Exhibit 99.2

FOURTH QUARTER 2017 Supplemental Information

MEDICALPROPERTIESTRUST.COM TABLE OF CONTENTS COMPANY OVERVIEW Company Information 3 FINANCIAL INFORMATION Reconciliation of Net Income to Funds from Operations 5 Debt Summary 6 Debt Maturity Schedule 7 Pro Forma Net Debt /Annualized Adjusted EBITDA 8 PORTFOLIO INFORMATION Lease and Mortgage Loan Maturity Schedule 9 Total Pro Forma Gross Assets and Actual Revenue by Asset Type, Operator, State and Country 10 EBITDAR to Rent Coverage 13 Summary of Acquisitions and Development Projects 14 FINANCIAL STATEMENTS Consolidated Statements of Income 15 Consolidated Balance Sheets 16 Other Income Generating Assets 17 FORWARD-LOOKING STATEMENT Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results of the Company or future events to differ materially from those expressed in or underlying such forward-looking statements, including without limitation: Normalized FFO per share; expected payout ratio, the amount of acquisitions of healthcare real estate, if any; estimated debt metrics, portfolio diversification, capital markets conditions, the repayment of debt arrangements; statements concerning the additional income to the Company as a result of ownership interests in certain hospital operations and the timing of such income; the payment of future dividends, if any; completion of additional debt arrangement, and additional investments; national and international economic, business, real estate and other market conditions; the competitive environment in which the Company operates; the execution of the Company’s business plan; financing risks; the Company’s ability to maintain its status as a REIT for federal income tax purposes; acquisition and development risks; potential environmental and other liabilities; and other factors affecting the real estate industry generally or healthcare real estate in particular. For further discussion of the factors that could affect outcomes, please refer to the “Risk Factors” section of the Company’s Annual Report on Form10-K for the year ended December 31, 2016, and as updated by the Company’s subsequently filed Quarterly Reports on Form10-Q and other SEC filings. Except as otherwise required by the federal securities laws, the Company undertakes no obligation to update the information in this report. On the Cover: Willamette Valley Medical Center, an acute care hospital in McMinnville, Oregon operated by RCCH Healthcare Partners. Q4 2017 | SUPPLEMENTAL INFORMATION 2

MEDICALPROPERTIESTRUST.COM COMPANY OVERVIEW Medical Properties Trust, Inc. is a Birmingham, Alabama based self-advised real estate investment trust formed to capitalize on the changing trends in healthcare delivery by acquiring and developingnet-leased healthcare facilities. MPT’s financing model allows hospitals and other healthcare facilities to unlock the value of their underlying real estate in order to fund facility improvements, technology upgrades, staff additions and new construction. Facilities include acute care hospitals, inpatient rehabilitation hospitals, long-term acute care hospitals, and other medical and surgical facilities. OFFICERS Edward K. Aldag, Jr. R. Steven Hamner Emmett E. McLean J. Kevin Hanna BOARD OF DIRECTORS Edward K. Aldag, Jr. G. Steven Dawson R. Steven Hamner D. Paul Sparks, Jr. Michael G. Stewart C. Reynolds Thompson, III CORPORATE HEADQUARTERS Medical Properties Trust, Inc. 1000 Urban Center Drive, Suite 501 Birmingham, AL 35242 (205)969-3755 (205)969-3756 (fax) www.medicalpropertiestrust.com Chairman, President and Chief Executive Officer Executive Vice President and Chief Financial Officer Executive Vice President, Chief Operating Officer, Treasurer and Secretary Vice President, Controller and Chief Accounting Officer MPT Officers, from left: R. Steven Hamner, Emmett E. McLean, J. Kevin Hanna and Edward K. Aldag, Jr. Q4 2017 | SUPPLEMENTAL INFORMATION 3

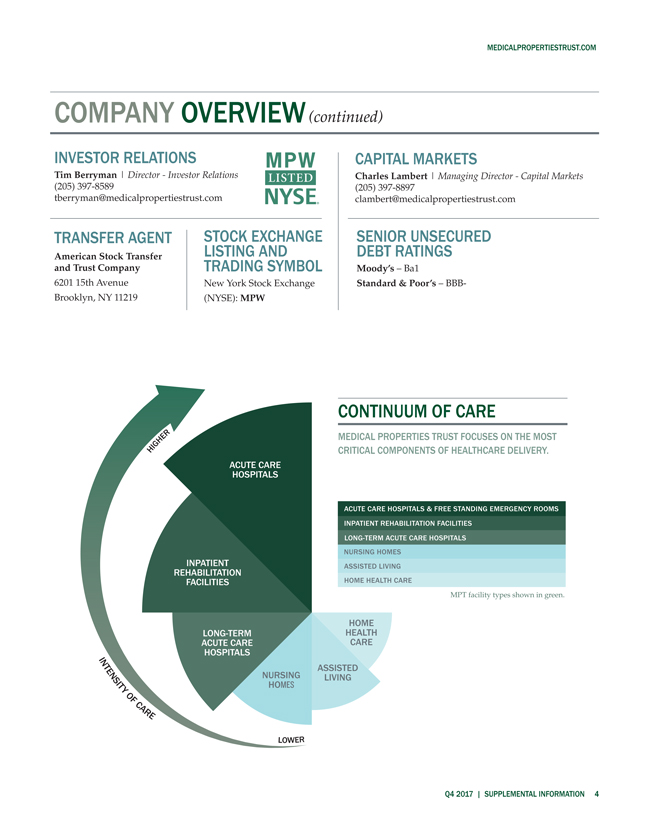

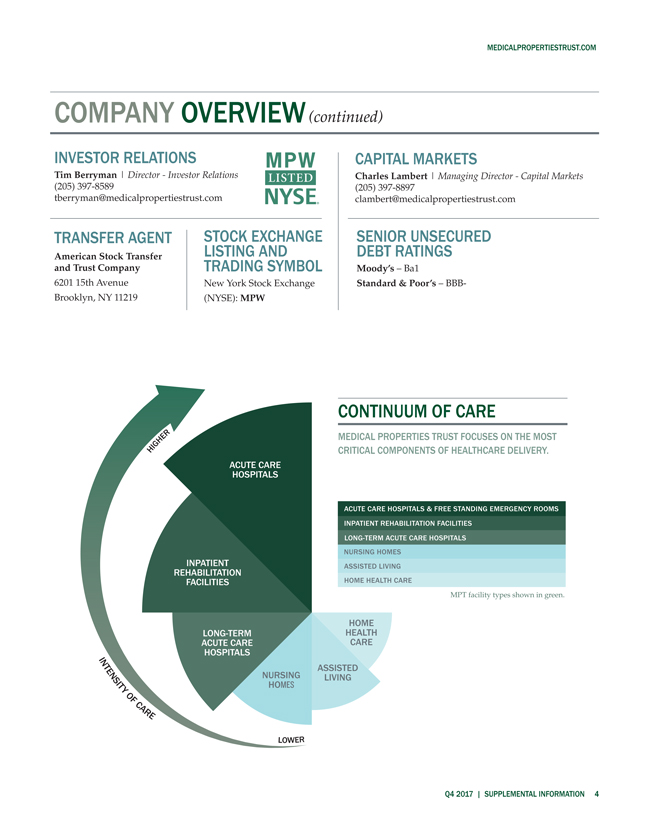

MEDICALPROPERTIESTRUST.COM COMPANY OVERVIEW(continued) INVESTOR RELATIONS Tim Berryman | Director—Investor Relations (205)397-8589 tberryman@medicalpropertiestrust.com CAPITAL MARKETS Charles Lambert | Managing Director—Capital Markets (205)397-8897 clambert@medicalpropertiestrust.com TRANSFER AGENT American Stock Transfer and Trust Company 6201 15th Avenue Brooklyn, NY 11219 STOCK EXCHANGE LISTING AND TRADING SYMBOL New York Stock Exchange (NYSE): MPW SENIOR UNSECURED DEBT RATINGS Moody’s – Ba1 Standard & Poor’s –BBB- CONTINUUM OF CARE MEDICAL PROPERTIES TRUST FOCUSES ON THE MOST CRITICAL COMPONENTS OF HEALTHCARE DELIVERY. ACUTE CARE HOSPITALS & FREE STANDING EMERGENCY ROOMS INPATIENT REHABILITATION FACILITIES LONG-TERM ACUTE CARE HOSPITALS NURSING HOMES ASSISTED LIVING HOME HEALTH CARE MPT facility types shown in green. HIGHER Q4 2017 | SUPPLEMENTAL INFORMATION 4 ACUTE HOSPITALS CARE REHABILITATION INPATIENT FACILITIES INTENSITY OF CARE HEALTH HOME ACUTE LONG-TERM CARE CARE HOSPITALS ASSISTED NURSING HOMES LIVING

MEDICALPROPERTIESTRUST.COM

FINANCIAL INFORMATION

RECONCILIATION OF NET INCOME TO FUNDS FROM OPERATIONS

(Unaudited)

(Amounts in thousands, except per share data)

| | | | | | | | | | | | | | | | |

| | | For the Three Months Ended | | | For the Twelve Months Ended | |

| | | December 31, 2017 | | | December 31, 2016 | | | December 31, 2017 | | | December 31, 2016 | |

FFO INFORMATION: | | | | | | | | | | | | | | | | |

Net income attributable to MPT common stockholders | | $ | 71,944 | | | $ | 43,039 | | | $ | 289,793 | | | $ | 225,048 | |

Participating securities’ share in earnings | | | (1,102 | ) | | | (129 | ) | | | (1,409 | ) | | | (559 | ) |

| | | | | | | | | | | | | | | | |

Net income, less participating securities’ share in earnings | | $ | 70,842 | | | $ | 42,910 | | | $ | 288,384 | | | $ | 224,489 | |

Depreciation and amortization(A) | | | 36,815 | | | | 26,976 | | | | 127,559 | | | | 96,157 | |

Gain on sale of real estate | | | — | | | | — | | | | (7,431 | ) | | | (67,168 | ) |

| | | | | | | | | | | | | | | | |

Funds from operations | | $ | 107,657 | | | $ | 69,886 | | | $ | 408,512 | | | $ | 253,478 | |

Write-off of straight-line rent and other | | | 4,223 | | | | — | | | | 5,340 | | | | 3,063 | |

Transaction costs fromnon-real estate dispositions | | | — | | | | 70 | | | | — | | | | 5,944 | |

Acquisition expenses, net of tax benefit(A) | | | 9,103 | | | | 34,806 | | | | 28,453 | | | | 46,529 | |

Release of valuation allowance | | | — | | | | (3,956 | ) | | | — | | | | (3,956 | ) |

Impairment charges | | | — | | | | (66 | ) | | | — | | | | 7,229 | |

Unutilized financing fees / debt refinancing costs | | | 13,780 | | | | — | | | | 32,574 | | | | 22,539 | |

| | | | | | | | | | | | | | | | |

Normalized funds from operations | | $ | 134,763 | | | $ | 100,740 | | | $ | 474,879 | | | $ | 334,826 | |

| | | | | | | | | | | | | | | | |

Share-based compensation | | | 2,801 | | | | 2,111 | | | | 9,949 | | | | 7,942 | |

Debt costs amortization | | | 1,773 | | | | 1,814 | | | | 6,521 | | | | 7,613 | |

Additional rent received in advance(B) | | | (300 | ) | | | (300 | ) | | | (1,200 | ) | | | (1,200 | ) |

Straight-line rent revenue and other(A) | | | (26,544 | ) | | | (16,921 | ) | | | (82,276 | ) | | | (50,687 | ) |

| | | | | | | | | | | | | | | | |

Adjusted funds from operations | | $ | 112,493 | | | $ | 87,444 | | | $ | 407,873 | | | $ | 298,494 | |

| | | | | | | | | | | | | | | | |

PER DILUTED SHARE DATA: | | | | | | | | | | | | | | | | |

Net income, less participating securities’ share in earnings | | $ | 0.19 | | | $ | 0.13 | | | $ | 0.82 | | | $ | 0.86 | |

Depreciation and amortization(A) | | | 0.10 | | | | 0.09 | | | | 0.37 | | | | 0.37 | |

Gain on sale of real estate | | | — | | | | — | | | | (0.02 | ) | | | (0.26 | ) |

| | | | | | | | | | | | | | | | |

Funds from operations | | $ | 0.29 | | | $ | 0.22 | | | $ | 1.17 | | | $ | 0.97 | |

Write-off of straight-line rent and other | | | 0.01 | | | | — | | | | 0.01 | | | | 0.01 | |

Transaction costs fromnon-real estate dispositions | | | — | | | | — | | | | — | | | | 0.02 | |

Acquisition expenses, net of tax benefit(A) | | | 0.03 | | | | 0.11 | | | | 0.08 | | | | 0.18 | |

Release of valuation allowance | | | — | | | | (0.02 | ) | | | — | | | | (0.02 | ) |

Impairment charges | | | — | | | | — | | | | — | | | | 0.03 | |

Unutilized financing fees / debt refinancing costs | | | 0.04 | | | | — | | | | 0.09 | | | | 0.09 | |

| | | | | | | | | | | | | | | | |

Normalized funds from operations | | $ | 0.37 | | | $ | 0.31 | | | $ | 1.35 | | | $ | 1.28 | |

| | | | | | | | | | | | | | | | |

Share-based compensation | | | 0.01 | | | | 0.01 | | | | 0.03 | | | | 0.03 | |

Debt costs amortization | | | 0.01 | | | | 0.01 | | | | 0.02 | | | | 0.02 | |

Additional rent received in advance(B) | | | — | | | | — | | | | — | | | | — | |

Straight-line rent revenue and other(A) | | | (0.08 | ) | | | (0.06 | ) | | | (0.24 | ) | | | (0.19 | ) |

| | | | | | | | | | | | | | | | |

Adjusted funds from operations | | $ | 0.31 | | | $ | 0.27 | | | $ | 1.16 | | | $ | 1.14 | |

| | | | | | | | | | | | | | | | |

| (A) | Includes our share of real estate depreciation, acquisition expenses, and straight-line rent revenue from unconsolidated joint ventures. These amounts are included with the activity of all of our equity interests in the “Other income (expense)” line on the consolidated statements of income. |

| (B) | Represents additional rent received from one tenant in advance of when we can recognize as revenue for accounting purposes. This additional rent is being recorded to revenue on a straight-line basis over the lease life. |

Investors and analysts following the real estate industry utilize funds from operations, or FFO, as a supplemental performance measure. FFO, reflecting the assumption that real estate asset values rise or fall with market conditions, principally adjusts for the effects of GAAP depreciation and amortization of real estate assets, which assumes that the value of real estate diminishes predictably over time. We compute FFO in accordance with the definition provided by the National Association of Real Estate Investment Trusts, or NAREIT, which represents net income (loss) (computed in accordance with GAAP), excluding gains (losses) on sales of real estate and impairment charges on real estate assets, plus real estate depreciation and amortization and after adjustments for unconsolidated partnerships and joint ventures.

In addition to presenting FFO in accordance with the NAREIT definition, we also disclose normalized FFO, which adjusts FFO for items that relate to unanticipated ornon-core events or activities or accounting changes that, if not noted, would make comparison to prior period results and market expectations less meaningful to investors and analysts. We believe that the use of FFO, combined with the required GAAP presentations, improves the understanding of our operating results among investors and the use of normalized FFO makes comparisons of our operating results with prior periods and other companies more meaningful. While FFO and normalized FFO are relevant and widely used supplemental measures of operating and financial performance of REITs, they should not be viewed as a substitute measure of our operating performance since the measures do not reflect either depreciation and amortization costs or the level of capital expenditures and leasing costs necessary to maintain the operating performance of our properties, which can be significant economic costs that could materially impact our results of operations. FFO and normalized FFO should not be considered an alternative to net income (loss) (computed in accordance with GAAP) as indicators of our financial performance or to cash flow from operating activities (computed in accordance with GAAP) as an indicator of our liquidity.

We calculate adjusted funds from operations, or AFFO, by subtracting from or adding to normalized FFO (i) unbilled rent revenue,(ii) non-cash share-based compensation expense, and (iii) amortization of deferred financing costs. AFFO is an operating measurement that we use to analyze our results of operations based on the receipt, rather than the accrual, of our rental revenue and on certain other adjustments. We believe that this is an important measurement because our leases generally have significant contractual escalations of base rents and therefore result in recognition of rental income that is not collected until future periods, and costs that are deferred or arenon-cash charges. Our calculation of AFFO may not be comparable to AFFO or similarly titled measures reported by other REITs. AFFO should not be considered as an alternative to net income (calculated pursuant to GAAP) as an indicator of our results of operations or to cash flow from operating activities (calculated pursuant to GAAP) as an indicator of our liquidity.

Q4 2017 | SUPPLEMENTAL INFORMATION 5

MEDICALPROPERTIESTRUST.COM

FINANCIAL INFORMATION

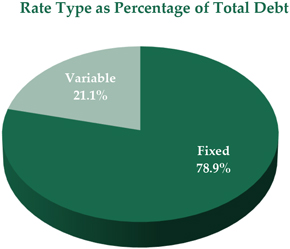

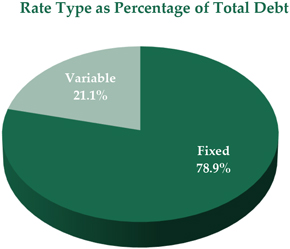

DEBT SUMMARY

(as of December 31, 2017)

($ amounts in thousands)

| | | | | | | | | | | | |

Debt Instrument | | Rate Type | | | Rate | | | Balance | |

2021 Credit Facility Revolver | | | Variable | | | | 2.660% - 2.810 | %(A) | | $ | 830,000 | |

2021 Credit Facility Revolver (GBP)(B) | | | Variable | | | | 1.750 | % | | | 10,810 | |

2022 Term Loan | | | Variable | | | | 2.980 | % | | | 200,000 | |

4.000% Notes Due 2022 (Euro)(C) | | | Fixed | | | | 4.000 | % | | | 600,250 | |

6.375% Notes Due 2024 | | | Fixed | | | | 6.375 | % | | | 500,000 | |

5.500% Notes Due 2024 | | | Fixed | | | | 5.500 | % | | | 300,000 | |

3.325% Notes Due 2025 (Euro)(C) | | | Fixed | | | | 3.325 | % | | | 600,250 | |

5.250% Notes Due 2026 | | | Fixed | | | | 5.250 | % | | | 500,000 | |

5.000% Notes Due 2027 | | | Fixed | | | | 5.000 | % | | | 1,400,000 | |

| | | | | | | | | | | | |

| | | | | | | | | $4,941,310 | |

Debt issuance costs | | | | | | | | | | | (42,643 | ) |

| | | | | | | | | | | | |

| | | Weighted average rate | | | | 4.422 | % | | $ | 4,898,667 | |

| | | | | | | | | | | | |

| (A) | The interest rate on $50 million of the outstanding revolver balance at December 31, 2017 was 4.750%. |

The $50 million tranche was repaid on January 2, 2018.

| (B) | Represents credit facility borrowings in pound sterling and converted to U.S. dollars at December 31, 2017. |

| (C) | Represents bonds issued in euros and converted to U.S. dollars at December 31, 2017. |

Q4 2017 | SUPPLEMENTAL INFORMATION 6

MEDICALPROPERTIESTRUST.COM

FINANCIAL INFORMATION

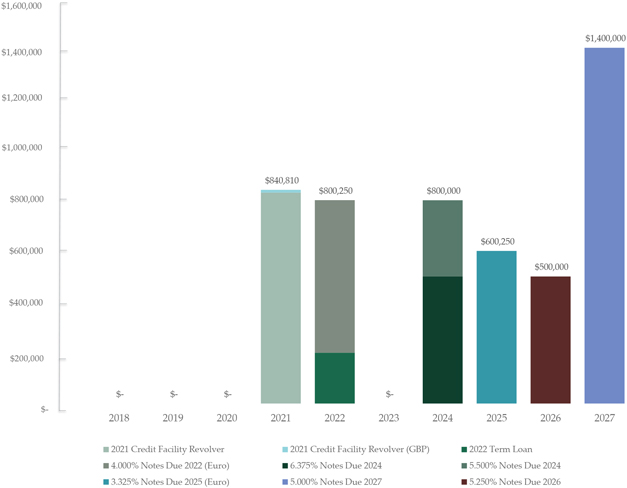

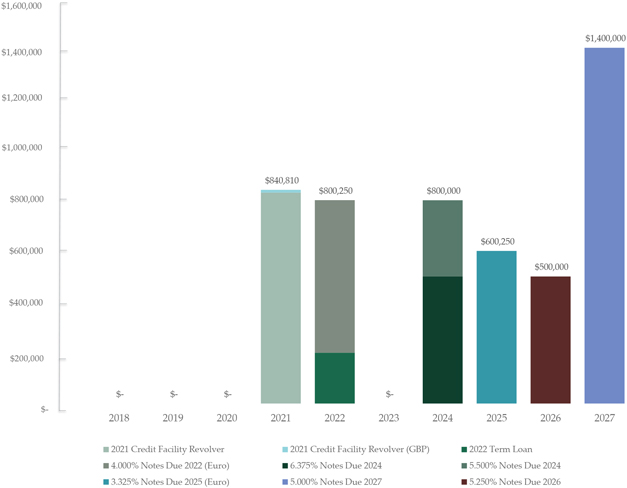

DEBT MATURITY SCHEDULE

($ amounts in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Debt Instrument | | 2018 | | | 2019 | | | 2020 | | | 2021 | | | 2022 | | | 2023 | | | 2024 | | | 2025 | | | 2026 | | | 2027 | |

2021 Credit Facility Revolver | | $ | — | | | $ | — | | | $ | — | | | $ | 830,000 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

2021 Credit Facility Revolver (GBP) | | | — | | | | — | | | | — | | | | 10,810 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

2022 Term Loan | | | — | | | | — | | | | — | | | | — | | | | 200,000 | | | | — | | | | — | | | | — | | | | — | | | | — | |

4.000% Notes Due 2022 (Euro) | | | — | | | | — | | | | — | | | | — | | | | 600,250 | | | | — | | | | — | | | | — | | | | — | | | | — | |

6.375% Notes Due 2024 | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 500,000 | | | | — | | | | — | | | | — | |

5.500% Notes Due 2024 | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 300,000 | | | | — | | | | — | | | | — | |

3.325% Notes Due 2025 (Euro) | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 600,250 | | | | — | | | | — | |

5.250% Notes Due 2026 | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 500,000 | | | | — | |

5.000% Notes Due 2027 | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 1,400,000 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | $ | — | | | $ | — | | | $ | — | | | $ | 840,810 | | | $ | 800,250 | | | $ | — | | | $ | 800,000 | | | $ | 600,250 | | | $ | 500,000 | | | $ | 1,400,000 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Q4 2017 | SUPPLEMENTAL INFORMATION 7

MEDICALPROPERTIESTRUST.COM

FINANCIAL INFORMATION

PRO FORMA NET DEBT / ANNUALIZED ADJUSTED EBITDA

(Unaudited)

(Amounts in thousands)

| | | | |

| | | For the Three Months Ended | |

| | | December 31, 2017 | |

Net income attributable to MPT common stockholders | | $ | 71,944 | |

Pro forma adjustments for acquisitions that occurred after the period(A) | | | 400 | |

| | | | |

Pro forma net income | | $ | 72,344 | |

Add back: | | | | |

Interest expense | | | 56,456 | |

Unutilized financing fees/ debt refinancing costs | | | 13,780 | |

Depreciation and amortization | | | 38,167 | |

Stock-based compensation | | | 2,801 | |

Mid-quarter acquisitions | | | 1,106 | |

Write-off of straight-line rent and other | | | 4,223 | |

Acquisition expenses | | | 8,661 | |

Income tax expense | | | 1,898 | |

| | | | |

4Q 2017 Pro forma adjusted EBITDA | | $ | 199,436 | |

| | | | |

Annualization | | $ | 812,944 | |

| | | | |

Total debt | | $ | 4,898,667 | |

Pro forma changes to cash and debt balance after December 31, 2017(A) | | | (153,972 | ) |

| | | | |

Pro forma net debt | | $ | 4,744,695 | |

| | | | |

Pro forma net debt / annualized adjusted EBITDA | | | 5.8 | x |

| (A) | The schedule reflects our previously disclosed commitment to acquire one RCCH facility for $17.5 million. |

Investors and analysts following the real estate industry utilize net debt (debt less cash) to EBITDA (net income before interest expense, income taxes, depreciation and amortization) as a measurement of leverage that shows how many years it would take for us to pay back our debt, assuming net debt and EBITDA are held constant. The table above considers the pro forma effects on net debt and EBITDA from investments and capital transactions that were either completed during the period or disclosed as firm commitments, assuming such transactions were consummated/fully funded as of the beginning of the period. In addition, we show EBITDA adjusted to exclude stock compensation expense, gains or losses on real estate and other dispositions, debt refinancing charges, impairment charges, and acquisition expenses to derive Pro forma Annualized Adjusted EBITDA, which is anon-GAAP measure. We believe Pro forma Net Debt and Pro forma Annualized Adjusted EBITDA are useful to investors and analysts as they allow for a more current view of our credit quality and allow for the comparison of our credit strength between periods and to other real estate companies without the effect of items that by their nature are not comparable from period to period.

Q4 2017 | SUPPLEMENTAL INFORMATION 8

MEDICALPROPERTIESTRUST.COM

PORTFOLIO INFORMATION

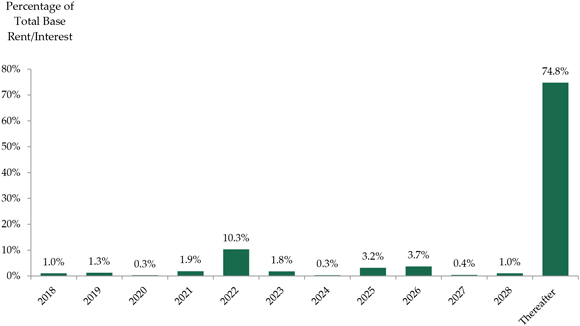

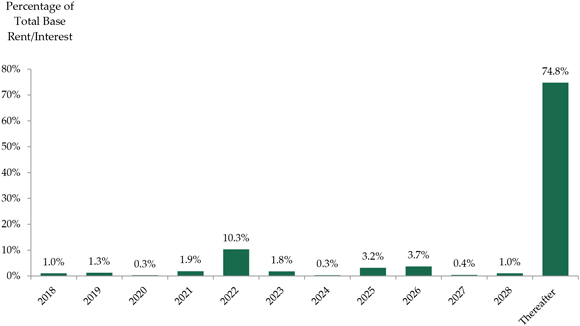

LEASE AND MORTGAGE LOAN MATURITY SCHEDULE

(as of December 31, 2017)

($ amounts in thousands)

| | | | | | | | | | | | |

Years of Maturities(A) | | Total Properties (B) | | | Base Rent/Interest (C) | | | Percent of Total

Base Rent/Interest | |

2018 | | | 15 | | | $ | 7,561 | | | | 1.0 | % |

2019 | | | 4 | | | | 9,082 | | | | 1.3 | % |

2020 | | | 1 | | | | 2,032 | | | | 0.3 | % |

2021 | | | 3 | | | | 13,397 | | | | 1.9 | % |

2022 | | | 15 | | | | 74,227 | | | | 10.3 | % |

2023 | | | 4 | | | | 12,883 | | | | 1.8 | % |

2024 | | | 1 | | | | 2,273 | | | | 0.3 | % |

2025 | | | 7 | | | | 22,957 | | | | 3.2 | % |

2026 | | | 6 | | | | 26,501 | | | | 3.7 | % |

2027 | | | 1 | | | | 2,990 | | | | 0.4 | % |

2028 | | | 5 | | | | 7,452 | | | | 1.0 | % |

Thereafter | | | 200 | | | | 539,223 | | | | 74.8 | % |

| | | | | | | | | | | | |

| | | 262 | | | $ | 720,578 | | | | 100.0 | % |

| | | | | | | | | | | | |

| (A) | Lease/Loan expiration is based on the fixed term of the lease/loan and does not factor in potential renewal options provided for in our agreements. |

| (B) | Excludes three of our facilities that are under development, our Twelve Oaks facility that is not fully occupied, the nine properties that we own through joint venture arrangements, and an ancillary property. The schedule reflects our previously disclosed commitment to acquire one RCCH facility for $17.5 million. |

| (C) | Represents base rent/interest income on an annualized basis but does not include tenant recoveries, additional rents and other lease-related adjustments to revenue (i.e., straight-line rents and deferred revenues). |

Q4 2017 | SUPPLEMENTAL INFORMATION 9

MEDICALPROPERTIESTRUST.COM

PORTFOLIO INFORMATION

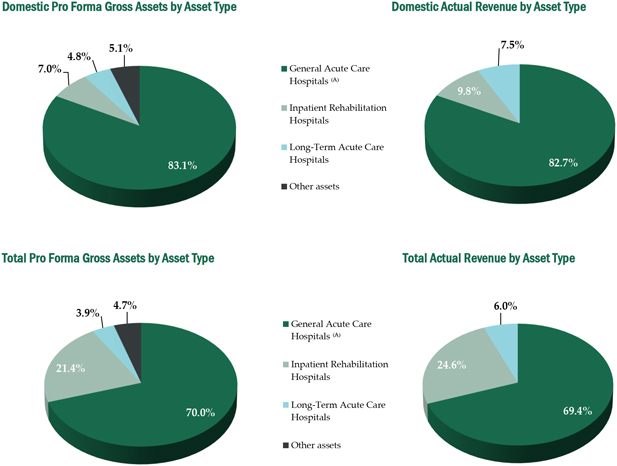

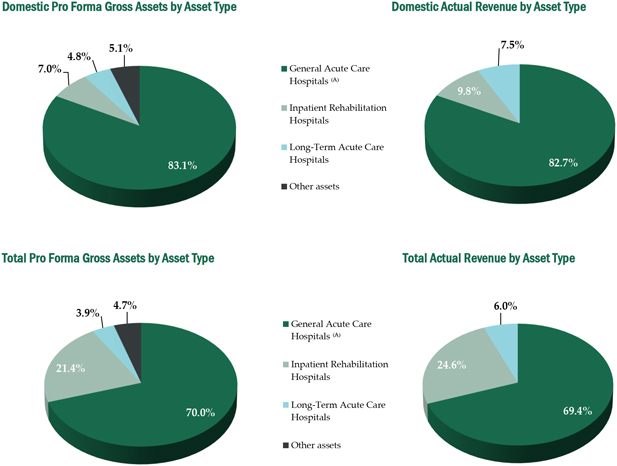

TOTAL PRO FORMA GROSS ASSETS AND ACTUAL REVENUE BY ASSET TYPE

(December 31, 2017)

($ amounts in thousands)

| | | | | | | | | | | | | | | | |

Asset Types | | Total Pro Forma

Gross Assets(B) | | | Percentage of

Pro Forma

Gross Assets | | | YTD Actual

Revenue | | | Percentage of

Total Actual

Revenue | |

General Acute Care Hospitals(A) | | $ | 6,638,799 | | | | 70.0 | % | | $ | 488,764 | | | | 69.4 | % |

Inpatient Rehabilitation Hospitals | | | 2,024,767 | | | | 21.4 | % | | | 173,149 | | | | 24.6 | % |

Long-Term Acute Care Hospitals | | | 367,987 | | | | 3.9 | % | | | 42,832 | | | | 6.0 | % |

Other assets | | | 444,659 | | | | 4.7 | % | | | — | | | | — | |

| | | | | | | | | | | | | | | | |

Total | | $ | 9,476,212 | | | | 100.0 | % | | $ | 704,745 | | | | 100.0 | % |

| | | | | | | | | | | | | | | | |

| (A) | Includes three medical office buildings. |

| (B) | Represents investment concentration as a percentage of gross real estate assets, other loans, and equity investments, assuming all binding real estate commitments on new investments and unfunded amounts on development deals and commenced capital improvement projects are fully funded. See press release dated February 8, 2018 for reconciliation of total assets to pro forma total gross assets at December 31, 2017. |

Q4 2017 | SUPPLEMENTAL INFORMATION 10

MEDICALPROPERTIESTRUST.COM

PORTFOLIO INFORMATION

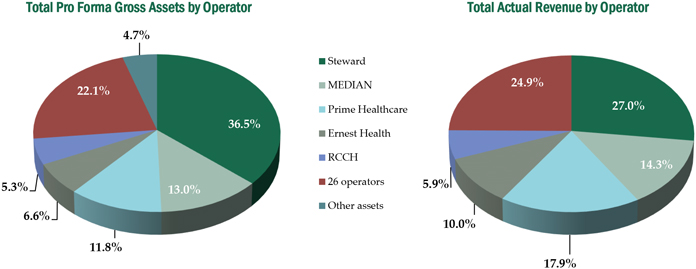

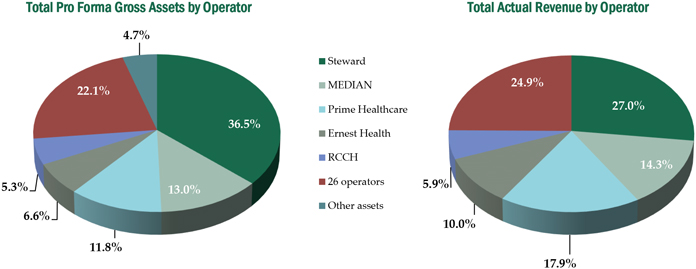

TOTAL PRO FORMA GROSS ASSETS AND ACTUAL REVENUE BY OPERATOR

(December 31, 2017)

($ amounts in thousands)

| | | | | | | | | | | | | | | | |

Operators | | Total Pro Forma

Gross Assets (A) | | | Percentage of

Pro Forma

Gross Assets | | | YTD Actual

Revenue | | | Percentage of

Total Actual

Revenue | |

Steward | | $ | 3,457,384 | | | | 36.5 | % | | $ | 190,172 | | | | 27.0 | % |

MEDIAN | | | 1,229,325 | | | | 13.0 | % | | | 100,531 | | | | 14.3 | % |

Prime Healthcare | | | 1,119,484 | | | | 11.8 | % | | | 126,269 | | | | 17.9 | % |

Ernest Health | | | 629,161 | | | | 6.6 | % | | | 70,665 | | | | 10.0 | % |

RCCH | | | 506,265 | | | | 5.3 | % | | | 41,890 | | | | 5.9 | % |

26 operators | | | 2,089,934 | | | | 22.1 | % | | | 175,218 | | | | 24.9 | % |

Other assets | | | 444,659 | | | | 4.7 | % | | | — | | | | — | |

| | | | | | | | | | | | | | | | |

Total | | $ | 9,476,212 | | | | 100.0 | % | | $ | 704,745 | | | | 100.0 | % |

| | | | | | | | | | | | | | | | |

| (A) | Represents investment concentration as a percentage of gross real estate assets, other loans, and equity investments, assuming all binding real estate commitments on new investments and unfunded amounts on development deals and commenced capital improvement projects are fully funded. See press release dated February 8, 2018 for reconciliation of total assets to pro forma total gross assets at December 31, 2017. |

Q4 2017 | SUPPLEMENTAL INFORMATION 11

MEDICALPROPERTIESTRUST.COM

PORTFOLIO INFORMATION

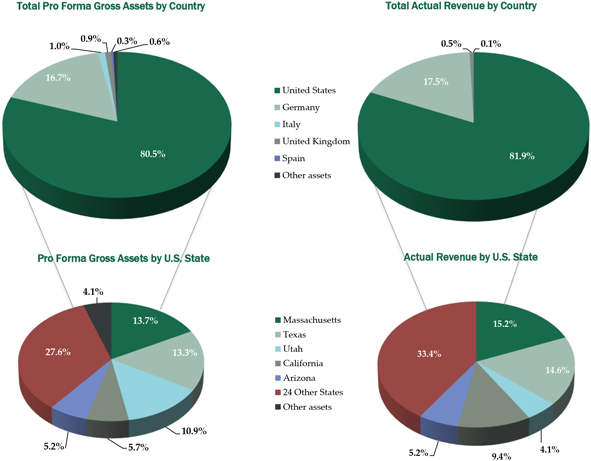

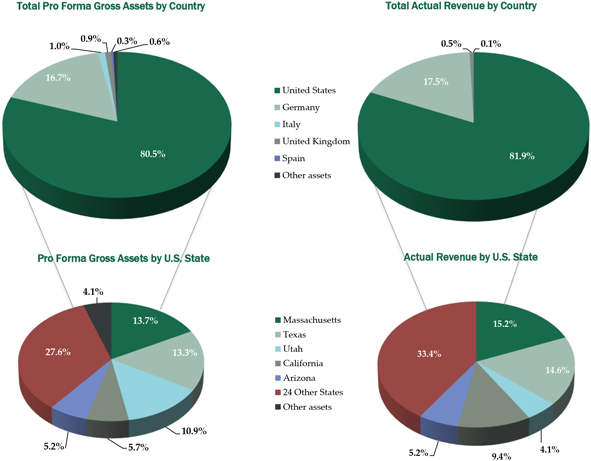

TOTAL PRO FORMA GROSS ASSETS AND ACTUAL REVENUE BY U.S. STATE AND COUNTRY

(December 31, 2017)

($ amounts in thousands)

| | | | | | | | | | | | | | | | |

U.S. States and Other Countries | | Total Pro Forma

Gross Assets (A) | | | Percentage of

Pro Forma

Gross Assets | | | YTD Actual

Revenue | | | Percentage of

Total Actual

Revenue | |

Massachusetts | | $ | 1,297,226 | | | | 13.7 | % | | $ | 107,195 | | | | 15.2 | % |

Texas | | | 1,257,390 | | | | 13.3 | % | | | 102,926 | | | | 14.6 | % |

Utah | | | 1,035,501 | | | | 10.9 | % | | | 28,831 | | | | 4.1 | % |

California | | | 542,876 | | | | 5.7 | % | | | 66,241 | | | | 9.4 | % |

Arizona | | | 491,284 | | | | 5.2 | % | | | 36,393 | | | | 5.2 | % |

24 Other States | | | 2,618,536 | | | | 27.6 | % | | | 235,545 | | | | 33.4 | % |

Other assets | | | 387,050 | | | | 4.1 | % | | | — | | | | — | |

| | | | | | | | | | | | | | | | |

United States | | $ | 7,629,863 | | | | 80.5 | % | | $ | 577,131 | | | | 81.9 | % |

| | | | |

Germany | | $ | 1,581,726 | | | | 16.7 | % | | $ | 123,453 | | | | 17.5 | % |

Italy | | | 99,347 | | | | 1.0 | % | | | — | | | | — | |

United Kingdom | | | 81,766 | | | | 0.9 | % | | | 3,681 | | | | 0.5 | % |

Spain | | | 25,901 | | | | 0.3 | % | | | 480 | | | | 0.1 | % |

Other assets | | | 57,609 | | | | 0.6 | % | | | — | | | | — | |

| | | | | | | | | | | | | | | | |

International | | $ | 1,846,349 | | | | 19.5 | % | | $ | 127,614 | | | | 18.1 | % |

| | | | | | | | | | | | | | | | |

Total | | $ | 9,476,212 | | | | 100.0 | % | | $ | 704,745 | | | | 100.0 | % |

| | | | | | | | | | | | | | | | |

| (A) | Represents investment concentration as a percentage of gross real estate assets, other loans, and equity investments, assuming all binding real estate commitments on new investments and unfunded amounts on development deals and commenced capital improvement projects are fully funded. See press release dated February 8, 2018 for reconciliation of total assets to pro forma total gross assets at December 31, 2017. |

Q4 2017 | SUPPLEMENTAL INFORMATION 12

MEDICALPROPERTIESTRUST.COM

PORTFOLIO INFORMATION

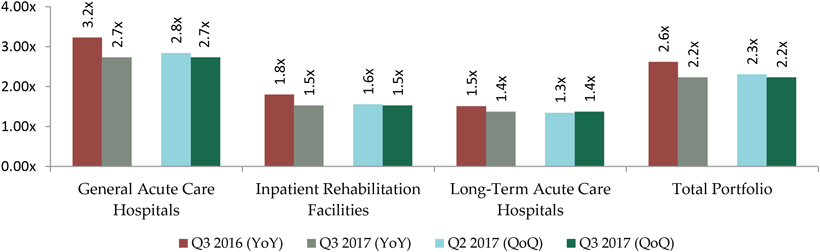

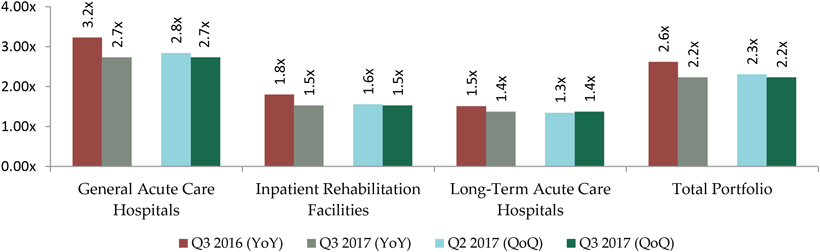

Same Store EBITDAR(1) Rent Coverage

YOY and Sequential Quarter Comparisons by Property Type

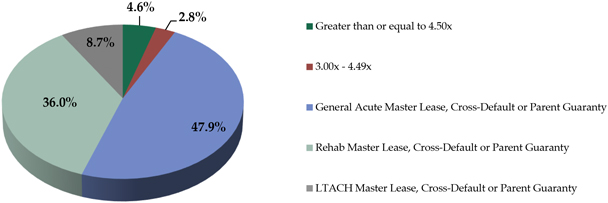

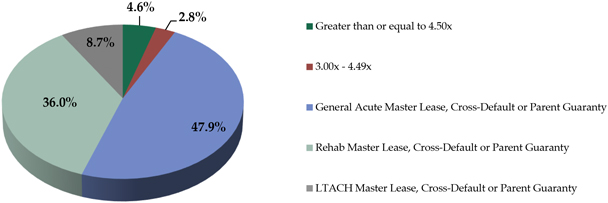

Stratification of Portfolio EBITDAR Rent Coverage

| | | | | | | | | | | | |

EBITDAR Rent Coverage TTM | | Investment

(in thousands) | | | No. of Facilities | | | Percentage of

Investment | |

Greater than or equal to 4.50x | | $ | 190,750 | | | | 4 | | | | 4.6 | % |

3.00x - 4.49x | | $ | 115,000 | | | | 1 | | | | 2.8 | % |

Total Master Leased, Cross-Defaulted and/or with Parent Guaranty: 1.7x | | $ | 3,824,745 | | | | 120 | | | | 92.6 | % |

General Acute Master Leased, Cross-Defaulted and/or with Parent Guaranty: 1.8x | | $ | 1,977,427 | | | | 41 | | | | 47.9 | % |

Inpatient Rehabilitation Facilities Master Leased, Cross-Defaulted and/or with Parent Guaranty: 1.5x | | $ | 1,486,226 | | | | 62 | | | | 36.0 | % |

Long-Term Acute Care Hospitals Master Leased, Cross-Defaulted and/or with Parent Guaranty: 1.4x | | $ | 361,092 | | | | 17 | | | | 8.7 | % |

Notes:

Same Store represents properties with at least 24 months of financial reporting data. Properties that do not provide financial reporting and disposed assets are not included. Adeptus facilities excluded until bankruptcy proceedings are resolved and operations stabilize.

All data presented is on a trailing twelve month basis.

| (1) | EBITDAR adjusted fornon-recurring items. |

Q4 2017 | SUPPLEMENTAL INFORMATION 13

MEDICALPROPERTIESTRUST.COM

PORTFOLIO INFORMATION

SUMMARY OF COMPLETED ACQUISITIONS / DEVELOPMENT PROJECTS FOR THE TWELVE MONTHS ENDED DECEMBER 31, 2017

($ amounts in thousands)

| | | | | | | | | | | | | | | | |

Operator | | Location | | | Costs Incurred as of

12/31/2017 | | | Rent Commencement

Date | | | Acquisition/

Development | |

Adeptus Health | | | Mesa, Arizona | | | $ | 51,350 | | | | 2/10/2017 | | | | Development | |

Adeptus Health | | | Austin, Texas | | | | 4,979 | | | | 3/2/2017 | | | | Development | |

Adeptus Health | | | San Tan Valley, Arizona | | | | 6,184 | | | | 4/13/2017 | | | | Development | |

Steward | | | Florida, Ohio & Pennsylvania | | | | 301,292 | | | | 5/1/2017 | | | | Acquisition | |

RCCH | | | Lewiston, Idaho | | | | 87,500 | | | | 5/1/2017 | | | | Acquisition | |

Adeptus Health | | | Cypress, Texas | | | | 4,365 | | | | 5/8/2017 | | | | Development | |

MEDIAN & Affiliates | | | Germany | | | | 171,538 | | | | 1H 2017 | | | | Acquisition | |

Alecto | | | Ohio & West Virginia | | | | 40,451 | | | | 6/1/2017 | | | | Acquisition | |

MEDIAN & Affiliates | | | Germany | | | | 45,282 | | | | 7/2017 | | | | Acquisition | |

Steward | | | Arizona, Utah, Texas & Arkansas | | | | 1,500,000 | (A) | | | 9/29/2017 | | | | Acquisition | |

MEDIAN & Affiliates | | | Germany | | | | 94,720 | | | | 11/30/2017 | | | | Acquisition | |

| | | | | | | | | | | | | | | | |

| | | | | | $ | 2,307,661 | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| (A) | Includes $100 million of equity investments. |

SUMMARY OF CURRENT INVESTMENT COMMITMENTS AS OF DECEMBER 31, 2017

($ amounts in thousands)

| | | | | | | | | | | | |

Operator | | Location | | | Commitment | | | Acquisition/

Development | |

RCCH | | | Washington | | | $ | 17,500 | | | | Acquisition | |

| | | | | | | | | | | | |

| | | | | | $ | 17,500 | | | | | |

| | | | | | | | | | | | |

SUMMARY OF CURRENT DEVELOPMENT PROJECTS AS OF DECEMBER 31, 2017

($ amounts in thousands)

| | | | | | | | | | | | | | | | |

Operator | | Location | | | Commitment | | | Cost Incurred as of

12/31/2017 | | | Estimated

Completion Date | |

Ernest Health | | | Flagstaff, Arizona | | | $ | 28,067 | | | $ | 21,794 | | | | Q1 2018 | |

Circle Health | | | United Kingdom | | | | 43,592 | | | | 14,694 | | | | Q1 2019 | |

Surgery Partners | | | Idaho Falls, Idaho | | | | 113,468 | | | | 11,207 | | | | Q1 2020 | |

| | | | | | | | | | | | | | | | |

| | | | | | $ | 185,127 | | | $ | 47,695 | | | | | |

| | | | | | | | | | | | | | | | |

Q4 2017 | SUPPLEMENTAL INFORMATION 14

MEDICALPROPERTIESTRUST.COM

FINANCIAL STATEMENTS

MEDICAL PROPERTIES TRUST, INC. AND SUBSIDIARIES

Consolidated Statements of Income

(Amounts in thousands, except per share data)

| | | | | | | | | | | | | | | | |

| | | For the Three Months Ended | | | For the Twelve Months Ended | |

| | | December 31, 2017 | | | December 31, 2016 | | | December 31, 2017 | | | December 31, 2016 | |

| | | (Unaudited) | | | (Unaudited) | | | (Unaudited) | | | (A) | |

Revenues | | | | | | | | | | | | | | | | |

Rent billed | | $ | 124,642 | | | $ | 92,861 | | | $ | 435,782 | | | $ | 327,269 | |

Straight-line rent | | | 18,907 | | | | 14,558 | | | | 65,468 | | | | 41,067 | |

Income from direct financing leases | | | 19,188 | | | | 17,126 | | | | 74,495 | | | | 64,307 | |

Interest and fee income | | | 42,224 | | | | 28,738 | | | | 129,000 | | | | 108,494 | |

| | | | | | | | | | | | | | | | |

Total revenues | | | 204,961 | | | | 153,283 | | | | 704,745 | | | | 541,137 | |

Expenses | | | | | | | | | | | | | | | | |

Real estate depreciation and amortization | | | 36,112 | | | | 26,524 | | | | 125,106 | | | | 94,374 | |

Impairment charges | | | — | | | | (66 | ) | | | — | | | | 7,229 | |

Property-related | | | 1,811 | | | | 1,120 | | | | 5,811 | | | | 2,712 | |

Acquisition expenses | | | 8,649 | | | | 39,894 | | | | 29,645 | | | | 46,273 | |

General and administrative | | | 15,312 | | | | 13,090 | | | | 58,599 | | | | 48,911 | |

| | | | | | | | | | | | | | | | |

Total operating expenses | | | 61,884 | | | | 80,562 | | | | 219,161 | | | | 199,499 | |

| | | | | | | | | | | | | | | | |

Operating income | | | 143,077 | | | | 72,721 | | | | 485,584 | | | | 341,638 | |

Interest expense | | | (56,456 | ) | | | (38,465 | ) | | | (176,954 | ) | | | (159,597 | ) |

Gain (loss) on sale of real estate and other asset dispositions, net | | | — | | | | (70 | ) | | | 7,431 | | | | 61,224 | |

Unutilized financing fees / debt refinancing costs | | | (13,780 | ) | | | — | | | | (32,574 | ) | | | (22,539 | ) |

Other income (expense) | | | 1,433 | | | | 1,056 | | | | 10,432 | | | | (1,618 | ) |

Income tax benefit (expense) | | | (1,898 | ) | | | 8,003 | | | | (2,681 | ) | | | 6,830 | |

| | | | | | | | | | | | | | | | |

Income from continuing operations | | | 72,376 | | | | 43,245 | | | | 291,238 | | | | 225,938 | |

Loss from discontinued operations | | | — | | | | — | | | | — | | | | (1 | ) |

| | | | | | | | | | | | | | | | |

Net income | | | 72,376 | | | | 43,245 | | | | 291,238 | | | | 225,937 | |

Net income attributable tonon-controlling interests | | | (432 | ) | | | (206 | ) | | | (1,445 | ) | | | (889 | ) |

| | | | | | | | | | | | | | | | |

Net income attributable to MPT common stockholders | | $ | 71,944 | | | $ | 43,039 | | | $ | 289,793 | | | $ | 225,048 | |

| | | | | | | | | | | | | | | | |

Earnings per common share – basic: | | | | | | | | | | | | | | | | |

Income from continuing operations | | $ | 0.19 | | | $ | 0.13 | | | $ | 0.82 | | | $ | 0.86 | |

Loss from discontinued operations | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | |

Net income attributable to MPT common stockholders | | $ | 0.19 | | | $ | 0.13 | | | $ | 0.82 | | | $ | 0.86 | |

| | | | | | | | | | | | | | | | |

Earnings per common share – diluted: | | | | | | | | | | | | | | | | |

Income from continuing operations | | $ | 0.19 | | | $ | 0.13 | | | $ | 0.82 | | | $ | 0.86 | |

Loss from discontinued operations | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | |

Net income attributable to MPT common stockholders | | $ | 0.19 | | | $ | 0.13 | | | $ | 0.82 | | | $ | 0.86 | |

| | | | | | | | | | | | | | | | |

Weighted average shares outstanding – basic | | | 364,382 | | | | 319,833 | | | | 349,902 | | | | 260,414 | |

Weighted average shares outstanding – diluted | | | 364,977 | | | | 319,994 | | | | 350,441 | | | | 261,072 | |

Dividends declared per common share | | $ | 0.24 | | | $ | 0.23 | | | $ | 0.96 | | | $ | 0.91 | |

| (A) | Financials have been derived from the prior year audited financial statements. |

Q4 2017 | SUPPLEMENTAL INFORMATION 15

MEDICALPROPERTIESTRUST.COM

FINANCIAL STATEMENTS

MEDICAL PROPERTIES TRUST, INC. AND SUBSIDIARIES

Consolidated Balance Sheets

(Amounts in thousands, except per share data)

| | | | | | | | |

| | | December 31, 2017 | | | December 31, 2016 | |

| | | (Unaudited) | | | (A) | |

ASSETS | | | | | | | | |

Real estate assets | | | | | | | | |

Land, buildings and improvements, intangible lease assets, and other | | $ | 5,944,220 | | | $ | 4,317,866 | |

Net investment in direct financing leases | | | 698,727 | | | | 648,102 | |

Mortgage loans | | | 1,778,316 | | | | 1,060,400 | |

| | | | | | | | |

Gross investment in real estate assets | | | 8,421,263 | | | | 6,026,368 | |

Accumulated depreciation and amortization | | | (455,712 | ) | | | (325,125 | ) |

| | | | | | | | |

Net investment in real estate assets | | | 7,965,551 | | | | 5,701,243 | |

Cash and cash equivalents | | | 171,472 | | | | 83,240 | |

Interest and rent receivables | | | 78,970 | | | | 57,698 | |

Straight-line rent receivables | | | 185,592 | | | | 116,861 | |

Other assets | | | 618,703 | | | | 459,494 | |

| | | | | | | | |

Total Assets | | $ | 9,020,288 | | | $ | 6,418,536 | |

| | | | | | | | |

LIABILITIES AND EQUITY | | | | | | | | |

Liabilities | | | | | | | | |

Debt, net | | $ | 4,898,667 | | | $ | 2,909,341 | |

Accounts payable and accrued expenses | | | 211,188 | | | | 207,711 | |

Deferred revenue | | | 18,178 | | | | 19,933 | |

Lease deposits and other obligations to tenants | | | 57,050 | | | | 28,323 | |

| | | | | | | | |

Total Liabilities | | | 5,185,083 | | | | 3,165,308 | |

Equity | | | | | | | | |

Preferred stock, $0.001 par value. Authorized 10,000 shares; no shares outstanding | | | — | | | | — | |

Common stock, $0.001 par value. Authorized 500,000 shares; issued and outstanding - 364,424 shares at December 31, 2017 and 320,514 shares at December 31, 2016 | | | 364 | | | | 321 | |

Additionalpaid-in capital | | | 4,333,027 | | | | 3,775,336 | |

Distributions in excess of net income | | | (485,932 | ) | | | (434,114 | ) |

Accumulated other comprehensive loss | | | (26,049 | ) | | | (92,903 | ) |

Treasury shares, at cost | | | (777 | ) | | | (262 | ) |

| | | | | | | | |

Total Medical Properties Trust, Inc. Stockholders’ Equity | | | 3,820,633 | | | | 3,248,378 | |

Non-controlling interests | | | 14,572 | | | | 4,850 | |

| | | | | | | | |

Total Equity | | | 3,835,205 | | | | 3,253,228 | |

| | | | | | | | |

Total Liabilities and Equity | | $ | 9,020,288 | | | $ | 6,418,536 | |

| | | | | | | | |

| (A) | Financials have been derived from the prior year audited financial statements. |

Q4 2017 | SUPPLEMENTAL INFORMATION 16

MEDICALPROPERTIESTRUST.COM

FINANCIAL STATEMENTS

OTHER INCOME GENERATING ASSETS AS OF DECEMBER 31, 2017

($ amounts in thousands)

| | | | | | | | | | | | | | |

Operator | | Investment | | | Annual

Interest

Rate | | | YTD RIDEA

Income(A) | | | Security / Credit Enhancements |

Non-Operating Loans | | | | | | | | | | | | | | |

Vibra Healthcare acquisition loan(B) | | $ | 4,332 | | | | 10.25 | % | | | | | | Secured and cross-defaulted with real estate, other agreements and guaranteed by Parent |

Alecto working capital | | | 12,500 | | | | 11.44 | % | | | | | | Secured and cross-defaulted with real estate and guaranteed by Parent |

IKJG/HUMC working capital | | | 3,002 | | | | 10.40 | % | | | | | | Secured and cross-defaulted with real estate and guaranteed by Parent |

Ernest Health | | | 21,854 | | | | 9.45 | % | | | | | | Secured and cross-defaulted with real estate and guaranteed by Parent |

Other | | | 15,321 | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | $ | 57,009 | | | | | | | | | | | |

Operating Loans | | | | | | | | | | | | | | |

Ernest Health(C) | | $ | 93,200 | | | | 15.00 | % | | $ | 15,617 | | | Secured and cross-defaulted with real estate and guaranteed by Parent |

| | | | | | | | | | | | | | |

| | $ | 93,200 | | | | | | | | 15,617 | | | |

Equity investments(D) | | | | | | | | | | | | | | |

Domestic | | $ | 164,332 | | | | | | | $ | 5,677 | | | |

International(E) | | $ | 124,065 | | | | | | | $ | 6,882 | (F) | | |

| (A) | Income earned on operating loans is reflected in the interest income line of the income statement. |

| (B) | Original amortizing acquisition loan was $41 million; loan matures in 2019. |

| (C) | Due to compounding, effective interest rate is 16.8%. |

| (D) | All earnings in income from equity investments are reported on a one quarter lag basis. |

| (E) | Includes equity investments in Spain, Italy, and Germany. |

| (F) | Excludes our share of real estate depreciation and acquisition expenses of certain unconsolidated joint ventures. |

Q4 2017 | SUPPLEMENTAL INFORMATION 17

1000 Urban Center Drive, Suite 501 Birmingham, AL 35242 (205)969-3755 NYSE: MPW www.medicalpropertiestrust.com Contact: Tim Berryman, Director—Investor Relations (205)397-8589 or tberryman@medicalpropertiestrust.com or Charles Lambert, Managing Director—Capital Markets (205)397-8897 or clambert@medicalpropertiestrust.com At the Very heArt of heAlthcAre® .