UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant þ

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | |

| ¨ | | Preliminary Proxy Statement |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| þ | | Definitive Proxy Statement |

| ¨ | | Definitive Additional Materials |

| ¨ | | Soliciting Material Pursuant to §240.14a-12 |

Tower Group International, Ltd.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | | | |

| þ | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | | |

| | | | | | |

| | |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | | |

| | | | | | |

| | |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | | | | | |

| | |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | | |

| | | | | | |

| | |

| | (5) | | Total fee paid: |

| | | |

| | | | | | |

| |

| ¨ | | Fee paid previously with preliminary materials. |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | | |

| | | | | | |

| | |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | | |

| | | | | | |

| | |

| | (3) | | Filing Party: |

| | | |

| | | | | | |

| | |

| | (4) | | Date Filed: |

| | | |

| | | | | | |

TOWER GROUP INTERNATIONAL, LTD.

Crown House, 4 Par-la-Ville Road

Hamilton HM 08, Bermuda

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Our Stockholders:

The Annual Meeting of Stockholders of Tower Group International, Ltd. (the “Company”) will be held on Tuesday, May 7, 2013, at 9:00 a.m. local time, at the Fairmont Hamilton Princess Hotel, 76 Pitts Bay Road, Pembroke HM 08, Bermuda for the following purposes:

| | (1) | To elect two Directors; |

| | (2) | To ratify the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the year 2013; |

| | (3) | To reapprove the material terms of the Company’s Short Term Performance Incentive Plan; |

| | (4) | To approve the Company’s 2013 Long Term Incentive Plan; |

| | (5) | To approve the material terms of the Company’s 2013 Long Term Incentive Plan; |

| | (6) | To approve, on an advisory basis, the Company’s executive compensation; and |

| | (7) | To consider such other business as may properly come before the meeting. |

Stockholders of record at the close of business on March 19, 2013 are entitled to notice of, and to vote at, the meeting.

By Order of the Board of Directors,

Elliot S. Orol

Senior Vice President, General Counsel

and Secretary

March 20, 2013

TOWER GROUP INTERNATIONAL, LTD.

Crown House, 4 Par-la-Ville Road

Hamilton HM 08, Bermuda

PROXY STATEMENT

The accompanying proxy is solicited by the Board of Directors of Tower Group International, Ltd. (the “Company”), for use at the Annual Meeting of Stockholders (the “Annual Meeting”) to be held at the Fairmont Hamilton Princess Hotel, 76 Pitts Bay Road, Pembroke HM 08, Bermuda on Tuesday, May 7, 2013, at 9:00 a.m. local time. This proxy statement, the foregoing Notice and the enclosed Proxy are being sent to stockholders of the Company on or about March 27, 2013.

Any proxy may be revoked at any time before it is voted by written notice mailed or delivered to the Secretary of the Company, by delivering a proxy bearing a later date or by attending the Annual Meeting and voting in person. If your proxy card is signed and returned without specifying a vote or an abstention on any proposal, it will be voted in accordance with the recommendation of the Board of Directors of the Company (the “Board of Directors” or the “Board”) on each proposal.

The proxy materials are available over the Internet at the web site address shown on your proxy card. Internet voting and voting by telephone are available 24 hours a day. Please refer to the enclosed proxy card for voting instructions. If you have access to the Internet, we encourage you to vote this way. If you vote over the Internet, please do not return your proxy card. Stockholders can elect to view future proxy statements and annual reports over the Internet instead of receiving paper copies in the mail. You can choose this option and save the Company the cost of producing and mailing the documents by following the instructions provided if you vote over the Internet. Should you choose to view future proxy statements and annual reports over the Internet, you will receive an e-mail next year with voting instructions and the Internet address of those materials.

The Board of Directors knows of no other matters that are likely to be brought before the Annual Meeting other than those specified in the notice thereof. If any other matters properly come before the meeting, however, the persons named in the enclosed proxy, or their duly constituted substitutes acting at the meeting, will be authorized to vote or otherwise act thereon in accordance with their judgment on such matters. If the enclosed proxy is properly executed and returned prior to voting at the meeting, the shares represented thereby will be voted in accordance with the instructions marked thereon. In the absence of instructions, executed proxies will be voted “FOR” the two nominees for the Board of Directors, “FOR” the ratification of the appointment by the Audit Committee of the Board of Directors of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the year 2013, “FOR” the reapproval of the material terms of the Company’s Short Term Performance Incentive Plan, “FOR” the approval of the of the Company’s 2013 Long Term Incentive Plan, “FOR” the approval of the material terms of the Company’s 2013 Long Term Incentive Plan, and “FOR” the approval of the Company’s executive compensation.

With respect to proposal 1, Directors will be elected by a majority of the votes cast in an uncontested election. For purposes of electing Directors in uncontested elections, a majority of the votes cast means that the number of shares cast “for” a Director must exceed the number of shares cast “against” that Director. “Abstentions” and “broker non-votes” do not count as votes cast “FOR” or “AGAINST” a Director’s election.

With respect to proposal 2 (ratification of the appointment of the Company’s independent registered public accounting firm), the affirmative vote of the majority of the outstanding shares of common stock of the Company present in person or by proxy entitled to vote at the Annual Meeting is required. Abstentions will count as votes “AGAINST” the proposal.

1

With respect to proposal 3 (reapproval of the material terms of the Company’s Short Term Performance Incentive Plan), proposal 4 (approval of the Company’s 2013 Long Term Incentive Plan), proposal 5 (approval of the material terms of the Company’s 2013 Long Term Incentive Plan), and proposal 6 (approval, on an advisory basis, of the Company’s executive compensation), the affirmative vote of the majority of the outstanding shares of common stock of the Company present in person or by proxy entitled to vote at the Annual Meeting is required. Abstentions will count as votes “AGAINST” the proposal. Broker non-votes are not counted as voting power present and, therefore, are not counted in the vote.

If you hold shares through an account with a bank or broker, the bank or broker may vote your shares on some matters even if you do not provide voting instructions. Brokerage firms have the authority to vote shares on certain matters when their customers do not provide voting instructions. However, on other matters, when the brokerage firm has not received voting instructions from its customers, the brokerage firm cannot vote the shares on that matter and a “broker non-vote” occurs. This means that brokers may not vote your shares on items 1, 3, 4, 5 and 6 if you have not given your broker specific instructions as to how to vote. Please be sure to give specific voting instructions to your broker so that your vote can be counted.

Stockholders of record at the close of business on March 19, 2013 are entitled to vote at the Annual Meeting. On March 19, 2013, the Company had outstanding 57,432,150 shares of common stock, $.01 par value per share. Each outstanding share of common stock is entitled to one vote and there is no cumulative voting. As to each proposal, the presence, in person or by proxy, of stockholders entitled to cast at least a majority of the votes that all stockholders are entitled to cast on the particular matter shall constitute a quorum for the purpose of considering that matter. Abstentions and broker non-votes will be counted for the purpose of determining whether a quorum is present.

On March 13, 2013, pursuant to an Agreement and Plan of Merger, dated as of July 30, 2012 (the “Merger Agreement”), among Tower Group, Inc. (the “Predecessor Company”), Canopius Holdings Bermuda Limited, Canopius Mergerco, Inc., and Condor 1 Corporation, as amended by Amendment No. 1 to the Merger Agreement, dated as of November 8, 2012 (the Merger Agreement as so amended, the “Amended Merger Agreement”), by and among the parties to the Merger Agreement, the Predecessor Company merged with a wholly-owned subsidiary of Canopius Holdings Bermuda Limited and the shares of common stock of the Predecessor Company were exchanged, in accordance with the terms of the Amended Merger Agreement, for shares of common stock of the Company (the “Merger”).A copy of the Annual Report of the Predecessor Company for the year ended December 31, 2012 is being mailed simultaneously herewith and is electronically available to stockholders on the Internet by logging ontowww.proxyvote.comand following the instructions provided.

2

Table of Contents

3

Cost of Solicitation

The Company is soliciting proxies on its own behalf and will bear the expenses of printing and mailing this proxy statement. The Company will also request persons, firms and corporations holding shares in their own names, or in the names of their nominees, which shares are beneficially owned by others, to send this proxy material to and obtain proxies from such beneficial owners and will reimburse such holders for their reasonable expenses in so doing.

The Board of Directors has nominated the two persons named below to serve as Directors of the Company until their successors have been duly elected and qualified. The Company believes that each nominee named below will be able to serve. However, should any such nominee not be able to serve as a Director, the persons named in the proxies have advised the Company that they will vote for the election of such substitute nominee as the Board of Directors may propose.

Nominees for Director

Directors hold office in accordance with the bye-laws of the Company, which provide for Class I, II and III Directors. The Directors in each class serve three-year terms, with the expiration of terms staggered according to class. Officers are elected by and serve at the discretion of the Board of Directors. The following Directors have terms that expire at the 2013 Annual Meeting and have been nominated to stand for election as Class I Directors with terms expiring in 2016:

| | | | | | |

Name | | Age | | | Position |

| | |

Charles A. Bryan | | | 66 | | | Director |

| | |

Robert S. Smith | | | 54 | | | Director |

The names of the nominees, their principal occupation, length of service as Directors of the Company and certain other biographical information are set forth below:

Charles A. Bryan, C.P.A., F.C.A.S., C.P.C.U.

Director

Mr. Bryan currently serves as a Director of the Company. From 2004 until the closing of the Merger in March 2013, he served as a member of the board of directors of the Predecessor Company. He is Chairman of the Compensation Committee and a member of the Audit Committee of the Board of Directors, positions he also held while serving as a member of the board of directors of the Predecessor Company. He has been the President of CAB Consulting, LLC, an insurance consulting firm that has provided general management, merger and acquisition, actuarial and accounting services, since 2001. From 1998 to 2000, Mr. Bryan served as Senior Vice President and Chief Actuary for Nationwide Insurance Group. He has been a partner at Ernst & Young LLP, Chief Executive Officer of Direct Response Corporation and a Senior Vice President of USAA. Mr. Bryan is a Fellow of the Casualty Actuarial Society, a Certified Public Accountant, and a Chartered Property and Casualty Underwriter. Mr. Bryan also serves on the Board of Directors of Safe Auto, Medical Mutual of Ohio and Munich Re America including Munich Re America’s affiliates, Hartford Steam Boiler and American Modern Insurance Group (statutory companies only). Mr. Bryan received an M.B.A. in General Management from Golden Gate University in 1976, an M.S. in Mathematics from Purdue University in 1969 and a B.S. in Mathematics from John Carroll University in 1968.

The Board of Directors believes that Mr. Bryan possesses the experience, qualifications, attributes, and skills necessary to serve on the Board because of his more than 40 years of relevant

4

actuarial, accounting, and insurance industry-related experience, his years of service on various insurance-related boards of directors, and his extensive knowledge of the Company and its business. In addition, he has a number of relevant professional designations, such as C.P.A., F.C.A.S., and C.P.C.U., which indicate his knowledge of insurance, actuarial and accounting issues.

Robert S. Smith

Director

Mr. Smith currently serves as a Director of the Company. From February 2009 until the closing of the Merger in March 2013, he served as a member of the board of directors of the Predecessor Company. He is Chairman of the Investment Committee and a member of the Compensation Committee of the Board of Directors, positions he also held while serving as a member of the board of directors of the Predecessor Company. Prior to serving as a member of the board of directors of the Predecessor Company, Mr. Smith served as a member of the board of directors of CastlePoint Holdings, Ltd., a company that merged with the Predecessor Company in February 2009. He held that position from January 2006 until February 2009. Mr. Smith is currently a principal of Sherier Capital LLC, a business advisory firm that he founded in 2005, and a Managing Director of National Capital Merchant Banking, LLC, an investment firm that he joined in April 2008. He was previously Chief Operating Officer (from December 1999 to April 2004) and Executive Vice-President (from April 2004 to August 2004) of Friedman, Billings, Ramsey Group, Inc., where he was instrumental in, among other things, growing Friedman, Billings, Ramsey Group, Inc. from a privately-held securities boutique to a nationally recognized investment bank, helping accomplish its 1997 initial public offering, the creation of an affiliated public company, FBR Asset Investment Corporation, and the merger of the two companies in 2003. Before joining Friedman, Billings, Ramsey Group, Inc. as its General Counsel in 1997, Mr. Smith was an attorney with the law firm of McGuireWoods LLP from 1986 to 1996. Mr. Smith currently serves on the Steering Committee of the Washington Performing Arts Society Legacy Society (“WPAS”) and as a member of the WPAS Pension Committee. He is also a director of Precise Systems, Inc., an employee-owned company serving federal Department of Defense customers. Mr. Smith received his LL.B. and Dip L.P. (graduate Diploma in Legal Practice) from Edinburgh University, and his LL.M. from the University of Virginia.

The Board of Directors believes that Mr. Smith possesses the experience, qualifications, attributes, and skills necessary to serve on the Board because of his more than 20 years of relevant experience including investment experience, service as a senior executive of a public company, experience in the public securities markets, and his corporate legal background.

The Board of Directors recommends a vote “FOR” the election of each of the nominees for Director.

CORPORATE GOVERNANCE

Director Independence

The Board of Directors applies the standards of the NASDAQ Stock Market (“NASDAQ”) in determining whether a Director is “independent.” The NASDAQ rules generally provide that no Director or nominee for Director qualifies as “independent” unless the Board of Directors affirmatively determines that such person has no relationship with the Company that, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a Director. Specifically, the following persons may not be considered independent: (i) a Director or nominee for Director who is, or at any time during the past three years was, employed by the Company or by any subsidiary of the Company; (ii) a Director or nominee for Director who accepts, or has a family member who accepts, any payments from the Company or any subsidiary of the Company in excess of $120,000 during any period of twelve consecutive months within any of the past three fiscal

5

years preceding the determination of independence other than (1) compensation for Board or Board committee service, (2) compensation paid to a family member who is a non-executive employee of the Company or a subsidiary of the Company or (3) benefits under a tax-qualified retirement plan, or non-discretionary compensation; (iii) a Director or nominee for Director who has a family member who is, or at any time during the past three years was, employed by the Company or any subsidiary of the Company as an executive officer; (iv) a Director or nominee for Director who is, or has a family member who is, a partner in, or a controlling stockholder or an executive officer of, any organization to which the Company made, or from which the Company received, payments for property or services in the current or any of the past three fiscal years that exceeded 5% of the recipient’s consolidated gross revenues for that year or $200,000, whichever is more, other than (1) payments arising solely from investments in the Company’s securities or (2) payments under non-discretionary charitable contribution matching programs; (v) a Director or nominee for Director who is, or has a family member who is, employed as an executive officer of another entity at any time during the past three years where any of the executive officers of the Company serves on the compensation committee of such other entity; and (vi) a Director or nominee for Director who is, or has a family member who is, a current partner of the Company’s independent registered public accounting firm or was a partner or employee of the Company’s independent registered public accounting firm, who worked on the Company’s audit at any time during the past three years.

The Board of Directors, in applying the above-referenced standards, has affirmatively determined that each of the following individuals is an “independent” Director of the Company: Charles A. Bryan, William W. Fox, Jr., William A. Robbie, Steven W. Schuster, Robert S. Smith, Jan R. Van Gorder and Austin P. Young, III. As part of the Board’s process in making such determination, each such Director provided confirmation that (a) all of the above-cited objective criteria for independence are satisfied and (b) each such Director has no other relationship with the Company that would interfere with the exercise of independent judgment in carrying out the responsibilities of a Director.

Payment of Fees to Independent Directors.In March 2013, the Board of Directors approved a policy providing that independent Directors shall not accept directly or indirectly any consulting, legal, advisory, or other compensatory fee from the Company or any of its subsidiaries, other than fees paid to any such Director in his or her capacity as a member of the Board and its Committees. The policy was initially adopted by the board of directors of the Predecessor Company in July 2006 and was in effect at the time of the Merger.

Offer of Resignation Upon Change of Employment.In March 2013, the Board of Directors approved a policy providing that any Director who changes his or her principal employment submit a letter of resignation to the Board, which shall determine in its discretion whether or not to accept such resignation. The policy was initially adopted by the board of directors of the Predecessor Company in October 2008 and was in effect at the time of the Merger.

Majority Vote Standard in Uncontested Director Elections.In March 2013, the Board of Directors approved a policy providing for a majority voting standard for the election of Directors in uncontested elections. In accordance with the policy, a nominee for Director must receive more votes cast “for” than “against” by stockholders at the annual meeting of stockholders to be elected or re-elected to the Board in an uncontested election of Directors. A Director who does not receive a majority of the votes cast in such an election must submit his or her resignation to the Board of Directors. Within 90 days after such annual meeting, the Board shall determine, acting upon the recommendation of its Corporate Governance and Nominating Committee, whether or not to accept such resignation and shall disclose in a required filing with the United States Securities and Exchange Commission (the “SEC” or the “Commission”) its determination and the rationale and process for such determination. The policy was initially adopted by the board of directors of the Predecessor Company in November 2011 and was in effect at the time of the Merger.

6

Lead Director. In March 2013, the Corporate Governance and Nominating Committee adopted a policy establishing the position of lead independent Director, with responsibilities that include, among others, presiding at executive sessions of the independent Directors, collaborating with the Chairman and Chief Executive Officer with respect to setting of Board agendas, and communicating with the Chairman and Chief Executive Officer on behalf of the independent Directors, when appropriate, with respect to the views and concerns of the independent Directors and other Board matters. The policy was initially adopted by the corporate governance and nominating committee of the board of directors of the Predecessor Company in November 2012 and was in effect at the time of the Merger.

Independent Directors

The Company’s Board of Directors has determined that seven of its eight members, constituting more than a majority, meet NASDAQ’s standards for independence. See “Director Independence” above. The independent Directors of the board of directors of the Predecessor Company met in executive session at least twice during 2012.

Stock Ownership Guidelines

Stock Ownership Guidelines for Directors.In March 2013, the Board of Directors approved director stock ownership guidelines requiring each of the Company’s independent Directors to own, within five years from the later of April 1, 2009 or the date on which such Director joins the Board and at all times thereafter, common stock of the Company having a minimum market value equal to three times the base annual cash retainer paid to the Directors. All of the Company’s independent Directors are currently in compliance with such director stock ownership guidelines. These guidelines were initially adopted by the board of directors of the Predecessor Company in February 2009 and were in effect at the time of the Merger.

Stock Ownership Guidelines for Chief Executive Officer and Other Named Executive Officers.In March 2013, the Board of Directors approved stock ownership guidelines for the Company’s Chief Executive Officer and other Named Executive Officers requiring each such officer to own, within five years from the later of March 1, 2011 or the date such officer becomes a Named Executive Officer and at all times thereafter, common stock of the Company having a minimum market value equal to (1) with respect to the Chief Executive Officer, five times his or her annual base salary, and (2) with respect to each of the other Named Executive Officers, two times his or her annual base salary. These guidelines were initially adopted by the board of directors of the Predecessor Company in February 2011 and were in effect at the time of the Merger.

Anti-Pledging Policy.In March 2013, the Corporate Governance and Nominating Committee adopted a policy prohibiting the Directors and designated executive officers of the Company from pledging any shares of stock, stock options, stock appreciation rights, restricted stock units or performance shares of the Company arising out of any agreement entered into by a Director or officer following the date of adoption of this policy. This policy was initially adopted by the corporate governance and nominating committee of the Predecessor Company in November 2012 and was in effect at the time of the Merger.

Anti-Hedging Policy.In March 2013, the Corporate Governance and Nominating Committee adopted a policy prohibiting the Directors and designated executive officers of the Company from engaging in hedging, derivative or other speculative transactions in the Company’s securities including, among others, short sales, swaps or collars with respect to the Company’s securities, purchases or sales of put or call options, transactions intended to capitalize on short-term movements in the price of the Company’s securities, and transactions intended to allow an investor to own the

7

Company’s securities without the full risks and rewards of ownership. This policy was initially adopted by the corporate governance and nominating committee of the Predecessor Company in February 2013 and was in effect at the time of the Merger.

Audit Committee

The Company’s Board of Directors has determined that all members of the Audit Committee meet the standards of independence required of Audit Committee members by applicable NASDAQ and SEC rules and regulations. See “Director Independence” above.

The Board of Directors has determined that: (i) none of the members of the Audit Committee has participated in the preparation of the financial statements of the Company or any current subsidiary of the Company at any time during the past three years; (ii) all of the members of the Audit Committee are able to read and understand fundamental financial statements, including a company’s balance sheet, income statement and cash flow statement; and (iii) Austin P. Young, III, who previously served as an audit partner in the Houston and New York offices of KPMG Peat Marwick until 1986, is an Audit Committee financial expert. In making this last determination, the Board of Directors made a qualitative assessment of Mr. Young’s level of knowledge and experience based on a number of factors, including his formal education, past employment experience in accounting and professional certification in accounting.

The Audit Committee operates under a formal written charter adopted by the Board of Directors that governs its duties and conduct. The charter is reviewed annually. Copies of the charter can be obtained free of charge on the Company’s web site,www.twrgrpintl.com, or by contacting the Company’s Secretary at the address appearing on the first page of this proxy statement.

The Company’s independent registered public accounting firm reports directly to the Audit Committee. The Audit Committee meets with management and the Company’s independent registered public accounting firm before the filing of officers’ certifications with the SEC to receive information concerning, among other things, any significant deficiencies in the design or operation of internal control over financial reporting. The Audit Committee has also established procedures to enable confidential and anonymous reporting to the Audit Committee of concerns regarding accounting or auditing matters. The Company conducts an appropriate review of all related party transactions for potential conflict of interest situations on an ongoing basis, and all such transactions must be approved by the Audit Committee.

Compensation Committee

The Company’s Board of Directors has determined that all members of the Compensation Committee meet the standards of independence required of Compensation Committee members by applicable NASDAQ and SEC rules and regulations. See “Director Independence” above. Further, each member is a “non-employee Director,” as defined under Rule 16b-3(b)(3) of the Securities Exchange Act of 1934, as amended, and an “outside Director” as defined in Treasury Regulations Section 1.162-27, promulgated under the Internal Revenue Code of 1986, as amended (the “Code”). The Compensation Committee operates under a formal written charter adopted by the Board of Directors that governs its duties and conduct. The charter is reviewed annually. Copies of the charter can be obtained free of charge on the Company’s web site,www.twrgrpintl.com, or by contacting the Company’s Secretary at the address appearing on the first page of this proxy statement.

8

Corporate Governance and Nominating Committee

All members of the Corporate Governance and Nominating Committee have been determined to meet NASDAQ’s standards of independence. See “Director Independence” above. The Corporate Governance and Nominating Committee operates under a formal written charter that governs its duties and conduct. The charter is reviewed annually. Copies of the charter can be obtained free of charge on the Company’s web site,www.twrgrpintl.com, or by contacting the Company’s Secretary at the address appearing on the first page of this proxy statement.

As part of its duties, the Corporate Governance and Nominating Committee develops and recommends to the Board of Directors corporate governance principles. The Corporate Governance and Nominating Committee also identifies and recommends individuals for Board of Directors membership. To be considered for membership on the Board of Directors, a candidate should meet the following criteria, at a minimum: a solid education, extensive business, professional or academic experience, and the requisite reputation, character, skills and judgment, which, in the Corporate Governance and Nominating Committee’s view, have prepared him or her for dealing with the multifaceted financial, business and other issues that confront a Board of Directors of a corporation with the size, complexity, reputation and success of the Company.

The Corporate Governance and Nominating Committee does not have a formal diversity policy with respect to the identification and recommendation of individuals for Board of Directors membership. However, in carrying out this responsibility, the Corporate Governance and Nominating Committee values differences in professional experience, educational background, viewpoint and other individual qualities and attributes that facilitate and enhance the oversight by the Board of Directors of the business and affairs of the Company.

In connection with each of the Company’s annual meetings of stockholders, the Corporate Governance and Nominating Committee will consider candidates for Director recommended by any stockholder who (a) has been a continuous record owner of at least 2% of the Company’s common stock for at least one year prior to submission and (b) provides a written statement that the holder intends to continue ownership of the shares through the stockholders meeting. Such recommendations or other proposals of business to be considered by the stockholders must be made by written notice addressed to the Secretary of the Company no more than 120 days and no fewer than 90 days prior to the anniversary of the date of the previous year’s annual meeting of stockholders and in any event at least 45 days prior to the first anniversary of the date on which the Company first mailed its proxy materials for the previous year’s annual meeting of stockholders. Consequently, any such recommendation for Director or other proposal for consideration by the stockholders with respect to the Company’s 2014 annual meeting of stockholders must be made no earlier than January 7, 2014 and no later than February 6, 2014.

Pursuant to the above procedures, once the Corporate Governance and Nominating Committee has identified prospective nominees, background information will be solicited on the candidates, following which they will be investigated, interviewed and evaluated by the Corporate Governance and Nominating Committee, which will then report to the Board of Directors. No distinctions will be made as between internally-recommended candidates and those recommended by stockholders.

All the Director nominees named in this proxy statement meet the Board of Directors’ criteria for membership and were recommended by the Corporate Governance and Nominating Committee for election by stockholders at the Annual Meeting.

All nominees for election at the Annual Meeting are current members of the Board standing for re-election.

9

Investment Committee

All members of the Investment Committee have been determined to meet NASDAQ’s standards of independence. See “Director Independence” above. The Investment Committee assists the Board in its general oversight of the investments of the Company and the periodic evaluation of the Company’s investment portfolio managers. The Investment Committee operates under a formal written charter adopted by the Board of Directors that governs its duties and conduct. The charter is reviewed annually. Copies of the charter can be obtained free of charge on the Company’s web site,www.twrgrpintl.com, or by contacting the Company’s Secretary at the address appearing on the first page of this proxy statement.

Code of Business Conduct and Ethics

The Company has adopted a Code of Business Conduct and Ethics that includes provisions ranging from restrictions on gifts to conflicts of interest, portions of which Code are intended to meet the definition of a “code of ethics” under applicable SEC rules. The Code of Business Conduct and Ethics is applicable to all Directors, officers and employees, including the principal executive officer, principal financial officer and persons performing similar functions. Copies of the Code of Business Conduct and Ethics can be obtained free of charge from the Company’s web site,www.twrgrpintl.com, or by contacting the Company’s Secretary at the address appearing on the first page of this proxy statement.

Communications with the Board of Directors

A stockholder who wishes to communicate with the Board of Directors, or specific individual Directors, may do so by directing a written request addressed to such Directors to the attention of the Company’s Secretary at the address appearing on the first page of this proxy statement, or by e-mail atboardofdirectors@twrgrp.com. All communications directed to members of the Board of Directors will be forwarded to the intended Director(s).

Additional Information Regarding the Board

Board Leadership Structure.The Board of Directors has not separated the positions of Chairman of the Board and Chief Executive Officer of the Company. Both positions are held by Michael H. Lee, who was chairman of the board of directors and chief executive officer of the Predecessor Company at the time of the Merger. The Board believes that this structure serves the Company well, by facilitating communication between the Board and senior management of the Company as well as Board oversight of the Company’s business and affairs.

In view of evolving best practices with respect to Board leadership structure and to enhance the Company’s corporate governance, the Corporate Governance and Nominating Committee established the position of lead independent Director in March 2013, and designated Mr. Van Gorder to serve in that position. The corporate governance and nominating committee of the Predecessor Company initially established the position of lead independent Director in November 2012, and designated Mr. Van Gorder to serve in that position. The responsibilities of the lead independent Director include, among others, presiding at executive sessions of the independent Directors, collaborating with the Chairman and Chief Executive Officer with respect to setting of Board agendas, and communicating with the Chairman and Chief Executive Officer on behalf of the independent Directors, when appropriate, with respect to the views and concerns of the independent Directors and other Board matters.

10

Board Role in Risk Oversight.The Board of Directors plays a significant role in providing oversight of the Company’s management of risk. Senior management has responsibility for the management of risk and reports to the Board with respect to its ongoing enterprise risk management efforts. Because responsibility for the oversight of elements of the Company’s risk management extends to various committees of the Board, the Board has determined that it, rather than any one of its committees, should retain the primary oversight role for risk management. In exercising its oversight of risk management, the Board has delegated to the Audit Committee primary responsibility for the oversight of risk related to the Company’s financial statements and processes, and has determined that the Company’s internal audit function should report directly to the Audit Committee and on a dotted line basis to the Company’s Senior Vice President, General Counsel and Secretary. The Board has delegated to the Compensation Committee primary responsibility for the oversight of risk related to the Company’s compensation policies and practices. The Board has delegated to the Corporate Governance and Nominating Committee primary responsibility for the oversight of risk related to the Company’s corporate governance practices. The Board has delegated to the Investment Committee primary responsibility for the oversight of risk related to the Company’s investments. Each committee advises the Board with respect to such committee’s particular risk oversight responsibilities.

Meetings. During 2012, the board of directors of the Predecessor Company met 15 times. The standing independent committees of the board of directors of the Predecessor Company consisted of the audit, compensation, corporate governance and nominating, and investment committees. In 2012, each director of the Predecessor Company attended at least 75% of the total number of meetings of the Predecessor Company’s board of directors and any committees on which such director served. All directors were present at the annual meeting of stockholders of the Predecessor Company in 2012.

Board Committees. The audit committee of the Predecessor Company met 10 times in 2012. During 2012, the audit committee of the Predecessor Company consisted of Messrs. Young (Chair), Bryan, Fox and Robbie. The membership of the Audit Committee of the Company is identical to that of the Predecessor Company. Among other duties, the Audit Committee selects the Company’s independent registered public accounting firm; reviews and recommends action by the Board of Directors regarding the Company’s quarterly and annual reports filed with the SEC; discusses the Company’s audited financial statements with management and the Company’s independent registered public accounting firm; and reviews the scope and results of the independent audit and any internal audit.

The compensation committee of the Predecessor Company met 15 times in 2012. During 2012, the compensation committee of the Predecessor Company consisted of Messrs. Bryan (Chair), Schuster, Smith and Van Gorder. The membership of the Compensation Committee of the Company is identical to that of the Predecessor Company. Among other duties, the Compensation Committee evaluates the performance of the Company’s principal officers, reviews and approves the compensation of principal officers, and administers the Company’s various compensation plans.

The corporate governance and nominating committee of the Predecessor Company met four times in 2012. During 2012, the corporate governance and nominating committee of the Predecessor Company consisted of Messrs. Schuster (Chair), Bryan, Fox and Van Gorder. The membership of the Corporate Governance and Nominating Committee of the Company is identical to that of the Predecessor Company. Among other duties, the Corporate Governance and Nominating Committee is responsible for recommending to the Board of Directors candidates for nomination to the Board as well as corporate governance principles applicable to the Company.

The investment committee of the Predecessor Company met four times in 2012. During 2012, the investment committee of the Predecessor Company consisted of Messrs. Smith (Chair), Robbie,

11

Schuster and Young. The membership of the Investment Committee of the Company is identical to that of the Predecessor Company. Among other duties, the Investment Committee monitors the performance of the Company’s investment portfolio and evaluates the Company’s investment portfolio managers.

While the Company has not adopted a formal policy with regard to attendance by members of the Board of Directors at annual stockholder meetings, it encourages all Directors to attend the Annual Meeting.

Compensation Committee Interlocks and Insider Participation

No member of the Compensation Committee is or has ever been an officer or employee of the Company or of any of its subsidiaries or affiliates. None of the Company’s executive officers served as a director or member of the compensation committee (or other board committee performing similar functions) of any entity of which a member of the Company’s Compensation Committee was an executive officer, nor did any of the Company’s executive officers serve as a member of the compensation committee (or other board committee performing similar functions or, in the absence of such a committee, the entire board of directors) of any entity for which any of the Company’s Directors served as an executive officer.

The Board and Board Committees

The following table shows each of the four current standing committees established by the Board and the members and chairman of each committee:

| | | | | | | | |

| Name | | Audit Committee | | Compensation

Committee | | Corporate

Governance and

Nominating

Committee | | Investment

Committee |

Charles A. Bryan* | | X | | CHAIR | | X | | |

William W. Fox, Jr.* | | X | | | | X | | |

Michael H. Lee | | | | | | | | |

William A. Robbie* | | X | | | | | | X |

Steven W. Schuster* | | | | X | | CHAIR | | X |

Robert S. Smith* | | | | X | | | | CHAIR |

Jan R. Van Gorder* | | | | X | | X | | |

Austin P. Young, III* | | CHAIR | | | | | | X |

Number of meetings in 2012 | | 10 | | 15 | | 4 | | 4 |

Transactions with Related Persons

Board of Directors Related Party Policies

In March 2013, the Board of Directors approved a policy providing that independent Directors shall not accept directly or indirectly any consulting, legal, advisory, or other compensatory fee from the Company or any of its subsidiaries, other than fees paid to any such Director in his or her capacity as a member of the Board of Directors and its committees. This policy was initially adopted by the board of directors of the Predecessor Company in July 2006 and was in effect at the time of the Merger.

12

In March 2013, the Board of Directors adopted a policy that calls for the prior review and approval by the Audit Committee of any proposed transaction (or series of transactions) between the Company and any related party. Under the policy, full disclosure of all facts and circumstances relating to the proposed transaction must be made to the Audit Committee, which may only approve transactions that are in, or are not inconsistent with, the best interests of the Company and its stockholders. Related parties are defined as executive officers, 5% stockholders, Directors, director nominees and any of their immediate family members (as those terms are defined under Item 404 of Regulation S-K). This policy was initially adopted by the board of directors of the Predecessor Company in February 2007 and was in effect at the time of the Merger.

MANAGEMENT — DIRECTORS AND EXECUTIVE OFFICERS

The table below sets forth the names, ages and positions of the Company’s Directors and executive officers.

| | | | | | |

| Name | | Age | | | Position |

Michael H. Lee(2) | | | 55 | | | Chairman of the Board, President and Chief Executive Officer |

Charles A. Bryan(1) | | | 66 | | | Director |

William W. Fox, Jr.(3) | | | 71 | | | Director |

William A. Robbie(3) | | | 61 | | | Director |

Steven W. Schuster(3) | | | 58 | | | Director |

Robert S. Smith(1) | | | 54 | | | Director |

Jan R. Van Gorder(2) | | | 65 | | | Director |

Austin P. Young, III(2) | | | 72 | | | Director |

William E. Hitselberger | | | 55 | | | Executive Vice President and Chief Financial Officer |

Gary S. Maier | | | 48 | | | Executive Vice President and Chief Underwriting Officer |

Salvatore V. Abano | | | 49 | | | Senior Vice President and Chief Information Officer |

William F. Dove | | | 46 | | | Senior Vice President, Chief Risk Officer and Chief Actuary |

Scott T. Melnik | | | 41 | | | Senior Vice President, Claims |

Elliot S. Orol | | | 57 | | | Senior Vice President, General Counsel and Secretary |

Christian K. Pechmann | | | 63 | | | Senior Vice President, Marketing |

Laurie A. Ranegar | | | 51 | | | Senior Vice President, Operations |

Catherine M. Wragg | | | 42 | | | Senior Vice President, Human Resources and Administration |

| (1) | Denotes Class I Director with term to expire in 2013. |

| (2) | Denotes Class II Director with term to expire in 2015. |

| (3) | Denotes Class III Director with term to expire in 2014. |

Set forth below is certain biographical information for each of the Company’s Directors and executive officers (other than Messrs. Bryan and Smith, for whom such information is provided above under “Election of Directors — Nominees for Director”):

Michael H. Lee

Chairman of the Board, President and Chief Executive Officer

Mr. Lee currently serves as Chairman of the Board of Directors, President and Chief Executive Officer of the Company. Prior to the closing of the Merger in March 2013, Mr. Lee had served as Chairman of the Predecessor Company’s board, and President and Chief Executive Officer of the Predecessor Company since its formation in 1995. Before founding the Predecessor Company’s first insurance subsidiary, Tower Insurance Company of New York, in 1990, Mr. Lee was an attorney in private practice specializing in advising entrepreneurs on the acquisition, sale and formation of

13

businesses in various industries. Mr. Lee received a B.A. in Economics from Rutgers University in 1980 and a J.D. from Boston College Law School in 1983. He is admitted to practice law in New York and New Jersey. Mr. Lee has worked in the insurance industry for over 20 years with experience in insurance, finance, underwriting, sales and marketing, claims management and administration and law. Mr. Lee also served as Chairman, President and Chief Executive Officer of CastlePoint Holdings, Ltd. from its formation in 2006 until its merger into the Predecessor Company in February 2009.

The Board of Directors believes that Mr. Lee possesses the experience, qualifications, attributes, and skills necessary to serve on the Board because of his more than 20 years of experience in all aspects of insurance, finance, mergers and acquisitions and the formation of various businesses, his having provided leadership and strategic direction to the Company as its Chairman, President, and Chief Executive Officer, and to the Predecessor Company as its founder, Chairman, President, and Chief Executive Officer since 1995, as well as his unparalleled knowledge of the Company and its business.

William W. Fox, Jr.

Director

Mr. Fox currently serves as a Director of the Company. From April 2006 until the closing of the Merger in March 2013, he served as a member of the board of directors of the Predecessor Company. He is a member of the Audit Committee and the Corporate Governance and Nominating Committee of the Board of Directors, positions he also held while serving as a member of the board of directors of the Predecessor Company. He has over 40 years experience in the insurance and reinsurance industry. Mr. Fox was employed by Balis & Co., Inc. and its successor, the Guy Carpenter reinsurance brokerage division of Marsh & McLennan Companies, from 1962 through 1988, and again from 1992 through 1999. Mr. Fox had a number of positions at Balis & Co., Inc., and Guy Carpenter, including President of Balis from 1985 through 1988 and again from 1992 through 1999. Mr. Fox also served as a member of Guy Carpenter’s Executive Committee and Board of Directors, and as a Managing Director of J&H, Marsh & McLennan. Between 1992 and 1999, Mr. Fox was also the Chief Executive Officer of Excess Reinsurance Company. In 1988, Mr. Fox founded PW Reinsurance Management Company, as a joint venture with Providence Washington Insurance Company (“PW Group”) to underwrite reinsurance on behalf of PW Group. Mr. Fox was a Senior Vice President of PW Group from 1988 to 1989 and was responsible for selecting and overseeing reinsurance intermediaries. In 1989, the Baloise Insurance Group acquired Providence and appointed Mr. Fox President of the PW Group. Mr. Fox has served on several insurance-related boards of directors and is currently the Chairman of the Board of MII Management Group, the Attorney-in-Fact for MutualAid Exchange. Mr. Fox is a member of the CPCU Society and holds a Pennsylvania Property and Casualty License.

The Board of Directors believes that Mr. Fox possesses the experience, qualifications, attributes, and skills necessary to serve on the Board because of his more than 40 years of relevant industry-related experience in the fields of insurance and reinsurance, his years of service on various insurance-related boards of directors, and his extensive knowledge of the Company and its business.

William A. Robbie, C.P.A.

Director

Mr. Robbie currently serves as a Director of the Company. From February 2009 until the closing of the Merger in March 2013, he served as a member of the board of directors of the Predecessor Company. He is a member of the Audit Committee and the Investment Committee of the Board of Directors, positions he also held while serving as a member of the board of directors of the Predecessor Company. Prior to serving as a member of the board of directors of the Predecessor Company, Mr. Robbie served as a member of the board of directors of CastlePoint Holdings, Ltd., a company that merged with the Predecessor Company in February 2009. He held that position from January 2006

14

until February 2009. From 2004 through 2009, he provided financial and corporate governance advisory services to the insurance industry through his own consulting firm. Mr. Robbie was Chief Financial Officer of Platinum Underwriters Reinsurance Ltd., a property and casualty reinsurance company in Bermuda, from 2002 to 2004 with responsibility for that company’s finance, claims and IT functions. He was the lead financial team member in the initial public offering of Platinum Underwriters Reinsurance Ltd., which became a separate public company from St. Paul Reinsurance, Inc. where he held the same position from August 2002 to November 2002. From 1997 to 2002, Mr. Robbie held various positions at XL Capital Ltd., a Bermuda-based insurance, reinsurance and financial risk company, and its subsidiaries, including Executive Vice President of Global Services, Senior Vice President and Corporate Treasurer, and Chief Financial and Administrative Officer of XL Re, Ltd., with responsibility for that company’s finance, claims, IT, human resources, business processing and administration functions. Prior to that, he held a variety of senior positions in the insurance industry, including roles as Chief Financial Officer of Prudential AARP Operations, Chief Accounting Officer at Continental Insurance Companies, Treasurer of Monarch Life Insurance Company and various positions at Aetna Life and Casualty Company. From 2005 to 2008, Mr. Robbie was a director and chairman of the Audit Committee of American Safety Insurance Company, Ltd. Mr. Robbie is a Certified Public Accountant. Mr. Robbie received his B.A. from St. Michael’s College and his Master of Accounting and M.B.A. from Northeastern University.

The Board of Directors believes that Mr. Robbie possesses the experience, qualifications, attributes, and skills necessary to serve on the Board because of his more than 30 years of relevant industry-related experience in finance, including serving as Chief Financial Officer of insurance and reinsurance companies, and his extensive background in accounting and business administration.

Steven W. Schuster

Director

Mr. Schuster currently serves as a Director of the Company. From 1997 until the closing of the Merger in 2013, he served as a member of the board of directors of the Predecessor Company. He is Chairman of the Corporate Governance and Nominating Committee and a member of both the Compensation Committee and the Investment Committee of the Board of Directors, positions he also held while serving as a member of the board of directors of the Predecessor Company. Mr. Schuster has been engaged in the practice of corporate law for over 30 years and is co-chair of McLaughlin & Stern LLP’s corporate and securities department, where he has been a partner since 1995. Mr. Schuster received his B.A. from Harvard University in 1976 and his J.D. from New York University in 1980.

The Board of Directors believes that Mr. Schuster possesses the experience, qualifications, attributes, and skills necessary to serve on the Board because of his more than 30 years of relevant corporate and securities legal and transactional experience and his extensive knowledge of the Company and its business.

Jan R. Van Gorder

Director

Mr. Van Gorder currently serves as a Director of the Company. From February 2009 until the closing of the Merger in March 2013, he served as a member of the board of directors of the Predecessor Company. He is the lead independent Director of the Board of Directors and a member of both its Compensation Committee and Corporate Governance and Nominating Committee, positions he also held while serving as a member of the board of directors of the Predecessor Company. Prior to serving as a member of the board of directors of the Predecessor Company, Mr. Van Gorder served as a member of the board of directors of CastlePoint Holdings, Ltd., a company that merged with the Predecessor Company in February 2009. He held that position from March 2007 to February 2009. Mr. Van Gorder was employed by Erie Insurance Group from November 1981 through December

15

2006. He held a variety of positions at that company, including Acting Chief Executive Officer from January 2002 to May 2002 and his most recent position as Senior Executive Vice-President, Secretary and General Counsel from December 1990 through December 2006. He served as a consultant and acting Secretary and General Counsel at Erie Insurance Group during the period January 1, 2007 through May 12, 2007. Mr. Van Gorder served as a member of the board of directors of Erie Indemnity Company, Erie, Pennsylvania, from 1990 to 2004. Mr. Van Gorder has also served as a Director and Chairman of the Insurance Federation of Pennsylvania. Mr. Van Gorder received a B.A. in International Relations from the University of Pennsylvania in 1970 and a J.D. from Temple University School of Law in 1975.

The Board of Directors believes that Mr. Van Gorder possesses the experience, qualifications, attributes, and skills necessary to serve on the Board because of his more than 30 years of relevant insurance industry-related legal and business experience, including serving as General Counsel of a public insurance company, and his years of service on various insurance-related boards of directors.

Austin P. Young, III, C.P.A.

Director

Mr. Young currently serves as a Director of the Company. From 2004 until the closing of the Merger in March 2013, he served as a member of the board of directors of the Predecessor Company. He is Chairman of the Audit Committee and a member of the Investment Committee of the Board of Directors, positions he also held while serving as a member of the board of directors of the Predecessor Company. He also serves as a Director and the Chairman of the Audit Committee of Insperity, Inc. and Amerisafe, Inc. Previously, he served as Senior Vice President, Chief Financial Officer and Treasurer of CellStar Corporation from 1999 to December 2001, when he retired. Before joining CellStar Corporation, he served as Executive Vice President — Finance and Administration of Metamor Worldwide, Inc. from 1996 to 1999. Mr. Young also held the position of Senior Vice President and Chief Financial Officer of American General Corporation for over eight years. He was a partner in the Houston and New York offices of KPMG Peat Marwick where his career spanned 22 years before joining American General Corporation. He holds an accounting degree from the University of Texas and is also a member of the Houston, Texas, and New York State Chapters of Certified Public Accountants, the American Institute of Certified Public Accountants and Financial Executives International.

The Board of Directors believes that Mr. Young possesses the experience, qualifications, attributes, and skills necessary to serve on its Board of Directors because of his more than 50 years of relevant experience in the financial and accounting fields, his years of service on various boards of directors and audit committees, and his extensive knowledge of the Company and its business.

William E. Hitselberger

Executive Vice President and Chief Financial Officer

Mr. Hitselberger currently serves as Executive Vice President and the Chief Financial Officer of the Company. Prior to the closing of the Merger in March 2013, Mr. Hitselberger served as Executive Vice President and Chief Financial Officer of the Predecessor Company. Initially, he joined the Predecessor Company in December 2009 as Senior Vice President and became Chief Financial Officer in March 2010 and Executive Vice President in May 2012. Before joining the Predecessor Company, Mr. Hitselberger served as Executive Vice President and Chief Financial Officer of PMA Capital Corporation from April 2004 to November 2009 and as Senior Vice President, Chief Financial Officer and Treasurer from June 2002 to March 2004. Prior to this, he served as Vice President of The PMA Insurance Group from 1996 to 2002. Mr. Hitselberger is a Certified Public Accountant and a Chartered Financial Analyst. Mr. Hitselberger graduated from the University of Pennsylvania, where he received a B.S. in Economics in 1980.

16

Gary S. Maier

Executive Vice President and Chief Underwriting Officer

Mr. Maier currently serves as Executive Vice President and the Chief Underwriting Officer of Tower Group, Inc., a subsidiary of the Company and the holding company for its U.S. operations. Prior to the closing of the Merger in March 2013, Mr. Maier served as Executive Vice President and Chief Underwriting Officer of the Predecessor Company. Initially, he joined the Predecessor Company in June 2005 as Senior Vice President and Chief Underwriting Officer and became Executive Vice President in May 2012. Before joining the Predecessor Company, Mr. Maier served from April 2002 to September 2004 as Senior Vice President and Chief Underwriting Officer of OneBeacon Insurance Group in New York. In his role at OneBeacon Insurance Group, Mr. Maier managed the New York and New Jersey territories. From February 1987 to March 2002, Mr. Maier served in a variety of positions at Chubb Insurance Group, including most recently as Senior Vice President and Chief Underwriting Officer of Commercial Lines for Chubb Insurance Group’s Mid-Atlantic Region, where he managed a $400 million middle-market commercial portfolio in seven states with six field offices and a regional small commercial underwriting center. Mr. Maier graduated from the University of Mount Union with a B.S. in Mathematics and Computing.

Salvatore V. Abano

Senior Vice President and Chief Information Officer

Mr. Abano currently serves as Senior Vice President and Chief Information Officer of Tower Group, Inc., a subsidiary of the Company and the holding company for its U.S. operations. From June 2008 until the closing of the Merger in March 2013, Mr. Abano served as Senior Vice President and Chief Information Officer of the Predecessor Company. From 2006 to 2008, Mr. Abano served as Vice President of Technology, Systems Development and Infrastructure for QBE the Americas. From 2004 to 2006, Mr. Abano was the Chief Technology Officer in the United States Army, under Operation Iraqi Freedom III, for the central region of Iraq. He was awarded the Bronze Star, Combat Action Badge, and other prestigious awards during his military reserves deployment. Mr. Abano is now a retired field grade officer from the military reserves with 26 years of service. Prior to his overseas deployment, Mr. Abano held the position of Vice President and CIO for Kemper Insurance Companies Northeast Region from 1999-2004, and was Assistant Vice President of Technology and Strategic Software Development for Munich Re America (formerly American Reinsurance Corporation) from 1993-1999. Mr. Abano has held various positions within the insurance and financial services industry, including with American International Group. Mr. Abano received an M.B.A. in Business Management and Technology from Regis University in 2003, and is a graduate of Brooklyn College, The City University of New York, where he received a B.S. in Computer and Information Science in 1986.

William F. Dove

Senior Vice President, Chief Risk Officer and Chief Actuary

Mr. Dove currently serves as Senior Vice President, Chief Risk Officer and Chief Actuary of the Company. Prior to the closing of the Merger in March 2013, Mr. Dove served as Senior Vice President, Chief Risk Officer and Chief Actuary of the Predecessor Company. He joined the Predecessor Company in October 2011 as Senior Vice President and Chief Risk Officer and became Chief Actuary in January 2012. Before joining the Predecessor Company, Mr. Dove served in a series of roles with various subsidiaries of ACE Limited since 2003, most recently as Chief Operating Officer and Chief Actuary of Brandywine Group Holdings since 2007. Prior to that, he served as Chief Technical Officer of ACE Risk Management from 2006 to 2007 and as President of ACE Financial Solutions from 2004 to 2006. From 1995 to 2003, he served as Senior Vice President and Chief Pricing Actuary for Centre Insurance Company. From 1991 to 1995 he served as Assistant Vice President for Continental Insurance Company. He currently serves on the Audit & Compliance Committee of the Princeton Family YMCA and the Citizens’ Financial Advisory Committee for Princeton, NJ. He is a

17

Fellow of the Casualty Actuarial Society, an Associate of the Society of Actuaries, a member of the American Academy of Actuaries and a Chartered Enterprise Risk Analyst. He holds a B.A. in Mathematics from Haverford College in Haverford, PA.

Scott T. Melnik

Senior Vice President, Claims

Mr. Melnik currently serves as Senior Vice President of Claims of Tower Group, Inc., a subsidiary of the Company and the holding company for its U.S. operations. From June 2008 until the closing of the Merger in March 2013, Mr. Melnik served as Senior Vice President, Claims of the Predecessor Company. Initially, he joined the Predecessor Company in March 1999 as a Claims Manager and throughout his more than thirteen years with the Predecessor Company served in a number of other management positions within the Claims Division. Over the last 20 years in the insurance industry, Mr. Melnik has been involved in the technical claim handling and management of various types of property and casualty insurance claims, both personal and commercial lines. Before joining the Predecessor Company, Mr. Melnik held management positions in the Risk Management division of CNA Insurance Companies. From 1991 to 1994, he held positions at the self-insured and reciprocal management firm Wright Risk Management.

Elliot S. Orol

Senior Vice President, General Counsel and Secretary

Mr. Orol currently serves as Senior Vice President, General Counsel and Secretary of the Company. Prior to the closing of the Merger in March 2013, Mr. Orol had served as Senior Vice President, General Counsel and Secretary of the Predecessor Company since December 2008. Before joining Predecessor Company, Mr. Orol served until November 2008 at The Navigators Group, Inc. as Chief Compliance Officer from November 2004, Senior Vice President and General Counsel from May 2005, and Secretary from May 2006. Prior to joining Navigators, Mr. Orol was in private legal practice and, from 2002 to 2003, served as Managing Director and General Counsel of Gerling Global Financial Products, Inc. From 1999 through 2001, he was a partner with the law firm of Cozen O’Connor. He served from 1996-1999 as Vice President, General Counsel and Secretary of the GRE Insurance Group, and from 1987-1996 as Vice President of The Continental Insurance Company. Mr. Orol received a B.S. in Mathematics from the State University of New York at Binghamton, a J.D. from the University of Chicago Law School and an M.B.A. from the University of Chicago Graduate School of Business.

Christian K. Pechmann

Senior Vice President, Marketing

Mr. Pechmann currently serves as Senior Vice President, Marketing of Tower Group, Inc., a subsidiary of the Company and the holding company for its U.S. operations. Prior to the closing of the Merger in March 2013, Mr. Pechmann had served as Senior Vice President, Marketing of the Predecessor Company since September 2003. Before joining the Predecessor Company, Mr. Pechmann was employed in various profit center and underwriting management roles at Kemper Insurance Companies. His last position with that company was as Northeast Region President, responsible for the regional branch offices. A 1971 graduate of Hartwick College, Mr. Pechmann received a B.A. in English.

Laurie A. Ranegar

Senior Vice President, Operations

Ms. Ranegar currently serves as Senior Vice President of Operations of Tower Group, Inc., a subsidiary of the Company and the holding company for its U.S. operations. She is responsible for service delivery, billing and collections, premium audit, statistical reporting and technology user

18

acceptance testing. Prior to the closing of the Merger in March 2013, Ms. Ranegar had served as Senior Vice President of Operations of the Predecessor Company since October 2003. She has 29 years of insurance industry experience with extensive experience in off-shoring back office processes. Before joining the Predecessor Company, she was Regional Operations Director of the Northeast for Kemper Insurance. Before joining Kemper, Ms. Ranegar held management positions at Highlands Insurance Group, Inc. from 1996 until 2002, where she held the positions of Vice President, Claim Field Operations, and Vice President, Underwriting and Operations, responsible for a commercial small business service center. She began her insurance career with Aetna Life and Casualty and is a graduate of the University of Pittsburgh with a B.A. in Economics.

Catherine M. Wragg

Senior Vice President, Human Resources and Administration

Ms. Wragg currently serves as Senior Vice President, Human Resources and Administration of Tower Group, Inc., a subsidiary of the Company and the holding company for its U.S. operations. Prior to the closing of the Merger in March 2013, Ms. Wragg had served as Senior Vice President, Human Resources and Administration of the Predecessor Company since May 2011. Initially, she joined the Predecessor Company in December 1995 and was promoted to Managing Vice President in January 2008. Ms. Wragg is currently responsible for all aspects of employee relations, recruiting, benefits, compensation, real estate, general office administration and related expenses. Before joining Predecessor Company, Ms. Wragg was responsible for the oversight of the payroll and benefits function with the firm Bachner, Tally, Polevoy and Misher LLP from 1993 through 1995. Ms. Wragg studied English at Northern Arizona University.

19

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding the ownership of the Company’s common stock as of March 19, 2013 by: (i) each person known to the Company to own beneficially more than 5% of the outstanding common stock; (ii) each of the Company’s Directors and persons referred to in the Summary Compensation Table; and (iii) all of the Directors and executive officers as a group. As used in this table, “beneficially owned” means the sole or shared power to vote or dispose of, or to direct the voting or disposition of, the shares, or the right to acquire such power within 60 days after March 19, 2013 with respect to any shares.

| | | | | | | | |

| Name(1) | | Shares

Beneficially

Owned(2) | | | Percent

Beneficially

Owned | |

Michael H. Lee(3) | | | 4,369,467 | | | | 7.5 | % |

Columbia Wanger Asset Management LLC(4) | | | 4,086,731 | | | | 7.1 | % |

BlackRock Inc.(5) | | | 3,067,657 | | | | 5.3 | % |

Charles A. Bryan | | | 25,157 | | | | | * |

William F. Dove | | | 31,369 | | | | | * |

William W. Fox, Jr. | | | 15,660 | | | | | * |

William E. Hitselberger | | | 46,227 | | | | | * |

Gary S. Maier | | | 80,405 | | | | | * |

Elliot S. Orol | | | 39,421 | | | | | * |

William A. Robbie | | | 35,662 | | | | | * |

Steven W. Schuster | | | 13,259 | | | | | * |

Robert S. Smith | | | 31,821 | | | | | * |

Jan R. Van Gorder | | | 18,978 | | | | | * |

Austin P. Young, III | | | 21,073 | | | | | * |

Total Directors and Executive Officers | | | 4,809,116 | | | | 8.3 | % |

| (1) | Each named stockholder’s business address is 120 Broadway, New York, New York 10271, with the exceptions of: Columbia Wanger Asset Management LLC the business address of which is 227 West Monroe Street, Suite 3000, Chicago, IL 60606; and BlackRock Inc., the business address of which is 40 East 52nd Street, New York, NY 10022. |

| (2) | To the Company’s knowledge, the persons named in the table have sole voting and investment power with respect to all shares of common stock shown as beneficially owned by them, unless otherwise noted in the footnotes to this table. |

| (3) | Includes 608,505 shares issuable upon the exercise of stock options held by Mr. Lee. Pursuant to a loan agreement dated as of September 28, 2007 between Citigroup Global Markets Inc. and Mr. Lee, Mr. Lee pledged, in 2007, 2,862,735 shares. He has pledged no additional shares since 2007 and has advised the Company of his intention to gradually reduce the number of shares so pledged. As described under “Corporate Governance – Stock Ownership Guidelines” above, the Company adopted in March 2013 a prospective anti-pledging policy with respect to shares of the Company’s stock. The Predecessor Company had adopted such anti-pledging policy with respect to shares of its stock in November 2012, and such policy was in effect at the time of the Merger. |

| (4) | Based solely on the Schedule 13G filing made by Columbia Wanger Asset Management LLC on February 14, 2013, adjusted to reflect the closing of the Merger on March 13, 2013. |

| (5) | Based solely on the Schedule 13G/A filing made by BlackRock Inc. on February 8, 2013, adjusted to reflect the closing of the Merger on March 13, 2013. |

20

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires the Company’s officers and Directors and persons who own more than 10% of a registered class of the Company’s equity securities to file initial reports of ownership and reports of changes in ownership with the SEC. Such persons are required by SEC regulation to furnish the Company with copies of all Section 16(a) forms they file. Based solely on the Company’s review of the copies of such forms received by the Predecessor Company with respect to fiscal year 2012 or written representations from certain reporting persons during the year ended December 31, 2012, all Section 16(a) filing requirements applicable to the Directors, officers and greater than 10% stockholders were complied with by such persons, except that one report covering one transaction was filed late by Mr. Robbie and four reports covering four transactions were filed late by Mr. Young.

COMPENSATION DISCUSSION AND ANALYSIS

Executive Summary

This Compensation Discussion and Analysis is intended to provide stockholders with a detailed description of the Company’s executive compensation philosophy, program and objectives, the compensation decisions made by the Compensation Committee for 2012, and the factors considered in making those decisions. The Predecessor Company’s compensation committee, which existed until the closing of the Merger, and the Company’s Compensation Committee, which was established immediately following the closing of the Merger and consists of the same members, are together referred to, unless otherwise noted, as the “Compensation Committee” or the “Committee.” This Compensation Discussion and Analysis focuses on the 2012 compensation of our Named Executive Officers (“NEOs”), who are:

| | |

| Name | | Title |

Michael H. Lee | | Chairman of the Board, President and Chief Executive Officer |

William E. Hitselberger | | Executive Vice President and Chief Financial Officer |

Gary S. Maier | | Executive Vice President and Chief Underwriting Officer |

William F. Dove | | Senior Vice President, Chief Risk Officer and Chief Actuary |

Elliot S. Orol | | Senior Vice President, General Counsel and Secretary. |

2012 Say-on-Pay Results and What the Compensation Committee and Management Are Doing in Response

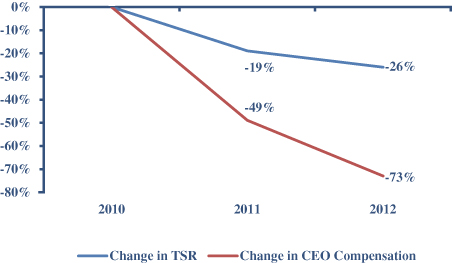

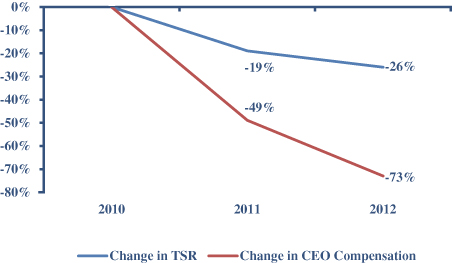

At the 2012 annual meeting of stockholders of the Predecessor Company, 29.6% of the shares present in person or by proxy were cast in a nonbinding advisory say-on-pay vote in support of the Predecessor Company’s executive compensation program and policies. The Compensation Committee and the Company’s senior management have considered extensively these results and have taken several significant steps to address stockholder concerns.

Stockholder Communications

During the past year, our Chairman, President and Chief Executive Officer, Michael H. Lee, and our Executive Vice President and Chief Financial Officer, William E. Hitselberger, talked with many of the Company’s largest stockholders to better understand and address their executive compensation concerns.

21

Further, members of the Compensation Committee and our Senior Vice President, General Counsel and Secretary, Elliot S. Orol, met with each of the two leading proxy advisory firms and certain large stockholders to review their executive compensation concerns and the substantial modifications to the Company’s executive compensation program that the Committee is making to address those concerns. The table below summarizes the modifications the Committee is making to the Company’s executive compensation program:

| | |

Stockholder

Concern | | Our Response |

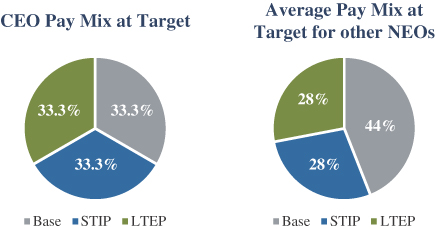

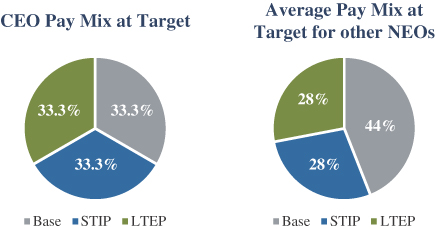

| No performance-based long term incentive equity awards | | We have adopted, subject to stockholder approval, a new 2013 Long Term Incentive Plan with awards for NEOs based 75% upon two financial performance metrics, relative total shareholder return (50%) and return on tangible equity (25%), each measured over a three-year performance period and vesting at the end of such three-year period. Total shareholder return will be measured relative to a selected peer group. Return on tangible equity will be measured against pre-established levels determined with reference to the operating return on equity for the selected peer group for the prior three-year period. Performance-based award payouts will range from no award if threshold performance is not met, to above-target awards for superior performance. |

Dividends on unvested stock | | We have eliminated the payment of dividends on unvested stock and restricted stock units (“RSUs”) issued under the new 2013 Long Term Incentive Plan. Dividends will instead be credited to holders of unvested stock and RSUs, and will be paid only if and when the restricted stock or RSUs vest; otherwise, dividends will be forfeited. |

| CEO SERP benefit | | The CEO’s SERP benefit has been substantially reduced and is now calculated using the same percentage of annual cash compensation used for other SERP participants. |

| Stock pledging | | The Company has adopted an anti-pledging policy. |

| Stock hedging | | The Company has adopted an anti-hedging policy. |