Regional Structural Geology Interpretation of the Aeromagnetic Data from the VTEM Survey

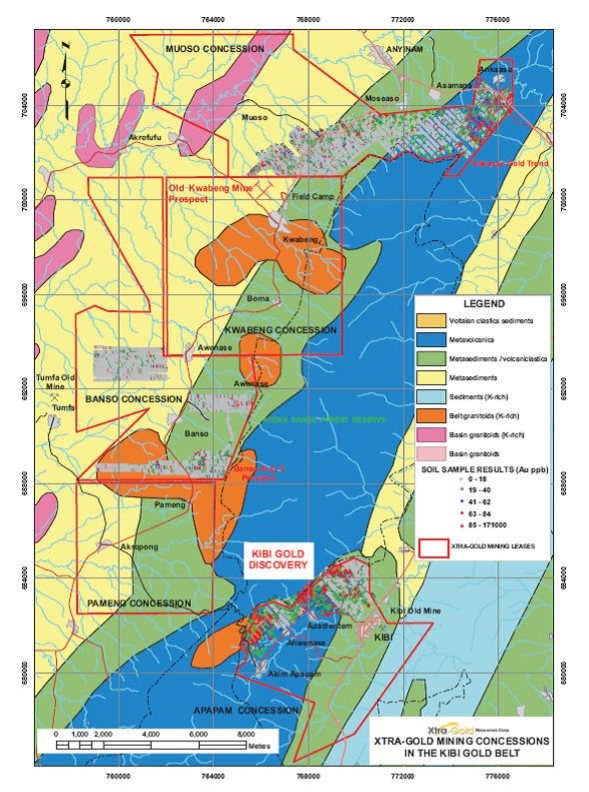

In December 2011, SRK Consulting (Canada) Inc. provided our company with a report of their structural geological interpretation of aeromagnetic data covering our Kibi Gold Belt mining concessions to assist in understanding the structural setting of gold mineralization in the area and to provide a practical structural framework for future exploration targeting. The defined area of interest is ~705 square kilometers in area and is located at the northern extremity of the Kibi Gold Belt. The area of interest was based on the extent of the VTEM Survey conducted by Geotech Airborne Limited. The SRK Consulting (Canada) Inc. report documents the methodology, results, conclusion and recommendations from the structural geological interpretation.

The scope of work included a desktop structural interpretation of the airborne geophysical data we acquired over the area of interest. Based on the available airborne geophysical data, SRK Consulting (Canada) Inc. constructed form lines outlining the internal geometry of stratigraphy within our area of interest. In general, form lines within our area of interest display a strong southwest-northeast trend, parallel to the tectonic grain in the known greenstone belts of Ghana. Variations from this trend occur in a north-west-southeast-trending belt along the lower portion of our area of interest.

SRK Consulting (Canada) Inc. Conclusions

● A fault network was interpreted and subdivided in terms of age. The fault network comprises dominant southwest- northeast-trending faults, subparallel to the dominant trend observed in the form lines that include early reactivated DE extensional faults. These faults are interpreted to have developed (or reactivated) during the Eburnean Orogeny (D2 -D5 ) and are believed to be closely linked to gold mineralization.

● Two types of intrusions (belt and basin type granitoids) were identified in our area of interest, both of which were emplaced before the culmination of the Eburnean Orogeny (D5 ) and therefore are overprinted by D5 deformation.

● A late (D6 ) fault set is represented by east-west-rending faults that are linked by minor northwest-southeast- trending faults. These are characterized by narrow, linear breaks in the magnetic data often with little to no visible offset in the magnetic stratigraphy. These late faults are interpreted to have resulted from northeast-southwest compression that may have occurred at the final stages of the Eburnean Orogeny or post-dated the Eburnean Orogeny.

● Several areas of structural complexity were identified within our area of interest, including left and right- hand steps along the major fault corridors, intersections between D2 -D5 faults and intersections between D2 -D5 and D5 faults, particularly in the vicinity of intrusions.

SRK Consulting (Canada) Inc. Recommendations

● Regional ground-truthing of the regional structural interpretation should be conducted. This should aim to not only identify whether a given fault is present, but also characterize each fault in terms of:

● fault products (including the brittle/brittle-ductile/ductile nature of the fault);

● orientation of associated foliations and lineations if present;

● kinematics; and

● alteration or gold mineralization present.

● A confidence rating should be compiled for each interpreted fault identified as part of this interpretation. This may include using existing geological mapping, satellite imagery, other geophysical datasets, or ground-truthing to produce a confidence rating based on the number of datasets, a given fault is identified in, or based on the resolution of datasets a given interpreted fault is based on.

● Regional ground-truthing of the regional lithological interpretation should be conducted. This should focus on the location of the boundary between the basin and belt assemblages, as well as better defining the internal variation within both these assemblages, including their known relationships with gold mineralization.

● Conduct a regional geochemical survey to verify the validity of identified target areas and conduct close- spaced soil geochemical sampling to guide exploration drilling in areas of positive results.

Our Prior Exploration Activities

Please refer to our annual reports on Form 20-F and Form 10-K previously filed with the SEC for any exploration activities conducted by us before the three years required by this annual report.

Kibi Project

Overview

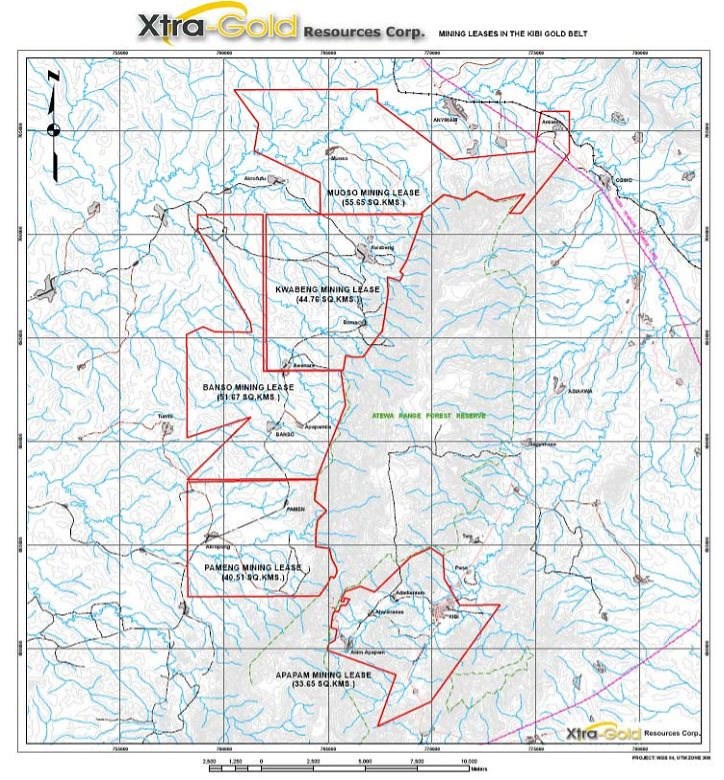

Our Kibi project is also referred to in this annual report as the Apapam concession and is comprised of a 33.65 square kilometer land position.

Our Kibi project land position also encompasses the following two land staking applications:

● the Akim Apapam concession is a reconnaissance license contiguous to the southwest extremity of our Kibi project covering an area of 7.0 square kilometers (700 hectares); and

● the Apapam concession extension is a ground extension along the northwest boundary of our Kibi project covering an area of 1.42 square kilometers (142 hectares).

The Akim Apapam concession application was made to provide a buffer area. The Akim Apapam concession was covered by a first pass (200 meters x 25 meters) soil geochemistry survey in 2011; with 2012 exploration efforts including a single trench (157 meters) and 27 hand auger holes (147 meters) targeting a gold-in-soil anomaly. The Apapam concession extension application was made to cover certain trench and drill gold intercepts. The applications for the Akim Apapam concession and the Apapam concession extension were submitted by our company to the Minerals Commission of Ghana on January 15, 2008 and November 19, 2009, and as at the date of this annual report, approval of these applications is still pending and there is no assurance that either of them will be granted.

The Apapam concession contains two small scale mining licenses, comprising approximately 0.1012 square kilometers (10.12 hectares) located within the northwest portion of the concession which were granted to third parties before our company's application for the Apapam concession. None of the in situ, lode gold mineralization occurrences, described in the October 31, 2012 independent National Instrument 43-101 technical report prepared by SEMS Exploration Services Ltd. are located within and/or proximal to these third party small scale mining licenses, and there is no current knowledge of any lode gold occurrences being present on these parcels. No information is available on past and/or current alluvial gold mining activity on these small scale mining licenses.

Location and Access

Our Kibi project lies within the Kibi-Winneba greenstone belt in the Eastern Region of Ghana and is located on the eastern flank of the Atewa Range along the headwaters of the Birim River in the immediate vicinity of the district capital of Kibi, approximately 75 kilometers NNW of the nation's capital city of Accra. Access to our Kibi project is by driving northwest from Accra on the paved Accra-Kumasi Trunk Road, the main national highway, for approximately 90 kilometers until the town of Kibi, marked by a road sign, is reached. One would make a left hand turn at the Kibi sign and drive southwest for approximately 5 kilometers to arrive at our Apapam concession. A tarred road emanating from the Accra-Kumasi Trunk Road, approximately 15 kilometers northeast of Kibi, dissects the north-central and south-eastern portions of our concession, while the tarred road servicing the town of Apapam provides access to the concession's south-western extremity. Our Kibi project is located approximately 15 kilometers south-southeast from our field camp.

The Kibi-Winneba greenstone belt is characterized by a narrow sequence of Birimian metavolcanics underlying most of the Atewa Range, which is covered by an extensive laterite/bauxite capping, and surrounded by a thick package of Birimian metasediments dominating the flanks and the lower lying areas. Our Kibi project covers the Birimian volcanic-sediment contact which we believe represents a highly favorable environment for the hosting of lode gold deposits throughout Ghana.

Historic Work

Before the exploration work conducted by our company, very little systematic exploration work for bedrock gold deposits has been conducted in the Kibi area since the 1930s.

Prior Exploration by Xtra-Gold

2021 Exploration Program

Exploration activities for the 2021 year continued to focus on the Kibi Gold Project (Apapam Mining Lease). Seventy-five (75) diamond core boreholes totalling 11,343 metres were completed by the Company's in-house drilling crews in 2021 with drilling efforts primarily targeting mineral expansion opportunities within Zone 3 of the Kibi Gold Project.

We did not conduct any exploration activities on our Kwabeng, Pameng, Banso and Muoso projects during the 2021 year.

Exploration activities for the first half of 2021 focussed on definition drilling of the Double 19 gold system (3,292 m) and exploration drilling targeting gold mineralization expansion opportunities within Zone 3 of the Kibi Gold Project (2,150 m). The Zone 3 target generation drilling program was designed to follow up on early-stage gold shoots / showings discovered by previous drilling / trenching efforts (2008 - 2012) and to test prospective litho-structural gold settings identified by recently completed 3D geological modelling. The assay results for the 36 boreholes (5,982 m) completed from January to June 2021 (#KBDD21379 - #KBDD21414), were reported by the Company on April 14 and August 11, 2021, including the following highlights:

- 48.8 m at 0.76 grams per tonne gold ("g/t Au"), including 6.9 m at 1.91 g/t Au, from 134.0 m in hole #KBDD21387; and 15.1 m at 1.24 g/t Au from 200.0 m in undercut hole #KBDD21391 (Double 19 - Definition Drilling)

- 13.5 m at 1.92 g/t Au from 138.5 m in hole #KBDD21384; 11.6 m at 1.00 g/t Au and 17.1 m at 1.13 g/t Au from 92.0 m and 121.9 m respectively in #KBDD21386; and 7.6 m at 2.12 g/t Au and 8.75 m at 1.03 g/t Au from 101.0 m and 125.25 m in respectively in # KBDD21390 (Double 19 - Definition Drilling)

- 65.0 m at 1.03 g/t Au, including 13.5 m at 2.42 g/t Au, from 33.0 m in hole #KBDD21411; and 43.1 m at 0.75 g/t Au, including 3.0 m at 3.65 g/t Au and 9.0 m at 1.29 g/t Au, from 28.5 m in #KBDD21402 (Boomerang West Target - Exploration Drilling)

- 7.3 m at 1.93 g/t Au from 70.7 m in hole #KBDD21409; and 15.0 m at 1.02 g/t Au from 99.0 m in undercut hole #KBDD21410 (Twin Zone Target - Exploration Drilling)

Exploration activities for the second half of 2021, focused on gold mineralization expansion opportunities along the southwestern (Zone 3) segment of the over three-kilometre-long Zone 2 - Zone 3 anticlinal fold structure. With the exploration program focussing on follow up drilling of the early-stage Boomerang East, Boomerang West, and Twin Zone (formerly JK East) targets positioned along similar second-order fold hinge structures as the neighbouring Double 19 gold shoot, and scout drilling of prospective litho-structural gold settings identified by recently completed detailed 3D geological modelling. The assay results for the 39 boreholes (5,982 m) completed from late July to December 2021 (#KBDD21415 - #KBDD21453), as well as five (5) boreholes completed in January 2022 (#KBDD22454 - #KBDD22458), were reported by the Company on February 18, 2022, including the following highlights:

Boomerang East Target

- 6.0 meters ("m") at 6.19 grams per tonne gold ("g/t Au"), including 2.6 m at 13.82 g/t Au, from 52.0 m in hole #KBDD21434

- 33.5 m at 1.22 g/t Au, including 7.5 m at 3.76 g/t Au, from 31.5 m in hole #KBDD21453

- 16.5 m at 6.23 g/t Au, including 6.5 m at 13.74 g/t Au, from 1.5 m in hole #KBDD22455

- 13.5 m at 1.64 g/t Au, including 6.0 m at 3.35 g/t Au, from 0.0 m in #KBDD22458; followed by second interval of 21.0 m at 1.46 g/t Au from 39.0 m, including 11.0 m at 2.49 g/t Au

- gold mineralization at Boomerang East target traced over an approximately 400 m section across the southeastern limb of the NE-trending Zone 2 - Zone 3 anticlinal fold structure; with the mineralization predominantly being spatially associated with a series of apparent second-order (parasitic) fold structures

Boomerang West Target

- 29.0 m at 1.04 g/t Au, including 4.5 m at 3.27 g/t Au, from 50.0 m in #KBDD21423

- 6.0 m at 3.12 g/t Au from 9.0 m in hole #KBDD21425

- Boomerang West target occupies a NE-plunging, tight to isoclinal, anticlinal fold hinge zone; with gold mineralization traced over an approximately 240 m trend-length and 80 m width of the anticlinal fold structure, and down to a vertical depth of approximately 165 m

Twin Zone Target

- 13.2 m at 1.07 g/t Au from 161.0 m in hole #KBDD21419

- 4.0 m at 3.53 g/t Au from 157.0 m in hole #KBDD21448

- gold mineralization at the early-stage Twin Zone target intermittently traced over an approximately 275 m down-plunge distance, and down to a vertical depth of approximately 150 m, along the limbs of two parallel, NE-trending, second-order (parasitic) fold structures

2022 Exploration Program

Exploration activities for the 2022 year continued to focus on the Company's flagship Kibi Gold Project (Apapam Mining Lease) with the continuation of the drilling program targeting mineralization expansion opportunities along the Zone 3 gold mineralization trend. Eighty-one (81) diamond core boreholes totalling 15,012 metres ("m") were completed by the Company's in-house drilling crews in 2022, including 62 holes (12,396 m) dedicated to the further delineation of the Boomerang East gold system identified in late 2021. Drilling efforts for the current year also included 16 holes (2,240 m) designed to test structural geology and geophysical targets on the grassroots Cobra Creek (Zone 5) auriferous shear corridor prospect.

We did not conduct any exploration activities on our Kwabeng, Pameng, Banso and Muoso projects during the 2022 year.

The present Boomerang East drilling work forms part of an exploration initiative targeting gold mineralization expansion opportunities along the southwestern (Zone 3) segment of the over three-kilometer-long Zone 2 - Zone 3 anticlinal fold structure; stretching over one kilometer beyond the limits of the present gold system footprint area. Drill results for a total of 90 holes (15,551.5 m) have been reported to date for the ongoing Zone 3 gold target expansion drill program initiated in late July 2021.

Gold mineralization within the Kibi Gold Project area consists predominantly of tensional arrays of auriferous quartz-carbonate veins hosted by folded diorite bodies with an interpreted Belt-type granitoid affinity. The gold-bearing zones occupy the hinges and limbs of predominantly anticlinal fold structures. Over 20 significant gold occurrences hosted by Belt (Dixcove)- and Basin (Cape Coast)-type granitoids are known in Ghana, with a number constituting significant deposits. These deposits represent a relatively new style of gold mineralization for orogenic gold deposits within the West African Birimian terrain. Belt-type intrusion-hosted gold deposits include Newmont Mining's Subika deposit at their Ahafo mine and Asante Gold's Chirano deposit (formerly Kinross Mining) within the Sefwi gold belt, as well as the former Golden Star Resources' Hwini-Butre deposit at the southern extremity of the Ashanti gold belt.

Drilling activities on the Kibi Gold Project for the 2022 year primarily targeted gold mineralization expansion opportunities along the southwestern (Zone 3) segment of the over three-kilometer-long Zone 2 - Zone 3 anticlinal fold structure, including: 62 holes (12,396 m) dedicated to the further delineation of the Boomerang East gold system identified in late 2021; and three scout holes (376 m) to test prospective litho-structural gold settings. The assay results for 50 boreholes (10,135 m) completed from January to mid-November 2022 on the Boomerang East gold system were reported by the Company on February 18, June 23, September 27 and December 21, 2022, including the following highlights:

Boomerang East: Upper Shoot (s)

- 16.5 meters ("m") at 6.23 grams per tonne gold ("g/t Au"), including 6.5 m at 13.74 g/t Au, from 1.5 m in hole KBDD22455

- 11.3 m at 2.41 g/t Au, including 6.0 m at 3.40 g/t Au, from 11.0 m in hole KBDD22464

- 9.1 m at 1.21 g/t Au from 93.9 m in hole KBDD22469; followed by second interval of 16.3 m at 2.06 g/t Au from 141.7 m, including 5.7 m at 3.10 g/t Au

- 13.5 m at 3.20 g/t Au from 37.0 m in hole KBDD22478

Boomerang East: Lower Shoot (main gold zone)

- 77.0 m at 1.59 g/t Au, including 31.0 m at 3.23 g/t Au, from 122.0 m in hole KBDD22481

- 46.0 m at 1.39 g/t Au, including 20.0 m at 2.01 g/t Au, from 127.0 m in hole KBDD22475

- 43.0 m at 1.57 g/t Au, including 13.0 m at 3.21 g/t Au, from 52.0 m in hole KBDD22480

- 50.0 m at 1.35 g/t Au from 180.2 m in hole KBDD22484

- 45.0 m at 1.32 g/t Au, including 21.0 m at 2.03 g/t Au, from 12.0 m in hole KBDD22485

- 33.0 m at 1.76 g/t Au, including 15.0 m at 2.48 g/t Au, from 233.0 m in hole KBDD22463

Footwall Shoot (in footwall of main Lower Shoot gold zone)

- 22.0 m at 2.40 g/t Au, including 7.0 m at 5.35 g/t Au, from 226.0 m in KBDD22497

- 19.0 m at 0.76 g/t Au, including 7.0 m at 1.70 g/t Au, from 313.0 m in KBDD22495

Current 3D litho-structural modelling indicates that the Boomerang East gold system is emplaced within the inner arc of a tight, moderate NE-plunging, isoclinally folded diorite body. The mineralization appears to occur as a system of stacked, flat-lying to concave-shaped, NE-plunging gold shoots occupying the apparent fold hinge of the NE-trending Zone 2 - Zone 3 anticlinal fold structure.

Drilling to date has outlined three (3) principal gold shoots, including the Upper Shoot (s), the Lower Shoot, and the Footwall Shoot, across an approximately 250 m cross-plunge distance. The Lower Shoot, presently the most prominent mineralization shoot of the Boomerang East gold system, has so far been delineated from practically surface to a down-plunge depth of approximately 400 m along the fold hinge structure (approximately 275 m vertical depth from surface), and across an approximately 175 m NW-SE lateral distance. With the recently identified Footwall Shoot, a parallel mineralization zone lying approximately 25 m - 45 m below the main Lower Shoot gold zone (i.e., in the footwall), traced to date along the entire, approximately 400 m plunge-length of the Lower Shoot, and across an approximately 50 m - 150 m lateral distance.

Drilling efforts for the 2022 year also included 16 holes (2,240 m) on the grassroots Cobra Creek (Zone 5) target; an approximately 550 m wide, NE-trending, quartz-feldspar porphyry ("QFP") hosted, multi-structure braided shear zone system traced by trenching / outcrop stripping over an approximately 850 m strike length. Xtra-Gold undertook a 43 borehole (2,639 m) Phase I diamond core drill program on the Cobra Creek gold zone in 2016. Initial drilling efforts yielded exploration significant mineralized intercepts, including highlights of 4.5 m grading 10.9 g/t Au and 5.2 m grading 9.51 g/t Au (see the Company's news release of October 19, 2016).

The 2022 Cobra Creek exploration drilling program included: 8 holes (774 m) designed to better target / dissect flat-lying to shallow dipping gold-bearing extensional veining arrays and/or shallow plunging auriferous shoots; and 8 scout holes (1,466 m) targeting high-priority induced polarization (IP) / resistivity anomalies along the southeastern margin and projected southwestern extension of the QFP body.

Mineralized intercept highlights for the 8 holes targeting the down-plunge extensions of veining arrays and/or shallow plunging shoots, include: 10.4 m grading 2.0 g/t Au, including 10.05 g/t Au over 1.0 m, from 18.0 m in hole #CCDD22044; 16.9 m grading 1.61 g/t Au and 2.0 m grading 4.63 g/t Au from 25.1 m and 57.0 m respectively in #CCDD22047; 8.0 m grading 2.05 g/t Au, including 6.5 g/t Au over 1.0 m, from 10.0 m in #CCDD22048; and 4.0 m grading 4.44 g/t Au from 24.0 m in #CCDD22054. None of the 8 scout holes targeting geophysical targets returned any significant auriferous intercepts.

In late March, also in relation to our Kibi Gold Project, Xtra-Gold engaged TechnoImaging LLC ("TechnoImaging") of Salt Lake City, Utah, USA to undertake 3D geophysical modelling of an approximately 70 km2 subset area (585 line-km) of the Company's regional helicopter-borne VTEM - Mag survey, completed by Geotech Airborne Limited in 2011, to help identify prospective litho-structural gold setting targets. The geophysical modelling work included 3D joint inversion for conductivity and chargeability of the VTEM survey data, as well as 3D inversion of the Total Magnetic Intensity (TMI) to magnetic susceptibility and magnetization vector models. The Company received the final product of the TechnoImaging geophysical modelling work in mid-July and study result compilation is currently ongoing.

In mid-November, Xtra-Gold commissioned Tect Geological Consulting of West Somerset, South Africa ("Tect") to conduct an updated structural analysis of the Zone 2 - Zone 3 mineralization system footprint area of the Kibi Gold Project. The detailed 3D litho-structural modelling work, encompassing an additional 90 drill holes (15,551.5 m) completed since the previous 2021 geological modelling, in combination with the 3D VTEM / TMI inversion models produced by TechnoImaging, was undertaken to further define the structural controls of the gold mineralization and to generate high-priority exploration targets to help guide ongoing gold system expansion drilling efforts. The Company received the final product of the updated structural study from Tect in mid-February 2023, and study result compilation is currently ongoing.

2023 Exploration Program

Exploration activities for the 2023 year continued to focus on the Company's flagship Kibi Gold Project (Apapam Mining Lease) with the continuation of the drilling program targeting mineralization expansion opportunities along the Zone 3 gold mineralization trend. Sixty-one (61) diamond core boreholes totalling 14,115 metres ("m") were completed by the Company's in-house drilling crews in 2023, including 49 holes (12,202 m) dedicated to the further expansion / definition of the Boomerang gold system (formerly Boomerang East & Boomerang West targets) and 12 scout drill holes (2,113 m) targeting prospective litho-structural settings generated by the recently completed 3D VTEM / TMI inversion-modelling.

We did not conduct any field exploration activities on our Kwabeng, Pameng, Banso and Muoso projects during the 2023 year.

The present Boomerang gold system expansion / definition drilling work forms part of an exploration initiative focussing on multiple mineralization expansion targets occupying the south-western (Zone 3) portion of the mineralization-hosting 1st-order F2 synclinorium fold structure; over 1 km beyond the limits of the previously defined Zone 2 - Zone 3 gold mineralization footprint area. . Drill results for a total of 132 holes (26,968.5 m) have been reported to date for the ongoing Zone 3 gold target expansion drill program initiated in late July 2021.

Current 3D litho-structural modelling indicates that the Zone 2 - Zone 3 gold mineralization footprint area occupies a licence-scale, 1st-order F2 synclinorium fold structure. Deposits are characterized by tensional arrays of auriferous quartz-carbonate veins typically hosted within or spatially associated with F1 or F2 folded / strained diorite units, and/or metasedimentary rock - diorite contacts, with the diorite bodies having an interpreted Belt-type granitoid affinity. Over 20 significant gold occurrences hosted by Belt (Dixcove)- and Basin (Cape Coast)-type granitoids are known in Ghana, with a number constituting significant deposits. These deposits represent a relatively new style of gold mineralization for orogenic gold deposits within the West African Birimian terrain. Belt-type intrusion-hosted gold deposits include Newmont Mining's Subika deposit at their Ahafo mine and Asante Gold's Chirano deposit (formerly Kinross Mining) within the Sefwi gold belt, as well as the former Golden Star Resources' Hwini-Butre deposit at the southern extremity of the Ashanti gold belt.

The assay results for 39 boreholes (10,250 m) completed from January to November 2023, including 27 holes (6,142 m) dedicated to the further expansion / definition of the Boomerang gold system and 12 scout holes (4,108 m) targeting prospective Zone 3 litho-structural settings, were reported by the Company on September 8 and December 20, 2023, including the following highlights:

Expansion Drilling (Boomerang SW Strike-Extension)

- 9.0 m at 5.27 grams per tonne gold ("g/t Au"), including 4.5 m at 8.98 g/t Au, from 65.5 m; and 15.4 m at 1.59 g/t Au, including 7.5 m at 2.01 g/t Au, from 120.0 m in KBDD23524

- 22.0 m at 1.17 g/t Au, including 15.7 m at 1.50 g/t Au, from 194.0 m in KBDD23522

- 4.5 m at 12.72 g/t Au, including 1.5 m at 33.73 g/t Au, from 145.5 m in KBDD23535

Expansion Drilling (Boomerang - SE Lateral / Down-Dip Extension)

- 55.1 m at 0.75 g/t Au, including 39.3 m at 0.95 g/t Au, and including 19.3 m at 1.45 g/t Au, from 353.9 m in KBDD23538

- 20.0 m at 0.84 g/t Au from 134.0 m; and 28.0 m at 0.47 g/t Au from 163.0 m in KBDD23534

- 9.0 m at 1.00 g/t Au from 40.0 m; and 33.0 m at 0.50 g/t Au from 184.0 m; and 29.0 m at 0.35 g/t Au from 304.0 m; and 6.0 m at 1.67 g/t Au from 357.0 m in KBDD22504

- 9.1 m at 0.75 g/t Au from 77.0; and 10.5 m at 0.71 g/t Au from 129.0; and 41.0 m at 0.72 g/t Au from 294.0 in KBDD22505

Definition Drilling (Boomerang - Main "Lower Shoot" Gold Zone)

- 51.0 m at 1.31 g/t Au, including 16.5 m at 3.09 g/t Au, from 127.0 m in KBDD23528

- 53.0 m at 1.06 g/t Au, including 30.0 m at 1.60 g/t Au, from 31.0 m in KBDD23527

- 33.0 m at 1.17 g/t Au, including 19.0 m at 1.76 g/t Au, from 7.0 m in KBDD23519

- 56.0 m at 1.40 g/t Au, including 20.0 m at 2.54 g/t Au, from 166.0 m in KBDD23530

- 50.0 m at 1.28 g/t Au, including 22.0 m at 1.93 g/t Au, from 258.0 m in KBDD23536

New High-Grade Gold Target (Boomerang "Deep")

- 9.0 m at 9.29 g/t Au, including 4.5 m at 16.94 g/t Au, from 400.0 m in KBDD23536 (~90 m stratigraphy below (cross-plunge) of main Lower Shoot)

Current 3D litho-structural modelling appears to indicate that the Boomerang mineralization expansion target, consisting of a multi-shoot gold system extending over approximately 650 m strike and 750 m down-plunge distances respectively, occupies a F2 meso-scale (parasitic) fold hinge structure developed on the north-western limb of the mineralization-controlling 1st-order F2 synclinorium fold. With the mineralization occurring as a NE-plunging system of stacked, flat-lying to concave-shaped, shallow SE-dipping gold shoots hosted within folded / strained diorite bodies and/or associated metasedimentary rock - diorite contacts.

Drilling to date has outlined three (4) principal gold shoots, including the Upper Shoot (s), the Lower Shoot, the Footwall Shoot and the SW Shoot (formerly Boomerang West), across an approximately 370 m cross-plunge distance. The Lower Shoot, presently the most prominent mineralization shoot of the Boomerang gold system, has so far been delineated from practically surface to a down-plunge depth of approximately 500 m along the fold hinge structure (approximately 345 m vertical depth from surface), and across an approximately 200 m NW-SE lateral distance.

Additional exploration activities on the Kibi Gold Project for the 2023 year included commencement of ground-proofing work on high-priority exploration targets generated by the recently completed 3D VTEM / TMI inversion models-based litho-structural modelling work. With a total of 542 infill soil geochemical samples and 179 prospecting (grab) samples collected on the newly identified Central Fold target centred approximately 1.5 km southeast of the Zone 2 - Zone 3 gold mineralization trend. A further 139 prospecting (grab) samples were collected from an extensive auriferous silicified / pyritized siltstone rock float train spatially associated with an interpreted fold-nose structure located approximately 0.5 km southwest of the Boomerang mineralization expansion target. In situ source of auriferous siltstone material yet to be established by trenching / drilling. Final compilation of the soil and prospecting sampling work is currently in progress.

Future Exploration Plans

2024 Proposed Exploration Program

As at the date of this annual report, during 2024, we plan to conduct:

● follow-up trenching of Zone 1 - Zone 2 - Zone 3 early-stage gold shoots / showings to guide future mineralization expansion drilling efforts;

● prospecting, reconnaissance geology, hand augering and/or scout pitting, and trenching of high priority gold-in-soil anomalies and grassroots gold targets across the extent of the Apapam concession; and

● a diamond core drill program of approximately 15,000 metres, at an estimated cost of $850,000, to be implemented utilizing the Company's in-house operated drill rigs; consisting of a combination of expansion drilling of newly emerging gold shoots and scout drilling of prospective litho-structural gold settings within the Zone 2 - Zone 3 mineralization footprint area; and scout drilling of new grassroots gold targets across the Apapam concession.

Note:

● 1 gram per tonne (g/t) = 1 part per million (ppm) = 1,000 parts per billion (ppb)

● All gold results for our exploration programs are reported in g/t gold (Au) unless otherwise indicated

Gold Intercept Reporting Criteria

Unless otherwise indicated, "Reported Intercepts" represent core-lengths; true width of mineralization is unknown at this time. Individual sample results were length-weighted to yield average composite interval grades as reported. Unless otherwise indicated "Significant Intercepts" satisfy following criteria: minimum metal factor (grade x length) of 2.5; with minimum 0.25 grams per tonne ("g/t") gold average grade over interval. Intercepts also constrained with a 0.25 g/t gold minimum cut-off grade at top and bottom of intercept, with no upper cut-off applied, and maximum of five (5) consecutive samples of internal dilution (<0.25 g/t gold). All internal intervals above 15 g/t gold indicated.

Quality-Control Program

We have implemented a quality-control program to ensure best practice in the sampling and analysis of the diamond drill core, reverse circulation (RC) chip samples, saprolite trench and saw-cut channel samples, and soil samples. Drill core is HQ diameter (63.5 millimeters) in upper oxidized material (regolith) and NQ diameter (47.6 millimeters) in the lower fresh rock portion of the hole. Drill core is saw cut and half the core is sampled in standard intervals. The remaining half of core is stored in a secure location. Reverse circulation (RC) chip samples are taken at one-meter intervals under dry drilling conditions by experienced geologists, with all samples weighed on site. Saprolite trench samples consist of continuous, horizontal channels collected from a canal excavated along the bottom sidewall of the trench (~ 0.10 meters above floor). All samples are transported in security-sealed bags to Intertek Minerals Limited, an ISO 17025:2005 accredited laboratory located in Tarkwa, Ghana. As of the date of this annual report, a 1,000 gram split of the sample is pulverized to better than 85% passing 75 microns, and analyzed by industry standard 50 gram fire assay fusion with atomic absorption spectroscopy finish. Samples with observed visible gold and/or exhibiting typical Kibi-type granitoid hosted mineralization characterized by liberated, particulate gold grains are pulverized in their entirety to better than 85% passing 75 microns, and analyzed three times by industry standard 50 gram fire assay fusion with atomic absorption spectroscopy finish; with the arithmetic average of the three assays reported. Our company inserts a certified reference standard (low to high grade), analytical blank, and field duplicate sample in every batch of 20 drill core / reverse circulation (RC) chip / trench channel / saw cut channel samples. Validation parameters are established in the database to ensure quality control.

Recovery and Sale of Placer Gold

There were no placer gold recovery operations carried out at this project from 2012 to 2022.

Apapam Mining Lease

XG Mining's interest in our Kibi project was previously held by a prospecting license granted by the Government of Ghana on March 29, 2004 covering a licensed area of 33.65 square kilometers. In May 2008, XG Mining applied to the Government of Ghana to convert the Kibi prospecting license to a mining lease. When our application received parliamentary approval, the Government of Ghana granted and registered the Apapam mining lease to XG Mining on the following terms and conditions.

The Apapam mining lease is dated December 18, 2008 and is owned and controlled by our company, as to a 90% interest; and is registered to our subsidiary, XG Mining, while the remaining 10% free carried interest in XG Mining is held by the Government of Ghana. The Apapam mining lease covers a lease area of 33.65 square kilometers and is located in the East Akim District of the Eastern Region of Ghana. The Apapam mining lease had a seven year term which expired on December 17, 2015.

All required documentation to extend the lease for our Kibi Project (formerly known as the Apapam Project) for 15 years from December 17, 2015 has been submitted to the Ghana Minerals Commission. As these extensions generally take years for the regulatory review to be completed, the Company is not yet in receipt of the extension approval. However, until the Company receives the extension documents, the old lease remains in force under the mineral laws. The extension is in accordance with the terms of application and payment of fees to the Minerals Commission of Ghana ("Mincom"). All gold production will be subject to a production royalty of the net smelter returns ("NSR") payable to the Government of Ghana.

We have been granted surface and mining rights by the Government of Ghana to work, develop and produce gold in the Apapam lease area (including the processing, storing and transportation of ore and materials).

With respect to the Apapam mining lease, we are:

● required to pay applicable taxes and annual rental ("ground rents") fees to the Government of Ghana in the amount of approximately $12,454.08 (GH¢124,540.80), when the renewal extension is granted; and

● committed to pay a royalty in each quarter to the Government of Ghana, through the Commissioner of Internal Revenue, based on the production for that quarter within 30 days from the quarter end as well as a royalty on all timber felled in accordance with existing legislation;

● required to:

● commence commercial production of gold within two years from the date of the mining lease;

● conduct our operations with due diligence, efficiency, safety and economy, in accordance with good commercial mining practices and in a proper and workmanlike manner, observing sound technical and engineering principles using appropriate modern and effective equipment, machinery, materials and methods and paying particular regard to the conservation of resources, reclamation of land and environmental protection generally; and

● mine and extract ore in accordance with preceding paragraph, utilizing methods which include dredging, quarrying, pitting, trenching, stoping and shaft sinking in the Apapam lease area.

We are further required to furnish to the government authorities of Ghana, comprised of the Minister of Lands, Forestry and Mines, the Head of the Inspectorate Division of the Minerals Commission, the Chief Executive of the Minerals Commission and the Director of Ghana Geological Survey (the "government authorities"), with technical records which include:

● a report in each quarter not later than 30 days after the quarter end to the government authorities in connection with quantities of gold won in that quarter, quantities sold, revenue received and royalties payable;

● a report half-yearly not later than 40 days after the half year end to the government authorities summarizing the results of operations during the half year and technical records, which report shall also contain a description of any geological or geophysical work carried out by our company in that half year and a plan upon a scale approved by the Head of the Inspectorate Division of the Minerals Commission showing dredging areas and mine workings;

● a report in each financial year not later than 60 days after the end of the financial year summarizing the results of our operations in the lease area during that financial year and the technical records, which report shall further contain a description of the proposed operations for the following year with an estimate of the production and revenue to be obtained;

● a report not later than three months after the expiration or termination of the Apapam mining lease, to the government authorities giving an account of the geology of the lease area including the stratigraphic and structural conditions and a geological map on scale prescribed in the Mining Regulations;

● a report not less than 21 days in advance of the proposed alteration, issuance or borrowing to the government authorities (except for the Head of the Inspectorate Division of the Minerals Commission and the Director of Ghana Geological Survey) of any proposed alteration to our regulations,

● a report not less than 21 days in advance of the proposed alteration, issuance or borrowing to the government authorities (except for Head of the Inspectorate Division of the Minerals Commission and the Director of Ghana Geological Survey) on the particulars of any fresh share issuance or borrowings in excess of an amount equal to the stated capital of XG Mining;

● a copy of XG Mining's annual financial reports to the government authorities (except for the Head of the Inspectorate Division of the Minerals Commission and the Director of Ghana Geological Survey) including a balance sheet, profit and loss account and notes thereto certified by a qualified accountant, who is a member of the Ghana Institute of Chartered Accountants, not later than 180 days after the financial year end; and

● such other reports and information in connection with our operations to the government authorities as they may reasonably require.

We are entitled to:

● surrender all of our rights in respect of any part of the lease area not larger in aggregate than 20% of the lease area by providing not less than two months' notice to the Government of Ghana;

● surrender a larger part of the lease area by providing not less than 12 months' notice; and

● terminate our interest in the Apapam mining lease if the mine can no longer be economically worked, by giving not less than nine months' notice to the government authorities, without prejudice to any obligation or liability incurred before such termination.

The Government of Ghana has the right to terminate our interest in the Apapam mining lease if we:

● fail to make payments when due;

● contravene or fail to comply with terms and conditions of the mining lease (however, we have 120 days to remedy from the notice of such event);

● become insolvent or commit an act of bankruptcy; or

● submit false statements to the government authorities.

The Apapam mining lease further provides that XG Mining shall report forthwith to the government authorities if it discovers any other mineral deposits apart from gold and silver in the lease area, who in turn will provide XG Mining with the first option to prospect further and to work the said minerals subject to satisfactory arrangements made between XG Mining and the government authorities.

Kwabeng Project

Our Kwabeng Project is also referred to in this annual report as the Kwabeng concession and is comprised of 44.76 square kilometers.

Location and Access

The Kwabeng concession is located in the Atiwa West District of the Eastern Region of Ghana, along the western, lower flank and base of the Atewa Range, approximately 10 kilometers north-northwest of our Kibi project which is located on the Apapam concession. The eastern boundary of the Kwabeng concession is demarcated by the Atewa Forest Reserve.

Access to our Kwabeng project can be gained by driving northwest from Accra on the Accra-Kumasi Trunk Road, for approximately 110 kilometers until arrival at Anyinam, making a left hand turn at the road sign that reads "Kwabeng" in the middle of the Town of Anyinam and driving in a southwesterly direction approximately 10 kilometers until arriving at a sign reading "Xtra-Gold Mining" before reaching the town of Kwabeng.

Historical Work

There has been very little exploration for lode source gold deposits at our Kwabeng and Pameng projects; however, there has been detailed exploration for placer gold deposits. Prior to the recovery of placer gold from our Kwabeng project during 2007 and 2008 and our Kibi and Pameng projects during 2010 and 2011, these projects contained approximately 12,583,000 bank cubic meters of auriferous gravels. As at the date of this annual report, the company does not feel an accurate calculation of the remaining cubic metres and grade figures on our Kibi, Kwabeng and Pameng projects can be made. In addition to the mineralized material, there is potential to define reserves with further exploration.

The placer gold deposit currently located at our Kwabeng concession was mined by the former owner in the early 1990's for 15 months and produced approximately 16,800 ounces of gold before operations were ceased due to mining difficulties as noted hereunder. The placer gold is contained in a gravel deposit distributed across the floor of the river valleys west of the Atewa Range which can easily be excavated.

Prior Exploration by Xtra-Gold

2021 Exploration Program

Exploration work on our Kwabeng project during the 2021 year was limited to airborne geophysical survey compilation and satellite remote sensing imagery.

2022 Exploration Program

Exploration work on our Kwabeng project during the 2022 year was limited to geological / geophysical compilation to identify and/or further define grassroots targets; and the continuation of placer gold recovery operations at this project (commenced in March 2013).

2023 Exploration Program

Exploration work on our Kwabeng project during the 2023 year was limited to geological / geophysical compilation to identify and/or further define grassroots targets; and the continuation of placer gold recovery operations at this project (commenced in March 2013).

2024 Proposed Exploration Program.

As at the date of this annual report, during 2024, we plan to conduct:

● ongoing geological compilation, prospecting, soil geochemical sampling, hand augering and/or scout pitting, and trenching to identify and/or further advance grassroots targets; and

● the continuation of placer gold recovery operations at this project (commenced in March 2013).

Recovery and Sale of Placer Gold

As at December 31, 2023, we have sold an aggregate of 21,620 fine ounces of gold from placer gold recovered from the mineralized material at our Kwabeng project during 2007, 2008, and 2013 to 2023 fiscal years. We did not have an exclusive agreement with any company or entity to buy the placer gold that was recovered. No placer gold recovery operations were conducted at this project during 2009 through 2012.

The gold price (approximately $2,233 per ounce as at March 30, 2024) is significantly greater compared to the approximately $300 per ounce gold price during the previous mining effort by the former operator of this project. On the basis of an annual recovery of placer gold of approximately 700,000 bank cubic meters, we anticipate that recovery of placer gold operations at this project could be sustained for 2 years. However, this will depend upon numerous factors including the grade and commercial recoverability of the mineralized material and the selling gold price at the relevant time.

Resumption of Placer Gold Recovery Operations at our Kwabeng Project

Placer gold recovery operations at our Kwabeng project resumed in 2013. As stated elsewhere in this annual report, we plan to focus our efforts and our financial resources primarily on planned exploration activities on our Kwabeng project (see "Kwabeng Project - 2024 Exploration Program").

Former Ownership

In the early 1990's, the former mining lessee invested approximately $24,000,000 to open and operate a mine at the Kwabeng concession. The mining operation lasted for 15 months and 16,800 ounces of gold was produced before the mine was shut down due to a poor gold price, mining methodology and a lack of funds to continue mining operations.

Resources and Reserves

No mineral resources or mineral reserves have been identified on our Kwabeng project.

Kwabeng Mining Lease

The Kwabeng mining lease is dated July 26, 1989 and is owned and controlled by our company, as to a 90% interest; and is registered to our subsidiary, XG Mining, while the remaining 10% free carried interest in XG Mining is held by the Government of Ghana. The Kwabeng mining lease covers a lease area of 44.76 square kilometers and has a 30 year term expiring on July 26, 2019. We have applied for a 15 year renewal extension. We have been granted surface and mining rights by the Government of Ghana to work, develop and produce gold in the lease area (including processing, storing and transportation of ore and materials). See "Kibi Project - Apapam Mining Lease" for identical mining lease terms for the Kwabeng mining lease, except for the name of the mining lease, the lease registration particulars, the lease area and annual ground rents of approximately $16,392.68 (GH¢163,926.83), when the renewal extension is granted.

The Kwabeng mining lease further provides that XG Mining shall report forthwith to the government authorities if we discover any other minerals in the Kwabeng lease area and will provide XG Mining with the first option to prospect further and to work the said minerals subject to satisfactory arrangements made between XG Mining and the government authorities.

Ancillary Operations

Field Camp at Kwabeng Project

Our company possesses our fully operational and well maintained field camp comprised of an administrative office, living quarters and workshop facilities located on our Kwabeng concession which is accessible by paved road located approximately two hours drive from the capital city of Accra. Our field camp is the base of operations for the majority of our administrative activities and all of our exploration activities. All of our senior Ghanaian staff is accommodated in the field camp with our junior staff located in the surrounding towns and villages. XG Mining has rehabilitated the field camp which included installation of a communication system for Internet access, electronic mail, telephone and facsimile service and minor construction repairs. Our field camp is within cell phone coverage and is supplied with electricity from the national power grid, which lines run along the road accessing our field camp.

Fuel and Spare Parts Supply

We deliver fuel from Accra by tanker and discharge the fuel into and store the fuel in the fuel tank facility located within our field camp. We purchase spare parts for all of our equipment either locally or from suppliers overseas and store such parts in the secure spare parts warehouse located at our field camp.

Workspace

There is adequate office space at our field camp to accommodate our administrative, geology, surveying, equipment maintenance and other departments, as well as their technical support and our laborers.

Equipment Maintenance

Any maintenance of our excavators or other equipment which we may own will be carried out in the workshops located within our field camp.

Capital Expenditures

We do not anticipate any significant capital expenditures in the next 12 months in connection with placer gold recovery operations.

Pameng Project

Our Pameng project is also referred to in this annual report as the Pameng concession and is comprised of 40.51 square kilometers.

The Pameng concession is located in the East Akim District of the Eastern Region of Ghana, along the western, lower flank and base of the Atewa Range, approximately 2 kilometers west-northwest of our Kibi project which is located on the Apapam concession. Access to our Pameng project can be gained by driving northwest from Accra on the Accra-Kumasi Trunk Road for approximately 125 kilometers until arrival at the village of Pameng where there is a road sign reading "Pameng". Make a left hand turn at the Pameng sign and drive southwest approximately 2 kilometers to reach our Pameng concession. Our Pameng concession is located approximately 12.5 kilometers south-southwest from our field camp.

Historical Work

To the best of our knowledge, the Pameng concession has never been subjected to modern, systematic exploration for lode gold mineralization.

Prior Exploration by Xtra-Gold

2021 Exploration Programs

Exploration activities on our Pameng project during the 2021 year was limited to airborne geophysical survey compilation and satellite remote sensing imagery.

2022 Exploration Program

Exploration work on our Pameng project during the 2022 year was limited to geological / geophysical compilation to identify and/or further define grassroots targets; and the continuation of placer gold recovery operations at this project.

2023 Exploration Programs

Exploration work on our Pameng project during the 2023 year was limited to geological / geophysical compilation to identify and/or further define grassroots targets; and the continuation of placer gold recovery operations at this project.

Future Exploration Plans for 2024

As at the date of this annual report, during 2024, we have planned the following exploration activities at this project:

● ongoing geological compilation, prospecting, soil geochemical sampling, and scout trenching to identify and/or further advance grassroots targets.

Recovery and Sale of Placer Gold

During 2010 and 2011, we negotiated with independent Ghanaian contract miners and operators in connection with their placer gold recovery operations at our Pameng project on fixed payment terms to our company. During 2010, 4,720 ounces of gold was recovered and produced by the contract miners from our Pameng project for which we received and sold 897 ounces of gold for gross proceeds of $1,128,451. During 2011, 5,621 ounces of gold was recovered and produced by the contract miners at this project for which we received and sold 1,068 ounces of gold for $1,489,058. During 2012, we sold 53 ounces of gold for gross proceeds of $87,997 which was the remaining payment we had received from the contract miners during their 2010 and 2011 placer gold recovery operations at this project. No placer gold recovery operations were conducted at this project from 2012 to 2019. Gold recovery operations resumed in 2020. Gold sales of 1,195 ounces of pure gold in 2023 (2022 - 2, 087 ounces of pure gold, 2021 - 2,871 ounces of pure gold) were sold for $2,055,798 (2022 -$3,704,167, 2021 -$4,074,170).

Mineral Reserves

No mineral resources or mineral reserves have been identified on our Pameng project.

Pameng Mining Lease

The Pameng mining lease is dated July 26, 1989 and is owned and controlled by our company, as to a 90% interest; and is registered to our subsidiary, XG Mining, while the remaining 10% free carried interest in XG Mining is held by the Government of Ghana. The Pameng mining lease covers a lease area of 40.51 square kilometers and has a 30-year term expiring on July 26, 2019. We have applied for a 15-year renewal extension. We have been granted surface and mining rights by the Government of Ghana to work, develop and produce gold in the lease area (including processing, storing and transportation of ore and materials). See "Kibi Project - Apapam Mining Lease" for identical mining lease terms for the Pameng mining lease, except for the name of the mining lease, the lease registration particulars, the lease area and annual ground rents payable in the amount of approximately $14,789.22 (GH¢147,892.20), when the renewal extension is granted.

The Pameng mining lease further provides that XG Mining shall report forthwith to the government authorities if we discover any other minerals in the Pameng lease area, and will provide XG Mining with the first option to prospect further and to work the said minerals subject to satisfactory arrangements made between XG Mining and the government authorities.

Banso Project

Our Banso project is also referred to in this annual report as the Banso concession and is comprised of 55.28 square kilometers.

Location and Access

The Banso concession is located in the East Akim District of the Eastern Region of Ghana, approximately 7 kilometers south-southwest from our field camp.

Both of the Banso concession and the Muoso concession lie in the Kibi-Winneba Gold Belt on the western flanks of the prominent Atewa Range, which is underlain by Birimian greenstone, phyllites, meta-tuffs, epi-diorite, meta-greywacke and chert. The valleys, over which this concession is located, are underlain by thick sequences of Birimian metasediments. The north-western end of the Atewa Range is the type-locality for the Birimian metasediments and metavolcanics. The area where both of our Banso and Muoso projects are located is one of the oldest placer gold mining areas of Ghana, dating back many centuries.

Access to the Banso concession is gained by driving northwest approximately 136 kilometers from Accra on the paved Accra-Kumasi Trunk Road.

Historic Work

Historical exploration and mining have mainly focused on placer gold. Before the acquisition of our interest in the Banso concession, to the best of our knowledge and based on mining records in Ghana, there had never been a detailed documented bedrock exploration program conducted on this concession.

2021 to 2023 Exploration Programs

No significant lode gold exploration work was conducted by our company on our Banso project from 2013 to 2023. Exploration activities on our Banso project during the 2023 year was limited to geological / geophysical compilation to identify and/or further define grassroots targets; and the continuation of placer gold recovery operations at this project.

Future Exploration Plans for 2024

As at the date of this annual report, during 2024, we have planned the following exploration activities at this project:

● ongoing geological compilation, prospecting, soil geochemical sampling, hand augering and/or scout pitting, and trenching to identify and/or further advance grassroots targets; and

● the continuation of placer gold recovery operations at these projects (commenced in 2015 to present).

Mineral Reserves

No mineral resources or mineral reserves have been identified on our Banso project.

Banso Mining Lease

The Banso mining lease is dated January 6, 2011 and is owned and controlled by our company, as to a 90% interest; and is registered to XG Mining, while the remaining 10% free carried interest in XG Mining is held by the Government of Ghana. The Banso mining lease covers a lease area of 51.67 square kilometers and has a 14 year term expiring on January 5, 2025. We have been granted surface and mining rights by the Government of Ghana to work, develop and produce gold in the lease area (including processing, storing and transportation of ore and materials). See "Kibi Project - Apapam Mining Lease" for identical mining lease terms for the Banso mining lease, except for the name of the mining lease, the lease registration particulars, the lease area and annual ground rents in the amount of approximately $18,914.63 (GH¢189,146.34).

The Banso mining lease further provides that XG Mining shall report forthwith to the government authorities if we discover any other minerals in the Banso lease area, and will provide XG Mining with the first option to prospect further and to work the said minerals subject to satisfactory arrangements made between XG Mining and the government authorities.

Muoso Project

Our Muoso project is also referred to in this annual report as the Muoso concession and is comprised of 55.28 square kilometers.

Location and Access

The Muoso concession is located in the East Akim District of the Eastern Region of Ghana, approximately 1 kilometer north from our field camp.

Access to our Muoso project is gained by driving northwest approximately 80 kilometers from Accra on the paved Accra-Kumasi Trunk Road. This highway passes through the easternmost portion of the Muoso concession and shares a common boundary with the Kwabeng concession. From the town of Osino, one would drive northwest approximately 5 kilometers to the town of Anyinam, from which an all weather direct road heads south through the centre of the Muoso concession and onto the Banso concession, approximately 15 kilometers south of the Accra-Kumasi Trunk Road. The town of Muoso is approximately 10 kilometers from Anyinam. A number of dirt roads, trails and footpaths offer additional access to this concession.

Historic Work

Historical exploration and mining have mainly focused on placer gold. Before the acquisition of our interest in the Muoso concession, to the best of our knowledge and based on mining records in Ghana, there had never been a detailed documented bedrock exploration program conducted on this concession.

Prior Exploration by Xtra-Gold

No significant lode gold exploration work was conducted by our company on our Muoso project from 2014 through to the end of our fiscal year. Exploration activities on our Muoso project during the 2023 year was limited to geological / geophysical compilation to identify and/or further define grassroots targets; and the continuation of placer gold recovery operations at this project.

Future Exploration Plans for 2024

As at the date of this annual report, during 2024, we have planned the following exploration activities at this project:

● ongoing geological compilation, prospecting, soil geochemical sampling, hand augering and/or scout pitting, and trenching to identify and/or further advance grassroots targets; and

● the continuation of placer gold recovery operations at these projects (commenced in 2015 to present).

Resources and Reserves

No mineral resources or mineral reserves have been identified on our Muoso project.

Muoso Mining Lease

The Muoso mining lease is dated January 6, 2011 and is owned and controlled by our company, as to a 90% interest; and is registered to XG Mining, while the remaining 10% free carried interest is held by the Government of Ghana. The Muoso mining lease covers an area of 55.28 square kilometers and has a 13 year term expiring on January 5, 2024. We have been granted surface and mining rights by the Government of Ghana to work, develop and produce gold in the Muoso lease area (including processing, storing and transportation of ore and materials). See "Kibi Project - Apapam Mining Lease" for identical terms for the Muoso mining lease, except for the name of the mining lease, the lease registration particulars, the lease area and annual ground rents payable in the amount of approximately $20,237.88 (GH¢202,378.80).

The Muoso mining lease further provides that XG Mining shall report forthwith to the government authorities if we discover any other minerals in the Muoso lease area, and will provide XG Mining with the first option to prospect further and to work the said minerals subject to satisfactory arrangements made between XG Mining and the government authorities.

Item 4A Unresolved Staff Comments

Not applicable.

Item 5 Operating and Financial Review and Prospects

A. Operating Results -

Our company reported a net loss after tax for the year ended December 31, 2023 of $165,928 (December 31, 2022 - income of $631,767, December 31, 2021 - income of $835,976). Our company's basic and diluted loss per share for the year ended December 31, 2023 was $0.00 (December 31, 2022 - income of $0.01, December 31, 2021 - income of $0.02). All years benefited from gold recovery results and from other income, being dividends and interest. The impairment charge against private investments in the 2023 year was a significant component of the loss. Another significant change is the tax expense as the company has used its tax shelter position in Ghana.

The weighted average number of shares outstanding was 46,361,078 (December 31, 2022 - 46,542,900, December 31, 2021 - 46,779,574). Average shares outstanding were reduced in 2023 and 2022 through share repurchases. Average shares were increased in 2021 via the exercise of stock options, and reduced from share repurchases. Average fully diluted shares in 2023 were 46,361,078 (2022 - 48,822,024, 2021 - 48,925,574), with the difference being in the money stock options and warrants. These items did not materially affect earnings per share.

We incurred expenses of $1,424,430 in the year ended December 31, 2023 (December 31, 2022 - $1,705,057, December 31, 2021 - $2,161,514). Exploration expense decreased slightly in 2023 as fewer drilling supplies were purchased as compared to 2022. Exploration expense decreased significantly in 2022 as fewer drilling supplies were purchased as compared to 2021. Exploration expense increased significantly in 2021 as more consultants were engaged to assist with the hard rock program, work on the NI 43-101 technical report, and more drilling was undertaken. We expense all exploration costs. Depreciation in 2023 was slightly lower than the 2022 depreciation level due to minimal asset additions in 2023. Depreciation in 2022 increased slightly as the addition of a pickup truck and a drill mostly offset the reduced depreciation on the remaining fixed asset base. Depreciation increased in 2021 with the addition of three pickup trucks. General and administrative expense in 2023 of $442,552 decreased from the 2022 expense of $535,147 and increased from $377,345 in 2021. Most of the difference in general and administrative expense was created by stock-based compensation. Non-cash stock-based compensation expense was $23,750 in 2023, $237,078 in 2022, and $2,504 in 2021. The Company granted 62,500 stock options in 2023. The Company granted 450,000 stock options in 2022 and extended the terms of the other remaining options. The company did not grant stock options in 2021.

Exploration activities for the 2023 year continued to focus on the Company's flagship Kibi Gold Project (Apapam Mining Lease) with the continuation of the drilling program targeting mineralization expansion opportunities along the Zone 3 gold mineralization trend. Sixty-one (61) diamond core boreholes totalling 14,115 metres ("m") were completed by the Company's in-house drilling crews in 2023, including 49 holes (12,202 m) dedicated to the further expansion / definition of the Boomerang gold system (formerly Boomerang East & Boomerang West targets) and 12 scout drill holes (2,113 m) targeting prospective litho-structural settings generated by the recently completed 3D VTEM / TMI inversion-modelling.

We did not conduct any field exploration activities on our Kwabeng, Pameng, Banso and Muoso projects during the 2023 year.

The present Boomerang gold system expansion / definition drilling work forms part of an exploration initiative focussing on multiple mineralization expansion targets occupying the south-western (Zone 3) portion of the mineralization-hosting 1st-order F2 synclinorium fold structure; over 1 km beyond the limits of the previously defined Zone 2 - Zone 3 gold mineralization footprint area. . Drill results for a total of 132 holes (26,968.5 m) have been reported to date for the ongoing Zone 3 gold target expansion drill program initiated in late July 2021.

Current 3D litho-structural modelling indicates that the Zone 2 - Zone 3 gold mineralization footprint area occupies a licence-scale, 1st-order F2 synclinorium fold structure. Deposits are characterized by tensional arrays of auriferous quartz-carbonate veins typically hosted within or spatially associated with F1 or F2 folded / strained diorite units, and/or metasedimentary rock - diorite contacts, with the diorite bodies having an interpreted Belt-type granitoid affinity. Over 20 significant gold occurrences hosted by Belt (Dixcove)- and Basin (Cape Coast)-type granitoids are known in Ghana, with a number constituting significant deposits. These deposits represent a relatively new style of gold mineralization for orogenic gold deposits within the West African Birimian terrain. Belt-type intrusion-hosted gold deposits include Newmont Mining's Subika deposit at their Ahafo mine and Asante Gold's Chirano deposit (formerly Kinross Mining) within the Sefwi gold belt, as well as the former Golden Star Resources' Hwini-Butre deposit at the southern extremity of the Ashanti gold belt.

The assay results for 39 boreholes (10,250 m) completed from January to November 2023, including 27 holes (6,142 m) dedicated to the further expansion / definition of the Boomerang gold system and 12 scout holes (4,108 m) targeting prospective Zone 3 litho-structural settings, were reported by the Company on September 8 and December 20, 2023, including the following highlights:

Expansion Drilling (Boomerang SW Strike-Extension)

- 9.0 m at 5.27 grams per tonne gold ("g/t Au"), including 4.5 m at 8.98 g/t Au, from 65.5 m; and 15.4 m at 1.59 g/t Au, including 7.5 m at 2.01 g/t Au, from 120.0 m in KBDD23524

- 22.0 m at 1.17 g/t Au, including 15.7 m at 1.50 g/t Au, from 194.0 m in KBDD23522

- 4.5 m at 12.72 g/t Au, including 1.5 m at 33.73 g/t Au, from 145.5 m in KBDD23535

Expansion Drilling (Boomerang - SE Lateral / Down-Dip Extension)

- 55.1 m at 0.75 g/t Au, including 39.3 m at 0.95 g/t Au, and including 19.3 m at 1.45 g/t Au, from 353.9 m in KBDD23538

- 20.0 m at 0.84 g/t Au from 134.0 m; and 28.0 m at 0.47 g/t Au from 163.0 m in KBDD23534

- 9.0 m at 1.00 g/t Au from 40.0 m; and 33.0 m at 0.50 g/t Au from 184.0 m; and 29.0 m at 0.35 g/t Au from 304.0 m; and 6.0 m at 1.67 g/t Au from 357.0 m in KBDD22504

- 9.1 m at 0.75 g/t Au from 77.0; and 10.5 m at 0.71 g/t Au from 129.0; and 41.0 m at 0.72 g/t Au from 294.0 in KBDD22505

Definition Drilling (Boomerang - Main "Lower Shoot" Gold Zone)

- 51.0 m at 1.31 g/t Au, including 16.5 m at 3.09 g/t Au, from 127.0 m in KBDD23528

- 53.0 m at 1.06 g/t Au, including 30.0 m at 1.60 g/t Au, from 31.0 m in KBDD23527

- 33.0 m at 1.17 g/t Au, including 19.0 m at 1.76 g/t Au, from 7.0 m in KBDD23519

- 56.0 m at 1.40 g/t Au, including 20.0 m at 2.54 g/t Au, from 166.0 m in KBDD23530

- 50.0 m at 1.28 g/t Au, including 22.0 m at 1.93 g/t Au, from 258.0 m in KBDD23536

New High-Grade Gold Target (Boomerang "Deep")

- 9.0 m at 9.29 g/t Au, including 4.5 m at 16.94 g/t Au, from 400.0 m in KBDD23536 (~90 m stratigraphy below (cross-plunge) of main Lower Shoot)

Current 3D litho-structural modelling appears to indicate that the Boomerang mineralization expansion target, consisting of a multi-shoot gold system extending over approximately 650 m strike and 750 m down-plunge distances respectively, occupies a F2 meso-scale (parasitic) fold hinge structure developed on the north-western limb of the mineralization-controlling 1st-order F2 synclinorium fold. With the mineralization occurring as a NE-plunging system of stacked, flat-lying to concave-shaped, shallow SE-dipping gold shoots hosted within folded / strained diorite bodies and/or associated metasedimentary rock - diorite contacts.

Drilling to date has outlined three (4) principal gold shoots, including the Upper Shoot (s), the Lower Shoot, the Footwall Shoot and the SW Shoot (formerly Boomerang West), across an approximately 370 m cross-plunge distance. The Lower Shoot, presently the most prominent mineralization shoot of the Boomerang gold system, has so far been delineated from practically surface to a down-plunge depth of approximately 500 m along the fold hinge structure (approximately 345 m vertical depth from surface), and across an approximately 200 m NW-SE lateral distance.

Additional exploration activities on the Kibi Gold Project for the 2023 year included commencement of ground-proofing work on high-priority exploration targets generated by the recently completed 3D VTEM / TMI inversion models-based litho-structural modelling work. With a total of 542 infill soil geochemical samples and 179 prospecting (grab) samples collected on the newly identified Central Fold target centred approximately 1.5 km southeast of the Zone 2 - Zone 3 gold mineralization trend. A further 139 prospecting (grab) samples were collected from an extensive auriferous silicified / pyritized siltstone rock float train spatially associated with an interpreted fold-nose structure located approximately 0.5 km southwest of the Boomerang mineralization expansion target. In situ source of auriferous siltstone material yet to be established by trenching / drilling. Final compilation of the soil and prospecting sampling work is currently in progress.

Exploration activities for the 2022 year continued to focus on the Company's flagship Kibi Gold Project (Apapam Mining Lease) with the continuation of the drilling program targeting mineralization expansion opportunities along the Zone 3 gold mineralization trend. Eighty-one (81) diamond core boreholes totalling 15,012 metres ("m") were completed by the Company's in-house drilling crews in 2022, including 62 holes (12,396 m) dedicated to the further delineation of the Boomerang East gold system identified in late 2021. Drilling efforts for the current year also included 16 holes (2,240 m) designed to test structural geology and geophysical targets on the grassroots Cobra Creek (Zone 5) auriferous shear corridor prospect.

We did not conduct any exploration activities on our Kwabeng, Pameng, Banso and Muoso projects during the 2022 year.

The present Boomerang East drilling work forms part of an exploration initiative targeting gold mineralization expansion opportunities along the southwestern (Zone 3) segment of the over three-kilometer-long Zone 2 - Zone 3 anticlinal fold structure; stretching over one kilometer beyond the limits of the present gold system footprint area. Drill results for a total of 90 holes (15,551.5 m) have been reported to date for the ongoing Zone 3 gold target expansion drill program initiated in late July 2021.

Gold mineralization within the Kibi Gold Project area consists predominantly of tensional arrays of auriferous quartz-carbonate veins hosted by folded diorite bodies with an interpreted Belt-type granitoid affinity. The gold-bearing zones occupy the hinges and limbs of predominantly anticlinal fold structures. Over 20 significant gold occurrences hosted by Belt (Dixcove)- and Basin (Cape Coast)-type granitoids are known in Ghana, with a number constituting significant deposits. These deposits represent a relatively new style of gold mineralization for orogenic gold deposits within the West African Birimian terrain. Belt-type intrusion-hosted gold deposits include Newmont Mining's Subika deposit at their Ahafo mine and Asante Gold's Chirano deposit (formerly Kinross Mining) within the Sefwi gold belt, as well as the former Golden Star Resources' Hwini-Butre deposit at the southern extremity of the Ashanti gold belt.

Drilling activities on the Kibi Gold Project for the 2022 year primarily targeted gold mineralization expansion opportunities along the southwestern (Zone 3) segment of the over three-kilometer-long Zone 2 - Zone 3 anticlinal fold structure, including: 62 holes (12,396 m) dedicated to the further delineation of the Boomerang East gold system identified in late 2021; and three scout holes (376 m) to test prospective litho-structural gold settings. The assay results for 50 boreholes (10,135 m) completed from January to mid-November 2022 on the Boomerang East gold system were reported by the Company on February 18, June 23, September 27 and December 21, 2022, including the following highlights:

Boomerang East: Upper Shoot (s)

- 16.5 meters ("m") at 6.23 grams per tonne gold ("g/t Au"), including 6.5 m at 13.74 g/t Au, from 1.5 m in hole KBDD22455

- 11.3 m at 2.41 g/t Au, including 6.0 m at 3.40 g/t Au, from 11.0 m in hole KBDD22464

- 9.1 m at 1.21 g/t Au from 93.9 m in hole KBDD22469; followed by second interval of 16.3 m at 2.06 g/t Au from 141.7 m, including 5.7 m at 3.10 g/t Au

- 13.5 m at 3.20 g/t Au from 37.0 m in hole KBDD22478

Boomerang East: Lower Shoot (main gold zone)

- 77.0 m at 1.59 g/t Au, including 31.0 m at 3.23 g/t Au, from 122.0 m in hole KBDD22481

- 46.0 m at 1.39 g/t Au, including 20.0 m at 2.01 g/t Au, from 127.0 m in hole KBDD22475

- 43.0 m at 1.57 g/t Au, including 13.0 m at 3.21 g/t Au, from 52.0 m in hole KBDD22480

- 50.0 m at 1.35 g/t Au from 180.2 m in hole KBDD22484

- 45.0 m at 1.32 g/t Au, including 21.0 m at 2.03 g/t Au, from 12.0 m in hole KBDD22485

- 33.0 m at 1.76 g/t Au, including 15.0 m at 2.48 g/t Au, from 233.0 m in hole KBDD22463

Footwall Shoot (in footwall of main Lower Shoot gold zone)

- 22.0 m at 2.40 g/t Au, including 7.0 m at 5.35 g/t Au, from 226.0 m in KBDD22497

- 19.0 m at 0.76 g/t Au, including 7.0 m at 1.70 g/t Au, from 313.0 m in KBDD22495

Current 3D litho-structural modelling indicates that the Boomerang East gold system is emplaced within the inner arc of a tight, moderate NE-plunging, isoclinally folded diorite body. The mineralization appears to occur as a system of stacked, flat-lying to concave-shaped, NE-plunging gold shoots occupying the apparent fold hinge of the NE-trending Zone 2 - Zone 3 anticlinal fold structure.

Drilling to date has outlined three (3) principal gold shoots, including the Upper Shoot (s), the Lower Shoot, and the Footwall Shoot, across an approximately 250 m cross-plunge distance. The Lower Shoot, presently the most prominent mineralization shoot of the Boomerang East gold system, has so far been delineated from practically surface to a down-plunge depth of approximately 400 m along the fold hinge structure (approximately 275 m vertical depth from surface), and across an approximately 175 m NW-SE lateral distance. With the recently identified Footwall Shoot, a parallel mineralization zone lying approximately 25 m - 45 m below the main Lower Shoot gold zone (i.e., in the footwall), traced to date along the entire, approximately 400 m plunge-length of the Lower Shoot, and across an approximately 50 m - 150 m lateral distance.

Drilling efforts for the 2022 year also included 16 holes (2,240 m) on the grassroots Cobra Creek (Zone 5) target; an approximately 550 m wide, NE-trending, quartz-feldspar porphyry ("QFP") hosted, multi-structure braided shear zone system traced by trenching / outcrop stripping over an approximately 850 m strike length. Xtra-Gold undertook a 43 borehole (2,639 m) Phase I diamond core drill program on the Cobra Creek gold zone in 2016. Initial drilling efforts yielded exploration significant mineralized intercepts, including highlights of 4.5 m grading 10.9 g/t Au and 5.2 m grading 9.51 g/t Au (see the Company's news release of October 19, 2016).

The 2022 Cobra Creek exploration drilling program included: 8 holes (774 m) designed to better target / dissect flat-lying to shallow dipping gold-bearing extensional veining arrays and/or shallow plunging auriferous shoots; and 8 scout holes (1,466 m) targeting high-priority induced polarization (IP) / resistivity anomalies along the southeastern margin and projected southwestern extension of the QFP body.

Mineralized intercept highlights for the 8 holes targeting the down-plunge extensions of veining arrays and/or shallow plunging shoots, include: 10.4 m grading 2.0 g/t Au, including 10.05 g/t Au over 1.0 m, from 18.0 m in hole #CCDD22044; 16.9 m grading 1.61 g/t Au and 2.0 m grading 4.63 g/t Au from 25.1 m and 57.0 m respectively in #CCDD22047; 8.0 m grading 2.05 g/t Au, including 6.5 g/t Au over 1.0 m, from 10.0 m in #CCDD22048; and 4.0 m grading 4.44 g/t Au from 24.0 m in #CCDD22054. None of the 8 scout holes targeting geophysical targets returned any significant auriferous intercepts.

In late March, also in relation to our Kibi Gold Project, Xtra-Gold engaged TechnoImaging LLC ("TechnoImaging") of Salt Lake City, Utah, USA to undertake 3D geophysical modelling of an approximately 70 km2 subset area (585 line-km) of the Company's regional helicopter-borne VTEM - Mag survey, completed by Geotech Airborne Limited in 2011, to help identify prospective litho-structural gold setting targets. The geophysical modelling work included 3D joint inversion for conductivity and chargeability of the VTEM survey data, as well as 3D inversion of the Total Magnetic Intensity (TMI) to magnetic susceptibility and magnetization vector models. The Company received the final product of the TechnoImaging geophysical modelling work in mid-July and study result compilation is currently ongoing.

In mid-November, Xtra-Gold commissioned Tect Geological Consulting of West Somerset, South Africa ("Tect") to conduct an updated structural analysis of the Zone 2 - Zone 3 mineralization system footprint area of the Kibi Gold Project. The detailed 3D litho-structural modelling work, encompassing an additional 90 drill holes (15,551.5 m) completed since the previous 2021 geological modelling, in combination with the 3D VTEM / TMI inversion models produced by TechnoImaging, was undertaken to further define the structural controls of the gold mineralization and to generate high-priority exploration targets to help guide ongoing gold system expansion drilling efforts. The Company received the final product of the updated structural study from Tect in mid-February 2023, and study result compilation is currently ongoing.