1

South Texas Oil Company

Management Presentation

IPAA OGIS – New York

April 20-22, 2009

Michael J. Pawelek

Chairman & CEO

Forward-Looking Statements

This communication may contain “forward-looking statements” within the meaning of the federal securities laws, including statements regarding planned capital expenditures (including the amount and nature thereof), estimates of future production, the number of wells we anticipate drilling in 2009 and beyond, availability and costs of drilling rigs and other oil field services, the number and nature of potential drilling locations, our growth strategies, anticipated trends in our business, our future results of operations, estimates regarding future net revenues from oil and natural gas reserves and the present value thereof, estimates, plans and projections relating to acquired properties, quality and nature of our asset base, our ability to successfully and economically explore for and develop oil and gas resources, market conditions in the oil and gas industry, the assumptions upon which estimates are based and other expectations, beliefs, plans, objectives, models, strategies, assumptions or statements about future events or performance often, but not always, using such words as “expects,” “anticipates,” “plans,” “estimates,” “seeks,” “believes,” “hopes,” “predicts,” “envisions,” “intends,” “potential,” “possible,” “probable,” “opportunities,” “confident,” or stating that certain actions “may,” “will,” “should,” or “could,” be taken, occur or be achieved ("forward-looking qualifiers"). Statements concerning oil and gas reserves also may be deemed to be forward-looking statements in that they reflect estimates based on certain assumptions that the resources involved can be economically exploited and other assumptions.

All forward-looking statements contained in this communication (whether or not accompanied by a forward looking qualifier) are based on current expectations, plans, estimates and projections that involve a number of risks and certainties, which could cause actual results to differ materially from those reflected in the statements. These risks include, but are not limited to, the risks of the oil and gas industry (for example, operational risks in exploring for, developing and producing crude oil and natural gas; risks and uncertainties involving geology of oil and gas deposits; the uncertainty of reserve estimates; the uncertainty of estimates and projections relating to future production, costs and expenses; potential delays or changes in plans with respect to exploration, development projects or capital expenditures; and health, safety and environmental risks); uncertainties as to the availability and cost of financing; fluctuations in oil and gas prices; risks related to our hedging program; inability to realize expected value from acquisitions; inability of our management team to execute its plans to meet its goals; loss of services of our management team; inability to replace oil and gas reserves; shortage of drilling equipment, oil field personnel and services; and unavailability of gathering systems, pipelines and processing facilities. All forward-looking statements contained in this communication (whether or not accompanied by a forward-looking qualifier) are based on the estimates, opinions and beliefs of our management at the time the statements are made and should be considered approximations unless specifically indicated otherwise. We assume no obligation to update forward-looking statements should circumstances or our management’s estimates or opinions change. Unless the context otherwise indicates, when we refer to “South Texas,” the “Company,” “us,” “we,” “our,” “ STXX” or “ours” in this presentation, we are describing South Texas Oil Company, together with its subsidiaries.

The SEC generally permits oil and gas companies to disclose in their filings with the SEC only proved reserves, which are reserve estimates that geological and engineering data demonstrate with reasonable certainty to be recoverable in future years from known reservoirs under existing economic and operating conditions. In this presentation, South Texas uses the term “resource potential” which could be equated with “probable” and “possible” reserves. SEC guidelines prohibit probable and possible reserves from being included in filings with the SEC. Probable reserves are unproved reserves which are more likely than not to be recoverable. Possible reserves are unproved reserves which are less likely to be recoverable than probable reserves. Resource potential includes both types of reserves. Estimates of probable and possible reserves which may potentially be recoverable through additional drilling or recovery techniques are by their nature much more uncertain than estimates of proved reserves and accordingly are subject to substantially greater risk of not actually being realized by the Company. In addition, our production forecasts and expectations for future periods are dependant upon many assumptions, including estimates of production decline rates from existing wells and the undertaking and outcome of future drilling activity, which may be affected by significant commodity price declines or drilling costs increases.

2

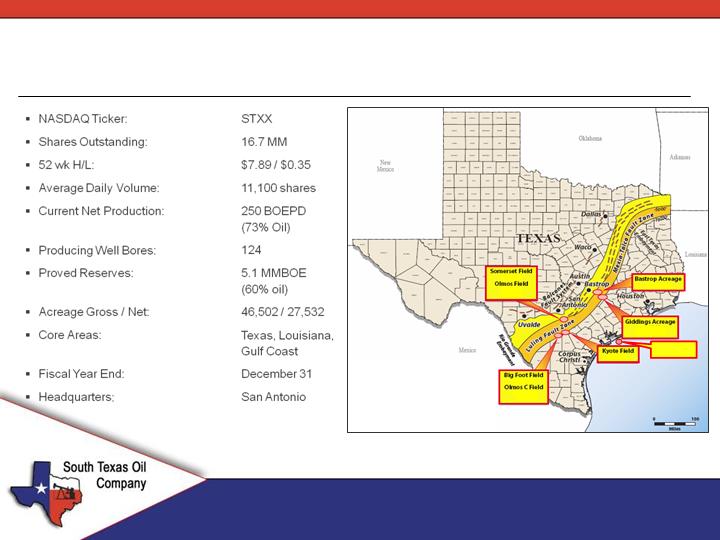

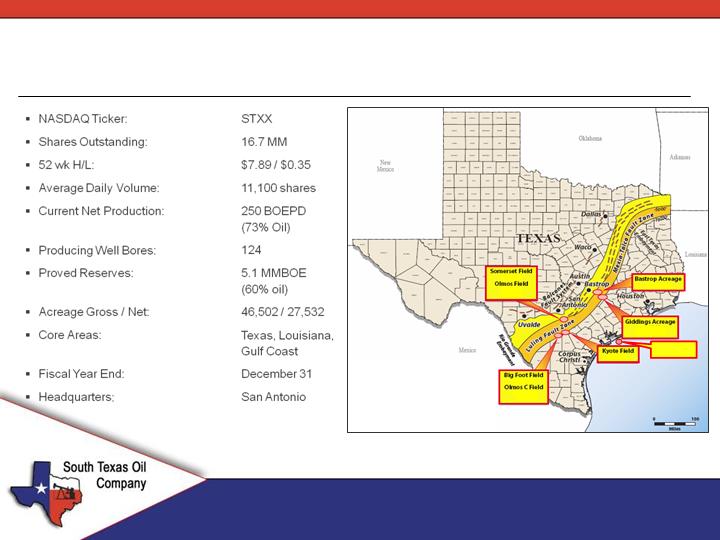

Company Overview

San Antonio-based South Texas Oil Company (NASDAQ: STXX) is an independent

energy company engaged in the acquisition, production, exploration and

development of crude oil and natural gas. Our core operating areas include Texas,

Louisiana and the Gulf Coast.

South Texas Oil controls a large inventory of lower-risk developmental / exploitation

locations and higher-risk, high-reward exploration prospects. The Company

leverages its geological and geophysical strengths by acquiring high-quality,

operated properties and further enhances an asset's value through field-level cost

reduction. It continually evaluates producing property acquisition opportunities

complementary to its core operating areas.

3

Company Profile

4

Giddings

CO

Matagorda

Bay

All data as of 12/31/08, except share data

Corporate Strategy

5

Develop Our Existing Properties

Core Areas: South Texas (Giddings, Bastrop and Big Foot Fields), and Matagorda Bay

Create reserve and production growth from our identified drilling locations

~27,000 net acres controlled

Divest non-core assets

Maximize Operational Control

Operate 100% of assets except DJ Basin

Maintain substantial working interest

Pursue Selective Acquisitions and Joint Ventures

Blue Moon JV

Reduce Costs Through Economies of Scale and Efficient Operations

Recent Developments

6

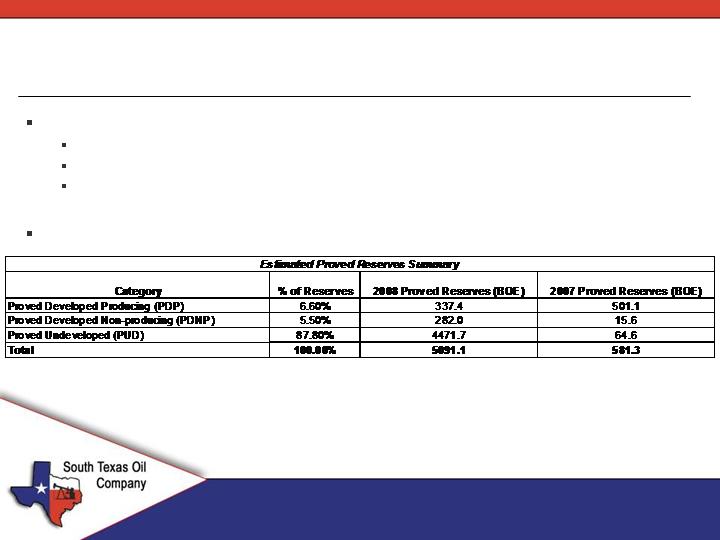

2008 Total Proved Reserves of 5.1 MMBoe, up from 0.581 MMBoe in 2007

Restructured $26.1MM in Debt

2009 Cap-Ex Budget of $10.0MM

New Management Team June 2008

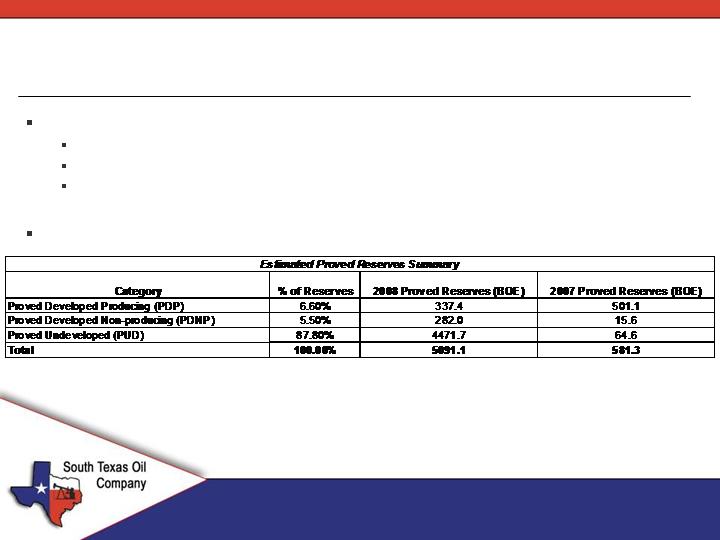

2008 Proved Reserves

7

As of December 31, 2008, Total Proved Reserves of 5.1 MMBoe

3.1 million barrels of oil and 12.1 billion cubic feet of natural gas

Reserve mix is approximately 60% crude oil

12% proved developed and 88% PUD

SEC PV-10 Value of $70.3MM*, up from $18.3MM in 2007

Reserves are Engineered by Forrest A. Garb & Associates, Inc.

*Reconciliation of PV-10 to standardized measure of cash flows is available in the Company’s annual filing on Form 10-K

Debt Restructuring

8

Restructured $26.1MM of Debt with Convertible Preferred Stock and Debt/Asset

Exchange

Converted $16.3MM of Debt into Convertible Preferred stock

Perpetual preferred, no coupon or dividend, non-voting

Extinguished $9.8MM of Debt via Sale of DJ Basin Property and U34 Drilling

Rig

Non-core assets

Company-focus entirely on Giddings Field, Matagorda Bay and Blue Moon prospects

Subject to Customary Closing Considerations

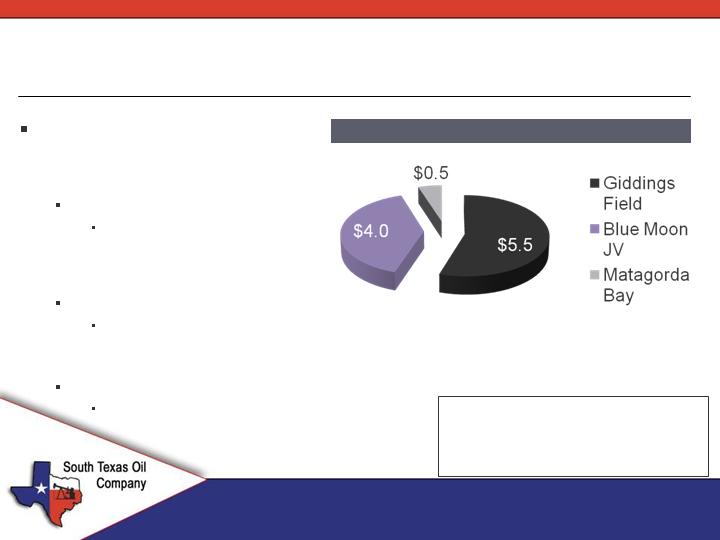

2009 Capital Expenditure Budget

9

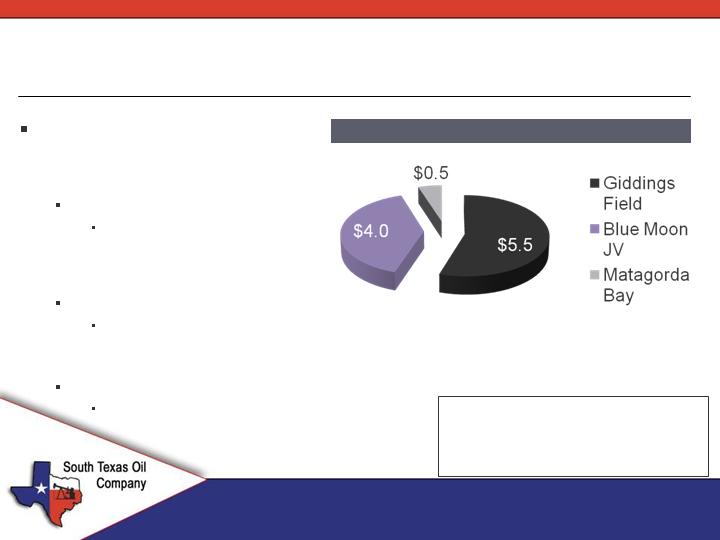

Board-approved 2009

CAPEX Budget of $10.0MM

Giddings Field

27 lateral development wells

for recompletion / re-entries

potential

Blue Moon Exploration JV

Varied-risk projects focusing

on Texas, Louisiana and GOM

Matagorda Bay

Completion activity

2009 Preliminary CAPEX* ($MM)

*The preliminary 2009 CAPEX budget excludes

acquisitions, but may include installation of gathering

system infrastructure and pipeline hookups, and

geophysical operations, including seismic data

acquisition. The CAPEX budget may be modified

depending upon commodity prices and market conditions.

Giddings Field Overview

10

Identified 27 new laterals and

low-cost re-entries to drill

Conventional redevelopment,

high IP rates with steep decline

47 producing wells

Net production 205 BOEPD

Acreage Leasehold

16,655 gross

14,142 net

100% Operated, ~80% WI

2009 CAPEX of $5.5MM

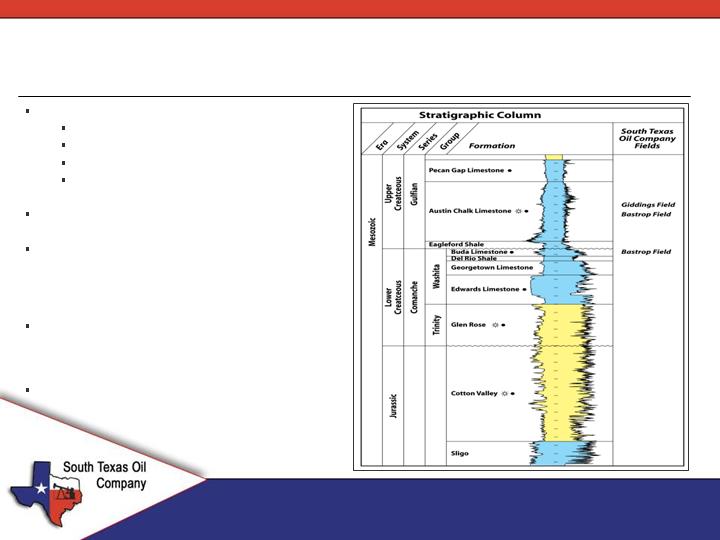

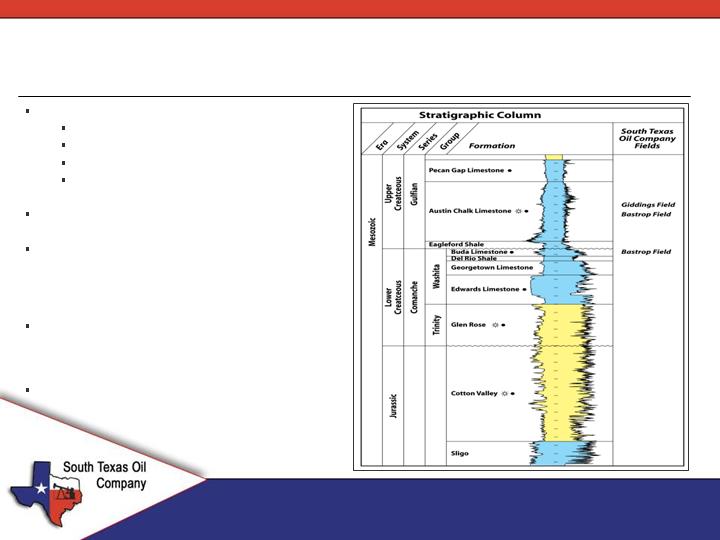

Giddings Field Geology

11

Target Formations (6,000’ – 12,000’):

Austin Chalk Limestone

Buda Limestone

Georgetown Limestone

Wilcox uphole potential

Naturally fractured, carbonate

Well log and seismic data indicate high

permeability fracture systems strike in an

NE-SW direction which are separated by

lower permeability Limestone

Horizontal drilling allows multiple fracture

zones, which are not connected, to be

developed by a single well

Giddings Field has historically produced over

1.5 Billion BOE

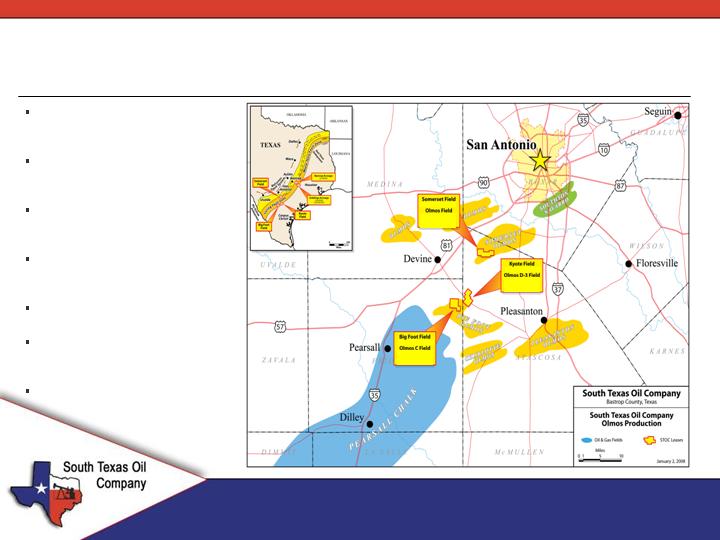

12

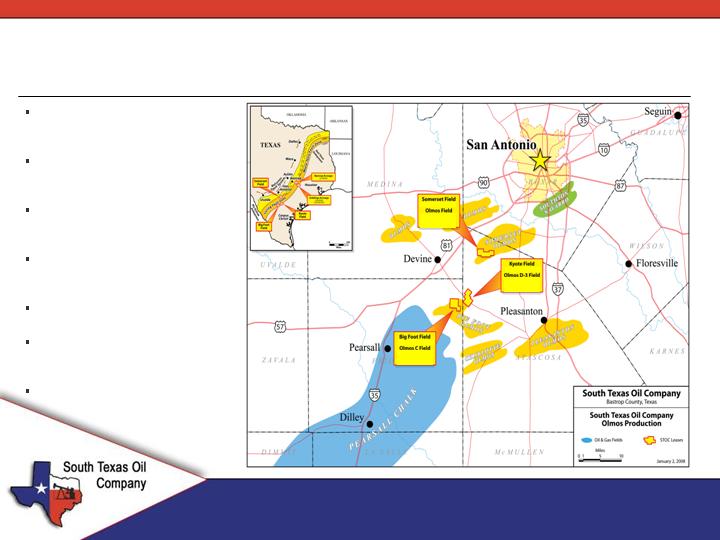

Shallow oil play located in Frio

and Atascosa Counties

Target Olmos B and Olmos D

formations (3,100’ – 3,600’)

73 wells cumulatively producing

30 BOPD

100% working interest in 4,050

net acres

Recently completed 2 re-fracs

20 additional wells identified for

workovers

Existing wells drilled on 20 acre

spacing, potential down spacing

Big Foot Field Overview

Blue Moon Exploration JV

13

Project Agreement announced in December 2008

Identify, lease and develop oil and gas prospects in Texas, Louisiana and the Gulf

of Mexico

Exclusive rights to first-look at all prospects

Option to operate with a minimum 25% WI

Access to all geological, geochemical, geophysical, seismographic and petroleum

engineering data which includes over 4,000 square miles of 3D seismic data and

3,500 miles of 2D seismic data

2009 CAPEX of $4.0MM

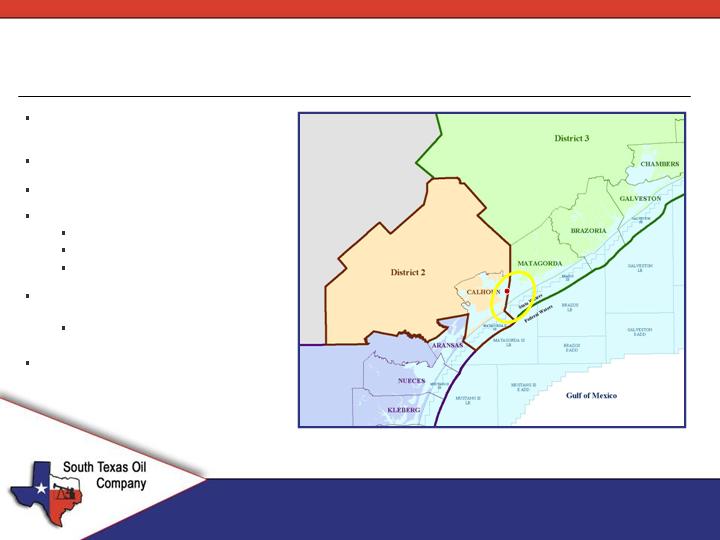

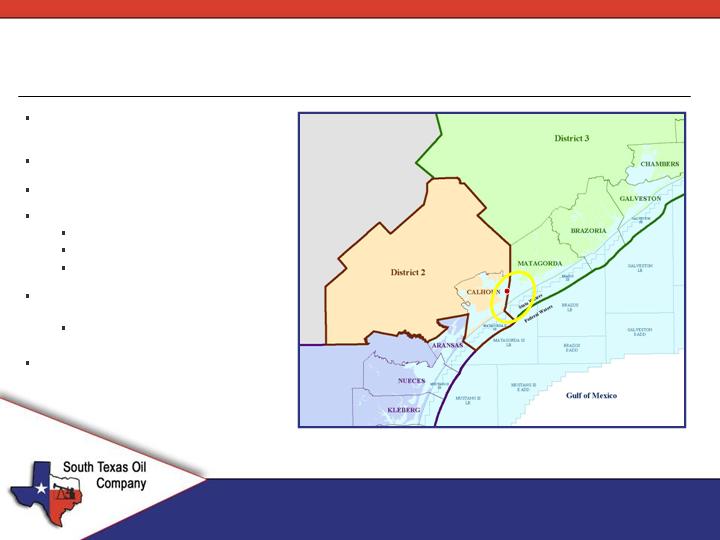

Matagorda Bay Overview

14

Shallow Texas state waters in Calhoun

County, drilled with a barge rig

STXX operates, WI ranges from 20% - 40%

Acreage leasehold 2,240 gross / 652 net

Target Formations (8,500’ – 12,500’):

Bolmex

Melbourne

Nodosaria

4 exploratory prospects identified from a

120 square mile 3D survey

Drilled 127-1 and 150-1 wells

2009 CAPEX of $0.5MM

Source: Texas RRC

Matagorda Bay Wells

15

Well 127-1

Commenced drilling in July 2008, reached TMD of 12,464

feet in August 2008

Successfully cased and cemented, no hurricane damage

Diagnostic well log analysis indicated multiple gas and

condensate pay zones

Completion operations underway in Nodosaria Formation

1-mile gas sales line permitted

STXX operates with ~20.5% WI

Well 150-1

Commenced drilling in November 2008, reached TMD of

10,260 feet in December 2008

Captured up-dip proved reserves in Bolmex Formation

Completion operations underway

STXX operates with ~37.5% WI

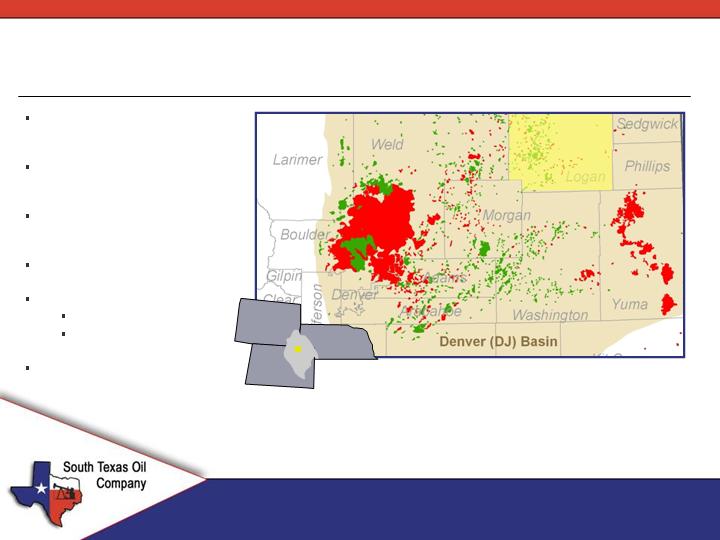

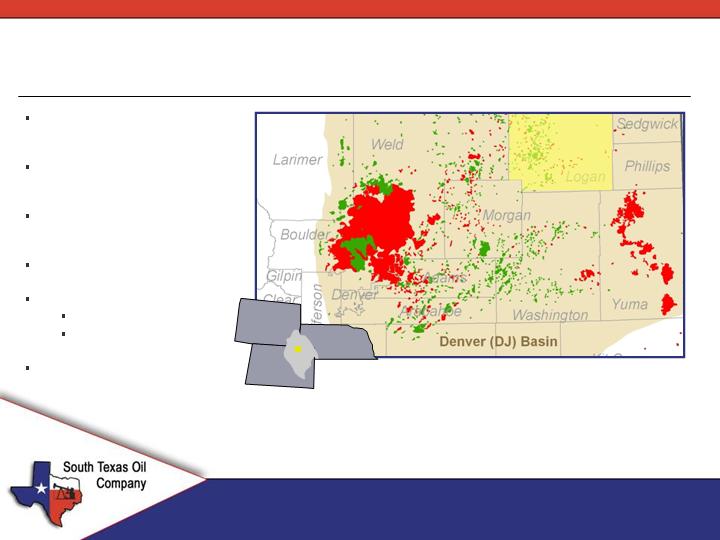

DJ Basin Overview

16

Located in Logan County,

northeastern Colorado

37.5% working interest, non-

operated

Current net production is 15

BOEPD from 4 producing wells

Geological evaluation completed

Acreage Leasehold

23,111 gross

8,666 net

Predominantly contiguous

CO

Denver

Julesburg

Basin

Source: COGCC

DJ

Basin

NE

CO

WY

Logan

Target Formations: D & J Sands

Management

17

Michael J. Pawelek, Chairman, President & CEO

27 years of experience in the oil and gas industry

Previous firms: Clayton Williams, TXO, Universal Seismic, Boss Exploration, Sonterra Resources

Geophysicist, BS degree in Engineering from Texas A&M University

Wayne A. Psencik, EVP Chief Operating Officer

22 years of experience in oil and gas operations

Previous firms: Chesapeake, El Paso, Coastal Oil & Gas, Boss Exploration, Sonterra Resources

BS degree in Petroleum Engineering from Texas A&M University

Sherry L. Spurlock, EVP Chief Financial Officer

25 years of experience in oil and gas financial management

Previous firms: Deloitte, Brigham Exploration, United Oil & Minerals, Boss Exploration, Sonterra Resources

CPA, BBA degree in Accounting from Stephen F. Austin State University

Theodore J. Wicks, EVP Corporate Development

15 years of experience in energy investment banking, accounting and finance

Previous firms: Petro Capital Group, First Albany Capital, SMH Capital, KeyBanc, RBC Capital Markets

MBA in Finance, BA degree in Accounting and Finance, both from University of St. Thomas

Robert W. Kuehner, VP Land

38 years of experience in Land Management

Previous firms: Union Oil Co of California, Hilliard Oil & Gas, Suburban Propane, Clayton Williams, Bob Kuehner & Co

BBA degree, Petroleum Land Management from University of Texas, AAPL Member since 1970

Board of Directors

18

Michael J. Pawelek, Chairman, President & CEO

27 years of experience in the oil and gas industry

Previous firms: Clayton Williams, TXO, Universal Seismic, Boss Exploration, Sonterra Resources

Geophysicist, BS degree in Engineering from Texas A&M University

Bryce W. Rhodes

Former President and CEO of Whittier Energy Corp (2003-2007). Joined Whittier in 1985

30 years of experience in the oil and gas industry

Doyle A. Valdez

President of Valco Resource Management Inc., an oil and gas production marketing firm since 1987

26 years of experience in the oil and gas industry

Previous firms: United Resources, EnerPro Inc.

Former President of the Austin Independent School District Board of Trustees

Stanley A. Hirschman

President of CPointe Associates, Inc. since 1997

Previous firms: Software Etc., T.J. Maxx, Gap Stores, Banana Republic

Member of National Association of Corporate Directors and KPMG Audit Committee Institute

David M. Lieberman

40 years of experience in financial and operations management. Extensive CFO experience. CPA

Previous firms: Price Waterhouse, Dalrada Financial, John Goyak & Assoc, JLS Services

Investment Highlights

19

Proven Record in Creating and Implementing Development Projects

Experienced Management Team and Technical Staff

Restructuring Successfully Underway, Strengthened Balance Sheet

Diverse Asset Base with High Level of Operating Control

Large Inventory of Lower Risk Development Opportunities

Significant Exploration Upside