included in and subject to this Agreement as if the Additional Lands were listed in Exhibit A;

(c)if Owner (or either of them) is the Acquiring Party, the Additional Lands shall be deemed to be included in and subject to this Agreement as if the Additional Lands were listed in Exhibit Aunless TRC notifies Owner, in writing, within sixty (60) days following TRC’s receipt of Owner’s notice, that TRC declines to include the Additional Lands in this Agreement, in which event Owner shall be free to hold and operate such Additional Lands for its own account, free and clear of any claims by or obligations to TRC;

(d)if TRC or Owner propose to include Additional Lands pursuant to this Section 1.2 that are burdened, as of the date of acquisition, by any royalties on production (including without limitation any royalties created by or under the Acquisition Documents) (“Third Party Royalties”), then the Acquiring Party shall provide the other Party copies of any leases, purchase agreements, deeds or other documents reflecting such burdens. TRC in “good faith” located additional claims following signing of the Memorandum of Understanding to further safeguard against Third Party acquisitions. Should additional Third Party lands be acquired, they will be so for the benefit of the Project and shall be governed by this Agreement; and

(e)Following the inclusion of Additional Lands in the Property pursuant to this Section 1.2, the Parties shall take such actions and execute such instruments (including without limitation an amendment to this Agreement) as either Party may reasonably desire or as may be required under the terms of the Acquisition Documents or applicable law to subject the Additional Lands and the Acquisition Documents to the terms of this Agreement.

1.3Activities Outside the Area of Interest. Nothing in this Agreement shall be construed to limit either Party’s right to stake, purchase, lease, apply for or otherwise acquire, on its own behalf and without any obligation whatsoever to the other, any right, title or interest whatsoever in or to any real property or mineral interests situated outside of the Area of Interest, and such right, title and interest shall not be subject to this Agreement.

1.4Relinquishment of Property. If TRC elects to abandon or relinquish any portion of the Property (the “Relinquished Property”), either before or after TRC’s exercise of the Option, TRC shall first provide notice thereof to Owner, specifying which portion of the Property is to be abandoned or relinquished, and within thirty (30) days from and after such notice Owner may elect to receive all or any portion of such Relinquished Property by notice to TRC. In such a case, TRC shall, rather than abandoning or relinquishing such property, deliver to Owner a duly executed deed in recordable form conveying to Owner (85.0% to Steven Van Ert and 15.0% to Noel Cousins as tenants in common) all of TRC’s rights, title and interest in the Relinquished Property so elected by Owner and warranting the absence of any lien or encumbrance arising by, through or under TRC; provided, however, that such obligation shall not extend to rights included in the Property pursuant to Section 1.2 that are held under lease or similar agreement with a third party and to whom TRC has a similar pre-existing obligation to relinquish such Property; and provided, further, that if the lease or other agreement with the third party does not preclude a transfer to Owner, Owner shall have the right to elect to receive a transfer of such rights, but

which right must be exercised within thirty (30) days after TRC’s required notice to Owner. For avoidance of doubt, the Parties acknowledge that Owner may elect to take ownership of all, none or some portion of the Relinquished Property, in Owner’s discretion. Upon delivery of such deed or transfer, all of TRC’s rights, title, interest and obligations with respect to the Relinquished Property shall terminate, except that: (1) TRC shall perform its reclamation obligations under Section 11.3, and (2) if the Relinquished Property includes unpatented mining claims and notice of relinquishment is provided after July 1 of any calendar year, TRC shall be required (as provided in Section 13.3) to make all filings and payments to the Bureau of Land Management (“BLM”) and to Inyo County to maintain such claims for that calendar and assessment year.

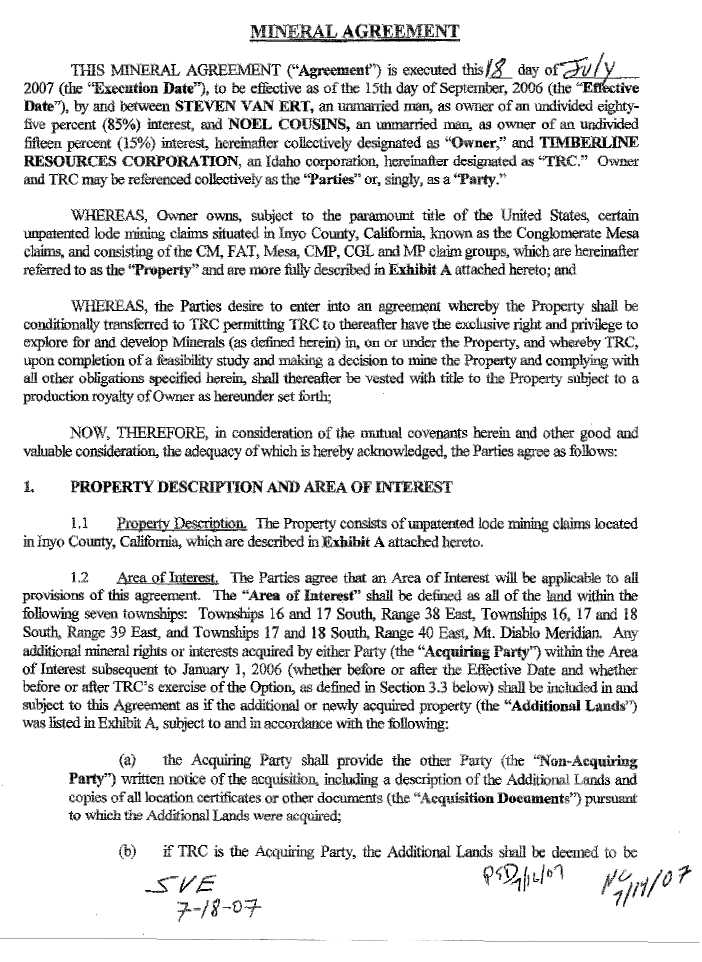

2. WARRANTIES AND REPRESENTATIONS

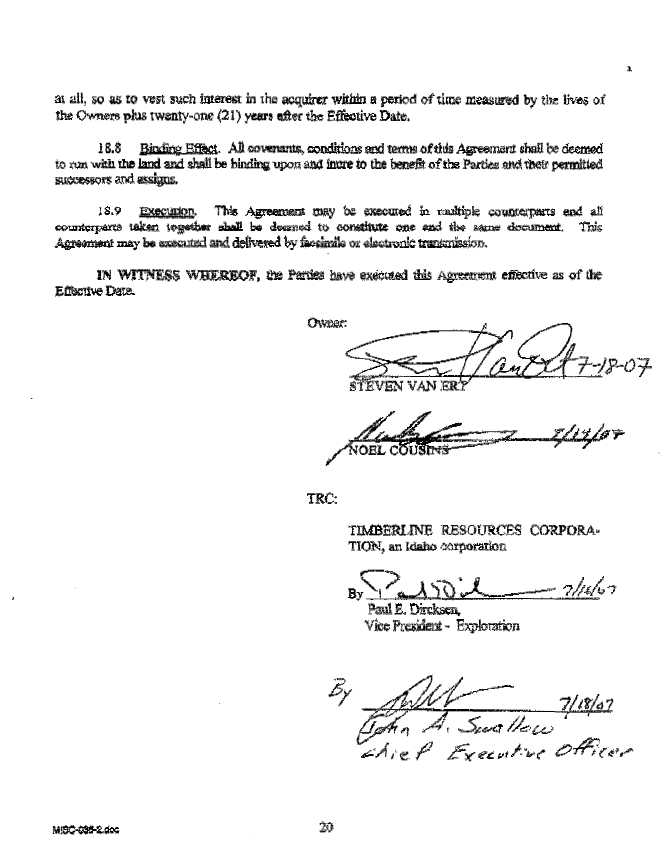

2.1By TRC. TRC represents and warrants to Owner that TRC has the full right, power

|

and capacity to enter into and perform this Agreement upon the terms set forth herein, and doing so will not be in breach of any other agreement to which TRC is a party. TRC is a corporation in good standing under the laws of Idaho and is authorized to do business in California. All transactions contemplated herein and any corporate or other actions required to authorize TRC to enter into and perform this Agreement have been properly taken. The person signing this Agreement for TRC has proper corporate authority to do so as TRC’s Chief Executive Officer. TRC agrees not to encumber title to the Property while this Agreement is in effect.

2.2By Owner. Owner represents and warrants to TRC that the Owner has the full right, power and capacity to enter into and perform this Agreement upon the terms set forth herein, and doing so will not be in breach of any other agreement to which Owner is a party. Owner further represents and warrants to TRC that each of the individuals comprising Owner is unmarried. Owner agrees not to encumber title to the Property while this Agreement is in effect. The representations and warranties of Owner set forth above are the joint and several obligations of each of the persons comprising Owner. Owner specifically makes no representations or warranties related to (i) ownership of the Property, (ii) the process of location, the filing for record and maintenance of the unpatented mineral claims, (iii) the existence of a mineral discovery within the unpatented mining claims included within the Property, or (iv) the accuracy of any data or technical information furnished by Owner to TRC either before or subsequent to the execution of this agreement.

3. CONDITIONAL TRANSFER AND EXPLORATION AND DEVELOPMENT

RIGHTS

3.1Conditional Transfer. Within sixty (60) days after the Parties’ execution of this

|

Agreement, Owner shall conditionally transfer the Property to TRC using a deed substantially in the form attached hereto asExhibit B (the “Transfer Deed”), in accordance with and subject to all the terms and conditions of this Agreement, which Transfer Deed shall reserve to Owner the Royalty provided for herein. Owner’s conveyance of the Property shall be secured by (1) a deed of trust listing Owner as the beneficiary a form of which is attached hereto asExhibit D (“Deed of Trust”), which Deed of Trust shall be executed by TRC and recorded in the official records of

Inyo County, California immediately after recording of the Transfer Deed and prior to TRC’s causing any physical disturbance on the Property, but in any event within thirty (30) days after TRC’s receipt of the Transfer Deed, and (2) a duly executed and recordable reconveyance deed substantially in the form attached hereto asExhibit C (the “Reconveyance Deed”), which shall be held in escrow in the Law offices of Deconcini, McDonald, Yetwin & Lacy, P.C. (“DMYL”) with instructions to the deliver the Reconveyance Deed to Owner if the Option to purchase the Property expires or upon the termination of this Agreement caused by any breach thereof by TRC. TRC shall execute and deliver to DMYL the Reconveyance Deed prior to Owner’s obligation to deliver to TRC the Transfer Deed. Within thirty (30) days after the Transfer Deed is recorded, TRC shall prepare and file with the BLM a notice of transfer of interest for all unpatented mining claims within the Property, pay all required filing fees, and provide a copy of the same to Owner.

3.2Exploration and Development Rights. Upon the Parties’ execution of this Agreement, TRC shall have the exclusive right and privilege of entering upon the Property to Explore, Prospect for and Develop, but not Mine Minerals contained upon or within the Property. TRC shall have no right to Mine Minerals from the Property or use the Property for Mine purposes unless and until TRC’s Option to purchase the Property is exercised as provided herein.

3.3Option to Purchase Property. TRC shall have an option to purchase the Property upon the terms and conditions set forth in Section 6.1 of this Agreement (the “Option”). The Option may be exercised at any time while this Agreement remains in effect and, if exercised, shall allow TRC the right to Mine the Property subject to applicable laws and regulations.

3.4Definitions. As used in this Section 3 and elsewhere in this Agreement, the following terms shall have the following definitions:

“Explore” and “Prospect” shall mean entering and conducting all means and methods of search above and below the surface, with or without machinery and equipment, including, but without being limited to:

| a) | | Conducting geologic, geophysical, geochemical and other exploration |

| studies and tests. |

| b) | | Digging or excavating pits, adits, shafts and other types of excavation. |

| c) | | Drilling test holes. |

| d) | | Excavating drill hole sites, sumps and mud pits. |

| e) | | Constructing roads reasonably required for ingress, egress, access to |

| work and campsites, and communication. |

| f) | | Extracting and removing samples in non-commercial quantities for the |

| purpose of collecting information and making analyses and tests. |

g) Building camp and other facilities to service exploration operations.

“Development” or “Develop” shall include (without limitation) all preparation for the removal and recovery of Minerals from the Property, including the preparation of a feasibility study, and construction or installation of a mill or any other improvements to be used for the mining, handling, milling, processing or other beneficiation of Minerals recovered from the Property.

“Mine” shall mean the mining, extracting, producing, handling, milling or other processing of Minerals for commercial sale.

“Minerals” shall mean any and all mineral substances of any nature as may be subject to location under the General Mining Law of the United States, together with any rights to sand, gravel and other common minerals or materials that may be exercised by virtue of holding such mining claims or that may be otherwise obtained by TRC.

4. PAYMENTS TO OWNER

4.1TRC Shares. On execution of this Agreement, TRC shall issue and deliver to Owner

|

one hundred thousand (100,000) shares of TRC common stock. The stock will be issued with an effective date of September 15, 2006 in proportion to Owner’s interest in this Agreement (that is, 85,000 shares will be issued and delivered to Steven Van Ert and 15,000 shares will be issued and delivered to Noel Cousins). TRC agrees to further issue and deliver to Owner one hundred thousand (100,000) shares of TRC common stock on September 15 of each subsequent year that this Agreement remains in effect, in the same proportion as specified above. Owner acknowledges that the stock certificates evidencing the TRC Shares may carry a legend indicating that the shares have not been registered under the Securities Act of 1933, as amended, and are restricted securities for purposes of U.S. federal securities laws. TRC represents that such securities require a one-year holding period before they can be offered for sale but agrees that in any case the restrictions imposed on TRC shares granted to Owner under this Agreement may not exceed restrictions on similarly situated securities. The removal of the restrictive legend is done by request of Owner through a selling broker to the Transfer Agent and includes an opinion letter from TRC counsel. TRC will not unduly delay any registration process that is within TRC’s control, and if TRC’s stock is registered on the Toronto Stock Exchange or any other stock exchange, Owner may elect to take any or all shares to which it is entitled hereunder through that exchange upon notice to TRC.

| A. | | Representations and | | Warranties Regarding Shares. TRC represents and |

| warrants to Owner as follows with respect to all TRC shares issued or to be issued to Owner in |

| connection with this Agreement (including the shares contemplated in Section 6.1 below): |

| |

| | | (1) | | Capitalization. | | The authorized capital of TRC consists, on the |

| Execution Date, of | | shares of common stock, | | shares of which |

| are issued and outstanding. All of the outstanding shares of common stock have been |

| | duly authorized, are fully paid and nonassessable, and were issued in compliance with all applicable federal and state securities laws. |

| |

| | (2)Valid Issuance of Shares. All TRC shares, when issued and delivered in accordance with the terms of this Agreement, will be validly issued, fully paid and nonassessable, and free of restrictions on transfer other than restrictions on transfer under applicable state and federal securities laws or applicable exchange requirements. The shares will be issued in compliance with all applicable federal and state securities laws and all applicable exchange requirements. |

| |

| | (3)Disclosure. TRC has made available to Owner all the information reasonably available to TRC that Owner has requested concerning the shares. No representation or warranty of TRC contained in this Agreement, and no certificate furnished or to be furnished to Owner under this Agreement, contains or will contain any untrue statement of a material fact or omits to state a material fact necessary in order to make the statements contained herein or therein not misleading in light of the circumstances under which they were made. |

| |

| 4.2 | Payments Prior to Exercise of Option. |

| |

| | A. | Initial Payment. TRC shall pay to Owner upon execution of this Agreement |

| |

the sum of $75,000, which will be paid in accordance with each Owner’s interest in the Property ($63,750 to Steven Van Ert and $11,250 to Noel Cousins). Such payment shall not be credited toward any other obligation of TRC.

B.Tax Offset Payment. TRC shall make a one time payment to each of the persons constituting Owner to offset their state and federal tax obligations for the receipt of the initial 100,000 shares of TRC common stock delivered in accordance with Section 4.1 and any taxes imposed for such reimbursement. Payment will be based on such persons’ actual tax bracket (based on the representation of a tax preparer or counsel for Owner, but not to exceed 34%) and the closing price of TRC’s common shares on the Execution Date. Such payment shall be delivered to such persons at least one month prior to the relevant federal income tax payment deadline.

C.Subsequent Payments.Unless the Option has been properly exercised or this Agreement has been terminated prior to the dates set forth below, TRC shall pay Owner the following payments on or before the dates set forth below:

| By September | | 15, | | 2007 | | $75,000 |

| By September | | 15, | | 2008 | | $100,000 |

| By September | | 15, | | 2009 | | $125,000 |

| By September | | 15, | | 2010 | | $150,000 |

| By September | | 15, | | 2011 | | $175,000 |

| By September | | 15, | | 2012 | | $200,000 |

| By September | | 15, | | 2013 | | $225,000 |

| By September | | 15, | | 2014 and annually thereafter | | |

| until exercise of Option or termination | | |

| of Agreement | | $250,000 |

| | All such payments shall be paid to each Owner according to his pro-rata ownership interest. Such payments may be made in currency or by check of TRC or its agent (at the option of TRC), and said payments shall be made to Owner in the manner and at the addresses specified in Section 15. Such payments shall not be credited toward any other obligation of TRC. |

| |

| 5. | ROYALTIES |

| |

| | 5.1Production Royalty. Subject to Section 6 of this Agreement, TRC shall pay to Owner, |

| |

as a production royalty (the “Royalty”), four percent (4.0%) of the Net Smelter Returns from all Minerals mined and removed from the Property. Notwithstanding any provision of this Agreement to the contrary, the Royalty shall be payable only with respect to Minerals that are ultimately and actually recovered and for which TRC receives payment or consideration. TRC shall have no obligation to pay any Royalty on Minerals extracted from the Property for testing purposes, including without limitation for bulk samples, assays, geochemical analyses, amenability to milling and recovery determinations, pilot plant tests and test trommel operations, unless and until such Minerals are subsequently sold.

5.2Net Smelter Returns. The term “Net Smelter Returns” as used herein shall mean the actual sale proceeds received by TRC from the sale of Minerals to a smelter, refinery or other processor (as reported on the smelter settlement sheet) less only the following expenses actually incurred and borne by TRC: (i) the actual costs of freighting or transporting said Minerals from the mine or mill to the point or points of sale (including without limitation costs of loading, transporting and insuring the ores, metals, minerals and concentrates in transit), unless already deducted by the purchaser; and (ii) all charges and costs of or relating to smelting and refining (including without limitation sampling, assaying and weighing charges), unless already deducted by the purchaser. If such smelter is owned or controlled by TRC or any of its affiliates, then charges, costs and penalties for such operations shall mean (for the purposes of calculating Net Smelter Returns) the amount that TRC would have incurred if such operations were carried out at facilities not owned or controlled by TRC then offering comparable services for comparable products on prevailing terms. For avoidance of doubt, in calculating Net Smelter Returns there shall not be any deduction for any costs of mining, or any costs of transporting Minerals to the mill, or any costs of processing Minerals other than said smelting and refining costs.

5.3Advance Minimum Royalty Payments. Upon exercise of its Option and each year thereafter on or before the anniversary date of such exercise for so long as any of the mining claims (or any amendments, relocations or replacements thereof) or other tracts constituting the Property (including any Additional Lands acquired pursuant to Section 1.2 above) are owned by TRC or its successors, TRC shall pay Owner (allocating 85% to Steven Van Ert and 15% to Noel Cousins) the sum of One Hundred Fifty Thousand Dollars ($150,000), which amount shall be a credit against any

Royalty owing on production of Minerals during such year. This amount shall be a minimum royalty and shall not be credited against Royalty on production for subsequent years. If TRC desires to abandon or relinquish any of the mining claims (or any amendments, relocations or replacements thereof) or other tracts constituting the Property (including any Additional Lands acquired pursuant to Section 1.2 above), then the provisions of Section 1.4 above shall apply.

| 5.4 | Royalty Payments. |

| |

| | A.Generally. Royalty payments shall be made by TRC, in accordance with |

| |

Section 15, on or before the last day of each calendar month for all Minerals sold during the preceding calendar month by TRC.

B.Provisional Payments. If any Royalty becomes due and payable hereunder prior to final settlement with a smelter, refiner or other bona fide purchaser, or prior to TRC’s final determination, in accordance with Section 13.4, of all of the facts necessary to calculate the amount of Royalty payable to Owner with respect to commingled Minerals, then TRC shall pay to Owner a provisional Royalty based upon TRC’s then current estimates of such facts and the preliminary settlement with the smelter, refiner or other bona fide purchaser. Payments of provisional Royalty shall be subject to subsequent adjustment in accordance with Section 5.4. C.

C.Adjustments. If TRC determines that any Royalty payment made pursuant to this Agreement was underpaid or overpaid, then TRC shall correct such overpayment or underpayment by adjustment to the amount of the next subsequent payment.

DTaking In Kind. Owner may, by notice to TRC, elect to receive Royalty in the form of doré, in which case Owner shall make arrangements for the acceptance and transfer of doré as will accommodate TRC’s normal shipping schedule. For purposes of determining the credits for minimum royalty obligations, the value of Royalty taken in kind shall be based on the contained value of such ores or concentrates as of the date of delivery to Owner. Contained value shall be based on assays performed as a part of the sale by TRC of similar doré and the spot metal prices published inMetals Week or other generally acceptable industry guide for the date of transfer.

E.Statement. At such time as TRC makes any payment of Royalty or provisional Royalty to Owner, TRC shall provide Owner a brief written statement setting forth the manner in which such payment of Royalty or provisional Royalty was calculated and shall include settlement sheets and such other documentation as will allow Owner to readily understand and verify the calculation of the Royalty payment.

5.5Audits. All Royalty payments made during each calendar year shall be considered final and in full satisfaction of all obligations of TRC with respect thereto (except in the event of fraud or intentional misrepresentation), unless Owner gives TRC written notice describing and setting forth a specific objection to the determination thereof within six (6) months following the

end of the calendar year during which such Royalty payments were paid. Owner shall have the right, upon reasonable notice and at reasonable times, to have TRC’s accounts and records relating to mining operations and Royalty calculations audited by an independent auditor. If such audit determines that there has been a deficiency or an excess in the payment(s) made to Owner, such deficiency or excess shall be resolved by adjusting the next monthly Royalty payment due hereunder, or by direct payment if no monthly Royalty payment follows the audit determination, or such payment is insufficient to fully adjust for such deficiency or excess. Owner shall pay all costs of such audit unless a deficiency of five percent (5%) or more of the amount due to Owner is determined to exist. TRC shall pay the costs of such audit if a deficiency of five percent (5%) or more of the amount due to Owner is determined to exist. All books and records used by TRC to calculate Royalty due hereunder shall be kept in accordance with GAAP, consistently applied. Failure on the part of Owner to provide a notice of objection within the six-month period shall establish the correctness and preclude the filing of exceptions thereto or making of claims for adjustment thereon (by either Party) except where fraud or intentional misrepresentation can be shown.

5.6Other Minerals. If non-metallic minerals are produced from the Property, Owner shall be entitled to a production royalty of eight percent (8.0%) of the gross receipts received by TRC for the sale of such non-metallic minerals, without any deductions therefrom.

| 6. | OPTION TO PURCHASE PROPERTY AND REDUCE ROYALTY |

| |

| | 6.1Option to Purchase Property. Owner hereby grants to TRC, and TRC shall have, the |

| |

exclusive Option to purchase and retain all of Owner’s right, title and interest in the Property. The Option shall be exercised after completion of a feasibility study for the mining of the Property and the decision by TRC’s board of directors to commence commercial production of Minerals from the Property, and shall be exercised by written notice to Owner together with (1) a copy of said feasibility study, (2) a written resolution by said board to commence commercial production of Minerals from the Property, and (3) one million (1,000,000) TRC common shares issued and delivered to Owner in proportion to Owner’s interest in this Agreement (that is, 850,000 shares will be issued and delivered to Steven Van Ert and 150,000 shares will be issued and delivered to Noel Cousins). Owner acknowledges that the stock certificates evidencing such shares may carry a legend that indicates that the shares have not been registered under the Securities Act of 1933, as amended. If TRC’s stock is registered on the Toronto Stock Exchange or any other stock exchange, Owner may elect to take any or all shares to which it is entitled hereunder through that exchange upon notice to TRC. If the Option is timely exercised by TRC, the Parties shall close the purchase and sale of the Property at a closing (the “Option Closing”) to be held at 10:00 a.m. on the date that is ten (10) days following Owner’s receipt of the notice of exercise of the Option and said study, resolution and shares, at a location in Reno, Nevada , specified by TRC in its notice, unless the Parties otherwise mutually agree. At the Option Closing, the following shall occur: (i) Owner shall deliver to TRC a duly executed release of the Deed of Trust in recordable form, (ii) Owner shall notify DMYL to deliver the Reconveyance Deed to TRC, (iii) this Agreement shall terminate, subject to the provisions of Section 11.5 below. The provisions of Section 4.1. A above shall apply to the TRC shares issued and delivered pursuant to this Section 6.1.

6.2Option to Reduce Royalty. At any time prior to the Option Closing, TRC shall have the exclusive right to purchase from Owner one-quarter of the four percent (4.0%) Royalty (the “Royalty Reduction Option”) for a cash payment of One Million Dollars ($1,000,000), to be split by the Owner in proportion to the respective ownership interests (the “Royalty Reduction Payment”). If TRC desires to exercise the Royalty Reduction Option, TRC shall deliver written notice of exercise to Owner. If the Royalty Reduction Option is timely exercised by TRC, the Parties shall close the purchase and sale of the one percent (1.0%) Royalty interest at a closing (the “Royalty Reduction Closing”) to be held at 10:00 a.m. on the date that is ten (10) days following Owner’s receipt of the notice of exercise of the Royalty Reduction Option, at a location specified by TRC in its notice, unless the Parties otherwise mutually agree. At the Royalty Reduction Closing, the following shall occur: (i) TRC shall deliver to Owner a cashiers’ check or certified funds in the amount of the Royalty Reduction Payment (split to the Owner as provided above), and (ii) Owner shall deliver to TRC a duly executed conveyance substantially in the form attached hereto asExhibit D of one percent (1.0%) of the Royalty payable on the production of Minerals from the Property. If the Royalty Reduction Closing occurs, then the Royalty accruing under this Agreement shall be owned as follows:

| | Owner: three percent (3.0%)

TRC: one percent (1.0%)

|

The royalty on non-metallic minerals shall be unaffected by any Royalty Reduction Closing.

| 7. | WORK COMMITMENT |

| |

| | 7.1Work Commitment Obligation. Prior to exercise of the option, TRC shall conduct a |

| |

minimum of One Hundred Thousand Dollars ($100,000) of exploration work on or for the benefit of the Property during each Lease Year until such time as Minerals are being mined from the Property in commercial quantities, or TRC exercises its Option to Purchase the Property. Any Exploration Expenditures in excess of the required annual amounts may be carried forward or credited toward any subsequent Lease Year’s work obligation. All Exploration Expenditures shall be made on or for the benefit of the Property. Within thirty (30) days after the end of each Lease Year, TRC shall deliver to Owner a written accounting and summary of monies spent on the Property for exploration work and included in Exploration Expenditures.

7.2Exploration Expenditures. For purposes of this Agreement, “Exploration Expenditures” shall mean and include all direct and indirectcosts incurred to Explore, Prospect and Develop the Property, including without limitation the following: (a) costs of surveying (including without limitation geophysical and geochemical surveys), mapping, sampling, bulk sampling, drilling and trenching; (b) costs of operations and payments in connection with obtaining or maintaining exploration or similar or related permits, licenses, approvals, consents or authorizations (but excluding the cost of any bonds); (c) costs of conducting required environmental, wildlife or similar, related or associated studies, reports, analyses or documents;

and (d) all other costs incurred in the conduct of other activities that are incidental to, in furtherance of, in preparation for or associated with any or all of the foregoing; provided however, that Exploration Expenditures shall not include corporate overhead charges.

7.3Lease Year. For purposes of this Agreement, the term “Lease Year” shall mean and refer to the period commencing on September 15 of a calendar year and ending on September 14 of the following calendar year. The first Lease Year shall be deemed to have commenced on September 15, 2006.

7.4Payment in Lieu. If TRC fails to perform the minimum work requirement for any particular Lease Year, TRC may elect, in its sole discretion, to pay Owner the difference between the annual work obligation as set forth in Section 7.1 for the Lease Year in question and the cost of the work actually performed during that Lease Year and, upon such payment, TRC shall be deemed to have satisfied in full the minimum work requirement for that Lease Year. In the event TRC fails to perform the minimum work requirements for any particular Lease Year and elects not to make the payment described in the preceding sentence, and subject to TRC’s right to contest the default under Section 11.2, Owner may declare this Agreement terminated by providing written notice thereof to TRC and DMYL shall be directed to deliver the Reconveyance Deed to Owner.

Owner or its duly authorized representatives shall be permitted to enter on the Property and the workings thereon of TRC at all reasonable times for the purpose of inspection, but in such a manner as not to unreasonably hinder the operations of TRC. Owner shall indemnify and hold harmless TRC from and against all claims, demands and liabilities arising from or relating to such entry or inspection, except to the extent caused by TRC’s negligence or willful misconduct.

TRC agrees to furnish to Owner all geologic or other data generated by TRC. Data shall be provided on November 1 of each year during continuance of this Agreement, to update Owner on data gathered between those dates. TRC shall furnish Owner copies of all basic maps, drill logs, engineering and geological data, and other factual data and factual material pertaining to the Property prepared by or for TRC (including interpretative data); provided, however, that: (1) TRC shall be under no obligation whatsoever to provide Owner with any financial information or any information regarding proprietary techniques or processes; (2) Owner shall rely and act on all information provided by TRC at Owner’s sole risk; and (3) TRC shall have no liability on account of any such information received or acted on by Owner. Any non-public information received by Owner under this provision that is specifically marked by TRC as confidential shall be held as confidential at all times that this Agreement is in effect. TRC agrees to allow Owner or its agent (duly authorized in writing) to examine, at its place of storage, and take possession and ownership of any core or drill cuttings from the Property that were retained by TRC after termination of this Agreement. Owner shall have thirty (30) days within which to remove, at Owner’s sole cost, such core or cuttings as Owner chooses to

remove. TRC shall not be liable for the loss or destruction of core or cuttings not removed within the said thirty (30) day period.

| 10. | TITLE |

| |

| | 10.1Provision of Information. Upon request by TRC, Owner shall promptly furnish to |

| |

TRC copies of all information in its possession or under its control relating to title to or description of the Property, including without limitation copies of any abstracts and certificates of title, title insurance policies, commitments for title insurance, title reports, memoranda or opinions of counsel, certificates of location, amendments or relocations, prior deeds, contracts, applications for patent, proofs of labor, maps, surveys and documents filed with any local, state or federal governmental agency. TRC shall promptly reimburse Owner for the costs of such copies. Upon execution of this Agreement, Owner shall provide to TRC any and all information in its possession or under its control regarding any existing or past industrial, milling, manufacturing, waste storage, exploration, development, mining, processing or beneficiating use of the Property. Pursuant to this Section 10.1, Owner shall only be obligated to provide to TRC information that is in its possession or under its control, and Owner shall not be obligated to obtain or provide any other information or documents.

10.2Title Defects and Cure. If (1) in the reasonable opinion of TRC’s counsel, Owner’s title is defective, or (2) Owner’s title is contested or challenged by any person, entity or governmental agency and Owner is unable or unwilling to promptly correct the defects or alleged defects in title, TRC may attempt, with all reasonable dispatch, to perfect, defend or initiate litigation to protect Owner’s title, at TRC’s sole risk and expense. All such expenses shall be credited as Exploration Expenditures. In that event, Owner shall execute all documents and shall take such other actions as are reasonably necessary to assist TRC in its efforts to perfect, defend or protect Owner’s title.

10.3Amendment and Relocation.Provided that TRC shall first give notice and obtain approval from the Owner, which approval shall not be unreasonably withheld, TRC shall have the right to relocate or amend or the location of any of the mining claims included in the Property whenever TRC reasonably deems such action desirable in order to perfect the mining claims, cure defective locations, include additional ground in the mining claims, convert the mining claims to mill sites or for any other reason. Any such relocation or amendment shall be made by TRC as agent for and in the name of Owner, except to the extent such mining claims are part of the Additional Lands included in this Agreement pursuant to Section 1.2 and such claims are owned by a third party. Any new locations resulting from such actions or relocations shall be deemed part of the Property and shall be subject to all of the terms and conditions of this Agreement. Any abandonment shall be subject to the provisions of Section 1.4.

10.4Lesser Interest. If Owner’s title to any mining claim or other parcel or tract within the Property from which production is made is less than 100%, then the Royalty payable under this Agreement shall be reduced to the same proportion as the undivided right and title actually owned by Owner bears to the entire undivided right and title to that claim, parcel or tract from which such production is made. All other payments and obligations required hereunder shall

remain the same regardless of any actual or alleged title defects or lesser interest.

10.5No Limitation. Nothing herein contained and no notice or action that may be taken under this Section 10 shall limit or detract from TRC’s right to terminate this Agreement at any time.

10.6Liability. TRC at any time may withdraw from or discontinue any action, activity or application undertaken or initiated by it pursuant to Section 10.2 or 10.3. TRC shall not be liable to Owner in any way (except for payment of any costs or obligations accrued before such withdrawal or discontinuance) if Owner is unsuccessful in, withdraws from or discontinues any such action, activity or application.

10.7Additional and After-Acquired Title. If Owner subsequently acquires any further right, title or interest in or to the Property, Owner shall promptly provide TRC with written notice thereof, and such right, title and interest shall, without payment of additional consideration, become part of the Property subject to all of the terms and conditions of this Agreement.

| 11. | TERMINATION AND TERM |

| |

| | 11.1By TRC. TRC shall have the right to terminate this Agreement at any time upon notice |

| |

to Owner specifying an effective termination date. Upon the effective date of such notice, this Agreement shall automatically terminate without further action of the Parties, and TRC shall have no further rights or obligations hereunder other than such as have accrued prior to the date of such termination and those specified in Section 11.3.

11.2Default/Termination by Owner. If TRC shall be in default in making any payment or performing any other obligation herein, Owner may give written notice to TRC of such default, setting forth in such notice the nature and details of such default. TRC shall have thirty (30) days after receiving a notice of default to remedy a default in payment, and thirty (30) days after receiving a notice of default with respect to any other default in which to commence to cure such default and thereafter to diligently prosecute such cure until completion. If TRC fails to cure or commence to cure the default within the times specified, or if TRC fails to contest such default by written notice to Owner within fifteen (15) days after receiving a notice of default from Owner, Owner may terminate this Agreement by written notice to TRC. If TRC contests the existence of a default, TRC shall initiate arbitration proceedings in accordance with Section 12 of this Agreement within the time periods specified above. If TRC disputes the default and the matter is submitted to arbitration, this Agreement and all rights granted to TRC under this Agreement shall not be terminated in whole or in part by Owner unless the arbitrator determines that TRC is in default and thereafter TRC fails to cure the default within the period specified in the arbitrator’s decision or sixty (60) days after such default has been confirmed in arbitration, whichever is longer.

11.3Removal of Equipment/ Reclamation. Following the termination of this Agreement pursuant to Section 11.1 or 11.2, TRC shall have no further rights or obligations hereunder other than such as have accrued prior to the date of such termination, except as provided in this Section 11.3, and DMYL shall be instructed to deliver the Reconveyance Deed to Owner. TRC shall within one hundred

and twenty (120) days from the termination of the Agreement remove all structures, machinery, equipment and other property of every description placed upon the Property, provided that TRC shall not remove any underground ladders or timbers or stulls required for support of mine openings. All drill, mining, and other roads, sites, excavations and disturbances made by TRC shall be reclaimed to the written satisfaction of all federal, state and local regulatory agencies, except for any that Owner specifically directs in writing to be left in place. Such exceptions will become the sole responsibility of Owner who will assume liability and reclamation responsibility for such exceptions. The Property shall be left in a safe condition and in full compliance with all federal, state, county and local regulations and ordinances pertaining to reclamation and the environment. If TRC does not remove its structures, machinery or equipment during such period, Owner may, at its sole election, make arrangements to do so and the cost thereof shall be borne by TRC, or sell the equipment and retain any proceeds from such sale.

11.4Term. Subject to Section 11.5 below, this Agreement shall terminate automatically twenty (20) years after the Execution Date, unless sooner terminated through exercise of the Option or as otherwise provided herein; provided, however, if the Option to Purchase has not been exercised, TRC shall have the right to extend this Agreement for additional one-year terms for a total of not more than ten (10) years, provided that TRC has fully performed all its obligations under this Agreement, and is conducting exploration, pre-development or mining activities on the Property on the date of expiration of the term being extended. TRC shall deliver written notice to Owner of its intention to exercise its right to extend the Agreement under this provision.

11.5Survival. All representations, warranties and other provisions of this Agreement containing rights and obligations that are intended to continue beyond the termination of this Agreement shall survive such termination and remain in effect until their existence is of no benefit to either Party.

| 12. | ARBITRATION |

| |

| | 12.1Resolution of Disputes. Any dispute, controversy or claim arising out of or |

| |

relating to this Agreement or the subject matter of this Agreement, or the breach, termination or validity of this Agreement, shall be settled by binding arbitration as provided in this Section 12.

12.2Appointment of Arbitrator. There shall be one arbitrator appointed by the Parties who shall be disinterested in the dispute, controversy or claim, shall have no connection with any Party and shall have knowledge or experience in the general subject matter to be arbitrated. If the Parties fail to agree on an arbitrator within twenty (20) days after arbitration is initiated, the Parties shall each submit the names of three arbitrators to the then current Executive Director of the Rocky Mountain Mineral Law Foundation who shall select the arbitrator from the names so submitted.

12.3Procedures. The place of arbitration shall be at a location designated by the Arbitrator. If the Parties do not agree on a procedure, the then current Commercial Arbitration

Rules of the American Arbitration Association shall apply to the extent they are not inconsistent with this Section. The arbitrator shall apply the law as made applicable by the Agreement. Unless the procedure for discovery is otherwise agreed to by the Parties, the arbitrator, at the request of a Party, shall establish rules for pre-hearing discovery which shall comport with due process, expeditious determination of the issues and fairness. Unless otherwise agreed by the Parties, the depositions of no more than two witnesses on each side may be taken without the consent of the arbitrator. The Federal Rules of Civil Procedure shall govern all aspects of the depositions, including admissibility.

12.4Award. The decision in the arbitration shall be rendered, unless otherwise agreed by the Parties, no later than thirty (30) days after the date the hearings were closed. The decision of the arbitrator shall be in writing and shall be final and binding on the Parties. If the Parties settle the dispute in the course of arbitration, such settlement shall be approved by the arbitrator on request of either Party and become the award. The arbitrator shall award reasonable attorney fees, arbitration fees and related costs incurred by the prevailing Party to the prevailing Party.

| 13. | OPERATIONS AND RELATED RIGHTS AND OBLIGATIONS |

| |

| | 13.1Conduct of Operations. TRC shall conduct its operations hereunder in a good and |

| |

miner-like manner, and shall strictly and fully comply with all applicable federal, state and local laws, rules, regulations and ordinances. TRC shall obtain all required or applicable regulatory permits and authorizations, and post all required or applicable reclamation bonds, before making any disturbance on the Property. Nothing contained herein shall be construed, and no covenants shall be implied, to require TRC to open or develop any mine or mines on the Property or to perform any exploration, development or other work thereon at any time that TRC in its discretion determines not to conduct such activities, so long as TRC complies with the express requirements of this Agreement. Whether or not any such exploration, development, miningor other activities shall at any time be conducted and the location, manner, method,extent, rate and timing of such activities shall be determined within the sole and absolute discretion of TRC. Whenever TRC deems it necessary or advisable, it may discontinue or resume exploration, or development, from time to time during the term hereof.

13.2Protection from Liens. TRC agrees to pay all expenses incurred in connection with its operations hereunder and to permit no liens arising from any act of TRC or its agents or contractors to remain upon the Property.

13.3Annual Claim Maintenance Requirements. TRC shall perform all work, filings and payments required to maintain the Property pursuant to federal, state and county laws or regulations during the term of this Agreement. TRC shall pay all annual fees required to maintain the Property to the BLM, and shall provide Owner with evidence of such payment on or before August 1 of each year. TRC shall prepare and timely record each year with Inyo County appropriate affidavits documenting the intent to maintain the Property. TRC has fulfilled its obligation to reimburse Owner for claim maintenance fees paid to the BLM for the assessment year beginning September 1, 2006.

13.4Commingling. TRC shall have the right of mixing or commingling, at any location and either underground or at the surface, any ores, metals, Minerals or mineral products from the Property and other properties, provided that TRC first shall provide to Owner a written statement describing in detail how commingling will be done. Owner shall then have thirty (30) days to object to such procedures. Any commingling dispute not resolved by the Parties within thirty (30) days thereafter shall be resolved by arbitration as provided herein. Such authorized commingling procedures shall be followed at all times prior to any mixing or commingling by TRC, and such procedures shall be the basis of allocation of the Royalty payable to Owner under this Agreement in the event of a sale by TRC of Minerals so mixed or commingled.

13.5Cross-Mining Rights and Vertical Boundaries. Following exercise of the Option, TRC shall have cross-mining rights involving ores and minerals, waste materials, water, ventilation, mining machinery, mining equipment, and mining supplies as may be necessary, useful or convenient from time to time in the conduct of mining operations in, upon or under the Property or in, upon or under other properties owned or controlled by TRC in the area. Owner and TRC agree that vertical boundaries shall be applicable in determining ownership of Minerals and other materials from the Property. The Property shall not be used for the disposal of waste or overburden from any other property unless such disposal is done as part of an integrated mining operation involving concurrent commercial production from the Property.

13.6Permits and Approvals. Owner understands that TRC may make efforts to obtain permits, licenses, rights, approvals or authorizations from governmental or private persons or entities in connection with the exercise by TRC of its rights under this Agreement. Upon request by TRC, Owner shall assist and cooperate fully with TRC in any such endeavors, including without limitation by the execution of pertinent documents, so long as such requests are reasonable and Owner is not required to incur more than nominal expense in doing so.

13.7Indemnification and Insurance. TRC shall indemnify Owner against and hold Owner harmless from any suit, claim, judgment, demand or liability whatsoever arising out of TRC’s ownership of the Property or any of the activities of TRC or its agents or contractors in the exercise of any of its rights pursuant to this Agreement. TRC shall maintain reasonable insurance to support the indemnification required by this Agreement in an amount of at least Two Million Dollars ($2,000,000.00) as comprehensive form general liability for each occurrence for combined bodily injury and property damage. Owner shall be named as co-insured under such policies and TRC shall provide Owner with a certificate of such insurance prior to the commencement of any operations under this Agreement or any entry onto the Property. TRC’s obligations under this provision shall relate back and include any activities undertaken by TRC from and after August 7, 2006.

| | 14. ASSIGNMENTS AND TRANSFERS

|

TRC may not assign, sublease or otherwise transfer its interest in this Agreement without Owner’s prior written consent in each instance, which shall not be unreasonably withheld. No assignment, sublease or transfer shall be effective against the non-transferring party until that party

receives written notice of the transfer in accordance with Section 15. Any permitted transfer shall be binding upon and extend to the successors, heirs and assigns of the Parties. If TRC is merged into or acquired by another entity, the shares to be conveyed under Sections 4.1 and 6.1 shall be valued, at the election of Owner, as either equivalent shares of the new entity, or a cash value equal to the greater value of the closing price of TRC’s shares on (i) the day of the announcement of the assignment, transfer or merger, or (ii) the day of the closing of the transaction.

| 15. | NOTICES AND PAYMENTS |

| |

| | 15.1Notices. Any notice required to be given to Owner hereunder shall be in writing and |

| |

shall be given by personal delivery or by registered or certified mail, return receipt requested, addressed as follows:

| | Steven Van Ert

P.O. Box 3785

Chatsworth, CA 91313

Noel Cousins

P.O. Box 37061

Tucson, AZ 85740

|

| | John C. Lacy, Esq.

DeConcini McDonald Yetwin & Lacy, P.C.

2525 East Broadway Boulevard, Suite 200

Tucson, AZ 85716-5300

(520) 322-5000

|

and any notice given to TRC shall be in writing and shall be given by personal delivery or by registered or certified mail, return receipt requested, addressed as follows:

| | Timberline Resources Corporation

1100 East Lakeshore Drive, Suite 301

Coeur d’Alene, ID 83814

|

Either Party may, by notice to the other given as aforesaid, change its mailing address for future notices. All such notices shall be effective upon personal delivery or upon the deposit thereof in the United States mail with postage prepaid and addressed as aforesaid.

15.2Payments. All payments to Owner and all deliveries of shares to Owner shall be allocated between the two persons constituting Owner as provided herein, and shall be delivered in accordance with Section 15.1 above. Either of the persons constituting Owner may from time to time notify TRC to deliver payments or shares to a bank account or agent, and TRC shall comply with such

| 16. | TAXES |

| |

| | 16.1Real and Personal Property Taxes. During the term of this Agreement (and |

| |

thereafter if the Option is exercised), TRC shall timely pay all ad valorem and real property taxes and assessments levied upon, assessed against or relating to the Property and all taxes and assessments levied or assessed upon or against the personal property of TRC located on or about the Property. Upon termination of this Agreement (other than by exercise of the Option), any applicable taxes shall be prorated as of the effective date of termination, provided, however, that if TRC’s activities have resulted in a different taxing status of the Property, TRC shall remain responsible for any increase in taxes until the new taxing status is removed unless Owner consents to such new taxing status.

16.2Taxes Related to Operations. During the term of this Agreement (and thereafter if the Option is exercised), TRC shall pay all taxes, assessments and fees imposed or assessed in connection with the production of Minerals from the Property or other activities of TRC pursuant to this Agreement, including without limitation any net proceeds, production, occupation, sales, severance, privilege, or other similar or related taxes.

16.3Cooperation. Owner shall promptly furnish to TRC all bills, demands, notices or statements received by Owner that relate to any tax, assessment or fee for which TRC is responsible under the provisions of this Section 16.

If TRC is delayed or interrupted in or prevented from exercising its rights or performing its obligations, as herein provided, by reasons of "force majeure," then, and in all such cases, TRC shall be excused, without liability, from performance of its obligations set forth in this Agreement (except as to obligations to pay money or transfer common stock), but the provisions shall again come into full force and effect upon the termination of the period of delay, prevention, disability or condition. TRC shall notify Owner of the beginning and ending date of any period of force majeure and the period of time required for performance under this Agreement shall be extended for the period of the disability. "Force majeure" includes all disabilities arising from causes beyond the reasonable control of TRC; including, without limitation, acts of God, accidents, fires, damages to facilities, labor troubles, unavailability of fuels, supplies and equipment, unusually severe weather, orders or requirements of courts or government agencies, or the inability to obtain environmental clearance or operating permits that may be required by governmental authorities.

| 18. | GENERAL |

| |

| | 18.1Memorandum. Upon execution of this Agreement, the Parties shall also execute and |

| |

record, in the real property records of Inyo County, California, a memorandum of this Agreement to provide public notice of this Agreement. In the event of any conflict or inconsistency between this Agreement and the memorandum, this Agreement shall control. This Agreement shall not be recorded by either Party.

18.2Governing Law. This Agreement shall be governed by the laws of the State of California, and by the laws, rules and regulations of the United States of America applicable to the location and possession of, and title to, the mining claims subject hereto.

18.3Interpretation and Enforcement. If any court or administrative body (including any arbitrators under Section 12) of competent jurisdiction determines that any provision of this Agreement is unenforceable, illegal or in conflict with any federal, state or local law, the Parties shall petition (or shall hereby be deemed to have petitioned) such court or administrative body to reform such provision in such a way as to carry out the intent of the Parties to the maximum extent permissible. However, if the court or administrative body declines to so act, such provision shall be considered severable from the rest of this Agreement and the other provisions of this Agreement shall remain unaffected and in full force and effect, and this Agreement shall be construed and enforced as if it did not contain such provision. Subject to the preceding sentences of this Section 18.3, no modification or alteration of this Agreement shall be effective unless in writing and executed by all Parties. The headings used in this Agreement are for convenience only and shall be disregarded in construing this Agreement. This Agreement shall be construed as though both Parties jointly drafted it. This Agreement may be specifically enforced. In the case of any judicial proceeding, each of the Parties, on behalf of themselves and their successors, hereby attorns to the exclusive jurisdiction of the courts of the State of California or the federal district court for the District of California, as may be applicable, in respect of any disputes arising hereunder, with venue to be in Inyo County, California or the nearest federal court, as the case may be.

18.4Good Faith and Fair Dealing. The Parties shall be under obligations of good faith and fair dealing with respect to all conduct and actions related to this Agreement.

18.5Waiver. Failure by Owner at any time, or from time to time, to enforce or to require strict observance of any of the terms of this Agreement shall not constitute a waiver thereof, nor limit or impair such terms in any respect. In addition, any such failure shall not affect Owner’s right to avail itself at any time of such remedies as it may have for any default hereunder by TRC.

18.6Entire Agreement. This Agreement and the attached Exhibits set forth the entire, complete and final agreement between the Parties with respect to the subject matter hereof and supersede all prior negotiations and agreements between the Parties with respect to the subject matter of this Agreement, including but not limited to the Memorandum of Understanding and the Original Lease insofar as the Memorandum of Understanding and the Original Lease relate to the Property.

18.7Perpetuities. Notwithstanding any provision of this Agreement to the contrary,

The “Property” consists of the following unpatented lode mining claims situated in Inyo County, California, the names of which, the serial number assigned by the California State Office of the Bureau of Land Management and the place of record of the location notice thereof in the official records of Inyo County are as follows:

| CLAIM NAME | | BLM CAMC # | | COUNTY RECORDING # |

| CM | | 1 | | CAMC | | 267755 | | 96/108 |

| CM | | 2 | | CAMC | | 267756 | | 96/109 |

| CM | | 3 | | CAMC | | 267757 | | 96/110 |

| CM | | 4 | | CAMC | | 267758 | | 96/111 |

| CM | | 5 | | CAMC | | 267759 | | 96/112 |

| CM | | 6 | | CAMC | | 267760 | | 96/113 |

| CM | | 7 | | CAMC | | 267761 | | 96/114 |

| CM | | 8 | | CAMC | | 267762 | | 96/115 |

| CM | | 9 | | CAMC | | 267763 | | 96/116 |

| CM | | 10 | | CAMC | | 267764 | | 96/117 |

| CM | | 11 | | CAMC | | 267765 | | 96/118 |

| CM | | 12 | | CAMC | | 267766 | | 96/119 |

| CM | | 13 | | CAMC | | 267767 | | 96/120 |

| CM | | 14 | | CAMC | | 267768 | | 96/121 |

| CM | | 15 | | CAMC | | 267769 | | 96/122 |

| CM | | 16 | | CAMC | | 267770 | | 96/123 |

| CM | | 17 | | CAMC | | 267771 | | 96/124 |

| CM | | 29 | | CAMC | | 267776 | | 96/129 |

| CM | | 31 | | CAMC | | 267778 | | 96/131 |

| CM | | 33 | | CAMC | | 267780 | | 96/133 |

| CLAIM NAME | | BLM CAMC # | | COUNTY RECORDING # |

| CM 40 | | CAMC | | 267787 | | 96/140 |

| CM 42 | | CAMC | | 267788 | | 96/141 |

| CM 44 | | CAMC | | 267789 | | 96/142 |

| CM 63 | | CAMC | | 267805 | | 96/158 |

| CM 64 | | CAMC | | 267806 | | 96/159 |

| CM 66 | | CAMC | | 267808 | | 96/161 |

| CM 67 | | CAMC | | 267809 | | 96/162 |

| CM 68 | | CAMC | | 267810 | | 96/163 |

| CM 69 | | CAMC | | 267811 | | 96/164 |

| CM 70 | | CAMC | | 267812 | | 96/165 |

| FAT | | 147 | | CAMC | | 269062 | | 96/1832 |

| FAT | | 148 | | CAMC | | 269063 | | 96/1833 |

| FAT | | 149 | | CAMC | | 269064 | | 96/1834 |

| FAT | | 150 | | CAMC | | 269065 | | 96/1835 |

| FAT | | 151 | | CAMC | | 269066 | | 96/1836 |

| FAT | | 152 | | CAMC | | 269067 | | 96/1837 |

| FAT | | 153 | | CAMC | | 269068 | | 96/1838 |

| FAT | | 154 | | CAMC | | 269069 | | 96/1839 |

| FAT | | 155 | | CAMC | | 269070 | | 96/1840 |

| FAT | | 156 | | CAMC | | 269071 | | 96/1841 |

| FAT | | 157 | | CAMC | | 269072 | | 96/1842 |

| FAT | | 158 | | CAMC | | 269073 | | 96/1843 |

| FAT | | 159 | | CAMC | | 269074 | | 96/1844 |

| FAT | | 160 | | CAMC | | 269075 | | 96/1845 |

| FAT | | 161 | | CAMC | | 269076 | | 96/1846 |

| FAT | | 162 | | CAMC | | 269077 | | 96/1847 |

| CLAIM NAME | | BLM CAMC # | | COUNTY RECORDING # |

| FAT | | 163 | | CAMC | | 269078 | | 96/1848 |

| FAT | | 164 | | CAMC | | 269079 | | 96/1849 |

| FAT | | 165 | | CAMC | | 269080 | | 96/1850 |

| FAT | | 166 | | CAMC | | 269081 | | 96/1851 |

| FAT | | 167 | | CAMC | | 269082 | | 96/1852 |

| FAT | | 168 | | CAMC | | 269083 | | 96/1853 |

| FAT | | 171 | | CAMC | | 270065 | | 96/4464 |

| FAT | | 172 | | CAMC | | 270066 | | 96/4465 |

| FAT | | 173 | | CAMC | | 270067 | | 96/4466 |

| FAT | | 174 | | CAMC | | 270068 | | 96/4467 |

| FAT | | 175 | | CAMC | | 270069 | | 96/4468 |

| FAT | | 176 | | CAMC | | 270070 | | 96/4469 |

| FAT | | 177 | | CAMC | | 270071 | | 96/4470 |

| FAT | | 178 | | CAMC | | 270072 | | 96/4471 |

| FAT | | 179 | | CAMC | | 270073 | | 96/4472 |

| FAT | | 180 | | CAMC | | 270074 | | 96/4473 |

| FAT | | 181 | | CAMC | | 270075 | | 96/4474 |

| FAT | | 182 | | CAMC | | 270076 | | 96/4475 |

| FAT | | 183 | | CAMC | | 270077 | | 96/4476 |

| FAT | | 184 | | CAMC | | 270078 | | 96/4477 |

| FAT | | 185 | | CAMC | | 270079 | | 96/4478 |

| FAT | | 186 | | CAMC | | 270080 | | 96/4479 |

| FAT | | 191 | | CAMC | | 270085 | | 96/4484 |

| FAT | | 193 | | CAMC | | 270088 | | 96/4486 |

| FAT | | 195 | | CAMC | | 270089 | | 96/4488 |

| FAT | | 197 | | CAMC | | 270090 | | 96/4490 |

| CLAIM NAME | | BLM CAMC # | | COUNTY RECORDING # |

| FAT 199 | | CAMC | | 270093 | | 96/4492 |

| FAT 211 | | CAMC | | 271324 | | 97/0726 |

| FAT 213 | | CAMC | | 271326 | | 97/0728 |

| FAT 215 | | CAMC | | 271328 | | 97/0730 |

| FAT 217 | | CAMC | | 271330 | | 97/0732 |

| FAT 219 | | CAMC | | 271332 | | 97/0734 |

| FAT 221 | | CAMC | | 271334 | | 97/0736 |

| FAT 223 | | CAMC | | 271336 | | 97/0738 |

| FAT 225 | | CAMC | | 271338 | | 97/0740 |

| Mesa | | #3 | | CAMC | | 264621 | | 94/4291 |

| Mesa | | #21 | | CAMC | | 264622 | | 94/5693 |

| Mesa | | #23 | | CAMC | | 264623 | | 94/5694 |

| Mesa | | #24 | | CAMC | | 264624 | | 94/5695 |

| Mesa | | # 26 | | CAMC | | 265625 | | 94/5696 |

| Mesa | | #4 | | CAMC | | 267098 | | 95/4130 |

| Mesa | | #5 | | CAMC | | 267099 | | 95/4131 |

| Mesa | | #6 | | CAMC | | 267100 | | 95/4132 |

| Mesa | | #7 | | CAMC | | 267101 | | 95/4133 |

| Mesa | | #8 | | CAMC | | 267102 | | 95/4134 |

| Mesa | | #9 | | CAMC | | 267103 | | 95/4135 |

| Mesa | | #10 | | CAMC | | 267104 | | 95/4136 |

| Mesa | | #11 | | CAMC | | 267105 | | 95/4137 |

| Mesa | | #12 | | CAMC | | 267106 | | 95/4138 |

| Mesa | | #13 | | CAMC | | 267107 | | 95/4139 |

| Mesa | | #25 | | CAMC | | 267108 | | 95/4140 |

| CMP 1 | | CAMC | | 280789 | | 03/1109 |

| CLAIM NAME | | BLM CAMC # | | COUNTY RECORDING # |

| CMP 2 | | CAMC | | 280790 | | 03/1110 |

| CMP 3 | | CAMC | | 280791 | | 03/1111 |

| CMP 4 | | CAMC | | 280792 | | 03/1112 |

| CMP 5 | | CAMC | | 280793 | | 03/1113 |

| CMP 6 | | CAMC | | 280794 | | 03/1114 |

| CMP 7 | | CAMC | | 280795 | | 03/1115 |

| MP | | 1 | | CAMC | | 286713 | | 06/5246 |

| MP | | 2 | | CAMC | | 286714 | | 06/5247 |

| MP | | 3 | | CAMC | | 286715 | | 06/5248 |

| MP | | 4 | | CAMC | | 286716 | | 06/5249 |

| MP | | 5 | | CAMC | | 286717 | | 06/5250 |

| MP | | 6 | | CAMC | | 286718 | | 06/5251 |

| MP | | 7 | | CAMC | | 286719 | | 06/5252 |

| MP | | 8 | | CAMC | | 286720 | | 06/5253 |

| MP | | 9 | | CAMC | | 286721 | | 06/5254 |

| MP | | 10 | | CAMC | | 286722 | | 06/5255 |

| MP | | 11 | | CAMC | | 286723 | | 06/5256 |

| MP | | 12 | | CAMC | | 286724 | | 06/5257 |

| MP | | 13 | | CAMC | | 286725 | | 06/5258 |

| MP | | 14 | | CAMC | | 286726 | | 06/5259 |

| MP | | 15 | | CAMC | | 286727 | | 06/5260 |

| MP | | 16 | | CAMC | | 286728 | | 06/5261 |

| MP | | 17 | | CAMC | | 286729 | | 06/5262 |

| CGL 1 | | CAMC | | 286730 | | 06/5263 |

| CGL 2 | | CAMC | | 286731 | | 06/5264 |

| CGL 3 | | CAMC | | 286732 | | 06/5265 |

| CLAIM NAME | | BLM CAMC # | | COUNTY RECORDING # |

| CGL | | 4 | | CAMC | | 286733 | | 06/5266 |

| CGL | | 5 | | CAMC | | 286734 | | 06/5267 |

| CGL | | 6 | | CAMC | | 286735 | | 06/5268 |

| CGL | | 7 | | CAMC | | 286736 | | 06/5269 |

| CGL | | 8 | | CAMC | | 286737 | | 06/5270 |

| CGL | | 9 | | CAMC | | 286738 | | 06/5116 |

| CGL | | 10 | | CAMC | | 286739 | | 06/5115 |

| CGL | | 11 | | CAMC | | 286740 | | 06/5117 |

| CGL | | 12 | | CAMC | | 286741 | | 06/5118 |

| CGL | | 13 | | CAMC | | 286742 | | 06/5119 |

| CGL | | 14 | | CAMC | | 286743 | | 06/5120 |

| CGL | | 16 | | CAMC | | 286744 | | 06/5121 |

| CGL | | 18 | | CAMC | | 286745 | | 06/5122 |

| CGL | | 29 | | CAMC | | 286746 | | 06/5271 |

| CGL | | 30 | | CAMC | | 286747 | | 06/5272 |

| CGL | | 31 | | CAMC | | 286748 | | 06/5273 |

| CGL | | 32 | | CAMC | | 286749 | | 06/5274 |

| CGL | | 33 | | CAMC | | 286750 | | 06/5275 |

| CGL | | 34 | | CAMC | | 286751 | | 06/5276 |

| CGL | | 35 | | CAMC | | 286752 | | 06/5277 |

| CGL | | 36 | | CAMC | | 286753 | | 06/5278 |

| CGL | | 37 | | CAMC | | 286754 | | 06/5123 |

| CGL | | 38 | | CAMC | | 286755 | | 06/5124 |

| CGL | | 39 | | CAMC | | 286756 | | 06/5125 |

| CGL | | 40 | | CAMC | | 286757 | | 06/5126 |

| CGL | | 41 | | CAMC | | 286758 | | 06/5127 |

| CLAIM NAME | | BLM CAMC # | | COUNTY RECORDING # |

| CGL | | 42 | | CAMC | | 286759 | | 06/5128 |

| CGL | | 43 | | CAMC | | 286760 | | 06/5129 |

| CGL | | 44 | | CAMC | | 286761 | | 06/5130 |

| CGL | | 45 | | CAMC | | 286762 | | 06/5131 |

| CGL | | 46 | | CAMC | | 286763 | | 06/5132 |

| CGL | | 47 | | CAMC | | 286764 | | 06/5133 |

| CGL | | 48 | | CAMC | | 286765 | | 06/5134 |

| CGL | | 49 | | CAMC | | 286766 | | 06/5279 |

| CGL | | 50 | | CAMC | | 286767 | | 06/5280 |

| CGL | | 51 | | CAMC | | 286768 | | 06/5281 |

| CGL | | 52 | | CAMC | | 286769 | | 06/5282 |

| CGL | | 53 | | CAMC | | 286770 | | 06/5283 |

| CGL | | 54 | | CAMC | | 286771 | | 06/5284 |

| CGL | | 55 | | CAMC | | 286772 | | 06/5285 |

| CGL | | 56 | | CAMC | | 286773 | | 06/5286 |

| CGL | | 57 | | CAMC | | 286774 | | 06/5287 |

| CGL | | 58 | | CAMC | | 286775 | | 06/5288 |

| CGL | | 59 | | CAMC | | 286776 | | 06/5289 |

| CGL | | 60 | | CAMC | | 286777 | | 06/5290 |

| CGL | | 61 | | CAMC 286778 | | 06/5291 |

| CGL | | 62 | | CAMC | | 286779 | | 06/5292 |

| CGL | | 63 | | CAMC | | 286780 | | 06/5135 |

| CGL | | 64 | | CAMC | | 286781 | | 06/5136 |

| CGL | | 65 | | CAMC | | 286782 | | 06/5137 |

| CGL | | 66 | | CAMC | | 286783 | | 06/5138 |

| CGL | | 67 | | CAMC | | 286784 | | 06/5139 |

| CLAIM NAME | | BLM CAMC # | | COUNTY RECORDING # |

| CGL | | 68 | | CAMC | | 286785 | | 06/5140 |

| CGL | | 69 | | CAMC | | 286786 | | 06/5293 |

| CGL | | 70 | | CAMC | | 286787 | | 06/5294 |

| CGL | | 71 | | CAMC | | 286788 | | 06/5295 |

| CGL | | 72 | | CAMC | | 286789 | | 06/5296 |

| CGL | | 73 | | CAMC | | 286790 | | 06/5297 |

| CGL | | 74 | | CAMC | | 286791 | | 06/5298 |

| CGL | | 75 | | CAMC | | 286792 | | 06/5299 |

| CGL | | 76 | | CAMC | | 286793 | | 06/5300 |

| CGL | | 77 | | CAMC | | 286794 | | 06/5301 |

| CGL | | 78 | | CAMC | | 286795 | | 06/5302 |

| CGL | | 79 | | CAMC | | 286796 | | 06/5303 |

| CGL | | 81 | | CAMC | | 286797 | | 06/5304 |

| CGL | | 83 | | CAMC | | 286798 | | 06/5305 |

| CGL | | 85 | | CAMC | | 286799 | | 06/5306 |

| CGL | | 86 | | CAMC | | 286800 | | 06/5307 |

| CGL | | 87 | | CAMC | | 286801 | | 06/5308 |

| CGL | | 88 | | CAMC | | 286802 | | 06/5309 |

| CGL | | 89 | | CAMC | | 286803 | | 06/5310 |

| CGL | | 90 | | CAMC | | 286804 | | 06/5311 |

| CGL | | 91 | | CAMC | | 286805 | | 06/5312 |

| CGL | | 92 | | CAMC | | 286806 | | 06/5313 |

| CGL | | 93 | | CAMC | | 286807 | | 06/5314 |

| CGL | | 94 | | CAMC | | 286808 | | 06/5315 |

| CGL | | 95 | | CAMC | | 286809 | | 06/5316 |

| CGL | | 300 | | CAMC | | 286810 | | 06/5317 |

| CLAIM NAME | | BLM CAMC # | | COUNTY RECORDING # |

| CGL | | 301 | | CAMC | | 286811 | | 06/5318 |

| CGL | | 302 | | CAMC | | 286812 | | 06/5319 |

| CGL | | 303 | | CAMC | | 286813 | | 06/5320 |

| CGL | | 304 | | CAMC | | 286814 | | 06/5321 |

| CGL | | 305 | | CAMC | | 286815 | | 06/5322 |

| CGL | | 306 | | CAMC | | 286816 | | 06/5323 |

| CGL | | 307 | | CAMC | | 286817 | | 06/5324 |

| CGL | | 308 | | CAMC | | 286818 | | 06/5325 |

| CGL | | 309 | | CAMC | | 286819 | | 06/5326 |

| CGL | | 310 | | CAMC | | 286820 | | 06/5327 |

| CGL | | 311 | | CAMC | | 286821 | | 06/5328 |

| CGL | | 312 | | CAMC | | 286822 | | 06/5329 |

| CGL | | 313 | | CAMC | | 286823 | | 06/5330 |

| CGL | | 314 | | CAMC | | 286824 | | 06/5331 |

| CGL | | 315 | | CAMC | | 286825 | | 06/5332 |

| CGL | | 316 | | CAMC | | 286826 | | 06/5333 |

| CGL | | 317 | | CAMC | | 286827 | | 06/5334 |

| CGL | | 318 | | CAMC | | 286828 | | 06/5335 |

| CGL | | 319 | | CAMC | | 286829 | | 06/5336 |

| CGL | | 320 | | CAMC | | 286830 | | 06/5337 |

| CGL | | 321 | | CAMC | | 286831 | | 06/5338 |

| CGL | | 322 | | CAMC | | 286832 | | 06/5339 |

| CGL | | 323 | | CAMC | | 286833 | | 06/5340 |

| CGL | | 324 | | CAMC | | 286834 | | 06/5341 |

| CGL | | 325 | | CAMC | | 286835 | | 06/5342 |

| CGL | | 326 | | CAMC | | 286836 | | 06/5343 |

| CLAIM NAME | | BLM CAMC # | | COUNTY RECORDING # |

| CGL | | 327 | | CAMC | | 286837 | | 06/5344 |

| CGL | | 328 | | CAMC | | 286838 | | 06/5345 |

| CGL | | 329 | | CAMC | | 286839 | | 06/5346 |

| CGL | | 330 | | CAMC | | 286840 | | 06/5347 |

| CGL | | 331 | | CAMC | | 286841 | | 06/5348 |

| CGL | | 332 | | CAMC | | 286842 | | 06/5349 |

| CGL | | 333 | | CAMC | | 286843 | | 06/5350 |

| CGL | | 401 | | CAMC | | 286844 | | 06/5351 |

| CGL | | 402 | | CAMC | | 286845 | | 06/5352 |

| CGL | | 403 | | CAMC | | 286846 | | 06/5353 |

| CGL | | 404 | | CAMC | | 286847 | | 06/5354 |

| CGL | | 405 | | CAMC | | 286848 | | 06/5355 |

| CGL | | 406 | | CAMC | | 286849 | | 06/5356 |

| CGL | | 407 | | CAMC | | 286850 | | 06/5357 |

| CGL | | 408 | | CAMC | | 286851 | | 06/5358 |

| CGL | | 409 | | CAMC | | 286852 | | 06/5359 |

| CGL | | 410 | | CAMC | | 286853 | | 06/5360 |

| CGL | | 411 | | CAMC | | 286854 | | 06/5361 |

| CGL | | 412 | | CAMC | | 286855 | | 06/5362 |

| CGL | | 413 | | CAMC | | 286856 | | 06/5363 |

| CGL | | 414 | | CAMC | | 286857 | | 06/5364 |

| CGL | | 415 | | CAMC | | 286858 | | 06/5365 |

| CGL | | 416 | | CAMC | | 286859 | | 06/5366 |

| CGL | | 417 | | CAMC | | 286860 | | 06/5367 |

| CGL | | 418 | | CAMC | | 286861 | | 06/5368 |

AFTER RECORDING, PLEASE RETURN TO: Timberline Resources Corporation 1100 East Lakeshore Drive, Suite 301 Coeur d’Alene, Idaho 83814

(With Reservation of Royalty)

|

This Mining Deed (“Deed”) is made effective as of

__________________

, 2007, by and betweenSTEVEN VAN ERT, an unmarried man, and NOEL COUSINS, an unmarried man

(“Grantor”), and TIMBERLINE RESOURCES CORPORATION, an Idaho corporation whose address is 1100 East Lakeshore Drive, Suite 301, Coeur d’Alene, Idaho 83814 (“Grantee”).

For good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, Grantor and Grantee undertake and agree as follows:

1.Conveyance of Mining Claims. Grantor hereby quitclaims to Grantee the unpatented lode mining claims described inExhibit 1 attached hereto and by reference made a part hereof (the “Claims”), together with any improvements located thereon, any ores, minerals, waste dumps, tailings materials and mineral rights belonging or in any way appertaining thereto, and any water rights, easements, rights-of-way, access rights and other appurtenances thereto; RESERVING, however, unto Grantor the Royalty and related rights set forth in Section 3 hereof.

2.Representations and Warranties. Grantor makes no representations or warranties regarding the validity or ownership of the Claims. Grantee represents and warrants to Grantor that Grantee has the full right, power and capacity to enter into and perform this Deed upon the terms set forth herein, and doing so will not be in breach of any other agreement to which Grantee is a party. Grantee is a corporation in good standing under the laws of Idaho. All corporate and other actions required to authorize Grantee to enter into and perform this Deed have been properly taken. The person signing this Deed for Grantee has proper corporate authority to do so as Grantee’s Chief Executive Officer.

3.Reservation of Royalty. Grantor reserves, and Grantee agrees to pay, a four percent (4.0%) net smelter returns production royalty from any production and sale of minerals from the Claims, to be determined and paid in accordance with the provisions ofExhibit 2attached hereto and by reference made a part hereof (the “Royalty”), which Royalty shall run with the Claims (including any amendments or relocations thereof) and the land within the Claims and

shall be binding upon Grantee and any and all successors to Grantee, such that Grantor shall be entitled to the Royalty regardless of who owns or mines the Claims.

4.Survival of Mineral Agreement. This Deed is given pursuant to that certain Mineral Agreement dated

__________________

, 2007 (but effective September 15, 2006) by and between Grantor and Grantee (“Mineral Agreement”), the terms and conditions of which shall survive the execution and delivery of this Deed.

5.Construction. This Deed shall be construed in accordance with and governed by the laws of the State of California without regard for choice of laws or conflict of laws principles that would require or permit the application of the laws of any other jurisdiction.

6.Binding Effect. This Deed shall inure to the benefit of and be binding upon the parties and their respective successors and assigns.

7.Execution. This Deed may be executed in counterparts, all of which taken together shall constitute a single and complete instrument.

IN WITNESS WHEREOF, Grantor and Grantee have executed this Deed on the dates indicated in the acknowledgements below, but effective as of the date first set forth above.

TIMBERLINE RESOURCES CORPORA-

TION, an Idaho corporation

|

By

John Swallow, Chief Executive Officer

|

| STATE OF CALIFORNIA | | ) |

| | | : ss. |

| COUNTY OF | | ) |

On this

______

day of

______________

, 2007, personally appeared before me, a Notary Public, STEVEN VAN ERT, who acknowledged that he executed the above instrument.

| [seal] | | |

| |

|

| | | NOTARY PUBLIC, residing in |

| |

| My commission expires: | | |

| |

|

| STATE OF ARIZONA | | ) |

| | | : ss. |

| COUNTY OF | | ) |

On this

______

day of

______________

, 2007, personally appeared before me, a Notary Public, NOEL COUSINS, who acknowledged that he executed the above instrument.

| [seal] | | |

| |

|

| | | NOTARY PUBLIC, residing in |

| |

| My commission expires: | | |

| |

|

| STATE OF IDAHO | | ) |

| | | | | ) ss. |

| COUNTY OF | | | | ) |

| |

| | |

| |

| On this | | day of | | _______________

, 2007, personally appeared before me, a Notary |

| Public, John | | Swallow, the | | Chief Executive Officer of TIMBERLINE RESOURCES |

CORPORATION, an Idaho corporation, who acknowledged that he executed the above instrument on behalf of said corporation.

[seal]

__________________________________________

NOTARY PUBLIC, residing in My commission expires:

__________________________________________

_____________________

Exhibit 1

Claims

(Attach Exhibit A from Mineral Agreement)

1.Royalty. Grantee shall pay to Grantor (allocating 85% to Steven Van Ert and 15% to Noel Cousins) the production Royalty of four percent (4.0%) of the Net Smelter Returns from all Minerals mined and removed from the Claims. “Minerals” shall mean any and all mineral substances of any nature as may be subject to location under the General Mining Law of the United States, together with any rights to sand, gravel and other common minerals or materials that may be exercised by virtue of holding such mining claims or that may be otherwise obtained by Grantee. Notwithstanding any other provision of this Deed, the Royalty shall be payable only with respect to Minerals that are ultimately and actually recovered and for which Grantee receives payment or consideration. Grantee shall have no obligation to pay any Royalty on Minerals extracted from the Claims for testing purposes, including without limitation for bulk samples, assays, geochemical analyses, amenability to milling and recovery determinations, pilot plant tests and test trommel operations, unless and until such Minerals are subsequently sold.