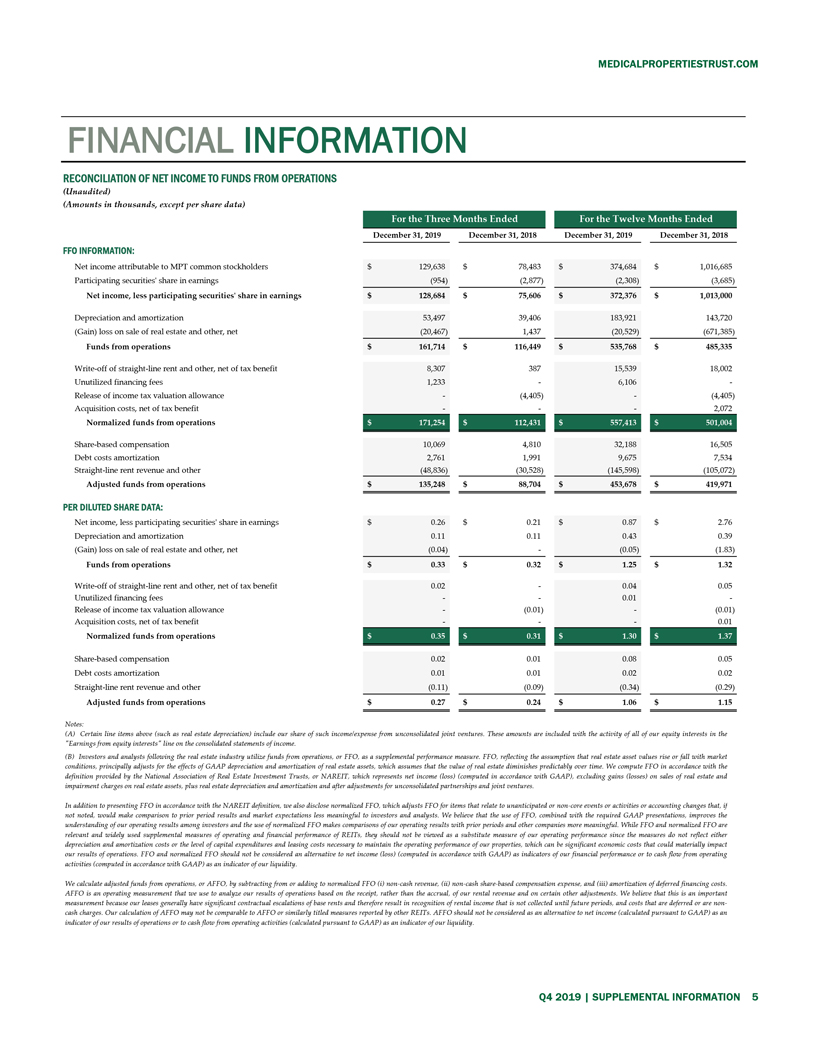

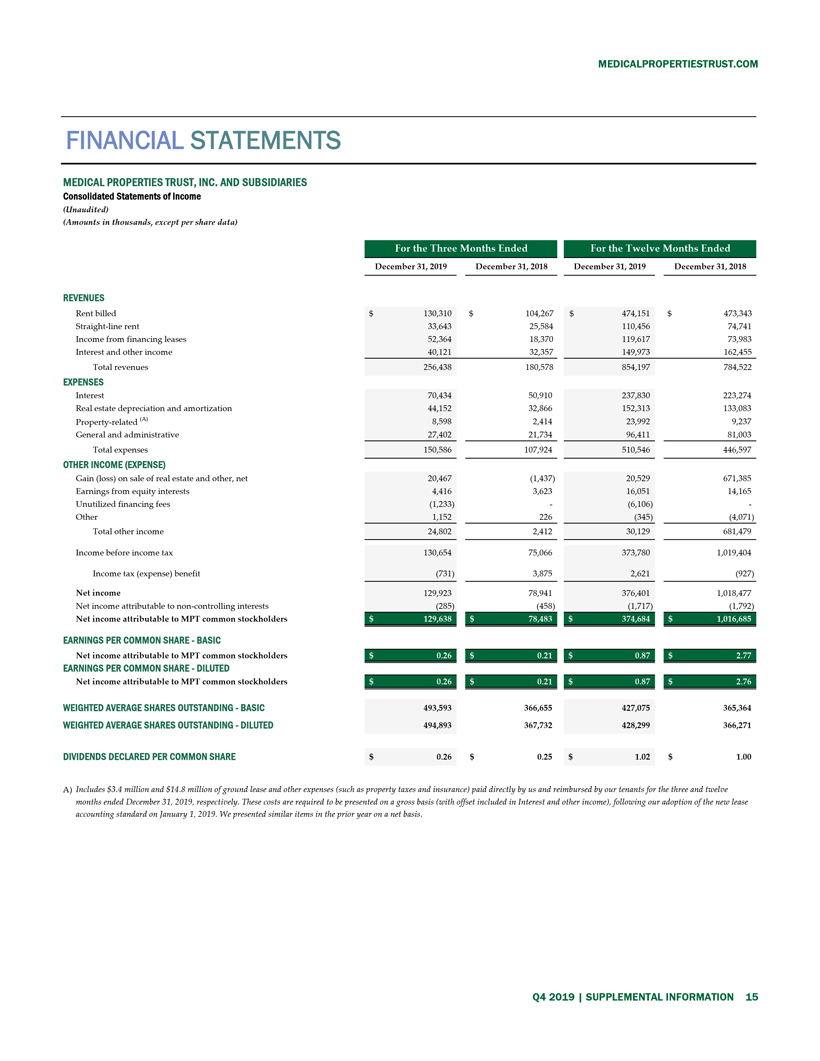

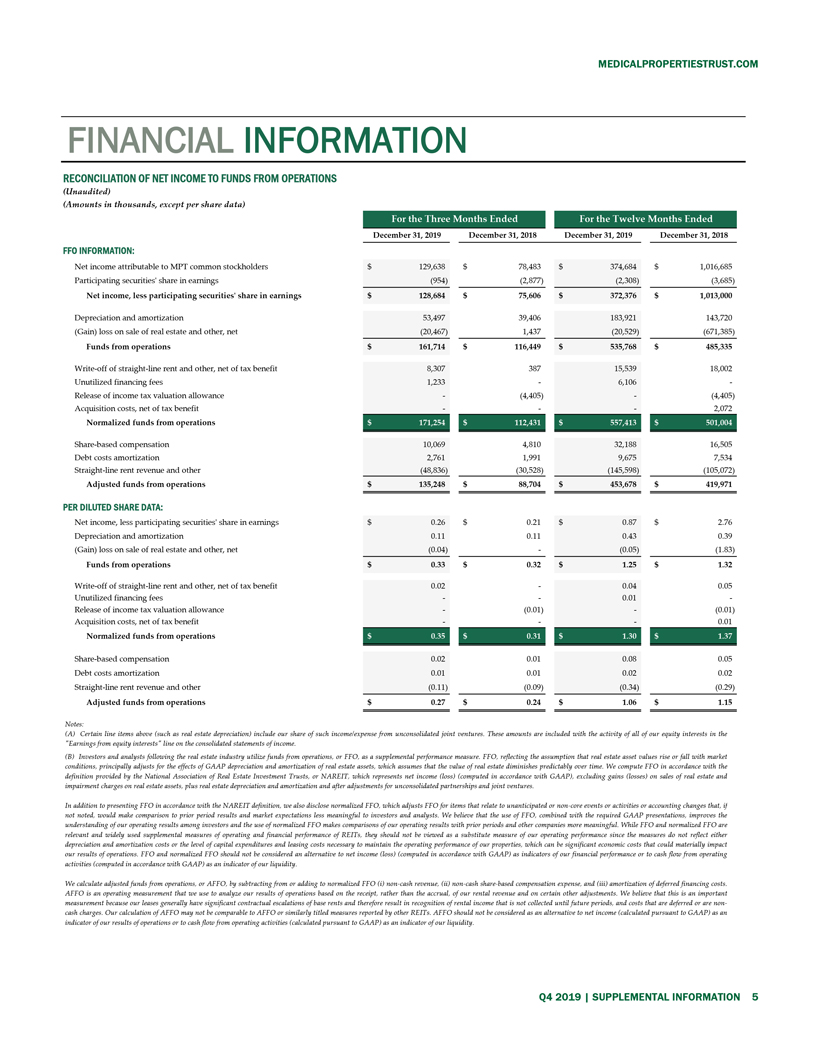

FINANCIAL INFORMATION RECONCILIATION OF NET INCOME TO FUNDS FROM OPERATIONS (Unaudited) (Amounts in thousands, except per share data) December 31, 2019 December 31, 2018 December 31, 2019 December 31, 2018 FFO INFORMATION: Net income attributable to MPT common stockholders $ 129,638 $ 78,483 $ 374,684 $ 1,016,685 Participating securities’ share in earnings (954) (2,877) (2,308) (3,685) Net income, less participating securities’ share in earnings $ 128,684 $ 75,606 $ 372,376 $ 1,013,000 Depreciation and amortization 53,497 39,406 183,921 143,720 (Gain) loss on sale of real estate and other, net (20,467) 1,437 (20,529) (671,385) Funds from operations $ 161,714 $ 116,449 $ 535,768 $ 485,335Write-off of straight-line rent and other, net of tax benefit 8,307 387 15,539 18,002 Unutilized financing fees 1,233 — 6,106 — Release of income tax valuation allowance — (4,405) — (4,405) Acquisition costs, net of tax benefit — — — 2,072 Normalized funds from operations Share-based compensation 10,069 4,810 32,188 16,505 Debt costs amortization 2,761 1,991 9,675 7,534 Straight-line rent revenue and other (48,836) (30,528) (145,598) (105,072) Adjusted funds from operations $ 135,248 $ 88,704 $ 453,678 $ 419,971 PER DILUTED SHARE DATA: Net income, less participating securities’ share in earnings $ 0.26 $ 0.21 $ 0.87 $ 2.76 Depreciation and amortization 0.11 0.11 0.43 0.39 (Gain) loss on sale of real estate and other, net (0.04) — (0.05) (1.83) Funds from operations $ 0.33 $ 0.32 $ 1.25 $ 1.32Write-off of straight-line rent and other, net of tax benefit 0.02 — 0.04 0.05 Unutilized financing fees — — 0.01 — Release of income tax valuation allowance — (0.01) — (0.01) Acquisition costs, net of tax benefit — — — 0.01 Normalized funds from operations Share-based compensation 0.02 0.01 0.08 0.05 Debt costs amortization 0.01 0.01 0.02 0.02 Straight-line rent revenue and other (0.11) (0.09) (0.34) (0.29) Adjusted funds from operations $ 0.27 $ 0.24 $ 1.06 $ 1.15 Notes: (A) Certain line items above (such as real estate depreciation) include our share of such income/expense from unconsolidated joint ventures. These amounts are included with the activity of all of our equity interests in the “Earnings from equity interests” line on the consolidated statements of income. (B) Investors and analysts following the real estate industry utilize funds from operations, or FFO, as a supplemental performance measure. FFO, reflecting the assumption that real estate asset values rise or fall with market conditions, principally adjusts for the effects of GAAP depreciation and amortization of real estate assets, which assumes that the value of real estate diminishes predictably over time. We compute FFO in accordance with the definition provided by the National Association of Real Estate Investment Trusts, or NAREIT, which represents net income (loss) (computed in accordance with GAAP), excluding gains (losses) on sales of real estate and impairment charges on real estate assets, plus real estate depreciation and amortization and after adjustments for unconsolidated partnerships and joint ventures. In addition to presenting FFO in accordance with the NAREIT definition, we also disclose normalized FFO, which adjusts FFO for items that relate to unanticipated ornon-core events or activities or accounting changes that, if not noted, would make comparison to prior period results and market expectations less meaningful to investors and analysts. We believe that the use of FFO, combined with the required GAAP presentations, improves the understanding of our operating results among investors and the use of normalized FFO makes comparisons of our operating results with prior periods and other companies more meaningful. While FFO and normalized FFO are relevant and widely used supplemental measures of operating and financial performance of REITs, they should not be viewed as a substitute measure of our operating performance since the measures do not reflect either depreciation and amortization costs or the level of capital expenditures and leasing costs necessary to maintain the operating performance of our properties, which can be significant economic costs that could materially impact our results of operations. FFO and normalized FFO should not be considered an alternative to net income (loss) (computed in accordance with GAAP) as indicators of our financial performance or to cash flow from operating activities (computed in accordance with GAAP) as an indicator of our liquidity. We calculate adjusted funds from operations, or AFFO, by subtracting from or adding to normalized FFO(i) non-cash revenue,(ii) non-cash share-based compensation expense, and (iii) amortization of deferred financing costs. AFFO is an operating measurement that we use to analyze our results of operations based on the receipt, rather than the accrual, of our rental revenue and on certain other adjustments. We believe that this is an important measurement because our leases generally have significant contractual escalations of base rents and therefore result in recognition of rental income that is not collected until future periods, and costs that are deferred or arenon-cash charges. Our calculation of AFFO may not be comparable to AFFO or similarly titled measures reported by other REITs. AFFO should not be considered as an alternative to net income (calculated pursuant to GAAP) as an indicator of our results of operations or to cash flow from operating activities (calculated pursuant to GAAP) as an indicator of our liquidity. Q4 2019 | SUPPLEMENTAL INFORMATION 5