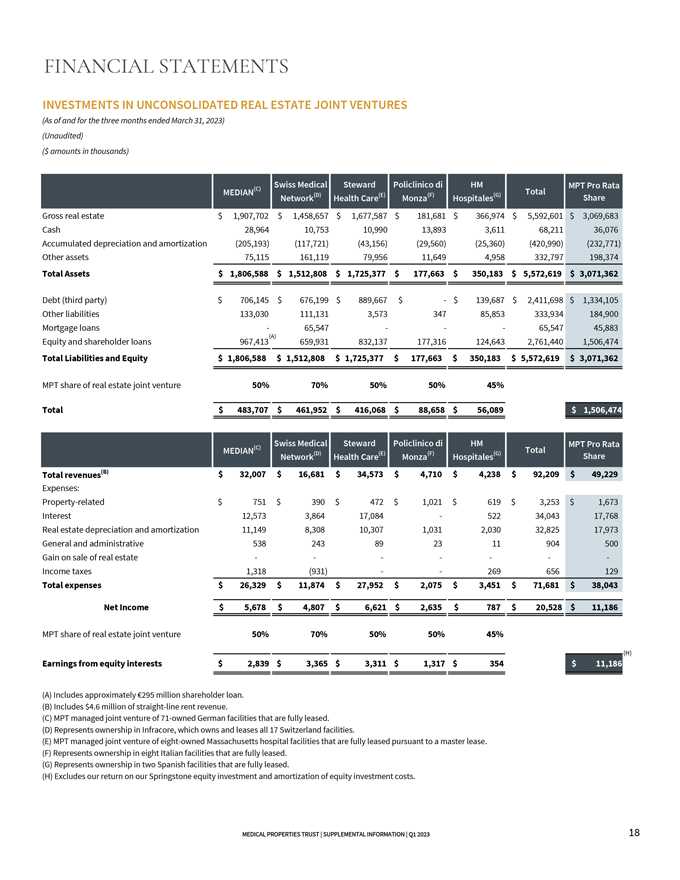

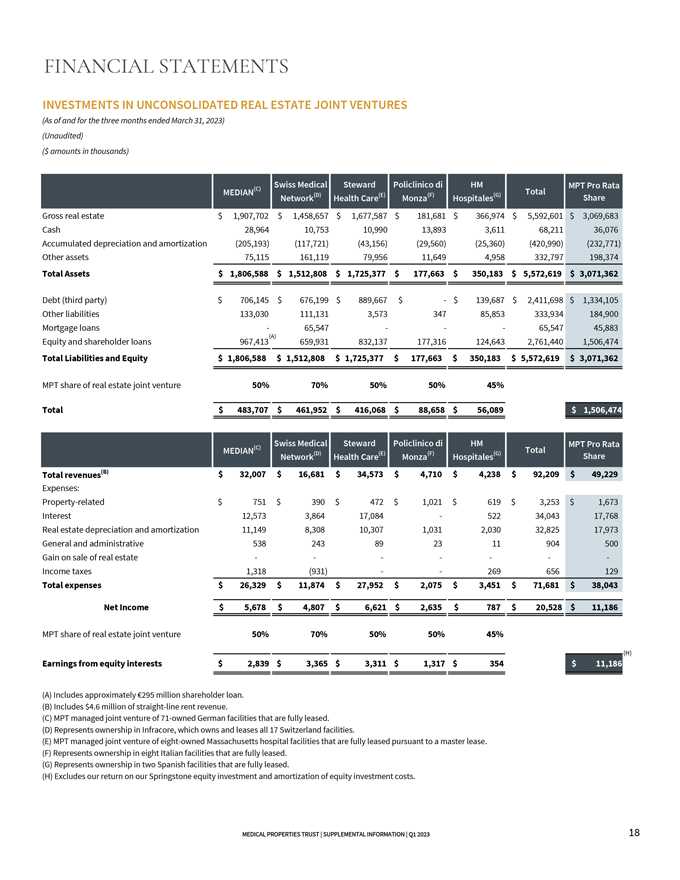

FINANCIAL STATEMENTS INVESTMENTS IN UNCONSOLIDATED REAL ESTATE JOINT VENTURES (As of and for the three months ended March 31, 2023) (Unaudited) ($ amounts in thousands) Swiss Medical Steward Policlinico di HM MPT Pro Rata MEDIAN(C) (D) (E) (F) (G) Total Network Health Care Monza Hospitales Share Gross real estate $ 1,907,702 $ 1,458,657 $ 1,677,587 $ 181,681 $ 366,974 $ 5,592,601 $ 3,069,683 Cash 28,964 10,753 10,990 13,893 3,611 68,211 36,076 Accumulated depreciation and amortization (205,193) (117,721) (43,156) (29,560) (25,360) (420,990) (232,771) Other assets 75,115 161,119 79,956 11,649 4,958 332,797 198,374 Total Assets $ 1,806,588 $ 1,512,808 $ 1,725,377 $ 177,663 $ 350,183 $ 5,572,619 $ 3,071,362 Debt (third party) $ 706,145 $ 676,199 $ 889,667 $ — $ 139,687 $ 2,411,698 $ 1,334,105 Other liabilities 133,030 111,131 3,573 347 85,853 333,934 184,900 Mortgage loans — 65,547 — — — 65,547 45,883 (A) Equity and shareholder loans 967,413 659,931 832,137 177,316 124,643 2,761,440 1,506,474 Total Liabilities and Equity $ 1,806,588 $ 1,512,808 $ 1,725,377 $ 177,663 $ 350,183 $ 5,572,619 $ 3,071,362 MPT share of real estate joint venture 50% 70% 50% 50% 45% Total $ 483,707 $ 461,952 $ 416,068 $ 88,658 $ 56,089 $ 1,506,474 Swiss Medical Steward Policlinico di HM MPT Pro Rata MEDIAN(C) (D) (E) (F) (G) Total Network Health Care Monza Hospitales Share Total revenues(B) $ 32,007 $ 16,681 $ 34,573 $ 4,710 $ 4,238 $ 92,209 $ 49,229 Expenses: Property-related $ 751 $ 390 $ 472 $ 1,021 $ 619 $ 3,253 $ 1,673 Interest 12,573 3,864 17,084— 522 34,043 17,768 Real estate depreciation and amortization 11,149 8,308 10,307 1,031 2,030 32,825 17,973 General and administrative 538 243 89 23 11 904 500 Gain on sale of real estate — —— — — -Income taxes 1,318 (931) — 269 656 129 Total expenses $ 26,329 $ 11,874 $ 27,952 $ 2,075 $ 3,451 $ 71,681 $ 38,043 Net Income $ 5,678 $ 4,807 $ 6,621 $ 2,635 $ 787 $ 20,528 $ 11,186 MPT share of real estate joint venture 50% 70% 50% 50% 45% (H) Earnings from equity interests $ 2,839 $ 3,365 $ 3,311 $ 1,317 $ 354 $ 11,186 (A) Includes approximately €295 million shareholder loan. (B) Includes $4.6 million of straight-line rent revenue. (C) MPT managed joint venture of 71-owned German facilities that are fully leased. (D) Represents ownership in Infracore, which owns and leases all 17 Switzerland facilities. (E) MPT managed joint venture of eight-owned Massachusetts hospital facilities that are fully leased pursuant to a master lease. (F) Represents ownership in eight Italian facilities that are fully leased. (G) Represents ownership in two Spanish facilities that are fully leased. (H) Excludes our return on our Springstone equity investment and amortization of equity investment costs. MEDICAL PROPERTIES TRUST | SUPPLEMENTAL INFORMATION | Q1 2023 18