UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

| FORM 10-K | ||||||||||||||

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||

For the fiscal year ended December 31, 2023

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||

For the transition period from to

Commission File Number: 000-51280

MORNINGSTAR, INC.

(Exact Name of Registrant as Specified in its Charter)

| Illinois | 36-3297908 | |||||||

| (State or Other Jurisdiction of | (I.R.S. Employer | |||||||

| Incorporation or Organization) | Identification Number) | |||||||

22 West Washington Street

Chicago, Illinois

60602

(Address of Principal Executive Offices) (Zip Code)

(312) 696-6000

(Registrant's Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered | ||||||

| Common stock, no par value | MORN | The Nasdaq Stock Market LLC | ||||||

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☒ | Accelerated filer | ☐ | Non-accelerated filer | ☐ | Smaller reporting company | ☐ | Emerging growth company | ☐ | ||||||||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of shares of common stock held by non-affiliates of the registrant as of June 30, 2023 was $5.1 billion. As of February 16, 2024, there were 42,728,182 shares of the registrant's common stock, no par value, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Certain parts of the registrant's Definitive Proxy Statement for the 2024 Annual Meeting of Shareholders, which will be filed not later than 120 days after the registrant's fiscal year ended December 31, 2023, are incorporated into Part III of this Form 10-K.

Table of Contents

2

Part I

Item 1. Business

Our Mission

Our mission is to empower investor success and everything we do at Morningstar is in the service of the investor. The investing ecosystem is complex, and navigating it with confidence requires a trusted, independent voice. We deliver our perspective to institutions, advisors, and individuals with a single-minded purpose: to empower every investor with conviction that they can make better-informed decisions and realize success on their own terms.

Our Business

Morningstar, Inc. is a leading global provider of independent investment insights. Our core competencies are data, research, and design, and we employ each of these to create products that clearly convey complex investment information. We started with affordable publications for individuals, then moved to creating technology solutions for professionals to help them research and select investments for clients. Today, we offer a variety of products and solutions that serve a wide range of market participants, including individual and institutional investors in public and private capital markets, financial advisors and wealth managers, asset managers, retirement plan providers and sponsors, and issuers of fixed-income securities. We also apply our investing expertise to managing assets for clients who prefer to employ the expertise of professional portfolio management teams. Since our founding in 1984, we’ve expanded our presence in global markets where investors need an independent view they can trust.

We structure our business to help investors in three key areas. First, we support individuals, financial advisors and wealth managers, asset managers, and institutions who make their own investment decisions. Through our Morningstar Data and Analytics and PitchBook segments and our Morningstar Sustainalytics products, our customers have access to a wide selection of investment data, fundamental equity research, manager research, private capital markets research, environmental, social, and governance (ESG) ratings, fund ratings, and indexes directly on our proprietary desktop or web-based software platforms, or through direct data feeds, direct shares, streaming capabilities and application programming interfaces (APIs). Major product areas and products within our Morningstar Data and Analytics segment include Morningstar Data, Morningstar Direct, Morningstar Advisor Workstation, and Morningstar Research, while the PitchBook segment includes the PitchBook Platform and data as well as Leveraged Commentary & Data (LCD).

Second, through our Morningstar Wealth and Morningstar Retirement segments, we provide investment management services and advisor tools and platforms. Morningstar Wealth's managed portfolio offerings help advisors deliver investor-friendly products based on our valuation-driven, fundamentals-based approach to investing, applying Morningstar's expertise in asset allocation, investment selection, and portfolio construction. Meanwhile Morningstar Wealth's practice and portfolio management software allows advisors to continually demonstrate their value to clients, from aggregating client accounts to provide visibility into holdings and creating an initial investment proposal, to reporting portfolio performance and providing automated rebalancing. Through Morningstar Retirement, we help retirement plan sponsors and retirement specialist advisors build high-quality savings programs for employees. Morningstar Wealth includes Investment Management, Morningstar.com, and Morningstar Office. In addition, we provide investable solutions to build portfolios based on unique Morningstar intellectual property through our Morningstar Indexes products. Investors also use our indexes as benchmarks, to create investable products based off our proprietary research, or to construct portfolios using customized indexes.

Finally, through our Morningstar Credit segment, Morningstar DBRS provides independent credit ratings services for financial institutions, corporate and sovereign entities, and structured finance products and instruments.

While other companies may offer research, ratings, data, software products, indexes, or investment management services, we are one of the few companies that can deliver all of these with the mission of empowering investor success. We believe that focus on putting investors first, paired with the way we use design and technology to communicate complex financial information, sets us apart from our peers in the financial services industry.

3

Our Data, Research, and Ratings

Morningstar’s trusted data, research, and ratings underpin everything we do across our business. Our data covers a wide range of investment offerings, including managed investment products, publicly listed companies, private companies, fixed-income securities, private credit, and bank loans.

We focus our data, research, and ratings efforts on several areas:

Manager research (including mutual funds, exchange-traded funds, separately-managed accounts, and other vehicles)

We’ve been providing independent analyst research on managed investment strategies since the mid-1980s. In 2023, we united our two forward-looking managed investment ratings–the Morningstar Analyst Rating and the Morningstar Quantitative Ratings for funds–into a single rating: the Morningstar Medalist Rating. Decades of experience blending human and machine-driven research and analysis already underpinned our qualitative and quantitative ratings approaches. Combining them into a one ratings system reflects our confidence in the efficacy and quality of the combination at scale. The combination leaves underlying methodologies for analyst and quantitative ratings unchanged but simplifies how we present our ratings to investors and makes it easier to analyze, select, and monitor managed investments. The Medalist Rating covers more than 179,000 mutual funds, exchange-traded funds (ETFs), separately managed accounts, and model portfolios and more than 412,000 share classes worldwide. This augments other quantitative ratings and analytics, such as the Morningstar Rating for funds (the “star rating”), which ranks managed investment strategies such as mutual funds based on their past risk-adjusted performance versus their Morningstar category peers. We also publish research and ratings on state-sponsored college-savings plans, target-date funds, and health-savings accounts.

In addition, the Morningstar Style Box visually depicts a strategy’s underlying investment style, making it easier to compare investments and build portfolios. The star rating and style box have become important tools that millions of investors and advisors use to make investment decisions.

We also offer the Morningstar Sustainability Rating, Low Carbon Risk Designation, and Sustainability Summary to help investors evaluate funds based on ESG factors.

As of December 31, 2023, we had more than 130 manager research analysts and other researchers globally, including teams in North America, Europe, Australia, and Asia.

Public company and private market research

As part of our research efforts on individual stocks, we popularized the concepts of economic moat, a measure of competitive advantage originally developed by Warren Buffett, and margin of safety, which reflects the size of the discount in a stock's price relative to its estimated value. The Morningstar Rating for stocks is based on the stock's current price relative to our analyst-generated fair value estimates, as well as the company's level of business risk and economic moat. Our analysts cover approximately 1,600 companies using a consistent, proprietary methodology that focuses on fundamental analysis, competitive advantage assessment, and intrinsic value estimation. Morningstar’s data and research on publicly traded companies is used extensively in our products and solutions, such as institutional equity research, Morningstar Indexes such as the Morningstar Wide Moat Focus Index, our Global Market Barometer, and as a basis for equity portfolio strategies used in Morningstar Managed Portfolios.

Morningstar adheres to a globally consistent framework that integrates ESG risk into our equity research. Analysts identify valuation-relevant risks for each company using Morningstar Sustainalytics' ESG Risk Ratings, which measure a company's exposure to material ESG risks, and then evaluate the probability that those risks materialize and the associated valuation impact. Results from this research inform Morningstar's assessment of a stock's intrinsic value and the margin of safety required before assigning a Morningstar Rating for stocks.

4

PitchBook’s Institutional Research Group is a provider of investment strategy, fund performance and industry research. The group leverages PitchBook’s proprietary data, such as valuations, deal multiples, and fund returns, to deliver analysis that allows clients to quickly gauge trends, price transactions, assess risks and identify notable company sets in the private capital markets. As of December 31, 2023, the team provides coverage of the private equity, venture capital, real assets, leveraged loan, high-yield bond, and private credit asset classes. PitchBook also provides full-time analyst coverage of emerging technology industries, delivering comprehensive assessments of disruptive sectors to help clients better segment and size markets, understand company and investor landscapes, evaluate opportunities, and develop conviction around the growth trajectories of emerging industries.

As of December 31, 2023, we had 128 public equity researchers and 35 private markets researchers globally, making us one of the largest providers of independent equity research. In addition to our analyst-driven coverage, we provide quantitative ratings and reports for approximately 59,000 publicly traded companies across Morningstar's solutions and cover 3.8 million privately-held companies through the PitchBook Platform.

Credit ratings

Morningstar DBRS provides global credit ratings as the world’s fourth largest credit rating agency. We rate more than 4,000 issuers and 60,000 securities worldwide, providing independent credit ratings for financial institutions, corporate and sovereign entities, and structured finance products and instruments. Our goal is to bring more clarity, diversity, and responsiveness to the ratings process. Our approach and size provide the agility to respond to customers’ needs with the necessary expertise and resources.

As of December 31, 2023, we had 549 credit rating analysts and analytical support staff based in the United States (U.S.), Canada, Europe, and India.

ESG ratings

Morningstar Sustainalytics’ ESG Risk Ratings empower investors by providing them with the tools to assess financially material ESG risks that could affect the long-term performance of their investments at the security, fund, and portfolio levels. The ratings introduce a single measurement unit to assess ESG risks across 20 different material ESG issues (MEIs). Unlike other ESG ratings that are based on a relative, best-in-class approach, Morningstar Sustainalytics’ ESG Risk Ratings are designed to provide a powerful signal of a company’s absolute ESG risk that is comparable across peers and sub-industries while allowing for aggregation at the portfolio level. As of December 31, 2023, we rated more than 19,000 companies worldwide, and offered more than 13,700 ESG Risk Ratings free to the public so that any investor can benefit from our research.

As of December 31, 2023, we employed over 750 ESG research and data analysts based in the U.S., Canada, Europe, and Asia.

Our Segments and Products

We operate our business through five reportable segments: Morningstar Data and Analytics, PitchBook, Morningstar Wealth, Morningstar Credit, and Morningstar Retirement. All remaining operating segments and business activities that are not significant enough to require separate reportable segment disclosure are referred to as, and included in, Corporate and All Other in our Consolidated Financial Statements.

Morningstar Data and Analytics

Morningstar Data and Analytics provides investors comprehensive data, research and insights, and investment analysis to empower investment decision-making. Morningstar Data and Analytics includes Morningstar Data, Morningstar Direct, Morningstar Advisor Workstation, Direct Web Services, Morningstar Research Distribution, and Morningstar Publishing System. These products provide seamless access to Morningstar's managed investment, public equities, and fixed-income data, with a focus on making the work of portfolio managers, product developers, marketers, advisors, and analysts more efficient and effective. Morningstar Data, Morningstar Direct and Morningstar Advisor Workstation are the largest product areas in this segment.

5

Morningstar Data's licensed data gives asset managers, redistributors, and wealth managers independent, comprehensive, and timely data and research they can use to empower investor success. Our offering spans managed investments (including mutual funds, ETFs, separate accounts, collective investment trusts, and model portfolios), equities, and fixed income securities and is available globally.

We are well-known for enriching raw data on managed investments with research-driven intellectual property, resulting in proprietary statistics, such as the Morningstar Category, Morningstar Style Box, and Morningstar Rating, which we distribute through licensed data feeds. We also offer a wide range of other data sets, including information on investment performance, risk analytics, full historical portfolio holdings, operations data (such as managed investments’ fees and expenses), cash flows, financial statement data, consolidated industry statistics, and investment ownership.

Clients license Morningstar Data to build transparent products and services that investors, from those just starting out to sophisticated and high net worth individuals, can understand and use to reach their investing goals. Morningstar Data is used to serve retail investors and their intermediaries, supporting a variety of investor communications, including websites, print publications, and marketing fact sheets, as well as for internal research and product development. Demand for Morningstar Data has increased as clients build digital solutions, prepare for regulatory requirements, and incorporate automation, artificial intelligence (AI), machine learning, and other forms of data analytics into their workflows. We’re committed to covering our clients’ whole portfolios and offering the data they need to make informed investment decisions.

Our goal is to offer clients data that is available quickly and in the format most appropriate for their workflows. Our data feeds enable our clients to discover the data that they need, and to schedule delivery in S3, FTP, CSV, XML, JSON, Text, and TSV output formats. We provide access to Morningstar Data utilizing an application programming interface (API) format to download and process large data files. The Morningstar Data team applies emerging methods in AI to regression, classification, deep learning, natural language processing, and optical character recognition to extract data from structured and unstructured content. The Morningstar Data team uses a "human in the loop" approach where machine inferences are presented to a data analyst for validation. Validated data is published in Morningstar products and used to retrain and continuously improve the Morningstar Data team's machine learning models. This approach enables Morningstar to produce data faster without compromising the quality of data that our clients use in making sound investment decisions.

Pricing is based on the number of investment vehicles, the amount of information provided for each security, the frequency of updates, the method of delivery, the size of the licensing firm, the level of distribution, and the intended use by the client, otherwise known as the “use-case.”

In 2023, Morningstar Data’s largest markets were North America and Europe.

Our main global competitors for mutual fund data include FE fundinfo and LSEG (Refinitiv). We also compete against smaller players that focus on local or regional information.

For market and equity data, we primarily compete with Bloomberg, FactSet, ICE Data Services, LSEG (Refinitiv), and S&P Global.

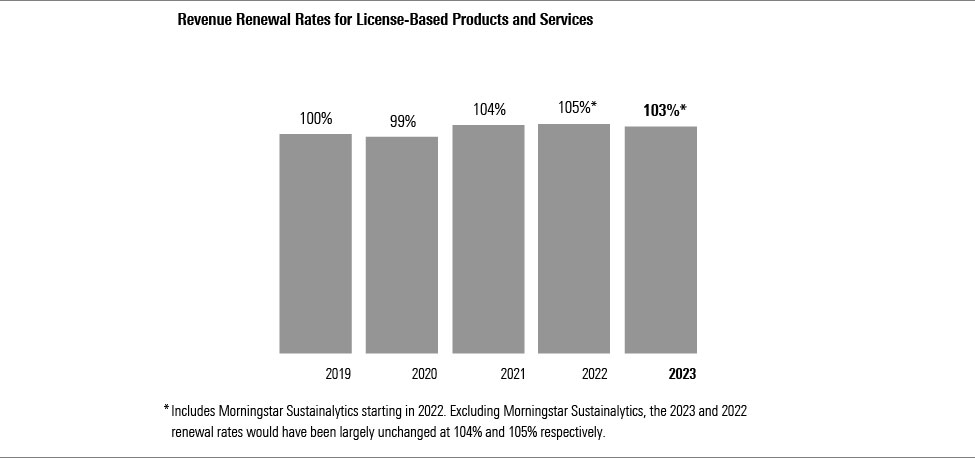

We estimate that the annual revenue renewal rate for Morningstar Data was approximately 104% in both 2023 and 2022.

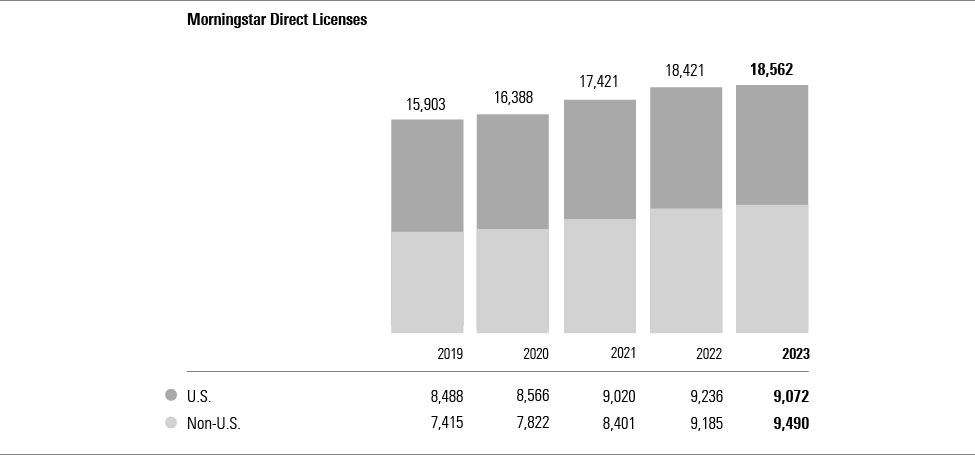

Morningstar Direct is an investment-analysis and reporting platform that delivers rich data and analytics across asset classes and streamlines the creation and distribution of collateral to client-facing groups and internal teams. Built on Morningstar's global database of registered and non-registered securities and data from third-party providers, the platform helps equity and multi-asset strategy asset managers with market research, product positioning, competitive analysis, and distribution strategies. Wealth managers predominately use the tool to assist with manager research, fund selection, and the construction, monitoring, and distribution of model portfolios.

6

In 2023, we laid the groundwork for the future of Morningstar Direct with several important releases. Direct Lens is a new experience inside Morningstar Direct that unifies our portfolio capabilities in a clear and intuitive interface, so users spend less time searching for the right tools and more time analyzing data. Self-service data feeds in Morningstar Direct give users a new way to get the data they want, when they need it, in the format they need. And the Morningstar Data Python package gives data scientists, data strategists, and quantitative analysts access to our data in favorite coding environments, so they can combine our data with proprietary or third-party data to explore new frontiers of data science. During the year, we also expanded the datapoints, calculations, and portfolio-level data in Morningstar Direct, enriching our data coverage across fixed income, ETFs, ESG, model portfolios, and alternatives to reflect investors' more complex and dynamic strategies.

Morningstar Direct is a desktop application that is installed locally on users’ computers. The Morningstar Direct desktop application connects over the internet to databases and application servers hosted primarily in Morningstar data centers, with some use of cloud (AWS) infrastructure. A large portion of Morningstar Direct’s features and functionality are delivered using modern web components and frameworks delivered within the legacy application.

Pricing for Morningstar Direct is based on the number of licenses purchased. We have simplified our licensing model to eliminate charges for add-on features to maximize our customer experience and allow users to extract more value from our products.

Morningstar Direct's primary markets are North America and Europe.

Morningstar Direct's primary competitors are Bloomberg, eVestment Alliance, FactSet Research System’s Cognity and SPAR, Refinitiv’s Eikon, Strategic Insight’s Simfund, and Zephyr.

We estimate that our annual revenue renewal rate for Morningstar Direct in 2023 was approximately 101% versus 99% in 2022.

Morningstar Advisor Workstation is a connected suite of tools spanning proposal creation, investment research, investment planning, and more designed to help our clients provide great advice to their clients. It is powered by Morningstar’s data, research, investor profiling tools, and robust portfolio analytics.

The software is typically sold through an enterprise contract and is primarily for retail advisors because of its strong ties and integration with home-office applications and processes and a library of Financial Industry Regulatory Authority (FINRA) reviewed reports that meet compliance needs. It allows advisors to build and maintain a client portfolio database that can be fully connected with the home-office firm's back-office technology and resources. This helps advisors present and illustrate their portfolio investment strategies, show the value of their advice, and meet existing and emerging regulatory requirements, all at scale.

7

In 2023, we continued to enhance Morningstar Advisor Workstation. We launched the Investment Planning Experience, a new workflow which helps advisors meet demand for more personalized advice for investors. We also introduced Enterprise Analytics, which offers firms deeper visibility and insights into firm wide advisor activity, including better visibility into compliance risk from proposal generation. The compliance dashboard supports firm monitoring activities by sharing insights into how proposals align to firm compliance policies for key regulations such as Regulation Best Interest in the U.S. and the Client Focused Reforms in Canada.

We also continued to build out the App Hub ecosystem, a two-sided digital marketplace initially introduced in 2022 where clients can access third-party applications that connect into the platform. Enhancements to the ecosystem included making several new app providers available to advisors, including Asset-Map and iCapital. With access to a growing marketplace of advisor-tech and advisor-services applications, our clients can build on their subscription of Morningstar Advisor Workstation with additional tools designed to help them create better and differentiated advice.

Pricing for Morningstar Advisor Workstation for our enterprise clients varies based on the number of users, the number of research databases licensed, and level of functionality deployed. We charge fixed annual fees per licensed user for a base configuration of Advisor Workstation, but pricing varies significantly based on the scope of the license. We also provide a three-tiered pricing model for individual subscribers who are not affiliated with an active enterprise client.

Morningstar Advisor Workstation is offered in the U.S. and Canada.

Competitors for Morningstar Advisor Workstation include Broadridge, CapIntel, Orion, Riskalyze, and YCharts. Occasionally, broker/dealers also decide to build their own internal tools and attempt to bring their advisors’ practice management tools in-house.

We estimate that our annual revenue renewal rate for Advisor Workstation for 2023 was approximately 93% versus 89% in 2022.

PitchBook

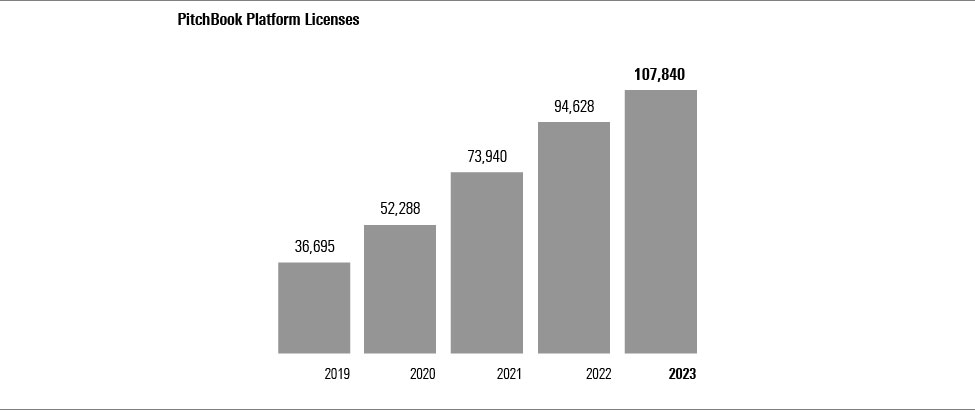

PitchBook provides investors with access to a broad collection of data and research covering the private capital markets, including venture capital, private equity, private credit and bank loans, and merger and acquisition (M&A) activities. Investors can also access Morningstar's data and research on public equities. The PitchBook segment is primarily comprised of the PitchBook Platform, but also includes direct data (which is also included in the PitchBook product area as reported in 2023), as well as buyside equity data and LCD.

The PitchBook Platform is an all-in-one web-hosted solution for investment and research professionals, including venture capital and private equity firms, corporate development teams, investment banks, limited partners, lenders, law firms, and accounting firms. Clients rely on PitchBook for a central, easy-to-use platform that provides access to the broadest collection of data and research covering the private capital markets as well as Morningstar's data and research on public equities. In addition to the PitchBook Platform, PitchBook also offers a mobile application, customer relationship management (CRM) integrations, Excel and PowerPoint plug-ins, data feeds, and flexible, à la carte data solutions that allow clients to access a variety of data points on demand.

To accommodate our clients' diverse needs, the platform offers data and analytical tools including company profiles for both private and public companies, advanced search functionality, and other features that help to inform discovery and research, and optimize workflow by surfacing relevant information and insights. Our clients source deals, raise capital, build buyer lists, benchmark funds, and network with the PitchBook Platform.

8

The 2022 acquisition of LCD added leveraged loan and high-yield bond data, news, and analysis to PitchBook’s capabilities. During 2023, PitchBook substantially completed the integration of LCD’s core data offering and LCD research and news onto the PitchBook Platform, adding significantly to PitchBook’s existing debt transaction, issuer, and borrower coverage and positioning it as a one-stop shop for private finance transaction data, news, and research. PitchBook’s integration of LCD data introduced 53,000 debt financing rounds, 92,000 loan and bond facilities underneath those financing rounds, and 15,000 issuers, in addition to PitchBook’s existing database of more than 400,000 private credit transactions. During 2023, the PitchBook Platform’s private credit coverage was expanded to include data on an additional 9,800 credit events, 2,200 unique loan transactions and 330 unique collateralized loan obligations. We also launched the Credit Pitch newsletter, which had a subscriber base of more than 240,000 as of December 2023.

In 2023, PitchBook continued to expand the reach of its public and private equity data and introduced new capabilities to inform investor strategies and provide context on market shifts and the expansion and contraction of verticals. Key enhancements included the introduction of a new clinical trials dataset to evaluate biotech and pharma companies, and the VC Exit Predictor, a proprietary tool and scoring methodology to predict exit outcomes for VC-backed companies. At the same time, PitchBook continued to enhance its core datasets across global venture capital, private equity, and M&A, with a focus on the expanding number of companies, deals and funds under coverage in the Middle East, Africa, Latin America and Asia-Pacific regions as it added approximately 80,000 deals in these regions. Finally, to support deal execution and valuation workflows, PitchBook enhanced its public equity datasets and capabilities with the addition of more detailed industry metrics and improved timeliness and quality of information on public company profiles.

Additionally, PitchBook invested in new capabilities and data sets to help limited partners (LPs) make better allocation decisions using our comprehensive and transparent fund data. These include a new benchmark experience to streamline performance benchmarking workflows and the introduction of the Manager Scoring tool, a new methodology that helps limited partners discover and evaluate top performing private fund managers.

Pricing for the PitchBook Platform is based on the number of seats, with standard base license fees per user and customized prices for large enterprises, boutiques, and startup firms.

In 2023, PitchBook’s largest markets were North America and Europe.

PitchBook's main competitors are CB Insights, Preqin, and S&P Global Market Intelligence as well as certain smaller, niche competitors.

In 2023, we estimate that our annual revenue renewal rate for the PitchBook Platform was approximately 112% versus 121% in 2022.

PitchBook had 107,840 licensed users worldwide as of December 31, 2023.

9

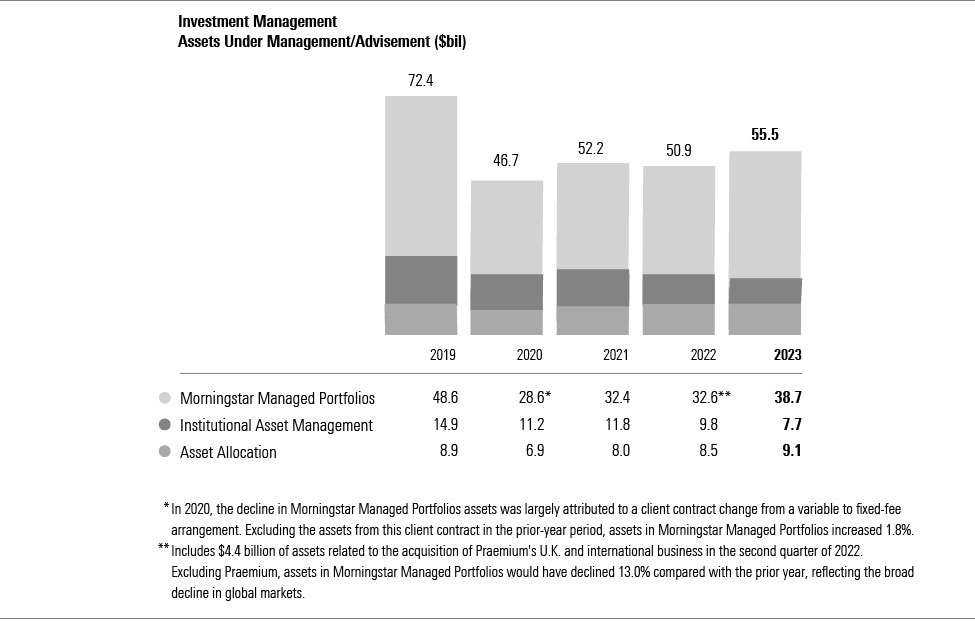

Morningstar Wealth

Morningstar Wealth’s mission is to empower both advisors and investors to succeed. Morningstar Wealth brings together Investment Management, which includes our model portfolios and wealth platforms; practice and portfolio management software for registered investment advisers (RIAs) (Morningstar Office); data aggregation and enrichment capabilities (ByAllAccounts); and our individual investor platform (Morningstar.com). Morningstar Wealth products are designed to streamline workflows, and help advisors deliver scalable and customized advice, with the ultimate goal of helping clients achieve their long-term financial goals. As of December 31, 2023, Morningstar Wealth assets under management and advisement (AUMA) totaled $55.5 billion.

Investment Management’s flagship offering is Morningstar® Managed Portfolios, an advisor service consisting of model portfolios designed for fee-based independent financial advisors. Our core markets are the U.S., U.K., South Africa, and Australia. We target like-minded advisors who hire us to manage a substantial portion of their client’s assets in alignment with our principles of putting investors first, keeping costs low, and investing for the long-term. We build our multi-asset strategies using mutual funds, ETFs, and individual securities, and tailor them to meet specific investment time horizons, risk levels, and projected outcomes. In 2023, net flows exceeded $2.8 billion across our Managed Portfolios.

Morningstar Managed Portfolios are available through two core distribution channels: the Morningstar Wealth Platforms, which offer fee-based discretionary asset management services, also known as a turnkey asset management program (TAMP) in the U.S.; or as strategist models on third-party managed account platforms. We charge asset-based program fees for Managed Portfolios, which are typically based on the distribution channel (i.e., TAMP versus strategist models) and the products contained within the portfolios. We offer the Morningstar Wealth Platforms in the U.S. and in Europe, Middle East, and Africa (EMEA). We serve as a fund and model provider in our other international markets.

Our U.S. and EMEA wealth platforms are end-to-end digital investing experiences, designed to meet the unique needs of the local region and offering access to our model portfolios. Advisors working with our U.S. wealth platform also have access to a curated selection of third-party portfolios that have undergone a rigorous selection process, as well as our direct indexing capabilities, which allow advisors to personalize index portfolios to address their clients’ individual preferences and tax management needs. Our proprietary wealth platforms offer functionality such as risk assessments, proposals, digital account opening and ongoing management, client reporting, customer support, marketing services, and back-office features, such as trading and billing services. Using our wealth platform allows U.S.-based advisors share fiduciary responsibility with us.

In addition to Morningstar Managed Portfolios, other services we provide include institutional asset-management (e.g., act as a subadvisor) and asset-allocation services for asset managers, broker/dealers, and insurance providers. We offer these services through a variety of registered entities in Australia, Canada, the United Arab Emirates (UAE), France, Japan, South Africa, the U.K., and the U.S.

We base pricing for institutional asset-management and asset-allocation services on the scope of work, our degree of investment discretion, and the level of service required. For most of our contracts, we receive asset-based fees.

For Morningstar Managed Portfolios offered through our U.S. Morningstar Wealth Platform and the Morningstar Wealth Platform itself, our primary competitors are AssetMark, Envestnet, Orion/Brinker Capital, and SEI Investments Company. Our primary strategist offering competitors are BlackRock, Russell, and Vanguard in the U.S., and we face competition from Financial Express and Tatton in EMEA, and Elston, Iress, Lonsec, Russell, and Zenith in Australia. We also compete with in-house research teams at independent broker/dealers who build proprietary portfolios for use on brokerage firm platforms, as well other registered investment advisers that provide investment strategies or models on these platforms.

10

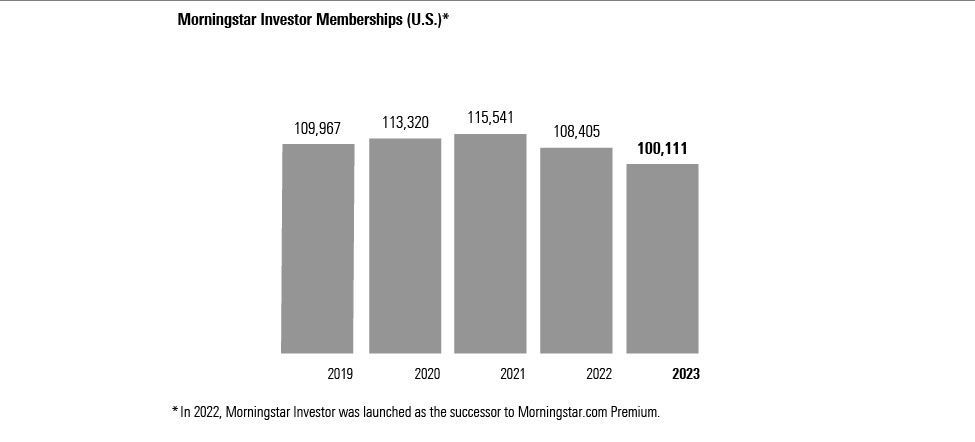

Morningstar.com helps individual investors discover, evaluate, and monitor stocks, ETFs, and mutual funds; build and monitor portfolios; and monitor the markets. Revenue is generated from paid memberships for Morningstar Investor, Morningstar Premium, and internet advertising sales. Morningstar Investor is the successor to Morningstar Premium in the U.S. and Australia.

Our Morningstar Investor offering is focused on providing transparency into investment choices to enable investors to make informed decisions about their portfolios. Members have access to proprietary Morningstar research, ratings, data, and tools, including analyst reports, portfolio management tools (such as Portfolio X-Ray), and stock and fund screeners. We offer Investor and Premium memberships in Australia, Canada, Italy, the U.K., and the U.S.

Unlike many consumer-facing websites, Morningstar.com sells advertising space directly to advertisers. This approach allows us to build meaningful relationships with our advertisers and helps us protect the integrity of our brand.

In 2023, we continued to invest in the technology platform supporting Morningstar.com, with notable enhancements including data infrastructure and web performance upgrades. These allowed us to introduce new experiences such as our Asset Management Company pages and our revamped stock quote page with new portfolio exposure and customizable data point functionality. We also continued to develop our individual investor digital portfolio and research tools in Morningstar Investor, which are designed to make it easier for individuals to better understand what they own across their full portfolio, find new investment ideas, and make more informed investment decisions. We charge a monthly or annual subscription fee for Morningstar Investor and Morningstar Premium and an annual subscription fee for Morningstar Newsletters.

Morningstar.com primarily competes with trading platforms that concurrently offer research and investing advice, such as Fidelity, Schwab, and TD Ameritrade. Research sites, such as Seeking Alpha, The Motley Fool, and Zacks Investment Research, also compete with us for paid membership. In addition, free or “freemium” websites, such as Dow Jones/Marketwatch and Yahoo Finance, are also competitors for some customers. Kiplinger, TheStreet.com, and The Wall Street Journal all compete for the advertising dollars of entities wishing to reach an engaged audience of investors.

11

As of December 31, 2023, Morningstar.com had more than 100,000 paid Morningstar Investor members in the U.S. plus an additional roughly 12,500 Premium and Morningstar Investor members across other global markets.

Morningstar Credit

Morningstar Credit provides investors with credit ratings, research, data, and credit analytics solutions that we believe contribute to the transparency of international and domestic credit markets. Morningstar Credit includes Morningstar DBRS and Morningstar Credit data and credit analytics.

Morningstar DBRS is the fourth largest credit rating agency in the world, offering a wide range of credit rating services and products. Morningstar DBRS generates its revenue from providing independent credit ratings on financial institutions, corporates, and sovereigns, as well as on securitizations and other structured finance instruments, such as asset-backed securities (ABS), residential mortgage-backed securities (RMBS), commercial mortgage-backed securities (CMBS), and collateralized loan obligations (CLO). The credit analysis and the assignment of credit ratings can take place on issuance of new bonds or on a continuous basis for existing credit exposures. The fees to the issuer are based on the type of issuance, the size of the transaction, and the complexity of the analysis.

Credit ratings are forward-looking opinions on credit risk that reflect the creditworthiness of a company or fixed-income security. They are determined within the framework of a ratings committee that represents a collective assessment of Morningstar DBRS’s opinion rather than the opinion of an individual analyst. These credit ratings are based on information that incorporates both global and local considerations and the use of approved methodologies and are determined in compliance with policies and procedures designed to avoid or manage conflicts of interest. Morningstar DBRS’s credit rating methodologies are publicly available and support the objectivity and integrity of the credit rating process. Morningstar DBRS also offers a micro-website dedicated to ESG factors deemed relevant to credit ratings analysis.

In addition to ratings and research opinions, Morningstar DBRS also offers data products derived from its ratings activities and analytical tools. These include ratings data feeds that can be integrated into companies’ internal databases, web-based research, and analytical tools.

In 2023, Morningstar DBRS’s largest markets by revenue were the U.S., followed by Canada and EMEA.

Morningstar DBRS competes with several other firms, including Fitch, Kroll Bond Ratings, Moody’s, and S&P Global Ratings.

For 2023, we estimate that transaction-based fees comprised 50% of Morningstar DBRS's revenue; the remainder can be classified as transaction-related, or revenue generated by annual fees tied to surveillance, research, and other services.

12

Morningstar Retirement

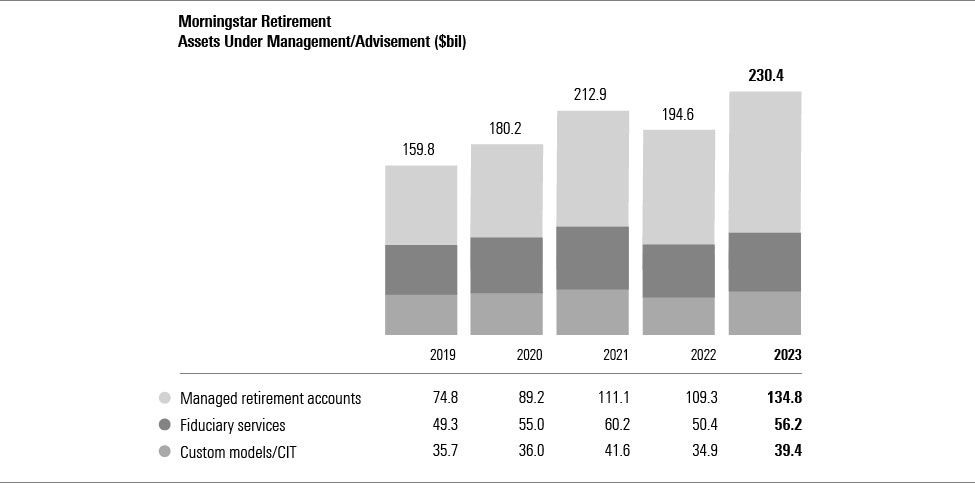

Morningstar Retirement offers products designed to help individuals reach their retirement goals. Its offerings include managed retirement accounts (MRA), fiduciary services, Morningstar Lifetime Allocation funds, and custom models. As of December 31, 2023, Morningstar Retirement AUMA totaled $230.4 billion.

Delivered primarily through the Morningstar Retirement Manager platform, our MRA program helps retirement plan participants define, track, and achieve their retirement goals. As part of this service, we deliver personalized recommendations for a target retirement income goal, a recommended contribution rate to help achieve that goal, a portfolio mix based on our Total Wealth methodology, and specific investment recommendations. We then manage the participant’s investment portfolio for them, assuming full discretionary control. We also offer advisor managed accounts, a program that allows advisor firms to specify and assume fiduciary responsibility for the underlying portfolios that are used within MRA. We do not hold assets in custody for the MRA we provide.

Within the managed accounts market, there are three large players (MRA, Edelman/Financial Engines, and Fidelity) and several smaller players, which are a combination of legacy and newer players. Technology-based companies like Pontera are also creating competing services to our MRA by developing a back door into an individual’s retirement account that wealth managers can use to manage their clients’ retirement assets in real time. In our fiduciary services offering, we help plan sponsors build out and manage an appropriate investment lineup for their participants while helping to mitigate their fiduciary risk. Morningstar Plan Advantage is an extension of our fiduciary services that includes a technology platform that is designed to help advisors at broker/dealer firms to more easily offer fiduciary protection, provider pricing, and investment reporting services to their plan sponsor clients. Our main competitors in fiduciary services are Mesirow and Wilshire Associates, but we are starting to see growing competition from smaller players, such as LeafHouse Financial. Broker/dealers are also looking to introduce their own fiduciary services distributed through their advisors.

With our custom models, we offer two different services. We work with retirement plan record-keepers to design scalable solutions for their investment lineups, including target maturity models and risk-based models. We also provide custom model services direct to large plan sponsors, creating target date funds that are customized around a plan’s participant demographics and investment menus. For custom models, we often compete with retirement plan consultants. We also serve as a non-discretionary subadvisor and index provider for the Morningstar Lifetime Allocation Funds, a series of target-date collective investment trusts (CITs) offered by Benefit Trust to retirement plan sponsors. For the Lifetime Allocation Funds, we compete with other providers of target-date funds.

In 2023, we added around 250 plans and 5,100 participants across the 18 RIAs and one asset manager on our advisor managed accounts network. We also onboarded one of the nation’s largest retirement plans onto managed accounts, developed a new IRA managed accounts offering, and expanded our Morningstar Plan Advantage platform with our two existing large broker dealer clients.

Pricing for Morningstar Retirement is generally asset-based and depends on several factors, including the level of services offered (including whether the services involve acting as a fiduciary under the Employee Retirement Income Security Act, or ERISA), the number of participants, the level of systems integration required, total assets under management or advisement, and the availability of competing products.

13

Corporate and All Other

Corporate and All Other includes unallocated corporate expenses as well as financial results from Morningstar Sustainalytics and Morningstar Indexes.

Morningstar Sustainalytics provides ESG data, research, analysis, and insights to institutional investors globally, covering equity, fixed income, and sovereign asset classes. Our flagship ESG Risk Rating allows investors to assess financially material ESG risks that could affect the long-term performance of their investments. Morningstar Sustainalytics also serves corporate issuers and banking institutions through its corporate solutions products and is

a leading provider of green bond Second Party Opinions.

In addition to our risk management products, Morningstar Sustainalytics provides a range of sustainable-investing solutions for investors and financial professionals. We offer products such as our European Union Taxonomy solution, which are designed to enable investors to respond to emerging regulation surrounding sustainability reporting. Our data allows values-based investors to limit their exposure to controversial areas by applying exclusions to personalize their portfolios. Our active ownership data allows investors to understand if their sustainability funds are voting assets under management towards sustainability issues and whether a non-ESG fund is advancing other resolutions.

We’ve also expanded our data coverage and ratings to address specific sustainability themes. In 2023, we launched a Low-Carbon Transition Rating (LCTR) which provides a forward-looking, science-based evaluation of a company’s alignment with a net-zero pathway. The rating examines a firm's current management practices and answers the question: to what degree would the world warm if all companies behaved like the company examined?

In 2023, Morningstar announced a new strategic structure that more tightly connects the index capabilities of Morningstar Indexes with the ESG data, ratings, and research of Morningstar Sustainalytics.

Morningstar Sustainalytics operates on a subscription-based pricing model for its ESG research products, which supports a recurring revenue model. The corporate solutions unit deploys a model that combines one-time revenue with subscription-based recurring licensing revenue.

In 2023, Morningstar Sustainalytics' largest markets were EMEA and North America.

14

Major competitors for Morningstar Sustainalytics include FTSE Russell, Moody's, MSCI, and S&P Global. While the traditional ESG research market continues to consolidate, we expect that the market will continue to evolve as new entrants emerge and investors acquire ESG data from new distributors (for example, directly from stock exchanges). Large asset managers like BlackRock, State Street, UBS, and JP Morgan are also investing heavily to build in-house ESG capabilities and sustainable investing products. New technologies, specifically those that employ AI, are facilitating these trends by accelerating the sourcing and use of unstructured ESG data.

We estimate that our annual revenue renewal rate for Morningstar Sustainalytics' license-based products was approximately 97% in 2023 versus 100% in 2022.

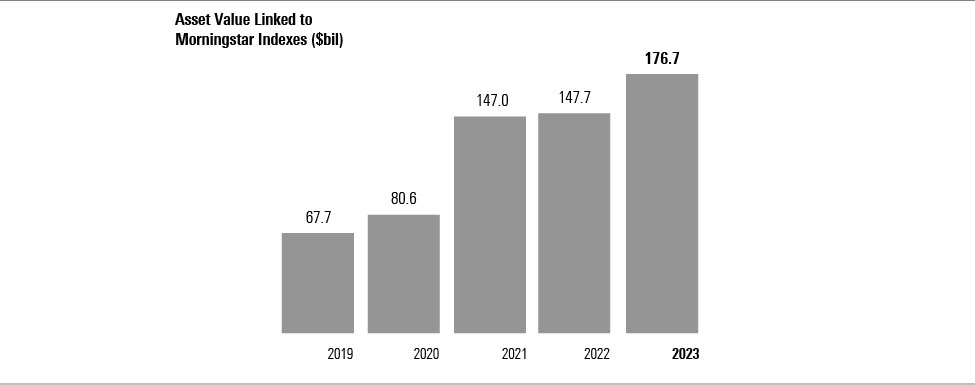

Morningstar Indexes offers a broad range of market indexes that can be used as performance benchmarks and as the basis for investment products and other portfolio strategies for a wide range of retail and institutional investor clients. Drawing on Morningstar's intellectual property, our global family of indexes tracks major global regions, strategies, and asset classes, including equity, fixed income, and multi-asset as well as private markets and sustainability.

We believe that investors and financial service providers today are looking for better value from their index provider, with demand for broad market indexes that are high quality but also inexpensive. We also believe that strategic beta indexes for investment strategies and market exposure, of growing importance to all investors, should be unique, research-driven and deliver better outcomes to investors. Morningstar is responding to this need by offering high-quality core beta benchmarks while delivering Morningstar research and insights through unique and differentiated strategic beta indexes.

In 2023, Morningstar Indexes completed a multi-year global project to bring index calculations in-house, significantly decreasing our reliance on outside vendors and bringing additional benefits to our clients and the business. We also introduced a number of new product innovations including the launch of global single factors indexes working with the Morningstar quantitative research team, the Next Gen AI Index in collaboration with Morningstar Equity Research, the Global Unicorn Industry Vertical Indexes working with PitchBook and Sustainable Activities Involvement Indexes with Morningstar Sustainalytics. Morningstar Indexes also broadened channels of distribution in 2023, with major advances in index licensing for direct indexing in the U.S. and for structured products in Europe. Further, in June 2023, Morningstar announced a new strategic structure that more tightly connects the index capabilities of Morningstar Indexes with the ESG data, ratings, and research of Morningstar Sustainalytics.

We license Morningstar Indexes to numerous institutions to use as the basis for ETFs, exchange-traded notes, mutual funds, derivatives and separately managed accounts. Firms license Morningstar Indexes for product creation (where we typically receive the greater of a minimum fee or basis points tied to assets under management) and data licensing (where we typically receive annual licensing fees). In both cases, pricing varies based on the level of distribution, the type of user, and the specific indexes licensed. In addition, Morningstar Indexes offers index calculation and administration services through its growing Index Services business.

In 2023, Morningstar Indexes’ largest markets were North America and EMEA.

Major competitors for Morningstar Indexes include Bloomberg Indices, FTSE Russell, MSCI, and S&P Dow Jones Indices (offered through S&P Global).

15

Our Strategy

16

Our strategy is to deliver insights and experiences that make us essential to investor workflow. Proprietary data sets, meaningful analytics, independent research, and effective investment strategies are at the core of the powerful digital solutions that investors across our client segments rely on. We have a keen focus on innovation across data, research, product, and delivery so that we can effectively cater to the evolving needs and expectations of investors globally.

We execute our strategy through four connected elements: our values, our work, our clients, and our brand. The interaction between these four elements has enabled Morningstar to establish a position in the industry that is differentiated from our competition. We believe that our intangible assets, including the strength of our brand and our unique intellectual property, are difficult for competitors to replicate. Additionally, we strive to provide our customers with demonstrable value from our solutions making them reluctant to undertake the cost of switching to other providers.

We are currently focused on the following four strategic priorities:

Deliver differentiated insights across asset classes to public and private market investors

Shifting investor needs and expectations, innovative investment approaches and technologies, and a changing political and regulatory environment continue to drive the evolution of the financial services industry. We remain committed to empowering the modern investor with new data, research, and analytics. This includes:

•Expanding our data, research, and analytics to deliver unique, personalized, and impactful insights to investors across asset classes.

•Optimizing our advisor platform and service position by driving innovation and delivering exceptional investment solutions to advisors, facilitating great outcomes for the clients they serve around the world.

•Providing regulatory and compliance solutions for our wealth, buy-side, and asset management clients.

•Pursuing actionable information and developing workflow tools to serve core use cases of identifying private market investment opportunities, raising capital, valuing companies and investments, and buying/selling a company.

Leverage advances in AI to drive innovation across internal and external products and services

Morningstar has always been at the forefront of technology, and we believe that AI is a significant technology that will redefine the investment landscape. We use the Intelligence Engine – the core for all Morningstar’s AI developments – across our teams to get better and faster at our work, by speeding up our data collection processes, detecting data errors and system outages, increasing our support team's responsiveness, and improving our client interactions throughout the entire buying journey. This includes:

•Combining the breadth of Morningstar’s data, research, and analytical capabilities with latest advances in AI to provide better, faster, and targeted insights to investors.

•Utilizing AI to improve the quality and efficiency of data collection, synthesis, and dissemination processes.

•Using AI as a tool to improve business productivity and enable team members to focus on more high-value work.

We seek to apply AI the Morningstar way—thoughtfully to provide investors the benefits of AI without compromising the integrity and privacy of their data. The Intelligence Engine is designed to advance our mission and support good investor outcomes by taking an approach that is ethical, secure, trustworthy, transparent, and accountable.

Drive operational excellence and scalability to support growth targets

Morningstar has grown significantly in the last few years, and as we have continued to focus on growth in 2023 and beyond, we are emphasizing execution and scalability in our operations, processes, and technology. This includes:

•Creating a secure, robust, and scalable infrastructure that leverages advanced technology in our data, research, and product quality and delivery efforts.

•Scaling the demand generation function across Morningstar and driving transformation in global sales, customer success, and customer support functions to improve sales effectiveness.

•Scaling corporate systems to create more integrated platforms that enable growth of business areas while reducing legacy system fragmentation.

17

Build an inclusive culture that drives exceptional talent engagement and development

Morningstar’s people and culture strategy is centered on providing a focused and differentiated approach to human capital driven by business needs. We are committed to cultivating a culture that develops talent and drives innovation. This includes:

•Strengthening the organization by investing in the people we have today and boosting resilience in our teams by building the bench of talent for the future. To drive a high-performance culture, we are focused on building the next generation of leaders at Morningstar with programs focused on our top performers, supporting and developing our managers, and modernizing our performance and talent management processes.

•Driving operational scale by continued enhancements to our integrated talent strategy focused on workforce, location, talent development, and early career programs; automating processes as appropriate; and leveraging our internal communications capabilities to meet the needs of our global employee footprint.

•Monitoring organizational well-being, including globally operationalizing workforce metrics to detect and mitigate structural barriers to inclusion and equity.

Our People and Culture

At Morningstar, our people are our most important asset. We are committed to fostering an environment where the people who power our mission know their ideas are welcome, their voices are heard, and their contributions are rewarded.

At Morningstar, our people are our most important asset. We are committed to fostering an environment where the people who power our mission know their ideas are welcome, their voices are heard, and their contributions are rewarded.

Our human capital management efforts are managed by the chief people officer and implemented with support from leaders across the company, with oversight from our chief executive officer (CEO) and board of directors. The compensation committee of our board of directors approves incentive plan design and performance goals and reviews emerging compensation policies, practices, and potential risks. In addition, human capital management efforts are implemented by leaders across the company.

As of December 31, 2023, we had 11,334 permanent, full-time employees around the world. Approximately 40% of our employees work in India, 30% in the U.S., 11% in Continental Europe, 8% in Canada, 7% in the United Kingdom (U.K.), and the remainder in Australia, Asia (ex-India), and other regions.

Diversity, Equity, and Inclusion

We believe that diverse teams make better decisions and that our colleagues' diverse backgrounds, beliefs, and experiences make Morningstar a stronger firm. As a global employer, our goal is to build an inclusive environment that encourages open dialogue, sparks creativity, and fuels innovation that may lead to better business outcomes.

As of December 31, 2023, approximately 40% of our employees are female. As of the same date, 50% of our board of directors are female. In the U.S., our employee population identifies as approximately 65% White, 22% Asian, 5% Hispanic, 5% Black, and 3% Mixed Race and Other.

Morningstar’s adjusted pay gap provides an assessment of equal pay for equal work. It examines a group of employees performing substantially similar work and highlights individuals with lower pay relative to their measured peer group. In our latest adjusted pay gap analysis, we found that, overall, women are paid 98.3% of what men are paid, and U.S. underrepresented minorities are paid 98.7% of what the U.S. non-underrepresented minorities are paid. Employees who were identified through this examination received a pay increase, separate from their ordinary course annual compensation consideration, as part of our October 1, 2023 pay cycle.

For additional breakdowns on our diverse representation by organizational level and functional areas, as well as more details on Morningstar’s pay equity program, see Morningstar’s 2023 Corporate Sustainability Report (expected to be published in spring 2024). To comply with local regulations, Morningstar also publishes a U.K. Pay Gap report available at gender-pay-gap.service.gap.uk.

18

Employee Engagement

Our organization’s "people analytics” team actively monitors and shares metrics related to the employee experience. These key performance indicators include employee satisfaction, intent to stay, discretionary effort, and enablement. We ask the same questions of our employee base routinely to best understand trends over time. We also evaluate perceptions of managers, psychological safety, and overall well-being via methods such as surveys, exit interviews, and focus groups.

Our organization’s "people analytics” team actively monitors and shares metrics related to the employee experience. These key performance indicators include employee satisfaction, intent to stay, discretionary effort, and enablement. We ask the same questions of our employee base routinely to best understand trends over time. We also evaluate perceptions of managers, psychological safety, and overall well-being via methods such as surveys, exit interviews, and focus groups.

Based on our average measurement across the year, Morningstar’s overall engagement score declined to 69% compared to 80% in 2022. In 2023, we applied workforce reductions in some business units and exercised cost containment measures which impacted our overall scores. Our people and culture team in partnership with our executive leadership will continue to monitor and understand employee sentiment and respond with empathy to support employees. Morningstar’s global turnover increased to 22% in 2023 from 19% in 2022, however, this increase was driven by involuntary turnover largely due to the significant reduction and shift of our China operations and targeted reorganizations in certain areas of the business. Involuntary turnover increased to 10% in 2023 from 3% in 2022. By contrast, voluntary turnover dropped from 16% in 2022 to 12% in 2023.

Morningstar’s efforts to reward and support our colleagues reflect our belief that people are central to our success. We offer a variety of benefits through a total rewards package that supports the financial, physical, emotional, and social well-being of our colleagues. In 2023, our benefits expansion efforts focused on expanded digital health capabilities for employees globally and enhancing mental health support in the U.S.

Professional Growth

Morningstar offers a variety of educational and career development programs to ensure ongoing growth opportunities for all colleagues. Our goal is to provide a meaningful set of development options and experiences for colleagues at all levels, in all relevant job fields, and in all locations across the company. Notably, we offer our employees annual educational stipends to spend on their choice of professional development resources, while also providing financial support for continuing education and the pursuit of professional certifications.

We also offer programs for employee learning and growth. The Morningstar Development Program is the primary entry point to Morningstar for recent college graduates. Through this program, we place new hires into many different entry roles and offer the flexibility to explore and learn through guided placements into subsequent roles.

The program in its original design is currently active in the U.S., Canada, the U.K., and Spain. A modified version of the program has been piloted in India for early entry talent. For those further along in their career, Morningstar provides a learning journey for leaders and managers. Our Advancing Leaders Program curates learning modules designed around leadership competencies that we look to develop in existing and aspiring leaders throughout the organization.

A detailed list of our global benefits offerings can be found in Morningstar’s 2023 Corporate Sustainability Report (expected to be published in spring 2024).

Major Customer Groups

Given our strategy and core capabilities discussed above, we focus on seven primary customer groups:

•Advisors and wealth managers (including independent financial advisors and those affiliated with Registered Investment Advisors (RIAs), broker/dealers or other intermediaries)

•Asset managers (including fund companies, insurance companies, and other companies that build and manage portfolios of securities for their clients)

•Institutional asset owners and consultants

•Fixed-income security issuers and arrangers

•Private market investors

•Retirement (including retirement plan providers, advisors, and sponsors)

•Individual investors

19

Advisors and wealth managers

Financial advisors are professionals who offer guidance on different aspects of personal finance, aiding individuals and businesses in making more informed investment decisions to reach their financial goals. They can work independently or within financial services firms and often possess certifications or licenses like Certified Financial Planner (CFP), Chartered Financial Analyst (CFA), or Series 7, based on the services they provide and the regulatory standards in their area.

This customer group typically includes independent advisors at RIA firms, advisors affiliated with independent broker/dealers, dually registered advisors (who have the ability to offer brokerage services and investment advisory services), and advisors who are employees of a broker/dealer. These broker/dealers include wirehouses, regional broker/dealers, and banks, which together with RIA firms help comprise the wealth manager component of this customer group.

The advisor landscape is broad in both the U.S. and in other parts of the world where we focus. Our largest market is the U.S., where there were more than 327,000 financial advisors in 2022 according to recent data from the U.S. Bureau of Labor Statistics. We believe our deep understanding of individual investors’ needs allows us to work with advisors to help them make more efficient use of their time and deliver better investment outcomes for their clients.

Our advisor solutions also draw on Morningstar’s proprietary investment research methodologies and research insights allowing advisors to provide better recommendations for their clients. We sell our advisor-related solutions directly to independent financial advisors and through enterprise licenses, which allow financial advisors associated with the licensing firm to use our products. We also sell certain solutions directly to wealth managers. Our main products for financial advisors include products in the Morningstar Data and Analytics, Morningstar Wealth, and Morningstar Retirement segments including Morningstar Advisor Workstation, Morningstar Office, Morningstar Managed Portfolios, and Advisor Managed Accounts. In addition, our main products for wealth managers include Morningstar Data and Morningstar Direct in the Morningstar Data and Analytics segment.

Asset management firms

Asset management firms manufacture financial products and manage and distribute investment portfolios. This customer group includes individuals involved in sales, marketing, product development, business intelligence, and distribution, as well as investment management (often referred to as the “buy side”), which includes portfolio management and research.

Our asset management offerings help companies connect with their clients because of Morningstar’s strong brand presence with both financial advisors and individual investors. We offer a global reach and have earned investors’ trust with our independent approach, investor-centric mission, and thought leadership.

We serve asset managers through our Morningstar Data and Analytics and Morningstar Credit segments. The main products we offer for asset management firms include Morningstar Direct, Morningstar Data, and Morningstar Indexes. For the buy side, the main products include Morningstar Research, Morningstar DBRS, Morningstar Data, Morningstar Direct, and Morningstar Sustainalytics.

Institutional asset owners and investment consultants

Institutional asset owners operate in a fiduciary capacity on behalf of their beneficiaries, overseeing large pools of capital, which according to WTW 2023 Global Pension Study, in aggregate exceed $100 trillion in assets under management across public pension funds, sovereign wealth funds, endowments, foundations, corporate pensions, and insurance general accounts.

Investment consultants serve these organizations in an advisory capacity, aiding in the development of investment policy, conducting manager due diligence, risk management and performance reporting. We offer a range of solutions to this diverse set of sponsoring entities, investors and advisors across multiple geographies, including through the Morningstar Data and Analytics and PitchBook segments. Our primary products for this customer group include Morningstar Direct (in Morningstar Data and Analytics), Morningstar Indexes, Morningstar Sustainalytics, and PitchBook.

20

Private market participants

PitchBook covers the full lifecycle of venture capital, private equity, private credit, and M&A activities, including the limited partners, investment funds, lenders, and service providers involved. We serve this customer group through our PitchBook segment. Our main product for this customer group is the PitchBook Platform, an all-in-one research and analysis web-hosted solution that gives clients the ability to access data, discover new connections, and conduct research on potential investment opportunities. An Excel plug-in and mobile capabilities are included with the platform license, and Morningstar public equity research is also delivered through the platform. PitchBook also makes our data available to clients in more flexible formats such as Application Programming Interfaces (APIs) and feeds.

As of December 31, 2023, PitchBook served over 10,600 clients, including investment and research firms, venture capital and private equity firms, investment banks, limited partners, lenders, law firms, and accounting firms. We also served corporate development teams at firms across industry sectors.

Fixed income security issuers, arrangers, and investors

We serve fixed income security issuers, arrangers, and investors through our Morningstar Credit segment. Morningstar DBRS typically issues credit ratings in response to requests from issuers, intermediaries, or investors. Morningstar DBRS credit ratings are requested for corporate short and long-term fixed income obligations, sovereign debt, single project financings and structured finance programs, including securitization of receivables, such as auto loans, credit cards, residential real estate loans and commercial real estate loans. In addition, claims-paying-ability credit ratings are issued for life, property/casualty, financial guaranty, title, and mortgage insurance companies.

We estimate that the global ratings market totaled $10 billion as of year-end 2021, representing a 6.3% compound annual growth rate over the prior decade. In 2022, global issuance fell sharply due to uncertainty related to the macroeconomic environment and the future path of interest rates. We estimate that the global ratings market totaled roughly $7.7 billion as of year-end 2022 and $8.2 billion as of year-end 2023 driving a decline in the 10-year compound annual growth rate to 2.1%. As the macroeconomic environment stabilizes, we expect a return to higher long-term growth rates, supported by various secular trends.

Credit markets continue to evolve with companies using structured products as a key avenue for raising capital. Overall demand for structured products by institutional investors, including banks in the U.S. and Europe, remains high.

As of December 31, 2023, we provided ratings for more than 4,000 issuers of debt.

Retirement market participants

In the U.S., 401(k) and other types of defined-contribution (DC) retirement plans are the dominant retirement savings vehicle offered by employers. According to the Investment Company Institute, there were $9.9 trillion in assets in DC plans at end of the third quarter of 2023, compared to $3.1 trillion in private-sector defined benefit (DB) plans and $8.0 trillion in government DB plans. Total retirement assets across all markets totaled $35.7 trillion at the end of that same period.

We serve this market through our Morningstar Retirement segment. Our services are designed to help improve the DC retirement system by offering highly personalized savings and investment advice at the employee level, scalable investment and risk mitigation services at the plan and advisor level, and industry research at the policy and institutional level. Currently, our focus is the U.S. market, because it continues to demonstrate healthy growth, and because many of our services are not easily adapted to foreign markets due to significant differences in regulatory frameworks that govern retirement saving and investing.

Our core retirement products (managed retirement accounts, advisor managed accounts, Morningstar Plan Advantage, and fiduciary services, and custom models) primarily reach individual investors through employers (plan sponsors) that offer DC plans for their employees. As of December 31, 2023, we served 94 retirement service providers, broker dealers, asset managers, plan sponsors, and RIAs, representing about 319,200 retirement plans.

21

Recordkeepers and advisors are the two main distribution channels for our services, while asset managers are an emerging channel. We generally service these channels using one of three delivery platforms: managed accounts, advisor managed accounts, and Morningstar Plan Advantage. The former is more geared toward recordkeepers, while our advisor managed accounts enables advisors and asset managers to incorporate their firm’s investment allocation philosophies and branding into this participant advice service. Morningstar Plan Advantage is a practice-management and compliance platform that is powered by our network of data connections with record-keepers that helps retirement plan advisors manage and grow their book of business.

Individual investors

We offer tools and content for individual investors who invest to build wealth and save for other goals, such as retirement or college tuition. A Gallup survey released in 2023 found that approximately 61% of individuals in the U.S. invest in the stock market either directly, through mutual funds, or self-directed retirement plans. We design products for individual investors who are actively involved in the investing process and want to take charge of their own investment decisions. We also reach individuals who want to learn more about investing or want to validate the advice they receive from brokers or financial advisors.

We serve this market through our Morningstar Wealth segment. We offer three products for individual investors. Our largest based on engagement is our investing media site Morningstar.com, which offers data, editorial and research content available for free to registered customers and visitors. Our second product is Morningstar Investor (Morningstar Premium outside of the U.S. and Australia), which provides access to Morningstar’s research, advanced screening tools and portfolio management tools. The third product is a set of investment newsletters based on different investment types and investing strategies.

Revenue Types

We leverage our proprietary data and research to sell products and services across our portfolio that generate revenue in three primary ways:

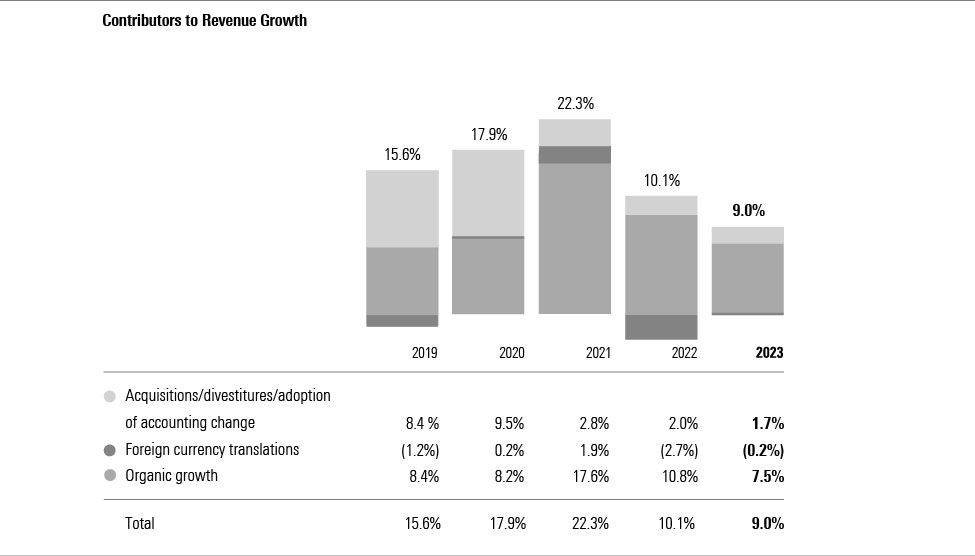

License-based: The majority of our research, data, and proprietary platforms are accessed via subscription services that grant access on either a per user or enterprise-basis for a specified period of time. License-based revenue represented 74.4% of our 2023 consolidated revenue compared to 71.2% in 2022 and 66.6% in 2021.

Asset-based: We charge basis points and other fees for assets under management or advisement. Asset-based revenue represented 13.7% of our 2023 consolidated revenue compared to 14.4% in 2022 and 15.6% in 2021.

Transaction-based: Revenue is transactional, or one-time, in nature, compared with the recurring revenue streams represented by our licensed and asset-based products. Transaction-based revenue represented 11.9% of our 2023 consolidated revenue compared to 14.4% in 2022 and 17.8% in 2021.

Largest Customer

In 2023, our largest customer accounted for less than 3% of our consolidated revenue.

Acquisitions and Divestitures

Since our founding in 1984, we've supported our organic growth by introducing new products and services and expanding our existing offerings. From 2006 through 2023, we also completed 43 acquisitions to support our growth objectives. We had one asset acquisition in 2023 and had no divestitures in 2023.

For more information about our acquisitions, refer to Note 8 of the Notes to our Consolidated Financial Statements.

22

International Operations

We conduct our business operations outside of the U.S. through wholly- or majority-owned subsidiaries located in each of the following 31 countries: Australia, Brazil, Canada, Cayman Islands, Chile, China, Cyprus, Denmark, France, Germany, Hong Kong, India, Italy, Japan, Jersey, Luxembourg, Mexico, the Netherlands, New Zealand, Norway, Poland, Romania, Singapore, South Africa, South Korea, Spain, Sweden, Switzerland, Thailand, UAE, and the U.K. See Note 6 of the Notes to our Consolidated Financial Statements for additional information concerning revenue from customers and assets from our business operations outside the U.S.

Intellectual Property and Other Proprietary Rights

We treat our brand name and logo, product names, databases and related content, software, technology, know-how, and the like as proprietary. We seek to protect this intellectual property through a combination of: (i) trademark, copyright, patent and trade secrets laws; (ii) licensing and nondisclosure agreements; and (iii) other security and related technical measures designed to restrict unauthorized access and use. For example, we generally provide our intellectual property to third parties using standard licensing agreements, which define the extent and duration of any third-party usage rights and provide for our continued ownership in any intellectual property furnished.