SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx Filed by a Party other then the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to § 240.14a-12 |

QC HOLDINGS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | 1) | Title of each class of securities to which transaction applies: |

| | 2) | Aggregate number of securities to which transaction applies: |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | Amount Previously Paid: |

| | 2) | Form, Schedule or Registration Statement No.: |

April 28, 2005

Dear Fellow Stockholder:

You are invited to attend the annual meeting of stockholders of QC Holdings, Inc. The meeting will be held at 10:00 a.m., local time, on Tuesday, June 7, 2005, at the Doubletree Hotel, 10100 College Boulevard, Overland Park, Kansas 66210. At the annual meeting you will be asked to re-elect the company’s board of directors. We will also be discussing our results for the past year and answering your questions.

You will notice in reading the proxy statement that Gregory L. Smith, a director of the company and its predecessors since 1988, will retire from the board at this year’s annual meeting. We want to express our appreciation to Mr. Smith for his contributions to the company during his 17 years of service.

Whether or not you attend the annual meeting, it is important that your shares be represented and voted at the meeting. Please mark, sign and date your proxy card today and return it in the envelope provided. You can also vote by telephone or via the Internet as described on the proxy card.

Thank you for your support of QC Holdings and your involvement in this important process.

|

Sincerely, |

|

|

Don Early |

Chairman and Chief Executive Officer |

QC HOLDINGS, INC.

9401 Indian Creek Parkway, Suite 1500

Overland Park, Kansas 66210

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

Tuesday, June 7, 2005

TO THE STOCKHOLDERS OF QC HOLDINGS, INC.

NOTICE IS HEREBY GIVEN that the annual meeting of stockholders of QC Holdings, Inc. will be held at the Doubletree Hotel, 10100 College Boulevard, Overland Park, Kansas 66210 at 10:00 a.m., local time, on Tuesday, June 7, 2005, for the following purposes:

| | 1. | To elect six directors, each for a term of one year and until their successors are elected and qualified; and |

| | 2. | To transact any other business properly introduced at the meeting. |

These items of business are more fully described in the proxy statement accompanying this notice.

Only stockholders of record at the close of business on April 18, 2005, are entitled to notice of and to vote at the meeting or any adjournment or postponement thereof. On April 18, 2005, the record date for the annual meeting, there were 20,700,250 shares of common stock outstanding. Each outstanding share is entitled to one vote.

The board of directors of the company encourages you to mark, sign and date your proxy card and return it today in the enclosed postage prepaid envelope, or vote by telephone or via the Internet (as described on the proxy card), whether or not you intend to be present at the annual meeting.

|

By Order of the Board of Directors |

|

|

Mary Lou Andersen |

Secretary |

Overland Park, Kansas

April 28, 2005

QC HOLDINGS, INC.

9401 Indian Creek Parkway, Suite 1500

Overland Park, Kansas 66210

PROXY STATEMENT

FOR

ANNUAL MEETING OF STOCKHOLDERS

Tuesday, June 7, 2005

SOLICITATION AND REVOCABILITY OF PROXIES

This proxy statement and the enclosed proxy card are furnished to the stockholders of QC Holdings, Inc., a Kansas corporation, in connection with the solicitation of proxies by the company for use at the company’s annual meeting of stockholders, and any adjournments or postponements thereof, to be held at the Doubletree Hotel, 10100 College Boulevard, Overland Park, Kansas at 10:00 a.m., local time, on Tuesday, June 7, 2005. The mailing of this proxy statement, the proxy card, the notice of annual meeting and the accompanying 2004 annual report to stockholders is expected to begin on May 3, 2005. All costs of solicitation will be borne by the company.

You are requested to vote your shares by following the instructions on the proxy card for voting by telephone or via the Internet or by completing, signing, dating and returning the proxy promptly in the enclosed postage prepaid envelope. Your proxy may be revoked by written notice of revocation delivered to the secretary of the company, by executing and delivering a later dated proxy or by voting in person at the annual meeting. Attendance at the annual meeting will not constitute a revocation of your proxy unless you vote in person at the annual meeting or deliver an executed and later dated proxy. Proxies duly executed and received in time for the annual meeting will be voted in accordance with the stockholders’ instructions. If no instructions are given, proxies will be voted as follows:

| | 1. | to elect Don Early, Mary Lou Andersen, Richard B. Chalker, Gerald F. Lamberti, Francis P. Lemery and Mary V. Powell as directors to serve for one year terms until the 2006 annual meeting of stockholders and until their respective successors are duly elected and qualified; and |

| | 2. | in the discretion of the proxy holder as to any other matter properly coming before the annual meeting. |

OUTSTANDING VOTING SECURITIES OF THE COMPANY

Only the record holders of shares of common stock as of the close of business on April 18, 2005, are entitled to vote on the matters to be presented at the annual meeting, either in person or by proxy. At the close of business on April 18, 2005, there were outstanding and entitled to vote a total of 20,700,250 shares of common stock, constituting all the outstanding voting securities of the company.

The presence at the annual meeting, in person or by proxy, of the holders of at least a majority of the shares of common stock as of the record date is necessary to constitute a quorum. Abstentions and broker non-votes are counted for purposes of determining the presence of a quorum at the annual meeting. Each share of common stock is entitled to one vote for each director to be elected and for each other matter properly brought to a vote of the stockholders at the annual meeting. The affirmative vote of a plurality of the shares of common stock present or represented at the annual meeting is required to elect the directors.

1

ELECTION OF DIRECTORS

At the annual meeting, the stockholders will elect six directors to hold office for one year terms until the company’s 2006 annual meeting of stockholders and until their successors are duly elected and qualified. It is intended that the names of the nominees listed below will be placed in nomination at the annual meeting to serve as directors and that the persons named in the proxy will vote for their election. All nominees listed below are currently members of the board of directors. Each nominee has consented to being named in this proxy statement and to serve if elected. If any nominee becomes unavailable to serve as a director for any reason, the shares represented by the proxies will be voted for the person, if any, designated by the board of directors. The board of directors has no reason to believe that any nominee will be unavailable to serve.

The nominees for director of the company, as well as certain information about them, are as follows:

| | | | | | |

| | | Name

| | Age

| | Position

|

| | | Don Early | | 62 | | Chairman, Chief Executive Officer and Director |

| | | |

| | | Mary Lou Andersen | | 60 | | Vice Chairman, Secretary and Director |

| | | |

| | | Richard B. Chalker | | 64 | | Director |

| | | |

| | | Gerald F. Lamberti | | 76 | | Director |

| | | |

| | | Francis P. Lemery | | 65 | | Director |

| | | |

| | | Mary V. Powell | | 74 | | Director |

Don Early has served as chairman of the board of directors and chief executive officer of the company since May 2004. Mr. Early founded the company in 1984 and has served as a director since then. He served as president and chief executive officer from 1984 until May 2004. Mr. Early is married to Ms. Andersen. Mr. Early holds a degree in business administration from the University of Missouri.

Mary Lou Andersen has served as vice chairman of the board of directors since May 2004. She has been employed by the company in a variety of executive positions since 1988, including vice president and chief operating officer until May 2004. Ms. Andersen became a director of the company in 1997. Ms. Andersen is married to Mr. Early, and is the mother of Darrin Andersen, the president and chief operating officer of the company.

Richard B. Chalker joined the company’s board of directors in July 2004 immediately following the company’s initial public offering. Mr. Chalker currently serves as a director of PBI/Gordon Corporation, an employee-owned manufacturer of pesticides and professional turf and agricultural products, and Decorize, Inc., a manufacturer of home furnishings and accessories listed on the American Stock Exchange. Mr. Chalker retired in 2004 as Division Vice President, Tax and Customs, of Hallmark Cards after eight years of service. Mr. Chalker also spent 32 years at Ernst & Young LLP, including 19 years as a partner specializing in taxation. He holds a degree in industrial administration from Yale University and a law degree from DePaul University.

Gerald F. Lamberti joined the company’s board of directors in July 2004 immediately following the company’s initial public offering. Mr. Lamberti retired from the Federal Deposit Insurance Corporation (FDIC) in 1998, where he was an attorney for over 25 years, including the last 13 years as Regional Counsel, Kansas City Region, FDIC. Prior to joining the FDIC, Mr. Lamberti was Deputy General Counsel of the United States Catholic Conference in Washington, D.C. He holds a degree in accounting from St. John’s University School of Commerce and a law degree from St. John’s University Law School. Mr. Lamberti served three years in the U.S. Air Force in the Korean War, in which he received the Distinguished Flying Cross.

2

Francis P. Lemery joined the company’s board of directors in July 2004 immediately following the company’s initial public offering. Mr. Lemery retired in 1999 as Senior Vice President and Actuary of Kansas City Life Insurance Company (KCLI), a Nasdaq SmallCap Market company. He served on the board of directors of KCLI from 1985 to 1999. Mr. Lemery has been a Fellow of the Society of Actuaries since 1968, and a member of the American Academy of Actuaries since 1969. He holds a degree in business administration and a masters degree in actuarial science from the University of Michigan.

Mary V. Powell joined the company’s board of directors in July 2004 immediately following the company’s initial public offering. Ms. Powell has been a partner in Johnson-Powell Accounting Services for more than 25 years, where she provides accounting, auditing and tax preparation services primarily to privately-owned businesses. Ms. Powell has been engaged in providing accounting, auditing and tax preparation services to individuals and private businesses since 1968.

The Board of Directors recommends a voteFOR

the election of the nominees for director named above.

OTHER BOARD INFORMATION

Board and Committee Meetings

During 2004, the board of directors met seven times. Each director attended more than 75% of the meetings of the board of directors. The company anticipates that all directors will attend the annual meeting of stockholders. The board of directors has established an executive committee, an audit committee and a compensation committee. In 2004, each director attended all of the meetings of the board committees on which he or she served. The independent members of the board of directors oversee the enforcement of the company’s procedures regarding nominations and corporate governance.

The following table provides membership and meeting information for each of the board committees:

| | | | | | | | | |

| | | Executive Committee(1)

| | | Audit Committee

| | | Compensation Committee

| |

Don Early | | x | (2) | | | | | | |

Mary Lou Andersen | | | | | | | | | |

Richard B. Chalker | | | | | x | (2),(3) | | x | |

Gerald F. Lamberti | | | | | | | | x | |

Francis P. Lemery | | x | | | x | (3) | | x | (2) |

Mary V. Powell | | x | | | x | (3) | | x | |

| | | |

# of Meetings in 2004 | | 0 | | | 3 | | | 2 | |

| (1) | Executive committee was formed in December 2004 |

| (3) | Audit committee financial expert |

3

Director Compensation

In 2004, each non-employee director received $12,500 for his or her service to the company following the company’s initial public offering of common stock in July 2004. Also, in connection with the company’s initial public offering, each non-employee director was granted an option to purchase 7,500 shares of common stock, at an exercise price of $14.00 per share, the initial public offering price. It is the current policy of the board of directors to grant each non-employee director an option to purchase 10,000 shares of common stock on an annual basis in consideration of his or her continued service on the board. In accordance with this policy, on January 3, 2005, each non-employee director received an option to purchase 10,000 shares of common stock at $18.94 per share, the closing price for the common stock on the Nasdaq National Market on that date. All options granted to the non-employee directors were fully vested on the date of grant.

The company’s non-employee directors currently receive the following fees for board and committee participation:

| | |

Annual retainer | | $25,000 |

Board meeting fee | | $ 1,000 per meeting |

Annual grant of stock options | | 10,000 shares |

Executive Committee(1) | | |

Audit Committee | | |

Annual retainer, chairman | | $ 6,000 |

Annual retainer, member | | $ 3,000 |

Committee meeting fee | | $ 750 |

Compensation Committee | | |

Annual retainer, chairman | | $ 3,000 |

Annual retainer, member | | $ 2,000 |

Committee meeting fee | | $ 750 |

| | (1) | Currently, there is no compensation for serving on the executive committee. |

Prior to the company’s initial public offering, each director received a $1,000 monthly retainer fee. As a result, Don Early, the company’s chairman and chief executive officer, Mary Lou Andersen, the company’s vice chairman and secretary, and Gregory L. Smith, the company’s only directors prior to the initial public offering, each received $7,000 through July 2004 for their respective service as a member of the board of directors. Following the company’s initial public offering, the company ceased compensating its employee directors for their service on the board other than reimbursement provided to all directors for reasonable out-of-pocket expenses incurred in attending board and committee meetings.

The following is a description of each committee of the board of directors. The board has determined that all of the members of the audit committee and the compensation committee, and each of the members of the executive committee, other than Mr. Early, are “independent directors” as defined in Nasdaq Rule 4200(a)(15), and that each of those directors was independent throughout 2004.

Executive Committee

The executive committee was formed in December 2004 to act on behalf of the board of directors between the regularly scheduled and special meetings of the full board. The executive committee has the power and authority to act on all matters that can be brought before the full board of directors other than certain actions that are reserved to the board in the company’s bylaws.

4

Audit Committee

The audit committee of the board of directors is responsible for overseeing management’s financial reporting practices and internal controls. The audit committee acts under a written charter that was adopted by the board of directors on June 15, 2004. A copy of the audit committee’s charter is attached as an exhibit to this proxy statement. The board of directors has determined that each member of the audit committee is an “audit committee financial expert” as defined by the rules of the Securities and Exchange Commission (SEC). The audit committee was established in accordance with all applicable rules of the SEC.

Audit and Other Service Fees

Grant Thornton LLP has audited the financial statements of the company for 2004 and 2003, and the audit committee has reappointed Grant Thornton LLP as independent registered public accounting firm for 2005. A representative of Grant Thornton LLP will be present at the annual meeting with the opportunity to make a statement if he or she desires and will be available to respond to questions.

The following table sets forth the aggregate fees billed to the company for fiscal years ended December 31, 2004, and 2003 by the company’s principal accounting firm, Grant Thornton LLP:

| | | | | | |

| | | 2004

| | 2003

|

Audit fees (1) | | $ | 455,856 | | $ | 71,295 |

Audit-related fees (2) | | | 8,400 | | | 5,500 |

Tax fees (3) | | | 118,194 | | | 113,579 |

All other fees (4) | | | — | | | — |

| | |

|

| |

|

|

Total | | $ | 582,450 | | $ | 190,374 |

| (1) | Includes services rendered for the audit of the company’s annual financial statements, work on SEC registration statements, filings and consents, and review of financial statements included in quarterly reports on Form 10-Q. In 2004, includes $240,404 for services rendered in connection with the company’s initial public offering and filing of a Registration Statement on Form S-1. |

| (2) | Includes services rendered for the audit of certain of the company’s employee benefit plans. |

| (3) | Includes tax return preparation and other tax consulting. |

| (4) | Consists of services other than the services described above under “Audit Fees,” “Audit-Related Fees” and “Tax Fees.” |

The audit committee has considered whether the provision of non-audit services is compatible with maintaining Grant Thornton’s independence. Additionally, the audit committee approved all non-audit and tax services performed by Grant Thornton LLP in 2004 in accordance with the pre-approval policy of the audit committee described below.

In August 2004, the audit committee adopted a pre-approval policy under which audit, non-audit and tax services to be rendered by the company’s independent public accountants are pre-approved by the audit committee. Pursuant to this policy, the audit committee pre-approves audit, non-audit and tax services to be provided by the independent registered public accounting firm, at specified dollar levels, which dollar levels are reviewed by the committee periodically, and no less often than annually. Any proposed services exceeding the pre-approved fee level or budgeted amount requires specific pre-approval by the audit committee. Additionally, the audit committee may provide explicit prior approval of specific engagements not within the scope of a previous pre-approval resolution. The services performed by Grant Thornton in 2004 were all within the pre-approval limits adopted by the audit committee. The pre-approval policy also specifies certain services (consistent with the SEC rules and regulations) that may not be provided by the company’s independent registered public accounting firm in any circumstance.

5

Audit Committee Report

In connection with the consolidated financial statements for the fiscal year ended December 31, 2004, the audit committee has:

| | • | | reviewed and discussed the audited financial statements with management and with representatives of Grant Thornton LLP, independent registered public accounting firm; |

| | • | | discussed with the independent registered public accounting firm the matters required to be discussed byStatement On Auditing Standards No. 61 (Communications with Audit Committees); and |

| | • | | received from the independent registered public accounting firm the written disclosures and letter regarding Grant Thornton LLP’s independence as required byIndependence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), and discussed the independence of Grant Thornton LLP with representatives of the independent registered public accounting firm. |

Based on these actions, the audit committee recommended to the board of directors that the company’s audited financial statements be included in its annual report on Form 10-K for the year ended December 31, 2004, for filing with the SEC.

|

| Richard B. Chalker, Chairman |

| Francis P. Lemery |

| Mary V. Powell |

|

| Audit Committee of the Board of Directors |

Compensation Committee

The compensation committee is responsible for overseeing and evaluating the compensation of the executive officers, including the chief executive officer, of the company and its subsidiaries, and their performance relative to compensation, in order to assure that they are compensated in a manner consistent with the stated compensation strategy of the company, internal equity considerations, competitive practices and the requirements of applicable regulatory bodies. In addition, the committee evaluates and makes recommendations regarding the compensation of non-employee directors, including their compensation for service on board committees and the terms and awards of any stock compensation.

The compensation committee periodically evaluates the company’s annual and long-term incentive plans, equity-related plans and certain employee benefit programs. The compensation committee acts as the stock option committee under the company’s stock option plans. As the stock option committee, the compensation committee determines (i) the times when options will be granted, (ii) the number of shares of common stock of the company subject to each option granted to the non-employee directors, officers and other employees of the company, and (iii) the option exercise price for each option granted under the plans. The compensation committee exercises all other rights granted to the stock option committee or the board of directors under the company’s stock option plans. The compensation committee’s report is found later in this proxy statement under the heading “Executive Compensation - Compensation Committee Report.”

6

Nominating Procedures

On June 15, 2004, the company adopted procedures regarding nominations and corporate governance. The policy can be found on the company’s website, www.qcholdings.com, by selecting “Corporate Governance” under the heading “Investor Relations.” Directors of the company meeting the independence standards set forth in Nasdaq Rule 4200(a)(15) are charged with enforcement of the policy.

The independent directors evaluate and select nominees to the board based on their ability to fulfill the duties of care and loyalty to the company’s stockholders. To be considered for nomination to the board of directors, an individual should:

| | • | | Be of the highest character and integrity and have an inquiring mind, the willingness to ask hard questions and the ability to work with others; |

| | • | | Be free of any conflict of interest that would violate applicable laws or regulations or otherwise interfere with the individual’s ability to perform properly his or her duties as a director; |

| | • | | Be willing to devote sufficient time to the company’s affairs and diligently fulfill his responsibilities as a director; |

| | • | | Have substantial experience in the one or more areas of business, education or government service that will provide value to the overall board of directors; and |

| | • | | Have the capacity and desire to represent the best interests of the stockholders as a whole. |

The six nominees for election at the 2005 annual meeting of stockholders were nominated pursuant to these nominating procedures. All nominees are already serving as directors of the company.

On April 25, 2005, Gregory L. Smith, who has been a member of the board of directors of the company and its predecessors since 1988, notified the company that he will retire from the board at the annual meeting. Mr. Smith owns more than 10% of the company’s common stock. Although the company and Mr. Smith consider Mr. Smith to be an “independent director” under the Nasdaq National Market rules, out of an abundance of caution, Mr. Smith has not served on the company’s audit committee or compensation committee since the company’s initial public offering. In view of the continuing discussions relating to the independence of Mr. Smith, Mr. Smith has determined that he will retire from the board at the end of his current term.

The board of directors will consider nominees recommended by stockholders for the 2006 annual meeting of stockholders, provided that the name of each nominee is submitted in writing, no later than January 15, 2006, to the corporate secretary or the nominating committee, QC Holdings, Inc., 9401 Indian Creek Parkway, Suite 1500, Overland Park, Kansas 66210. Each submission must include a statement of the qualifications of the nominee, the consent of the nominee evidencing a willingness to serve as a director, if elected, and a commitment by the nominee to meet personally with the board of directors. Additional submission requirements are contained in the company’s bylaws, a copy of which may be obtained from the company’s secretary at the address shown above.

Other than the submission requirements set forth above, there are no differences in the way the non-employee directors evaluate their own nominees for director and the way they evaluate a nominee recommended by a stockholder.

7

EXECUTIVE OFFICERS

Officers are elected on an annual basis by the board of directors and serve at the discretion of the board. Certain biographical information about the executive officers of the company follows:

| | | | | | | | |

| | | Name

| | Age

| | Position

| | |

| | | Don Early* | | 62 | | Chairman, Chief Executive Officer and Director | | |

| | | Mary Lou Andersen* | | 60 | | Vice Chairman, Secretary and Director | | |

| | | Darrin J. Andersen | | 36 | | President and Chief Operating Officer | | |

| | | Douglas E. Nickerson | | 39 | | Chief Financial Officer | | |

| | | Robert L. Albin | | 64 | | Senior Vice President | | |

| | | R. Michael Peck | | 61 | | Senior Vice President, Western U.S. | | |

| | | David M. Kusuda | | 59 | | Senior Vice President, Eastern U.S. | | |

| * | Information is provided under the heading “Election of Directors” above for Don Early and Mary Lou Andersen. Information relating to the company’s other executive officers with respect to their principal occupations and positions during the past five years is as follows: |

Darrin J. Andersen has served as the company’s president and chief operating officer since May 2004. Mr. Andersen joined the company in February 1998 and served as chief financial officer from December 1999 until April 2004. Prior to joining the company, Mr. Andersen worked in the accounting department of Newell Rubbermaid, a manufacturing company listed on the New York Stock Exchange, and in the audit group of Deloitte & Touche. Mr. Andersen is the president-elect of the Community Financial Services Association of America. Mr. Andersen is the son of Mary Lou Andersen. Mr. Andersen holds a degree in accounting from the University of Kansas, and earned a certified public accountant certificate in 1992.

Douglas E. Nickerson joined the company as chief financial officer in April 2004. Prior to joining the company, Mr. Nickerson served for eight years in various management positions with Stilwell Financial Inc., now known as Janus Capital Group, Inc., a New York Stock Exchange provider of diversified financial services. From 2001 to 2003, Mr. Nickerson served as vice president—controller and treasurer of Stilwell, and from 1999 to 2001 served as vice president - controller. Mr. Nickerson holds a degree in accounting from Kansas State University and a law degree from the University of Missouri - Kansas City. He is a certified public accountant.

Robert L. Albin joined the company as senior vice president in February 2003, after serving as a consultant to the company for approximately six months. Prior to that, Mr. Albin served three years with Western Union North America, a financial services company, as Executive Vice President and Chief Operating Officer. Mr. Albin was formerly president of First Data Payment Services, a division of First Data Corp, a New York Stock Exchange financial services company. Mr. Albin also served as president-domestic retail services for First Data Corp, overseeing the American Express money order and money gram worldwide money wiring services. Mr. Albin holds a degree in history and political science from Missouri Valley College.

R. Michael Peck has served as regional vice president, western U.S., since January 2000. Mr. Peck was named senior vice president in December 2004. Prior to joining the company, Mr. Peck spent 24 years with House of Lloyd’s, a direct marketing consumer products company, as an operations manager and vice president of sales. Mr. Peck holds degrees in biology and administration and a masters degree in education from the University of Missouri.

David M. Kusuda has served as regional vice president, eastern U.S., since December 2001. Mr. Kusuda was named senior vice president in December 2004. Prior to joining the company, Mr. Kusuda spent seven years with First Data Corp, in its Western Union division as senior vice president, agent network management. Before joining First Data Corp he served for three years as national sales manager of Innovative Services of America. Mr. Kusuda also spent 14 years with Citicorp, where he held various sales and marketing positions. Mr. Kusuda holds a degree in business administration from Regis University.

8

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

AND MANAGEMENT

The following table sets forth information regarding the beneficial ownership of shares of common stock for (i) each director and nominee for election as a director of the company; (ii) each named executive officer, (iii) all directors and executive officers as a group, and (iv) each person known to the company to be the beneficial owner of more than 5% of the outstanding shares. Beneficial ownership for directors and officers is shown as of April 18, 2005, and beneficial ownership for other 5% or greater stockholders is shown as of December 31, 2004. Except as otherwise indicated, each stockholder has sole voting and investment power with respect to the shares beneficially owned.

| | | | |

Name and Address of Beneficial Owner

| | Amount and

Nature of

Beneficial

Ownership

| | Percent of

Shares

Outstanding (1)

|

Named Executive Officers and Directors (2) | | | | |

Don Early | | 8,450,000 | | 39.4 |

Mary Lou Andersen | | 759,000 | | 3.5 |

Gregory L. Smith (3), (4) | | 3,603,400 | | 16.8 |

Richard B. Chalker (3) | | 18,500 | | * |

Gerald F. Lamberti (3) | | 17,500 | | * |

Francis P. Lemery (3) | | 19,000 | | * |

Mary V. Powell (3) | | 18,100 | | * |

Darrin J. Andersen (5) | | 424,000 | | 2.0 |

Robert L. Albin (6) | | 106,250 | | * |

David M. Kusuda (7) | | 50,000 | | * |

All directors and executive officers as a group (12 persons) (8) | | 13,773,550 | | 64.3 |

| | |

5% Stockholders (9) | | | | |

Gilder, Gagnon Howe & Co. LLC (10) 1775 Broadway, 26th Floor New York, New York 10019 | | 1,464,810 | | 6.8 |

| (1) | Computed for each officer and director as of April 18, 2005, on the basis of shares of common stock outstanding plus the options currently exercisable or exercisable in the next 60 days, and computed for the other 5% stockholders on the basis of the shares outstanding as of December 31, 2004. |

| (2) | The address of all of the named individuals is c/o QC Holdings, Inc., 9401 Indian Creek Parkway, Suite 1500, Overland Park, Kansas 66210. |

| (3) | Includes 17,500 shares of common stock issuable upon the exercise of options that are currently exercisable or exercisable within 60 days of the record date. |

| (4) | Excludes 299,100 shares held in irrevocable trusts for the benefit of Mr. Smith’s children and grandchildren, over which Mr. Smith has no voting or investment power. |

| (5) | Includes 200,000 shares of common stock issuable upon the exercise of options that are currently exercisable or exercisable within 60 days of the record date. |

| (6) | Includes 100,000 shares of common stock issuable upon the exercise of options that are currently exercisable or exercisable within 60 days of the record date. |

| (7) | Includes 50,000 shares of common stock issuable upon the exercise of options that are currently exercisable or exercisable within 60 days of the record date. |

| (8) | Includes an aggregate of 737,500 shares of common stock issuable upon the exercise of options that are currently exercisable or exercisable within 60 days of the record date. |

| (9) | Excludes 5% stockholders listed above as executive officers or directors. |

| (10) | Beneficial ownership of common stock is based solely on Schedule 13G filings with the SEC. |

9

Section 16(a) Beneficial Ownership Reporting Compliance

The company is required to identify any director, officer or 10% or greater beneficial owner of common stock who failed to file timely a report with the SEC required under Section 16(a) of the Securities Exchange Act of 1934 relating to ownership and changes in ownership of the company’s common stock. The required reports consist of initial statements on Form 3, statements of changes on Form 4 and annual statements on Form 5. Based solely upon a review of reports filed under Section 16(a) of the Exchange Act and certain written representations of directors and officers of the company, the company is not aware of any director, officer or 10% or greater beneficial owner of common stock who failed to file on a timely basis any report required by Section 16(a) of the Exchange Act for calendar year 2004.

10

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table sets forth the cash and other compensation paid in 2004 and 2003 to the company’s chief executive officer and the company’s four most highly compensated executive officers whose annual total salary and bonus in 2004 exceeded $100,000 (the “named executive officers”).

| | | | | | | | | | | | | | | | | |

| | | | | Annual Compensation

| | | Long Term

Compensation

| | |

Name and Principal Position

| | Year

| | Salary

| | Bonus

| | Other Annual Compensation

| | | Securities

Underlying

Options (#)

| | All Other Compensation (1)

|

Don Early

Chairman and CEO | | 2004

2003 | | $

| 354,200

150,000 | | $

| 320,000

200,844 | | $

| 15,679

66,209 | (2)

| | —

— | | $

| 6,500

1,763 |

| | | | | | |

Mary Lou Andersen

Vice Chairman and Secretary | | 2004

2003 | |

| 283,300

118,500 | |

| 167,600

92,000 | |

| 15,250

51,942 | (3)

| | 125,000

— | |

| 6,500

1,348 |

| | | | | | |

Darrin J. Andersen

President and COO | | 2004

2003 | |

| 238,500

127,500 | |

| 211,100

130,000 | |

| 4,908

4,150 | (4)

| | 150,000

— | |

| 6,507

2,051 |

| | | | | | |

Robert L. Albin

Senior Vice President | | 2004

2003 | |

| 150,000

137,500 | |

| 28,000

3,000 | |

| —

62,500 |

(5) | | 12,500

— | |

| 4,883

1,170 |

| | | | | | |

David M. Kusuda

Senior Vice President, Eastern U.S. | | 2004

2003 | |

| 152,900

137,500 | |

| 58,600

28,000 | |

| —

— |

| | 37,500

— | |

| 3,946

2,381 |

| (1) | Consists of the company’s contribution to the employee’s 401(k) plan. |

| (2) | Consists of directors’ fees of $7,000 and $12,000 paid while the company was privately-owned, and car expense of $8,679 and $7,600, for 2004 and 2003, respectively. For 2003, also includes the payment of personal expenses of $46,609. |

| (3) | Consists of directors’ fees of $7,000 and $12,000 paid while the company was privately-owned, and car expense of $8,250 and $7,600, for 2004 and 2003, respectively. For 2003, also includes the payment of personal expenses of $32,342. |

| (4) | Consists solely of car expense for 2004 and 2003. |

| (5) | Consists of consulting fees earned in 2003 before Mr. Albin became an employee of the company. |

11

Stock Options

The following table sets forth information concerning stock option grants made to the named executive officers in the year ended December 31, 2004. Options granted to the named executive officers are for 10-year terms and were all granted at an option exercise price equal to the fair market value of the common stock on the date of grant. When granted, the options were scheduled to vest at the rate of 25% per year over four years beginning one year after the date of grant.

Option Grants in the Year Ended December 31, 2004

| | | | | | | | | | | | | | | |

| | | Individual Grants

| | Potential Realizable Value at Assumed Annual

Rates of Stock Price Appreciation for Option Term

|

Name

| | Number of

Securities

Underlying

Options Granted (#)

| | % of Total Options Granted to Employees

in Fiscal Year

| | Exercise

Price ($/sh)

| | Expiration Date

| | 5% ($)

| | 10% ($)

|

Don Early | | — | | — | | $ | — | | — | | $ | — | | $ | — |

| | | | | | |

Mary Lou Andersen | | 125,000 | | 13.0 | | | 17.30 | | 12/14/2014 | | | 1,361,704 | | | 3,451,817 |

| | | | | | |

Darrin J. Andersen | | 100,000

50,000 | | 10.4

5.2 | |

| 17.30

14.00 | | 12/14/2014

7/15/2014 | |

| 1,089,363

440,783 | |

| 2,761,453

1,117,351 |

| | | | | | |

Robert L. Albin | | 12,500 | | 1.3 | | | 17.30 | | 12/14/2014 | | | 136,170 | | | 345,182 |

| | | | | | |

David M. Kusuda | | 37,500 | | 3.9 | | | 17.30 | | 12/14/2014 | | | 408,511 | | | 1,035,545 |

The following table sets forth information concerning stock options exercised by the named executive officers during the year ended December 31, 2004, and the number of shares and the value of the options outstanding as of December 31, 2004, for each named executive officer. All information set forth below relates to the grant of stock options under the QC Holdings, Inc. 1999 Stock Option Plan or the 2004 Equity Incentive Plan, other than an option to purchase 200,000 shares of common stock granted to Robert L. Albin pursuant to a consulting agreement entered into before Mr. Albin became an employee of the company.

Aggregated Option Exercises in Last Fiscal Year

and Fiscal Year-End Option Values

| | | | | | | | | | | | |

Name

| | Shares

Acquired on

Exercise (#)

| | Value

Realized

($)

| | Number of Securities

Underlying Unexercised

Options at Fiscal Year End

(#)

| | Value of Unexercised In-the-

Money Options at Fiscal

Year End (1) ($)

|

| | | | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

Don Early | | — | | — | | — | | — | | — | | — |

Mary Lou Andersen | | — | | — | | — | | 125,000 | | — | | 232,500 |

Darrin J. Andersen | | — | | — | | 200,000 | | 150,000 | | 3,432,000 | | 444,000 |

Robert L. Albin | | — | | — | | 100,000 | | 112,500 | | 1,671,000 | | 1,694,250 |

David M. Kusuda | | — | | — | | 150,000 | | 87,500 | | 2,506,500 | | 905,250 |

| (1) | Based on the closing sales price of the common stock on the Nasdaq National Market of $19.16 per share on December 31, 2004, less the option exercise price. |

12

Compensation Committee Report

The compensation committee of the board of directors was formed on June 15, 2004, and consists of four independent members of the board of directors. The compensation committee is responsible for approving the compensation of the chief executive officer and, in consultation with the chief executive officer, the compensation of the other executive officers of the company, and the non-employee members of the board of directors. See “Other Board Information—Compensation Committee” above for a further description of the functions of the compensation committee. The compensation committee also serves as the stock option committee under the company’s stock option plans, and as such, approves all stock option grants to non-employee directors, officers and all other employees of the company.

In 2004, the compensation committee reviewed the company’s historic compensation practices as part of the transition from private-company compensation practices to more traditional compensation practices of publicly-traded companies. As a private company, substantial stock-based incentives were provided to executives at the time they were recruited to the company, but the company did not provide annual stock-based compensation to those executives. The compensation committee believes that annual stock-based compensation should be an important component of the compensation program for senior executives. The compensation committee made grants of stock options in 2004, but is reviewing and evaluating other forms of equity-based compensation, including particularly restricted stock awards. In setting base salary and awarding bonuses and stock option grants, the compensation committee believes that 2004 represented the first step in the process of reviewing and reformulating an overall compensation program for senior executives, including the chief executive officer. The compensation committee believes that executive compensation should include (1) base salary that is normally tied to industry and local marketplace factors to attract and retain key executives; (2) short-term bonuses tied directly or indirectly to achieving certain financial criteria; and (3) a long-term incentive component with three to five year goals. The compensation committee has not developed with senior management the long-term incentive component of the executive compensation program and continues to work with senior management, as a new public company and a new compensation committee, to identify and monitor the key financial criteria that will be used to evaluate the executives of the company. The compensation committee recognizes the difficulty in balancing the emphasis on short-term and medium-term financial criteria in developing a successful executive compensation program and recognizes that undue emphasis on any particular financial result, such as earnings per share, can create the wrong incentives.

In 2004, the compensation committee considered the base salaries of the chief executive officer and the other executive officers in light of industry and local marketplace information. Bonuses were awarded in 2004 to the chief executive officer and the other executive officers based on the overall performance of the chief executive officer and the other executive officers, including their efforts in completing the initial public offering of the company, and the overall outstanding financial performance of the company in 2004. The committee did not increase the base salary of Mr. Early, Ms. Andersen or Mr. Andersen for 2005 in light of the increases effected in summer 2004 in connection with the initial public offering process.

In 2004, the compensation committee supplemented the cash compensation of each of the executive officers, other than the chief executive officer, with stock option grants. The 2004 stock option grants were based in part upon (1) the level of stock option grants at comparable publicly-traded companies, (2) the possible impact on market price and market perceptions of the initial stock option grants at the company as a new publicly-traded company, and (3) the committee’s views regarding the importance of stock-based compensation to provide the maximum motivation to management to implement the de novo store growth strategy of the company and the significant burden on executive management to achieve those goals. The committee did not grant stock options to Mr. Early, the company’s chairman and chief executive officer, based in part on discussions with and a recommendation by Mr. Early, to first study the impact of stock option grants to the chief executive officer on the company’s common stock.

13

The compensation committee is continuing the process of reviewing and evaluating its policies with respect to executive compensation and views this as a dynamic and continuing process for a young, publicly-traded company. The committee continues to study the industry and other publicly-traded companies to determine the most effective package of compensation alternatives that will motivate executives to achieve the short and long-term goals of the company and to attract and retain key executive employees.

|

Francis P. Lemery, Chairman Richard B. Chalker Gerald F. Lamberti Mary V. Powell |

|

| Compensation Committee of the Board of Directors |

Compensation Committee Interlocks and Insider Participation

Historically, the company’s entire board of directors, including Don Early, chairman and chief executive officer, and Mary Lou Andersen, vice chairman and secretary, participated in deliberations regarding executive officer compensation. In connection with the company’s initial public offering, the compensation committee was formed to determine executive compensation, and since that time the committee has consisted solely of independent directors. No interlocking relationship exists between the company’s board of directors or compensation committee and the board of directors or compensation committee of any other company.

14

Performance Graph

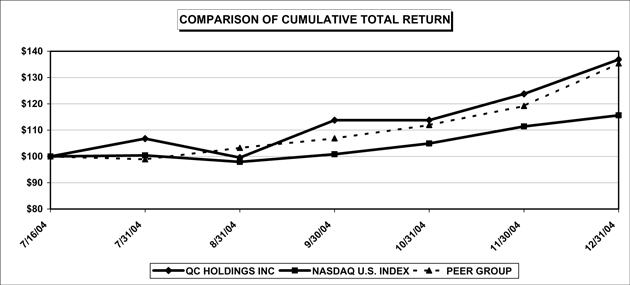

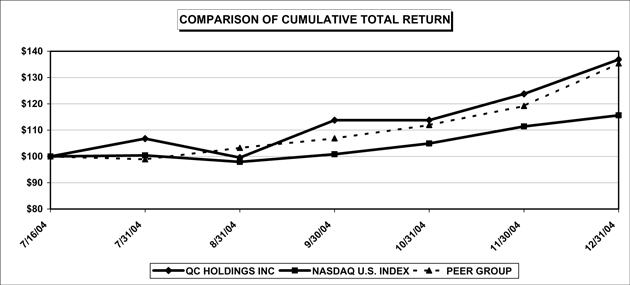

The following graph shows the total stockholder return of an investment of $100 in cash for (i) the company’s common stock, (ii) the Nasdaq U.S. Index, and (iii) the company’s peer group from the date of the company’s initial public offering of common stock through the end of the last fiscal year (July 16, 2004 through December 31, 2004). The Nasdaq U.S. Index and the peer group results are calculated by Standard & Poor’s Institutional Market Services.

The graph assumes that $100.00 was invested in the company’s common stock on July 16, 2004, at the price of $14.00 per share, the initial public offering price. The closing sales prices were used for each index on July 16, 2004. All values assume reinvestment of the full amount of any dividends. No cash dividends have been declared on the company’s common stock. Stockholder returns over the indicated period should not be considered indicative of future stockholder returns.

Performance Graph

The company’s peer group consists of Ace Cash Express, Inc., Advance America Cash Advance Centers, Inc., Cash America International, Inc., Dollar Financial Corp., EZCorp Inc., and First Cash Financial Services Inc.

15

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Beginning in 1999, companies controlled by Don Early, the company’s chief executive officer, and Mary Lou Andersen, the company’s vice chairman, acquired six coin-operated laundromats. In exchange for the right to offer check cashing or payday loan services at these locations, the company maintained oral agreements with the laundromat companies to pay all or a portion of the rent, utilities, employee or maintenance expenses at the laundromats. The company entered into these arrangements to determine whether check cashing and payday loan operations could be effectively combined with a laundromat store. During 2004, the company continued to pay a portion of the expenses at one laundromat at which the company continues to offer payday loans. In 2004, the company incurred total store expenses for this one shared payday loan and laundromat store of $197,000. Prior to the company’s initial public offering, the company advanced funds on a non-interest-bearing basis to each of the laundromat companies to cover a portion of their operating shortfalls. The highest aggregate unpaid amount owed to the company by the laundromat companies in 2004 was $176,000. The laundromat companies repaid all indebtedness owed to the company in June 2004.

In 1997, the company loaned Ms. Andersen $88,000 to purchase 799,000 shares of the company’s common stock. Ms. Andersen signed a promissory note bearing interest at a variable rate, which ranged from 6% in 2001 to 1.62% in 2004. The highest amount of indebtedness outstanding under the loan during 2004 was $45,711. The company also loaned Ms. Andersen $43,543 in 2001 for personal purposes. Ms. Andersen signed a promissory note bearing interest at a variable rate, which ranged from 4.75% to 1.62%. The highest amount of indebtedness outstanding under this loan during 2004 was $42,758. Ms. Andersen repaid these loans in full in March 2004.

In 1999, the company loaned Darrin J. Andersen, the company’s president, $120,360 to purchase 244,000 shares of the company’s common stock. Mr. Andersen signed a promissory note bearing interest at a variable rate, which ranged from 6% in 2001 to 1.62% in 2004. The highest amount of indebtedness outstanding under the loan during 2004 was $100,875. The company also loaned Mr. Andersen $100,000 in December, 2003 for personal purposes. Mr. Andersen signed a promissory note bearing interest at a variable rate, which decreased from 1.81% in 2003 to 1.62% in 2004. The highest amount of indebtedness outstanding under the loan during 2004 was $100,826. Mr. Andersen repaid the loans in full in May 2004.

In 1999, the company redeemed 1,710,000 shares of the company’s common stock from Gregory L. Smith, a director of the company, at a total redemption price of $2,100,000. The company paid a portion of the redemption price in cash and issued Mr. Smith a $500,000 subordinated note, bearing interest at 9% for the balance of the redemption price. Throughout 2002 and 2003, the unpaid principal balance of the subordinated note was $400,000. The company made interest payments to Mr. Smith of $36,000 in each of those years. Through March 31, 2004, the company had paid $200,000 in principal and $4,500 in interest payments to Mr. Smith to reduce the remaining principal balance of the loan to $200,000. In April 2004, the company repaid Mr. Smith’s loan, and $1,500 in additional interest.

The compensation committee approves the salary and bonus paid to D. Scott Smith, one of the company’s three regional directors. D. Scott Smith is the son of Gregory L. Smith. In 2004, the company paid D. Scott Smith salary and bonus totaling in excess of $60,000. In 2004, the company granted D. Scott Smith the option to purchase 10,000 shares at $14.00 per share, and 10,000 shares at $17.30 per share.

The compensation committee approves the salary and bonus paid to Mike Waters, the company’s vice president of governmental affairs. Mr. Waters is the brother of Mary Lou Andersen and the uncle of Darrin J. Andersen. In 2004, the company paid Mr. Waters salary and bonus totaling in excess of $60,000. In July 2004, the company granted Mr. Waters an option to purchase 10,000 shares of the company’s common stock at $14.00 per share. In December 2004, the company granted Mr. Waters an option to purchase 5,000 shares of the company’s common stock at $17.30 per share.

The company loaned R. Michael Peck, the company’s senior vice president for the western U.S., $51,692 through May 1, 2004, and agreed to loan him up to $78,000 for personal purposes. The promissory note

16

executed by Mr. Peck bore interest at a variable interest rate equal to the applicable federal rate under the Internal Revenue Code. In 2004, the rate applied to Mr. Peck’s note was 1.62%. Mr. Peck repaid the loan and agreed to cancel the outstanding loan commitments in June 2004.

In February 2004, the company purchased a single-family residence with nine acres of land in Pauma Valley, California for approximately $1,330,000. The company sold the residence and all the furnishings purchased by the company for the property to Mr. Early and Ms. Andersen in November 2004 for $1,850,000, the fair value of the residence and the furnishings as established by independent appraisals.

Prior to June 30, 2004, the company maintained $15 million of life insurance on Mr. Early and $2 million of life insurance on Gregory L. Smith. Both policies were term policies owned by the company and under which the company was the beneficiary. Pursuant to a stockholders agreement with Mr. Early and Mr. Smith, the company agreed, subject to the terms of any applicable bank agreements, to use the proceeds of those insurance policies to repurchase a portion of the shares of the company’s common stock held by Mr. Early or Mr. Smith, as applicable, upon their death. In 2004, the annual premiums for the policies on Mr. Early and Mr. Smith were $154,000 and $11,000, respectively. The stockholders agreement was terminated effective June 30, 2004. The company canceled the life insurance policy on Mr. Smith effective that day. The company continues to maintain the life insurance on Mr. Early, but, effective June 30, 2004, the company’s obligation to use the life insurance proceeds to purchase any stock from Mr. Early’s estate terminated.

In exchange for Mr. Early’s agreement to terminate the requirement to maintain life insurance and the stock repurchase obligations, the company entered into a registration rights agreement with Mr. Early. The registration rights agreement grants to Mr. Early’s estate and certain beneficiaries of his estate three demand registration rights, which may be effected by the holders of stock from Mr. Early’s estate for up to two years after his death. Demand registration may be effected only if the gross proceeds of the offering are at least $15 million. The company has agreed to pay the expenses of each demand registration, other than underwriting commissions and discounts and the fees of counsel to the selling stockholders in the registration. The agreement includes certain other customary provisions for a registration rights agreement, including various obligations of the company to facilitate the filing and effectiveness of the demand registrations.

17

CORPORATE GOVERNANCE

The company maintains a corporate website, www.qcholdings.com. The following corporate policies of the company and its board of directors are available on the company’s website by selecting “Corporate Governance” under the heading “Investor Relations”:

| | • | | Procedures Regarding Nominations and Corporate Governance |

| | • | | Charter of the Audit Committee |

| | • | | Charter of the Compensation Committee |

The company’s Code of Ethics applies to all employees, officers and directors, and specifically the chief executive officer and the chief financial officer of the company.

STOCKHOLDER COMMUNICATIONS WITH DIRECTORS

Stockholders may communicate with the board generally or with a specific director at any time by writing to the company’s corporate secretary at 9401 Indian Creek Parkway, Suite 1500, Overland Park, Kansas 66210. The secretary will review all messages received and will forward any message that reasonably appears to be a communication from a stockholder about a matter of stockholder interest that is intended for communication to the board.

STOCKHOLDER PROPOSALS

Proposals of stockholders intended to be presented at the annual meeting of stockholders to be held in 2006 must be received by the secretary of the company, at QC Holdings, Inc., 9401 Indian Creek Parkway, Suite 1500, Overland Park, Kansas 66210, no later than January 15, 2006, to be eligible for inclusion in the company’s proxy statement and proxy related to that meeting. Additionally, if properly requested, a stockholder may submit a proposal for consideration at the 2006 annual meeting of stockholders, but not for inclusion in the company’s proxy statement. Under the company’s bylaws, for a stockholder to properly request that business be brought before an annual meeting of stockholders, the secretary of the company must receive the request from a stockholder of record entitled to vote at the meeting. Notice of matters proposed to be brought before the 2006 annual meeting of stockholders must also be received on or before January 15, 2006. A copy of the company’s bylaws, which include additional conditions, may be obtained without charge from the secretary of the company at the address shown above.

ANNUAL REPORT

The 2004 annual report to stockholders of the company, which includes the company’s annual report on Form 10-K, is included with this proxy statement.

OTHER MATTERS

The board of directors is not aware of any other matters that will be presented for action at the annual meeting. If other matters properly come before the meeting, it is intended that the holders of the proxies hereby solicited will vote thereon in accordance with their best judgment.

Dated: April 28, 2005

18

EXHIBIT A

CHARTER OF AUDIT COMMITTEE

(As adopted on June 15, 2004)

The Audit Committee (the “Audit Committee”) of the Board of Directors of QC Holdings, Inc (the “Company”) is appointed by and will assist the Board of Directors of the Company (the “Board”) in fulfilling its responsibilities to the stockholders, potential stockholders and the investment community with respect to matters involving the accounting, financial reporting and internal control functions of the Company and its subsidiaries. This will include assisting the Board in overseeing: (a) the integrity of the Company’s financial statements, (b) the Company’s compliance with legal and regulatory requirements, (c) the independent auditors’ qualifications, independence and performance, and (d) the performance of the Company’s internal audit function. The Audit Committee also will prepare the Audit Committee report that Securities and Exchange Commission (the “SEC”) rules require to be included in the Company’s annual proxy statement. The Audit Committee also will review periodically and oversee the financial reporting process, the system of internal controls and the audit process, and will oversee the Company’s process for monitoring compliance with the Company’s policies and code of business conduct and ethics.

| II. | Membership and Qualification |

The Audit Committee will consist of three or more directors as determined by the Board, each of whom will be an independent director as defined in: (a) NASD Rules 4200(a)(15) (b) Section 10A(m)(3) of the Securities Exchange Act of 1934 (the “Exchange Act”), Rule 10A-3(b)(1) under the Exchange Act (subject to exemption provided in Rule 10A-3(c)), and any other rules and regulations of the SEC adopted thereunder, all as may be amended from time to time. The Audit Committee members will be elected annually by the Board for the term of one year, or until their successors are duly elected and qualified. The Board may remove any Audit Committee member at any time. Unless an Audit Committee Chairman is elected by the full Board, the Audit Committee members may designate a Chairman by majority vote of the full Audit Committee membership.

If an Audit Committee member simultaneously serves on the audit committees of more than three public companies, the Board must determine that such simultaneous service would not impair such member’s ability to serve effectively on the Company’s Audit Committee and such determination by the Board must be disclosed in the Company’s annual proxy statement.

| | (b) | Special Qualifications |

Each member of the Audit Committee must, in the judgment of the Board, be financially literate and have the ability to read and understand the Company’s basic financial statements, including the Company’s balance sheet, income statement and cash flow statement. In addition, at least one member of the Audit Committee, in the judgment of the Board, must have (a) accounting or related financial management expertise and sophistication as a result of past employment experience in finance or accounting, requisite professional certification in accounting or any comparable experience or background which results in the individual’s financial sophistication, including being or having been a chief executive officer, chief financial officer or other senior officer with financial oversight responsibilities, and, (b) qualify as an “audit committee financial expert” as defined by the SEC in Item 401(h)(2) of Regulation S-K, as amended from time to time.

A-1

| III. | Meetings and Other Actions |

The Audit Committee will meet at least four times each year and at such other times as may be necessary to fulfill its responsibilities. It will meet following the end of each fiscal quarter of the Company prior to the release of quarterly or annual earnings to review the financial results of the Company for the preceding fiscal quarter or the preceding fiscal year, as the case may be. Meetings may be called by the Chairman of the Audit Committee or the Chairman of the Board. All meetings and other actions of the Audit Committee will be held and taken pursuant to the Bylaws of the Company, including bylaw provisions governing notice of meetings and waiver thereof, the number of Audit Committee members required to take actions at meetings and by written consent, and other related matters.

| | (i) | As part of its meetings, the Audit Committee will meet separately, at least quarterly, with management, with the Company’s internal auditors, if any, and with the Company’s independent auditors. |

| | (ii) | Unless otherwise authorized by the Board, the Audit Committee will not delegate any of its authority to any subcommittee. |

| | (iii) | Reports of meetings of and actions taken at meetings or by written consent by the Audit Committee since the most recent Board meeting (except to the extent covered in an interim report circulated to the Board) will be made by the Audit Committee Chairman or his or her delegate to the Board at its next regularly scheduled meeting following the Audit Committee meeting or action and will be accompanied by any recommendations from the Audit Committee to the Board. In addition, the Audit Committee Chairman or his or her delegate will be available to answer any questions the other directors may have regarding the matters considered and actions taken by the Audit Committee. |

| 4. | Goals, Responsibilities and Authority |

In carrying out its duties and responsibilities, the Audit Committee should design its policies and procedures to be flexible, so that it may be in a position to react or respond appropriately to changing circumstances or conditions and to ensure that the corporate accounting and financial reporting practices of the Company, as well as the auditing process, are in accordance with all applicable requirements, and also are appropriately tailored for the Company’s specific business and financial risks. In carrying out its duties and responsibilities, the following are within the responsibilities and authority of the Audit Committee.

In conjunction with management, the independent auditors and the internal auditors, if any, the Audit Committee will periodically evaluate the adequacy of the Company’s financial reporting systems and business process controls, discuss significant exposures and the actions management has taken to monitor and control such exposures, and elicit any recommendations for the improvement of the internal control procedures or particular areas where new or more detailed controls or procedures are desirable. In addition, the Audit Committee will review significant findings noted by the independent auditors and the internal auditors in the course of their audit functions, as well as management responses.

| | (b) | Financial Reporting Generally |

In connection with its general oversight of the Company’s financial reporting, the Audit Committee will:

| | (1) | Evaluate significant accounting and reporting issues identified in any analyses prepared by management or the independent auditors or otherwise identified in the course of the Audit |

A-2

| | Committee’s review of the Company’s financial statements and discussions with its auditors, with due consideration of their impact on the Company’s financial statements. |

| | (2) | Review with management and the independent auditors, management’s proposals regarding: new accounting pronouncements; the adoption of, and changes of choice regarding, material accounting principles and practices to be followed when preparing the financial statements of the Company, including with respect to material new transactions or events; alternative principles and practices that could have been followed; the reasons for selecting the principles and practices to be followed; the financial impacts of the principles and practices selected as compared to those of the other alternatives available; and the provision of any “pro forma” or “adjusted” non-GAAP information. Inquire as to whether the independent or internal auditors have any concerns regarding: the possibility of significant accounting or reporting risks or exposures; the appropriateness and quality of significant accounting treatments and whether there has been any aggressive creativity in any such treatments; any business transactions that may affect the fair presentation of the Company’s financial condition or results of operations; or any weaknesses in the Company’s internal control systems. |

| | (3) | Establish and maintain procedures for: |

| | (i) | The receipt, retention and treatment of any complaints received by the Company regarding accounting, internal accounting controls or auditing matters; and |

| | (ii) | The confidential, anonymous submission by employees of the Company of any concerns regarding questionable accounting or auditing matters. |

| | (4) | Affirm in connection with the Audit Committee’s review of the Company’s annual and quarterly financial statements that the independent auditors communicate certain matters to the Audit Committee as required by professional standards related to their audit of the annual financial statements and their review of the interim financial information. |

| | (5) | Discuss with management, on a pre-issuance basis all of the following: |

| | (i) | The types of information to be disclosed and types of presentation to be made in earnings press releases and in financial information and earnings guidance provided to analysts and rating agencies; |

| | (ii) | Significant financial reporting matters to be disclosed in any SEC filings, such as a change in accounting principles or extraordinary and non-recurring items and transactions or any other filing containing the Company’s financial statements; and |

| | (iii) | Significant matters to be disclosed in Form 8-K filings with the SEC. |

| | (6) | The Audit Committee Chairman may represent the entire Audit Committee for purposes of reviewing and discussing with management and the independent auditors the Company’s earnings press releases, financial information and earnings guidance furnished to analysts and rating agencies, and interim financial statements. |

A-3

In fulfilling its duties and responsibilities, the Audit Committee will:

| | (1) | Review and discuss with management and the independent auditors the Company’s annual report on Form 10-K and annual audited financial statements prior to the filing of such financial statements with the SEC, including the Company’s disclosures under “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” The Audit Committee will review any items communicated by the independent auditors to the Audit Committee in accordance with SAS 61, including any difficulties encountered in the course of the audit work, any restrictions on the scope of activities or access to requested information, and any significant disagreements with management. The Audit Committee will recommend to the Board whether the audited financial statements should be included in the Company’s Form 10-K. |

| | (2) | Review and discuss with management and the independent auditors the Company’s quarterly financial statements prior to the filing of its Form 10-Q, including the Company’s disclosures under “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” The Audit Committee will review any items communicated by the independent auditors in accordance with generally accepted auditing standards. |

| | (3) | Prior to the filing of the respective audit report with the SEC, review with the independent auditors the following items as to which the independent auditors are required to report to the Audit Committee: (a) all critical accounting policies and practices to be used, (b) all alternative treatments of material items within generally accepted accounting principles that have been discussed with management, ramifications of the use of such alternative disclosures and treatments, and the treatment preferred by the independent auditors, and, (c) other material written communications between the independent auditors and management, including any management letter or schedule of unadjusted differences. |

| | (4) | From time to time as determined by the Audit Committee, review with the independent auditors and management all material transactions involving related persons or entities, with clear discussion of arrangements that may involve transaction terms or other aspects that differ from those which would likely be negotiated with clearly independent parties. |

| | (5) | From time to time as determined by the Audit Committee, review with the independent auditors their judgments about the quality and appropriateness of the Company’s accounting principles as applied to its financial reporting. |

| | (6) | Provide an open avenue of communication among the independent auditors, financial and senior management, the internal auditing group, if any, and the Board. |

| | (d) | Oversight of the Company’s Internal Audit Function |

In conjunction with the Audit Committee’s review of financial statements and reports, the Audit Committee will:

| | (1) | Oversee the Company’s internal auditing group, if any, which will report functionally to the Audit Committee and administratively to the CFO. |

| | (2) | Review periodically with management the appointment and replacement of the senior internal auditing executive. |

A-4

| | (3) | Review with management and the independent auditors the adequacy and effectiveness of the Company’s financial reporting processes and controls, including: (a) internal controls and procedures for financial reporting (including any significant deficiencies in the design or operation of internal controls, any material weaknesses in internal controls and any fraud, whether or not material, that involves management or other employees who have a significant role in the internal controls), and, (b) disclosure controls and procedures. |

| | (4) | Review all material reports to management prepared by the internal auditing group and management’s responses. |

| | (5) | Discuss with the independent auditors and management the internal auditing group responsibilities, budget, staffing and independence and any recommended changes in the planned scope of the internal audit. |

| | (6) | Meet with the Company’s internal auditors (or other personnel responsible for the Company’s internal audit function) periodically in a private session without other members of management present to discuss matters that the Audit Committee or the internal auditors believe should be discussed. |

The Audit Committee has sole authority and direct responsibility to appoint, compensate, evaluate, retain, replace and oversee the work of the independent auditors rendering or issuing an audit report or related work or performing other audit, review or attest services for the Company. The independent auditors will report directly to the Audit Committee and will, in all respects, be accountable to the Audit Committee. Accordingly, the Audit Committee will have directly responsibility to:

| | (1) | Select, retain, and if necessary, replace the Company’s independent auditors, based upon the Audit Committee’s review of the independence and effectiveness of the independent auditors. |

| | (2) | Approve the fees and other compensation to be paid to the independent auditors and the funding thereof. The Company will provide for appropriate funding, as determined by the Audit Committee, for payment of compensation to the independent auditors for the purpose of rendering or issuing an audit report or related work or performing other audit, review or attest services for the Company. |

| | (3) | Meet with management and the independent auditors to review the scope of the proposed audit for the current year and material audit procedures to be used. |

| | (4) | Oversee the work of the independent auditors (including resolution of disagreements between management and the independent auditors regarding financial reporting) for the purposes of preparing or issuing an audit report or related work or performing other audit, review or attest services for the Company. |

| | (5) | Evaluate the qualifications, performance and independence of the independent auditors on an ongoing basis, including the following: |

| | (i) | consider whether the provision of permitted non-audit services is compatible with maintaining the independent auditors’ independence. |

| | (ii) | obtain and review a report from the independent auditors at least annually regarding: (a) the independent auditors’ internal quality-control procedures, (b) any material issues raised by the most recent internal quality-control review, or peer review, of the firm, or by any inquiry or investigation by |

A-5

| | governmental or professional authorities within the preceding five years respecting one or more independent audits carried out by the firm, (c) any steps taken to deal with any such issues, and, (d) all relationships between the independent auditors and the Company (including disclosures required by Independence Standards Board Standard No. 1, as amended from time to time). |

| | (iii) | review and evaluate the qualifications, performance and independence of the lead audit partner of the independent auditors. |

| | (iv) | take into account the opinions of management and the senior internal auditing executive. |

| | (v) | consider the timing and process for implementing the rotation of the lead audit partner, the concurring partner and any other audit partner subject to rotation and consider whether there should be a regular rotation of the audit firm itself. |

| | (vi) | present its conclusions with respect to the independent auditors to the Board for its information at least annually. |

| | (6) | Pre-approve all auditing services and permitted non-audit services (including the fees and terms thereof) to be performed for the Company by its independent auditors, subject to the exceptions for non-audit services described in Section 10A(i)(1)(B) of the Exchange Act which must be approved by the Audit Committee prior to the completion of the audit. In lieu of pre-approving audit and permitted non-audit services, the Audit Committee may establish policies and procedures for the engagement of independent auditors to perform such services, provided that the policies and procedures are detailed as to the particular service, the Audit Committee is informed of such service, and such policies and procedures do not include delegation of the Audit Committee’s responsibilities to management. |

| | (7) | Recommend to the Board policies for the Company’s hiring of employees or former employees of the independent auditors who participated in any capacity in the audit of the Company. |

| | (8) | Engage independent counsel and other advisors as the Audit Committee determines necessary or advisable to carry out its duties. The Company will provide for appropriate funding, as determined by the Audit Committee, for payment of compensation to any advisors employed by the Audit Committee. |

| | (f) | Reporting Responsibilities |

In fulfilling its duties and responsibilities the Audit Committee will:

| | (1) | Regularly update the Board of Directors about the Audit Committee’s activities and make appropriate recommendations. |