UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

o Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

x Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material Pursuant to §240.14a-12

SOUTH TEXAS OIL COMPANY

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x No fee required.

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| | (1) Title of each class of securities to which transaction applies: |

| | (2) Aggregate number of securities to which transaction applies: |

| | (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) Proposed maximum aggregate value of transaction: |

¨ Fee paid previously with preliminary materials.

¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

SOUTH TEXAS OIL COMPANY

300 E. Sonterra Blvd., Suite 1220

San Antonio, Texas 78258

210-545-5994

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on September 2, 2009

Dear Stockholder:

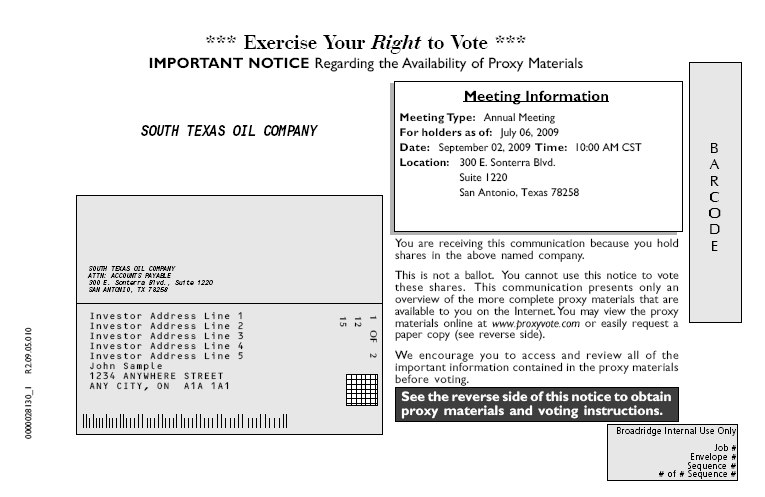

You are hereby notified that South Texas Oil Company will hold its Annual Meeting of Stockholders on Wednesday, September 2, 2009 at 10:00 a.m. Central Time in our offices, located at 300 E. Sonterra Blvd., Suite 1220, San Antonio, Texas 78258, for the following purposes:

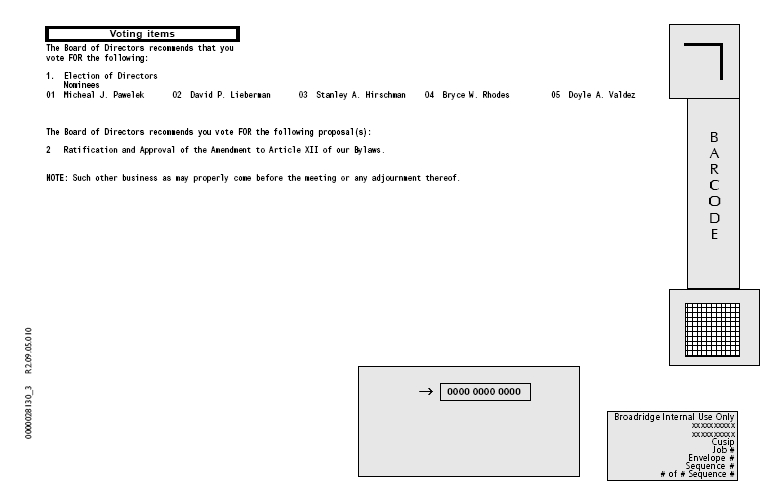

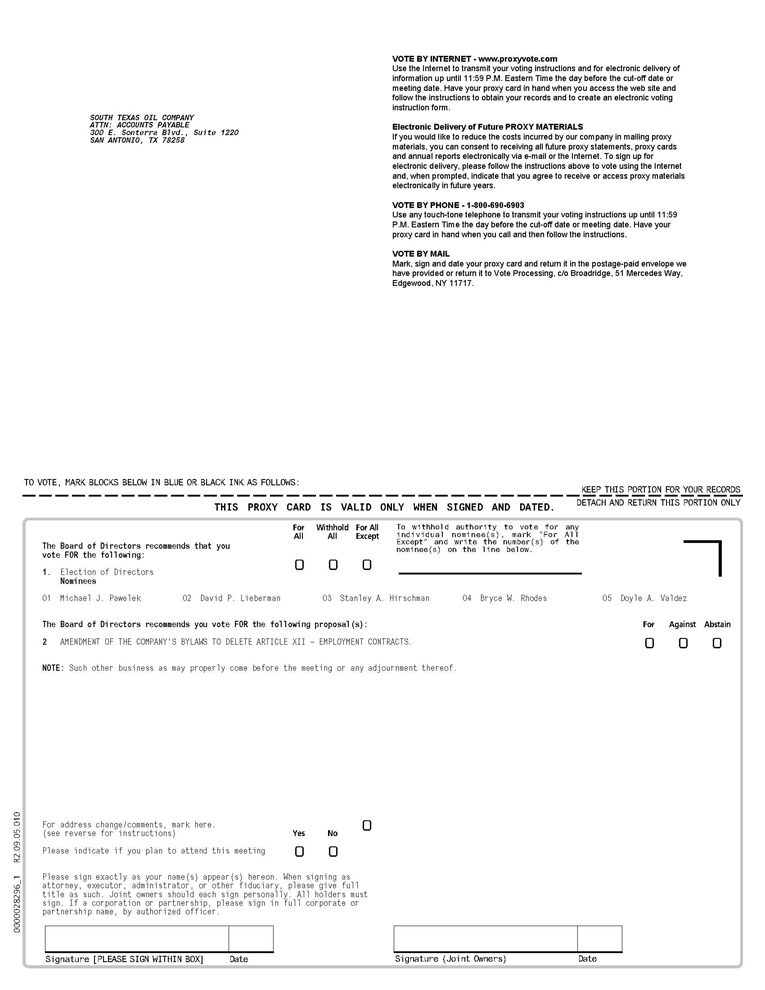

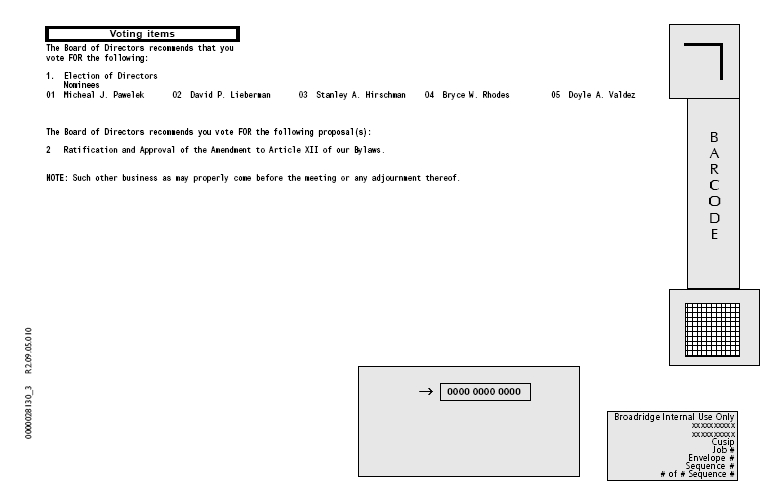

| | 1. | To elect the members of the Board of Directors of the Company to serve until the next annual meeting of the Company’s stockholders; |

| | 2. | To approve an amendment the Company’s Bylaws by the deletion of Article XII – Employment Contracts, which Article currently prohibits the Company from entering into binding employment contracts in excess of 90 days without obtaining the approval of a majority of our stockholders; and |

| | 3. | To transact such other business as may properly come before the meeting or any adjournment(s) thereof. |

Holders of record of the Company’s common stock as of the close of business on July 6, 2009 are entitled to notice of, and to vote at, the Annual Meeting. Your vote is important.

If you attend the Annual Meeting, you may vote your shares in person. However, even if you plan to attend the Annual Meeting, please complete, date, sign and return the enclosed proxy card in the enclosed postage paid envelope or vote by Internet or phone by following the instruction on the proxycard or the Notice of Internet Availability. Returning your proxy card will not limit your rights to attend or vote at the meeting. The prompt return of proxies will ensure that we obtain a quorum and will save us the expense of further solicitation.

| | By Order of the Board of Directors of |

| | South Texas Oil Company, |

| | |

| | /s/ Roy D. Toulan, Jr. |

| | |

| | Roy D. Toulan, Jr. |

| | Corporate Secretary |

San Antonio, Texas

July 24, 2009

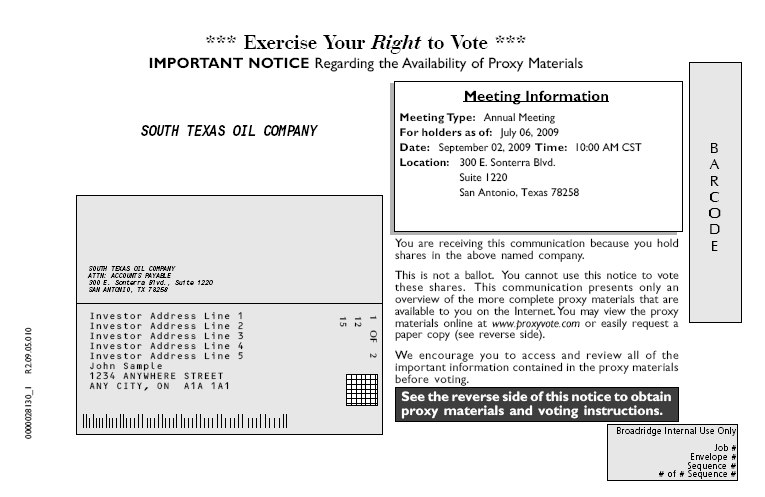

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON SEPTEMBER 2, 2009.

The proxy statement and annual report to security holders furnished to our stockholders prior to the annual stockholder meeting being held on September 2, 2009 are available at www.proxyvote.com.

SOUTH TEXAS OIL COMPANY

300 E. Sonterra Blvd., Suite 1220

San Antonio, Texas 78258

PROXY STATEMENT

FOR THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON SEPTEMBER 2, 2009

GENERAL INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

The Board of Directors of South Texas Oil Company is soliciting your proxy to vote your shares at our Annual Meeting of Stockholders (the “Annual Meeting”), at which we will give all of our stockholders of record the opportunity to vote on matters that will be presented at the Annual Meeting, which have been summarized in the notice of annual meeting of stockholders. Each proposal is described in more detail in this Proxy Statement, and this Proxy Statement provides you with information on these matters to assist you in voting your shares.

Date, Time and Place

The Annual Meeting will be held on Wednesday, September 2, 2009 at 10:00 a.m., Central Time, at our corporate headquarters, located at 300 E. Sonterra Blvd., Suite 1220, San Antonio, Texas 78258.

Record Date; Stockholders Entitled to Vote

The close of business on July 6, 2009 (the “Record Date”) has been established by the Board of Directors as the record date for the determination of stockholders entitled to notice of and to vote at the Annual Meeting or any adjournments or postponements of the Annual Meeting.

At the close of business on the Record Date, there were 16,788,862 shares of our common stock outstanding and entitled to vote held by approximately 6,627 holders of record and approximately 2,827 beneficial holders. Each share of our common stock entitles the holder to one vote at the Annual Meeting on all matters properly presented at the meeting.

A complete list of stockholders of record entitled to vote at the Annual Meeting will be available for examination by any stockholder at our headquarters at 300 E. Sonterra Blvd., Suite 1220, San Antonio, Texas 78258, for purposes pertaining to the Annual Meeting, during normal business hours for a period of ten (10) days prior to the Annual Meeting and at the Annual Meeting.

Quorum

A quorum, consisting of the holders of one-third of our outstanding shares entitled to vote, represented in person or by proxy, is required by our Bylaws before any action may be taken at the Annual Meeting. We count abstentions and broker “non-votes” as present and entitled to vote for the purposes of determining a quorum.

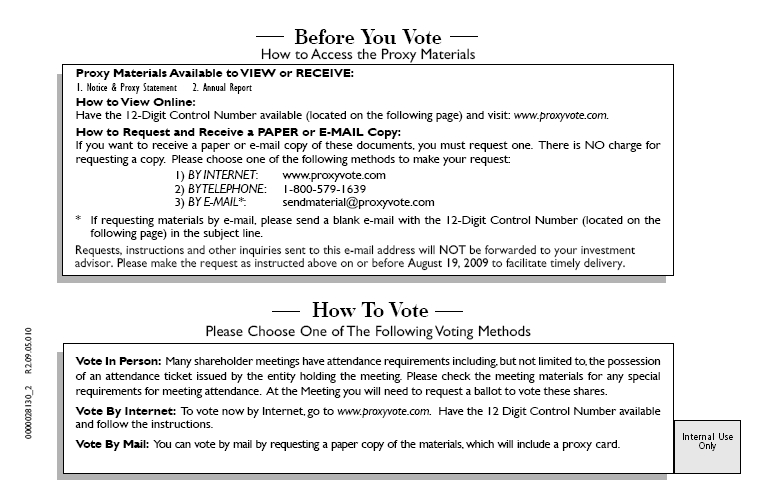

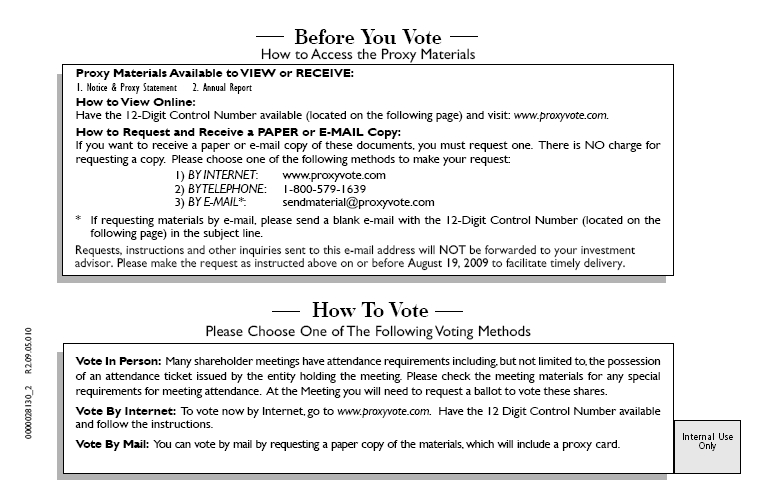

Internet Availability of Proxy Materials

Under rules adopted by the U.S. Securities and Exchange Commission (the “SEC”), we are furnishing proxy materials to our stockholders primarily via the Internet, instead of mailing printed copies of those materials to each stockholder. On July 24, 2009, we mailed to our stockholders (other than those who previously requested electronic or paper delivery) a Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access our proxy materials, including our proxy statement and our annual report, and to vote online or by telephone. If you would prefer to receive a paper copy of our proxy materials, please follow the instructions included in the Notice.

Broker Non-Vote

The NASDAQ Marketplace Rules permit brokers to vote their customers’ shares held in street name on routine matters when the brokers have not received voting instructions from their customers. Brokers may not vote their customers’ shares held in street name on non-routine matters unless they have received voting instructions from their customers. Non-voted shares on non-routine matters are called broker non-votes. Broker non-votes, although counted for purposes of determining the presence of a quorum, will have the effect of a vote neither for nor against such proposal.

Routine Matters

The election of directors is a routine matter on which brokers may vote even if they have not received instructions from their customers. Non-routine matters are matters such as stockholder proposals, although there are no stockholder proposals under consideration at the Annual Meeting.

Votes Required to Approve the Proposal to Elect Directors

Directors are elected by plurality vote. This means that the director nominees who receive the most votes will be elected to fill the available seats on the Board. Neither abstentions nor broker non-votes will have an effect on the votes for or against the election of a director.

Votes Required to Approve the Amendment to the Bylaws

Our bylaws typically may be amended by majority vote of our Board of Directors; however, Article XII—Employment Contracts of our bylaws may only be amended by the ratification and approval of a majority of our stockholders that hold a class or series of shares entitled to vote. Since the proposal to amend our bylaws affects the rights of stockholders to vote on a specific corporate action, the proposal is deemed to be a non-routine matter. Accordingly, broker non-votes, although counted for purposes of determining the presence of a quorum, will have the effect of a vote neither for nor against such proposal.

Votes Required to Approve Other Proposals (if any)

All other proposals, if any, will be approved if a majority of the shares present in person or by proxy are cast for the proposal. Shares represented by proxy which are marked “abstain” will count toward the number of shares present but will not count as an affirmative vote and, therefore, an abstention will have the effect of a vote against the proposal. Broker non-votes will not be considered present at the meeting with respect to the proposals and so will have no effect on the approval of proposals.

We are not aware of any matters that will be considered at the Annual Meeting other than the proposals to elect directors and to amend our bylaws. However, if any other matters arise at the Annual Meeting, the person named in your proxy will vote in accordance with his best judgment.

Voting of Proxies

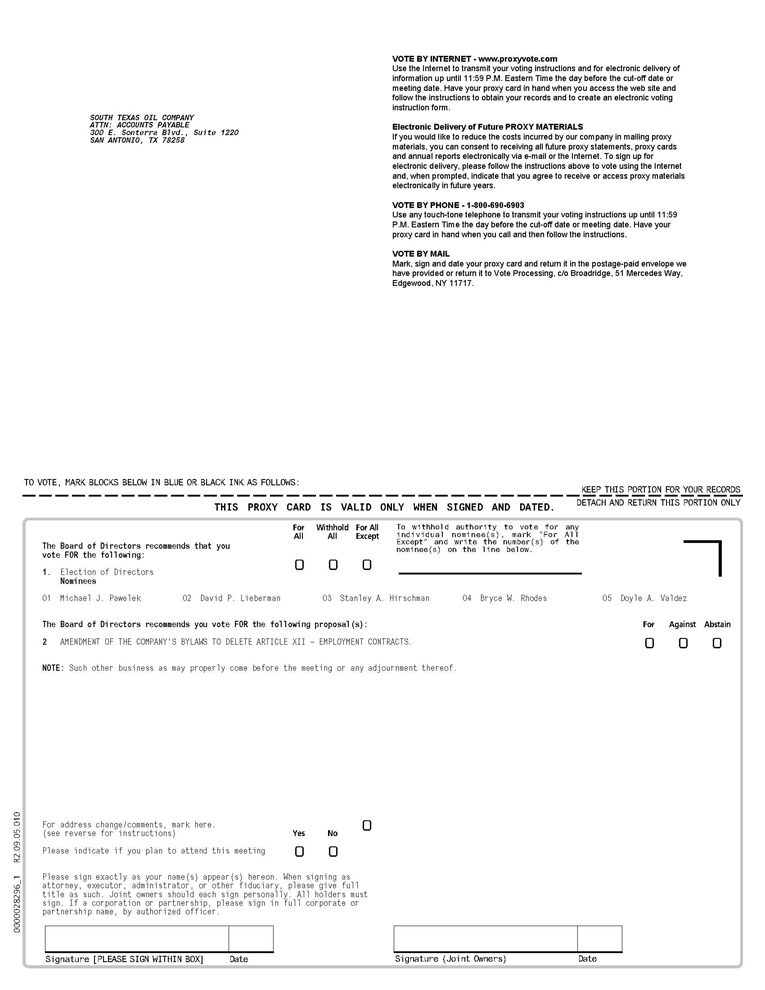

You may vote by mail, via the Internet, by phone or in person at the Annual Meeting. Giving a proxy means that you authorize the persons named in the Proxy Card to vote your shares at the Annual Meeting, in the manner directed by you.

| | · | Internet . You can submit a proxy over the Internet to vote your shares at the annual meeting by following the instructions provided either in the Notice or on the proxy card or voting instruction form you received if you requested and received a printed set of the proxy materials by mail. |

| | · | Telephone. If you requested and received a printed set of the proxy materials by mail, you can submit a proxy over the telephone to vote your shares at the annual meeting by following the instructions provided on the proxy card or voting instruction form enclosed with the proxy materials you received. If you received a Notice only, you can submit a proxy over the telephone to vote your shares by following the instructions at the Internet website address referred to in the Notice. |

| | · | Mail . If you requested and received a printed set of the proxy materials by mail, you can submit a proxy by mail to vote your shares at the Annual Meeting by completing, signing and returning the proxy card or voting instruction form enclosed with the proxy materials you received. |

The Internet voting procedures are designed to verify stockholders’ identities, allow stockholders to give voting instructions and confirm that their instructions have been recorded properly. Stockholders who vote by Internet or by phone need not return a Proxy Card by mail.

If you hold your shares in street name through a bank, broker or other intermediary, you are a “beneficial owner” of our common stock. In order to vote your shares, you must give voting instructions to your bank, broker or other intermediary who is the “nominee holder” of your shares. We ask brokers, banks and other nominee holders to obtain voting instructions from the beneficial owners of shares that are registered in the nominee’s name. Proxies that are transmitted by nominee holders on behalf of beneficial owners will count toward a quorum and will be voted as instructed by the nominee holder.

Every stockholder’s vote is important. Accordingly, you should provide your voting instructions to the Company by mail, phone or the Internet or to your broker or other nominee, whether or not you plan to attend the Annual Meeting in person.

Revoking Your Proxy or Changing Your Vote

Whether stockholders submit their proxies by Internet, phone or mail, a stockholder has the power to revoke his or her proxy or change his or her vote at any time prior to the date of the Annual Meeting. You can revoke your proxy or change your vote by:

| • | sending either (i) a written notice of the revocation of your proxy or (ii) an executed Proxy Card bearing a date later than the date of your previous proxy by mail to our Corporate Secretary, Roy D. Toulan, Jr., 300 E. Sonterra Blvd., Suite 1220, San Antonio, Texas 78258, for receipt prior to the Annual Meeting; |

| • | submitting another proxy by Internet or phone with a later date than your previous proxy (either by Internet, phone or mail) for receipt prior to the Annual Meeting; or |

| • | attending the Annual Meeting and voting in person, which will automatically cancel any proxy previously given. |

Solicitation of Proxies

This solicitation is being made on behalf of our Board of Directors. We will pay the costs related to the printing and mailing of the Notice, this Proxy Statement and soliciting and obtaining the proxies, including the cost of reimbursing brokers, banks and other financial institutions for forwarding proxy materials to their customers.

Attending the Meeting

Stockholders and persons holding proxies from stockholders may attend the Annual Meeting. If you plan to attend the Annual Meeting, please bring valid photo identification and proof of ownership of your shares of our common stock to the Annual Meeting. Examples of acceptable proof of ownership include a copy of the Proxy Card, a letter from your bank or broker stating that you owned shares of our capital stock as of the close of business on the Record Date, or a brokerage account statement indicating that you owned shares of our capital stock as of the close of business on the Record Date.

Dissenters Rights of Appraisal

None.

Stockholder Proposals

If a stockholder wishes to present a proposal to be included in our Proxy Statement for the 2010 Annual Meeting of Stockholders, the proponent and the proposal must comply with the proxy proposal submission rules of the Securities and Exchange Commission (“SEC”). We anticipate holding our 2010 Annual Meeting on or about May 15, 2010. One of the requirements to submit a proposal is that it be received by the Corporate Secretary within a reasonable time before we begin to print and send our proxy materials for the 2010 Annual Meeting. In light of the time required to prepare our proxy materials for printing and distribution, the proposals should be sent to us no later than December 31, 2009. Proposals we receive after that date will not be included in the 2010 Proxy Statement. We urge stockholders to submit proposals by Certified Mail—Return Receipt Requested.

A stockholder proposal not included in our proxy statement for the 2010 Annual Meeting of Stockholders will be ineligible for presentation at the 2010 Annual Meeting of Stockholders unless the stockholder gives timely notice of the proposal in writing to the Corporate Secretary of South Texas Oil Company at the principal executive offices of the Company, as described above. The stockholder’s notice must set forth, as to each proposed matter, the following: (a) a brief description of the business desired to be brought before the meeting and reasons for conducting such business at the meeting; (b) the name and address, as they appear on our books, of the stockholder proposing such business; (c) the class and number of shares of our securities that are beneficially owned by the stockholder; (d) any material interest of the stockholder in such business; and (e) any other information that is required to be provided by such stockholder pursuant to proxy proposal submission rules of the SEC. The presiding officer of the meeting may refuse to acknowledge any matter not made in compliance with the foregoing procedure.

You may obtain a copy of the current rules for submitting stockholder proposals from the SEC at:

U.S. Securities and Exchange Commission

Division of Corporation Finance

100 F Street, N.E.

Washington, DC 20549

or through the SEC’s Internet web site: www.sec.gov. Request SEC Release No. 34-40018, May 21, 1998.

PROPOSAL I

ELECTION OF DIRECTORS

Our directors are elected annually by the stockholders to serve until the next annual meeting of stockholders and until their successors are duly elected and qualified. The minimum number of directors is established by our Bylaws, and may be increased by the majority vote of the Board of Directors. The current authorized number of directors is five. Assuming the presence of a quorum, a plurality of the votes cast in person or by proxy at the Annual Meeting is required for the election of each director.

All five nominees are currently directors of the Company. Two of the Company’s current directors, Bryce Rhodes and Doyle Valdez, were elected as new directors to our Board at our 2008 Annual Meeting of Stockholders, held December 19, 2008. With the election of Messrs. Rhodes and Valdez, the number of independent directors serving on our Board increased to four. All five of our incumbent directors are standing for re-election.

The Board of Directors recommends that the five nominees listed below be elected to hold office until the next Annual Meeting of Stockholders or until their respective successors have been duly elected and qualified. There are no arrangements or understandings between any nominee and any other person pursuant to which any nominee was selected.

There were no third-party fees paid by us to assist in the process of identifying or evaluating candidates. If any nominee becomes unavailable for any reason, a substitute nominee may be proposed by our Board, unless the Board chooses to reduce the number of directors serving on our Board.

Nominees

Mr. Michael J. Pawelek (incumbent nominee), age 51, has been Chairman of the Board of Directors of the Company since November 2007 and serves on the Board’s Executive and Compensation committees. He has been Chief Executive Officer and President of the Company since June 23, 2008. Mr. Pawelek began his career as a geophysicist with Clayton Williams Company in 1981. From 1985 to 1989 he was employed by TXO Production Corporation as a district geophysicist. In 1989, he founded CPX Petroleum, which drilled over 60 wells under his management. From 1991 to 1999, he founded and was the chief executive officer of Universal Seismic Associates, Inc., which generated annual revenue of $65 million and had over 400 employees. From 1999 to 2001, he served as Vice President of Operations of Amenix USA, Inc., a private exploration and production company focused on oil and gas exploration in Louisiana. From 2001 to 2004, he held a similar position at IBC Petroleum, managing the company’s assets while seeking financial partners. From 2004 to 2007 he was President of BOSS Exploration & Production Corporation, a privately held Gulf Coast production company. Immediately prior to joining the Company as its CEO, Mr. Pawelek served as President of Sonterra Resources, Inc., a company that has oil and gas assets in Texas state waters in Matagorda Bay. Mr. Pawelek received a BS degree in Engineering from Texas A&M University.

Mr. David P. Lieberman, (incumbent nominee), age 64, has been a member of the Company’s Board of Directors since November 2007 and serves on the Board’s Audit Committee (Chairman and Financial Expert), Compensation and Nomination committees. Mr. Lieberman has been the Chief Financial Officer of Datascension, Inc., a telephone market research company that provides both outbound and inbound services to corporate customers, since January 2008 and a director of that company since 2006. He has over 40 years of financial experience beginning with five years as an accountant with Price Waterhouse, from 1967 through 1972. Mr. Lieberman has held executive management positions with both public and private companies, including serving in various senior executive positions, and he has a strong financial and operations background. From 2006 to 2007, he served as Chief Financial Officer of Dalrada Financial Corporation, a publicly traded payroll processing company based in San Diego. From 2003 to 2006, he was the Chief Financial Officer for John Goyak & Associates, Inc., a Las Vegas-based aerospace consulting firm. In the 1990s, Mr. Lieberman served as President and Chief Operating Officer of both JLS Services, Inc. and International Purity, and also served as Chief Financial Officer for California Athletic Clubs, Inc. Mr. Lieberman attended the University of Cincinnati, where he received his B.A. in Business, and is a licensed CPA in the State of California. He resides in Las Vegas, Nevada.

Mr. Stanley A. Hirschman, (incumbent nominee), age 62, has been a member of the Company’s Board of Directors since November 2007 and serves on the Board’s Executive, Audit and Nominating committees. Since 1997, Mr. Hirschman has been President of CPointe Associates, Inc., a Plano, Texas executive management and retail operations consulting firm. He is an investment due diligence specialist and works regularly with public companies dealing with the difficulties of the balance between increased regulatory requirements and reasonable corporate governance. He has been a director of Axion Power International, Inc. since 2006 and Datascension, Inc. since July 2008. He was a director of Mustang Software, Inc. from 1995 and its chairman from 1999 to its acquisition in 2000. Prior to establishing CPointe Associates, he was Vice President Operations, Software Etc., Inc., a 396-store retail software chain, from 1989 until 1996. He also held senior executive management positions with T.J. Maxx, Gap Stores and Banana Republic. Mr. Hirschman is a member of the National Association of Corporate Directors, the KMPG Audit Committee Institute and attended the Harvard Business School Audit Committees in the New Era of Governance symposium. He is active in community affairs and serves on the Advisory Board of the Salvation Army Adult Rehabilitation Centers.

Mr. Bryce W. Rhodes (incumbent nominee), age 55, has been a member of the Company’s Board of Directors since December 2008 and serves on the Board’s Audit and Nominating and Corporate Governance committees. Mr. Rhodes has been providing oil and gas investment advice and management services to Whittier Properties, LLC since March 2007. Prior to then, Mr. Rhodes served as the President and Chief Executive Officer and board member of Whittier Energy Corporation from September 2003 until the sale of the company in March 2007. Mr. Rhodes was a Vice President of Whittier Energy Company since its incorporation in 1991 through September 2003. In that capacity, he managed its acquisitions and exploration investments. He served on the board of directors of PYR Energy Corporation, a public oil and gas exploration company from April 1999 until its sale in July 2007. Mr. Rhodes began his career in 1979 as a strategic planning analyst for Santa Fe International Corporation and joined the M.H. Whittier Corporation, an independent oil company in 1985 as an investment analyst. He currently provides investment consulting and management services for the Whittier Trust Company and is a member of the board of directors of Canadian Phoenix Corporation. He serves on several community boards and chairs the board of directors of the Helen Woodward Animal Center in Rancho Santa Fe, California.

Mr. Doyle A. Valdez (incumbent nominee), age 53, has been a member of the Company’s Board of Directors since December 2008 and serves on the Board’s Compensation and Nominating and Corporate Governance committees. Mr. Valdez is President of Valco Resource Management, Inc., an oil and gas production marketing and consulting firm that he established in 1987. Mr. Valdez holds a BBA with concentration in finance from St. Edward’s University, and has worked in the energy industry for 26 years. From 2001 to 2003, he served as Vice-President of Marketing for United Resources, LP. In 1986-1987, Mr. Valdez was the Marketing Director of EnerPro, Inc. Mr. Valdez is the former President of the Austin Independent School District Board of Trustees. In 2007, the University of Texas created the Doyle Valdez Social Justice Award to recognize and honor an outstanding individual who works everyday to implement the principles of social justice.

Material Proceedings

There are no material proceedings to which any director, officer or affiliate of the Company, any owner of record or beneficially of more than five percent of any class of voting securities of the Company, or any associate of any such director, officer, affiliate of the registrant, or security holder is a party adverse to the Company or any of its subsidiaries or has a material interest adverse to the Company or any of its subsidiaries.

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION OF EACH OF THE ABOVE DIRECTOR NOMINEES

PROPOSAL II

AMENDMENT OF THE COMPANY’S BYLAWS TO DELETE ARTICLE XII – EMPLOYMENT CONTRACTS

Article XII of the Company’s Bylaws provides:

No contract of employment or amendment to a contract of employment between the Corporation and any person(s), firm(s), corporation(s), partnership(s), association(s) or other entity(s), or any combination of any of the above, whether oral or in writing, for a period of time to exceed 90 days shall be binding upon the corporation unless and until:

(i) Such contract shall have been approved by a majority vote of the Board of Directors of the Corporation, called and held in accordance with the By-Laws and,

(ii) Such approval of such contract by the Board of Directors of the Corporation shall have been ratified by a majority vote by class of each and every class of shares entitled to vote Such vote of the shareholders shall be at a meeting of shareholders specifically called or such purpose, all requisite notices having been given in accordance with the corporation's Articles of Incorporation and its By-Laws relative to calls and notices for special meetings of shareholders.

This paragraph of the By-Laws shall not be amended or eliminated until ratified by a majority vote by class of each and every class of shares entitled to vote. Such vote of the shareholders shall be at a meeting of shareholders specifically called for such purpose, all requisite notices having been given in accordance with the corporation's Articles of Incorporation and its By-Laws relative to calls and notices for special meetings of shareholders.

Our Board of Directors and the Compensation Committee believe that in order to succeed, every company must attract and retain qualified employees, consultants and advisors. Towards that end, the ability to quickly and efficiently negotiate and structure equity and cash compensation packages is critical for most emerging companies. As a company structures a compensation package, it needs to address what type of equity award should be granted, including incentive stock options, non-qualified stock options, stock appreciation rights and restricted stock awards. Similarly, management, our Board and Compensation Committee believe that we should maintain flexibility and efficiency to quickly implement individual employee or consultant contracts to enhance our ability to attract and retain highly qualified officers, directors, key employees and other persons. We believe that such long term contracts are necessary to motivate such persons to continue in service to the Company and to expend maximum effort to improve our business results and earnings.

We further believe that the requirement of stockholder approval of such contracts presents a significant impediment to that critical corporate goal, in terms of the uncertainty of outcome, expense and the time required to prepare for and conduct a special meeting of stockholders for each new or renewed employment contract. While we have considered and appreciate the loss of stockholder rights if this proposal to delete Article XII of the Bylaws is adopted by our stockholders, we believe that loss is mitigated by our existing approval process, which requires that a proposed employment contract be (i) adopted by a majority vote of the Compensation Committee (consisting of all independent directors), (ii) recommended by such Compensation Committee to the Board of Directors, and (iii) approved by a majority of the Board of Directors of the Corporation able to vote thereon.

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR” THE

AMENDMENT OF THE COMPANY’S BYLAWS TO DELETE ARTICLE XII

EXECUTIVE OFFICER COMPENSATION

Overview

This compensation discussion and analysis describes the significant elements of compensation awarded to, earned by, or paid during the fiscal year ended December 31, 2008, to each of our executive officers who are listed as named executive officers in our Summary Compensation Table below. This discussion focuses on the information contained in the following tables and related footnotes for primarily the last completed fiscal year. We have also included discussion of compensation actions taken before the last completed fiscal year to the extent we consider it contributes to the understanding of our executive compensation disclosure.

The principal components of our executive compensation program are salary and equity incentives including restricted stock grants and incentive stock options. Additionally, we have agreement and contract provisions with our named executive officers providing for certain post-termination compensation. Our strategy is to design and balance these compensation components such that we will adequately compensate and retain our executive officers.

Our Compensation Committee administers our executive compensation program. The primary role of the Compensation Committee is to (i) reviewing and making determinations with respect to matters having to do with the compensation of executive officers and Directors of the Company and (ii) administering certain plans relating to the compensation of officers and Directors.

Our named executive officers are (or were):

| Michael J. Pawelek | Chief Executive Officer, President and Chairman of the Board |

| Sherry L. Spurlock | Executive Vice President and Chief Financial Officer |

| Wayne A. Psencik | Executive Vice President and Chief Operating Officer |

| J. Scott Zimmerman | Former Chief Executive Officer and President |

| Murray N. Conradie | Former Chief Executive Officer and Chairman of the Board |

Summary Compensation Table

The following table summarizes the total compensation paid to or earned by our named executive officers for the fiscal years ended December 31, 2008 and 2007.

| SUMMARY COMPENSATION TABLE | |

| FOR THE YEARS ENDED DECEMBER 31, 2008 and 2007 | |

| Name & Principal Position | | Year | | Salary ($) | | | Stock Awards ($) (1) | | | Option Awards ($)(1) | | | All Other Compensation ($) | | | Total ($) | |

| | | | | | | | | | | | | | | | | | |

Michael J. Pawelek, CEO, President and Chairman of the Board | | 2008 | | $ | 103,758 | (2) | | $ | 948,056 | | | $ | - | | | $ | 3,000 | (3) | | $ | 1,054,814 | |

| | | 2007 | | $ | - | | | $ | - | | | $ | - | | | $ | - | | | $ | - | |

Sherry L. Spurlock CFO, Executive Vice President | | 2008 | | $ | 62,283 | (2) | | $ | 948,056 | | | $ | - | | | $ | - | | | $ | 1,010,339 | |

| | | 2007 | | $ | - | | | $ | - | | | $ | - | | | $ | - | | | $ | - | |

Wayne A. Psencik, COO, Executive Vice President | | 2008 | | $ | 93,450 | (2) | | $ | 948,056 | | | $ | - | | | $ | - | | | $ | 1,041,506 | |

| | | 2007 | | $ | - | | | $ | - | | | $ | - | | | $ | - | | | $ | - | |

J. Scott Zimmerman, Former CEO and President | | 2008 | | $ | 82,500 | (4) | | $ | - | | | $ | - | | | $ | 182,500 | (5) | | $ | 265,000 | |

| | | 2007 | | $ | 42,500 | (4) | | $ | - | | | $ | 261,373 | | | $ | - | | | $ | 303,873 | |

Murray N. Conradie, Former CEO and Chairman of the Board | | 2008 | | $ | 14,331 | (6) | | $ | - | | | $ | - | | | $ | 244,072 | (6)(7) | | $ | 258,403 | |

| | | 2007 | | $ | 207,000 | | | $ | - | | | $ | 1,306,863 | | | $ | 29,000 | (7)(8) | | $ | $1,542,863 | |

| | (1) | Stock and option award values represent the compensation cost of awards recognized for financial statement purposes, in accordance with Statement of Financial Accounting Standards 123, as revised (SFAS 123R). Assumptions used to determine SFAS 123R values are described in Note 7 Stockholders’ Equity in our Notes to the Consolidated Financial Statements on our Form 10-K for the year ended December 31, 2008. |

| | (2) | Messrs. Pawelek and Psencik, and Ms. Spurlock began their employment with the Company on June 23, 2008. |

| | (3) | Mr. Pawelek was elected as the Chairman of Board and outside director on January 22, 2008. He continued to serve in this position until his employment with the Company began on June 23, 2008, at which time he was no longer an outside director but continued to serve as Chairman of the Board. During the portion of 2008 that Mr. Pawelek served as an outside director, we paid to him approximately $3,000 in director fee compensation. |

| | (4) | Mr. Zimmerman was named President of the Company on June 18, 2007. On January 22, 2008, he also became the Chief Executive Officer. On June 23, 2008, Mr. Zimmerman resigned as President and Chief Executive Officer of the Company. |

| | (5) | Mr. Zimmerman received post-termination payment of 50,000 shares of the Company’s common stock in exchange for consulting services he provided to the Company subsequent to his resignation as an executive officer and employee of the Company. The cost of stock payments recognized for financial statement purposes was determined in accordance with EITF Abstract Issue No. 96-18, “Accounting for Equity Instruments That Are Issued to Other Than Employees for Acquiring, or in Conjunction with Selling, Goods or Services. |

| | (6) | Mr. Conradie resigned from his position as Chief Executive Officer and Chairman of the Board on January 22, 2008. He continued to receive post-termination cash compensation from the Company throughout the remainder of 2008 in the form of consulting fees and health insurance benefits. The approximate total $237,000 paid to Mr. Conradie as post-termination compensation is presented as All Other Compensation. |

| | (7) | Mr. Conradie was paid by the Company approximately $24,000 during 2007, and approximately $7,100 during 2008, for the rental of approximately four acres of land used by the Company as a field office and storage facility, and for the rental of equipment belonging to Mr. Conradie and used by the Company in the field. |

| | (8) | Mr. Conradie received a monthly vehicle allowance totaling $5,000 during 2007. |

Outstanding Equity Awards

The following table sets forth the outstanding equity awards of our named executive officers at December 31, 2008.

| OUTSTANDING EQUITY AWARDS |

| AT DECEMBER 31, 2008 |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | Equity | |

| | | | | | | | | Equity | | | | | | | | | | | | | Equity | | | Incentive Plan | |

| | | | | | | | | Incentive | | | | | | | | | | | | | Incentive Plan | | | Awards: | |

| | | | | | | | | Plan | | | | | | | | | | | | | Awards: | | | Market or | |

| | | | | | | | | Awards: | | | | | | | | | | | | | Number of | | | Payout | |

| | | Number of | | | Number of | | | Number of | | | | | | | Number of | | | Market | | | Unearned | | | Value of | |

| | | Securities | | | Securities | | | Securities | | | | | | | Shares or | | | Value of | | | Shares, Units | | | Unearned | |

| | | Underlying | | | Underlying | | | Underlying | | | | | | | Units of | | | Shares or | | | or Other | | | Shares, Units | |

| | | Unexercised | | | Unexercised | | | Unexercised | | | Option | | | | Stock That | | | Units of | | | Rights That | | | or Other | |

| | | Options | | | Options | | | Unearned | | | Exercise | | Option | | Have Not | | | Stock That | | | Have Not | | | Rights That | |

| | | (#) | | | (#) | | | Options | | | Price | | Expiration | | Vested | | | Have Not | | | Vested | | | Have Not | |

| Name | | Exercisable | | | Unexercisable | | | (#) | | | ($/share) | | Date | | (#) | | | Vested ($) | | | (#) | | | Vested ($) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Michael J. Pawelek | | | - | | | | - | | | | 833,334 | (1) | | $ | 2.00 | | 9/18/2018 | | | 258,264 | (2) | | $ | 142,045 | | | | * | (3) | | $ | 2,000,000 | |

| Sherry L. Spurlock | | | - | | | | - | | | | 833,334 | (1) | | $ | 2.00 | | 9/18/2018 | | | 258,264 | (2) | | $ | 142,045 | | | | * | (3) | | $ | 2,000,000 | |

| Wayne A. Psencik | | | - | | | | - | | | | 833,334 | (1) | | $ | 2.00 | | 9/18/2018 | | | 258,264 | (2) | | $ | 142,045 | | | | * | (3) | | $ | 2,000,000 | |

| | (1) | Messrs. Pawelek, Psencik and Ms. Spurlock have each been granted performance stock options to purchase 833,334 shares of our common stock each under the terms of our Equity Incentive Compensation Plan (the “Plan”). The performance stock options vest in accordance with the achievement of certain performance criteria concerning (i) our production of oil and gas (“Production Objective” columns) and (ii) the increase on our oil and gas reserves (“Reserve Objective” columns), as set forth below: |

Percentage of Performance Option Shares Issuable

Under Performance Option

Agreement | | Production Objective:

Monthly Average per day

for Three Consecutive Months | | Shares that

Vest Based on

Achievement of

Production Objective | | | Reserve Objective

Over

Reserves on December 31, 2007 | | | Shares that

Vest Based on

Achievement

of Reserve Objective | | | Total of Percentage Performance Option Shares

to Vest | |

| 20% | | 500 Boe (net) | | | 83,334 | | | | 50 | % | | | 83,334 | | | | 166,668 | |

| 35% | | 1,000 Boe (net) | | | 145,833 | | | | 150 | % | | | 145,833 | | | | 291,666 | |

| 45% | | 1,500 Boe (net) | | | 187,500 | | | | 250 | % | | | 187,500 | | | | 375,000 | |

| | | | | | 416,667 | | | | | | | | 416,667 | | | | 833,334 | |

| | (2) | During 2008, Messrs. Pawelek, Psencik and Ms. Spurlock were each granted the right to be issued shares of restricted common stock equal in value to $3,000,000 on the date of issuance over a two-year period in three equal installments of $1,000,000. The first tranche, consisting of 258,264 shares to each of the named executive officers, was issued in June 2008. These shares vested on January 1, 2009. |

| | (3) | As part of the award described at note (2), the Company will grant the second installment of shares of restricted stock to Messrs. Pawelek, Psencik and Ms. Spurlock on June 23, 2009, and the Company will make the third installment of shares of restricted stock on June 23, 2010, as to all three employees. The number of shares of restricted stock to be issued in both installments to each individual employee (as denoted by the “*” in the table above) will be determined on each grant date by dividing $1,000,000 by the public trading price of our common stock during the five-day period preceding each installment issue date, but at a price not less than $0.50 per share. The shares of restricted stock may not be sold, transferred or hypothecated by the officers unless and until the restrictions lapse and the officer remains an employee of the Company. The shares to be issued on June 23, 2009 and June 23, 2010, will vest on January 1, 2010 and January 1, 2011, respectively. |

Additional Narrative Disclosure

Employment Agreements

The terms and provisions of each of the employment agreements for the Company’s named executive officers at December 31, 2008, are substantially similar. The following discussion provides a summary of the material terms of the employment agreements, which summary is qualified in its entirety by reference to the complete terms of such agreements, the forms of which are incorporated herein by reference, as filed with the Securities and Exchange Commission as exhibits to our Form 8-K on June 25, 2008.

| | · | Term: The employment agreements for Messrs. Pawelek, Psencik and Ms. Spurlock each has a three-year term that began on June 23, 2008, as approved by the Company’s stockholders on September 19, 2008. |

| | · | Annual Salaries: The employment agreements provide annual salaries of $200,000, $180,000, and $120,000 for Mr. Pawelek, Mr. Psencik and Ms. Spurlock, respectively. |

| | · | Equity Awards (Restricted Common Stock): The employment agreements for Messrs. Pawelek, Psencik and Ms. Spurlock each granted the officer the right to be issued a number of shares of restricted common stock equal in value to $3,000,000 over a two-year period in three equal installments of $1,000,000 of restricted stock. The Company’s executive officers have each been issued the first tranche, with the second installment of the restricted stock grant to be made on June 23, 2009, and the third installment to be made on June 23, 2010. The number of shares of restricted stock to be issued in each installment will be determined by the public trading price of our common stock during the five-day period preceding each installment issue date, subject to a minimum price of $0.50 per share. The shares of restricted stock may not be sold, transferred or hypothecated by the officers unless and until the restrictions lapse and the officer remains an employee. The restrictions on each tranche of restricted stock, assuming the conditions are met, lapse on an annual basis beginning January 1, 2009. For all restricted shares subject to this award, forfeiture restrictions will lapse upon the termination of an officer’s employment by us without cause or if the officer terminates employment with us for good reason, or the occurrence of other events as described further in our Equity Incentive Compensation Plan (the “Plan”). |

| | · | Equity Award (Performance Options): Messrs. Pawelek, Psencik and Ms. Spurlock have each been granted performance stock options to purchase 833,334 shares of our common stock each, at an exercise price of $2.00 per share under the terms of the Plan. The performance stock options vest in accordance with the achievement of certain performance criteria concerning (i) our production of oil and gas and (ii) the increase on our oil and gas reserves, as set forth below: |

Percentage of Performance Option Shares Issuable Under Performance Option Agreement | | Production Objective: Monthly Average per day for Three Consecutive Months | | Shares that Vest based on Achievement of Production Objective | | | Reserve Objective Over Reserves on December 31, 2007 | | | Shares that Vest based on Achievement of Reserve Objective | | | Total of Percentage Performance Option Shares to Vest | |

| Options granted to each of Pawelek, Psencik and Spurlock: | | | | | | | | | | | | | | |

| 20% | | 500 Boe (net) | | | 83,334 | | | | 50 | % | | | 83,334 | | | | 166,668 | |

| 35% | | 1,000 Boe (net) | | | 145,833 | | | | 150 | % | | | 145,833 | | | | 291,666 | |

| 45% | | 1,500 Boe (net) | | | 187,500 | | | | 250 | % | | | 187,500 | | | | 375,000 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | 416,667 | | | | | | | | 416,667 | | | | 833,334 | |

The performance stock options expire on June 30, 2018. All unvested performance stock options shall fully vest and become exercisable upon the termination of an officer’s employment by us without cause or if the officer terminates employment with us for good reason, or the occurrence of other events as described further in the Plan.

| | · | Non-Competition: Under the terms of their respective employment agreements, Messrs. Pawelek and Psencik and Ms. Spurlock have agreed not to compete with us for a period of six months after the termination of employment with us. In addition, each individual has agreed not to solicit or induce any person or entity that is engaged in any business activity or relationship with us or any of our subsidiaries or affiliates to terminate or reduce that business activity or relationship for a period of two years after the officer’s employment terminates. |

| | · | Termination – Respective Rights: Under the terms of the employment agreements, we have the right to terminate each officer’s employment for cause. Our sole responsibility upon such termination would be the payment of accrued and unpaid salary, reimbursable expenses and vacation accrued through the employment termination date. If we terminate an officer’s employment without cause or if the officer terminates employment for good reason, we are obligated to pay the officer the lesser of six-month’s salary or the salary remaining to be paid to the officer for the remaining term under the employment agreement, plus accrued and unpaid reimbursable expenses and vacation, and the continuation of group medical and dental insurance for the applicable period. |

Other Agreements with Named Executive Officers Providing for Post-Termination Compensation

On January 22, 2008, Mr. Conradie resigned as a director and officer our parent company and all of our subsidiaries. Mr. Conradie was retained by us as a consultant for a one-year period to assist in the management transition and to offer guidance on specific current or anticipated business opportunities and projects, which agreement could be terminated by either party after the expiration of the initial 90 days of the contract term. The consulting agreement was terminated in June 2008. Pursuant to the contract, we remained obligated to pay Mr. Conradie’s consulting fees and the cost of Mr. Conradie’s health insurance, on an independent contractor basis during the full consulting contract period. The final payments under this arrangement were made in December 2008.

On January 22, 2008 and concurrent with the resignation of Mr. Conradie, Mr. Zimmerman, who was then serving as President, was appointed our Chief Executive Officer and a director of our Board. Mr. Zimmerman retained those positions with us until June 23, 2008, when he resigned. In addition to the cash compensation earned by Mr. Zimmerman, we granted Mr. Zimmerman incentive options to purchase shares of our common stock according to the Executive Stock Option Plan. Mr. Zimmerman did not have a written employment contract with us. Mr. Zimmerman resigned June 23, 2008, concurrent with the appointment of new senior management for the Company. We entered into a consulting agreement with Mr. Zimmerman effective July 1, 2008, with a term of one year, whereby Mr. Zimmerman provides certain services to us in the role of a consultant in exchange for issuance of 100,000 shares of our common stock. The stock is payable in four equal tranches of 25,000 shares on each of September 30, 2008; December 31, 2008; March 31, 2009; and June 30, 2009.

DIRECTOR COMPENSATION

Director Compensation Table

The following table sets forth the aggregate cash compensation paid by us to our directors for services rendered during the period indicated.

COMPENSATION PAID TO DIRECTORS

YEAR ENDED DECEMBER 31, 2008

Name | | Fees Earned or Paid in Cash ($) (1) | | | Stock Awards ($) | | | Option Awards ($) (2) | | | Non-Equity Incentive Plan Compensation ($) | | | Non-Qualified Deferred Compensation Earnings ($) | | | All Other Compensation ($) | | | Total ($) | |

| | | | | | | | | | | | | | | | | | | | | | |

| Stanley A. Hirschman | | $ | 14,000 | | | $ | - | | | $ | 78,410 | (3) | | $ | - | | | $ | - | | | $ | - | | | $ | 92,410 | |

| David P. Lieberman | | $ | 14,000 | | | $ | - | | | $ | 78,410 | (3) | | $ | - | | | $ | - | | | $ | - | | | $ | 92,410 | |

| Bryce W. Rhodes | | $ | 3,000 | | | $ | - | | | $ | 1,100 | (4) | | $ | - | | | $ | - | | | $ | - | | | $ | 4,100 | |

| Doyle A. Valdez | | $ | 3,000 | | | $ | - | | | $ | 1,100 | (4) | | $ | - | | | $ | - | | | $ | - | | | $ | 4,100 | |

| Murray N. Conradie (5) | | $ | - | | | $ | - | | | $ | - | | | $ | - | | | $ | - | | | $ | - | | | $ | - | |

| Owen Naccarato (5) | | $ | 16,000 | | | $ | - | | | $ | - | | | $ | - | | | $ | - | | | $ | - | | | $ | 16,000 | |

| Edward Shaw (5) | | $ | - | | | $ | - | | | $ | - | | | $ | - | | | $ | - | | | $ | - | | | $ | - | |

| J. Scott Zimmerman (5) | | $ | - | | | $ | - | | | $ | - | | | $ | - | | | $ | - | | | $ | - | | | $ | - | |

| | (1) | Paid to independent directors. |

| | (2) | Based on options for 20,000 shares of common stock granted to each of Messrs. Hirschman, Lieberman, Rhodes and Valdez during 2008, and additional options for 20,000 shares of common stock granted to each of Messrs. Hirschman and Lieberman prior to 2008. Amounts listed in this column represent the compensation expense of stock awards and option awards recognized by us under Statement of Financial Accounting Standards No. 123 (revised 2004) (SFAS 123R) for fiscal year ending December 31, 2008, rather than amounts realized by the named individuals. |

| | (3) | Messrs. Hirschman and Lieberman each have options outstanding at December 21, 2008, for an aggregate of 40,000 shares of common stock. |

| | (4) | Messrs. Rhodes and Valdez each have options outstanding at December 31, 2008, for an aggregate of 20,000 shares of common stock. |

| | (5) | Mr. Conradie resigned from the Board of Directors on January 22, 2008. Messrs. Naccarato and Shaw resigned from the Board of Directors on December 19, 2008. Mr. Zimmerman resigned from the Board of Directors on June 23, 2008. |

Narrative to Directors’ Compensation Table

For January through November of fiscal year 2008, each non-employee director received an annual cash retainer fee of $3,000 for the partial year during which these directors served in that capacity, for all services including committee participation and meetings of the Board of Directors attended regardless of form of attendance. Beginning in December 2008, the non-employee director fee structure was modified to be based on Board of Directors and/or committee of the Board of Directors meetings attended. Non-employee directors receive $3,000 per Board of Directors meeting; the chairman of the Audit Committee receives $2,250 per Audit Committee meeting; all other Audit Committee members receive $1,500 per Audit Committee meeting; all other committee members (chairman and other positions) receive $500 per committee meeting. Employee directors were not compensated in cash for their service on our Board of Directors. All directors are reimbursed for their reasonable out-of-pocket expenses in serving on the Board of Directors or any committee of the Board of Directors.

For our fiscal year ending December 31, 2008, each non-employee director who was elected as a non-employee director received options to purchase 20,000 shares of our common at an exercise price of $0.47 per share. One-half of the stock options vested on March 31, 2009, and the remaining 50% will vest on the day prior to the Annual Meeting. The stock options have a term of 10 years, subject to earlier termination following the director’s cessation of Board of Directors service.

INDEPENDENT PUBLIC ACCOUNTANTS

In March 2007, the Company replaced Larry O’Donnell, CPA, P.C., its prior independent auditors, and engaged Causey Demgen & Moore, Inc. as its independent auditors to provide the requisite audit services for the Company. There were no disputes or conflicts as to the application of accounting policies or principles between the Company and its former independent auditor. We do not expect our current independent auditor to be present at the Annual Meeting.

Audit Fees

For the fiscal year ended December 31, 2008, our principal accountant billed $87,510 for the audit of the Company’s annual financial statements and review of financial statements included in our Form 10-Q filings. For the fiscal year ended December 31, 2007, our principal accountant billed $39,480, for the audit of the Company’s annual financial statements and review of financial statements included in our Form 10-QSB filings.

Audit-Related Fees

For the fiscal years ended December 31, 2008 and 2007, our principal accountant billed $0 and $915, respectively, for assurance and related services that were reasonably related to the performance of the audit or review of our financial statements outside of those fees disclosed above under “Audit Fees”.

Tax Fees

For the fiscal years ended December 31, 2008 and 2007, our principal accountant billed $0 and $0, respectively, for tax compliance, tax advice, and tax planning services.

All Other Fees

For the fiscal years ended December 31, 2008 and 2007, our principal accountant billed $0 and $0, respectively, for products and services other than those described above.

Pre-Approval Policies and Procedures

Prior to engaging the Company’s accountants to perform a particular service, our Board of Directors obtains an estimate for the service to be performed. The Board of Directors, in accordance with procedures for the Company, approved all of the services described above prior to the services being performed.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information as of March 10, 2009, as to shares of our common stock beneficially owned by: (i) each person who is known by us to own beneficially more than 5% of our common stock, (ii) each of our current named executive officers, (iii) each of our directors and (iv) all our directors and executive officers as a group. Unless otherwise stated below, the address of each beneficial owner listed on the table is c/o South Texas Oil Company, 300 E. Sonterra Blvd., Suite 1220, San Antonio, Texas 78258. The percentage of common stock beneficially owned is based on 16,788,862 shares outstanding as of March 10, 2009.

Name and Address of Beneficial Owner | | Shares Beneficially Owned | | | Right to Acquire Beneficial Ownership within 60 days | | | Total | | | Percentage Beneficial Ownership | |

| | | | | | | | | | | | | |

The Longview Fund, L.P. (1) 600 Montgomery Street, 44th Floor San Francisco, CA 94111 | | | 7,126,871 | | | | 750,000 | | | | 7,876,871 | | | | 46.96 | % |

Doud Oil & Gas Company LLC 25528 Genesee Trail Road Golden, CO 80401 | | | 2,419,355 | | | | - | | | | 2,419,355 | | | | 14.46 | % |

| | | | | | | | | | | | | | | | | |

| Directors and Named Executive Officers | | | | | | | | | | | | | | | | |

| Stanley A. Hirschman, Director | | | | | | | 40,000 | | | | 40,000 | | | | * | |

| David P. Lieberman, Director | | | | | | | 40,000 | | | | 40,000 | | | | * | |

| Bryce W. Rhodes, Director | | | | | | | 20,000 | | | | 20,000 | | | | * | |

| Doyle A. Valdez, Director | | | | | | | 20,000 | | | | 20,000 | | | | * | |

| Michael J. Pawelek, CEO, Chairman | | | 258,264 | | | | 416,667 | | | | 674,931 | | | | 4.02 | % |

| Wayne Psencik, COO | | | 258,264 | | | | 416,667 | | | | 674,931 | | | | 4.02 | % |

| Sherry L. Spurlock, CFO | | | 258,264 | | | | 416,667 | | | | 674,931 | | | | 4.02 | % |

| Theodore J. Wicks, EVP | | | 0 | | | | 250,000 | | | | 250,000 | | | | 1.49 | % |

| Executive Officers and Directors as a group | | | 774,792 | | | | 1,620,001 | | | | 2,394,793 | | | | 14.27 | % |

* less than 1%

MANAGEMENT

The following sets forth the names and ages of all our named executive officers and the positions and offices with us held by such persons:

| Name | | Age | | Position |

| Michael J. Pawelek | | 51 | | Chairman, President and CEO |

| Wayne A. Psencik | | 45 | | Executive Vice President, Chief Operating Officer |

| Sherry L. Spurlock | | 47 | | Executive Vice President, Chief Financial Officer |

| Theodore J. Wicks | | 40 | | Executive Vice President, Corporate Development |

Mr. Michael J. Pawelek has been Chairman of the Board of Directors of the Company since November 2007 and serves on the Board’s Executive committee. He has been Chief Executive Officer and President of the Company since June 2008. In 1981, Mr. Pawelek began his career as a geophysicist focused on the Austin Chalk trend with Clayton Williams Company through 1985. From 1985 to 1989 he was employed by TXO Production Corporation as a district geophysicist. In 1989, he founded CPX Petroleum, which drilled over 60 wells under his management. From 1991 to 1999, he founded and was the Chief Executive Officer of Universal Seismic Associates, Inc., which generated annual revenue of $65 million and had over 400 employees. From 1999 to 2001, he served as Vice President of Operations of Amenix USA, Inc., a private exploration and production company focused on oil and natural gas exploration in Louisiana. From 2001 to 2004, he held a similar position at IBC Petroleum, managing the company’s assets while seeking financial partners. From 2004 to 2007 he was President of BOSS Exploration & Production Corporation, a privately held Gulf Coast production company. Immediately prior to joining the Company as its CEO, Mr. Pawelek served as President of Sonterra Resources, Inc., a company that has oil and natural gas assets in Texas state waters in Matagorda Bay. Mr. Pawelek received a BS degree in Engineering from Texas A&M University.

Mr. Wayne A. Psencik is the Executive Vice President and Chief Operating Officer and has served in such capacity since June 2008. Mr. Psencik previously served as Vice President of Operations at Sonterra Resources, Inc. and its predecessor companies, from April 2007 through June 2008. From 2005 to 2007, he held the position of Vice President of Operations of Boss Exploration & Production Corporation. From 2001 to 2005, Mr. Psencik served as an engineer and drilling manager at El Paso Production Company, where he was responsible for the design and implementation of drilling and completion operations and the supervision of staff engineers in the Gulf of Mexico unit. From 1999 to 2001 he was a consulting drilling engineer for Coastal Oil and Gas Company focused in the Gulf of Mexico. Mr. Psencik served as district manager from 1996 to 1999 for Chesapeake Operating Company for its southern division. From 1994 to 1996, Mr. Psencik held positions of drilling engineer for Chesapeake Operating Company, focusing on horizontal drilling in Texas and Louisiana. From 1991 to 1994, he was a drilling engineer working Gulf of Mexico projects for AGIP Petroleum. Mr. Psencik earned his BS degree in petroleum engineering from Texas A&M University.

Ms. Sherry L. Spurlock is the Executive Vice President and Chief Financial Officer and has served in such capacity since June 2008. Prior to joining our Company, Ms. Spurlock served as Chief Financial Officer of Sonterra Resources, Inc. and its predecessor companies, from April 2007 through June 2008. From 2005 to 2007, she was the Chief Financial Officer of Boss Exploration & Production Corporation, where she was responsible for the preparation of the financial statements and other financial and accounting matters. From 2000 to 2005, Ms. Spurlock was the controller and held various other financial positions with United Oil & Minerals, LP, a private oil and natural gas exploration company. From 1992 to 2000, Ms. Spurlock served as Controller at Brigham Exploration Company, an Austin, Texas-based publicly traded exploration and production company. While at Brigham, she was responsible for the SEC reporting and internal management reporting among other audit and accounting systems management. Prior to that, she held accounting positions at private and public oil and natural gas companies and began her career as an accountant at Deloitte, Haskins and Sells. Ms. Spurlock is a certified public accountant and holds a BBA degree in accounting from Stephen F. Austin State University.

Mr. Theodore J. Wicks is the Executive Vice President of Corporate Development and has served in such capacity since October 2008. Prior to joining our Company, Mr. Wicks was a Managing Director with Petro Capital Securities, LLC (“PCS”), a Dallas-based energy investment bank, since 2007. Mr. Wicks’ responsibilities at PCS included client coverage and leading the structuring and execution of a wide variety of M&A, strategic advisory and capital markets transactions for clients across all sectors of the energy industry. Prior to PCS, Mr. Wicks was a Vice President in the energy investment banking group of First Albany Capital. From 2006 to 2007, Mr. Wicks was a Vice President in the energy investment banking group of Sanders Morris Harris. From 2004 to 2005, Mr. Wicks was a Director in the Equity Capital Markets group at KeyBanc Capital Markets, and from 1999 through 2003, Mr. Wicks was a Vice President in the Equity Capital Markets group of RBC Capital Markets. Mr. Wicks earned his Masters of Business Administration in Finance and Bachelor of Arts with Accounting and Finance concentrations from the University of St. Thomas.

CORPORATE GOVERNANCE

Director Independence

Our common stock is listed on the National Association of Securities Dealers Automated Quotations System Global Market (“NASDAQ”). NASDAQ rules generally require that a majority of our directors and all of the members of our Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee be independent. Currently, we have five directors, four of whom qualify as independent directors under NASDAQ rules.

In making its determination of independence, the Board of Directors considers certain categorical standards of independence as set forth in stock exchange corporate governance rules and all relevant facts and circumstances to ascertain whether there is any relationship between a director and our Company that, in the opinion of the Board of Directors, would interfere with the exercise of independent judgment by the director in carrying out the responsibilities of the director. Under these standards and criteria, our Board of Directors has determined that Messrs. Lieberman, Hirschman, Rhodes and Valdez are independent as defined in applicable Securities and Exchange Commission and NASDAQ rules and regulations and that each constitutes an “independent director” as defined in NASDAQ Marketplace Rule 4200.

Attendance at Board Meetings

During the 2008 fiscal year, the Board held seven (7) Special Meetings, acted eleven (11) times by unanimous consent, and held an annual meeting immediately after the Annual Meeting of Stockholders on December 19, 2008. During the 2008 fiscal year, each Director, either in person or telephonically, attended all meetings of the Board and each committee of the Board on which such Director serves.

Audit Committee

The charter of the Audit Committee was approved and adopted by the Board of Directors at the August 27, 2007 Board Meeting. The Audit Committee (i) appoints the independent registered public accounting firm for the Company and monitors the performance of such firm, (ii) reviews and approves the scope and results of the annual audits, evaluates with the independent registered public accounting firm the annual audit of the Company’s financial statements and audit of internal control over financial reporting, monitors the performance of the Company’s internal audit function, (v) reviews with management the annual and quarterly financial statements, (vi) reviews with management and the internal auditors the status of internal control over financial reporting, (vii) reviews and maintains procedures for the anonymous submission of complaints concerning accounting and auditing irregularities and (viii) reviews problem areas having a potential financial impact on the Company which may be brought to its attention by management, the internal auditors, the independent registered public accounting firm or the Board. In addition, the Audit Committee pre-approves all non-audit related services provided by the independent registered public accounting firm and approves the independent registered public accounting firm's fees for services rendered to the Company.

The Audit Committee held five meetings during the year ended December 31, 2008. The members of the Audit Committee are Stanley Hirschman, David Lieberman and Bryce Rhodes; each of whom is an independent director as defined in NASDAQ Marketplace Rule 4200. Mr. Lieberman is the Audit Committee’s Chairman and financial expert. See Mr. Lieberman’s relevant biography contained elsewhere in this Proxy Statement. On December 19, 2008, Mr. Rhodes was elected to replace Owen Naccarato on the Audit Committee. Mr. Naccarato resigned as a director of the Company on December 19, 2008, after having served for the entire preceding portion of 2008. Mr. Naccarato was also an independent director as defined in NASDAQ Marketplace Rule 4200.

The Audit Committee has reviewed and discussed the audited financial statements with management, and has discussed with the independent auditors the maters required to be discussed by the statement on Auditing Standards No. 61, as amended and adopted by the Public Company Accounting Oversight Board in Rule 3200T. The Audit Committee has received the written disclosures and the letter from the independent accountants required by Independence Standards Board Standard No. 1, as adopted by the Public Company Accounting Oversight Board in Rule 3600T, and has discussed with the independent accountant the independent accountant’s independence. Based on its review and discussions with the independent auditors, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Company’s annual report on Form 10-K for the last fiscal year for filing with the Commission.

Members of the Audit Committee

Stanley Hirschman

David Lieberman

Bryce Rhodes

Nominating and Corporate Governance Committee

The members of the Nominating and Corporate Governance Committee are Stanley Hirschman, David Lieberman and Doyle Valdez, each an Independent Director. Mr. Hirschman is Chairman of the Nominating and Corporate Governance Committee. On December 19, 2008, Mr. Valdez was elected to replace Owen Naccarato on the committee, who resigned as a director of the Company after having served for the entire preceding portion of 2008. During the year ended December 31, 2008, the Nominating and Corporate Governance Committee held two meetings.

The Nominating and Corporate Governance Committee functions include identifying persons for future nomination for election to the Board of Directors. The Nominating and Corporate Governance Committee approves and adopts Corporate Governance Guidelines and oversees an annual self evaluation conducted by the Board in order to determine whether the Board and its Committees are functioning effectively. The Nominating and Corporate Governance Committee also oversees individual Director self assessments in connection with the evaluation of such Director for purposes of making a recommendation to the Board as to the persons who should be nominated for election or re-election, as the case may be, at the upcoming annual meeting of stockholders.

The Nominating and Corporate Governance Committee considers candidates for Board membership suggested by its members and other Board members, as well as management and stockholders. There are no differences in the manner in which the Nominating and Corporate Governance Committee evaluates nominees for the Board of Directors based on whether or not the nominee is recommended by a stockholder. The Nominating and Corporate Governance Committee evaluates prospective nominees against a number of minimum standards and qualifications, including business experience and financial literacy. The Nominating and Corporate Governance Committee also considers such other factors as it deems appropriate, including the current composition of the Board, the balance of management and Independent Directors, the need for Audit Committee or other relevant expertise and the evaluations of other prospective nominees. The Committee then determines whether to interview the prospective nominees, and, if warranted, one or more of the members of the Nominating and Corporate Governance Committee, and others as appropriate, may interview such prospective nominees in person or by telephone. After completing this evaluation and interview, the Nominating and Corporate Governance Committee makes a recommendation to the full Board of Directors as to the persons who should be nominated by the Board of Directors. The Board of Directors then determines the nominees after considering the recommendation and report of the Nominating and Corporate Governance Committee.

Compensation Committee

As of December 19, 2008, the members of the Compensation Committee are David Lieberman, Bryce Rhodes and Doyle Valdez, all of whom are independent directors. Mr. Rhodes serves as Chairman of the Compensation Committee. The members of the Compensation Committee for the preceding portion of the year ended December 31, 2008, were Michael Pawelek, Owen M. Naccarato and David Lieberman. Messrs. Naccarato and Lieberman were independent directors, and Mr. Naccarato was the Chairman. During the year ended December 31, 2008, the Compensation Committee held four meetings.

The Compensation Committee functions include (i) reviewing and making determinations with respect to matters having to do with the compensation of executive officers and Directors of the Company and (ii) administering certain plans relating to the compensation of officers and Directors.

The Compensation Committee has full and complete discretion to establish the compensation payable to the Company’s Chief Executive Officer, and that of other executive officers. With regard to such other executive officers, the Compensation Committee considers the recommendations of the Chief Executive Officer. The Compensation Committee following authorization by the Company’s Board of Directors has delegated to the Company’s Chief Executive Officer authority with respect to management annual salary decisions up to $150,000 per employee upon consultation with the Chairman of the Compensation Committee and the authority to grant up to 1,000 stock options per new employee at the director level or below of the Company. The Compensation Committee has otherwise not delegated to management any of its responsibilities with respect to the compensation of the executive officers of the Company, except in respect to the day-to-day operations of the Company's compensation plans.

The charter of the Compensation Committee was approved and adopted by the Board of Directors at the August 27, 2007 Board Meeting. The Charter of the Compensation Committee more fully describes the purposes, membership, duties and responsibilities of the Compensation Committee described herein.

Committee Charters

Copies of the charters of our respective Committees are available on the Company website, www.southtexasoil.com, under the “Corporate Governance” tab.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires our directors and executive officers and persons who beneficially own more than ten percent of a registered class of our equity securities to file with the SEC initial reports of ownership and reports of change in ownership of common stock and other equity securities of our Company. Officers, directors and greater than ten percent stockholders are required by SEC regulations to furnish us with copies of all Section 16(a) forms they file. To our knowledge, the following persons have failed to file, on a timely basis, the identified reports required by Section 16(a) of the Exchange Act during the 2008 fiscal year: Mr. Hirschman filed one late Form 4, with one transaction not timely filed; Messrs. Lieberman and Wicks each had one known failure to file a Form 4, with one transaction each not timely filed; Messrs. Valdez and Rhodes each had each failed to file a Form 3 and Form 4, with one transaction not timely filed; Messrs. Pawelek and Psencik and Ms. Spurlock each had one known failure to file a Form 4, with two transactions not timely reported.

Transactions with Related Persons

In the ordinary course of business, from time to time we purchase products or services from, or engage in other transactions with, various third parties deemed to be related parties (as that term is defined for purposes of Section 404(a) of Regulation S-K). Occasionally, certain of these transactions may involve individuals who currently or have recently served as members of our executive management and/or Board of Directors We also have been involved in transactions with certain of our stockholders who, by virtue of the amount beneficially owned of our outstanding stock, are deemed to be related parties. These transactions are conducted in the ordinary course of business and on an arms-length basis. The following describes these transactions that occurred during the year ended December 31, 2008, and which involved amounts exceeding $120,000.

We are deemed to have a related party relationship with The Longview Fund, L.P. (“Longview”) because Longview is the beneficial owner of an amount in excess of 10% of our issued and outstanding common stock at December 31, 2008. Refer to Note 4 – Long-Term Debt in our Notes to the Consolidated Financial Statements on our Form 10-K for the year ended December 31, 2008, for a description of our credit facility with Longview and the related notes payable. Interest paid during the year ended December 31, 2008 on notes payable to Longview was $899,106.

We are deemed to have a related party relationship with a third party who operates and is a joint interest owner in our oil and gas properties located in the DJ Basin in Colorado. This party is the beneficial owner of an amount in excess of 10% of our issued and outstanding common stock at December 31, 2008. We acquired our interests in these properties from the operator in a transaction which closed during 2007, whereby we exchanged 2,419,335 shares of our common stock, then valued at $7.5 million, for a 37.5% interest in the oil and gas properties. The Company received approximately $338,089 in net oil and gas revenue distributions for the properties from the related party during the year ended December 31, 2008. We paid to the related party approximately $ 23,587 and $202,074 for capital expenditures and lease operating expenses, respectively, during 2008.

Stockholder Communications to the Board of Directors

Stockholders may submit communications to our Board of Directors, its Committees or the Chairperson of the Board of Directors or any of its Committees or any individual members of the Board of Directors by addressing a written communication to: Board of Directors, c/o South Texas Oil Company, 300 E. Sonterra Blvd., San Antonio, Texas 78258. Stockholders should identify in their communication the addressee, whether it is our Board of Directors, its Committees or the Chairperson of the Board of Directors or any of its Committees or any individual member of the Board of Directors. Stockholder communications will be forwarded to our Corporate Secretary, who will acknowledge receipt to the sender, unless the sender has submitted the communication anonymously, and forward a copy of the communication to the addressee on our Board of Directors or, if the communication is addressed generally to our Board of Directors, to our Chairperson of the Board of Directors.

Management knows of no business to be presented at the Annual Meeting other than the maters set forth in this proxy statement, but should any other mater requiring a vote of stockholders arise, management will vote the proxies according to their best judgment in our interest.

Whether or not you intend to be present at the Annual Meeting of Stockholders,

we urge you to submit our signed proxy promptly.

| /s/ Roy D. Toulan, Jr. |

| |

| Roy D. Toulan, Jr. |

| Corporate Secretary |

| San Antonio, Texas |

| July 24, 2009 |