UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2016

or

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 001-32559

Medical Properties Trust, Inc.

MPT Operating Partnership, L.P.

(Exact Name of Registrant as Specified in Its Charter)

| | |

Maryland Delaware | | 20-0191742 20-0242069 |

(State or Other Jurisdiction of Incorporation or Organization) | | (IRS Employer Identification No.) |

1000 Urban Center Drive, Suite 501 Birmingham, AL | | 35242 |

| (Address of Principal Executive Offices) | | (Zip Code) |

(205) 969-3755

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | |

Title of Each Class | | Name of Each Exchange on Which Registered |

Common Stock, par value $0.001 per share of Medical Properties Trust, Inc. | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Medical Properties Trust, Inc. Yes ☒ No ☐ MPT Operating Partnership, L.P. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Medical Properties Trust, Inc. Yes ☐ No ☒ MPT Operating Partnership, L.P. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Medical Properties Trust, Inc. Yes ☒ No ☐ MPT Operating Partnership, L.P. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Medical Properties Trust, Inc. Yes ☒ No ☐ MPT Operating Partnership, L.P. Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (Check one):

Medical Properties Trust, Inc.

| | | | | | |

| Large accelerated Filer | | ☒ | | Accelerated Filer | | ☐ |

| Non-accelerated Filer | | ☐ (Do not check if a smaller reporting company) | | Smaller Reporting Company | | ☐ |

MPT Operating Partnership, L.P.

| | | | | | |

| Large accelerated Filer | | ☐ | | Accelerated Filer | | ☐ |

| Non-accelerated Filer | | ☒ (Do not check if a smaller reporting company) | | Smaller Reporting Company | | ☐ |

Indicate by check mark whether the registrant is a shell company (as defined in 12b-2 of the Act).

Medical Properties Trust, Inc. Yes ☐ No ☒ MPT Operating Partnership, L.P. Yes ☐ No ☒

As of June 30, 2016, the aggregate market value of the 236,587,490 shares of common stock, par value $0.001 per share (“Common Stock”), held by non-affiliates of the registrant was $3,598,495,723 based upon the last reported sale price of $15.21 on the New York Stock Exchange on that date. For purposes of the foregoing calculation only, all directors and executive officers of the registrant have been deemed affiliates.

As of February 24, 2017, 320,934,225 shares of Medical Properties Trust, Inc. Common Stock were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive Proxy Statement for the Annual Meeting of Stockholders to be held on May 25, 2017 are incorporated by reference into Items 10 through 14 of Part III, of this Annual Report on Form 10-K.

TABLE OF CONTENTS

2

EXPLANATORY NOTE

This report combines the Annual Reports on Form10-K for the year ended December 31, 2016, of Medical Properties Trust, Inc., a Maryland corporation, and MPT Operating Partnership, L.P., a Delaware limited partnership, through which Medical Properties Trust, Inc. conducts substantially all of its operations. Unless otherwise indicated or unless the context requires otherwise, all references in this report to “we,” “us,” “our,” “our company,” “Medical Properties,” “MPT,” or “the Company” refer to Medical Properties Trust, Inc. together with its consolidated subsidiaries, including MPT Operating Partnership, L.P. Unless otherwise indicated or unless the context requires otherwise, all references to “our operating partnership” or “the operating partnership” refer to MPT Operating Partnership, L.P. together with its consolidated subsidiaries.

CAUTIONARY LANGUAGE REGARDING FORWARD LOOKING STATEMENTS

We make forward-looking statements in this Annual Report onForm 10-K that are subject to risks and uncertainties. These forward-looking statements include information about possible or assumed future results of our business, financial condition, liquidity, results of operations, plans and objectives. Statements regarding the following subjects, among others, are forward-looking by their nature:

| | • | | our projected operating results; |

| | • | | our ability to acquire or develop additional facilities in the United States (“U.S.”) or Europe; |

| | ��� | | availability of suitable facilities to acquire or develop; |

| | • | | our ability to enter into, and the terms of, our prospective leases and loans; |

| | • | | our ability to raise additional funds through offerings of debt and equity securities and/or property disposals; |

| | • | | our ability to obtain future financing arrangements; |

| | • | | estimates relating to, and our ability to pay, future distributions; |

| | • | | our ability to service our debt and comply with all of our debt covenants; |

| | • | | our ability to compete in the marketplace; |

| | • | | lease rates and interest rates; |

| | • | | projected capital expenditures; and |

| | • | | the impact of technology on our facilities, operations and business. |

The forward-looking statements are based on our beliefs, assumptions and expectations of our future performance, taking into account information currently available to us. These beliefs, assumptions and expectations can change as a result of many possible events or factors, not all of which are known to us. If a change occurs, our business, financial condition, liquidity and results of operations may vary materially from those expressed in our forward-looking statements. You should carefully consider these risks before you make an investment decision with respect to our common stock and other securities, along with, among others, the following factors that could cause actual results to vary from our forward-looking statements:

| | • | | the factors referenced in this Annual Report onForm 10-K, including those set forth under the sections captioned “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and “Business;” |

3

| | • | | U.S. (both national and local) and European (in particular Germany, the United Kingdom, Spain and Italy) political, economic, business, real estate, and other market conditions; |

| | • | | the competitive environment in which we operate; |

| | • | | the execution of our business plan; |

| | • | | acquisition and development risks; |

| | • | | potential environmental contingencies and other liabilities; |

| | • | | other factors affecting the real estate industry generally or the healthcare real estate industry in particular; |

| | • | | our ability to maintain our status as a real estate investment trust, or REIT, for U.S. federal and state income tax purposes; |

| | • | | our ability to attract and retain qualified personnel; |

| | • | | changes in foreign currency exchange rates; |

| | • | | U.S. (both federal and state) and European (in particular Germany, the United Kingdom, Spain and Italy) healthcare and other regulatory requirements; and |

| | • | | U.S. national and local economic conditions, as well as conditions in Europe and any other foreign jurisdictions where we own or will own healthcare facilities, which may have a negative effect on the following, among other things: |

| | • | | the financial condition of our tenants, our lenders, or institutions that hold our cash balances, which may expose us to increased risks of default by these parties; |

| | • | | our ability to obtain equity or debt financing on attractive terms or at all, which may adversely impact our ability to pursue acquisition and development opportunities, refinance existing debt and our future interest expense; and |

| | • | | the value of our real estate assets, which may limit our ability to dispose of assets at attractive prices or obtain or maintain debt financing secured by our properties or on an unsecured basis. |

When we use the words “believe,” “expect,” “may,” “potential,” “anticipate,” “estimate,” “plan,” “will,” “could,” “intend” or similar expressions, we are identifying forward-looking statements. You should not place undue reliance on these forward-looking statements. Except as required by law, we disclaim any obligation to update such statements or to publicly announce the result of any revisions to any of the forward-looking statements contained in this Annual Report on Form10-K to reflect future events or developments.

4

PART I

Overview

We are a self-advised real estate investment trust (“REIT”) focused on investing in and owningnet-leased healthcare facilities across the U.S. and selectively in foreign jurisdictions. We have operated as a REIT since April 6, 2004, and accordingly, elected REIT status upon the filing of our calendar year 2004 federal income tax return. Medical Properties Trust, Inc. was incorporated under Maryland law on August 27, 2003, and MPT Operating Partnership, L.P. was formed under Delaware law on September 10, 2003. We conduct substantially all of our business through MPT Operating Partnership, L.P. We acquire and develop healthcare facilities and lease the facilities to healthcare operating companies under long-term net leases, which require the tenant to bear most of the costs associated with the property. We also make mortgage loans to healthcare operators collateralized by their real estate assets. In addition, we selectively make loans to certain of our operators through our taxable REIT subsidiaries, the proceeds of which are typically used for acquisition and working capital purposes. Finally, from time to time, we acquire a profits or other equity interest in our tenants that gives us a right to share in such tenants’ profits and losses.

Our investments in healthcare real estate, including mortgage and other loans, as well as any equity investments in our tenants are considered a single reportable segment as further discussed in Note 1 of Item 8 in Part II of this Annual Report onForm 10-K. All of our investments are currently located in the United States and Europe. At December 31, 2016 and 2015, we had $6.4 billion and $5.6 billion, respectively, in total assets made up of the following:

| | | | | | | | | | | | | | | | |

| (dollars in thousands) | | 2016 | | | | | | 2015 | | | | |

Real estate owned (gross) | | $ | 4,912,320 | | | | 76.6 | % | | $ | 3,875,536 | | | | 69.1 | % |

Mortgage loans | | | 1,060,400 | | | | 16.5 | % | | | 757,581 | | | | 13.5 | % |

Other loans | | | 155,721 | | | | 2.4 | % | | | 664,822 | | | | 11.9 | % |

Construction in progress | | | 53,648 | | | | 0.8 | % | | | 49,165 | | | | 0.9 | % |

Other assets | | | 236,447 | | | | 3.7 | % | | | 262,247 | | | | 4.6 | % |

| | | | | | | | | | | | | | | | |

Total(1) | | $ | 6,418,536 | | | | 100.0 | % | | $ | 5,609,351 | | | | 100.0 | % |

| | | | | | | | | | | | | | | | |

| (1) | Includes $1.3 billion of healthcare real estate owned and other assets in Europe in 2016 and 2015. |

Revenue by property type:

The following is our revenue by property type for the year ended December 31 (dollars in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2016 | | | | | | 2015 | | | | | | 2014 | | | | |

General Acute Care Hospitals(1) | | $ | 344,523 | | | | 63.7 | % | | $ | 255,029 | | | | 57.7 | % | | $ | 187,060 | | | | 59.9 | % |

Inpatient Rehabilitation Hospitals | | | 149,964 | | | | 27.7 | % | | | 134,198 | | | | 30.4 | % | | | 71,564 | | | | 22.9 | % |

Long-Term Acute Care Hospitals | | | 46,650 | | | | 8.6 | % | | | 52,651 | | | | 11.9 | % | | | 53,908 | | | | 17.2 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total revenue(2) | | $ | 541,137 | | | | 100.0 | % | | $ | 441,878 | | | | 100.0 | % | | $ | 312,532 | | | | 100.0 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | Includes three medical office buildings. |

| (2) | Includes $101.6 million and $83.0 million in revenue (primarily from rehabilitation facilities) from the healthcare real estate assets in Europe in 2016 and 2015, respectively. |

See “Overview” in Item 7 of this Annual Report onForm 10-K for details of transaction activity for 2016, 2015 and 2014. More information is available on the Internet at www.medicalpropertiestrust.com.

5

Portfolio of Properties

As of February 24, 2017, our portfolio consisted of 232 properties: 215 facilities (of the 220 facilities that we own) are leased to 30 tenants, five are under development, and the remaining assets are in the form of mortgage loans to four operators. Our facilities consist of 136 general acute care hospitals, 79 inpatient rehabilitation hospitals, and 17 long-term acute care hospitals (“LTACHs”).

At February 24, 2017, no single property accounted for more than 3.6% of our total gross assets.

Outlook and Strategy

Our strategy is to lease the facilities that we acquire or develop to experienced healthcare operators pursuant to long-term net leases. Alternatively, we have structured certain of our investments as long-term, interest-only mortgage loans to healthcare operators, and we may make similar investments in the future. Our mortgage loans are structured such that we obtain similar economic returns as our net leases. In addition, we have obtained and will continue to obtain profits or other interests in certain of our tenants’ operations in order to enhance our overall return. The market for healthcare real estate is extensive and includes real estate owned by a variety of healthcare operators. We focus on acquiring and developing thosenet-leased facilities that are specifically designed to reflect the latest trends in healthcare delivery methods and that focus on the most critical components of healthcare. We typically invest in facilities that have the highest intensity of care including:

| | • | | General acute care — provide inpatient care for the treatment of acute conditions and manifestations of chronic conditions. They also provide ambulatory care through hospital outpatient departments and emergency rooms. |

| | • | | Inpatient rehabilitation — provide rehabilitation to patients with various neurological, muscular, skeletal orthopedic and other medical conditions following stabilization of their acute medical issues. |

| | • | | Long-term acute care — specialty-care hospital designed for patients with serious medical problems that require intense, special treatment for an extended period of time, sometimes requiring a hospital stay averaging in excess of three weeks. |

6

Diversification

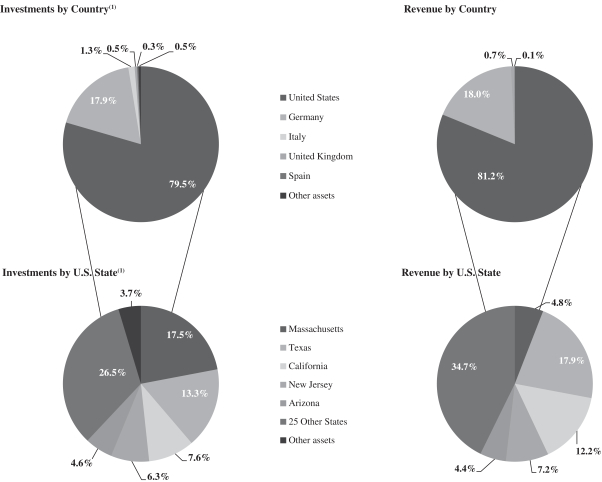

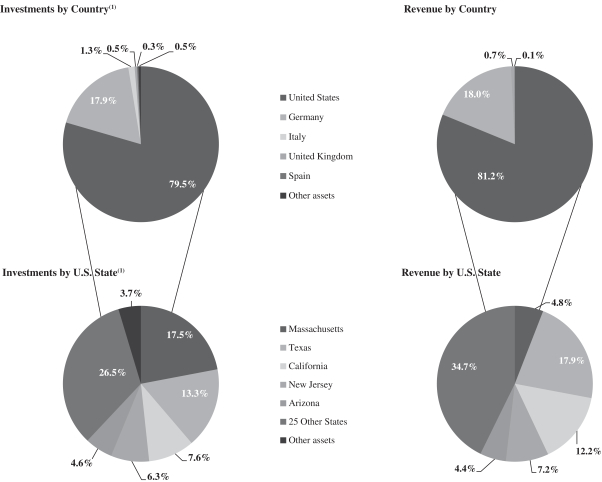

A fundamental component of our business plan is the continued diversification of our tenant relationships, the types of hospitals we own and the geographic areas in which we invest. From a tenant relationship perspective, see section titled “Significant Tenants” below for detail. See sections titled “Revenue by Property Type” and “Portfolio of Properties” above for information on the diversification of our hospital types. From a geographical perspective, we have investments across the U.S. and in Europe. See below for investment and revenue concentration in the U.S. and our global concentration at December 31, 2016:

| (1) | Represents investment concentration as a percentage of gross real estate assets, other loans, and equity investments assuming all real estate commitments at December 31, 2016 are fully funded. |

We continue to believe that Europe represents an attractive market in which to invest, particularly in Germany. Germany is an attractive investment opportunity for us given Germany’s strong macroeconomic position and healthcare environment. Germany’s Gross Domestic Product (“GDP”), which is approximately $3,363 billion according to World Bank 2015 data, has been relatively more stable than other countries in the European Union due to Germany’s stable business practices and monetary policy. In addition to cultural influences, government policies emphasizing sound public finance and a significant presence of small andmedium-sized enterprises (which employ 68% of the employment base) have also contributed to Germany’s strong and sustainable economic position. The above factors have contributed to an unemployment rate in Germany of 3.9% as of December 2016, which is significantly less than the 9.6% unemployment rate in the European Union as of December 2016, according to Eurostat.

7

Underwriting/Asset Management

Our revenue is derived from rents we earn pursuant to the lease agreements with our tenants, from interest income from loans to our tenants and other facility owners and from profits or equity interests in certain of our tenants’ operations. Our tenants operate in the healthcare industry, generally providing medical, surgical and rehabilitative care to patients. The capacity of our tenants to pay our rents and interest is dependent upon their ability to conduct their operations at profitable levels. We believe that the business environment of the industry segments in which our tenants operate is generally positive for efficient operators. However, our tenants’ operations are subject to economic, regulatory and market conditions that may affect their profitability, which could impact our results. Accordingly, we monitor certain key factors, changes to which we believe may provide early indications of conditions that may affect the level of risk in our portfolio.

Key factors that we consider in underwriting prospective tenants and in our ongoing monitoring of our tenants’ (and any guarantors’) performance include the following:

| | • | | the scope and breadth of clinical services and programs, including admission levels by service type; |

| | • | | the current, historical and prospective operating margins (measured by a tenant’s earnings before interest, taxes, depreciation, amortization and facility rent) of each tenant and at each facility; |

| | • | | the ratio of our tenants’ operating earnings both to facility rent and to other fixed costs, including debt costs; |

| | • | | trends in the source of our tenants’ revenue, including the relative mix of public payors (including Medicare, Medicaid/MediCal, and managed care in the U.S. as well as equivalent payors in Germany, the United Kingdom, Italy, and Spain) and private payors (including commercial insurance and private pay patients); |

| | • | | trends in tenant cash collections, including comparison to recorded net patient service revenues; |

| | • | | the effect of any legal, regulatory or compliance proceedings with our tenants; |

| | • | | the effect of evolving healthcare legislation and other regulations (including changes in reimbursement) on our tenants’ profitability and liquidity; |

| | • | | demographics of the local and surrounding areas in which our tenants operate; |

| | • | | the competition, including the prospective tenant’s market position relative to competition; |

| | • | | evaluation of medical staff doctors and physician leadership associated with the facility/facilities, including specialty, tenure and number of procedures performed; |

| | • | | evaluation of the operator’s and facility’s administrative team, as applicable, including background and tenure within the healthcare industry; |

| | • | | compliance, accreditation, quality performance and health outcomes as measured by The Centers for Medicare and Medicaid Services (“CMS”) and Joint Commission; and |

| | • | | the level of investment in the hospital infrastructure and health IT systems. |

Healthcare Industry

The delivery of healthcare services, whether in the U.S. or elsewhere, requires real estate and, as a consequence, healthcare providers depend on real estate to maintain and grow their businesses. We believe that the healthcare real estate market provides investment opportunities due to the:

| | • | | compelling demographics driving the demand for healthcare services; |

| | • | | specialized nature of healthcare real estate investing; and |

| | • | | consolidation of the fragmented healthcare real estate sector. |

8

United States

Healthcare is the single largest industry in the U.S. based on GDP. According to the National Health Expenditures report dated July 2016 by the CMS: (i) national health expenditures are projected to grow 5.1% in 2017; (ii) the average compound annual growth rate for national health expenditures, over the projection period of 2017 through 2025, is anticipated to be 6.0%; and (iii) the healthcare industry is projected to represent 20.1% of U.S. GDP by 2025.

Germany

The healthcare industry is also the single largest industry in Germany. Behind only the U.S., Netherlands and France, Germany’s healthcare expenditures represent approximately 11.0% of its total GDP according to the Organization for EconomicCo-operation and Development’s 2013 data.

The German rehabilitation market (which includes our facilities in Germany) serves a broader scope of treatment with over 1,233 rehabilitation facilities (compared to 1,165 in the U.S.) and 208.5 beds per 100,000 population (compared to 114.7 in the U.S.). Approximately 90% of the payments in the German system come from governmental sources. The largest payor category is the public pension fund system representing 39% of payments. Public health insurance and payments for government employees represent 46% of payments. The balance of the payments into the German rehabilitation market come from a variety of sources including private pay and private insurance. One particular focus area of investors in the German market is the healthcare industry because the German Social Code mandates universal access, coverage and a high standard of care, thereby creating a robust healthcare dynamic in the country.

United Kingdom

Healthcare services in the United Kingdom are provided through the National Health Service (“NHS”). In 2013, the United Kingdom spent 8.8% of GDP on healthcare. The majority of this funding for the NHS comes from general taxation, and a smaller proportion from national insurance (a payroll tax). The NHS also receives income from copayments, people using NHS services as private patients, and some other minor sources. In 2012, 10.9% of the United Kingdom population had private voluntary health insurance provided mostly through employers. Private insurance offers more rapid and convenient access to care, especially for elective hospital procedures. It is estimated that four insurers account for 87.5% of the market, with small providers comprising the rest.

Publicly owned hospitals are organized either as NHS trusts, approximately 98 in number or as Foundation trusts, approximately 147 in number. NHS trusts are accountable to the Department of Health while foundation trusts enjoy greater freedom from central control. An estimated 548 hospitals are located in the United Kingdom and offer a range of treatments. Their charges to private patients are not regulated, and they receive no public subsidies. NHS use of private hospitals remains low with about 3.6% of NHS funding used for this purpose. The NHS budget was flat for the period from 2010 to 2015.

Italy

The Italian national health service (Servizio Sanitario Nazionale) is regionally based and organized at the national, regional, and local levels. Under the Italian constitution, responsibility for healthcare is shared by the national government and the 19 regions and 2 autonomous provinces. The central government controls the distribution of tax revenue for publicly financed health care and defines a national statutory benefits package to be offered to all residents in every region — the “Essential Levels of Care.” The 19 regions and two autonomous provinces have responsibility for the organization and delivery of health services through local health units.

Public financing accounted for 78% of total health spending in 2013, with total expenditure standing at 9.1% of GDP. The public system is financed primarily through a corporate tax (approximately 35.6% of the

9

overall funding in 2012) pooled nationally and allocated back to regions, typically the source region, and a fixed proportion of national value-added tax revenue (approximately 47.3% of the total in 2012) collected by the central government and redistributed to regions unable to raise sufficient resources to provide the essential levels of care.

In 2011, there were approximately 194,000 beds in public hospitals and 47,500 beds in private accredited hospitals. A diagnosis-related group-based prospective payment system operates across the country and accounts for most hospital revenue.

Private health insurance plays a limited role in the health system, accounting for roughly 1% of total spending in 2009. Approximately 15% of the population has some form of private insurance which generally covers services excluded under the Essential Levels of Care, to offer a higher standard of comfort and privacy in hospital facilities, and wider choice among public and private providers. Some private health insurance policies also cover copayments for privately provided services, or a daily rate of compensation during hospitalization. There are two types of private health insurance: corporate, where companies cover employees and sometimes their families; andnon-corporate, with individuals buying insurance for themselves or their family.

Depending on the region, public funds are allocated by local health units to public and accredited private hospitals. Rates paid to hospitals include all hospital costs including those of physicians. Funding for health is defined by the July 2014 Pact for Health which defines funding between $143.4 billion and $151.3 billion annually for the years 2014 to 2016.

Spain

The Spanish health system was established by the General Health Law of 1986. This law carries out a mandate of the Spanish Constitution which establishes the right of all citizens to protection of their health. The National Health System (Sistema Nacional de Salud, SNS) is the administrative device set up by the law. Spain spends approximately 9.6% of its GDP on health care. Expenditures for private healthcare are 26.4% of total health expenditures have been growing at a compounded annual growth rate of 1.7%. 80% of all Spanish patients use a combination of both private and public healthcare services.

Private hospitals comprise 53% of total Spanish hospitals and 32% of total beds. Private hospitals account for 24% of hospital discharges, 30% of surgeries and 20% of visits to Accident and Emergency Services. Demand for private hospital services is increasing at a compound rate of 3.8% from 2008 through 2011. In terms of private insurance, the top ten companies in Spain account for 82% of the market.

Our Leases and Loans

The leases for our facilities are “net” leases with terms generally requiring the tenant to pay all ongoing operating and maintenance expenses of the facility, including property, casualty, general liability and other insurance coverages, utilities and other charges incurred in the operation of the facilities, as well as real estate and certain other taxes, ground lease rent (if any) and the costs of capital expenditures, repairs and maintenance (including any repairs mandated by regulatory requirements). Similarly, borrowers under our mortgage loan arrangements retain the responsibilities of ownership, including physical maintenance and improvements and all costs and expenses. Our leases and loans typically require our tenants to indemnify us for any past or future environmental liabilities. Our current leases and loans have a weighted-average remaining initial lease or loan term of 14.1 years (see Item 2 for more information on remaining lease or loan terms). Based on current monthly revenue, approximately 99% of our leases and loans provide for annual rent or interest escalations based on either increases in the U.S. Consumer Price Index (“CPI”) or minimum annual rent or interest escalations ranging from 0.5% to 5%. In some cases, our domestic leases and loans provide for escalations based on CPI subject to floors and/or ceilings. In certain limited cases, we may have arrangements that provide for additional rents based on the level of a tenant’s revenue.

10

RIDEA Investments

We have and will make equity investments, loans (with equity like returns) and obtain profit interests in certain of our tenants. Some of these investments fall under a structure permitted by the REIT Investment Diversification and Empowerment Act of 2007 (“RIDEA”), which was signed into law under the Housing and Economic Recovery Act of 2008. Under the provisions of RIDEA, a REIT may lease “qualified health care properties” on an arm’s length basis to a taxable REIT subsidiary (“TRS”) if the property is operated on behalf of such subsidiary by a person who qualifies as an “eligible independent contractor.” We view RIDEA as a structure primarily to be used on properties that present attractive valuation entry points. At December 31, 2016, our RIDEA investments totaled approximately $105.8 million.

Significant Tenants

At December 31, 2016, we had total assets of approximately $6.4 billion comprised of 231 healthcare properties in 30 states, in Germany, the United Kingdom, Italy, and Spain. The properties are leased to or mortgaged by 30 different hospital operating companies. On a gross asset basis (which is total assets before accumulated depreciation/amortization and assumes all real estate commitments at that time are fully funded), our top five tenants were as follows (dollars in thousands):

Gross Assets by Operator

| | | | | | | | | | | | | | | | |

| | | As of December 31, 2016 | | | As of December 31, 2015 | |

Operators | | Total

Gross Assets | | | Percentage of

Total Gross Assets | | | Total

Gross Assets | | | Percentage of

Total Gross Assets | |

Steward | | $ | 1,250,000 | | | | 17.5 | % | | $ | — | | | | — | |

Prime | | | 1,144,055 | | | | 16.0 | % | | | 1,032,353 | | | | 17.1 | % |

MEDIAN | | | 993,677 | | | | 13.9 | % | | | 1,031,039 | | | | 17.1 | % |

Ernest | | | 627,906 | | | | 8.8 | % | | | 579,182 | | | | 9.6 | % |

RCCH | | | 566,600 | | | | 7.9 | % | | | 1,059,989 | | | | 17.6 | % |

Affiliates of Steward Health Care System LLC (“Steward”) lease five facilities pursuant to a master lease agreement, which has a15-year term with three five-year extension options, plus annual inflation-based escalators. At December 31, 2016, these facilities had an average remaining lease term of 14.8 years. In addition to the master lease, we hold a mortgage loan on four facilities with terms and provisions substantially similar to the master lease agreement. The master lease and loan agreements include extension options that must include all or none of the properties, cross default provisions for the leases and loans, and a right of first refusal for the repurchase of the leased properties. We closed on the Steward properties on October 3, 2016 for a combined investment of $1.25 billion, which includes a $50 million minority equity contribution in Steward.

Affiliates of Prime Healthcare Services, Inc. (“Prime”) lease 22 facilities pursuant to five master lease agreements. Four of the master leases are for 10 years and contain two renewal options of five years each. The fifth master lease is for 15 years and contains three renewal options for five years each. Rent escalates each year based on the CPI increase, with a 2% minimum floor. At the end of the initial or any renewal term, Prime must exercise any available extension or purchase option with respect to all or none of the leased and mortgaged properties relative to each master lease. The master leases include repurchase options, including provisions establishing minimum repurchase prices equal to our total investment. At December 31, 2016, these facilities had an average remaining initial fixed term of 8.1 years. In addition to leases, we hold mortgage loans on three facilities owned by affiliates of Prime. The terms and provisions of these loans are generally equivalent to the terms and provisions of our Prime lease arrangements.

Affiliates of Median Kliniken S.à r.l.(“MEDIAN”) lease 50 facilities pursuant to two master lease agreements. Each master lease agreement has an approximate27-year fixed term with no renewal or repurchase

11

options. The annual escalator for one master lease that represents 15 facilities of the MEDIAN portfolio provides for fixed increases of 2% for 2017 and additional fixed increases of 0.5% each year thereafter. In addition, at December 31, 2020 and every three years thereafter, rent will be increased, if needed, to reflect 70% of cumulative increases in German CPI. The annual escalator for the other master lease that covers the remaining facilities of the MEDIAN portfolio provides for increases of the greater of 1% or 70% of the change in German CPI.

Affiliates of Ernest Health, Inc. (“Ernest”) lease 22 facilities, including one under development, pursuant to a master lease agreement and two stand-alone lease agreements. The original master lease agreement entered into in 2012, covering 20 properties, had a20-year initial fixed term with three five-year extension options and provides for consumer price-indexed increases, limited to a 2% floor and 5% ceiling annually. At December 31, 2016, these facilities had a remaining initial fixed lease term of 15.2 years. This master lease includes purchase options that allow the lessee to purchase the leased property at on option price equal to the greater of fair market value of the lease property or the lease base increased by an amount equal to the annual rate of increase in the CPI on each adjustment date. All leases and loans are cross-defaulted, including the mortgage loans. In addition to the original master lease, Ernest affiliates lease the remaining properties, including one property that is currently under development, pursuant to two separate stand-alone leases that have terms generally similar to the original master lease agreement. Furthermore, we hold a mortgage loan on four facilities owned by affiliates of Ernest that will mature in 2032. The terms and provisions of these loans are generally equivalent to the terms and provisions of the original master lease agreement.

Affiliates of RCCH Healthcare Partners (“RCCH”) (formally Capella Healthcare Inc.) lease six facilities (four of which are leased pursuant to a master lease agreement). The master lease agreement has an initial fixed13.5-year term with four five-year extension options, plus consumer price-indexed increases, limited to a 2% floor and a 4% ceiling annually. The extension options may be exercised with respect to any or all of the properties. At the end of the fixed term, and during any exercised extension options, the lessee will have the right of first refusal to purchase the leased property. At December 31, 2016, these facilities had an average remaining initial fixed lease term of 12.2 years. In addition to the master lease, two facilities are leased pursuant to stand-alone leases with a weighted average remaining fixed term of 12.3 years. The terms and provisions of these leases are generally equivalent to the terms and provisions of the master lease agreement.

No other tenant accounted for more than 7% of our total gross assets at December 31, 2016.

Environmental Matters

Under various federal, state and local environmental laws and regulations, a current or previous owner, operator or tenant of real estate may be required to remediate hazardous or toxic substance releases or threats of releases. There may also be certain obligations and liabilities on property owners with respect to asbestos containing materials. Investigation, remediation and monitoring costs may be substantial. The confirmed presence of contamination or the failure to properly remediate contamination on a property may adversely affect our ability to sell or rent that property or to borrow funds using such property as collateral and may adversely impact our investment in that property. Generally, prior to completing any acquisition or closing any mortgage loan, we obtain Phase I environmental assessments (or their equivalent studies outside the U.S.) in order to attempt to identify potential environmental concerns at the facilities. These assessments are carried out in accordance with an appropriate level of due diligence and generally include a physical site inspection, a review of relevant environmental and health agency database records, one or more interviews with appropriate site-related personnel, review of the property’s chain of title and review of historic aerial photographs and other information on past uses of the property. We may also conduct limited subsurface investigations and test for substances of concern where the results of the Phase I environmental assessments or other information indicates possible contamination or where our consultants recommend such procedures. Upon closing and for the remainder of the lease or loan term, our transaction documents require our tenants to repair and remediate any environmental concern at the applicable facility, and to comply in full with all environmental laws and regulations.

12

California Seismic Standards

California’s Alfred E. Alquist Hospital Facilities Seismic Safety Act of 1973 (the “Alquist Act”) established a seismic safety building standards program under the Office of Statewide Health Planning and Development (“OSHPD”) jurisdiction for hospitals built on or after March 7, 1973. It required the California Building Standards Commission to adopt earthquake performance categories, seismic evaluation procedures, standards and timeframes for upgrading certain facilities, and seismic retrofit building standards. These regulations required hospitals to meet certain seismic performance standards to ensure that they are capable of providing medical services to the public after an earthquake or other disaster. This legislation was adopted to avoid the loss of life and the disruption of operations and the provision of emergency medical services that may result from structural damage sustained to hospitals resulting from an earthquake.

The Building Standards Commission completed its adoption of evaluation criteria and retrofit standards in 1998. The Alquist Act required the Building Standards Commission to adopt certain evaluation criteria and retrofit standards such as:

| | • | | hospitals in California must conduct seismic evaluations and submit these evaluations to the OSHPD, Facilities Development Division for its review and approval; |

| | • | | hospitals in California must identify the most critical nonstructural systems that represent the greatest risk of failure during an earthquake and submit timetables for upgrading these systems to the OSHPD, Facilities Development Division for its review and approval; and |

| | • | | hospitals in California must prepare a plan and compliance schedule for each regulated building demonstrating the steps a hospital will take to bring the hospital buildings into substantial compliance with the regulations and standards. |

Since the Alquist Act, subsequent legislation has modified requirements of seismic safety standards and deadlines for compliance. Originally, hospital buildings considered hazardous and at risk of collapse in the event of an earthquake must have been retrofitted, replaced or removed from providing acute care services by January 1, 2008; however, provisions were made to allow this deadline to be extended to January 1, 2013.

Senate Bill 499 was signed into law that provided for a number of seismic relief measures, including criteria for reclassifying buildings into a lower seismic risk category. These buildings would have until January 1, 2030 to comply with structural seismic safety standards. Buildings denied reclassification must have met seismic compliance standards by January 1, 2013, unless further extensions were granted.

California’s AB 306 legislation permitted OSHPD to grant extensions to acute care hospitals that lacked the financial capacity to meet the January 1, 2013, retrofit deadline, and instead, requires them to replace those buildings by January 1, 2020. More recently, California SB 90 allows a hospital to seek an extension for seismic compliance up to seven years based on three elements:

| | • | | the structural integrity of the building; |

| | • | | the loss of essential hospital services to the community if the hospital is closed; and |

As of December 31, 2016, we have 13 hospitals in California totaling investments of $542.9 million. Exclusive of four hospitals granted extensions by OSHPD, all of our California buildings are seismically compliant through 2030 as determined by OSHPD. For our hospitals that were granted extensions, three (representing a total investment of $173.3 million) completed their seismic retro upgrades in 2016 and are currently awaiting final OSHPD reclassification. Our fourth hospital (with a total investment of $20 million) that was granted an extension began retrofit planning this year, and we expect full compliance by their 2020 deadline.

Under our current agreements, our tenants are responsible for capital expenditures in connection with seismic laws. We do not expect California seismic standards to have a negative impact on our financial condition

13

or cash flows. We also do not expect compliance with California seismic standards to materially impact the financial condition of our tenants.

Competition

We compete in acquiring and developing facilities with financial institutions, other lenders, real estate developers, healthcare operators, other REITs, other public and private real estate companies, and private real estate investors. Among the factors that may adversely affect our ability to compete are the following:

| | • | | we may have less knowledge than our competitors of certain markets in which we seek to invest in or develop facilities; |

| | • | | some of our competitors may have greater financial and operational resources than we have; |

| | • | | some of our competitors may have lower costs of capital than we do; |

| | • | | our competitors or other entities may pursue a strategy similar to ours; and |

| | • | | some of our competitors may have existing relationships with our potential customers. |

To the extent that we experience vacancies in our facilities, we will also face competition in leasing those facilities to prospective tenants. The actual competition for tenants varies depending on the characteristics of each local market. Virtually all of our facilities operate in highly competitive environments, and patients and referral sources, including physicians, may change their preferences for healthcare facilities from time to time. The operators of our properties compete on a local and regional basis with operators of properties that provide comparable services. Operators compete for patients and residents based on a number of factors including quality of care, reputation, physical appearance of a facility, location, services offered, physicians, staff, and price. We also face competition from other health care facilities for tenants, such as physicians and other health care providers that provide comparable facilities and services.

For additional information, see “Risk Factors” in Item 1A of this Annual Report on Form10-K.

Insurance

Our leases and mortgage loans require our tenants to carry property, loss of income, general liability, professional liability, and other insurance coverages in order to protect our interests. We monitor the adequacy of such coverages on an ongoing basis. In addition, we maintain separate insurance that provides coverage for bodily injury and property damage to third parties arising from our ownership of the healthcare facilities that are leased to and occupied by our tenants, as well as contingent business interruption insurance. At December 31, 2016, we believe that the policy specifications and insured limits are appropriate given the relative risk of loss, the cost of the coverage, and standard industry practice.

Healthcare Regulatory Matters

The following discussion describes certain material federal healthcare laws and regulations that may affect our operations and those of our tenants. The discussion, however, does not address all applicable federal healthcare laws, and does not address state healthcare laws and regulations, except as otherwise indicated. These state laws and regulations, like the federal healthcare laws and regulations, could affect the operations of our tenants and, accordingly, our operations. In addition, in some instances we own a minority interest in our tenants’ operations and, in addition to the effect on our tenant’s ability to meet its financial obligations to us, our ownership and investment returns may also be negatively impacted by such laws and regulations. Moreover, the discussion relating to reimbursement for healthcare services addresses matters that are subject to frequent review and revision by Congress and the agencies responsible for administering federal payment programs. Consequently, predicting future reimbursement trends or changes, along with the potential impact to us, is inherently difficult.

14

Ownership and operation of hospitals and other healthcare facilities are subject, directly and indirectly, to substantial federal, state, and local government healthcare laws, rules, and regulations. Our tenants’ failure to comply with these laws and regulations could adversely affect their ability to meet their obligations to us. Physician investment in us or in our facilities also will be subject to such laws and regulations. Although we are not a healthcare provider or in a position to influence the referral of patients or ordering of items and services reimbursable by the federal government, to the extent that a healthcare provider engages in transactions with our tenants, such as sublease or other financial arrangements, the Anti-Kickback Statute and the Stark Law (both discussed in this section) could be implicated. Our leases and mortgage loans require the tenants to comply with all applicable laws, including healthcare laws. We intend for all of our business activities and operations to conform in all material respects with all applicable laws, rules, and regulations, including healthcare laws, rules, and regulations.

Applicable Laws

Anti-Kickback Statute. The federal Anti-Kickback Statute (codified at 42 U.S.C.§ 1320a-7b(b)) prohibits, among other things, the offer, payment, solicitation, or acceptance of remuneration, directly or indirectly, in return for referring an individual to a provider of items or services for which payment may be made in whole, or in part, under a federal healthcare program, including the Medicare or Medicaid programs. Violation of the Anti-Kickback Statute is a crime, punishable by fines of up to $25,000 per violation, five years imprisonment, or both. Violations may also result in civil sanctions, including civil monetary penalties of up to $50,000 per violation, exclusion from participation in federal healthcare programs, including Medicare and Medicaid, and additional monetary penalties in amounts treble to the underlying remuneration.

The Office of Inspector General of the Department of Health and Human Services (“OIG”) has issued “Safe Harbor Regulations” that describe practices that will not be considered violations of the Anti-Kickback Statute. Nonetheless, the fact that a particular arrangement does not meet safe harbor requirements does not also mean that the arrangement violates the Anti-Kickback Statute. Rather, the safe harbor regulations simply provide a guaranty that qualifying arrangements will not be prosecuted under the Anti-Kickback Statute. We intend to use commercially reasonable efforts to structure our arrangements involving facilities, so as to satisfy, or meet as closely as possible, all safe harbor conditions. We cannot assure you, however, that we will meet all the conditions for an applicable safe harbor.

Physician Self-Referral Statute (“Stark Law”). Any physicians investing in us or our subsidiary entities could also be subject to the Ethics in Patient Referrals Act of 1989, or the Stark Law (codified at 42 U.S.C. § 1395nn). Unless subject to an exception, the Stark Law prohibits a physician from making a referral to an “entity” furnishing “designated health services,” including certain inpatient and outpatient hospital services, clinical laboratory services, and radiology services, paid by Medicare or Medicaid if the physician or a member of his immediate family has a “financial relationship” with that entity. A reciprocal prohibition bars the entity from billing Medicare or Medicaid for any services furnished pursuant to a prohibited referral. Sanctions for violating the Stark Law include denial of payment, refunding amounts received for services provided pursuant to prohibited referrals, civil monetary penalties of up to $15,000 per prohibited service provided, and exclusion from the participation in federal healthcare programs. The statute also provides for a penalty of up to $100,000 for a circumvention scheme.

There are exceptions to the self-referral prohibition for many of the customary financial arrangements between physicians and providers, including employment contracts, leases, and recruitment agreements. Unlike safe harbors under the Anti-Kickback Statute, the Stark Law imposes strict liability on the parties to an arrangement and an arrangement must comply with every requirement of a Stark Law exception or the arrangement is in violation of the Stark Law.

The CMS has issued multiple phases of final regulations implementing the Stark Law and continues to make changes to these regulations. While these regulations help clarify the exceptions to the Stark Law, it is unclear

15

how the government will interpret many of these exceptions for enforcement purposes. Although our lease agreements require lessees to comply with the Stark Law, and we intend for facilities to comply with the Stark Law where we own an interest in our tenants’ operations, we cannot offer assurance that the arrangements entered into by us and our facilities will be found to be in compliance with the Stark Law, as it ultimately may be implemented or interpreted. In addition, changes to the Stark Law could require our tenants to restructure certain arrangements with physicians, which could impact the business of our tenants.

False Claims Act. The federal False Claims Act prohibits the making or presenting of any false claim for payment to the federal government; it is the civil equivalent to federal criminal provisions prohibiting the submission of false claims to federally funded programs. Additionally,qui tam, or whistleblower, provisions of the federal False Claims Act allow private individuals to bring actions on behalf of the federal government alleging that the defendant has defrauded the federal government. Whistleblowers may collect a portion of the federal government’s recovery — an incentive which increases the frequency of such actions. A successful federal False Claims Act case may result in a penalty of three times the actual damages, plus additional civil penalties payable to the government, plus reimbursement of the fees of counsel for the whistleblower. Many states have enacted similar statutes preventing the presentation of a false claim to a state government, and we expect more to do so because the Social Security Act provides a financial incentive for states to enact statutes establishing state level liability.

The Civil Monetary Penalties Law. Among other things, the Civil Monetary Penalties law prohibits the knowing presentation of a claim for certain healthcare services that is false or fraudulent, the presentation of false or misleading information in connection with claims for payment, and other acts involving fraudulent conduct. Penalties include a monetary civil penalty of up to $10,000 for each item or service, $15,000 for each individual with respect to whom false or misleading information was given, as well as treble damages for the total amount of remuneration claimed.

Licensure. Our tenants are subject to extensive federal, state, and local licensure, certification, and inspection laws and regulations including, in some cases, certificate of need laws. Further, various licenses and permits are required to dispense narcotics, operate pharmacies, handle radioactive materials, and operate equipment. Failure to comply with any of these laws could result in loss of licensure, certification or accreditation, denial of reimbursement, imposition of fines, and suspension or decertification from federal and state healthcare programs.

EMTALA. Our tenants that provide emergency care are subject to the Emergency Medical Treatment and Active Labor Act (“EMTALA”). This federal law requires such healthcare facilities to conduct an appropriate medical screening examination of every individual who presents to the hospital’s emergency room for treatment and, if the individual is suffering from an emergency medical condition, to either stabilize the condition or make an appropriate transfer of the individual to a facility able to handle the condition. The obligation to screen and stabilize emergency medical conditions exists regardless of an individual’s ability to pay for treatment. There are severe penalties under EMTALA if a hospital fails to screen or appropriately stabilize or transfer an individual or if the hospital delays appropriate treatment in order to first inquire about the individual’s ability to pay. Liability for violations of EMTALA includes, among other things, civil monetary penalties and exclusion from participation in the federal healthcare programs. Our lease and mortgage loan agreements require our tenants to comply with EMTALA, and we believe our tenants conduct business in substantial compliance with EMTALA.

Reimbursement Pressures.Healthcare facility operating margins continue to face significant pressure due to the deterioration in pricing flexibility and payor mix, a shift toward alternative payment models, increases in operating expenses that exceed increases in payments under the Medicare program, reductions in levels of Medicaid funding due to state budget shortfalls, and other similar cost pressures on our tenants. More specifically, LTACHs continue to face reimbursement pressures including those resulting from the passage of the SGR Reform Act of 2013, and CMS is also implementing regulatory restrictions on reimbursement for hospital outpatient departments, which could lead to decreased reimbursement for our tenants. We cannot predict how and

16

to what extent these or other initiatives will impact the business of our tenants or whether our business will be adversely impacted.

Healthcare Reform.Generally, the Patient Protection and Affordable Care Act ( the “Reform Law”) provides expanded health insurance coverage through tax subsidies and federal health insurance programs, individual and employer mandates for health insurance coverage, and health insurance exchanges. The Reform Law also includes various cost containment initiatives, including quality control and payment system refinements for federal programs, such aspay-for-performance criteria and value-based purchasing programs, bundled provider payments, accountable care organizations, geographic payment variations, comparative effectiveness research, and lower payments for hospital readmissions. The Reform Law also increases health information technology standards for healthcare providers in an effort to improve quality and reduce costs. The Reform Law has led, and will continue to lead, to significant changes in the healthcare system. There are, however, continuing efforts to repeal and replace the Reform Law. We cannot predict the continued impact of the Reform Law, or the impact of its possible repeal and replacement, on our business, as some aspects benefit the operations of our tenants, while other aspects present challenges.

Employees

We have 54 employees as of February 24, 2017. As we continue to grow, we expect our head count to increase as well. However, we do not believe that any adjustments to the number of employees will have a material effect on our operations or to general and administrative expenses as a percent of revenues. We believe that our relations with our employees are good. None of our employees are members of any union.

Available Information

Our website address is www.medicalpropertiestrust.com and provides access in the “Investor Relations” section, free of charge, to our Annual Report onForm 10-K, quarterly reports onForm 10-Q, current reports onForm 8-K, including exhibits, and all amendments to these reports as soon as reasonably practicable after such material is electronically filed with or furnished to the Securities and Exchange Commission (“SEC”). Also available on our website, free of charge, are our Corporate Governance Guidelines, the charters of our Ethics, Nominating and Corporate Governance, Audit and Compensation Committees and our Code of Ethics and Business Conduct. If you are not able to access our website, the information is available in print free of charge to any stockholder who should request the information directly from us at(205) 969-3755. Information on or connected to our website is neither part of nor incorporated by reference into this Annual Report or any other SEC filings.

17

The risks and uncertainties described herein are not the only ones facing us and there may be additional risks that we do not presently know of or that we currently consider not likely to have a significant impact on us. All of these risks could adversely affect our business, results of operations and financial condition. Some statements in this report including statements in the following risk factors constitute forward-looking statements. Please refer to the section entitled “Cautionary Language Regarding Forward Looking Statements” at the beginning of this Annual Report.

RISKS RELATED TO OUR BUSINESS AND GROWTH STRATEGY(Including Financing Risks)

Limited access to capital may restrict our growth.

Our business plan contemplates growth through acquisitions and development of facilities. As a REIT, we are required to make cash distributions, which reduce our ability to fund acquisitions and developments with retained earnings. We are dependent on acquisition financing and access to the capital markets for cash to make investments in new facilities. Due to market or other conditions, we may have limited access to capital from the equity and debt markets. We may not be able to obtain additional equity or debt capital or dispose of assets on favorable terms, if at all, at the time we need additional capital to acquire healthcare properties or to meet our obligations, which could have a material adverse effect on our results of operations and our ability to make distributions to our stockholders.

Our indebtedness could adversely affect our financial condition and may otherwise adversely impact our business operations and our ability to make distributions to stockholders.

As of February 24, 2017, we had $3.0 billion of debt outstanding, which excludes the €200 million 5.750% Senior Notes due 2020 to be redeemed on March 4, 2017.

Our indebtedness could have significant effects on our business. For example, it could:

| | • | | require us to use a substantial portion of our cash flow from operations to service our indebtedness, which would reduce the available cash flow to fund working capital, development projects and other general corporate purposes and reduce cash for distributions; |

| | • | | require payments of principal and interest that may be greater than our cash flow from operations; |

| | • | | force us to dispose of one or more of our properties, possibly on disadvantageous terms, to make payments on our debt; |

| | • | | increase our vulnerability to general adverse economic and industry conditions; limit our flexibility in planning for, or reacting to, changes in our business and the industry in which we operate; |

| | • | | restrict us from making strategic acquisitions or exploiting other business opportunities; |

| | • | | make it more difficult for us to satisfy our obligations; and |

| | • | | place us at a competitive disadvantage compared to our competitors that have less debt. |

Our future borrowings under our loan facilities may bear interest at variable rates in addition to the $0.8 billion in variable interest rate debt that we had outstanding as of February 24, 2017. If interest rates increase significantly, our operating results would decline along with the cash available for distributions to our stockholders.

In addition, most of our current debt is, and we anticipate that much of our future debt will be,non-amortizing and payable in balloon payments. Therefore, we will likely need to refinance at least a portion of that debt as it matures. There is a risk that we may not be able to refinance debt maturing in future years or that

18

the terms of any refinancing will not be as favorable as the terms of the then-existing debt. If principal payments due at maturity cannot be refinanced, extended or repaid with proceeds from other sources, such as new equity capital or sales of facilities, our cash flow may not be sufficient to repay all maturing debt in years when significant balloon payments come due. Additionally, we may incur significant penalties if we choose to prepay the debt. See Item 7 of Part II of this Annual Report on Form10-K for further information on our current debt maturities.

Covenants in our debt instruments limit our operational flexibility, and a breach of these covenants could materially affect our financial condition and results of operations.

The terms of our unsecured credit facility (“Credit Facility”) and the indentures governing our outstanding unsecured senior notes, and other debt instruments that we may enter into in the future are subject to customary financial and operational covenants. For example, our Credit Facility imposes certain restrictions on us, including restrictions on our ability to: incur debts; create or incur liens; provide guarantees in respect of obligations of any other entity; make redemptions and repurchases of our capital stock; prepay, redeem or repurchase debt; engage in mergers or consolidations; enter into affiliated transactions; dispose of real estate; and change our business. In addition, the agreements governing our unsecured credit facility limit the amount of dividends we can pay as a percentage of normalized adjusted funds from operations, as defined, on a rolling four quarter basis. Through the quarter ending December 31, 2016, the dividend restriction was 95% of normalized adjusted funds from operations (“FFO”). The indentures governing our senior unsecured notes also limit the amount of dividends we can pay based on the sum of 95% of FFO, proceeds of equity issuances and certain other net cash proceeds. Finally, our senior unsecured notes require us to maintain total unencumbered assets (as defined in the related indenture) of not less than 150% of our unsecured indebtedness.

Fromtime-to-time, the lenders of our Credit Facility may adjust certain covenants to give us more flexibility to complete a transaction; however, such modified covenants are temporary, and we must be in a position to meet the lowered reset covenants in the future. Our continued ability to incur debt and operate our business is subject to compliance with the covenants in our debt instruments, which limit operational flexibility. Breaches of these covenants could result in defaults under applicable debt instruments and other debt instruments due to cross-default provisions, even if payment obligations are satisfied. Financial and other covenants that limit our operational flexibility, as well as defaults resulting from a breach of any of these covenants in our debt instruments, could have a material adverse effect on our financial condition and results of operations.

Failure to hedge effectively against interest rate changes may adversely affect our results of operations and our ability to make distributions to our stockholders.

As of February 24, 2017, we had approximately $0.8 billion in variable interest rate debt, which constitutes 26.5% of our overall indebtedness and subjects us to interest rate volatility. We may seek to manage our exposure to interest rate volatility by using interest rate hedging arrangements, such as when we entered into the $125 million of interest rate swaps in 2010 to fix the interest rate on our 2006 Senior Unsecured Notes due 2016, which were paid in full on October 31, 2016. However, even these hedging arrangements involve risk, including the risk that counterparties may fail to honor their obligations under these arrangements, that these arrangements may not be effective in reducing our exposure to interest rate changes and that these arrangements may result in higher interest rates than we would otherwise have. Moreover, no hedging activity can completely insulate us from the risks associated with changes in interest rates. Failure to hedge effectively against interest rate changes may materially adversely affect our results of operations and our ability to make distributions to our stockholders.

Dependence on our tenants for payments of rent and interest may adversely impact our ability to make distributions to our stockholders.

We expect to continue to qualify as a REIT and, accordingly, as a REIT operating in the healthcare industry, we are severely limited by current tax law with respect to our ability to operate or manage the businesses conducted in our facilities.

19

Accordingly, we rely heavily on rent payments from our tenants under leases or interest payments from operators under mortgage or other loans for cash with which to make distributions to our stockholders. We have no control over the success or failure of these tenants’ businesses. Significant adverse changes in the operations of our facilities, or the financial condition of our tenants, operators or guarantors, could have a material adverse effect on our ability to collect rent and interest payments and, accordingly, on our ability to make distributions to our stockholders. Facility management by our tenants and their compliance with healthcare and other laws could have a material impact on our tenants’ operating and financial condition and, in turn, their ability to pay rent and interest to us.

It may be costly to replace defaulting tenants and we may not be able to replace defaulting tenants with suitable replacements on suitable terms.

Failure on the part of a tenant to comply materially with the terms of a lease could give us the right to terminate our lease with that tenant, repossess the applicable facility, cross default certain other leases and loans with that tenant and enforce the payment obligations under the lease. The process of terminating a lease with a defaulting tenant and repossessing the applicable facility may be costly and require a disproportionate amount of management’s attention. In addition, defaulting tenants or their affiliates may initiate litigation in connection with a lease termination or repossession against us or our subsidiaries. If a tenant-operator defaults and we choose to terminate our lease, we are then required to find another tenant-operator, such as the case was with our Monroe facility in 2014. The transfer of most types of healthcare facilities is highly regulated, which may result in delays and increased costs in locating a suitable replacement tenant. The sale or lease of these properties to entities other than healthcare operators may be difficult due to the added cost and time of refitting the properties. If we are unable tore-let the properties to healthcare operators, we may be forced to sell the properties at a loss due to the repositioning expenses likely to be incurred bynon-healthcare purchasers. Alternatively, we may be required to spend substantial amounts to adapt the facility to other uses. There can be no assurance that we would be able to find another tenant in a timely fashion, or at all, or that, if another tenant were found, we would be able to enter into a new lease on favorable terms. Defaults by our tenants under our leases may adversely affect our results of operations, financial condition, and our ability to make distributions to our stockholders. Defaults by our significant tenants under master leases (like Steward, Prime, MEDIAN, Ernest, and RCCH) will have an even greater effect.

It may be costly to find new tenants when lease terms end and we may not be able to replace such tenants with suitable replacements on suitable terms.

Failure on the part of a tenant to renew or extend the lease at the end of its fixed term on one of our facilities could result in us having to search for, negotiate with and execute new lease agreements, such was the case with our two South Carolina facilities — Bennettsville and Cheraw in 2015. The process of finding and negotiating with a new tenant along with costs (such as maintenance, property taxes, utilities, etc.) that we will incur while the facility is untenanted may be costly and require a disproportionate amount of management’s attention. There can be no assurance that we would be able to find another tenant in a timely fashion, or at all, or that, if another tenant were found, we would be able to enter into a new lease on favorable terms. If we are unable tore-let the properties to healthcare operators, we may be forced to sell the properties at a loss due to the repositioning expenses likely to be incurred bynon-healthcare purchasers. Alternatively, we may be required to spend substantial amounts to adapt the facility to other uses. Thus, thenon-renewal or extension of leases may adversely affect our results of operations, financial condition, and our ability to make distributions to our stockholders. This risk is even greater for those properties under master leases (like Steward, Prime, MEDIAN, Ernest, and RCCH) because several properties have the same lease ending dates.

20

We have made investments in the operators of certain of our healthcare facilities and the cash flows (and related returns) from these investments are subject to more volatility than our properties with the traditional net leasing structure.

At December 31, 2016, we have 11 investments in the operations of certain of our healthcare facilities by utilizing RIDEA (or similar investments). These investments include profits interest, equity investments, and equity like loans that generate returns dependent upon the operator’s performance. As a result, the cash flow and returns from these investments may be more volatile than that of our traditionaltriple-net leasing structure. Our business, results of operations, and financial condition may be adversely affected if the related operators fail to successfully operate the facilities efficiently and in a manner that is in our best interest.

We have limited experience with healthcare facilities in Germany, the United Kingdom, Italy, and Spain or anywhere else outside the U.S.

We have limited experience investing in healthcare properties or other real estate-related assets located outside the U.S. Investing in real estate located in foreign countries, including Germany, the United Kingdom, Italy, and Spain, creates risks associated with the uncertainty of foreign laws and markets including, without limitation, laws respecting foreign ownership, the enforceability of loan and lease documents and foreclosure laws. German real estate and tax laws are complex and subject to change, and we cannot assure you we will always be in compliance with those laws or that compliance will not expose us to additional expense. The properties we acquired in connection with the MEDIAN acquisition (as more fully described in Note 3 to Item 8 of this Form10-K) will also face risks in connection with unexpected changes in German or European regulatory requirements, political and economic instability, potential imposition of adverse or confiscatory taxes, possible challenges to the anticipated tax treatment of the structures that allow us to acquire and hold investments, possible currency transfer restrictions, the difficulty in enforcing obligations in other countries and the burden of complying with a wide variety of foreign laws. In addition, to qualify as a REIT, we generally will be required to operate anynon-U.S. investments in accordance with the rules applicable to U.S. REITs, which may be inconsistent with local practices. We may also be subject to fluctuations in local real estate values or markets or the European economy as a whole, which may adversely affect our European investments.

In addition, the rents payable under our leases of foreign assets are payable in either euros or British pounds, which could expose us to losses resulting from fluctuations in exchange rates to the extent we have not hedged our position, which in turn could adversely affect our revenues, operating margins and dividends, and may also affect the book value of our assets and the amount of stockholders’ equity. Further, any international currency gain recognized with respect to changes in exchange rates may not qualify under the 75% gross income test that we must satisfy annually in order to qualify and maintain our status as a REIT. Although we expect to hedge some of our foreign currency risk, we may not be able to do so successfully and may incur losses on our investments as a result of exchange rate fluctuations. Furthermore, we are subject to laws and regulations, such as the Foreign Corrupt Practices Act and similar local anti-bribery laws, that generally prohibit companies and their employees, agents and contractors from making improper payments to governmental officials for the purpose of obtaining or retaining business. Failure to comply with these laws could subject us to civil and criminal penalties that could materially adversely affect our results of operations, the value of our international investments, and our ability to make distributions to our stockholders.

Our revenues are dependent upon our relationships with, and success of, our largest tenants, Steward, Prime, MEDIAN, Ernest, RCCH and Adeptus Health.

For the year ended December 31, 2016, our top tenants were Steward, Prime, MEDIAN, Ernest, RCCH, and Adeptus Health representing 4.8% (based on fourth quarter revenue only when we closed the Steward acquisition), 22.3%, 17.3%, 12.5%, 9.7% and 7.0 %, respectively, of our total revenues. Our relationships with these operators and their financial performance and resulting ability to satisfy their lease and loan obligations to us are material to our financial results and our ability to service our debt and make distributions to our stockholders. We are dependent

21

upon the ability of these operators to make rent and loan payments to us, and any failure to meet these obligations could have a material adverse effect on our financial condition and results of operations.

Our tenants operate in the healthcare industry that is highly regulated by federal, state, and local laws and changes in regulations may negatively impact our tenants’ operations until they are able to make the appropriate adjustments to their business. For example, recent modifications to regulations concerning patient criteria and reimbursement for LTACHs have resulted in volume and profitability declines in certain facilities operated by Ernest.

We are aware of various federal and state inquiries, investigations and other proceedings currently affecting several of our tenants and would expect such government compliance and enforcement activities to be ongoing at any given time with respect to one or more of our tenants, either on a confidential or public basis. During the second quarter of 2016, the Department of Justice joined a lawsuit against Prime alleging irregular admission practices intended to increase the number of inpatient care admissions of Medicare patients, including unnecessarily classifying some patients as “inpatient” rather than “observation”. Other large acute hospital operators have also recently defended similar allegations, sometimes resulting in financial settlements and agreements with regulators to modify admission policies, resulting in lower reimbursements for those patients.