Exhibit 99.2

OTELCO Inc. OTEL (Nasdaq) www.otelco.com November 07, 2018

Forward Looking Statements This presentation contains forward - looking statements that are subject to risks and uncertainties . Forward - looking statements give our current expectations relating to our financial condition, results of operations, plans, objectives, future performance and business . These statements may include words such as “anticipate,” “estimate,” “expect,” “project,” “plan,” “intend,” “believe” and other words and terms of similar meaning in connection with any discussion of the timing or nature of future operating or financial performance or other events . These forward - looking statements are based on assumptions that we have made in light of our experience in the industry in which we operate, as well as our perceptions of historical trends, current conditions, expected future developments and other factors we believe are appropriate under the circumstances . Although we believe that these forward - looking statements are based on reasonable assumptions, you should be aware that many factors could affect our actual financial condition or results of operations, or cause our actual results to differ materially from those in the forward - looking statements 1

Diverse Customer Base Carrier Enterprise Residential Institutional/Higher Ed Municipal Government Service Footprint Eleven RLECs in 6 states CLEC in ME, MA & NH 2

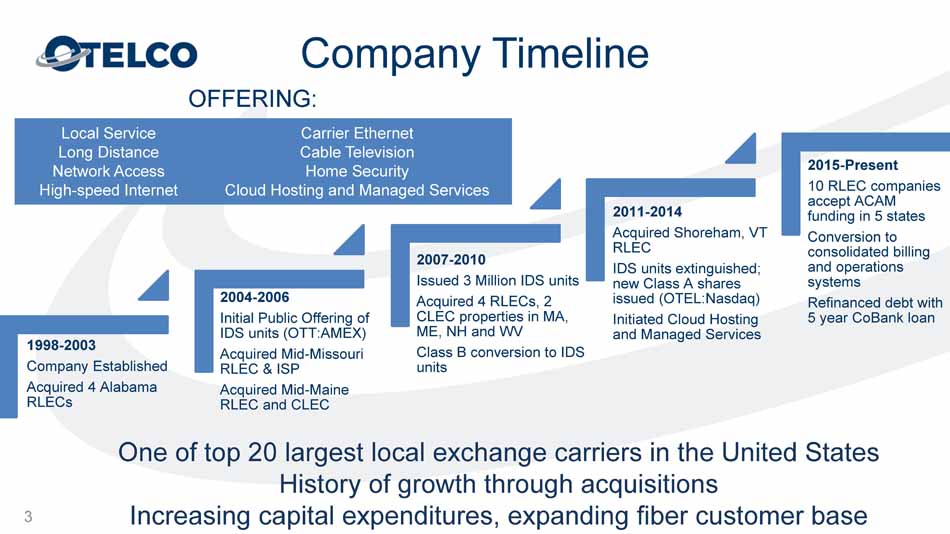

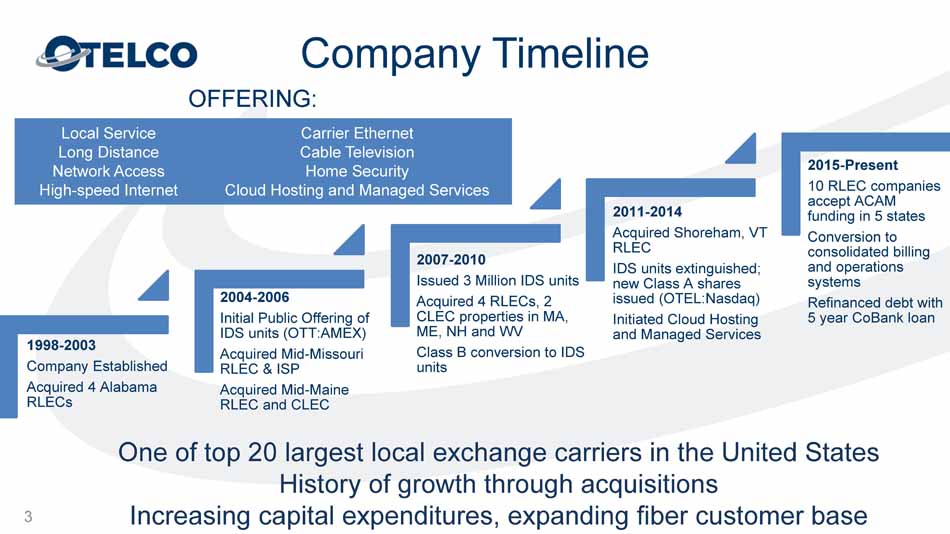

1998 - 2003 Company Established Acquired 4 Alabama RLECs 2004 - 2006 Initial Public Offering of IDS units (OTT:AMEX) Acquired Mid - Missouri RLEC & ISP Acquired Mid - Maine RLEC and CLEC 2007 - 2010 Issued 3 Million IDS units Acquired 4 RLECs, 2 CLEC properties in MA, ME, NH and WV Class B conversion to IDS units 2011 - 2014 Acquired Shoreham, VT RLEC IDS units extinguished; new Class A shares issued ( OTEL:Nasdaq ) Initiated Cloud Hosting and Managed Services 2015 - Present 10 RLEC companies accept ACAM funding in 5 states Conversion to consolidated billing and operations systems Refinanced debt with 5 year CoBank loan Company Timeline One of top 20 largest local exchange carriers in the United States History of growth through acquisitions Increasing capital expenditures, expanding fiber customer base Local Service Long Distance Network Access High - speed Internet OFFERING: Carrier Ethernet Cable Television Home Security Cloud Hosting and Managed Services 3

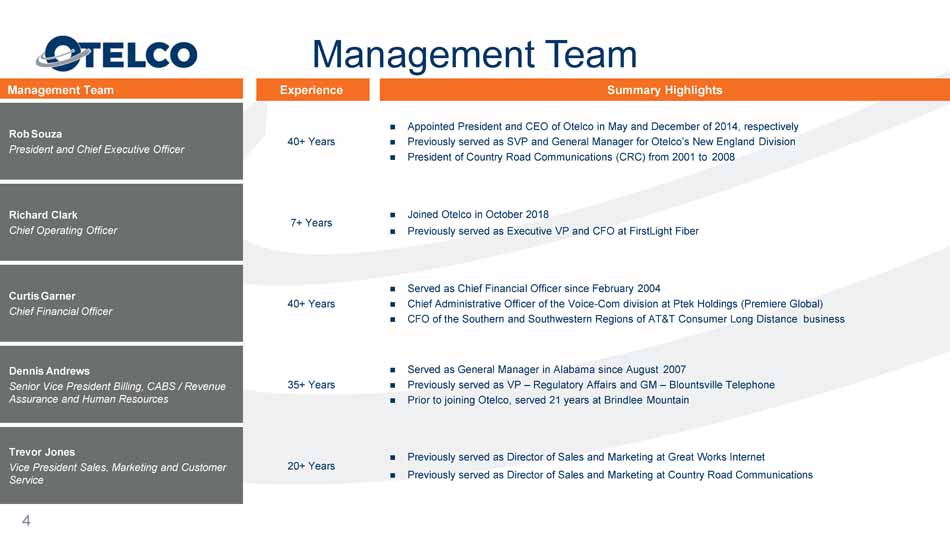

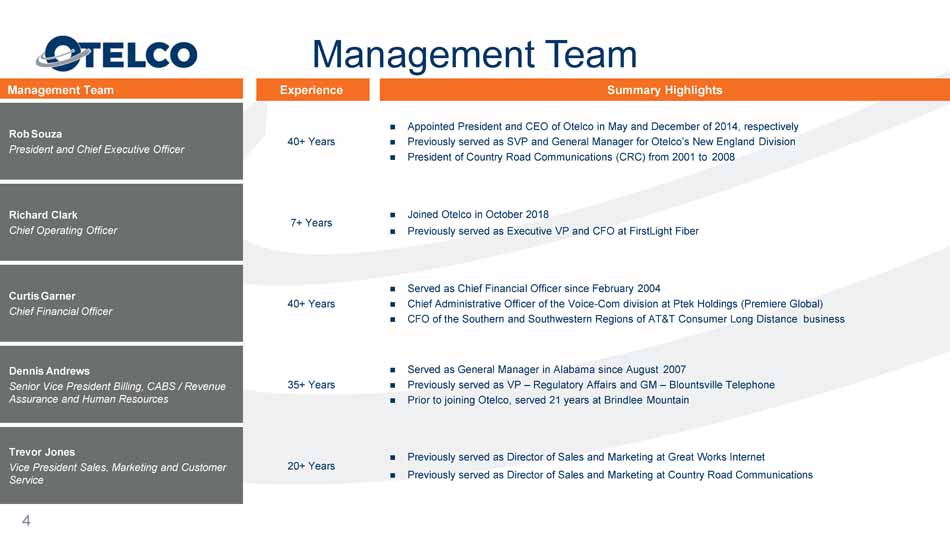

Management Team Management Team Experience Summary Highlights Rob Souza President and Chief Executive O fficer 40+ Years Appointed President and CEO of Otelco in May and December of 2014, respectively Previously served as SVP and General Manager for Otelco’s New England Division President of Country Road Communications (CRC) from 2001 to 2008 Richard Clark Chief Operating Officer 7 + Years Joined Otelco in October 2018 Previously served as Executive VP and CFO at FirstLight Fiber Curtis Garner Chief Financial Officer 40+ Years Served as Chief Financial Officer since February 2004 Chief Administrative Officer of the Voice - Com division at Ptek Holdings (Premiere Global) CFO of the Southern and Southwestern Regions of AT&T Consumer Long Distance business Dennis Andrews Senior Vice President Billing, CABS / Revenue Assurance and Human Resources 35+ Years Served as General Manager in Alabama since August 2007 Previously served as VP – Regulatory Affairs and GM – Blountsville Telephone Prior to joining Otelco, served 21 years at Brindlee Mountain Trevor Jones Vice President Sales, Marketing and Customer Service 20+ Years Previously served as Director of Sales and Marketing at Great Works Internet Previously served as Director of Sales and Marketing at Country Road Communications 4

Network Footprint RLEC (BLUE) CLEC (YELLOW) 2,000 Mile Fiber Network 24,000 Data Lines Over 93,000 Access Line Equivalents 56 Cell Towers Served 5

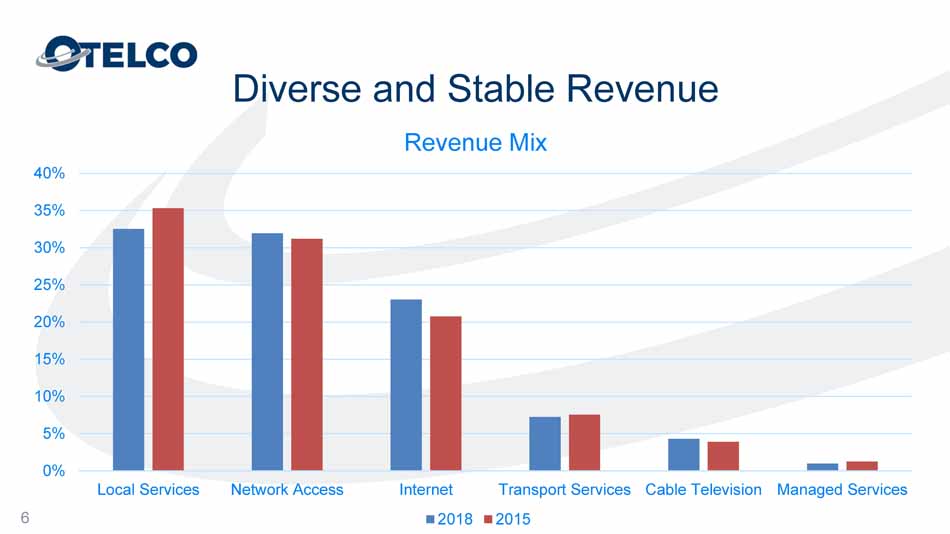

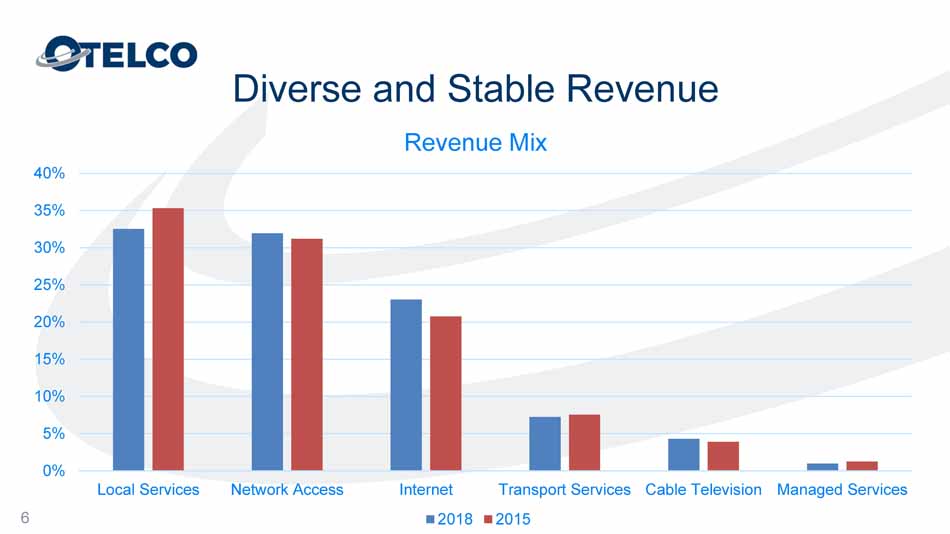

Diverse and Stable Revenue 0% 5% 10% 15% 20% 25% 30% 35% 40% Local Services Network Access Internet Transport Services Cable Television Managed Services Revenue Mix 2018 2015 6

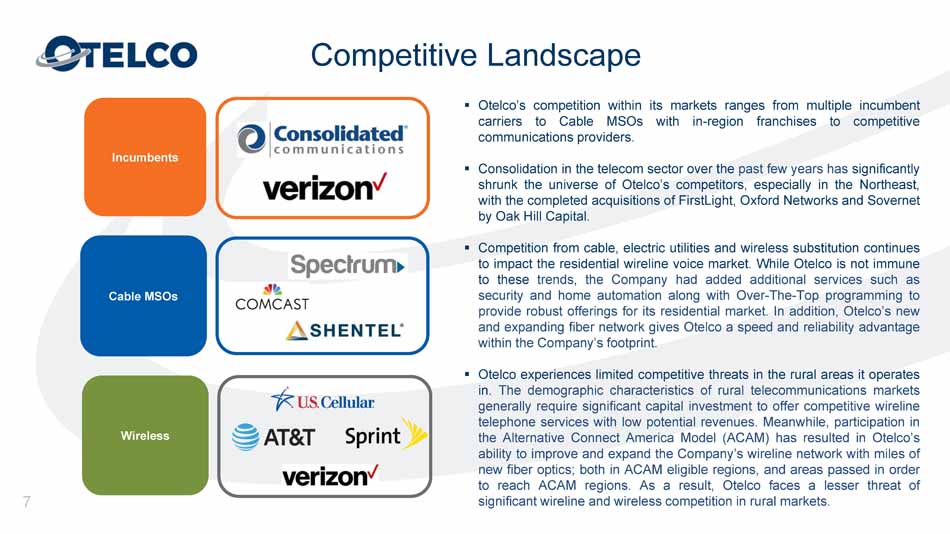

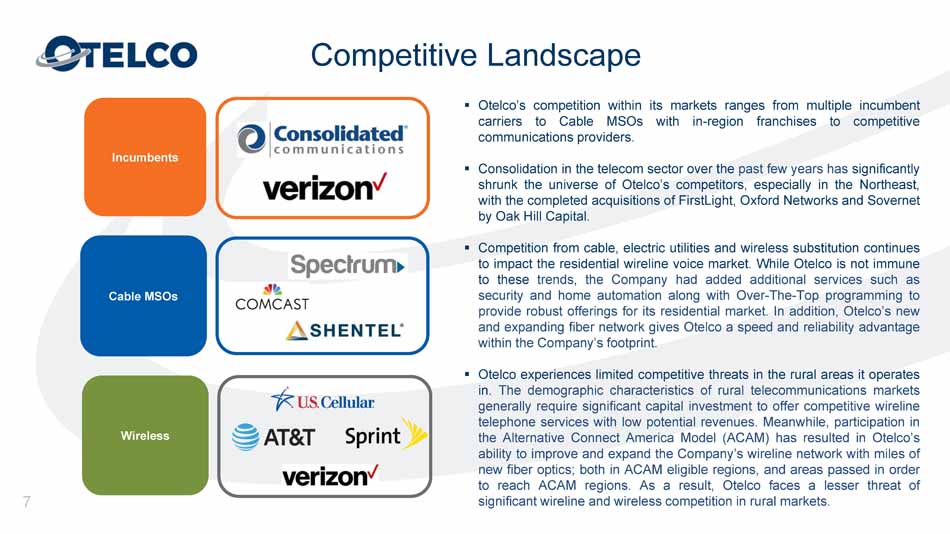

Incumbents Cable MSOs Competitive Landscape ▪ Otelco’s competition within its markets ranges from multiple incumbent carriers to Cable MSOs with in - region franchises to competitive communications providers . ▪ Consolidation in the telecom sector over the past few years has significantly shrunk the universe of Otelco’s competitors, especially in the Northeast, with the completed acquisitions of FirstLight, Oxford Networks and Sovernet by Oak Hill Capital . ▪ Competition from cable, electric utilities and wireless substitution continues to impact the residential wireline voice market . While Otelco is not immune to these trends, the Company had added additional services such as security and home automation along with Over - The - Top programming to provide robust offerings for its residential market . In addition, Otelco’s new and expanding fiber network gives Otelco a speed and reliability advantage within the Company’s footprint . ▪ Otelco experiences limited competitive threats in the rural areas it operates in . The demographic characteristics of rural telecommunications markets generally require significant capital investment to offer competitive wireline telephone services with low potential revenues . Meanwhile, participation in the Alternative Connect America Model (ACAM) has resulted in Otelco’s ability to improve and expand the Company’s wireline network with miles of new fiber optics ; both in ACAM eligible regions, and areas passed in order to reach ACAM regions . As a result, Otelco faces a lesser threat of significant wireline and wireless competition in rural markets . Wireless 7

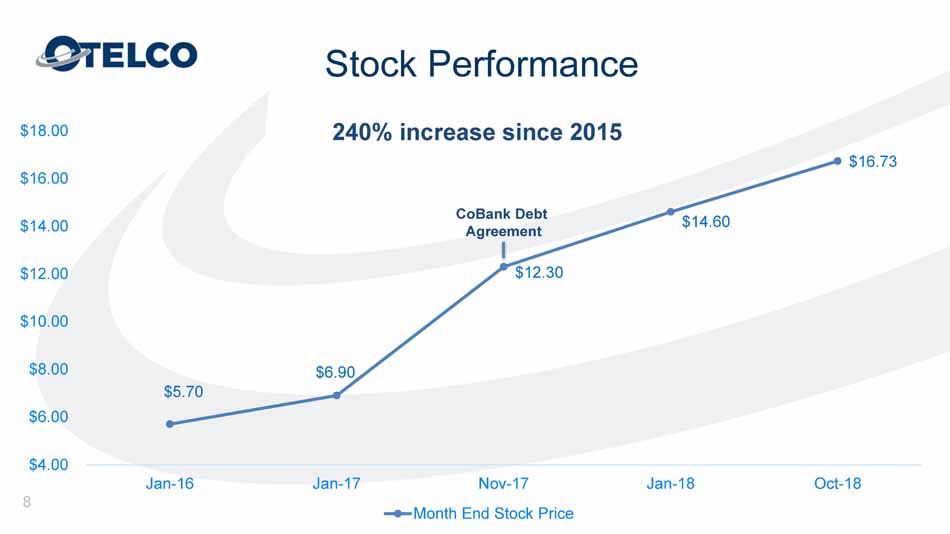

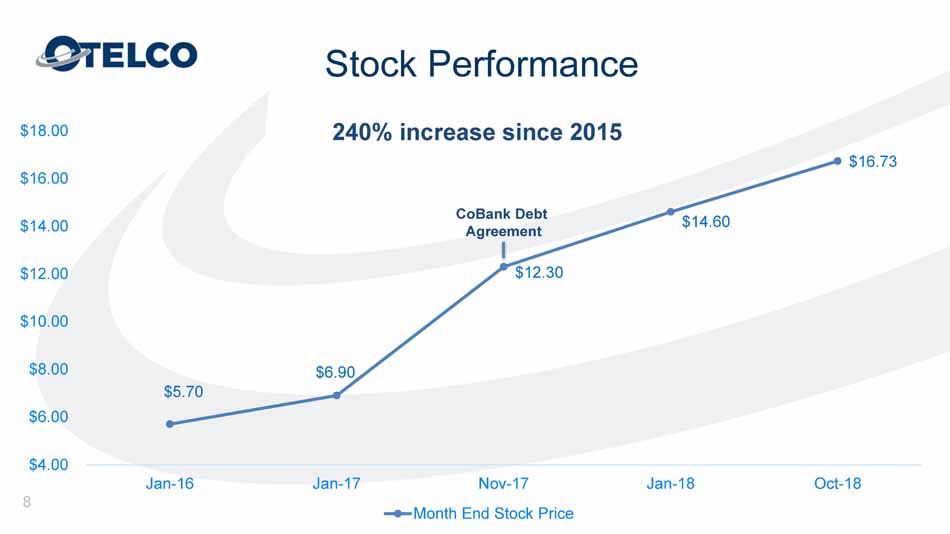

Stock Performance $5.70 $6.90 $12.30 $14.60 $16.73 $4.00 $6.00 $8.00 $10.00 $12.00 $14.00 $16.00 $18.00 Jan-16 Jan-17 Nov-17 Jan-18 Oct-18 Month End Stock Price CoBank Debt Agreement 240% increase since 2015 8

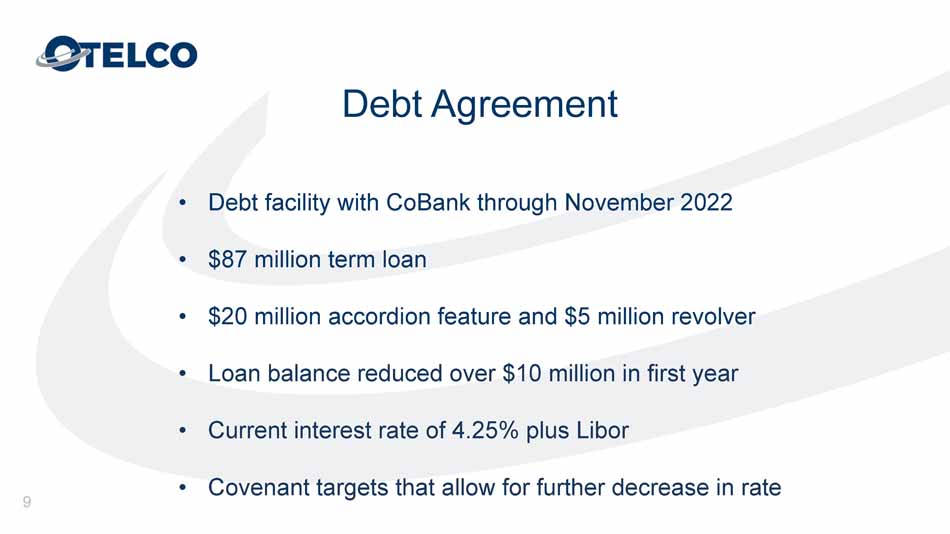

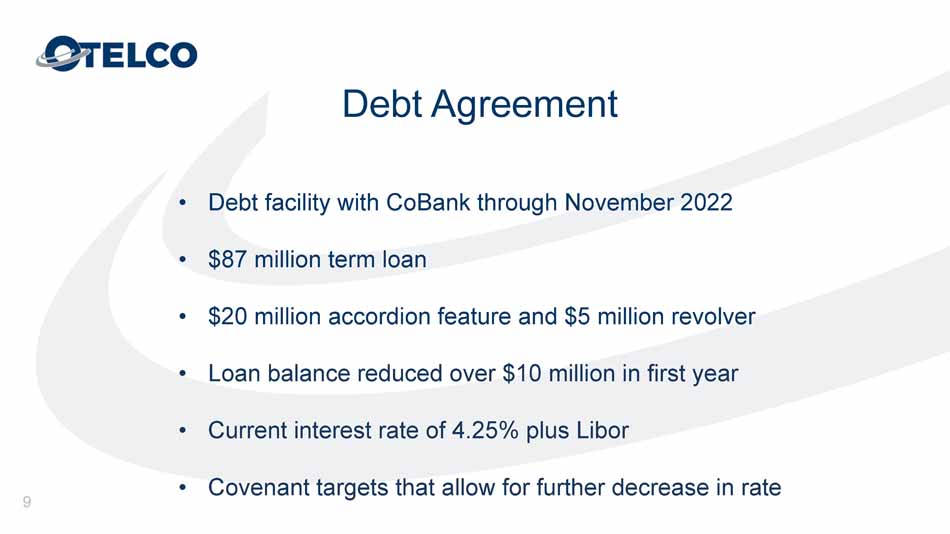

Debt Agreement • Debt facility with CoBank through November 2022 • $87 million term loan • $20 million accordion feature and $5 million revolver • Loan balance reduced over $10 million in first year • Current interest rate of 4.25% plus Libor • Covenant targets that allow for further decrease in rate 9

Impact of Tax Cuts and Jobs Act HISTORY • 2015 effective rate of 39.8% • 2016 effective rate of 41.5% TAX ACT • Lowered Corporate tax rate to 21% • Extension of bonus depreciation • Expensing of Capex to 2023 IMPACT • Anticipated effective rate of 25.0% in 2018 • Estimated cash tax savings of $2.1 million for 2018 10

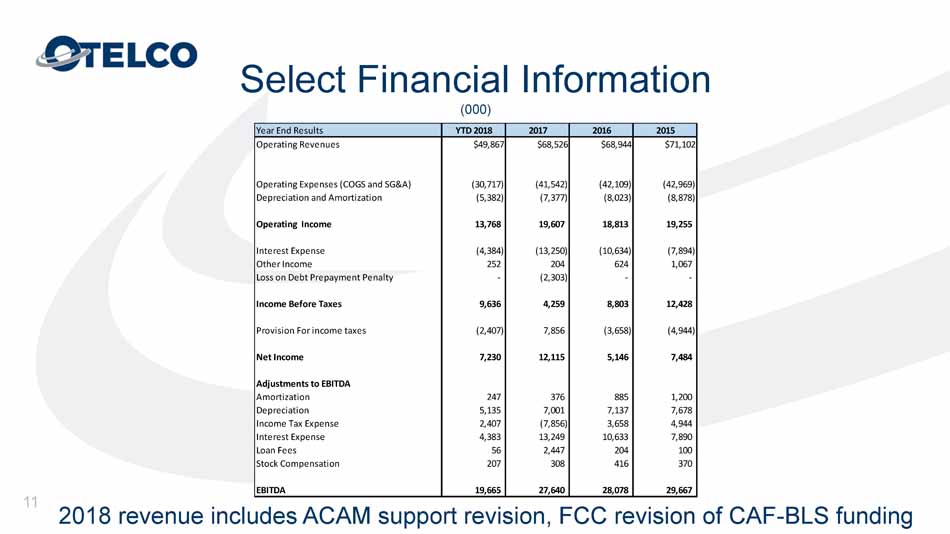

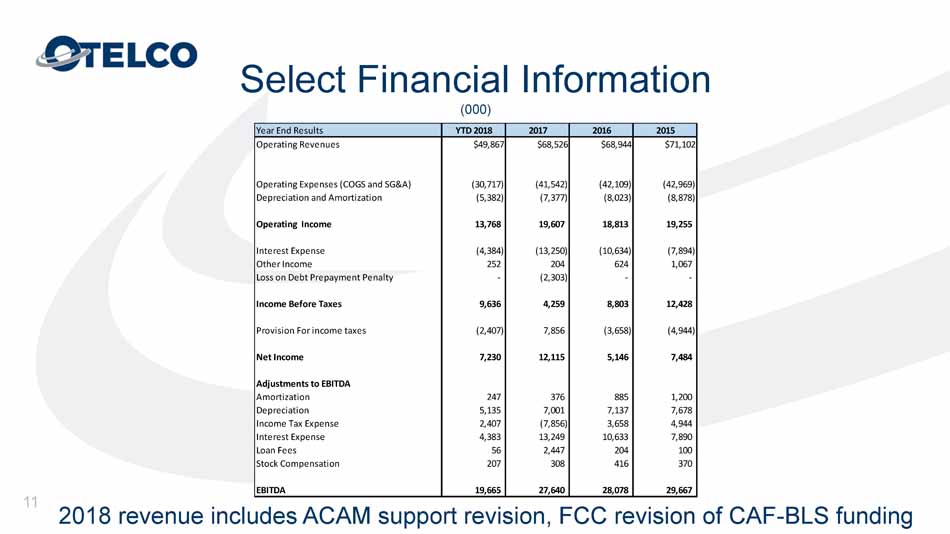

Select Financial Information (000) 2018 revenue includes ACAM support revision, FCC revision of CAF - BLS funding 11 Year End Results YTD 2018 2017 2016 2015 Operating Revenues $49,867 $68,526 $68,944 $71,102 Operating Expenses (COGS and SG&A) (30,717) (41,542) (42,109) (42,969) Depreciation and Amortization (5,382) (7,377) (8,023) (8,878) Operating Income 13,768 19,607 18,813 19,255 Interest Expense (4,384) (13,250) (10,634) (7,894) Other Income 252 204 624 1,067 Loss on Debt Prepayment Penalty - (2,303) - - Income Before Taxes 9,636 4,259 8,803 12,428 Provision For income taxes (2,407) 7,856 (3,658) (4,944) Net Income 7,230 12,115 5,146 7,484 Adjustments to EBITDA Amortization 247 376 885 1,200 Depreciation 5,135 7,001 7,137 7,678 Income Tax Expense 2,407 (7,856) 3,658 4,944 Interest Expense 4,383 13,249 10,633 7,890 Loan Fees 56 2,447 204 100 Stock Compensation 207 308 416 370 EBITDA 19,665 27,640 28,078 29,667

*S LEVERAGE RATIO 3.43 3.43 3.38 3.19 3.19 2.93 75,000 80,000 85,000 90,000 95,000 100,000 105,000 2016 Q1 2016 Q3 2017 Q1 2017 Q3 2018 Q1 2018 Q3 Total Debt (000) $6m in additional principal prepayments through September 2018. 12 See appendix for reconciliation to GAAP measures

Operational Objectives Execute on ACAM FTTP Projects Realize Efficiencies of Consolidated Billing and Operations Optimize Key Strategies Effective Deployment of Capital 13

Operational Objectives What is ACAM? • 2016 FCC order • Preserve and advance service in areas served by rate - of - return carriers • Specific obligations: number of locations and broadband speeds within eligible census blocks • 10 Otelco RLECs qualify OTELCO: Current Status • 10 eligible RLECs opted for ACAM funding (VT not Eligible) • Will continue to receive funding through 2026 • Building to current and new customers in all regions • Able to meet some obligations with current DSL network • Secured additional funding through CAF II auction; will build to additional locations in Massachusetts Expected Impact • Vastly extended fiber network with potential to serve over 12,000 locations • Increase revenue per customer • More attractive for targeted acquisition Execute on ACAM F iber T o T he P remise Projects 14

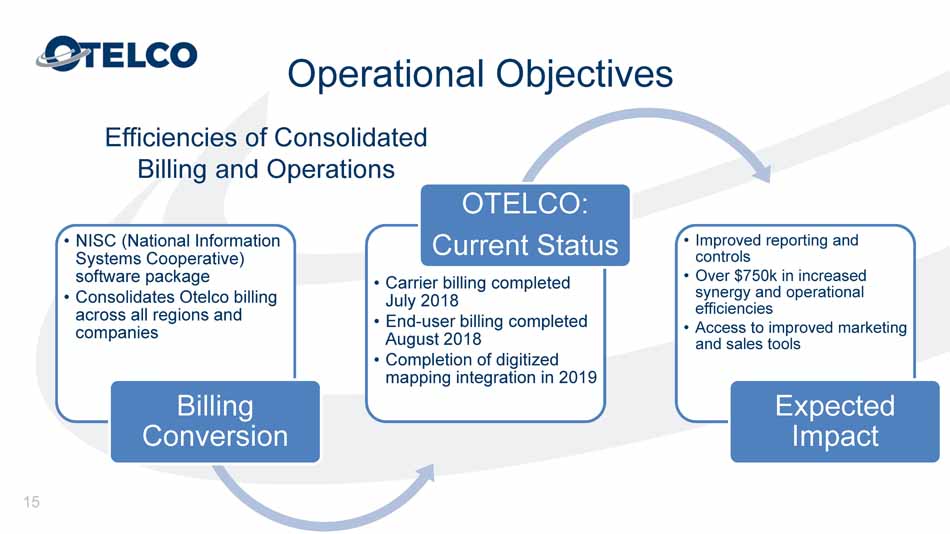

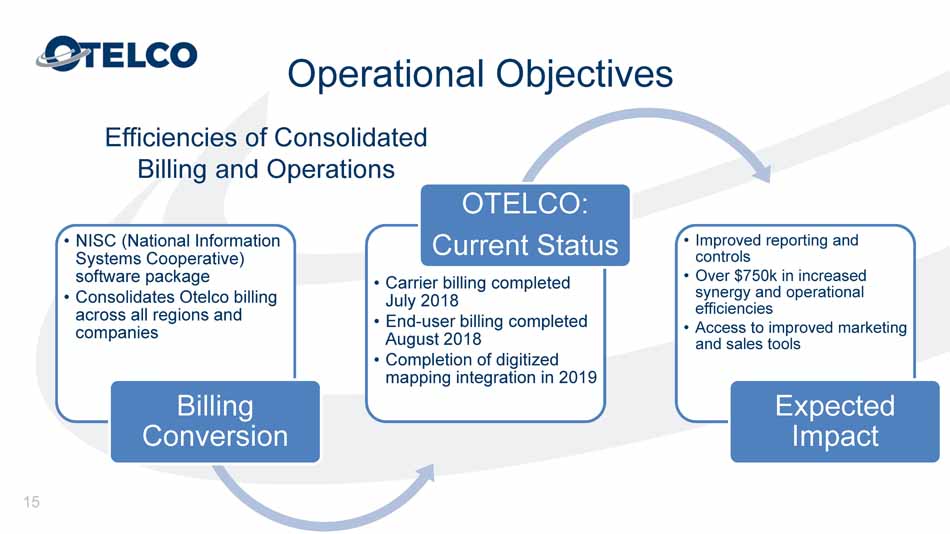

Operational Objectives • NISC (National Information Systems Cooperative) software package • Consolidates Otelco billing across all regions and companies Billing Conversion • Carrier billing completed July 2018 • End - user billing completed August 2018 • Completion of digitized mapping integration in 2019 OTELCO: Current Status • Improved reporting and controls • Over $750k in increased synergy and operational efficiencies • Access to improved marketing and sales tools Expected Impact Efficiencies of Consolidated Billing and Operations 15

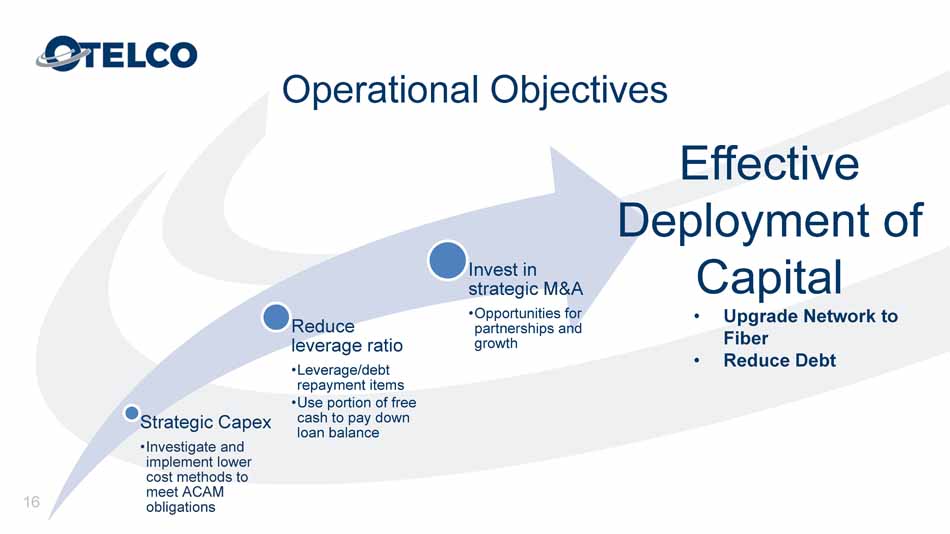

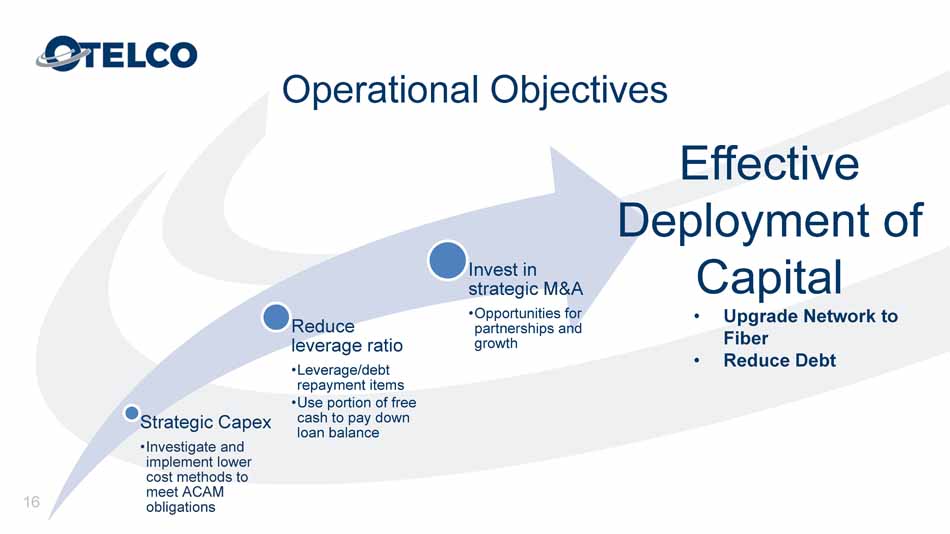

Operational Objectives Strategic Capex • Investigate and implement lower cost methods to meet ACAM obligations Reduce leverage ratio • Leverage/debt repayment items • Use portion of free cash to pay down loan balance Invest in strategic M&A • Opportunities for partnerships and growth Effective Deployment of Capital • Upgrade Network to Fiber • Reduce Debt 16

Operational Objectives Capture New Revenue with Fiber Offerings Market aggressively in new fiber footprints Evolve product lines Price competitively Upsell Fiber to existing customers Collaborate on Municipal Broadband Projects Identify municipalities that are overlooked and underserved Develop customized solution to solve problem Execute and deliver cost effectively Effectively Manage Expenses Manage operational efficiency Network optimization Optimize Key Strategies • Increase Sales • Manage Expense 17

Appendix: Leverage Ratio 18 Q1 2016 Q3 2016 Q1 2017 Q3 2017 Q1 2018 Q3 2018 Net income 7,099 6,043 5,004 5,679 12,502 14,612 Depreciation 7,542 7,250 7,098 7,034 6,997 6,911 Interest expense less interest income 7,226 8,537 9,500 9,211 7,463 5,634 Interest expense - amortized loan cost 1,098 1,298 1,264 1,241 4,634 4,250 Income tax expense 4,689 4,029 3,529 3,667 (8,086) (8,159) Amortization - intangibles 1,124 1,005 728 433 359 333 Loan fees 160 189 158 233 2,426 2,310 Stock-based compensation 342 390 370 342 285 278 Securities expense 6 - - - - - Consolidated EBITDA 29,287 28,741 27,649 27,840 26,580 26,169 Senior notes payable 80,305 78,837 74,256 69,717 82,946 75,004 Debt issuance cost 4,695 4,163 3,619 3,158 1,879 1,646 Senior notes outstanding 85,000 83,000 77,875 72,875 84,825 76,650 Subordinated notes payable 14,497 14,701 14,937 15,176 - - Debt issuance cost 840 793 713 634 - - Subordinated notes outstanding 15,337 15,494 15,650 15,810 - - Notes outstanding 100,337 98,494 93,525 88,685 84,825 76,650 Leverage 3.43 3.43 3.38 3.19 3.19 2.93 Trailing 12 Months (000)

www.Otelco.com 2 19