- STXS Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Stereotaxis (STXS) 8-KRegulation FD Disclosure

Filed: 28 Sep 10, 12:00am

NASDAQ: STXS Exhibit 99.1 |

Forward-Looking Statements 2 During the course of this presentation, the Company may make projections and other forward- looking statements regarding future events or the future financial performance of the Company, including without limitation, statements regarding future operating results, growth opportunities and other statements that refer to Stereotaxis’ plans, prospects, expectations, strategies, intentions and beliefs. These statements are subject to many risks and uncertainties that could cause actual results to differ materially from expectations. For a detailed discussion of risks and uncertainties that affect the Company’s business and qualify the forward-looking statements made in this presentation, we refer you to the Company’s recent public filings filed with the SEC, specifically the Form 10-K for the fiscal year ended December 31, 2009. The Company’s projections and forward-looking statements are based on factors that are subject to change and therefore these statements speak only as of the date they are given. The Company assumes no obligation to update any projections or forward-looking statements. In addition, regarding orders and backlog, there can be no assurance that the Company will recognize revenue related to its purchase orders and other commitments in any particular period, or at all, because some of these purchase orders and other commitments are subject to contingencies that are outside of our control. These orders and commitments may be revised, modified, or canceled either by their express terms, as a result of negotiations, or by project changes or delays. |

Investment Considerations Two innovative technology platforms: Niobe ® Magnetic Navigation System Odyssey ™ Enterprise Solutions Substantial IP portfolio Large, fast growing (+20%) cardiology ablation market Poised for continued growth in electrophysiology (EP) Expansion into new markets New geographic opportunities Broad clinical applications beyond EP Multi-dimensional strategy to accelerate growth 3 |

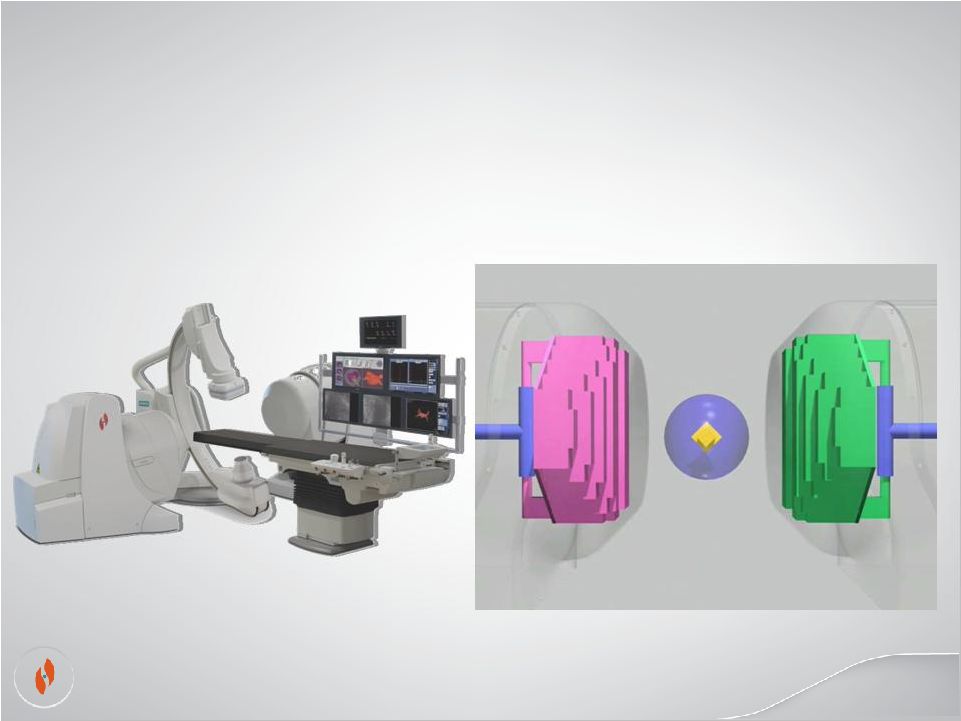

Niobe Magnetic Navigation System Magnet-guided catheter distal tip provides precise remote control of therapeutic devices. 4 |

Niobe Provides Precision and Safety Precise control of catheter distal tip provides: Effective lesion creation through constant contact Exceptional mapping capability Exemplary safety Proven in all chambers of the heart 5 |

Manual Niobe Physician Efficacy Safety Efficiency In procedure room exposed to fluoroscopy Physician: Significant X-ray exposure Patient: Major event rate ~2.8% Higher variability in procedure times In control room outside fluoroscopy field Clearly better in several applications - VT, pediatrics, congenital heart diseases Other applications comparable to manual Physician: Almost no X-ray exposure Patient: Major event rate ~0.1% Standardized process drives tighter distribution around procedure times High re-do rates Niobe’s Advantages 6 |

Atrial Fibrillation 30 Publications Up to 100% acute success 4 Improved chronic outcomes 5 Pediatric Arrhythmia 5 publications 93% acute success 3 Low fluoro, no complications Congenital Heart 6 publications 90% success rate 6 “As easy as normal adults” Ventricular Tachycardia 13 publications Up to 100% acute success 7 85% freedom at 1 year 8 Radiation Reduction Patients – 67% 1 Physicians – 90% 2 1. Haghjoo, JCE 2009. 2. Latcu, Arch Cardiovasc Dis 2009. 3. Schwagten, PACE 2009. 4. DiBiase, JCE 2009. 5. Augello, Heart Rhythm 2009. 6. Schwagten, PACE 2009. 7. Haghjoo, JCE 2009. 8. Dibiase, Heart Rhythm 2009. 7 Strong Clinical Validation More than 150 peer-reviewed publications highlight Niobe’s value |

Major Advantages in Ventricular Tachycardia Ablation 97% 24% 170 25 8 81% 28% 228 57 13 0 50 100 150 200 250 Acute Success (%) Recurrence (%) Case Time (min) Fluoro Time (min) RF Apps STXS Manual p = 0.03 p < 0.01 p < 0.001 NS 8 NS • VT is an abnormally fast heart rhythm that originates from one of the ventricles and can lead to potentially life threatening complications. • 64 consecutive VT ablation patients – 37 Niobe; 27 manual procedures – Idiopathic & Scar-Related • No complications in Niobe group • 1 tamponade/death in manual group • Conclusion: Niobe offers “major clinical & cost advantages for VT ablation” Schwagten, et al. Eur Heart J 2010, 31 (Supp):932. |

Global EP Market is Large and Growing Source: Millennium Research Group (2009); Stereotaxis internal analysis 9 EP Procedures Routine AF VT Other Total Complex Prevalence Annual Procedures Annual Growth >20M >10M >3M >5M >18M 170K 100K 30K 40K 170K <10% 25% 15% 15% 20% Stereotaxis focused on complex ablation, high-growth segments |

Niobe Market Adoption & Procedure Growth 30,000 + procedures Cumulative Procedures Growing Worldwide Penetration 141 Systems Installed 60% US - 40% OUS Canada - 3 United States - 77 Europe - 49 Saudi Arabia - 1 Russia - 1 China - 5 Korea - 1 Japan - 1 Singapore - 1 Taiwan - 1 Australia - 1 10 |

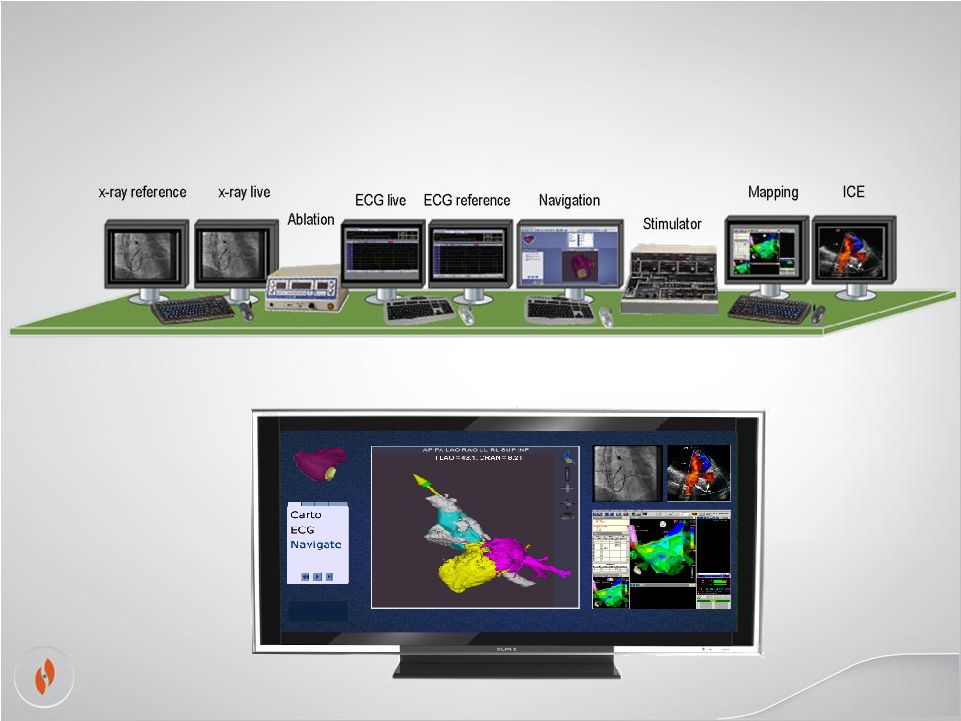

Odyssey Enterprise TM Solutions 11 Odyssey Vision Integrates and centralizes all EP lab related information to significantly enhance physicians’ efficiency |

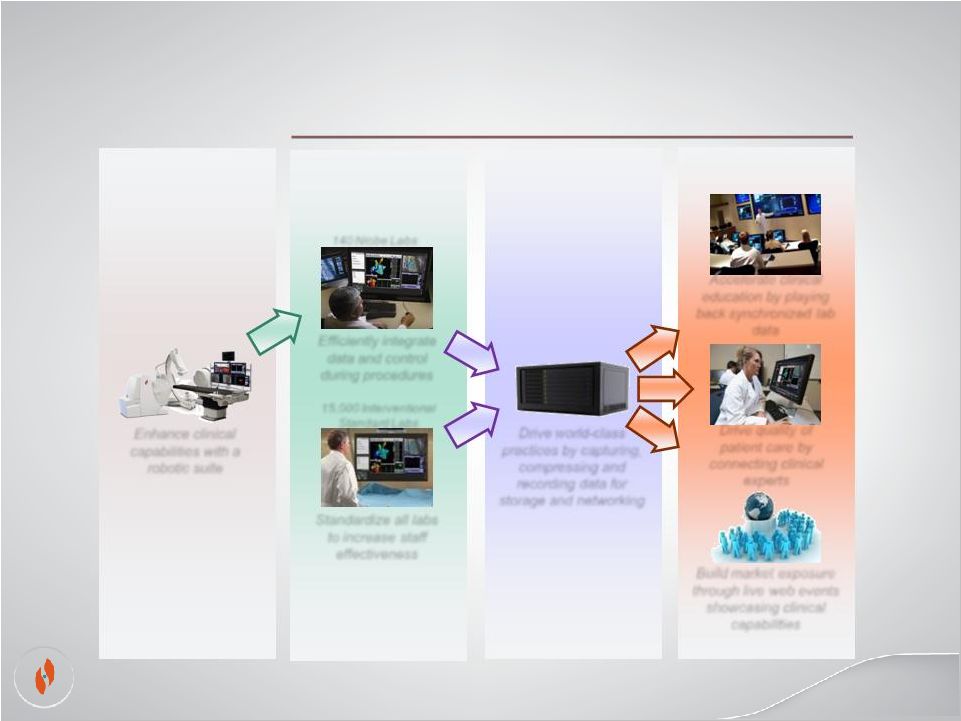

The Odyssey Product Line 12 140 Niobe Labs CONNECT CINEMA VISION Efficiently integrate data and control during procedures Standardize all labs to increase staff effectiveness Drive world-class practices by capturing, compressing and recording data for storage and networking NIOBE Accelerate clinical education by playing back synchronized lab data Drive quality of patient care by connecting clinical experts Build market exposure through live web events showcasing clinical capabilities Enhance clinical capabilities with a robotic suite 15,000 Interventional Standard Labs ODYSSEY |

Business Model Capital Revenue Recurring Revenue Niobe Odyssey Workstation Odyssey Cinema • 141 Niobe systems installed • 2,500 EP labs worldwide • 20+% growth; ~60% margin • 25% growth (YTD 2010 vs. 2009) • 80% margin Capital Driven • Technical service • Software license Niobe Utilization • Stereotaxis disposables • Royalty from J&J BWI 27% growth (2009 vs. 2008); 65+% margin 13 |

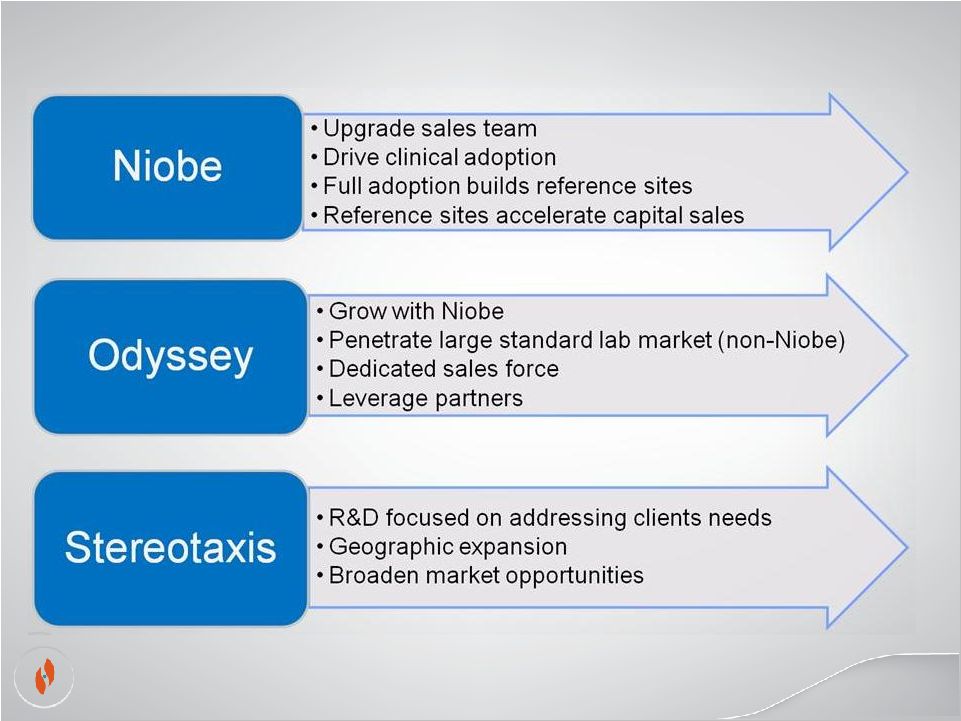

14 Strategies to Accelerate Growth |

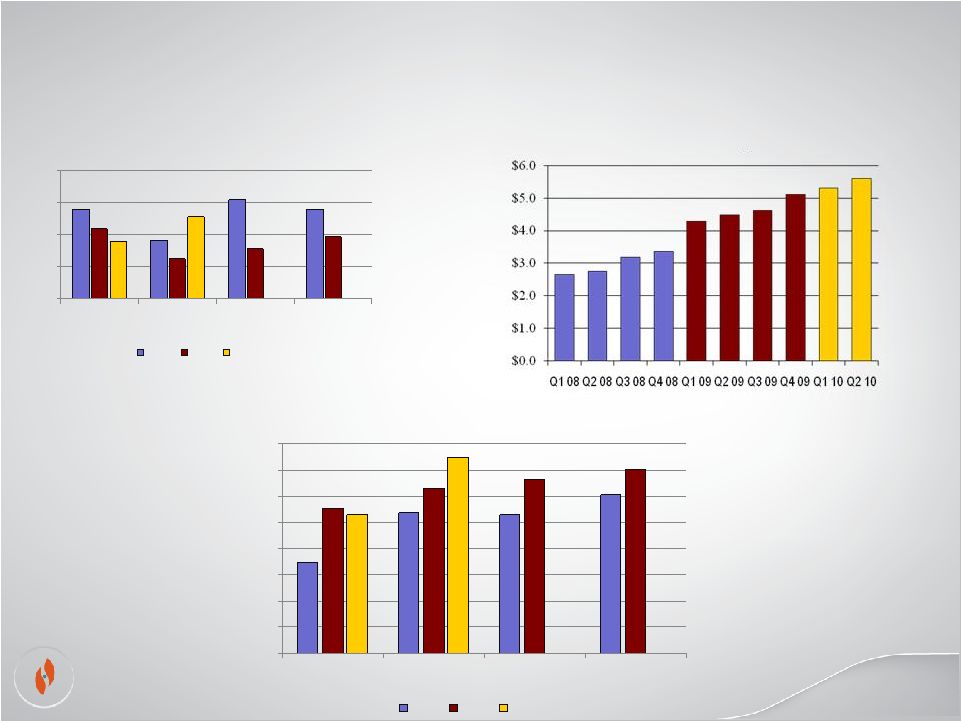

$0.0 $4.0 $8.0 $12.0 $16.0 Q1 Q2 Q3 Q4 2008 2009 2010 $11.2 $8.8 $7.2 $7.3 $5.0 $10.2 $12.4 $6.3 $11.2 $7.7 New Orders to Backlog Revenue Momentum Recurring Revenue $ millions $ millions $0 $2 $4 $6 $8 $10 $12 $14 $16 Q1 Q2 Q3 Q4 2008 2009 2010 $7.0 $11.1 $10.6 $10.7 $12.6 $15.0 $10.6 $13.3 $12.1 $14.1 $ millions Stereotaxis Financial Update 15 |

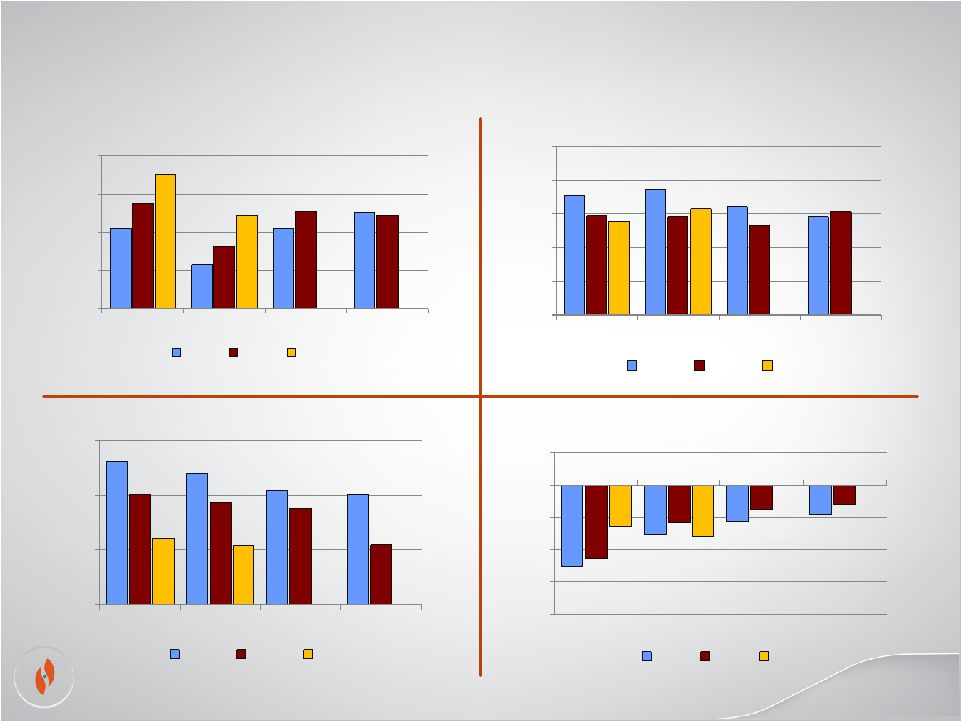

$0.0 $4.0 $8.0 $12.0 Q1 Q2 Q3 Q4 2008 2009 2010 Total Inventory -$20.0 -$15.0 -$10.0 -$5.0 $0.0 $5.0 Q1 Q2 Q3 Q4 2008 2009 2010 Cash Flow (Burn) $0.0 $5.0 $10.0 $15.0 $20.0 $25.0 Q1 Q2 Q3 Q4 2008 2009 2010 Operating Expenses 55.0% 60.0% 65.0% 70.0% 75.0% Q1 Q2 Q3 Q4 2008 2009 2010 Gross Margin Percentage $ millions $ millions $ millions 65.5% 68.9% 72.5% 60.8% 63.1% 65.5% 67.8% 67.6% 67.3% $17.8 $14.8 $14.0 $18.7 $14.6 $16.1 $13.3 $14.6 $15.3 -$12.6 -$11.4 -$6.4 -$7.6 -$5.8 -$5.6 -$3.5 -$4.5 -$2.9 $10.5 $8.1 $4.9 $9.6 $7.5 $8.4 $7.0 $8.1 $4.4 67.2% $15.8 $4.3 -$7.9 Stereotaxis Financial Update 16 |

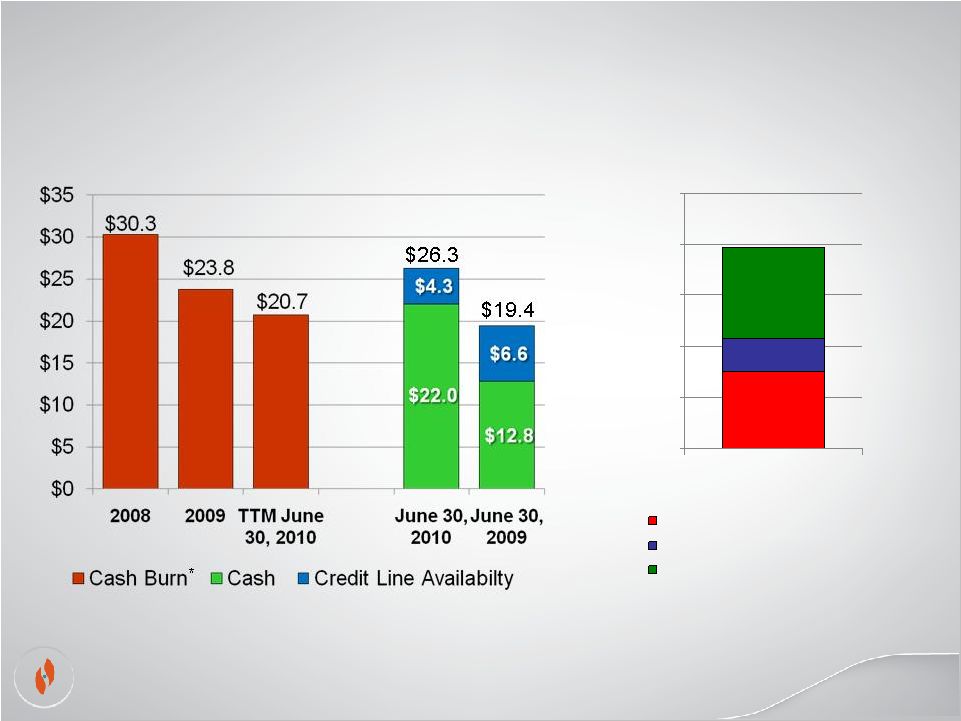

Liquidity $3.0 $1.3 $3.6 $0 $2 $4 $6 $8 $10 2010 Operating Cash Flow Ex A/R BWI Debt Accounts Receivable Q2 2010 Cash Burn Analysis $ Millions $7.9 $ Millions 17 * Cash burn includes repayment of Biosense Webster advance. |

Investment Considerations Two innovative technology platforms: Niobe ® Magnetic Navigation System Odyssey ™ Enterprise Solutions Substantial IP portfolio Large, fast growing (+20%) cardiology ablation market Poised for continued growth in electrophysiology (EP) Expansion into new markets New geographic opportunities Broad clinical applications beyond EP Multi-dimensional strategy to accelerate growth 18 |

Q & A 19 |