UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM 10-K

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2005

OR

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 000-51280

MORNINGSTAR, INC.

(Exact Name of Registrant as Specified in its Charter)

Illinois | | 36-3297908 |

(State or Other Jurisdiction of

Incorporation or Organization) | | (I.R.S. Employer

Identification Number) |

225 West Wacker Drive

Chicago, Illinois

60606-6303

(Address of Principal Executive Offices)

(312) 696-6000

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the Act:

Common stock, no par value

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the Registrant is a large accelerated filer, accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer in Rule 12b-2 of the Exchange Act.

Large accelerated filer | o | | | Accelerated filer o | | Non-accelerated filer ý |

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

The aggregate market value of shares of common stock held by non-affiliates of the Registrant as of June 30, 2005 was $255,104,055.

As of March 2, 2006, there were 40,371,921 shares of the Registrant’s common stock, no par value, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Certain parts of the Registrant’s Definitive Proxy Statement for the 2006 Annual Meeting of Shareholders are incorporated into Part III of this Form 10-K.

Part I

Item 1. Business

We are a leading provider of independent investment research to investors around the world. Since our founding in 1984, our mission has been to create great products that help investors reach their financial goals. We offer an extensive line of Internet, software, and print-based products for individual investors, financial advisors, and institutional clients. We also provide asset management services to advisors and institutions. In addition to our U.S.-based products and services, we offer local versions of our products designed for investors in Asia, Australia, Canada, and Europe. We serve more than 4.9 million individual investors, 185,000 financial advisors, and 750 institutional clients. We have operations in 12 countries and hold minority ownership positions in companies located in four other countries.

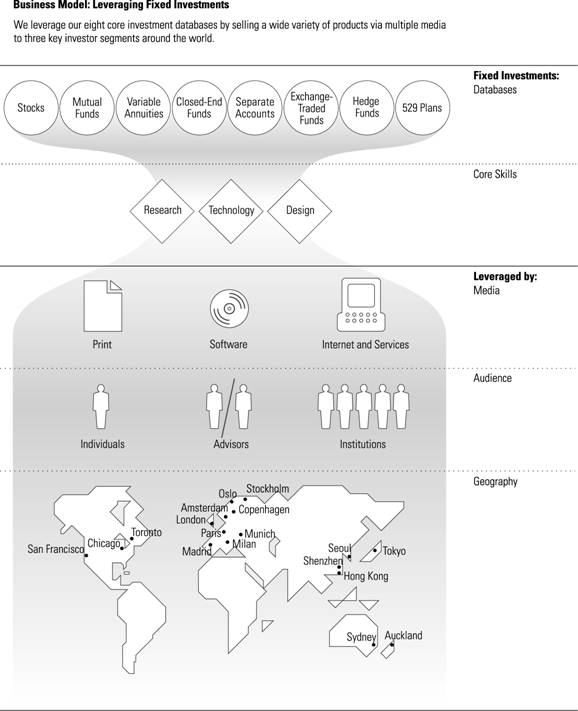

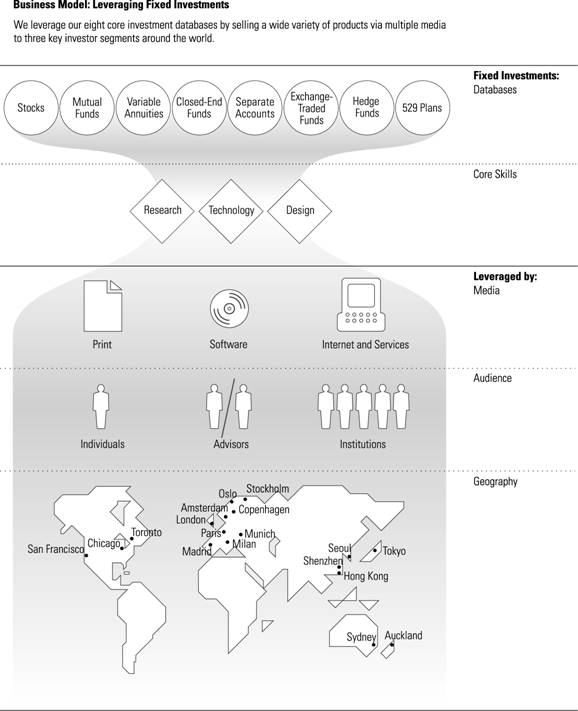

We maintain a series of comprehensive databases on eight key types of investments that are widely used by investors both in the United States and in non-U.S. markets. After establishing these databases, we add additional value and insight to the raw data by investing in our core skills of research, technology, and design. As of December 31, 2005, we provided extensive data on more than:

• 17,800 mutual fund share classes in the United States;

• 43,000 mutual funds and similar vehicles in international markets;

• 7,100 stocks;

• 2,600 hedge funds;

• 4,800 separate accounts;

• 50,200 variable annuity/life subaccounts;

• 200 exchange-traded funds;

• 600 closed-end funds; and

• 80 state-sponsored college savings plans (commonly known as Section 529 College Savings Plans).

Morningstar’s business model is based on leveraging our investments in the databases we maintain, as well as our core skills of research, technology, and design. We leverage these investments by selling a wide variety of products via multiple media to three key market segments around the world.

2

3

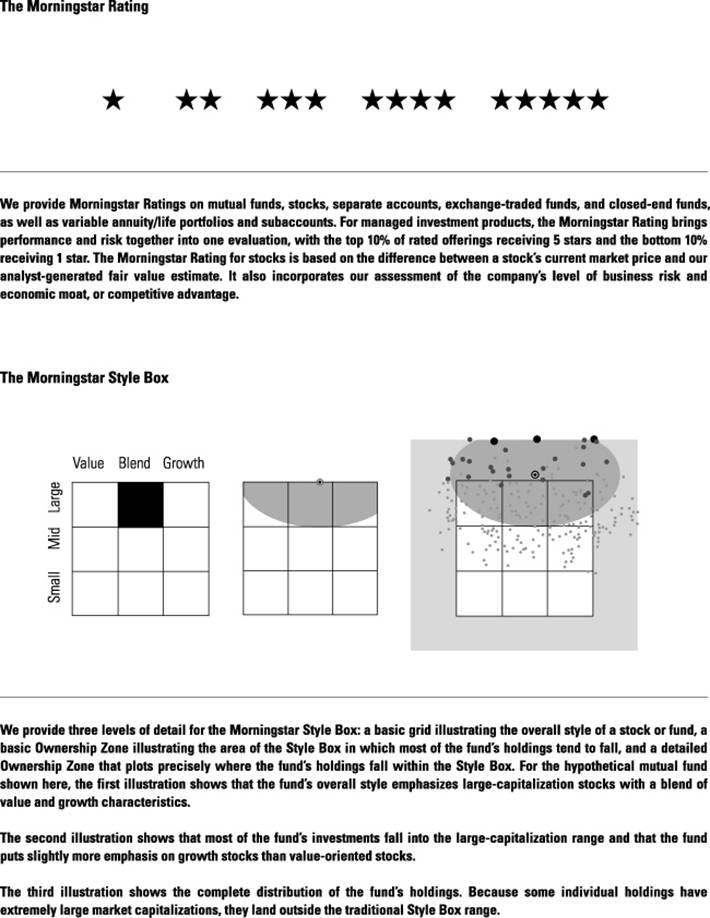

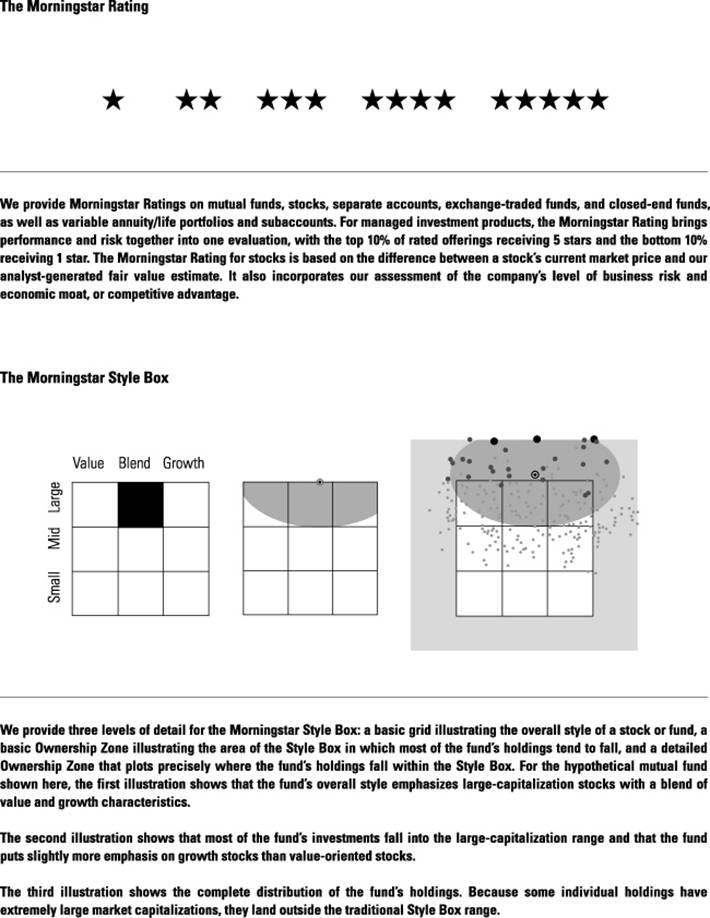

Our data and proprietary analytical tools such as the Morningstar Rating for mutual funds, which rates past performance based on risk- and cost-adjusted returns, and the Morningstar Style Box, which provides a visual summary of a mutual fund’s underlying investment style, have become important tools that millions of investors and advisors use in making investment decisions. We’ve created other tools such as the Ownership Zones, Sector Deltas, and Market Barometer, which allow investors to see how different investments work together to form a portfolio and to track its progress. We developed a Portfolio X-Ray tool that helps investors reduce risk and understand the key characteristics of their portfolios based on nine different factors.

More recently, we’ve expanded our research efforts to individual stocks and have worked to popularize the concepts of economic moat and margin of safety. The Morningstar Rating for stocks is based on our analyst-generated fair value estimates, as well as the company’s level of business risk and economic moat, or competitive advantage. We offer a variety of qualitative measures such as Stewardship Grades, which help investors identify stocks and funds that have demonstrated a high level of commitment to shareholders and stewardship of investors’ capital.

We’ve also developed in-depth advice on security selection and portfolio building to meet the needs of investors looking for integrated portfolio solutions. We believe many investors rely on these tools because they offer a useful framework for comparing potential investments and making decisions. Our independence and our history of innovation also make us a trusted resource for investors.

4

5

Growth Strategies

We operate our business in three global segments—Individual, Advisor, and Institutional. Our mission is to create great products that help investors reach their financial goals, and this mission guides all of our operations and product offerings. In keeping with our mission, we are pursuing four key growth strategies, which we describe below. We review our growth strategies on a regular basis and make refinements as necessary to guide our business. Since becoming a public company, we no longer consider strategic acquisitions to be a core growth strategy because we only expect to make acquisitions in support of our other objectives. And, we have added a new growth strategy of becoming a global leader in funds-of-funds investment management, as described in greater detail below.

Enhance our position in each of our three market segments by focusing on our four major Internet-based platforms.

We believe that individual investors, financial advisors, and institutional clients increasingly want integrated solutions as opposed to having to use different research tools for different parts of their portfolios. To help meet the market need for integrated solutions, one of our key strategies is to focus our product offerings on four of our major platforms:

• Morningstar.com for individual investors;

• Morningstar Advisor Workstation for financial advisors;

• Morningstar Direct for institutional investment research professionals; and

• Morningstar Retirement Manager for the retirement market.

These products all include integrated research and portfolio tools, allowing investors to use our proprietary information and advice across multiple security types. We believe we can achieve deeper penetration of our current audiences with each of these platforms, as well as extend their reach to new segments. With Morningstar.com, we’re focusing on expanding beyond our core audience of mutual fund investors by adding more stock investors and continuing to expand our reach with our core audience of experienced and engaged investors. With Advisor Workstation, we’re adding functionality that will help us reach more advisors in the United States and globally. With Morningstar Direct, we’re focusing on expanding functionality and reaching a broader audience. For the Retirement Manager platform, we’re focusing on our managed account offering as more plan providers have been adopting managed accounts. We recently added Advice by Ibbotson to our retirement advice platform following our recent acquisition of Ibbotson Associates.

Become a global leader in funds-of-funds investment management.

The large number of managed investment products available has made assembling them into well-constructed portfolios a difficult task for many investors. Consequently, funds-of-funds offerings have seen strong growth within the mutual fund, variable annuity, and hedge fund industries. We believe assembling and evaluating funds of funds is a natural extension of our expertise in understanding managed investment products.

Our investment management programs combine managed investment vehicles—typically mutual funds—in portfolios designed to help investors and financial advisors meet their specific financial goals. Morningstar Managed Portfolios, which we introduced in 2001, is a fee-based discretionary asset management service that includes a series of mutual fund and exchange-traded fund portfolios tailored to meet specific investment time horizons and risk levels. We also offer a managed account service as part of our Morningstar Retirement Manager platform for the retirement market, which we introduced in 2003. We offer these managed accounts for plan participants who choose to delegate management of their portfolios to Morningstar’s investment professionals, who select investment options and make retirement planning choices for the

6

participant. We believe that retirement plan participants will continue to adopt managed accounts because of the complexity involved in retirement planning.

In addition to the assets we manage directly, we had a total of $22.1 billion in assets under advisement in our Investment Consulting business as of December 31, 2005. This total includes consulting relationships as well as agreements where we act as a portfolio construction manager for a mutual fund or variable annuity and receive a basis point fee. We see continued potential to expand this part of our business, including in our operations outside the United States.

Expand the range of services we offer investors, financial advisors, and institutional clients.

We plan to expand our product offerings to better meet the needs of investors. We plan to continue building new databases for additional types of investment offerings, including hedge funds, various types of managed investment pools in international markets, and other widely used investment products. We expect to continue expanding our product offerings in two primary areas:

• Expand our stock-research capabilities. Our equity research builds on our approach to mutual fund analysis, which has historically focused on analyzing the individual stocks that make up each fund’s portfolio. In addition to the agreements we have in place with six major investment banks to provide research under the terms of the Global Analyst Research Settlement, we are continuing to pursue opportunities to distribute our equity research in the United States and in major international markets. We also believe that investors’ increasing awareness of the value of independent research will strengthen our business over the long term; and

• Expand our capabilities in hedge fund research. We plan to continue expanding our research and data on hedge funds to help investors analyze this alternative asset class, with the goal of making the hedge fund industry more transparent to investors. Hedge funds worldwide now represent more than $2 trillion in investor assets, according to the December 2005 Hedge Fund Manager/Advent survey of hedge fund administrators. Offering data on hedge funds is a natural extension of our work on other managed investment vehicles. We introduced our hedge fund database in early 2005 and now have comprehensive data on more than 2,600 hedge funds. We plan to add our hedge fund data to additional Morningstar products and begin offering analyst reports on hedge funds during 2006.

Expand our international brand presence, products, and services.

Over the past several years, we have expanded our product offerings internationally. Our international operations generated $29.4 million in revenue in 2005, compared with $25.4 million in 2004. We plan to continue expanding our international operations to meet the increasing demand for wide-ranging, independent investment insight by investors around the globe. Because approximately half of the world’s investable assets are located outside of the United States, we believe there are significant opportunities for us in non-U.S. markets.

Acquisitions

Historically, we have focused primarily on organic growth by introducing new products and services and expanding our marketing efforts for existing products. However, we have made and expect to continue making selective acquisitions that support our four key growth strategies. In reviewing potential acquisitions, we plan to focus on transactions that:

• offer a good strategic fit with our mission of creating great products that help investors reach their financial goals;

7

• help us build our proprietary investment databases, research capabilities, technical expertise, or customer base faster and more cost effectively than we could if we built them ourselves; and

• offer a good cultural fit with our entrepreneurial spirit and brand leadership.

Ibbotson Associates

On March 1, 2006, we completed our acquisition of Ibbotson Associates, a privately held firm specializing in asset allocation research and services, for approximately $83 million in cash, subject to adjustments for working capital and other items. Ibbotson had $37.2 million in revenue for its fiscal year ended June 30, 2005. Ibbotson’s key products and services include:

• a well-established investment consulting practice that provides asset allocation and fund research to institutions;

• a portfolio and asset management business that constructs actively managed funds-of-funds offerings for financial institutions;

• managed retirement accounts for participants in 401(k) and other defined contribution plans;

• the EnCorr software for investment management and strategic asset allocation;

• asset allocation, forecasting, and optimization software widely used in broker-dealer advisor platforms;

• a long-term database of capital markets returns;

• training and educational services; and

• the Stocks, Bonds, Bills, and Inflation annual reference guides.

We believe the Ibbotson acquisition complements our growth strategies in several key areas, including investment consulting, managed retirement accounts, and institutional and advisor software.

Variable Annuity Research and Data Service (VARDS)

In January 2005, we acquired the VARDS unit from Finetre Corporation for $8.2 million in cash. VARDS provides research and data on variable annuities and is used by many firms that offer variable annuities. The service is also used by many brokerage firms for research, due diligence, and suitability determination. We believe this acquisition strengthens our investment database and will enhance our efforts to provide investors with the information they need to make well-informed decisions when investing in variable annuities. The acquisition contributed approximately $2.4 million of revenue in 2005.

We have also made other acquisitions over the past several years. For more information, refer to Note 7 of the Notes to our Consolidated Financial Statements.

Business Segments, Products, and Services

We divide our business operations into three segments:

• Individual, which focuses on products and services for individual investors;

• Advisor, which focuses on products and services for financial advisors; and

• Institutional, which focuses on products and services for institutional clients, including banks, brokerage firms, insurance companies, mutual fund companies, media outlets, and retirement plan providers and sponsors.

8

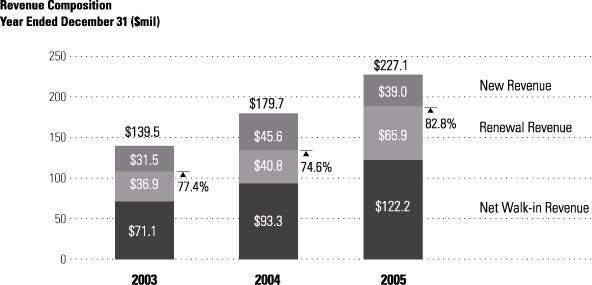

The table below shows our revenue by business segment for each of the past three years:

| | 2005 | | | | 2004 | | | | 2003 | | | |

| | | | | | | | | | | | | |

Revenue by Segment | | $000 | | % | | $000 | | % | | $000 | | % | |

Individual | | $63,448 | | 27.9 | % | $46,996 | | 26.2 | % | $35,406 | | 25.4 | % |

Advisor | | 72,689 | | 32.0 | | 60,880 | | 33.9 | | 49,161 | | 35.2 | |

Institutional | | 95,947 | | 42.2 | | 78,402 | | 43.6 | | 59,745 | | 42.8 | |

Elimination of intersegment revenue | | (4,970 | ) | (2.1 | ) | (6,620 | ) | (3.7 | ) | (4,816 | ) | (3.4 | ) |

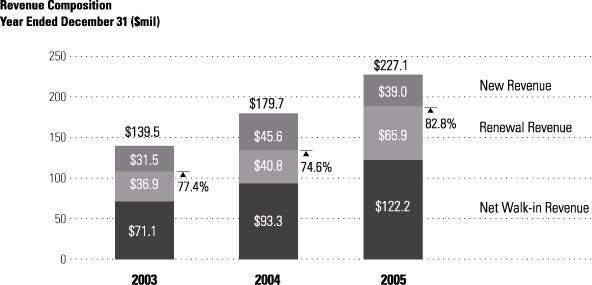

Consolidated revenue | | $227,114 | | 100.0 | % | $179,658 | | 100.0 | % | $139,496 | | 100.0 | % |

For information on segment operating income (loss), refer to Note 5 of the Notes to our Consolidated Financial Statements.

Individual Segment

For individual investors, our largest product is our U.S.-based Web site, Morningstar.com, which includes our Premium Membership service and Internet advertising sales. Morningstar is a leader in broad-based, innovative investment research, and Morningstar.com has consistently received positive reviews from major business publications such as Barron’s, Forbes, and The Wall Street Journal. Our Individual business segment also includes Morningstar Equity Research, which we distribute through several channels. Investors can access our equity research through our Premium Membership service on Morningstar.com. In addition, our independent equity research is currently distributed through six major investment banks to meet the requirement for independent research under the Global Analyst Research Settlement, as well as to several other companies who provide our research to their affiliated financial advisors or to individual investors. We also offer several print and online publications focusing on stocks, mutual funds, personal finance, and other investing topics. We offer free local Web sites for individual investors in Australia, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Italy, Japan, Korea, the Netherlands, New Zealand, Norway, People’s Republic of China, Spain, Sweden, Switzerland, and the United Kingdom. Our Web sites and individual investor publications reach more than 4.9 million investors worldwide.

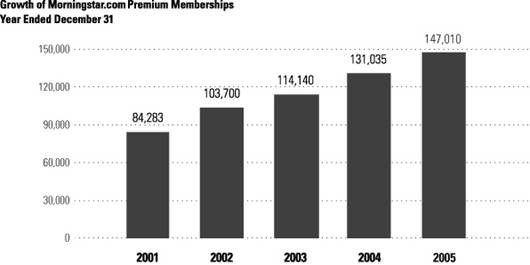

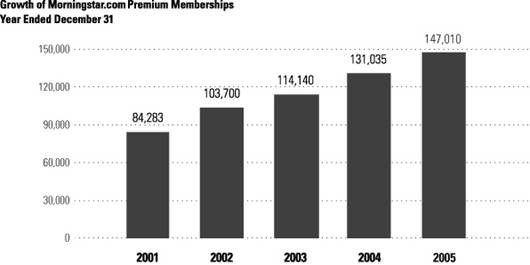

Within the Individual business segment, most of our products target experienced investors who are actively involved in the investing process and want to take charge of their own investment decisions. We also reach individuals who want to learn more about investing and investors who seek out third-party sources to validate the advice they receive from brokers or financial planners. Our client base in this segment consists of more than 230,000 paying customers, including 147,010 Premium members of Morningstar.com and 84,000 subscribers who purchase our investment newsletters designed for individual investors. In addition to this customer base, approximately 4,300 public and private libraries in the United States subscribe to our services. We also offer a series of books and workbooks about investing, as well as formatted printable reports on individual securities.

We promote our individual investor products primarily through traditional direct mail, e-mail, promotions on our 20 investor Web sites worldwide, public relations, and advertising on related Web sites.

Our strategy is to increase the number of investors who sign up for Morningstar.com Premium Membership by continuing to develop and promote Premium content such as analyst reports, Fund Analyst Picks and Pans, and value-added portfolio tools, which we market to registered users and other investors. As a core marketing strategy for Morningstar.com, we use search marketing, which includes working to optimize our site’s ranking in organic search results along with purchasing advertisements on third-party sites such as Yahoo! and Google based on investment-related key words that can bring interested investors to relevant content on Morningstar.com.

9

In our Individual business segment, we compete with the personal finance Web sites of AOL Money & Finance, CNN Money, MarketWatch, MSN Money, The Motley Fool, SmartMoney.com, The Street.com, The Wall Street Journal Online, and Yahoo! Finance. Our print publications compete with Agora Publishing, Forbes, The Motley Fool, Phillips Investment Resources, and Value Line.

We believe our Individual segment has a modest amount of seasonality. The first quarter tends to show more sales activity for Premium Membership on Morningstar.com and other products such as the Morningstar Stocks 500 and Morningstar Funds 500, which are reference guides that we publish once a year. Sales in our Individual segment tend to be slightly lower over the spring and summer months. However, the impact of this seasonality tends to be moderated by our diversified product base and the fact that we recognize revenue ratably over the term of each subscription.

Our largest customer in the Individual segment made up less than 10% of segment revenue in 2005.

Morningstar.com

Our largest Web site for individual investors is Morningstar.com in the United States. As of December 31, 2005, the free membership services offered through Morningstar.com had more than 4.6 million registered users worldwide, who have access to comprehensive data on individual stocks, mutual funds, and other investments to help them conduct research and track performance. In addition, Morningstar.com features extensive market data, Morningstar articles, proprietary portfolio tools, and educational content to help investors of all levels access timely, relevant investment information. Morningstar.com also includes Portfolio X-Ray, which helps investors reduce risk and understand key characteristics of their portfolios, and a variety of other portfolio tools.

We use our free content as a gateway into paid Premium Membership, which includes access to written analyst reports on more than 1,700 stocks, 2,000 mutual funds, and 100 exchange-traded funds, as well as Analyst Picks and Pans, Stewardship Grades, and Premium Stock and Fund Screeners. We currently offer Premium Membership services only in the United States.

In 2005, we launched the Morningstar Stewardship Grade for stocks on Morningstar.com to help individual investors evaluate a company’s financial transparency, shareholder friendliness, management incentives and ownership, and overall corporate stewardship of investors’ capital. The Morningstar Stewardship Grade for stocks follows a similar grading system for mutual funds that we introduced in 2004.

In 2005, we responded to greater investor demand for information on exchange-traded funds by expanding our coverage on these funds. Our analysts covered more than 100 exchange-traded funds as of December 31, 2005, compared with about 35 as of December 31, 2004. We introduced a new rating for exchange-traded funds in March 2006. To help draw investors deeper into Morningstar.com and highlight the full range of information available on the site, in 2005 we launched a new home page for free and registered users. The new home page highlights more of the most popular content on the site, including articles written by our analyst staff and links to our stock and fund data pages. We developed and introduced a similar home page for Premium members in early 2006.

As of December 31, 2005, we had 147,010 paid Premium subscribers for Morningstar.com in the United States. We currently charge $14.95 for a monthly subscription, $135 for an annual subscription, $225 for a two-year subscription, and $320 for a three-year subscription for Morningstar.com’s Premium service. We also sell advertising space on Morningstar.com.

Morningstar.com is one of our five largest products and was our largest product in the Individual segment in 2005. This product accounted for 11.2%, 11.5%, and 11.7% of our consolidated revenue in 2005, 2004, and 2003, respectively.

10

Morningstar Equity Research

As of December 31, 2005, we offered independent equity research on more than 1,700 companies. Our approach to stock analysis focuses on long-term fundamentals. Our analysts evaluate companies by assessing each firm’s competitive advantage, analyzing the level of business risk, and completing an in-depth projection of future cash flows. For the companies we cover, we create an analyst-generated fair value estimate, a Morningstar Rating for stocks, a rating for business risk, and an assessment of the company’s economic moat. Economic moat is a concept originally developed by Warren Buffett that describes a company’s competitive advantage relative to other companies. For the remaining 5,400 stocks included in our database, we offer quantitatively generated grades for growth, profitability, and financial health, as well as descriptive text that explains the company’s business operations. We currently deliver our equity research to individual investors as part of our Premium Membership service on Morningstar.com and to six major investment banks under the terms of the Global Analyst Research Settlement, as well as to several other companies who provide our research to their affiliated financial advisors or to individual investors.

We have significantly expanded our equity research coverage over the past several years. We currently provide analyst reports on more than 99% of the market capitalization of the stocks included in the S&P 500 index. We continue to expand our analyst staff to support these research efforts and had 87 stock analysts in the United States as of December 31, 2005, compared with 73 as of December 31, 2004.

We also introduced a new discounted cash-flow (DCF) model for valuing real estate investment trusts (REITs) in 2005, replacing the net asset value model we previously used. We believe that Morningstar is the first independent research firm to use a DCF approach as a primary tool for valuing REITs.

Pricing for Morningstar Equity Research that we deliver related to the Global Analyst Research Settlement or for other institutional clients varies based on the level of distribution, the number of securities covered, the amount of custom coverage required, and the length of the contract term. Morningstar Equity Research, which primarily consists of research related to the Global Analyst Research Settlement, was the second largest product in the Individual segment based on revenue in 2005, following Morningstar.com.

Morningstar Mutual Funds

Morningstar Mutual Funds is a reference publication that features our signature one-page reports on approximately 1,500 mutual funds. These reports contain historical performance data, portfolio statistics, proprietary measurement tools, and analyst reports. Twice a month, subscribers receive updated reports for approximately 150 of the covered funds, along with news, analyst commentary, industry research, and summary performance data for all 1,500 funds. Subscribers can also access a Web-based version for the most current information. We charge $549 for a one-year subscription to Morningstar Mutual Funds.

Morningstar FundInvestor

Morningstar FundInvestor is a monthly newsletter that provides information and insight on 500 of the most popular mutual funds. It also includes a list of 150 Analyst Picks—hand-selected funds that our analysts think are the most compelling for long-term investors. Each monthly issue contains extensive data, ideas on building better portfolios, news on current developments and changes within the fund industry, and proprietary research and ratings. Morningstar FundInvestor also features three mutual fund portfolios constructed and updated by Morningstar’s senior analyst team. We charge $99 for a one-year subscription to Morningstar FundInvestor.

Morningstar StockInvestor

Morningstar StockInvestor is a monthly newsletter that includes updates on two model portfolios (a Tortoise portfolio designed for conservative investors and a Hare portfolio designed for more risk-tolerant investors), a Red Flags column that cautions investors about stocks to avoid, and the Morningstar Bellwether 50, a watchlist of 50 dominant companies with wide economic moats, or competitive advantages.

11

Each issue also offers ideas about how investors can improve their stock selection and learn from leading portfolio managers. We charge $109 for a one-year subscription to Morningstar StockInvestor.

In addition to the products mentioned above, we offer several other investment newsletters and a series of books about investing in stocks and mutual funds, which are available directly from us and in bookstores. We launched three new print newsletters in 2005, Morningstar Practical Finance, Morningstar DividendInvestor, and Morningstar GrowthInvestor, as well as a new series of investing workbooks about stocks and mutual funds. In early 2006, we introduced a new annual softcover reference guide on exchange-traded funds, the Morningstar ETFs 100.

Advisor Segment

For financial advisors, our largest products are Morningstar Advisor Workstation, a comprehensive Web-based investment planning system, and Principia, our leading CD-ROM-based investment research and planning software. We also offer Morningstar Managed Portfolios, a fee-based discretionary asset management program distributed exclusively through financial advisors. Our advisor products are integrated into the daily operations and research processes of many financial advisors who use our research and tools to provide guidance for individual investors. According to the most recent report published in June 2003 by the consulting firm Tiburon Strategic Advisors, Morningstar was ranked as the leading provider of investment research and data, financial planning software, and asset allocation software among 1,476 independent financial advisors surveyed. Morningstar has also received the CPA Wealth Provider Financial Planning Award in the Financial Planning Software Vendors category for each of the past three years for Principia and Morningstar Advisor Workstation. This award recognizes companies that have taken the lead through innovation, efficiency, initiative, or growth in the financial planning area.

We sell our advisor-related products both directly to independent financial advisors and through enterprise licenses, which allow financial advisors associated with the licensing enterprise to use our products. Most of our license agreements in the Advisor segment have terms ranging from one to three years. As of December 31, 2005, we had established relationships with more than 130,000 financial advisors in the United States and approximately 55,000 financial advisors in international markets. Approximately 13% of our Advisor segment revenue was from international sales in 2005. In addition to the U.S. versions of our Advisor products, we offer products for financial advisors in a variety of international markets. For example, we have international versions of Advisor Workstation tailored to markets in Asia, Australia, Canada, and Europe, and we offer products similar to Principia in Canada and Australia.

Our products for advisors are sold primarily through our sales force and direct mail, with promotional support from online and print advertising, public relations, and conference exhibits. We also use the annual Morningstar Investment Conference to promote our offerings for advisors. We believe that there are substantial opportunities to increase Advisor Workstation sales by attracting additional brokerage firms and investment advisors to sign up as clients. We also expect to expand our offerings to financial advisors in international markets. Our primary competitors in the Advisor segment include Standard & Poor’s, SunGard, and Thomson Financial Services. For Morningstar Managed Portfolios, our primary competitors are AssetMark, Brinker Capital, Envestnet PMC, SEI Investments, and Standard & Poor’s.

In the Advisor segment, sequential revenue growth tends to be higher in the second quarter because our annual investment conference is held once per year in June. Other products in this segment generally have not shown marked seasonality.

Our largest customer in this segment accounted for less than 10% of segment revenue in 2005.

12

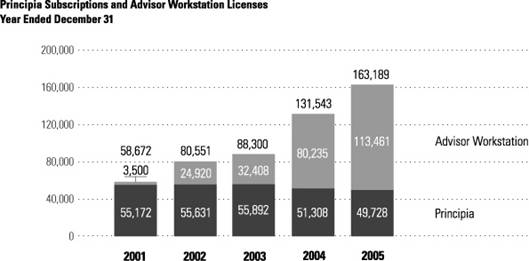

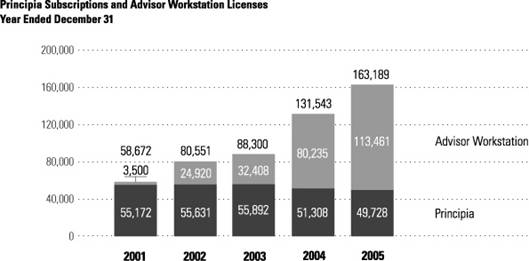

Morningstar Advisor Workstation

Morningstar Advisor Workstation, a Web-based investment planning system, provides financial advisors with a comprehensive set of tools for conducting their core business—including investment research, planning, and presentation tools. It also allows advisors to build and maintain a client portfolio database that can be fully integrated with the firm’s back-office technology and resources. Moreover, it helps advisors create customized reports for client portfolios that combine mutual funds, stocks, separate accounts, variable annuity/life subaccounts, exchange-traded funds, and closed-end funds. As of December 31, 2005, more than 113,000 advisors in the United States were licensed to use Advisor Workstation, which is available in two editions: the Office Edition for independent financial advisors and the Enterprise Edition for financial advisors affiliated with larger firms. We generally charge $5,000 per year for the Office Edition. Pricing for the Enterprise Edition varies based on the number of users, as well as the level of functionality offered and generally ranges between $80 and $2,500 per licensed user.

In 2005, we added a series of Advisor Compliance Tools to the Enterprise Edition of Advisor Workstation, including our Compliance Data Digest to help institutions manage compliance issues related to point-of-sale requirements for financial advisors. The Compliance Data Digest tool allows advisors to view information about mutual fund breakpoints, rights of accumulation linkage rules, and letter of intent policies commonly contained in the mutual fund prospectus or Statement of Additional Information. We also introduced a new Share Class Analyzer report that helps advisors select the most appropriate, cost-effective share class and present a comprehensive cost analysis to their clients. We created a Virtual Training Center to allow users to participate in self-directed tutorials on all Advisor Workstation functionality. In addition, we expanded the range of data universes covered by our hypothetical illustrator and other reporting tools. We also made a number of improvements to the account management and reporting functionality included in Advisor Workstation Office Edition. For example, we now offer a batch reporting feature that allows advisors to automatically generate professional-quality reports for an entire practice.

Morningstar Advisor Workstation is one of our five largest products and made up 12.9%, 10.8%, and 7.7% of our consolidated revenue in 2005, 2004, and 2003, respectively.

Morningstar Principia

Principia is our CD-ROM-based investment research and planning software for financial planners and had 49,728 subscriptions as of December 31, 2005. The modules offered in Principia provide data on mutual funds, stocks, hedge funds, separate accounts, variable annuity/life subaccounts, and closed-end funds. Each module is available separately or together in a CD-ROM format and features searching, screening, and ranking tools. Principia allows advisors to create integrated portfolios for clients and offers three-page Portfolio Snapshot reports that provide a comprehensive picture of the client’s portfolio. The Snapshot report shows overall style and sector weightings as well as the cumulative exposure to individual stocks. The Snapshot report is among those approved by the National Association of Securities Dealers for financial advisors to distribute and review with their clients. Principia prices generally range from approximately $635 per year for monthly updates on one investment database to $2,725 per year for monthly updates on the complete package spanning all investment universes. Pricing for Principia Enterprise licenses varies based on the investment universes selected, level of functionality, and number of users and generally starts at about $635 per user.

During 2005, we added a Defined Contribution Plans module to Principia, which is designed to help financial advisors evaluate an organization’s 401(k) or 403(b) plan lineup and build a recommended list of investment selections. It allows advisors to analyze 401(k) and 403(b) plans by highlighting several characteristics of mutual funds offered through a given plan, including diversification across asset classes, styles, and regions; quality of the investment options; and fees associated with the plan and its investment options. This module is designed to be used in tandem with the other mutual fund modules offered through Principia. The price for the new module is $1,990 per year.

Principia is one of our five largest products and accounted for 12.7%, 16.3%, and 20.7% of our consolidated revenue in 2005, 2004, and 2003, respectively.

13

Morningstar Managed Portfolios

Morningstar Managed Portfolios is a fee-based discretionary asset management service that includes a series of mutual fund and exchange-traded fund portfolios tailored to meet specific investment time horizons and risk levels. This program is only available through financial advisors. Our team of investment professionals uses a disciplined process for asset allocation, fund selection, and portfolio construction. They actively monitor the portfolios and make adjustments as needed. We complement these asset management services with online client-management functions such as risk profiling and access to client statements, transaction capabilities, and performance reports.

We introduced the Morningstar Managed Portfolios program in 2001 and had approximately $1.4 billion in assets under management as of December 31, 2005. We charge asset-based fees for Morningstar Managed Portfolios. The management fee is based on a tiered schedule that depends on the client’s average daily portfolio balance and generally ranges from 0.20% to 0.40% of assets.

The Morningstar Managed Portfolios program is offered through Morningstar Investment Services, Inc., a registered investment advisor, registered broker-dealer, NASD member, and wholly owned subsidiary of Morningstar.

Institutional Segment

For institutional clients, our key products and services include Licensed Data, a set of investment data spanning eight core databases, available through electronic data feeds; Investment Profiles & Guides, which are designed for institutions to use in communicating investment information to individual investors; Morningstar Direct, a Web-based institutional research platform that provides advanced research and tools on the complete range of securities in Morningstar’s global database; Investment Consulting, which focuses on investment monitoring and asset allocation for funds of funds, including mutual funds and variable annuities; and Morningstar Retirement Manager, a suite of advice and guidance services for retirement plan participants.

As of December 31, 2005, we served approximately 750 clients through our Institutional segment, including banks, brokerage firms, insurance companies, mutual fund companies, media outlets, and retirement plan sponsors and providers. We believe our institutional clients value our independence, breadth of information, and customized services; in addition, we believe our research, tools, and advice reach many individual investors through this channel. Across the Institutional segment, we’ve established relationships with many of the largest companies in the financial services industry, including Fidelity, MetLife, Nationwide, and Prudential. Approximately 21% of our institutional sales are to clients located outside of the United States—primarily in Australia, Canada, and various countries in Europe. We typically sell our institutional products based on a contract term of one to three years.

We market our products for institutional clients almost exclusively through our sales team. We provide marketing support for our sales team in the form of online and print advertising, public relations, direct mail, and conference exhibits. We also have data reselling agreements with third-party providers of investment tools and applications, allowing us to increase the distribution of our data with minimal additional cost.

For Licensed Data and Investment Profiles & Guides, our primary competitors are Bowne, FactSet Research Systems, Lipper, and Standard & Poor’s. For Morningstar Direct, our primary competitors are Informa, Lipper, Markov, Mobius Data Subscriptions, Strategic Insight, and Zephyr Management. Our Investment Consulting business competes primarily with Lipper, Standard & Poor’s, and Wilshire, as well as some smaller competitors in the retirement consulting business. In the retirement advice market, we compete primarily with Financial Engines and Promanage.

Most products within our Institutional segment have not shown pronounced seasonality over the past three years.

14

Our largest customer in the Institutional segment accounted for less than 10% of segment revenue in 2005.

Licensed Data

Our Licensed Data service offers a set of investment data spanning eight core databases, available through electronic data feeds. Available data packages include proprietary statistics such as the Morningstar Style Box and Morningstar Rating and a wide range of other data, including information on investment performance, portfolio composition, operations data, fees and expenses, cash flows, and ownership. Institutions can use Licensed Data in a variety of investor communications, including Web sites, print publications, and marketing fact sheets, as well as for internal research and product development. We deliver Licensed Data as an electronic data feed using XML technology for rapid transmission and ease of use. Pricing for Licensed Data is based on the number of funds or other securities covered, the amount of information provided for each security, and the level of distribution.

Licensed Data is one of our five largest products and accounted for 14.3%, 15.1%, and 16.1% of our consolidated revenue in 2005, 2004, and 2003, respectively.

Investment Consulting

Our Investment Consulting services focus on investment monitoring and asset allocation for funds of funds, including mutual funds and variable annuities. Our investment professionals evaluate portfolios, recommend strategies, help set investment policies, design asset allocations, and monitor ongoing performance. We offer these consulting services to clients in the United States, Asia, Australia, Canada, and Europe, including insurance companies, investment management companies, mutual fund companies, and broker-dealers. We also provide services for retirement plan sponsors and providers, including developing plan lineups, creating investment policy statements, and monitoring investment performance.

Our team of investment consultants draws on both quantitative research tools and qualitative expertise to assess investment vehicles, provide detailed analysis of performance and portfolio characteristics, and make comprehensive recommendations for improvement. We also offer investment manager search services. Our staff combines the depth of Morningstar’s historical fundamental databases with detailed investment knowledge and investment experience to recommend qualified candidates for subadvisory firms, mutual fund managers, variable insurance trust managers, and separate account managers. Our investment monitoring services include analyst reports, customizable board reports, select lists, watchlists, and in-depth attribution analysis. Pricing for our consulting services is based on the scope of work and the level of service required. For agreements where we act as a portfolio construction manager for a mutual fund or variable annuity, we receive asset-based fees.

We offer our Investment Consulting services through Morningstar Associates, LLC, a registered investment advisor and wholly owned subsidiary of Morningstar. Investment Consulting is one of our five largest products and accounted for 9.6%, 7.7%, and 6.5% of our consolidated revenue in 2005, 2004, and 2003, respectively.

Morningstar Retirement Manager

Morningstar Retirement Manager is a suite of advice and guidance services that helps retirement plan participants plan and invest for retirement. It gives clear guidance explaining whether participants’ suggested plans are on target to meet their retirement goals. As part of this service, we also offer specific suggestions for contribution rates, asset mix, investment style, and sector exposure to help participants maximize their retirement portfolios, as well as specific recommendations for funds to invest in. Morningstar Retirement Manager includes a managed account service designed for plan participants who choose to delegate management of their portfolios to Morningstar’s investment professionals. We offer these services primarily through retirement plan providers—typically third-party asset management companies or companies that offer administrative services to retirement plans. These providers often supply investment offerings to retirement plan sponsors and their participants. As of December 31, 2005, more than 9 million plan participants had

15

access to Morningstar Retirement Manager through approximately 69,000 plan sponsors and 30 plan providers. Pricing for Morningstar Retirement Manager depends on the number of participants, as well as the level of service we provide.

Morningstar Retirement Manager is offered through Morningstar Associates, LLC, a registered investment advisor and wholly owned subsidiary of Morningstar.

Licensed Tools and Content

We offer an extensive set of online tools and editorial content that institutional clients can license to use in their Web sites and software products. Clients can select from among more than 40 different tools and content offerings or purchase modular packages focusing on screening and performance tools, editorial commentary and educational articles, as well as goal planning and portfolio analysis. Our online tools and content can be customized to meet the needs of international audiences, and can also be modified to analyze a set of investments, focus on client-defined data points, or perform calculations required by specific products or services. We also offer a fully integrated set of tools and applications to provide portfolio answers and analysis in context. Pricing for Licensed Tools and Content depends on the audience, the level of distribution, and the scope of information and functionality licensed.

Investment Profiles & Guides

Our Investment Profiles & Guides are designed for institutions to use as an alternative to creating their own materials for use in communicating with clients, or for companies to use in communicating with retirement plan participants. Investment Profiles are single-page reports that combine key elements from our data, design, and editorial content to clearly present the essential facts about an investment. They cover mutual funds, stocks, exchange-traded funds, hedge funds, variable annuity/life subaccounts, separate accounts, custom funds, offshore funds, pension and life funds, and Section 529 College Savings Plans. We also offer Investment Guides, which are a collection of Investment Profiles combined with summary information and educational articles. Morningstar handles all of the document production, including data collection, design, and delivery. Pricing for Investment Profiles and Investment Guides is based on the number of securities covered, the amount of information we provide, and the level of distribution.

Morningstar Direct

Morningstar Direct is a Web-based institutional research platform that provides advanced research on the complete range of securities in Morningstar’s global database. This comprehensive research platform allows research and marketing professionals to conduct advanced performance comparisons and in-depth analyses of a portfolio’s underlying investment style. Morningstar Direct includes access to numerous investment universes, including U.S. mutual funds; European and offshore funds; funds based in Australia, Canada, China, and Hong Kong; stocks; separate accounts; global hedge funds; closed-end funds; exchange-traded funds; Section 529 College Savings Plans; and market indexes. Pricing for Morningstar Direct is based on the number of licenses purchased: $15,000 for the first user, $10,000 for the second user, and $7,500 for each additional user.

During 2005, we launched the next generation of Morningstar Direct, expanding the range of data universes to allow institutions to conduct research across global markets and adding the full range of Morningstar’s available data on stocks, hedge funds, and Section 529 College Savings Plans. We also expanded our sales efforts outside the United States.

Morningstar Indexes

Based on the same methodology as the Morningstar Style Box, our 16 real-time indexes track the U.S. equity market by capitalization and investment style. They include a broad market index, three capitalization-based indexes, three composite style indexes, and nine indexes based on both investment style and market capitalization. The Morningstar Indexes cover approximately 97% of the market capitalization of

16

the U.S. equity market. We charge licensing fees for the Morningstar Indexes, with fee levels generally customized by client.

Barclays Global Investors is licensing our 16 style-based indexes and has introduced nine exchange-traded funds (ETFs) based on the Morningstar Indexes.

During 2005, we introduced the Morningstar China Index Series, a series of 10 market indexes tracking China’s entire stock market since its inception. In early 2006, we created the Morningstar Dividend Leaders Index, a broadly diversified portfolio of 100 stocks that have strong potential for sustaining and increasing dividend payouts. First Trust Advisors L.P. is licensing the Dividend Leaders Index from Morningstar and introduced an exchange-traded fund based on this index in February 2006.

Marketing and Sales

We promote our print, software, Web-based products and services, and consulting services with a staff of sales and marketing professionals, as well as public relations. Our marketing staff includes both product specialists and a corporate marketing group that manages company initiatives. As part of these groups, we have several strategic account managers who oversee all aspects of our largest institutional client relationships. We also have a sales operations staff, which focuses on tracking revenue, forecasting sales, and other tasks to support our sales team. Across all three of our segments, we emphasize high levels of product support to help our customers use our products effectively and provide our product managers with feedback from customers. We had approximately 170 sales and marketing professionals on staff as of December 31, 2005.

International Operations

We conduct our business operations outside of the United States through a variety of subsidiaries and other operating companies. We have wholly owned or majority-owned operating subsidiaries doing business in each of the following markets: Australia, Canada, France, Germany, Italy, the Netherlands, New Zealand, Norway, People’s Republic of China (both Hong Kong and the mainland), Spain, and the United Kingdom. See Note 5 of the Notes to our Consolidated Financial Statements for additional information concerning revenue from customers and long-lived assets from our business operations outside the United States. See Note 17 of the Notes to our Consolidated Financial Statements for information on a legal proceeding that may, if decided adversely to us, affect our ownership of our Australian and New Zealand subsidiaries.

In addition, we hold minority ownership positions in operating companies based in Denmark, Japan, Korea, and Sweden. Our ownership in these companies is either held directly by us or indirectly through separate non-U.S. subsidiaries that we control. As of December 31, 2005, we owned approximately 35% of the outstanding shares in Morningstar Japan K.K. (Morningstar Japan); our share had a market value of approximately $82.1 million. Morningstar Japan is publicly traded under ticker 4765 on the Osaka Stock Exchange “Hercules Market.” See Note 8 of the Notes to our Consolidated Financial Statements for information on investments in unconsolidated entities.

To enable these companies to do business in their designated territories, we provide them with the rights to the Morningstar name and logo and with access to certain of our products and technology. Each company operating within a particular country is responsible for developing marketing plans tailored to meet the specific needs of investors within its own market and working with Morningstar’s data collection and development centers to create and maintain databases, develop new products, and enhance existing products.

See Item 1A—Risk Factors for a discussion of the risks related to our business operations outside of the United States.

Intellectual Property and Other Proprietary Rights

We treat our brand, product names and logos, software, technology, databases, and other products as proprietary. We try to protect this property by using trademark, copyright, patent and trade secrets laws,

17

licensing and nondisclosure arrangements, and other security measures. For example, in the normal course of business, we only provide our intellectual property to third parties through standard licensing agreements. The purposes of these agreements are to both define the extent and duration of any third party usage rights and to provide for our continued ownership in any intellectual property furnished.

Because of the value of our brand name and logo, we have tried to register one or both of them in all of the relevant international classes under the trademark laws of most of the jurisdictions in which we do business. As we move into new markets, we are continuing to effect these registrations and, in some jurisdictions, the registration of certain product identifiers as well. To date, we have registered our name and/or logo in 12 countries and the European Union and have applied for registrations in several other countries.

We currently hold two U.S. patents, one U.K. patent, and one Canadian patent. We do not rely on our patents and do not believe patents are important to our business.

From time to time, we encounter jurisdictions in which one or more third parties have a pre-existing trademark registration in certain relevant international classes that may prevent us from registering our own marks in those jurisdictions. It is possible that our continued ability to use the “Morningstar” name or logo, either on a stand-alone basis or in association with certain products or services, could be compromised in such jurisdictions because of these pre-existing registrations. Similarly, from time to time, we encounter situations in certain jurisdictions where one or more third parties are already using the Morningstar name, either as part of a registered corporate name, a registered domain name or otherwise. It is possible that our ability to continue to effectively market certain of our products and/or services could be adversely affected by these usages.

“Morningstar” and the Morningstar logo are registered marks of Morningstar in the United States and in certain other jurisdictions. The following are also trademarks or service marks of our company:

Morningstar® Advisor WorkstationSM | | Morningstar® Mutual FundsTM |

Morningstar.com® | | Morningstar® Ownership ZoneSM |

Morningstar DirectSM | | Morningstar® Principia® |

Morningstar® FundInvestorTM | | Morningstar RatingTM |

Morningstar® IndexesSM | | Morningstar® Retirement ManagerSM |

Morningstar® Investment GuidesTM | | Morningstar® Stewardship GradeSM |

Morningstar® Investment ProfilesTM | | Morningstar® StockInvestorTM |

Morningstar® Licensed DataSM | | Morningstar Style BoxTM |

Morningstar® Managed PortfoliosSM | | Portfolio X-Ray® |

License Agreements

In the majority of our licensing agreements, we license our products and/or other intellectual property to our customers for a fee. We generally use our own standard agreements, whether in paper or electronic form, and we do not provide our products and services to customers or other users without having an agreement in place.

We also maintain licensing agreements with each of our joint venture companies and with Morningstar Japan. We put these agreements in place so these companies can use our intellectual property, such as our products and trademarks, to develop and market similar products under our name in their operating territories.

18

We also license certain intellectual property from third parties, and in the ordinary course of our business, we incorporate and use intellectual property from a variety of third-party sources.

Seasonality

We believe our business has a modest amount of seasonality. Most of our products are sold with subscription or license terms of at least one year, and we recognize revenue ratably over the term of each subscription or license agreement. This tends to moderate seasonality in sales patterns for individual products. Over the past three years, sequential revenue growth on a company level in the first quarter has been slightly higher than in other quarters. Refer to the discussion in Business Segments, Products, and Services above for additional information on the seasonality of each segment.

Customers

In 2005, our largest customer accounted for less than 5% of our consolidated revenue.

19

Competitive Landscape

The economic and financial information market has been marked by increased consolidation over the past five years, with the strongest players generally gaining market share at the expense of smaller competitors. Our largest competitors are Lipper, Standard & Poor’s, and Thomson Financial Services. These companies have financial resources that are significantly greater than ours. We also have a number of smaller competitors in each of our three business segments; for more information, refer to the discussion in Business Segments, Products, and Services above. Most of our competitors compete with individual products or segments of our business; we are not aware of any company that offers substantially similar product solutions in all three of our segments.

Our international operations compete with a variety of other companies not named above, including Brain Power, IWL Limited, MoneyMate, and vanEyk Research.

We believe the most important competitive factors in our industry are brand and reputation, data quality and comprehensiveness, quality of investment analysis and analytics, design, reliability, product support capabilities, and value of the products and services provided.

Research and Development

A key aspect of our growth strategy is to expand our investment research capabilities and enhance our existing products and services. We strive to rapidly adopt new technology that can improve the products and services we deliver to our customers. We have also built a flexible technology platform that allows our products to work together across a full range of investment databases, delivery formats, and market segments. As a general practice, we manage our own Web sites and build our own software applications rather than relying on outside vendors. This allows us to control our development and better manage costs, enabling us to respond quickly to market changes and to meet customer needs efficiently. As of December 31, 2005, our technology team consisted of approximately 300 programmers and technology and infrastructure professionals.

In 2005, 2004, and 2003 our development expense represented 8.7%, 9.0%, and 10.5%, respectively, of our revenue. We expect that development expense will continue to represent a meaningful percentage of our revenue in the future.

Government Regulation

United States

Our investment advisory and broker-dealer businesses are subject to extensive regulation in the United States at both the federal and state level, as well as by self-regulatory organizations. Financial services companies are among the nation’s most extensively regulated. The Securities and Exchange Commission (SEC) is responsible for enforcing the federal securities laws and serves as a supervisory body for all federally registered investment advisors and broker-dealers.

As of December 31, 2005, three of our subsidiaries, Morningstar Investment Services, Inc., Morningstar Associates, LLC, and mPower Advisors, LLC are registered as investment advisors with the SEC under the Investment Advisers Act of 1940 (Advisers Act). As registered investment advisors, these companies are subject to the requirements and regulations of the Advisers Act. Such requirements relate to, among other things, record-keeping and reporting requirements, disclosure requirements, and limitations on principal transactions between an advisor and advisory clients, as well as general anti-fraud prohibitions.

Because Morningstar Associates provides investment advisory services to retirement plans and their participants, it may be acting as a fiduciary under the Employee Retirement and Investment Security Act of 1974 (ERISA). As a fiduciary under ERISA, Morningstar Associates has duties of loyalty and prudence, as well as duties to diversify investments and to follow plan documents to the extent that they comply with ERISA.

We provide each of our investment advisor companies with financial and operational support. However, each of them operates independently from other areas of Morningstar, using separate personnel and making independent investment decisions.

20

Morningstar Investment Services is a broker-dealer registered under the Securities Exchange Act of 1934 (Exchange Act) and a member of the National Association of Securities Dealers (NASD). The regulation of broker-dealers has, to a large extent, been delegated by the federal securities laws to self-regulatory organizations, including the NASD. Subject to approval by the SEC, the NASD adopts rules that govern its members. The NASD conducts periodic examinations of the operations of Morningstar Investment Services. Broker-dealers are subject to regulations that cover all aspects of the securities business, including sales practices, market making and trading among broker-dealers, use and safekeeping of clients’ funds and securities, capital structure, record-keeping, and the conduct of directors, officers, and employees. Violation of applicable regulations can result in the revocation of a broker-dealer license, the imposition of censures or fines, and the suspension or expulsion of a firm or its officers or employees. Morningstar Investment Services is subject to certain net capital requirements under the Exchange Act. The net capital requirements, which specify minimum net capital levels for registered broker-dealers, are designed to measure the financial soundness and liquidity of broker-dealers.

Additional legislation and regulations, including those relating to the activities of investment advisors and broker-dealers, changes in rules imposed by the SEC or other U.S. or non-U.S. regulatory authorities and self regulatory organizations, or changes in the interpretation or enforcement of existing laws and rules may adversely affect our business and profitability. Our businesses may be materially affected not only by regulations applicable to it as an investment advisor or broker-dealer, but also by regulations that apply to companies generally.

Australia

In order to provide financial information services in Australia, our Australian subsidiary, Morningstar Research Pty Limited (Morningstar Australia), must hold an Australian Financial Services License and submit to the jurisdiction of the Australian Securities and Investments Commission (ASIC). This license requires Morningstar Australia to maintain positive net asset levels and sufficient cash resources to cover three months of expenses and to comply with the audit requirements of the ASIC. The availability of this license may be adversely affected by the legal proceeding described in Note 17 of the Notes to our Consolidated Financial Statements.

Employees

We had approximately 1,130 employees as of December 31, 2005, including approximately 180 investment analysts, 140 data analysts, 300 programmers and technology staff, 40 designers, and 170 sales and marketing professionals. Our employees are not represented by any collective bargaining organizations and we have never experienced a work stoppage.

21

Executive Officers

As of December 31, 2005, we had 14 executive officers. The information below summarizes certain information about each of these officers.

Name | | Age | | Position |

Joe Mansueto | | 49 | | Chairman, Chief Executive Officer, and Director |

Tim Armour | | 57 | | Managing Director |

Chris Boruff | | 40 | | President, Advisor Business |

Bevin Desmond | | 39 | | President, International Business |

Martha Dustin Boudos | | 39 | | Chief Financial Officer |

Catherine Gillis Odelbo | | 43 | | President, Individual Business |

Tao Huang | | 43 | | Chief Operating Officer |

Elizabeth Kirscher | | 41 | | President, Data Services Business |

Art Lutschaunig | | 47 | | President and Chief Investment Officer, Morningstar Investment Services |

Don Phillips | | 43 | | Managing Director and Director |

Patrick Reinkemeyer | | 40 | | President, Morningstar Associates |

John Rekenthaler | | 45 | | Vice President, Research and New Product Development |

Richard E. Robbins | | 43 | | General Counsel and Corporate Secretary |

David W. Williams | | 45 | | Managing Director, Design |

| | | | |

Joe Mansueto

Joe Mansueto founded Morningstar in 1984. He has served as our chairman since our inception, and as our chief executive officer from inception to 1996 and from 2000 to the present. He holds a bachelor’s degree in business administration from The University of Chicago and a master’s degree in business administration from The University of Chicago Graduate School of Business.

Tim Armour

Tim Armour has been one of our managing directors since 2000. He is responsible for strategic relationships and business development. He joined us in 1998 as our chief operating officer and from 1999 to 2000 served as our president. He holds a bachelor’s degree in business administration from Gettysburg College and a master’s degree in business administration from the Columbia Business School at Columbia University.

Chris Boruff

Chris Boruff has been the president of our advisor business since 2000. He is responsible for overseeing strategy, development, and marketing associated with our products for financial advisors. He joined us in 1996 as product manager for Principia, and from 1997 to 1998, he served as senior product manager of advisor products. From 1999 to 2000, he served as vice president of advisor products, where he was responsible for all marketing related to financial advisors. He holds a bachelor’s degree in economics and psychology from Northwestern University.

Bevin Desmond

Bevin Desmond has been president of our international business since 2000. She is responsible for identifying and developing new markets, managing and directing operations, and launching new products. She joined us in 1993 and was one of three employees who started our international business. From 1998 to 2000, she served as manager of all international ventures. She holds a bachelor’s degree in psychology from St. Mary’s College.

22

Martha Dustin Boudos

Martha Dustin Boudos has been our chief financial officer since 2001. She oversees our finance, human resources, and accounting operations. She joined us in 1992 as a marketing manager. She also played a key role in the creation of our Web site for individual investors, Morningstar.com. From 1998 to 2000, she was responsible for our retirement advice service. During 2001, she served as our vice president of human resources. She holds a bachelor’s degree in political science from Wellesley College and a master’s degree in business administration from the Kellogg School of Management at Northwestern University.

Catherine Gillis Odelbo

Catherine Gillis Odelbo has been president of our Individual segment since 2000. She joined us in 1988 as a mutual fund analyst and from 1999 to 2000 served as senior vice president of content development for the company, as well as publisher and editor of our stock and closed-end fund research. She holds a bachelor’s degree in American history from The University of Chicago and a master’s degree in business administration from The University of Chicago Graduate School of Business.

Tao Huang

Tao Huang has been our chief operating officer since 2000. He is responsible for corporate strategy, oversight of all business units, and directing our day-to-day operations. He joined us in 1990 as a software developer and from 1996 to 1998 served as chief technology officer. From 1998 to 2000, he served as senior vice president of business development and head of international operations. He holds a bachelor’s degree in computer science from Hunan University in China, a master’s degree in computer science from Marquette University, and a master’s degree in business administration from The University of Chicago Graduate School of Business.

Elizabeth Kirscher

Elizabeth Kirscher has been president of our data services business since 2000. She is responsible for managing our investment databases and related products. She joined us in 1995 as a major accounts manager in our institutional sales area. From 1998 to 1999, she served as international product manager and worked on the launch of Morningstar Japan. From 1999 to 2000, she was director of sales and business development for Morningstar.com and marketed Morningstar.com data and tools to other Web sites. She holds a bachelor’s degree from Vassar College and a master’s degree in business administration from the Columbia Business School at Columbia University.

Art Lutschaunig

Art Lutschaunig has been president and chief investment officer for Morningstar Investment Services since August 2001. He is responsible for managing the investment services business, including oversight of the group’s investment research and portfolio management. Before joining us in May 2001, he was an independent consultant. From 2000 to 2001, he served as president of Giving Capital, Inc. He holds a bachelor’s degree in marketing from Villanova University.

Don Phillips

Don Phillips has been one of our managing directors since 2000. He is responsible for corporate strategy, research, and corporate communications. He joined us in 1986 as our first analyst. He served as our vice president and publisher from 1991 to 1996, as our president from 1996 to 1998, and as our chief executive officer from 1998 to 2000. He has served on our board of directors since August 1999. He also serves on the board of directors for Morningstar Japan. He holds a bachelor’s degree in English from the University of Texas and a master’s degree in American literature from The University of Chicago.

23

Patrick Reinkemeyer

Patrick Reinkemeyer has been president of Morningstar Associates since October 2004. He is responsible for Morningstar’s investment consulting and retirement businesses. From 2001 until October 2004, he served as president of Morningstar’s institutional investment consulting business. He joined us in 1996. From 1996 to 1997, he directed our print and software variable annuity/life products. He holds a bachelor’s degree in history from Middlebury College and a master’s degree in business administration from The University of Chicago Graduate School of Business.

John Rekenthaler

John Rekenthaler has been vice president of new product development since October 2004. In April 2005, he took on additional responsibilities as vice president of research. From 2001 until October 2004, he served as president of Morningstar Associates and head of the company’s retirement advice business. He joined us in 1988 as an assistant editor and from 1998 to 2000 he served as our director of research. From 1991 to 1995, he served as editor of Morningstar Mutual Funds and Morningstar FundInvestor. He holds a bachelor’s degree in English from the University of Pennsylvania and a master’s degree in business administration from The University of Chicago Graduate School of Business.

Richard E. Robbins

Richard E. Robbins has been our general counsel and corporate secretary since August 2005. He is responsible for directing Morningstar’s legal department and managing its relationships with outside counsel. From May 1999 until he joined Morningstar, he was a partner at Sidley Austin Brown & Wood LLP, which he joined as an associate in August 1991. He holds bachelor’s and master’s degrees in computer science and electrical engineering from the Massachusetts Institute of Technology and a juris doctor degree from The University of Chicago Law School.

David W. Williams

David W. Williams has been one of our managing directors since 2000. He is in charge of design and its application to brand identity, products, communications, and the workplace. He joined us in 1993 and has been instrumental in establishing design as one of our recognized core capabilities. He holds a bachelor’s degree in industrial design from The Ohio State University and a master’s degree in fine arts from the Yale University School of Art.

Company Information

We were incorporated in Illinois on May 16, 1984. Our corporate headquarters and U.S. operations are located at 225 West Wacker Drive, Chicago, Illinois, 60606.

We maintain a Web site at http://corporate.morningstar.com. Our Annual Report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to any of these documents are available free of charge on this site as soon as reasonably practicable after the reports are filed with or furnished to the Securities and Exchange Commission. We also post quarterly press releases on our financial results and other documents containing additional information related to our company on this site. Our Web site and the information contained in or connected to our Web site are for informational purposes only and are not part of this Annual Report on Form 10-K.

24

Item 1A. Risk Factors

You should carefully consider the risks described below and all of the other information included in this Form 10-K when deciding whether to invest in our common stock or otherwise evaluating our business. If any of the following risks actually occur, our business, financial condition, or operating results could suffer. In this case, the trading price of our common stock could decline, and you may lose all or part of your investment.

Competition could reduce our share of the investment research market and hurt our financial performance.

We operate in a highly competitive market, with many investment research providers competing for business from individual investors, financial advisors, and institutional clients. We compete with many different types of companies that vary in size, product scope, and media focus including large and well-established distributors of financial information, such as Lipper, a division of Reuters, The McGraw-Hill Companies, through its Standard & Poor’s division, and Thomson Corporation, through its Thomson Financial Services division. In addition to these key competitors, we compete with a variety of other companies in different areas of our business, which we discuss in greater detail in the Business Segments, Products, and Services section in Item 1—Business above.

Many of our competitors have larger customer bases and significantly greater resources than we do. This may allow these competitors to respond more quickly to new technologies and changes in market demand, to devote greater resources to developing and promoting their services, and to make more attractive offers to potential clients, subscribers, and strategic partners. Industry consolidation may also lead to more intense competition. Increased competition could result in price reductions, reduced gross margins, or loss of market share, any of which could hurt our business, operating results, or financial condition.

If we do not maintain and increase the number of subscriptions and license agreements, our operating results could suffer.