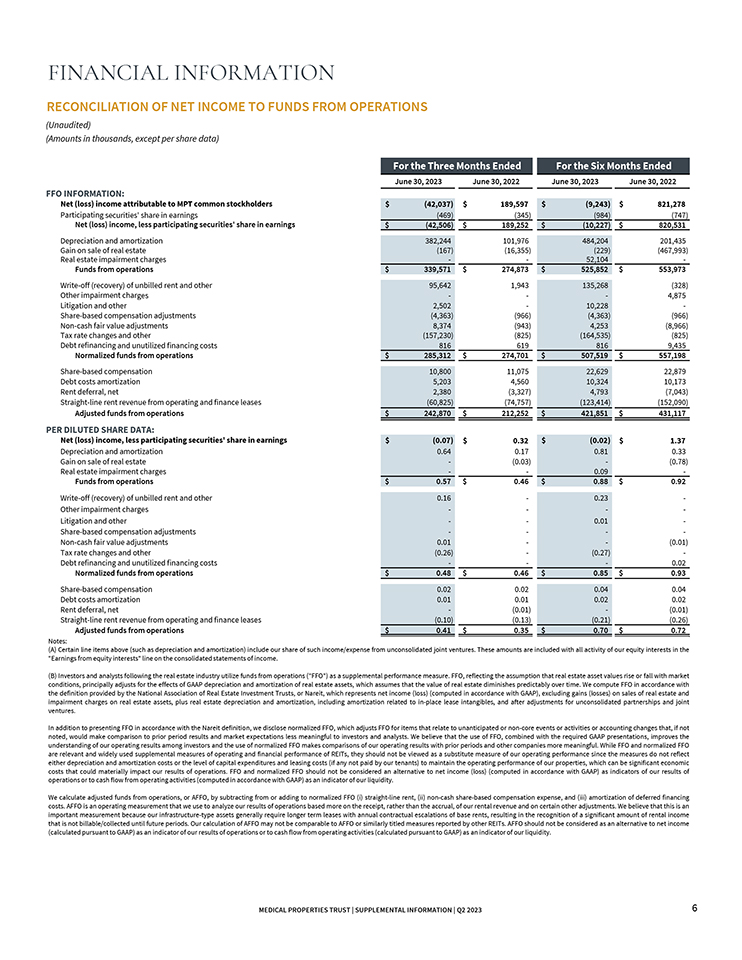

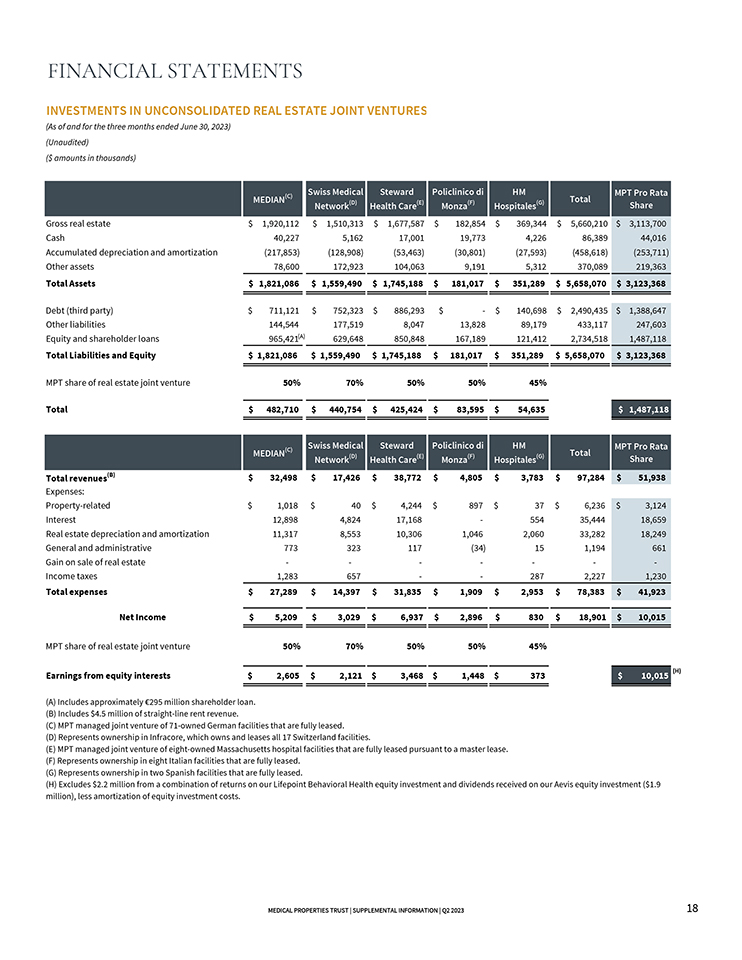

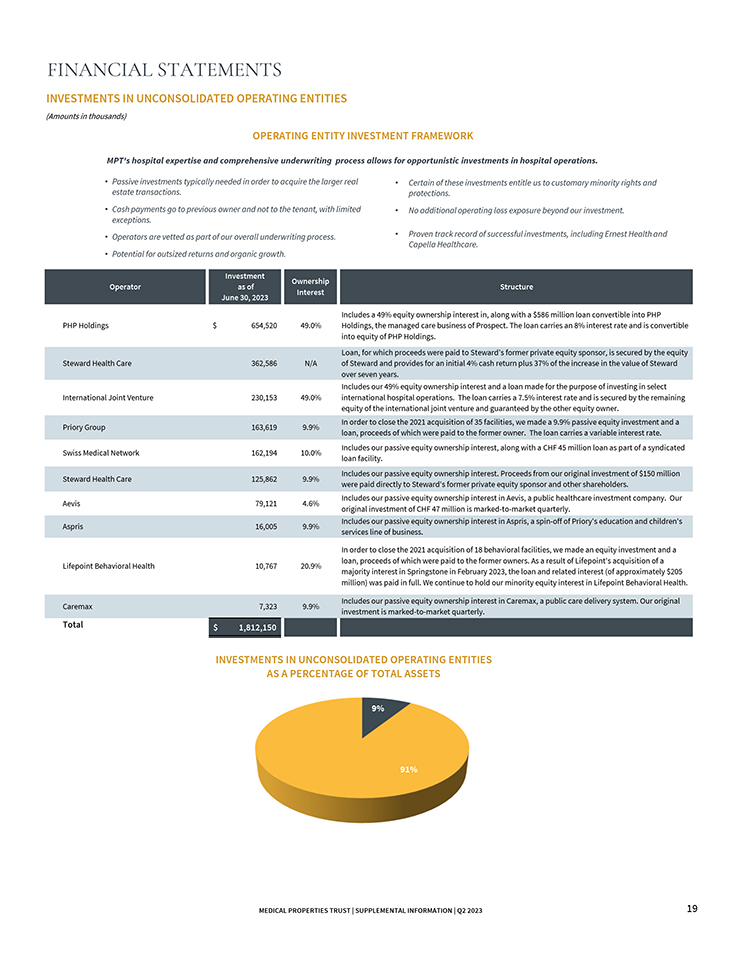

FINANCIAL STATEMENTS INVESTMENTS IN UNCONSOLIDATED REAL ESTATE JOINT VENTURES (As of and for the three months ended June 30, 2023) (Unaudited) ($ amounts in thousands) MEDIAN(C) Swiss Medical Network(D) Steward Health Care(E) Policlinico di Monza(F) HM Hospitales(G) Total MPT Pro Rata Share Gross real estate $ 1,920,112 $ 1,510,313 $ 1,677,587 $ 182,854 $ 369,344 $ 5,660,210 $ 3,113,700 Cash 40,227 5,162 17,001 19,773 4,226 86,389 44,016 Accumulated depreciation and amortization (217,853) (128,908) (53,463) (30,801) (27,593) (458,618) (253,711) Other assets 78,600 172,923 104,063 9,191 5,312 370,089 219,363 Total Assets $ 1,821,086 $ 1,559,490 $ 1,745,188 $ 181,017 $ 351,289 $ 5,658,070 $ 3,123,368 Debt (third party) $ 711,121 $ 752,323 $ 886,293 $ - $ 140,698 $ 2,490,435 $ 1,388,647 Other liabilities 144,544 177,519 8,047 13,828 89,179 433,117 247,603 Equity and shareholder loans 965,421(A) 629,648 850,848 167,189 121,412 2,734,518 1,487,118 Total Liabilities and Equity $ 1,821,086 $ 1,559,490 $ 1,745,188 $ 181,017 $ 351,289 $ 5,658,070 $ 3,123,368 MPT share of real estate joint venture 50% 70% 50% 50% 45% Total $ 482,710 $ 440,754 $ 425,424 $ 83,595 $ 54,635 $ 1,487,118 MEDIAN(C) Swiss Medical Network(D) Steward Health Care(E) Policlinico di Monza(F) HM Hospitales(G) Total MPT Pro Rata Share Total revenues(B) $ 32,498 $ 17,426 $ 38,772 $ 4,805 $ 3,783 $ 97,284 $ 51,938 Expenses: Property-related $ 1,018 $ 40 $ 4,244 $ 897 $ 37 $ 6,236 $ 3,124 Interest 12,898 4,824 17,168 - 554 35,444 18,659 Real estate depreciation and amortization 11,317 8,553 10,306 1,046 2,060 33,282 18,249 General and administrative 773 323 117 (34) 15 1,194 661 Gain on sale of real estate - - - - - - - Income taxes 1,283 657 - 287 2,227 1,230 Total expenses $ 27,289 $ 14,397 $ 31,835 $ 1,909 $ 2,953 $ 78,383 $ 41,923 Net Income $ 5,209 $ 3,029 $ 6,937 $ 2 ,896 $ 830 $ 18,901 $ 10,015 MPT share of real estate joint venture 50% 70% 50% 50% 45% Earnings from equity interests $ 2,605 $ 2,121 $ 3,468 $ 1,448 $ 373 $ 10,015 (H) (A) Includes approximately €295 million shareholder loan. (B) Includes $4.5 million of straight-line rent revenue. (C) MPT managed joint venture of 71-owned German facilities that are fully leased. (D) Represents ownership in Infracore, which owns and leases all 17 Switzerland facilities. (E) MPT managed joint venture of eight-owned Massachusetts hospital facilities that are fully leased pursuant to a master lease. (F) Represents ownership in eight Italian facilities that are fully leased. (G) Represents ownership in two Spanish facilities that are fully leased. (H) Excludes $2.2 million from a combination of returns on our Lifepoint Behavioral Health equity investment and dividends received on our Aevis equity investment ($1.9 million), less amortization of equity investment costs. MEDICAL PROPERTIES TRUST | SUPPLEMENTAL INFORMATION | Q2 2023 18