- MORN Dashboard

- Financials

- Filings

-

Holdings

-

Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Morningstar (MORN) DEF 14ADefinitive proxy

Filed: 1 Apr 22, 6:09am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No.)

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material under §240.14a-12 | |

Morningstar, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ | No fee required | |

☐ | Fee paid previously with preliminary materials | |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 | |

April 1, 2022

Dear Shareholders:

At Morningstar, our mission is to empower investor success and that extends to you, our fellow shareholders. Foundational to your empowerment is a clear understanding of our strategy and priorities. We encourage you to read our shareholder letter that accompanies the annual report for a full review of Morningstar’s accomplishments in 2021 and strategic initiatives for 2022, but also wanted to take this opportunity to share with you some notable priorities for our Board of Directors (Board). |  |

Growth and resilience characterized Morningstar in 2021, both as a business and as a team. The Company’s financial results demonstrated impressive growth across the enterprise, with PitchBook and DBRS Morningstar, our two largest product areas, achieving record levels of annual revenue in 2021. Sustainalytics and Workplace Solutions achieved impressive organic revenue growth over the year and are well poised for future success. Morningstar Indexes also expanded significantly with the acquisition of Moorgate Benchmarks in the third quarter. During the year we focused our wealth management offerings and announced that we had signed a definitive agreement in the fourth quarter to acquire Praemium’s U.K. and international businesses. This transaction will allow us to gain a valuable platform outside the U.S. and bring scale to our operations faster than we might otherwise have achieved.

This success would not be possible without the continued dedication of the Morningstar team. As successive waves of coronavirus variants closed offices, disrupted supply chains, and complicated travel plans during 2021, employees across the enterprise deftly adjusted to changing conditions. Teams supported each other and their local communities in myriad ways including the launch of the biggest fundraising campaign in Company history and an onsite vaccination clinic hosted at Morningstar’s office in Mumbai. Morningstar welcomed over 3,100 new employees to the Company over the course of the year and found creative ways to communicate and connect with them remotely. Those strategies were also deployed in other contexts, such as our Morningstar Investment Conferences, where our teams engaged with investors, advisors and other stakeholders in hybrid virtual / in-person environments.

The 2021 priorities of our Board similarly reflected growth and resilience, including the following:

| • | Comprehensive Approach to Guiding Corporate Strategy – Our Board actively advises the Company’s corporate strategy. Our annual strategy day is a highlight of the year for its engaging discussions on challenges and opportunities facing each of Morningstar’s product areas. With an agenda that covers each area of the business, insights emerge on common themes, and approaches that were successful in one area can be leveraged by the management of another. Our updated strategy in the wealth management area is a result of such discussions. Throughout 2021, our Board expanded its opportunity to provide strategic counsel by participating in product demos, thematic workshops, and topical roundtables conducted by management before each of the formal Board meetings in our typical schedule. These in-depth sessions provide Board members detailed background on Morningstar’s products and services and facilitate real-time feedback on key initiatives. They also allow the Board to engage with a broader group of Morningstar’s senior management, providing context to succession planning discussions, and exemplifying the incredible talent within the Morningstar team. |

| • | Continued Focus on Cybersecurity – Events, including those raised by our security analysts, found in headlines across our industry, and experienced by our own Board members and employees, helped inform our Board review of information security in 2021. For example, our Board reviewed the terms of the Company’s significant software and cloud computing vendor agreements after political turmoil in the U.S. in early 2021 caused major technology platforms to rapidly terminate service to companies that posted content that violated the platform’s policies. Separately, our Audit Committee provided oversight of a project to evaluate and adjust our workforce location strategy in light of shifts in Morningstar’s business continuity and data privacy risk profile. The pace of change in our industry and the economy at large demands nimbleness and close collaboration between the Board and management. With data and information core to our products and services, cybersecurity is likely to remain a key area of focus for the Board. |

| • | An ESG Lens on our Governance Practices – We continue to believe that ESG factors permeate so much of the Company’s work that it is not a topic that should be delegated to a subset of our Board members. Instead, each committee of the Board oversees specific components of sustainability and, in 2021, we updated our committee charters to reflect these areas of focus. As described more fully in the Enterprise Sustainability Highlights, our Audit |

i

i

Committee oversees topics of cybersecurity and ethics; our Compensation Committee guides benefits, pay and incentive practices; and our Nominating and Corporate Governance Committee reviews compliance and governance. Other ESG topics are addressed with the full Board such as pay equity, talent acquisition, employee engagement, and succession planning. We believe this comprehensive framework allows for meaningful oversight by our Board members of each of the Company’s material ESG topics. |

Looking forward to 2022, we expect our Board to support the Company’s strategic initiatives including the following:

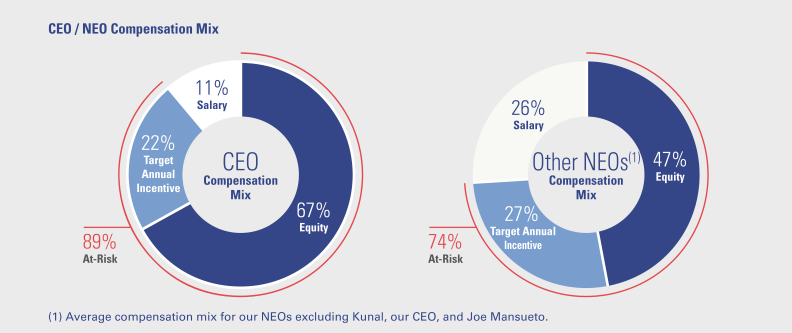

| • | Aligning Employee Compensation and Shareholder Success – While many of the factors contributing to the tight labor markets around the world are outside of our control, Morningstar and the Board are focused on those components it can control to ensure we can attract and retain the best talent for continued growth. During 2021, this focus was evidenced in our higher bonus expense, driven by strong financial performance, and salary increases, for employees whose contributions to the Company warranted recognition. We believe that employees who have an owner’s mindset approach new opportunities with a holistic view of what Morningstar has to offer, rather than being confined to their role, product area, or reporting lines. Accordingly, in 2022, we expect to consider ways to expand the population of employees receiving performance-based market stock units tied to total shareholder return to align compensation more closely to shareholder success. Led by our Compensation Committee, we carefully design our incentive plans and other benefit programs to focus on the health and well-being of our employees, foster meaningful career development, and motivate our teams. Our Board will use data driven analysis to assess the impact of these design choices and make further refinements throughout 2022 and beyond. |

| • | Organizational Design Responsive to Changes in our Regulatory Landscape – Morningstar is adept at operating in highly regulated environments. For example, our credit ratings business is subject to regulation by the U.S. Securities and Exchange Commission (SEC), Ontario Securities Commission, U.K. Financial Conduct Authority (FCA) and European Securities and Markets Authority (ESMA). Additionally, our investment management business is regulated by the SEC and other agencies in the U.S., ESMA, FCA, Australian Securities and Investments Commission, and South African Financial Sector Conduct Authority among others. We have developed expertise in implementing policies and procedures while establishing monitoring, control and audit practices that help monitor compliance with, in some cases, very prescriptive regulatory requirements in each of the jurisdictions where we operate. This background prepares us well for new and developing regulation applicable to our index and Sustainalytics products and services. A focus of the Board in 2022 will be guiding the Company’s organizational decisions to structure the business for long-term growth. |

This is by no means an exhaustive list; they are just some of the ways we are creating a Company built with independence, integrity, and empowerment as top priorities.

We will hold our 2022 Annual Shareholders’ Meeting at 9 a.m. Central time on Friday, May 13, 2022 as a hybrid meeting. We are excited for the opportunity to see many of you in person and also appreciate the virtual capabilities that afford other participants the ability to attend without the time and expense for travel. As in previous years, our Annual Shareholders’ Meeting will include time for Q&A with management and the Board and will offer a variety of ways to connect and participate. We strongly encourage you to read both our proxy statement and annual report in their entirety and ask that you support our Board’s recommendations.

On behalf of the Board of Directors, we look forward to working with you, and serving you, in the years to come. We sincerely appreciate your continued support of Morningstar.

Sincerely,

|  | |

| Joe Mansueto | Kunal Kapoor | |

| Executive Chairman and Chairman of the Board | Chief Executive Officer |

ii 2022 Proxy Statement

Morningstar, Inc.

Notice of Annual Shareholders’ Meeting

To be held on May 13, 2022

April 1, 2022

Dear Shareholder:

You are cordially invited to attend our 2022 Annual Shareholders’ Meeting, which will be held at 9 a.m. Central time on Friday, May 13, 2022 at our corporate headquarters at 22 W. Washington St., Chicago, Illinois 60602. In order to facilitate participation from our shareholders around the world, our annual meeting will also be webcast live.

We are holding the annual meeting for the following purposes:

| • | To elect the ten director nominees listed in the proxy statement to hold office until the next annual shareholders’ meeting and until their respective successors have been elected and qualified. |

| • | To hold an advisory vote to approve executive compensation. |

| • | To ratify the appointment of KPMG LLP as our independent registered public accounting firm for 2022. |

| • | To transact other business that may properly come before the meeting or any adjournment or postponement of the meeting. |

The proxy statement, which follows this notice, fully describes these items.

You may vote at the meeting and any postponements or adjournments of the meeting if you were a shareholder of record as of the close of business on March 14, 2022, the record date for the meeting. A list of shareholders entitled to vote will be available for inspection for 10 days prior to the meeting at our corporate headquarters.

To ensure that your vote is recorded promptly, please vote as soon as possible, even if you plan to attend the annual meeting. For further details, please refer to the “Proxy Statement Summary” on Page 1 and the question “How do I vote?” on Page 64. If you have any questions concerning the meeting or the proposals, please contact our Investor Relations department at investors@morningstar.com.

Leah Trzcinski

Associate General Counsel and Corporate Secretary

iii

iii

Caution Concerning Forward-Looking Statements

This proxy statement contains, and statements made by Morningstar and its representatives at the annual meeting may contain, forward-looking statements as that term is used in the Private Securities Litigation Reform Act of 1995. These statements are based on our current expectations about future events or future financial performance. Forward-looking statements by their nature address matters that are, to different degrees, uncertain, and often contain words such as “may,” “could,” “expect,” “intend,” “plan,” “seek,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “prospects,” or “continue.” These statements involve known and unknown risks and uncertainties that may cause the events we discuss not to occur or to differ significantly from what we expect. We describe risks and uncertainties that could cause actual results and events to differ materially in the “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and “Quantitative and Qualitative Disclosures about Market Risk” sections of our Forms 10-K and 10-Q. If any of these risks and uncertainties materialize, our actual future results may vary significantly from what we expected. We do not undertake to update our forward-looking statements as a result of new information or future events.

iv 2022 Proxy Statement

v

v

This summary highlights key elements of our proxy statement. For more complete information, you should review the entire proxy statement along with our 2021 Annual Report.

| Date: May 13, 2022 |  | Time: 9:00 a.m. Central Time |  | Record Date: March 14, 2022 | |||||

| Where: There are three ways to participate in the annual meeting: 1. Participants may attend in person to vote their shares and ask live questions during the meeting at 2. Shareholders may view and listen to a live webcast of the meeting, vote their shares electronically during the meeting, and submit written questions during the meeting by visiting www.virtualshareholdermeeting.com/MORN2022. 3. Other participants may view and listen to a live webcast of the meeting and submit written questions or ask them live via webcam during the meeting by registering in advance at shareholders.morningstar.com in the Events & Presentations section of the Investor Relations area of our corporate website. Participants electing this option will not be able to vote during the meeting. | |||||||||

Even if you plan on attending our meeting on May 13, 2022, please vote as soon as possible before the meeting by:

| Internet: | |

• Before the meeting: Go to www.proxyvote.com. Use the Internet to transmit your voting instructions and for electronic delivery of information up until 11:59 p.m. Eastern Time on May 12, 2022. Have your Notice of Internet Availability or proxy card in hand when you access the website and follow the instructions to obtain your records and to create an electronic voting instruction form.

• During the meeting: Go to www.virtualshareholdermeeting.com/MORN2022. You may attend the meeting via the Internet and vote during the meeting. Have your Notice of Internet Availability or proxy card in hand when you access the website and follow the instructions. |

| Phone: Call 1-800-690-6903 with any touchtone telephone to transmit your voting instructions up until 11:59 p.m. Eastern Time on May 12, 2022. Have your proxy card in hand when you call and then follow the instructions. |

| Mail: Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. |

A webcast replay of the annual meeting will also be archived in the Investor Relations area of our corporate website, shareholders.morningstar.com/. For additional information on the annual meeting, please refer to the Questions and Answers About the Annual Meeting and the Proxy Materials on Page 62.

1

1

| Proxy Statement Summary |

Annual Meeting Proposals and Board Recommendations

Proposal | Board Recommendation | More Information | ||

Proposal 1: Election of Directors | FOR the election of each of the director nominees listed in this proxy statement |

Page 7 | ||

Proposal 2: Advisory Vote to Approve Executive Compensation | FOR the approval of the resolution relating to the executive compensation of our named executive officers as disclosed in this proxy statement |

Page 54 | ||

Proposal 3: Ratification of the Appointment of | FOR the ratification of the appointment of KPMG as our independent registered public accounting firm for 2022 |

Page 55 | ||

About Morningstar

Morningstar, Inc. is a leading provider of independent investment research in North America, Europe, Australia, and Asia. The Company offers an extensive line of products and services for individual investors, financial advisors, asset managers and owners, retirement plan providers and sponsors, and institutional investors in the debt and private capital markets. Morningstar provides data and research insights on a wide range of investment offerings, including managed investment products, publicly listed companies, private capital markets, debt securities, and real-time global market data. Morningstar also offers investment management services through its investment advisory subsidiaries, with approximately $265 billion in assets under advisement and management as of December 31, 2021. The Company has operations in 29 countries.

2 2022 Proxy Statement

Corporate Governance Highlights

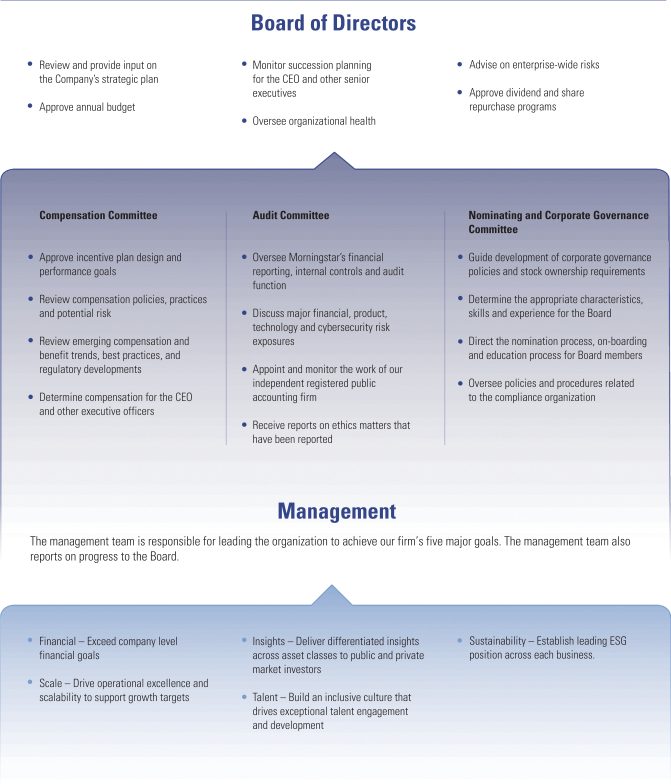

Our Board of Directors is responsible for providing oversight, counseling, and direction to our management team in the long-term interests of Morningstar and its shareholders.

Morningstar Board of Directors

Morningstar’s brand is associated with independence, transparency, and objective, investor-focused research and ratings. Our Board of Directors is responsible for providing oversight, counsel, and direction to our management team in the long-term interests of Morningstar and its shareholders. Led by our Nominating and Corporate Governance Committee’s regular reviews, our Board regularly assesses our governance practices in the context of current trends, regulatory changes, and recognized best practices.

Board Composition

The Board holds responsibility for naming the chairman of the board and the chief executive officer of Morningstar. We value the independent members of our Board while leveraging the long-term expertise and deep commitment of our founder and significant shareholder, Joe Mansueto. Joe Mansueto has served as chairman since our inception and as chief executive officer from 1984 to 1996 and again from 2000 to 2017, when Kunal Kapoor succeeded him as CEO. In his current capacity as executive chairman and chairman of the board, Joe Mansueto continues to oversee matters pertaining to capital allocation, corporate strategy, and executive leadership development.

We believe that Joe Mansueto’s contributions as chairman are central to our business success and longevity; his commitment to and knowledge of the principles that underpin Morningstar is unmatched. His understanding of the Company, combined with Kunal Kapoor’s long history at the firm and their close working relationship, helps guide the investor-focused culture that sets us apart in the industry.

|

Board Structure

| |

• Significant majority of directors are

• Independent committee Chairs

• Executive sessions of independent

• Directors are not over-committed to

• Directors offer to resign upon change

• Value diversity and an appropriate | ||

| Board Role in Risk Oversight

| |

• Annual Board review of material

• Review and input on strategic plan

• Regular review of organizational health

• Each committee focused on risks | ||

| Attendance by Directors at the

2021 Annual Meeting |

3

3

We nominate individuals whose background, knowledge, and experience would be expected to assist the Board in furthering the interests of Morningstar and its shareholders.

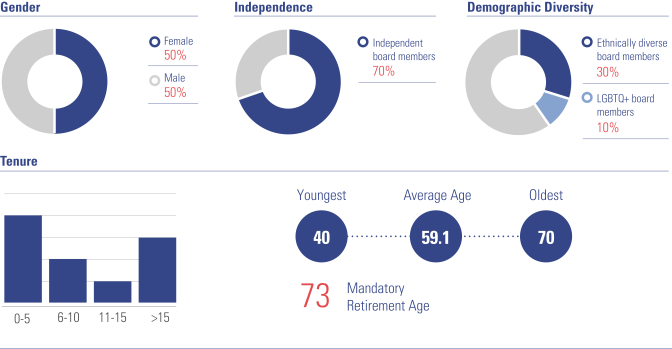

The Company strives to maintain a Board that possesses a combination of skills, professional experience, and diversity of backgrounds and tenure necessary to effectively oversee the Company’s business. To reflect the Company’s commitment to diversity, the Board amended the Company’s Nominating and Corporate Governance Committee Charter in May 2021 to include a commitment that, as part of the search process for each new director, the Nominating and Corporate Governance Committee will ensure that the applicant pool for new directors includes qualified candidates who reflect diverse backgrounds, such as diversity of thought, race, ethnicity, gender, age, geographic origin, and sexual orientation. In evaluating the suitability of individual Board members, the committee will take into account factors such as the individual’s general understanding of technology, marketing, sales, finance, and other disciplines relevant to the success of a publicly traded company; understanding of Morningstar’s business and industry; education and professional background, including current employment and other board memberships; reputation for integrity; and any other factors it considers to be relevant. Each of the 10 directors currently serving is standing for election at the annual meeting. Information regarding the director nominees is provided below.

Board Diversity Snapshot

4 2022 Proxy Statement

Enterprise Sustainability Highlights

Corporate sustainability and the integration of ESG data, research, tools, and services across the Morningstar enterprise is a priority for the Company and for the Board.

Board Oversight of ESG

While serving on the Board, our directors have become familiar with the sustainable investing and corporate sustainability landscapes, including best practices related to product and strategy development. Given its critical importance to the Company’s product areas and business strategy, oversight of ESG and sustainability-related matters at the Board level has not been assigned to a specific committee. Instead, ESG integration and Company sustainability efforts are woven into a variety of agenda items at Board and committee meetings. The Board provides oversight and guidance on each of the Company’s material ESG topics as outlined below. Additional information regarding ESG at Morningstar can be found in our Enterprise Sustainability Report.

Board Contribution to Material ESG Topics

| Business Ethics At each of its regular meetings, the Audit Committee receives a report on ethics matters that have been reported through Morningstar’s Ethics Hotline or through the other channels available to employees and other stakeholders. In addition, the Audit Committee reviews any related party transactions or potential conflicts of interest. The Nominating and Corporate Governance Committee oversees work by our compliance organization to meet regulatory requirements. The status of any material legal and regulatory matters are reported to the Board and the input of our independent directors is sought when there are allegations that bring Morningstar’s independence and integrity into question. |

| Diversity Equity and Inclusion Members of Morningstar’s talent & culture team are regular participants at Board meetings providing updates on the organizational health of the Company. As a data-driven Company, these presentations include analysis by demographic to assess opportunities for progress toward Morningstar’s diversity, equity, and inclusion goals. The Nominating and Corporate Governance Committee leads our director recruitment and selection process to ensure that the applicant pool for new directors includes qualified candidates who reflect diverse backgrounds, such as diversity of thought, race, ethnicity, gender, age, geographic origin, and sexual orientation. | |||||

5

5

| Enterprise Sustainability Highlights |

| Governance Structure Under Morningstar’s corporate governance framework, the Board has oversight of the Code of Ethics and any material enterprise-wide governance policies. The Board participates in the Company’s shareholder engagement activities and looks forward to meeting current and potential shareholders at our annual meetings. Annually, the Board and each committee performs a self-evaluation to identify opportunities for improved effectiveness. |

| Data and Information Security Members of Morningstar’s technology and information security team present regularly at Audit Committee meetings. They review dashboards to provide an update on the status of the Company’s infrastructure, systems and products. The Audit Committee discussion focuses on new developments and trends in the industry to evaluate risks and vulnerabilities to the Company’s cybersecurity and data privacy. | |||||

| Employee Engagement The Board recognizes that Morningstar’s unique culture has contributed to its success and is focused on preserving it through employee engagement. The Board is highly involved in succession planning for each member of the executive leadership team and is eager to meet senior leaders throughout the organization. The Board reviews information regarding pay equity and trends in talent acquisition, retention and development among the Company’s employees. The Compensation Committee reviews Morningstar’s benefits programs to foster an ownership mindset where employees across the Company are motivated to contribute to the Company’s success. |

| Customer and Product Responsibility At each meeting the Board conducts an in-depth review of one or two of Morningstar’s businesses. In these sessions, the vast and varied experiences of our Board members facilitate insightful discussions to guide management growth initiatives. Each year, the Board devotes a full day to corporate strategy and reviews the three-year plans for each business before setting the budget priorities for the upcoming year. This exercise drives accountability toward ambitious goals and results. | |||||

6 2022 Proxy Statement

Election of Directors

Each of our current directors is standing for election to hold office until the annual meeting to be held in 2023 and until his or her successor, if any, is elected and qualified. Our nominees for election as directors include:

| • | Seven independent directors, as defined in the applicable rules for companies traded on the Nasdaq Global Select Market (Nasdaq); |

| • | One director who, as the retired former chief executive officer of DBRS, the credit rating agency we acquired in 2019, is expected to qualify as independent in October 2022; and |

| • | Two members of our executive management team, our founder and our chief executive officer. |

Each director serves a one-year term with all directors subject to annual election. Every one of the nominees is currently a director. At the recommendation of the Nominating and Corporate Governance Committee, the Board nominated each person listed below for election at the annual meeting. Unless proxy cards are otherwise marked, the persons named as proxy holders will vote all proxies received FOR the election of each nominee. If any director nominee is unable or unwilling to stand for election at the time of the annual meeting, the persons named as proxy holders may vote either for a substitute nominee designated by the Board to fill the vacancy or for the balance of the nominees, leaving a vacancy. Alternatively, the Board may reduce the size of the Board. The Board believes that each nominee will be able and willing to serve if elected as a director.

Recommendation of the Board

The Board recommends that you vote FOR the election of each of the following nominees. We describe certain individual qualifications and skills that led the Board to conclude that each person should serve as a director below.

| ||||||||||||||||||

Name | Age | Director Since | Primary or Former Occupation | Independent | Other Public Company Boards | |||||||||||||

| Joe Mansueto | 65 | 1984 | Executive Chairman and Chairman of the Board of Morningstar, Inc. |

|

|

| |||||||||||

| Kunal Kapoor | 46 | 2017 | Chief Executive Officer of Morningstar, Inc. |

|

|

| |||||||||||

| Robin Diamonte | 57 | 2015 | Chief Investment Officer of Raytheon Technologies Corp. |  |

|

| |||||||||||

| Cheryl Francis | 68 | 2002 | Co-Chair of Corporate Leadership Center |  | 2 |

| |||||||||||

| Steve Joynt | 70 | 2019 | Former Chief Executive Officer of DBRS |

|

|

| |||||||||||

| Steve Kaplan | 62 | 1999 | Neubauer Family Distinguished Service Professor of Entrepreneurship and Finance at The University of Chicago Booth School of Business |  |

|

| |||||||||||

| Gail Landis | 69 | 2013 | Founding Partner of Evercore Asset Management, LLC |  |

|

| |||||||||||

| Bill Lyons | 66 | 2007 | Former President and Chief Executive Officer of American Century Companies, Inc. |  |

|

| |||||||||||

| Doniel Sutton | 48 | 2021 | Chief People Officer at Fastly, Inc. |  | 1 |

| |||||||||||

| Caroline Tsay | 40 | 2017 | Chief Executive Officer of Compute Software, Inc. |  | 1 |

| |||||||||||

7

7

| Proposal 1: Election of Directors |

Director Re-Nomination Process

Our Nominating and Corporate Governance Committee appreciates the importance of critically evaluating individual directors and their contributions to our Board in connection with re-nomination decisions. In deciding whether to recommend re-nomination of a director for election at our annual meeting, our Nominating and Corporate Governance Committee considers a variety of factors, including:

| • | The extent to which the director’s judgment, skills, qualifications and experience (including that gained due to tenure on our Board) continue to contribute to the success of our Board and our Company; |

| • | Feedback from the annual Board and committee evaluation; |

| • | Attendance and participation at, and preparation for, Board and committee meetings and the annual meeting of shareholders; |

| • | Independence and any actual or perceived conflicts of interest; |

| • | The extent to which the director continues to contribute to the diversity of our Board; |

| • | Shareholder feedback, including the support received at the prior annual meeting of shareholders; |

| • | Outside board and other affiliations, including time commitments; and |

| • | Willingness to serve. |

A director nominee’s judgment, skills, qualifications, and experience (including that gained due to tenure on our Board) in the following areas are considered particularly relevant:

| • | CEO leadership |

| • | Business development & operations |

| • | Accounting, finance, and M&A |

| • | Client relations and insights |

| • | Governance and regulatory compliance |

| • | Talent management and compensation |

| • | Technology |

| • | Industry experience (for example, asset management and advisory, retirement, private capital markets, credit ratings) |

Our Nominating and Corporate Governance Committee ensures that our director nominees include a diverse set of professionals whose background, knowledge, and experience would be expected to assist the Board in furthering the interests of Morningstar and its shareholders.

8 2022 Proxy Statement

| Proposal 1: Election of Directors |

Succession Planning and Director Recruitment Process

The Nominating and Corporate Governance Committee establishes procedures for the nomination process and recommends candidates for election to the Board. Consideration of new Board nominee candidates involves a series of internal discussions, review of information concerning candidates, and interviews with selected candidates. Board members or employees typically suggest candidates for nomination to the Board. In 2021, we did not use a search firm or pay fees to other third parties in connection with seeking or evaluating Board nominee candidates. The Nominating and Corporate Governance Committee will consider candidates proposed by shareholders using the same criteria it uses for other candidates. A shareholder who is seeking to recommend a prospective nominee for the Nominating and Corporate Governance Committee’s consideration should submit the candidate’s name and qualifications to our corporate secretary at Morningstar, Inc., 22 W. Washington St., Chicago, Illinois 60602. In addition, our by-laws permit a shareholder, or group of up to 20 shareholders, owning continuously for at least three years shares of our common stock representing an aggregate of at least 3% of our outstanding shares, to nominate and include in our proxy materials director nominees constituting up to the greater of 20% of the Board or two director nominees, provided that the shareholder(s) and nominee(s) satisfy the requirements set forth in our by-laws, which can be found in the Investor Relations area of our corporate website at shareholders.morningstar.com in the Governance section.

Diversity of our Potential and Incumbent Directors

We believe our nominees’ tenure and diversity create a balanced Board, which contributes to a rich dialogue representing a range of perspectives. In evaluating the suitability of individual Board members, the Nominating and Corporate Governance Committee weighs factors such as the individual’s judgment, skills, and qualifications. For a list of the areas where experience is considered particularly relevant, see the section on our Director Re-Nomination Process. To reflect the Company’s commitment to diversity, the Nominating and Corporate Governance Committee ensures that the applicant pool for new directors includes qualified candidates who reflect diverse backgrounds, such as diversity of thought, race, ethnicity, gender, age, geographic origin, and sexual orientation. Morningstar’s commitment to board diversity is further evidenced by our submission of a comment letter in support of Nasdaq’s listing rules related to board diversity. As described above, the Committee shall consider nominations by a shareholder using the foregoing criteria.

9

9

| Proposal 1: Election of Directors |

Board Composition and Governance Overview

We ensure that our nominees to the Board include a diverse set of professionals with experience across various industries and with relevant skills to promote the Company’s future growth and success.

| Board Diversity Matrix (As of March 14, 2022) | ||||||||||||||||

| Total Number of Directors: 10 | ||||||||||||||||

| Female | Male | Non-Binary | Did Not Disclose Gender | |||||||||||||

Part I: Gender Identity |

|

|

|

|

|

|

|

|

|

|

|

| ||||

Directors | 5 | 5 | 0 | 0 | ||||||||||||

Part II: Demographic Background |

|

|

|

|

|

|

|

|

|

|

|

| ||||

African American or Black | 1 | 0 | 0 | 0 | ||||||||||||

Alaskan Native or Native American | 0 | 0 | 0 | 0 | ||||||||||||

Asian | 1 | 1 | 0 | 0 | ||||||||||||

Hispanic or Latinx | 0 | 0 | 0 | 0 | ||||||||||||

Native Hawaiian or Pacific Islander | 0 | 0 | 0 | 0 | ||||||||||||

White | 3 | 4 | 0 | 0 | ||||||||||||

Two or More Races or Ethnicities | 0 | 0 | 0 | 0 | ||||||||||||

LGBTQ+ | 1 | |||||||||||||||

Did Not Disclose Demographic Background | 0 | |||||||||||||||

Corporate Governance Overview

We are committed to sound corporate governance. Our Nominating and Corporate Governance Committee regularly reviews our governance practices in the context of current corporate governance trends, regulatory changes, and recognized best practices. The following chart highlights our significant corporate governance policies and practices:

| Board Practices |  | Board Governance Policies |  | Shareholder Rights |

• Annual Board meeting focused on

• Annual Board and committee self- evaluations

• Regular executive sessions of

• Directors are not over committed to | • Annual election of directors

• Retirement age policy for directors

• Significant stock ownership and

• Commitment to diversity within the | • Shareholder right to call special meetings

• Proxy access right

• Majority vote standard

• Single-class capital structure with

• Annual advisory vote on executive compensation |

10 2022 Proxy Statement

| Proposal 1: Election of Directors |

The following table provides a summary of information about our director nominees. Directors are elected annually by a majority of votes cast. Morningstar’s Board of Directors recommends that you vote “FOR” the election of each of the 10 nominees.

|  |  |  |  |  |  |  |  |  | |||||||||||||

Tenure and Independence |

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||

Tenure | 38 | 5 | 7 | 20 | 3 | 23 | 9 | 15 | 1 | 5 | ||||||||||||

Independence |

|

|

|

| • | • |

| • | • | • | • | • | ||||||||||

Composition |  |

|

|

|

|

|

|

|

|

| ||||||||||||

Audit Committee |

|

|

|

|  |  |

|

|  |

|  |  | ||||||||||

Compensation Committee |

|

|

|

|

|  |

|  |

|  |  |

| ||||||||||

Nominating and Corporate Governance Committee |

|

|

|

|  |

|

|  |  |  |

|  | ||||||||||

Diversity |

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||

Age | 65 | 46 | 57 | 68 | 70 | 62 | 69 | 66 | 48 | 40 | ||||||||||||

Gender Identity |

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||

Female |

|

|

|

| • | • |

|

| • |

| • | • | ||||||||||

Male | • | • |

|

| • | • |

| • |

|

| ||||||||||||

Race / Ethnicity |

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||

Black / African American |

|

|

|

|

|

|

|

|

|

| • |

| ||||||||||

Asian |

|

|

| • |

|

|

|

|

|

|

| • | ||||||||||

White | • |

| • | • | • | • | • | • |

|

| ||||||||||||

LGBTQ+ |

|

|

|

| • |

|

|

|

|

|

|

| ||||||||||

Chairman of the Board

Chairman of the Board  Committee Chair

Committee Chair  Member

Member

BOARD COMPOSITION

| ||||||

Our Board is responsible for providing oversight, counseling, and direction to our management team in the long-term interest of the Company and our shareholders. The Board believes that the 2022 nominees are of an appropriate composition to effectively oversee and constructively challenge the performance of management in the execution of our strategy.

| Detailed information about each nominee’s background, skills, and experience can be found beginning on the next page. | |||||

11

11

| Proposal 1: Election of Directors |

| Board Nominees |  | The Board of Directors recommends a vote FOR each director nominee. |

Joe Mansueto

Age 65

Director Since: 1984

Board Committees: None | Joe Mansueto founded Morningstar in 1984 and became executive chairman in 2017. He has served as chairman since our Company’s inception and as chief executive officer from 1984 to 1996 and from 2000 to 2016. Joe oversaw the Company’s international expansion, growth into new businesses, and development of its valuable intellectual property used throughout the financial industry. Joe is the owner and chairman of Chicago Fire FC, an American professional soccer franchise, as well as a significant investor in several media companies, real estate properties and other ventures. Joe has received several awards for his leadership and influence including from InvestmentNews, MutualFundWire.com, SmartMoney, and Tiburon CEO Summit. | QUALIFICATIONS • Founder and largest shareholder of the Company, with knowledge of all aspects of the business and the financial information industry.

• Commitment to research integrity and independence set the tone at Morningstar and created our trusted brand.

EDUCATION

• Master’s degree in business administration from The University of Chicago Booth School of Business.

• Bachelor’s degree in business administration from The University of Chicago. |

Kunal Kapoor

Age 46

Director Since: 2017

Board Committees: None | Kunal Kapoor became chief executive officer of Morningstar in 2017. Before assuming his current role, he served as president, responsible for product development and innovation, sales and marketing, and driving strategic prioritization across the firm. Before becoming president in 2015, Kunal was head of global products and client solutions. Kunal became head of our global client solutions group in 2013 and took on additional responsibility for the products group in 2014. Prior to that, Kunal served in consecutive roles as president of a number of our divisions including Data, Equity and Market Data/Software, and Individual Software. Kunal joined Morningstar in 1997. He is a member of the board of directors of Wealth Enhancement Group, a privately - owned independent wealth management firm. | QUALIFICATIONS

• Leadership roles in many of Morningstar’s businesses during Kunal’s 25-year tenure at the Company.

• Uniquely able to advise the Board on the opportunities and challenges of managing the Company and its strategy for growth, as well as its day-to-day operations and risks.

EDUCATION

• Master’s degree in business administration from The University of Chicago Booth School of Business.

• Bachelor’s degree in economics and environmental policy from Monmouth College.

• Chartered Financial Analyst (CFA). |

12 2022 Proxy Statement

| Proposal 1: Election of Directors |

Robin Diamonte

Age 57

Director Since: 2015

Board Committees: Audit Nominating and Corporate Governance | Robin Diamonte was appointed to the Board in December 2015. She is the chief investment officer of Raytheon Technologies Corp., the aerospace defense company formed in 2020 from the merger of Raytheon Corporation and the United Technologies Corporation aerospace business. Robin had been vice president and chief investment officer at United Technologies Corporation since 2004. Before joining United Technologies Corporation, she held several positions during her 12-year tenure at Verizon Investment Management Corporation, the asset management arm of Verizon Communications Inc., rising from research analyst to managing director. Robin serves on the board for the Committee on Investment of Employee Benefit Assets (CIEBA), representing more than 100 of the country’s largest private sector retirement funds on fiduciary and investment issues in Washington. | QUALIFICATIONS

• Extensive experience in the retirement industry as a chief investment officer overseeing over $115 billion in global retirement assets.

• Unique perspective as a customer of Morningstar products and research for over 25 years since she first started as an investment analyst with Verizon in 1994.

EDUCATION

• Master’s degree in business administration from the University of New Haven.

• Bachelor’s degree in electrical engineering from the University of New Haven. |

Cheryl Francis

Age 68

Director Since: 2002

Board Committees: Audit Compensation | Cheryl Francis was elected to the Board in July 2002. She has been co-chair of Corporate Leadership Center, a not-for-profit organization focused on developing tomorrow’s business leaders, since August 2008 and vice-chair from October 2002 to August 2008. She has been an independent business and financial advisor since 2000. From 1995 to 2000, she served as executive vice president and chief financial officer of R.R. Donnelley & Sons Company, a print media company. Prior to her role at R.R. Donnelley, Cheryl held several positions on the management team of FMC Corporation including corporate treasurer, and served as chief financial officer of FMC Gold, a public company. Cheryl was an adjunct professor for the University of Chicago Graduate School of Business from 1991 to 1993. She currently serves as a member of the board of directors of HNI Corporation and Aon plc. | QUALIFICATIONS

• Valuable perspective as an independent business and financial advisor and previously CFO of a public company.

• Runs a leadership organization that engages with senior executives, CEOs, and leading academics on current business topics.

• Currently serves on two other public company boards and previously served on two other public company boards.

EDUCATION

• Master’s degree in business administration from The University of Chicago Booth School of Business.

• Bachelor’s degree from Cornell University. |

13

13

| Proposal 1: Election of Directors |

Steve Joynt

Age 70

Director Since: 2019

Board Committees: None | Steve Joynt was appointed to the Board in December 2019. He served as chief executive officer of DBRS, the global credit ratings agency acquired by Morningstar in July 2019, where he spent three years directing the global vision, mission, and strategic objectives for DBRS. Prior to that, he spent more than 20 years at the global credit ratings agency Fitch Group in a variety of roles, including as the company’s chief executive officer from 2002 to 2012. Earlier in his career, Steve spent 12 years at Standard & Poor’s in a variety of analytical roles, culminating in the role of managing director of U.S. structured finance. | QUALIFICATIONS

• Over 40 years in leadership roles within the credit ratings industry, with excellent understanding of fixed income securities, including sovereign, corporate, asset backed, and structured credits.

• Valuable operating experience as CEO of a regulated company.

EDUCATION

• Bachelor’s degree in business administration from the University of Arizona. |

Steve Kaplan

Age 62

Director Since: 1999

Board Committees: Compensation Nominating and Corporate Governance | Steve Kaplan served as a member of our advisory board beginning in 1998 and was elected to the Board in August 1999. Since 1988, he has been a professor at The University of Chicago Booth School of Business where he currently is the Neubauer Family Distinguished Service Professor of Entrepreneurship and Finance and Kessenich E.P. Faculty Director at the Polsky Center for Entrepreneurship and Innovation. Steve serves as a research associate at the National Bureau of Economic Research and has formerly served as associate editor of the Journal of Financial Economics. Having previously served on the boards of directors of public and private companies, Steve has experience developing and advising executive talent. | QUALIFICATIONS

• Extensive background on issues in private equity, venture capital, entrepreneurial finance, corporate governance, executive talent, and corporate finance.

• Guidance and analysis of both organic growth opportunities and potential acquisitions.

EDUCATION

• Ph.D. in business economics from Harvard University.

• Bachelor’s degree in applied mathematics and economics from Harvard College. |

14 2022 Proxy Statement

| Proposal 1: Election of Directors |

Gail Landis

Age 69

Director Since: 2013

Board Committees: Audit Nominating and Corporate Governance | Gail Landis was elected to the Board in May 2013. She was a founding partner of Evercore Asset Management, LLC, an institutional asset management firm, and served as managing principal from 2005 until her retirement in December 2011. From 2003 to 2005, she served as head of distribution for the Americas for Credit Suisse Asset Management, the asset management division of Credit Suisse AG. In her long career in active investment management at Sanford C. Bernstein & Co., Inc. and its successor company AllianceBernstein L.P. between 1981 and 2002, she served in a broad array of roles as an equity analyst, a senior portfolio manager, and as a business leader. Gail remains active in the investment community serving on several non-profit boards and investment committees, including the investment committee of the David Rockefeller Fund. | QUALIFICATIONS

• Over 30 years of experience as an investment management executive, with an excellent understanding of the marketing and business development needs of institutional investors.

• Keen awareness of the investing needs of advisers, and the clients they serve, through dynamic market environments.

EDUCATION

• Master’s degree in business administration from New York University’s Stern School of Business.

• Bachelor’s degree in East Asian studies from Boston University. |

Bill Lyons

Age 66

Director Since: 2007

Board Committees: Compensation Nominating and Corporate Governance | Bill Lyons was appointed to the Board in September 2007. He served as president and chief executive officer of American Century Companies, Inc., an investment management company, from September 2000 until his retirement in March 2007. From 1987 to 2000, he served in other capacities at American Century Companies, Inc., including as general counsel, chief operating officer, and president. During his time at American Century, he served on the board of the Investment Company Institute, Washington, D.C., and was appointed to several special task forces that developed best practices for mutual fund governance. He is active in civic and non-profit organizations in the greater Kansas City area, including current service on five non-profit boards (two as chair) and three related investment committees overseeing endowment and foundation assets. He previously served as a member of the board of directors of NIC Inc. and The Nasdaq Stock Market, LLC. | QUALIFICATIONS

• Extensive experience in the mutual fund industry with unique insight and a keen perspective on our customers’ priorities and challenges.

• Business acumen and corporate governance mindset as the former chief executive officer of a private investment management company. Extensive experience in active investment management and investment process oversight.

EDUCATION

• Juris doctor degree from Northwestern University School of Law.

• Bachelor’s degree in history from Yale University. |

15

15

| Proposal 1: Election of Directors |

Doniel Sutton

Age 48

Director Since: 2021

Board Committees: Audit Compensation | Doniel Sutton was appointed to the board in May 2021. She has served as chief people officer of Fastly, Inc., a leading global provider of edge cloud platform services, since September 2020. From March 2017 to April 2019 she served as senior vice president, head of people at PayPal Holdings Inc., a global payments and technology company, and worked in other leadership capacities within the human resources group during her seven-year tenure at the company. From August 1997 to September 2011, she held a variety of senior human resource leadership positions with Prudential Financial, Bank of America Corporation and Honeywell International. Doniel currently serves as a member of the board of directors of Ross Stores, Inc. | QUALIFICATIONS

• Wealth of experience in human capital management, global business expansions and large-scale mergers, acquisitions, and business integrations.

• Experience in rapidly growing technology companies providing insights on strategies supporting innovation, scale, and growth.

• Currently serves on the board of another public company.

EDUCATION

• Master’s degree in business administration in human resources management from the University of Illinois at Urbana-Champaign.

• Bachelor’s degree in finance from the University of Illinois at Urbana-Champaign. |

Caroline Tsay

Age 40

Director Since: 2017

Board Committees: Audit Nominating and Corporate Governance | Caroline Tsay was elected to the Board in May 2017. She has served as chief executive officer of Compute Software, Inc., an enterprise cloud infrastructure software company, since January 2017. From March 2013 to December 2016, she served as vice president and general manager of software at Hewlett Packard Enterprise Company, an information technology company. From April 2007 to March 2013, she held several product leadership positions across the consumer search, e-commerce, and advertising businesses at Yahoo! Inc., a digital media company. Caroline currently serves on the board of directors of The Coca-Cola Company, and formerly served as a member of the board of directors of Rosetta Stone Inc. and Travelzoo Inc. | QUALIFICATIONS

• Background in technology as well as significant leadership and management experience.

• Expertise in the areas of cloud infrastructure and sales provide insight relevant to product development and marketing.

• Currently serves on the board of another public company and previously served on two other public company boards.

EDUCATION

• Master’s degree in management science and engineering from Stanford University.

• Bachelor’s degree in computer science from Stanford University. |

16 2022 Proxy Statement

Board of Directors and Corporate Governance

Corporate Governance Guidelines

We have adopted a set of Corporate Governance Guidelines to guide the Board in its objective of enhancing shareholder value over the long term. The Nominating and Corporate Governance Committee is responsible for overseeing the Corporate Governance Guidelines and reporting and making recommendations to the Board concerning corporate governance matters. We have posted the guidelines in the Investor Relations area of our corporate website at shareholders.morningstar.com in the Governance section.

Among other matters, the Corporate Governance Guidelines include the following items concerning the Board:

• Board Size: The Board believes that a board of directors consisting of seven to 12 members is an appropriate size based on our present circumstances. The Board periodically evaluates whether a larger or smaller slate of directors would be preferable. | ✓ Board currently consists of 10 members. | |

• Board Vacancies: The Board may fill Board vacancies. Directors appointed by the Board to fill vacancies serve until the next annual meeting at which directors are to be elected. | ✓ Board has not filled any vacancies since the last annual meeting. | |

• Board Independence: The Board believes that, except during periods of temporary vacancies, a substantial majority of its directors must be independent. In determining the independence of a director, the Board applies the relevant Nasdaq requirements and applicable law and regulations. | ✓ Board currently comprised of 70% independent directors. | |

• Board Refreshment: The Board believes it can continue to evolve and adopt new viewpoints through the process for the evaluation and nomination of director candidates. In that regard, the Nominating and Corporate Governance Committee and the Board consider each member’s length of service and openness to new ideas when considering the appropriate slate of candidates to recommend for nomination. | ✓ Since 2017, we have added four new directors who have brought valuable and varied experience in distinct and critical areas. | |

• Retirement Age: Directors are required to retire from the Board when they reach the age of 73. A director reaching the age of 73 following his or her election to the Board may continue to serve until the next annual meeting. On the recommendation of the Nominating and Corporate Governance Committee, the Board may waive this requirement for any director if deemed in the best interests of the Company. | ✓ Board currently has an average age of 59.1 years. | |

• Overboarding Policy: Directors who are currently serving as the chief executive officer or other executive officer of a public company may serve on a total of no more than three public company boards, including Morningstar’s. Directors who are not currently serving as the chief executive officer or other executive officer of a public company may serve on no more than four public company boards, including Morningstar’s. | ✓ None of the current directors serve on more than two other public company boards. | |

• Offer to Resign upon Change in Circumstances: The Board believes that any director who discontinues his or her present employment or who materially changes his or her position should promptly tender a written offer of resignation to the Board. The Nominating and Corporate Governance Committee will then evaluate whether the Board should accept the resignation based on a review of whether the director continues to satisfy the Board’s membership criteria in light of his or her changed circumstances. | ✓ None of the directors have experienced a change in circumstances since the last annual meeting. | |

17

17

| Board of Directors and Corporate Governance |

Governance and Ethics Policies

Our Board is required to comply with our Code of Ethics and other material enterprise-wide governance and ethics policies. In 2021, we updated our anti-bribery and corruption policies and adopted two new global policies: Morningstar’s Anti-Slavery and Human Trafficking Statement and Human Rights Policy. Morningstar’s Anti-Slavery and Human Trafficking Statement was developed in accordance with the U.K. Modern Slavery Act of 2015 and Australia Modern Slavery Act of 2018, applying these country-specific principles to our global business. Our Human Rights Policy reaffirms our Company’s responsibility to ensure proper human rights practices throughout our value chain and in all business functions and publicly expresses our Company’s commitment to internationally recognized human rights standards.

We have posted our Code of Ethics and other significant Company policies in our sustainability policy center at:

morningstar.com/company/corporate-sustainability-policies-reports.

The Board believes there should be a substantial majority of independent directors on the Board. The Board also believes that it is useful and appropriate to have members of management, including the chief executive officer, as directors.

In order to qualify as independent under the Nasdaq listing rules, a director must satisfy a two-part test. First, the director must not fall into any of several categories that would automatically disqualify the director from being deemed independent. Second, no director qualifies as independent unless the Board affirmatively determines that the director has no direct or indirect relationship with the Company that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

The Board has determined that each of our director nominees are independent under the Nasdaq listing rules, other than Joe Mansueto, Kunal Kapoor, and Steve Joynt. Joe and Kunal are members of our senior management team, and Steve is not considered independent under Nasdaq requirements because he was employed from July to October 2019 by DBRS when it was a subsidiary of the Company. We expect that Steve will qualify as independent in October 2022 when he reaches the third anniversary of his retirement from DBRS.

In making this determination, the Board reviewed and discussed information provided by the directors and management with regard to each director nominee’s business and personal activities as they relate to the Company. The Board considered ordinary course or immaterial transactions between the Company and organizations where the directors or their family members are employed in a non-executive officer capacity or serve as directors. In addition, the Board considered a charitable contribution of $35 million to be paid over time by Joe Mansueto to support the creation of an institute to advance urban scholarship and education at The University of Chicago, where Steve Kaplan is a professor. With respect to Robin Diamonte, the Board reviewed ordinary course transactions between the Company and Raytheon Technologies Corp., where she is chief investment officer but not an executive officer. The Board found nothing in the relationships to be contrary to the standards for determining independence as contained in the Nasdaq’s requirements and the Company’s Corporate Governance Guidelines.

The Board has determined that each member of the Audit Committee qualifies as independent under special standards established by the SEC for members of audit committees. The Board has also determined that each Audit Committee member has sufficient knowledge to read and understand the Company’s financial statements and to serve on the Audit Committee. Additionally, the Board has determined that Cheryl Francis, the Chair of the Audit Committee, qualifies as an audit committee financial expert under the relevant SEC rules. This designation is related to Cheryl’s experience and understanding with respect to certain accounting and auditing matters. The designation does not impose upon her any duties, obligations, or liabilities that are

18 2022 Proxy Statement

| Board of Directors and Corporate Governance |

greater than those generally imposed on her as a member of the Audit Committee and the Board. Her designation as an audit committee financial expert pursuant to this SEC requirement does not affect the duties, obligations, or liabilities of any member of the Audit Committee or the Board.

The Board has determined that each member of the Compensation Committee qualifies as independent under special standards established by the SEC for members of compensation committees.

We ensure that our standing Board committees, the Audit, Compensation, and Nominating and Corporate Governance Committees, are led by and comprised entirely of independent directors. We believe this structure benefits Morningstar and contributes to our strong corporate governance framework.

19

19

| Board of Directors and Corporate Governance |

Board Responsibilities and Structure

The primary responsibilities of the Board are to provide oversight, counseling, and direction to our management team in the long-term interests of the Company and our shareholders. The table below highlights some key responsibilities of the Board, the committees, and management within our governance structure.

20 2022 Proxy Statement

| Board of Directors and Corporate Governance |

Board Leadership Structure

The chief executive officer and management are responsible for seeking the advice and, in appropriate situations, the approval of the Board with respect to certain extraordinary corporate actions.

The Board is responsible for determining the respective roles of the chairman of the board and chief executive officer. Joe Mansueto served as chairman of the board and chief executive officer of the Company until January 1, 2017. At that time, Joe stepped back from our day-to-day operations to instead focus on strategy, capital allocation, advising our senior team, and leading the Board. Joe serves as chairman of the Board and executive chairman of the Company. Kunal Kapoor has served as chief executive officer and a Board member since January 1, 2017. The Board believes that the current structure, which combines Joe’s unparalleled knowledge of all aspects of the business and its history as founder and largest shareholder with Kunal’s management of the day-to-day operations, benefits the business.

The Board has not designated a lead director; however, the independent directors choose from among themselves a lead director with respect to specific matters when appropriate. The Board believes this practice has been working well. The Chair of the Nominating and Corporate Governance Committee works closely with the chairman to set the agenda for each Board meeting and provides feedback on the areas of focus and form of materials presented to the Board. The Chair of the Nominating and Corporate Governance Committee serves as a liaison between the chairman and the independent directors.

The Board has delegated various responsibilities and authority to different Board committees, as described below. Each committee Chair sets the agenda for his or her respective committee meetings, and reviews and provides feedback on the areas of focus and form of materials. The committee Chair takes into account whether their committee is appropriately carrying out its core responsibilities and focusing on the key issues facing the Company, as may be applicable from time to time. To do so, each Chair engages with key members of management and subject matter experts in advance of each committee meeting. These committees regularly report on their activities and actions to the full Board. Board members have access to all of our employees outside of Board meetings.

Attendance at Board, Committee, and Annual Shareholders’ Meetings

The Board and its committees meet throughout the year on a set schedule. From time to time as appropriate, the Board and its committees also hold special meetings and may act by written consent. The Board held six meetings in 2021, one of which was a special meeting to discuss an acquisition opportunity. We expect each director to attend each meeting of the Board and the committees on which he or she serves as well as the annual meeting. As a result of the COVID-19 pandemic government restrictions and our concern for the health and safety of our Board members, three of the Board’s meetings in 2021 were held via video conference with optional in-person attendance. In 2021, each director attended at least 75% of the meetings of the Board and the committees on which he or she served. Each of the directors standing for reelection attended our 2021 Annual Shareholders’ Meeting.

Executive Sessions

Executive sessions of our independent directors are held at the end of every regularly scheduled Board meeting as well as whenever deemed appropriate by the Board. The independent directors determine who among them will be responsible for chairing sessions for the independent directors. Following discussion, the independent directors may, at their discretion, invite the Chairman, CEO, other employees or independent outside advisors or experts to participate. Committee agendas also include regularly scheduled sessions for the independent directors to meet without members of management present. This executive session is led by the independent Chair of that committee. This practice has proved useful in ensuring open and constructive discussion among the Board members.

21

21

| Board of Directors and Corporate Governance |

The Board currently has standing Audit, Compensation, and Nominating and Corporate Governance Committees and appoints the members to each of these committees. Each member of the Audit, Compensation, and Nominating and Corporate Governance committees is an independent director under Nasdaq standards. Each Board committee has a written charter reviewed annually by the respective committee and approved by the Board. A copy of each charter is available in the Investor Relations area of our corporate website at shareholders.morningstar.com in the Governance section. The table below shows the members of each committee as of the date of this proxy statement, and the number of meetings held by each committee during 2021.

Director | Audit | Compensation | Nominating and Corporate Governance | |||||||||

Joe Mansueto |

|

|

|

|

|

|

|

|

| |||

Kunal Kapoor |

|

|

|

|

|

|

|

|

| |||

Robin Diamonte | Member |

|

|

| Member | |||||||

Cheryl Francis | Chair | Member |

|

|

| |||||||

Steve Joynt |

|

|

|

|

|

|

|

|

| |||

Steve Kaplan |

|

|

| Chair | Member | |||||||

Gail Landis | Member |

|

|

| Member | |||||||

Bill Lyons |

|

|

| Member | Chair | |||||||

Doniel Sutton | Member | Member |

|

|

| |||||||

Caroline Tsay | Member |

|

|

| Member | |||||||

2021 Meetings | 9 | 4 | 4 | |||||||||

22 2022 Proxy Statement

| Board of Directors and Corporate Governance |

AUDIT COMMITTEE

| ||

Members:

Cheryl Francis (chair) Robin Diamonte Gail Landis Doniel Sutton Caroline Tsay

Meetings Held in 2021: 9

• All current members are independent within the meaning of the Nasdaq standards for independence for directors and audit committee members.

• All current members satisfy Nasdaq financial literacy requirements, having accounting or other relevant management expertise, and Cheryl Francis has been designated as an “audit committee financial expert” as defined by SEC rules.

|

Primary Responsibilities:

• Oversee the integrity of the Company’s financial statements and internal control over financial reporting.

• Appoint and determine the compensation of the independent auditor.

• Pre-approve audit and permitted non-audit engagement fees and terms of the independent auditor.

• Evaluate the qualifications, performance, and independence of the independent auditor, including obtaining a report of the independent auditor describing the firm’s internal quality control procedures any material issues raised by the most recent internal quality control review or Public Company Accounting Oversight Board inspection.

• Review and discuss with management and the independent auditor the annual audited and quarterly unaudited financial statements included in the Company’s Annual Report on Form 10-K and Quarterly Reports on Form 10- Q, respectively.

• Review reports and disclosures and discuss with the independent auditor Morningstar’s accounting for related-party, insider, and affiliated party transactions.

• Review and evaluate the audit plan, performance and responsibilities of the Company’s internal audit function.

• Discuss risk assessment and risk management policies with respect to major financial, product, technology, and cybersecurity risk exposures.

• Discuss with management and the independent registered public accounting firm any correspondence with regulators or governmental agencies and any employee complaints or published reports that raise material issues regarding Morningstar’s financial statements or accounting policies.

• Establish procedures for the receipt, retention and treatment of complaints regarding accounting, internal accounting controls or auditing matters and the confidential, anonymous submission by the Company’s employees of concerns regarding questionable accounting, auditing, or ethics matters, and the review of any submissions received pursuant to such procedures.

| |

23

23

| Board of Directors and Corporate Governance |

COMPENSATION COMMITTEE

| ||

Members:

Steve Kaplan (chair) Cheryl Francis Bill Lyons Doniel Sutton

Meetings Held in 2021: 4

• All members are independent within the meaning of the Nasdaq standards of independence for directors and compensation committee members.

• All members qualify as “non-employee directors” for purposes of Rule 16b-3 under the Exchange Act and satisfy the requirements of “outside directors” pursuant to §162(m) of the Internal Revenue Code, as amended.

|

Primary Responsibilities:

• Annually evaluate the CEO’s performance with respect to the corporate goals and objectives relevant to CEO compensation and recommend the terms and grant of the compensation paid to the CEO.

• Annually review and approve the evaluation process and compensation structure for the Company’s executive officers as recommended by the CEO. Review the performance of the Company’s executive officers and approve the terms and grant of their compensation.

• Oversee the administration of the Company’s compensation plans, benefit plans, incentive plans and equity-based plans, approve plan amendments, oversee compliance, interpret plan guidelines, and determine grants to employees, in a manner consistent with the terms of such plans.

• Review non-employee director compensation and how those practices compare with those of comparable public corporations and recommend changes to the Board, when appropriate.

• Review and recommend to the Board for approval compensation plans, policies, programs, and amendments to existing compensation plans, designed to attract, retain, motivate, and appropriately reward employees.

• Oversee the Company’s compliance with SEC rules and regulations regarding any “say on pay” or other shareholder vote regarding Morningstar’s compensation programs and review the results of any such votes or other shareholder engagement.

• Review emerging compensation and benefit trends, best practices, and regulatory developments applicable to the Company, and report and make recommendations to the Board regarding such developments, as appropriate.

• Review Morningstar’s compensation policies and practices and assess whether such policies and practices are reasonably likely to encourage risk taking that would have a material adverse effect on the Company.

| |

24 2022 Proxy Statement

| Board of Directors and Corporate Governance |

NOMINATING AND CORPORATE GOVERNANCE COMMITTEE

| ||

Members:

Bill Lyons (chair) Robin Diamonte Steve Kaplan Gail Landis Caroline Tsay

Meetings Held in 2021: 4

• All members are independent within the meaning of the Nasdaq standards of independence for directors.

|

Primary Responsibilities:

• Review the qualifications of, approve, and recommend to the Board those persons to be nominated for membership on the Board who shall be submitted to the shareholders for election at each annual meeting of shareholders.

• Review and make recommendations to the Board regarding the appropriate size, performance, composition, duties, and responsibilities of the Board and its committees.

• Oversee searches for candidates for election to the Board and recommends criteria and individuals for appointment to the Board and its committees.

• Review and recommend to the Board tenure and retirement policies and actions taken in response to a resignation offer from any director with a significant job change for non-employee directors.

• Monitor compliance by directors, the CEO, and other executive officers with the Company’s stock ownership and retention guidelines and conflicts of interest policies.

• Review and make recommendations to the Board regarding the function, structure, and operation of the Board and the orientation and continuing education of directors.

• Review the Company’s material governance and ethics policies, oversee compliance therewith, and consider any significant requests for waivers or interpretations of such policies.

• Review, and make recommendations to the Board regarding, management’s response to shareholder proposals properly submitted to the Company.

• Review emerging corporate governance trends, best practices, and regulatory developments applicable to the Company.

• Oversee risks related to the Company’s governance structure, policies, and processes.

• Review the CEO’s corporate goals and objectives and monitor performance toward such goals.

• Oversee compliance by Morningstar and its subsidiaries with applicable laws and regulations.

| |

25

25

| Board of Directors and Corporate Governance |

Engagement with Management and Other Stakeholders

The commitment of our directors extends well beyond the preparation for, and attendance at, regular and special meetings. Engagement beyond the boardroom provides our directors with additional insights into our business and industry, as well as valuable perspectives on performance and opportunities for future growth. Some examples of the ways in which the Board contributes meaningfully to Morningstar’s success outside of the boardroom include the following:

| • | Press and Media Information: Our directors receive frequent updates on significant developments and informational packages including press coverage and current events that relate to Morningstar’s business, people, and industry. |

| • | Product Demos: These in-depth sessions, thematic workshops, and topical roundtables provide Board members detailed background on Morningstar’s products and services and facilitate real-time feedback on key initiatives. |

| • | Talent Development: Our directors spend time with employees and managers throughout the organizational structure, sharing insights and experiences as a development and retention tool and to instill Morningstar’s culture across the organization. |

| • | Strategy Day: Each year we host a strategy day bringing together our Board with Morningstar’s executive leadership team to discuss challenges and opportunities facing the business. |

| • | Stakeholder Engagement: Our directors maintain key relationships with stakeholders, including employees, customers, suppliers, regulators, industry associations and communities. |

Shareholder Engagement