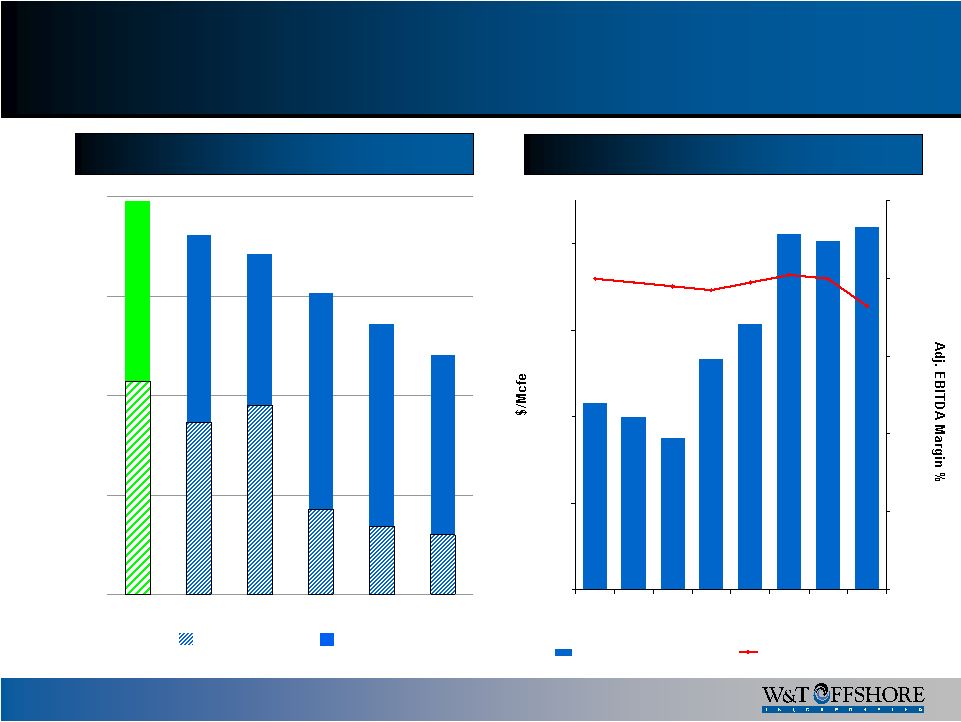

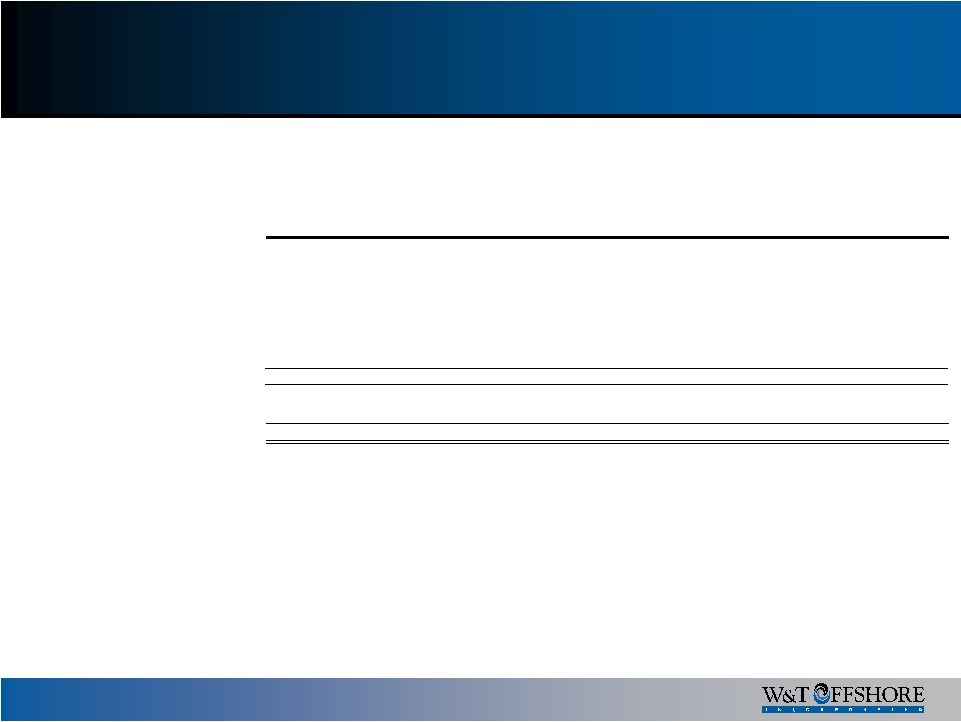

38 Reconciliation of Net Income to EBITDA The following table presents a reconciliation of our consolidated net income to consolidated EBITDA to Adjusted EBITDA: We define EBITDA as net income plus income tax expense, net interest expense (income), and depreciation, depletion, amortization and accretion. We believe the presentation of EBITDA and Adjusted EBITDA provide useful information regarding our ability to service debt and to fund capital expenditures and help our investors understand our operating performance and make it easier to compare our results with those of other companies that have different financing, capital and tax structures. Adjusted EBITDA excludes the loss on extinguishment of debt and the unrealized gain or loss related to our open derivative contracts. Although not prescribed under generally accepted accounting principles, we believe the presentation of EBITDA and Adjusted EBITDA are relevant and useful because they help our investors understand our operating performance and make it easier to compare our results with those of other companies that have different financing, capital and tax structures. EBITDA and Adjusted EBITDA should not be considered in isolation from or as a substitute for net income, as an indication of operating performance or cash flows from operating activities or as a measure of liquidity. EBITDA and Adjusted EBITDA, as we calculate them, may not be comparable to EBITDA and Adjusted EBITDA measures reported by other companies. In addition, EBITDA and Adjusted EBITDA do not represent funds available for discretionary use. Nine Months Ended September 30, 2000 2001 2002 2003 2004 2005 2006 2007 ($ in thousands) Net income 48,204 $ 63,569 $ 2,049 $ 116,582 $ 149,482 $ 189,023 $ 199,104 $ 94,890 $ Income taxes -- -- 52,408 61,156 80,008 101,003 107,205 48,988 Net interest expense (income) 4,918 3,902 3,001 2,229 1,842 (1,601) 11,261 26,149 Depreciation, depletion, amortization and accretion 29,775 65,293 89,941 143,692 164,808 183,833 337,627 373,358 EBITDA 82,177 $ 132,764 $ 147,399 $ 323,659 $ 396,140 $ 472,258 $ 655,242 $ 543,385 $ Loss on extinguishment of debt -- -- -- -- -- -- -- 2,806 Unrealized derivatives loss (gain) -- -- -- -- -- -- (13,476) 21,360 Adjusted EBITDA 82,177 $ 132,764 $ 147,399 $ 323,659 $ 396,140 $ 472,258 $ 641,766 $ 567,551 $ Year Ended December 31, |