UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number: 811-21576

Stock Dividend Fund, Inc.

(Exact name of registrant as specified in charter)

10670 N. Central Expressway

Suite 470

Dallas, Texas 75231

(Address of principal executive offices) (Zip code)

Laura S. Adams

10670 N. Central Expressway

Suite 470

Dallas, Texas 75231

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-704-6072

Date of fiscal year end: December 31

Date of Reporting Period: December 31, 2024

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N -CSR in its regulatory, disclosure review, inspection and policymaking roles.

A registrant is required to disclose the information specified by Form N -CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N -CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. % 3507.

Item 1. Reports to Shareholders.

STOCK DIVIDEND FUND, INC.

ANNUAL REPORT

DECEMBER 31, 2024

STOCK DIVIDEND FUND, INC.

Fund Symbol: SDIVX

ADDITIONAL INFORMATION

This annual shareholder report contains important information about the Stock Dividend Fund, Inc. – SDIVX for the period January 1, 2024 to December 31, 2024, as well as certain changes to the Fund. You can find additional information about the Fund at https://www.funddocuments.com. You can also request this information by contacting us at 1-800-704-6072.

EXPENSE INFORMATION

What were the Fund costs for the past year?

(based on a hypothetical $10,000 investment)

| Fund Name | | Costs of a $10,000 Investment | | | Costs as a percentage of a

$10,000 investment* | |

| | | | | | | | | |

| Stock Dividend Fund, Inc. | | $ | 85.00 | | | | 0.85 | % |

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE

For the period December 31, 2023 through December 31, 2024 the total return of the Fund was up 12.53% versus the S&P 500 up 25.02% and the S&P 500 High Dividend ETF which was up 15.32%. The S&P 500 has been meaningfully driven by a handful of large cap technology stocks with high valuation levels and virtually no dividend income, both of which are inconsistent with the strategy of the Fund. Our performance will lag when these Technology stocks significantly outperform. We are confident that money will flow back toward value and income stocks and our portfolio should perform relatively well, especially if interest rates decline.

The turnover of the Fund in 2024 was below average expectations at 3.74% as we did not feel compelled to realize capital gains only to pay tax and then invest in other high dividend paying opportunities. We liked our portfolio in 2024.

The Fund continues to hold what we feel are very high quality companies with stable cash flows and relatively conservative and transparent balance sheets.

The Fund begins 2025 with a meaningfully above market internal portfolio dividend yield and strong cash flows which we would expect to perform well going forward.

Sincerely,

Steven Adams

Portfolio Manager

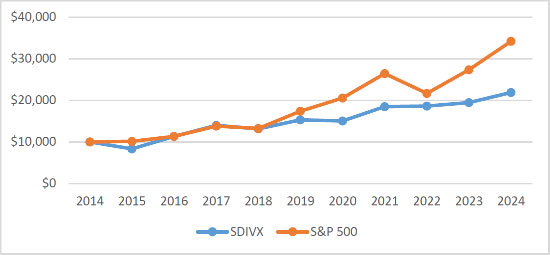

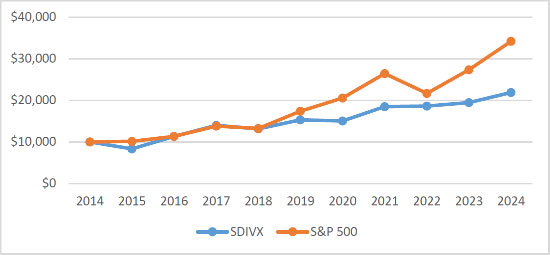

PERFORMANCE GRAPH

AVERAGE ANNUAL RETURNS

| | | 1 YEAR | | | 5 YEARS | | | 10 YEARS | | | ENDING VALUE | |

| Stock Dividend Fund, Inc. | | | 12.53 | % | | | 7.44 | % | | | 8.14 | % | | | 21,909 | |

| S&P 500 Index | | | 25.02 | % | | | 14.51 | % | | | 13.08 | % | | | 34,223 | |

| | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

| SDIVX | $10,000 | $8,322 | $11,349 | $13,967 | $13,161 | $15,296 | $15,065 | $18,496 | $18,620 | $19,469 | $21,909 |

| S&P 500 | $10,000 | $10,138 | $11,347 | $13,821 | $13,214 | $17,374 | $20,570 | $26,469 | $21,675 | $27,374 | $34,223 |

Cumulative Performance Comparison of $10,000 Investment

Past performance is not a good predictor of future performance. The returns shown do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund Shares. Updated performance data current to the most recent month-end can be obtained by calling 1-800-704-6072.

FUND STATISTICS (as of December 31, 2024)

NET ASSETS: $29.75 MILLION

PORTFOLIO HOLDINGS: 20

PORTFOLIO TURNOVER IN 2024: 3.74%

ADVISORY FEES PAID BY FUND IN 2024: $252,542

| ASSET ALLOCATION | |

| | |

| Pharmaceutical Preps | 16.57% |

| National Commercial Banks | 14.22% |

| Cigarettes | 11.31% |

| Petroleum Refining | 10.65% |

| Telephone Communications, Except Radiotelephone | 10.48% |

| Electronic Computers | 5.82% |

| Paper Prods | 4.77% |

| Gold and Silver Ores | 4.62% |

| Compu Comm Equip | 4.22% |

| Canned, Frozen & Preserved Fruit, Veg | 4.19% |

| Biolog Prod | 4.08% |

| Food & Kindred Products | 3.74% |

| Pipe Lines | 3.74% |

| Other Assets, Less Liabilities, Net | 1.59% |

| | 100.00% |

| TOP TEN HOLDINGS* | |

| | |

| 1. | Bristol-Myers Squibb Co |

| 2. | Bank of America | 6.56% |

| 3. | Chevron Corp. | 6.29% |

| 4. | Altria Group Inc | 6.27% |

| 5. | AT&T Inc | 5.94% |

| 6. | Apple Inc | 5.82% |

| 7. | Citigroup Inc | 5.26% |

| 8. | AbbVie Inc. | 5.21% |

| 9. | British American Tobacco Industries | 5.04% |

| 10. | Kimberly-Clark Corp | 4.77% |

| | | 58.26% |

| * | | Portfolio holdings are subject to change and are not recommendations of individual stocks |

HOW HAS THE FUND CHANGED

The Fund decided to change auditors for the 2024 audit year and going forward primarily due to proposed audit cost. This change was ratified by shareholders. There were no other material changes during the year ended December 31, 2024.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Stock Dividend Fund, Inc. Fund documents not be householded, please contact us at 1-800-704-6072. Your instructions will typically be effective within 30 days of receipt by Stock Dividend Fund, Inc.

AVAILABILITY OF ADDITIONAL INFORMATION ABOUT THE FUND

For additional information about the Fund, including its prospectus, financial information, holdings and proxy information, visit https://www.funddocuments.com or request this information by contacting us at 1-800-704-6072.

For a more thorough understanding of our investment process, including a fuller description of our investment criteria and how we apply these criteria to our particular companies, we encourage you to read our shareholder letters contained within previous Annual and Semi-Reports, as well as current shareholder letters, available at https://www.funddocuments.com.

Item 2. Code of ethics

The registrant, as of the end of the period covered by this report, has adopted a code of ethics that applies to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party. The registrant did not grant any waivers or exceptions to the code during the covered period.

A copy of the code of ethics is attached as an Exhibit to this Form N -CSR filing. A copy of the Code of Ethics can be obtained free of charge by calling us at 1-800-704-6072.

Item 3. Audit Committee Financial Expert

The entire Board of Directors, in effect, acts as the audit committee. The Board has two financial experts serving on the Board. Laura Adams and Jennifer Lapeyre are the financial experts. Mrs. Adams is an “interested” Director and Mrs. Lapeyre is an “independent” Director.

Item 4. Principal Accountant Fees and Services

(a) Audit Fees

The aggregate fees paid to the principal accountant for professional services rendered by the principal accountant for the audit of the registrant’s annual financial statements or for services that are normally provided by the principal accountant in connection with statutory and regulatory filings or engagements were $15,500 for the fiscal year ended December 31, 2023, and estimated at $21,525 for the fiscal year ended December 31, 2024. Audit fees include amounts related to the annual audit of the registrant’s financial statements, spot checks for compliance with Rule 17f-2 and services normally provided by the auditor in connection with statutory and regulatory filings.

(b) Audit-Related Fees

There were no fees paid to the principal accountant for assurance and related services rendered by the principal accountant to the registrant that are reasonably related to the performance of the audit of the registrant’s financial statements and are not reported under paragraph (a) of Item 4.

There were no fees paid to the principal accountant for assurance and related services rendered by the principal accountant to the registrant’s investment adviser and any entity controlling, controlled by or under common control with the investment adviser that provides ongoing services to the registrant that are reasonably related to the performance of the audit of their financial statements.

(c) Tax Fees

There were no fees paid to the principal accountant for professional services rendered by the principal accountant to the registrant for tax compliance, tax advice and tax planning.

There were no fees paid to the principal accountant for professional services rendered by the principal accountant to the registrant’s investment adviser and any entity controlling, controlled by or under common control with the investment adviser that provides ongoing services to the registrant for tax compliance, tax advice and tax planning for the fiscal year ended December 31, 2023, and for the fiscal year ended December 31, 2024.

(d) All Other Fees

The aggregate fees paid to the principal accountant for products and services rendered by the principal accountant to the registrant not reported in paragraphs (a)-(c) of Item 4 were $0 for the fiscal year ended December 31, 2023 and for $0 for the fiscal year ended December 31, 2024.

The aggregate fees paid to the principal accountant for products and services rendered by the principal accountant to the registrant’s investment adviser and any entity controlling, controlled by or under common control with the investment adviser that provides ongoing services to the registrant not reported in paragraphs (a)-(c) of Item 4 were $0 for the fiscal year ended December 31, 2023 and $0 for the fiscal year ended December 31, 2024.

(e) (1) The registrant’s audit committee (entire Board) is directly responsible for approving the services to be provided by the auditors, including:

(i) pre-approval of all audit and audit related services;

(ii) pre-approval of all non-audit related services to be provided to the Fund by the auditors;

(iii) pre-approval of all non-audit related services to be provided to the registrant by the auditors to the registrant’s investment adviser or to any

entity that controls, is controlled by or is under common control with the registrant’s investment adviser and that provides ongoing services to the registrant where the non-audit services relate directly to the operations or financial reporting of the registrant; and

(iv) establishment by the audit committee, if deemed necessary or appropriate, as an alternative to committee pre-approval of services to be provided by the auditors, as required by paragraphs (ii) and (iii) above, of policies and procedures to permit such services to be pre-approved by other means, such as through establishment of guidelines or by action of a designated member or members of the committee; provided the policies and procedures are detailed as to the particular service and the committee is informed of each service and such policies and procedures do not include delegation of audit committee responsibilities, as contemplated under the Securities Exchange Act of 1934, to management; subject, in the case of (ii) through (iv), to any waivers, exceptions or exemptions that may be available under applicable law or rules.

(e) (2) There were no services provided to the registrant described in paragraphs (b)-(d) of Item 4 that required approval by the audit committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of regulation S-X.

(f) No disclosures are required by this Item 4(f).

(g) N/A

(h) N/A

(i) N/A

(j) N/A

Item 5. Audit Committee of Listed Registrants. N/A

Item 6. Schedule of Investments.

(a) Please see schedule of investments contained in the Financial Statements and Financial Highlights included under Item 7 of this Form N-CSR.

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

Stock Dividend Fund, Inc.

ANNUAL REPORT

DECEMBER 31, 2024

Stock Dividend Fund, Inc.

1-800-704-6072

Fund Symbol: SDIVX

https://www.funddocuments.com

This report is provided for the general information of Stock Dividend Fund, Inc. shareholders. It is not authorized for distribution unless preceded or accompanied by an effective prospectus, which contains more complete information about the Fund. Please read it carefully before you invest.

SCHEDULE OF INVESTMENTS

DECEMBER 31, 2024

| DESCRIPTION | | SHARES | | | MARKET VALUE | |

| | | | | | | |

| COMMON STOCKS – 98.42% | | | | | | | | |

| | | | | | | | | |

| Pharmaceutical Preps-16.57% | | | | | | | | |

| AbbVie Inc. | | | 8,730 | | | $ | 1,551,321 | |

| Bristol-Myers Squibb Co | | | 37,368 | | | | 2,113,534 | |

| Pfizer Inc. | | | 47,761 | | | | 1,267,099 | |

| | | | | | | | 4,931,954 | |

| | | | | | | | | |

| National Commercial Banks-14.22% | | | | | | | | |

| Bank of America | | | 44,380 | | | | 1,950,501 | |

| Citigroup Inc. | | | 22,232 | | | | 1,564,910 | |

| Wells Fargo | | | 10,166 | | | | 714,060 | |

| | | | | | | | 4,229,471 | |

| | | | | | | | | |

| Cigarettes-11.31% | | | | | | | | |

| British American Tobacco Industries | | | 41,314 | | | | 1,500,524 | |

| Altria Group, Inc. | | | 35,673 | | | | 1,865,341 | |

| | | | | | | | 3,365,865 | |

| | | | | | | | | |

| Petroleum Refining-10.65% | | | | | | | | |

| Chevron Corp. | | | 12,916 | | | | 1,870,753 | |

| Valero Energy Corp | | | 10,569 | | | | 1,295,654 | |

| | | | | | | | 3,166,407 | |

| | | | | | | | |

| Telephone Communications, Except Radiotelephone-10.48% | | | | | | | | |

| AT&T | | | 77,649 | | | | 1,768,068 | |

| Verizon | | | 33,788 | | | | 1,351,182 | |

| | | | | | | | 3,119,250 | |

| | | | | | | | | |

| Electronic Computers-5.82% | | | | | | | | |

| Apple Inc. | | | 6,917 | | | | 1,732,155 | |

| | | | | | | | | |

| Paper Prods-4.77% | | | | | | | | |

| Kimberly-Clark Corp | | | 10,833 | | | | 1,419,556 | |

| | | | | | | | | |

| Gold and Silver Ores-4.62% | | | | | | | | |

| Newmont Corp. | | | 36,957 | | | | 1,375,540 | |

| | | | | | | | | |

| Computer Communications Equipment-4.22% | | | | | | | | |

| Cisco Systems Inc. | | | 21,206 | | | | 1,255,395 | |

SCHEDULE OF INVESTMENTS, continued

DECEMBER 31, 2024

| DESCRIPTION | | SHARES | | | MARKET VALUE | |

| | | | | | | |

| Canned, Frozen & Preserved Fruit, Veg-4.19% | | | | | | | | |

| The Kraft Heinz Company | | | 40,557 | | | | 1,245,505 | |

| | | | | | | | | |

| Biolog Prod-4.08% | | | | | | | | |

| Amgen Inc. | | | 4,659 | | | | 1,214,322 | |

| | | | | | | | | |

| Food and Kindred Products-3.74% | | | | | | | | |

| Conagra Brands Inc | | | 40,105 | | | | 1,112,914 | |

| | | | | | | | | |

| Pipe Lines (No Natural Gas)-3.74% | | | | | | | | |

| HF Sinclair Corp | | | 31,734 | | | | 1,112,277 | |

| | | | | | | | | |

| Total common stocks (cost $23,273,496) | | | | | | $ | 29,280,612 | |

| | | | | | | | | |

| SHORT-TERM INVESTMENTS – 1.38% | | | | | | | | |

| Schwab Money Market Fund (Single Class Fund)-current interest at 0.45% | | | 410,903 | | | $ | 410,903 | |

| | | | | | | | | |

| Total short-term investments (cost $ 410,903) | | | | | | | 410,903 | |

| | | | | | | | | |

| Total investment securities – 99.80% (cost $23,684,399) | | | | | | | 29,691,515 | |

| | | | | | | | | |

| Other assets less liabilities – 0.20% | | | | | | | 58,639 | |

| | | | | | | | | |

| Net assets - 100.00% | | | | | | $ | 29,750,154 | |

STATEMENT OF ASSETS AND LIABILITIES

DECEMBER 31, 2024

| ASSETS | | | |

| Investment securities, at fair value (cost $23,273,496) | | $ | 29,280,612 | |

| Cash | | | 410,903 | |

| Dividends receivable | | | 80,302 | |

| Total assets | | | 29,771,817 | |

| | | | | |

| LIABILITIES | | | | |

| Advisory fees payable | | | 21,663 | |

| Total liabilities | | | 21,663 | |

| | | | | |

| NET ASSETS - | | | | |

| Equivalent to $23.38 per share based on 1,172,180 shares of common stock issued and outstanding; 100,000,000 shares authorized, $0.001 par value | | $ | 29,750,154 | |

| | | | | |

| NET ASSETS CONSIST OF: | | | | |

| Common stock | | $ | 1,172 | |

| Paid-in capital | | | 23,741,865 | |

| Net unrealized appreciation | | | 6,007,117 | |

| Net assets | | $ | 29,750,154 | |

| | | | | |

| Net asset value per share | | $ | 25.38 | |

STATEMENT OF OPERATIONS

FOR THE YEAR ENDED DECEMBER 31, 2024

| INVESTMENT INCOME | | | |

| Dividends | | $ | 1,258,399 | |

| Interest | | | 1,783 | |

| Total investment income | | | 1,260,182 | |

| | | | | |

| EXPENSES - | | | | |

| Advisory fees | | | 252,542 | |

| Foreign Tax paid | | | 1,627 | |

| Misc Expense | | | 143 | |

| Total Expenses | | | 254,312 | |

| | | | | |

| Net investment income | | | 1,005,870 | |

| | | | | |

| GAIN (LOSS) ON INVESTMENTS - | | | | |

| Net realized gain on investments | | | 296,362 | |

| Net increase in unrealized appreciation of investments | | | 2,147,930 | |

| | | | | |

| Net realized and unrealized gain on investments | | | 2,444,292 | |

| | | | | |

| Net increase in net assets resulting from operations | | $ | 3,450,162 | |

STATEMENT OF CHANGES IN NET ASSETS

| | | Year Ended | | | Year Ended | |

| | | December 31, 2024 | | | December 31, 2023 | |

| INCREASE (DECREASE) IN NET ASSETS FROM OPERATIONS: | | | | | | | | |

| Net investment income | | $ | 1,005,870 | | | $ | 998,912 | |

| Net realized gain (loss) on investments | | | 296,362 | | | | 3,316,671 | |

| Net unrealized appreciation (depreciation) of investments | | | 2,147,930 | | | | (3,133,763 | ) |

| Net increase (decrease) in net assets resulting from operations | | | 3,450,162 | | | | 1,181,820 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

| Total Distributions | | | (1,302,232 | ) | | | (4,315,583 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS ($) | | | | | | | | |

| Shares sold | | | 223,000 | | | | 122,894 | |

| Shares issued for distribution reinvest | | | 1,025,955 | | | | 4,071,695 | |

| Shares redeemed | | | (1,630,257 | ) | | | (5,023,510 | ) |

| | | | (381,302 | ) | | | (828,921 | ) |

| | | | | | | | | |

| TOTAL INCREASE (DECREASE) IN NET ASSETS | | | 1,766,628 | | | | (3,962,684 | ) |

| | | | | | | | | |

| NET ASSETS, beginning of year | | | 27,983,526 | | | | 31,946,210 | |

| | | | | | | | | |

| NET ASSETS, end of year (includes undistributed net income of $- and $-, respectively) | | $ | 29,750,154 | | | $ | 27,983,526 | |

FINANCIAL HIGHLIGHTS

PER SHARE DATA AND RATIOS FOR A SHARE OUTSTANDING THROUGHOUT EACH YEAR ENDED:

| | | YEAR | | | YEAR | | | YEAR | | | YEAR | | | YEAR | |

| | | ENDED | | | ENDED | | | ENDED | | | ENDED | | | ENDED | |

| | | 2024 | | | 2023 | | | 2022 | | | 2021 | | | 2020 | |

| Net asset value, beginning of year | | $ | 23.57 | | | $ | 26.67 | | | $ | 27.92 | | | $ | 27.67 | | | $ | 28.98 | |

| | | | | | | | | | | | | | | | | | | | | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.87 | | | | 0.87 | | | | 0.84 | | | | 0.86 | | | | 0.83 | |

| Net realized and unrealized gain (loss) on investments | | | 2.09 | | | | 0.06 | | | | (0.67 | ) | | | 5.41 | | | | (1.28 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Total from investment operations | | | 2.96 | | | | 0.93 | | | | 0.17 | | | | 6.27 | | | | (0.45 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.89 | ) | | | (0.91 | ) | | | (0.85 | ) | | | (0.86 | ) | | | (0.83 | ) |

| Net realized gains | | | (0.26 | ) | | | (3.12 | ) | | | (0.57 | ) | | | (5.16 | ) | | | (0.03 | ) |

| Total distributions | | | (1.15 | ) | | | (4.03 | ) | | | (1.42 | ) | | | (6.02 | ) | | | (0.86 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Net asset value, end of year | | $ | 25.38 | | | $ | 23.57 | | | $ | 26.67 | | | $ | 27.92 | | | $ | 27.67 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total Return | | | 12.53 | % | | | 4.56 | % | | | 0.67 | % | | | 22.78 | % | | | (1.51 | )% |

| | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (in 1000’s) | | $ | 29,750 | | | $ | 27,984 | | | $ | 31,846 | | | $ | 33,037 | | | $ | 28,482 | |

| | | | | | | | | | | | | | | | | | | | | |

| Ratio of expenses to average net assets (a) | | | 0.85 | % | | | 0.86 | % | | | 0.86 | % | | | 0.85 | % | | | 0.87 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Ratio of net investment income to average net assets | | | 3.37 | % | | | 3.54 | % | | | 2.97 | % | | | 2.63 | % | | | 3.15 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Portfolio turnover rate (annualized) | | | 3.74 | % | | | 41.34 | % | | | 28.97 | % | | | 38.45 | % | | | 34.06 | % |

(a) The Fund’s actual expenses are calculated daily at 0.85% of net asset value (NAV).

NOTES TO FINANCIAL STATEMENTS

Stock Dividend Fund, Inc. (the “Fund”) was incorporated in the State of Texas on April 6, 2004 and is registered under the Investment Company Act of 1940 as a non-diversified, open-end management investment company. The investment objective of the Fund is to achieve growth and income by investing primarily in dividend paying common stocks. The effective date of the Fund’s registration with the SEC was November 29, 2004.

| 2. | SIGNIFICANT ACCOUNTING POLICIES |

Basis of Presentation

The financial statements have been prepared in conformity with accounting principles in the United States of America (“GAAP”). The Fund is considered an investment company under GAAP and follows the accounting and reporting guidance applicable to investment companies in the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 946, Financial Services-Investment Company.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from these estimates.

Security Valuation

Securities listed on a national securities exchange or in the over-the-counter market are valued at the last quoted sales price on the day of valuation, or if no quoted sales price was reported on that date, the last quoted bid price. Short-term investments are valued at fair value. Securities for which quotations are not readily available are valued at their estimated fair value as determined in good faith by the Fund’s Board of Directors.

Securities Transactions and Investment Income

Securities transactions are recorded on a trade-date basis. Dividend income is recorded on the ex-dividend date and interest income is recorded on the accrual basis. Realized gains and losses are determined on a specific identification basis of the securities sold. Unrealized gains and losses resulting from the appreciation and depreciation of securities carrying values are included in the statement of operations.

Distribution of Income and Gains

The Fund generally declares and pays dividends annually from net investment income and from net realized gains, if any. Distributions from realized gains for book purposes may include short-term capital gains, which are included in ordinary income for tax purposes. Dividends are paid upon Board approval by the end of each calendar year.

NOTES TO FINANCIAL STATEMENTS, continued

| 2. | SIGNIFICANT ACCOUNTING POLICIES (continued) |

Federal Income Taxes

The Fund’s policy is to continue to comply with the requirements of the Internal Revenue Code that are applicable to regulated investment companies and to distribute all of its taxable income, including any realized gains on investments, to its shareholders. The Fund also intends to distribute sufficient net investment income and net capital gains, if any, so that it will not be subject to excise tax on undistributed income and gains. Therefore, no federal income tax or excise provision is required.

Net investment income (loss), net realized gains (losses) and the cost of investments in securities may differ for financial statement and income tax purposes. The character of distributions from net investment income (loss) or net realized gains (losses) may differ from their ultimate characterization for income tax purposes. At December 31, 2024, there were no material differences. Also, due to the timing of dividend distributions, the fiscal year in which amounts are distributed may differ from the year that the income or realized gains were recorded by the Fund.

Subsequent Events

Subsequent events were evaluated through February 20, 2025, the date the financial statements were available for issuance and filed.

| 3. | FAIR VALUE OF INVESTMENTS |

In accordance with GAAP, fair value is defined as the price that the Fund would receive to sell an asset or pay to transfer a liability in an orderly transaction between market participants at the measurement date. GAAP also establishes a framework for measuring fair value, and a three-level hierarchy for fair value measurements based upon the transparency of inputs to the valuation of an asset or liability. Inputs may be observable or unobservable and refer broadly to the assumptions that market participants would use in pricing the asset or liability. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability based on market data obtained from sources independent of the Fund. Unobservable inputs reflect the Fund’s own assumptions about the assumptions that market participants would use in pricing the asset or liability developed based on the best information available in the circumstances. Each investment is assigned a level based upon the observability of the inputs which are significant to the overall valuation. The three-tier hierarchy of inputs is summarized below.

Level 1 - quoted prices in active markets for identical investments.

Level 2 - observable inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either directly or indirectly (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.).

Level 3 - significant unobservable inputs for the asset or liability (including the Fund’s own assumptions in determining the fair value of investments).

NOTES TO FINANCIAL STATEMENTS, continued

The following table summarizes the valuation of the Fund’s investments by the above fair value hierarchy levels as of December 31, 2024:

| Level | | Investments in Securities | | | Other Financial Instruments* | |

| Level 1: | | | | | | | | |

| Common Stock | | $ | 29,280,612 | | | $ | 0 | |

| Short term investments | | | 410,903 | | | | 0 | |

| Total Level 1: | | | 29,691,515 | | | | 0 | |

| Level 2 | | | 0 | | | | 0 | |

| Level 3 | | | 0 | | | | 0 | |

| Total | | $ | 29,691,515 | | | $ | 0 | |

* Other financial instruments are derivative instruments not reflected in the Portfolio of Investments, such as futures forwards and swap contracts, which are valued at the unrealized appreciation / depreciation on the instrument. As of December 31, 2024, the Fund did not own any other financial instruments.

| 3. | FAIR VALUE OF INVESTMENTS (continued) |

Transfers between levels are recognized at the end of the reporting period. There were no transfers between level 1 and level 2 during the year. There were no level 3 investments held by the Fund during the year ended December 31, 2024.

NOTES TO FINANCIAL STATEMENTS, continued

| 4. | CAPITAL SHARE TRANSACTIONS |

Capital share transactions in the Fund’s $0.001 par value common stock were as follows:

| | | Year Ended December 31, 2024 | | | Year Ended December 31, 2023 | |

| | | Shares | | | Amount | | | Shares | | | Amount | |

| Shares sold | | | 8,874 | | | $ | 223,000 | | | | 4,688 | | | $ | 122,894 | |

| Shares issued in reinvestment of dividends | | | 40,153 | | | | 1,025,955 | | | | 178,648 | | | | 4,070,819 | |

| | | | 49,027 | | | $ | 1,248,955 | | | | 183,336 | | | $ | 4,193,713 | |

| | | | | | | | | | | | | | | | | |

| Shares redeemed | | | (64,200 | ) | | | (1,630,257 | ) | | | (193,861 | ) | | | (5,023,510 | ) |

| | | | | | | | | | | | | | | | | |

| Net increase (decr) | | | (15,173 | ) | | | (381,302 | ) | | | (10,525 | ) | | | (829,797 | ) |

| | | | | | | | | | | | | | | | | |

| Beginning of year | | | 1,187,355 | | | | 24,123,152 | | | | 1,197,880 | | | | 24,952,949 | |

| | | | | | | | | | | | | | | | | |

| End of year | | | 1,172,180 | | | $ | 23,741,865 | | | | 1,187,355 | | | $ | 24,123,152 | |

| 5. | INVESTMENT TRANSACTIONS |

The aggregate cost of purchases and proceeds from sales of investment securities, excluding short-term investments, aggregated $1,114,153 and $1,923,929, respectively, for the year ended December 31, 2024.

| 6. | ADVISORY FEES AND OTHER TRANSACTIONS WITH AFFILIATES |

The Fund and the Advisor are under common control and the existence of that control may create operating results and financial position different than if they were autonomous.

The Fund has an investment advisory agreement with Adams Asset Advisors, LLC (the “Advisor”) to provide investment advisory services to the Fund. Steven Adams is managing member of the Advisor and is also an officer and shareholder of the Fund, and his wife, Laura S. Adams is a member of the Advisor and also a director of the Fund. Under the terms of the agreement, the Fund will pay the Advisor a monthly fee at the annual rate of 0.85% of the Fund’s average daily net assets.

The fee is computed daily and payable monthly. The Advisor has contractually agreed to pay all operating expenses of the Fund, except brokerage fees and commissions, interest, taxes and extraordinary expenses.

NOTES TO FINANCIAL STATEMENTS, continued

| 6. | ADVISORY FEES AND OTHER TRANSACTIONS WITH AFFILIATES, continued |

The advisory fee for 2024, as computed pursuant to the investment advisory agreement, totaled $252,542, of which $21,663 was payable on December 31, 2024.

The Advisor acts as the transfer agent for the Fund, with Fidelity Investments as the sub-transfer agent. There are no fees associated with these services.

The Fund acts as its own custodian, effective September 1, 2008, and is in compliance per requirements of Rule 17f-2. There are no fees associated with these services.

| 7. | MANAGEMENT OWNERSHIP: Directors and Officers of the Fund and their ownership: |

| Name | | Fund Shares Owned

as of 12/31/24 | | | Dollar Range of Ownership

as of 12/31/24 | | | Percent of Class | |

| | | | | | | | | | |

| Laura S. Adams | | | 120,969 | | | | >$1,000,000 | | | | 10.32 | % |

| President & Director* | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Steven Adams | | | 120,969 | | | | >$1,000,000 | | | | 10.32 | % |

| Portfolio Manager* | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Jennifer T. Lapeyre | | | 0 | | | | $0-$10,000 | | | | 0.00 | % |

| Director | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Vicky L. Hubbard | | | 0 | | | | $0-$10,000 | | | | 0.00 | % |

| Director | | | | | | | | | | | | |

*Laura S. Adams, President and an “interested” Director of the Fund and her husband, Steven Adams, Portfolio Manager of the Fund, control these shares through family related accounts. Total ownership of both is 120,969 shares.

To discourage short-term trades by investors and to compensate the Fund for costs that may be incurred by such trades, the Fund may impose a redemption fee of 2% of the total redemption amount if shares are held less than 365 days. For the year ended December 31, 2024, there were no redemption fees received by the Fund.

NOTES TO FINANCIAL STATEMENTS, continued

Income and long-term capital gain distributions are determined in accordance with Federal income tax regulations, which may differ from accounting principles generally accepted in the United States.

On December 24, 2024, the Fund paid an income distribution of $0.8886 per share to shareholders of record on December 23, 2024 for a total distribution of $1,005,870 (100% qualified), and a long-term capital gain distribution of $0.2618 per share for a total distribution of $296,362. Combined total was $1.1504 per share or $1,302,232.

On June 1, 2023, the Fund paid an income distribution of $0.3981 per share to shareholders of record on May 31, 2023 for a total distribution of $ 414,000 (100% qualified), and also a long-term capital gain distribution of $2.44 per share for a total distribution of $2,956,650. In addition, on December 21, 2023, the Fund paid an income distribution of $0.5127 per share to shareholders of record on December 20, 2023 for a total distribution of $584,049 (100% qualified), and also a long-term capital gain distribution of $0.6795 per share for a total distribution of $774,524.

The Fund’s distributable earnings on a tax basis are determined only at the end of each fiscal year. As of December 31, 2024, the Fund’s most recent fiscal year-end, the components of distributable earnings on a tax basis were as follows:

| Unrealized Appreciation | | $ | 6,007,116 | |

| Undistributed Realized Long-Term Gains | | $ | 0 | |

| Undistributed Ordinary Income | | $ | 0 | |

| Total Distributable Earnings, Net | | $ | 6,007,116 | |

As of December 31, 2024, the tax basis components of unrealized appreciation (depreciation) and cost of investments were as follows:

| Gross tax appreciation of investments | | $ | 6,846,330 | |

| Gross tax depreciation of investments | | $ | (839,214 | ) |

| Net tax appreciation of investments | | $ | 6,007,116 | |

| Federal tax cost of investments, Including short-term investments | | $ | 23,684,399 | |

As of December 31, 2024, open Federal tax years, subject to examination, include the tax years ended December 31, 2022 through December 31, 2024. As of and during the year ended December 31, 2024, the Fund did not have a liability for any unrecognized tax benefits. The Fund has no examination in progress and is not aware of any tax positions for which it is reasonably possible that the total tax amounts of unrecognized tax benefits will significantly change in the next twelve months.

BOARD APPROVAL OF MANAGEMENT AGREEMENTS

APPROVAL OF INVESTMENT ADVISORY AGREEMENT

At an in-person meeting held on January 16, 2025, the Board of Directors, including a majority of Directors that are not “interested” persons of the Fund (as the term is defined in the 1940 Act), re-approved the annual Advisory Agreement based upon its review of the qualitative and quantitative information provided by the Investment Advisor. The Directors considered, among other things, the following information regarding the Investment Advisor:

| 1) | Nature, extent and quality of services provided by the Advisor – The Directors reviewed the nature, quality and scope of current services provided by the Advisor under the Advisory Agreement. The Directors also analyzed the experience of the Investment Advisor and capabilities as a portfolio manager, noting that the Advisor has managed separate account portfolio’s successfully with assets far in excess of the Fund’s NAV for decades. The Advisor’s Form ADV was reviewed as well as internal compliance policies and experience managing other portfolios. In addition, the portfolio and brokerage transactions of the Fund were reviewed. Based on this review, the Directors concluded that the range and quality of services to be provided by the Investment Advisor to the Fund were appropriate and to support the selection of the original Investment Advisor. |

| 2) | Investment performance – The Directors reviewed the performance of the Fund as compared to market benchmarks for various time periods. This review focused on investment strategy and long term performance potential. For 2024 the Fund was up 12.53% versus up 25.02% for the S&P 500 Index and up 15.32% for the SPDR S&P 500 High Dividend ETF. For the five years ended 2024 annualized the Fund was up 7.44% versus up 14.51% for the S&P 500 Index and up 6.84% for the SPDR S&P 500 High Dividend ETF. For the ten years ended 2024 annualized the Fund was up 8.14% versus up 13.08% for the S&P 500 Index and up 8.17% for the WisdomTree U.S. High Dividend Fund (Using ticker DHS as the SPDR S&P 500 High Dividend ETF does not have a ten year history yet). It was noted that growth oriented strategies with high p/e technology weightings like the S&P 500 have outperformed large cap dividend and value oriented strategies for several years. The Directors concluded that the performance of the Fund managed by the Investment Advisor, both short term and longer term, was satisfactory and in-line with similar high dividend and value oriented Funds. |

| 3) | Cost of services to the Fund and profitability of the Advisor – The Directors considered the Fund’s management fee and total expense ratio of the Fund relative to industry averages. The Directors determined that the Advisor is receiving a fee (0.85%) that is in line with fees charged for other funds and that the Advisor is operating profitably, is viable and should remain an ongoing entity. The Directors also noted that the Advisor is paying all expenses (except transaction commissions) associated with managing the Fund out of the management fee, which is very advantageous to shareholders versus other funds. |

| 4) | Economies of Scale – The Directors considered information regarding economies of scale with respect to management of the Fund and noted that the Fund and its shareholders are already experiencing and benefitting from an expense ratio (0.85%) that would be expected from that of funds with significantly larger asset bases. |

| 5) | Conclusions – Based on the above review and discussions, the Directors concluded that it is in the best interest of the Fund and the shareholders to approve the Advisory Agreement. |

ADDITIONAL INFORMATION

PROXY VOTING INFORMATION

Adams Asset Advisors, LLC, the Fund’s Advisor, is responsible for exercising the voting rights associated with the securities held by the Fund. A description of our policies and procedures on fulfilling this responsibility is available without charge, upon request, by calling 1-800-704-6072. Information about how each Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 may be obtained (1) without charge, upon request, by calling 800-704-6072 and (2) on the SEC’s website at http://sec.gov.

QUARTERLY FILING OF PORTFOLIO HOLDINGS

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (SEC) for the first and third quarters of each fiscal year on Form N-PORT. The Fund’s Forms N -PORT are available on the SEC’s website at http://www.sec.gov. The Fund’s Forms N-PORT may also be reviewed and copied at the SEC’s Public Reference Room in Washington DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

LIQUIDITY RISK MANAGEMENT PROGRAM

The Fund has adopted and implemented a written liquidity risk management program as required by Rule 22e-4 (the “Liquidity Rule”) under the Investment Company Act. The program is reasonably designed to assess and manage the Fund’s liquidity risk, taking into consideration, among other factors, the Fund’s investment strategy and the liquidity of its portfolio investments during normal and reasonably foreseeable stressed conditions; its short and long-term cash flow projections; and is cash holdings and access to other funding sources.

During the fiscal year ended December 31, 2024, the Board of Directors reviewed the Fund’s investments and determined that the Fund held adequate levels of cash and highly liquid investments to meet shareholder redemption activities in accordance with applicable requirements. The Board of Directors concluded the Fund’s liquidity risk management program is reasonable designed to prevent violation of the Liquidity Rule and that the Fund’s liquidity risk management program has been effectively implemented.

Report of Independent Registered Public Accounting Firm

Board of Directors and Shareholders

Stock Dividend Fund, Inc.

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Stock Dividend Fund, Inc. (the “Fund”) as of December 31, 2024, the related statements of operations and changes in net assets, and the financial highlights for the year then ended, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of December 31, 2024, and the results of its operations, changes in its net assets, and its financial highlights for the year then ended in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the entity’s management. Our responsibility is to express an opinion on the entity’s financial statements based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audit we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the entity’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audit included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audit provides a reasonable basis for our opinion.

Other Matter

The financial statements of the Fund as of December 31, 2023, and for the year then ended, were audited by other auditors whose report dated February 21, 2024, expressed an unmodified opinion on those financial statements.

We have served as the Fund’s auditor since 2024.

/s/ Bodwell Vasek Wells DeSimone LLP

Dallas, Texas

February 20, 2025

Item 8: Changes in and Disagreements with Accountants for Open-End Management Investment Companies. There have been no changes in or disagreements with the Fund’s accountants.

Item 9: Proxy Disclosures for Open-End Management Investment Companies. Shareholders voted to approve the new Auditor of the Fund for 2024. There were no other matters submitted to a vote of shareholders during the period covered by the report.

Item 10: Remuneration Paid to Directors, Officers, and others of Open-End Management Investment Companies. No Remuneration is Paid to Directors, Officers or others.

Item 11: Statement Regarding Basis for Approval of Investment Advisory Contract. The information is included as part of the material filed under Item 7 of this Form.

Item 12: Disclosure of Closed End fund Proxy Voting Policies/Procedures. N/A

Item 13: Portfolio Managers of Closed-End funds. Not Applicable

Item 14: Purchases of Equity Securities by Closed-End funds. Not Applicable

Item 15: Submission of Matters to a Vote of Security Holders. Not Applicable

Item 16: Controls and Procedures.

| (a) | Disclosure Controls and Procedures. The registrant’s President and CCO have concluded that the registrant’s disclosure controls and procedures, as defined in Rule 30a-3(c)under the Investment Company Act of 1940, as amended (the “1940 Act”)are effective, as of a date within 90 days of the filing date of the report that includes the disclosure required by this paragraph, based on the evaluation of these controls and procedures required by Rule 30a-3(b) under the 1940 act and Rules 13a-15(b) or 15d-15(b) under the Securities Exchange Act of 1934. |

| (b) | Internal Controls. There were no changes in the registrant’s internal control over financial reporting (as defined in Rule 30a-3(b) under the 1940 Act that occurred during the registrant’s fiscal year that have materially affected, or is reasonable likely to material affect, the registrant’s internal control over financial reporting. |

Item 17. Disclosure of Securities Lending Activities for Closed-End Management Investment Companies. Not Applicable

Item 18. Recovery of Erroneously Awarded Compensation.

Item 19. Exhibits.

| (5) | Independent Public Accountant changed by shareholder vote in 2024 primarily due to excessive cost proposal for 2024 audit services. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Stock Dividend Fund | |

| | |

| By | /s/ Laura S. Adams | |

| | Laura S. Adams

President | |

| | Principal Executive Officer and Principal Financial Officer | |

| | |

| Date | February 20, 2025 | |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and dates indicated.

| Stock Dividend Fund | |

| | |

| By | /s/ Laura S. Adams | |

| | Laura S. Adams

President | |

| | Principal Executive Officer and Principal Financial Officer | |

| | |

| Date | February 20, 2025 | |