Exhibit 99.2

SUPPLEMENTAL OPERATING AND FINANCIAL DATA

MARCH 31, 2013

| | | | |

| BioMed Realty Trust, Inc. | | Corporate Communications Contact | | www.biomedrealty.com |

| 17190 Bernardo Center Drive | | Rick Howe | | (858) 485-9840 phone |

| San Diego, CA 92128 | | Senior Director, Corporate Communications | | (858) 485-9843 fax |

| | richard.howe@biomedrealty.com | | |

TABLE OF CONTENTS

MARCH 31, 2013

| | | | | | | | | | |

| | | Page | | | | | Page | |

First Quarter Highlights | | | 3 | | | Common and Preferred Stock Data | | | 20 | |

Investor Information | | | 4 | | | Market Summary | | | 21 | |

Equity Research Coverage | | | 5 | | | Property Listing - Consolidated Portfolio | | | 22-23 | |

Financial and Operating Highlights | | | 6 | | | Redevelopment, Pre-development and | | | | |

Capitalization Summary | | | 7 | | | Other Capital Improvements | | | 24 | |

Portfolio Summary | | | 8 | | | Capital Expenditures | | | 25 | |

Consolidated Balance Sheets | | | 9 | | | Property Listing - Unconsolidated Partnerships | | | 26 | |

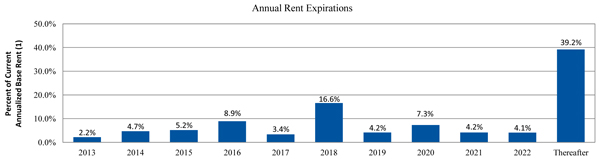

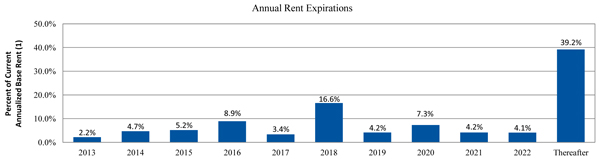

Consolidated Statements of Operations | | | 10 | | | Lease Expirations | | | 27 | |

Balance Sheet / Operations Statement Detail | | | 11 | | | Expirations by Market | | | 28 | |

FFO, CFFO and AFFO | | | 12 | | | 10 Largest Tenants | | | 29 | |

FFO, CFFO and AFFO per Share | | | 13 | | | Same Property Analysis | | | 30 | |

Reconciliation of EBITDA and Adjusted EBITDA | | | 14 | | | Acquisitions | | | 31 | |

Reconciliation of Net Operating Income | | | 15 | | | Leasing Activity | | | 32 | |

Interest Expense | | | 16 | | | Tenant Improvements, Leasing Commissions | | | | |

Coverage Ratios | | | 17 | | | and Tenant Concessions | | | 33 | |

Debt Summary | | | 18 | | | Non-GAAP Financial Measure Definitions | | | 34 | |

Debt Maturities | | | 19 | | | Definitions | | | 35 | |

This Supplemental Operating and Financial Data package contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 based on current expectations, forecasts and assumptions that involve risks and uncertainties that could cause actual outcomes and results to differ materially. These risks and uncertainties include, without limitation: general risks affecting the real estate industry (including, without limitation, the inability to enter into or renew leases, dependence on tenants’ financial condition, and competition from other developers, owners and operators of real estate); adverse economic or real estate developments in the life science industry or the company’s target markets; risks associated with the availability and terms of financing, the use of debt to fund acquisitions, developments and other investments, and the ability to refinance indebtedness as it comes due; failure to maintain the company’s investment grade credit ratings with the ratings agencies; failure to manage effectively the company’s growth and expansion into new markets, or to complete or integrate acquisitions and developments successfully; reductions in asset valuations and related impairment charges; risks and uncertainties affecting property development and construction; risks associated with downturns in foreign, domestic and local economies, changes in interest rates and foreign currency exchange rates, and volatility in the securities markets; ownership of properties outside of the United States that subject the company to different and potentially greater risks than those associated with the company’s domestic operations; risks associated with the company’s investments in loans, including borrower defaults and potential principal losses; potential liability for uninsured losses and environmental contamination; risks associated with the company’s potential failure to qualify as a REIT under the Internal Revenue Code of 1986, as amended, and possible adverse changes in tax and environmental laws; and risks associated with the company’s dependence on key personnel whose continued service is not guaranteed. For a further list and description of such risks and uncertainties, see the reports filed by the company with the Securities and Exchange Commission, including the company’s most recent annual report on Form 10-K and quarterly reports on Form 10-Q. The company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

All amounts shown in this report are unaudited.

This Supplemental Operating and Financial Data package is not an offer to sell or solicitation to buy securities of BioMed Realty Trust, Inc. Any offers to sell or solicitations to buy securities of BioMed Realty Trust, Inc. shall be made only by means of a prospectus approved for that purpose.

2

FIRST QUARTER HIGHLIGHTS

MARCH 31, 2013

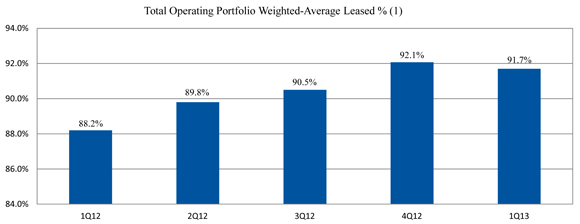

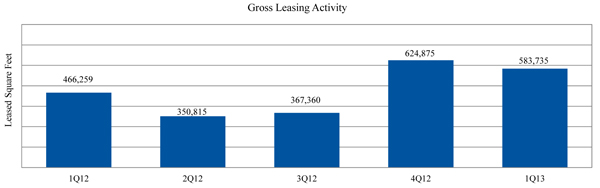

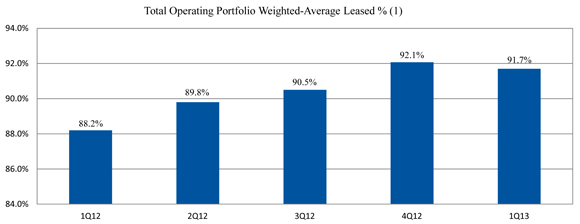

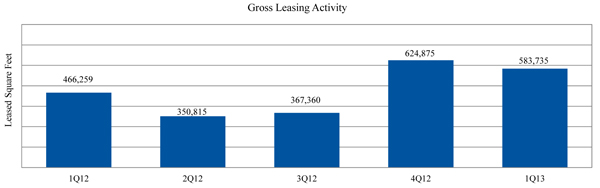

| | • | | Executed 29 leasing transactions during the quarter representing approximately 583,700 square feet, contributing to an operating portfolio leased percentage on a weighted-average basis of approximately 91.7% at quarter end, and comprised of: |

| | • | | 16 new leases totaling approximately 419,700 square feet, highlighted by: |

| | • | | a pre-lease with Life Technologies Corporation for approximately 204,900 square feet at the company’s Science Center at Oyster Point property in South San Francisco, California; |

| | • | | a pre-lease with Momenta Pharmaceuticals, Inc. for approximately 104,700 square feet at the company’s 320 Bent Street property in Cambridge, Massachusetts; |

| | • | | a lease expansion with Risk Management Solutions for approximately 31,500 square feet at the company’s Pacific Research Center (PRC) in Newark, California; and |

| | • | | a new lease with a global pharmaceutical company for approximately 30,200 square feet at the company’s Monte Villa property in Bothell, Washington. |

| | • | | 13 lease renewals totaling approximately 164,000 square feet, highlighted by: |

| | • | | a lease extension with Momentive Performance Materials, Inc. for approximately 61,900 square feet at the company’s The Landmark at Eastview campus in Tarrytown, New York; and |

| | • | | a lease extension with Fujifilm Diosynth Biotechnologies for approximately 30,600 square feet at the company’s 3000 Weston Parkway property in Cary, North Carolina. |

| | • | | In connection with the new Life Technologies lease at the company’s Science Center at Oyster Point, the company entered into a lease termination agreement with Elan Corporation related to their departure from this property in South San Francisco. The company received a termination fee of $46.5 million which is expected to increase funds from operations (FFO) by approximately $35.2 million, of which approximately $21.6 million ($0.12 per diluted share) was recognized during the first quarter. The remaining $13.6 million is expected to be recognized in the second quarter. |

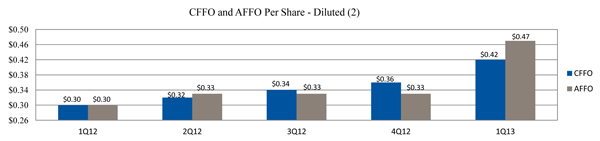

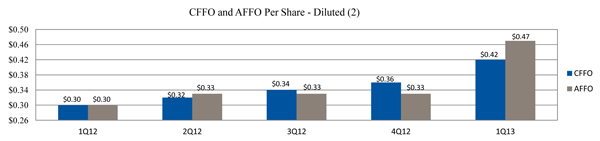

| | • | | Core funds from operations (CFFO) was $0.42 per diluted share, as compared to $0.30 per diluted share in the first quarter of 2012. FFO, calculated in accordance with standards established by NAREIT, was $0.41 per diluted share, as compared to $0.30 per diluted share in the first quarter of 2012. |

| | • | | Adjusted funds from operations (AFFO) for the quarter was $0.47 per diluted share, as compared to $0.30 per diluted share in the first quarter of 2012. |

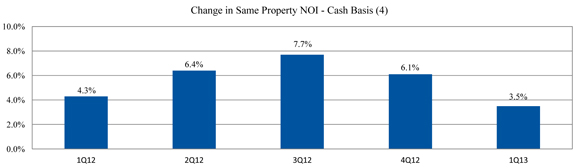

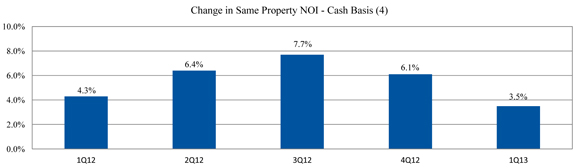

| | • | | Same property net operating income on a cash basis increased 3.5% as compared to the same period in 2012. |

| | • | | Generated total revenues for the quarter of approximately $160.5 million, up from approximately $120.0 million in the same period in 2012 and the highest in the company’s history. Rental revenues for the quarter increased to approximately $103.0 million from approximately $91.5 million in the same period in 2012. |

| | • | | Reported net income available to common stockholders for the quarter of approximately $8.4 million, or $0.05 per diluted share. |

| | • | | Acquired the Woodside Technology Park property in Redwood City, California for $87.0 million, excluding transaction costs, comprised of three buildings with an aggregate of approximately 256,000 square feet of laboratory and office space, which was 100% leased to five tenants at acquisition. |

| | • | | Acquired The Campus at Lincoln Centre in Foster City, California from Life Technologies Corporation for $37.0 million, excluding transaction costs. The company intends to redevelop the 19-acre site, which currently includes seven buildings encompassing approximately 280,000 square feet. |

| | • | | Completed a follow-on public offering of common stock, raising approximately $287.0 million in net proceeds. |

| | • | | Completed the redemption of all 7,920,000 shares of its Series A preferred stock at $25.30217 per share, equal to the original issuance price of $25.00 per share, plus accrued and unpaid dividends up to the redemption date. |

| | • | | Continued to enhance the breadth and depth of the company’s organization: |

| | • | | Appointed Daniel M. Bradbury, former Chief Executive Officer of Amylin Pharmaceuticals, to its Board of Directors; and |

| | • | | Promoted Denis J. Sullivan, Jr. to Vice President, Acquisitions. |

| | • | | Entered into a definitive agreement to merge with Wexford Science & Technology, LLC, a private real estate investment and development company that owns and develops institutional quality life science real estate for academic and medical research organizations. Wexford Science & Technology owns approximately 1.6 million square feet of laboratory and office space in U.S. educational and research centers, in addition to three properties under construction expected to comprise approximately 935,000 square feet of rentable space upon completion, as well as other pipeline projects. |

| | • | | Subsequent to the end of the quarter: |

| | • | | Completed a follow-on public offering of common stock, raising approximately $354.1 million in net proceeds. |

| | • | | Entered into a build-to-suit transaction to construct two new buildings pre-leased to Regeneron Pharmaceuticals for a 15 year term totaling approximately 297,000 square feet at The Landmark at Eastview in Tarrytown, New York, and extended Regeneron’s lease for approximately 360,500 square feet at The Landmark into 2029. |

About BioMed Realty Trust

BioMed Realty delivers optimal real estate solutions for biotechnology and pharmaceutical companies, scientific research institutions, government agencies and other entities involved in the life science industry. BioMed Realty owns or has interests in properties comprising approximately 13.5 million rentable square feet. The company’s properties are located predominantly in the major U.S. life science markets of Boston, Maryland, San Francisco, San Diego, New York/New Jersey, Pennsylvania and Seattle, which have well-established reputations as centers for scientific research. Additional information is available atwww.biomedrealty.com.

3

INVESTOR INFORMATION

MARCH 31, 2013

| | | | | | |

Company Information |

| Corporate Headquarters | | Trading Symbols | | Transfer Agent | | Stock Exchange Listing |

| 17190 Bernardo Center Drive | | BMR | | Computershare Shareowner Services LLC | | New York Stock Exchange |

| San Diego, CA 92128 | | | | 250 Royall Street | | |

| (858) 485-9840 | | | | Canton, MA 02021 | | |

| (858) 485-9843 (fax) | | | | (877) 296-3711 | | |

| | | |

| Please visit our corporate website at: | | www.biomedrealty.com | | | | |

| | | |

Board of Directors | | Senior Management | | | | |

| Alan D. Gold | | Alan D. Gold | | Karen A. Sztraicher | | Stephen A. Willey |

| Chairman | | Chairman and | | Executive Vice President, | | Vice President, |

| Daniel M. Bradbury | | Chief Executive Officer | | Asset Management | | Chief Accounting Officer |

| Barbara R. Cambon | | R. Kent Griffin, Jr. | | Jonathan P. Klassen | | Janice L. Kameir |

| Edward A. Dennis, Ph.D. | | President and | | Senior Vice President, | | Vice President, |

| Richard I. Gilchrist | | Chief Operating Officer | | General Counsel and Secretary | | Human Resources |

| Gary A. Kreitzer | | Gary A. Kreitzer | | John P. Bonanno | | Robert M. Sistek |

| Theodore D. Roth | | Executive Vice President | | Senior Vice President, | | Vice President, Finance |

| M. Faye Wilson | | and Director | | Leasing & Development | | William F. X. Kane |

| | Matthew G. McDevitt | | Kevin M. Simonsen | | Vice President, |

| | Executive Vice President, | | Vice President, | | Leasing & Development |

| | Real Estate | | Real Estate Legal | | Denis J. Sullivan, Jr. |

| | Greg N. Lubushkin | | Bruce D. Steel | | Vice President, |

| | Chief Financial Officer | | Managing Director, | | Acquisitions |

| | | | BioMed Ventures | | |

|

Tentative Schedule for Quarterly Results |

| Second Quarter 2013 | | July 31, 2013 | | | | |

| Third Quarter 2013 | | October 30, 2013 | | | | |

| Fourth Quarter 2013 | | February 5, 2014 | | | | |

| First Quarter 2014 | | April 30, 2014 | | | | |

4

EQUITY RESEARCH COVERAGE

MARCH 31, 2013

| | | | | | |

| BMO Capital Markets | | Richard C. Anderson Joshua Patinkin | | (212) 885-4180 (212) 883-5102 | | richard.anderson@bmo.com joshua.patinkin@bmo.com |

| | | |

| Cantor Fitzgerald | | David Toti Evan Smith | | (212) 915-1219 (212) 915-1220 | | dtoti@cantor.com evan.smith@cantor.com |

| | | |

| Cowen and Company | | James Sullivan Michael Gorman | | (646) 562-1380 (646) 562-1381 | | james.sullivan@cowen.com michael.gorman@cowen.com |

| | | |

| Goldman Sachs | | Matthew Rand Andrew Rosivach | | (212) 902-4227 (212) 902-2796 | | matthew.rand@gs.com andrew.rosivach@gs.com |

| | | |

| Green Street Advisors | | Jeff Theiler John Hornbeak | | (949) 640-8780 | | jtheiler@greenst.com jhornbeak@greenst.com |

| | | |

| Jefferies & Co. | | Omotayo Okusanya David Shamis | | (212) 336-7076 (212) 284-1796 | | tokusanya@jefferies.com dshamis@jefferies.com |

| | | |

| KeyBanc Capital Markets | | Jordan Sadler Craig Mailman | | (917) 368-2280 (917) 368-2316 | | jsadler@keybanccm.com cmailman@keybanccm.com |

| | | |

| Macquarie Capital (USA) | | Robert Stevenson Nicholas Yulico | | (212) 231-8068 (212) 231-8028 | | rob.stevenson@macquarie.com nicholas.yulico@macquarie.com |

| | | |

| Morgan Stanley | | Paul Morgan Vance Edelson | | (415) 576-2627 (212) 761-0078 | | paul.b.morgan@morganstanley.com vance.edelson@morganstanley.com |

| | | |

| Raymond James | | Paul D. Puryear William A. Crow | | (727) 567-2253 (727) 567-5294 | | paul.puryear@raymondjames.com bill.crow@raymondjames.com |

| | | |

| Robert W. Baird & Co. | | Mathew R. Spencer | | (414) 298-5053 | | mspencer@rwbaird.com |

| | | |

| Stifel, Nicolaus & Company, Inc. | | Daniel Bernstein Seth P. Cohn | | (443) 224-1351 (443) 224-1354 | | bernsted@stifel.com cohns@stifel.com |

| | | |

| UBS Securities | | Ross T. Nussbaum | | (212) 713-4760 | | ross.nussbaum@ubs.com |

| | | |

| Wells Fargo Securities | | Brendan Maiorana Young Ku | | (443) 263-6516 (443) 263-6564 | | brendan.maiorana@wachovia.com young.ku@wachovia.com |

5

FINANCIAL AND OPERATING HIGHLIGHTS

MARCH 31, 2013

(In thousands, except per share and ratio amounts)

| | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | |

| | | 3/31/13 | | | 12/31/12 | | | 9/30/12 | | | 6/30/12 | | | 3/31/12 | |

Selected Operating Data | | | | | | | | | | | | | | | | | | | | |

Total revenues | | $ | 160,450 | | | $ | 138,771 | | | $ | 134,537 | | | $ | 124,848 | | | $ | 120,012 | |

EBITDA (1) | | | 95,878 | | | | 85,018 | | | | 81,774 | | | | 63,302 | | | | 66,485 | |

Pro Forma Adjusted EBITDA (1) | | | 88,396 | | | | 88,784 | | | | 85,647 | | | | 79,571 | | | | 75,291 | |

Net operating income - cash basis (2) | | | 98,784 | | | | 92,728 | | | | 92,032 | | | | 86,800 | | | | 83,432 | |

General and administrative expense | | | 10,028 | | | | 10,608 | | | | 10,226 | | | | 8,576 | | | | 8,614 | |

Acquisition-related expenses | | | 2,236 | | | | 22 | | | | 176 | | | | 12,245 | | | | 633 | |

Capitalized interest | | | 2,840 | | | | 2,268 | | | | 1,926 | | | | 2,090 | | | | 2,360 | |

Interest expense, net | | | 25,902 | | | | 26,745 | | | | 26,817 | | | | 23,825 | | | | 22,219 | |

Operating margin (3) | | | 70.1 | % | | | 70.9 | % | | | 70.8 | % | | | 70.3 | % | | | 69.4 | % |

General and administrative expense / Total revenues | | | 6.2 | % | | | 7.6 | % | | | 7.6 | % | | | 6.9 | % | | | 7.2 | % |

Change in same property net operating income - cash basis (4) | | | 3.5 | % | | | 6.1 | % | | | 7.7 | % | | | 6.4 | % | | | 4.3 | % |

Net income/(loss) available to common stockholders | | | 8,388 | | | | 4,516 | | | | 2,758 | | | | (8,713 | ) | | | (1,339 | ) |

Net income/(loss) per share - diluted | | $ | 0.05 | | | $ | 0.03 | | | $ | 0.02 | | | $ | (0.06 | ) | | $ | (0.01 | ) |

FFO - diluted (5) | | | 71,333 | | | | 59,546 | | | | 56,166 | | | | 40,680 | | | | 50,197 | |

FFO per share - diluted (5) | | $ | 0.41 | | | $ | 0.36 | | | $ | 0.34 | | | $ | 0.24 | | | $ | 0.30 | |

CFFO - diluted (5) | | | 73,569 | | | | 59,568 | | | | 56,342 | | | | 52,925 | | | | 50,830 | |

CFFO per share - diluted (5) | | $ | 0.42 | | | $ | 0.36 | | | $ | 0.34 | | | $ | 0.32 | | | $ | 0.30 | |

AFFO - diluted (5) | | | 81,424 | | | | 55,004 | | | | 55,641 | | | | 55,334 | | | | 50,472 | |

AFFO per share - diluted (5) | | $ | 0.47 | | | $ | 0.33 | | | $ | 0.33 | | | $ | 0.33 | | | $ | 0.30 | |

Dividend per share - common stock | | $ | 0.235 | | | $ | 0.235 | | | $ | 0.215 | | | $ | 0.215 | | | $ | 0.215 | |

CFFO payout ratio (6) | | | 56.0 | % | | | 65.3 | % | | | 63.2 | % | | | 67.2 | % | | | 71.7 | % |

AFFO payout ratio (6) | | | 50.0 | % | | | 71.2 | % | | | 65.2 | % | | | 65.2 | % | | | 71.7 | % |

| (1) | For definitions and discussion of EBITDA and Pro Forma Adjusted EBITDA, see page 34. For a quantitative reconciliation of the differences between EBITDA, Adjusted EBITDA, Pro Forma Adjusted EBITDA and net income available to common stockholders, see page 14. |

| (2) | For definitions and discussion of net operating income - cash basis, see page 15. |

| (3) | See page 15 for detail. |

| (4) | Compared to the same period in the prior year. See page 30 for detail. |

| (5) | For definitions and discussion of FFO, CFFO and AFFO, see page 34. For a quantitative reconciliation of the differences between FFO, CFFO, AFFO and net income available to common stockholders, see pages 12 and 13. |

| (6) | See page 13 for detail of the CFFO and AFFO payout ratios. |

6

CAPITALIZATION SUMMARY

MARCH 31, 2013

(In thousands, except per share and ratio amounts)

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | 3/31/13 | | | 12/31/12 | | | 9/30/12 | | | 6/30/12 | | | 3/31/12 | |

Capitalization | | | | | | | | | | | | | | | | | | | | | | |

Total common shares outstanding | | | | | 169,055 | | | | 154,328 | | | | 154,335 | | | | 154,184 | | | | 154,163 | |

Total units outstanding (1) | | | | | 2,919 | | | | 2,933 | | | | 2,943 | | | | 2,943 | | | | 2,957 | |

| | | | | | | | | | | | | | | | | | | | | | |

Total common shares and units outstanding | | | | | 171,974 | | | | 157,261 | | | | 157,278 | | | | 157,127 | | | | 157,120 | |

Common share price at quarter end | | | | $ | 21.60 | | | $ | 19.33 | | | $ | 18.72 | | | $ | 18.68 | | | $ | 18.98 | |

| | | | | | | | | | | | | | | | | | | | | | |

Equity value at quarter end | | | | $ | 3,714,640 | | | $ | 3,039,847 | | | $ | 2,944,240 | | | $ | 2,935,122 | | | $ | 2,982,134 | |

Preferred stock at liquidation value | | | | | — | | | | 198,000 | | | | 198,000 | | | | 198,000 | | | | 198,000 | |

Consolidated debt | | | | | 2,255,941 | | | | 2,170,983 | | | | 2,142,405 | | | | 2,106,021 | | | | 1,812,258 | |

| | | | | | | | | | | | | | | | | | | | | | |

Total capitalization | | | | $ | 5,970,581 | | | $ | 5,408,830 | | | $ | 5,284,645 | | | $ | 5,239,143 | | | $ | 4,992,392 | |

| | | | | | | | | | | | | | | | | | | | | | |

Debt / Total assets | | | | | 45.1 | % | | | 44.9 | % | | | 44.3 | % | | | 43.9 | % | | | 39.9 | % |

Debt / Total gross assets | | | | | 40.0 | % | | | 39.9 | % | | | 39.7 | % | | | 39.6 | % | | | 36.0 | % |

Debt / Total capitalization | | | | | 37.8 | % | | | 40.1 | % | | | 40.5 | % | | | 40.2 | % | | | 36.3 | % |

Coverage Ratios (2) | | | | | | | | | | | | | | | | | | | | | | |

Debt / Pro Forma Adjusted EBITDA | | | | | 6.4 | | | | 6.1 | | | | 6.2 | | | | 6.6 | | | | 6.0 | |

Interest coverage | | | | | 3.8 | | | | 3.7 | | | | 3.6 | | | | 3.8 | | | | 3.8 | |

Fixed charge coverage | | | | | 3.2 | | | | 3.0 | | | | 2.9 | | | | 3.0 | | | | 3.0 | |

Total Consolidated Debt | | | | | | | | | | | | | | | | | | | | | | |

Secured debt / Total gross assets | | | | | 10.1 | % | | | 10.5 | % | | | 10.7 | % | | | 10.3 | % | | | 11.1 | % |

Floating rate debt / Total debt | | | | | 27.1 | % | | | 24.1 | % | | | 23.0 | % | | | 22.7 | % | | | 23.5 | % |

Adjusted floating rate debt / Total debt (3) | | | | | 11.5 | % | | | 7.4 | % | | | 6.1 | % | | | 13.2 | % | | | 12.5 | % |

Unencumbered real estate / Total real estate | | | | | 77.7 | % | | | 77.0 | % | | | 76.8 | % | | | 77.0 | % | | | 75.2 | % |

Unencumbered CABR / Total CABR (4) | | | | | 79.1 | % | | | 79.3 | % | | | 79.1 | % | | | 79.3 | % | | | 77.9 | % |

Unsecured line of credit capacity | | | | $ | 535,000 | | | $ | 632,000 | | | $ | 650,500 | | | $ | 658,590 | | | $ | 723,090 | |

| | | | | | |

| Bond Covenants (5) | | Requirements | | | | | | | | | | | | | | | |

Total outstanding debt / Total assets | | Must be £ 60% | | | 41.2 | % | | | 41.1 | % | | | 41.3 | % | | | 41.2 | % | | | 37.2 | % |

Secured debt / Total assets | | Must be £ 40% | | | 10.4 | % | | | 10.8 | % | | | 11.0 | % | | | 10.7 | % | | | 11.5 | % |

Consolidated income available for debt service / Annual debt service charge | | Must be ³ 1.5X | | | 3.2 | | | | 3.0 | | | | 2.9 | | | | 2.9 | | | | 3.2 | |

Unencumbered assets / Unsecured debt - Notes due 2020 | | Must be ³ 150% | | | 257 | % | | | 260 | % | | | 259 | % | | | 258 | % | | | 299 | % |

Unencumbered assets / Unsecured debt - Notes due 2016, Notes due 2022 | | Must be ³ 150% | | | 255 | % | | | 257 | % | | | 257 | % | | | 255 | % | | | 296 | % |

| (1) | Includes both operating partnership (OP) and long term incentive plan (LTIP) units outstanding. |

| (2) | For discussion of coverage ratios, see page 34. See page 17 for the calculation of interest and fixed charge coverage ratios. See page 14 for calculation of Pro Forma Adjusted EBITDA. |

| (3) | Includes effect of interest rate swaps on the Company’s unsecured senior term loan facility. See page 18 for more information. |

| (4) | For current annualized base rent (CABR) by market, see page 21. |

| (5) | Calculated in accordance with the covenants contained in the indenture that governs the terms of the Company’s unsecured senior notes due 2020 and supplemental and base indentures that govern the terms of the Company’s unsecured senior notes due 2016 and unsecured senior notes due 2022, which are included as exhibits to the Company’s Forms 8-K filed with the SEC on April 30, 2010, March 30, 2011, and June 28, 2012, respectively. The covenants for the unsecured senior notes due 2020, unsecured senior notes due 2016, and unsecured senior notes due 2022 are identical, except that the unencumbered total asset value definition for the unsecured senior notes due 2020 includes investments in unconsolidated partnerships accounted for under the equity method of accounting, whereas the unencumbered total asset value definition for the unsecured senior notes due 2016 and unsecured senior notes due 2022 excludes such investments in unconsolidated partnerships. |

7

PORTFOLIO SUMMARY

MARCH 31, 2013

| | | | | | | | | | | | | | | | |

| | | Gross

Book Value | | | Buildings | | | Rentable

Square Feet | | | Weighted-

Average

Leased % (1) | |

| | | (In thousands) | | | | | | | | | | |

Stabilized (2) | | $ | 3,575,932 | | | | 105 | | | | 8,278,755 | | | | 99.4 | % |

Lease up (2) | | | 1,166,124 | | | | 54 | | | | 4,413,310 | | | | 68.0 | % |

| | | | | | | | | | | | | | | | |

Total operating portfolio | | $ | 4,742,056 | | | | 159 | | | | 12,692,065 | | | | 91.7 | % |

| | | | | | | | | | | | | | | | |

| | | | |

Redevelopment (3) | | $ | 48,799 | | | | 4 | | | | 196,867 | | | | 42.9 | % |

Pre-Development (3) | | | 94,084 | | | | — | | | | 1,096,000 | | | | — | |

Unconsolidated partnership portfolio (4) | | | 32,118 | | | | 3 | | | | 352,863 | | | | 56.4 | % |

Development potential (3) | | | 184,502 | | | | — | | | | 3,303,000 | | | | — | |

| | | | | | | | | | | | | | | | |

Total portfolio | | $ | 5,101,559 | | | | 166 | | | | 17,640,795 | | | | | |

| | | | | | | | | | | | | | | | |

| (1) | Calculated based on gross book value for each asset multiplied by the percentage leased. |

| (2) | See pages 22-23 for detail of consolidated portfolio and page 35 for definitions of terms. |

| (3) | See page 24 for detail of the consolidated portfolio and page 35 for definitions of terms. |

| (4) | See page 26 for detail of the unconsolidated partnership portfolio. |

8

CONSOLIDATED BALANCE SHEETS

MARCH 31, 2013

(In thousands)

| | | | | | | | | | | | | | | | | | | | |

| | | 3/31/13 | | | 12/31/12 | | | 9/30/12 | | | 6/30/12 | | | 3/31/12 | |

| Assets | | | | | | | | | | | | | | | | | | | | |

Investments in real estate, net | | $ | 4,424,867 | | | $ | 4,319,716 | | | $ | 4,327,426 | | | $ | 4,309,421 | | | $ | 4,037,928 | |

Investments in unconsolidated partnerships | | | 32,118 | | | | 32,367 | | | | 31,955 | | | | 32,562 | | | | 32,901 | |

Cash and cash equivalents | | | 18,552 | | | | 19,976 | | | | 20,646 | | | | 17,385 | | | | 13,336 | |

Accounts receivable, net | | | 35,888 | | | | 4,507 | | | | 7,128 | | | | 4,241 | | | | 4,426 | |

Accrued straight-line rents, net | | | 155,591 | | | | 152,096 | | | | 144,975 | | | | 139,346 | | | | 134,371 | |

Deferred leasing costs, net | | | 167,648 | | | | 172,363 | | | | 180,925 | | | | 185,354 | | | | 164,002 | |

Other assets | | | 164,968 | | | | 133,454 | | | | 118,052 | | | | 111,383 | | | | 158,285 | |

| | | | | | | | | | | | | | | | | | | | |

Total assets | | $ | 4,999,632 | | | $ | 4,834,479 | | | $ | 4,831,107 | | | $ | 4,799,692 | | | $ | 4,545,249 | |

| | | | | | | | | | | | | | | | | | | | |

| Liabilities and Equity | | | | | | | | | | | | | | | | | | | | |

Liabilities: | | | | | | | | | | | | | | | | | | | | |

Mortgage notes payable, net | | $ | 569,390 | | | $ | 571,652 | | | $ | 574,497 | | | $ | 550,704 | | | $ | 559,111 | |

Exchangeable senior notes | | | 180,000 | | | | 180,000 | | | | 180,000 | | | | 180,000 | | | | 180,000 | |

Unsecured senior notes, net | | | 894,397 | | | | 894,177 | | | | 893,955 | | | | 893,737 | | | | 645,749 | |

Unsecured senior term loan | | | 395,486 | | | | 405,456 | | | | 405,216 | | | | 400,000 | | | | 400,000 | |

Unsecured line of credit | | | 215,000 | | | | 118,000 | | | | 87,000 | | | | 78,000 | | | | 26,000 | |

Accounts payable, accrued expenses and other liabilities | | | 199,731 | | | | 180,653 | | | | 178,706 | | | | 157,829 | | | | 156,669 | |

| | | | | | | | | | | | | | | | | | | | |

Total liabilities | | | 2,454,004 | | | | 2,349,938 | | | | 2,319,374 | | | | 2,260,270 | | | | 1,967,529 | |

Equity: | | | | | | | | | | | | | | | | | | | | |

Stockholders’ equity: | | | | | | | | | | | | | | | | | | | | |

Preferred stock | | | — | | | | 191,469 | | | | 191,469 | | | | 191,469 | | | | 191,469 | |

Common stock | | | 1,691 | | | | 1,543 | | | | 1,543 | | | | 1,542 | | | | 1,541 | |

Additional paid-in capital | | | 3,065,589 | | | | 2,781,849 | | | | 2,779,035 | | | | 2,776,046 | | | | 2,773,248 | |

Accumulated other comprehensive loss, net | | | (55,480 | ) | | | (54,725 | ) | | | (56,988 | ) | | | (57,326 | ) | | | (58,882 | ) |

Dividends in excess of earnings | | | (474,619 | ) | | | (443,280 | ) | | | (411,529 | ) | | | (381,105 | ) | | | (339,243 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total stockholders’ equity | | | 2,537,181 | | | | 2,476,856 | | | | 2,503,530 | | | | 2,530,626 | | | | 2,568,133 | |

Noncontrolling interests | | | 8,447 | | | | 7,685 | | | | 8,203 | | | | 8,796 | | | | 9,587 | |

| | | | | | | | | | | | | | | | | | | | |

Total equity | | | 2,545,628 | | | | 2,484,541 | | | | 2,511,733 | | | | 2,539,422 | | | | 2,577,720 | |

| | | | | | | | | | | | | | | | | | | | |

Total liabilities and equity | | $ | 4,999,632 | | | $ | 4,834,479 | | | $ | 4,831,107 | | | $ | 4,799,692 | | | $ | 4,545,249 | |

| | | | | | | | | | | | | | | | | | | | |

9

CONSOLIDATED STATEMENTS OF OPERATIONS

MARCH 31, 2013

(In thousands, except share and per share data)

| | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | |

| | | 3/31/13 | | | 12/31/12 | | | 9/30/12 | | | 6/30/12 | | | 3/31/12 | |

Revenues: | | | | | | | | | | | | | | | | | | | | |

Rental | | $ | 102,956 | | | $ | 103,978 | | | $ | 101,467 | | | $ | 95,708 | | | $ | 91,475 | |

Tenant recoveries | | | 32,637 | | | | 31,638 | | | | 31,765 | | | | 28,939 | | | | 28,453 | |

Other revenue | | | 24,857 | | | | 3,155 | | | | 1,305 | | | | 201 | | | | 84 | |

| | | | | | | | | | | | | | | | | | | | |

Total revenues | | | 160,450 | | | | 138,771 | | | | 134,537 | | | | 124,848 | | | | 120,012 | |

| | | | | | | | | | | | | | | | | | | | |

Expenses: | | | | | | | | | | | | | | | | | | | | |

Rental operations | | | 40,553 | | | | 39,502 | | | | 38,944 | | | | 37,044 | | | | 36,729 | |

Depreciation and amortization | | | 60,764 | | | | 52,963 | | | | 51,372 | | | | 47,575 | | | | 44,934 | |

General and administrative | | | 10,028 | | | | 10,608 | | | | 10,226 | | | | 8,576 | | | | 8,614 | |

Acquisition-related expenses | | | 2,236 | | | | 22 | | | | 176 | | | | 12,245 | | | | 633 | |

| | | | | | | | | | | | | | | | | | | | |

Total expenses | | | 113,581 | | | | 103,095 | | | | 100,718 | | | | 105,440 | | | | 90,910 | |

| | | | | | | | | | | | | | | | | | | | |

Income from operations | | | 46,869 | | | | 35,676 | | | | 33,819 | | | | 19,408 | | | | 29,102 | |

Equity in net loss of unconsolidated partnerships | | | (319 | ) | | | (379 | ) | | | (339 | ) | | | (317 | ) | | | (355 | ) |

Interest expense, net | | | (25,902 | ) | | | (26,745 | ) | | | (26,817 | ) | | | (23,825 | ) | | | (22,219 | ) |

Other (expense)/income | | | (3,190 | ) | | | (292 | ) | | | (208 | ) | | | (549 | ) | | | 174 | |

| | | | | | | | | | | | | | | | | | | | |

Income/(loss) from continuing operations | | | 17,458 | | | | 8,260 | | | | 6,455 | | | | (5,283 | ) | | | 6,702 | |

Income/(loss) from discontinued operations | | | — | | | | — | | | | — | | | | 49 | | | | (4,420 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net income/(loss) | | | 17,458 | | | | 8,260 | | | | 6,455 | | | | (5,234 | ) | | | 2,282 | |

Net (income)/loss attributable to noncontrolling interests | | | (146 | ) | | | (93 | ) | | | (46 | ) | | | 172 | | | | 30 | |

| | | | | | | | | | | | | | | | | | | | |

Net income/(loss) attributable to the Company | | | 17,312 | | | | 8,167 | | | | 6,409 | | | | (5,062 | ) | | | 2,312 | |

Preferred stock dividends | | | (2,393 | ) | | | (3,651 | ) | | | (3,651 | ) | | | (3,651 | ) | | | (3,651 | ) |

Cost on redemption of preferred stock | | | (6,531 | ) | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Net income/(loss) available to common stockholders | | $ | 8,388 | | | $ | 4,516 | | | $ | 2,758 | | | $ | (8,713 | ) | | $ | (1,339 | ) |

| | | | | | | | | | | | | | | | | | | | |

Income/(loss) from continuing operations per share available to common stockholders: | | | | | | | | | | | | | | | | | | | | |

Basic and diluted earnings per share | | $ | 0.05 | | | $ | 0.03 | | | $ | 0.02 | | | $ | (0.06 | ) | | $ | 0.02 | |

| | | | | | | | | | | | | | | | | | | | |

Income/(loss) from discontinued operations per share available to common stockholders: | | | | | | | | | | | | | | | | | | | | |

Basic and diluted earnings per share | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | (0.03 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net income/(loss) per share available to common stockholders: | | | | | | | | | | | | | | | | | | | | |

Basic and diluted earnings per share | | $ | 0.05 | | | $ | 0.03 | | | $ | 0.02 | | | $ | (0.06 | ) | | $ | (0.01 | ) |

| | | | | | | | | | | | | | | | | | | | |

Weighted-average common shares outstanding: | | | | | | | | | | | | | | | | | | | | |

Basic | | | 159,692,470 | | | | 152,790,669 | | | | 152,785,451 | | | | 152,775,422 | | | | 152,659,258 | |

| | | | | | | | | | | | | | | | | | | | |

Diluted | | | 162,713,677 | | | | 155,728,210 | | | | 155,728,209 | | | | 152,775,422 | | | | 155,625,204 | |

| | | | | | | | | | | | | | | | | | | | |

10

BALANCE SHEET / OPERATIONS STATEMENT DETAIL

MARCH 31, 2013

(In thousands)

| | | | | | | | | | | | | | | | | | | | |

| | | 3/31/13 | | | 12/31/12 | | | 9/30/12 | | | 6/30/12 | | | 3/31/12 | |

Restricted cash | | $ | 4,068 | | | $ | 3,554 | | | $ | 3,443 | | | $ | 2,485 | | | $ | 4,830 | |

Real estate held for sale | | | — | | | | — | | | | — | | | | — | | | | 28,000 | |

Acquired above-market leases, net | | | 12,432 | | | | 18,099 | | | | 20,234 | | | | 22,292 | | | | 23,670 | |

Acquired below-market ground lease, net | | | 11,310 | | | | 11,368 | | | | 11,426 | | | | 11,484 | | | | 11,542 | |

Deferred loan costs, net | | | 16,240 | | | | 17,512 | | | | 18,878 | | | | 19,476 | | | | 18,445 | |

Lease incentives, net | | | 21,140 | | | | 21,741 | | | | 21,990 | | | | 21,925 | | | | 24,778 | |

Construction loan receivable, net (1) | | | 55,981 | | | | 21,695 | | | | 1,275 | | | | 1,275 | | | | — | |

Other | | | 43,797 | | | | 39,485 | | | | 40,806 | | | | 32,446 | | | | 47,020 | |

| | | | | | | | | | | | | | | | | | | | |

Other assets | | $ | 164,968 | | | $ | 133,454 | | | $ | 118,052 | | | $ | 111,383 | | | $ | 158,285 | |

| | | | | | | | | | | | | | | | | | | | |

Security deposits | | $ | 12,186 | | | $ | 12,417 | | | $ | 12,296 | | | $ | 12,501 | | | $ | 11,941 | |

Dividends and distributions payable | | | 40,413 | | | | 40,607 | | | | 37,465 | | | | 37,433 | | | | 37,431 | |

Accounts payable, accrued expenses and other liabilities | | | 133,420 | | | | 114,123 | | | | 114,533 | | | | 95,123 | | | | 100,689 | |

Derivative instruments | | | 5,435 | | | | 5,285 | | | | 5,702 | | | | 3,701 | | | | 289 | |

Acquired below-market leases, net | | | 8,277 | | | | 8,221 | | | | 8,710 | | | | 9,071 | | | | 6,319 | |

| | | | | | | | | | | | | | | | | | | | |

Accounts payable, accrued expenses and other liabilities | | $ | 199,731 | | | $ | 180,653 | | | $ | 178,706 | | | $ | 157,829 | | | $ | 156,669 | |

| | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | |

| | | 3/31/13 | | | 12/31/12 | | | 9/30/12 | | | 6/30/12 | | | 3/31/12 | |

Lease termination revenue | | $ | 24,001 | | | $ | 2,483 | | | $ | 935 | | | $ | 81 | | | $ | 32 | |

Construction loan revenue | | | 807 | | | | 387 | | | | 326 | | | | 149 | | | | — | |

Other revenue | | | 49 | | | | 285 | | | | 44 | | | | (29 | ) | | | 52 | |

| | | | | | | | | | | | | | | | | | | | |

Other revenue | | $ | 24,857 | | | $ | 3,155 | | | $ | 1,305 | | | $ | 201 | | | $ | 84 | |

| | | | | | | | | | | | | | | | | | | | |

Rental operations expenses | | $ | 27,165 | | | $ | 26,753 | | | $ | 26,480 | | | $ | 24,583 | | | $ | 24,673 | |

Real estate taxes | | | 13,388 | | | | 12,749 | | | | 12,464 | | | | 12,461 | | | | 12,056 | |

| | | | | | | | | | | | | | | | | | | | |

Rental operations | | $ | 40,553 | | | $ | 39,502 | | | $ | 38,944 | | | $ | 37,044 | | | $ | 36,729 | |

| | | | | | | | | | | | | | | | | | | | |

(Loss)/gain on extinguishment of debt | | $ | — | | | $ | (100 | ) | | $ | — | | | $ | 34 | | | $ | 174 | |

Non-cash adjustment for securities | | | (2,825 | ) | | | — | | | | — | | | | (545 | ) | | | — | |

Realized (loss)/gain on foreign currency transactions | | | (160 | ) | | | 16 | | | | 40 | | | | — | | | | — | |

Income tax expense | | | (205 | ) | | | (208 | ) | | | (248 | ) | | | (38 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Other (expense)/income | | $ | (3,190 | ) | | $ | (292 | ) | | $ | (208 | ) | | $ | (549 | ) | | $ | 174 | |

| | | | | | | | | | | | | | | | | | | | |

| (1) | Represents funding of draws on a $355 million construction loan secured by first priority mortgages on a 1.1 million square foot laboratory, office and retail development project located in Boston, Massachusetts, of which the Company’s funding obligation is $255 million. |

11

FFO, CFFO AND AFFO (1)

MARCH 31, 2013

(In thousands)

| | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | |

| | | 3/31/13 | | | 12/31/12 | | | 9/30/12 | | | 6/30/12 | | | 3/31/12 | |

Reconciliation of net income/(loss) available to common stockholders to funds from operations excluding acquisition-related expenses (CFFO): | | | | | | | | | | | | | | | | | | | | |

Net income/(loss) available to common stockholders | | $ | 8,388 | | | $ | 4,516 | | | $ | 2,758 | | | $ | (8,713 | ) | | $ | (1,339 | ) |

Adjustments: | | | | | | | | | | | | | | | | | | | | |

Impairment loss | | | — | | | | — | | | | — | | | | — | | | | 4,552 | |

Noncontrolling interests in operating partnership | | | 154 | | | | 86 | | | | 53 | | | | (166 | ) | | | (26 | ) |

Depreciation & amortization - unconsolidated partnerships | | | 369 | | | | 323 | | | | 323 | | | | 323 | | | | 323 | |

Depreciation & amortization - consolidated entities | | | 60,764 | | | | 52,963 | | | | 51,372 | | | | 47,575 | | | | 44,934 | |

Depreciation & amortization - consolidated entities - discontinued operations | | | — | | | | — | | | | — | | | | — | | | | 92 | |

Depreciation & amortization - allocable to noncontrolling interests of consolidated joint ventures | | | (30 | ) | | | (30 | ) | | | (28 | ) | | | (27 | ) | | | (27 | ) |

| | | | | | | | | | | | | | | | | | | | |

Funds from operations (FFO) - basic | | $ | 69,645 | | | $ | 57,858 | | | $ | 54,478 | | | $ | 38,992 | | | $ | 48,509 | |

Interest expense - exchangeable senior notes due 2030 (2) | | | 1,688 | | | | 1,688 | | | | 1,688 | | | | 1,688 | | | | 1,688 | |

| | | | | | | | | | | | | | | | | | | | |

FFO - diluted | | $ | 71,333 | | | $ | 59,546 | | | $ | 56,166 | | | $ | 40,680 | | | $ | 50,197 | |

Acquisition-related expenses | | | 2,236 | | | | 22 | | | | 176 | | | | 12,245 | | | | 633 | |

| | | | | | | | | | | | | | | | | | | | |

CFFO - diluted | | $ | 73,569 | | | $ | 59,568 | | | $ | 56,342 | | | $ | 52,925 | | | $ | 50,830 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Reconciliation of CFFO to adjusted funds from operations (AFFO): | | | | | | | | | | | | | | | | | | | | |

Adjustments: | | | | | | | | | | | | | | | | | | | | |

Recurring capital expenditures and second generation tenant improvements (3) | | | (9,795 | ) | | | (5,738 | ) | | | (2,739 | ) | | | (1,716 | ) | | | (4,629 | ) |

Leasing commissions | | | (1,580 | ) | | | (1,476 | ) | | | (2,001 | ) | | | (1,335 | ) | | | (1,419 | ) |

Gain on extinguishment of debt | | | — | | | | (19 | ) | | | — | | | | (34 | ) | | | (174 | ) |

Non-cash adjustment for securities | | | 2,825 | | | | — | | | | — | | | | 545 | | | | — | |

Amortization of deferred interest costs | | | 1,718 | | | | 1,724 | | | | 1,730 | | | | 1,736 | | | | 1,742 | |

Amortization of deferred loan costs | | | 1,351 | | | | 1,354 | | | | 1,255 | | | | 1,225 | | | | 1,035 | |

Amortization of fair-value of debt acquired | | | (189 | ) | | | (159 | ) | | | (178 | ) | | | (130 | ) | | | (231 | ) |

Amortization of debt discounts | | | 219 | | | | 222 | | | | 218 | | | | 172 | | | | 168 | |

Amortization of lease incentives | | | 627 | | | | 576 | | | | 561 | | | | 659 | | | | 1,173 | |

Depreciation included in general and administrative expense | | | 481 | | | | 510 | | | | 484 | | | | 455 | | | | 442 | |

Non-cash equity compensation | | | 3,011 | | | | 2,860 | | | | 3,094 | | | | 2,887 | | | | 2,689 | |

Cost on redemption of preferred stock | | | 6,531 | | | | — | | | | — | | | | — | | | | — | |

Straight line rents | | | (2,605 | ) | | | (6,330 | ) | | | (5,288 | ) | | | (4,300 | ) | | | (3,454 | ) |

Share of unconsolidated partnership adjustments (4) | | | 40 | | | | 34 | | | | 26 | | | | 26 | | | | 1 | |

Fair-value lease revenue | | | 5,221 | | | | 1,878 | | | | 2,137 | | | | 2,219 | | | | 2,299 | |

| | | | | | | | | | | | | | | | | | | | |

AFFO - diluted | | $ | 81,424 | | | $ | 55,004 | | | $ | 55,641 | | | $ | 55,334 | | | $ | 50,472 | |

| | | | | | | | | | | | | | | | | | | | |

| (1) | For definitions and discussion of FFO, CFFO and AFFO, see page 34. |

| (2) | The calculations of FFO, CFFO and AFFO per share diluted include the assumed issuance of common stock pursuant to the exchange provision of the exchangeable senior notes due 2030, which is dilutive based on the “if converted” method for all periods presented since the original issuance in January 2010. Under the if converted method, if the add back of interest charges relating to the exchangeable senior notes due 2030 divided by the corresponding number of common shares issuable upon exchange is dilutive, the potentially issuable shares are included in the calculations of FFO, CFFO and AFFO per diluted share. |

| (3) | Includes revenue enhancing and non-revenue enhancing recurring capital expenditures. Excludes first generation tenant improvements. For definitions of recurring capital expenditures and first and second generation leases, see page 35. |

| (4) | Share of unconsolidated partnership adjustments includes the Company’s share of amortization of deferred loan costs, lease incentives, straight line rents and fair-value lease revenue. |

12

FFO, CFFO AND AFFO PER SHARE (1)

MARCH 31, 2013

(In thousands, except share, per share and ratio amounts)

| | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | |

| | | 3/31/13 | | | 12/31/12 | | | 9/30/12 | | | 6/30/12 | | | 3/31/12 | |

FFO - basic | | $ | 69,645 | | | $ | 57,858 | | | $ | 54,478 | | | $ | 38,992 | | | $ | 48,509 | |

FFO - diluted | | | 71,333 | | | | 59,546 | | | | 56,166 | | | | 40,680 | | | | 50,197 | |

CFFO - diluted | | | 73,569 | | | | 59,568 | | | | 56,342 | | | | 52,925 | | | | 50,830 | |

AFFO - diluted | | | 81,424 | | | | 55,004 | | | | 55,641 | | | | 55,334 | | | | 50,472 | |

FFO per share - basic | | $ | 0.42 | | | $ | 0.37 | | | $ | 0.35 | | | $ | 0.25 | | | $ | 0.31 | |

FFO per share - diluted (2) | | | 0.41 | | | | 0.36 | | | | 0.34 | | | | 0.24 | | | | 0.30 | |

CFFO per share - diluted (2) | | | 0.42 | | | | 0.36 | | | | 0.34 | | | | 0.32 | | | | 0.30 | |

AFFO per share - diluted (2) | | | 0.47 | | | | 0.33 | | | | 0.33 | | | | 0.33 | | | | 0.30 | |

Dividends and distributions declared per common share | | $ | 0.235 | | | $ | 0.235 | | | $ | 0.215 | | | $ | 0.215 | | | $ | 0.215 | |

| | | | | | | | | | | | | | | | | | | | |

CFFO payout ratio | | | 56.0 | % | | | 65.3 | % | | | 63.2 | % | | | 67.2 | % | | | 71.7 | % |

AFFO payout ratio | | | 50.0 | % | | | 71.2 | % | | | 65.2 | % | | | 65.2 | % | | | 71.7 | % |

Weighted-average common shares and units outstanding diluted (3) | | | 164,111,880 | | | | 157,265,242 | | | | 157,223,682 | | | | 157,111,463 | | | | 157,108,910 | |

Dilutive effect of exchangeable senior notes due 2030 (2) | | | 10,259,496 | | | | 10,259,496 | | | | 10,127,232 | | | | 10,127,232 | | | | 10,127,232 | |

| | | | | | | | | | | | | | | | | | | | |

Weighted-average common shares and units outstanding diluted - FFO, CFFO and AFFO | | | 174,371,376 | | | | 167,524,738 | | | | 167,350,914 | | | | 167,238,695 | | | | 167,236,142 | |

| | | | | | | | | | | | | | | | | | | | |

| (1) | For definitions and discussion of FFO, CFFO and AFFO, see page 34. |

| (2) | The calculations of FFO, CFFO and AFFO per share diluted include the assumed issuance of common stock pursuant to the exchange provision of the exchangeable senior notes due 2030, which is dilutive based on the “if converted” method for all periods presented since the original issuance in January 2010. Under the if converted method, if the add back of interest charges relating to the exchangeable senior notes due 2030 divided by the corresponding number of common shares issuable upon exchange is dilutive, the potentially issuable shares are included in the calculations of FFO, CFFO and AFFO per diluted share. |

| (3) | The three months ended June 30, 2012 includes 2,947,140 shares of OP and LTIP units, which are considered anti-dilutive for purposes of calculating diluted earnings per share. The three months ended March 31, 2013, December 31, 2012, September 30, 2012, June 30, 2012 and March 31, 2012 include 1,398,203, 1,537,032, 1,495,473, 1,388,901 and 1,483,706 shares of unvested restricted stock, respectively, which are considered anti-dilutive for purposes of calculating diluted earnings per share. |

13

RECONCILIATION OF EBITDA AND ADJUSTED EBITDA (1)

MARCH 31, 2013

(In thousands)

| | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | |

| | | 3/31/13 | | | 12/31/12 | | | 9/30/12 | | | 6/30/12 | | | 3/31/12 | |

Reconciliation of net income/(loss) available to common stockholders to earnings before interest, taxes, depreciation and amortization (EBITDA), Adjusted EBITDA and Pro Forma Adjusted EBITDA: | | | | | | | | | | | | | | | | | | | | |

Net income/(loss) available to common stockholders | | $ | 8,388 | | | $ | 4,516 | | | $ | 2,758 | | | $ | (8,713 | ) | | $ | (1,339 | ) |

Interest expense, net | | | 25,902 | | | | 26,745 | | | | 26,817 | | | | 23,825 | | | | 22,219 | |

Interest expense - unconsolidated partnerships | | | 250 | | | | 263 | | | | 256 | | | | 254 | | | | 256 | |

Income tax expense | | | 205 | | | | 208 | | | | 248 | | | | 38 | | | | — | |

Depreciation & amortization - consolidated entities | | | 60,764 | | | | 52,963 | | | | 51,372 | | | | 47,575 | | | | 44,934 | |

Depreciation & amortization - discontinued operations | | | — | | | | — | | | | — | | | | — | | | | 92 | |

Depreciation & amortization - unconsolidated partnerships | | | 369 | | | | 323 | | | | 323 | | | | 323 | | | | 323 | |

| | | | | | | | | | | | | | | | | | | | |

EBITDA | | | 95,878 | | | | 85,018 | | | | 81,774 | | | | 63,302 | | | | 66,485 | |

Noncontrolling interests | | | 146 | | | | 93 | | | | 46 | | | | (172 | ) | | | (30 | ) |

Impairment loss | | | — | | | | — | | | | — | | | | — | | | | 4,552 | |

Preferred dividends | | | 2,393 | | | | 3,651 | | | | 3,651 | | | | 3,651 | | | | 3,651 | |

Cost on redemption of preferred stock | | | 6,531 | | | | — | | | | — | | | | — | | | | — | |

Non-cash adjustment for securities | | | 2,825 | | | | — | | | | — | | | | 545 | | | | — | |

Acquisition-related expenses | | | 2,236 | | | | 22 | | | | 176 | | | | 12,245 | | | | 633 | |

| | | | | | | | | | | | | | | | | | | | |

Adjusted EBITDA | | | 110,009 | | | | 88,784 | | | | 85,647 | | | | 79,571 | | | | 75,291 | |

Elan Corporation lease termination revenue, net | | | (21,613 | ) | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Pro Forma Adjusted EBITDA | | $ | 88,396 | | | $ | 88,784 | | | $ | 85,647 | | | $ | 79,571 | | | $ | 75,291 | |

| | | | | | | | | | | | | | | | | | | | |

| (1) | For definitions and discussion of EBITDA, Adjusted EBITDA and Pro Forma Adjusted EBITDA, see page 34. |

14

RECONCILIATION OF NET OPERATING INCOME (1)

MARCH 31, 2013

(In thousands, except ratio amounts)

| | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | |

| | | 3/31/13 | | | 12/31/12 | | | 9/30/12 | | | 6/30/12 | | | 3/31/12 | |

Net income/(loss) | | $ | 17,458 | | | $ | 8,260 | | | $ | 6,455 | | | $ | (5,234 | ) | | $ | 2,282 | |

(Income)/loss from discontinued operations | | | — | | | | — | | | | — | | | | (49 | ) | | | 4,420 | |

Equity in net loss of unconsolidated partnerships | | | 319 | | | | 379 | | | | 339 | | | | 317 | | | | 355 | |

Interest expense, net | | | 25,902 | | | | 26,745 | | | | 26,817 | | | | 23,825 | | | | 22,219 | |

Other expense/(income) | | | 3,190 | | | | 292 | | | | 208 | | | | 549 | | | | (174 | ) |

| | | | | | | | | | | | | | | | | | | | |

Income from operations | | | 46,869 | | | | 35,676 | | | | 33,819 | | | | 19,408 | | | | 29,102 | |

Depreciation and amortization | | | 60,764 | | | | 52,963 | | | | 51,372 | | | | 47,575 | | | | 44,934 | |

General and administrative | | | 10,028 | | | | 10,608 | | | | 10,226 | | | | 8,576 | | | | 8,614 | |

Acquisition-related expenses | | | 2,236 | | | | 22 | | | | 176 | | | | 12,245 | | | | 633 | |

| | | | | | | | | | | | | | | | | | | | |

Consolidated net operating income | | $ | 119,897 | | | $ | 99,269 | | | $ | 95,593 | | | $ | 87,804 | | | $ | 83,283 | |

| | | | | | | | | | | | | | | | | | | | |

Revenues: | | | | | | | | | | | | | | | | | | | | |

Rental | | $ | 102,956 | | | $ | 103,978 | | | $ | 101,467 | | | $ | 95,708 | | | $ | 91,475 | |

Tenant recoveries | | | 32,637 | | | | 31,638 | | | | 31,765 | | | | 28,939 | | | | 28,453 | |

Other revenue (2) | | | 24,857 | | | | 3,155 | | | | 1,305 | | | | 201 | | | | 84 | |

| | | | | | | | | | | | | | | | | | | | |

Total revenues | | | 160,450 | | | | 138,771 | | | | 134,537 | | | | 124,848 | | | | 120,012 | |

Expenses: | | | | | | | | | | | | | | | | | | | | |

Rental operations | | | 40,553 | | | | 39,502 | | | | 38,944 | | | | 37,044 | | | | 36,729 | |

| | | | | | | | | | | | | | | | | | | | |

Consolidated net operating income | | $ | 119,897 | | | $ | 99,269 | | | $ | 95,593 | | | $ | 87,804 | | | $ | 83,283 | |

| | | | | | | | | | | | | | | | | | | | |

Consolidated net operating income - cash basis (3) | | $ | 98,784 | | | $ | 92,728 | | | $ | 92,032 | | | $ | 86,800 | | | $ | 83,432 | |

| | | | | | | | | | | | | | | | | | | | |

Operating margin (4) | | | 70.1 | % | | | 70.9 | % | | | 70.8 | % | | | 70.3 | % | | | 69.4 | % |

Operating expense recovery (5) | | | 80.5 | % | | | 80.1 | % | | | 81.6 | % | | | 78.1 | % | | | 77.5 | % |

| (1) | For a definition and discussion of net operating income, see page 34. |

| (2) | Includes lease termination income, see page 11 for detail. |

| (3) | Consolidated net operating income - cash basis is calculated as (consolidated net operating income - straight line rents - fair value lease revenue - lease incentive revenue - bad debt expense - other revenue). |

| (4) | Operating margin is calculated as ((rental revenues + tenant recovery revenues - rental operations) / (rental revenues + tenant recovery revenues)). |

| (5) | Operating expense recovery is calculated as (tenant recovery revenues / rental operations). |

15

INTEREST EXPENSE

MARCH 31, 2013

(In thousands)

| | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | |

| | | 3/31/13 | | | 12/31/12 | | | 9/30/12 | | | 6/30/12 | | | 3/31/12 | |

Mortgage notes payable | | $ | 10,004 | | | $ | 10,103 | | | $ | 10,077 | | | $ | 9,882 | | | $ | 10,275 | |

Exchangeable senior notes | | | 1,688 | | | | 1,688 | | | | 1,688 | | | | 1,688 | | | | 1,688 | |

Unsecured senior notes | | | 10,334 | | | | 10,334 | | | | 10,334 | | | | 7,767 | | | | 7,678 | |

Unsecured senior term loan | | | 1,940 | | | | 2,039 | | | | 2,022 | | | | 1,911 | | | | 42 | |

Unsecured line of credit | | | 461 | | | | 417 | | | | 346 | | | | 533 | | | | 1,508 | |

Line of credit fees | | | 656 | | | | 712 | | | | 729 | | | | 664 | | | | 664 | |

Derivative instruments | | | 560 | | | | 579 | | | | 522 | | | | 467 | | | | 10 | |

| | | | | | | | | | | | | | | | | | | | |

Interest expense, net - cash basis | | $ | 25,643 | | | $ | 25,872 | | | $ | 25,718 | | | $ | 22,912 | | | $ | 21,865 | |

| | | | | | | | | | | | | | | | | | | | |

Non-cash interest expense: | | | | | | | | | | | | | | | | | | | | |

Amortization of fair-value of debt acquired | | | (189 | ) | | | (159 | ) | | | (178 | ) | | | (130 | ) | | | (231 | ) |

Amortization of debt discounts | | | 219 | | | | 222 | | | | 218 | | | | 172 | | | | 168 | |

Amortization of deferred loan costs | | | 1,351 | | | | 1,354 | | | | 1,255 | | | | 1,225 | | | | 1,035 | |

Amortization of deferred interest costs | | | 1,718 | | | | 1,724 | | | | 1,730 | | | | 1,736 | | | | 1,742 | |

Capitalized interest | | | (2,840 | ) | | | (2,268 | ) | | | (1,926 | ) | | | (2,090 | ) | | | (2,360 | ) |

| | | | | | | | | | | | | | | | | | | | |

Interest expense, net | | $ | 25,902 | | | $ | 26,745 | | | $ | 26,817 | | | $ | 23,825 | | | $ | 22,219 | |

| | | | | | | | | | | | | | | | | | | | |

16

COVERAGE RATIOS (1)

MARCH 31, 2013

(In thousands, except ratio amounts)

| | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | |

| | | 3/31/13 | | | 12/31/12 | | | 9/30/12 | | | 6/30/12 | | | 3/31/12 | |

Interest coverage ratio | | | | | | | | | | | | | | | | | | | | |

Pro Forma Adjusted EBITDA | | $ | 88,396 | | | $ | 88,784 | | | $ | 85,647 | | | $ | 79,571 | | | $ | 75,291 | |

Interest expense: | | | | | | | | | | | | | | | | | | | | |

Interest expense, net | | | 25,902 | | | | 26,745 | | | | 26,817 | | | | 23,825 | | | | 22,219 | |

Interest expense - unconsolidated partnerships | | | 250 | | | | 263 | | | | 256 | | | | 254 | | | | 256 | |

Amortization of deferred interest costs | | | (1,718 | ) | | | (1,724 | ) | | | (1,730 | ) | | | (1,736 | ) | | | (1,742 | ) |

Amortization of deferred loan costs | | | (1,351 | ) | | | (1,354 | ) | | | (1,255 | ) | | | (1,225 | ) | | | (1,035 | ) |

Amortization of debt discounts | | | (219 | ) | | | (222 | ) | | | (218 | ) | | | (172 | ) | | | (168 | ) |

Amortization of fair-value of debt acquired | | | 189 | | | | 159 | | | | 178 | | | | 130 | | | | 231 | |

| | | | | | | | | | | | | | | | | | | | |

Total interest expense | | $ | 23,053 | | | $ | 23,867 | | | $ | 24,048 | | | $ | 21,076 | | | $ | 19,761 | |

| | | | | | | | | | | | | | | | | | | | |

Interest coverage ratio | | | 3.8 | | | | 3.7 | | | | 3.6 | | | | 3.8 | | | | 3.8 | |

| | | | | | | | | | | | | | | | | | | | |

Fixed charge coverage ratio | | | | | | | | | | | | | | | | | | | | |

Pro Forma Adjusted EBITDA | | $ | 88,396 | | | $ | 88,784 | | | $ | 85,647 | | | $ | 79,571 | | | $ | 75,291 | |

Fixed charges: | | | | | | | | | | | | | | | | | | | | |

Interest expense, net | | | 25,902 | | | | 26,745 | | | | 26,817 | | | | 23,825 | | | | 22,219 | |

Interest expense - unconsolidated partnerships | | | 250 | | | | 263 | | | | 256 | | | | 254 | | | | 256 | |

Amortization of deferred interest costs | | | (1,718 | ) | | | (1,724 | ) | | | (1,730 | ) | | | (1,736 | ) | | | (1,742 | ) |

Amortization of deferred loan costs | | | (1,351 | ) | | | (1,354 | ) | | | (1,255 | ) | | | (1,225 | ) | | | (1,035 | ) |

Amortization of debt discounts | | | (219 | ) | | | (222 | ) | | | (218 | ) | | | (172 | ) | | | (168 | ) |

Amortization of fair-value of debt acquired | | | 189 | | | | 159 | | | | 178 | | | | 130 | | | | 231 | |

Principal payments | | | 2,072 | | | | 2,063 | | | | 1,975 | | | | 1,918 | | | | 2,092 | |

Preferred dividends | | | 2,393 | | | | 3,651 | | | | 3,651 | | | | 3,651 | | | | 3,651 | |

| | | | | | | | | | | | | | | | | | | | |

Total fixed charges | | $ | 27,518 | | | $ | 29,581 | | | $ | 29,674 | | | $ | 26,645 | | | $ | 25,504 | |

| | | | | | | | | | | | | | | | | | | | |

Fixed charge coverage ratio | | | 3.2 | | | | 3.0 | | | | 2.9 | | | | 3.0 | | | | 3.0 | |

| | | | | | | | | | | | | | | | | | | | |

| (1) | For a discussion of coverage ratios, see page 34. |

17

DEBT SUMMARY

MARCH 31, 2013

(Dollars in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Stated

Rate | | | Effective

Rate | | | Principal

Balance | | | Unamortized

Premium /

(Discount) | | | Carrying

Value | | | Maturity

Date | |

Consolidated Debt: | | | | | | | | | | | | | | | | | | | | | | | | |

Fixed Rate Mortgages: | | | | | | | | | | | | | | | | | | | | | | | | |

9900 Belward Campus Drive | | | 5.64 | % | | | 3.99 | % | | $ | 10,732 | | | $ | 720 | | | $ | 11,452 | | | | 07/17 | |

9901 Belward Campus Drive | | | 5.64 | % | | | 3.99 | % | | | 13,216 | | | | 882 | | | | 14,098 | | | | 07/17 | |

Center for Life Science | Boston | | | 7.75 | % | | | 7.75 | % | | | 337,476 | | | | — | | | | 337,476 | | | | 06/14 | |

500 Kendall Street (Kendall D) | | | 6.38 | % | | | 5.45 | % | | | 59,617 | | | | 2,333 | | | | 61,950 | | | | 12/18 | |

Shady Grove Road | | | 5.97 | % | | | 5.97 | % | | | 144,414 | | | | — | | | | 144,414 | | | | 09/16 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total / Weighted-Average on Fixed Rate Mortgages | | | 7.06 | % | | | 6.89 | % | | | 565,455 | | | | 3,935 | | | | 569,390 | | | | | |

Fixed Rate Debt: | | | | | | | | | | | | | | | | | | | | | | | | |

Unsecured Exchangeable Senior Notes Due 2030 | | | 3.75 | % | | | 3.75 | % | | | 180,000 | | | | — | | | | 180,000 | | | | 01/30 | |

Unsecured Senior Notes Due 2016 | | | 3.85 | % | | | 3.99 | % | | | 400,000 | | | | (1,590 | ) | | | 398,410 | | | | 04/16 | |

Unsecured Senior Notes Due 2020 | | | 6.13 | % | | | 6.27 | % | | | 250,000 | | | | (1,962 | ) | | | 248,038 | | | | 04/20 | |

Unsecured Senior Notes Due 2022 | | | 4.25 | % | | | 4.36 | % | | | 250,000 | | | | (2,051 | ) | | | 247,949 | | | | 07/22 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Subtotal / Weighted-Average on Unsecured Senior Notes | | | 4.59 | % | | | 4.73 | % | | | 900,000 | | | | (5,603 | ) | | | 894,397 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total / Weighted-Average on Fixed Rate Debt | | | 5.35 | % | | | 5.36 | % | | | 1,645,455 | | | | (1,668 | ) | | | 1,643,787 | | | | | |

Variable Rate Debt: | | | | | | | | | | | | | | | | | | | | | | | | |

Unsecured Senior Term Loan - U.S. Dollar (1) | | | 1.85 | % | | | 2.64 | % | | | 243,596 | | | | — | | | | 243,596 | | | | 03/17 | |

Unsecured Senior Term Loan - GBP (2) | | | 2.14 | % | | | 2.39 | % | | | 151,890 | | | | — | | | | 151,890 | | | | 03/17 | |

Unsecured Line of Credit (3) | | | 1.75 | % | | | 1.75 | % | | | 215,000 | | | | — | | | | 215,000 | | | | 07/15 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total / Weighted-Average on Variable Rate Debt | | | 1.89 | % | | | 2.26 | % | | | 610,486 | | | | — | | | | 610,486 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total / Weighted-Average on Unsecured Debt | | | 3.53 | % | | | 3.73 | % | | | 1,690,486 | | | | (5,603 | ) | | | 1,684,883 | | | | | |

Total / Weighted-Average on Consolidated Debt | | | 4.41 | % | | | 4.53 | % | | $ | 2,255,941 | | | $ | (1,668 | ) | | $ | 2,254,273 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Share of Unconsolidated Partnership Debt: | | | | | | | | | | | | | | | | | | | | | | | | |

PREI Secured Construction Loan (20%) (variable) | | | 3.21 | % | | | 3.21 | % | | | 27,795 | | | | — | | | | 27,795 | | | | 08/13 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total / Weighted-Average on Share of Unconsolidated Partnership Debt | | | 3.21 | % | | | 3.21 | % | | | 27,795 | | | | — | | | | 27,795 | | | | | |

Total / Weighted-Average on Consolidated and Share of Unconsolidated Partnership Debt | | | 4.40 | % | | | 4.51 | % | | $ | 2,283,736 | | | $ | (1,668 | ) | | $ | 2,282,068 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | The Company entered into interest rate swap agreements that effectively fix the interest rate on $200 million of the unsecured senior term loan facility at 2.81% for the remaining term of the loan, subject to adjustments based on the Company’s credit ratings. Including the effect of these swaps, the weighted-average effective interest rate for the $243.6 million outstanding under the unsecured senior term loan facility was 2.64% at March 31, 2013. |

| (2) | The Company amended the unsecured senior term loan facility and converted $156.4 million of outstanding borrowings into British pounds sterling equal to £100 million. The principal balance represents the dollar amount based on the exchange rate of $1.52 to £1.00 at the end of the quarter. The Company entered into interest rate swap agreements that effectively fix the interest rate on £100 million at 2.39% for the remaining term of the loan, subject to adjustments based on the Company’s credit ratings. |

| (3) | Effective rate excludes facility fee of 35 bps on the entire capacity of the unsecured line of credit, or $750.0 million, which equals approximately $664,000 per quarter. |

18

DEBT MATURITIES

MARCH 31, 2013

(In thousands)

Weighted-average debt maturity is 5.2 years for consolidated debt (excluding extension options).

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2013 | | | 2014 | | | 2015 | | | 2016 | | | 2017 | | | Thereafter | | | Total | |

Consolidated debt: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Fixed rate debt: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Fixed rate mortgages | | $ | 6,292 | | | $ | 339,088 | | | $ | 6,482 | | | $ | 143,784 | | | $ | 27,338 | | | $ | 42,471 | | | $ | 565,455 | |

Unsecured exchangeable senior notes due 2030 (1) | | | — | | | | — | | | | — | | | | — | | | | — | | | | 180,000 | | | | 180,000 | |

Unsecured senior notes due 2016 | | | — | | | | — | | | | — | | | | 400,000 | | | | — | | | | — | | | | 400,000 | |

Unsecured senior notes due 2020 | | | — | | | | — | | | | — | | | | — | | | | — | | | | 250,000 | | | | 250,000 | |

Unsecured senior notes due 2022 | | | — | | | | — | | | | — | | | | — | | | | — | | | | 250,000 | | | | 250,000 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total fixed rate debt | | | 6,292 | | | | 339,088 | | | | 6,482 | | | | 543,784 | | | | 27,338 | | | | 722,471 | | | | 1,645,455 | |

Variable rate debt: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Unsecured senior term loan - U.S. Dollar | | | — | | | | — | | | | — | | | | — | | | | 243,596 | | | | — | | | | 243,596 | |

Unsecured senior term loan - GBP | | | — | | | | — | | | | — | | | | — | | | | 151,890 | | | | — | | | | 151,890 | |

Unsecured line of credit | | | — | | | | — | | | | 215,000 | | | | — | | | | — | | | | — | | | | 215,000 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total variable rate debt | | | — | | | | — | | | | 215,000 | | | | — | | | | 395,486 | | | | — | | | | 610,486 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total consolidated debt | | $ | 6,292 | | | $ | 339,088 | | | $ | 221,482 | | | $ | 543,784 | | | $ | 422,824 | | | $ | 722,471 | | | $ | 2,255,941 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Share of unconsolidated partnership debt: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

PREI secured construction loan (20%) (variable) | | | 27,795 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 27,795 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Share of total unconsolidated partnership debt | | $ | 27,795 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | 27,795 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total consolidated and share of unconsolidated partnership debt | | $ | 34,087 | | | $ | 339,088 | | | $ | 221,482 | | | $ | 543,784 | | | $ | 422,824 | | | $ | 722,471 | | | $ | 2,283,736 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | The holders of the unsecured exchangeable senior notes due 2030 (the “2030 Notes”) have the right to require the Company to repurchase the 2030 Notes, in whole or in part, for cash on each of January 15, 2015, January 15, 2020 and January 15, 2025, or upon the occurrence of a designated event, in each case for a repurchase price equal to 100% of the principal amount of the 2030 Notes plus accrued and unpaid interest. |

19

COMMON AND PREFERRED STOCK DATA

MARCH 31, 2013

(Shares in thousands)

Summary of Common Shares

| | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | |

| | | 03/31/13 | | | 12/31/12 | | | 09/30/12 | | | 06/30/12 | | | 03/31/12 | |

Earnings per share | | | | | | | | | | | | | | | | | | | | |

Weighted-average common shares outstanding | | | 159,692 | | | | 152,791 | | | | 152,785 | | | | 152,775 | | | | 152,659 | |

Weighted-average OP and LTIP units outstanding | | | 2,924 | | | | 2,937 | | | | 2,943 | | | | — | | | | 2,966 | |

Dilutive effect of performance units | | | 98 | | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Diluted common shares - EPS | | | 162,714 | | | | 155,728 | | | | 155,728 | | | | 152,775 | | | | 155,625 | |

| | | | | | | | | | | | | | | | | | | | |

Funds from operations | | | | | | | | | | | | | | | | | | | | |

Weighted-average common shares outstanding | | | 159,692 | | | | 152,791 | | | | 152,785 | | | | 152,775 | | | | 152,659 | |

Weighted-average OP and LTIP units outstanding | | | 2,924 | | | | 2,937 | | | | 2,943 | | | | 2,948 | | | | 2,966 | |

Dilutive effect of performance units | | | 98 | | | | — | | | | — | | | | — | | | | — | |

Dilutive effect of restricted stock | | | 1,398 | | | | 1,537 | | | | 1,496 | | | | 1,389 | | | | 1,484 | |

Dilutive effect of exchangeable senior notes due 2030 | | | 10,259 | | | | 10,260 | | | | 10,127 | | | | 10,127 | | | | 10,127 | |

| | | | | | | | | | | | | | | | | | | | |

Diluted common shares - FFO | | | 174,371 | | | | 167,525 | | | | 167,351 | | | | 167,239 | | | | 167,236 | |

| | | | | | | | | | | | | | | | | | | | |

Closing common shares, OP and LTIP units outstanding | | | 171,974 | | | | 157,261 | | | | 157,278 | | | | 157,127 | | | | 157,120 | |

Preferred shares outstanding | | | — | | | | 7,920 | | | | 7,920 | | | | 7,920 | | | | 7,920 | |

High price | | $ | 22.30 | | | $ | 19.68 | | | $ | 19.94 | | | $ | 20.30 | | | $ | 19.65 | |

Low price | | $ | 19.47 | | | $ | 18.19 | | | $ | 18.10 | | | $ | 17.52 | | | $ | 17.72 | |

Average closing price | | $ | 20.88 | | | $ | 19.07 | | | $ | 18.81 | | | $ | 18.71 | | | $ | 18.65 | |

Closing price | | $ | 21.60 | | | $ | 19.33 | | | $ | 18.72 | | | $ | 18.68 | | | $ | 18.98 | |

Dividends per share - annualized | | $ | 0.94 | | | $ | 0.94 | | | $ | 0.86 | | | $ | 0.86 | | | $ | 0.86 | |

Closing dividend yield - annualized | | | 4.4 | % | | | 4.9 | % | | | 4.6 | % | | | 4.6 | % | | | 4.5 | % |

|

Dividends per Share | |

| | | 03/31/13 | | | 12/31/12 | | | 09/30/12 | | | 06/30/12 | | | 03/31/12 | |

Common Stock - BMR | | | | | | | | | | | | | | | | | | | | |

Amount | | $ | 0.235 | | | $ | 0.235 | | | $ | 0.215 | | | $ | 0.215 | | | $ | 0.215 | |

Declared | | | March 15, 2013 | | | | December 12, 2012 | | | | September 14, 2012 | | | | June 15, 2012 | | | | March 15, 2012 | |

Record | | | March 28, 2013 | | | | December 31, 2012 | | | | September 28, 2012 | | | | June 29, 2012 | | | | March 30, 2012 | |

Paid | | | April 15, 2013 | | | | January 15, 2013 | | | | October 15, 2012 | | | | July 16, 2012 | | | | April 16, 2012 | |

Preferred Stock - BMR PrA(1) | | | | | | | | | | | | | | | | | | | | |

Amount | | | — | | | $ | 0.46094 | | | $ | 0.46094 | | | $ | 0.46094 | | | $ | 0.46094 | |

Declared | | | — | | | | December 12, 2012 | | | | September 14, 2012 | | | | June 15, 2012 | | | | March 15, 2012 | |

Record | | | — | | | | December 31, 2012 | | | | September 28, 2012 | | | | June 29, 2012 | | | | March 30, 2012 | |

Paid | | | — | | | | January 15, 2013 | | | | October 15, 2012 | | | | July 16, 2012 | | | | April 16, 2012 | |

| (1) | The Company voluntarily redeemed all shares of its Series A preferred stock on March 15, 2013, at a redemption price of $25.30217 per share (the sum of the $25.00 per share redemption price and a quarterly dividend of $0.46094 prorated through the redemption date). |

20

MARKET SUMMARY

MARCH 31, 2013

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Current (1) | | | Expiration (2) | |

Market | | Leased

Square

Feet | | | Annualized Base

Rent | | | Percent of

Annualized

Base Rent | | | Annualized

Base Rent per

Leased Sq Ft | | | Annualized

Base Rent | | | Percent of

Annualized

Base Rent | | | Annualized

Base Rent

per Leased

Sq Ft | |

| | | | | | (In thousands) | | | | | | | | | (In thousands) | | | | | | | |

Boston | | | 2,965,467 | | | $ | 160,596 | | | | 36.9 | % | | $ | 54.16 | | | $ | 171,762 | | | | 34.4 | % | | $ | 57.92 | |

Maryland | | | 1,584,443 | | | | 60,267 | | | | 13.9 | % | | | 38.04 | | | | 75,326 | | | | 15.1 | % | | | 47.54 | |

San Francisco | | | 2,324,056 | | | | 60,041 | | | | 13.8 | % | | | 25.83 | | | | 68,063 | | | | 13.6 | % | | | 29.29 | |

San Diego | | | 1,778,114 | | | | 58,659 | | | | 13.5 | % | | | 32.99 | | | | 74,519 | | | | 14.9 | % | | | 41.91 | |

New York / New Jersey | | | 1,233,247 | | | | 40,983 | | | | 9.4 | % | | | 33.23 | | | | 51,179 | | | | 10.3 | % | | | 41.50 | |

Pennsylvania | | | 638,632 | | | | 15,079 | | | | 3.5 | % | | | 23.61 | | | | 15,902 | | | | 3.2 | % | | | 24.90 | |

Seattle | | | 270,707 | | | | 12,407 | | | | 2.9 | % | | | 45.83 | | | | 14,516 | | | | 2.9 | % | | | 53.62 | |

University Related - Other | | | 830,426 | | | | 27,087 | | | | 6.1 | % | | | 32.62 | | | | 27,752 | | | | 5.6 | % | | | 33.42 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total portfolio / weighted-average | | | 11,625,092 | | | $ | 435,119 | | | | 100.0 | % | | $ | 37.43 | | | $ | 499,019 | | | | 100.0 | % | | $ | 42.93 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | |

| | | Percent Leased | | | | | | | | | | | | | |

Market | | Total

Operating

Portfolio | | | Redevelopment (3) | | | Unconsolidated

Partnership

Portfolio (4) | | | | | | | | | | | | | |

Boston | | | 97.6 | % | | | — | | | | 45.0 | % | | | | | | | | | | | | | | | | |

Maryland | | | 96.7 | % | | | 61.4 | % | | | — | | | | | | | | | | | | | | | | | |

San Francisco | | | 78.3 | % | | | — | | | | — | | | | | | | | | | | | | | | | | |

San Diego | | | 88.8 | % | | | — | | | | 100.0 | % | | | | | | | | | | | | | | | | |

New York / New Jersey | | | 85.2 | % | | | — | | | | — | | | | | | | | | | | | | | | | | |

Pennsylvania | | | 88.0 | % | | | — | | | | — | | | | | | | | | | | | | | | | | |

Seattle | | | 73.9 | % | | | — | | | | — | | | | | | | | | | | | | | | | | |

University Related - Other | | | 98.8 | % | | | — | | | | — | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total portfolio (5) | | | 89.1 | % | | | 61.4 | % | | | 56.4 | % | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total portfolio weighted-average leased % (6) | | | 91.7 | % | | | 42.9 | % | | | 56.4 | % | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | Current annualized base rent is the monthly contractual rent as of the current quarter ended, or if rent has not yet commenced, the first monthly rent payment due at each rent commencement date, multiplied by 12 months. |

| (2) | Annualized base rent at expiration is the monthly contractual rent as of date of expiration of the applicable lease (not including any extension option(s)), multiplied by 12 months. |

| (3) | See page 24 for detail of the consolidated portfolio and page 34 for definitions of terms. |

| (4) | See page 26 for detail of the unconsolidated partnership portfolio. |

| (5) | Calculated based on leased square feet divided by total square feet. |

| (6) | Calculated based on gross book value for each asset multiplied by the percentage leased. |

21

PROPERTY LISTING - CONSOLIDATED PORTFOLIO

MARCH 31, 2013

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | Property | | | | | Rentable

Square | | | Percent of

Rentable | | | Leased

Square | | | Percent Leased | |

| | | Property | | Acquisition Date | | Status (1) | | Buildings | | | Feet | | | Sq Ft | | | Feet | | | 3/31/13 | | | 12/31/12 | |

| | Boston | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

1 | | Albany Street | | May 31, 2005 | | Stabilized | | | 2 | | | | 75,003 | | | | 0.6 | % | | | 75,003 | | | | 100.0 | % | | | 100.0 | % |

2 | | 320 Bent Street | | December 14, 2011 | | Stabilized | | | 1 | | | | 195,198 | | | | 1.5 | % | | | 191,576 | | | | 98.1 | % | | | 98.1 | % |

3 | | 301 Binney Street | | December 14, 2011 | | Stabilized | | | 1 | | | | 417,290 | | | | 3.2 | % | | | 403,381 | | | | 96.7 | % | | | 96.7 | % |

4 | | 301 Binney Street Garage | | December 14, 2011 | | Stabilized | | | 1 | | | | 503 Stalls | | | | n/a | | | | 503 Stalls | | | | 100.0 | % | | | 100.0 | % |

5 | | 210 Broadway | | February 9, 2012 | | Lease Up | | | 1 | | | | 64,812 | | | | 0.5 | % | | | 32,842 | | | | 50.7 | % | | | 50.7 | % |

6 | | Center for Life Science | Boston | | November 17, 2006 | | Stabilized | | | 1 | | | | 704,159 | | | | 5.5 | % | | | 696,331 | | | | 98.9 | % | | | 98.8 | % |

7 | | Charles Street | | April 7, 2006 | | Stabilized | | | 1 | | | | 47,912 | | | | 0.4 | % | | | 47,912 | | | | 100.0 | % | | | 100.0 | % |

8 | | Coolidge Avenue | | April 5, 2005 | | Lease Up | | | 1 | | | | 37,684 | | | | 0.3 | % | | | 29,431 | | | | 78.1 | % | | | 78.3 | % |

9 | | 21 Erie Street | | May 31, 2005 | | Stabilized | | | 1 | | | | 48,627 | | | | 0.4 | % | | | 48,627 | | | | 100.0 | % | | | 100.0 | % |

10 | | 40 Erie Street | | May 31, 2005 | | Stabilized | | | 1 | | | | 100,854 | | | | 0.8 | % | | | 100,854 | | | | 100.0 | % | | | 100.0 | % |

11 | | 47 Erie Street Parking Structure | | May 31, 2005 | | Stabilized | | | 1 | | | | 447 Stalls | | | | n/a | | | | 447 Stalls | | | | 100.0 | % | | | 100.0 | % |

12 | | Fresh Pond Research Park | | April 5, 2005 | | Stabilized | | | 6 | | | | 90,702 | | | | 0.7 | % | | | 89,176 | | | | 98.3 | % | | | 98.3 | % |

13 | | 50 Hampshire Street | | February 9, 2012 | | Stabilized | | | 1 | | | | 183,052 | | | | 1.4 | % | | | 183,052 | | | | 100.0 | % | | | 100.0 | % |

14 | | 60 Hampshire Street | | February 9, 2012 | | Stabilized | | | 1 | | | | 39,014 | | | | 0.3 | % | | | 39,014 | | | | 100.0 | % | | | 100.0 | % |

15 | | Kendall Crossing Apartments | | December 14, 2011 | | Stabilized | | | 1 | | | | 37 Apts. | | | | n/a | | | | 36 Apts. | | | | 96.6 | % | | | 94.5 | % |

16 | | 500 Kendall Street (Kendall D) | | May 31, 2005 | | Stabilized | | | 1 | | | | 349,325 | | | | 2.7 | % | | | 346,535 | | | | 99.2 | % | | | 99.2 | % |

17 | | 675 W. Kendall Street (Kendall A) | | May 31, 2005 | | Stabilized | | | 1 | | | | 302,919 | | | | 2.4 | % | | | 302,919 | | | | 100.0 | % | | | 100.0 | % |

18 | | Sidney Street | | May 31, 2005 | | Stabilized | | | 1 | | | | 191,904 | | | | 1.5 | % | | | 191,904 | | | | 100.0 | % | | | 100.0 | % |

19 | | Vassar Street | | May 31, 2005 | | Stabilized | | | 1 | | | | 60,845 | | | | 0.5 | % | | | 60,845 | | | | 100.0 | % | | | 100.0 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Total Boston | | | | | | | 25 | | | | 2,909,300 | | | | 22.7 | % | | | 2,839,402 | | | | 97.6 | % | | | 97.6 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Maryland | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

20 | | Beckley Street | | December 17, 2004 | | Stabilized | | | 1 | | | | 77,225 | | | | 0.6 | % | | | 77,225 | | | | 100.0 | % | | | 100.0 | % |

21 | | 9900 Belward Campus Drive | | July 18, 2012 | | Lease Up | | | 1 | | | | 49,317 | | | | 0.4 | % | | | 36,550 | | | | 74.1 | % | | | 83.8 | % |