UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21569

Pioneer Asset Allocation Trust

(Exact name of registrant as specified in charter)

60 State Street, Boston, MA 02109

(Address of principal executive offices) (ZIP code)

Terrence J. Cullen, Amundi Pioneer Asset Management, Inc.,

60 State Street, Boston, MA 02109

(Name and address of agent for service)

Registrant’s telephone number, including area code: (617) 742-7825

Date of fiscal year end: July 31, 2020

Date of reporting period: August 1, 2019 through January 31, 2020

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss. 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

Pioneer Solutions –

Balanced Fund

Semiannual Report | January 31, 2020

| | |

| Ticker Symbols: |

Class A | PIALX |

Class C | PIDCX |

Class R | BALRX |

Class Y | IMOYX |

Beginning in March 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer, bank or insurance company. Instead, the reports will be made available on the Fund’s website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications electronically by contacting your financial intermediary or, if you invest directly with the Fund, by calling 1-800-225-6292.

You may elect to receive all future reports in paper free of charge. If you invest directly with the Fund, you can inform the Fund that you wish to continue receiving paper copies of your shareholder reports by calling 1-800-225-6292. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held in your account if you invest through your financial intermediary or all funds held within the Pioneer Fund complex if you invest directly.

visit us: www.amundipioneer.com/us

| |

|

| 2 |

| | |

| 4 |

| | |

| 9 |

| | |

| 10 |

| | |

| 11 |

| | |

| 19 |

| | |

| 21 |

| | |

| 23 |

| | |

| 31 |

| | |

| 40 |

| | |

| 45 |

Pioneer Solutions – Balanced Fund | Semiannual Report | 1/31/20 1

Dear Shareholders,

The new decade has arrived delivering a first quarter that will go down in the history books. The beginning of the year seemed to extend the positive market environment of 2019 and then, March roared in like a lion and the COVID-19 pandemic became a global crisis impacting lives and life as we know it. The impact on the global economy from the COVID-19 virus pandemic, while currently unknown, are likely to be considerable. It is clear that several industries have already felt greater effects than others. And the markets, which do not thrive on uncertainty, have been volatile. Our business continuity plan was implemented given the new COVID-19 guidelines, and most of our employees are working remotely. To date, our operating environment has faced no interruption. I am proud of the careful planning that has taken place and confident we can maintain this environment for as long as is prudent. History in the making for a company that first opened its doors way back in 1928.

Since 1928, Amundi Pioneer’s investment process has been built on a foundation of fundamental research and active management, principles which have guided our investment decisions for more than 90 years. We believe active management – that is, making active investment decisions – can help mitigate the potential risks during periods of market volatility. As the early days of 2020 have reminded us, in today’s global economy, investment risk can materialize from a number of factors, including a slowing economy, changing U.S. Federal Reserve policy, oil price shocks, political and geopolitical factors and, unfortunately, major public health concerns such as a viral pandemic.

At Amundi Pioneer, active management begins with our own fundamental, bottom-up research process. Our team of dedicated research analysts and portfolio managers analyze each security under consideration, communicating directly with the management teams of the companies issuing the securities and working together to identify those securities that best meet our investment criteria for our family of funds. Our risk management approach begins with each and every security, as we strive to carefully understand the potential opportunity, while considering any and all risk factors.

2 Pioneer Solutions – Balanced Fund | Semiannual Report | 1/31/20

Today, as investors, we have many options. It is our view that active management can serve shareholders well, not only when markets are thriving, but also during periods of market stress. As you consider your long-term investment goals, we encourage you to work with your financial advisor to develop an investment plan that paves the way for you to pursue both your short- and long-term goals.

We remain confident that the current crisis, like others in human history, will pass, and we greatly appreciate the trust you have placed in us and look forward to continuing to serve you in the future.

Sincerely,

Lisa M. Jones

Head of the Americas, President and CEO of U.S.

Amundi Pioneer Asset Management USA, Inc.

January 31, 2020

Any information in this shareowner report regarding market or economic trends or the factors influencing the Fund’s historical or future performance are statements of opinion as of the date of this report. Past performance is no guarantee of future results.

Pioneer Solutions – Balanced Fund | Semiannual Report | 1/31/20 3

Portfolio Management Discussion |

1/31/20 In the following interview, portfolio managers Kenneth Taubes and Marco Pirondini discuss the market environment over the six-month period ended January 31, 2020, and the investment strategies applied to Pioneer Solutions –Balanced Fund during the period. Mr. Taubes, Executive Vice President, Chief Investment Officer, U.S., and a portfolio manager at Amundi Pioneer Asset Management, Inc. (Amundi Pioneer), and Mr. Pirondini, Senior Managing Director, Head of Equities, U.S., and a portfolio manager at Amundi Pioneer, are responsible for the day-to-day management of the Fund.

Q How did the Fund perform during the six-month period ended January 31, 2020?

A The Fund’s Class A shares returned 5.23% at net asset value during the six-month period ended January 31, 2020, while the Fund’s blended benchmark, which is comprised of 60% Morgan Stanley Capital International (MSCI) World NR Index1/40% Bloomberg Barclays U.S. Aggregate Bond Index, returned 6.50%. During the same period, the Fund’s market benchmarks, the MSCI World NR Index (the MSCI Index) and the Bloomberg Barclays U.S. Aggregate Bond Index (the Bloomberg Barclays Index), returned 7.94% and 4.20%, respectively, while the average return of the 484 mutual funds in Morningstar’s World Allocation Funds category was 4.10%.

Q Could you characterize the economic and market environment during the six-month period ended January 31, 2020?

A Global equity and fixed-income markets both delivered robust returns thanks to investors’ perception of declining risk for the world economy. After prolonged uncertainty surrounding U.S.-China trade policy through much of the summer, the two countries reached a much-anticipated “Phase One” agreement in December. As part of the initial deal, the U.S agreed to halt fresh tariffs and roll back some of the existing tariffs on Chinese goods;

1 The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages.

4 Pioneer Solutions – Balanced Fund | Semiannual Report | 1/31/20

in return, China agreed to purchase more agricultural products from American farmers. Even though a full trade deal between the two countries was not formalized, the progress in the negotiations was well received by the markets. In addition, the U.S. House of Representatives’ backing of the Trump administration’s deal with Canada and Mexico reduced trade concerns with regard to two of the United States’ largest trading partners.

The markets also benefited from the accommodative monetary policies of the world’s central banks, which helped offset signs of slowing economic growth. In the United States, the economy continued to be driven by consumers amid the lowest unemployment rate of the last 50 years. Elsewhere, the decisive reelection of U.K. Prime Minister Boris Johnson paved the way for Brexit to take place and removed much of the uncertainty that had been swirling since the initial Brexit vote in 2016.

The generally favorable backdrop helped propel global equities to strong gains over the six-month period. U.S. stocks led the way, followed by the developed and emerging international markets, respectively. Global bond markets were also positive, with both credit-sensitive and interest-rate-sensitive asset categories delivering healthy returns.

Q Which of your investment decisions had the biggest effects on the Fund’s benchmark-relative performance during the six-month period ended January 31, 2020?

A During a six-month period that saw global stocks perform well overall, the Fund’s overweight to equities versus fixed-income investments was a sizable contributor to relative returns. However, allocations to European and emerging markets equities – while posting gains in absolute terms – were a hindrance to the Fund’s benchmark-relative performance.

With regard to fixed income, the Fund’s short-duration positioning compared with the Bloomberg Barclays Index detracted from benchmark-relative performance as interest rates generally declined over the six-month period. (Duration is a measure of the sensitivity of the price, or the value of principal, of a fixed-income investment to a change in interest rates, expressed as a number of years.) We maintained a shorter duration compared with the Bloomberg Barclays Index in an attempt to help cushion the portfolio against the potential negative effects of rising

Pioneer Solutions – Balanced Fund | Semiannual Report | 1/31/20 5

interest rates, given the solid economic growth trends in the United States. However, as rates fell and bond prices rallied for much of the six-month period, the short-duration positioning ultimately detracted from the Fund’s relative returns.

Q Did the Fund invest in any derivative securities during the six-month period ended January 31, 2020? If so, did the derivatives have an effect on the Fund’s performance?

A Tactical derivative usage does not constitute a component of the Fund’s investment strategy. While the Fund may invest in derivatives, it did not do so during the six-month period.

Q What factors are you watching most closely as you determine investment strategy for the Fund going forward?

A We have continued to favor owning stocks of cyclical companies – or stocks more exposed to the ebbs and flows of the economic cycle – over noncyclicals based on our expectations that progress toward a formal U.S./China trade agreement would create a positive foundation for the world economy. We have maintained a portfolio bias towards the value style within equities over growth, based on the substantial valuation discount of the former category. Our economic outlook has also prompted us to increase the Fund’s weightings in developed market and emerging markets international stocks, particularly in the financials, energy, and information technology sectors.

Late in the period, the spread of the coronavirus contributed to weakness in stock prices and caused the decline in bond yields to accelerate. We expect concerns over the coronavirus will have a significant impact on global economic growth. The influence of the virus on the world economy is an evolving situation, but the Fund’s underlying allocation incorporates elements of defensiveness through an emphasis on reasonably valued assets and the use of risk-management strategies in the sub-funds in which the Fund invests, as those portfolios can adopt more tactical stances.

4 Pioneer Solutions – Balanced Fund | Semiannual Report | 1/31/20

Please refer to the Schedule of Investments on pages 21–22 for a full listing of fund securities.

All investments are subject to risk, including the possible loss of principal. In the past several years, financial markets have experienced increased volatility, depressed valuations, decreased liquidity and heightened uncertainty. These conditions may continue, recur, worsen or spread.

The Fund is a “fund-of-funds” which seeks to achieve its investment objectives by investing primarily in funds managed by Amundi Pioneer, rather than making direct investments in securities. The Fund’s performance depends on the adviser’s skill in determining the strategic asset allocations, the mix of underlying funds, as well as the performance of those underlying funds. The underlying funds’ performance may be lower than the performance of the asset class that they were selected to represent. In addition to the Fund’s operating expenses, investors will indirectly bear the operating expenses of investments in any underlying funds. Each of the underlying funds has its own investment risks.

At times, the Fund’s investments may represent industries or sectors that are interrelated or have common risks, making them more susceptible to any economic, political, or regulatory developments or other risks affecting those industries and sectors. Investments in equity securities are subject to price fluctuation.

When interest rates rise, the prices of fixed income securities held by the underlying funds will generally fall. Conversely, when interest rates fall, the prices of fixed income securities held by underlying funds will generally rise.

Investments in the Fund are subject to possible loss due to the financial failure of issuers of underlying securities and their inability to meet their debt obligations.

Investing in foreign and/or emerging markets securities involves risks relating to interest rates, currency exchange rates, economic, and political conditions.

Some of the underlying funds may invest in real estate investment trust (REIT) securities, the value of which can fall for a variety of reasons, such as declines in rental income, fluctuating interest rates, poor property management, environmental liabilities, uninsured damage, increased competition, or changes in real estate tax laws.

The Fund may invest in underlying funds with exposure to commodities. The value of commodity-linked derivatives may be affected by changes in overall market movements, commodity index volatility, changes in interest rates, factors affecting a particular industry or commodity, international economic, political and regulatory developments, supply and demand, and governmental regulatory policies.

Pioneer Solutions – Balanced Fund | Semiannual Report | 1/31/20 7

The Fund may use derivatives, such as options, futures, inverse floating rate obligations, swaps, and others, which can be illiquid, may disproportionately increase losses, and have a potentially large impact on fund performance. Derivatives may have a leveraging effect on the Fund.

The Fund may invest in credit default swaps, which may in some cases be illiquid, and they increase credit risk since the fund has exposure to both the issuer of the referenced obligation and the counterparty to the credit default swap.

Some of the underlying funds employ leverage, which increases the volatility of investment returns and subjects the Fund to magnified losses if an underlying fund’s investments decline in value. Some of the underlying funds may employ short selling, a speculative strategy. Unlike the possible loss on a security that is purchased, there is no limit on the amount of loss on an appreciating security that is sold short.

The value of the investments held by the Fund for cash management or temporary defensive purposes may be affected by market risks, changing interest rates, and by changes in credit ratings of the investments. If the Fund holds cash uninvested, the Fund will not earn income on the cash and the Fund’s yield will go down. These risks may increase share price volatility.

There is no assurance that these and other strategies used by the Fund will be successful. Please see the prospectus for a more complete discussion of the Fund’s risks.

Before making an investment in any fund, you should consider all the risks associated with it.

Before investing, consider the product’s investment objectives, risks, charges and expenses. Contact your advisor or Amundi Pioneer Asset Management, Inc., for a prospectus or summary prospectus containing this information. Read it carefully.

Any information in this shareowner report regarding market or economic trends or the factors influencing the Fund’s historical or future performance are statements of opinion as of the date of this report. Past performance is no guarantee of future results.

8 Pioneer Solutions – Balanced Fund | Semiannual Report | 1/31/20

Portfolio Summary |

1/31/20 Asset Allocations

(As a percentage of total investments)*Actual Portfolio Holdings

(As a percentage of total investments)*

| | | | |

| Balanced/Flexible | | | |

Pioneer Multi-Asset Income Fund Class K | | | 30.29 | % |

Pioneer Flexible Opportunities Fund Class K | | | 20.63 | |

| International Equities | | | | |

Pioneer Global Equity Fund Class K | | | 12.32 | % |

Pioneer International Equity Fund Class Y | | | 11.97 | |

| Fixed Income | | | |

Pioneer Strategic Income Fund Class K | | | 4.48 | % |

Pioneer ILS Interval Fund | | | 3.06 | |

Pioneer Multi-Asset Ultrashort Income Fund Class K

| | | 2.61

| |

Pioneer Corporate High Yield Fund Class Y | | | 1.18 | |

Pioneer Bond Fund Class K | | | 0.26 | |

| U.S. Equities | | | | |

Pioneer Core Equity Fund Class K | | | 4.02 | % |

Pioneer Equity Income Fund Class K | | | 3.49 | |

Pioneer Fund Class K | | | 3.08 | |

Pioneer Fundamental Growth Fund Class K | | | 2.61 | |

Annual and semiannual reports for the underlying Pioneer funds may be obtained on the funds’ web page(s) at www.amundipioneer.com/us.

* Excludes temporary cash investments and all derivative contracts except for options purchased. The Fund is actively managed, and current holdings may be different. The holdings listed should not be considered recommendations to buy or sell any securities.

Pioneer Solutions – Balanced Fund | Semiannual Report | 1/31/20 9

Prices and Distributions | 1/31/20 | |

|

| Net Asset Value per Share | | |

| Class | 1/31/20 | 7/31/19 |

| A | $11.16 | $11.29 |

| C | $10.19 | $10.32 |

| R | $11.10 | $11.19 |

| Y | $11.33 | $11.46 |

| | | | |

| Distributions per Share: 8/1/19–1/31/20 | |

| Net Investment | Short-Term | Long-Term |

| Class | Income | Capital Gains | Capital Gains |

A

| $0.3630 | $ — | $0.3624 |

| C | $0.2799 | $ — | $0.3624 |

| R | $0.3103 | $ — | $0.3624 |

| Y | $0.3869 | $ — | $0.3624 |

The Morgan Stanley Capital International (MSCI) World NR Index is an unmanaged measure of the performance of stock markets in the developed world. The Bloomberg Barclays U.S. Aggregate Bond Index is an unmanaged measure of the U.S. bond market. Index returns are calculated monthly, assume reinvestment of dividends and, unlike Fund returns, do not reflect any fees, expenses or sales charges. It is not possible to invest directly in an index.

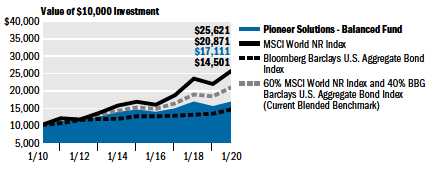

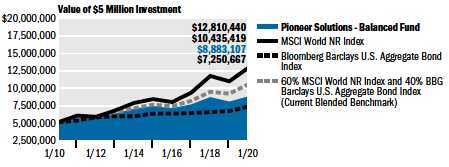

The indices defined here pertain to the “Value of $10,000 Investment” and “Value of $5 Million Investment” charts on pages 11–18.

10 Pioneer Solutions – Balanced Fund | Semiannual Report | 1/31/20

| | |

Performance Update | 1/31/20 | Class A Shares |

Investment Returns

The mountain chart below shows the change in value of a $10,000 investment made in Class A shares of Pioneer Solutions – Balanced Fund at public offering price during the periods shown, compared to that of the MSCI World NR Index and the Bloomberg Barclays U.S. Aggregate Bond Index, and the Fund’s blended benchmark.

| | | | | | |

| Average Annual Total Returns | | | | |

(As of January 31, 2020) | | | | |

| | Public | | Bloomberg | 60% MSCI World NR |

| Net Asset | Offering | | Barclays | Index/40% Bloomberg |

| Value | Price | MSCI World | U.S. Aggregate | Barclays U.S. Aggregate |

| Period | (NAV) | (POP) | NR Index | Bond Index | Bond Index |

10 years | 5.63% | 5.00% | 9.87% | 3.79% | 7.64% |

5 years | 3.20 | 1.98 | 9.00 | 3.01 | 6.76 |

1 year | 8.89 | 2.63 | 17.73 | 9.64 | 14.65 |

| |

| Expense Ratio |

(Per prospectus dated December 1, 2019) |

| Gross |

1.12% |

Call 1-800-225-6292 or visit www.amundipioneer.com/us for the most recent month-end performance results. Current performance may be lower or higher than the performance data quoted.

The performance data quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, and shares, when redeemed, may be worth more or less than their original cost.

(Please see the following page for additional performance and expense disclosure)

Pioneer Solutions – Balanced Fund | Semiannual Report | 1/31/20 11

NAV results represent the percent change in net asset value per share. POP returns reflect deduction of the maximum 5.75% sales charge. NAV returns would have been lower had sales charges been reflected. All results are historical and assume the reinvestment of dividends and capital gains. Other share classes are available for which performance and expenses will differ.

Performance results shown reflect any applicable expense waivers in effect during the periods shown. Without such waivers Fund performance would be lower. Waivers may not be in effect for all funds. Certain fee waivers are contractual through a specified period. Otherwise, fee waivers can be rescinded at any time. See the prospectus and financial statements for more information.

Please see the financial highlights for a more recent expense ratio. Expense ratios in the financial highlights, unlike those shown in the prospectus, do not reflect acquired fund fees and expenses.

The performance table and graph do not reflect the deduction of fees and taxes that a shareowner would pay on Fund distributions or the redemption of Fund shares.

Effective November 17, 2014, Amundi Pioneer became directly responsible for portfolio management of the Fund. The performance shown for periods prior to November 17, 2014, reflects the investment strategies employed during those periods.

12 Pioneer Solutions – Balanced Fund | Semiannual Report | 1/31/20

| | |

Performance Update | 1/31/20 | Class C Shares |

Investment Returns

The mountain chart below shows the change in value of a $10,000 investment made in Class C shares of Pioneer Solutions – Balanced Fund during the periods shown, compared to that of the MSCI World NR Index and the Bloomberg Barclays U.S. Aggregate Bond Index, and the Fund’s blended benchmark.

| | | | | | |

| Average Annual Total Returns | | | | |

(As of January 31, 2020) | | | | |

| | | | Bloomberg | 60% MSCI World NR |

| | | | Barclays | Index/40% Bloomberg |

| If | If | MSCI World | U.S. Aggregate | Barclays U.S. Aggregate |

| Period | Held | Redeemed | NR Index | Bond Index | Bond Index |

10 years | 4.88% | 4.88% | 9.87% | 3.79% | 7.64% |

5 years | 2.46 | 2.46 | 9.00 | 3.01 | 6.76 |

1 year | 8.06 | 8.06 | 17.73 | 9.64 | 14.65 |

| |

| Expense Ratio |

(Per prospectus dated December 1, 2019) |

| Gross |

1.86% |

Call 1-800-225-6292 or visit www.amundipioneer.com/us for the most recent month-end performance results. Current performance may be lower or higher than the performance data quoted.

The performance data quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, and shares, when redeemed, may be worth more or less than their original cost.

(Please see the following page for additional performance and expense disclosure)

Pioneer Solutions – Balanced Fund | Semiannual Report | 1/31/20 13

Class C shares held for less than one year are also subject to a 1% contingent deferred sales charge (CDSC). “If Held” results represent the percent change in net asset value per share. NAV returns would have been lower had sales charges been reflected. All results are historical and assume the reinvestment of dividends and capital gains. Other share classes are available for which performance and expenses will differ.

Performance results shown reflect any applicable expense waivers in effect during the periods shown. Without such waivers Fund performance would be lower. Waivers may not be in effect for all funds. Certain fee waivers are contractual through a specified period. Otherwise, fee waivers can be rescinded at any time. See the prospectus and financial statements for more information.

Please see the financial highlights for a more recent expense ratio. Expense ratios in the financial highlights, unlike those shown in the prospectus, do not reflect acquired fund fees and expenses.

The performance table and graph do not reflect the deduction of fees and taxes that a shareowner would pay on Fund distributions or the redemption of Fund shares.

Effective November 17, 2014, Amundi Pioneer became directly responsible for portfolio management of the Fund. The performance shown for periods prior to November 17, 2014, reflects the investment strategies employed during those periods.

14 Pioneer Solutions – Balanced Fund | Semiannual Report | 1/31/20

| | |

Performance Update | 1/31/20 | Class R Shares |

Investment Returns

The mountain chart below shows the change in value of a $10,000 investment made in Class R shares of Pioneer Solutions – Balanced Fund during the periods shown, compared to that of the MSCI World NR Index and the Bloomberg Barclays U.S. Aggregate Bond Index, and the Fund’s blended benchmark.

| | | | | |

| Average Annual Total Returns | | | |

(As of January 31, 2020) | | | |

| | | Bloomberg | 60% MSCI World NR |

| Net Asset | | Barclays | Index/40% Bloomberg |

| Value | MSCI World | U.S. Aggregate | Barclays U.S. Aggregate |

| Period | (NAV) | NR Index | Bond Index | Bond Index |

10 years | 5.52% | 9.87% | 3.79% | 7.64% |

5 years | 2.98 | 9.00 | 3.01 | 6.76 |

1 year | 8.67 | 17.73 | 9.64 | 14.65 |

| | |

| Expense Ratio | |

(Per prospectus dated December 1, 2019) |

| Gross | Net |

1.70% | 1.45% |

Call 1-800-225-6292 or visit www.amundipioneer.com/us for the most recent month-end performance results. Current performance may be lower or higher than the performance data quoted.

The performance data quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, and shares, when redeemed, may be worth more or less than their original cost.

(Please see the following page for additional performance and expense disclosure)

Pioneer Solutions – Balanced Fund | Semiannual Report | 1/31/20 15

The performance shown for Class R shares for the period prior to the commencement of operations of Class R shares on July 1, 2015, is the net asset value performance of the Fund’s Class A shares, which has not been restated to reflect any differences in expenses, including Rule 12b-1 fees applicable to Class A shares. Since fees for Class A shares generally are higher than those of Class R shares, the performance of Class R shares prior to their inception would have been higher than the performance shown. For the period beginning July 1, 2015, the actual performance of Class R shares is reflected. Class R shares are not subject to sales charges and are available for limited groups of eligible investors, including institutional investors. All results are historical and assume the reinvestment of dividends and capital gains. Other share classes are available for which performance and expenses will differ.

Performance results reflect any applicable expense waivers in effect during the periods shown. Without such waivers Fund performance would be lower. Waivers may not be in effect for all funds. Certain fee waivers are contractual through a specified period. Otherwise, fee waivers can be rescinded at any time. See the prospectus and financial statements for more information.

The net expense ratio reflects the contractual expense limitation currently in effect through December 1, 2020, for Class R shares. There can be no assurance that Amundi Pioneer will extend the expense limitation beyond such time. Please see the prospectus and financial statements for more information.

Please see the financial highlights for more recent expense ratios. Expense ratios in the financial highlights, unlike those shown in the prospectus, do not reflect acquired fund fees and expenses.

The performance table and graph do not reflect the deduction of fees and taxes that a shareowner would pay on Fund distributions or the redemption of Fund shares.

Effective November 17, 2014, Amundi Pioneer became directly responsible for portfolio management of the Fund. The performance shown for periods prior to November 17, 2014, reflects the investment strategies employed during those periods.

16 Pioneer Solutions – Balanced Fund | Semiannual Report | 1/31/20

| | |

Performance Update | 1/31/20 | Class Y Shares |

Investment Returns

The mountain chart below shows the change in value of a $5 million investment made in Class Y shares of Pioneer Solutions – Balanced Fund during the periods shown, compared to that of the MSCI World NR Index and the Bloomberg Barclays U.S. Aggregate Bond Index, and the Fund’s blended benchmark.

| | | | | |

| Average Annual Total Returns | | | |

(As of January 31, 2020) | | | |

| | | Bloomberg | 60% MSCI World NR |

| Net Asset | | Barclays | Index/40% Bloomberg |

| Value | MSCI World | U.S. Aggregate | Barclays U.S. Aggregate |

| Period | (NAV) | NR Index | Bond Index | Bond Index |

10 years | 5.92% | 9.87% | 3.79% | 7.64% |

5 years | 3.42 | 9.00 | 3.01 | 6.76 |

1 year | 9.17 | 17.73 | 9.64 | 14.65 |

| | |

| Expense Ratio | |

(Per prospectus dated December 1, 2019) |

| Gross |

|

0.94% |

|

Call 1-800-225-6292 or visit www.amundipioneer.com/us for the most recent month-end performance results. Current performance may be lower or higher than the performance data quoted.The performance data quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, and shares, when redeemed, may be worth more or less than their original cost.

(Please see the following page for additional performance and expense disclosure)

Pioneer Solutions – Balanced Fund | Semiannual Report | 1/31/20 17

Class Y shares are not subject to sales charges and are available for limited groups of eligible investors, including institutional investors.

All results are historical and assume the reinvestment of dividends and capital gains. Other share classes are available for which performance and expenses will differ.

Performance results shown reflect any applicable expense waivers in effect during the periods shown. Without such waivers Fund performance would be lower. Waivers may not be in effect for all funds. Certain fee waivers are contractual through a specified period. Otherwise, fee waivers can be rescinded at any time. See the prospectus and financial statements for more information.

Please see the financial highlights for a more recent expense ratio. Expense ratios in the financial highlights, unlike those shown in the prospectus, do not reflect acquired fund fees and expenses.

The performance table and graph do not reflect the deduction of fees and taxes that a shareowner would pay on Fund distributions or the redemption of Fund shares.

Effective November 17, 2014, Amundi Pioneer became directly responsible for portfolio management of the Fund. The performance shown for periods prior to November 17, 2014, reflects the investment strategies employed during those periods.

18 Pioneer Solutions – Balanced Fund | Semiannual Report | 1/31/20

Comparing Ongoing Fund Expenses

As a shareowner in the Fund, you incur two types of costs:

(1) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses; and

(2) transaction costs, including sales charges (loads) on purchase payments.

This example is intended to help you understand your ongoing expenses (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 at the beginning of the Fund’s latest six-month period and held throughout the six months.

Using the Tables

Actual Expenses

The first table below provides information about actual account values and actual expenses. You may use the information in this table, together with the amount you invested, to estimate the expenses that you paid over the period as follows:

(1) Divide your account value by $1,000

Example: an $8,600 account value ÷ $1,000 = 8.6

(2) Multiply the result in (1) above by the corresponding share class’s number in the third row under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Expenses Paid on a $1,000 Investment in Pioneer Solutions Balanced Fund

Based on actual returns from August 1, 2019 through January 31, 2020.

| Share Class | A | C | R | Y |

Beginning Account | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 |

Value on 8/1/19 | | | | |

Ending Account Value | $1,052.30 | $1,049.20 | $1,051.70 | $1,053.60 |

(after expenses) | | | | |

on 1/31/20 | | | | |

Expenses Paid | $2.58 | $6.03 | $3.46 | $1.34 |

During Period* | | | | |

* Expenses are equal to the Fund’s annualized net expense ratio of 0.50%, 1.17%, 0.67% and 0.26%, for Class A, Class C, Class R and Class Y shares, respectively, multiplied by the average account value over the period, multiplied by 184/366 to reflect the one half-year period. Fund expense ratios do not include estimates for acquired fund fees and expenses (AFFE). If AFFE estimates were included, expenses paid during the period would have been $6.04, $9.48, $6.91 and $4.80 for Class A, Class C, Class R and Class Y shares, respectively, based on the respective expense ratio for each class of 1.17%, 1.84%, 1.34% and 0.93%.

Pioneer Solutions – Balanced Fund | Semiannual Report | 1/31/20 19

Hypothetical Example for Comparison Purposes

The table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any transaction costs, such as sales charges (loads) that are charged at the time of the transaction. Therefore, the table below is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

Expenses Paid on a $1,000 Investment in Pioneer Solutions Balanced Fund

Based on a hypothetical 5% per year return before expenses, reflecting the period from August 1, 2019 through January 31, 2020.

| Share Class | A | C | R | Y |

Beginning Account | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 |

Value on 8/1/19 | | | | |

Ending Account Value | $1,022.62 | $1,019.25 | $1,021.77 | $1,023.83 |

(after expenses) | | | | |

on 1/31/20 | | | | |

Expenses Paid | $2.54 | $5.94 | $3.40 | $1.32 |

During Period* | | | | |

* Expenses are equal to the Fund’s annualized net expense ratio of 0.50%, 1.17%, 0.67% and 0.26%, for Class A, Class C, Class R and Class Y shares, respectively, multiplied by the average account value over the period, multiplied by 184/366 to reflect the one half-year period. Fund expense ratios do not include estimates for acquired fund fees and expenses (AFFE). If AFFE estimates were included, expenses paid during the period would have been $5.94, $9.32, $6.80 and $4.72 for Class A, Class C, Class R and Class Y shares, respectively, based on the respective expense ratio for each class of 1.17%, 1.84%, 1.34% and 0.93%.

20 Pioneer Solutions – Balanced Fund | Semiannual Report | 1/31/20

| | | | | | | | | |

Schedule of Investments | 1/31/20 (unaudited) | | |

|

|

|

| | | | | Change | | | |

| | | | | in Net | | | |

| | |

| Net

| Unrealized | Capital | | |

| | | Realized | Appreciation | Gain | Dividend | |

| Shares | | | Gain (Loss) | (Depreciation)

| Distributions

| Income | Value |

| | AFFILIATED ISSUERS — 99.0%* | | | | |

| | MUTUAL FUNDS — 96.0% | | | | | |

| 109,720 | | Pioneer Bond Fund Class K | $ 617 | $ 23,200 | $ — | $ 19,019 | $ 1,099,402 |

| 836,586 | | Pioneer Core Equity Fund | | (563,929) | 1,381,114 | 467,272 | 181,547 | 16,991,063 |

| | Class K | | | | | | |

| 483,457 | | Pioneer Corporate High Yield | | — | (3,834) | — | — | 4,955,436 |

| | Fund Class Y | | | | | | |

| 418,874 | | Pioneer Equity Income Fund | | 230,405 | (195,767) | 416,134 | 169,325 | 14,765,305 |

| | Class K | | | | | | |

| 7,090,262 | | Pioneer Flexible Opportunities | (6,006) | 2,443,547 | — | 1,459,509 | 87,210,221 |

| | Fund Class K | | | | | | |

| 433,624 | | Pioneer Fund Class K | | — | (47,699) | — | — | 13,013,042 |

| 403,552 | | Pioneer Fundamental Growth | | 24,730 | 590,734 | 671,674 | 48,991 | 11,033,115 |

| | Fund Class K | | | | | | |

| 3,477,267 | | Pioneer Global Equity Fund | | 27,999 | 3,103,670 | — | 716,833 | 52,089,455 |

| | Class K | | | | | | |

| 2,322,111 | | Pioneer International Equity | | 312,136 | 1,814,165 | 152,924 | 1,178,985 | 50,598,789 |

| | Fund Class Y | | | | | | |

| 11,397,450 | | Pioneer Multi-Asset Income | | (119,906) | 1,485,313 | — | 4,107,673 | 128,107,342 |

| | Fund Class K | | | | | | |

| 1,108,682 | | Pioneer Multi-Asset Ultrashort | | 3,188 | (22,358) | — | 428,755 | 11,020,300 |

| | Income Fund Class K | | | | | | |

| 1,705,669 | | Pioneer Strategic Income | | 396,347 | 159,668 | — | 370,141 | 18,984,096 |

| | Fund Class K | | | | | | |

| | Other affiliated securities not | 1,105,667 | (1,279,109) | 1,074,771 | 70,442 | — |

| | held at period end | | | | | | |

| | TOTAL MUTUAL FUNDS | | | | | | |

| | (Cost $398,566,444) | $ 1,411,248 | $ 9,452,644 | $ 2,782,775 | $ 8,751,220 | $ 409,867,566 |

| | CLOSED-END FUND — 3.0% | | | | |

| 1,554,404 | | Pioneer ILS Interval Fund | | — | (590,674) | — | 857,565 | 12,963,730 |

| | TOTAL CLOSED-END FUND | | | | | | |

| | (Cost $15,000,000) | | — | (590,674) | — | 857,565 | 12,963,730 |

| | TOTAL INVESTMENTS IN AFFILIATED ISSUERS — 99.0% | | | |

| | (Cost $413,566,444) | $ 1,411,248 | $ 8,861,970 | $ 2,782,775 | $ 9,608,785 | $ 422,831,296 |

| | OTHER ASSETS AND LIABILITIES — 1.0% | | | | $ 4,340,524 |

| | TOTAL NET ASSETS — 100.0% | | | | | $ 427,171,820 |

|

* Affiliated funds managed by Amundi Pioneer Asset Management, Inc., (the “Adviser”). | | |

The accompanying notes are an integral part of these financial statements.

Pioneer Solutions – Balanced Fund | Semiannual Report | 1/31/20 21

Schedule of Investments | 1/31/20 (unaudited) (continued)

Purchases and sales of securities (excluding temporary cash investments) for the period ended January 31, 2020, aggregated $63,892,577 and $78,906,449, respectively.

The Fund is permitted to engage in purchase and sale transactions (“cross trades”) with certain funds and accounts for which the Adviser serves as the Fund’s investment adviser, as set forth in Rule 17a-7 under the Investment Company Act of 1940, pursuant to procedures adopted by the Board of Trustees. Under these procedures, cross trades are effected at current market prices. During the period ended January 31, 2020, the Fund did not engage in any cross trade activity.

At January 31, 2020, the net unrealized appreciation on investments based on cost for federal tax purposes of $415,258,744 was as follows:

| Aggregate gross unrealized appreciation for all investments in which | |

| there is an excess of value over tax cost | $ 26,227,640 |

| Aggregate gross unrealized depreciation for all investments in which | |

| there is an excess of tax cost over value | (18,655,088) |

| Net unrealized appreciation | $ 7,572,552 |

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels below.

Level 1 – quoted prices in active markets for identical securities.

Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risks, etc.). See Notes to Financial Statements — Note 1A.

Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining fair value of investments). See Notes to Financial Statements — Note 1A.

The following is a summary of the inputs used as of January 31, 2020, in valuing the Fund’s assets:

| | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Affiliated Mutual Funds | | $ | 409,869,566 | | | $ | — | | | $ | — | | | $ | 409,869,566 | |

Affiliated Closed-End Fund | | | — | | | | 12,963,730 | | | | — | | | | 12,963,730 | |

| Total | | $ | 409,869,566 | | | $ | 12,963,730 | | | $ | — | | | $ | 422,831,296 | |

During the six months ended January 31, 2020, there were no transfers between Levels 1, 2, and 3.

The accompanying notes are an integral part of these financial statements.

22 Pioneer Solutions – Balanced Fund | Semiannual Report | 1/31/20

| | |

Statement of Assets and Liabilities | 1/31/20 (unaudited) | |

|

| ASSETS: | | | |

| Investments in securities of affiliated funds, at value (cost $413,566,444) | | $ | 422,831,296 | |

| Cash | | | 1,461,078 | |

| Receivables — | | | | |

| Investment securities sold | | | 3,634,030 | |

| Fund shares sold | | | 107,806 | |

| Dividends | | | 714,450 | |

| Other assets | | | 8,202 | |

| Total assets | | $ | 428,756,862 | |

| LIABILITIES: | | | | |

| Payables — | | | | |

| Investment securities purchased | | $ | 984,049 | |

| Fund shares repurchased | | | 407,255 | |

| Trustees’ fees | | | 1,753 | |

| Professional fees | | | 42,268 | |

| Transfer agent fees | | | 61,232 | |

| Due to affiliates | | | 21,013 | |

| Accrued expenses | | | 67,472 | |

| Total liabilities | | $ | 1,585,042 | |

| NET ASSETS: | | | | |

| Paid-in capital | | $ | 415,231,663 | |

| Distributable earnings | | | 11,940,157 | |

| Net assets | | $ | 427,171,820 | |

| NET ASSET VALUE PER SHARE: | | | | |

No par value (unlimited number of shares authorized) | | | | |

| Class A (based on $351,491,288/31,495,051 shares) | | $ | 11.16 | |

| Class C (based on $73,047,001/7,168,673 shares) | | $ | 10.19 | |

| Class R (based on $1,072,488/96,650 shares) | | $ | 11.10 | |

| Class Y (based on $1,561,043/137,738 shares) | | $ | 11.33 | |

| MAXIMUM OFFERING PRICE PER SHARE: | | | | |

| Class A (based on $11.16 net asset value per share/100%-5.75% | | | | |

maximum sales charge) | | $ | 11.84 | |

The accompanying notes are an integral part of these financial statements.

Pioneer Solutions – Balanced Fund | Semiannual Report | 1/31/20 23

| | |

Statement of Operations (unaudited) | |

| FOR THE SIX MONTHS ENDED 1/31/20 | |

|

| INVESTMENT INCOME: | | | |

| Dividend income from underlying affiliated funds | | $ | 9,608,785 | |

| Interest | | | 8,243 | |

| Total investment income | | $ | 9,617,028 | |

| EXPENSES: | | | | |

| Administrative expense | | $ | 104,803 | |

| Transfer agent fees | | | | |

| Class A | | | 156,252 | |

| Class C | | | 10,264 | |

| Class R | | | 79 | |

| Class Y | | | 997 | |

| Distribution fees | | | | |

| Class A | | | 438,367 | |

| Class C | | | 373,902 | |

| Class R | | | 2,472 | |

| Shareowner communications expense | | | 55,847 | |

| Custodian fees | | | 5,744 | |

| Registration fees | | | 64,400 | |

| Professional fees | | | 68,188 | |

| Printing expense | | | 12,670 | |

| Trustees’ fees | | | 9,756 | |

| Insurance expense | | | 1,774 | |

| Miscellaneous | | | 9,131 | |

| Total expenses | | $ | 1,314,646 | |

| Net investment income | | $ | 8,302,382 | |

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS: | | | | |

| Net realized gain (loss) on: | | | | |

| Underlying affiliated funds | | $ | 1,411,248 | |

| Capital gain on distributions from underlying affiliated issuers | | | 2,782,775 | |

| | $ | 4,194,023 | |

| Change in net unrealized appreciation (depreciation) on: | | | | |

| Underlying affiliated funds | | $ | 8,861,970 | |

| Net realized and unrealized gain (loss) on investments | | $ | 13,055,993 | |

| Net increase in net assets resulting from operations | | $ | 21,358,375 | |

The accompanying notes are an integral part of these financial statements.

24 Pioneer Solutions – Balanced Fund | Semiannual Report | 1/31/20

Statements of Changes in Net Assets

| | | | | | | |

| | Six Months | | | | |

| | Ended | | | Year | |

| | 1/31/20 | | | Ended | |

| | (unaudited) | | | 7/31/19 | |

| FROM OPERATIONS: | | | | | | |

Net investment income (loss) | | $ | 8,302,382 | | | $ | 12,044,799 | |

Net realized gain (loss) on investments | | | 4,194,023 | | | | 14,977,221 | |

Change in net unrealized appreciation (depreciation) | | | | | | | | |

| on investments | | | 8,861,970 | | | | (35,439,953 | ) |

| Net increase (decrease) in net assets resulting | | | | | | | | |

| from operations | | $ | 21,358,375 | | | $ | (8,417,933 | ) |

| DISTRIBUTIONS TO SHAREOWNERS: | | | | | | | | |

| Class A ($0.72 and $0.61 per share, respectively) | | $ | (21,592,985 | ) | | $ | (19,411,188 | ) |

| Class C ($0.64 and $0.51 per share, respectively) | | | (4,366,055 | ) | | | (4,152,900 | ) |

| Class R ($0.67 and $0.59 per share, respectively) | | | (60,137 | ) | | | (64,328 | ) |

| Class Y ($0.75 and $0.63 per share, respectively) | | | (99,948 | ) | | | (77,347 | ) |

| Total distributions to shareowners | | $ | (26,119,125 | ) | | $ | (23,705,763 | ) |

| FROM FUND SHARE TRANSACTIONS: | | | | | | | | |

Net proceeds from sales of shares | | $ | 17,125,108 | | | $ | 62,652,210 | |

Reinvestment of distributions | | | 25,829,283 | | | | 23,230,250 | |

Cost of shares repurchased | | | (39,595,184 | ) | | | (124,650,763 | ) |

| Net increase (decrease) in net assets resulting | | | | | | | | |

| from Fund share transactions | | $ | 3,359,207 | | | $ | (38,768,303 | ) |

| Net decrease in net assets | | $ | (1,401,543 | ) | | $ | (70,891,999 | ) |

| NET ASSETS: | | | | | | | | |

Beginning of period | | $ | 428,573,363 | | | $ | 499,465,362 | |

End of period | | $ | 427,171,820 | | | $ | 428,573,363 | |

The accompanying notes are an integral part of these financial statements.

Pioneer Solutions – Balanced Fund | Semiannual Report | 1/31/20 25

| | | | | | | | | | | | | |

Statements of Changes in Net Assets (continued) | | | | |

| | |

| | |

| | |

| | |

| | Six Months | | | Six Months | | | | | | | |

| | Ended | | | Ended | | | | | | | |

| | 1/31/20 | | | 1/31/20 | | | Year Ended | | | Year Ended | |

| | Shares | | | Amount | | | 7/31/19 | | | 7/31/19 | |

| | (unaudited) | | | (unaudited) | | | Shares | | | Amount | |

| Class A | | | | | | | | | | | | |

Shares sold | | | 1,122,168 | | | $ | 12,800,035 | | | | 3,984,693 | | | $ | 46,169,679 | |

Reinvestment of distributions | | | 1,899,157 | | | | 21,346,527 | | | | 1,854,341 | | | | 19,173,928 | |

Less shares repurchased | | | (2,482,094 | ) | | | (28,285,011 | ) | | | (6,415,867 | ) | | | (72,577,768 | ) |

| Net increase (decrease) | | | 539,231 | | | $ | 5,861,551 | | | | (576,833 | ) | | $ | (7,234,161 | ) |

| Class C | | | | | | | | | | | | | | | | |

Shares sold | | | 371,342 | | | $ | 3,889,059 | | | | 1,421,159 | | | $ | 14,479,540 | |

Reinvestment of distributions | | | 422,177 | | | | 4,331,537 | | | | 412,953 | | | | 3,923,059 | |

Less shares repurchased | | | (1,036,656 | ) | | | (10,842,751 | ) | | | (4,701,030 | ) | | | (49,729,859 | ) |

| Net (decrease) | | | (243,137 | ) | | $ | (2,622,155 | ) | | | (2,866,918 | ) | | $ | (31,327,260 | ) |

| Class R | | | | | | | | | | | | | | | | |

Shares sold | | | 12,575 | | | $ | 142,128 | | | | 32,448 | | | $ | 363,534 | |

Reinvestment of distributions | | | 5,384 | | | | 60,137 | | | | 6,280 | | | | 64,328 | |

Less shares repurchased | | | (9,061 | ) | | | (99,694 | ) | | | (66,231 | ) | | | (760,573 | ) |

| Net increase (decrease) | | | 8,898 | | | $ | 102,571 | | | | (27,503 | ) | | $ | (332,711 | ) |

| Class Y | | | | | | | | | | | | | | | | |

Shares sold | | | 25,319 | | | $ | 293,886 | | | | 143,892 | | | $ | 1,639,457 | |

Reinvestment of distributions | | | 7,983 | | | | 91,082 | | | | 6,571 | | | | 68,935 | |

Less shares repurchased | | | (31,817 | ) | | | (367,728 | ) | | | (140,020 | ) | | | (1,582,563 | ) |

| Net increase | | | 1,485 | | | $ | 17,240 | | | | 10,443 | | | $ | 125,829 | |

The accompanying notes are an integral part of these financial statements.

26 Pioneer Solutions – Balanced Fund | Semiannual Report | 1/31/20

| | Six Months | | | | | | | | | | | | | | | | |

| | Ended | | | Year | | | Year | | | Year | | | Year | | | Year | |

| | 1/31/20 | | | Ended | | | Ended | | | Ended | | | Ended | | | Ended | |

| | (unaudited) | | | 7/31/19 | | | 7/31/18 | | | 7/31/17 | | | 7/31/16* | | | 7/31/15* | |

| | |

| Class A | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 11.29 | | | $ | 12.12 | | | $ | 11.89 | | | $ | 11.35 | | | $ | 12.78 | | | $ | 12.73 | |

| Increase (decrease) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) (a) | | $ | 0.23 | | | $ | 0.32 | | | $ | 0.20 | | | $ | 0.17 | | | $ | 0.20 | | | $ | 0.29 | |

Net realized and unrealized gain (loss) on investments | | | 0.36

| | | | (0.54 | ) | | | 0.25 | | | | 0.61

| | | | (0.50 | ) | | | 0.12 | |

| Net increase (decrease) from investment operations | | $ | 0.59 | | | $ | (0.22 | ) | | $ | 0.45 | | | $ | 0.78 | | | $ | (0.30 | ) | | $ | 0.41 | |

| Distributions to shareowners: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | $ | (0.36 | ) | | $ | (0.34 | ) | | $ | (0.22 | ) | | $ | (0.24 | ) | | $ | (0.27 | ) | | $ | (0.36 | ) |

| Net realized gain | | | | | | | (0.27 | ) | | | — | | | | —

| | | | (0.86 | ) | | | — | |

| Total distributions | | $ | (0.72 | ) | | $ | (0.61 | ) | | $ | (0.22 | ) | | $ | (0.24 | ) | | $ | (1.13 | ) | | $ | (0.36 | ) |

| Net increase (decrease) in net asset value | | $ | (0.13 | ) | | $ | (0.83 | ) | | $ | 0.23 | | | $ | 0.54 | | | $ | (1.43 | ) | | $ | 0.05 | |

| Net asset value, end of period | | $ | 11.16 | | | $ | 11.29 | | | $ | 12.12 | | | $ | 11.89 | | | $ | 11.35 | | | $ | 12.78 | |

| Total return (b) | | | | | | | (1.32 | )% | | | 3.79 | % | | | 7.04 | % | | | (2.11 | )% | | | 3.33 | % |

| Ratio of net expenses to average net assets† | | | | | | | 0.45 | % | | | 0.57 | % | | | 0.68 | % | | | 0.67 | % | | | 0.66 | % |

| Ratio of net investment income (loss) to average net assets† | | | | | | | 2.82 | % | | | 1.67 | % | | | | | | | 1.77 | % | | | 2.25 | % |

| Portfolio turnover rate | | | | | | | 44 | % | | | 146 | % | | | 27 | % | | | 16 | % | | | 89 | % |

| Net assets, end of period (in thousands) | | $ | 351,491 | | | $ | 349,505 | | | $ | 382,265 | | | $ | 114,528 | | | $ | 125,608 | | | $ | 140,863 | |

* | The Fund was audited by an independent registered public accounting firm other than Ernst & Young LLP.

| | | | |

† | In addition to the expenses which the Fund bears directly, the Fund indirectly bears pro rata shares of the expenses of the funds in which the Fund invests. Because each of the underlying funds bears its own varying expense levels and because the Fund may own differing proportions of each fund at different times, the amount of expenses incurred indirectly by the Fund will vary from time to time.

|

(a) | The per-share data presented above is based on the average shares outstanding for the period presented. | | | | | | |

(b) | Assumes initial investment at net asset value at the beginning of each period, reinvestment of all distributions, the complete redemption of the investment at net asset value at the end of each period and no sales charges. Total return would be reduced if sales charges were taken into account.

|

(c) | Not annualized. | | | | | | | | |

(d)

| Annualized.

| | | | | | | | |

The accompanying notes are an integral part of these financial statements.

Pioneer Solutions – Balanced Fund | Semiannual Report | 1/31/20 27

| | | | | | | | |

Financial Highlights (continued) | | | | | | | |

|

| | Six Months | | | | | | | | | | | | | | | | |

| | Ended | | | Year | | | Year | | | Year | | | Year | | | Year | |

| | 1/31/20 | | | Ended | | | Ended | | | Ended | | | Ended | | | Ended | |

| | (unaudited) | | | 7/31/19 | | | 7/31/18 | | | 7/31/17 | | | 7/31/16* | | | 7/31/15* | |

| | |

| Class C | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 10.32 | | | $ | 11.12 | | | $ | 10.92 | | | $ | 10.44 | | | $ | 11.84 | | | $ | 11.82 | |

| Increase (decrease) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) (a) | | $ | 0.17 | | | $ | 0.20 | | | $ | 0.15 | | | $ | 0.09 | | | $ | 0.12 | | | $ | 0.17 | |

| Net realized and unrealized gain (loss) on investments | | | 0.34 | | | | (0.49 | ) | | | | | | | 0.55 | | | | (0.47 | ) | | | 0.14 | |

| Net increase (decrease) from investment operations | | $ | 0.51 | | | $ | (0.29 | ) | | $ | 0.34 | | | $ | 0.64 | | | $ | (0.35 | ) | | $ | 0.31 | |

| Distributions to shareowners: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | $ | (0.28 | ) | | $ | (0.24 | ) | | $ | (0.14 | ) | | $ | (0.16 | ) | | $ | (0.19 | ) | | $ | (0.29 | ) |

| Net realized gain | | | (0.36 | ) | | | (0.27 | ) | | | —

| | | | — | | | | (0.86 | ) | | | — | |

| Total distributions | | $ | (0.64 | ) | | $ | (0.51 | ) | | $ | (0.14 | ) | | $ | (0.16 | ) | | $ | (1.05 | ) | | $ | (0.29 | ) |

| Net increase (decrease) in net asset value | | $ | (0.13 | ) | | $ | (0.80 | ) | | $ | 0.20 | | | $ | 0.48 | | | $ | (1.40 | ) | | $ | 0.02 | |

| Net asset value, end of period | | $ | 10.19 | | | $ | 10.32 | | | $ | 11.12 | | | $ | 10.92 | | | $ | 10.44 | | | $ | 11.84 | |

| Total return (b) | | | 4.92 | %(c) | | | (2.14 | )% | | | 3.09 | % | | | 6.26 | % | | | (2.81 | )% | | | 2.64 | % |

| Ratio of net expenses to average net assets† | | | 1.17 | %(d) | | | 1.19 | % | | | | | | | 1.38 | % | | | 1.37 | % | | | 1.35 | % |

| Ratio of net investment income (loss) to average net assets† | | | 3.28 | %(d) | | | 1.96 | % | | | | | | | 0.84 | % | | | 1.10 | % | | | 1.44 | % |

| Portfolio turnover rate | | | 15 | %(c) | | | 44 | % | | | | | | | 27 | % | | | 16 | % | | | 89 | % |

| Net assets, end of period (in thousands) | | $ | 73,047 | | | $ | 76,524 | | | $ | 114,266 | | | $ | 49,277 | | | $ | 59,444 | | | $ | 74,720 | |

* The Fund was audited by an independent registered public accounting firm other than Ernst & Young LLP.

† In addition to the expenses which the Fund bears directly, the Fund indirectly bears pro rata shares of the expenses of the funds in which the Fund invests. Because each of the underlying funds bears its own varying expense levels and because the Fund may own differing proportions of each fund at different times, the amount of expenses incurred indirectly by the Fund will vary from time to time.

(a) The per-share data presented above is based on the average shares outstanding for the period presented.

(b) Assumes initial investment at net asset value at the beginning of each period, reinvestment of all distributions and the complete redemption of the investment at net asset value at the end of each period.

(c) Not annualized.

(d) Annualized.

The accompanying notes are an integral part of these financial statements.

28 Pioneer Solutions – Balanced Fund | Semiannual Report | 1/31/20

| | | | | | | | | | | | | | | | | | | |

| | Six Months | | | | | | | | | | | | | | | | |

| | Ended | | | Year | | | Year | | | Year | | | Year | | | Period Ended | |

| | 1/31/20 | | | Ended | | | Ended | | | Ended | | | Ended | | | 7/1/15 to | |

| | (unaudited) | | | 7/31/19 | | | 7/31/18 | | | 7/31/17 | | | 7/31/16* | | | 7/31/15* | |

| | |

| Class R | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 11.19 | | | $ | 12.04 | | | $ | 11.83 | | | $ | 11.30 | | | $ | 12.78 | | | $ | 12.74 | |

| Increase (decrease) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) (a) | | $ | 0.23 | | | $ | 0.23 | | | $ | 0.05 | | | $ | 0.11 | | | $ | 0.15 | | | $ | 0.01 | |

| Net realized and unrealized gain (loss) on investments | | | 0.35 | | | | (0.49 | ) | | | 0.37 | | | | 0.65 | | | | (0.47 | ) | | | 0.03 | |

| Net increase (decrease) from investment operations | | $ | 0.58 | | | $ | (0.26 | ) | | $ | 0.42 | | | $ | 0.76 | | | $ | (0.32 | ) | | $ | 0.04 | |

| Distributions to shareowners: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | $ | (0.31 | ) | | $ | (0.32 | ) | | $ | (0.21 | ) | | $ | (0.23 | ) | | $ | (0.30 | ) | | $ | — | |

| Net realized gain | | | (0.36 | ) | | | (0.27 | ) | | | — | | | | — | | | | (0.86 | ) | | | — | |

| Total distributions | | $ | (0.67 | ) | | $ | (0.59 | ) | | $ | (0.21 | ) | | $ | (0.23 | ) | | $ | (1.16 | ) | | $ | — | |

| Net increase (decrease) in net asset value | | $ | (0.09 | ) | | $ | (0.85 | ) | | $ | 0.21 | | | $ | 0.53 | | | $ | (1.48 | ) | | $ | 0.04 | |

| Net asset value, end of period | | $ | 11.10 | | | $ | 11.19 | | | $ | 12.04 | | | $ | 11.83 | | | $ | 11.30 | | | $ | 12.78 | |

| Total return (b) | | | 5.17 | %(c) | | | (1.64 | )% | | | 3.49 | % | | | 6.89 | % | | | (2.34 | )% | | | 0.31 | %(c) |

| Ratio of net expenses to average net assets† | | | 0.67 | %(d) | | | 0.78 | % | | | 0.79 | % | | | 0.90 | % | | | 0.90 | % | | | 0.93 | %(d) |

| Ratio of net investment income (loss) to average net assets† | | | 3.98 | %(d) | | | 2.05 | % | | | 0.42 | % | | | 0.98 | % | | | 1.28 | % | | | 0.66 | %(d) |

| Portfolio turnover rate | | | 15 | %(c) | | | 44 | % | | | 146 | % | | | 27 | % | | | 16 | % | | | 89 | % |

| Net assets, end of period (in thousands) | | $ | 1,072 | | | $ | 982 | | | $ | 1,388 | | | $ | 31 | | | $ | 14 | | | $ | 10 | |

Ratios with no waiver of fees and assumption of

| | | | | | | | | | | | | | | | | | | | | | | | |

expenses by the Adviser and no reduction for fees paid indirectly: | | | | | | | | | | | | | | | | | | | | | | | | |

| Total expenses to average net assets | | | 0.67 | % | | | 1.03 | % | | | 0.86 | % | | | 1.38 | % | | | 1.58 | % | | | 1.00 | %(d) |

| Net investment income (loss) to average net assets | | | 3.98 | % | | | 1.80 | % | | | 0.35 | % | | | 0.50 | % | | | 0.60 | % | | | 0.58 | %(d) |

* The Fund was audited by an independent registered public accounting firm other than Ernst & Young LLP.

† In addition to the expenses which the Fund bears directly, the Fund indirectly bears pro rata shares of the expenses of the funds in which the Fund invests. Because each of the underlying funds bears its own varying expense levels and because the Fund may own differing proportions of each fund at different times, the amount of expenses incurred indirectly by the Fund will vary from time to time.

(a) The per-share data presented above is based on the average shares outstanding for the period presented.

(b) Assumes initial investment at net asset value at the beginning of each period, reinvestment of all distributions and the complete redemption of the investment at net asset value at the end of each period.

(c) Not annualized.

(d) Annualized.

The accompanying notes are an integral part of these financial statements.

Pioneer Solutions – Balanced Fund | Semiannual Report | 1/31/20 29

| | | | | | | |

Financial Highlights (continued) | | | | | | |

|

| | Six Months | | | | | | | | | | | | | | | | |

| | Ended | | | Year | | | Year | | | Year | | | Year | | | Year | |

| | 1/31/20 | | | Ended | | | Ended | | | Ended | | | Ended | | | Ended | |

| | (unaudited) | | | 7/31/19 | | | 7/31/18 | | | 7/31/17 | | | 7/31/16* | | | 7/31/15* | |

| | |

| Class Y | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 11.46 | | | $ | 12.29 | | | $ | 12.06 | | | $ | 11.51 | | | $ | 12.94 | | | $ | 12.88 | |

| Increase (decrease) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) (a) | | $ | 0.25 | | | $ | 0.39 | | | $ | 0.26 | | | $ | 0.19 | | | $ | 0.26 | | | $ | 0.37 | |

| Net realized and unrealized gain (loss) on investments | | | 0.37 | | | | (0.59 | ) | | | 0.22 | | | | 0.63 | | | | (0.53 | ) | | | 0.09 | |

| Net increase (decrease) from investment operations | | $ | 0.62 | | | $ | (0.20 | ) | | $ | 0.48 | | | $ | 0.82 | | | $ | (0.27 | ) | | $ | 0.46 | |

| Distributions to shareowners: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | $ | (0.39 | ) | | $ | (0.36 | ) | | $ | (0.25 | ) | | $ | (0.27 | ) | | $ | (0.30 | ) | | $ | (0.40 | ) |

| Net realized gain | | | (0.36 | ) | | | (0.27 | ) | | | — | | | | — | | | | (0.86 | ) | | | — | |

| Total distributions | | $ | (0.75 | ) | | $ | (0.63 | ) | | $ | (0.25 | ) | | $ | (0.27 | ) | | $ | (1.16 | ) | | $ | (0.40 | ) |

| Net increase (decrease) in net asset value | | $ | (0.13 | ) | | $ | (0.83 | ) | | $ | 0.23 | | | $ | 0.55 | | | $ | (1.43 | ) | | $ | 0.06 | |

| Net asset value, end of period | | $ | 11.33 | | | $ | 11.46 | | | $ | 12.29 | | | $ | 12.06 | | | $ | 11.51 | | | $ | 12.94 | |

| Total return (b) | | | 5.36 | %(c) | | | (1.14 | )% | | | 3.94 | % | | | 7.33 | % | | | (1.85 | )% | | | 3.63 | % |

| Ratio of net expenses to average net assets† | | | 0.26 | %(d) | | | 0.27 | % | | | 0.40 | % | | | 0.47 | % | | | 0.40 | % | | | 0.36 | % |

| Ratio of net investment income (loss) to average net assets† | | | 4.27 | %(d) | | | 3.37 | % | | | 2.14 | % | | | 1.67 | % | | | 2.22 | % | | | 2.92 | % |

| Portfolio turnover rate | | | 15 | %(c) | | | 44 | % | | | 146 | % | | | 27 | % | | | 16 | % | | | 89 | % |

| Net assets, end of period (in thousands) | | $ | 1,561 | | | $ | 1,562 | | | $ | 1,547 | | | $ | 698 | | | $ | 1,107 | | | $ | 1,165 | |

* The Fund was audited by an independent registered public accounting firm other than Ernst & Young LLP.

† In addition to the expenses which the Fund bears directly, the Fund indirectly bears pro rata shares of the expenses of the funds in which the Fund invests. Because each of the underlying funds bears its own varying expense levels and because the Fund may own differing proportions of each fund at different times, the amount of expenses incurred indirectly by the Fund will vary from time to time.

(a) The per-share data presented above is based on the average shares outstanding for the period presented.

(b) Assumes initial investment at net asset value at the beginning of each period, reinvestment of all distributions and the complete redemption of the investment at net asset value at the end of each period.

(c) Not annualized.

(d) Annualized.

The accompanying notes are an integral part of these financial statements.

30 Pioneer Solutions – Balanced Fund | Semiannual Report | 1/31/20

Notes to Financial Statements |

1/31/20 (unaudited) 1. Organization and Significant Accounting Policies

Pioneer Solutions – Balanced Fund (the “Fund”) is the sole series of Pioneer Asset Allocation Trust the “Trust”, a Delaware statutory trust. The Fund is registered under the Investment Company Act of 1940 as an open-end management investment company. The investment objective of the Fund is to seek long-term capital growth and current income.

The Fund is a “fund of funds”. The Fund seeks to achieve its investment objective by investing primarily in other funds (“underlying funds”). The Fund may also invest directly in securities and use derivatives. The Fund invests primarily in funds managed by Amundi Pioneer Asset Management, Inc. The Fund may also invest in securities of unaffiliated mutual funds or exchange-traded funds (“ETFs”). The Fund indirectly pays a portion of the expenses incurred by underlying funds. Consequently, an investment in the Fund entails more direct and indirect expenses than direct investment in the applicable underlying funds.

The Fund offers five classes of shares designated as Class A, Class C, Class K, Class R and Class Y shares. Class K shares had not commenced operations as of January 31, 2020. Each class of shares represents an interest in the same portfolio of investments of the Fund and has identical rights (based on relative net asset values) to assets and liquidation proceeds. Share classes can bear different rates of class-specific fees and expenses such as transfer agent and distribution fees. Differences in class-specific fees and expenses will result in differences in net investment income and, therefore, the payment of different dividends from net investment income earned by each class. The Amended and Restated Declaration of Trust of the Fund gives the Board of Trustees the flexibility to specify either per-share voting or dollar-weighted voting when submitting matters for shareowner approval. Under per-share voting, each share of a class of the Fund is entitled to one vote. Under dollar-weighted voting, a shareowner’s voting power is determined not by the number of shares owned, but by the dollar value of the shares on the record date. Each share class has exclusive voting rights with respect to matters affecting only that class, including with respect to the distribution plan for that class. There is no distribution plan for Class Y shares.

Amundi Pioneer Asset Management, Inc., an indirect wholly owned subsidiary of Amundi and Amundi’s wholly owned subsidiary, Amundi USA, Inc., serves as the Fund’s investment adviser (the “Adviser”). Amundi Pioneer Distributor, Inc., an affiliate of Amundi Pioneer Asset Management, Inc., serves as the Fund’s distributor (the “Distributor”).

Pioneer Solutions – Balanced Fund | Semiannual Report | 1/31/20 31

In August 2018, the Securities and Exchange Commission (“SEC”) released a Disclosure Update and Simplification Final Rule. The Final Rule amends Regulation S-X disclosures requirements to conform them to U.S. Generally Accepted Accounting Principles (“U.S. GAAP”) for investment companies. The Fund’s financial statements were prepared in compliance with the new amendments to Regulation S-X.

The Fund is an investment company and follows investment company accounting and reporting guidance under U.S. GAAP. U.S. GAAP requires the management of the Fund to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of income, expenses and gain or loss on investments during the reporting period. Actual results could differ from those estimates.

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements:

A. Security Valuation

The net asset value of the Fund is computed once daily, on each day the New York Stock Exchange (“NYSE”) is open, as of the close of regular trading on the NYSE.

Shares of open-end registered investment companies (including money market mutual funds) are valued at such funds’ net asset value.

Shares of exchange-listed closed-end funds are valued by using the last sale price on the principal exchange where they are traded. Shares of closed-end interval funds that offer their shares at net asset value, are valued at such funds’ net asset value.

Securities for which independent pricing services or broker-dealers are unable to supply prices or for which market prices and/or quotations are not readily available or are considered to be unreliable are valued by a fair valuation team comprised of certain personnel of the Adviser pursuant to procedures adopted by the Fund’s Board of Trustees. The Adviser’s fair valuation team uses fair value methods approved by the Valuation Committee of the Board of Trustees. The Adviser’s fair valuation team is responsible for monitoring developments that may impact fair valued securities and for discussing and assessing fair values on an ongoing basis, and at least quarterly, with the Valuation Committee of the Board of Trustees.

Inputs used when applying fair value methods to value a security may include credit ratings, the financial condition of the company, current market conditions and comparable securities. The Fund may use fair value methods if it is determined that a significant event has occurred after the close of the exchange or market on which the security trades and prior to the

32 Pioneer Solutions – Balanced Fund | Semiannual Report | 1/31/20

determination of the Fund’s net asset value. Examples of a significant event might include political or economic news, corporate restructurings, natural disasters, terrorist activity or trading halts. Thus, the valuation of the Fund’s securities may differ significantly from exchange prices, and such differences could be material.

At January 31, 2020, no securities were valued using fair value methods (other than securities valued using prices supplied by independent pricing services, broker-dealers or using a third party insurance industry pricing model).

B. Investment Income and Transactions

Dividend income is recorded on the ex-dividend date, except that certain dividends from foreign securities where the ex-dividend date may have passed are recorded as soon as the Fund becomes aware of the ex-dividend data in the exercise of reasonable diligence.

Interest income, including interest on income-bearing cash accounts, is recorded on the accrual basis. Dividend and interest income are reported net of unrecoverable foreign taxes withheld at the applicable country rates and net of income accrued on defaulted securities.

Interest and dividend income payable by delivery of additional shares is reclassified as PIK (payment-in-kind) income upon receipt and is included in interest and dividend income, respectively.

Security transactions are recorded as of trade date. Gains and losses on sales of investments are calculated on the identified cost method for both financial reporting and federal income tax purposes.

C. Foreign Currency Translation

The books and records of the Fund are maintained in U.S. dollars. Amounts denominated in foreign currencies are translated into U.S. dollars using current exchange rates.

Net realized gains and losses on foreign currency transactions, if any, represent, among other things, the net realized gains and losses on foreign currency contracts, disposition of foreign currencies and the difference between the amount of income accrued and the U.S. dollars actually received. Further, the effects of changes in foreign currency exchange rates on investments are not segregated on the Statement of Operations from the effects of changes in the market prices of those securities, but are included with the net realized and unrealized gain or loss on investments.

D. Federal Income Taxes

It is the Fund’s policy to comply with the requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute all of its net taxable income and net realized capital gains, if any, to

Pioneer Solutions – Balanced Fund | Semiannual Report | 1/31/20 33

its shareowners. Therefore, no provision for federal income taxes is required. As of January 31, 2020, the Fund did not accrue any interest or penalties with respect to uncertain tax positions, which, if applicable, would be recorded as an income tax expense on the Statement of Operations. Tax returns filed within the prior three fiscal years remain subject to examination by federal and state tax authorities.

The amount and character of income and capital gain distributions to shareowners are determined in accordance with federal income tax rules, which may differ from U.S. GAAP. Distributions in excess of net investment income or net realized gains are temporary over distributions for financial statement purposes resulting from differences in the recognition or classification of income or distributions for financial statement and tax purposes. Capital accounts within the financial statements are adjusted for permanent book/tax differences to reflect tax character, but are not adjusted for temporary differences.

The tax character of current year distributions payable will be determined at the end of the current taxable year. The tax character of distributions paid during the year ended July 31, 2019 was as follows:

| | | 2019 | |

| Distributions paid from: | | | |