QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to Section 240.14a-11(c) or Section 240.14a-12 |

GRAMERCY CAPITAL CORP. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

| Dear Stockholder: | | April 19, 2005 |

You are invited to attend the annual meeting of stockholders of Gramercy Capital Corp. This year's meeting will be held on Wednesday, May 18, 2005 at 10:00 a.m., local time, at the Grand Hyatt New York Hotel, Park Avenue at Grand Central Terminal, 109 East 42nd Street, New York, New York.

The attached proxy statement, with the accompanying formal notice of the meeting, describes the matters expected to be acted upon at the meeting. We urge you to review these materials carefully and to take part in the affairs of our company by voting on the matters described in the accompanying proxy statement. We hope that you will be able to attend the meeting. Our directors and management team will be available to answer questions. Afterwards, there will be a vote on the matters set forth in the accompanying proxy statement.

Your vote is important. Whether you plan to attend the meeting or not, please complete the enclosed proxy card and return it as promptly as possible. If you attend the meeting, you may continue to have your shares of common stock voted as instructed in the proxy or you may withdraw your proxy at the meeting and vote your shares of common stock in person. We look forward to seeing you at the meeting.

| | | Sincerely, |

| | | |

| | |  |

| | | |

| | | Stephen L. Green

Chairman of the Board |

GRAMERCY CAPITAL CORP.

420 Lexington Avenue

New York, New York 10170-1881

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

to be held on May 18, 2005

The 2005 annual meeting of stockholders of Gramercy Capital Corp. will be held on Wednesday, May 18, 2005 at 10:00 a.m., local time, at the Grand Hyatt New York Hotel, Park Avenue at Grand Central Terminal, 109 East 42nd Street, New York, New York. At the annual meeting, stockholders will vote upon the following proposals:

1. To elect two Class I directors to serve until the 2008 annual meeting of stockholders and until their successors are duly elected and qualified;

2. To ratify the selection of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2005; and

3. To consider and act upon any other matters that may properly be brought before the annual meeting or at any adjournments or postponements thereof.

Any action may be taken on the foregoing matters at the annual meeting on the date specified above, or on any date or dates to which, by original or later adjournment, the annual meeting may be adjourned, or to which the annual meeting may be postponed.

Our Board of Directors has fixed the close of business on March 30, 2005 as the record date for determining the stockholders entitled to notice of, and to vote at, the annual meeting, and at any adjournments or postponements thereof. Only stockholders of record of our common stock at the close of business on that date will be entitled to notice of, and to vote at, the annual meeting, and at any adjournments or postponements thereof. A list of stockholders entitled to vote at the annual meeting will be available at the annual meeting and for ten calendar days prior to the annual meeting, between the hours of 8:30 a.m. and 4:30 p.m., local time, at our corporate offices located at 420 Lexington Avenue, New York, New York 10170-1881. You may arrange to review this list by contacting our Corporate Secretary, Andrew S. Levine.

You are requested to fill in and sign the enclosed form of proxy, which is being solicited by our Board of Directors, and to mail it promptly in the enclosed postage-prepaid envelope. Any proxy may be revoked by delivery of a later dated proxy. In addition, stockholders of record who attend the annual meeting may vote in person, even if they have previously delivered a signed proxy.

| | | By Order of our Board of Directors |

|

|

|

|

|

Andrew S. Levine

Corporate Secretary |

New York, New York

April 19, 2005

Whether or not you plan to attend the annual meeting, please complete, sign, date and promptly return the enclosed proxy card in the postage-prepaid envelope provided. For specific instructions on voting, please refer to the instructions on the proxy card or the information forwarded by your broker, bank or other holder of record. If you attend the annual meeting, you may vote in person if you wish, even if you have previously signed and returned your proxy card. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote in person at the meeting, you must obtain a proxy issued in your name from such broker, bank or other nominee.

TABLE OF CONTENTS

| | Page

|

|---|

| QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING | | 1 |

| | Who is entitled to vote at the meeting? | | 1 |

| | What is the purpose of the meeting? | | 1 |

| | What constitutes a quorum? | | 1 |

| | What vote is needed to approve each proposal? | | 1 |

| | Can I change my vote after I submit my proxy card? | | 2 |

| | How do I vote? | | 2 |

| | How is my vote counted? | | 2 |

| | What other information should I review before voting? | | 2 |

| | Who is soliciting my proxy? | | 3 |

| PROPOSAL 1: ELECTION OF DIRECTORS | | 4 |

| | Information Regarding the Nominees and the Continuing Directors | | 4 |

| | Class I Nominees for Election—Terms to Expire in 2008 | | 4 |

| | Class II Continuing Directors—Terms Expire in 2006 | | 5 |

| | Class III Continuing Directors—Terms Expire in 2007 | | 5 |

| | Biographical Information Regarding Executive Officers Who Are Not Directors | | 6 |

| | The Board of Directors and its Committees | | 7 |

| | Director Compensation | | 8 |

| PROPOSAL 2: RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | | 9 |

| | Fee Disclosure | | 9 |

| | Pre-Approval Policies and Procedures of our Audit Committee | | 9 |

| AUDIT COMMITTEE REPORT | | 10 |

| CORPORATE GOVERNANCE MATTERS | | 12 |

| Corporate Governance Guidelines | | 12 |

| Director Independence | | 12 |

| Code of Business Conduct and Ethics | | 12 |

| Audit Committee Financial Expert | | 12 |

| | Communications with our Board of Directors | | 13 |

| | Whistleblowing and Whistleblower Protection Policy | | 13 |

| | Director Attendance at Annual Meetings | | 13 |

| | Identification of Director Candidates | | 13 |

| | Executive Sessions of Non-Management Directors | | 14 |

| EXECUTIVE COMPENSATION | | 15 |

| | Summary Compensation Table | | 15 |

| | Option/SAR Grants In Fiscal Year 2004 | | 16 |

| | Aggregated Option/SAR Exercises in Fiscal Year 2004 and 2004 Year-End Option/SAR Values | | 16 |

| | Equity Compensation Plan Information | | 17 |

| | 2004 Equity Incentive Plan | | 17 |

| | Compensation Committee Interlocks and Insider Participation | | |

| COMPENSATION COMMITTEE REPORT | | 19 |

| STOCK PERFORMANCE GRAPH | | 20 |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | | 21 |

| | Section16(a) Beneficial Ownership Reporting Compliance | | 22 |

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | | 23 |

| | Registration Rights Agreement | | |

| | Origination Agreement | | |

| | Organization | | |

| OTHER MATTERS | | 26 |

| | Solicitation of Proxies | | 26 |

| | Stockholder Proposals | | 26 |

| | Householding of Proxy Materials | | 26 |

| | Other Matters | | 27 |

i

GRAMERCY CAPITAL CORP.

420 Lexington Avenue

New York, New York 10170-1881

PROXY STATEMENT

FOR 2005 ANNUAL MEETING OF STOCKHOLDERS

to be held on May 18, 2005

We are sending this proxy statement and the enclosed proxy card to our stockholders on or about April 19, 2005 in connection with the solicitation of proxies by the Board of Directors of Gramercy Capital Corp. for use at the 2005 annual meeting of stockholders to be held on Wednesday, May 18, 2005 at 10:00 a.m., local time, at the Grand Hyatt New York Hotel, Park Avenue at Grand Central Terminal, 109 East 42nd Street, New York, New York or at any postponement or adjournment of the meeting.

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING

Who is entitled to vote at the meeting?

If our records show that you were a stockholder of our common stock at the close of business on March 30, 2005, which is referred to in this proxy statement as the record date, you are entitled to receive notice of the meeting and to vote the shares of common stock that you held on the record date. Each outstanding share of common stock entitles its holder to cast one vote for each matter to be voted upon.

What is the purpose of the meeting?

At the annual meeting, you will be asked:

- •

- to vote upon the election of two Class I directors;

- •

- to ratify the selection of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2005; and

- •

- to consider and act upon any other matters that may properly be brought before the meeting or at any adjournments or postponements thereof.

What constitutes a quorum?

The presence, in person or by proxy, of holders of a majority of the total number of outstanding shares of common stock entitled to vote at this meeting is necessary to constitute a quorum for the transaction of business at the meeting. As of the record date, there were 18,833,000 shares of common stock outstanding and entitled to vote at the meeting.

What vote is needed to approve each proposal?

The affirmative vote of the holders of record of a plurality of all of the votes cast at the meeting at which a quorum is present is necessary for the election of the Class I directors. The affirmative vote

1

of the holders of record of a majority of all of the votes cast at the meeting at which a quorum is present is required for the ratification of our independent registered public accounting firm and the approval of any other matters properly presented at the meeting for stockholder approval. Abstentions do not constitute a vote "for" or "against" any matter being voted on at the annual meeting and will not be counted as "votes cast," although they will count toward the presence of a quorum. Broker "non-votes," or proxies from brokers or nominees indicating that such broker or nominee has not received instructions from the beneficial owner or other entity entitled to vote such shares on a particular matter with respect to which such broker or nominee does not have discretionary voting power, will be treated in the same manner as abstentions for purposes of the annual meeting.

Can I change my vote after I submit my proxy card?

If you cast a vote by proxy, you may revoke it at any time before it is voted by:

- •

- filing a written notice revoking the proxy with our Corporate Secretary at our address;

- •

- signing and forwarding to us a proxy dated later; or

- •

- appearing in person and voting by ballot at the meeting.

If you attend the meeting, you may vote in person whether or not you have previously given a proxy, but your presence (without further action) at the meeting will not constitute revocation of a previously given proxy.

How do I vote?

We request that you complete, sign, date and promptly return the accompanying proxy card in the enclosed postage-prepaid envelope. You may also attend the meeting in person and vote in person. If your shares of common stock are held by a broker, bank or other nominee (i.e., in "street name"), you will receive instructions from your nominee which you must follow in order to have your shares of common stock voted. Such stockholders who wish to vote in person at the meeting will need to obtain a proxy form from the broker, bank or other nominee that holds their shares of common stock of record.

How is my vote counted?

If you properly execute a proxy in the accompanying form, and if we receive it prior to voting at the meeting, the shares of common stock that the proxy represents will be voted in the manner specified on the proxy. If no specification is made, the common stock will be votedfor the election of the nominees for the Class I directors named in this proxy statement andfor ratification of our Audit Committee's selection of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2005, and as recommended by our Board of Directors with regard to all other matters in its discretion. It is not anticipated that any matters other than those set forth in the proxy statement will be presented at the meeting. If other matters are presented, proxies will be voted in accordance with the discretion of the proxy holders. In addition, no stockholder proposals or nominations were received on a timely basis, so no such matters may be brought to a vote at the meeting.

What other information should I review before voting?

For your review, our 2004 annual report, including financial statements for the fiscal year ended December 31, 2004, is being mailed to you concurrently with the mailing of this proxy statement. You may also obtain, free of charge, a copy of our 2004 annual report on our website athttp://www.gramercycapitalcorp.com. You may also obtain a copy of our Annual Report on Form 10-K, which contains additional information about our company, free of charge, by directing your request in

2

writing to Gramercy Capital Corp., 420 Lexington Avenue, New York, New York 10170-1881, Attention: Investor Relations. The 2004 annual report and the Annual Report on Form 10-K, however, are not part of the proxy solicitation material.

Who is soliciting my proxy?

This solicitation of proxies is made by and on behalf of our Board of Directors. We will pay the cost of the solicitation of proxies. We have retained Morrow & Co., Inc. at an aggregate estimated cost of $3,500, plus out-of-pocket expenses, to assist in the solicitation of proxies. In addition to the solicitation of proxies by mail, our directors, officers and employees may solicit proxies personally or by telephone.

No person is authorized on our behalf to give any information or to make any representations with respect to the proposals other than the information and representations contained in this proxy statement, and, if given or made, such information and/or representations must not be relied upon as having been authorized and the delivery of this proxy statement shall, under no circumstances, create any implication that there has been no change in our affairs since the date hereof.

3

PROPOSAL 1: ELECTION OF DIRECTORS

Our Board of Directors currently consists of seven members and is divided into three classes, with the directors in each class serving for a term of three years and until their successors are duly elected and qualified. The term of one class expires at each annual meeting of stockholders.

At the annual meeting, two directors will be elected to serve until the 2008 annual meeting and until their successors are duly elected and qualified. Our Nominating and Corporate Governance Committee has recommended Messrs. Hall and Kelter to our Board of Directors as nominees for election to serve as Class I directors. These nominees are currently serving as Class I directors. Following the recommendation of the Nominating and Corporate Governance Committee, our Board has nominated Messrs. Hall and Kelter to serve as Class I directors. Our Board anticipates that each nominee will serve, if elected, as a director. However, if either nominee is unable to accept election, proxies voted in favor of such nominee will be voted for the election of such other person or persons as our Nominating and Corporate Governance Committee may recommend to our Board.

The Board of Directors unanimously recommends a vote FOR each Nominee.

Information Regarding the Nominees and the Continuing Directors

The following table and biographical descriptions set forth certain information with respect to each nominee for election as Class I director at the annual meeting and the continuing directors whose terms expire at the annual meetings of stockholders in 2006 and 2007, respectively, based upon information furnished by each director.

Name

| | Age

| | Director Since

|

|---|

| Class I Nominee Directors (terms to expire in 2008) | | | | |

| Hugh F. Hall | | 38 | | 2004 |

| Jeffrey E. Kelter | | 50 | | 2004 |

| Class II Continuing Directors (terms expire in 2006) | | | | |

| Stephen L. Green | | 66 | | 2004 |

| Allan J. Baum | | 48 | | 2004 |

| Class III Continuing Directors (terms expire in 2007) | | | | |

| Marc Holliday | | 38 | | 2004 |

| Paul J. Konigsberg | | 68 | | 2004 |

| Charles S. Laven | | 53 | | 2004 |

Class I Nominees for Election—Terms to Expire in 2008

Hugh F. Hall has served as a director and chief operating officer since August 2004. Prior to joining us, he worked as an independent consultant since January 2004 advising SL Green Realty Corp., or SL Green on the development of our business plan. Before working with SL Green, Mr. Hall was a managing director at RBS Greenwich Capital from 2002-2003, where he was responsible for the structuring, pricing and distribution of mezzanine debt, preferred equity investments and other high yield structured debt interests. From 1996 to 2002, Mr. Hall was a director at Credit Suisse First Boston, or CSFB, where he established and ran the high yield private placement group, acting on behalf of principals and agents. While at CSFB, he developed a number of the practices now employed in the single asset high yield finance business, including the structuring of multiple tranches of mortgage and mezzanine debt and preferred equity in single transactions. In these positions he has worked on transactions in over 40 states in the United States. Mr. Hall received two B.A. degrees from the University of Massachusetts, Amherst and a J.D. degree from Boston University.

Jeffrey E. Kelter has served as director since August 2004. From 1997 to 2004, Mr. Kelter was president and chief executive officer and a trustee of Keystone Property Trust, an industrial REIT.

4

Keystone merged during the third quarter of 2004 with and into a joint venture between ProLogis and affiliates of investment companies managed by Eaton Vance Management. Mr. Kelter had been president and a trustee of Keystone from its formation in December 1997 and was appointed chief executive officer in December 1998. He has over 20 years of experience in all phases of commercial real estate including development and third-party management. Prior to forming Keystone, he served as president and chief executive officer of Penn Square Properties, Inc. in Philadelphia, Pennsylvania, a real estate company which he founded in 1982. At Penn Square he developed, owned, managed and leased more than 4.5 million square feet of office and warehouse projects throughout the Pennsylvania and New Jersey markets. Mr. Kelter received a B.A. from Trinity College.

Class II Continuing Directors—Terms Expire in 2006

Stephen L. Green has served as chairman of the board since August 2004. Mr. Green has served as SL Green's chairman and member of the Executive Committee of its board of directors since 1997. Mr. Green was chief executive officer of SL Green from 1997 until January 2004, when Marc Holliday was promoted to that position. Mr. Green founded SL Green's predecessor, S.L. Green Properties, Inc., in 1980. Mr. Green is an at-large member of the executive committee of the Board of Governors of the Real Estate Board of New York and has previously served as chairman of the Real Estate Board of New York's Tax Committee. He currently serves as a member on the Board of Directors of the Starlight Foundation and Street Squash. Mr. Green received a B.A. degree from Hartwick College and a J.D. degree from Boston College Law School.

Allan J. Baum has served as a director since August 2004. Mr. Baum retired from CSFB in 2001, where he was a managing director and head of the structured finance unit for commercial mortgage-backed securities. Prior to his ten years with CSFB, Mr. Baum held the position of vice president in the Real Estate Investment Bank of Citicorp. He has also held positions in the tax-exempt housing finance and taxable mortgage finance areas of Merrill Lynch. Mr. Baum currently serves as a director of Community Development Trust (a for-profit, mission-oriented REIT), National Cooperative Bank and NCB, FSB. He previously served as vice president of the Commercial Mortgage Securities Association. Mr. Baum holds a B.A. degree from Dartmouth College and an MBA in Finance from Columbia University Graduate School of Business.

Class III Continuing Directors—Terms Expire in 2007

Marc Holliday. Mr. Holliday has been our president and chief executive officer and director since August 2004. Mr. Holliday is chief executive officer, president and a director of SL Green. He was chief investment officer of SL Green from July 1998, when he joined SL Green, through 2003 and was named its president and elected to its board of directors in 2001. Prior to joining SL Green, he was Managing Director and Head of Direct Originations for New York-based Capital Trust (NYSE: CT), a mezzanine finance company. While at Capital Trust, Mr. Holliday was in charge of originating direct principal investments for the firm, consisting of mezzanine debt, preferred equity and first mortgages. From 1991 to 1997, Mr. Holliday served in various management positions, including senior vice president at Capital Trust's predecessor company, Victor Capital Group, a private real estate investment bank specializing in advisory services, investment management, and debt and equity placements. Mr. Holliday received a B.S. degree in Business and Finance from Lehigh University in 1988, as well as an M.S. degree in Real Estate Development from Columbia University in 1990.

Paul J. Konigsberg. Mr. Konigsberg has been a director since August 2004. Mr. Konigsberg is a senior partner and president of Konigsberg Wolf and Co. PC, a New York-based accounting firm, and has held these positions for 20 years. Mr. Konigsberg is on the board of directors and chairman of the audit committee of National Medical Health Card, a NASDAQ-listed company. Previously, Mr. Konigsberg served on the boards of directors of two New York Stock Exchange-listed companies, Savin Business Machines and Ipco Hospital Supplies. Mr. Konigsberg is the former treasurer and serves

5

as a board member of the UJA Federation of New York and a member of the board of overseers and chairman of the finance committee of the Albert Einstein College of Medicine. Mr. Konigsberg is a member of the New York State Society of CPAs and The American Institute of Certified Public Accountants. Mr. Konigsberg has a LLM in taxation from the New York University Law School.

Charles S. Laven. Mr. Laven has been a director since August 2004. Mr. Laven is president of Forsyth Street Advisors LLC, a New York based company specializing in real estate finance, municipal bonds and housing. From 1991 to 2003, Mr. Laven was a partner of Hamilton, Rabinovitz, & Alschuler, Inc., or "HR&A", a financial, policy and management consulting firm focusing on complex housing finance, real estate, economic development and strategic planning problems. Prior to his twelve years with HR&A, Mr. Laven served as principal of Caine Gressel Midgley Slater Incorporated and, from 1981-1982, served as principal of Charles Laven and Associates. Mr. Laven currently serves as chairman of the Urban Homesteading Assistance Board. Mr. Laven also is a board member of the Delaware Valley Opera and Dance Notation Bureau. Mr. Laven holds a B.S. degree in architectural design from the Massachusetts Institute of Technology. In 1981, Mr. Laven was a Loeb Fellow in Advanced Environmental Affairs at the Harvard University School of Design.

Biographical Information Regarding Executive Officers Who Are Not Directors

Robert R. Foley. Mr. Foley has served as our chief financial officer since August 2004. Prior to joining our company, he worked as an independent consultant since May 2004 advising SL Green on the development of our business plan. Before working with SL Green, Mr. Foley was a vice president in the Special Situations Group of Goldman, Sachs & Co. where from 2000 until 2004 he directed that firm's principal investment activities in commercial real estate B notes, mezzanine loans, preferred equity, and distressed debt. From 1997 to 2000, Mr. Foley was responsible at Goldman Sachs for the structuring, capital commitment, pricing and distribution of mezzanine debt, non-securitized commercial mortgage loans and loans to real estate investment trusts and real estate operating companies. From 1988 until 1997, Mr. Foley held a range of senior capital markets, principal investing and client relationship management roles with Bankers Trust Company and BT Securities Corporation (now Deutsche Bank) in New York and Los Angeles. From 1981 to 1986, Mr. Foley was an accountant and consultant in the San Francisco office of Touche, Ross & Co. (now Deloitte & Touche), an international independent public accounting firm. Mr. Foley earned Bachelor of Arts degrees in Economics and Political Science from Stanford University in 1981, and an MBA from The Wharton School of the University of Pennsylvania in 1988. Mr. Foley is a certified public accountant. Mr. Foley is 44 years old.

Andrew Mathias. Mr. Mathias has served as our chief investment officer since August 2004. Mr. Mathias joined SL Green in March 1999 as a vice president and was promoted to director of investments in 2002, a position he held until his promotion to chief investment officer in January 2004. Prior to joining SL Green, from July 1998, Mr. Mathias was with New York-based Capital Trust (NYSE: CT), a mezzanine finance company. From June 1995 to July 1998, Mr. Mathias worked at Capital Trust's predecessor company, Victor Capital Group, a private real estate investment bank specializing in advisory services, investment management, and debt and equity placements. While there, he worked on a wide variety of real estate principal investments and advisory transactions, both on behalf of third party clients and for the firm's own account. Mr. Mathias also worked on the high yield/restructuring desk at Bear Stearns and Co. Mr. Mathias received a B.S. degree in Economics from the Wharton School at the University of Pennsylvania. Mr. Mathias is 31 years old.

Gregory F. Hughes. Mr. Hughes has served as our chief credit officer since August 2004. Mr. Hughes is SL Green's chief financial officer, responsible for finance, capital markets, investor relations and administration. Prior to joining SL Green in February 2004, from 2002 to 2003 Mr. Hughes was managing director and chief financial officer of the private equity real estate group at

6

JP Morgan Partners. From 1999 to 2002, Mr. Hughes was a partner and chief financial officer of Fortress Investment Group, an investment and asset management firm which managed an $873 million real estate private equity fund and a New York Stock Exchange listed real estate investment trust with assets in excess of $1.3 billion. While at Fortress Investment Group, Mr. Hughes was actively involved in evaluating a broad range of real estate equity and structured finance investments and arranged various financings to facilitate acquisitions and fund recapitalizations. Mr. Hughes also served as chief financial officer of Wellsford Residential Property Trust and Wellsford Real Properties, where he was responsible for the firm's financial forecasting and reporting, treasury and accounting functions, capital markets and investor relations. While at Wellsford, Mr. Hughes was involved in numerous public and private debt and equity offerings and during his tenure, Wellsford became one of the first real estate investment trusts to obtain an investment grade rating. From 1985 to 1992, Mr. Hughes worked at Kenneth Leventhal & Co., a public accounting firm specializing in real estate and financial services. Mr. Hughes received his B.S. degree in Accounting from the University of Maryland and is a certified public accountant. Mr. Hughes is 41 years old.

The Board of Directors and its Committees

We are managed by a seven-member Board of Directors. The Board has affirmatively determined that Messrs. Allan J. Baum, Jeffrey E. Kelter, Paul J. Konigsberg and Charles S. Laven, representing a majority of its members, are independent of our management, as such term is defined by the rules of the New York Stock Exchange Inc., or the NYSE. Our Board of Directors held two meetings during fiscal year 2004. Each of the directors attended at least 75% of the total number of meetings of our Board of Directors held during 2004.

Audit Committee. We have a standing Audit Committee, consisting of Messrs. Konigsberg (chairman), Baum and Laven, each of whom is "independent" within the meaning of the rules of the NYSE and the U.S. Securities and Exchange Commission, or the SEC. The Board of Directors has determined that Mr. Konigsberg is an "audit committee financial expert" as defined in rules promulgated by the SEC under the Sarbanes-Oxley Act of 2002. Our Audit Committee is responsible for, among other things, engaging our independent registered public accounting firm, reviewing with the independent registered public accounting firm the plans and results of their audit engagement, approving professional services to be provided by the independent registered public accounting firm, reviewing the independence of the auditors, considering the range of audit and non-audit fees, reviewing the adequacy of our internal controls, accounting and reporting practices and assessing the quality and integrity of our consolidated financial statements. Our Board approved a charter for our Audit Committee, a copy of which is available on our website atwww.gramercycapitalcorp.com and is attached as Exhibit A to our annual proxy statement. Additional information regarding the functions performed by our Audit Committee is set forth in the "Audit Committee Report" included in this annual proxy statement. Our Audit Committee held two meetings during fiscal year 2004. Each of the committee members attended at least 75% of the total number of meetings of our Audit Committee held during fiscal year 2004.

Compensation Committee. We have a standing Compensation Committee, consisting of Messrs. Kelter (chairman), Baum and Laven, each of whom is "independent" within the meaning of the rules of the NYSE. Our Compensation Committee, among other things, (1) evaluates the performance of our chief executive officer and other executive officers; (2) evaluates the performance of our external manager, GKK Manager LLC, or our Manager; (3) reviews the compensation and fees payable to our Manager under our management agreement; and (4) administers the issuance of any award under our 2004 Equity Incentive Plan. Our Board approved a written charter for our Compensation Committee, a copy of which is available on our website atwww.gramercycapitalcorp.com. Our Compensation Committee held one meeting during fiscal year 2004. See "Executive Compensation—Report on Executive Compensation."

7

Nominating and Corporate Governance Committee. We have a standing Nominating and Corporate Governance Committee, consisting of Messrs. Laven (Chairman), Kelter and Konigsberg, each of whom is "independent" within the meaning of the rules of the NYSE. Our Nominating and Corporate Governance Committee is responsible for, among other things, assisting the Board in identifying individuals qualified to become Board members, recommending to the Board the director nominees to be elected at each annual meeting of stockholders, recommending to the Board the directors to serve on each of the Board's committees, developing and recommending to the Board the corporate governance principles and guidelines applicable to our company and directing the Board in an annual review of its performance. Our Board approved a written charter for our Nominating and Corporate Governance Committee, a copy of which is available on our website atwww.gramercycapitalcorp.com. Our Nominating and Corporate Governance Committee was established in August 2004. Our Nominating and Corporate Governance Committee held no meetings during fiscal year 2004.

Investment Committee. We have a standing Investment Committee consisting of Messrs. Holliday (chairman), Green and Kelter. Our Investment Committee must unanimously approve all transactions in which we invest between $15 million and $50 million. Our Investment Committee held four meetings during fiscal year 2004, during which all transactions between $15 million and $50 million were discussed.

Director Compensation

Directors of our company who are also officers receive no additional compensation for their services as directors. During the fiscal year ended December 31, 2004, each independent director received a fee in the amount of $16,667, representing the pro rated portion of their $40,000 annual fee for the period from August 2, 2004, the date of our initial public offering, through December 31, 2004. Each independent director also received $1,250 for each meeting of our Board of Directors or a committee of our Board of Directors attended. The annual fee payable to our independent directors is payable quarterly, half in cash and half in restricted stock, as determined by our compensation committee, with each director having the option to elect to take additional amounts of stock in lieu of cash, up to the full amount. During fiscal year 2004, all payments were made in cash. During fiscal year 2005, each director will be paid in cash for the first two quarters and with restricted stock for the third and fourth quarters; provided, however, that each director has the right to defer cash payments for the first two quarters pursuant to our 2004 Equity Incentive Plan. This plan provides that a director may elect to defer up to 100% (in increments of 1%) of the director's compensation. Any portion of the annual fee that is paid in stock is made under our 2004 Equity Incentive Plan. During 2004, the meeting fees were paid in cash. In addition, we reimburse all directors for reasonable out-of-pocket expenses incurred in connection with their services on the Board of Directors.

Each director who served as a committee chairman received an additional fee of $3,000, except that the chairman of our Audit Committee received an additional annual fee of $5,000, which was payable in cash. Upon our initial public offering, each independent director received 2,500 shares of our restricted common stock and options to purchase 2,500 shares at the initial public offering price. The restricted stock and options vest as follows: one third on each of June 30, 2005, 2006 and 2007.

8

PROPOSAL 2: RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

Our Audit Committee has selected the accounting firm of Ernst & Young LLP to serve as our independent registered public accounting firm for the fiscal year ending December 31, 2005, subject to ratification of this appointment by our common stockholders. Ernst & Young LLP has served as our independent registered public accounting firm since our formation in April 2004 and is considered by our management to be well-qualified. Ernst & Young LLP has advised us that neither it nor any member thereof has any financial interest, direct or indirect, in our company or any of our subsidiaries in any capacity.

Fee Disclosure

Audit Fees

Fees for audit services totaled approximately $445,019 in 2004. Audit fees include fees associated with our annual audit and the reviews of our quarterly reports on Form 10-Q. In addition, audit fees include fees for public filings in connection with various investments and services relating to public filings in connection with our initial public offering.

Audit-Related Fees

Fees for audit-related services totaled approximately $20,000 in 2004. The audit-related services principally include fees for agreed-upon procedures projects.

Tax Fees

Fees for tax services, including tax compliance, tax advice and tax planning, provided by a third party firm other than Ernst & Young LLP, totaled approximately $57,500 in 2004.

All Other Fees

We did not incur fees in 2004 for other services not included above.

Our Audit Committee considers whether the provision by Ernst & Young LLP of the services that are required to be described under "All Other Fees" is compatible with maintaining Ernst & Young LLP's independence from both management and our company.

A representative of Ernst & Young LLP will be present at the annual meeting, will be given the opportunity to make a statement if he or she so desires and will be available to respond to appropriate questions.

Pre-Approval Policies and Procedures of our Audit Committee

Our Audit Committee must pre-approve all audit services and permissible non-audit services provided by our independent registered public accounting firm, except for anyde minimis non-audit services. Non-audit services are consideredde minimis if (i) the aggregate amount of all such non-audit services constitutes less than 5% of the total amount of revenues we paid to our independent registered public accounting firm during the fiscal year in which they are provided; (ii) we did not recognize such services at the time of the engagement to be non-audit services; and (iii) such services are promptly brought to our Audit Committee's attention and approved prior to the completion of the audit by our Audit Committee or any of its member(s) who has authority to give such approval. None of the fees reflected above were approved by our Audit Committee pursuant to thisde minimis exception. Our Audit Committee may delegate to one or more of its members who is an independent director the authority to grant pre-approvals. All services provided by Ernst & Young LLP in 2004 were pre- approved by our Audit Committee.

Our Board of Directors unanimously recommends a vote FOR the ratification of the selection of Ernst & Young LLP as our independent registered public accounting firm.

9

AUDIT COMMITTEE REPORT

The following is a report by our Audit Committee regarding the responsibilities and functions of our Audit Committee. This Report shall not be deemed to be incorporated by reference in any previous or future documents filed by us with the SEC under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except to the extent that we specifically incorporate the Report by reference in any such document.

Our Audit Committee oversees our financial reporting process on behalf of our Board of Directors, in accordance with our Audit Committee Charter, which was approved in 2004. Management has the primary responsibility for the preparation, presentation and integrity of our financial statements, accounting and financial reporting principles, internal controls, and procedures designed to ensure compliance with accounting standards, applicable laws and regulations. In fulfilling its oversight responsibilities, our Audit Committee reviewed the audited financial statements in the Annual Report on Form 10-K for the year ended December 31, 2004 with management, including a discussion of the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments and the clarity of disclosures in the financial statements.

Our Audit Committee reviewed with the independent registered public accounting firm, who are responsible for auditing our financial statements and for expressing an opinion on the conformity of those audited financial statements with accounting principles generally accepted in the United States, their judgments as to the quality, not just the acceptability, of our accounting principles and such other matters as are required to be discussed with the Audit Committee under Statement on Auditing Standards No. 61, as currently in effect. Our Audit Committee received the written disclosure and the letter from our independent registered public accounting firm required by the Independence Standards Board Standard No. 1, as currently in effect, discussed with our independent registered public accounting firm the auditors' independence from both management and our company and considered the compatibility of our independent registered public accounting firm's provision of non-audit services to our company with their independence.

Our Audit Committee discussed with our independent registered public accounting firm the overall scope and plans for their audit. Our Audit Committee met with our independent registered public accounting firm, with and without management present, to discuss the results of their examinations, their evaluations of our internal controls and the overall quality of our financial reporting, including off-balance sheet investments.

In reliance on the reviews and discussions referred to above, but subject to the limitations on the role and responsibilities of our Audit Committee referred to below, our Audit Committee recommended to our Board of Directors (and our Board of Directors has approved) that the audited financial statements be included in the Annual Report on Form 10-K for the year ended December 31, 2004 for filing with the SEC.

Our Board of Directors has determined that our Audit Committee has at least one "audit committee financial expert," as defined in Item 401(h) of SEC Regulation S-K, such expert being Mr. Konigsberg, and that he is "independent," as that term is used in Item 7(d)(3)(iv) of Schedule 14A under the Securities Exchange Act of 1934, as amended.

The members of our Audit Committee, with the exception of Mr. Konigsberg, are not professionally engaged in the practice of auditing or accounting. Committee members rely, without independent investigation or verification, on the information provided to them and on the representations made by management and independent registered public accounting firm. Accordingly, our Audit Committee's oversight does not provide an independent basis to determine that management has maintained appropriate accounting and financial reporting principles or appropriate internal controls and procedures designed to assure compliance with accounting standards and applicable laws

10

and regulations. Furthermore, our Audit Committee's considerations and discussions referred to above do not assure that the audit of our financial statements has been carried out in accordance with the standards of the Public Company Accounting Oversight Board (United States), that the financial statements are presented in accordance with U.S. generally accepted according principles or that Ernst & Young LLP is in fact "independent."

| | | Submitted by our Audit Committee |

|

|

Paul J. Konigsberg, chairman

Allan J. Baum

Charles S. Laven |

11

CORPORATE GOVERNANCE MATTERS

This section of our proxy statement contains information about a variety of our corporate governance policies and practices. In this section, you will find information about how we are complying with the NYSE's final corporate governance rules that were approved by the SEC. We are committed to operating our business under strong and accountable corporate governance practices. You are encouraged to visit the corporate governance section of the "Investor Relations—Corporate Governance" page of our corporate website atwww.gramercycapitalcorp.com to view or to obtain copies of our committee charters, code of business conduct and ethics and corporate governance principles. Additional information relating to the corporate governance of our company is also included in other sections of this proxy statement.

Corporate Governance Guidelines

Our Board of Directors has adopted Corporate Governance Guidelines that address significant issues of corporate governance and set forth procedures by which our Board carries out its responsibilities. Among the areas addressed by the Corporate Governance Guidelines are director qualification standards, director responsibilities, director access to management and independent advisors, director compensation, director orientation and continuing education, management succession, annual performance evaluation of the Board and management responsibilities. Our Nominating and Corporate Governance Committee is responsible for assessing and periodically reviewing the adequacy of the Corporate Governance Guidelines and will recommend, as appropriate, proposed changes to the Board.

Director Independence

Our Corporate Governance Guidelines provide that a majority of our directors serving on our Board must be independent as required by the listing standards of the NYSE and the applicable rules promulgated by the SEC. Our Board has affirmatively determined, based upon its review of all relevant facts and circumstances, that each of the following directors and director nominee has no direct or indirect material relationship with us and is independent under the listing standards of the NYSE and the applicable rules promulgated by the SEC: Messrs. Allan J. Baum, Jeffrey E. Kelter, Paul J. Konigsberg and Charles S. Laven. Our Board has determined that Messrs. Green, Holliday and Hall, are not independent because they are also executive officers or officers of our company.

Code of Business Conduct and Ethics

Our Board of Directors has adopted a Code of Business Conduct and Ethics that applies to our directors, executive officers and employees. The Code of Business Conduct and Ethics was designed to assist our directors, executive officers and employees in complying with the law, resolving moral and ethical issues that may arise and in complying with our policies and procedures. Among the areas addressed by the Code of Business Conduct and Ethics are compliance with applicable laws, conflicts of interest, use and protection of our company's assets, confidentiality, communications with the public, accounting matters, records retention, fair dealing, discrimination and harassment and health and safety.

Audit Committee Financial Expert

Our Board of Directors has determined that our Audit Committee has at least one "audit committee financial expert," as defined in Item 401(h) of SEC Regulation S-K, such expert being Mr. Konigsberg, and that he is "independent," as that term is used in Item 7(d)(3)(iv) of Schedule 14A under the Securities Exchange Act of 1934, as amended. Mr. Konigsberg has agreed to serve as our audit committee financial expert.

12

Communications with our Board of Directors

We have a process by which stockholders and/or other parties may communicate with our Board of Directors or individual directors. Any such communications may be sent to our Board by U.S. mail or overnight delivery and should be directed to Andrew S. Levine, Corporate Secretary, at Gramercy Capital Corp., 420 Lexington Avenue, New York, New York 10170-1881, who will forward them on to the intended recipient. Any such communications may be made anonymously.

Whistleblowing and Whistleblower Protection Policy

Our Audit Committee has established procedures for (1) the receipt, retention and treatment of complaints received by our company regarding accounting, internal accounting controls or auditing matters, and (2) the confidential and anonymous submission by our employees of concerns regarding questionable accounting or auditing matters. If you wish to contact our Audit Committee to report complaints or concerns relating to the financial reporting of our company, you may do so in writing to the Chairman of our Audit Committee, c/o Corporate Secretary, Gramercy Capital Corp., 420 Lexington Avenue, New York, New York 10170-1881. Any such communications may be made anonymously.

Director Attendance at Annual Meetings

We encourage each member of our Board of Directors to attend each annual meeting of stockholders.

Identification of Director Candidates

Our Nominating and Corporate Governance Committee assists our Board of Directors in identifying and reviewing director candidates to determine whether they qualify for membership on the Board and for recommending to the Board the director nominees to be considered for election at our annual meetings of stockholders.

In making recommendations to our Board, our Nominating and Corporate Governance Committee considers such factors as it deems appropriate. These factors may include judgment, skill, diversity, education, experience with businesses and other organizations comparable to our company, the interplay of the candidate's experience with the experience of other Board members, the candidate's industry knowledge and experience, the ability of a nominee to devote sufficient time to the affairs of our company and the extent to which the candidate generally would be a desirable addition to the Board and any committees of the Board.

Our Nominating and Corporate Governance Committee may solicit and consider suggestions of our directors or management regarding possible nominees. Our Nominating and Corporate Governance Committee may also procure the services of outside sources or third parties to assist in the identification of director candidates.

Our Nominating and Corporate Governance Committee may consider director candidates recommended by our stockholders. Our Nominating and Corporate Governance Committee will apply the same standards in considering candidates submitted by stockholders as it does in evaluating candidates submitted by members of our Board. Any recommendations by stockholders should follow the procedures outlined under "Stockholder Proposals" in this proxy statement and should also provide the reasons supporting a candidate's recommendation, the candidate's qualifications and the candidate's written consent to being considered as a director nominee. In addition, any stockholder recommending a director candidate should submit information demonstrating the number of shares of common stock that he or she owns.

13

Executive Sessions of Non-Management Directors

In accordance with the Corporate Governance Guidelines, the non-management directors serving on our Board of Directors meet in executive session after each regularly scheduled meeting of the Audit Committee without the presence of any directors or other persons who are part of our management. The executive sessions regularly are chaired by the chair of the Board committee having jurisdiction over the particular subject matter to be discussed at the particular session or portion of a session.

14

EXECUTIVE COMPENSATION

Summary Compensation Table

Because our management agreement provides that our Manager assumes principal responsibility for managing our affairs, our executive officers, who are employees of our Manager, do not receive cash compensation from us for serving as our executive officers. However, in their capacities as officers or employees of our Manager, or its affiliates, they devote a portion of their time to our affairs as is required for the performance of the duties of our Manager under the management agreement.

Our Manager has informed us that, because the services to be performed by its officers or employees in those capacities as such may not be performed exclusively for us, it may not be able to segregate and identify that portion of the compensation awarded to, earned by or paid to our executive officers by our Manager or its affiliates, including SL Green, that relates to their services to us. Our Manager or its affiliates, including SL Green, compensates each of our executive officers. Our Manager has entered into four-year employment agreements with each of the managing directors who are not also employees of SL Green. Each employment agreement includes standard non-compete provisions which extend for 12 months after termination of employment as well as other restrictive covenants.

We may from time to time, at the discretion of the Compensation Committee, grant shares of our common stock or options to purchase shares of our common stock to our executive officers pursuant to the 2004 Equity Incentive Plan. The following table sets forth information regarding the base compensation awarded to our chief executive officer and each of our other four most highly compensated executive officers (collectively, the "named executive officers").

| | Annual Compensation

| | Long-Term Compensation

| |

|

|---|

Name and Principal Position

| | Year

| | Salary($)

| | Bonuses($)

| | Other Annual

Compensation

| | Restricted

Stock

Awards(1)(2)

| | Securities

Underlying

Options/

SARs(2)(3)

| | All Other

Compensation

($)

|

|---|

Marc Holliday

Chief Executive Officer, President | | 2004 | | — | | — | | — | | 75,000 | | 75,000 | | — |

Hugh F. Hall

Chief Operating Officer |

|

2004 |

|

— |

|

— |

|

— |

|

25,000 |

|

125,000 |

|

— |

Robert R. Foley

Chief Financial Officer |

|

2004 |

|

— |

|

— |

|

— |

|

10,000 |

|

140,000 |

|

— |

Andrew Mathias

Chief Investment Officer |

|

2004 |

|

— |

|

— |

|

— |

|

55,000 |

|

55,000 |

|

— |

Gregory F. Hughes

Chief Credit Officer |

|

2004 |

|

— |

|

— |

|

— |

|

35,000 |

|

35,000 |

|

— |

- (1)

- Except with respect to Messrs. Hall and Foley, one-third of the number of shares will vest per year commencing on June 30, 2005. With respect to Messrs. Hall and Foley, one-quarter of the number of shares will vest per year commencing on June 30, 2005.

- (2)

- In consideration for services rendered, our executive officers received grants of restricted stock and options to purchase our common stock.

- (3)

- As of December 31, 2004, options to purchase a total of 505,000 shares of common stock have been granted to our directors and officers, including options to purchase 430,000 shares of common stock granted to our named executive officers.

15

Option/SAR Grants In Fiscal Year 2004

The following table sets forth the options/stock appreciation rights, or SARs, granted with respect to the fiscal year ended December 31, 2004 to our named executive officers.

| |

| | Percent Of

Total

Options/SARs

Granted To

Employees In

Fiscal Year

| |

| |

| | Potential Realizable Value At

Assumed Annual Rates Of

Share Price Appreciation For

Option Term(3)

|

|---|

| | Number Of

Securities

Underlying

Options/SARs

Granted(1)

| | Exercise

Price Per

Share Of

Common

Stock(2)

| |

|

|---|

Name

| | Expiration

Date

|

|---|

| | 5%

| | 10%

|

|---|

| Marc Holliday | | 75,000 | | 11.7 | % | $ | 15.00 | | Aug 2, 2014 | | 707,506 | | 1,792,960 |

Hugh F. Hall |

|

125,000 |

|

19.5 |

% |

$ |

15.00 |

|

Aug 2, 2014 |

|

1,179,177 |

|

2,988,267 |

Robert R. Foley |

|

140,000 |

|

21.9 |

% |

$ |

15.00 |

|

Aug 2, 2014 |

|

1,320,679 |

|

3,346,859 |

Andrew Mathias |

|

55,000 |

|

8.6 |

% |

$ |

15.00 |

|

Aug 2, 2014 |

|

518,838 |

|

1,314,838 |

Gregory F. Hughes |

|

35,000 |

|

5.5 |

% |

$ |

15.00 |

|

Aug 2, 2014 |

|

330,170 |

|

836,715 |

- (1)

- Except with respect to Messrs. Hall and Foley, one-third of the number of shares will vest per year commencing on June 30, 2005. With respect to Messrs. Hall and Foley, one-quarter of the number of shares will vest per year commencing on June 30, 2005.

- (2)

- The exercise price for the options was based on the market price of the common stock on the date the options were granted.

- (3)

- In accordance with the rules of the SEC, these amounts are the hypothetical gains, or "option spreads" from the exercise price, that would exist for the respective options based on assumed rates of annual compound share price appreciation of 5% and 10% from the date the options were granted over the full option term. No gain to the optionee is possible without an actual increase in the price of the common stock, which would benefit all stockholders.

Aggregated Option/SAR Exercises in Fiscal Year 2004 and 2004 Year-End Option/SAR Values

The following table provides information regarding option exercises in 2004 by our named executive officers and the value of their unexercised options held at the end of 2004.

| |

| |

| | Number of shares underlying unexercised options/SARs

at fiscal year-end

| | Value of unexercised in-the-money options/SARs at fiscal year-end($)(1)

|

|---|

Name

| | Shares

acquired

on exercise

| | Value

realized

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| Marc Holliday | | N/A | | — | | 0 | | 75,000 | | N/A | | $ | 1,545,000 |

Hugh F. Hall |

|

N/A |

|

— |

|

0 |

|

125,000 |

|

N/A |

|

$ |

2,575,000 |

Robert R. Foley |

|

N/A |

|

— |

|

0 |

|

140,000 |

|

N/A |

|

$ |

2,884,000 |

Andrew Mathias |

|

N/A |

|

— |

|

0 |

|

55,000 |

|

N/A |

|

$ |

1,133,000 |

Gregory F. Hughes |

|

N/A |

|

— |

|

0 |

|

35,000 |

|

N/A |

|

$ |

721,000 |

- (1)

- The value of unexercised in-the-money options at fiscal year-end, based on the market price for our common stock at the close of trading on December 31, 2004 of $20.60 per share.

16

Equity Compensation Plan Information

The following table summarizes information, as of December 31, 2004, relating to our equity compensation plans pursuant to which shares of our common stock or other equity securities may be granted from time to time.

Plan category

| | Number of securities to be issued upon exercise of outstanding options, warrants and rights

| | Weighted average exercise price of outstanding options, warrants and rights

| | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a))

|

|---|

| Equity compensation plans approved by security holders(1) | | 640,500 | | $ | 15.05 | | 1,240,750 |

| Equity compensation plans not approved by security holders | | N/A | | | N/A | | N/A |

| | Total | | 640,500 | | $ | 15.05 | | 1,240,750 |

- (1)

- Includes information related to our 2004 Equity Incentive Plan.

2004 Equity Incentive Plan

At the July 2004 meeting of our Board of Directors, our Board adopted, and our stockholders ratified, a long-term, ten-year compensation program for certain employees, directors, officers, advisors, consultants and other personnel, including our Manager and employees of our Manager and SL Green, and any joint venture affiliates of ours or SL Green. Our Compensation Committee may provide that our Manager, SL Green, any joint venture affiliates of us or SL Green and employees of the foregoing may be eligible to participate in the equity incentive plan. Of the options or stock that have not been granted at the time of the initial public offering, the compensation committee shall have the right to make such awards in the form of equity incentive compensation on such terms as the compensation committee may deem appropriate. Our Compensation Committee has the authority to administer and interpret the equity incentive plan, to authorize the granting of awards, to determine the eligibility of an employee, director or consultant to receive and award, to determine the number of shares of common stock to be converted by each award, to determine the terms, provisions and conditions of each award, to prescribe the form of instruments evidencing awards and to take any other actions and make all other determinations that it deems necessary or appropriate. Our Compensation Committee, in its discretion, may delegate to the Chief Executive Officer of the Company all or part of the Committee's authority and duties with respect to awards;provided, however, that the Company may not delegate its authority and duties with respect to awards that have been, or will be, granted to the Chief Executive Officer, Chief Operating Officer, Chief Financial Officer, Chief Credit Officer or President or any Executive Vice President of the Company.

Subject to adjustment upon certain corporate transactions or events, up to a maximum of 6,250,000 shares, but not more than 10% of the common stock outstanding at the time of the grant, may be subject to stock options, restricted stock, phantom stock and dividend equivalent rights under the equity incentive plan. The maximum number of shares of common stock that may underlie awards, other than options, in any one year to any eligible person, shall not exceed 200,000. In addition, subject to adjustment upon certain corporate transactions or events, a participant may not receive options for more than 300,000 shares of our common stock in one year. Any common stock withheld or surrendered by plan participants in connection with the payment of an option exercise price or in connection with tax withholding will not count towards the share limitation and will be available for issuance under the equity incentive plan. If an option or other award granted under the equity incentive plan expires or terminates, the common stock subject to any portion of the award that expires

17

or terminates without having been exercised or paid, as the case may be, will again become available for the issuance of additional awards. Unless the equity incentive plan is previously terminated by our board of directors, no new award may be granted under the equity incentive plan after the tenth anniversary of the date that such plan was initially approved by our board of directors. No award may be granted under our equity incentive plan to any person who, assuming exercise of all options and payment of all awards held by such person, would own or be deemed to own more than 9.8% of our outstanding common stock.

Compensation Committee Interlocks and Insider Participation

There are no Compensation Committee interlocks and none of our employees participates on the Compensation Committee.

18

COMPENSATION COMMITTEE REPORT

The following is a report by our Compensation Committee regarding the responsibilities and functions of our Compensation Committee. This Report shall not be deemed to be incorporated by reference in any previous or future documents filed by us with the SEC under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except to the extent that we specifically incorporate the Report by reference in any such document.

Our Compensation Committee evaluates the performance of our chief executive officer and other officers. Our Compensation Committee also evaluates the performance of our Manager and reviews the compensation and fees payable to our Manager under our management agreement. In addition our Compensation Committee administers the issuance of any award under our 2004 Equity Incentive Plan. Our Compensation Committee is comprised of the independent directors, Messrs. Kelter (Chairman), Baum and Laven.

Because our management agreement with our Manager provides that our Manager assumes principal responsibility for managing our affairs, our executive officers do not receive cash compensation from us for serving as our executive officers. However, in their capacities as officers of our Manager or its affiliates, they devote such portion of their time to our affairs as is required for the performance of the duties of our Manager under the management agreement.

Our Compensation Committee has reviewed the performance of our Manager has determined that the compensation and fees payable to it are consistent with our goals and objectives. Our Compensation Committee approved the restricted shares and options to purchase shares of our commons stock that were granted to our executive officers.

| | | Submitted by our Compensation

Committee of our Board of Directors |

|

|

Jeffrey E. Kelter (Chairman)

Allan J. Baum

Charles S. Laven |

19

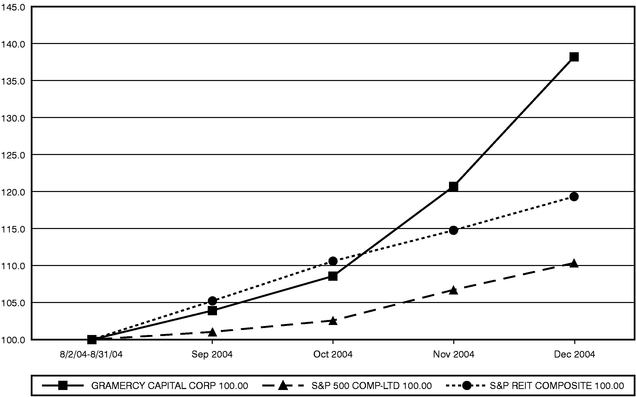

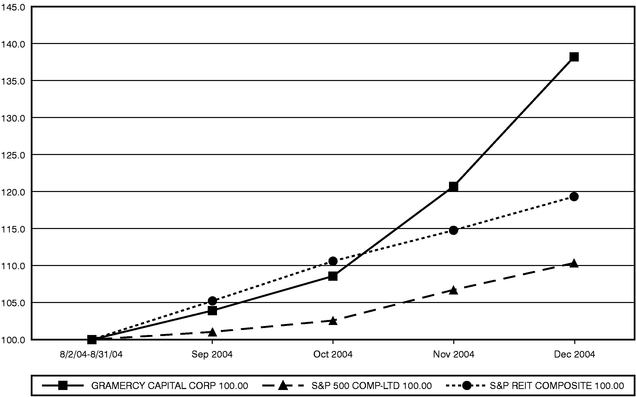

STOCK PERFORMANCE GRAPH

The following graph provides a comparison of the cumulative total stockholder return on the common stock from the closing price on August 2, 2004 of $15.01 per share to the closing price per share on the NYSE on December 31, 2004 of $20.60 with the cumulative total return on the Standard & Poor's 500 Composite Stock Price Index and the Standard & Poor's REIT Composite Index for the same periods. Total return values were calculated based on cumulative total return assuming (i) the investment of $100 in our common stock, the Standard & Poor's 500 Composite Stock Price Index and the Standard & Poor's REIT Composite Index on August 2, 2004 and (ii) reinvestment of dividends. The historical information set forth below is not necessarily indicative of future performance. The data shown is based on the share prices or index values, as applicable, as of the end of each month shown.

| | Aug. 2004(1)

| | Sept. 2004

| | Oct. 2004

| | Nov. 2004

| | Dec. 2004

|

|---|

| Gramercy | | 100.00 | | 103.93 | | 108.59 | | 120.72 | | 138.24 |

| S&P 500 | | 100.00 | | 101.04 | | 102.58 | | 106.73 | | 110.36 |

| S&P REIT | | 100.00 | | 105.23 | | 110.61 | | 114.78 | | 119.34 |

Source for Standard & Poor's 500 Composite Stock Price Index and Standard & Poor's REIT Composite Index data: Standard & Poor's

Index data: Standard & Poor's

- (1)

- Assumes (i) an initial investment of $100 in our common stock, in the Standard & Poor's 500 Composite Stock Price Index and in the Standard & Poor's REIT Composite Index on August 2, 2004 and (ii) reinvestment of dividends.

The stock performance graph shall not be deemed to be "soliciting material" or to be "filed" with the SEC or subject to Regulations 14A or 14C or to the liabilities of Section 18 of the Exchange Act, except to the extent that we specifically request that such information be treated as soliciting material or specifically incorporate it by reference into a filing under the Securities Act of 1933, as amended, or the Exchange Act.

20

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth the beneficial ownership of our common stock, as of March 31, 2005, for (i) each person known to us to be the beneficial owner of more than 5% of our outstanding common stock, (ii) each of our directors and nominees for director, (iii) each of our named executive officers who is not a director and (iv) our directors, nominees for director and executive officers as a group. Except as otherwise described in the notes below, the following beneficial owners have sole voting power and sole investment power with respect to all shares of common stock set forth opposite their respective names.

In accordance with SEC rules, each listed person's beneficial ownership includes:

- •

- all shares the investor actually owns beneficially or of record;

- •

- all shares over which the investor has or shares voting or dispositive control (such as in the capacity as a general partner of an investment fund); and

- •

- all shares the investor has the right to acquire within 60 days (such as upon exercise of options that are currently vested or which are scheduled to vest within 60 days).

Unless otherwise indicated, all shares are owned directly and the indicated person has sole voting and investment power. The table does not include options to purchase an aggregate of 640,500 shares issued to directors, officers and employees of SL Green and our Manager that will not vest or be exercisable prior to June 30, 2005. Except as indicated in the footnotes to the table below, the business address of the stockholders listed below is the address of our principal executive office, 420 Lexington Avenue, New York, New York 10170.

Name**

| | Amount And Nature of Beneficial Ownership of Common Stock

| | Percent of

Total(1)

| |

|---|

| SL Green Realty Corp. | | 4,710,000 | | 25.0 | % |

| Stephen L. Green | | 106,000 | | * | |

| Marc Holliday | | 140,000 | | * | |

| Hugh F. Hall | | 25,000 | | * | |

| Robert R. Foley | | 10,000 | | * | |

| Andrew Mathias | | 103,000 | | * | |

| Gregory F. Hughes | | 35,000 | | * | |

| Allan J. Baum | | 2,500 | | * | |

| Jeffrey E. Kelter | | 2,500 | | * | |

| Paul J. Konigsberg | | 6,500 | | * | |

| Charles S. Laven | | 4,000 | | * | |

| Stitching Pensioenfonds ABP(2) | | 1,285,000 | | 9.65 | % |

| All Directors and Executive Officers as a Group (10 Persons) | | 428,000 | | 2.27 | % |

- *

- Less than 1% of class.

- **

- Unless otherwise indicated, the business address is 420 Lexington Avenue,

New York, New York 10170

- (1)

- As of March 31, 2005, 18,833,000 shares of common stock were outstanding. For purposes of computing the percentage of outstanding shares of common stock held by each person, any share of common stock which such person has the right to acquire pursuant to the exercise of stock options exercisable within 60 days or pursuant to the redemption of units (assuming we elect to issue common stock rather than pay cash upon redemption) is deemed to be outstanding, but is

21

not deemed to be outstanding for the purpose of computing the percentage ownership of any other person.

- (2)

- The business address for this stockholder is Oude Lindestraat 70, Postbus 2889, 6401 DL Heerlen, The Kingdom of the Netherlands.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires our executive officers and directors, and persons who own more than 10% of a registered class of our equity securities, to file reports of ownership and changes in ownership with the SEC and the NYSE. Officers, directors and persons who own more than 10% of a registered class of our equity securities are required to furnish us with copies of all Section 16(a) forms that they file. To our knowledge, based solely on review of the copies of such reports furnished to us, all Section 16(a) filing requirements applicable to our executive officers, directors and persons who own more than 10% of a registered class of our equity securities were filed on a timely basis, except that Mr. Konigsberg, one of our directors, filed a late statement of change in beneficial ownership on Form 4 reporting the purchase of 4,000 shares that occurred in December 2004.

22

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Management Agreement

In connection with our initial public offering in April 2004, we entered into a Management Agreement with our Manager, which provides for an initial term through December 2007 with automatic one-year extension options and subject to certain termination rights. We pay our Manager an annual management fee equal to 1.75% of our gross stockholders equity, which is defined as the aggregate gross proceeds from sales of our operating partnership's common and preferred equity capital. For the period from April 12, 2004 through December 31, 2004, we paid or had payable an aggregate of approximately $1,349 to the Manager under this agreement.

As of December 31, 2004, our Manager and SL Green Operating Partnership, L.P., held 15 units and 85 units, respectively, of the Class B limited partner interests of the Operating Partnership, which represents 100% of all Class B limited partner interests. SL Green Operating Partnership, L.P. intends to own at least 70 units of the Class B limited partner interests. To provide an incentive for our Manager to enhance the value of our common stock, our Manager and SL Green Operating Partnership, L.P. are entitled through their ownership of Class B limited partner interests of the Operating Partnership to an incentive return equal to 25% of the amount by which funds from operations (as defined in the partnership agreement of the Operating Partnership) plus certain accounting gains exceed the product of our weighted average stockholders' equity (as defined in the partnership agreement of the Operating Partnership) multiplied by 9.5% (divided by 4 to adjust for quarterly calculations). We will record any distributions on the Class B limited partner interests as an incentive distribution expense in the period when earned and when payments of such amounts has become probable and reasonably estimable in accordance with the partnership agreement. No amounts were earned or accrued under this agreement as of December 31, 2004.

Asset Servicing Agreement and Outsourcing Agreement

We are obligated to reimburse our Manager for its costs incurred under an Asset Servicing Agreement and a separate Outsourcing Agreement between our Manager and SL Green Operating Partnership, L.P. The Asset Servicing Agreement provides for an annual fee payable by us of 0.15% of the carrying value of our investments, excluding certain defined investments for which other servicing arrangements are executed and further reduced by fees paid directly to outside servicers by us. The Outsourcing Agreement provides for an annual fee of $1.25 million per year, increasing 3% annually over the prior year. For the period from April 12, 2004 through December 31, 2004, we paid or had payable an aggregate of $521,000 and $95,000 to our Manager under the outsourcing and asset servicing agreements, respectively.

Purchases of Common Stock

In connection with our incorporation, a subsidiary of SL Green purchased 500,000 shares of our common stock for $200,000, or $0.40 per share, as our initial capitalization. The purchase price represented the estimated fair value of such shares at the time of formation. On August 2, 2004, SL Green purchased 3,125,000 shares, or 25% of the shares sold in our initial public offering, at $15.00 per share. SL Green also has the right to purchase 25% of any shares of stock sold in future offerings. On December 31, 2004 and January 3, 2005, we completed the private offering and sale of common stock pursuant to purchase and sale agreements we entered into on December 3, 2004. Various institutional investors directly acquired 4,225,000 shares of common stock and an additional 1,275,000 shares of common stock were sold to SL Green Operating Partnership, L.P., an affiliate of SL Green Realty Corp.

23

Registration Rights Agreement

We entered into a registration rights agreement with each of the purchasers in the private placement transaction whereby we agreed to file a registration statement with the SEC no later than August 31, 2005, covering the shares we sold in the private placement.

Origination Agreement