SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | | | |

¨ | | Preliminary Proxy Statement | | ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x | | Definitive Proxy Statement | | |

| | | |

¨ | | Definitive Additional Materials | | | | |

| |

| ¨ | | Soliciting Material Pursuant to Section 240.14a-11(c) or Section 240.14a-12 |

EAGLE HOSPITALITY PROPERTIES TRUST, INC.

(Name of Registrant as Specified in its Charter)

Payment of Filing Fee (Check the appropriate box):

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

EAGLE HOSPITALITY PROPERTIES TRUST, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held On May 20, 2005

You are cordially invited to attend the 2005 annual meeting of stockholders of Eagle Hospitality Properties Trust, Inc. to be held on Friday, May 20, 2005, at 10:00 a.m., at the Cincinnati Marriott Hotel at RiverCenter, 10 West RiverCenter Boulevard, Covington, Kentucky 41011. The principal purposes of the annual meeting are to elect nine directors, ratify the appointment of Grant Thornton LLP as independent auditors of Eagle for the 2005 fiscal year and to transact such other business as may properly come before such meeting or any adjournments.

Only stockholders of record at the close of business on March 18, 2005 will be entitled to vote at the meeting or any adjournments.

Whether or not you expect to attend the meeting, please complete, date and sign the enclosed proxy and mail it promptly in the enclosed envelope in order to ensure representation of your shares. No postage need be affixed if the proxy is mailed in the United States.

|

| BY ORDER OF THE BOARD OF DIRECTORS |

|

THOMAS A. FREDERICK |

| Chief Financial Officer, Treasurer and Secretary |

EAGLE HOSPITALITY PROPERTIES TRUST, INC.

100 E. RiverCenter Blvd., Suite 480

Covington, Kentucky 41011

PROXY STATEMENT

FOR

ANNUAL MEETING OF STOCKHOLDERS

To Be Held On May 20, 2005

This proxy statement is furnished to stockholders of Eagle Hospitality Properties Trust, Inc. in connection with the solicitation of proxies for use at the 2005 annual meeting of stockholders of Eagle to be held on Friday, May 20, 2005, at 10:00 a.m., at the Cincinnati Marriott Hotel at RiverCenter, 10 West RiverCenter Boulevard, Covington, Kentucky 41011 for the purposes set forth in the notice of meeting. This solicitation is made on behalf of the Board of Directors of Eagle.

Holders of record of shares of common stock of Eagle as of the close of business on the record date, March 18, 2005, are entitled to receive notice of, and to vote at, the meeting. The outstanding common stock constitutes the only class of securities entitled to vote at the meeting and each share of common stock entitles the holder to one vote. At the close of business on March 18, 2004, there were 17,362,373 shares of common stock issued and outstanding.

Eagle’s 2004 Annual Report has been mailed with this proxy statement. This proxy statement, the form of proxy and the 2004 Annual Report were mailed to stockholders on or about April 20, 2005.

Proposal One, the election of directors of Eagle, requires the vote of a plurality of all of the votes cast at the meeting provided that a quorum is present. For purposes of the election of directors, abstentions and broker non-votes will not be counted as votes cast and will have no effect on the result of the vote, although they will count toward the presence of a quorum.

Proposal Two, the ratification of the appointment of Grant Thornton LLP as independent auditors for the 2005 fiscal year, requires the affirmative vote of a majority of the votes cast on the proposal, provided that a quorum is present. For purposes of the vote on Proposal Two, abstentions and broker non-votes will not be counted as votes cast and will have no effect on the result of the vote, although they will count toward the presence of a quorum.

Shares represented by proxies in the form enclosed, if such proxies are properly executed and returned and not revoked, will be voted as specified. Where no specification is made on a properly executed and returned form of proxy, the shares will be voted FOR the election of all nominees for director, FOR the ratification of the appointment of Grant Thornton LLP and

1

FOR authorization of the proxy to vote upon such other business as may properly come before the meeting or any adjournments. You may vote by mail or in person at the meeting.

To vote by mail, sign, date and complete the enclosed proxy card and return it in the enclosed self-addressed stamped envelope. No postage need be affixed if the proxy is mailed in the United States. If you hold your shares through a bank, broker or other nominee, they will give you separate instructions on voting your shares.

PROPOSAL ONE:

ELECTION OF DIRECTORS

Board of Directors

The directors of Eagle are elected by the stockholders annually. Each director’s term of office expires at the annual meeting. Each of the directors has been nominated for election at the meeting to hold office until the 2006 annual meeting of stockholders and until their successors are elected and qualified.

The Board of Directors of Eagle recommends a vote FOR Messrs. Butler, Blackham, Banta, Costello, Engel, Fisher, George, Kohlhepp and McDowell to hold office until the 2006 annual meeting of stockholders and until their successors are elected and qualified. Should any one or more of these nominees become unable to serve for any reason, the Board of Directors may designate substitute nominees, in which event the person named in the enclosed proxy will vote for the election of such substitute nominee or nominees, or may reduce the number of directors on the Board of Directors.

Nominee for Election to Term Expiring 2006

William P. Butler, 62, has been our non-executive Chairman of the Board of Directors since our initial public offering. He is also the Chairman of the Board and Chief Executive Officer of Corporex Companies LLC, which he founded in 1965. Under Mr. Butler’s leadership, Corporex has evolved into a diverse financial investment company focusing on investing, family country clubs, hospitality and real estate development and management. Operating nearly 40 years, Corporex now includes such affiliates as Corporex Capital LLC, Five Seasons Sports Country Clubs, Corporex Realty & Investment LLC and Corporex Management & Leasing. Mr. Butler is also the chairman of, and the owner of an 85% interest in, Commonwealth Hotels, Inc., the manager with respect to nine of our hotels and our strategic alliance partner. He is also the founder of the Greater Cincinnati/Northern Kentucky Chapter of the National Association of Industrial and Office Parks (NAIOP) and the Metropolitan Growth Alliance, a group dedicated to regional planning and development for Northern Kentucky.

J. William Blackham, 51, is our President and Chief Executive Officer, a position he has held since our formation. Prior to our initial public offering, Mr. Blackham served as

2

Executive Vice President of Corporex, and as a member of Corporex’s Executive Management Board. Mr. Blackham joined Corporex in 1990 as Senior Vice President, Finance. He has almost 28 years experience in the acquisition, development, marketing, disposition, management and financing of real estate. Prior to joining Corporex, he was Executive Vice President of Tambone Corporation, a Boston based real estate development and investment firm. Mr. Blackham’s responsibilities included all asset purchase and sales transactions as well as project and corporate financing. Mr. Blackham holds a Bachelors Degree in Finance, Magna Cum Laude, from Boston College and an MBA from The Wharton School at the University of Pennsylvania. He is also a member of several professional organizations including National Association of Real Estate Investment Trusts (NAREIT), the Urban Land Institute (ULI), and the Pension Real Estate Association (PREA), and serves as an honorary Consular in Cincinnati for the Government of Brazil.

Robert J. Kohlhepp, 61, has served as a director since our initial public offering. Mr. Kohlhepp is Vice Chairman of Cintas Corporation, a $2.8 billion revenue, publicly-traded entity, which is highly regarded for its consistent and high-quality performance. Mr. Kohlhepp joined the company 37 years ago. He is a CPA with an MBA from Xavier University. He serves as director on several other publicly-traded companies and is a trustee of Xavier University in Cincinnati.

Frank C. McDowell, 56, has served as a director since our initial public offering. Mr. McDowell resides in San Francisco and is the retired Vice Chairman of BRE Properties, Inc. Trust. Mr. McDowell was promoted to Vice Chairman of BRE in January 2004. Since 1995, Mr. McDowell served as BRE’s Chief Executive Officer and until December 2003, also as President. BRE is a $3.0 billion asset, publicly-traded REIT which has existed for 35 years. BRE specializes in apartments. Mr. McDowell has 25 years of experience in the real estate industry, serving on numerous industry-related Boards.

Louis D. George, 53, has served as a director since our initial public offering. Since August 2004, Mr. George has served as Director of Taft, Stettinius & Hollister LLP, a full-service midwestern law firm, where he provides management expertise and reports to the managing partner and Executive Committee. From 2002 until June 2004, Mr. George was Chief Executive Officer of the New Ventures division of the Sheakley Company in Cincinnati. From 2000 to 2001, Mr. George was Managing Director of myCFO, a financial services firm headquartered in Redwood City, California. Prior to that, Mr. George was a national partner at Deloitte & Touche for approximately 15 years with a specialty in tax and real estate. Mr. George has an accounting degree from West Virginia University, and is a CPA. He serves as a district Board member of the Urban Land Institute and on the Boards of numerous Cincinnati non-profit organizations.

Thomas R. Engel, 61, has served as a director since our initial public offering. Mr. Engel is located in Boston and is the owner and Chief Executive Officer of T.R. Engel Group, LLC (“TRE”), an asset management advisory group with emphasis in hospitality acting on a national and international level. Prior to creating TRE in 1998, Mr. Engel was Senior Vice President for seven years at Equitable Life in charge of Equitable’s hotel portfolio. Mr. Engel

3

entered the hotel industry in 1982 and has worked at Hyatt Corporation and Holiday Inn Corporation in previous years. Mr. Engel has a graduate degree in business from Northwestern University, and qualifies as a hospitality industry expert.

Thomas E. Costello, 65, has served as a director since our initial public offering. Until 2002, Mr. Costello served more than 10 years as the Chief Executive Officer of Xpedx, a wholly-owned subsidiary of International Paper Inc. In 2000, Xpedx sales surpassed $7 billion, and the Company employed more than 9,000 people worldwide. Prior to joining Xpedx, Mr. Costello served as Vice President of Sales & Marketing/Officer at Dixon Paper, serving 16 years with the company. He was also President of Rampart Containers and held numerous positions with Mead Corporation. Mr. Costello is also on the Board of Corporex. Mr. Costello has served on such Boards as Thomas More College Executive Committee and Board of Trustees and the Alumni Board of Indiana University Kelley School of Business.

Thomas E. Banta, 42, has served as a director since our initial public offering. Mr. Banta is Executive Vice President of Corporex Companies. He is in charge of all real estate development and property management functions. Mr. Banta is a member of the Executive Management Board of Corporex. He is a graduate of Indiana University, and has been with Corporex 20 years, his entire career. Mr. Banta is the Corporex director designee under the nomination rights agreement.

Paul S. Fisher, 49, has served as a director since our initial public offering. Mr. Fisher is President, Chief Financial Officer and Trustee of CenterPoint Properties Trust and been an Executive Vice President of the CenterPoint since 1993. CenterPoint is a publicly-traded real estate investment trust engaged in the development, redevelopment and management of industrial property in the Chicago region. CenterPoint owns or operates approximately 40 million square feet of properties. Mr. Fisher has also served as the CenterPoint’s General Counsel and Secretary. Mr. Fisher is a graduate of The University of Notre Dame with a Bachelor of Arts degree in Economics, Doctor of Law degree from The University of Chicago Law School and serves on the Advisory Board of the Guthrie Center for Real Estate Research at the Kellogg Graduate School of Business.

Independent Directors

At least a majority of Eagle’s directors and all of the members of the audit committee and the governance and compensation committee must meet the test of “independence” as defined by the NYSE. The NYSE standards provide that to qualify as an “independent” director, in addition to satisfying certain bright-line criteria, the Board of Directors must affirmatively determine that a director has no material relationship with Eagle (either directly or as a partner, shareholder or officer of an organization that has a relationship with the company). The Board of Directors has determined that each of Messrs. Costello, Engel, Fisher, George, Kohlhepp and McDowell satisfies the bright-line criteria and that none has a relationship with Eagle that would interfere with such person’s ability to exercise independent judgment as a member of the Board. Therefore, Eagle believes that each of such directors, or two-thirds of the Board, is independent under the NYSE rules.

4

Committees of the Board of Directors

Audit Commitee. During 2004, the audit committee consisted of Messrs. Engel, Fisher and George. Mr. Fisher serves as chairman of the audit committee. The audit committee approves the engagement of independent public accountants, reviews with the independent public accountants the plans and results of the audit engagement, approves professional services provided by the independent public accountants, reviews the independence of the independent public accountants, approves audit and non-audit fees and reviews the adequacy of Eagle’s internal accounting controls.

The Board of Directors has made the following determinations about the composition of the audit committee:

| | Ÿ | | Each member is financially literate. |

| | Ÿ | | At least one member, Mr. Fisher, is a financial expert. |

| | Ÿ | | No member has accepted any consulting, advisory or other compensatory fee from Eagle other than as set forth below under “—Compensation of Directors.” |

During 2004, the audit committee held one in-person meeting, which was held after our initial public offering.

The audit committee has adopted a process for stockholders to send communications to the audit committee with concerns or complaints concerning Eagle’s regulatory compliance, accounting, audit or internal controls issues. Written communications may be addressed to the Chairman of the Audit Committee, Eagle Hospitality Properties Trust, Inc., 100 E. RiverCenter Blvd., Suite 480, Covington, Kentucky 41011. To view an online version of the audit committee’s charter, please visit the “Investor Relations/Corporate Governance” section of our website atwww.eaglehospitality.com. A copy is also attached as Appendix A to this Proxy Statement.

Governance and Compensation Committee. During 2004, the governance and compensation committee consisted of Messrs. Costello, Kohlhepp and McDowell. Mr. Kohlhepp serves as Chairman of the governance and compensation committee. With the recommendations of the Chief Executive Officer, the governance and compensation committee determines the compensation for Eagle’s executive officers with the consent of the full Board of Directors and implements Eagle’s 2004 Long-Term Incentive Plan (the “LTIP”) with the consent of the full Board. The committee also determines the compensation of the Chief Executive Officer. In addition, the committee makes recommendations to the Board concerning corporate governance policies and practices, Board member qualification standards, director nominees, Board responsibilities and compensation, the size and responsibilities of each of the committees, Board access to management and independent advisors and management succession.

On an annual basis, the governance and compensation committee assesses the appropriate skills and characteristics of existing and new Board members. This assessment includes

5

consideration as to the members’ independence, diversity, ages, skills, expertise, character and business experience in the context of the needs of the Board. The same criteria are used by the governance and compensation committee in evaluating nominees for directorship.

In making any nominee recommendations to the Board, the governance and compensation committee will consider persons recommended by stockholders so long as the recommendation is submitted to the committee prior to the date which is 120 days before the anniversary of the mailing of the prior year’s proxy statement. Any such nominations, together with appropriate biographical information, should be submitted to the Chairman of the Governance and Compensation Committee, Eagle Hospitality Properties Trust, Inc., 100 E. RiverCenter Blvd., Suite 480, Covington, Kentucky 41011. However, the governance and compensation committee may, in its sole discretion, reject any such recommendation for any reason. For additional information regarding Eagle’s corporate governance guidelines, please visit the “Investor Relations/Corporate Governance” section of our website. In addition, the governance and compensation committee’s charter is available on our website atwww.eaglehospitality.com for review.

During 2004, the governance and compensation committee held one in-person meeting, which was held after our initial public offering.

Meetings of the Board of Directors; Non-Management Director Executive Sessions

The Board of Directors held one in-person meeting in 2004, which was held after our initial public offering. The non-management directors of Eagle met in executive session at the in-person meeting of the Board of Directors. The Chairman of the Corporate Governance and Compensation Committee presides over such executive sessions.

Each director, except Mr. Costello, attended the 2004 meeting of our Board of Directors and the meeting of the committee of our Board of Directors on which the director served. The Board of Directors encourages its members to attend each annual meeting of stockholders.

The Board of Directors has established a process for interested parties, including stockholders, to communicate directly with the non-management directors. Written communications may be addressed to the Chairman of the Board of Directors, Eagle Hospitality Properties Trust, Inc., 100 E. RiverCenter Blvd., Covington, Kentucky 41011. This information is also available by visiting the “Contact Us” section of our website atwww.eaglehospitality.com.

Compensation of Directors

Eagle pays directors who are not employees of Eagle fees for their services as directors. During 2004, non-employee directors received prorated annual compensation of $34,000, commencing on the date of our initial public offering. Directors also receive a fee of $1,000 plus out-of-pocket expenses for attendance in person at each meeting of the Board of Directors, but only to the extent that Eagle has more than four meetings in a single year. In 2004, no director was paid this additional fee. The respective chairs of our audit committee

6

and our governance and compensation committee received an additional $5,000 in annual compensation, which was prorated for 2004 commencing on the date of our initial public offering.

In addition, at the time of our initial public offering on October 6, 2004, each person, other than Mr. Butler, serving as a non-employee director received 4,167 shares of restricted stock under the LTIP. Mr. Butler received 83,333 shares of restricted stock. The restricted stock awards granted to Mr. Butler vest on each of the first five anniversaries of the date of grant. The restricted stock awards granted to the other non-employee directors vest 100% on the first anniversary of the date of grant. Dividends are paid on all restricted stock awards at the same rate and on the same date as on shares of Eagle common stock.

Officers of Eagle who are directors are not paid any director fees.

Executive Officers

The following information is provided with respect to the executive officers of Eagle. Executive Officers are elected by, and serve at the discretion of, the Board of Directors.

J. William Blackham, Chief Executive Officer and President. Biographical information regarding Mr. Blackham is set forth under “Proposal One—Election of Directors.”

Thomas A. Frederick, 50, has served as our Chief Financial Officer, Treasurer and Secretary since October, 2004. From 1986 through 2000, Mr. Frederick held various financial and operating positions with Huffy Corporation, then a New York Stock Exchange listed company, including serving as a Chief Financial Officer. From 2000 to 2003, Mr. Frederick was senior vice president and Chief Financial Officer of Frequency Marketing, Inc., a software and consulting services provider. In 2003, Mr. Frederick served as President of Hammer Graphics, Inc. during a challenging debt restructuring. Less than one month after Mr. Frederick became President, a court-appointed receiver was established for the benefit of Hammer Graphics, Inc. Mr. Frederick is a CPA with 10 years experience in public accounting with KPMG LLP. Mr. Frederick earned his Masters in Business Administration from Wright State University in 1976 and a Bachelor of Science in Accounting, Summa Cum Laude, from Wright State University in 1975.

7

Executive Compensation

The following table sets forth information concerning the compensation of the Chief Executive Officer and the Chief Financial Officer (the “Named Executive Officers”) for the year ended December 31, 2004:

Summary Compensation Table

| | | | | | | | | | | | | | | |

| | | | | | | | | Long-Term Compensation

| | |

Name and Principal Position

| | Year

| | Salary(1)

| | Bonus

| | Restricted Stock Awards(2)

| | LTIP

Payouts

| | All Other Compensation(3)

|

J. William Blackham President and CEO | | 2004 | | $ | 75,000 | | — | | $ | 812,497 | | — | | $ | 74 |

Thomas A. Frederick CFO, Treasurer and Secretary | | 2004 | | $ | 50,000 | | — | | $ | 203,121 | | — | | $ | 74 |

| (1) | | The executive officers did not receive any salary from Eagle until consummation of our initial public offering and therefore only received three months of salary during 2004. Under the terms of their respective employment agreements, Mr. Blackham’s and Mr. Frederick’s annual salary is $300,000 and $200,000 respectively. |

| (2) | | Represents the dollar value of restricted stock awards calculated by multiplying the closing market price of Eagle common stock on the date of grant by the number of shares of restricted stock awarded. This valuation does not take into account the diminution in value attributable to the restrictions applicable to the shares of restricted stock. The restricted stock awards vest one-fifth on each anniversary of the date of grant. Dividends are paid on all restricted stock awards at the same rate and on the same date as on shares of Eagle common stock. See “Restricted Stock Holdings.” |

| (3) | | Consists of amounts contributed by Eagle for term life insurance premiums. |

Restricted Stock Holdings

The total restricted stock holdings and their fair market value based on the per share closing price of $10.30 as of December 31, 2004 are set forth below. The values do not reflect diminution of value attributable to the restrictions applicable to the shares of restricted stock. All of the shares of restricted stock vest one-fifth on each anniversary of the date of grant. Dividends are paid on all restricted stock, whether or not vested, at the same rate and on the same date as on shares of Eagle common stock.

| | | | | |

Name

| | Total Shares of

Restricted Stock

| | Value at December 31, 2004

|

J. William Blackham | | 83,333 | | $ | 858,330 |

Thomas A. Frederick | | 20,833 | | $ | 214,579 |

Employment Contracts

Each of Messrs. Blackham and Frederick entered into employment agreements with us at the time of our initial public offering. We believe that these agreements benefit us by helping

8

to retain the executive and by allowing each executive to focus on his duties without the distraction of the concern for his personal situation in the event of, among other things, a possible change in control of our company.

Chief Executive Officer

Mr. Blackham entered into a five-year employment contract effective as of October 6, 2004. Thereafter, the term of his agreement can be extended for an additional year, on each anniversary of the agreement, unless either party gives 60 days’ prior written notice that the term will not be extended. This contract provides for a minimum annual base salary at the rate of $300,000. In addition, Mr. Blackham received 83,333 shares of restricted stock pursuant to his employment agreement at the time of our initial public offering. The restricted stock awards granted to Mr. Blackham vest on each of the first five anniversaries of the date of grant. Dividends are paid on all restricted stock awards at the same rate and on the same date as on shares of Eagle common stock.

His contract includes provisions restricting him from competing with Eagle for a period of one year if his contract is not renewed and upon payment by Eagle of an amount equal to Mr. Blackham’s annual salary.

Chief Financial Officer

Mr. Frederick entered into a three-year employment contract effective October 6, 2004. As with Mr. Blackham’s agreement, Mr. Frederick’s agreement can be extended for an additional year, on each anniversary of the agreement, unless either party gives 60 days’ prior written notice that the term will not be extended. Mr. Frederick’s contract provides for a minimum annual base salary at the rate of $200,000. In addition, Mr. Frederick received 20,833 shares of restricted stock pursuant to his employment agreement at the time of our initial public offering. The restricted stock awards granted to Mr. Frederick vest on each of the first five anniversaries of the date of grant. Dividends are paid on all restricted stock awards at the same rate and on the same date as on shares of Eagle common stock.

His contract includes provisions restricting him from competing with Eagle during employment and, except in certain circumstances, for a period of one year after termination of employment.

Change in Control Provisions

Each executive’s employment agreement provides severance benefits if the executive’s employment ends under certain circumstances following a change in control of the Company. With respect to Mr. Blackham, the contract generally provides that, if within 24 months from the date of a change in control (as defined below), the employment of the executive officer is terminated without cause or the executive resigns for good reason, such executive officer will be entitled to receive:

| | Ÿ | | any accrued but unpaid salary and bonuses; |

| | Ÿ | | vesting as of the executive’s last day of employment of any unvested stock options or restricted stock previously issued to the executive; |

9

| | Ÿ | | payment of the executive’s life, health and disability insurance coverage following the executive’s termination for a period of three years; and |

| | Ÿ | | payment equal to his base salary for three years plus his bonus equal to three times the greater of his average bonus paid during the last two years and his most recent bonus, if any. |

With respect to Mr. Frederick, the contract generally provides that, if within 12 months from the date of a change in control (as defined below), the employment of the executive officer is terminated without cause or the executive resigns for good reason, such executive officer will be entitled to receive:

| | Ÿ | | any accrued but unpaid salary and bonuses; |

| | Ÿ | | vesting as of the executive’s last day of employment of any unvested stock options or restricted stock previously issued to the executive; |

| | Ÿ | | payment of the executive’s life, health and disability insurance coverage following the executive’s termination for a period of one year; and |

| | Ÿ | | payment equal to his base salary for one year. |

For purposes of the contracts described in the preceding paragraphs, “change in control” generally means any of the following events:

| | Ÿ | | the acquisition of 50% or more of Eagle’s common stock or voting stock by any person in a single transaction or series of related or unrelated transactions; |

| | Ÿ | | a merger in which Eagle’s stockholders before the merger do not own at least 50% of the merged company; |

| | Ÿ | | a sale of all or substantially all of Eagle’s assets in one or a series of related sales; |

| | Ÿ | | a tender offer for Eagle’s securities representing more than 50% of the outstanding voting stock; or |

| | Ÿ | | with respect to Mr. Blackham’s agreement only, the current incumbent directors cease to be a majority of our Board. |

Governance and Compensation Committee Interlocks and Insider Participation

During 2004, the governance and compensation committee consisted of Messrs. Costello, Kohlhepp and McDowell. None of the members of the governance and compensation committee is a current or past employee of Eagle and each was and is independent under the rules and regulations of the New York Stock Exchange.

Governance and Compensation Committee Report

The governance and compensation committee directs the administration of Eagle’s LTIP and determines compensation for Eagle’s executive officers. The committee’s compensation policies are designed to: 1) promote the success, and enhance the value, of Eagle by linking

10

the personal interests of our employees, officers, directors and consultants to those of our stockholders; 2) provide such persons with an incentive for outstanding corporate performance; and 3) provide flexibility to Eagle in its ability to motivate, attract, and retain the services of employees, officers, directors and consultants upon whose judgment, interest, and special effort the successful conduct of Eagle’s operation is largely dependent.

Compensation for executives is based generally on the following principles:

| | Ÿ | | variable compensation should comprise a significant part of an executive’s compensation with the percentage at-risk increasing at increased levels of responsibility; |

| | Ÿ | | employee stock ownership aligns the interests of employees and stockholders; |

| | Ÿ | | compensation must be competitive with that offered by companies that compete with Eagle for executive talent; and |

| | Ÿ | | differences in executive compensation within Eagle should reflect differing levels of responsibility and performance. |

A key determinant of overall levels of compensation is the pay practices of public equity REITs that have revenues comparable to Eagle.

There are three components to Eagle’s executive compensation program: base salary; annual incentive compensation; and long-term incentive compensation. The more senior the position, the greater the portion of compensation that varies with performance.

Annual Compensation. Executive salaries other than that of the Chief Executive Officer are recommended to the committee by the Chief Executive Officer and are designed to be competitive with the peer group companies described above. The Chief Executive Officer’s base salary is determined by the committee. Each executive officer’s annual base salary was prorated for 2004 from the time of our initial pubic offering until the end of the calendar year.

Eagle’s executive officers participate in an annual cash incentive bonus program whereby they are eligible for cash bonuses based on a percentage of their annual base salary as of the prior December. In addition to considering the pay practices of Eagle’s peer group in determining each executive’s bonus percentage, the committee also considers the executive’s ability to influence overall performance of Eagle. No bonuses were awarded for 2004 for either Messrs. Blackham or Frederick.

Long-Term Incentives. As an incentive to retain executive officers, Eagle’s long-term incentive plan for officers provides for annual grants of restricted stock under the LTIP. The shares of restricted stock issued to our executive officers in connection with our initial public offering vest one-fifth on each anniversary of the date of grant.

Section 162(m) of the Internal Revenue Code generally denies a deduction for compensation in excess of $1 million paid to certain executive officers, unless certain performance, disclosure and stockholder approval requirements are met. Restricted Stock

11

grants and certain other awards under the LTIP are intended to qualify as “performance-based” compensation not subject to Section 162(m) deduction limitation. The committee believes that a substantial portion of compensation awarded under Eagle’s compensation program would be exempted from the $1 million deduction limitation. The committee’s intention is to qualify, to the extent reasonable, a substantial portion of each executive officer’s compensation for deductibility under applicable tax laws.

Chief Executive Officer Compensation. During 2004, Mr. Blackham’s base salary and long-term incentive awards were determined by the committee substantially in conformity with the policies described above for all other executive officers of Eagle. The Chief Executive Officer’s 2004 compensation was based solely upon a pro-ration of amounts due under his employment contract and restricted stock awards issued in connection with the Company’s initial public offering. Mr. Blackham’s base salary of $300,000 was prorated for 2004 from the time of our initial pubic offering until December 31, 2004. For 2004, Mr. Blackham was paid $75,000 in base salary. Mr. Blackham earned no cash bonus in 2004.

In addition, during 2004, Mr. Blackham was granted long-term incentive compensation consisting of shares of restricted stock valued at $9.75 on the date of grant, which vest one-fifth on the anniversary of the date of grant. No awards of stock options were made in 2004.

Governance and Compensation Committee

| | | | |

| Thomas E. Costello | | Frank C. McDowell | | Robert J. Kohlhepp (chair) |

Audit Committee Report

The Board of Directors has adopted a written charter for the audit committee, a copy of which is attached hereto as Appendix A and is available by visiting the “Investor Relations/Corporate Governance” section of our website atwww.eaglehospitality.com.

Purpose and Function of the Audit Committee. The audit committee oversees the financial reporting process on behalf of the Board of Directors. Management is responsible for Eagle’s financial statements and the financial reporting process. The independent auditors are responsible for expressing an opinion on the conformity of the audited financial statements with accounting principles generally accepted in the United States.

In fulfilling its oversight responsibilities, the audit committee has reviewed with management and the independent auditors Eagle’s audited financial statements for the year ended December 31, 2004. The audit committee also reviewed and discussed with management and the independent auditors the disclosures made in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Controls and Procedures” included in the 2004 Annual Report on Form 10-K.

In addition, the audit committee received written disclosures from the independent accountants required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), and the audit committee discussed with the independent

12

accountants that firm’s independence from management and Eagle and considered the compatibility of non-audit services with the auditors’ independence.

Independent Auditor Fees. During the years ended December 31, 2004 and 2003, fees incurred related to our independent registered public accounting firm, Grant Thornton LLP, consisted of the following:

| | | | | | |

| | | Year Ended

December 31,

|

| | | 2004

| | 2003

|

Audit Fees (1) | | $ | 107 | | $ | — |

Audit-Related Fees (2) | | | 137 | | | 11 |

Tax Fees (3) | | | 28 | | | — |

All Other Fees (4) | | | — | | | — |

| | |

|

| |

|

|

Total | | $ | 272 | | $ | 11 |

| | |

|

| |

|

|

| (1) | | Represents professional fees associated with the audits of Eagle’s annual consolidated financial statements, quarterly reviews, and $101,000 related to Eagle’s IPO. |

| (2) | | Represents professional fees associated with required audits of acquired properties in compliance with Rule 3-14 of Regulation S-X of the Securities and Exchange Commission. |

| (3) | | Represents professional fees associated with tax planning, tax consultation, and review of tax returns. |

| (4) | | No other professional services were incurred. |

Pre-Approval Policies. The audit committee has adopted a policy requiring the pre-approval of all fees paid to its independent auditor. Before an independent auditor is engaged to render any service, the proposed services must either be specifically pre-approved by the audit committee or such services must fall within a category of services that are pre-approved by the audit committee without specific case-by-case consideration.

The audit committee has pre-approved the provision by the independent auditor of the following services without specific case-by-case consideration during 2005:

| | Ÿ | | Services associated with testing of and accounting for significant transactions in an amount not to exceed $10,000; |

| | Ÿ | | Services associated with a review of the Quarterly Report on Form 10-Q for the three months ended March 31, 2005 in an amount not to exceed $7,000; |

| | Ÿ | | Due diligence services related to property acquisitions and dispositions (including title-holding entity due diligence) in an amount not to exceed $10,000; |

| | Ÿ | | Financial statement audits of property acquisitions if and when Rule 3-14 threshold requirements are met in an amount not to exceed $10,000; |

| | Ÿ | | Consultations with Eagle’s management as to the accounting or disclosure treatment of transactions or events and/or the actual or potential impact of final or proposed |

13

rules, standards or interpretations by the SEC, FASB, PCAOB or other regulatory or standard-setting bodies in an amount not to exceed $10,000; and

| | Ÿ | | Federal, state, local, franchise and other tax services, including consulting services, other than advocacy-related services such as representation before any taxing or judicial authority with respect to returns under examination or to obtain rulings in advance of proposed transactions, in an amount not to exceed $10,000. |

Any services in excess of these pre-approved amounts, or any services not described above, require the pre-approval of the audit committee chair, with a review by the audit committee at its next scheduled meeting.

The audit committee discussed with Eagle’s internal and independent auditors the overall scope and plans for their respective audits. The audit committee held one in-person meeting during 2004.

Recommendations of the Audit Committee. In reliance on the reviews and discussions referred to above, the audit committee recommended to the Board of Directors (and the Board has approved) that the audited financial statements be included in the 2004 Annual Report on Form 10-K for filing with the SEC.

Audit Committee

| | | | |

| Thomas R. Engel | | Paul S. Fisher (chair) | | Louis D. George |

14

VOTING SECURITIES AND PRINCIPAL STOCKHOLDERS

The following table sets forth the beneficial ownership of shares of common stock as of December 31, 2004 for each person or group known to Eagle to be holding more than 5% of the common stock, for each director and Named Executive Officer and for the directors and executive officers of Eagle as a group. The number of shares shown represents the number of shares of common stock the person “beneficially owns,” as determined by the rules of the SEC, including the number of shares that may be issued upon redemption of common partnership interests (“Common Units”) in EHP Operating Partnership, L.P. (the “Operating Partnership”). The Operating Partnership is controlled by Eagle as its sole general partner. The Operating Partnership is obligated to redeem each Common Unit at the request of the holder thereof for the cash value of one share of common stock or, at Eagle’s option, one share of common stock.

| | | | | |

Name of Beneficial Owner

| | Number of Shares

Beneficially Owned

| | Percent

of All

Shares (1)

| |

William P. Butler (2) | | 3,933,657 | | 18.7 | % |

J. William Blackham (3) | | 199,062 | | 1.1 | % |

Thomas A. Frederick | | 20,833 | | * | |

Thomas E. Banta (4) | | 90,465 | | * | |

Thomas E. Costello (5) | | 98,458 | | * | |

Thomas R. Engel | | 4,367 | | * | |

Paul F. Fisher | | 4,167 | | * | |

Louis D. George | | 5,667 | | * | |

Robert J. Kohlhepp | | 14,167 | | * | |

Frank C. McDowell | | 14,167 | | * | |

All executive officers and directors as a group (10 persons) | | 4,385,100 | | 20.7 | % |

Deutsche Bank AG and its affiliates (6) | | 1,258,000 | | 7.2 | % |

Artisan Partners Limited Partnership and its affiliates (7) | | 1,602,100 | | 9.2 | % |

| (1) | | The total number of shares outstanding used in calculating this percentage assumes that: 1) no Common Units held by other persons are exchanged for shares of common stock; and 2) Common Units that are subject to future vesting pursuant to the terms of the formation documents that governed the entities that owned the nine initial hotels prior to the initial public offering or the agreements pursuant to which such employee acquired the interest in such entities will have vested in full. |

| (2) | | Number of shares beneficially owned includes 3,623,242 shares issuable upon redemption of Common Units. |

| (3) | | Number of shares beneficially owned includes 115,629 shares issuable upon redemption of Common Units. |

| (4) | | Number of shares beneficially owned includes 86,298 shares issuable upon redemption of Common Units. |

| (5) | | Number of shares beneficially owned includes 84,381 shares issuable upon redemption of Common Units. |

| (6) | | Deutsche Bank AG is located at Taunusanlage 12, D-60325, Frankfurt am Main, Federal Republic of Germany. Information obtained from Schedule 13G filed with the SEC. |

| (7) | | Artisan Partners Limited Partnership is located at 875 East Wisconsin Avenue, Suite 800 Milwaukee, WI 53202. Information obtained from Schedule 13G filed with the SEC. |

15

EQUITY COMPENSATION PLAN INFORMATION

The following table provides information as of December 31, 2004 with respect to the shares of common stock that may be issued under Eagle’s existing equity compensation plans:

| | | | | | |

Plan Category

| | Number of Securities to

be Issued Upon

Exercise of

Outstanding Options (2)

| | Weighted-Average

Exercise Price of

Outstanding Options

| | Number of Securities

Remaining Available

for Future Issuance

Under Equity

Compensation Plans

|

Equity Compensation Plans Approved by Stockholders (1) | | — | | — | | 422,132 |

Equity Compensation Plans Not Approved by Stockholders | | — | | — | | — |

| (1) | | Consists of the LTIP, under which the governance and compensation committee may grant stock options, performance shares or units, stock appreciation rights and restricted stock to employees, officers and directors of Eagle and consultants providing services to Eagle. Subsequent to December 31, 2004, the number of shares available for future issuance under the LTIP increased automatically under the terms of the LTIP by 131,435 shares. |

| (2) | | Eagle issued no stock options under the LTIP in 2004. |

RELATED PARTY TRANSACTIONS

Certain of our directors and officers and the employees of Commonwealth Hotels, Inc. and Corporex directly or indirectly owned all or a substantial amount of the ownership interests in the entities that owned our nine initial hotels prior to our initial public offering. The owners of those entities contributed the entity ownership interests to us as part of our acquisition of those hotel assets.

Simultaneously with the closing of the offering, our Operating Partnership issued an aggregate of 5,566,352 units and we issued 146,540 shares of common stock and made a cash payment equal to $51.1 million plus $5.0 million equal to the hotels’ collective net working capital as of the closing to acquire 100% of the interests in the entities that owned eight of our initial hotels and a 49% interest in the entity that owns the ninth hotel. No later than January 31, 2006, we will acquire the remaining 51% interest in the ninth hotel for 427,485 Operating Partnership units.

For purposes of determining the amount of consideration we delivered in exchange for the initial hotels, we valued the assets based on several factors, including a multiple of expected future earnings, internal rate of return analysis, replacement costs and analysis of sales of similar assets. No single factor was given greater weight than any other. Our valuations may not have reflected the fair market values of the initial assets; however, our management believed that the total fair value of all consideration given in connection with our formation transactions (including the assumption of liabilities) was equal to the fair value of the assets acquired. We did not obtain any independent appraisals of any of the initial hotels.

16

The contributing entities have no right under the contribution and sale agreements to require us to deliver more cash or a greater number of Operating Partnership units (other than the right of the original contributors of the Embassy Suites Hotel Columbus/Dublin, the Embassy Suites Hotel Cleveland/Rockside and the Embassy Suites Hotel Denver-International Airport to receive earn-out payments totaling in the aggregate up to 833,333 additional Operating Partnership units only if certain operating measurements are achieved over a trailing 12-month period within three years from the contribution).

Each of the acquisition agreements contained representations and warranties concerning the ownership and operation of the initial hotels and other customary matters. Each contributing or selling entity has agreed to indemnify us against breaches of the representations and warranties made by such entity in the related acquisition agreement. The amount of such indemnification claims by us is severally limited with respect to each contributor or selling entity to the amount of the purchase price paid to such entity in the acquisition agreement. In addition, the indemnification obligations of the contributing or selling entities survives until October 2005 and is secured by a pledge of the shares or Operating Partnership units we issued in exchange for the initial properties.

Each of our directors and officers and employees of Commonwealth Hotels, Inc. and Corporex who, at the time of the acquisition of the hotels, beneficially owned any interests in the entities that owned the initial nine hotels prior to our initial public offering, are listed below as of October 1, 2004, along with the related interests conveyed or sold to us and the number of Operating Partnership units issued, shares of common stock issued or cash paid in exchange for such initial hotels.

17

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | Direct Ownership Interest

| | Participation Agreement Interest

| | | Total

| |

Contributor

| | Percent

Ownership

| | | Property

| | Operating

Partnership

Units

| | | Shares of

Common

Stock

| | Cash

Payments

(20)

| | Operating

Partnership

Units

| | | Shares of

Common

Stock

| | Cash

Payments

(20)

| | | Operating

Partnership

Units

| | | Shares of

Common

Stock

| | Cash

Payments

(20)

| |

William P. Butler | | 100.0 | % | | Embassy Suites Hotel Cleveland/

Rockside | | 475,593 | | | — | | | — | | (47,443 | ) | | — | | | — | | | 428,150 | | | — | | | — | |

| | | 100.0 | % | | Embassy Suites Hotel Columbus/Dublin | | 952,182 | | | — | | | — | | (82,492 | ) | | — | | | — | | | 869,690 | | | — | | | — | |

| | | 98.0 | % | | Embassy Suites Hotel RiverCenter | | 821,442 | (1) | | — | | | — | | (23,697 | ) | | — | | | — | | | 797,745 | | | — | | | — | |

| | | 55.039 | % | | Embassy Suites Hotel Denver-

International Airport | | 1,863 | | | — | | $ | 5,127,563 | | — | | | — | | | — | | | 1,863 | | | — | | $ | 5,127,563 | |

| | | 45.4893 | % | | Embassy Suites Hotel Tampa-Airport/

Westshore | | — | | | 18,750 | | | 8,044,748 | | — | | | — | | | — | | | — | | | 18,750 | | | 8,044,748 | |

| | | 78.0 | % | | Hilton Cincinnati Airport | | 133,325 | | | — | | | — | | — | | | — | | | — | | | 133,325 | | | — | | | — | |

| | | 54.7954 | % | | Cincinnati Landmark Marriott | | 574,628 | | | — | | | 12,326,920 | | — | | | — | | | — | | | 574,628 | | | — | | | 12,326,920 | |

| | | 45.4893 | % | | Hyatt Regency Rochester | | — | | | — | | | 5,539,746 | | — | | | — | | $ | (118,363 | ) | | — | | | — | | | 5,421,383 | |

| | | 66.669 | % | | Chicago Marriott Southwest at Burr Ridge | | 916,300 | | | — | | | — | | (98,459 | ) | | — | | | — | | | 817,841 | | | — | | | — | |

Subtotal: | | | | | | | 3,875,333 | | | 18,750 | | | 31,038,977 | | (252,091 | ) | | — | | | (118,363 | ) | | 3,623,242 | | | 18,750 | | | 30,920,614 | |

J. William Blackham | | — | | | Embassy Suites Hotel Cleveland/

Rockside | | — | | | — | | | — | | 12,532 | | | — | | | — | | | 12,532 | | | — | | | — | |

| | | — | | | Embassy Suites Hotel Columbus/Dublin | | — | | | — | | | — | | 24,399 | | | — | | | — | | | 24,399 | | | — | | | — | |

| | | 1.0 | % | | Embassy Suites Hotel RiverCenter | | 8,382 | | | — | | | — | | — | | | — | | | — | | | 8,382 | | | — | | | — | |

| | | 1.9674 | % | | Embassy Suites Hotel Denver-

International Airport | | 14,639 | | | — | | | — | | — | | | — | | | — | | | 14,639 | | | — | | | — | |

| | | 1.68 | % | | Cincinnati Landmark Marriott | | 39,267 | | | — | | | — | | — | | | — | | | — | | | 39,267 | | | — | | | — | |

| | | — | | | Hyatt Regency Rochester | | — | | | — | | | — | | — | | | — | | | 139,276 | | | — | | | — | | | 139,276 | |

| | | — | | | Chicago Marriott Southwest at Burr Ridge | | — | | | — | | | — | | 16,410 | | | — | | | — | | | 16,410 | | | — | | | — | |

Subtotal: | | | | | | | 62,288 | | | — | | | — | | 53,341 | | | — | | | 139,276 | | | 115,629 | (2) | | — | | | 139,276 | (3) |

Daniel T. Fay | | — | | | Embassy Suites Hotel Cleveland/

Rockside | | — | | | — | | | — | | 12,532 | | | — | | | — | | | 12,532 | | | — | | | — | |

| | | — | | | Embassy Suites Hotel Columbus/Dublin | | — | | | — | | | — | | 32,531 | | | — | | | — | | | 32,531 | | | — | | | — | |

| | | — | | | Embassy Suites Hotel RiverCenter | | — | | | — | | | — | | 23,697 | | | — | | | — | | | 23,697 | | | — | | | — | |

| | | 1.9674 | % | | Embassy Suites Hotel Denver-

International Airport | | 14,639 | | | — | | | — | | — | | | — | | | — | | | 14,639 | | | — | | | — | |

| | | 8.0372 | % | | Embassy Suites Hotel Tampa-Airport/

Westshore | | — | | | 69,793 | | | 623,601 | | — | | | — | | | — | | | — | | | 69,793 | | | 623,601 | |

| | | 15.0 | % | | Hilton Cincinnati Airport | | 25,640 | | | — | | | — | | — | | | — | | | — | | | 25,640 | | | — | | | — | |

| | | 1.68 | % | | Cincinnati Landmark Marriott | | 4,019 | | | — | | | 422,963 | | — | | | — | | | — | | | 4,019 | | | — | | | 422,963 | |

| | | 8.0372 | % | | Hyatt Regency Rochester | | — | | | 57,997 | | | 282,819 | | — | | | — | | | (20,913 | ) | | — | | | 57,997 | | | 261,906 | |

| | | — | | | Chicago Marriott Southwest at Burr Ridge | | — | | | — | | | — | | 16,410 | | | — | | | — | | | 16,410 | | | — | | | — | |

Subtotal: | | | | | | | 44,298 | | | 127,790 | | | 1,329,383 | | 85,170 | | | — | | | (20,913 | ) | | 129,468 | (4) | | 127,790 | | | 1,308,470 | |

18

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | Direct Ownership Interest

| | Participation Agreement Interest

| | Total

| |

Contributor

| | Percent

Ownership

| | | Property

| | Operating

Partnership

Units

| | Shares of

Common

Stock

| | Cash

Payments

(20)

| | Operating

Partnership

Units

| | | Shares of

Common

Stock

| | Cash

Payments

| | Operating

Partnership

Units

| | | Shares of

Common

Stock

| | Cash

Payments(20)

| |

Todd W. Kibler | | — | | | Embassy Suites Hotel Cleveland/

Rockside | | — | | — | | | — | | 3,133 | | | — | | — | | 3,133 | | | — | | | — | |

| | | 0.6562 | % | | Embassy Suites Hotel

Denver-International Airport | | 2,334 | | — | | $ | 15,076 | | — | | | — | | — | | 2,334 | | | — | | $ | 15,076 | |

| | | — | | | Chicago Marriott Southwest at Burr Ridge | | — | | — | | | — | | 16,410 | | | — | | — | | 16,410 | | | — | | | — | |

Subtotal: | | | | | | | 2,334 | | — | | | 15,076 | | 19,543 | | | — | | — | | 21,877 | (5) | | — | | | 15,076 | (6) |

Gordon Snyder | | — | | | Embassy Suites Hotel Cleveland/

Rockside | | — | | — | | | — | | 3,133 | | | — | | — | | 3,133 | | | — | | | — | |

| | | — | | | Embassy Suites Hotel Columbus/Dublin | | — | | — | | | — | | 8,133 | | | — | | — | | 8,133 | | | — | | | — | |

| | | 0.6562 | % | | Embassy Suites Hotel Denver-

International Airport | | 2,334 | | — | | | 15,076 | | — | | | — | | — | | 2,334 | | | — | | | 15,076 | |

| | | 0.42 | % | | Cincinnati Landmark Marriott | | 6,381 | | — | | | 41,233 | | — | | | — | | — | | 6,381 | | | — | | | 41,233 | |

| | | — | | | Chicago Marriott Southwest at Burr Ridge | | — | | — | | | — | | 5,470 | | | — | | — | | 5,470 | | | — | | | — | |

Subtotal: | | | | | | | 8,715 | | — | | | 56,309 | | 16,736 | | | — | | — | | 25,451 | (7) | | | | | 56,309 | (8) |

Pat Boyleson | | 0.42 | % | | Cincinnati Landmark Marriott | | 6,381 | | — | | | 41,233 | | — | | | — | | — | | 6,381 | | | — | | | 41,233 | |

Subtotal: | | | | | | | 6,381 | | — | | | 41,233 | | — | | | — | | — | | 6,381 | (9) | | — | | | 41,233 | (10) |

Thomas Banta | | — | | | Embassy Suites Hotel Cleveland/

Rockside | | — | | — | | | — | | 12,532 | | | — | | — | | 12,532 | | | — | | | — | |

| | | — | | | Embassy Suites Hotel Columbus/Dublin | | — | | — | | | — | | 16,266 | | | — | | — | | 16,266 | | | — | | | — | |

| | | 1.0 | % | | Embassy Suites Hotel RiverCenter | | 8,382 | | — | | | — | | — | | | — | | — | | 8,382 | | | — | | | — | |

| | | 1.3075 | % | | Embassy Suites Hotel Denver-

International Airport | | 4,198 | | | | | 35,476 | | — | | | — | | — | | 4,198 | | | — | | | 35,476 | |

| | | 1.68 | % | | Cincinnati Landmark Marriott | | 23,041 | | — | | | 194,691 | | — | | | — | | — | | 23,041 | | | — | | | 194,691 | |

| | | — | | | Chicago Marriott Southwest at Burr Ridge | | — | | — | | | — | | 21,879 | | | — | | — | | 21,879 | | | — | | | — | |

Subtotal: | | | | | | | 35,621 | | — | | | 230,167 | | 50,677 | | | — | | — | | 86,298 | (11) | | — | | | 230,166 | (12) |

Michael C. O'Donnell | | 1.3075 | % | | Embassy Suites Hotel Denver-

International Airport | | 4,331 | | — | | | 33,876 | | — | | | — | | — | | 4,331 | | | — | | | 33,876 | |

| | | 2.0 | % | | Hilton Cincinnati Airport | | 3,418 | | — | | | — | | — | | | — | | — | | 3,418 | | | — | | | — | |

| | | 0.84 | % | | Cincinnati Landmark Marriott | | 11,885 | | — | | | 92,985 | | — | | | — | | — | | 11,885 | | | — | | | 92,985 | |

| | | — | | | Chicago Marriott Southwest at Burr Ridge | | — | | — | | | — | | 10,940 | | | — | | — | | 10,940 | | | — | | | — | |

Subtotal: | | | | | | | 19,634 | | — | | | 126,861 | | 10,940 | | | — | | — | | 30,574 | (13) | | — | | | 126,861 | (14) |

Glen Sibley | | 2.6224 | % | | Embassy Suites Hotel Denver-

International Airport | | 9,327 | | — | | | 60,262 | | — | | | — | | — | | 9,327 | | | — | | | 60,262 | |

Subtotal: | | | | | | | 9,327 | | — | | | 60,262 | | — | | | — | | — | | 9,327 | (15) | | — | | | 60,262 | (16) |

Therese Lusby | | 0.6562 | % | | Embassy Suites Hotel Denver-

International Airport | | 2,334 | | — | | | 15,076 | | — | | | — | | — | | 2,334 | | | — | | | 15,076 | |

Subtotal: | | | | | | | 2,334 | | — | | | 15,076 | | — | | | — | | — | | 2,334 | (17) | | — | | | 15,076 | (18) |

Thomas Costello | | 2.426 | % | | Embassy Suites Hotel Denver-

International Airport | | 24,609 | | — | | | 55,751 | | — | | | — | | — | | 24,609 | | | — | | | 55,751 | |

| | | 0.8077 | % | | Cincinnati Landmark Marriott | | 22,426 | | — | | | 32,918 | | — | | | — | | — | | 22,426 | | | — | | | 32,918 | |

| | | 2.2220 | % | | Chicago Marriott Southwest at Burr Ridge | | 37,346 | | — | | | 40,828 | | | | | | | | | 37,346 | | | — | | | 40,828 | |

Subtotal: | | | | | | | 84,381 | | | | | 129,497 | | | | | | | | | 84,381 | | | — | | | 129,496 | |

Mark Arstingstall | | — | | | Embassy Suites Hotel Cleveland/

Rockside | | — | | — | | | — | | 3,133 | | | — | | — | | 3,133 | | | — | | | — | |

| | | — | | | Chicago Marriott Southwest at Burr Ridge | | — | | — | | | — | | 5,470 | | | — | | — | | 5,470 | | | — | | | — | |

Subtotal: | | | | | | | | | | | | | | 8,603 | | | | | | | 8,603 | (19) | | — | | | — | |

Related Parties | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Subtotal: | | | | | | | 4,150,646 | | 146,540 | | | 33,042,841 | | (7,081 | ) | | — | | — | | 4,143,565 | | | 146,540 | | | 33,042,841 | |

| | | | | | | |

| |

| |

|

| |

|

| |

| |

| |

|

| |

| |

|

|

|

Non/Former

Corporex Employees | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Subtotal: | | — | | | — | | 19,551 | | — | | | 126,323 | | 7,081 | | | — | | — | | 26,632 | | | — | | | 126,323 | |

Total: | | | | | | | 4,170,197 | | 146,540 | | $ | 33,169,164 | | — | | | — | | — | | 4,170,197 | | | 146,540 | | $ | 33,169,164 | |

| | | | | | | |

| |

| |

|

| |

|

| |

| |

| |

|

| |

| |

|

|

|

19

| (1) | | Amounts shown assume the issuance of 427,485 operating partnership units to acquire the remaining 51% interest in the entity that owns the Embassy Suites Hotel Cincinnati-RiverCenter. We initially acquired only 49% of the interests in such entity upon completion of our initial public offering. We have the right and obligation to acquire the remaining 51% interest for 427,485 operating partnership units no later than January 31, 2006. Until such time as we acquire the remaining 51% interest in such entity, Mr. Butler will retain operating control over the hotel. |

| (2) | | Number shown includes (a) 18,600 operating partnership units that are subject to future vesting pursuant to the terms of the formation documents that governed the entities that owned the initial hotels or the agreements pursuant to which such employee acquired the interest in such entities and (b) 39,326 operating partnership units that are subject to future vesting pursuant to one or more profit participation agreements between such employee and affiliates of Corporex. Such consideration will vest over the next several years, subject to such employee’s future employment with us or an affiliate of Corporex. |

| (3) | | Number shown includes $19,916 in cash that is subject to future vesting pursuant to one or more profit participation agreements between such employee and affiliates of Corporex. Such consideration will vest over the next several years, subject to such employee’s future employment with us or an affiliate of Corporex. |

| (4) | | Number shown includes (a) 8,783 operating partnership units that are subject to future vesting pursuant to the terms of the formation documents that governed the entities that owned the initial hotels or the agreements pursuant to which such employee acquired the interest in such entities and (b) 43,978 operating partnership units that are subject to future vesting pursuant to one or more profit participation agreements between such employee and affiliates of Corporex. Such consideration will vest over the next several years, subject to such employee’s future employment with us or an affiliate of Corporex. |

| (5) | | Number shown includes (a) 1,400 operating partnership units that are subject to future vesting pursuant to the terms of the formation documents that governed the entities that owned the initial hotels or the agreements pursuant to which such employee acquired the interest in such entities and (b) 18,650 operating partnership units that are subject to future vesting pursuant to one or more profit participation agreements between such employee and affiliates of Corporex. Such consideration will vest over the next several years, subject to such employee’s future employment with us or an affiliate of Corporex. |

| (6) | | Number shown includes $9,046 in cash that is subject to future vesting pursuant to the terms of the formation documents that governed the entities that owned the initial hotels or the agreements pursuant to which such employee acquired the interest in such entities. Such consideration will vest over the next several years, subject to such employee’s future employment with us or an affiliate of Corporex. |

| (7) | | Number shown includes (a) 2,996 operating partnership units that are subject to future vesting pursuant to the terms of the formation documents that governed the entities that owned the initial hotels or the agreements pursuant to which such employee acquired the interest in such entities and (b) 12,362 operating partnership units that are subject to future vesting pursuant to one or more profit participation agreements between such employee and affiliates of Corporex. Such consideration will vest over the next several years, subject to such employee’s future employment with us or an affiliate of Corporex. |

| (8) | | Number shown includes $19,354 in cash that is subject to future vesting pursuant to the terms of the formation documents that governed the entities that owned the initial hotels or the agreements pursuant to which such employee acquired the interest in such entities. Such consideration will vest over the next several years, subject to such employee’s future employment with us or an affiliate of Corporex. |

| (9) | | Number shown includes 1,595 operating partnership units that are subject to future vesting pursuant to the terms of the formation documents that governed the entities that owned the initial hotels or the agreements pursuant to which such employee acquired the interest in such entities. Such consideration will vest over the next several years, subject to such employee’s future employment with us or an affiliate of Corporex. |

| (10) | | Number shown includes $10,308 in cash that is subject to future vesting pursuant to the terms of the formation documents that governed the entities that owned the initial hotels or the agreements pursuant to which such employee acquired the interest in such entities. Such consideration will vest over the next several years, subject to such employee’s future employment with us or an affiliate of Corporex. |

20

| (11) | | Number shown includes (a) 8,279 operating partnership units that are subject to future vesting pursuant to the terms of the formation documents that governed the entities that owned the initial hotels or the agreements pursuant to which such employee acquired the interest in such entities and (b) 40,143 operating partnership units that are subject to future vesting pursuant to one or more profit participation agreements between such employee and affiliates of Corporex. Such consideration will vest over the next several years, subject to such employee’s future employment with us or an affiliate of Corporex. |

| (12) | | Number shown includes $69,958 in cash that is subject to future vesting pursuant to the terms of the formation documents that governed the entities that owned the initial hotels or the agreements pursuant to which such employee acquired the interest in such entities. Such consideration will vest over the next several years, subject to such employee’s future employment with us or an affiliate of Corporex. |

| (13) | | Number shown includes (a) 5,570 operating partnership units that are subject to future vesting pursuant to the terms of the formation documents that governed the entities that owned the initial hotels or the agreements pursuant to which such employee acquired the interest in such entities and (b) 10,940 operating partnership units that are subject to future vesting pursuant to one or more profit participation agreements between such employee and affiliates of Corporex. Such consideration will vest over the next several years, subject to such employee’s future employment with us or an affiliate of Corporex. |

| (14) | | Number shown includes $43,572 in cash that is subject to future vesting pursuant to the terms of the formation documents that governed the entities that owned the initial hotels or the agreements pursuant to which such employee acquired the interest in such entities. Such consideration will vest over the next several years, subject to such employee’s future employment with us or an affiliate of Corporex. |

| (15) | | Number shown includes 5,596 operating partnership units that are subject to future vesting pursuant to the terms of the formation documents that governed the entities that owned the initial hotels or the agreements pursuant to which such employee acquired the interest in such entities. Such consideration will vest over the next several years, subject to such employee’s future employment with us or an affiliate of Corporex. |

| (16) | | Number shown includes $36,157 in cash that is subject to future vesting pursuant to the terms of the formation documents that governed the entities that owned the initial hotels or the agreements pursuant to which such employee acquired the interest in such entities. Such consideration will vest over the next several years, subject to such employee’s future employment with us or an affiliate of Corporex. |

| (17) | | Number shown includes 1,400 operating partnership units that are subject to future vesting pursuant to the terms of the formation documents that governed the entities that owned the initial hotels or the agreements pursuant to which such employee acquired the interest in such entities. Such consideration will vest over the next several years, subject to such employee’s future employment with us or an affiliate of Corporex. |

| (18) | | Number shown includes $9,046 in cash that is subject to future vesting pursuant to the terms of the formation documents that governed the entities that owned the initial hotels or the agreements pursuant to which such employee acquired the interest in such entities. Such consideration will vest over the next several years, subject to such employee’s future employment with us or an affiliate of Corporex. |

| (19) | | Number shown includes 7,710 operating partnership units that are subject to future vesting pursuant to one or more profit participation agreements between such employee and affiliates of Corporex. Such consideration will vest over the next several years, subject to such employee’s future employment with us or an affiliate of Corporex. |

| (20) | | Excludes pro rata share of the cash portion of the purchase price equal to the hotels’ collective net working net capital as of closing. |

Mr. Blackham has separate investments in, and has entered profit participation agreements with respect to, other unrelated real estate investments by Corporex or its affiliates.

With respect to all of our initial hotels (other than the Embassy Suites Hotel Tampa-Airport/Westshore and the Hyatt Regency Rochester), we have agreed to indemnify the

21

contributors for any tax liability they incur if, during the ten-year period following our initial public offering, we (i) directly or indirectly sell, exchange or otherwise dispose of the properties contributed under such agreement in a taxable transaction before the tenth anniversary of the completion of our initial public offering, in certain cases, (ii) fail to use commercially reasonable efforts to make available to these contributors and their permitted transferees and persons taxable on the income of a contributor or permitted transferee opportunities to guarantee specified amounts of liabilities of our Operating Partnership to defer such guarantors’ tax liabilities. For example, in the case of a taxable disposition of one of the initial hotels within 10 years of its contribution, we would have to indemnify the contributors for tax on the gain allocable to them under Section 704(c) of the Internal Revenue Code and for the tax on indemnification payments.

We used approximately $44.1 million of the net proceeds from the offering to repay outstanding consolidated mortgage debt, all of which had been previously guaranteed by subsidiaries of Corporex. Mr. Butler beneficially owns all of the outstanding capital stock of Corporex. We also used $21.4 million of the net proceeds to repay outstanding loans from Corporex and Commonwealth Hotels, Inc. to certain of the entities that we acquired in the formation transactions.

Mr. Butler has retained a 51% interest in the entity that owns the Embassy Suites Hotel Cincinnati-RiverCenter until we acquire such remaining interest from him no later than January 31, 2006. Until such time as we acquire the remaining 51% interest in such entity, Mr. Butler retains operating control over the hotel.

Additionally, Mr. Butler and Daniel T. Fay beneficially own all of the outstanding capital stock of Commonwealth Hotels, Inc., the hotel manager for nine of our ten hotels, and benefit from the payment of management fees by us to Commonwealth Hotels, Inc. pursuant to our management agreements. Commonwealth Hotels, Inc. receives a base management fee and, if the hotels meet and exceed identified thresholds, an additional incentive management fee. Assuming these management agreements had been in place during the trailing 12 months ended December 31, 2003 at the rate that we are required to pay from October 1, 2004 through December 31, 2005 on eight of the initial nine hotels, Commonwealth Hotels, Inc. would have received $1.55 million in base management fees and no incentive management fees for the seven then completed hotels currently under its management.

In connection with our initial public offering, Mr. Blackham resigned from all positions with Corporex and become a full-time employee and continues as Chief Executive Officer of our company. We issued 83,333 shares of restricted stock to Mr. Butler, 83,333 shares of restricted stock to Mr. Blackham, 20,833 shares of restricted stock to Mr. Frederick and 4,167 shares of restricted stock to each of our other directors. Although distributions will be paid on all restricted stock, whether or not vested, at the same rate and on the same date as on shares of our common stock, these holders are prohibited from selling such shares until they vest. With respect to Messrs. Butler, Blackham and Frederick, one-fifth of the shares of restricted stock will vest on each of the first five anniversaries of the date of grant. With respect to the remaining directors, all of the shares of restricted stock will vest on the first anniversary of the date of grant.

22

We executed strategic alliance agreements with Corporex, Commonwealth Hotels, Inc. and Messrs. Butler and Fay regarding full-service and all-suites lodging investment opportunities any of them identify in the future during the term of the agreement. We agreed with Corporex to make Mr. Blackham available to Corporex at mutually agreed upon times to provide Corporex with transitional management and consulting services through December 31, 2005 for a $10,000 per month fee, plus expense reimbursement, paid to us.

Immediately prior to our initial public offering, we issued 208,332 shares of common stock to Corporex and a trust that was to be established for the benefit of some of its employees in exchange for its execution of a strategic alliance agreement with us, which shares will vest after one year unless the agreement is terminated in the first year due to a default by Corporex.

Related party term debt for the Company at October 1, 2004, the date of the initial public offering, and as of March 31, 2005 follows:

| | | | | | |

| ($000s) | | As of March 31,

2005

| | As of October 1, 2004

|

First mortgage payable to Corporex at the 30 day LIBOR rate plus 2.75% collateralized by all the real and personal property of the Embassy Suites Hotel Cleveland/Rockside. This loan was due August 2005 and was retired in February, 2005. | | $ | — | | $ | 23,820 |

| | |

Note payable to Corporex at prime plus 1%; due January 2005. Retired subsequent to the initial public offering. | | | — | | | 19,865 |

| | |

Note payable to Commonwealth Hotels, Inc. at prime plus 1%; due January 2005. Retired subsequent to the initial public offering. | | | — | | | 1,540 |

| | |

Balance sheet post closing adjustments, net | | $ | 1,219 | | | — |

| | |

Management fees payable to Commonwealth Hotels, Inc. | | | 195 | | | 188 |

| (1) | | The Company incurred interest expense for the related party debt of approximately $0.3 million for the period from October 1, 2004 through December 31, 2004 and $0.2 million for the period from January 1, 2005 until the loan was repaid in February, 2005. |

23

PROPOSAL TWO:

RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS

The Board of Directors, upon the recommendation of the audit committee, has appointed the accounting firm of Grant Thornton LLP to serve as independent auditors of Eagle for the 2005 fiscal year, subject to ratification of this appointment by the stockholders of Eagle. Grant Thornton LLP has served as independent auditors of Eagle since its commencement of operations and is considered by management of Eagle to be well qualified. Eagle has been advised by that firm that neither it nor any member thereof has any financial interest, direct or indirect, in Eagle or any of its subsidiaries in any capacity.

Fees incurred related to services provided by Grant Thornton LLP for the fiscal years ended December 31, 2003 and 2004 are previously described in the “Audit Committee Report” section of this proxy statement. The audit committee has determined that the rendering of the non-audit services by Grant Thornton LLP has been compatible with maintaining the auditor’s independence.

Representatives of Grant Thornton LLP will be present at the meeting, will have the opportunity to make a statement if they so desire and will be available to respond to appropriate questions.

The Board of Directors recommends a vote FOR the proposal to ratify the appointment of Grant Thornton LLP as independent auditors of Eagle for the 2005 fiscal year.

OTHER MATTERS

Eagle’s management knows of no other matters that may be presented for consideration at the meeting. However, if any other matters properly come before the meeting, it is the intention of the person named in the proxy to vote such proxy in accordance with his judgment on such matters.

24

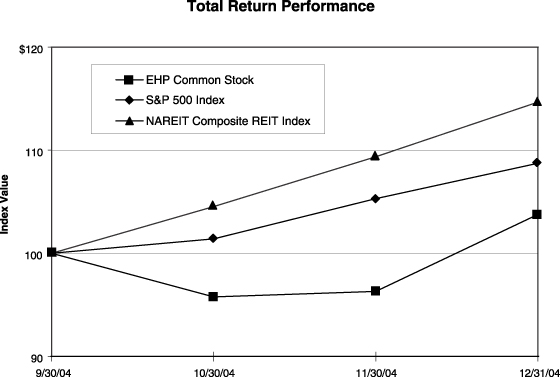

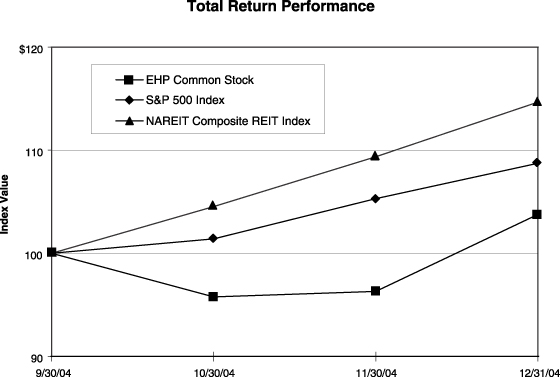

STOCK PRICE PERFORMANCE GRAPH