Washington, D.C. 20549

300 E. Sonterra Blvd., Suite 1220

The enclosed Information Statement is being furnished to you to inform you that the foregoing consent action have been approved by the holders of or persons able to direct the vote of a majority of the outstanding shares of our common stock. The Board is not soliciting your proxy in connection with the stockholder consent actions and proxies are not requested from stockholders. The stockholder consent actions will not become effective before a date which is 20 days after this Information Statement is first mailed to our stockholders (the “Effective Date”). You are urged to read the Information Statement in its entirety for a description of the action taken by a majority of our stockholders.

300 E. Sonterra Blvd., Suite 1220

IS REQUIRED IN CONNECTION WITH THIS INFORMATION STATEMENT.

This Information Statement is being furnished on the Release Date to the holders of record of South Texas Oil Company of the Company’s common stock as of the close of business on March 10, 2009.

The Board of Directors of South Texas Oil Company has approved and three stockholders holding an aggregate of 9,949,725 shares of common stock issued and outstanding as of March 5, 2009, representing that number of votes, have consented in writing to the actions described below. Such approval and consent constitute the approval and consent of a majority of the total number of shares of the Company’s outstanding common stock and is sufficient under the Nevada Revised Statutes, the Company’s Articles of Incorporation and Bylaws, as amended, to approve the actions. Accordingly, the actions will not be submitted to the other stockholders of South Texas Oil Company for a vote, and this Information Statement is being furnished to such other stockholders to provide them with certain information concerning the actions in accordance with the requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the regulations promulgated under the Exchange Act, including Regulation 14C.

The close of business on March 10, 2009, has been established by the Board of Directors as the Record Date for the determination of stockholders entitled to this Information Statement and this notice of the Written Consents from certain of our major stockholders with respect to (i) our issuance of preferred stock in exchange for the cancellation of secured debt and (ii) the amendment to out Articles of Incorporation to increase the number of our authorized shares of common stock.

You may obtain a copy of the current rules for submitting stockholder proposals from the SEC at:

U.S. Securities and Exchange Commission

100 F Street, N.E.

or through the Commission’s Internet web site: www.sec.gov. Request SEC Release No. 34-40018, May 21, 1998.

Pursuant to the South Texas Oil Company’s Bylaws and the Nevada Revised statutes, a vote by the holders of at least a majority of the Company’s outstanding capital stock is required to effect the action described herein. The Company’s Articles of Incorporation do not authorize cumulative voting. As of the Record Date, the Company’s had 16,788,862 voting shares of common stock issued and outstanding. The voting power representing not less than 8,386,431 shares of our common stock is required to pass any stockholder resolutions. The consenting stockholders, who consist of three stockholders of South Texas Oil Company, are collectively the record and beneficial owners of 9,949,725 shares of common stock, which represents 59.36% of the issued and outstanding shares of the South Texas Oil Company’s common stock. Pursuant to Nevada Revised statutes, the consenting stockholders voted in favor of the actions described herein in a Stockholder Consent, dated March 5, 2009. The consenting stockholders’ names, affiliation with the Company, and beneficial holdings are as follows:

None.

The following table sets forth certain information as of March 10, 2009, as to shares of our common stock beneficially owned by: (i) each person who is known by us to own beneficially more than 5% of our common stock, (ii) each of our current named executive officers, (iii) each of our directors and (iv) all our directors and executive officers as a group. Unless otherwise stated below, the address of each beneficial owner listed on the table is c/o South Texas Oil Company, 300 E. Sonterra Blvd., Suite 1220, San Antonio, Texas 78258. The percentage of common stock beneficially owned is based on 16,788,862 shares outstanding as of March 10, 2009.

To the knowledge of management, there are no present arrangements or pledges of securities of the Company which may result in a change in control of the Company.

The following actions were taken based upon the unanimous recommendation of the Board of Directors of South Texas Oil Company Board and the written consent of the consenting stockholders:

On Friday, February 20, 2009, the Company entered into definitive agreements with Longview to restructure $26.1 million of the Company’s secured debt, represented by secured Notes, plus accrued interest. The debt restructuring includes

The Securities Exchange Agreement provides for the payment of $16.3 million, plus accrued interest, payable under the Notes by the Company’s issuance of its approximately 1.6 million shares (plus such additional shares as may result from accrued interest) of Preferred Stock to Longview, which is convertible into the Company’s common stock. The Preferred Stock will be issued in exchange for the discharge and release of the Notes in the amount of $16.3 million, plus accrued interest. The Security Exchange Agreement does not include or affect the perpetual overriding royalty interests in the oil and gas production of the Company’s properties or the mortgages or security interests granted by the Company to secure the payment of the overriding royalty interests.

On April 1, 2008, the Company and Longview entered into a securities purchase agreement, as amended by the June 2008 Amendment Agreement, and as otherwise be amended, supplemented, restated or modified and in effect from time to time, pursuant to which Longview purchased from the Company, among other things, secured Notes, each bearing 12.5% annual interest payable quarterly to Longview. In June and September 2008, the Company and Longview agreed to capitalize the quarterly payment of interest under the Notes until their maturity in September 2009.

The Company and its Subsidiaries also granted to Longview perpetual overriding royalty interests in the oil and gas production of the Company’s properties, and the Company granted security and pledge agreements that provided Longview with first priority security interests in substantially all of the Company’s assets. In addition, the Company agreed to grant to Longview certain mortgages in the Company’s oil and gas producing properties.

The Preferred Stock is perpetual and has a stated value of $10.00 per share, has no coupon rate or mandatory dividends, and has no voting rights.

The shares of Preferred Stock are convertible into shares of common stock at any time subsequent to 90 days after the issuance of the shares at a conversion price of $0.50 per share of common stock.

The conversion of the Preferred Stock is subject to a 9.99% limitation on Longview’s ownership of the Company’s common stock at one time..

The holders of the Preferred Stock has been granted registration rights for the resale of the common stock underlying the Preferred Stock. The registration rights are subject to certain limitations which may be imposed by Commission rules with respect to the number of common stock shares that can be included in any one registration statement,

The issuance of Preferred Stock is subject to shareholder approval of the Debt/Equity Exchange Transaction, and the closing of the Securities Exchange Agreement will take place upon the effectiveness of such approval, which will occur on the twenty first day following the first mailing of this Information Statement to the Company’s stockholders.

The exchange transaction will result in the reduction of the Company’s current secured debt from approximately $42.1 million to approximately $16.0 million.

The Company will have increased available cash for operations by reduction of debt service of approximately $8,800 per day (or approximately $3.2 million per year) associated with the reduction of debt as a result of the proposed exchange. There are currently no arrears in principal or interest in respect to the Notes.

The Company will have a significant improvement of its balance sheet and total stockholders’ equity, which will result in a greater ability to attract future financing to support strategic growth.

Upon full conversion of the Preferred Stock, our issued and outstanding common shares will increase by approximately 193%.

The per common share conversion price for the preferred has been fixed at $0.50 at a time when our common stock was trading at $0.37, representing an approximate 35% premium.

The anticipated increase in total stockholders’ equity and the conversion price premium will result in an anti-dilutive net effect to holders of our common stock.

The rights of holders of our common stock, pre conversion, will be subordinate to the preferred stock with respect to dividends and liquidation events.

The newly designated Preferred Stock will be convertible into shares of the Company’s common stock. The existing Notes are not convertible into the common stock of the Company.

The common stock underlying the Preferred Stock will be listed on NASDAQ upon conversion; neither the debt represented by the Notes nor the Preferred Stock issued in exchanged for the Notes are or will be listed on a national securities exchange.

While the common stock underlying the Preferred Stock will have voting rights upon conversion, neither the debt represented by the Notes nor the Preferred Stock issued in exchanged for the Notes have voting rights.

The Notes bear interest at the annual rate of 12.5%, which is paid quarterly by adding the interest amount to the principal owed under the Notes. The Preferred Stock has no coupon rate or dividends payable.

The Asset Purchase and Sale transaction for the disposition of both the Colorado property and drilling rig will close concurrently with the closing of Securities Exchange Agreement and the issuance of the Company’s Series A Convertible Preferred Stock to Longview. Following the closing of both transactions, the Company’s remaining senior secured debt will be approximately $16.0 million.

The Company’s Board of Directors has determined that the terms of the Securities Exchange Agreement are in the best interests of the Company and has approved the Securities Exchange Agreement and directed Executive Management of the Company to take all actions required to secure the approval of the Company’s Stockholders by consent. On March 5, 2009, the consenting stockholders, who consist of three current stockholders of South Texas Oil Company, and are collectively the record and beneficial owners of 9,949,725 shares of common stock, which represents 59.36% of the issued and outstanding shares of South Texas Oil Company’s common stock, approved the Securities Exchange transaction, pursuant to Nevada Revised Statutes 78.320.

To amend the Company’s Articles of Incorporation to increase our authorized (i) common stock from 50,000,000 to 200,000,000 shares having a par value of $0.001 per share.

We anticipate future efforts to raise additional capital to meet the needs of our oil and natural gas exploration and development activities, as part of our strategic growth plan. Our efforts to raise additional funds in the future may involve the issuance of convertible debt, pure equity, or a combination thereof, in one or more transactions. However, we do not have any current specific plans, proposals or arrangements, written or otherwise, to issue any of the newly available authorized shares of stock for any purpose, including future acquisitions and/or financings.

A change in the authorized capital stock of a Nevada corporation requires an amendment to the Company’s Articles of Incorporation. Nevada Revised Statutes 78.390 requires stockholder approval to amend the Company’s Articles of Incorporation, which may be by stockholders’ consent without a meeting as provided in Nevada Revised Statutes 78.320.

The following information and documents are attached and incorporated herein by reference:

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| R | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | |

| | For the fiscal year ended December 31, 2008 |

| | |

| OR |

| |

| £ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File No. 001-33777

South Texas Oil Company

(Exact Name of Registrant as Specified in Its Charter)

| Nevada | 74-2949620 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) |

300 East Sonterra Boulevard, Suite 1220

San Antonio, Texas 78258

(Address of principal executive offices, including zip code)

(210) 545-5994

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

| Title of each class | | Name of each exchange on which registered |

| Common Stock, par value $0.001 per share | | The NASDAQ Global Market |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes £ No R

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes £ No R

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes R No £

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. £

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a small reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer £ | Accelerated filer £ |

Non-accelerated filer £ | Smaller reporting company R |

| (Do not check if a smaller reporting company) | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes £ No R

The aggregate market value of the voting stock held by non-affiliates of the registrant based on the closing price of the Registrant’s common stock of $3.69 per share as reported on the NASDAQ Global Stock Market on June 30, 2008 was $33,505,886.

As of March 17, 2009, there were outstanding 16,788,862 shares of common stock.

Documents Incorporated by Reference

Information required by Part III will either be included in the registrant’s definitive proxy statement filed with the Securities and Exchange Commission or filed as an amendment to this Form 10-K no later than 120 days after the end of the registrant’s fiscal year, to the extent required by the Securities Exchange Act of 1934, as amended.

TABLE OF CONTENTS

| PART I | | 1 |

| ITEM 1. | BUSINESS | 1 |

| ITEM 1A. | RISK FACTORS | 17 |

| ITEM 1B. | UNRESOLVED STAFF COMMENTS | 29 |

| ITEM 2. | PROPERTIES | 29 |

| ITEM 3. | LEGAL PROCEEDINGS | 29 |

| ITEM 4. | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS | 30 |

| PART II | | 30 |

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY | 30 |

| ITEM 6. | SELECTED FINANCIAL DATA | 33 |

| ITEM 7. | MANAGEMENT DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 33 |

| ITEM 7A. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 43 |

| ITEM 8. | FINANCIAL STATEMENTS AND SUPPLEMETARY DATA | 43 |

| ITEM 9. | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | 43 |

| ITEM 9A(T). | CONTROLS AND PROCEDURES | 43 |

| ITEM 9B. | OTHER INFORMATION | 45 |

| PART III | | 45 |

| ITEM 10. | DIRECTORS, EXECUTIVE OFFICERS, AND CORPORATE GOVERNANCE | 45 |

| ITEM 11. | EXECUTIVE COMPENSATION | 45 |

| ITEM 12. | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS | 45 |

| ITEM 13. | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE | 45 |

| ITEM 14. | PRINCIPAL ACCOUNTANT FEES AND SERVICES | 45 |

| PART IV | | 46 |

| ITEM 15. | EXHIBITS AND FINANCIAL STATEMENT SCHEDULES | 46 |

| | |

| SIGNATURES | |

| CERTIFICATIONS | | |

GLOSSARY OF TERMS

As commonly used in the oil and natural gas industry and as used in this Annual Report on Form 10-K, the following terms and abbreviations have the following meanings:

2-D seismic or 2-D data. Seismic data that is acquired and processed to yield a two-dimensional cross section of the subsurface.

3-D seismic or 3-D data. The method by which a three dimensional image of the earth’s subsurface is created through the interpretation of reflection seismic data collected over a surface grid. 3-D seismic surveys allow for a more detailed understanding of the subsurface than do conventional surveys and contribute significantly to field appraisal, exploitation and production.

Annulus. The space around a pipe in a wellbore.

Anomaly. An entity or property that differs from what is typical or expected, or which differs from that predicted by a theoretical model. It may be the measurement of the difference between an observed or measured value and the expected values of a physical property.

Bbl. One stock tank barrel or 42 United States gallons liquid volume.

Bcf. One billion cubic feet

Bcfe. One billion cubic feet equivalent, determined using a ratio of six Mcf of natural gas to one Bbl of oil, condensate or natural gas liquids.

Boe. Barrel of oil equivalent. Boe is calculated by converting 6 Mcf of natural gas to 1 Bbl of oil.

Boe/d. Boe per day.

Bopd. Barrels of oil per day.

Behind pipe reserves. Behind-pipe reserves are expected to be recovered from zones in existing wells, which will require additional completion work or future recompletion prior to the start of production.

Bore hole. The wellbore itself, including the openhole or uncased portion of the well. Bore hole may refer to the inside diameter of the wellbore wall, the rock face that bounds the drilled hole.

Btu. One British thermal unit, which is the heat required to raise the temperature of a one-pound mass of water from 58.5 to 59.5 degrees Fahrenheit.

Butane. A gaseous hydrocarbon of the paraffin series.

CO2 or carbon dioxide. A gas that can be found in naturally occurring reservoirs, typically associated with ancient volcanoes, and also is a major byproduct from manufacturing and power production, also utilized in enhanced oil recovery through injection into an oil reservoir.

Commercial well; commercially productive well. An oil and natural gas well which produces oil and natural gas in sufficient quantities such that proceeds from the sale of such production exceed production expenses and taxes.

Completion. The installation of permanent equipment for the production of oil or natural gas or, in the case of a dry hole, the reporting of abandonment to the appropriate agency.

Compression. A force that tends to shorten or squeeze, decreasing volume or increasing pressure.

Condensate. Hydrocarbons associated with natural gas which are liquid under surface conditions but gaseous in a reservoir before extraction.

Darcy. A unit of permeability, equivalent to the passage of 1 cubic centimeter of fluid of 1 centipoise viscosity flowing in 1 second under a pressure of 1 atmosphere through a porous medium having a cross-sectional area of 1 square centimeter and a length of 1 centimeter.

Delay rental. A payment made to the lessor under a non-producing oil and natural gas lease at the end of each year to continue the lease in force for another year during its primary term.

Depletion. The reduction in petroleum reserves due to production.

Development activities. Activities following exploration including the installation of facilities and the drilling and completion of wells for production purposes.

Developed Acreage. The number of acres which are allocated or assignable to producing wells or wells capable of production.

Developed acres. Acres spaced or assigned to productive wells.

Development costs. All costs incurred in bringing a field to commercial production.

Development well. A well drilled within the proved area of an oil or natural gas reservoir to the depth of a stratigraphic horizon known to be productive.

Division order. A contract setting forth the interest of each owner of a natural gas or oil property, which serves as the basis on which the purchasing company pays each owner’s respective share of the proceeds from the natural gas or oil purchased.

Down-hole equipment. Equipment physically located in a wellbore.

Down-hole lift methods. Use of different equipment to aid in the production of a well whose own reservoir energy is not sufficient to economically produce the well.

Downspacing wells. Additional wells drilled between known producing wells to better exploit the reservoir.

Dry hole or dry well. A well found to be incapable of producing hydrocarbons in sufficient quantities such that proceeds from the sale of such production would exceed production expenses and taxes.

EOR. Enhanced oil recovery projects involve injection of heat, miscible or immiscible gas, or chemicals into oil reservoirs, typically following full primary or secondary water flood recovery efforts, in order to gain incremental recovery of oil from the reservoir.

Ethane. A colorless, gaseous compound of the paraffin series contained in the gases given off by petroleum and in illuminating gas.

Exploitation. The continuing development of a known producing formation in a previously discovered field. To maximize the ultimate recovery of oil or natural gas from the field by development wells, secondary recovery equipment or other suitable processes and technology.

Exploration. The initial phase in petroleum operations that includes generation of a prospect or play or both, and drilling of an exploration well.

Exploratory well. A well drilled to find and produce oil or natural gas reserves not classified as proved, to find a new reservoir in a field previously found to be productive of oil or natural gas in another reservoir or to extend a known reservoir.

Extensions and discoveries. As to any period, the increases to proved reserves from all sources other than the acquisition of proved properties or revisions of previous estimates

Farmin. An agreement which allows a party to earn a full or partial working interest (also known as an “earned working interest”) in an oil and natural gas lease in return for providing exploration funds.

Farmout. Sale or transfer of all or part of the operating rights from the working interest owner (the assignor or farmout party), to an assignee (the farmin party) who assumes all or some of the burden of development, in return for an interest in the property. The assignor may retain an overriding royalty or any other type of interest. For Federal tax purposes, a farmout may be structured as a sale or lease, depending on the specific rights and carved out interests retained by the assignor.

Federal unit. Acreage under Federal oil and natural gas leases subject to an agreement or plan among owners of the leasehold interests, which satisfies certain minimum arrangements and has been approved by an authorized representative of the U.S. Secretary of the Interior, to consolidate under a cooperative unit plan or agreement for the development of such acreage comprising a common oil and natural gas pool, field or like area, without regard to separate leasehold ownership of each participant and providing for the sharing of costs and benefits on a basis as defined in such agreement or plan under the supervision of a designated operator.

Fee land. The most extensive interest that can be owned in land, including surface and mineral, including oil and natural gas, rights.

Field. An area consisting of a single reservoir or multiple reservoirs all grouped on or related to the same individual geological structural feature and/or stratigraphic condition.

Finding costs. The ratio of capital costs necessary to establish production, divided by the reserves discovered usually reported in $/boe or $/mcfe.

Flow lines. The pipe through which oil or natural gas travels from well processing equipment to storage or sales.

Formation or interval. The fundamental unit of lithostratigraphy. A body of rock that is sufficiently distinctive and continuous that it can be mapped. In stratigraphy, a formation is a body of strata of predominately one type of combination of types. A group of rocks of the same age extending over a substantial area of a basin.

Frac or fracture. High pressure or explosive methods of breaking rock formations to facilitate production of oil or natural gas.

Gas or natural gas. A highly compressible, highly expansible mixture of hydrocarbons with a low specific gravity and occurring naturally in a gaseous form but which may contain liquids.

Gas lift. The process of raising or lifting fluid from a well by injecting gas down the well through tubing or through the tubing casing annulus. Injected gas aerates the fluid resulting in less pressure that the formation, the resulting higher formation pressure forces the fluid out of the wellbore. Gas may be injected continuously or intermittently, depending on the producing characteristics of the well and the arrangement of the gas-lift equipment.

Gathering system. The flowline network and process facilities that transport and control the flow of oil and natural gas from the wells to a main storage facility, processing plant or shipping point. A gathering system includes pumps, headers, separators, emulsion treaters, tanks, regulators, compressors, dehydrators, values and associated equipment.

Geophysical work. The use of seismic surveys and the interpretation of these surveys to better estimate the subsurface environment.

Gross acres or gross wells. The total acres or wells, as the case may be, in which a working interest is owned.

Held by production or HBP. A provision in an oil, gas and mineral lease that perpetuates a company’s right to operate a property or concession as long as the property or concession produced a minimum paying quantity of oil or natural gas.

Horizontal drilling. Involves drilling horizontally out from an existing vertical well bore, thereby potentially increasing the area and reach of the well bore that is in contact with the reservoir.

Horizontal wells. Wells which are drilled at angles greater than 70 degrees from vertical.

Hydraulic fracturing. Involves pumping a fluid with or without particulates into a formation t high pressure, thereby creating fractures in the rock and leaving the particulates in the fractures to ensure that the fractures remain open, thereby potentially increasing the ability of the reservoir to produce oil and natural gas.

Hydrocarbons. Oil, natural gas, condensate and other petroleum products.

Hydrostatic pressure. The force exerted by a body of fluid at rest. It increases directly with the density and the depth of the fluid and is expressed in many different units, including pounds per square inch or kilopascals.

Injection well. A well in which fluids are injected rather than produced, the primary objective typically being to maintain reservoir pressure. Two common types of injection are gas and water. Separated gas from production wells or possibly imported gas or carbon dioxide may be injected into the upper gas section of the reservoir. Water-injection wells are common, where filtered and treated water is injected to increase production of the reservoir.

Infill drilling. Drilling of a well between known producing wells to better exploit the reservoir.

Initial production rate. Generally, the maximum 24 hour production volume from a well.

LOE. Lease operating expense(s), a current period expense incurred to operate a well.

Landowner royalty. That interest retained by the holder of a mineral interest upon the execution of an oil and natural gas lease which typically ranges from 1/8 to ¼ of all gross revenues from oil and natural gas production, depending upon the area of the lease, unencumbered with any expenses of operation, development, or maintenance.

Leases. Means full or partial interests in oil and natural gas properties authorizing the owner of the lease to drill for, purchase and sell oil and natural gas in exchange for any or all rental, bonus and royalty payments. Leases are generally acquired from private landowners (fee leases) and from federal and state governments on acreage held by them.

Lithostratigrathy. The study and correlation of strata to elucidate earth history on the basis of its lithology, or the nature of the well log response, mineral content, grain, size, texture and color of rocks.

Low pressure gathering system. Small diameter pipelines interconnected in order to combine natural gas from producing wells which generally have pressures from 0 to 500 psa.

MBbl. One thousand barrels of oil or other liquid hydrocarbons.

MBbl/d. MBbl per day.

MBoe. One thousand barrels of oil equivalent

MBoe/d. MBoe per day.

MMBoe. One million barrels of oil equivalent.

Mcf. One thousand cubic feet.

Mcfe. One thousand cubic feet equivalent, determined using the ratio of six Mcf of natural gas to one Bbl of oil, condensate or natural gas liquids.

MMBbl. One million barrels of oil or other liquid hydrocarbons.

MMBtu. One million British thermal units.

MMcf. One million cubic feet.

MMcf/d. MMcf per day.

MMcfe. One million cubic feet equivalent, determined using a ratio of six Mcf of natural gas to one Bbl of oil, condensate or natural gas liquids.

MMcfe/d. MMcfe per day.

Millidarcy or md. A unit of fluid permeability equal to one-thousandth of a darcy.

Methane. Means a colorless, odorless, flammable gas, CH4, the first member of the methane series.

Multiple stacked reservoirs. Productive formation at different depths in a well or a field. As used in explanation, may be referred to as “multiple stacked objectives.” Can occur over a few feet or hundreds of feet in thickness.

NGLs. Natural gas liquids, which are the hydrocarbon liquids contained within natural gas.

NYMEX. New York Mercantile Exchange.

Net acres or net wells. The sum of the fractional working interests owned in gross acres or gross wells, as the case may be.

Net revenue interest. A share of production after all burdens, such as royalty and overriding royalty, have been deducted from the working interest. It is the percentage of production that each party actually receives.

Nonconventional gas. Non-conventional gas is a natural gas found in unusual underground situations such as very impermeable reservoirs, hydrates, and coal deposits.

Nonproducing reserves. Reserves subcategorized as non-producing include shut-in and behind-pipe reserves. Shut-in reserves are expected to be recovered from (1) completion intervals which are open at the time of the estimate, but which have not started producing, (2) wells which were shut-in for market conditions or pipeline connections, or (3) wells not capable of production for mechanical reasons. Behind-pipe reserves are expected to be recovered from zones in existing wells, which will require additional completion work or future recompletion prior to the start of production.

Oil. Crude oil or condensate.

Operator. An oil and natural gas venture participant that manages the joint venture, pays venture costs and bills the venture’s non-operators for their share of venture costs. The operator is also responsible to market all oil and natural gas production, except for those non-operators who take their participation in-kind.

Overriding royalty. A royalty interest that is created out of the operating or working interest. Unlike a royalty interest, an overriding royalty interest terminates with the operating interest from which it was created or carved out of. See “royalty interest”.

Over-pressurized. Subsurface pressure that is abnormally high, exceeding hydrostatic pressure at a given depth.

Paid-up lease. A lease for which the aggregate lease payments are paid in full on or prior to the commencement of the lease term.

Payout. The point in time when the cumulative total of gross income from the production of oil and natural gas from a given well, and any proceeds from the sale of such well, equals the cumulative total costs and expenses of acquiring, drilling, completing, and operating such well, including tangible and intangible drilling and completion costs.

P-waves. An elastic body wave or sound wave in which particles oscillate in the direction the wave propagates.

Perforate. To pierce the casing wall and cement of a wellbore to provide holes through which formation fluids may enter or to provide holes in the casing so that materials may be introduced into the annulus between the casing and the wall of the borehole.

Permeability. The measure of ease with which petroleum can move through a reservoir.

Play. A term applied to a portion of the exploration and production cycle following the identification by geologists and geophysicists of areas with potential oil and natural gas reserves.

Porosity. The relative volume of the pore space (or open area) compared to the total bulk volume of the reservoir.

Present value of estimated future net revenues or PV-10 value. When used with respect to oil and natural gas reserves, the estimated future gross revenues to be generated from the production of proved reserves, net of estimated production and future development costs, using the prices provided in this report and costs in effect as of the date indicated, without giving effect to non-property related expenses such as general and administrative expense, debt service and future income tax expenses or to depreciation, depletion and amortization, discounted using an annual discount rate of 10% and assuming continuation of existing economic conditions, and is not necessarily the same as market value.

Primary recovery. The first stage of oil production in which natural reservoir drives are used to recover oil, although some form of artificial lift may be required to exploit declining reservoir drives.

Productive well. A well that is found to be capable of producing hydrocarbons in sufficient quantities such that proceeds from the sale of such production exceeds production expenses and taxes.

Propane. A gaseous hydrocarbon of the paraffin series.

Prospect. Potential hydrocarbon trap which has been confirmed by geological and geophysical studies to the degree that drilling of an exploration well is warranted.

Proved developed nonproducing reserves or PDNPs. Proved reserves that have been developed and no material amount of capital expenditures are required to bring on production, but production has not yet been initiated due to timing, markets, or lack of third party completed connection to a natural gas sales pipeline.

Proved developed reserves or PDPs. Reserves that can be expected to be recovered through existing wells with existing equipment and operating methods. Additional oil and natural gas expected to be obtained through the application of fluid injection or other improved recovery techniques for supplementing the natural forces and mechanisms of primary recovery are included in “proved developed reserves” only after testing by a pilot project or after the operation of an installed program has confirmed through production response that increased recovery will be achieved.

Proved reserves. Proved oil and natural gas reserves are the estimated quantities of oil, natural gas and natural gas liquids which geological and engineering data demonstrate with reasonable certainty to be recoverable in future years from known reservoirs under existing economic and operating conditions, i.e., prices and costs as of the date the estimate is made. Prices include consideration of changes in existing prices provided only by contractual arrangements, but not on escalations based on future conditions.

Proved undeveloped drilling location. A site on which a development well can be drilled consistent with spacing rules for purposes of recovering proved undeveloped reserves.

Proved undeveloped reserves or PUDs. Reserves that are expected to be recovered from new wells on undrilled acreage or from existing wells where a relatively major expenditure is required for recompletion. Reserves on undrilled acreage are limited to those drilling units offsetting productive units that are reasonably certain of production when drilled. Proved reserves for other undrilled units are claimed only where it can be demonstrated with certainty that there is continuity of production from the existing productive formation. Estimates for proved undeveloped reserves are not attributed to any acreage for which an application of fluid injection or other improved recovery technique is contemplated, unless such techniques have been proved effective by actual tests in the area and in the same reservoir.

PSI. Pounds per square inch, a measure of pressure. Pressure is typically measured as “psig”, or the pressure in excess of standard atmospheric pressure.

Recompletion. The completion for production of an existing wellbore in another formation from that which the well has been previously completed.

Reprocessing. Refers to taking older seismic data and performing new mathematical techniques to refine subsurface images or to provide additional ways of interpreting the subsurface environment.

Reserve life. A ratio determined by dividing our estimated existing reserves determined as of the stated measurement date by production from such reserves for the prior twelve month period.

Reservoir. A porous and permeable underground formation containing a natural accumulation of economically productive oil and/or natural gas that is confined by impermeable rock or water barriers and is individual and separate from other reserves.

Rod pump. Used in connection with a pumping unit in order to aid in the production of a well. The rod pump moves up and down with the pumping unit and helps lift fluids from the wellbore.

Royalty. The share paid to the owner of mineral rights, expressed as a percentage of gross income from oil and natural gas produced and sold unemumbered by expenses relating to the drilling, completing and operating of the affected well.

Royalty interest. An interest that entitles the owner of such interest to a share of the mineral production from a property or to a share of the proceeds there from. It does not contain the rights and obligations of operating the property and normally does not bear any of the costs of exploration, development and operation of the property.

S-wave. An elastic body wave in which particles oscillate perpendicular to the direction in which the wave propagates.

Salt water disposal wells. A well used for the purpose of injecting produced water back into the ground.

Sand. An abrasive material composed of small quartz grains formed from the disintegration of pre-existing rocks.

Secondary recovery. The use of water-flooding or gas injection to maintain formation pressure during primary production and to reduce the rate of decline of the original reservoir drive. Water flooding of a depleted reservoir. The first improved recovery method of any type applied to a reservoir to produce oil not recoverable by primary recovery methods.

Shale. Fine-grained sedimentary rock composed mostly of consolidated clay or mud. Shale is the most frequently occurring sedimentary rock.

Shut-in well. A well that is not on production, but has not yet been plugged and abandoned. Wells may be shut-in in anticipation of future utility as a producing well, plugging and abandonment or other use.

Side track drilling. An operation where a new well bore is drilled from an existing well bore.

Slick water fracture stimulation. The use of water to treat the well in order to improve rate and reserves. Fluids are pumped into the wellbore at high pressure and rate causing a fracture to open in the rock and extending away from the wellbore.

Spud. The initial penetration of the ground or seafloor when drilling a well; the start of the drilling operation.

Standardized measure of discounted future net cash flows or the Standardized Measure. The present value of estimated future net revenues to be generated from the production of proved reserves, determined in accordance with the rules and regulations of the Securities and Exchange Commission (using prices and costs in effect as of the date of estimation) without giving effect to non-property related expenses such as general and administrative expenses, debt service, future income tax expenses or depreciation, depletion and amortization; discounted using an annual discount rate of 10%.

Stock tank barrel. 42 U.S. gallons liquid volume.

Stratigraphic. Refers to a zone or strata and is typically used in terms of how the hydrocarbon is trapped in the reservoir. A stratigraphic trap is where the rock type changes due to some geological event, such as thinning of the zone, and allows for the hydrocarbons to remain in place.

Stratigraphy. The study of the history, composition, relative ages and distribution of strata, and the interpretation of strata to elucidate earth history.

Successful well. A well capable of producing oil and/or natural gas in commercial quantities.

Test well. An exploration well.

Tcf. One trillion cubic feet of natural gas

Tcfe. One trillion cubic feet equivalent, determined using the ratio of six Mcf of natural gas to one Bbl of oil, condensate or natural gas liquids.

Trap. Geological structure in which hydrocarbons aggregate to form an oil or natural gas field.

Tubing. A relatively small-diameter pipe that is run into a well bore to serve as a conduit for the passage of oil and natural gas to the surface.

Undeveloped acreage. Lease acreage on which wells have not been drilled or completed to a point that would permit the production of commercial quantities of oil and natural gas regardless of whether such acreage contains proved reserves.

Unproved resources. Resources that are considered less certain to be recovered than proved reserves. Unproved resources may be further sub-classified to denote progressively increasing uncertainty of recoverability.

Waterflood. A method of secondary recovery in which water is injected into the reservoir formation to displace residual oil. The water from injection wells physically sweeps the displaced oil to adjacent production wells. Potential problems associated with waterflood techniques include inefficient recovery due to variable permeability, or similar conditions affecting fluid transport within the reservoir, and early water breakthrough that may cause production and surface processing problems.

Wellbore. A borehole or the hole drilled by a drilling bit. A wellbore may have casing in it or it may be open (uncased) or part of it may be open.

Working interest. The operating interest that gives the owner the right to drill, produce and conduct operating activities on the property and a share of production.

Workover. Maintenance on a producing well to restore or increase production.

PART I

ITEM 1. BUSINESS

This Annual Report on Form 10-K contains forward-looking statements based on expectations, estimates and projections as of the date of this filing. These statements by their nature are subject to risks, uncertainties and assumptions and are influenced by various factors. As a consequence, actual results may differ materially from those expressed in the forward-looking statements. For more information see “Forward-Looking Statements” included at the end of this Item 1. “Business” and see also Item 1A. “Risk Factors.”

References

When referring to South Texas Oil Company (“South Texas,” the “Company,” “we,” “us,” and “our”), the intent is to refer to South Texas and its consolidated subsidiaries as a whole or on an individual basis, depending on the context in which the statements are made.

Organization

South Texas Oil Company was incorporated under the laws of the State of Nevada on July 31, 2001 as Nutek Oil, Inc., a wholly owned subsidiary of Nutek, Inc., a Texas corporation (“Nutek”). Our Articles of Incorporation presently authorize 50,000,000 shares of common stock at $.001 par value and 5,000,000 shares of preferred stock at $.001 par value. On August 1, 2001 and January 8, 2004, Nutek made distributions of the Company’s common stock to its stockholders pursuant to a planned “spin-off” that resulted in all of the outstanding shares of the Company’s common stock being held by the stockholders of Nutek. On April 1, 2005, we changed our name from Nutek Oil, Inc. to South Texas Oil Company. Our business activities are primarily conducted through our wholly owned subsidiaries, Southern Texas Oil Company, STO Drilling Company, STO Operating Company, and STO Properties LLC, a wholly owned subsidiary of STO Operating Company. We operate in one reportable segment engaged in the exploration, development and production of oil and natural gas properties.

Overview

South Texas Oil Company is an independent oil and natural gas company engaged in the acquisition, production, exploration and development of oil and natural gas. Our management team has extensive technical and operating expertise in all areas of our geographic focus, which are primarily located in Texas, Louisiana, Colorado and the Gulf Coast. Our producing properties are located in highly prolific fields with long histories of oil and natural gas operations.

At December 31, 2008, our estimated total proved oil and natural gas reserves, as prepared by Forrest A. Garb & Associates Inc., our independent reserve engineering firm, were approximately 5.1 million barrels of oil equivalent (MMBoe), consisting of 3.1 million barrels of oil (MMBbl), and 12.1 billion cubic feet (Bcf) of natural gas. Approximately 12% of our proved reserves were classified as proved developed and 88% as proved undeveloped. We have operational control of approximately 96% of our proved reserves. The PV-10 value of our total proved reserves was approximately $70.3 million based on benchmark commodity prices as of December 31, 2008, which were $44.60 per barrel of oil and $5.71 per MMBtu of natural gas. For the year ended December 31, 2008, we produced 102.7 thousand barrels of oil equivalent (MBoe).

Our principal offices are located at 300 East Sonterra Boulevard, Suite 1220, San Antonio, Texas 78258, telephone number (210) 545-5994, fax number (210) 545-3317, and our website can be found at www.southtexasoil.com. Unless specifically incorporated by reference in this document, information that you may find on our website, or any other website, is not part of this document. Our stock is traded on the NASDAQ Global Market under the ticker symbol “STXX.”

Business Strategy

Our primary goal is to enhance stockholder value by increasing our cash flow, net asset value, and reserves per share through acquisitions, production, exploration, development and divestitures of oil and natural gas properties. Our strategy is to identify prospects internally, acquire lands encompassing those prospects and evaluate those prospects using subsurface geology, geophysical data, development and exploratory drilling. Using this strategy, we have developed an oil and natural gas portfolio of proved reserves, as well as development and exploratory drilling opportunities on high-potential conventional and non-conventional oil and natural gas prospects. We seek to be the named operator of our properties so that we can control the drilling programs to not only replace production, but add value through the growth of reserves and future operational synergies. Our strategy includes balancing risks by allocating capital expenditures between lower-risk development and exploitation activities and exploring higher-risk, higher-potential drilling prospects.

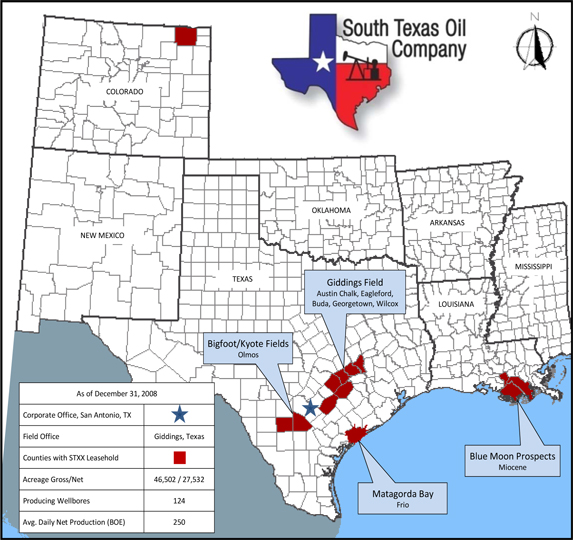

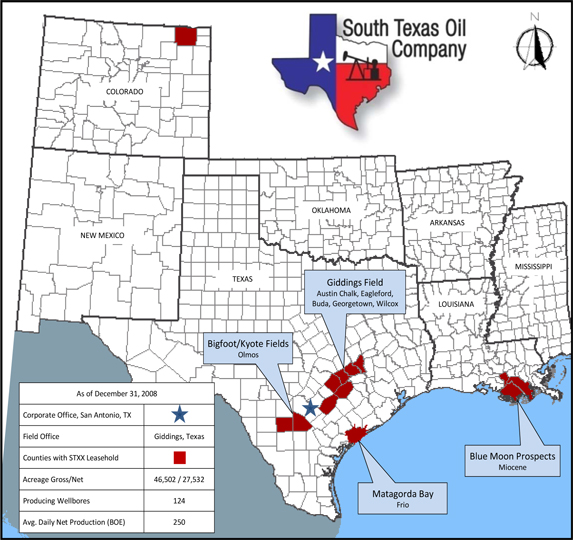

As of December 31, 2008, we controlled approximately 46,502 gross (27,532 net) acres and operated approximately 124 producing well bores located throughout 14 counties in Texas, Louisiana, Colorado and the Gulf Coast. The acreage that we operate and control includes Atascosa, Bastrop, Brazos, Burleson, Calhoun, Fayette, Frio, Gonzales, Lee, and Matagorda Counties in Texas, Assumption, Lafourche and Terrebonne Parishes in Louisiana, and Logan County, Colorado. As of December 31, 2008, our daily net production was approximately 250 barrels of oil equivalent (Boe), of which approximately 70% is oil.

Our development program is focused on lower risk, repeatable drilling opportunities to maintain or grow cash flow. We have conducted a geological, geophysical and engineering analysis on our existing assets and have identified 27 horizontal wells to drill from existing wellbores or offset locations that we have leased. Horizontal well drilling provides increased exposure to the formation in order to increase the flow rate and to recover additional oil and natural gas reserves not recoverable from the existing vertical wellbores. For 2009, we estimate our total drilling and development capital expenditures will be approximately $10.0 million. Our capital expenditure budget is under continuous review and is subject to on-going adjustment.

Key elements of our business strategy include the following:

| | · | Focus on Our Existing Assets. We intend to focus a significant portion of our growth efforts in our existing areas in Texas, Louisiana, Colorado and the Gulf Coast. We control approximately 46,502 gross (27,532 net) acres, which are largely characterized by long lived reserves and production histories in multiple oil and natural gas formations. We believe our focus on and experience in the areas we operate may expose us to acquisition opportunities which may not be available to the entire industry. |

| | · | Develop and Exploit Existing Oil and Natural Gas Properties. As of December 31, 2008, we had identified 27 horizontal wells to drill from existing wellbores or offset locations that we have leased. Horizontal well drilling provides more access to the formation in order to increase the flow rate and to recover additional oil and natural gas reserves not recoverable from the existing vertical wellbores. The 27 identified wells are located in the Giddings Field in south central Texas and within the Austin Chalk trend. Our primary target formations within this trend are the Austin Chalk, Buda, Georgetown, Eagleford and Wilcox. The Austin Chalk trend covering our acreage ranges from approximately 150 feet to 750 feet in thickness and is subdivided into upper, middle and lower zones, with a vertical depth ranging between 6,000 feet and 12,000 feet. Our development program within the Giddings Field is focused on lower risk, repeatable drilling opportunities to grow cash flow and proved reserves. Additionally, as of December 31, 2008, we drilled, cased and cemented two directional wells in Matagorda Bay which are currently undergoing completion procedures. Those two wells were drilled with a barge rig in shallow Texas state waters in Calhoun County with target formations in the Frio sands ranging from 8,500 feet to 12,500 feet. Total measured depth (TMD) for well #127-1 reached 12,464 feet in August 2008 and for well #150-1ST1 reached 10,260 feet in November 2008. |

| | · | Complete Selective Acquisitions, Joint Ventures and Divestitures. We seek to acquire and/or enter into joint ventures for producing oil and natural gas properties, primarily in our core areas. We evaluate acquisitions and joint ventures based on criteria designed to increase cash flow, reserves, and production on an accretive basis. In December 2008, we announced a joint venture project agreement with Blue Moon Exploration, a privately held Houston-based geological and geophysical prospect generation firm. Blue Moon Exploration’s prospects complement our existing core areas of focus while providing extensive access to geological, geophysical and seismic data. As part of this strategy, we may engage in strategic divestitures of non-core assets to redeploy capital into projects to develop both lower-risk and higher-return projects. We recently entered into an agreement to divest two non-core assets, which included our DJ Basin property located in Logan County, Colorado and our Unit U34 drilling rig, divestiture is expected to close in the second quarter of 2009. See “—Recent Developments—$26.1 Million Debt Restructuring and Non-Core Asset Divestitures”. |

We believe that the following strengths complement our business strategy:

| | · | High Quality Asset Base. We own, and plan to maintain, a geographically focused reserve base. Our principal operations are in the Giddings Field of south central Texas, Louisiana and the shallow Texas state waters of the Gulf Coast. Our properties are generally characterized by a high oil concentration, with long reserve lives, and a multi-year inventory of development drilling and exploitation projects. These resource plays present significant opportunities to grow our reserves with low finding and development costs. Since a majority of our acreage in these areas is held by production (HBP), we are not required to commit capital over a short period of time to avoid lease expirations. |

| | · | Operational Control. We seek to be the operator of our properties so that we can control the timing and extent of our capital expenditures and the drilling programs that not only replace production, but also add value through the growth of cash flow, reserves and future operational synergies. As of December 31, 2008, we maintained operational control of approximately 96% of our proved reserves. Our high degree of operating control allows us to control capital allocation and expenses and the timing of additional development and exploitation of our producing properties. |

| | · | Experienced Management Team with Significant Technical Expertise. Our management team has extensive technical and operating expertise in all areas of our geographic focus. We believe that the knowledge, experience and expertise of our staff will continue to support our efforts to enhance stockholder value. Since our new management team was installed in June 2008, we have implemented a disciplined top-to-bottom analysis of the Company and a comprehensive evaluation of our asset base and core operating areas, resulting in the achievement of substantial growth in proved reserves and other operational and financial efficiencies. We have increased our proved reserves from approximately 0.581 MMBoe in 2007 to approximately 5.1 MMBoe at December 31, 2008, a 778% increase. |

| | · | Insider Ownership. As of March 5, 2009, our management team and directors beneficially owned approximately 14% of our outstanding shares of common stock, which aligns management’s objectives with our stockholders. |

Capital Expenditures

Our efforts in 2008 were mainly focused on evaluating our existing assets to determine the best areas and techniques for development. This evaluation included a comprehensive and meticulous review of our asset base and core operating areas, our geological and geophysical data, reserves data and extensive land and title review and evaluation, which resulted in part to the increase in proved reserves reported. For 2009, our estimated capital expenditure budget is $10.0 million, and we intend to focus our drilling program primarily on the Austin Chalk, Buda, Georgetown, Eagleford and Wilcox formations in the Giddings Field where we currently have an inventory of 27 horizontal wells to drill with laterals that range from 500 feet to 5,000 feet. The capital expenditure budget includes an estimated $5.5 million for the Giddings Field horizontal wells, $4.0 million for the Blue Moon Exploration joint venture project focused in Texas and Louisiana, and $0.5 million for Matagorda Bay completion activities. Our 2009 capital expenditure budget presently excludes acquisitions, but may include installation of gathering system infrastructure and pipeline hookups and the acquisition of geophysical operations, including seismic data.

Due to current capital and credit market conditions in which numerous financial institutions have effectively restricted current liquidity within the capital markets throughout the United States and around the world, we cannot be certain that funding will be available to us in required amounts or on acceptable terms. To the extent we access credit or capital markets in the near term, our ability to obtain terms and pricing similar to its existing terms and pricing may be limited. Our current cash balances and cash flow from operations will not provide adequate working capital to fully fund our 2009 capital expenditure budget, and we intend to pursue potential debt and/or equity financing and to evaluate other alternatives, such as joint ventures with third parties or sales of interests in one or more of our properties in order to fund our capital expenditures. Such transactions may result in a reduction in our operating interests or require us to relinquish the right to operate the property. We also plan to renegotiate and/or refinance our existing secured debt, which includes approximately a $7.0 million senior secured bridge note and approximately $9.0 million in notes outstanding under our credit facility, which mature in September 2009 and December 2009, respectively. Entry into a new credit facility is expected to result in increased interest expense, and there can be no assurance that the borrowing base will remain at the current level. There can be no assurance that any such transactions can be completed or that such transactions will satisfy our operating capital requirements. If we are not successful in obtaining sufficient funding or completing an alternative transaction on a timely basis on terms acceptable to us, we could be required to curtail our expenditures or restructure our operations, and we would be unable to implement our original exploration and drilling program, either of which could have a material adverse effect on our business, financial condition and results of operations. Our capital expenditure budget may be modified depending upon commodity prices and market conditions.

Recent Developments

New Management Team and Relocation of Corporate Headquarters

On June 24, 2008, we announced that Michael Pawelek, South Texas Oil Company’s current Chairman of the Board, was named as our Chief Executive Officer and President. Additionally, Wayne Psencik was appointed as Executive Vice President and Chief Operating Officer, and Sherry Spurlock was appointed as Executive Vice President and Chief Financial Officer. The management change was an internally planned succession. Additionally, Theodore J. Wicks was appointed Executive Vice President of Corporate Development in October 2008 and Robert W. Kuehner was appointed Vice President of Land Management in August 2008. Effective July 1, 2008, South Texas Oil Company moved its corporate headquarters to 300 East Sonterra Boulevard, Suite 1220, San Antonio, Texas 78258. Our office number is (210) 545-5994 and the fax number is (210) 545-3317.

Senior Secured Bridge Financing

On September 19, 2008, we closed a $7.0 million bridge financing with the Longview Marquis Master Fund, L.P. (“Marquis”) in the form of a senior secured note of which $6.75 million was available to us for general working capital purposes. The senior secured note carries an interest rate of 12.5% per annum payable quarterly in cash and matures in September 2009.

Subsequent Events

$26.1 Million Debt Restructuring and Non-Core Asset Divestitures

On February 23, 2009, we announced a comprehensive debt restructuring and related agreements with The Longview Fund L.P. (“Longview”), which will extinguish 62% of our existing notes payable under our credit facility and our senior secured debt. The definitive agreements with Longview provide that Longview will restructure $26.1 million of debt (plus accrued interest) through (i) the payment of $16.3 million in debt (plus accrued interest) held by Longview in exchange for 1.6 million shares of our Series A Convertible Preferred Stock and (ii) a debt/non-core asset exchange between us and Longview valued at $9.8 million.

Pursuant to a securities exchange agreement, we will issue to Longview approximately 1.6 million shares of Series A Convertible Preferred Stock in exchange for the surrender and cancellation of approximately $16.3 million of notes payable held by Longview. Each share of Series A Convertible Preferred Stock has a stated value equal to $10.00 per share, has no coupon rate, does not pay dividends, and has no voting rights. The shares of Series A Convertible Preferred Stock are convertible into shares of our common stock at any time subsequent to 90 days after the issuance of the shares at a conversion price of $0.50 per share of common stock. Stockholders holding more than a majority of our outstanding common stock (approximately 59.36%) have approved the creation and issuance of the shares of Series A Preferred Stock to Longview, and we have filed an information statement with the Securities and Exchange Commission (the “SEC”), which is subject to SEC review. Following SEC review, we will provide notice to all of our stockholders that did not consent to such action, by delivery of an Information Statement prepared pursuant to Section 14 of the Securities Exchange Act of 1934 (the “Exchange Act”), and the exchange will close a minimum of 20 days following the mailing of the Information Statement to our stockholders.

We also entered into a definitive asset purchase and sale agreement with Longview sell our Colorado DJ Basin property and our Unit U34 drilling rig and associated assets to Longview for a combined total of $9.8 million. Subject to the terms and conditions of the purchase and sale agreement, on the closing date, we have agreed to convey these assets to Longview in exchange for Longview’s discharge and satisfaction of $9.8 million in debt. The Colorado property disposition includes our entire 37.5% non-operated working interest in 23,111 gross (8,666 net) acres located in Logan County, Colorado. The DJ Basin property includes approximately 217,000 Boe of proved reserves and an estimated 18 Boe/d of net production.

Closing of both transactions is subject to customary closing conditions and SEC review of our Information Statement on Schedule 14C. The final closing price will reflect typical closing and post-closing adjustments. Following the closing of both transactions, our remaining senior secured debt Marquis will be approximately $16.0 million.

Properties

As of December 31, 2008, we controlled approximately 46,502 gross (27,532 net) acres and operated approximately 124 producing well bores located throughout 14 counties and/or parishes in Texas, Louisiana, Colorado and the Gulf Coast. Our properties are located in the following areas in the United States:

| | · | Giddings Field, which is located in south central Texas, and includes the Bastrop, Brazos, Burleson, Fayette, Gonzales, and Lee Counties, Texas; |

| | · | Big Foot Field, which is located in south central Texas and includes the Atascosa and Frio Counties, Texas; |

| | · | DJ Basin, which is located in Logan County, Colorado (which properties we have subsequently agreed to divest); |

| | · | Gulf Coast, which includes our Matagorda Bay wells in the shallow state waters of Matagorda and Calhoun Counties, Texas; and |

| | · | Louisiana, which includes projects with Blue Moon Exploration in Assumption, Lafourche and Terrebonne Parishes, Louisiana. |

As of December 31, 2008, we controlled approximately 16,655 gross (14,142 net) acres, which included 47 producing well bores with net production of approximately 212 Boe/d in the Giddings Field. Our Giddings Field is 100% operated, and we hold an approximate 86% working interest. The majority of our proved reserves are located in the Giddings Field. As of December 31, 2008, we have identified 27 horizontal wells to drill from existing wellbores or offset locations that we have leased. We also possess approximately 70 linear miles of 2-D seismic data. For 2009, our capital expenditure budget includes $5.5 million for the Giddings Field horizontal well development program. Our development program within the Giddings Field is focused on lower risk, repeatable drilling opportunities to grow cash flow and reserves. Horizontal well drilling provides increased exposure to the formation in order to increase the flow rate and to recover additional oil and natural gas reserves not recoverable from the existing vertical wellbores. Horizontal drilling also allows multiple fracture zones, which are not connected, to be developed by a single well.

Our acreage position in the Giddings Field covers the Bastrop, Brazos, Burleson, Fayette and Lee, Counties, Texas. Our acreage leasehold primarily covers the updip, shallow side of the Giddings Field, which is an oil-prone area. The primary target formations of the 27 identified horizontal wells are the Austin Chalk, Buda, Georgetown, Eagleford and Wilcox. These formations are generally characterized by high initial production rates and steep decline rates, with first year production declines approaching approximately 60%. Well logs and seismic data indicate fracture systems striking in a NE-SW direction, which are separated by non-fractured carbonate. The Austin Chalk covering our acreage in the Giddings Field ranges from 150 feet to 750 feet in thickness, and consists of interbedded chalk and marl (limestone with shale).

The Giddings Field, is a 10- to 20- mile-wide trend extending from Mexico through Central Texas and into northwest Louisiana. The primary producing reservoir is the Austin Chalk (Upper Cretaceous, 85-90 million years old), with secondary production from the Taylor (Upper Cretaceous) and deeper Buda and Georgetown Formations (Lower Cretaceous 98-105 million years old). The Austin Chalk is subdivided into upper, middle and lower zones, with a vertical depth ranging between 6,000 and 12,000 feet. The Austin Chalk, Buda and Georgetown formations are a naturally fractured carbonate reservoir, with limited matrix porosity (1-5%) and permeability (0.003-0.03 md). Most hydrocarbon production in the Austin Chalk comes from an extensive network of fractures. The first commercial discovery in the Austin Chalk was made in Texas in 1923 at Luling Field, followed by the Pearsall Field in 1935, then the Giddings Field in 1960. The Giddings Field has historically produced over 1.5 billion Boe.

Our Big Foot Field is located in Frio and Atascosa Counties, Texas. The Big Foot Field was first discovered by Shell Oil Company in 1949, has produced over 5 million Boe and is characterized as a shallow, oily play. The primary producing formations are the Olmos B and Olmos D sands, which range in depth from 3,100 feet to 3,600 feet. We have 73 wells cumulatively producing approximately 30 barrels of oil net per day (Bopd), with a 100% working interest in 4,050 acres. South Texas Oil recently completed two re-fracs in two separate wells which previously were completed and producing. These wells were marginal producers pumping from 0.25 to 0.5 Bopd each. After fracture stimulation utilizing modern techniques, one of the wells is pumping at a stabilized rate of approximately 7 Bopd, up from 0.5 Bopd. Our geological and geophysical staff has initially identified 20 additional wells for potential workover activity. Our anticipated Big Foot Field refrac program could increase production and return shut-in wellbores to producing status. In addition to our workover activity, most of our existing wells in the Big Foot Field were drilled on 20-acre spacing, providing us with at least 40 additional infill drilling locations based on 10-acre well density.

As of December 31, 2008, South Texas Oil controlled approximately 23,111 gross (8,666 net) predominantly contiguous acres in the DJ Basin in Logan County, Colorado, in which it has approximately a non-operated, 37.5% net working interest. Current net production is approximately 18 Boe/d from four producing wells, or 7% of our daily production. We recently entered into a definitive asset purchase and sale agreement with Longview to divest our Colorado DJ Basin property and our Unit U34 drilling rig and associated assets to Longview for a combined total of $9.8 million. See “—Recent Developments—$26.1 Million Debt Restructuring and Non-Core Asset Divestitures”.

We control 2,240 gross (652 net) acres in shallow Texas state waters in Matagorda Bay, in which we currently have identified four exploratory prospects from a 120-square-mile 3-D seismic survey. As of June 2008, we agreed to contract operate the Matagorda Bay properties on behalf of Sonterra Resources, Inc., and we operate the Matagorda Bay wells and hold a working interest of approximately 20.5% and 37.5% on well #127-1 and well #150-1ST1, respectively. As of December 31, 2008, we drilled, cased and cemented two directional wells in Matagorda Bay, which are currently undergoing completion procedures. These wells were drilled with a barge rig in shallow Texas state waters (10-15 feet water depth) in Calhoun County, Texas. Target formations in the Frio sands are the Bolmex, Melbourne and Nodosaria which range from 8,500 feet to 12,500 feet. Total measured depth (TMD) for well #127-1 reached 12,464 feet in August 2008 and for well #150-1STI reached 10,260 feet in November 2008. Well #127-1 was a new exploratory drill and well #150-1ST1 was a side-track re-entry development well. Diagnostic well log analysis indicates multiple natural gas and condensate pay zones. A 1-mile gas sales pipeline is permitted.

We currently have leasehold acreage and are pursuing leases in Assumption, Lafourche and Terrebone Parishes, Louisiana. As part of our joint venture project agreement with Blue Moon Exploration, we are strategically focused on expanding our operations and developing oil and natural gas prospects throughout Louisiana. These prospects, which we anticipate operating, primarily target the Miocene formations. As of December 31, 2008, we leased 446 gross (22 net) acres in Lafourche Parish.

Drilling Activity

The following table sets forth the results of our drilling activities, which include the number and type of wells that we drilled during the years ended December 31, 2008, 2007 and 2006:

| | | Years Ended December 31, | |

| | | 2008 | | | 2007 | | | 2006 | |

| | | Gross1 | | | Net1 | | | Gross | | | Net | | | Gross | | | Net | |

| | | | | | | | | | | | | | | | | | | |

| Development wells, completed as: | | | | | | | | | | | | | | | | | | |

| Productive | | | 1.0 | | | | 0.93 | | | | 9.0 | | | | 6.43 | | | | 3.0 | | | | 1.87 | |

| Non-Productive | | | - | | | | - | | | | 3.0 | | | | 2.38 | | | | - | | | | - | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Exploratory wells, completed as: | | | | | | | | | | | | | | | | | | | | | | | | |

| Productive | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| Non-Productive | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| Total | | | 1.0 | | | | 0.93 | | | | 12.0 | | | | 8.81 | | | | 3.0 | | | | 1.87 | |

| (1) | Does not include 3.0 gross (1.58 net) wells that were in the process of being completed as of December 31, 2008. |

Developed and Undeveloped Acreage

The following table sets forth our developed and undeveloped gross and net leasehold acreage, including options to acquire leasehold acreage, as of December 31, 2008:

| | | Developed Acreage | | | Undeveloped Acreage | | | Total Acreage | |

| Location | | Gross | | | Net | | | Gross | | | Net | | | Gross | | | Net | |

| | | | | | | | | | | | | | | | | | | |

| Giddings Field | | | 10,532 | | | | 8,607 | | | | 6,123 | | | | 5,535 | | | | 16,655 | | | | 14,142 | |

| Big Foot Field | | | 3,972 | | | | 3,972 | | | | 78 | | | | 78 | | | | 4,050 | | | | 4,050 | |

| Matagorda Bay | | | 2,240 | | | | 652 | | | | - | | | | - | | | | 2,240 | | | | 652 | |

| DJ Basin | | | 2,700 | | | | 1,013 | | | | 20,411 | | | | 7,653 | | | | 23,111 | | | | 8,666 | |

| Louisiana | | | | | | | | | 446 | | | | 22 | | | | 446 | | | | 22 | |

| Total Acreage | | | 19,444 | | | | 14,244 | | | | 27,058 | | | | 13,288 | | | | 46,502 | | | | 27,532 | |

We use the successful efforts method of accounting for our oil and natural gas properties. Exploration costs such as exploratory geological and geophysical costs and delay rentals are charged against earnings as incurred. The costs to acquire, drill and equip exploratory wells are capitalized pending determinations of whether proved reserves can be attributed to our interests as a result of drilling the well. If management determines that commercial quantities of oil and natural gas have not been discovered, costs associated with exploratory wells are charged to exploration expense. Costs to acquire mineral interests, to drill and equip development wells, to drill and equip exploratory wells that find proved reserves, and related costs to plug and abandon wells and costs of site restoration are capitalized.

Depletion, depreciation and amortization of proved oil and natural gas properties is computed using the units of production method based on proved reserves. Sales of entire interests in proved and unproved properties, and sales of partial interests of proved properties result in the recognition of gains or losses. Sales of partial interests of unproved properties are generally treated as a recovery of the cost of the interests retained.

Capitalized costs of our proved and unproved properties at December 31, 2008 and 2007 are summarized as follows:

| | | December 31, | |

| | | 2008 | | | 2007 | |

| | | | | | | |

| Proved properties | | $ | 49,489,536 | | | $ | 23,383,575 | |

Less accumulated depreciation, depletion and amortization | | | (9,656,545 | ) | | | (5,727,612 | ) |

Net proved properties | | | 39,832,991 | | | | 17,655,963 | |

| | | | | | | | | |

| Unproved properties: | | | | | | | | |

Oil and gas leasehold costs | | | 944,359 | | | | 30,757,344 | |

| Drilling in progress | | | 4,924,395 | | | | - | |

| | | | 5,868,754 | | | | 30,757,344 | |

| | | | | | | | | |

| Net capitalized costs | | $ | 45,701,745 | | | $ | 48,413,307 | |

Production

Our oil and natural gas production volumes and average sales price for the years ended December 31, 2008, and 2007 are as follows:

| | | Years Ended December 31, | |

| | | 2008 | | | 2007 | |

| | | | | | | |

| Natural gas production (MMcf): | | | 153.9 | | | | 291.7 | |

| Oil production (MBbl) | | | 77.1 | | | | 121.1 | |

| Equivalent production (MBoe) | | | 102.7 | | | | 169.7 | |

| | | | | | | | | |

| Average price per unit: | | | | | | | | |

Natural gas (per Mcf) | | $ | 10.32 | | | $ | 3.40 | |

Oil (per Bbl) | | $ | 99.61 | | | $ | 35.99 | |

Equivalent (per Boe) | | $ | 90.14 | | | $ | 31.53 | |

Delivery Commitments

At December 31, 2008, we had no delivery commitments with our purchasers.

At December 31, 2008, our estimated total proved oil and natural gas reserves, as prepared by Forrest A. Garb & Associates Inc., an independent reserve engineering firm, were approximately 5.1 million barrels of oil equivalent, consisting of 3.1 million barrels of oil, and 12.1 billion cubic feet of natural gas. Approximately 12% of our proved reserves were classified as proved developed and 88% as proved undeveloped. We maintain operational control of approximately 96% of our proved reserves. The PV-10 value of our total proved reserves was approximately $70.3 million based on benchmark commodity prices as of December 31, 2008, which were $44.60 per barrel of oil and $5.71 per MMBtu of natural gas. For the year ended December 31, 2008, we produced 102.7 thousand barrels of oil and natural gas equivalent (MBoe). We booked a higher quantity of proved undeveloped locations due to what we believe is the lower-risk nature of these reserves as demonstrated through analogous well data from long-term historical production in the immediate areas that were evaluated. The majority of the low-risk proved undeveloped (PUD) locations are located in the Giddings Field, which has demonstrated reliable production and reservoir characteristics for us and other operators over the years.