TIMBERLINE RESOURCES CORPORATION AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED) |

| | Nine months Ended June 30, |

| | 2021 | | 2020 |

CASH FLOWS FROM OPERATING ACTIVITIES: | | | | |

Net loss | $ | (3,332,531) | $ | (2,511,423) |

Adjustments to reconcile net loss to net cash used by operating activities: | | | | |

Stock-based compensation | | 646,422 | | 161,100 |

Accretion of asset retirement obligation | | 4,224 | | 22,298 |

Amortization of discount on senior unsecured notes payable – related party | | - | | 47,320 |

Loss on extinguishment of debt – related party | | - | | 195,611 |

Impairment loss on claims – Elder Creek | | - | | 1,218,715 |

Changes in assets and liabilities: | | | | |

Prepaid expenses and other current assets | | (30,888) | | (22,760) |

Accounts receivable | | - | | 118,525 |

Accounts payable | | (57,642) | | (71,412) |

Accrued expenses | | (25,660) | | (82,529) |

Accrued interest | | - | | (5,125) |

Accrued expenses – related party | | 3,536 | | - |

Accrued interest – related party | | 63,284 | | 90,868 |

Accrued payroll, benefits and taxes | | 13,647 | | 37,020 |

Net cash used by operating activities | | (2,715,608) | | (801,792) |

| | | | |

CASH FLOWS FROM INVESTING ACTIVITIES: | | | | |

Purchase of mineral rights | | (64,000) | | - |

Proceeds from lease of mineral rights | | 78,571 | | 84,313 |

Proceed from LM LLC – bond advance | | - | | 205,194 |

Refund of reclamation bond | | - | | 12,500 |

Net cash provided by investing activities | | 14,571 | | 302,007 |

| | | | |

CASH FLOWS FROM FINANCING ACTIVITIES: | | | | |

Proceeds from sale of common stock and warrants, net | | 1,788,334 | | 600,000 |

Proceeds from subscribed shares | | 333,333 | | - |

Payments on payment obligation | | - | | (28,294) |

Proceeds from exercise of warrants | | 617,750 | | - |

Net cash provided by financing activities | | 2,739,417 | | 571,706 |

| | | | |

Net increase in cash and cash equivalents | | 38,380 | | 71,921 |

| | | | |

CASH AT BEGINNING OF PERIOD | | 2,520,726 | | 30,757 |

| | | | |

CASH AT END OF PERIOD | $ | 2,559,106 | $ | 102,678 |

| | | | |

Non-cash financing and investing activities: | | | | |

Shares of common stock to be issued under subscription | $ | 2,492,493 | $ | - |

See accompanying notes to consolidated financial statements.

8

TIMBERLINE RESOURCES CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

June 30, 2021 (Unaudited)

NOTE 1 – ORGANIZATION AND DESCRIPTION OF BUSINESS:

Timberline Resources Corporation (“Timberline” or “the Company) was incorporated in August of 1968 under the laws of the State of Idaho as Silver Crystal Mines, Inc., for the purpose of exploring for precious metal deposits and advancing them to production. In 2008, the Company reincorporated into the State of Delaware, pursuant to a merger agreement approved by its shareholders.

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES:

a.Basis of Presentation and Going Concern – The unaudited financial statements have been prepared by the Company in accordance with accounting principles generally accepted in the United States of America (“GAAP”) for interim financial information, as well as the instructions to Form 10-Q. Accordingly, they do not include all of the information and footnotes required by GAAP for complete financial statements. In the opinion of the Company’s management, all adjustments (consisting of only normal recurring accruals) considered necessary for a fair presentation of the interim financial statements have been included. Operating results for the three and nine-month periods ended June 30, 2021 are not necessarily indicative of the results that may be expected for the fiscal year ending September 30, 2021.

For further information refer to the financial statements and footnotes thereto in the Company’s Annual Report on Form 10-K for the year ended September 30, 2020.

The accompanying consolidated financial statements have been prepared under the assumption that the Company will continue as a going concern. The Company has incurred losses since its inception. The Company has sufficient cash to fund normal operations and meet all of its obligations for the next 12 months without raising additional funds. However, we are an exploration company with exploration programs that require significant cash expenditures. A significant drilling program, such as that we have planned, can result in depletion of cash and return us to a position of insufficient cash to support normal operations for 12 months. The Company currently has no historical recurring source of revenue, and its ability to continue as a going concern is dependent on its ability to raise capital to fund future exploration and working capital requirements, or the Company’s ability to profitably execute its business plan. The Company’s plans for the long-term continuation as a going concern include financing its future operations through sales of common stock and/or debt and the eventual profitable exploitation of its mining properties. While the Company has been successful in the past in obtaining financing, there is no assurance that it will be able to obtain adequate financing in the future or that such financing will be on terms acceptable to the Company. These factors raise substantial doubt about the Company’s ability to continue as a going concern.

The consolidated financial statements do not include any adjustments that might be necessary should the Company be unable to continue as a going concern. If the going concern basis were not appropriate for these financial statements, adjustments would be necessary in the carrying value of assets and liabilities, the reported expenses and the balance sheet classifications used.

b.New Accounting Pronouncements - In August 2020, the FASB issued ASU No. 2020-06 Debt - Debt With Conversion And Other Options (Subtopic 470-20) And Derivatives And Hedging - Contracts In Entity’s Own Equity (Subtopic 815-40): Accounting For Convertible Instruments And Contracts In An Entity’s Own Equity. The update simplifies the accounting for and disclosures related to company debt that is convertible or can be settled in a company’s own equity securities. The update is effective for fiscal years beginning after December 15, 2021. Management is evaluating the impact of this update on the Company’s financial statements.

Other accounting standards that have been issued or proposed by FASB that do not require adoption until a future date are not expected to have a material impact on the consolidated financial statements upon adoption.

c.Principles of Consolidation – The consolidated financial statements include the accounts of the Company and its wholly owned subsidiaries, BH Minerals USA, Inc.; Lookout Mountain LLC; Wolfpack Gold (Nevada) Corp.; Staccato Gold Resources, Ltd.; and Talapoosa Development Corp., after elimination of intercompany accounts and transactions. Due to the change in ownership of Lookout Mountain LLC and the associated transfer to the Company of all management and approval responsibilities, the Company began consolidating all balance sheet and expense transactions relative to the Lookout Mountain Project into its consolidated financial statements as of July 29, 2020.

d.Exploration Expenditures – All exploration expenditures are expensed as incurred. Significant property acquisition payments for active exploration properties are capitalized. If no mineable ore body is discovered, the Company determines to focus its exploration efforts elsewhere, claims fees and holding fees are not remitted, or for other

9

TIMBERLINE RESOURCES CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

June 30, 2021 (Unaudited)

reasons, previously capitalized costs are expensed in the period the property is abandoned. When it is determined that a mineral deposit can be economically developed as a result of establishing proven and probable reserves, the costs incurred after such determination will be capitalized and amortized over their useful lives. To date, the Company has not established the commercial feasibility of its exploration prospects; therefore, all exploration costs are being expensed.

e.Property Holding Costs – Holding costs to maintain a property, excluding mineral lease payments, are expensed in the period they are incurred. These costs include security and maintenance expenses, claim fees and payments, and environmental monitoring and reporting costs.

f.Fair Value Measurements – When required to measure assets or liabilities at fair value, the Company uses a fair value hierarchy based on the level of independent, objective evidence surrounding the inputs used. The Company determines the level within the fair value hierarchy in which the fair value measurements in their entirety fall. The categorization within the fair value hierarchy is based upon the lowest level of input that is significant to the fair value measurement. Level 1 uses quoted prices in active markets for identical assets or liabilities, Level 2 uses significant other observable inputs, and Level 3 uses significant unobservable inputs. The amount of the total gains or losses for the period are included in earnings that are attributable to the change in unrealized gains or losses relating to those assets and liabilities still held at the reporting date.

At June 30, 2021 and September 30, 2020, the Company had no assets or liabilities accounted for at fair value on a recurring basis or nonrecurring basis. The carrying amounts of financial instruments, including a senior unsecured note payable-related party, approximate fair value at June 30, 2021 and September 30, 2020.

g.Cash Equivalents – For the purposes of the statement of cash flows, the Company considers all highly liquid investments with original maturities of three months or less when purchased to be cash equivalents. Balances are insured by the Federal Deposit Insurance Corporation up to $250,000 for accounts at each financial institution.

h.Reclamation Bonds – Bonds paid to assure reclamation of properties covered by exploration permits are capitalized in the period paid, reduced as refunds are received or expensed as they are applied to reclamation obligations.

i.Estimates and Assumptions – The preparation of financial statements in accordance with GAAP requires the use of estimates and assumptions that affect the reported amounts of assets and liabilities at the dates of the financial statements, and the reported amounts of revenues and expenses during the reporting period. Significant areas requiring the use of management assumptions and estimates relate to long-lived asset impairments, asset retirement obligations, and stock-based compensation. Actual results could differ from these estimates and assumptions and could have a material effect on the Company’s reported financial position and results of operations.

j.Property and Equipment – Property and equipment are stated at cost. Depreciation of property and equipment is calculated using the straight-line method over the estimated useful lives of the assets, which ranges from two to seven years. Maintenance and repairs are charged to operations as incurred. Significant improvements are capitalized and depreciated over the useful life of the assets. Gains or losses on disposition or retirement of property and equipment are recognized in operating income or expenses.

k.Asset Impairments - Carrying Value of Property, Mineral Rights and Equipment – The Company reviews the carrying value of property, mineral rights, and equipment for impairment whenever events and circumstances indicate that the carrying value of an asset may not be recoverable from the estimated future cash flows expected to result from its use and eventual disposition. In cases where undiscounted expected future cash flows are less than the carrying value, an impairment loss is recognized equal to an amount by which the carrying value exceeds the fair value of the related assets. The factors considered by management in performing this assessment include current operating results, trends and prospects, the manner in which the property is used, the effects of obsolescence, demand, competition, and other economic factors.

l.Asset Retirement Obligations – The Company accounts for asset retirement obligations by following the methodology for accounting for estimated reclamation and abandonment costs as prescribed by GAAP. This guidance provides that the fair value of a liability for an asset retirement obligation (“ARO”) will be recognized in the period in which it is incurred if a reasonable estimate of fair value can be made and a contractual obligation exists. An ARO asset is capitalized as part of the carrying value of the assets to which it is associated, and depreciated over the useful life of the asset. Adjustments are made to the liability for changes resulting from passage of time and changes to either the timing or amount of the original estimate underlying the obligation. The Company has an asset retirement obligation associated with its exploration program at the Lookout Mountain Target on its Eureka Project, and its Paiute Project.

10

TIMBERLINE RESOURCES CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

June 30, 2021 (Unaudited)

m.Stock-based Compensation – The Company estimates the fair value of its stock-based option compensation, and warrants when issued, using the Black-Scholes model, which requires the input of some subjective assumptions. These assumptions include estimating the length of time employees will retain their vested stock options before exercising them (“expected life”), the estimated volatility of the Company’s common stock price over the expected term (“volatility”), employee forfeiture rate, the risk-free interest rate and the dividend yield. Changes in the subjective assumptions can materially affect the estimate of fair value of stock-based compensation.

The fair value of common stock awards is determined based upon the closing price of the Company’s stock on the grant date of the award. Compensation expense for grants that vest is recognized ratably over the vesting period.

n.Net Income (Loss) per Share – Basic earnings per share (“EPS”) is computed as net income (loss) available to common shareholders divided by the weighted-average number of common shares outstanding for the period. Diluted EPS reflects the potential dilution that could occur from common shares issuable through stock options, warrants, and other convertible securities.

The dilutive effect of convertible and outstanding securities as of June 30, 2021 and 2020 is as follows:

| June 30, 2021 | | June 30, 2020 |

Stock options – vested | 8,722,500 | | 5,400,000 |

Warrants | 67,628,336 | | 45,541,908 |

Total potential dilution | 76,350,836 | | 50,941,908 |

At June 30, 2021 and 2020, the effect of the Company’s common stock equivalents would have been anti-dilutive. Accordingly, only basic EPS is presented.

NOTE 3 – PROPERTY, MINERAL RIGHTS, AND EQUIPMENT:

The following is a summary of property, mineral rights, and equipment and accumulated depreciation at June 30, 2021 and September 30, 2020, respectively:

| Expected Useful Lives (years) | | June 30, 2021 | | September 30, 2020 |

| | | | | |

Mineral rights - Eureka | - | $ | 13,676,607 | $ | 13,701,178 |

Mineral rights – Other | - | | 65,000 | | 55,000 |

Total mineral rights | | | 13,741,607 | | 13,756,178 |

| | | | | |

Equipment and vehicles | 2-5 | | 53,678 | | 53,678 |

Office equipment and furniture | 3-7 | | 70,150 | | 70,150 |

Land | - | | 51,477 | | 51,477 |

Total property and equipment | - | | 175,305 | | 175,305 |

Less accumulated depreciation | - | | (123,828) | | (123,828) |

Property, mineral rights, and equipment, net | - | $ | 13,793,084 | $ | 13,807,655 |

For the nine months ended June 30, 2021 and 2020, the Company received mineral lease payments of $78,571 and $84,313, respectively, from a third party on two property blocks the Company leases at the Company’s Eureka property. Monthly payments in the amount of approximately $8,700 terminated subsequent to the end of the period on July 31,2021 due to the termination of the lease by the lessee. These receipts are recorded as a reduction to property, mineral rights, and equipment.

On June 25, 2021, in accordance with the terms of the leases, the lessee notified Timberline that it had elected to terminate its leases on the two property blocks effective June 30, 2021. The monthly payments in the amount of approximately $8,700 will cease for subsequent periods due to the termination of the lease. The claims in question had seen no exploration activity in many years, and they remain the property of BH Minerals USA, Inc., a wholly owned subsidiary of the Company.

NOTE 4 – RELATED-PARTY TRANSACTIONS:

11

TIMBERLINE RESOURCES CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

June 30, 2021 (Unaudited)

A senior unsecured note payable and interest accrued thereon payable to William Matlack, a shareholder and director of the Company, is disclosed in Note 5.

One corporate shareholder, which is related to a director of the Company, purchased 1,250,000 Units of the of the private placement offering which closed on June 25, 2021, which is disclosed in Note 6, on the same terms as other investors in the offering.

During the year ended September 30, 2020, two directors participated in a private placement offering of units of the Company, purchasing 909,091 units for total proceeds of $100,000. Each Unit was priced at $0.11 and consisted of one share of common stock of the Company and one common share Class L Warrant, with each warrant exercisable to acquire an additional share of common stock of the Company at a price of $0.20 per share until August 15, 2023. The participation of the directors of the Company in this private placement was on the same terms as other investors in the private placement offering. The Board of Directors approved the insiders’ participation in the private placement.

At June 30, 2021, two officers were owed a total of $3,536 for expenses recorded in accounts payable – related party on the consolidated balance sheet that were reimbursed subsequent to the end of the period.

NOTE 5 – SENIOR UNSECURED NOTE PAYABLE – RELATED PARTY:

On July 30, 2018, the Company entered into a loan agreement and promissory note with William Matlack, a significant shareholder and a director as of October 29, 2019, (the “Lender”). Under the loan agreement, the Lender loaned the Company $300,000 in the form of a senior unsecured note payable, with the principal bearing interest at an annual rate of 18%, compounded monthly. The loan is unsecured and has a maturity date of January 20, 2023. At June 30, 2021 and at September 30, 2020, the senior unsecured note payable was $300,000.

The accrued interest on the senior unsecured note payable was $205,776 and $142,492 at June 30, 2021 and September 30, 2020, respectively. Interest expense related to the senior unsecured note payable to this related party was $22,424 and $47,075 for the three months ended June 30, 2021 and June 30, 2020, respectively, and $64,658 and $138,187 for the nine months ended June 30, 2021 and June 30, 2020, respectively.

The $300,000 senior unsecured note payable is senior to any other debt obtained by the Company subsequent to June 30, 2021. The senior unsecured note payable requires that when the Company enters into any other financings, 25% of the proceeds of such financings will be paid toward reduction of the principal and interest accrued on the note. No payments have been made by the Company to the Lender; however, with the common stock private placement financing completed during June and July 2021, the 25% is payable to the holder, and the principal therefore is classified as a current liability at June 30, 2021. Management is working with the holder to pay $250,000 prior to the end of fiscal year 2021 to pay the interest payable on the note and a portion of the note principal and negotiate an amendment to the terms of the note. The Lender provided a waiver of default as of September 30, 2020 on the note that would otherwise have occurred due to such non-payment of the 25% of proceeds at the time of the financing in 2020.

12

TIMBERLINE RESOURCES CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

June 30, 2021 (Unaudited)

NOTE 6 – STOCKHOLDERS’ EQUITY:

Common Shares - Private Placement

On June 25, 2021, the Company closed on total subscriptions for a private placement offering for 23,070,798 Units of the Company at a price of $0.20 per Unit. Each Unit consisted of one share of common stock of the Company and one-half common share purchase Series M Warrant (each whole such warrant a “Warrant”), with each Warrant exercisable to acquire an additional share of common stock of the Company at a price of $0.30 per share until the Warrant expiration date of May 31, 2023. A total of 8,941,666 shares and 5,304,166 Warrants were paid for and issued during the quarter ended June 30, 2021, for net proceeds of $1,788,334 to the Company. Another $333,333 was received for shares subscribed but not yet issued as of the end of the quarter. Additionally, 102,000 broker Warrants were issued for finders fees. No cash was paid for finders fees during the quarter ended June 30, 2021. The units subscribed but not yet paid for at June 30, 2021 were accounted for as subscriptions receivable of $2,492,493. Subsequent to the close of the quarter ended June 30, 2021, and prior to the issuance of the financial statements for that period, cash of $2,375,393, net of $117,100 finders fees, was received and 14,129,132 shares and 6,725,481 Warrants were issued to complete the private placement transactions, including 494,248 Warrants issued for finders fees.

Common Shares issued for Exercise of Warrants

During the three months ended June 30, 2021, holders of Series D Warrants exercised 1,775,000 warrants for $0.14 per share to acquire 1,775,000 shares of the Company’s common stock for total cash proceeds of $248,500 to the Company. Also, holders of Series H Warrants exercised 375,000 warrants for $0.14 per share to acquire 375,000 shares of the Company’s common stock for total cash proceeds of $52,500 to the Company. During the three months ended June 30, 2021, 9,000,000 Series D warrants expired.

During the nine months ended June 30, 2021, holders of Series D Warrants exercised 3,500,000 warrants for $0.14 per share to acquire 3,500,000 shares of the Company’s common stock for total cash proceeds of $490,000 to the Company. Also, holders of Series E Warrants exercised 537,500 warrants for $0.14 per share to acquire 537,500 shares of the Company’s common stock for total cash proceeds of $75,250 to the Company. Also, holders of Series H Warrants exercised 375,000 warrants for $0.14 per share to acquire 375,000 shares of the Company’s common stock for total cash proceeds of $52,500 to the Company. At June 30, 2021, the Company has a total of 67,628,336 warrants outstanding.

| Shares | | Exercise Price ($) | Expiration Date |

Warrants: | | | | |

Outstanding and exercisable at September 30, 2020 | 75,634,670 | | | |

Series M Warrants issued June 25, 2021 | 5,304,166 | | 0.30 | May 31, 2023 |

Series M Warrants issued for finders fees | 102,000 | | 0.30 | May 31, 2023 |

Series D Warrants exercised | (3,500,000) | | 0.14 | |

Series E Warrants exercised | (537,500) | | 0.14 | |

Series H Warrants exercised | (375,000) | | 0.14 | |

Series D Warrants expired April 30, 2021 | (9,000,000) | | 0.14 | |

Outstanding and exercisable at June 30, 2021 | 67,628,336 | | | |

NOTE 7 – STOCK-BASED AWARDS:

On October 8, 2020, the Company granted a total of 1,100,000 options to purchase shares of the Company’s common stock that expire in five years with an exercise price of $0.25 in conjunction with the appointment of Patrick Highsmith as CEO (750,000 options), Mr. Steven Osterberg as VP-Exploration (250,000 options), and addition of Mr. Quinton Hennigh to the Board of Directors (100,000 options). Of Mr. Highsmith’s options, 187,500 vested immediately, with 187,500 vesting at each of the following three grant anniversary dates.

On May 6, 2021, the Company granted a total of 2,785,000 options to employees, consultants, officers and directors to purchase shares of the Company’s common stock that expire in five years with an exercise price of $0.25. All options vested upon issuance.

The fair value of the option awards granted and vested during the three months ended June 30, 2021 and 2020 was $519,400 and nil. The fair value of the option awards granted and vested during the nine months ended June 30, 2021 and 2020 was $646,422 and $161,100, respectively. The fair value of unvested options will be recognized as compensation in the amount of $44,321 in each of the following three years covered by the vesting period. Fair values of options issued

13

TIMBERLINE RESOURCES CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

June 30, 2021 (Unaudited)

were measured on the date of the grant with a Black-Scholes option-pricing model using the assumptions noted in the following table:

| Options Granted at May 6, 2021 | Options Granted at October 8, 2020 | Options Granted at October 29, 2019 |

Expected volatility | 167.9% | 171.9% | 149.5% |

Stock price on date of grant | $0.20 | $0.25 | $ 0.07 |

Exercise price | $0.25 | $0.25 | $ 0.08 |

Expected dividends | - | - | - |

Expected term (in years) | 5 | 5 | 5 |

Risk-free rate | 0.05% | 0.09% | 1.66% |

Expected forfeiture rate | 0% | 0% | 0% |

Fair value at grant date | $519,400 | $259,985 | $161,100 |

The following is a summary of options issued and outstanding at June 30, 2021:

| Options | | Weighted Average Exercise Price |

Outstanding at September 30, 2019 | | 3,280,000 | | $ | 0.26 |

Granted | | 2,550,000 | | | 0.08 |

Expired | | (430,000) | | | (0.43) |

Outstanding at September 30, 2020 | | 5,400,000 | | | 0.16 |

| Granted | | 3,885,000 | | | 0.25 |

| Expired | | - | | | - |

Outstanding at June 30, 2021 | | 9,285,000 | | $ | 0.20 |

Outstanding and exercisable at June 30, 2021 | | 8,722,500 | | $ | 0.20 |

Weighted average remaining contractual term (years) | | | | | 3.22 |

The aggregate of options exercisable as of June 30, 2021 had an intrinsic value of $517,500, based on the closing price of $0.23 per share of the Company’s common stock on June 30, 2021.

NOTE 8 – COMMITMENTS AND CONTINGENCIES:

The Company has the following commitments and contingencies:

Mineral Exploration

A portion of the Company’s mining claims on the Company’s properties are subject to lease and option agreements with various terms, obligations, and royalties payable in certain circumstances.

The Company pays federal and county claim maintenance fees on unpatented claims that are included in the Company’s mineral exploration properties. Should the Company continue to explore all of the Company’s mineral properties, it expects annual fees to total approximately $236,277 per year in the future.

Real Estate Lease Commitments

At September 30, 2020, the Company had real estate lease commitments for certain mineral properties totaling $72,000 annually. The Company’s office in Coeur d’Alene, Idaho and its facilities in Eureka, Nevada are rented on a month-to-month basis.

NOTE 9 – SUBSEQUENT EVENTS:

With the exception of events described in Note 6, as evaluated through the financial statement issuance date, there were no material events subsequent to June 30, 2021 that require disclosure.

14

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

As used in herein, the terms “Timberline,” the “Company,” “we,” “us,” and “our” refer to Timberline Resources Corporation.

This discussion and analysis contains forward-looking statements that involve known or unknown risks, uncertainties and other factors that may cause the actual results, performance, or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Except for historical information, the matters set forth herein, which are forward-looking statements, involve certain risks and uncertainties that could cause actual results to differ. Potential risks and uncertainties include, but are not limited to, unexpected changes in business and economic conditions; significant increases or decreases in gold prices; changes in interest and currency exchange rates; unanticipated grade changes; metallurgy, processing, access, availability of materials, equipment, supplies and water; results of current and future exploration and production activities; local and community impacts and issues; timing of receipt and maintenance of government approvals; accidents and labor disputes; environmental costs and risks; competitive factors, including competition for property acquisitions; and availability of external financing at reasonable rates or at all, and those set forth under the heading “Risk Factors” in our Form 10-K filed with the United States Securities and Exchange Commission (the “SEC”) on January 13, 2021. Forward-looking statements can be identified by terminology such as “may,” “will,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” “continues” or the negative of these terms or other comparable terminology. Although the Company believes that the expectations reflected in the forward-looking statements are reasonable, it cannot guarantee future results, levels of activity, performance, or achievements. Forward-looking statements are made based on management’s beliefs, estimates, and opinions on the date the statements are made, and the Company undertakes no obligation to update such forward-looking statements if these beliefs, estimates, and opinions should change, except as required by law.

This discussion and analysis should be read in conjunction with the accompanying unaudited consolidated financial statements and related notes. The discussion and analysis of the financial condition and results of operations are based upon the unaudited consolidated financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States of America. The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires the Company to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of any contingent liabilities at the financial statement date and reported amounts of revenue and expenses during the reporting period. On an on-going basis the Company reviews its estimates and assumptions. The estimates were based on historical experience and other assumptions that the Company believes to be reasonable under the circumstances. Actual results are likely to differ from those estimates under different assumptions or conditions, but the Company does not believe such differences will materially affect our consolidated financial position or results of operations. Critical accounting policies, the policies the Company believes are most important to the presentation of its consolidated financial statements and require the most difficult, subjective and complex judgments are outlined below in “Critical Accounting Policies” and have not changed significantly.

Corporate Overview

Our business is mineral exploration in Nevada with a focus on district-scale gold projects such as our district-scale Eureka Project, where we are focused on delivering high-grade Carlin-type gold discoveries. The Eureka property includes the historic Lookout Mountain and Windfall Mines in a total property position of approximately 24 square miles (62 square kilometers). The Eureka mineral resource was reported in compliance with Canadian NI 43-101 in an Updated Technical Report on the Lookout Mountain Project by Mine Development Associates, Effective March 1, 2013, filed on SEDAR April 12, 2013:

Resource Category | Tonnage (million short tons) | Grade (oz/ton) | Grade (grams/tonne) | Contained Au (troy oz) |

Measured | 3.04 | 0.035 | 1.20 | 106,000 |

Indicated | 25.90 | 0.016 | 0.55 | 402,000 |

Inferred | 11.71 | 0.012 | 0.41 | 141,000 |

We are also operator of the Paiute Joint Venture Project with Nevada Gold Mines in the Battle Mountain District. Both of these properties lie on the prolific Battle Mountain-Eureka gold trend. We also control the Seven Troughs Project in northern Nevada, which is one of the state's highest-grade former gold producers. In total, we control over 43 square miles (111 square kilometers) of mineral rights in Nevada. Detailed maps and mineral resource estimates for the Eureka Project and NI 43-101 technical reports for its projects may be viewed at http://timberlineresources.co/.

15

We are listed on the OTCQB, where we trade under the symbol “TLRS”, and on the TSX Venture Exchange, where we trade under the symbol "TBR".

Corporate Update

In January 2021, we announced the appointment of Mr. Patrick Highsmith, our President and CEO, to the board of directors effective January 1, 2021. At the Company’s annual meeting of shareholders on April 14, 2021, our shareholders approved a downsized board of directors, including five members: Leigh Freeman (Chairman), Quinton Hennigh, Patrick Highsmith, William Matlack, and Don McDowell. In another event subsequent to the end of the quarter, on May 6, 2021 we announced the appointment of Ms. Pamela Saxton to the board of directors. On August 6, 2021, Quinton Hennigh resigned from the board of directors as he accepted an executive position at Crescat Capital, a major shareholder of Timberline.

Summary of Exploration Activities for the Three Months ended June 30, 2021:

Exploration activities undertaken during the quarter ending June 30, 2021 continued advance of numerous Carlin-type gold occurrences within the 62 km2 (24 mi2) Eureka Project land position. In 2020 we demonstrated that there are many high-grade (defined as ≥ 3 g/t) gold intercepts both inside the existing resource and beyond its limits, that can add significant size and value to our flagship project. The Carlin-type gold resource at Lookout Mountain includes oxide mineralization that is exposed at the surface which provides a strong foundation for resource expansion. Nonetheless, we believe the best growth potential at Eureka will come from discovery of high-grade gold associated with many under-drilled targets at Lookout Mountain and elsewhere across the Eureka property. The 2021 program is designed to advance exploration towards discovery of additional high-grade gold through drill testing in step-outs beyond the limits of the current resource area and by advancing new targets through geologic, geochemical, and geophysical evaluations.

Highlights of the 2021 exploration program to-date include:

·Completed approximately 23% (1,409m) of the planned reverse circulation (RC) drilling at the Eureka Project – 5 holes completed in the Lookout Mountain area;

·Completed a controlled source audio magnetotellurics (CSAMT) geophysics survey, spanning 19 line-kilometers along four survey lines;

·Commenced an induced polarization/resistivity (IP) survey – planned for 29 line-kilometers primarily in the Windfall area;

·Geological mapping well underway in the central Oswego Trend and northern Lookout Trend; and

·Completed an orientation soil survey across the Windfall Trend and approximately 700 soil geochemical samples in the northern portion of the property.

Drilling

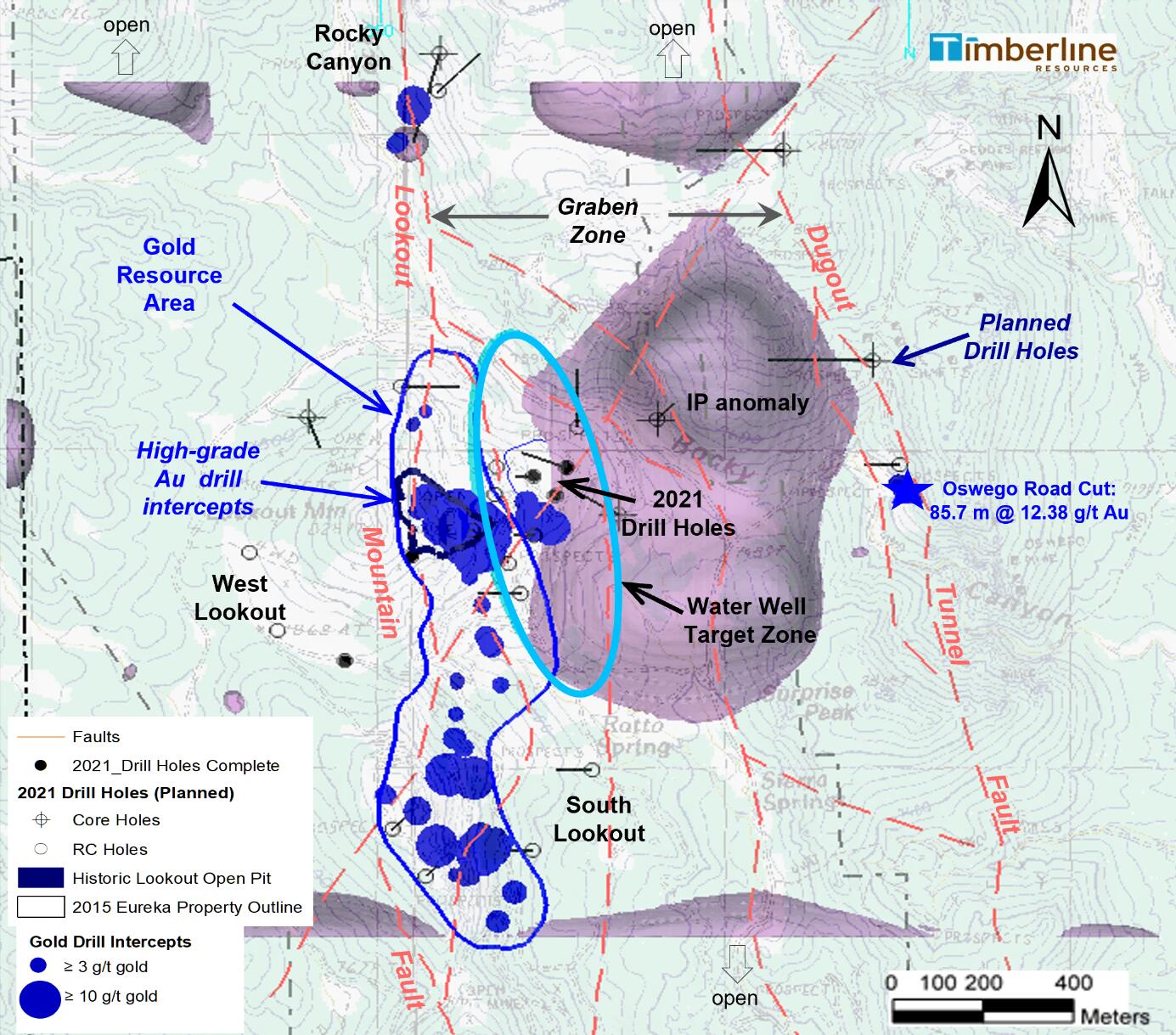

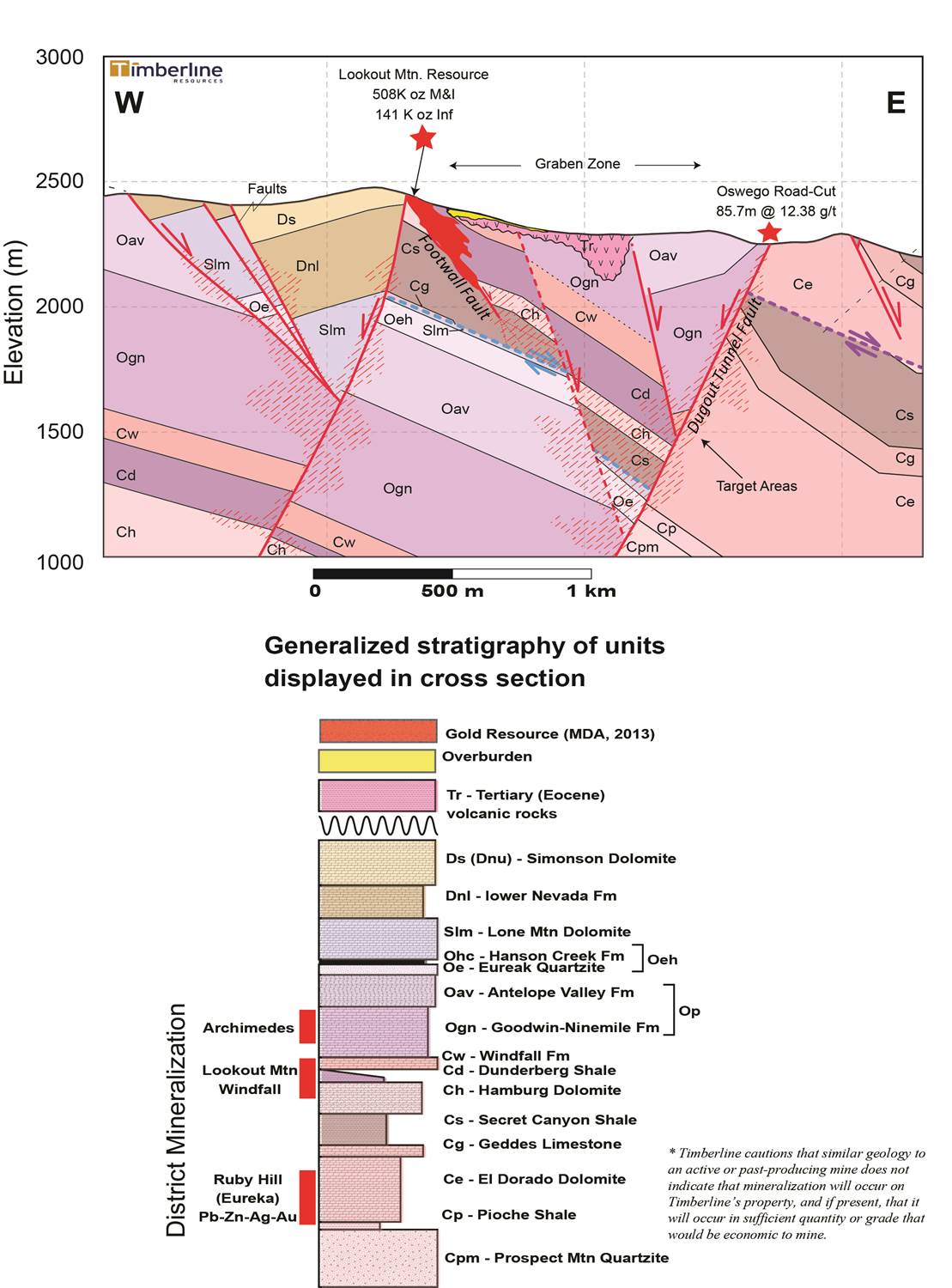

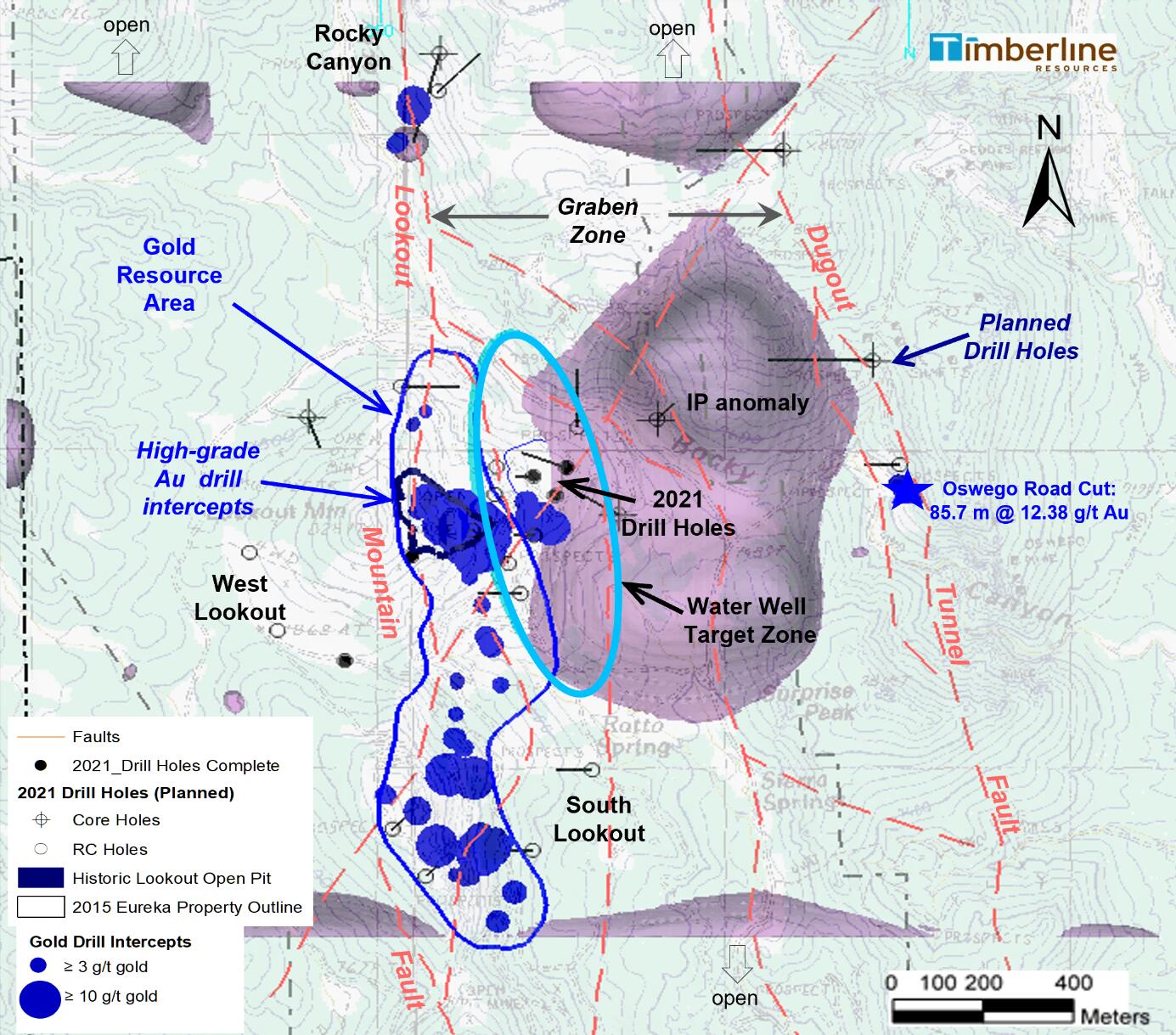

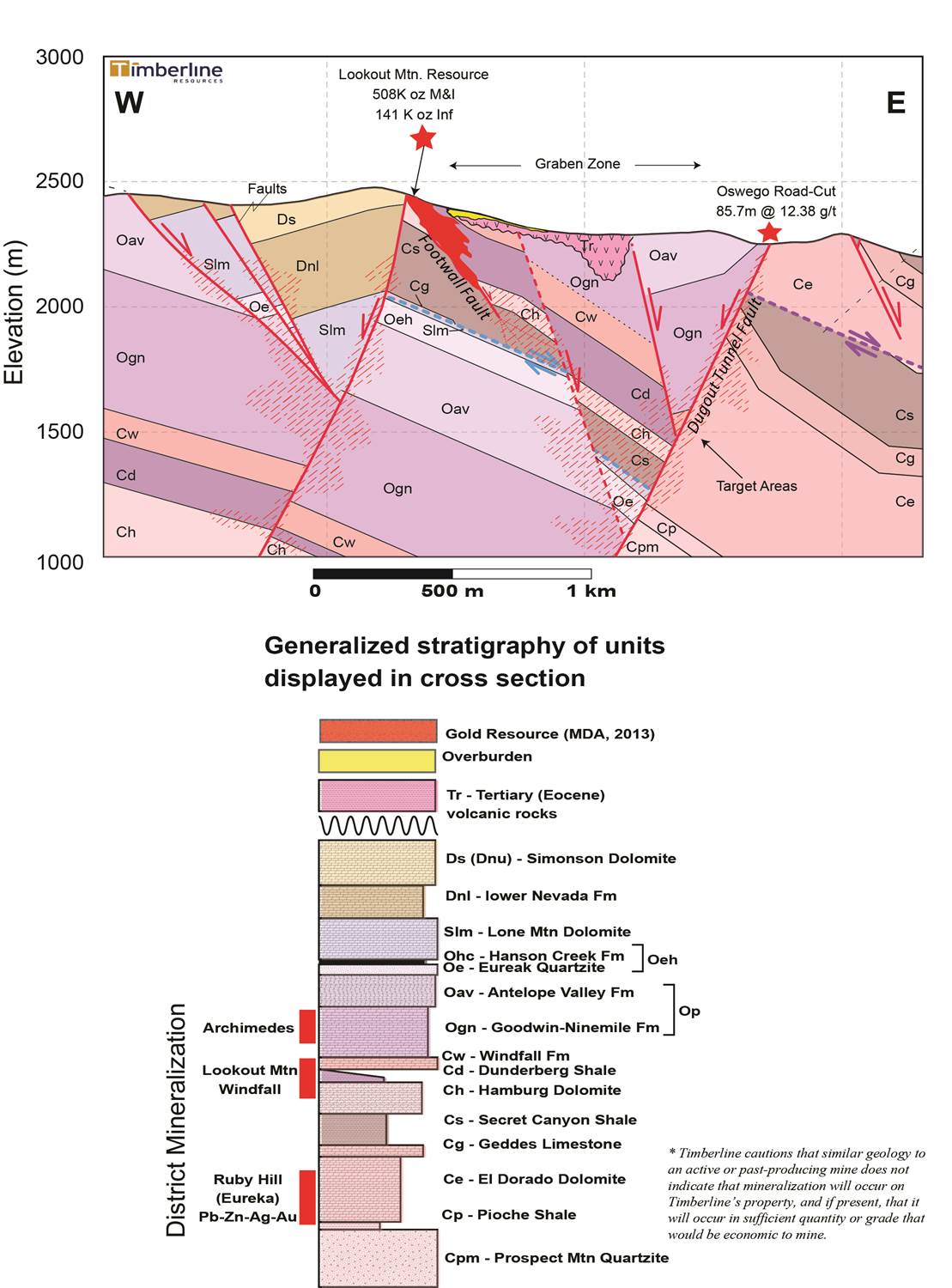

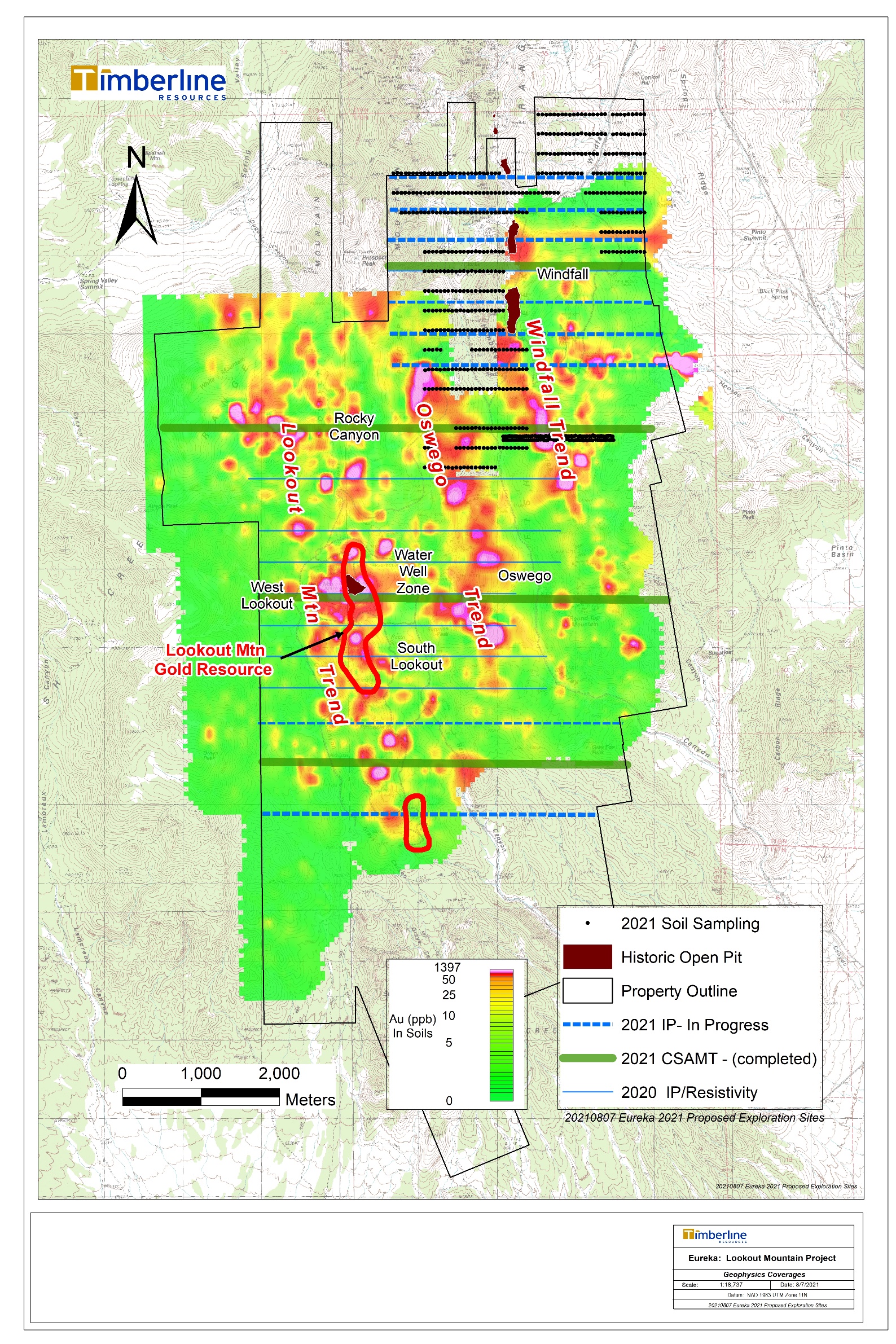

During late 2020 and early 2021 we announced drill results confirming new areas of high-grade gold inside the existing resource and to the east in the Water Well Zone (WWZ) (see Company news releases December 1, 2020 and January 7, 2021). Much of the Lookout Mountain gold resource is associated with a significant alteration zone and related collapse brecciation along the east-dipping Footwall Fault (Figure 2). East of that structure, high-angle faults cut the graben zone and some may be related to known gold mineralization we discovered in the WWZ (see Company news releases dated April 20, 2015 and January 7, 2021). The Graben Zone also hosts a 2 km-long strong IP (chargeability) anomaly near its central axis (Figure 1).

The Timberline team has applied geophysics in conjunction with geologic mapping and 3D modeling to develop these targets for testing in the 2021 drill program. RC drilling commenced in mid-July and five holes (1,409 meters) have been completed at the time of this writing (Figure 1). Three of these holes were aimed at expanding the WWZ mineralization to the north, including the northernmost hole, which is more than 200 meters from previous high-grade intercepts. The high-grade WWZ remains open to the northwest, north, south, and east. Several more holes are planned in 2021 to test the zone to the northwest and southeast. The first phase of drilling also included two new target areas to the southwest from the historic Lookout Mountain Pit.

Drilling is on hiatus during August, but drilling will restart in September when drill rigs and crews rotate back to the Eureka Project. The Company has been successful in securing a drilling contractor during a busy year by agreeing to flexibility in schedule so that drillers can manager other commitments in parallel. Timberline expects this drill program to run at least until November 2021.

16

Figure 1. Lookout Mountain Gold Resource Area and Graben Zone with Major Faults, IP anomalies, and 2021 Planned Drill Holes in Target Areas

Geophysics

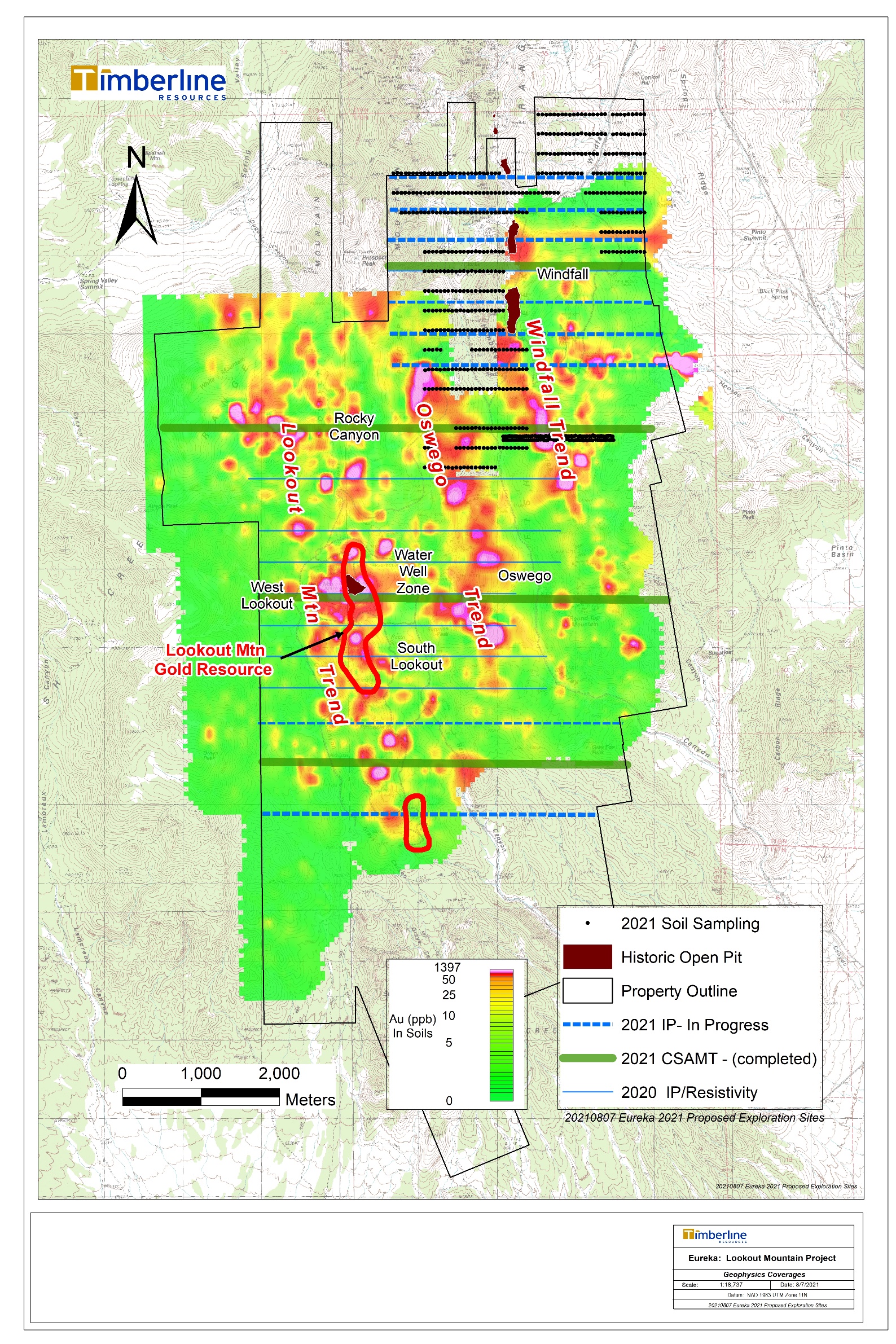

During the quarter ending June 30, 2021, Zonge Geosciences, Inc. (Zonge) completed a CSAMT survey along four lines totaling 19 line-kilometers (Figure 3). The four survey lines transect six major target areas on the Eureka Project: (1) Water Well Zone; (2) West Lookout; (3) Oswego; (4) Rocky Canyon; (5) the gap between South Lookout and the South Adit Zone; and (6) Windfall. These data are expected to provide enhanced insights into the alteration, structural geology, and stratigraphy of the rocks in three dimensions. This will be helpful in interpreting how best to drill in some of the newer target areas. It will also improve understanding how the three major trends on the property are related, the Windfall, the Oswego, and the Lookout Trends. Processing, analysis, and interpretation of the CSAMT data are on-going and will be integrated with new IP data and recent geologic mapping.

Since completion of the CSAMT survey, in mid-July Zonge has begun a new 29 line-kilometer IP survey. The IP survey builds on the very successful work conducted during late 2020 and will include multiple lines in the Windfall target area (Figure 3).

17

Figure 2. Lookout Mountain Geologic Cross Section and Schematic Gold Targets

18

Figure 3. Eureka Project Geologic Trends, and 2021 Geophysical Survey and Soil Sample Locations

19

Geochemistry

The gold systems at the Eureka Project often come to the surface where faults and altered rocks can be expressed in gold and pathfinder elements detectable in soils. Each of the three major trends at Eureka is reflected in gold anomalies in existing soils geochemical data (Figure 3), but the northern portion of the property position was never covered by previous workers.

In the quarter ending June 30th, we initiated a soil geochemical survey across unsurveyed areas of the property. The survey began with an orientation survey to test sampling and analytical methodology over an area of known mineralization. Systematic sampling commenced after a period of training and completion of the orientation survey; the sampling team has collected approximately 700 samples at the time of this writing. The new sampling augments the existing geochemical coverage (Figure 3) across the projected northern extensions of the three gold trends on the property. Initial samples have been submitted to ALS Global Laboratory for analysis by new state-of-the-art ultra-trace level technology which is likely to yield much more robust and comprehensive data than seen in previous surveys. The soil geochemistry survey is expected to provide high-resolution data that will support future drill targeting.

Results of Operations for the nine months ended June 30, 2021 and 2020

Consolidated Results

(US$) | Three Months Ended June 30, | Nine months Ended June 30, |

| 2021 | 2020 | | 2021 | | 2020 |

Exploration expenses: | | | | | | |

| Eureka | $ | 330,599 | $ | 14,221 | $ | 1,471,948 | $ | 173,452 |

| Other exploration properties | 97,309 | - | | 356,032 | | - |

Total exploration expenditures | 427,908 | 14,221 | | 1,827,980 | | 173,452 |

Non-cash expenses: | | | | | | |

| Stock option expenses | 519,400 | - | | 646,422 | | 161,100 |

| Depreciation, amortization and accretion | 1,408 | 18,133 | | 4,224 | | 22,298 |

| Accretion of discount on senior note payable | - | 15,533 | | - | | 47,320 |

Loss on extinguishment of debt | - | - | | - | | 195,611 |

Impairment of claims | - | 1,218,715 | | - | | 1,218,715 |

Total non-cash expenses | 520,808 | 1,252,381 | | 650,646 | | 1,645,044 |

Professional fees expenses | 39,384 | 10,224 | | 160,257 | | 129,689 |

Insurance expenses | 38,766 | 21,607 | | 102,367 | | 73,785 |

Salaries and benefits expenses | 74,584 | 49,931 | | 230,502 | | 242,545 |

Interest and other (income) expense | 44,564 | 35,460 | | 74,616 | | 113,897 |

Other general and administrative expenses | 117,245 | 47,954 | | 286,163 | | 133,011 |

Net loss | $ | 1,263,259 | $ | 1,431,778 | $ | 3,332,531 | $ | 2,511,423 |

Our consolidated net loss for the three months ended June 30, 2021 was $1,263,259, compared to a consolidated net loss of $1,431,778 for the three months ended June 30, 2020. As a result of the consolidation of Lookout Mountain LLC, total exploration expenses of $427,908 were recorded on our statement of operations for the three months ended June 30, 2021, compared with $14,221 for the three months ended June 30, 2020. The year-over-year increase in net loss is due to the significant increase in exploration expenses made possible by the infusion of cash that occurred near the close of fiscal year 2020, share-based compensation resulting from stock options issued to directors, officers and consultants, an increase in salaries and benefits resulting from adding an additional corporate officer, and increases in investor and legal fees resulting from costs associated with the preparation for the shareholder meeting held in April 2021, offset by reduced investor relations consulting fees during the three months ended June 30, 2021. These cost increases were offset by the reduction of interest expense and accretion of the discount on senior notes payable as a result of paying off significant debt late in fiscal year 2020. Insurance expense was somewhat higher in the comparative period due to the normal increases the industry is experiencing.

Our consolidated net loss for the nine months ended June 30, 2021 was $3,332,531, compared to a consolidated net loss of $2,511,423 for the nine months ended June 30, 2020. As a result of the consolidation of Lookout Mountain LLC, total exploration expenses of $1,827,980 were recorded on our statement of operations for the nine months ended June 30, 2021, compared with $173,452 for the nine months ended June 30, 2020. The year-over-year increase in net loss is due to the significant increase in exploration expenses made possible by the infusion of cash that occurred near the close of fiscal year 2020, an increase in share-based compensation resulting from stock options issued to directors, officers and consultants, an increase in salaries and benefits resulting from adding an additional corporate officer, all of which were

20

offset by the non-recurrence of the loss on modification of debt, the non-recurrence of a charge for impairment of claims, and the reduction of interest expense and accretion of the discount on senior notes payable as a result of paying off significant debt late in fiscal year 2020. Insurance expense was somewhat higher in the first nine months of 2021 due to the normal increases the industry is experiencing.

As made possible by the additional funding in 2021, we expect to continue to incur exploration expenses for the advancement of our Eureka Project.

Financial Condition and Liquidity

At June 30, 2021, we had assets of $19,434,111, consisting of cash of $2,559,106, subscriptions receivable of $2,492,493, property, mineral rights and equipment of $13,793,084, net of depreciation, reclamation bonds of $538,696, and prepaid expenses, deposits and other assets in the amount of $50,732.

On June 30, 2021, we had total liabilities of $793,474 and total assets of $19,434,111. This compares to total liabilities of $792,085 and total assets of $16,886,921 on September 30, 2020. As of June 30, 2021, our liabilities consist of $167,323 of trade payables and accrued liabilities, $209,312 of interest and expenses payable to related parties, $116,839 for asset retirement obligations, and $300,000 of senior unsecured note payable – related party. Of these liabilities, $416,839 are due within twelve months. The liabilities compared to September 30, 2020 experienced a minor net change as a result of a decrease in accrued trade payables offset by increases in accrued liabilities and accrued interest - related party. The increase in total assets was due to the infusions of cash and subscriptions receivable from private placements of our equity, offset by uses of cash to reduce accounts payable and to pay Company operating expenses.

On June 30, 2021, we had working capital of $4,419,996 and stockholders’ equity of $18,640,637 compared to working capital of $2,155,400 and stockholders’ equity of $16,094,836 for the year ended September 30, 2020. Working capital increased due to the increase in cash and subscriptions receivable associated with the private placement near the close of the quarter ended June 30, 2021, enhanced by reductions of accounts payable, and offset by increases in accrued expenses and accrued interest - related party and the current status of the senior unsecured note payable to a related party.

During the nine months ended June 30, 2021, we used cash from operating activities of $2,715,608, compared to cash used of $801,792 for the nine months ended June 30, 2020. The use of cash from operating activities results primarily from the net loss of $3,332,531 for the nine-month period ended June 30, 2021 compared to net loss of $2,511,423 for the nine months ended June 30, 2020. Each of the comparable periods experienced significantly different non-cash effects as a result of changes in stock-based compensation and non-recurrence of loss on extinguishment of debt and loss on abandonment of claims. Changes to the net loss for the comparative periods are described above.

During the nine-month period ended June 30, 2021, cash of $14,571 was provided by investment activities, compared with cash of $302,007 provided for the nine-month period ended June 30, 2020. During the nine months ended June 30, 2021, we received $78,571 for lease payments to us for company-owned mineral properties offset by $64,000 paid for mineral rights, compared to cash received of $12,500 for refunds of reclamation bonds paid previously, $205,194 from LM LLC for an advance on reclamation bond refunds due on claims assigned to LM LLC and $84,313 for lease payments to us for company-owned mineral properties for the nine months ended June 30, 2020.

During the nine-month period ended June 30, 2021, $2,739,417 was provided by financing activities, compared to cash of $571,706 provided during the nine-month period ended June 30, 2020. For the nine-month period ended June 30, 2021, cash of $1,788,334 was provided through the sale of stock and warrants, $617,750 provided by the exercise of warrants and $333,333 from the proceeds from stock subscriptions paid for which stock had not yet been issued. For the nine-month period ended June 30, 2020, cash of $600,000 was provided through the sale of stock and warrants, net of offering costs, and $28,294 cash was used for payment of the payment obligation.

Going Concern:

The audit opinion and notes that accompany our consolidated financial statements for the year ended September 30, 2020 disclose a ‘going concern’ qualification to our ability to continue in business. These consolidated financial statements have been prepared on the basis that the Company is a going concern, which contemplates the realization of our assets and the settlement of our liabilities in the normal course of our operations. Disruptions in the credit and financial markets over the past several years have had a material adverse impact on a number of financial institutions and investors and have limited access to capital and credit for many companies. In addition, commodity prices and mining equities have seen significant volatility which increases the risk to precious metal investors. Market disruptions and alternative investment options, among other things, may make it more difficult for us to obtain, or increase our cost of obtaining, capital and financing for our operations. Our access to additional capital may not be available on terms acceptable to us or at all. If we are unable to

21

obtain financing through equity investments, we will seek multiple solutions including, but not limited to, asset sales, corporate transactions, credit facilities or debenture issuances in order to continue as a going concern.

The consolidated financial statements do not include any adjustments that might be necessary should we be unable to continue as a going concern. We believe that the going concern condition cannot be removed with confidence until the Company has entered into a business climate where funding of its activities is more assured. If the going concern basis were not appropriate for these financial statements, adjustments would be necessary in the carrying value of assets and liabilities, the reported expenses and the balance sheet classifications used.

At June 30, 2021, we had working capital of $4,419,996. We have a cash balance of approximately $2,559,106 and approximately $676,635 outstanding in current liabilities. As of the date of this report on Form 10-Q, we have sufficient cash to meet our normal operating commitments for the next 12 months. Therefore, we do not expect to be required to engage in financial transactions to increase our cash balance or decrease our cash obligations in the near term. However, we are an exploration company with planned exploration programs that require significant cash expenditures. A significant drilling program, such as those we have planned, will result in depletion of cash and may return us to a position of insufficient cash to support normal operations for the following 12 months. Cash-raising efforts may include equity financings, corporate transactions, joint venture agreements, sales of assets, credit facilities or debenture issuances, or other strategic transactions.

We plan to follow up on our positive drill results on our Eureka and Paiute Projects. Principally, we plan to execute drilling as part of the ongoing exploration program at Eureka. Also, we may continue prudent exploration programs on our material exploration properties and/or fund some exploratory activities on early-stage properties. We will require additional funding and/or reductions in exploration and administrative expenditures in future periods. If we cannot obtain sufficient additional financing, we may be unable to make required property payments on a timely basis and be forced to return some or all of our leased or optioned properties to the underlying owners.

Financing Activities

On June 25, 2021, we closed on total subscriptions for a private placement offering for 23,070,798 Units of the Company at a price of $0.20 per Unit. Each Unit consisted of one share of our common stock and one-half common share purchase Class M Warrant (each whole such warrant a “Warrant”), with each Warrant exercisable to acquire an additional share of our common stock at a price of $0.30 per share until the Warrant expiration date of May 31, 2023. A total of 8,971,666 shares and 5,304,166 Warrants were paid for and issued during the quarter ended June 30, 2021, for net proceeds of $1,788,334 to the Company. Another $333,333 was received for shares subscribed but not yet issued as of the end of the quarter. Additionally, 102,000 broker Warrants were issued for finders fees. No cash was paid for finders fees during the quarter ended June 30, 2021. The units subscribed but not yet paid for at June 30, 2021 were accounted for as subscriptions receivable of $2,492,493. Subsequent to the close of the quarter ended June 30, 2021, and prior to the issuance of the financial statements for that period, cash of $2,375,393, net of $117,100 finders fees, was received and 14,129,132 shares and 6,725,481 Warrants were issued to complete the private placement transactions, including 494,248 Warrants issued during the subsequent period for finders fees.

One corporate shareholder, which is related to a director of the Company, purchased 1,250,000 Units of the of the private placement offering which closed on June 25, 2021, which is disclosed in Note 6, on the same terms as other investors in the offering. The Offering was completed under Rule 506(b) of Regulation D promulgated by the SEC under the Securities Act of 1933, as amended (the “Securities Act”), solely to persons who qualify as accredited investors and in accordance with applicable securities laws.

Subsequent Events

With the exception of events described in Financing Activities above, as evaluated through the financial statement issuance date, there were no material events subsequent to June 30, 2021 that require disclosure.

Off-Balance Sheet Arrangements

We do not have any off-balance sheet arrangements that are reasonably likely to have a current or future effect on our financial condition, revenues, results of operations, liquidity or capital expenditures.

Critical Accounting Policies and Estimates

See Note 2 to the financial statements contained in this Quarterly Report for a summary of the significant accounting policies used in the presentation of our financial statements. We are required to make estimates and assumptions that

22

affect the reported amounts and related disclosures of assets, liabilities, revenue and expenses. We believe that our most critical accounting estimates are related to asset impairments and asset retirement obligations.

Our critical accounting policies and estimates are as follows:

Asset Impairments - Carrying Value of Property, Mineral Rights and Equipment

Significant property acquisition payments for active exploration properties are capitalized. The evaluation of our mineral properties for impairment is based on market conditions for minerals, underlying mineralized material associated with the properties, and future costs that may be required for ultimate realization through mining operations or by sale. If no mineable ore body is discovered, or market conditions for minerals deteriorate, there is the potential for a material adjustment to the value assigned to such mineral properties.

We review the carrying value of equipment for impairment whenever events and circumstances indicate that the carrying value of an asset may not be recoverable from the estimated future cash flows expected to result from its use and eventual disposition. In cases where undiscounted expected future cash flows are less than the carrying value, an impairment or abandonment loss is recognized equal to an amount by which the carrying value exceeds the fair value of the asset. The factors considered by management in performing this assessment include current operating results, trends and prospects, the manner in which the equipment is used, and the effects of obsolescence, demand, competition, and other economic factors.

Asset Retirement Obligations

We have an obligation to reclaim our properties after the surface has been disturbed by exploration methods at the site. As a result, we have recorded a liability for the fair value of the reclamation costs we expect to incur at our Lookout Mountain Target on our Eureka Project, and our Paiute Project. We estimate applicable inflation and credit-adjusted risk-free rates as well as expected reclamation time frames. To the extent that the estimated reclamation costs change, such changes will impact future reclamation expense recorded. A liability is recognized for the present value of estimated environmental remediation (asset retirement obligation) in the period in which the liability is incurred if a reasonable estimate of fair value can be made. The offsetting balance is charged to the related long-lived asset. Adjustments are made to the liability for changes resulting from passage of time and changes to either the timing or amount of the original present value estimate underlying the obligation.

ITEM 3. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Not applicable.

ITEM 4. CONTROLS AND PROCEDURES

Conclusions of Management Regarding Effectiveness of Disclosure Controls and Procedures

At the end of the period covered by this Form 10-Q, an evaluation was carried out under the supervision of and with the participation of our management, including the Principal Executive Officer and the Principal Financial Officer of the effectiveness of the design and operations of our disclosure controls and procedures (as defined in Rule 13a – 15(e) and Rule 15d – 15(e) under the Exchange Act) as of the end of the period covered by this report. Based on that evaluation, the Principal Executive Officer and the Principal Financial Officer have concluded that our disclosure controls and procedures were not effective in ensuring that: (i) information required to be disclosed by the Company in reports that it files or submits to the SEC under the Exchange Act is recorded, processed, summarized, and reported within the time periods specified in applicable rules and forms and (ii) material information required to be disclosed in our reports filed under the Exchange Act is accumulated and communicated to our management, including our CEO and CFO, as appropriate, to allow for accurate and timely decisions regarding required disclosure.

Disclosure controls and procedures were not effective due primarily to a material weakness in the segregation of duties in the Company’s internal control of financial reporting.

Changes in Internal Control over Financial Reporting

There were no changes in our internal control over financial reporting (as defined in Rule 13a-15(f) or 15d-15(f)), that occurred during the quarter ended June 30, 2021 that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

23

PART II — OTHER INFORMATION

ITEM 1. LEGAL PROCEEDINGS.

We are not aware of any material pending litigation or of any proceedings known to be contemplated by governmental authorities which are, or would be, likely to have a material adverse effect upon us or our operations, taken as a whole. No director, officer or affiliate of Timberline and no owner of record or beneficial owner of more than 5% of our securities or any associate of any such director, officer or security holder is a party adverse to Timberline or has a material interest adverse to Timberline in reference to any currently pending litigation.

ITEM 1A. RISK FACTORS

There have been no material changes from the risk factors as previously disclosed in our Annual Report on Form 10-K for the year ended September 30, 2020, which was filed with the SEC on January 13, 2021.

ITEM 2. UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS.

All sales of unregistered equity securities during the fiscal quarter covered by this Quarterly Report on Form 10-Q were previously reported on Form 8-K.

ITEM 3. DEFAULTS UPON SENIOR SECURITIES.

None.

ITEM 4. MINE SAFETY DISCLOSURES

We consider health, safety and environmental stewardship to be a core value for the Company.

Pursuant to Section 1503(a) of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, issuers that are operators, or that have a subsidiary that is an operator, of a coal or other mine in the United States are required to disclose in their periodic reports filed with the SEC information regarding specified health and safety violations, orders and citations, related assessments and legal actions, and mining-related fatalities with respect to mining operations and properties in the United States that are subject to regulation by the Federal Mine Safety and Health Administration (“MSHA”) under the Federal Mine Safety and Health Act of 1977 (the “Mine Act”). During the nine months ended June 30, 2021, our U.S. exploration properties were not subject to regulation by the MSHA under the Mine Act.

ITEM 5. OTHER INFORMATION

None.

24

ITEM 6. EXHIBITS.

| |

| |

3.1 | Certificate of Incorporation of the Registrant as amended through October 31, 2014, incorporated by reference to the Company’s Form 10-K as filed with the Securities and Exchange Commission on December 23, 2014 |

3.2 | Amended By-Laws of the Registrant, incorporated by reference to the Company’s Form 8-K as filed with the Securities and Exchange Commission on August 13, 2015. |

4.1 | Specimen of the Common Stock Certificate, incorporated by reference to the Company’s Form 10SB as filed with the Securities Exchange Commission on September 29, 2005 |

4.2 | Form of Warrant Agreement incorporated by reference to the Company’s Form 10-Q filed with the Securities and Exchange Commission on August 11, 2016. |

4.3 | Form of Warrant Agreement for March and April 2017 Offering of Units, incorporated by reference to the Company’s Form 10-Q filed with the Securities and Exchange Commission on May 15, 2017. |

4.4 | Form of the Series H Warrant, incorporated by reference to exhibit 99.1 to the Company’s Form 8-K as filed with the Securities and Exchange Commission on April 1, 2019 |

4.5 | Form of the Series G Warrant, incorporated by reference to exhibit 4.4 to the Company’s Form 10-Q as filed with the Securities and Exchange Commission on August 14, 2019 |

4.6 | Form of the Series I Warrant, incorporated by reference to exhibit 4.8 to the Company’s Form 10-K as filed with the Securities and Exchange Commission on Jan 10, 2020 |

4.7 | Form of the Series J Warrant, incorporated by reference to exhibit 4.5 to the Company’s Form 8-K as filed with the Securities and Exchange Commission on October 25, 2019 |

4.8 | Form of the Series K Warrant, incorporated by reference to exhibit 4.8 to the Company’s Form 10-K as filed with the Securities and Exchange Commission on January 13, 2021 |

4.9 | Form of the Series L Warrant, incorporated by reference to exhibit 4.1 to the Company’s Form 8-K as filed with the Securities and Exchange Commission on September 1, 2020 |

4.10* | Form of the Series M Warrant |

31.1* | Certification of Chief Executive Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 (Rules 13a-14 and 15d-14 of the Exchange Act) |

31.2* | Certification of Principal Financial Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 (Rules 13a-14 and 15d-14 of the Exchange Act) |

32.1* | Certification of Chief Executive Officer pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 (18 U.S.C. 1350) |

32.2* | Certification of Principal Financial Officer pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 (18 U.S.C. 1350) |

101.INS* | XBRL Instance Document |

101.SCH* | XBRL Taxonomy Extension Schema Document |

101.CAL* | XBRL Taxonomy Extension Calculation Linkbase Document |

101.DEF* | XBRL Taxonomy Extension Definition Linkbase Document |

101.LAB* | XBRL Taxonomy Extension Label Linkbase Document |

101.PRE* | XBRL Taxonomy Extension Presentation Linkbase Document |

* - Filed herewith

25

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Company has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| TIMBERLINE RESOURCES CORPORATION |

| By: /s/ Patrick Highsmith ___________________________________ Patrick Highsmith President and Chief Executive Officer (Principal Executive Officer) Date: August 16, 2021 |

| By: /s/ Ted R. Sharp ___________________________________ Ted R. Sharp Chief Financial Officer (Principal Financial and Accounting Officer) Date: August 16, 2021 |

| |

26