RBC Capital Markets Global Energy and Power Conference June 7, 2011 Exhibit 99.1 |

1 1 Company Snapshot (1) Includes acquisition-related CAPEX. (2) Data as of 12/31/10 for offshore properties. Producing fields include offshore fields only. (3) Average daily production from 5/11/11 to 5/19/11; includes recently announced Permian acquisition production of 2,950 Boe/d. |

Key Investment Considerations • Strong operating track record with 27+ year history of success in the Gulf of Mexico • High-quality, oil-exposed reserve base with history of reserve and production growth • Strong financial position and healthy liquidity level • Conservative operating strategy with drilling budget financed through internally generated cash flow • Proven, experienced management team whose interests align with all stakeholders (CEO owns over 50% of stock) |

3 Company Overview • Large acreage position in the Gulf of Mexico primarily held by production • Added Permian Basin to the portfolio with acquisition on May 11, 2011 – Oily, longer-lived proved reserves – Provides “predictable growth” opportunities, and complements GOM conventional shelf and deepwater assets with high cash flow and upside potential – Reserves to production profile increases to 6.7 years, while oil and liquids percentage increases to 59% • Continued emphasis on reserve and production growth • Strong cash flow focused on full cycle economics • Active drilling program with 36 (27 onshore, 9 offshore) wells planned as part of $310 million capital program |

4 4 Company Diversification in Progress • Since April 2010, we have diversified our existing portfolio by acquiring producing assets at attractive prices in the deepwater GOM and the Permian basin (1) Pro forma for recently announced Permian basin acquisition. Permian Basin (1) • Proved Reserves: 182 Bcfe / 30 MMBoe • Acreage: 30,900 Net • ~6% of Production GOM Deepwater • Proved Reserves: 144 Bcfe / 24 MMBoe • Acreage: 137,792 Gross / 93,670 Net • ~31% of Production (1) GOM Shelf • Proved Reserves: 341 Bcfe / 57 MMBoe • Acreage: 709,183 Gross / 455,171 Net • ~62% of Production (1) Gulf Coast |

5 5 Strategic Plan • Pursue drilling and development of our recently acquired Permian Basin properties – Integrate West Texas operations • Expand/acquire acreage positions in onshore prospect areas • Continue evaluations of other potential acquisitions • Pursue active and balanced drilling program to increase reserves and production – Historically drilled within internally generated cash flow |

Onshore |

7 7 Permian Basin Acquisition Provides Base for Transformation • Signed purchase and sale agreement to acquire approximately 21,900 gross acres (21,500 net acres) from private sellers for approximately $377 million • Strong volumes from proved developed production – Current net daily production of about 2,950 BOE – Production grew ~55% from 1,900 BOE at Jan. 1, 2011 – Currently 73 producing wells • Proved and probable reserves – 30 MMBoe of proved reserves – 25 MMBoe of additional probable reserves • Conservative estimates of reserves – Analyses assume an average estimated ultimate recovery of ~100 MBoe net per well for PUDs and 40 acres spacing • High ratio of oil and liquid (91%) to gas production and reserves – Reserves to production ratio increases to 6.7 years and W&T’s % of oil / liquids increases to 59% |

8 8 Permian Basin Acquisition Provides Long-term Growth • Low risk operations with a multi-year extensive drilling inventory – 450 to 500 drilling locations identified for future exploration and development – Proved reserves based on 40 acre spacing but certain nearby operators are using 20 acre spacing – 3 drilling and 2 - 4 workover rigs continually working – Focused on improving operating efficiency • Plan for three drilling rigs working throughout remainder of 2011 – Primarily targeting the “Wolfberry” trend, but deeper targets have been tested and are producing – 2011 Capital Expenditures of $35 million - $40 million – Anticipate drilling 15 to 20 development wells in 2011 |

9 9 Newly Acquired Assets in West Texas: Martin, Dawson, Andrews & Gaines Counties |

Wolfberry West Texas Completions * Limestone Pay Organic Rich Shale Play Average Cased Depth of Wellbore Fractured Stimulation Stages Clear- fork Dean Non-organic Shale Non-pay Sandstone Play 12,500’ 13,250’ Devonian Silurian * Not drawn to scale. |

11 11 Other Onshore Activities • In addition to our West Texas Permian Basin acquisition, we are actively involved: – In South Texas – • Our initial well, in which we have a 25% non-operating working interest (WI), was completed and found 22 feet of gas and condensate. This area has potential for additional drilling opportunities. – In West Texas – • We have also acquired about 9,400 net acres in the Permian Basin through leasing and farm-outs and expect to have about seven exploratory wells drilled before the end of the year. Working interests vary; we should operate three or four of such exploratory wells. – In East Texas – • Our first well reached total depth in April. Due to downhole problems in this non-operated well, a sidetrack operation was commenced early in May and should be again at total depth in July. The original operation found both conventional and unconventional reservoirs. We had a 25% WI in the original well and have increased our participation to about 35% in the subsequent operation. This area has potential for additional drilling opportunities. |

12 12 Onshore 2011 Drilling Program South Texas WI: 50% 2 Wells East Texas WI: 25% 1 well Exploration Development West Texas WI: 25% to 100% 7 - 8 Wells West Texas WI: 100% 15 – 20 Wells • In addition to the recently announced Permian acquisition, we have also acquired 9,400 net exploratory acres in the Permian basin |

Gulf of Mexico |

14 Gulf of Mexico Highlights • Strong operating track record – 10 year exploration drilling success rate of 77% and 10 year development drilling success rate of 91% – Proved reserve replacement rate of 231% in 2010 – Excellent safety track record and culture of operating success – All-in F&D costs in 2010 of $2.59/Mcfe • Large acreage position • Great history of production and reserves – Highly prolific with multiple pay zones – Reserves at deeper but virtually untapped zones, significant upside potential – Established infrastructure on shelf – Substantial percentage of oil reserves – Reserve to production profile is consistent • Attractive reservoir characteristics – High porosity rock provides quick return on investment – Cash flow velocity significantly higher than most other basins – Balanced growth opportunities (high impact or low risk) • Costs historically adjust quickly to commodity prices due to shorter contract terms |

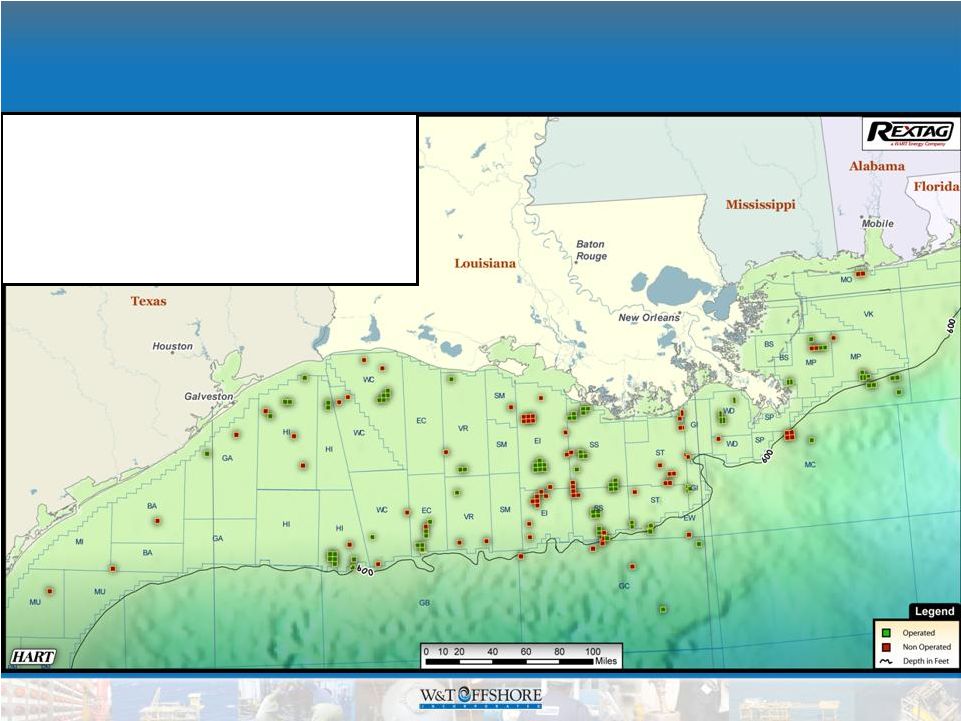

15 15 Gulf of Mexico Proved Reserve with Geographic Diversification • 67 fields • 80% operated • 846,975 gross acres, 548,841 net acres • 82% held by production • Producing 274 MMcfe per day • 44% oil & liquids / 56% gas |

16 Gulf of Mexico Recent Activity • We are integrating two purchases closed in 2010 consisting of virtually all proved, producing reserves – We acquired two properties from Total and closed the acquisition on 5/3/10 – We acquired three properties from Shell and closed 11/3/10 • Currently working to close a fourth Shell property consisting of virtually all proved, producing reserves • Restored production to the Main Pass 108 Field early in the 2011 second quarter – Current net production amounts to about 42MMcfe per day, or 35 MMcf and 1,300 barrels per day • Successfully drilled one exploratory well at Main Pass 180 and a development sidetrack at our MP 108 D-3 well • Anticipate drilling three more exploratory wells and four development wells offshore this year |

17 17 Concentrated Operations in Recently Acquired GOM Fields and Focus Areas |

18 18 Offshore 2011 Drilling Program Viosca Knoll Mississippi Canyon Atwater Valley Green Canyon Garden Banks East Breaks Mustang Island Matagorda Island Brazos Galveston High Island E. Cameron Vermilion Eugene Island Ship Shoal South Timbalier Ewing Bank West Delta Grand Isle Main Pass S. and E. Main Pass W. Cameron Exploration Development MP 180 A-2 WI: 100% Shelf (Drilled and successful) MP 108 #8 & Tex W5 WI: 75% Shelf West Cameron 73 #2 WI: 30% Deep Shelf Deepwater Prospect WI: 20% MP 108 D-3 ST WI: 100% Shelf (Drilled and successful) SS 349 E WI: 100% Shelf ST 316 A-2 ST WI: 40% Shelf SS 349 B WI: 100% Shelf |

19 Regulatory Developments -- Deepwater • Permits approved for 14 unique deepwater wells since drilling was halted after last year’s spill • Well control options – Operators to show how they would respond to subsea well control issue. – Helix Well Containment Group (HWCG) – Marine Well Containment Company (MWCC) – Total Deepwater Solution (TDWS) • W&T has executed a contract with HWCG • The first 3 approved deepwater drilling permit were members of the HWCG |

Other Operational and Financial Information |

PDP 41% PDNP 24% PUD 35% 21 21 Proved Reserves PDP 49% PDNP 32% PUD 19% Pro Forma 2010 2010 485 Bcfe 668 Bcfe |

22 22 Drilling Within Cash Flow Adjusted EBITDA vs. Capital Expenditures ($ in millions) Capital expenditures funded largely through internally generated cash flow $884 $820 $341 $450 $687+ $416 $276 $775 $359 $0 $100 $200 $300 $400 $500 $600 $700 $800 $900 $1,000 2007 2008 2009 2010 2011E Adj. EBITDA CAPEX, Excl. Acquisitions Acquisition CAPEX $884 $820 $341 $450 $687+ $416 $276 $775 $359 $0 $100 $200 $300 $400 $500 $600 $700 $800 $900 $1,000 2007 2008 2009 2010 2011E Adj. EBITDA CAPEX, Excl. Acquisitions Acquisition CAPEX Estimate |

23 23 Liquidity Profile • Cash balance at May 25, 2011 ~ $71 million • New four-year revolver with $525 million borrowing base – Borrowing base increases to $575 million when the fourth Shell property closes – The newly acquired Permian Basin assets have yet to be considered for an increase to the borrowing base – ~$150 million drawn on revolver pro forma for Permian acquisition and new high yield bond offering • Net cash provided by operating activities $464.8 million for 2010 |

Appendix |

25 The following table presents a reconciliation of our consolidated net income to consolidated EBITDA to Adjusted EBITDA: We define EBITDA as net income (loss) plus income tax expense (benefit), net interest expense (which includes interest income), depreciation, depletion, amortization and accretion and impairment of oil and natural gas properties. Adjusted EBITDA excludes the loss on extinguishment of debt and the unrealized gain or loss related to our derivative contracts. Although not prescribed under GAAP, we believe the presentation of EBITDA and Adjusted EBITDA provide useful information regarding our ability to service debt and fund capital expenditures and they help our investors understand our operating performance and make it easier to compare our results with those of other companies that have different financing, capital and tax structures. EBITDA and Adjusted EBITDA should not be considered in isolation from or as a substitute for net income, as an indication of operating performance or cash flow from operating activities or as a measure of liquidity. EBITDA and Adjusted EBITDA, as we calculate them, may not be comparable to EBITDA and Adjusted EBITDA measures reported by other companies. In addition, EBITDA and Adjusted EBITDA do not represent funds available for discretionary use. Reconciliation of Net Income to EBITDA Twelve Months Ended March 31, 2007 2008 2009 2010 2010 2011 2011 ($ in thousands) Net income 144,300 $ (558,819) $ (187,919) $ 117,892 $ 42,315 $ 18,649 $ 94,226 $ Income taxes (benefit) 71,459 (269,663) (74,111) 11,901 4,020 10,182 18,063 Net interest expense (income) 30,684 21,337 39,245 36,996 9,376 8,717 36,337 Depreciation, depletion, amortization and accretion 532,910 521,776 342,537 294,100 69,209 74,092 298,983 Impairment of oil and natural gas properties -- 1,182,758 218,871 -- -- -- -- EBITDA 779,353 897,389 338,623 460,889 124,920 111,640 447,609 Loss on extinguishment of debt 2,806 -- 2,926 -- -- -- -- Unrealized derivatives loss (gain) 37,831 (13,501) 5,370 9,511 (5,109) 21,617 36,237 Royalty relief recoupment -- -- -- (24,881) -- -- (24,881) Transportation allowance -- -- (5,558) 4,687 -- -- 4,687 Adjusted EBITDA 819,990 $ 883,888 $ 341,361 $ 450,206 $ 119,811 $ 133,257 $ 463,652 $ Year Ended December 31, Three Months Ended March 31, |

26 Forward-Looking Statement Disclosure This presentation, contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act and Section 21E of the Exchange Act. Forward-looking statements give our current expectations or forecasts of future events. They include statements regarding our future operating and financial performance. Although we believe the expectations and forecasts reflected in these and other forward-looking statements are reasonable, we can give no assurance they will prove to have been correct. They can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. You should understand that the following important factors, could affect our future results and could cause those results or other outcomes to differ materially from those expressed or implied in the forward-looking statements relating to: (1) amount, nature and timing of capital expenditures; (2) drilling of wells and other planned exploitation activities; (3) timing and amount of future production of oil and natural gas; (4) increases in production growth and proved reserves; (5) operating costs such as lease operating expenses, administrative costs and other expenses; (6) our future operating or financial results; (7) cash flow and anticipated liquidity; (8) our business strategy, including expansion into the deep shelf and the deepwater of the Gulf of Mexico, and the availability of acquisition opportunities; (9) hedging strategy; (10) exploration and exploitation activities and property acquisitions; (11) marketing of oil and natural gas; (12) governmental and environmental regulation of the oil and gas industry; (13) environmental liabilities relating to potential pollution arising from our operations; (14) our level of indebtedness; (15) timing and amount of future dividends; (16) industry competition, conditions, performance and consolidation; (17) natural events such as severe weather, hurricanes, floods, fire and earthquakes; and (18) availability of drilling rigs and other oil field equipment and services. We caution you not to place undue reliance on these forward-looking statements, which speak only as of the date of this presentation or as of the date of the report or document in which they are contained, and we undertake no obligation to update such information. The filings with the SEC are hereby incorporated herein by reference and qualifies the presentation in its entirety. Cautionary Note to U.S. Investors The United States Securities and Exchange Commission permits oil and gas companies, in their filings with the SEC, to disclose only proved reserves that a company has demonstrated by actual production or conclusive formation tests to be economically and legally producible under existing economic and operating conditions. U.S. Investors are urged to consider closely the disclosure in our Form 10-K for the year ended December 31, 2010, available from us at Nine Greenway Plaza, Suite 300, Houston, Texas 77046. You can obtain these forms from the SEC by calling 1-800-SEC-0330. |

W&T Offshore, Inc. (NYSE: WTI) Nine Greenway Plaza Suite 300 Houston, TX 77046 Main line - 713-626-8525 Fax - 713-626-8527 Investor Relations - 713-297-8024 www.wtoffshore.com www.investorrelations@wtoffshore.com |