Filed Pursuant to Rule 424(b)(1)

Registration No. 333-115297

PROSPECTUS

QC Holdings, Inc.

5,000,000 Shares

Common Stock

We are selling 5,000,000 shares of common stock. This is the initial public offering of our common stock. Prior to this offering, there has been no public market for our shares.

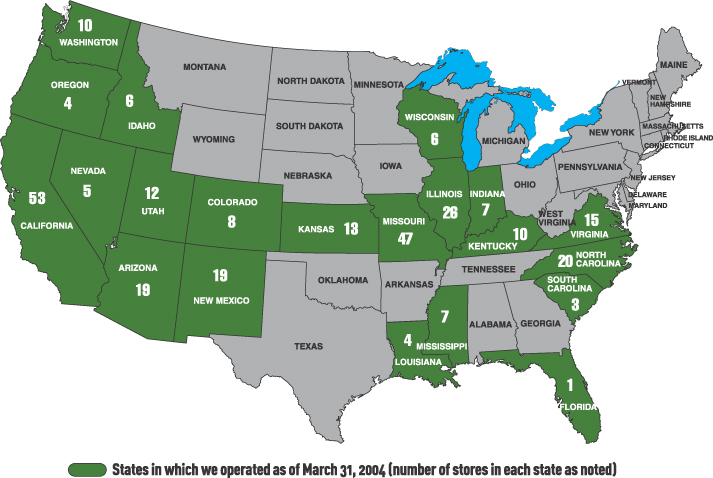

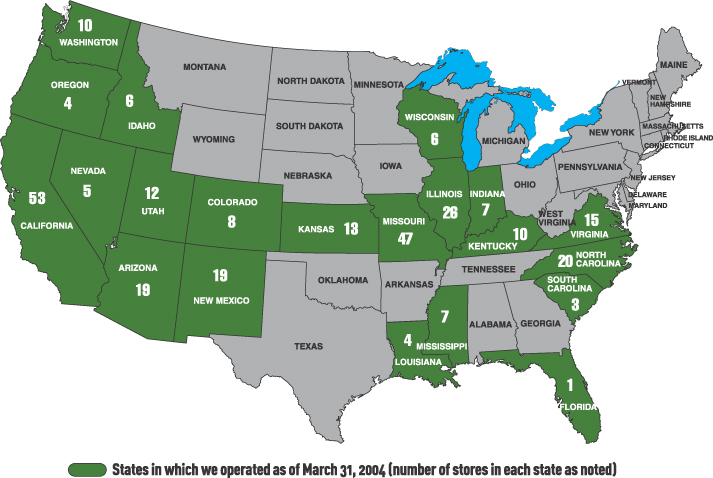

We are a leading provider of payday loans in the United States. As of March 31, 2004, we operated 295 payday loan stores in 21 states.

Our common stock has been approved for quotation on The Nasdaq Stock Market’s National Market under the symbol “QCCO.”

Investing in our common stock involves risks. See “Risk Factors” beginning on page 8.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| | | | | | |

| | | Per Share

| | Total

|

Public offering price | | $ | 14.00 | | $ | 70,000,000 |

Underwriting discounts and commissions | | $ | 0.98 | | $ | 4,900,000 |

Proceeds, before expenses, to us | | $ | 13.02 | | $ | 65,100,000 |

Four of our directors or executive officers have granted the underwriters a 30 day option to purchase up to an aggregate of 750,000 additional shares of common stock on the same terms as set forth above to cover over-allotments, if any. All of the shares to be sold upon the exercise of the over-allotment option are to be sold by the selling stockholders. The selling stockholders will only sell shares in this offering if the underwriters exercise their over-allotment option. We will not receive any proceeds from the sale of shares by the selling stockholders.

The underwriters expect to deliver the shares to purchasers on or about July 21, 2004.

| | |

Ferris, Baker Watts Incorporated | | JMP Securities |

The date of this prospectus is July 15, 2004

SUMMARY

This summary does not contain all of the information that you should consider before investing. We encourage you to read this entire prospectus, including the “Risk Factors” section and the financial statements and related notes, before deciding to invest in our common stock. All references to our fiscal year reflect the twelve-month period ended December 31 of that year. All references to non-financial operating statistics are as of March 31, 2004, unless the context indicates otherwise. Unless otherwise indicated, the information in this prospectus gives effect to a 10 for 1 stock split effectuated as a stock dividend during our second quarter 2004.

Our Company

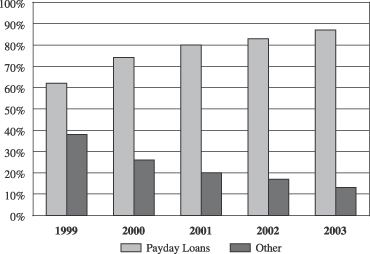

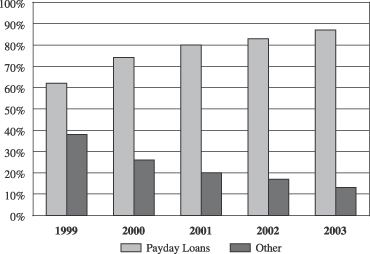

We are a leading provider of payday loans in the United States. We operate 295 stores in 21 states. Payday loan revenues constituted approximately 87% of our total revenue in fiscal year 2003 and in the three months ended March 31, 2004. We believe that our customers are typically middle-income, working individuals who use our services because they find them to be a convenient source for small, short-term loans. We focus on payday loans because of the strong customer demand for them. We also offer additional services in our stores, such as check cashing, title loans, money orders and money transfers.

We have 20 years of experience operating retail consumer finance businesses. We entered the payday loan industry in 1992, and we believe that we were one of the first companies to offer the payday loan product in the United States. We have served the same customer base since 1984, beginning with a rent-to-own business and continuing with check cashing services in 1988. We sold our rent-to-own stores in 1994. Several of our executives and senior managers have worked in all levels of our stores. Through this direct, store-level experience, we learned first-hand which products, services and practices were successful. We also learned the importance of creating personal relationships with customers and providing store managers with discretion, under corporate supervision, to determine how best to reach and serve customers in their markets.

From January 1, 1999 to March 31, 2004, we grew from 48 stores to 295 stores through a combination of acquisitions and new store openings. During this period, we opened 137 new stores, acquired 137 stores and closed 27 stores. Comparable store revenue and gross profit growth for stores open at least 24 months were 17% and 31%, respectively, for the year ended December 31, 2003. Our revenue and store gross profit for the year ended December 31, 2003 were $98.5 million and $36.1 million, respectively.

Industry Background

The payday loan industry began its rapid growth in 1996 when there were an estimated 2,000 payday loan stores in the United States. According to the Community Financial Services Association of America (CFSA) and the investment banking firm Stephens Inc., the industry has grown to approximately 22,000 payday loan stores in 2003, generating over $40 billion in annual loan volume. The growth of the payday loan industry has followed the increased acceptance of payday lending by state legislatures. Since 1996, the number of jurisdictions with legislation permitting or not prohibiting payday loans has grown from 6 states to 35 states and the District of Columbia. Each of these jurisdictions now regulates the payday loan business in some form, including licensure requirements, compliance examinations and lending regulations. We believe that the payday loan industry is fragmented and has only 10 companies operating more than 150 stores. We estimate that these 10 companies operate approximately 7,000 stores.

We believe consumers use payday loans for a variety of reasons. A survey by the Credit Research Center at the McDonough School of Business at Georgetown University found that 70% of payday loan customers surveyed who considered other sources of credit use payday loans for reasons of convenience, while only 6% of those payday loan customers use payday loans because they had no other alternative.

1

Competitive Strengths

We believe that the following competitive strengths position us well for growth:

Management Team with Significant Industry and Company Experience. Our management team has significant experience in the payday loan industry and other retail consumer finance businesses. In addition, they have extensive operating experience as a result of working at all levels of our stores. We believe that this store-level experience has been critical to our outstanding store performance.

Customer Service and Respect. We believe that customer loyalty results from treating customers in a positive, respectful manner and by providing quick and efficient service.

Lending Policy. We believe that our lending policies allow us to efficiently generate loan volume, enabling new stores to become profitable within six months of opening. For the year ended December 31, 2003, our stores generated an average of more than $350,000 of annual revenue and our highest-revenue store generated approximately $1.5 million in revenues.

Significant Role of Our Store Managers. We reward store managers for the success of their stores. We also encourage store managers to share with us the methods that bring them success. We believe that these practices encourage store managers to implement company strategies at the store level.

Balance Sheet Flexibility. Immediately after the closing of this offering, we will have no debt. With cash flow from operations and the net proceeds from this offering, we will be poised to grow through the opening of new stores and opportunistic acquisitions. In addition, we will have the ability to leverage our assets to further grow the company.

Business Strategies

Our primary objective is to increase our profits by expanding our payday lending business and increasing comparable store revenues and gross profit. To accomplish this, we:

Focus on Payday Loans. Our primary focus is to provide the most efficient payday loan services available. We deemphasize low-margin ancillary services, such as bill payments, and concentrate on payday lending.

Pursue De Novo Store Growth. Since 1998, we have grown from 48 stores in five states to 295 stores in 21 states, partly through opening 137 new, or de novo, stores. We believe that through de novo growth we can achieve a strong return on capital due to our new store economics.

Seek Opportunistic Acquisitions. Since 1998, we have acquired 137 stores. Our experience integrating acquired stores has taught us how to leverage our current management structure.

Promote Operational Excellence. Our company-wide Operational Excellence program, which we developed in 2002, is designed to refine operational procedures and improve our internal processes. This program has become part of our culture and continues to foster improvements to our systems and procedures.

Challenges

We face challenges in executing our business strategies. Among the most important we face are:

Regulation. The payday loan industry is highly regulated. Changes in laws governing payday loans, consumer protection or general lending practices may negatively affect our payday loan operations.

2

Loss of Key Personnel. Our success depends to a large degree upon the continued services of our senior managers. If we lose these senior managers, our operating results could suffer.

Employee Turnover. We experience high turnover among our store-level employees and in our store managers, which increases our operating costs and interferes with implementation of our store operating strategies.

Litigation and Regulatory Actions. The payday lending industry is sometimes the subject of state regulatory actions that result from new interpretations of existing laws. Should any state in which we operate change its historical interpretations of existing laws that permit our operation, our operating results could suffer.

Please see “Risk Factors” beginning on page 8 for information on these and other risks related to our business and this offering.

Company Information

Our principal executive offices are located at 2812 West 47th Avenue, Kansas City, Kansas 66103, and our telephone number is (913) 439-1100. Our website address is www.qcholdings.com. Our website and the information contained on our website are not incorporated into this prospectus or the registration statement of which it forms a part.

3

The Offering

Common stock offered by QC Holdings, Inc. | 5,000,000 shares |

Common stock to be outstanding after this offering | 20,371,000 shares |

Use of proceeds | We intend to use the net proceeds from this offering to retire all existing debt, to fund growth through the opening of de novo stores and through acquisitions and to fund working capital requirements. |

Listing | Our common stock has been approved for quotation on The Nasdaq Stock Market’s National Market under the symbol “QCCO.” |

We effectuated a 10 for 1 stock split in the form of a stock dividend during our second quarter 2004. All references to shares and per share data in this prospectus reflect the stock split and exclude 1,650,500 shares of common stock issuable upon exercise of outstanding options, at a weighted average price of $2.20 per share and exclude 430,000 shares of common stock issuable upon the exercise of stock options that we granted immediately prior to the effectiveness of the registration statement of which this prospectus forms a part at an option exercise price equal to the price per share in this offering.

The underwriters have an option to purchase up to 750,000 additional shares of our common stock from four of our directors or executive officers to cover over-allotments, if any. We will not receive any of the proceeds from the sale of shares by these selling stockholders. Except as otherwise indicated, the information in this prospectus assumes no exercise of the underwriters’ over-allotment option.

Each trademark, trade name or service mark of any other company or person appearing in this prospectus belongs to its holder or holders.

4

Summary Financial Data

We derived the following historical financial information from our audited consolidated financial statements as of December 31, 2002 and December 31, 2003 and for each of the years in the three-year period ended December 31, 2003 and our unaudited consolidated financial statements as of and for the three months ended March 31, 2004, and for the three months ended March 31, 2003, which are included elsewhere in this prospectus, and our audited consolidated financial statements as of and for the years ended December 31, 1999 and December 31, 2000 and as of December 31, 2001, which are not included in this prospectus. The as adjusted balance sheet data give effect to this offering and the use of proceeds as if they occurred at March 31, 2004. The unaudited consolidated financial statements include all adjustments, consisting of normal recurring adjustments, which we consider necessary for a fair presentation of the financial position and the results of operations for these periods. Operating results for the three months ended March 31, 2004 are not necessarily indicative of the results that may be expected for the entire year ending December 31, 2004. This table should be read together with the information contained in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our audited and unaudited consolidated financial statements and related notes included elsewhere in this prospectus. The information provided below gives effect to a 10 for 1 stock split, which was effectuated as a stock dividend during our second quarter 2004.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Year Ended December 31,

| | | Three Months Ended

March 31,

| |

| | | 1999

| | | 2000

| | | 2001

| | | 2002

| | | 2003

| | | 2003

| | | 2004

| |

| | | (Dollars in thousands, except per share and Operating Data) | |

| | | | | | | | | | | | | | | | | | (Unaudited) | |

Statement of Income Data: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total revenues | | $ | 18,629 | | | $ | 39,308 | | | $ | 60,283 | | | $ | 70,907 | | | $ | 98,494 | | | $ | 21,263 | | | $ | 28,183 | |

Total store expenses | | | 11,351 | | | | 26,746 | | | | 40,753 | | | | 47,120 | | | | 62,402 | | | | 13,677 | | | | 15,247 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Store gross profit | | | 7,278 | | | | 12,562 | | | | 19,530 | | | | 23,787 | | | | 36,092 | | | | 7,586 | | | | 12,936 | |

Other expenses | | | 4,293 | | | | 5,967 | | | | 9,807 | | | | 10,906 | | | | 13,446 | | | | 3,094 | | | | 4,129 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Income before taxes | | | 2,985 | | | | 6,595 | | | | 9,723 | | | | 12,881 | | | | 22,646 | | | | 4,492 | | | | 8,807 | |

Provision for income taxes | | | 1,029 | | | | 2,520 | | | | 3,826 | | | | 5,046 | | | | 8,722 | | | | 1,726 | | | | 3,556 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net income | | $ | 1,956 | | | $ | 4,075 | | | $ | 5,897 | | | $ | 7,835 | | | $ | 13,924 | | | $ | 2,766 | | | $ | 5,251 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Earnings (loss) per share (1): | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Basic | | $ | (0.21 | ) | | $ | 0.04 | | | $ | 0.31 | | | $ | 0.41 | | | $ | 0.41 | | | $ | (0.13 | ) | | $ | 0.34 | |

Diluted | | | (0.21 | ) | | | 0.04 | | | | 0.31 | | | | 0.41 | | | | 0.39 | | | | (0.13 | ) | | | 0.32 | |

Shares used to calculate earnings (loss) per share: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Basic | | | 16,666,129 | | | | 18,915,000 | | | | 18,915,000 | | | | 18,915,000 | | | | 15,934,673 | | | | 18,915,000 | | | | 11,688,010 | |

Diluted | | | 16,666,129 | | | | 18,991,998 | | | | 19,036,641 | | | | 19,256,263 | | | | 16,436,429 | | | | 19,381,398 | | | | 12,347,417 | |

Cash dividends per share | | | | | | | | | | | | | | | | | | $ | 0.03 | | | | | | | $ | 0.06 | |

Operating Data: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Stores (at end of period) | | | 122 | | | | 176 | | | | 204 | | | | 258 | | | | 294 | | | | 270 | | | | 295 | |

Percentage increase in comparable total store revenues from prior period (3) | | | 64.7 | % | | | 8.1 | % | | | 24.9 | % | | | 4.1 | % | | | 16.6 | % | | | 14.4 | % | | | 25.2 | % |

Payday loans: | | | | | | | | | | | | �� | | | | | | | | | | | | | | | | |

Number of loan transactions — new loans and refinances

(in thousands) | | | 443 | | | | 778 | | | | 1,194 | | | | 1,381 | | | | 1,878 | | | | 393 | | | | 519 | |

Loan volume (in thousands) | | $ | 85,610 | | | $ | 204,169 | | | $ | 327,334 | | | $ | 398,494 | | | $ | 590,071 | | | $ | 119,441 | | | $ | 168,848 | |

Average loan | | | 193.42 | | | | 262.29 | | | | 274.21 | | | | 288.53 | | | | 314.14 | | | | 303.97 | | | | 325.28 | |

Average fee | | | 26.06 | | | | 37.47 | | | | 40.89 | | | | 44.11 | | | | 47.76 | | | | 46.36 | | | | 49.29 | |

Loss Data: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Provision for losses as a percentage of revenues | | | 16.2 | % | | | 17.4 | % | | | 24.6 | % | | | 21.1 | % | | | 21.6 | % | | | 18.2 | % | | | 13.5 | % |

5

| | | | | | | | | | | | | | | | | | | | | |

| | | As of December 31,

| | As of March 31, 2004

|

| | | 1999

| | 2000

| | 2001

| | 2002

| | 2003

| | Actual

| | As

Adjusted (2)

|

| | | (Dollars in thousands) |

| | | | | (Unaudited) |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Balance Sheet Data: | | | | | | | | | | | | |

Cash and cash equivalents | | $ | 5,650 | | $ | 6,003 | | $ | 8,851 | | $ | 7,991 | | $ | 9,497 | | $ | 10,238 | | $ | 50,688 |

Loans receivable, net of allowance

for losses | | | 8,004 | | | 16,855 | | | 19,438 | | | 26,619 | | | 35,933 | | | 30,184 | | | 30,184 |

Total assets | | | 17,884 | | | 31,503 | | | 40,607 | | | 51,045 | | | 64,929 | | | 62,481 | | | 102,731 |

Current debt | | | 953 | | | 9,796 | | | 5,319 | | | 8,893 | | | 10,974 | | | 4,546 | | | |

Liability for mandatory stock redemption | | | | | | | | | | | | | | | 17,000 | | | 17,000 | | | |

Long-term debt | | | 5,696 | | | 5,666 | | | 10,942 | | | 7,771 | | | 18,880 | | | 18,744 | | | |

Shares subject to redemption | | | 7,000 | | | 11,000 | | | 11,000 | | | 11,000 | | | | | | | | | |

Stockholders’ equity | | | 2,743 | | | 2,851 | | | 8,754 | | | 16,665 | | | 9,333 | | | 14,035 | | | 94,575 |

| (1) | Basic earnings (loss) per share is computed using the two-class method by dividing income available to common stockholders by the weighted average number of common shares outstanding during the period. Diluted earnings (loss) per share is computed giving effect to all dilutive potential common shares that were outstanding during the period. The effect of stock options represents the only differences between the weighted average shares used for the basic earnings per share computation compared to the diluted earnings per share computation. |

The following table presents the computations of basic and diluted earnings per share for the periods presented.

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Year Ended December 31,

| | | Three Months Ended

March 31,

| |

| | | 1999

| | | 2000

| | 2001

| | 2002

| | 2003

| | | 2003

| | | 2004

| |

| | | (Dollars in thousands, except per share data) | |

| | | | | | | | | | | | | | | (Unaudited) | |

Net income | | $ | 1,956 | | | $ | 4,075 | | $ | 5,897 | | $ | 7,835 | | $ | 13,924 | | | $ | 2,766 | | | $ | 5,251 | |

Less: reduction to retained earnings in connection with shares subject to redemption | | | 5,483 | | | | 3,292 | | | | | | | | | 5,296 | | | | 5,296 | | | | | |

Less: dividend and participation rights associated with mandatory stock redemption (a) | | | | | | | | | | | | | | | | 2,162 | | | | | | | | 1,242 | |

| | |

|

|

| |

|

| |

|

| |

|

| |

|

|

| |

|

|

| |

|

|

|

Income (loss) available to common stockholders | | $ | (3,527 | ) | | $ | 783 | | $ | 5,897 | | $ | 7,835 | | $ | 6,466 | | | $ | (2,530 | ) | | $ | 4,009 | |

| | |

|

|

| |

|

| |

|

| |

|

| |

|

|

| |

|

|

| |

|

|

|

Weighted average number of actual common shares outstanding | | | 16,666,129 | | | | 18,915,000 | | | 18,915,000 | | | 18,915,000 | | | 18,137,718 | | | | 18,915,000 | | | | 15,308,110 | |

Reduction in weighted average shares associated with mandatory stock redemption (a) | | | | | | | | | | | | | | | | (2,203,045 | ) | | | | | | | (3,620,100 | ) |

| | |

|

|

| |

|

| |

|

| |

|

| |

|

|

| |

|

|

| |

|

|

|

Weighted average number of common shares outstanding | | | 16,666,129 | | | | 18,915,000 | | | 18,915,000 | | | 18,915,000 | | | 15,934,673 | | | | 18,915,000 | | | | 11,688,010 | |

Incremental shares from assumed conversion of stock options | | | | | | | 76,998 | | | 121,641 | | | 341,263 | | | 501,756 | | | | 466,398 | | | | 659,407 | |

| | |

|

|

| |

|

| |

|

| |

|

| |

|

|

| |

|

|

| |

|

|

|

Weighted average number of diluted common shares outstanding | | | 16,666,129 | | | | 18,991,998 | | | 19,036,641 | | | 19,256,263 | | | 16,436,429 | | | | 19,381,398 | | | | 12,347,417 | |

| | |

|

|

| |

|

| |

|

| |

|

| |

|

|

| |

|

|

| |

|

|

|

Basic earnings (loss) per share | | $ | (0.21 | ) | | $ | 0.04 | | $ | 0.31 | | $ | 0.41 | | $ | 0.41 | | | $ | (0.13 | ) | | $ | 0.34 | |

Diluted earnings (loss) per share | | | (0.21 | ) | | | 0.04 | | | 0.31 | | | 0.41 | | | 0.39 | | | | (0.13 | ) | | | 0.32 | |

6

Basic and diluted earnings (loss) per share computations are adjusted to reflect our obligation to purchase shares from two principal stockholders, Don Early and Gregory L. Smith, upon their death pursuant to our stockholders agreement with them. Under generally accepted accounting principles, for purposes of computing income available to common stockholders in the earnings per share calculations, we are required to include as a reduction to net income the increase in the carrying amount of the shares subject to redemption that is charged directly to retained earnings in any given period. Accordingly, we reduced net income available to common stockholders by $5.5 million in 1999, $3.3 million in 2000, $5.3 million in 2003 and $5.3 million for the three months ended March 31, 2003, to reflect the amount charged directly to retained earnings associated with this obligation. Pursuant to the stockholders agreement, we maintain insurance policies with respect to these two stockholders that will cover the entire share repurchase obligation. The stockholders agreement has been terminated effective June 30, 2004. Upon the termination of the stockholders agreement and related liability for mandatory stock redemption, the computation for earnings per share will no longer require the various adjustments associated with the shares subject to mandatory redemption as described herein.

| | (a) | As set forth in Statement of Financial Accounting Standards No. 150 (SFAS 150), Accounting for Certain Financial Instruments with Characteristics of Both Liabilities and Equity, which we adopted on July 1, 2003, the shares considered to be subject to redemption under the stockholders agreement are excluded from weighted average shares for purposes of computing basic and diluted earnings per share. The number of shares excluded will vary based on the change in the market price from period to period. Further, SFAS 150 requires that the portion of net income representing dividend and participation rights associated with the mandatory stock redemption be removed from income available to common stockholders pursuant to the two-class method set forth by Statement of Financial Accounting Standards No. 128,Earnings per Share. |

| (2) | The unaudited as adjusted balance sheet data as of March 31, 2004 gives effect to this offering and the application of a portion of the net proceeds thereof for the repayment of outstanding indebtedness, as well as the termination of the stockholders agreement during second quarter 2004, which removed the liability for mandatory stock redemption and increased stockholders’ equity by $17 million. |

| (3) | Comparable stores are stores which are open during the full periods for which a comparison is being made. For example, comparable stores for the quarterly analysis as of March 31, 2004 are those stores opened for at least 15 months on such date, and comparable stores for the annual analysis as of December 31, 2003 are those stores opened for at least 24 months on such date. |

7

RISK FACTORS

An investment in our common stock involves a high degree of risk. Before you decide whether to purchase the common stock offered by this prospectus, you should carefully consider these risk factors, as well as the other information contained in this prospectus. If any of these risks actually occur, our business, results of operations and financial condition could be significantly and negatively affected. This could cause the trading price of our common stock to decline, perhaps significantly.

Risks Related to Our Business

The payday loan industry is highly regulated under both federal and state laws. Changes in laws governing consumer protection and lending practices may negatively affect our business.

The financial services we offer are highly regulated and subject to supervision by various state and federal agencies. The payday loan industry in particular is highly regulated. There are 35 states that have either adopted specific laws regulating payday loans, such as laws setting maximum fees that a customer may be charged, or do not have laws that preclude or make unprofitable payday lending. In the remaining states, state usury laws, general small loan laws or other consumer credit laws preclude payday loans. Other regulations that may govern or affect payday lending include licensing requirements, filing and posting of fees, truth in lending, zoning restrictions, permitting requirements, currency transaction and other reporting requirements, and privacy of personal financial information. Failure to comply with any of these regulatory requirements could result in penalties, damages and refunds of fees.

Future legislation or regulations may restrict or prohibit payday lending and may have a negative effect on our business. For example, a law prohibiting payday loans was recently enacted in Georgia. States may also seek to impose new licensing requirements, reduce permissible fees or interpret or enforce existing requirements in new ways.

If we lose key managers or are unable to attract and retain the talent required for our business, our operating results could suffer.

Our future success depends to a significant degree upon the members of our senior management, particularly Don Early, our Chairman of the Board of Directors and Chief Executive Officer, Mary Lou Andersen, our Vice Chairman of the Board, and Darrin J. Andersen, our President and Chief Operating Officer. We believe that our corporate culture and success are tied directly to the influence of Mr. Early and Ms. Andersen. Mr. Andersen has also been critical to our growth through acquisitions and new store openings. Accordingly, we believe that the loss of the services of any of these individuals could adversely affect our business. Our continued growth will also depend upon our ability to attract and retain additional skilled management personnel. Competition for highly-skilled and experienced management is intense and likely to continue and increase. To the extent that we are unable to attract and retain the talent required for our business, our operating results could suffer.

Potential litigation and regulatory actions directed toward our industry could adversely affect our operating results, particularly in a limited number of key states.

During the last few years, we and our competitors have been subject to regulatory proceedings, class action lawsuits and other litigation regarding the offering of payday loans. For instance, we and other payday lenders operated and were licensed in Indiana under a state law that was generally interpreted to permit payday loans. In January 2000, the Indiana Attorney General issued an opinion that this statute did not allow payday lending. Following the issuance of this opinion, we were sued in two class action lawsuits alleging violations of this statute as interpreted by the Attorney General. We settled the lawsuits for an aggregate of approximately $1.0 million in 2001. In addition, we materially reduced operations in Indiana for approximately eight months, until the law was amended to permit payday lending. During this time, we incurred approximately $1.0 million of operating losses from our Indiana stores. Future interpretations of state law in other jurisdictions similar to that of the Indiana Attorney General could have an adverse impact on our ability to offer payday loans in those states.

8

Revenues from our stores located in Missouri, California, Illinois and New Mexico represented in excess of 60% of our total revenues for the year ended December 31, 2003. Revenues from Missouri and California represented 24% and 17%, respectively, of our total revenues for the year ended December 31, 2003. To the extent that laws are passed that affect our ability to offer payday loans or the manner by which we offer payday loans in any one of those states, our business could be adversely affected.

We could suffer losses from interpretations of state laws regulating any of our other financial services, including check cashing and title loans. Regulatory actions taken with respect to one financial service that we offer could negatively affect our ability to offer other financial services. For example, if we were the subject of regulatory action related to our check cashing, title loans or other products, that regulatory action could adversely affect our ability to maintain our licenses for payday lending. Moreover, the suspension or revocation of our license or other authorization in one state could adversely affect our ability to maintain licenses in other states. Accordingly, a violation of a law or regulation in otherwise unrelated products or jurisdictions could affect other parts of our business and adversely affect our business and operations as a whole.

Our operations in North Carolina are dependent on County Bank. If the FDIC or the state of Delaware restricts County Bank from participating in the payday loan business, our operating results could suffer.

Because North Carolina’s usury laws prevent us from operating there without a bank relationship, we entered into an arrangement with County Bank, a Delaware state chartered bank. Under this arrangement, we provide various services in connection with the bank’s origination of payday loans through our North Carolina stores, and we purchase from the bank a participation interest in those loans. During 2003, approximately 4% of our revenues were earned under this arrangement. North Carolina is the only state in which we presently use this so-called “bank model,” and we are using County Bank exclusively in that state for this purpose. In many other states, laws render the use of the bank model necessary or advantageous to payday lenders. The bank model is, however, subject to federal and state banking regulations. Under the bank model, a state chartered bank makes a payday loan from its offices outside the borrower’s state. The bank model is typically used where the borrower’s state limits the availability of payday loans. Under generally accepted legal principles, the state chartered bank may “export” the interest rate permitted by the state in which it is domiciled on loans made to consumers in other states, and the state where the consumer is located cannot impose its usury law on that loan. Only state chartered banks can take advantage of the bank model, because federal regulators have effectively prohibited national banks and federal savings associations from participating in the payday loan industry. States may attempt to regulate the use of the bank model and challenge the practice that permits the export of interest rates. For example, Georgia’s recent legislation prohibiting payday loans also prohibits the use of the bank model by payday lenders. Other states may pass legislation similar to Georgia’s, particularly if the Georgia legislation survives pending court challenges.

The Federal Deposit Insurance Corporation, or FDIC, is the primary federal regulator of County Bank. In July 2003, the FDIC issued guidance for banks operating in the payday loan industry. The FDIC sets limits on the dollar amount of payday loans County Bank is permitted to have outstanding at any time based on its capital. If the FDIC reduces these limits or restricts County Bank’s ability to continue its current arrangement with us, our ability to maintain or grow this portion of our business in states where we rely or intend to rely on the bank model could be significantly restricted. County Bank is also subject to FDIC inspection and authority, and, as a result of our arrangement with County Bank, we too are subject to such inspection and authority.

The state of Delaware is the state regulator of County Bank. If the state of Delaware were to order County Bank to cease or significantly curtail its payday lending services, our revenues derived from our arrangement with County Bank in North Carolina would be adversely affected.

In addition, we may become subject to litigation or regulatory proceedings focusing on our relationship with County Bank. If we were to be characterized as the lender of these County Bank loans, then the interest charged for these loans would violate North Carolina’s usury laws. Any resulting refunds or penalties we would likely

9

incur could significantly affect our results of operations. In addition, states could challenge the validity of our arrangement with County Bank. For example, although we do not offer payday loans in New York, recently the New York State Attorney General’s office filed a lawsuit against County Bank and the companies servicing its payday loans in New York challenging the validity of their arrangement in New York. Our arrangement with County Bank requires us to indemnify County Bank against the costs of these types of regulatory challenges to its arrangement with us.

In the future, we may expand into additional states utilizing the bank model. Regulatory changes in existing state laws could require or make advantageous a transition to the bank model.

Media reports and public perception of payday loans as being predatory or abusive could adversely affect our business.

Over the past few years, consumer advocacy groups and certain media reports have advocated governmental action to prohibit or severely restrict payday loans. The consumer groups and media reports typically focus on the cost to a consumer for this type of loan, which is higher than the interest typically charged by credit card issuers. This difference in credit cost is more significant if a consumer does not promptly repay the loan, but renews, or rolls over, that loan for one or more additional short-term periods. The consumer groups and media reports typically characterize these payday loans as predatory or abusive toward consumers. If this negative characterization of our payday loans becomes widely accepted by consumers, demand for our payday loans could significantly decrease, which could adversely affect our results of operations and financial condition.

Negative perception of our payday loans or other activities could also result in our being subject to more restrictive laws and regulations. For example, in recent state legislative sessions dozens of bills have been introduced to restrict or prohibit payday lending. Additionally, negative perception influences local zoning and other approvals necessary to open de novo stores.

Regular turnover among our store managers and store-level employees makes it more difficult for us to operate our stores and increases our costs of operations.

We experience high turnover among our store-level employees and in our store managers. In 2003, we sustained approximately 52% turnover among our store managers and approximately 101% turnover among our store-level employees. Turnover interferes with implementation of store operating strategies. High turnover in the future would perpetuate these operating pressures and increase our operating costs and could restrict our ability to grow.

We lack product and business diversification. Accordingly, our future revenues and earnings are more susceptible to fluctuations than a more diversified company.

Our primary business activity is offering payday loans. We also provide certain related services, such as check cashing and title loans, which accounted for approximately 13% of our revenues in 2003 and first quarter of 2004. If we are unable to maintain and grow the operating revenues from our payday loan business, our future revenues and earnings are not likely to grow and could decline. Our lack of product and business diversification could inhibit the opportunities for growth of our business, revenues and profits.

Any disruption in the availability of our information systems could adversely affect operations at our stores.

We rely upon our information systems to manage and operate our stores and business. Each store is part of an information network that permits us to maintain adequate cash inventory, reconcile cash balances daily, report revenues and expenses timely and, in North Carolina, to access County Bank’s loan approval system. Our back-up systems and security measures could fail to prevent a disruption in the availability of our information systems. Any disruption in the availability of our information systems could adversely affect our operations and our results of operations.

10

Our headquarters are located at a single location in Kansas City, Kansas. Our information systems and administrative and management processes are primarily provided to our regions and stores from this location, which could be disrupted if a catastrophic event, such as a tornado, power outage or act of terror, destroyed or severely damaged the headquarters. Any of these catastrophic events could adversely affect our operations and our results of operations.

Our business and results of operations may be adversely affected if we are unable to manage our growth effectively.

Our continued growth is dependent upon a number of factors, including the ability to hire, train and retain an adequate number of experienced managers and employees, the availability of good store locations, the availability of adequate financing for our expansion activities, the ability to obtain any government permits and licenses and other factors that are beyond our control. Expansion beyond the geographic areas where our stores are presently located will increase demands on management and divert their attention.

Further, acquisitions may entail numerous integration risks and impose costs on us, including:

| | • | difficulties integrating a workforce that understands and implements our vision of customer service and our Operational Excellence program; |

| | • | difficulties integrating acquired operations or services; |

| | • | the risk of the loss of key employees from acquired businesses; |

| | • | diversion of management’s attention from our core business; |

| | • | dilutive issuances of our equity securities (to the extent used to finance acquisitions); |

| | • | incurrence of indebtedness (to the extent used to finance acquisitions or de novo stores); |

| | • | assumption of known and unknown contingent liabilities; |

| | • | the potential impairment of acquired assets; and |

| | • | incurrence of significant immediate write-offs. |

Further, we may not be successful in identifying attractive acquisitions or completing acquisitions on favorable terms. Our failure to integrate acquired stores could adversely affect our business.

Competition in the retail financial services industry is intense and could cause us to lose market share and revenues.

We believe that the primary competitive factors in the payday loan industry are store location and customer service. We face intense competition in the payday loan industry, and we believe that the payday lending market is becoming more competitive as this industry matures and begins to consolidate. The payday loan industry has low barriers to entry, and new competitors may enter the market easily. We currently compete with services, such as overdraft protection, offered by traditional financial institutions and with other payday loan and check cashing stores and other financial service entities and retail businesses that offer payday loans or other similar financial services. Some of our competitors have larger and more established customer bases and substantially greater financial, marketing and other resources than we have. As a result, we could lose market share and our revenues could decline, thereby affecting our earnings and potential for growth.

General economic conditions affect our loan losses, and accordingly, our results of operations could be adversely affected by a general economic slowdown.

Provision for losses is one of our largest operating expenses, constituting 21.6% of total revenues for the year ended December 31, 2003, and 13.5% of total revenues for the three months ended March 31, 2004, with

11

payday loan losses constituting substantially all the losses. During each period, if a customer does not repay a payday loan when due and the check we present for payment is returned, all accrued fees, interest and outstanding principal are charged off as uncollectible, generally within 15 days after the loan was due. At the end of each period, management considers recent collection history to develop expected loss rates, which are used for the establishment of the allowance for loan losses. Any changes in economic factors that adversely affect our customers could result in higher loan loss experiences than anticipated, which could adversely affect our loan charge-offs and operating results.

If estimates of our loan losses are not adequate to absorb actual losses, our financial condition and results of operations may be adversely affected.

We maintain an allowance for loan losses at levels to cover the estimated incurred losses in the collection of our loan portfolio outstanding at the end of the applicable period. At the end of each period, management considers recent collection history to develop expected loss rates, which are used for the establishment of the allowance for loan losses. Our allowance for loan loss was $1.1 million on December 31, 2003 and $700,000 on March 31, 2004. Our allowance for loan losses is an estimate, and if actual loan losses are materially greater than our allowance for losses, our financial condition and results of operations could be adversely affected.

Because we maintain a significant supply of cash in our stores, we may experience losses due to employee error and theft.

Because our business requires us to maintain a significant supply of cash in our stores, we are subject to the risk of cash shortages resulting from employee errors and theft. We periodically experience employee error and theft in stores, which can significantly increase the operating expenses of those stores for the period in which the employee error or theft is discovered.

Risks Related to this Offering

Our executive officers, directors and principal stockholders may be able to exert significant control over our future direction.

After this offering, our executive officers, directors and principal stockholders will together control approximately 75% of our outstanding common stock. Don Early, our Chairman and Chief Executive Officer, alone will own approximately 45% of our common stock. The election of each director requires a plurality of the shares voting for directors at a meeting of stockholders at which a quorum is present. Approval of a significant corporate transaction, such as a merger or consolidation of the company, a sale of all or substantially all of its assets or a dissolution of the company, requires the affirmative vote of a majority of the outstanding shares of our common stock. Other actions requiring stockholder approval require the affirmative vote of a majority of the shares of common stock voting on the matter, provided that a quorum is present. A quorum requires the presence of a majority of the shares outstanding. As a result, one or more stockholders owning a relatively low percentage of the outstanding shares of our common stock could, acting together with Don Early, control all matters requiring our stockholders’ approval, including the election of directors and approval of significant corporate transactions. As a result, this concentration of ownership may delay, prevent or deter a change in control or change in board composition, could deprive our stockholders of an opportunity to receive a premium for their common stock as part of a sale of the company or its assets and might reduce the market price of our common stock.

Our quarterly results have fluctuated in the past and may fluctuate in the future. If they fluctuate in the future, the market price of our common stock could also fluctuate significantly.

Our quarterly results have fluctuated in the past and are likely to continue to fluctuate in the future. If they do so, our quarterly revenues and operating results may be difficult to forecast. It is possible that our future quarterly results of operations will not meet the expectations of securities analysts or investors. This could cause a material drop in the market price of our common stock.

12

Our business will continue to be affected by a number of factors, any one of which could substantially affect our results of operations for a particular fiscal quarter. Our quarterly results of operations can vary due to:

| | • | fluctuations in payday loan demand; |

| | • | fluctuations in our loan loss experience; and |

| | • | regulatory activity restricting our business. |

The price of our common stock after this offering may be lower than the offering price you pay and may be volatile.

Prior to this offering, our common stock has not been sold in a public market. After this offering, an active trading market in our common stock might not develop. If an active trading market develops, it may not continue. Moreover, if an active market develops, the trading price of our common stock may fluctuate widely as a result of a number of factors, many of which are outside of our control. In addition, the stock market has experienced extreme price and volume fluctuations that have affected the market prices of many companies. These broad market fluctuations could adversely affect the market price of our common stock. A significant decline in our stock price could result in substantial losses for individual stockholders and could lead to costly and disruptive securities litigation. If you purchase shares of our common stock in this offering, you will pay a price that was not established in a competitive market. Instead, you will pay a price that was negotiated with the representatives of the underwriters. The price of our common stock that will prevail in the market after this offering may be higher or lower than the offering price.

Future sales of shares of our common stock in the public market could depress our stock price and make it difficult for you to recover the full value of your investment.

Prior to this offering, there has been no public market for our common stock. We cannot predict the effect, if any, that market sales of shares of common stock or the availability of shares of common stock for sale will have on the market price of our common stock prevailing from time to time. If our existing stockholders sell substantial amounts of our common stock in the public market following this offering or if there is a perception that these sales may occur, the market price of our common stock could decline. All of the outstanding shares of common stock belonging to officers, directors and other stockholders are currently “restricted securities” under the Securities Act. Assuming the underwriters do not exercise their over-allotment option, after the lockup agreements pertaining to this offering expire 180 days from the date of this prospectus, unless earlier waived, up to 15,371,000 shares, and 1,491,250 shares issuable upon exercise of outstanding options will be eligible for future sale in the public market at prescribed times pursuant to Rule 144 under the Securities Act, or otherwise. This consists of all the outstanding shares of the company and all the options of the company then exercisable. Sales of a significant number of these shares of common stock in the public market could reduce the market price of our common stock.

The use of our common stock to fund acquisitions or to refinance debt incurred for acquisitions could dilute existing shares.

We intend to consider opportunities to acquire payday loan companies or businesses. We expect that future acquisitions, if any, could provide for consideration to be paid in cash, shares of our common stock, or a combination of cash and shares. If the consideration for an acquisition is paid in common stock, existing stockholders’ investments could be diluted. Furthermore, we may decide to incur debt to fund all or part of the costs of an acquisition and may later issue additional shares of common stock to reduce that debt or to provide funds for future acquisitions. The issuance of additional shares of common stock for those purposes would also dilute our existing stockholders’ investments.

Our anti-takeover provisions could prevent or delay a change in control of our company even if the change of control would be beneficial to our stockholders.

Provisions of our amended and restated articles of incorporation and amended and restated bylaws as well as provisions of Kansas law could discourage, delay or prevent a merger, acquisition or other change in control of

13

our company, even if the change in control would be beneficial to our stockholders. These provisions include:

| | • | authorizing the issuance of “blank check” preferred stock that could be issued by our board of directors without a stockholder vote to increase the number of outstanding shares and thwart a takeover attempt; |

| | • | limitations on the ability of stockholders to call special meetings of stockholders; and |

| | • | establishing advance notice requirements for nominations for election to the board of directors or for proposing matters that can be acted upon by stockholders at stockholder meetings. |

We will have broad discretion in how we use the proceeds of this offering, and we may not use these proceeds effectively. This could affect our profitability and cause our stock price to decline.

Our management will have considerable discretion in the application of the net proceeds of this offering, and you will not have the opportunity, as part of your investment decision, to assess whether we are using the proceeds appropriately. We intend to use a part of the net proceeds for repayment of indebtedness, and the balance for opening de novo stores, making acquisitions and funding future working capital requirements. We may use the net proceeds for corporate purposes that do not increase our profitability or our market value.

Investors will incur immediate and substantial dilution in the book value of their investment.

The initial public offering price of our common stock will be substantially higher than the net tangible book value per share of our outstanding common stock. If you purchase shares of our common stock, you will incur immediate and substantial dilution in the amount of $10.48 per share, based on the initial public offering price of $14.00 per share.

14

FORWARD-LOOKING STATEMENTS

This prospectus includes forward-looking statements regarding, among other things, our plans, strategies and prospects, both business and financial. All statements other than statements of current or historical fact contained in this prospectus are forward-looking statements. The words “believe,” “expect,” “anticipate,” “should,” “would,” “could,” “plan,” “will,” “may,” “intend,” “estimate,” “potential,” “continue” or similar expressions or the negative of these terms are intended to identify forward-looking statements.

We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations and business strategy. They can be affected by inaccurate assumptions, including the risks, uncertainties and assumptions described in “Risk Factors.” In light of these risks, uncertainties and assumptions, the forward-looking statements in this prospectus may not occur and actual results could differ materially from those anticipated or implied in the forward-looking statements. When you consider these forward-looking statements, you should keep in mind the risk factors and other cautionary statements in this prospectus.

Our forward-looking statements speak only as of the date they are made. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

15

USE OF PROCEEDS

Net proceeds to us from this offering are approximately $63.7 million based on the sale of 5,000,000 shares at the initial offering price of $14.00 per share and after deducting the underwriting discount and estimated expenses of the offering payable by us. We intend to use approximately $24.4 million of the net proceeds from this offering to pay in full the balances of all of our indebtedness under our bank loans. The following table sets forth the payoff amount for each of these obligations as of May 31, 2004, along with the applicable interest rates and maturities:

| | | | | | | |

Obligation

| | Payoff

Amount

| | Interest Rate

| | Maturity

|

Revolving Credit Facility | | $ | 4,006,328 | | Prime plus 1% | | Monthly interest payment plus repayment of all outstanding principal at maturity on October 31, 2004 |

Term Loan | | | 983,333 | | Prime plus 1% | | All principal and accrued interest due by March 1, 2019 |

Term Loan | | | 7,830,398 | | Prime plus 1% | | Monthly principal payments of $147,744 plus interest through October 31, 2008 |

Term Loan | | | 6,041,622 | | Prime plus 1% | | Monthly principal payments of $208,332 plus interest through October 31, 2006 |

Subordinated Term Loan | | | 5,206,215 | | 6% in year 1

8% in year 210% in year 3 | | Due October 2006 |

Subordinated Term Loan | | | 293,785 | | 6% in year 1

8% in year 210% in year 3 | | Due October 2006 |

| | |

|

| | | | |

Total | | $ | 24,361,681 | | | | |

| | |

|

| | | | |

We incurred all the indebtedness described in the table above, other than the $1.0 million term loan in October 2003, (1) for working capital purposes, (2) to refinance then existing term loans with our senior lender, and (3) to finance the redemption of shares of our common stock for $15.0 million. We incurred the $1.0 million term loan in 2004 to finance the purchase of real estate.

Net proceeds from this offering after repayment of indebtedness are approximately $39.3 million. We intend to use this balance to fund future growth through the opening of de novo stores and opportunistic acquisitions and for future working capital requirements. As of the date of this prospectus, we have entered into fully executed leases for 22 de novo store locations and are actively negotiating leases for 52 additional de novo store locations. From time to time, we evaluate and consider potential acquisition candidates that may become available. We have no current plans, arrangements, or understandings related to any material acquisitions.

We will not receive any of the proceeds from the shares of common stock sold by the selling stockholders pursuant to the underwriters’ over-allotment option, if exercised.

16

DIVIDEND POLICY

Currently, we have no dividend policy. All prior dividend decisions made by the board were made on the basis of facts and circumstances present at the relevant time. Immediately after the registration statement of which this prospectus forms a part was declared effective, four new members joined our board. The reconstituted board may adopt a dividend policy in the future.

We have paid dividends in the past. We paid an aggregate of $400,000 in dividends to our stockholders in 2003. We paid $3.1 million of dividends in 2004. We paid dividends in the fourth quarter of 2003 and the first two quarters of 2004 because we were a private company that had historically distributed none of our earnings to our stockholders. Recent changes in tax laws also made payment of cash dividends more attractive.

17

CAPITALIZATION

The following table sets forth our capitalization as of March 31, 2004:

| | • | on an actual basis, adjusted for the 10 for 1 split of our common stock effectuated as a stock dividend during our second quarter 2004; and |

| | • | on an as adjusted basis to give effect to (1) the sale of shares of our common stock in this offering at the initial public offering price of $14.00 per share, (2) our intended application of the net proceeds, after consideration of underwriting discounts and commissions and offering expenses, (3) amendment to the Articles of Incorporation to increase the number of authorized shares and (4) the termination of the stockholders agreement effective June 30, 2004, which removed the liability for mandatory stock redemption and increased stockholders’ equity by $17 million. |

This table should be read together with “Selected Financial Data,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes included elsewhere in this prospectus.

| | | | | | | | |

| | | As of March 31, 2004

| |

| | | Actual

| | | As

Adjusted

| |

| | | (Dollars in thousands) | |

| |

| | | (Unaudited) | |

| | |

Cash and cash equivalents | | $ | 10,238 | | | $ | 50,688 | |

| | |

|

|

| |

|

|

|

Debt: | | | | | | | | |

Revolving credit facility | | $ | 6 | | | $ | | |

Subordinated unsecured notes due October 2006 | | | 7,500 | | | | | |

Term loan due October 2006 | | | 6,458 | | | | | |

Term loan due October 2008 | | | 8,126 | | | | | |

Term loan due March 2019 | | | 1,000 | | | | | |

Other | | | 200 | | | | | |

Liability for mandatory stock redemption | | | 17,000 | | | | | |

| | |

|

|

| |

|

|

|

Total debt | | | 40,290 | | | | | |

| | |

|

|

| |

|

|

|

Stockholders’ equity: | | | | | | | | |

Common stock, $0.01 par value, 30,000,000 shares authorized, 19,087,600 shares issued and 15,333,000 shares outstanding, actual; 75,000,000 shares authorized, 20,333,000 shares issued and outstanding, as

adjusted (1) | | | 191 | | | | 203 | |

Retained earnings | | | 25,643 | | | | 25,443 | |

Additional paid-in capital | | | 5,248 | | | | 69,113 | |

Treasury stock, 3,754,600 shares at cost, actual; 0 as adjusted | | | (16,863 | ) | | | | |

Notes received for equity | | | (184 | ) | | | (184 | ) |

| | |

|

|

| |

|

|

|

Total stockholders’ equity | | | 14,035 | | | | 94,575 | |

| | |

|

|

| |

|

|

|

Total capitalization | | $ | 54,325 | | | $ | 94,575 | |

| | |

|

|

| |

|

|

|

| (1) | Excludes1,650,500 shares of our common stock reserved for issuance upon the exercise of options outstanding as of March 31, 2004 at a weighted average exercise price of $2.20 per share and excludes 430,000 shares of common stock issuable upon the exercise of stock options that we granted immediately prior to the effectiveness of the registration statement of which this prospectus forms a part at an option exercise price equal to the price per share in this offering. |

18

DILUTION

The net tangible book value of our common stock on March 31, 2004 was $7.8 million, or approximately $0.51 per share. Net tangible book value per share represents the amount of our total tangible assets less total liabilities, divided by the number of shares of common stock outstanding. Dilution in net tangible book value per share represents the difference between the amount per share paid by purchasers of shares of our common stock in this offering and the net tangible book value per share of our common stock immediately afterwards. After giving effect to the sale of 5,000,000 shares at the initial public offering price of $14.00 per share and after deducting underwriting discounts and commissions and estimated offering expenses payable by us, our net tangible book value at March 31, 2004 would have been approximately $71.5 million, or $3.52 per share. This represents an immediate increase in net tangible book value of $3.01 per share to existing stockholders and an immediate dilution in net tangible book value of $10.48 per share to new investors purchasing shares of common stock in this offering. The following table illustrates this dilution on a per share basis:

| | | | | |

Initial public offering price per share | | | | $ | 14.00 |

Net tangible book value per share at March 31, 2004 | | 0.51 | | | |

Increase per share attributable to this offering | | 3.01 | | | |

| | |

| | | |

As adjusted net tangible book value per share after this offering | | | | | 3.52 |

| | | | |

|

|

Dilution per share to new investors | | | | $ | 10.48 |

| | | | |

|

|

The following table summarizes, on an as adjusted basis, as of March 31, 2004, the total number of shares of our common stock, the total consideration paid and the average price per share paid by existing stockholders and by the new investors in this offering, calculated before deducting the underwriting discounts and commissions and estimated offering expenses:

| | | | | | | | | | | | | | |

| | | As of March 31, 2004

|

| | | Shares Purchased

| | | Total Consideration

| | | Average Price

Per Share

|

| | | Number

| | Percent

| | | Amount

| | Percent

| | |

Existing Stockholders | | 15,333,000 | | 75.4 | % | | $ | 1,932,238 | | 2.7 | % | | $ | 0.13 |

New Investors | | 5,000,000 | | 24.6 | | | | 70,000,000 | | 97.3 | | | | 14.00 |

| | |

| |

|

| |

|

| |

|

| | | |

Total | | 20,333,000 | | 100.0 | % | | $ | 71,932,238 | | 100.0 | % | | | |

| | |

| |

|

| |

|

| |

|

| | | |

The foregoing discussion and tables assume no exercise of outstanding options to purchase 1,650,500 shares of our common stock that are exercisable at a weighted average price of $2.20 per share. To the extent the outstanding options are exercised, there may be further dilution to new investors. The foregoing table also assumes no exercise of options to acquire 430,000 shares of common stock, which options we granted immediately prior to the effectiveness of the registration statement of which this prospectus forms a part at an option exercise price equal to the price per share in this offering.

19

SELECTED FINANCIAL DATA

We derived the following historical financial information from our audited consolidated financial statements as of December 31, 2002 and December 31, 2003 and for each of the years in the three-year period ended December 31, 2003 and our unaudited consolidated financial statements as of and for the three months ended March 31, 2004 and for the three months ended March 31, 2003, which are included elsewhere in this prospectus, and our audited consolidated financial statements as of and for the years ended December 31, 1999 and December 31, 2000 and as of December 31, 2001, which are not included in this prospectus. The as adjusted balance sheet data give effect to this offering and the use of proceeds as if they occurred at March 31, 2004. The unaudited consolidated financial statements include all adjustments, consisting of normal recurring adjustments, which we consider necessary for a fair presentation of the financial position and the results of operations for these periods. Operating results for the three months ended March 31, 2004 are not necessarily indicative of the results that may be expected for the entire year ending December 31, 2004. This table should be read together with the information contained in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our audited and unaudited consolidated financial statements and related notes included elsewhere in this prospectus. The information provided below gives effect to a 10 for 1 stock split, which was effectuated as a stock dividend during our second quarter 2004.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Year Ended December 31,

| | Three Months Ended March 31,

|

| | | 1999

| | | 2000

| | 2001

| | | 2002

| | 2003

| | 2003

| | | 2004

|

| | | (Dollars in thousands, except per share and Operating and Loss Data) |

| | | | | | | | | | | | | | | (Unaudited) |

Statement of Income Data: | | | | | | | | | | | | | | | | | | | | | | | | |

Revenues: | | | | | | | | | | | | | | | | | | | | | | | | |

Payday loan fees | | $ | 11,536 | | | $ | 29,169 | | $ | 47,935 | | | $ | 59,006 | | $ | 86,010 | | $ | 17,559 | | | $ | 24,516 |

Other | | | 7,093 | | | | 10,139 | | | 12,348 | | | | 11,901 | | | 12,484 | | | 3,704 | | | | 3,667 |

| | |

|

|

| |

|

| |

|

|

| |

|

| |

|

| |

|

|

| |

|

|

Total revenues | | | 18,629 | | | | 39,308 | | | 60,283 | | | | 70,907 | | | 98,494 | | | 21,263 | | | | 28,183 |

| | |

|

|

| |

|

| |

|

|

| |

|

| |

|

| |

|

|

| |

|

|

Store expenses: | | | | | | | | | | | | | | | | | | | | | | | | |

Salaries and benefits | | | 3,587 | | | | 7,919 | | | 10,631 | | | | 15,646 | | | 21,279 | | | 4,940 | | | | 6,117 |

Provision for losses | | | 3,017 | | | | 6,822 | | | 14,827 | | | | 14,943 | | | 21,293 | | | 3,873 | | | | 3,797 |

Occupancy | | | 2,696 | | | | 5,873 | | | 7,520 | | | | 8,509 | | | 10,862 | | | 2,696 | | | | 3,014 |

Depreciation and amortization | | | 167 | | | | 388 | | | 559 | | | | 952 | | | 1,397 | | | 266 | | | | 366 |

Other | | | 1,884 | | | | 5,744 | | | 7,216 | | | | 7,070 | | | 7,571 | | | 1,902 | | | | 1,953 |

| | |

|

|

| |

|

| |

|

|

| |

|

| |

|

| |

|

|

| |

|

|

Total store expenses | | | 11,351 | | | | 26,746 | | | 40,753 | | | | 47,120 | | | 62,402 | | | 13,677 | | | | 15,247 |

| | |

|

|

| |

|

| |

|

|

| |

|

| |

|

| |

|

|

| |

|

|

Store gross profit | | | 7,278 | | | | 12,562 | | | 19,530 | | | | 23,787 | | | 36,092 | | | 7,586 | | | | 12,936 |

| | | | | | | |

Regional expenses | | | 1,267 | | | | 2,791 | | | 4,340 | | | | 4,949 | | | 5,613 | | | 1,399 | | | | 1,820 |

Corporate expenses | | | 1,524 | | | | 1,715 | | | 3,397 | | | | 4,815 | | | 6,324 | | | 1,373 | | | | 1,791 |

Depreciation and amortization | | | 540 | | | | 415 | | | 944 | | | | 241 | | | 538 | | | 81 | | | | 132 |

Interest expense | | | 948 | | | | 1,008 | | | 1,210 | | | | 879 | | | 936 | | | 216 | | | | 356 |

Other, net | | | 14 | | | | 38 | | | (84 | ) | | | 22 | | | 35 | | | 25 | | | | 30 |

| | |

|

|

| |

|

| |

|

|

| |

|

| |

|

| |

|

|

| |

|

|

Income before taxes | | | 2,985 | | | | 6,595 | | | 9,723 | | | | 12,881 | | | 22,646 | | | 4,492 | | | | 8,807 |

Provision for income taxes | | | 1,029 | | | | 2,520 | | | 3,826 | | | | 5,046 | | | 8,722 | | | 1,726 | | | | 3,556 |

| | |

|

|

| |

|

| |

|

|

| |

|

| |

|

| |

|

|

| |

|

|

Net income | | $ | 1,956 | | | $ | 4,075 | | $ | 5,897 | | | $ | 7,835 | | $ | 13,924 | | $ | 2,766 | | | $ | 5,251 |

| | |

|

|

| |

|

| |

|

|

| |

|

| |

|

| |

|

|

| |

|

|

Earnings (loss) per share (1): | | | | | | | | | | | | | | | | | | | | | | | | |

Basic | | $ | (0.21 | ) | | $ | 0.04 | | $ | 0.31 | | | $ | 0.41 | | $ | 0.41 | | $ | (0.13 | ) | | $ | 0.34 |

Diluted | | | (0.21 | ) | | | 0.04 | | | 0.31 | | | | 0.41 | | | 0.39 | | | (0.13 | ) | | | 0.32 |

Shares used to calculate earnings (loss) per share: | | | | | | | | | | | | | | | | | | | | | | | | |

Basic | | | 16,666,129 | | | | 18,915,000 | | | 18,915,000 | | | | 18,915,000 | | | 15,934,673 | | | 18,915,000 | | | | 11,688,010 |

Diluted | | | 16,666,129 | | | | 18,991,998 | | | 19,036,641 | | | | 19,256,263 | | | 16,436,429 | | | 19,381,398 | | | | 12,347,417 |

| | | | | | | |

Cash dividends per share | | | | | | | | | | | | | | | | $ | 0.03 | | | | | | $ | 0.06 |

20

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Year Ended December 31,

| | | Three Months Ended March 31,

| |

| | | 1999

| | | 2000

| | | 2001

| | | 2002

| | | 2003

| | | 2003

| | | 2004

| |

| | | (Dollars in thousands, except per share and Operating and Loss Data) | |

| | | | | | |

| | | | | | | | | | | | | | | | | | (Unaudited) | |

Cash Flow Information: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Cash flows provided by (used for): | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Operating activities | | $ | 3,149 | | | $ | 4,954 | | | $ | 9,105 | | | $ | 10,968 | | | $ | 18,409 | | | $ | 2,651 | | | $ | 4,527 | |

Investing activities | | | (6,124 | ) | | | (13,357 | ) | | | (7,063 | ) | | | (12,275 | ) | | | (14,391 | ) | | | 3,226 | | | | 3,326 | |

Financing activities | | | 6,212 | | | | 8,756 | | | | 806 | | | | 447 | | | | (2,512 | ) | | | (3,426 | ) | | | (7,112 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net increase (decrease) in cash and cash equivalents | | $ | 3,237 | | | $ | 353 | | | $ | 2,848 | | | $ | (860 | ) | | $ | 1,506 | | | $ | 2,451 | | | $ | 741 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | | | | |

Operating Data: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Stores (at end of period) | | | 122 | | | | 176 | | | | 204 | | | | 258 | | | | 294 | | | | 270 | | | | 295 | |

Percentage increase in comparable total store revenues from prior period (3) | | | 64.7 | % | | | 8.1 | % | | | 24.9 | % | | | 4.1 | % | | | 16.6 | % | | | 14.4 | % | | | 25.2 | % |

Payday loans: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Number of loan transactions — new loans and refinances (in thousands) | | | 443 | | | | 778 | | | | 1,194 | | | | 1,381 | | | | 1,878 | | | | 393 | | | | 519 | |

Loan volume (in thousands) | | $ | 85,610 | | | $ | 204,169 | | | $ | 327,334 | | | $ | 398,494 | | | $ | 590,071 | | | $ | 119,441 | | | $ | 168,848 | |

Average loan | | | 193.42 | | | | 262.29 | | | | 274.21 | | | | 288.53 | | | | 314.14 | | | | 303.97 | | | | 325.28 | |

Average fee | | | 26.06 | | | | 37.47 | | | | 40.89 | | | | 44.11 | | | | 47.76 | | | | 46.36 | | | | 49.29 | |

| | | | | | | |

Loss Data: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Provision for losses as a percentage of revenues | | | 16.2 | % | | | 17.4 | % | | | 24.6 | % | | | 21.1 | % | | | 21.6 | % | | | 18.2 | % | | | 13.5 | % |

Allowance for Loan Losses: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balance at beginning of period | | $ | 98 | | | $ | 265 | | | $ | 565 | | | $ | 650 | | | $ | 750 | | | $ | 750 | | | $ | 1,090 | |

Adjustment to provision for losses based on evaluation of outstanding receivables at year end | | | 167 | | | | 300 | | | | 85 | | | | 100 | | | | 340 | | | | (210 | ) | | | (390 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Balance, at period end | | $ | 265 | | | $ | 565 | | | $ | 650 | | | $ | 750 | | | $ | 1,090 | | | $ | 540 | | | $ | 700 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Provision for Losses: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Charged-off to expense | | $ | 5,956 | | | $ | 14,540 | | | $ | 26,705 | | | $ | 32,934 | | | $ | 45,665 | | | $ | 10,414 | | | $ | 11,156 | |

Recoveries | | | (3,106 | ) | | | (8,018 | ) | | | (11,963 | ) | | | (18,091 | ) | | | (24,712 | ) | | | (6,331 | ) | | | (6,969 | ) |

Adjustment to provision for losses based on evaluation of outstanding receivables at period end | | | 167 | | | | 300 | | | | 85 | | | | 100 | | | | 340 | | | | (210 | ) | | | (390 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total provision for losses | | $ | 3,017 | | | $ | 6,822 | | | $ | 14,827 | | | $ | 14,943 | | | $ | 21,293 | | | $ | 3,873 | | | $ | 3,797 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | |

| | | As of December 31,

| | | As of March 31, 2004

| |

| | | 1999

| | | 2000

| | | 2001

| | | 2002

| | | 2003

| | | Actual

| | | As Adjusted (2)

| |

| | | (Dollars in thousands) | | | (Unaudited) | |

Balance Sheet Data: | | | | | | | | | | | | | | | | | | | | | | | | | |

Cash and cash equivalents | | $ | 5,650 | | | $ | 6,003 | | | $ | 8,851 | | | $ | 7,991 | | | $ | 9,497 | | | $ | 10,238 | | | $ | 50,688 | |

Loans receivable, net of allowance for losses | | | 8,004 | | | | 16,855 | | | | 19,438 | | | | 26,619 | | | | 35,933 | | | | 30,184 | | | | 30,184 | |

Total assets | | | 17,884 | | | | 31,503 | | | | 40,607 | | | | 51,045 | | | | 64,929 | | | | 62,481 | | | | 102,731 | |

Current debt | | | 953 | | | | 9,796 | | | | 5,319 | | | | 8,893 | | | | 10,974 | | | | 4,546 | | | | | |

Liability for mandatory stock redemption | | | | | | | | | | | | | | | | | | | 17,000 | | | | 17,000 | | | | | |

Long-term debt | | | 5,696 | | | | 5,666 | | | | 10,942 | | | | 7,771 | | | | 18,880 | | | | 18,744 | | | | | |

Shares subject to redemption | | | 7,000 | | | | 11,000 | | | | 11,000 | | | | 11,000 | | | | | | | | | | | | | |

Stockholders’ equity | | | 2,743 | | | | 2,851 | | | | 8,754 | | | | 16,665 | | | | 9,333 | | | | 14,035 | | | | 94,575 | |

21

| (1) | Basic earnings (loss) per share is computed using the two-class method by dividing income available to common stockholders by the weighted average number of common shares outstanding during the period. Diluted earnings (loss) per share is computed giving effect to all dilutive potential common shares that were outstanding during the period. The effect of stock options represents the only differences between the weighted average shares used for the basic earnings per share computation compared to the diluted earnings per share computation. |

The following table presents the computations of basic and diluted earnings per share for the periods presented.

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Year Ended December 31,

| | | Three Months Ended March 31,

| |

| | | 1999

| | | 2000

| | 2001

| | 2002

| | 2003