| UNITED STATES SECURITIES AND EXCHANGE COMMISSION |

Washington, D.C. 20549

|

| FORM 20-F |

| ANNUAL REPORT |

| FISCAL 2007 |

| ENDED MARCH 31, 2007 |

| [ ] | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | |

| | OR |

| [x] | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | |

| | OR |

| [ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

| | For the transition period from _____ to _____ |

SEC Filing Number:000-50737

LOGAN RESOURCES LTD.

(Exact name of Registrant as specified in its charter)

British Columbia, Canada

(Jurisdiction of incorporation or organization)

1066 West Hastings Street, #1640, Vancouver, British Columbia, Canada V6E 3X1

(Address of principal executive offices)

Securities to be registered pursuant to Section 12(b) of the Act:

None

Securities to be registered pursuant to Section 12(g) of the Act:

Common Shares, without par value

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

Indicate the number of issued and outstanding shares of each of the issuer's classes of capital or common stock as of the close of the period covered by the annual report.

35,110,363

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 12 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past ninety days.

Yes ___ Noxxx

Indicate by check mark which financial statement item the registrant has elected to follow:

Item 17xxxItem 18 ___

Page 1 of 104

Index to Exhibits on Page 103

| LOGAN RESOURCES LTD. |

| |

| FORM 20-F |

| ANNUAL REPORT |

| FISCAL 2007 |

| ENDED MARCH 31, 2007 |

TABLE OF CONTENTS

2

INTRODUCTION

Logan Resources Ltd. is organized under the laws of British Columbia, Canada. In this Annual Report, the “Company”, “Logan”, “we”, ” and “us” refer to Logan Resources Ltd. (unless the context otherwise requires). We refer you to the actual corporate documents for more complete information than may be contained in this Annual Report. Our principal corporate offices are located at 1066 West Hastings Street, Suite 1640, Vancouver, British Columbia, Canada, V6E 3X1. Our telephone number is 604-689-0299 and our fax number 604-689-0288.

BUSINESS OF LOGAN RESOURCES LTD.

Logan Resources Ltd. (the “Company") is a mineral exploration company. Its main focus is on property acquisition and exploration. The Company has interests in ten mineral properties (gold/copper/silver/uranium) in British Columbia, Yukon Territory, and Saskatchewan, respectively: Albert Creek, Antler Creek, Redford, Shell Creek, Heidi, Englishman, Cheyenne, Turn River, May Creek, and Carswell properties.

FINANCIAL AND OTHER INFORMATION

In this Annual Report, unless otherwise specified, all dollar amounts are expressed in Canadian Dollars (“CDN$” or “$”). The Government of Canada permits a floating exchange rate to determine the value of the Canadian Dollar against the U.S. Dollar (US$).

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 20-F contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, principally in ITEM #4, “Information on the Company” and ITEM #5, “Management’s Discussion and Analysis of Financial Condition and Results of Operations”. These statements may be identified by the use of words like “plan,” “expect,” “aim,” “believe,” “project,” “anticipate,” “intend,” “estimate,” “will,” “should,” “could” and similar expressions in connection with any discussion, expectation, or projection of future operating or financial performance, events or trends. In particular, these include statements about the Company’s strategy for growth, property exploration, mineral prices, future performance or results of current or anticipated mineral production, interest rates, foreign exchange rates, and the outcome of contingencies, such as acquisitions and/or legal proceedings.

Forward-looking statements are based on certain assumptions and expectations of future events that are subject to risks and uncertainties. Actual future results and trends may differ materially from historical results or those projected in any such forward-looking statements depending on a variety of factors, including, among other things, the factors discussed in this Annual Report under ITEM #3, “Key Information, Risk Factors” and factors described in documents that we may furnish from time to time to the Securities and Exchange Commission. We undertake no obligation to update publicly or revise any forward-looking statements because of new information, future events or otherwise.

3

GLOSSARY

Adit: A horizontal or nearly horizontal tunnel made for exploration or mining.

Alteration zones: portions of bedrock where the mineralogic composition of the rock has been changed by physical or chemical means, especially by the actions of hydrothermal solutions.

Andesite: A dark-colored, fine-grained volcanic rock.

Anomalies: deviations from uniformity or regularity in geophysical or geochemical quantities.

Anomalous values: results of geophysical or geochemical testing which deviate from the expected or calculated value.

Archean: rocks formed during the earliest part of Precambrian time, prior to 2,500 million years before present.

Arenaceous: Rocks with a high sand component in their make up.

Au: Gold

Base metal:any of the more common and more chemically active metals, e.g. lead, copper and zinc.

Bedrock conductors:portions of consolidated earth material which offers a low resistance to the passage of an electric current.

Breccia: Rock composed of sharp-angled fragments embedded in a fine-grained matrix.

Channel Sample: A sample taken continuously over a specified distance.

Chromium: A metal used for corrosion-resistant steels and whose compounds have many beautiful colors.

Cross-cut:a mining tunnel driven perpendicular to the dominant trend of a vein or ore bearing structure.

Cut-off grade:the lowest grade of mineralized material considered economic to mine and process; used in the calculation of reserves.

Deposit: A mineralized body which has been physically delineated by sufficient drilling, trenching, and/or underground work, and found to contain a sufficient average grade of metal or metals to warrant further exploration and/or development expenditures. Such a deposit does not qualify as a commercially mineable ore body or as containing reserves of ore, unless final legal, technical, and economic factors are resolved.

Diabase: A dark-colored very fine grained and hard intrusive rock.

Diamond drill holes:a drilling method whereby rock is drilled with a diamond impregnated, hollow drilling bit which produces a continuous, in-situ record of the rock mass intersected in the form of solid cylinders of rock which are referred to as core.

4

Differentiated: A natural process during cooling of rocks where by one type of rock can solidify first followed by another kind.

Drive:a mining tunnel driven parallel to the dominant trend of a vein or ore bearing structure.

Dyke: An igneous mass injected into a fissure in rock.

Electromagnetic:of, produced by or having to do with magnetic fields associated with currents artificially or naturally maintained in the sub-surface of the earth.

Epiclastic: Sediments consisting of weathered products of older rock.

Feasibility Study:a definitive engineering estimate of all costs, revenues, equipment requirements, and production levels likely to be achieved if a mine is developed. The study is used to define the economic viability of a project and to support the search for project financing.

Felsic:an igneous rock made up of light colored minerals; composed primarily of feldspar and silica.

Float: Rock this is not outcrop and has been transported some distance from its source

g/t; g Au/t: Grams per metric tonne; grams gold per metric tonne.

-genic:meaning suitable to or pertaining to, e.g. syngenic, meaning a ore deposit formed contemporaneously with the enclosing rocks

Geochemistry: The measurement of trace elements in naturally occurring rocks, soils and stream sediments as a means of detecting mineralization.

Geochemical sampling:a mineral exploration method whereby samples of soil, stream sediments, rocks, et. al. are collected in a systematic way and analyzed for a suite of elements.

Geological resources:Mineralized material which in total does not constitute ore, but which may contain one or more zones of ore. Geological resources are categorized as inferred, indicated and measured according to the degree of certainty with which their grade and tonnage are known. A geological resource is sometimes referred to as a "mineral resource".

Geophysical:relating to the physical properties, e.g. magnetic, seismic, et al of the earth and rock materials.

Gold or Au: A gold metallic element that is ductile and very malleable. This precious metal has industrial applications a well as being monetary value and used in jewelry.

Gossan: Brown to orange to red colored rocks and soil, where the color is due to weathering sulphides.

Grade:the amount of valuable mineral in each tonne of ore, expressed as ounces per ton or grams per tonne for precious metal and as a percentage by weight for other metals.

5

Grab Sample: Sample of selected rock or saprolite collected at random from within a restricted area of interest.

Grid:a systematic array of points or lines; e.g. a rectangular pattern of pits, boreholes or data collection locations used in mineral exploration.

Ground magnetic survey:a mineral exploration method involving the use of hand held magnetometer instruments which measure the intensity of the earth’s magnetic field. The survey usually takes the form of a regular pattern of parallel lines designed to cover the survey area with the objective of identifying magnetic anomalies, which may be indicative of hidden mineralization.

Hanging wall:the overlying side of a fault, ore body, or mine working, in particular the wall rock above a fault or inclined vein.

Heap leach:a relatively inexpensive processing method based on hydrometallurgical technology, whereby crushed rock is placed on an impermeable liner and is sprayed with a cyanide solution. The resulting gold bearing liquid is collected and the gold is recovered employing conventional technologies culminating in smelting and doré production.

Hectare: A unit of area in the metric system equal to 100 acres, or 10,000 square meters, and the equivalent of 2.471 acres in British Imperial and U.S. Customary measure.

Heterolithic: Composed of fragments of several different rock types.

Host rock:a volume of rock within which the ore body occurs.

Hydrogeological studies:studies concerning the occurrence, movement and condition of ground water.

Hydrothermal solutions:heated water, with or without demonstrable association with igneous processes.

Indicated resource:That material for which tonnage and grade are computed partly from specific measurements, samples or production data and partly from projection for a reasonable distance on geological evidence and for which the sites available for inspection, measurement and sampling are too widely or otherwise inappropriately spaced to outline the material completely or to establish its grade throughout.

Inferred resource:That material for which quantitative estimates are based largely on broad knowledge of the geological character of the deposit and for which there are few, if any, samples or measurements and for which the estimates are based on an assumed continuity or repetition for which there are reasonable geological indications, which indications may include comparison with deposits of similar type and bodies that are completely concealed may be included if there is specific evidence of their presence.

In-situ-resource:a tonnage of mineralized rock of intrinsic economic interest, the grades and limits of which are known with a specified degree of knowledge, expressed in terms of the material as it exists in the ground prior to mining.

6

IP (induced polarization):a geophysical technique for detecting buried disseminated sulphides through the application to the ground of electrical currents.

IP survey:systematic completion of IP on a grid over the area of interest.

Intrusive: Rock mass formed below the earth’s surface from magma, which has intruded into a pre-existing rock mass.

Komatiite: A volcanic rock with distinctive texture.

Lead or Pb: A soft, bluish metal that is ductile, heavy and acid resistant.

Limestone: A rock composed principally of calcium carbonate, used as an essential ingredient in making cement.

Lineament:a linear feature in the earth’s crust generally coincident with a geological fault.

Lithogeochemical:relating to the trace element and major oxide chemistry of rocks to define alteration systems associated with mineralization.

Lithological contact:a boundary between two different rock types.

Lode:a tabular or vein-like deposit of valuable minerals between well defined walls of rock.

Mafic:an igneous rock composed chiefly of one or more ferromagnesian (containing iron and magnesium), dark colored minerals.

Mafic-ultramafic: A dark colored intrusive rock.

Magnetic:having the property of attracting iron or steel, like a magnet.

Measured resource:That material for which tonnage and grade are computed from dimensions revealed in outcrops or trenches or underground workings or drill holes and for which the grade is computed from the results of adequate sampling, and for which the sites for inspection, sampling and measurement are so spaced and the geological character so well defined that the size, shape and mineral content are established and for which the computed tonnage and grade are judged to be accurate within stated limits.

Metamorphosed:a term used to describe a rock mass which has been subjected to metamorphism. Metamorphism is a geological process where the original mineral composition of a rock is changed or metamorphosed in response to local or regional scale changes in temperature, pressure and the action of chemically active fluids.

Metamorphism: A natural process of heat and compression that changes rocks.

Metagabbro: A gabbro that has been metamorphosed.

Metapyroxenite: A pyroxenite that has been metamorphosed.

Metasediments:sedimentary rocks, which are rocks formed out of the consolidation of sediment settled out of water, ice or air, which have been metamorphosed.

7

Mineralization:the process by which a mineral or minerals, usually metals, are introduced into a rock, resulting in an economically valuable or potentially valuable deposit. Also refers to mineral-bearing rock that has been identified by widely spaced drilling.

Mineralized material:a mineralized volume of rock which has been delineated by appropriately spaced drilling and/or underground sampling to support a sufficient tonnage and average grade of metals to warrant further exploration. Such a deposit does not qualify as a reserve, until a comprehensive evaluation based upon unit cost, grade, recoveries, and other material factors conclude legal and economic feasibility.

Net Smelter Return: A royalty payment made by a producer of metals based on gross mineral production from the property, less deductions of certain limited costs including smelter, refining, transportation and insurance costs.

Nickel or Ni: A white metallic metal, very malleable and ductile, largely used in alloys because of its corrosion resisting property.

NSR: Net smelter return.

Ore:rock that contains one or more minerals or metals, at least one of which has commercial value and which can be recovered at a profit.

Ore body:a continuous volume of mineralized material which may be economic and feasible to mine.

Outcrop: Bedrock that is exposed at surface, and is not covered by soil or other material.

Overburden:barren rock material, usually unconsolidated, overlying a mineral deposit and which must be removed prior to mining.

Palladium or Pd: A silver-white metallic chemical element. The metal and its alloys is used in electrical contacts, precision instruments and jewelry and as a catalyst in the chemical industry particularly for automobile exhaust systems to help control pollution.

Phanerozoic:that part of geologic time for which, in the corresponding rocks, the evidence of life is abundant; geologic time from 570 million years ago to the present.

Phanerozoic Basin:a general term for a depressed, Phanerozoic aged sediment filled area.

Placer mining:the extraction of gold from loosely consolidated material, often a riverbed.

Platinum or Pt: A silver-white metallic chemical element. It has a high melting point and is resistant to chemical attack. The pure metal and its alloys are used in jewelry, electrical contacts, in laboratories as an acid resistant material and as an important catalyst.

PGM: Platinum group metals, which includes platinum, palladium, ruthenium, osmium, rhodium and iridium.

Proterozoic: Rocks formed between 1 and 2.2 billion years ago. The second oldest geological period after Archaean.

8

Pyrite: A gold colored rock composed of iron and sulphur.

Pyroclastic: Material ejected into the air from a volcanic vent.

Pyroxenite: A dark rock composed of the mineral pyroxene.

Quartz or qtz: A very common hard rock forming mineral, generally clear to white but can be a variety of colors.

ppb: Parts per billion.

ppm: Parts per million.

Probable reserves:reserves for which quantity and grade and/or quality are computed from information similar to that used for proven reserves, but the sites for inspection, sampling, and measurement are further apart or otherwise less adequately spaced. The degree of assurance, although lower than that for proven reserves, is high enough to assume continuity between points of observation.

Proven reserves:reserves for which: (a) quantity is computed from dimensions revealed in outcrops, trenches, working or drill holes; grade and/or quality are computed from the results of detailed sampling; and (b) the sites for inspection, sampling, and measurement are spaced so closely and the geologic character is so well defined that size, shape, depth, and mineral content of reserves are well-established.

Plutonic rocks:a rock formed at considerable depth below the earth’s surface by crystallization of magma.

Raking:angle between a linear feature and the horizontal measured in the plane that contains the two.

Reserve:that part of a mineral deposit that could be economically and legally extracted or produced at the time of the reserve determination.

Reverse circulation drilling:a type of rotary drilling that uses a double-walled drill pipe. Compressed air, water or other drilling medium is forced down the space between the two pipes to the drill bit and the drilled chips are flushed back up to the surface through the center tube of the drill pipe.

Reverse circulation holes:a drilling method employing dual walled drill rods fitted with either a hammer or rotary drilling bit. The pressurized drilling fluid (air or water) travels down the outer annulus and the return fluid travels up the center of the drill rod carrying the sample of rock chips and dust-sized particles to the surface.

Saprolite: Rock that has weathered to clay; but, is in place and has not been moved by erosion or other forces.

Schist:a metamorphic rock characterized by a well-developed parallel orientation of more than 50% of the minerals present.

Scree: Boulders and related debris which has fallen or slid down a steep embankment, hill or cliff.

9

Sediments: Rocks, which are composed of various proportions of clay, silt, sand, gravel and pebbles.

Sedimentary:formed by the deposition of solid fragmented material that originates from weathering of rocks and is transported from a source to a site of deposition.

Shearing:the resulting action from stresses that cause or tend to cause contiguous parts of a body to slide relatively to each other in a direction parallel to their plane of contact.

Shear zones:linear areas of weakness along which a failure occurred whereby the portion of mass on one side of the area slides past the portion on the opposite side and which often form conduits for mineralizing fluids.

Silver or Ag: A white metallic element that is ductile, malleable and capable of high polish. This precious metal has major industrial applications in photography, x-ray films, electronics and electrical contacts, batteries, brazing alloys, catalysts, mirrors, jewelry and sterling ware.

Stock: An intrusive body that is very approximately circular and generally less than 100m to 200m across.

Stockwork:a mineral deposit in the form of a branching or interlocking network of veinlets.

stockwork of quartz veins:a crosscutting network of fractures filled with quartz.

Strata: A section of a formation that consist throughout of essentially the same kind of rock.

Stratigraphy:the arrangement of rock strata, especially as to geographic position and chronological order of sequence.

Strike:geological measurement of the direction of a horizontal line on the surface of the bed.

Stripping ratio:ratio of waste to ore.

Sulphides: A rock whose dominant component is the element sulphur.

Supracrustal rocks:rocks that overlie the basement. Basement is defined as a complex of undifferentiated rocks that underlies the oldest identifiable rocks in the area.

Tectonic: pertaining to the forces involved in, or the resulting structures or features of the large scale architecture of the upper part of the Earth’s crust.

Tectonized:a rock mass that has been severally modified by folding and/or faulting.

10

Tertiary:that portion of the geologic sedimentary section younger than the Cretaceous and older than the Quaternary ranging in age from approximately 55 million to 2 million years old.

ton: Short ton (2,000 pounds).

tonne: Metric tonne (1,000 kilograms).

Tuff: A rock formed by volcanic fragments generally less than 4 mm.

Vein:sheet-like body of minerals formed by fracture filling or replacement of the host rock.

VLF (very low frequency):a geophysical technique which utilizes the magnetic components of the electromagnetic field generated by long distance radio transmitters to delineate geological structures.

VMS (volcanogenic massive sulfide) deposits:deposits of base and precious metals were formed as layers at the bottom of bodies of water from sulfur-rich material erupted during volcanic activity

Volcanic:pertaining to the activities, structures or rock types of a volcano.

Winze:a vertical shaft in a mine sunk or excavated from top to bottom.

Zinc or Zn: A bluish-white metallic element resistant to atmospheric corrosion.

CONVERSION TABLE

The following table sets forth certain standard conversions from Standard Imperial units to the International System of Units (or metric units).

| To Convert From | To | Multiply By |

| Feet | Meters | 0.305 |

| Meters | Feet | 3.281 |

| Miles | Kilometers | 1.609 |

| Kilometers | Miles | 0.621 |

| Acres | Hectares | 0.405 |

| Hectares | Acres | 2.471 |

| Grams | Ounces (troy) | 0.032 |

| Ounces (troy) | Grams | 31.103 |

| Tonnes | Short tons | 1.102 |

| Short tons | Tonnes | 0.907 |

| Grams per tonne | Ounces (troy) | 0.029 |

| Ounces (troy) per tonne | Grams per tonne | 34.438 |

11

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISORS

- --- No Disclosure Necessary ---

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE.

- --- No Disclosure Necessary ---

ITEM 3. KEY INFORMATION.

3.A.1. Selected Financial Data

3.A.2. Selected Financial Data

The selected financial data of the Company for Fiscal 2007/2006/2005 ended March 31st were derived from the financial statements of the Company that have been audited by Manning Elliott LLP, independent registered public accounting firm, as indicated in their audit report which is included elsewhere in this Annual Report. The selected financial data of the Company for Fiscal 2004/2003 ended March 31st was derived from the audited financial statements of the Company; these financial statements are not included herein.

The selected financial data should be read in conjunction with the financial statements and other financial information included elsewhere in the Annual Report.

The Company has not declared any dividends since incorporation and does not anticipate that it will do so in the foreseeable future. The present policy of the Company is to retain all available funds for use in its operations and the expansion of its business.

Effective 1/30/2002, pursuant to a special resolution passed by shareholders 9/28/2001, the Company consolidated its capital on a five old common shares for one new common share basis. The Company also changed the name of the Company to Logan Resources Ltd. and increased its authorized share capital to 100,000,000 common shares without par value. References to numbers of shares and per-share data refer to post-consolidation figures unless otherwise indicated.

12

Table No. 1 is derived from the financial statements of the Company, which have been prepared in accordance with Canadian Generally Accepted Accounting Principles (GAAP) and Canadian/USA Generally Accepted Auditing Standards (GAAS). All material numerical differences between Canadian GAAP and US GAAP, as applicable to the Company, are described in footnotes to the financial statements.

Table No. 1

Selected Financial Data

(CDN$ in 000, except per share data)

| | | | | | | | | | | | | | | | |

| Year Ended | | 3/31/2007 | | | 3/31/2006 | | | 3/31/2005 | | | 3/31/2004 | | | 3/31/03 | |

| CANADIAN GAAP | | | | | | | | | | | | | | | |

| Revenue | $ | 0 | | $ | 0 | | $ | 0 | | $ | 0 | | $ | 0 | |

| Net Income (Loss) | $ | 894 | | $ | (180 | ) | $ | (571 | ) | $ | (148 | ) | $ | (102 | ) |

| Basic Income (Loss)/Share | $ | 0.03 | | $ | (0.01 | ) | $ | (0.03 | ) | $ | (0.02 | ) | $ | (0.01 | ) |

| Dividends Per Share | $ | 0.00 | | $ | 0.00 | | $ | 0.00 | | $ | 0.00 | | $ | 0.00 | |

| | | | | | | | | | | | | | | | |

| Wtd. Avg. Shares (000) | | 31,646 | | | 18,757 | | | 13,693 | | | 8,640 | | | 5,811 | |

| Period End Shares (000) | | 34,550 | | | 21,582 | | | 16,582 | | | 9,643 | | | 8,076 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Working Capital (3) | | 4,049 | | | 559 | | | 511 | | | (13 | ) | | (-) | |

| Mineral Properties | | 4,124 | | | 1,704 | | | 1,047 | | | 558 | | | 311 | |

| Capital Share | | 10,705 | | | 6,193 | | | 5,307 | | | 3,849 | | | 3,636 | |

| Shareholders’ Equity | | 8,217 | | | 2,299 | | | 1,556 | | | 551 | | | 344 | |

| Total Assets | | 8,374 | | | 2,480 | | | 1,611 | | | 713 | | | 372 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| US GAAP | | | | | | | | | | | | | | | |

| Net Loss | | (2,871 | ) | $ | (836 | ) | $ | (1,060 | ) | $ | (396 | ) | $ | (286 | ) |

| Loss per Share | $ | (0.09 | ) | $ | (0.06 | ) | $ | (0.08 | ) | $ | (0.05 | ) | $ | (0.05 | ) |

| Mineral Properties | $ | 0 | | $ | 0 | | $ | 0 | | $ | 0 | | $ | 0 | |

| Shareholders’ Equity | $ | 4,282 | | $ | 941 | | $ | 519 | | $ | (7 | ) | $ | 33 | |

| Total Assets | $ | 4,439 | | $ | 1,122 | | $ | 564 | | $ | 155 | | $ | 61 | |

| (1) | Cumulative Net Loss since incorporation through 3/31/2007 under US GAAP was ($8,765,332). |

| | | |

| (2) | a) | Under US GAAP, expenditures relating to exploration-stage properties are expensed in the period incurred. |

| | | |

| b) | Under US GAAP, during 2003, the Company recognized stock-based compensation based on the estimated fair value of stock options granted. This adjustment was not necessary in subsequent years. |

| | | |

| (3) | Cash committed for the mineral exploration was reclassified as current for 2004. Under the new classification working capital deficit is $13,000 |

| | |

| | |

13

3.A.3. Exchange Rates

In this Annual Report, unless otherwise specified, all dollar amounts are expressed in Canadian Dollars (CDN$). The Government of Canada permits a floating exchange rate to determine the value of the Canadian Dollar against the U.S. Dollar (US$).

Table No. 2 sets forth the exchange rates for the Canadian Dollar at the end of the five most recent fiscal years ended, the average rates for those periods, and the range of high and low rates for those periods. The data for each month during the most recent six months is provided.

For purposes of this table, the rate of exchange means the noon buying rate in New York City for cable transfers in foreign currencies as certified for customs purposes by the Federal Reserve Bank of New York. The table sets forth the number of Canadian Dollars required under that formula to buy one U.S. Dollar. The average rate means the average of the exchange rates on the last day of each month during the period.

Table No. 2

U.S. Dollar/Canadian Dollar

| | | | | |

| | Average | High | Low | Close |

| | | | | |

| | | | | |

| August 2007 | 1.06 | 1.06 | 1.05 | 1.06 |

| July 2007 | 1.05 | 1.05 | 1.05 | 1.05 |

| June 2007 | 1.07 | 1.07 | 1.06 | 1.07 |

| May 2007 | 1.09 | 1.10 | 1.09 | 1.10 |

| April 2007 | 1.13 | 1.14 | 1.13 | 1.13 |

| March 2007 | 1.17 | 1.17 | 1.17 | 1.17 |

| | | | | |

| | | | | |

| Fiscal Year Ended 3/31/2007 | 1.14 | 1.14 | 1.14 | 1.14 |

| Fiscal Year Ended 3/31/2006 | 1.19 | 1.20 | 1.19 | 1.19 |

| Fiscal Year Ended 3/31/2005 | 1.28 | 1.40 | 1.18 | 1.21 |

| Fiscal Year Ended 3/31/2004 | 1.35 | 1.48 | 1.30 | 1.31 |

| | | | | |

| Fiscal Year Ended 3/31/2003 | 1.38 | 1.60 | 1.51 | 1.47 |

| | | | | |

3.B. Capitalization and Indebtedness

3.C. Reasons For The Offer And Use Of Proceeds

--- No Disclosure Necessary ---

14

3.D. Risk Factors

Company is Incorporated in Canada, which has Different Laws

The articles of the Company and the laws of British Columbia are different from those typical in the United States. The typical rights of investors in Canadian companies differ modestly from those in the United States; refer to the relevant sections which are discussed in Section 9.A.5 and Section 10.B of this Annual Report. Such differences may cause investors legal difficulties.

Dependence Upon Key Management Employees

While engaged in the business of exploring mineral properties, the nature of the Company’s business, its ability to continue its exploration of potential exploration projects, and to develop a competitive edge in the marketplace, depends, in large part, on its ability to attract and maintain qualified key management personnel. Competition for such personnel is intense and the Company may not be able to attract and retain such personnel. The Company’s growth will depend on the efforts of its Senior Management, including its President/CEO, Seamus Young and its Corporate Secretary/CFO, Judith T. Mazvihwa. Loss of these individuals could have a material adverse effect on the Company. The Company has no key-man life insurance and there are no written agreements with them.

Management and Directors Are Associated with Other Resource Companies

Certain of the Directors and Senior Management of the Company (specifically, F. Charles Vickers, Clifford H. Frame, Peter F. Cummings, Judith Mazvihwa, and Seamus Young) are also Directors and/or Senior Management and/or significant shareholders of other companies, including those also involved in natural resources; refer to ITEM 6.A. for resumes. As the Company is engaged in the business of exploiting mineral properties, such associations may give rise to conflicts of interest from time to time. Law requires the directors of the Company to act honestly and in good faith with a view to the best interests of the Company and to disclose any interest that they may have in any project or opportunity of the Company. If a conflict of interest arises at a meeting of the Board of Directors, any Director in a conflict must disclose his interest and abstain from voting on such matter. In determining whether or not the Company will participate in any project or opportunity, the Directors will primarily consider the degree of risk to which the Company may be exposed and its financial position at the time. If not properly resolved, the Company could be placed at a disadvantage when considering which properties to acquire/explore and if/how to explore existing properties.

Control by Principal Stockholders, Officers and Directors Could AdverselyAffect the Company’s Stockholders

The Company’s Senior Management, Directors and greater-than-five-percent stockholders (and their affiliates), acting together, have the ability to control substantially all matters submitted to the Company’s stockholders for approval (including the election and removal of directors and any merger, consolidation or sale of all or substantially all of the Company’s assets) and to control the Company’s management and affairs. Accordingly, this concentration of ownership may have the effect of delaying, deferring or preventing a change in control of the Company, impeding a merger, consolidation, takeover or other business combination involving the Company or discouraging a potential acquirer from making a tender offer or otherwise attempting to obtain control of the Company, which in turn could materially adversely affect the market price of the Company’s stock.

15

Dilution Through Employee/Director/Consultant Options

Because the success of the Company is highly dependent upon its respective employees, the Company has granted to some or all of its key employees, Directors and consultants options to purchase common shares as non-cash incentives. To the extent that significant numbers of such options may be granted and exercised, the interests of the other stockholders of the Company may be diluted causing possible loss of investment value.

Stock Market Price and Volume Volatility

The market for the common shares of the Company may be highly volatile for reasons both related to the performance of the Company or events pertaining to the industry (i.e., price fluctuation/high production costs/accidents) as well as factors unrelated to the Company or its industry. The market price of metals is highly speculative and volatile. Instability in metal prices may affect the interest in mining properties and the development of production from such properties and may adversely affect the Company’s ability to raise capital to explore existing or new mineral properties. The Company’s common shares can be expected to be subject to volatility in both price and volume arising from market expectations. Stockholders of the Company may be unable to sell significant quantities of common shares in the public trading markets without a significant reduction in the price of the common shares.

Need for Additional Financing to Finish Property Exploration/Development

The Company is engaged in the business of exploiting mineral properties. The Company believes it has sufficient funds to continue operations for the next 6 to 12 months depending on the level of exploration expenditures. However, additional financing will be required to carry out current exploration plans for calendar 2008. In the long term, further financing will be required to continue exploration and to develop the mineral properties identified and to place them into commercial production. The exploitation of the Company’s mineral properties is, therefore, dependent upon the Company’s ability to obtain financing through equity financing or other means. Failure to obtain such financing may result in delay or indefinite postponement of work on the Company’s mineral properties, as well as the possible loss of such properties. Such delays, and possible inability to proceed with planned operations could cause loss of investment value.

History of Losses

The Company has a history of losses: (179,610), (571,209), ($147,619), ($101,904) and ($89,165) in Fiscal Years 2006/2005/2004/2003/2002 (in 2007 the Company had a income of $893,590 and a loss before income tax recovery of $450,439). Despite recent capital infusions, the Company will require significant additional funding to meet its business objectives. Capital will need to be available to help maintain and to expand work on the Company’s principal exploration properties. The Company may not be able to obtain additional financing on reasonable terms, or at all. If equity financing is required, then such financings could result in significant dilution to existing shareholders. If the Company is unable to obtain sufficient financing, the Company might have to dramatically slow exploration efforts and/or lose control of its projects. The Company has historically obtained the preponderance of its financing through the issuance of equity. There is no limit to the number of authorized common shares but the current authorized share capital is 100,000,000 common shares, and the Company has no current plans to obtain financing through means other than equity financing and/or loans. Such losses and the resulting need for external financings could result in losses of investment value.

16

Broker-Dealers May Be Discouraged From Effecting Transactions In Our CommonShares Because They Are Penny Stocks And Are Subject To The Penny Stock Rules.

Rules 15g-1 through 15g-9 promulgated under the Securities Exchange Act of 1934, as amended, impose sales practice and disclosure requirements on NASD broker-dealers who make a market in “a penny stock”. A penny stock generally includes any non-NASDAQ equity security that has a market price of less than US$5.00 per share. Our shares are quoted on the TSX Venture Exchange, and the price of our common shares ranged from CDN$0.19 (low) to CDN$0.75 (high) during the period from 04/01/2006 to 03/31/2007 trading at $0.375 on 10/03/2007. The additional sales practice and disclosure requirements imposed upon broker-dealers may discourage broker-dealers from effecting transactions in our shares, which could severely limit the market liquidity of the shares and impede the sale of our shares in the secondary market.

Under the penny stock regulations, a broker-dealer selling penny stock to anyone other than an established customer or “accredited investor” (generally, an individual with net worth in excess of US$1,000,000 or an annual income exceeding US$200,000, or US$300,000 together with his or her spouse) must make a special suitability determination for the purchaser and must receive the purchaser's written consent to the transaction prior to sale, unless the broker-dealer or the transaction is otherwise exempt.

In addition, the penny stock regulations require the broker-dealer to deliver, prior to any transaction involving a penny stock, a disclosure schedule prepared by the US Securities and Exchange Commission relating to the penny stock market, unless the broker-dealer or the transaction is otherwise exempt. A broker-dealer is also required to disclose commissions payable to the broker-dealer and the registered representative and current quotations for the securities. Finally, a broker-dealer is required to send monthly statements disclosing recent price information with respect to the penny stock held in a customer's account and information with respect to the limited market in penny stocks.

U.S. Investors May Not Be Able to Enforce Their Civil Liabilities Against Usor Our Directors, Controlling Persons and Officers

It may be difficult to bring and enforce suits against the Company. The Company is a corporation incorporated under the laws of British Columbia, Canada and governed by the Business Corporations Act(British Columbia).All or substantial portions of their assets are located outside of the United States, predominately in Canada. As a result, it may be difficult for U.S. holders of our common shares to effect service of process on these persons within the United States or to realize in the United States upon judgments rendered against them. In addition, a shareholder should not assume that the courts of Canada (i) would enforce judgments of U.S. courts obtained in actions against us or such persons predicated upon the civil liability provisions of the U.S. federal securities laws or other laws of the United States, or (ii) would enforce, in original actions, liabilities against us or such persons predicated upon the U.S. federal securities laws or other laws of the United States.

17

However, U.S. laws would generally be enforced by a Canadian court provided that those laws are not contrary to Canadian public policy, are not foreign penal laws or laws that deal with taxation or the taking of property by a foreign government and provided that they are in compliance with applicable Canadian legislation regarding the limitation of actions. Also, a Canadian court would generally recognize a judgment obtained in a U.S. Court except, for example, where:

| | a) | where the U.S. court where the judgment was rendered had no jurisdiction according to applicable Canadian law; |

| | b) | the judgment was subject to ordinary remedy (appeal, judicial review and any other judicial proceeding which renders the judgment not final, conclusive or enforceable under the laws of the applicable state) or not final, conclusive or enforceable under the laws of the applicable state; |

| | c) | the judgment was obtained by fraud or in any manner contrary to natural justice or rendered in contravention of fundamental principles of procedure; |

| | d) | a dispute between the same parties, based on the same subject matter has given rise to a judgment rendered in a Canadian court or has been decided in a third country and the judgment meets the necessary conditions for recognition in a Canadian court; |

| | e) | the outcome of the judgment of the U.S. court was inconsistent with Canadian public policy; |

| | f) | the judgment enforces obligations arising from foreign penal laws or laws that deal with taxation or the taking of property by a foreign government; or |

| | g) | there has not been compliance with applicable Canadian law dealing with the limitation of actions. |

As a “foreign private issuer”, the Company is exempt from the Section 14 proxyrules and Section 16 of the 1934 Securities Act

The submission of proxy and annual meeting of shareholder information (prepared to Canadian standards) on Form 6-K may result is shareholders having less complete and timely data. The exemption from Section 16 rules regarding sales of common shares by insiders may result in shareholders having less data.

Operating Hazards and Risks Associated with the Mining Industry Could Resultin a Significantly Negative Effect on the Company

Mining operations generally involve a high degree of risk. Hazards such as unusual or unexpected formations and other conditions are involved. Operations in which the Company has a direct or indirect interest will be subject to all the hazards and risks normally incidental to exploration, development and production of precious and base metals, any of which could result in work stoppages, damage to or destruction of mines and other producing facilities, damage to life and property, environmental damage and legal liability for any or all damage. The Company may become subject to liability for cave-ins and other hazards for which it cannot insure or against which it may elect not to insure where premium costs are disproportionate to the Company’s perception of the relevant risks. The payment of such insurance premiums and of such liabilities would reduce the funds available for exploration activities and could force the Company to cease operations.

18

The Expense of Meeting Environmental Regulations Could Cause a SignificantlyNegative Effect on the Company

The current and anticipated future operations of the Company, including further exploration activities require permits from various Canadian Federal and provincial governmental authorities. Such operations are subject to various laws governing land use, the protection of the environment, production, exports, taxes, labor standards, occupational health, waste disposal, toxic substances, mine safety and other matters. The permits which the Company may require for construction of mining facilities and conduct of mining operations must be obtainable on reasonable terms to the Company. Unfavorable amendments to current laws, regulations and permits governing operations and activities of mining companies, or more stringent implementation thereof, could have a materially adverse impact on the Company and cause increases in capital expenditures which could result in a cessation of operations by the Company.

Failure to comply with applicable laws, regulations and permitting requirements may result in enforcement actions thereunder, including orders issued by regulatory or judicial authorities causing operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment or remedial actions. Parties engaged in mining operations may be required to compensate those suffering loss or damage by reason of the mining activities and may have civil or criminal fines or penalties imposed for violation of applicable laws or regulations.

Large increases in capital expenditures resulting from any of the above factors could force the Company to cease operations.

The Company has No Proven Reserves on the Properties in Which It Has anInterest

The properties in which the Company has an interest or the concessions in which the Company has the right to earn an interest are in the exploratory stage only and are without a known body of ore. Properties on which mineral reserves are not found will have to be discarded causing the Company to write each respective property off thus sustaining a loss.

Mineral Prices May Not Support Corporate Profit

The mining industry is intensely competitive and even if commercial quantities of mineral resources are developed, a profitable market may not exist for the sale of same. If a profitable market does not exist the Company could have to cease operations.

Significant Negative Effect on the Company

The expenditures to be made by the Company in the exploration of its properties as described herein may not result in discoveries of mineralized material in commercial quantities. Most exploration projects do not result in the discovery of commercially mineable ore deposits.

19

ITEM 4. INFORMATION ON THE COMPANY

4.A. History and Development of the Company

Introduction

The Company is engaged in the acquisition and exploration of mineral resource properties. The Company has interests in ten mineral properties (gold/uranium/copper/silver) in British Columbia, Saskatchewan, and the Yukon Territory. Its mineral properties in British Columbia are Albert Creek, Antler Creek, Redford, in Saskatchewan the Company has the Carswell Dome property, and finally its properties in the Yukon Territory are the Shell Creek, Heidi, Englishman, Turn River, May Creek and Cheyenne properties. In the first three months of Fiscal 2008 from April 1, 2007 to June 30, 2007, the Company expended a total of $1,409,895 on property acquisition/exploration. $1,020,798 was spent on the Heidi property and $389,097 was spent on the Company’s other mineral interests.

The Company’s executive and registered office is located at:

1066 West Hastings Street

#1640, Vancouver,

British Columbia,

Canada,

V6E 3X1

Telephone number is 604-689-0299

Telephone number is 800-665-3772 (USA)

Telephone number is 877-689-6130 (Canada)

Facsimile: 604-690-0288

e-mail:info@loganresources.ca

website:www.loganresources.ca

The contact person is:

Seamus Young, President/CEO/Director.

The Company's fiscal year ends March 31st.

The Company's common shares trade on the TSX Venture Exchange in Toronto, Canada, under the symbol ”LGR”.

The Company has 100,000,000 common shares without par value authorized. At 3/31/2007, the end of the Company's most recent fiscal year, there were 34,550,363 issued and outstanding.

Incorporation and Name Changes

Logan Resources Ltd. (the “Company”) was incorporated as a specially limited company on 06/26/1978 in the Province of British Columbia, Canada, under the name “Logan Mines Ltd. (NPL)” by registration of its Articles and Memorandum pursuant to the Company Act (British Columbia). On 07/21/1992, the Company was converted to a limited company and the name of the Company was changed to “Consolidated Logan Mines Ltd.”. The Company was registered as an extraterritorial company in the Northwest Territories from 07/08/1979 to 08/07/1998. On 01/30/2002, the name of the Company was changed to “Logan Resources Ltd.”. The Company was extra-territorially registered in the Yukon Territory on 06/30/2003.

Stock Splits/Consolidations

On 07/21/1992, the Company consolidated its share capital on the basis of three old shares for one new share. On 01/30/2002, the Company consolidated its share capital on the basis of five old shares for one new share. All references to number of shares or to per share data refer to post-consolidation data unless otherwise indicated.

20

Corporate History

In May 2000, the Company entered into an agreement to acquire the Antler Creek Property by issuing 20,000 post-consolidation common shares at a deemed fair market value of $10,000. This agreement was amended in June 2002. In September 2000, the Company entered into a Letter Agreement to acquire a 100% interest in the Albert Creek Property, by incurring $235,000 in related expenditures and issuing 220,000 post-consolidation common shares in three stages over four years.

In late 2001, the Company allowed the last four mineral claims representing 50 units (the Spanish Mountain Property) to lapse.

In January 2003, the Company entered into an option agreement to acquire a 100% interest in the Shell Creek Property, by paying $155,000, incurring $1,550,000 in exploration expenditures and issuing 1,000,000 common shares, all in stages over a five - year period.

In April 2003, the Company entered into an option agreement to acquire a 100% interest in the Heidi Mineral Claims, by paying $180,000, issuing 1,000,000 common shares, and incurring $600,000 of exploration expenditures, all in stages over a period of five years. The Company has met all the terms of the property agreement and now has 100% interest in the Heidi property. Subsequent to 03/31/2007, the Company staked an additional 166 claims, increasing the number of mineral claims from 54 to 220.

In April 2003, the Company entered into an option agreement to acquire a 100% interest in the Iron Horse Claims, by paying $75,000 and issuing up to 300,000 shares in stages over a period of three years. In April 2004, the Company allowed the option to lapse.

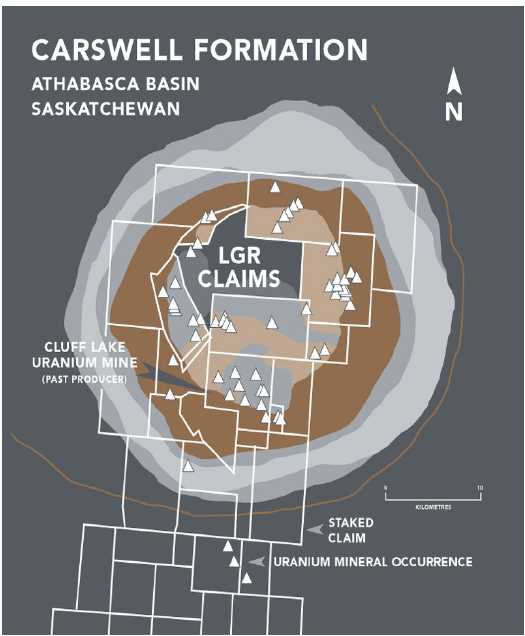

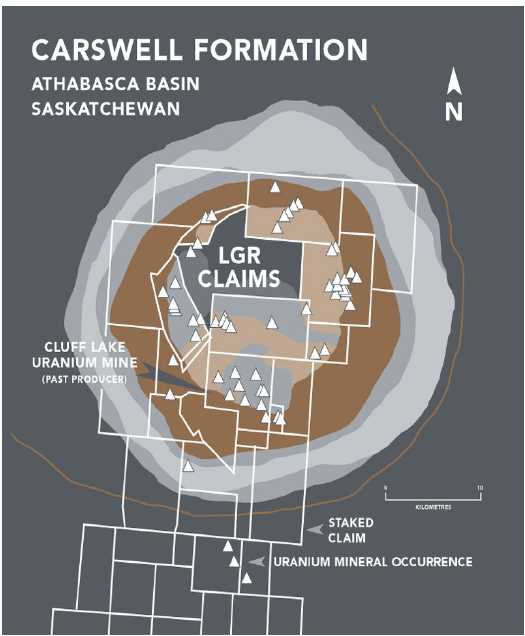

In 2005 the Company staked 2 claims covering an area of 7,552 hectares on the Carswell Dome Formation, Saskatchewan.

In March 2005, the Company entered into an option agreement, granting an option to a third party to earn a 50% interest in the Carswell Property by paying $25,000 cash, issuing 200,000 of its shares (all in stages over a period of three years) and incurring a total of $300,000 in exploration expenditures, all in stages over a period of five years.

In April 2005, pursuant to an option agreement dated April 15, 2004 and amended September 7, 2004, the Company granted an option to a third party to earn a 51% interest in the Albert Creek Property by issuing 150,000 of its shares and incurring a total of $300,000 in exploration expenditures, all in stages over a period of three years. The option agreement was cancelled by the optionee on March 16, 2006.

In December 2005, the Company entered into an option agreement to acquire a 100% interest in the Cheyenne Claims, by paying $300,000, issuing 1,000,000 of its shares, and incurring $500,000 of exploration expenditures, all in stages over a period of five years.

In August 2006, the Company entered into an option agreement to acquire a 100% interest in the May Creek property by issuing 750,000 shares, paying $225,000 and incurring $500,000 in exploration expenditures all in stages over a five year period.

In March 2007, the Company entered into an option agreement to acquire a 100% interest in the Englishman property by paying $50,000, issuing 250,000 shares and incurring $350,000 in exploration expenditures all in stages over a four year period.

In February 2007, The Company partnered with International KRL Resources Corp., a company related to Logan Resources Ltd. by common directors, and jointly acquired the Turn River project by staking 2,220 claims. Each company

21

has a 50% interest in the mineral property. In August 2007 the Company and International KRL Resources Corp. staked an additional 1,311 claims prospective for nickel. The Turn River Project now consists of 3,531 claims over twelve independent blocks, covering approximately 74,287 hectares (183,567) acres.

In September 2007 Both Logan Resources Ltd. and International KRL Resources Corp. signed an agreement with Longview Capital Partners Incorporated granting Longview Capital Partners the option to earn a 50% interest in the Turn River project in the Yukon for $15 million in staged exploration expenditures.

Financings

The Company has financed its operations through funds raised in loans, public/private placements of common shares, shares issued for property, shares issued in debt settlements, and shares issued upon exercise of stock options and share purchase warrants.

| Fiscal Year | Nature of Share Issuance | Number of Shares | Capital Raised |

| | | | |

| | | | |

| 2000 | Exercise of Warrants | 100,000 shares | $100,000 |

| 2001 | Options Exercised | 10,000 shares | $7,500 |

| | Shares for Property (1) | 40,000 shares | $20,000 |

| 2002 | Private Placement | 1,000,000 Units | $50,000 |

| | Shares for debt (1) | 1,053,400 shares | $131,678 |

| 2003 | Private Placement | 2,050,000 Units | $246,000 |

| | Agent Commissions (1) | 164,000 shares | $19,680 |

| | Shares for Property (1) | 100,000 shares | $12,000 |

| | Shares for Debt (1) | 427,532 shares | $64,130 |

| | Exercise of Warrants | 900,000 shares | $90,000 |

| 2004 | Private Placement | 186,700 Units | $28,005 |

| | Shares for Property (1) | 940,000 shares | $103,000 |

| | Exercise of Warrants | 315,424 shares | $57,717 |

| | Options Exercised | 312,000 shares | $62,400 |

| 2005 | Private Placement | 6,326,036 Units | $1,364,841 |

| | Exercise of Stock Options | 100,000 shares | $20,000 |

| | Exercise of warrants | 188,000 shares | $37,600 |

| | Shares for Property (1) | 250,000 shares | $62,500 |

| | Agent Commissions (1) | 74,318 shares | $18,579 |

| 2006 | Private Placement | 2,486,333 Units | $638,250 |

| | Exercise of Stock Options | 350,000 shares | $140,000 |

| | Exercise of warrants | 1,596,500 shares | $349,525 |

| | Shares for Property (1) | 500,000 shares | $126,000 |

| | Agent Commissions (1) | 67,500 shares | $30,375 |

| 2007 | Private Placement | 9,770,000 Units | $5,070,500 |

| | Exercise of Stock Options | 225,000 shares | $90,000 |

| | Exercise of warrants | 1,706,000 shares | $640,850 |

| | Shares for Property (1) | 800,000 shares | $285,000 |

| | Agent Commissions (1) | 467,500 shares | $233,750 |

| | | | |

| | | | |

| (1) Deemed fair market value for shares issued. |

| |

| Capital Expenditures | | |

| Fiscal 2001: | $ 27,317, | predominately for property acquisition/exploration |

| Fiscal 2002: | $ 37,299, | predominately for property acquisition/exploration |

| Fiscal 2003: | $186,828, | predominately for property acquisition/exploration |

| Fiscal 2004: | $177,549, | predominately for property acquisition/exploration |

| Fiscal 2005: | $483,308, | predominately for property acquisition/exploration |

| Fiscal 2006: | $748,218, | predominately for property acquisition/exploration |

| Fiscal 2007: | $2,294,676, | predominately for property acquisition/exploration |

22

Plan Of Operations

Source of Funds for Fiscal 2007

The Company’s primary source of funds since incorporation has been through the issuance of equity. Currently the Company does not have operating revenues, and the Company does not anticipate generating any during the next year. As of 3/31/2007, the Company had working capital of $4,049,000.

At 3/31/2007, the Company had 3,025,000 outstanding stock options with a weighted average exercise price of $0.47. At 3/31/2007, the Company had 5,665,000 outstanding share purchase warrants with a weighted average exercise price of $0.69. Since 3/31/2007 the Company granted 1,225,000 incentive stock options with exercise prices of $0.40 and $0.45. The Company is continuing to seek new equity investments.

Use of Funds for Fiscal 2008

During Fiscal 2008, the Company estimates that it might expend $780,000 on general/administrative expenses (expense excluding gains, losses and write/offs and non-cash stock based compensation). During Fiscal 2008, the Company estimates that it might expend $4,220,000 on property acquisition/exploration expenses.

Anticipated Changes to Facilities/Employees

The Company has no plans to add any additional personnel. Management anticipates that any property exploration efforts will be carried out by outside contractors.

4.B. BUSINESS OVERVIEW

The Company acquired three additional exploration properties in January 2003 and April 2003, the Shell Creek Property, the Heidi Mineral Claims, and the Iron Horse Claims (The Iron Horse property option agreement between Logan Resources Ltd. and Rich River Exploration Ltd. was terminated on April 24, 2004).In December 2005, the Company acquired the Cheyenne Property, a mineral exploration property located in the Yukon Territory. In August 2006, the Company acquired the May Creek property. In February 2007 and March 2007, the Company acquired the Turn River and Englishman properties. The May Creek, Turn River, and Englishman properties are all located in the Yukon Territory.

Redford Property, British Columbia, Canada

Location: 22km northeast of the town of Ucluelet, Vancouver Island.

The Company began Fiscal 2001 with only one property, the Redford Property, where it was conducting limited exploration, looking for gold. These modest efforts continued through most of Fiscal 2004. Diamond drilling was carried out on the Redford Property in March 2004. Six holes were drilled totaling 928.90 meters. Drill holes R-1-04 to R-4-04 and drill hole R-6-04 tested the strike and down-dip extensions of the Seamus Zone, the principal target on the property and drill hole R-5-04 tested the down-dip extension of the Walker Zone. The drill holes intersected intervals of albite-arsenic-gold mineralization with grades up to 1.18 g/t gold over 1.0 meter. Higher grades were obtained from previous surveys, up to 3.21g/t gold from feldspar-arsenopyrite alteration with quartz vein stockwork surrounding the drilled area. Additional drilling is recommended on the Seamus Zone to test the down dip extension of the arsenic–gold-quartz vein mineralization.

As a result of the drill results management decided to expand the property and stake 20 additional claims (345 claim units). The Company now owns a total of 25 claims (432 claim units) and carried out a rock chip sampling program. This program identified copper–cobalt–gold+/-magnetite skarn showings scattered throughout the northwestern part of the property including the magnetite skarn at the Brynnor Mine and the Tony showing. The massive sulphide Tony showing and surrounding skarn showings are at the center of an airborne magnetic high

23

of similar size and intensity of that over the Brynnor Mine. The recent chip sampling of the Tony showing returned 5 meters grading 0.559% copper, 0.0464 % cobalt and 0.164 g/t gold.

Copper–platinum–palladium mineralization hosted by the Karmutsen volcanics occurs over an area of 3 kilometers by 1 kilometer in the northwestern part of the Redford property and grab samples returned up to 1599 ppm copper and up to 13 ppb Pt and up to 38 ppb Pd. Additional trenching, IP and magnetometer surveys are recommended at and in the vicinity of the Tony showing to test the potential for a major copper–cobalt–gold+/-magnetite deposit in the area followed by diamond drilling if warranted. Total budget for both programs is $400,000.00 (David J. Bridge, MASc, P.Geo).

Logan Resources Ltd. is also seeking a joint venture partnership for the Redford property.

Antler Creek Property,British Columbia, Canada

Location: In the heart of Barkersville-Wells placer/lode gold camp, along strike from International Wayside’s Bonanza Ledge Zone.

The Company decided to add additional exploration properties starting in May 2000 and again in September 2004, the Antler Creek Property and Albert Creek Property, respectively. The Antler Creek Property was staked and then optioned by the Company in response to the nearby discovery, not on the Company’s property, of significant bulk tonnage-fissure-type gold intersection in Bonanza Ledge Gold zone. The property had had historic placer gold production from three creeks and been covered by Government Regional Geochemical Stream Silt Survey (RGS); the Company was unaware of any records of mapping, prospecting or soil geo-chemical surveys. During FY2001-FY2004, the Company has conducted modest exploration, mainly consisting of mapping, prospecting and soil/silt sampling.

Logan Resources Ltd. is also seeking a joint venture partnership for the Antler Creek property.

Subsequent to year end, the Company completed a Max Min electromagnetic (EM) survey over the Antler Creek gold project. The survey identified a number of conductors which Logan intends to test with a diamond drill program. The survey completed by EarthWorks Geophysical Consultants, of White Rock, BC, also recorded several secondary responses on the transverses.

Albert Creek Property, British Columbia, Canada

Location: In northern British Columbia, 60km west/southwest of Watson Lake, Yukon Territory.

The Albert Creek Property was the subject of mapping, prospecting and silt/soil sampling during FY2001/FY2003 and a fixed-wing air-magnetic survey, which outlined a linear northwest trending magnetic anomaly. The anomaly was tested with a 1200-meter diamond drilling program during Fiscal 2003. The drill program results were not sufficiently encouraging to warrant further exploration of this property at this time.

In 2004, the Company granted Forsys Metals Corp. (previously known as Forsys Technology), the right to earn a 51% interest in the Albert Creek Property. To earn this interest, the optionee issued 150,000 of its shares and had to incur a total of $300,000 in exploration expenditures over a five year period. Upon completion of these expenditures, the optionee would have the right to earn a further 20% interest in the property by delivering it to a bankable feasibility study.

On March 16, 2006, Logan Resources Ltd. accepted written confirmation from Forsys Metals Corp. canceling their option to acquire a 51% interest in the property. Forsys Metals Corp. is focusing on its projects in Namibia, Africa.

24

Last fiscal year, the Company carried out an exploration program consisting of line cutting, soil geochemistry and magnetic and horizontal loop electromagnetic geophysical surveys. No significant mineralization was found near surface. A report dated January 2006 by J.L. LeBel, P.Eng recommends a deep penetrating electromagnetic survey to explore for mineralization at depth greater than 100 m.

The Albert Creek claims are in good standing until 2010 and the property is available for option.

Shell Creek Property,Yukon Territory

Location:located 75 kilometres northwest of Dawson City, in west-central Yukon Territory.

In January 2003, the Company acquired the Shell Creek property. In 2005, the Shell Creek Property was subject to preliminary rock sampling program that was inconclusive. Follow-up bulk sampling of the quartz veins, soil sampling, mapping, trenching, and magnetometer/soil surveys revealed potential drill targets. An extensive exploration program was planned for the Shell Creek Property for summer 2005.

Logan Resources Ltd. increased the size of its Shell Creek property by 418 claims from the initial 70 claims acquired in accordance with an option agreement dated January 1, 2003. In 2005 the Shell Creek property consisted of 488 claims, covering an area of 98km2. Logan staked more claims around this property and it now comprises 628 mineral claims.

In 2005, an extensive silt sampling program was carried out on all the creeks on the property. Approximately 95 silt samples were collected over a 14km by 12km area. The samples were sent to Acme Labs for analysis which consisted of 30 multi-element ICP. The results from this analysis indicated a 12km long gold/copper anomaly.

A mapping and rock chip sampling program was carried out at the same time as the silt sampling program. The mapping and the assay results from the rock chip samples was successful in identifying the source and setting of the visible gold previously identified in quartz float on the property.

The recommended exploration program for 2005 included airborne magnetic survey, an induced polarization survey, a gravity survey and more geological mapping and sampling.

The year ending 31 March 2006 exploration program was directed to evaluate the potential for the existence of copper-uranium-gold mineralization in the Proterozoic-age rocks on the property. This program was encouraged by initial positive results of regional geology, geochemical (stream sediments) and geophysical (aeromagnetics) data. The 2006 program consisted of a detailed helicopter-borne magnetic survey, a soil geochemical survey over the Shell Creek ridge, an orientation induced polarization survey and a gravity survey.

The 2006 fieldwork program for the Shell Creek property began in the first week of June and the geophysical surveys were conducted by Aurora Geosciences Ltd. Three widely spaced reconnaissance lines of modified pole-dipole induced polarization/apparent resistivity (IP/Res) were surveyed totaling 16.7 kilometres with dipole separations of 25, 50 and 100 metres. There were 55 gravity readings at spacing of approximately 1 square kilometre were collected over the Shell Creek property.

The preliminary review of the Induced Polarization/Resistivity (IP/Res) geophysical surveys completed on the property detected a well-defined, near surface anomaly that was mapped over a distance of 300 metres and a deeper 100 to 150-metre long anomaly to the immediate west. Anomalous copper assays of up

25

to 230 ppm and 80 ppb gold are coincident with the near surface IP/Res anomaly. Both anomalies lie on the north side of an oblong 2.5 (E-W) x 1.5 (NS) kilometre gravity high with amplitude of greater than one milligal. These encouraging results define a significantly anomalous area that warrants an extensive drill program.

In 2006, silt geochemistry surveys were completed by Ryanwood Exploration under the supervision of the Company’s senior geological staff, Mark Terry. Approximately 1,000 soil samples were collected at 50 meter intervals on lines 250 meters and 500 meters apart over an area of 8.5km by 1.5km and the samples were sent to Acme Labs in Vancouver for analysis. Preliminary interpretation of the assay results show a significant east west copper anomaly over the entire length of the grid with some scattered gold and uranium anomalous numbers.

The results of the 2006 program were successful in providing a preliminary assessment of the potential for Olympic Dam-type mineralization.

An independent, NI 43-101 compliant report, dated 5 December 2005, on its Shell Creek Property, was written by Ontario based consulting geologist Peter T. George, P. Geo., the report was filed on SEDAR (www.sedar.com).

In his report, Mr. George stated that the regional geological setting of the Shell Creek area suggests that there is potential for Olympic Dam-type copper-uranium-gold mineralization in the area. This suggestion is supported by gold showings on the property plus anomalous copper and uranium stream sediment geochemical samples.

As the results of the 2006 program were successful in providing a preliminary assessment of the potential for Olympic Dam-type mineralization, Mr. George concluded that a drill program is warranted for the property and recommended that such a program be commenced in the 2007 field season to explore for Olympic Dam-type mineralization on the property.

Mr. George recognized a 6 kilometre by 3 kilometre area (18 square kilometres) that is underlain by anomalous copper-gold values, oblique structural trends not reflected on the near surface structural trends, and correlates with a regional gravity high. From this data Mr. George concluded that the area warranted follow-up by drilling and recommended 10 drill holes totalling 4,000 meters to provide an initial test of the 18 square kilometre area. Additional prospecting, and mapping were also recommended for the 2007 field season.

In 2007, the Company further evaluated the copper geochemical anomaly with a ground magnetic survey and mobile metal ions geochemical survey over a narrower line spaced grid. A total of 2,260 samples were collected in the geochemical survey. The assay results from these samples were greater than 200ppm copper and confirmed and increased the area covered by the copper anomaly. The Company drilled three holes on these areas of anomalous copper targets. As expected, these holes did not return significant values because the holes did not reach the intended target depths of 400-600 meters. The deepest hole drilled reached 176.26 meters. A two-meter sample assaying 1 g/t gold was intersected in the overburden-bedrock in Hole SCK-06-01. The Company plans to continue drilling in the following field season. Subsequent to March 31, 2007, Logan was mobilizing a diamond drill machine to the property in preparation for the diamond drill program. The Company also completed an airborne survey over the Shell Creek property, subsequent to March 31, 2007. Results from these exploration programs are still standing

Heidi Property, Yukon Territory

Location: Approximately 95 km east-northeast of Dawson, Yukon and approximately 30 km east of the Dempster Highway.

The Heidi mineral property, since being optioned, has been the subject of a 33 rock-chip sampling program from five trenches, all of which returned anomalous

26

gold with a significant percent containing encouraging results. Soil sampling immediately west of trenched area located two large and several small, strong gold anomalies in 2000 meter by 500 meter area. The anomalies remain open in several directions.

Induced Polarization (IP) and Magnetic (mag) surveys were carried out in August/September 2003. The IP covered an area of 1.5 km2 (6 lines, each 1 km long and 100 m line spacing) and the mag survey covered an area of 3.25 km2(23 lines, each approximately 1.4km long and 100 meter line spacing). The IP survey identified 3 main parallel zones which are possibly connected forming a tight “S” fold. The correlation between the IP and mag anormalies shows that the IP anormalies are open to the west, east and north.

Logan Resources Ltd. carried out a two day field evaluation program, in August 2004. The program focused on examining and sampling trenches dug on the discovery zone and other selected mineralized zones. A total of 19 rock chip samples were collected and sent for assay. The results show the presence of anomalous arsenopyrite in samples containing elevated gold values (Gold values in the rock chip samples ranged from 1.62g/t Au to 19.87g/t Au).

The magnetic and IP geophysical anomalies were compiled with soil geochemistry anomalies to help the property evaluation. The IP and soil survey anomalies overlap.

Work carried out on the Heidi Property by Logan Resources Ltd. and previous operators identified potential drill targets. The property was drill ready in 2005, and an extensive diamond drill program was planned when funds are available.

In 2006, Logan filed an independent NI 43-101 compliant report, dated 8 December, 2005, on the property on SEDAR (www.sedar.com). The author of the report is Mr. Peter T. George, P. Geo., a consulting geologist based in Hamilton, Ontario.

The 43-101 compliant report by Mr. George reviewed the results of earlier work by Homestake (1995 – 1996) and work completed in 2003 by the Vendor, which consisted of further geochemical sampling, a magnetometer survey and several IP test lines across coincident gold–arsenic geochemical anomalies. The Company’s sampling program during the course of its 2004 due diligence examination confirmed gold values reported by Homestake and independent grab samples which assayed up to 19.9 g/t gold.

Based on the results of both historical work (Homestake, 1995-1996), work by the vendor (2003) and the Company (2004), Mr. George concluded that the geological setting of the Heidi Property is permissive for epithermal gold mineralization in association with Tombstone Intrusives. He recommended an initial program of drilling of 1,600 metres in 8 holes to evaluate the current target area. If successful, this would be followed by induced polarization and in-fill drilling.

In fiscal 2007, the Company planned to continue drilling the Heidi property. Subsequent to March 31, 2007, the Company started a drill program designed to continue evaluating the targets identified in earlier programs. The Company completed 19 diamond drill holes on the Heidi property and it is waiting for assay results from the analytical laboratory.

Cheyenne Property, Yukon Territory

Location:60 km northeast of Dawson City, 1.5 km east of the Dempster Highway, and 30 km west of Logan’s Heidi gold property in the Mayo Mining District, Yukon Territory.

In December 2005 the Company acquired the Cheyenne property. Mineralized quartz veins are reported on the Cheyenne property, by previous operators as cutting a sequence of Proterozoic to lower Cambrian Hyland Group sedimentary

27

rocks. The veins are up to 1 meter in width and are tens of meters long. Assays are reported as high as 10% copper, 3% lead, 2.5% zinc, 300g/t silver and 30g/t gold. In other areas chip samples returned values as high as 270g/t gold. A historical drill program reported assay results up to 21g/t gold across 3.1 m.

Logan staked an additional 152 claims around the initial claims acquired and the Cheyenne gold project now consists of 364 mineral claims.

During the fiscal year ending March 31, 2007, Logan filed a NI 43-101 compliant report on its Cheyenne gold property with the B.C. Securities Commission. The author of this report is Mr. Peter T. George, P.Geo., a consulting geologist based in Hamilton, Ontario. Mr. George reported, there are seven known zones of gold and gold/silver mineralization over the property and Logan is the first operator to own the claims covering all seven showings. All of the known mineralization on the property appears to be related to hydrothermal fluids from the Antimony Mountain intrusion (Tombstone Intrusive type) and most of the gold showings on the Cheyenne property are vein type. Of particular interest is the Golden Wall showing, which is more typical of the skarn replacement type mineralization. The Golden Wall appears to be comprised of stratabound replacement type massive to disseminated sulphides. The Golden Wall zone is a high priority target and the Company rock sampled the zone.

The Company’s geologists collected six rock samples over a 10 meter area over the Golden Wall Zone as follow up to the geochemical sampling program conducted by the property’s previous operator. The samples were sent to Acme Laboratories Ltd. in Vancouver for fire assay analysis and the gold assay results are listed below.

Golden Wall (Cheyenne) Rock Sampling July 2006

| Sample Number | Total Au gm/mt |

| MH-07-2006-01 | 5.04 |

| MH-07-2006-02 | 2.16 |

| MH-07-2006-03 | 0.88 |

| MH-07-2006-04 | 1.08 |

| MH-07-2006-05 | 2.17 |

| MH-07-2006-06 | 3.08 |

These assay results verify geochemical surveys conducted by previous operators and confirm mineralization in the area. Logan also compiled results from recent and historic exploration activities conducted on the property. This process generated additional potential diamond drill targets on the Cheyenne property. The Company plans to carry out an aggressive exploration program on the Cheyenne property.

May Creek Property Yukon Territory

Location:Located in the Mayo Mining District in the Yukon Territory, 45 km west-northwest of the community of Mayo.