities; |

| | • | acquire and enhance software and hardware systems necessary for the operation of our business; |

| | • | develop enhanced technologies and features; |

| | • | increase the size of our staff; and |

| | • | expand our customer service capabilities to better serve our customers’ needs. |

Because we will incur many of these expenses before we receive any revenues from our efforts, our profits may be less than the profits we would generate if we developed our business more slowly. Further, we base our expenses in large part on our operating plans, current business strategies and future revenue projections. Many of our expenses are fixed in the short term, and we may not be able to quickly reduce spending if our revenues are lower than we project. In addition, we may find that these efforts are more expensive than we currently anticipate. Therefore, the timing of these expenses may contribute to fluctuations in our quarterly operating results.

Our operating results are difficult to predict and may adversely affect our stock price.

Our operating results have fluctuated in the past and are likely to vary significantly in the future based upon a number of factors, many of which we cannot control. We operate in a highly dynamic industry and future results could be subject to significant fluctuations. These fluctuations could cause us to fail to meet or exceed financial expectations of investors, which could cause our stock price to decline rapidly and significantly. Revenue and expenses in future periods may be greater or less than revenue and expenses in the immediately preceding period or in the comparable period of the prior year. Therefore, period-to-period comparisons of our operating results are not necessarily a good indication of our future performance. Some of the factors that could cause our operating results to fluctuate include:

| | • | the costs of establishing ourselves as an independent public company; |

| | • | the amount and timing of operating costs and capital expenditures relating to the expansion of our business operations and infrastructure; |

| | • | price competition that results in lower sales volumes, lower profit margins, or net losses; |

| | • | fluctuations in coupon redemption rates; |

| | • | the amount and timing of advertising and marketing costs; |

| | • | our ability to successfully integrate operations and technologies from any future acquisitions or other business combinations; |

| | • | changes in the number of visitors to our website or our inability to convert those visitors into customers; |

| | • | technical difficulties, including system or Internet failures; |

| | • | fluctuations in the demand for our products or overstocking or understocking of our products; |

10

| | • | introduction of new or enhanced services or products by us or our competitors; |

| | • | fluctuations in shipping costs, particularly during the holiday season; |

| | • | economic conditions generally or economic conditions specific to the Internet, online commerce, the retail industry or the mail order industry; |

| | • | changes in the mix of products that we sell; and |

| | • | fluctuations in levels of inventory theft, damage or obsolescence. |

If we fail to successfully manage or expand our inventory management and order fulfillment operations, we may be unable to meet customer demand for our products and may incur higher expenses or additional costs.

Our outsourced order fulfillment and distribution operations are located in Memphis, Tennessee. Historically, PC Mall has provided inventory management and order fulfillment services to us at this facility. PC Mall will continue to provide these services to us on an interim basis following this offering; however, we intend to establish our own inventory management and order fulfillment operations prior to the completion of our spin-off from PC Mall. We have no prior experience managing inventory management and order fulfillment operations, and we cannot assure you that we will be successful in this endeavor. Any failure in managing our current outsourced inventory management and order fulfillment operations or establishing our own inventory management and order fulfillment capabilities would require us to find one or more parties to provide these services for us and could seriously disrupt our operations and cause us to be unable to meet customer demand for our products. If we are required to engage one or more service providers to provide these services, we could incur higher fulfillment expenses than anticipated or incur additional costs for balancing product inventories among multiple distribution facilities. Further, we may need to expand our inventory management and order fulfillment operations in the future to accommodate increases in customer orders.

If we fail to accurately predict our inventory risk, our margins may decline as a result of write downs of our inventory due to lower prices obtained from older or obsolete products.

In 2003, we derived 84% of our gross sales from products sold out of inventory at an outsourced warehouse. We assume the inventory damage, theft and obsolescence risks, as well as price erosion risks for products that are sold out of inventory stocked at our outsourced warehouse. These risks are especially significant because some of the products we sell on our website are characterized by rapid technological change, obsolescence and price erosion (for example, computer hardware, software and consumer electronics), and because the distribution center sometimes stocks large quantities of particular types of inventory. Under our current arrangement with PC Mall for outsourced inventory management and order fulfillment, PC Mall passes inventory risk to us based on a fixed restocking fee on returns plus allocated charges of PC Mall’s overall inventory reserve. If the inventory reserve subsequently proves insufficient, additional inventory write-downs may be required. So long as we rely on PC Mall to provide these inventory management and order fulfillment functions for us, we will have limited control over the management of these inventory risks. After we have established our own inventory management and order fulfillment operations, we will bear those inventory risks directly.

Our ability to offer a broad selection of products at competitive prices is dependent on our ability to maintain existing and build new relationships with manufacturers and vendors. We do not have long-term agreements with our manufacturers or vendors, some of our manufacturers and vendors compete directly with us, and we do not have a direct relationship with many of our manufacturers and vendors.

We purchase products for resale both directly from manufacturers and indirectly through distributors and other sources, all of whom we consider our vendors. We have historically relied on PC Mall for substantially all of our vendor relationships. During 2003, we offered products on our website from over 1,000 third-party manufacturers. We do not have any long-term agreements with any of these vendors. Any agreements with vendors governing our

11

purchase of products are generally terminable by either party upon 30 days’ notice or less. In general, we agree to offer products on our website and the vendors agree to provide us with information about their products and honor our customer service policies. PC Mall has historically provided us with vendor consideration in connection with its inventory management and order fulfillment functions. As we transition to performing inventory management and order fulfillment functions on our own prior to the completion of our spin-off from PC Mall, we will have to establish and build our own relationships with vendors and obtain favorable product pricing and vendor consideration. We may not be able to negotiate with vendors on terms as favorable as those obtained through PC Mall for a number of reasons, including lower product volumes, limited credit history, and a limited history of independently doing business with these vendors. If we do not maintain our existing relationships or build new relationships with vendors on acceptable terms, including favorable product pricing and vendor consideration, we may not be able to offer a broad selection of products or continue to offer products at competitive prices, and customers may refuse to shop at our website. In addition, some vendors may decide not to offer particular products for sale on the Internet, and others may avoid offering their new products to retailers such as us who offer a mix of close-out and refurbished products in addition to new products. From time to time, vendors may terminate our right to sell some or all of their products, change the applicable terms and conditions of sale or reduce or discontinue the incentives or vendor consideration that they offer us. Any such termination or the implementation of such changes could have a negative impact on our operating results. Additionally, some products are subject to manufacturer or distributor allocation, which limits the number of units of those products that are available to us and other resellers.

We may need additional financing and may not be able to raise additional financing on favorable terms or at all, which could increase our costs, limit our ability to grow and dilute the ownership interests of existing stockholders.

We anticipate that we may need to raise additional capital in the future to facilitate long-term expansion, to respond to competitive pressures or to respond to unanticipated financial requirements. We cannot be certain that we will be able to obtain additional financing on commercially reasonable terms or at all. If we raise additional funds through the issuance of equity, equity-related or debt securities, such securities may have rights, preferences or privileges senior to those of the rights of our common stock and our stockholders will experience dilution of their ownership interests. Prior to this offering, our needs for working capital and general corporate purposes have been satisfied pursuant to PC Mall’s corporate-wide cash management policies. However, after the completion of this offering, PC Mall will not be required to provide funds to finance our operations, nor does PC Mall currently anticipate providing such funds. Additionally, our agreements with PC Mall will limit our ability to issue our equity securities in the future without PC Mall’s consent for up to three years following the distribution. For a description of these limitations, please see “—Risks Relating to our Relationship with PC Mall.”

Our failure to obtain additional financing or our inability to obtain financing on acceptable terms could require us to incur indebtedness that has high rates of interest or substantial restrictive covenants, issue equity securities that will dilute the ownership interests of existing stockholders, scale back our operations, or fail to address opportunities for expansion or enhancement of our operations.

If we do not successfully expand our website and processing systems to accommodate higher levels of traffic and changing customer demands, we could lose customers and our revenues could decline.

To remain competitive, we must continue to enhance and improve the functionality and features of our website. If we fail to upgrade our website in a timely manner to accommodate higher volumes of traffic, our website performance could suffer and we may lose customers. In addition, if we fail to expand the computer systems that we use to process and ship customer orders and process customer payments, we may not be able to fulfill customer orders successfully. As a result, we could lose customers and our revenues could decline. The Internet and the e-commerce industry is subject to rapid technological change. If competitors introduce new features and website enhancements embodying new technologies, or if new industry standards and practices emerge, our existing website and systems may become obsolete or unattractive. Developing our website and other systems entails significant technical and business risks. We may face material delays in introducing new

12

services, products and enhancements. If this happens, our customers may forgo the use of our website and use those of our competitors. We may use new technologies ineffectively, or we may fail to adapt our website, our transaction processing systems and our computer network to meet customer requirements or emerging industry standards.

If we fail to successfully expand our merchandise categories and product offerings in a cost-effective and timely manner, our reputation and the value of our new and existing brands could be harmed, customer demand for our products could decline and our profit margins may decrease.

We have generated the substantial majority of our revenues during the past five years from the sale of computer hardware, software and accessories and consumer electronics products. In the past year, we launched several new product categories, including home and housewares, watches and jewelry, DVD movies, and video games. While our merchandising platform has been incorporated into and tested in the online computer and consumer electronics retail markets, we cannot predict with certainty whether it can be successfully applied to other product categories. In addition, expansion of our business strategy into new product categories may require us to incur significant marketing expenses, develop relationships with new vendors and comply with new regulations. We may lack the necessary expertise in a new product category to realize the expected benefits of that new category. These requirements could strain our managerial, financial and operational resources. Additional challenges that may affect our ability to expand into new product categories include our ability to:

| | • | establish or increase awareness of our new brands and product categories; |

| | • | acquire, attract and retain customers at a reasonable cost; |

| | • | achieve and maintain a critical mass of customers and orders across all of our product categories; |

| | • | attract a sufficient number of new customers to whom our new product categories are targeted; |

| | • | successfully market our new product offerings to existing customers; |

| | • | maintain or improve our gross margins and fulfillment costs; |

| | • | attract and retain vendors to provide our expanded line of products to our customers on terms that are acceptable to us; and |

| | • | manage our inventory in new product categories. |

We cannot be certain that we will be able to successfully address any or all of these challenges in a manner that will enable us to expand our business into new product categories in a cost-effective or timely manner. If our new categories of products or services are not received favorably, or if our suppliers fail to meet our customer’s expectations, our results of operations would suffer and our reputation and the value of the applicable new brand and our other brands could be damaged. The lack of market acceptance of our new product categories or our inability to generate satisfactory revenues from any expanded product categories to offset their cost could harm our business. An investor in our common stock must consider the risks, uncertainties and difficulties frequently encountered by companies in new and rapidly evolving online markets such as those we have targeted.

The loss of key personnel or any inability to attract and retain additional personnel could affect our ability to successfully grow our business.

Our performance is substantially dependent on the continued services and the performance of our senior management, particularly our Chief Executive Officer, Adam Shaffer, and our President, Gary Guy. Our performance also depends on our ability to retain and motivate other officers and key employees. We do not have employment agreements with any of our key executives other than Mr. Shaffer. We do not maintain “key person” life insurance policies on any of our key employees. Our future success also depends on our ability to identify, attract, hire, train, retain and motivate other highly-skilled technical, managerial, editorial, merchandising,

13

marketing and customer service personnel. Competition for such personnel is intense, and we may not be able to successfully grow our business if we are unable to successfully attract, assimilate or retain sufficiently qualified personnel.

Our senior management team has not worked together as a group for a significant period of time, and may not be able to effectively manage our business.

Adam Shaffer, our Chief Executive Officer, joined our company in March 2004, and we intend to appoint a new Chief Financial Officer prior to completion of the distribution. As a result, our senior management team will lack a history of working together as a group. Our senior management team’s lack of shared experience could have an adverse effect on its ability to quickly and efficiently respond to problems and effectively manage our business.

Our ability to effectively manage our growth may prevent us from successfully expanding our business.

We have rapidly and significantly expanded our operations, and anticipate that further significant expansion will be required to address potential growth in our customer base and market opportunities. This expansion has placed, and is expected to continue to place, a significant strain on our managerial, operational and financial resources. Some of our officers have no prior senior management experience at public companies. We expect to add a number of key employees in the near future including managerial, technical, financial and operations personnel who will have to be integrated into our operations. To manage the expected growth of our operations and personnel, we will be required to improve existing operational and financial systems, procedures and controls, and to expand, train and manage our employee base.

We are dependent on the success of our advertising and marketing efforts, which are costly and may not achieve desired results, and on our ability to attract customers on cost-effective terms.

Our revenues depend on our ability to advertise and market our products effectively through our website, our eCOST.com catalog sent to selected customers, and our other advertising and marketing efforts. We expect to increase spending on advertising and marketing in the future. Increases in the cost of advertising and marketing, including costs of online advertising, paper and postage costs, costs and fees of third-party service providers and the costs of complying with applicable regulations, may limit our ability to advertise and market our business without impacting our profitability. If our advertising and marketing efforts prove ineffective or do not produce a sufficient level of sales to cover their costs, or if we decrease our advertising or marketing activities due to increased costs, restrictions enacted by regulatory agencies or for any other reason, our revenues and profit margins may decrease.

Our success depends on our ability to attract customers on cost-effective terms. We have relationships with online services, search engines, shopping engines, directories and other websites and e-commerce businesses through which we provide advertising banners and other links that direct customers to our website. We expect to rely on these relationships as significant sources of traffic to our website and to generate new customers. If we are unable to develop or maintain these relationships on acceptable terms, our ability to attract new customers on a cost-effective basis could be harmed. In addition, certain of our existing online marketing agreements require us to pay fixed placement fees or fees for directing visits to our website, neither of which may convert into sales.

Increased product returns or a failure to accurately predict product returns could decrease our revenues and impact profitability.

We make allowances for product returns in our financial statements based on historical return rates. We are responsible for returns of certain products ordered through our website from our outsourced distribution center as well as products that are shipped to our customers directly from our vendors. If our actual product returns significantly exceed our allowances for returns, especially as we expand into new product categories, our

14

revenues and profitability could decrease. In addition, because our allowances are based on historical return rates, the introduction of new merchandise categories, new products, changes in our product mix, or other factors may cause actual returns to exceed return allowances, perhaps significantly. In addition, any policies intended to reduce the number of product returns may result in customer dissatisfaction and fewer repeat customers.

Because we experience seasonal fluctuations in our revenues, our quarterly results may fluctuate.

Our business is moderately seasonal, reflecting the general pattern of peak sales for the retail industry during the holiday shopping season. Typically, a larger portion of our revenues occur during our first and fourth fiscal quarters. We believe that our historical revenue growth makes it difficult to predict the effect of seasonality on our future revenues and results of operations. In anticipation of increased sales activity during the first and fourth quarter, we incur additional expenses, including higher inventory and staffing costs. If sales for the first and fourth quarter do not meet anticipated levels, then increased expenses may not be offset, which could decrease our profitability. If we were to experience lower than expected sales during our first or fourth quarter, for whatever reason, it would decrease our profitability.

If we fail to offer a broad selection of products that customers find attractive, our revenues and profit margins could decrease.

In order to meet our strategic goals, we must successfully offer, on a continuous basis, a broad selection of appealing products that reflect our customers’ tastes and preferences. Consumer tastes are subject to frequent, significant and sometimes unpredictable changes. Our products must satisfy the diverse tastes of our customers and potential customers. To be successful, our product offerings must be broad and deep in scope, affordable, well-made, innovative and attractive to a wide range of consumers whose preferences may change regularly. We cannot predict with certainty that we will be successful in offering products that meet these requirements. If our product offerings fail to satisfy customers’ tastes or respond to changes in customer preferences, our revenues could decline and we could be required to mark down unsold inventory, which would decrease our profit margins. In addition, any failure to offer products in line with customers’ preferences could allow our competitors to gain market share.

If we are unable to provide satisfactory customer service, we could lose customers.

Our ability to provide satisfactory levels of customer service depends, to a large degree, on the efficient and uninterrupted operation of our customer service operations. Any material disruption or slowdown in our order processing systems resulting from labor disputes, telephone or Internet failures, power or service outages, natural disasters or other events could make it difficult or impossible to provide adequate customer service and support. Further, we may be unable to attract and retain adequate numbers of competent customer service representatives and relationship managers for our business customers, each of which is essential in creating a favorable interactive customer experience. Due to increased customer service needs during the holiday shopping season, we hire temporary employees during our third and fourth fiscal quarters. As a result, we may have difficulty properly staffing our customer service operations during our peak sales season. Further, temporary employees may not have the same levels of training or professional responsibility as full-time employees and, as a result, may be more likely to provide unsatisfactory service to our customers and potential customers. If we are unable to continually provide adequate staffing and training for our customer service operations, our reputation could be seriously harmed and we could lose customers. In addition, if our e-mail and telephone call volumes exceed our present system capacities, we could experience delays in placing orders, responding to customer inquiries and addressing customer concerns. Also, our customer service facility currently accommodates customer service representatives at close to its capacity during our peak sales period, so we may be required to expand our customer service facility in the near future. In addition, we may not be able to find additional suitable office space on acceptable terms or at all, which could seriously hinder our ability to provide satisfactory levels of customer service. Because our success depends in large part on keeping our customers satisfied, any failure to provide high levels of customer service would likely impair our reputation and decrease our revenues.

15

Implementation of a membership fee for access to premium offers and services may cause some of our customers to reduce or quit buying products from us.

To date, our customers have had equal access to all areas of our website and we have not charged any membership fees our customers. As part of our growth strategy, we intend to offer memberships to our customers allowing them to access premium features of our website for an annual fee. Customers who pay such membership fee will be eligible for certain exclusive offers, benefits and services which will not be available to our other customers who are not members. We have not previously implemented or operated a membership program, and we cannot predict with certainty the rate or extent to which our existing customers will sign up for and renew premium memberships. We also cannot be certain that implementation of our membership program will not adversely effect the volume and frequency of purchases by customers who do not become members.

Our business may be harmed by fraudulent activities on our website.

We have received in the past, and anticipate that we will receive in the future, communications from customers due to purported fraudulent activities on our website. Negative publicity generated as a result of fraudulent conduct by third parties could damage our reputation and diminish the value of our brand name. Fraudulent activities on our website could also subject us to losses. We expect to continue to receive requests from customers for reimbursement due to purportedly fraudulent activities or threats of legal action against us if no reimbursement is made.

Our facilities and systems are vulnerable to natural disasters or other catastrophic events.

Our headquarters, customer service center and the majority of our infrastructure, including computer servers, are located in California, an area that is susceptible to earthquakes and other natural disasters. Our outsourced distribution facility, located in Memphis, Tennessee, houses substantially all of the product inventory from which a substantial majority of our orders are shipped. A natural disaster or other catastrophic event, such as an earthquake, fire, flood, severe storm, break-in, terrorist attack or other comparable problems could cause interruptions or delays in our business and loss of data or render us unable to accept and fulfill customer orders in a timely manner, or at all. Our systems are not fully redundant, and we do not have duplicate geographic locations or earthquake insurance. Further, California has in the past experienced power outages as a result of limited electrical power supplies. These outages may recur in the future and could disrupt the operation of our business. In addition, because our inventory and distribution facilities are located in an area that is susceptible to harsh weather, a major storm, heavy snowfall or other similar event could prevent us from delivering products in a timely manner. We currently have no formal disaster recovery plan and our business interruption insurance may not adequately compensate us for losses that may occur.

Delivery of our products could be delayed or disrupted by factors beyond our control, and we could lose customers as a result.

We rely upon third party carriers for timely delivery of our product shipments. As a result, we are subject to carrier disruptions and increased costs due to factors that are beyond our control, including employee strikes, inclement weather and increased fuel costs. Any failure to deliver products to our customers in a timely and accurate manner may damage our reputation and brand and could cause us to lose customers. We do not have a written long-term agreement with any of these third party carriers, and we cannot be sure that these relationships will continue on terms favorable to us, if at all. If our relationship with any of these third party carriers is terminated or impaired or if any of these third parties is unable to deliver products for us, we would be required to use alternative carriers for the shipment of products to our customers. We may be unable to engage alternative carriers on a timely basis or on terms favorable to us, if at all. Potential adverse consequences include:

| | • | reduced visibility of order status and package tracking; |

| | • | delays in order processing and product delivery; |

16

| | • | increased cost of delivery, resulting in reduced margins; and |

| | • | reduced shipment quality, which may result in damaged products and customer dissatisfaction. |

We may not be able to compete successfully against existing or future competitors; PC Mall and some of our largest vendors currently compete with us.

The market for online sales of the products we offer is intensely competitive and rapidly evolving. We principally compete with a variety of online retailers, specialty retailers and other businesses that offer products similar to or the same as our products. Increased competition is likely to result in price reductions, reduced revenue and gross margins and loss of market share. We expect competition to intensify in the future because current and new competitors can enter our market with little difficulty and can launch new websites at a relatively low cost. In addition, some of our product vendors have sold, and continue to intensify their efforts to sell, their products directly to customers. We currently or potentially compete with a variety of businesses, including:

| | • | other multi-category online retailers such as Amazon.com and Buy.com; |

| | • | online discount retailers of computer and consumer electronics merchandise such as Computers4Sure, NewEgg and TigerDirect; |

| | • | liquidation e-tailers such as Overstock.com and SmartBargains.com; |

| | • | consumer electronics and office supply superstores such as Best Buy, Circuit City, CompUSA, Office Depot, OfficeMax and Staples; and |

| | • | manufacturers such as Apple, Dell, Gateway, Hewlett-Packard and IBM, that sell directly to customers. |

Many of our current and potential competitors described above have longer operating histories, larger customer bases, greater brand recognition and significantly greater financial, marketing and other resources than we do. In addition, online retailers may be acquired by, receive investments from or enter into other commercial relationships with larger, well-established and well-financed companies. Some of our competitors may be able to secure products from manufacturers or vendors on more favorable terms, devote greater resources to marketing and promotional campaigns, adopt more aggressive pricing or inventory availability policies and devote substantially more resources to website and systems development than we are able to. PC Mall currently offers many of the same products for sale as we offer, and PC Mall will not be restricted from competing with us in the future.

If the protection of our trademarks and proprietary rights is inadequate, our brand and reputation could be impaired and we could lose customers.

We have four trademarks that we consider to be material to the successful operation of business: eCOST®, eCOST.com®, eCOST.com Bargain Countdown™ and Bargain Countdown™. We currently use all of these marks in connection with telephone, mail order, catalog and online retail services. We also have several additional pending trademark applications. We rely on trademark and copyright law, trade secret protection and confidentiality agreements with our employees, consultants, suppliers and others to protect our proprietary rights. Our applications may not be granted, and we may not be able to secure significant protection for our service marks or trademarks. Our competitors or others could adopt trademarks or service marks similar to our marks, or try to prevent us from using our marks, thereby impeding our ability to build brand identity and possibly leading to customer confusion. Any claim by another party against us for customer confusion caused by our use of our trademarks or service marks, or our failure to obtain registrations for our marks, could negatively affect our competitive position and could cause us to lose customers.

We have also filed an application with the U.S. Patent and Trademark Office for patent protection for our proprietary Bargain Countdown™ technology. We may not be granted a patent for this technology, and may not

17

be able to enforce our patent rights if our competitors or others use infringing technology. If this occurs, our competitive position, revenues and profitability could be negatively affected.

Effective trademark, service mark, patent, copyright and trade secret protection may not be available in every country in which we will sell our products and offer our services. In addition, the relationship between regulations governing domain names and laws protecting trademarks and similar proprietary rights is unclear. Therefore, we may be unable to prevent third parties from acquiring domain names that are similar to, infringe upon or otherwise decrease the value of our trademarks and other proprietary rights. If we are unable to protect or preserve the value of our trademarks, copyrights, trade secrets or other proprietary rights for any reason, our competitive position could be negatively affected and we could lose customers.

We also rely on technologies that we license from related and third parties. These licenses may not continue to be available to us on commercially reasonable terms, or at all, in the future. As a result, we may be required to develop or obtain substitute technology of lower quality or at greater cost, which could negatively affect our competitive position, cause us to lose customers and decrease our profitability.

If third parties claim we are infringing their intellectual property rights, we could incur significant litigation costs, be required to pay damages, or change our business or incur licensing expenses.

Third parties have asserted, and may in the future assert that our business or the technologies we use infringe their intellectual property rights. Although we have not been subject to legal proceedings in the past, we may be subject to intellectual property legal proceedings and claims in the ordinary course of our business. We cannot predict whether third parties will assert additional claims of infringement against us in the future or whether any future claims will prevent us from offering popular products or operating our business as planned. On July 12, 2004, we received correspondence from MercExchange LLC alleging infringement of its U.S. patents relating to e-commerce and offering to license its patent portfolio to us. On July 15, 2004, we received a follow-up letter from MercExchange specifying which of our technologies it believes infringe certain of its patents, alone or in combination with technologies provided by third parties. Some of those patents are currently being litigated by third parties, and we are not involved in those proceedings. In addition, three of the four patents identified by MercExchange are under reexamination at the U.S. Patent and Trademark Office, which makes the scope of the claims of those patents uncertain. In the July 15 letter, MercExchange also advised us that it has a number of applications pending for additional patents. Each of the patents identified by MercExchange contains numerous claims, and we only recently received these letters. As a result, we have not yet had the opportunity to fully assess the merits of the identified patents or complete our evaluation of the possible impact on our business. MercExchange has filed lawsuits alleging infringement of some or all of its patents against third parties, resulting in settlements or verdicts in favor of MercExchange. At least one such verdict has been appealed to the United States Court of Appeals for the Federal Circuit. If we are forced to defend against this or any other third-party infringement claims, whether they are with or without merit or are determined in our favor, we could face expensive and time-consuming litigation, which could result in the imposition of a preliminary injunction preventing us from continuing to operate our business as currently conducted throughout the duration of the litigation or distract our technical and management personnel. If we are found to infringe, we may be required to pay monetary damages, which could include treble damages and attorneys’ fees for any infringement that is found to be willful, and either be enjoined or required to pay ongoing royalties with respect to any technologies found to infringe. Further, as a result of infringement claims either against us or against those who license technology to us, we may be required, or deem it advisable, to develop non-infringing technology, which could be costly and time consuming, or enter into costly royalty or licensing agreements. Such royalty or licensing agreements, if required, may be unavailable on terms that are acceptable to us, or at all. If a third party successfully asserts an infringement claim against us and we are enjoined or required to pay monetary damages or royalties or we are unable to develop suitable non-infringing alternatives or license the infringed or similar technology on reasonable terms on a timely basis, our business, results of operations and financial condition could be materially harmed.

We may be liable for misappropriation of our customers’ personal information.

If third parties or our employees are able to penetrate our network security or otherwise misappropriate our customers’ personal information or credit card information, or if we give third parties or our employees improper

18

access to our customers’ personal information or credit card information, we could be subject to liability. This liability could include claims for unauthorized purchases with credit card information, impersonation or other similar fraud claims. This liability could also include claims for other misuses of personal information, including unauthorized marketing purposes. Liability for misappropriation of this information could decrease our profitability. In addition, the Federal Trade Commission and state agencies have been investigating various Internet companies regarding their use of personal information. We could incur additional expenses if new regulations regarding the use of personal information are introduced or if government agencies investigate our privacy practices.