XTRA-GOLD RESOURCES CORP.

(An Exploration Stage Company)

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS' EQUITY

(Expressed in U.S. Dollars)

===================================================================================================================

Deficit

Common Stock Accumulated

----------------------- Additional During the

Number Paid-in exploration

of Shares Amount Capital Deficit Stage Total

- -------------------------------------------------------------------------------------------------------------------

BALANCE, DECEMBER 31, 2002 ....... 12,364,085 $ 12,364 $ 1,412,842 $(1,427,764) $ - $ (2,558)

Paid on behalf of the Company .... - - 5,258 - - 5,258

October 31, 2003, issuance

of stock for acquisition of

subsidiary ....................... 50,350,000 50,350 (50,350) - - -

Loss for the year ................ - - - - (2,700) (2,700)

----------- --------- ----------- ----------- ----------- -----------

BALANCE, DECEMBER 31, 2003 ....... 62,714,085 62,714 1,367,750 (1,427,764) (2,700) -

March, 2004 - private

placement at $0.35 per share ..... 2,000,000 2,000 698,000 - - 700,000

May, 2004 - private

placement at $0.35 per share ..... 2,129,400 2,129 743,161 - - 745,290

December, 2004 - acquisition

of subsidiary via issuance

of common stock .................. 2,698,350 2,699 1,616,311 - - 1,619,010

Share issuance costs ............. - - (76,298) - - (76,298)

Loss for the year ................ - - - - (398,533) (398,533)

----------- --------- ----------- ----------- ----------- -----------

BALANCE, DECEMBER 31, 2004 ....... 69,541,835 69,542 4,348,924 (1,427,764) (401,233) 2,589,469

May, 2005 - cancellation of

shares ........................... (47,000,000) (47,000) 47,000 - - -

June 2005 - for services ......... 10,000 10 5,490 - - 5,500

June, 2005 - private

placement at $0.55 per share ..... 536,218 536 294,384 - - 294,920

August, 2005 - private

placement at $0.55 per share ..... 300,000 300 164,700 - - 165,000

- continued -

The accompanying notes are an integral part of these consolidated financial statements.

F-7

XTRA-GOLD RESOURCES CORP.

(An Exploration Stage Company)

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS' EQUITY

(Expressed in U.S. Dollars)

===================================================================================================================

Deficit

Common Stock Accumulated

----------------------- Additional During the

Number Paid-in exploration

of Shares Amount Capital Deficit Stage Total

- -------------------------------------------------------------------------------------------------------------------

continued ...

November, 2005 - private

placement at $0.55 per share ..... 1,549,354 1,550 850,595 - - 852,145

Share issuance costs ............. - - (130,714) - - (130,714)

Stock-based compensation ......... - - 41,022 - - 41,022

Loss for the year ................ - - - - (272,572) (272,572)

----------- --------- ----------- ----------- ----------- -----------

BALANCE, DECEMBER 31, 2005 ....... 24,937,407 24,938 5,621,401 (1,427,764) (673,805) 3,544,770

February, 2006 - conversion of

promissory note at $0.55 per

share ............................ 90,909 91 49,909 - - 50,000

March, 2006 - exercise of

warrants at $0.75 per share ...... 108,500 108 81,267 - - 81,375

March, 2006 - private placement

at $0.70 per share ............... 792,029 792 553,628 - - 554,420

April, 2006 - exercise of

warrants at $0.75 per share ...... 177,200 177 132,723 - - 132,900

June, 2006 - cancellation of

shares ........................... (10,000) (10) (6,990) - - (7,000)

June, 2006 - private placement

at $0.90 per share ............... 578,112 578 519,722 - - 520,300

July, 2006 - private placement

at $0.90 per share ............... 1,132,000 1,132 1,017,668 - - 1,018,800

October, 2006 - private

placement at $1.10 per share ..... 282,000 282 309,918 - - 310,200

Share issuance costs ............. - - (240,616) - - (240,616)

Stock-based compensation ......... - - 206,041 - - 206,041

Loss for the year ................ - - - - (2,562,992) (2,562,992)

----------- --------- ----------- ----------- ----------- -----------

BALANCE, DECEMBER 31, 2006 ....... 28,088,157 28,088 8,244,671 (1,427,764) (3,236,797) 3,608,198

===================================================================================================================

- continued -

The accompanying notes are an integral part of these consolidated financial statements.

F-8

XTRA-GOLD RESOURCES CORP.

(An Exploration Stage Company)

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS' EQUITY

(Expressed in U.S. Dollars)

===================================================================================================================

Deficit

Common Stock Accumulated

----------------------- Additional During the

Number Paid-in exploration

of Shares Amount Capital Deficit Stage Total

- -------------------------------------------------------------------------------------------------------------------

continued ...

October, 2007 - Private

placement at $1.35 per unit ...... 668,202 668 901,405 - - 902,073

Share issuance costs ............. - - (89,533) - - (89,533)

Stock-based compensation ......... - - 195,623 - - 195,623

Loss for the year ................ - - - - (1,874,757) (1,874,757)

----------- --------- ----------- ----------- ----------- -----------

BALANCE, DECEMBER 31, 2007 ....... 28,756,359 $ 28,756 $ 9,252,166 $(1,427,764) $(5,111,554) $ 2,741,604

===================================================================================================================

The accompanying notes are an integral part of these consolidated financial statements.

F-9

XTRA-GOLD RESOURCES CORP.

(An Exploration Stage Company)

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Expressed in U.S. Dollars)

DECEMBER 31, 2007

================================================================================

1. HISTORY AND ORGANIZATION OF THE COMPANY

Silverwing Systems Corporation (the "Company"), a Nevada corporation,

was incorporated on September 1, 1998. On June 23, 1999, the Company

completed the acquisition of Advertain On-Line Canada Inc. ("Advertain

Canada"), a Canadian company operating in Vancouver, British Columbia,

Canada. The Company changed its name to Advertain On-Line Inc.

("Advertain") on August 19, 1999. Advertain Canada's business was the

operation of a web site, "Advertain.com", whose primary purpose was to

distribute entertainment advertising on the Internet.

In May 2001, the Company, being unable to continue its funding of

Advertain Canada's operations, decided to abandon its interest in

Advertain Canada. On June 15, 2001, the Company sold its investment in

Advertain Canada back to Advertain Canada's original shareholder. On

June 18, 2001, the Company changed its name from Advertain to

RetinaPharma International, Inc. ("RetinaPharma") and became inactive.

In 2003, the Company became a resource exploration company. On October

31, 2003, the Company acquired 100% of the issued and outstanding

common stock of Xtra-Gold Resources, Inc.("XGRI"). XGRI was

incorporated in Florida on October 24, 2003. On December 19, 2003, the

Company changed its name from RetinaPharma to Xtra-Gold Resources Corp.

In 2004, the Company acquired 100% of the issued and outstanding

capital stock of Canadiana Gold Resources Limited ("Canadiana") and 90%

of the issued and outstanding capital stock of Goldenrae Mining Company

Limited ("Goldenrae") (Note 5). Both companies are incorporated in

Ghana and the remaining 10% of the issued and outstanding capital stock

of Goldenrae is held by the Government of Ghana.

On October 20, 2005, XGRI changed its name to Xtra Energy Corp. ("Xtra

Energy").

On October 20, 2005, the Company incorporated Xtra Oil & Gas Ltd.

("XOG") in Alberta, Canada.

On December 21, 2005, Canadiana changed its name to Xtra-Gold

Exploration Limited ("XG Exploration").

On January 13, 2006, Goldenrae changed its name to Xtra-Gold Mining

Limited ("XG Mining").

On March 2, 2006, the Company incorporated Xtra Oil & Gas (Ghana)

Limited ("XOGG") in Ghana.

2. GOING CONCERN

The Company is in the exploration stage with respect to its resource

properties, incurred a loss of $1,874,757 for the year ended December

31, 2007 and has accumulated a deficit during the exploration stage of

$5,111,554. This raises substantial doubt about its ability to continue

as a going concern. The ability of the Company to continue as a going

concern is dependent on the Company's ability to raise additional

capital and implement its business plan. The financial statements do

not include any adjustments that might be necessary if the Company is

unable to continue as a going concern.

Management of the Company ("Management") is of the opinion that

sufficient financing will be obtained from external financing and

further share issuances to meet the Company's obligations. At December

31, 2007, the Company has working capital of $1,761,284.

F-10

XTRA-GOLD RESOURCES CORP.

(An Exploration Stage Company)

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Expressed in U.S. Dollars)

DECEMBER 31, 2007

================================================================================

3. SIGNIFICANT ACCOUNTING POLICIES

GENERALLY ACCEPTED ACCOUNTING PRINCIPLES

These consolidated financial statements have been prepared in

conformity with generally accepted accounting principles of the United

States of America ("US GAAP").

PRINCIPLES OF CONSOLIDATION

These consolidated financial statements include the accounts of the

Company, its wholly owned subsidiaries, Xtra Energy (from October 31,

2003), XG Exploration (from February 16, 2004), XOG (from October 20,

2005) and XOGG (from March 2, 2006) and its 90% owned subsidiary, XG

Mining (from December 22, 2004). All significant intercompany accounts

and transactions have been eliminated on consolidation.

USE OF ESTIMATES

The preparation of consolidated financial statements in conformity with

US GAAP requires Management to make estimates and assumptions that

affect the reported amounts of assets and liabilities and disclosure of

contingent assets and liabilities at the date of the financial

statements and the reported amounts of revenues and expenses during the

reporting period. Actual results could differ from those estimates.

CASH AND CASH EQUIVALENTS

The Company considers highly liquid investments with original

maturities of three months or less to be cash equivalents. At December

31, 2007 and 2006, cash and cash equivalents consisted of cash held at

financial institutions.

RECEIVABLES

No allowance for doubtful accounts has been provided. Management has

evaluated all receivables and believes they are all collectible.

RECOVERY OF GOLD

All gold recoveries from the Company's Ghana mine must be sold directly

to the Reserve Bank of Ghana. Recoveries and other income are

recognized when title and the risks and rewards of ownership to

delivered bullion and commodities pass to the buyer and collection is

reasonably assured.

TRADING SECURITIES

The Company's trading securities are reported at fair value, with

unrealized gains and losses included in earnings.

F-11

XTRA-GOLD RESOURCES CORP.

(An Exploration Stage Company)

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Expressed in U.S. Dollars)

DECEMBER 31, 2007

================================================================================

3. SIGNIFICANT ACCOUNTING POLICIES (cont'd...)

EQUIPMENT

Equipment is recorded at cost and is being amortized over its estimated

useful lives using the declining balance method at the following annual

rates:

Furniture and equipment 20%

Computer equipment 30%

Vehicles 30%

Mining equipment 20%

DEFERRED FINANCING COSTS

Deferred financing costs consist of expenses incurred to obtain funds

pursuant to the issuance of the convertible debentures and are being

amortized straight-line over the term of the debentures.

MINERAL PROPERTIES AND EXPLORATION AND DEVELOPMENT COSTS

The costs of acquiring mineral rights are capitalized at the date of

acquisition. After acquisition, various factors can affect the

recoverability of the capitalized costs. If, after review, management

concludes that the carrying amount of a mineral property is impaired,

it will be written down to estimated fair value. Exploration costs

incurred on mineral properties are expensed as incurred. Development

costs incurred on proven and probable reserves will be capitalized.

Upon commencement of production, capitalized costs will be amortized

using the unit-of-production method over the estimated life of the ore

body based on proven and probable reserves (which exclude

non-recoverable reserves and anticipated processing losses).

LONG-LIVED ASSETS

The Company accounts for long-lived assets under Statements of

Financial Accounting Standards Nos. 142 and 144 "Accounting for

Goodwill and Other Intangible Assets" and "Accounting for Impairment or

Disposal of Long-Lived Assets" ("SFAS 142 and 144"). In accordance with

SFAS 142 and 144, long-lived assets held and used by the Company are

reviewed for impairment whenever events or changes in circumstances

indicate that the carrying amount of an asset may not be recoverable.

For purposes of evaluating the recoverability of long-lived assets, the

recoverability test is performed using undiscounted net cash flows

related to the long-lived assets.

ASSET RETIREMENT OBLIGATIONS

The Company records the fair value of an asset retirement obligation as

a liability in the period in which it incurs a legal obligation

associated with the retirement of tangible long-lived assets that

result from the acquisition, construction, development, and/or normal

use of the long-lived assets. The Company also records a corresponding

asset which is amortized over the life of the asset. Subsequent to the

initial measurement of the asset retirement obligation, the obligation

is adjusted at the end of each period to reflect the passage of time

(accretion expense) and changes in the estimated future cash flows

underlying the obligation (asset retirement cost).

F-12

XTRA-GOLD RESOURCES CORP.

(An Exploration Stage Company)

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Expressed in U.S. Dollars)

DECEMBER 31, 2007

================================================================================

3. SIGNIFICANT ACCOUNTING POLICIES (cont'd...)

STOCK-BASED COMPENSATION

The Company calculates the fair value of all stock options granted and

records these amounts as compensation expense over the vesting period

of the options using the straight-line method. The Black-Scholes option

pricing model is used to calculate fair value.

INCOME TAXES

The Company accounts for income taxes under Statements of Financial

Accounting Standards No. 109, "Accounting for Income Taxes" ("SFAS

109"). Under SFAS 109, deferred tax assets and liabilities are

recognized for the future tax consequences attributable to differences

between the financial statement carrying amounts of existing assets and

liabilities and their respective tax bases. Deferred tax assets and

liabilities are measured using enacted tax rates expected to apply to

taxable income in the years in which those temporary differences are

expected to be recovered or settled. Under SFAS 109, the effect on

deferred tax assets and liabilities of a change in tax rates is

recognized in income in the period that includes the enactment date.

LOSS PER SHARE

Basic loss per common share is computed using the weighted average

number of common shares outstanding during the year. To calculate

diluted loss per share, the Company uses the treasury stock method and

the if converted method as defined in Financial Accounting Standards

No. 128, "Earnings Per Share." As of December 31, 2007, there were

1,074,511 warrants (2006 - 996,056); 1,480,000 options (2006 -

1,996,000) and convertible debentures exercisable into 900,000 common

shares (2006 - 900,000) outstanding which have not been included in the

weighted average number of common shares outstanding as these were

anti-dilutive.

FOREIGN EXCHANGE

The Company's functional currency is the U.S. dollar. The Company does

not have any significant non-monetary assets and liabilities that are

in a currency other than the U.S. dollar. Any monetary assets and

liabilities that are in a currency other than the U.S. dollar are

translated at the rate prevailing at year end. Revenue and expenses in

a foreign currency are translated at rates that approximate those in

effect at the time of translation. Gains and losses from translation of

foreign currency transactions into U.S. dollars are included in current

results of operations.

FINANCIAL INSTRUMENTS

The Company's financial instruments consist of cash and cash

equivalents, trading securities, receivables, accounts payable and

accrued liabilities and convertible debentures. It is management's

opinion that the Company is not exposed to significant interest,

currency or credit risks arising from its financial instruments. The

fair values of these financial instruments approximate their carrying

values unless otherwise noted. The Company has its cash primarily in

one commercial bank in Toronto, Ontario, Canada.

F-13

XTRA-GOLD RESOURCES CORP.

(An Exploration Stage Company)

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Expressed in U.S. Dollars)

DECEMBER 31, 2007

================================================================================

3. SIGNIFICANT ACCOUNTING POLICIES (cont'd...)

CONCENTRATION OF CREDIT RISK

The financial instrument which potentially subjects the Company to

concentration of credit risk is cash. The Company maintains cash in

bank accounts that, at times, may exceed federally insured limits. As

of December 31, 2007 and 2006, the Company has exceeded the federally

insured limit. The Company has not experienced any losses in such

accounts and believes it is not exposed to any significant risks on its

cash in bank accounts.

RECENT ACCOUNTING PRONOUNCEMENTS

In September 2006, the FASB issued SFAS No. 157, "Fair Value

Measurements". SFAS No. 157 establishes a framework for measuring the

fair value of assets and liabilities. This framework is intended to

provide increased consistency in how fair value determinations are made

under various existing accounting standards which permit, or in some

cases require, estimates of fair market value. SFAS No. 157 is

effective for fiscal years beginning after November 15, 2007, and

interim periods within those fiscal years. Earlier application is

encouraged, provided that the reporting entity has not yet issued

financial statements for that fiscal year, including any financial

statements for an interim period within that fiscal year. The Company

is currently assessing the impact of SFAS No. 157 on its financial

position and results of operations, but does not anticipate a material

impact.

In February, 2007, the FASB issued SFAS No. 159 "The Fair Value Option

for Financial Assets and Financial Liabilities". SFAS No. 159 permits

entities to choose to measure many financial assets and financial

liabilities at fair value. Unrealized gains and losses on items for

which the fair value option has been elected are reported in earnings.

SFAS No. 159 is effective for fiscal years beginning after November 15,

2007. The Company is currently assessing the impact of SFAS No. 159 on

its financial position and results of operations, but does not

anticipate a material impact.

4. INVESTMENTS IN TRADING SECURITIES

At December 31, 2007, the Company held investments classified as

trading securities, which consisted of various equity securities. All

trading securities are carried at fair value. As of December 31, 2007,

the fair value of trading securities was $2,167,741 (2006 -

$2,650,685).

5. EQUIPMENT

===========================================================================================

December 31, 2007 December 31, 2006

------------------------------------------------------------------

Accumulated Net Book Accumulated Net Book

Cost Amortization Value Cost Amortization Value

------------------------------------------------------------------

Furniture and equipment $ 4,058 $ 1,623 $ 2,435 $ 568 $ 170 $ 398

Computer equipment .... 22,790 6,753 16,037 10,568 3,467 7,101

Mining equipment ...... 208,699 18,590 190,109 45,489 2,494 42,995

Vehicles .............. 76,564 25,121 51,443 49,472 9,894 39,578

-------- -------- -------- -------- -------- --------

$312,111 $ 52,087 $260,024 $106,097 $ 16,025 $ 90,072

===========================================================================================

F-14

XTRA-GOLD RESOURCES CORP.

(An Exploration Stage Company)

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Expressed in U.S. Dollars)

DECEMBER 31, 2007

================================================================================

6. DEFERRED FINANCING COSTS

=======================================================================

December 31, 2007 December 31, 2006

---------------------------------------

Balance, beginning of year $32,342 $41,582

Costs incurred ............. - -

Amortization ............... 9,241 9,240

------- -------

Balance, end of year ....... $23,101 $32,342

=======================================================================

During the year ended December 31, 2005, the Company paid a finder's

fee of $45,000 and other expenses of $1,202 relating to a convertible

debenture financing (Note 9).

7. OIL AND GAS PROPERTY

During the year ended December 31, 2005, the Company entered into a

participation agreement for a 5% participating interest in certain oil

and gas leases in Saskatchewan, Canada ("Saskatchewan Project"). To

earn its interest, the Company was required to pay Ranger Canyon Energy

Inc. $13,925 and to pay its proportionate share of seismic and drilling

expenditures incurred. The Company's share of a drilling program

undertaken in 2005 was $32,613 and for 2006 it was $163,599. During the

year ended December 31, 2006, the Company sold its interest to an

unrelated oil and gas company for $309,287.

8. MINERAL PROPERTIES

=======================================================================

December 31, 2007 December 31, 2006

---------------------------------------

Acquisition costs .......... $1,607,729 $1,607,729

Asset retirement obligation

(Note 10) ................ 17,865 39,865

---------- ----------

Total ...................... $1,625,594 $1,647,594

=======================================================================

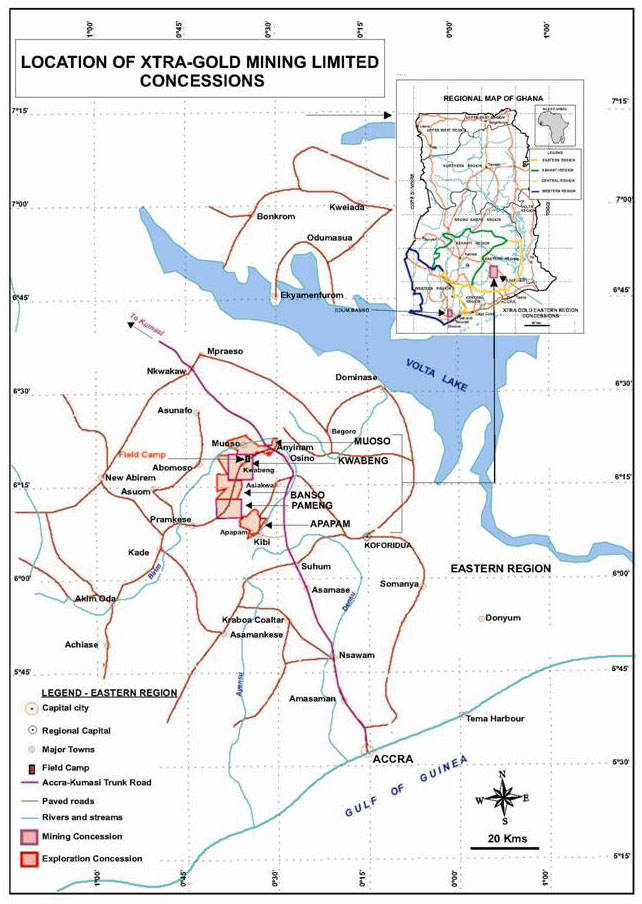

KWABENG AND PAMENG PROJECTS

The Company holds two mining leases in Ghana. These mining leases grant

the Company surface and mining rights to produce gold in the leased

areas until July 26, 2019. All gold production will be subject to a 3%

production royalty of the net smelter returns ("NSR").

APAPAM, BANSO AND MUOSO PROJECTS

The Company holds prospecting licences on its Apapam, Banso and Muoso

Projects in Ghana. These licences grant the Company the right to

conduct exploratory work to determine whether there are mineable

reserves of gold or diamonds in the licenced areas, are for two years

and are renewable. If mineable reserves of gold or diamonds are

discovered, the Company will have the first option to acquire a mining

lease.

F-15

XTRA-GOLD RESOURCES CORP.

(An Exploration Stage Company)

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Expressed in U.S. Dollars)

DECEMBER 31, 2007

================================================================================

8. MINERAL PROPERTIES (cont'd...)

OPTION AGREEMENT ON EDUM BANSO PROJECT

In October, 2005, XG Exploration entered into an option agreement (the

"Option Agreement") with Adom Mining Limited ("Adom") to acquire 100%

of Adom's right, title and interest in and to a prospecting licence on

the Edum Banso concession (the "Edum Banso Project") located in Ghana.

Adom further granted XG Exploration the right to explore, develop, mine

and sell mineral products from this concession. The Option Agreement

has a five year term.

The consideration paid was $15,000 with additional payments of $5,000

to be paid on the anniversary date of the Option Agreement in each year

during the term. Upon the commencement of gold production, an

additional $200,000 is to be paid, unless proven and probable reserves

are less than 2,000,000 ounces, in which case the payment shall be

reduced to $100,000. Upon successful transfer of title from Adom to XG

Exploration, a production royalty (the "Royalty") of 2% of the net

smelter returns shall be paid to Adom; provided, however that in the

event that less than 2,000,000 ounces of proven and probable reserves

are discovered, then the Royalty shall be 1%. The Royalty can be

purchased by XG Exploration for $2,000,000; which will be reduced to

$1,000,000 if proven and probable reserves are less than 2,000,000

ounces.

MINING LEASE AND PROSPECTING LICENCE COMMITMENTS

The Company is committed to expend, from time to time to the Minerals

Commission for an extension of an expiry date of a prospecting licence

(currently $15,000 for each occurrence) or a mining lease and the

Environmental Protection Agency ("EPA") (of Ghana) for processing and

certificate fees with respect to EPA permits, an aggregate of less than

$500 in connection with annual or ground rent and mining permits to

enter upon and gain access to the areas covered by the Company's mining

leases and prospecting licences.

9. CONVERTIBLE DEBENTURES

During the year ended December 31, 2005, the Company completed a

convertible debenture financing for gross proceeds of $900,000. The

debentures bear interest at 7% per annum, payable quarterly, and the

principal balance is repayable by June 30, 2010. Debenture holders have

the option to convert any portion of the outstanding principal into

common shares at the conversion rate of $1 per share.

10. ASSET RETIREMENT OBLIGATION

=======================================================================

December 31, 2007 December 31, 2006

---------------------------------------

Balance, beginning of year . $ 48,237 $ 43,833

Change in obligation ....... (22,000) -

Accretion expense .......... 2,162 4,404

-------- --------

Balance, end of year ....... $ 28,399 $ 48,237

=======================================================================

The Company has a legal obligation associated with its mineral

properties for clean up costs when work programs are completed.

F-16

XTRA-GOLD RESOURCES CORP.

(An Exploration Stage Company)

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Expressed in U.S. Dollars)

DECEMBER 31, 2007

================================================================================

10. ASSET RETIREMENT OBLIGATION (cont'd...)

The undiscounted amount of cash flows, required over the estimated

reserve life of the underlying assets, to settle the obligation,

adjusted for inflation, is estimated at $109,261 (2006 - $53,060). The

obligation was calculated using a credit-adjusted risk free discount

rate of 10% and an inflation rate of 2%. The life of the mine was

extended from 2007 to 2023 during fiscal 2007. It is expected that this

obligation will be funded from general Company resources at the time

the costs are incurred.

11. CAPITAL STOCK

CANCELLATION OF SHARES

In May 2005, 47,000,000 common shares owned by two directors were

returned to treasury and cancelled.

In June 2006, 10,000 common shares were returned to the Company in

settlement of a dispute and cancelled.

PRIVATE PLACEMENTS

In October 2007, the Company issued 668,202 units at $1.35 per unit for

gross proceeds of $902,073. Each unit consisted of one common share and

one half of one share purchase warrant. One whole warrant enables the

holder to acquire an additional common share at a price of $1.75 for

one year. The Company also issued finders warrants enabling the holder

to acquire up to 33,410 common shares at the same terms as the unit

warrants.

In October 2006, the Company issued 282,000 common shares at $1.10 per

share for gross proceeds of $310,200. For each two shares subscribed

for, the purchaser received one share purchase warrant which enables

the holder to acquire an additional common share at a price of $1.50 to

April 23, 2008.

In July 2006, the Company issued 1,132,000 common shares at $0.90 per

share for gross proceeds of $1,018,800. For each two shares subscribed

for, the purchaser received one share purchase warrant which enables

the holder to acquire an additional common share at a price of $1.50 to

July 31, 2007 which expiry date was extended to December 13, 2007

(expired).

In June 2006, the Company issued 578,112 common shares at $0.90 per

share for gross proceeds of $520,300. For each two shares subscribed

for, the purchaser received one share purchase warrant which enables

the holder to acquire an additional common share at a price of $1.50 to

June 16, 2007 (expired).

In March 2006, the Company issued 792,029 common shares at $0.70 per

share for gross proceeds of $554,420.

In November 2005, the Company issued 1,549,354 common shares at $0.55

per share for gross proceeds of $852,145.

In August 2005, the Company issued 300,000 common shares at $0.55 per

share for gross proceeds of $165,000. For each two shares subscribed

for, the purchaser received one share purchase warrant which enables

the holder to acquire an additional common share at a price of $0.75 to

August 31, 2006.

F-17

XTRA-GOLD RESOURCES CORP.

(An Exploration Stage Company)

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Expressed in U.S. Dollars)

DECEMBER 31, 2007

================================================================================

11. CAPITAL STOCK (cont'd...)

In June 2005, the Company issued 536,218 common shares at $0.55 per

share for gross proceeds of $294,920. For each two shares subscribed

for, the purchaser received one share purchase warrant which enables

the holder to acquire an additional common share at a price of $0.75 to

April 30, 2006.

ACQUISITION OF SUBSIDIARY

Effective December 22, 2004, the Company acquired 90% of the

outstanding shares of XG Mining in exchange for 2,698,350 shares of

common stock. In connection with this acquisition, 47,000,000 shares

owned by two officers and directors of the Company were returned to

treasury and cancelled.

STOCK OPTIONS

The number of shares reserved for issuance under the Company's equity

compensation option plan is 3,000,000. The terms and conditions of any

options granted, including the number and type of options, the exercise

period, the exercise price and vesting provisions, are determined by

the board of directors.

At December 31, 2007, the following stock options were outstanding:

===================================================================

Number of Options Exercise Price Expiry Date

-------------------------------------------------------------------

108,000 $ 0.70 April 21, 2009

432,000 $ 0.70 May 1, 2009

200,000 $ 0.90 August 1, 2009

270,000 $ 0.75 March 5, 2010

470,000 $ 0.75 March 12, 2010

===================================================================

Stock option transactions and the number of stock options outstanding

are summarized as follows:

=========================================================================================

2007 2006

---------------------------------------------------------

Weighted Weighted

Number Average Number Average

of Options Exercise Price of Options Exercise Price

---------------------------------------------------------

Outstanding, beginning of year 1,996,000 $ 0.72 1,020,000 $ 0.55

Granted ................... 740,000 0.75 1,696,000 0.75

Cancelled/Expired ......... (1,256,000) 0.70 (720,000) 0.55

---------- -------- --------- --------

Outstanding, end of year ..... 1,480,000 $ 0.75 1,996,000 $ 0.72

=========================================================================================

Exercisable, end of year ..... 572,995 $ 0.75 395,720 $ 0.67

=========================================================================================

The aggregate intrinsic value for options vested as of December 31,

2007 is approximately $355,000 (2006 - $110,000) and for total options

outstanding is approximately $917,000 (2006 - $555,000).

F-18

XTRA-GOLD RESOURCES CORP.

(An Exploration Stage Company)

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Expressed in U.S. Dollars)

DECEMBER 31, 2007

================================================================================

11. CAPITAL STOCK (cont'd...)

STOCK-BASED COMPENSATION

The fair value of stock options granted during the year ended December

31, 2007 totalled $189,063 (2006 - $816,990). During the year ended

December 31, 2007, $195,623 (2006 - $206,041) was expensed and included

in general and administrative expenses. The remaining $302,377 (2006 -

$703,659) will be expensed in future periods.

The following assumptions were used for the Black-Scholes valuation of

stock options granted during the years ended December 31, 2007 and

2006:

2007 2006

------- -------

Risk-free interest rate .......... 4.52% 4.94%

Expected life .................... 3 years 3 years

Annualized volatility ............ 55.30% 31.75%

Dividend rate .................... 0% 0%

The weighted average fair value of options granted was $0.26 (2006 -

$0.48).

WARRANTS

At December 31, 2007, the following warrants were outstanding:

=======================================================================

Number of Warrants Exercise Price Expiry Date

-----------------------------------------------------------------------

566,000 $ 1.50 July 13, 2008

141,000 $ 1.50 July 13, 2008

151,250 $ 1.75 October 10, 2008

216,261 $ 1.75 October 30, 2008

=======================================================================

Warrant transactions and the number of warrants outstanding are

summarized as follows:

=======================================================================

December 31, 2007 December 31, 2006

---------------------------------------

Balance, beginning of year ... 996,056 2,482,810

Issued ................... 367,511 996,056

Exercised ................ - (285,700)

Expired .................. (289,056) (2,197,110)

--------- ----------

Balance, end of year ......... 1,074,511 996,056

=======================================================================

F-19

XTRA-GOLD RESOURCES CORP.

(An Exploration Stage Company)

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Expressed in U.S. Dollars)

DECEMBER 31, 2007

================================================================================

12. RELATED PARTY TRANSACTIONS

During the years ended December 31, 2007 and 2006, the Company entered

into the following transactions with related parties:

(a) Paid or accrued consulting fees of $191,512 (2006 - $324,872)

to officers of the Company or companies controlled by such

officers.

(b) Paid or accrued directors' fees of $26,692 (2006 - $nil) to

directors of the Company or companies controlled by directors.

(c) On January 12, 2006, the Board approved the issuance of an

unsecured promissory note ("Note") in the aggregate amount of

$66,302 in connection with an account payable owing to an

officer and director of the Company ("Note Holder") with

respect to unpaid consulting fees, expenses incurred on behalf

of the Company and a bonus. Under the terms of the Note, the

Note Holder had the option to convert any portion owing under

the Note from time to time into shares of the Company at the

conversion price of $0.55 per share. On January 31, 2006, the

Note Holder provided the Company with a notice of conversion

to convert $50,000 of the outstanding Note into shares and was

subsequently issued 90,909 shares on February 9, 2006.

The amounts charged to the Company for the services provided have been

determined by negotiation among the parties. These transactions were in

the normal course of operations and were measured at the exchange

value, which represented the amount of consideration established and

agreed to by the related parties.

13. SUPPLEMENTAL DISCLOSURE WITH RESPECT TO CASH FLOWS

==============================================================================

Cumulative amounts

from the beginning of

the exploration stage

on January 1, 2003 to

December 31, 2007 2007 2006

-------------------------------------------

Cash paid during the period for:

Interest .................... $ 157,500 $ 63,000 $ 63,000

Income taxes ................ $ - $ - $ -

==============================================================================

The significant non-cash transaction during the year ended December 31,

2007 was the issuance of 33,410 finder's warrants in connection to a

private placement (Note 11).

The significant non-cash transaction during the year ended December 31,

2006 was the issuance of 90,909 common shares valued at $50,000 for

conversion of a promissory note (Note 12).

F-20

XTRA-GOLD RESOURCES CORP.

(An Exploration Stage Company)

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Expressed in U.S. Dollars)

DECEMBER 31, 2007

================================================================================

14. DEFERRED INCOME TAXES

Income tax benefits attributable to losses from United States of

America operations was $Nil for the years ended December 31, 2007 and

2006, and differed from the amounts computed by applying the United

States of America federal income tax rate of 34% to pretax losses from

operations as a result of the following:

=======================================================================

2007 2006

--------------------------

Loss for the year ........................ $(1,874,757) $(2,562,992)

=======================================================================

Computed "expected" tax (benefit) expense $ (637,417) $ (871,417)

Non deductible (taxable) items ........... (174,452) 290,082

Lower effective income tax rate on loss of

foreign subsidiaries .................... 90,383 34,816

Valuation allowance ...................... 721,486 546,519

----------- -----------

Net expected tax (benefit) expense ....... $ - $ -

=======================================================================

The tax effects of temporary differences that give rise to significant

deferred tax assets and deferred tax liabilities are presented below:

=======================================================================

2007 2006

--------------------------

Deferred tax assets:

Net operating loss carryforwards - US .. $ 983,035 $ 698,585

Net operating loss carryforwards - Ghana 648,335 226,546

Valuation allowance ...................... (1,631,370) (925,131)

----------- -----------

Total deferred tax assets ................ $ - $ -

=======================================================================

The valuation allowance for deferred tax assets as of December 31, 2007

and 2006 was $1,631,370 and $925,131 respectively. In assessing the

realizability of deferred tax assets, management considers whether it

is more likely than not that some portion or all of the deferred tax

assets will not be realized. The ultimate realization of deferred tax

assets is dependent upon the generation of future taxable income during

the periods in which those temporary differences become deductible.

Management considers the scheduled reversal of deferred tax

liabilities, projected future taxable income, and tax planning

strategies in assessing the realizability of deferred tax assets. In

order to fully realize the deferred tax asset attributable to net

operating loss carryforwards, the Company will need to generate future

taxable income of approximately $5,206,000 prior to the expiration of

the net operating loss carryforwards. Of the $5,206,000 of operating

loss carryforwards, $2,891,000 is attributable to the US, and expires

between 2019 and 2027, and the balance of $2,315,000 is attributable to

Ghana and expires between 2008 and 2011.

F-21

XTRA-GOLD RESOURCES CORP.

(An Exploration Stage Company)

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Expressed in U.S. Dollars)

DECEMBER 31, 2007

================================================================================

15. SEGMENTED INFORMATION

The Company has one reportable segment, being the exploration and

development of resource properties.

Geographic information is as follows:

=======================================================================

2007 2006

--------------------------

Capital assets:

Canada .............................. $ 16,089 $ 4,597

Ghana ............................... 1,869,529 1,733,069

----------- -----------

Total capital assets ..................... $ 1,885,618 $ 1,737,666

=======================================================================

16. CONTINGENCY AND COMMITMENTS

a) During the year ended December 31, 2006, a former consultant

to the Company's Ghanaian subsidiaries brought an action for

damages in the High Court of Ghana, alleging wrongful

termination and claiming $172,000 was owed. The Company

believed the lawsuit was without merit and vigorously defended

against it. No liability has been recorded in connection with

the lawsuit. On February 6, 2008, the High Court of Ghana

rendered its judgement and dismissed the action. The right to

appeal will expire on May 6, 2008.

b) Effective May 1, 2006, the Company entered into a management

consulting agreement with the Vice President, Exploration

whereby the Company will pay $4,672 (Cdn$5,000) per month for

three years. In the event of termination, without cause, 18

months of fees will be payable.

c) Effective November 1, 2006, the Company entered into a

management consulting agreement with the Vice President, Ghana

Operations whereby the Company will pay $1,000 per month for

one year.

d) Effective July 1, 2007, the Company entered into a management

consulting agreement with the Vice President, Finance whereby

the Company will pay $2,818 (Cdn$3,000) per month for one

year.

e) Effective December 1, 2007, the Company entered into a

management consulting agreement with the Secretary and

Treasurer whereby the Company will pay $5,895 (Cdn$6,500) per

month for one year.

17. SUBSEQUENT EVENT

Subsequent to December 31, 2007, the Company issued 1,062,000 units for

total proceeds of $1,593,000 pursuant to a private placement. Each unit

consists of one common share and one share purchase warrant. Each

warrant entitles the holder to acquire an additional common share for

$2.25 for one year from the earlier of the posting of its shares on an

over-the-counter bulletin board service or the listing of its shares on

a recognized stock exchange. The finder was paid a fee of $127,440 and

was issued 84,960 finder's warrants on the same terms as the unit

warrants.

F-22

TABLE OF CONTENTS

Page

----

Prospectus Summary ......................................................... 3

Risk Factors ............................................................... 8

Use of Proceeds ............................................................ 16

Market for Common Stock and Dividend Policy ................................ 16

Determination of Offering Price ............................................ 18

Forward-Looking Statements ................................................. 18

Management's Discussion and Analysis or Plan of Operation .................. 20

Business ................................................................... 29

Management ................................................................. 64

Executive Compensation ..................................................... 70

Certain Relationships and Related Transactions ............................. 79

Principal Stockholders ..................................................... 81

Description of Securities .................................................. 85

Selling Security Holders ................................................... 87

Plan of Distribution ....................................................... 89

Shares Eligible for Future Sale ............................................ 92

Legal Matters .............................................................. 92

Experts .................................................................... 92

Additional Information ..................................................... 92

Financial Statements ....................................................... F-1

2,782,375 SHARES

XTRA-GOLD RESOURCES CORP.

FINAL PROSPECTUS DATED MAY 12, 2008