March 5, 2014

VIA EDGAR

Mr. Jim B. Rosenberg

Senior Assistant Chief Accountant

Securities and Exchange Commission

Division of Corporation Finance

100 F Street, N.E.

Washington, D. C. 20549

| | Re: | Tower Group International, Ltd. |

Form 10-Q for the Quarterly Period Ended September 30, 2013

Filed February 12, 2014

File No. 001-35834

Dear Mr. Rosenberg:

The purpose of this letter is to respond to your letter dated February 21, 2014. For your convenience, we set forth in this letter the comments from your letter in bold typeface and include the responses below from Tower Group International, Ltd. (“TGIL”, “Tower” or the “Company”) to such comment.

Form 10-Q for the Quarterly Period Ended September 30, 2013

Notes to Consolidated Financial Statements (Unaudited)

Note 1 – Nature of Business

Significant Business Developments and Risks and Uncertainties

Loss Reserve Strengthening, Goodwill and Fixed Asset Impairment and Deferred Tax Valuation Allowance, page 7

| 1. | You refer to Note 9 for additional detail of the reserve charge by accident year, business segment and line of business. Note 9 to the financial statements states that the $470.5 million reserve strengthening related to the years 2008-2011 and provides a breakdown by segment and line of business. Please tell us where the breakdown by accident year has been made and why you believe this information is significant. |

Company response:

The Company believes that disclosure of the time periods from which such reserve development emerged is important as it provides the reader with a sense of whether the underwriting decisions that contributed to the reserve development are continuing or whether underwriting adjustments have been made which could change the reserve development trends. The Company believes that disclosure of the range of accident years associated with this material amount of reserve strengthening is important because it indicates to the reader that the Company believes that such reserve development is contained within a fixed number of accident years, and because it indicates to the reader that the Company is not experiencing significant adverse reserve development in its two most recent accident years, or from older accident years prior to

Bermuda Commercial Bank Building,

19 Par-la-Ville Road, Hamilton HM 11, Bermuda

MAIN: +1 441.279.6610 FAX: +1 441.279.6619

2008. However, the Company did not provide development attributable to each individual accident year because it believes that disclosure of specific levels of reserve by individual accident year would significantly increase the complexity of the disclosure but would not provide enhanced disclosure as each individual year within the disclosed time period had a significant amount of reserve strengthening, and no individual year generated a disproportionate amount of the reserve strengthening. We have attached as Exhibit 1 a summary of accident year loss reserve development. The footnote 1 cross reference to footnote 9 suggesting additional details by individual accident year was an inadvertent mistake. However, since such disclosures are required for the Company’s statutory annual filings, they will be contained in the statutory filings of the Company’s insurance company subsidiaries for the year ended December 31, 2013. In addition, disclosure of consolidated reserve changes by calendar year is required under Items 101-103 of Regulation S-K and this will be in the data that the Company plans to file in its annual report on Form 10-K for the year ended December 31, 2013.

| 2. | You state on page 7 that in the second and third quarters of 2013, the Company performed a comprehensive update to its internal reserve study in response to continued observance in the second and third quarters of 2013 of higher than expected reported loss development. You state on page 56 that the Company recognized in the second quarter of 2013 that the higher than expected reported loss development it had been experiencing had become a trend. You also state on page 65 of the original Form 10-K for the year ended December 31, 2012 that management’s estimates of prior years’ loss and loss expenses increased $74.2 million for the year ended December 31, 2012 due to a comprehensive review of loss reserves completed in the second quarter of 2012 and an updated analysis during the third quarter as well as recent loss emergence that occurred during the fourth quarter. Please tell us: |

| | • | | why the $74.2 million increase for the year ended December 31, 2012 was reasonable given the loss development observed; |

| | • | | when the higher than expected reported reserve losses began; |

| | • | | why the trend was not recognized prior to the second quarter of 2013; and |

| | • | | the facts and circumstances resulting in you concluding that loss development became a trend. |

Company Response:

Within the major casualty lines of business (Workers’ Compensation, CMP Liability, Other Liability and Commercial Auto Liability), we and an independent actuarial firm observed adverse actual versus expected reported loss development for accident years 2008-2011 during the first three quarters of 2013. For these accident years, evidence of a possible increase in reported loss activity began to emerge in the first quarter of 2013 and continued during the second quarter. The change in the reported loss development pattern during the second quarter of 2013 was primarily the reason why, in our judgment, the adverse development had become a trend in the second quarter 2013. Such trend continued in the third quarter 2013, leading to additional adverse development.

During 2012, we had observed a potentially similar trend during the first and second quarters. However, for the remaining quarters of 2012 the differences between observed actual and expected loss activity was not significant. Based on the observed trends in the first and second quarters of 2012 and the full actuarial reviews performed during 2012, we concluded that a $74.2 million increase in reserves ($65 million of which were recorded in the second quarter 2012) for the year ended December 31, 2012 was reasonable. However, because the adverse development observed during 2012 was generally limited to activity during the first half of 2012, we did not believe that the pattern of adverse development had become a trend until this activity was observed again during the first two consecutive quarters of 2013. Furthermore, an independent actuarial firm reviewed the reserve position as of December 31, 2012 and concluded that the carried reserves as of that date were within a range of reasonable estimates.

- 2 -

To illustrate the recent activity for 2013 and to contrast it with the activity reported in 2012, please see the attached Exhibit 2 related to the CMP Liability reported loss triangle. Please note that the first and second quarter 2013 link ratios for accident years 2007-2011 (highlighted in yellow) are above historical averages. Note also a number of link ratios for first quarter of 2012 highlighted in orange where link ratios higher than historical average were observed last year. However, many of these adverse data points were followed by link ratios lower than average in the remainder of 2012; these data points are highlighted in green. This provides additional context regarding why, in our judgment, the adverse development first observed in 2013 had become a trend and why, after we observed a second consecutive diagonal of higher than average link ratios, we concluded that the trend was continuing.

During the detailed review of gross and ceded liabilities performed by the Company and its independent actuarial firm in the second and third quarters of 2013, both the Company and the independent actuarial firm updated the loss development assumptions and loss ratio expectations and performed detailed reviews of other significant data. As a result of these detailed studies, the Company identified a need to increase loss development factors and other actuarial assumptions (initial expected loss ratios, net to gross ratios, for example) used to estimate ultimate losses for the casualty lines of business.

| 3. | We note that the amounts paid related to prior years of $585 million and $594 million for 2012 and 2011, respectively as disclosed on page F-32 of the original Form 10-K for the year ended December 31, 2012 appear significant compared to the respective beginning reserve balances. Please tell us what portion of the amounts paid related to prior years represent settlement of claims in excess of amounts accrued in the respective beginning balance. |

Company Response:

The loss reserves at the end of each year are comprised of case reserves (that is, reserves that are specifically allocated to an individual claim) and incurred but not reported (“IBNR”) reserves (that is, reserves that are not specifically allocated to an individual claim, but are held to allocate both to existing claims as new facts emerge and to new claims received by the Company). Due to the fact that a significant portion of paid loss activity is associated with IBNR reserves, it is not possible to determine whether paid losses on claims were in excess of amounts accrued as of the beginning of the reporting period.

The Company maintained the following levels of each reserve at the following year end dates:

| | | | | | | | |

| ($ millions) | | | | | | |

| December 31, | | Case | | | IBNR | |

2012(a) | | $ | 913.4 (52%) | | | $ | 846.5 (48%) | |

2011(a) | | $ | 766.3 (51%) | | | $ | 729.6 (49%) | |

2010(a) | | $ | 893.8 (56%) | | | $ | 716.6 (44%) | |

2009 | | $ | 638.5 (56%) | | | $ | 493.5 (44%) | |

2008 | | $ | 316.3 (59%) | | | $ | 218.7 (41%) | |

The increase in IBNR reserve as a level of total reserves results from two factors: (i) an increase in casualty lines of business written (ii) an increase in business resulting from acquisitions occurring primarily during 2009 and 2010. As acquisitions result in business that is new to the Company, such business is generally recorded with a higher level of IBNR at the acquisition date. In addition, IBNR levels increased at year end 2012 due to property losses associated with Superstorm Sandy, and IBNR levels in 2011 were affected by losses associated with Hurricane Irene. There were no significant catastrophe loss events occurring in the third or fourth quarters of 2008, 2009 or 2010 that impacted the IBNR levels of the Company.

- 3 -

We noted the following trends in prior year paid losses:

| | | | | | | | |

| ($ millions) | | | | | | |

| Year | | Prior year paid losses | | | % of prior year reserves | |

2012(a) | | $ | 585 | | | | 39 | % |

2011(a) | | $ | 594 | | | | 37 | % |

2010(a) | | $ | 401 | | | | 35 | % |

| (a) | Excludes the reciprocal businesses, which are non-controlled interests. |

With the exception of 2008 and 2009, prior year paid losses have ranged between 35% to 40% of prior year reserve balances. The Company believes that this pattern is reasonable, as it has had a ratio of casualty to property business of approximately 60%/40% during the past three years and given its focus on short-tail personal lines business and small average premium size commercial policies, both of which businesses have faster emerging and paid claim trends.

Reinsurance Agreements, page 7

| 4. | You disclose on page 7 that you entered into three new reinsurance agreements that have termination clauses if the credit ratings are downgraded below A-. You disclose that A.M. Best downgraded your financial strength rating on October 8 and December 20, 2013. Please tell us how any termination of these agreements would affect your liquidity and results of operations. |

Company Response:

Two of the three reinsurance agreements are multi-line quota share treaties with Arch Reinsurance Ltd. and Hannover Re (Ireland) plc and a third reinsurance agreement with Southport Re (Cayman), Ltd. The Arch and Hannover treaties cover certain commercial automobile liability, commercial multi-peril property, commercial multi-peril liability and brokerage other liability lines of business, and in addition, the Hannover treaty also covers workers’ compensation business. As a result of the announced merger agreement with ACP Re, it was decided not to renew these treaties in 2014. Should the agreements (which covered risk from July 1, 2013 to December 31, 2013) terminate, liquidity would improve at the Company, as the reinsurer would transfer premium funds back to the Company as well as payment obligations for future claims. Should the treaties terminate, the results of operations impact would also be positive to the Company unless the loss ratio on the reinsured business exceeded 69%. Should the loss ratios exceed these amounts, the underwriting results of operations would be negatively impacted. The Company believes that, as of September 30, 2013, its loss ratio on the business ceded to Hannover Re was 65.9%, and its loss ratio on the business ceded to Arch was 62.0%.

The third reinsurance arrangement was comprised of three treaties with Southport Re (Cayman), Ltd (“Southport”). Such treaties were negotiated primarily to improve the Company’s rating agency capital levels in advance of discussions with the rating agencies after the second quarter reserve charge. The first two treaties were retroactive treaties that provided protection against adverse loss development on workers’ compensation loss reserves for events occurring from January 1, 2011 to May 31, 2013. The third treaty was a quota share reinsurance treaty on workers’ compensation business in force as of July 1, 2013 or written by the Company after July 1, 2013. This contract was negotiated to expire on December 31, 2015.

- 4 -

As a result of the announced merger agreement with ACP Re, it was decided that the Southport treaties should be commuted. As a result of a negotiation between the Company and Southport, all of these treaties were commuted effective as of February 19, 2014, with the result of the commutation being that all premiums paid to Southport by the Company were returned to the Company, and all liabilities assumed by Southport were cancelled, and such liabilities became the obligation of the Company. As a result of the negotiation, all termination fees associated with the third treaty were waived. As a result of the return of the premium funds, liquidity will improve, and results of operations will benefit, in the case of the quota share agreement, if the loss ratio on the workers’ compensation business does not exceed 71%. Should the investment income earned on the premium funds returned to the Company under the retroactive treaty to protect against adverse loss development on workers’ compensation loss reserves for events occurring from January 1, 2011 to June 30, 2013 not be sufficient to provide for any adverse loss development that would have been covered under the treaty, the operating results will be adversely impacted. The operating results will also be adversely impacted if expected losses for workers’ compensation loss reserves for events occurring from January 1, 2011 to June 30, 2013 significantly exceed the Company’s estimates, or if the payment of such loss reserves occurs significantly faster than the Company’s estimates.

We anticipate disclosing these subsequent events in our consolidated financial statements for the year ended December 31, 2013.

A.M. Best, Fitch and Demotech Downgrade the Company’s Financial Strength and Issuer Credit Ratings, page 8

| 5. | You state on page 8 that some business written requires an A.M. Best rating of A- or better and that you expect the amount of premiums the insurance subsidiaries are able to write to significantly decrease as a result of the downgrades. Please tell us the extent to which insurance written requires the A- or better rating and quantify for us the expected effect on your financial position, liquidity and results of operations as a result of the downgrades. |

Company Response:

On page 8 of its September 30, 2013 Form 10-Q, the Company disclosed the following (emphasis added):

“On December 20, 2013, A.M. Best lowered the financial strength ratings of each of Tower’s insurance subsidiaries from “B++” (Good) to “B” (Fair) (the seventh highest of fifteen rating levels), as well as the issuer credit ratings of each of Tower’s insurance subsidiaries from “bbb” to “bb”. Previously, on October 8, 2013, A.M. Best had downgraded the financial strength rating of each of Tower’s insurance subsidiaries to “B++” (Good) and their respective issuer credit ratings to “bbb” from “a-”. In addition, on December 20, 2013 A.M. Best downgraded the issuer credit rating of TGI as well as the debt rating on its $146.9 million 5.00% senior convertible notes due 2014 (the “Notes”) to “b-” from “bb”. On the same date, A.M. Best also downgraded the financial strength rating of CastlePoint Reinsurance Company, Ltd. (Bermuda) to “B” (Fair) from “B++” (Good) and its issuer credit rating to “bb” from “bbb” and downgraded the issuer credit rating of Tower Group International, Ltd. to “b-” from “bb”. TGI and each of its insurance subsidiaries currently are and will continue to be under review with negative implications pending further discussions between A.M. Best and management.”

- 5 -

“Management expects these rating actions, in combination with other items that have impacted the Company in 2013, to result in a significant decrease in the amount of premiums the insurance subsidiaries are able to write. The net written premiums were $237.6 million and $1,093.4 million for the three and nine months ended September 30, 2013, respectively.Business written through certain program underwriting agents requires an A.M. Best rating of A- or greater.”

Tower’s products include the following lines of business: commercial multiple-peril packages, other liability, workers’ compensation, commercial automobile, fire and allied lines, inland marine, personal package, homeowners, personal automobile and assumed reinsurance. These products are sold, primarily, through retail agencies, wholesale agencies, program underwriting agents, and reinsurance brokerage units. With the exception of the personal automobile insurance written through retail agencies and wholesale agencies, which represented $25.2 million and $77.3 million of written premiums (excluding the Reciprocal Exchanges) for the three and nine months ended September 30, 2013, management believes the Company will be unable to continue writing business following the second A.M. Best rating downgrade on December 20, 2013. The total effect of these ratings actions on the Company’s financial position, results of operations or liquidity is not determinable at this stage.

In January 2014, Tower’s Board of Directors approved Tower’s merger with ACP Re. In light of the adverse ratings actions, concurrent with entering into its merger agreement with ACP Re, Tower entered into cut-through reinsurance treaties with affiliates of ACP Re. As a result of this merger, and the execution of the cut-through reinsurance treaties, Tower believes its insurance subsidiaries will retain significant portions of their business.

Note 5 – Goodwill, Intangible Fixed Asset Impairments

Goodwill Impairment Testing and Charge, page 16

| 6. | You stated on page 54 of the original 10-K for the year ended December 31, 2012 that the Commercial Insurance reporting unit indicated the carrying value exceeded fair value by 2% in step 1 of your goodwill analysis. In step 2 the implied fair value was greater than the carrying value by $5 million. Please tell us why you believed your assumptions in your goodwill analysis were reasonable. For example, tell us the basis for assuming a 42% control premium disclosed on page F-28. |

Company Response:

On page 54 of its originally filed Form 10-K for the year ended December 31, 2012, the Company disclosed the following (emphasis added):

“The process of evaluating goodwill for impairment requires judgments and assumptions to be made to determine the fair value of each reporting unit, including discounted cash flow calculations, assumptions that market participants would make in valuing each reporting unit and the level of the Company’s own share price.Fair value estimates utilize both the market approach and income approach. Management considered valuation techniques such as peer company price-to-earnings and price-to-book multiples and an in-depth analysis of projected future cash flows and relevant discount rates, which considered market participant inputs. Other significant assumptions include levels of surplus available for distribution, future business growth and earnings projections for each reporting unit. Estimates of fair value are subject to assumptions that are sensitive to change

- 6 -

and represent the Company’s reasonable expectation regarding future developments. Management also considers the implied control premium derived from its market capitalization and the implied fair value of the enterprise.

The first step of the Company’s analysis indicated that the Personal Insurance reporting unit’s fair value exceeded its carrying value by 9%. As such, the second step of the annual impairment assessment was not required. The first step of the Company’s analysis (“Step 1”) for Commercial Insurance indicated that its carrying value exceeded its fair value by 2%. Accordingly, management was required to perform the second step of the goodwill impairment test, which assumes the implied fair value from the Step 1 test is allocated to the fair value of each of the assets and liabilities in the Commercial Insurance reporting unit.In Step 2, the implied value of the Commercial Insurance reporting unit’s goodwill was greater than its goodwill carrying value by approximately $5 million considering an acquisition control premium of 42%; therefore, goodwill was not impaired and no write-down was required; however, the Step 1 comparison indicates a greater risk of future impairment for this reporting unit’s goodwill.

Of the assets and liabilities in Commercial Insurance, the value of business in the unearned premiums, the fair value of the distribution network and customer list and the reserve risk premium associated with losses and loss adjustment expense contain significant assumptions and judgment in estimating fair value. The second step of the impairment analysis for Commercial Insurance indicated that the implied goodwill for the reporting unit exceeded the carried value of goodwill. Accordingly, no impairment losses were recognized in 2012. Also, no impairment losses were recognized in 2011 or 2010.

In November and December 2012, Tower’s market capitalization was negatively impacted by what management believes was the uncertainty about the results of Superstorm Sandy coupled with the uncertainty as to the timing of the merger with Canopius: therefore, despite a temporary decline in the Company’s share price, management determined that there were no events or material changes in circumstances that indicated that a material change in the fair value of the Company’s reporting units had occurred.”

In performing Step 1 of the goodwill impairment test, as prescribed by ASC 350-20, management estimated fair value for each of its reporting units by taking the weighted average fair values calculated under the income approach (discounted cash flows) and four market approach models (applying the following financial metrics: share price to 2012 earnings, share price to 2013 projected earnings, book value per share, and tangible book value per share). The key assumptions used in estimating the fair value under the income approach included: (i) the Company’s future net cash flows projections based on its business plan, (ii) the surplus leverage required to produce the projected premium volume, (iii) a present value discount rate of 10%, and (iv) a 3% terminal value growth rate. In addition, under the market approach, management adopted the guideline company method (“GCM”) and used certain financial metrics from guideline companies to derive an estimated fair value for Tower. The estimated fair values calculated from the income approach and each of GCMs were weighted evenly, using 20% for each of the methods, in determining an overall estimated fair value. In addition, each of the insurance subsidiaries reported capital and surplus levels well above the limits established by the NAIC’s risk-based capital (“RBC”) system. Accordingly, there was no need to consider the need for an “expected capital infusion” from a market participant upon the acquisition of either of the reporting units.

- 7 -

Tower senior management considered each of its assumptions, historical performance, and expectations as to what a third-party market participant would consider. We believe the assumptions were reasonable. Further detail on the key assumptions is as follows:

Cash flow projections: Tower’s business plan was a comprehensive plan developed by Company’s senior management and represented their best estimate of the operations of the Company.

Surplus requirement: Management used a surplus requirement of 1.6x, as an approximation of the ratio of the Company’s surplus to net written premiums, as management believed this was a reasonable expectation to be used by a third-party market participant. Management considered surplus to premium ratios used in the property and casualty industry, and noted the 1.6x is within the observed range. In addition, while Tower’s surplus to net written premiums ratio has fluctuated over the years; 1.6x was within the Company’s historical range.

Discount rate: The discount rate selected was based on consideration of the estimated cost of equity, the industry in which the reporting units operate, and the risk associated with the cash flows. Based on these considerations, we utilized a rate of 10% to discount the estimated cash flows and terminal value. Management concluded this was a reasonable rate a third-party market participant would utilize in determining a fair value of Tower’s reporting units. In addition, as another data point supporting management’s expectation of the discount rate to be used by a third-party market participant, the Company considered its own after-tax cost of debt (3.8%), its cost of equity capital (10%), and its weighted average cost of capital (9.0%). We believed a third-party market participant would have a cost of capital structure similar to Tower’s, and accordingly, the discount rate used was determined to be reasonable.

Terminal value growth rate: A terminal year growth rate of 3% was assumed and subtracted from the discount rate of 10% to arrive at an estimated terminal year capitalization rate of 7%. The 3% long-term growth rate was based on a consideration of a blended, long-term growth, reflecting expectations in the markets in which each of reporting units operate, and, accordingly, a terminal growth rate that would be utilized by a third-party market participant.

Guideline companies: Tower used financial metrics from those companies it considered its competitors in both the commercial insurance and personal insurance lines. In determining the guideline companies for each of its reporting units, management considered those enterprises it competes with in the market place, the lines of business written by each of the peer companies, and the financial strength of each of the companies. Management concluded the guideline companies used in the GCM approach represent companies a third-party market participant would use in determining a fair value for the reporting units.

Control Premium:

According to ASC 350, “Substantial value may arise from the ability to take advantage of synergies and other benefits that flow from control over another entity. Consequently, measuring the fair value of a collection of assets and liabilities that operate together in a controlled entity is different from measuring the fair value of that entity’s individual equity securities. An acquiring entity often is willing to pay more for equity securities that give it a controlling interest than an investor would pay for a number of equity securities representing less than a controlling interest. That control premium may cause the fair value of a reporting unit to exceed its market capitalization.”

- 8 -

Based upon the results of the Step 1 analysis, the Company’s management concluded that its fair value was 42% above its market capitalization.

Management believed an implied 42% control premium was reasonable based upon its understanding of the Company, the volatility in its stock price, and forecasts going forward. Management believed the Company’s stock declined at the end of the third quarter and fourth quarter of 2012 primarily due to uncertainty regarding losses to be incurred in connection with Superstorm Sandy and uncertainty regarding the timing of the proposed merger with Canopius Holdings Bermuda Limited. Management believed the decline was not associated with concerns with the underlying business in each of the reporting units. As such, the fair values derived from the Step 1 test were considered reasonable fair values of each of the reporting units and of the enterprise as a whole.

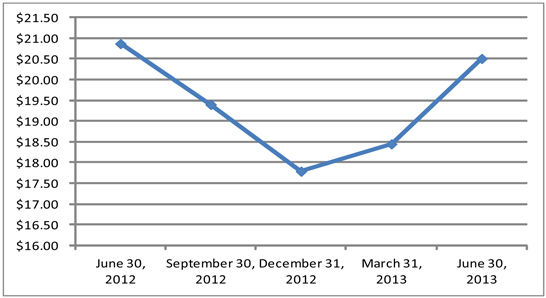

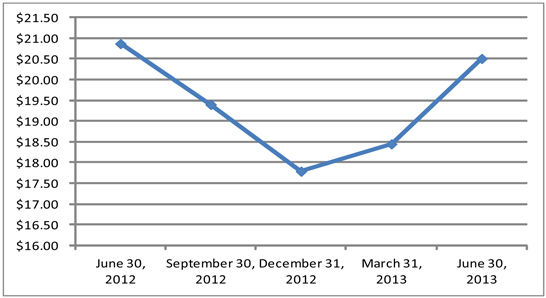

The table below reflects Tower’s quarterly stock price six months before and after the December 31, 2012 measurement date, and depicts the volatility of our stock price at this period of time (all prices have been adjusted for the March 13, 2013 1.133 conversion rate, as a result of the merger transaction between Tower Group, Inc. and Canopius Holdings Bermuda Limited):

Considering the December 31, 2012 share price was at a historically low value, the control premium would inherently be at the high end of an acceptable range. In assessing the 42% control premium, management also considered (i) recent target prices from its analysts, and (ii) control premiums from other business combinations within the insurance industry. Recent analyst target prices ranged from $17.65 to $22.06 per share (adjusted for the 1.133 conversion rate as a result of the merger transaction), or an average of $20.08 per share. Tower’s estimated fair value would have resulted in an approximately 20% control premium over the analyst target prices. Tower management reviewed similar transactions within the property and casualty industry over the past two years and noted the respective implied control premiums from those transactions ranged from 16% to 67%. Based on this data, Tower’s implied control premium as of December 31, 2012 fell within the range of those from similar transactions.

- 9 -

| 7. | You state that in conducting the goodwill impairment analysis as of June 30, 2013, the Company estimated each of the reporting units’ fair values using a market multiple approach based on tangible book values. Historically, the Company also utilized market multiple approaches based on (i) book value, (ii) estimates of projected results for future periods, and (iii) a valuation technique using discounted cash flows. You also state that based upon the significance of the loss reserve charge recorded in the second quarter of 2013 and the reduction to Tower’s insurance subsidiaries’ capital and surplus levels (see “Note 16 – Statutory Financial Information”), management in its judgment concluded a multiple of tangible book value was most indicative of a price a market participant would pay for the reporting units. In addition, the Commercial Insurance reporting unit’s estimated fair value was adjusted for the expected capital infusion a market participant would be expected to fund into the insurance businesses to maintain historical rating agency ratings. Please address the following: |

| | • | | Tell us why you believe the tangible book value is more appropriate to use and why the other factors that you historically used were no longer considered. In this respect, help us understand why you believe a multiple of tangible book value was most indicative of a price a market participant would pay for the reporting units. |

| | • | | Tell us how the new method to determine fair value of the reporting unit affected the impairment analysis. |

| | • | | Tell us what you mean by “the expected capital infusion a market participant would be expected to fund into the business to maintain historical rating agency rating”, why the reporting unit’s fair value was adjusted for this amount, how it was calculated, the assumptions used in determining the amount, and how the adjustment affected the goodwill impairment analysis. Tell us why you believe those assumptions are reasonable. |

Company Response:

In its 2012 and prior annual goodwill assessments, the Company estimated each of the reporting units’ fair values using an income approach (discounted cash flows) and market multiple approaches considering (i) price-to-earnings ratios based on current year earnings, (ii) price-to-earnings ratios based on estimates of projected results for future periods (iii) book values, and (iv) tangible book values. Management’s policy has been to apply the fair value methodology consistently each time a goodwill impairment test was performed, unless specific facts and circumstances existed that would require the Company to re-evaluate its fair value methodology. This is consistent with ASC 820-10-35-25, which allows a change in valuation technique as new information becomes available, information previously used is no longer available, or valuation techniques improve.

As disclosed in “Note 1 – Nature of Business,Significant Business Developments and Risks and Uncertainties” in the June 30, 2013 and September 30, 2013 Form 10-Qs, the Company recorded significant loss reserve strengthening, received rating downgrades from the rating agencies, the insurance regulators increased scrutiny and regulatory oversight of the insurance subsidiaries, and the Company had no commitments or assurances about its ability to raise additional capital to satisfy its senior convertible note obligations. Accordingly, management concluded there was substantial doubt about the Company’s ability to continue as a going concern. Management believed, as a result of these significant business developments, the fair value techniques should be re-evaluated pursuant to ASC 820-10-35-25.

The Company concluded a third-party market participant would place very limited or no reliance on fair value models that rely upon projections or forecasts. The Company concluded the market approach model using a tangible book value multiple would provide a fair value most indicative of

- 10 -

what a third-party market participant would consider in calculating a price it would be willing to pay for each of the reporting units. Accordingly, this change in valuation methodology was deemed appropriate.

In preparing the Step 1 goodwill impairment test in 2012, all fair value techniques resulted in fair values that were within a reasonable range. For the Personal Insurance reporting unit, the 2012 fair value calculated from the tangible book value market multiple approach resulted in the lowest fair value compared to each of the individual fair value techniques used, and, accordingly, was lower than the weighted average estimated fair value used. The significant reserve strengthening discussed in “Note 1 – Nature of Business” in the second quarter Form 10-Q related entirely to reserve development from the Commercial Insurance lines of business. Accordingly, the Company did not adjust the fair value for an “expected capital infusion.” See the discussion below regarding the “expected capital infusion” adjustment as it relates to the Commercial Insurance reporting unit. As of June 30, 2013, the Company did not impair the Personal Insurance reporting unit goodwill using only the tangible book value market multiple; management believes the change in approach did not impact the conclusion to not impair the Personal Insurance reporting unit goodwill.

For the Commercial Insurance reporting unit, the fair value calculated using the tangible book value multiple approach was the highest of each of the fair value techniques prepared, and, accordingly, was higher than the weighted average estimated fair value used in the 2012 goodwill impairment test. As of June 30, 2013, as disclosed in the second quarter Form 10-Q, the Company used only the tangible book value market multiple, reduced by an “expected capital infusion,” in deriving fair value for Commercial Insurance reporting unit. The expected capital infusion adjustment reflects the belief of the Company of the capital a third-party market participant would be required to contribute to this reporting unit to establish a surplus and rating sufficient for the reporting unit to continue to operate and produce business, and is the result of the significant decline in the capital and surplus levels in the insurance subsidiaries because of the reserve development in the Commercial Insurance lines of business. The expected capital infusion amount, which would decrease the price a market participant would be willing to pay, was calculated as the amount of capital required to get the Commercial Insurance reporting unit to the RBC level the Company was at prior to the second quarter 2013 reserve charges. The RBC is calculated from a risk-based model adopted by the state insurance regulators. The Company believes it was appropriate to provide for the expected capital infusion in its fair value model.

Alternatively, if the expected capital infusion amount was not included in the Commercial Insurance reporting unit determination of goodwill, the Commercial Insurance reporting unit would have failed the Step 1 impairment test, and goodwill would also be required to be fully impaired after the Step 2 test.

Note 9 – Loss and Loss Adjustment Expense, page 28

| 8. | You announced in an 8-K filed on October 7, 2013 that you were recording a $365 million reserve strengthening in the second quarter ended June 30, 2013. Please reconcile for us this amount to the actual prior year unfavorable development of $326.8 million recorded in the quarterly period ended June 30, 2013. |

- 11 -

Company Response:

The 8-K filing on October 7, 2013 disclosed that the Company expected it would strengthen its loss reserves by $365 million. Such amount was recorded in the Company’s financial statements as noted below:

Restatement of 2012 10-K reserve strengthening, associated with the year ended December 31;

| | | | |

2010 | | $ | 5.7 | |

2011 | | | 21.7 | |

2012 | | | 9.6 | |

| | | | |

| | $ | 37.0 | |

| |

Second Quarter 2013 | | | 326.8 | |

| | | | |

| | | 363.8 | |

Rounding | | | 1.2 | |

| | | | |

| | $ | 365.0 | |

| | | | |

| 9. | We refer to your disclosure on page 29 noting the updates to your loss development triangles based on the higher than expected reported losses, changes in loss development factors and other actuarial assumptions. Please tell us for each significant line of business and assumption the nature and extent of a) new events that occurred or b) additional experience/information obtained in the second quarter that led to the change in estimates of prior year unfavorable development of $470.5 million which resulted in an additional reserve of $326.8 million recorded in the second quarter of 2013 and $143.7 million recorded in the third quarter of 2013. Ensure your explanation clarifies the timing of the change in estimate such as why recognition occurred in the period that it did and why recognition in earlier periods was not required. |

Company Response:

As explained in the response to comment 2) above, within the major casualty lines of business (Workers’ Compensation, CMP Liability, Other Liability and Commercial Auto Liability) we and an independent actuarial firm observed adverse actual versus expected development for accident years 2008-2011 during the first three quarters of 2013. For these accident years, evidence of a possible increase in adverse development began to emerge in the first quarter of 2013 and continued during the second quarter of 2013. The change in the reported loss development pattern observed during the consecutive quarters of the first and second quarter of 2013 was the primary reason why, in our judgment the adverse development had become a trend.

Within the analysis of emerging experience we and the independent actuarial firm characterize any actual reported loss experience greater or less than our expectations as new information. Based on this information, we update underlying actuarial assumptions such that the impact of the new information is captured for the quarter and also for the resulting changes in ultimate loss estimates.

The table below displays the reserve change of $470.6 million by the Company’s major lines of business. In the first row, labeled “Actual vs. Expected,” the Company includes the actual reported losses during the first three quarters of 2013 for accident years 2012 and prior in excess of the sum of the expected reported losses for the first two quarters of 2013 as calculated at December 31, 2012 and for the third quarter of 2013 as calculated at June 30, 2013. The next row, labeled “Change in Underlying Assumptions,” measures the impact that the reported losses in excess of expected (i.e. the $186.1 million) have had on the actuarial assumptions (e.g. loss development factors, expected loss ratios) used in the actuarial analyses as of December 31, 2012 and June 30, 2013. These changes in the actuarial assumptions were incorporated into the

- 12 -

actuarial analyses at June 30, 2013 and September 30, 2013 and resulted in an additional increase in incurred losses of $284.5 million for accident years 2012 and prior. For the significant lines of business, the impact was estimated as summarized in the table below for accident years 2012 and prior.

Overview of Changes by Line - YTD Q3/13

(All years prior to 2013- in Millions)

| | | | | | | | | | | | | | | | | | | | | | | | |

Contributing Factors | | CMPL | | | WC | | | OL | | | AL | | | OTHER | | | Total | |

| | | | | | |

Actual Vs. Expected | | | 49.4 | | | | 69.6 | | | | 28.3 | | | | 61.9 | | | | -23.0 | | | | 186.1 | |

Change in Underlying Assumptions | | | 78.1 | | | | 104.8 | | | | 53.7 | | | | 42.8 | | | | 5.1 | | | | 284.5 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

TOTAL | | | 127.5 | | | | 174.4 | | | | 82.0 | | | | 104.6 | | | | -17.9 | | | | 470.6 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Highlights

Statutory Capital, page 48

| 10. | Please tell us the expected effect on your financial position, results of operations and liquidity in the event that: |

| | • | | you are not able to combine TRL with CastlePoint and the expected effects, if any, if you combine TRL with CastlePoint; and |

| | • | | two of your U.S. subsidiaries are determined to be below Company Action Level at September 30, 2013 and the restrictions and heightened regulatory oversight placed on several of your U.S. insurance subsidiaries. |

Company Response:

In February 2014, the Company received permission from the BMA to transfer assets from TRL to Castlepoint, and this transfer increased the assets that Castlepoint maintains in trust for the benefit of TICNY. The approved transfer from TRL to Castlepoint was $167 million, which significantly improved the sufficiency of assets in the trust. The Company continues to evaluate the combination of TRL and Castlepoint, but by accomplishing this asset transfer, the Company believes that the liquidity position of CastlePoint has improved significantly, and this improvement in liquidity will permit CastlePoint to increase the trust balances that support its reinsurance obligations to TICNY, which will in turn reduce loss in surplus that TICNY would experience due to insufficient trust assets relative to reinsurance obligations due from CastlePoint.

- 13 -

In its third quarter report on Form 10-Q, the Company noted the following:

The merger with ACP Re is expected to close by the summer of 2014, and there are contractual termination rights available to each of Tower and ACP Re under various circumstances. Therefore, there can be no guarantee that the Company will be able to remedy current statutory capital deficiencies in certain of its insurance subsidiaries or maintain adequate levels of statutory capital in the future. Consequently, there is substantial doubt about the Company’s ability to continue as a going concern. Should the Company no longer continue to support its capital or liquidity needs, or should the Company be unable to successfully execute the above mentioned initiatives, the above items would have a material adverse effect on its business, results of operations and financial position.

The restrictions and heightened regulatory oversight placed on several of the Company’s U.S. insurance subsidiaries have resulted in additional administrative actions and in additional compliance reports being necessary to conduct the Company’s business. The effect of these actions on the Company’s financial position, results of operations or liquidity is not determinable at this stage.

- 14 -

* * * * *

In response to the Staff’s comments, we acknowledge that:

| | • | | the Company is responsible for the adequacy and accuracy of the disclosure in the filing; |

| | • | | Staff comments or changes to disclosure in response to Staff comments do not foreclose the Commission from taking any action with respect to the filing; and |

| | • | | the Company may not assert Staff comments as a defense in any proceeding initiated by the Commission or any person under the federal laws of the United States. |

Thank you for your consideration of this response. If you have any further questions or comments, please contact me at (212) 655-2000.

|

| Very truly yours, |

|

/s/ William E. Hitselberger |

| Executive Vice President and Chief Financial Officer |

- 15 -

Exhibit 1

Tower Group Companies

Ultimate Loss and LAE for all Reserving Segments Excluding Reciprocals

YTD Net Prior Period Development (PPD)

| | | | |

| Development By Accident Year | | (Millions) | |

| |

2007&Prior | | $ | 19.3 | |

2008 | | $ | 32.5 | |

2009 | | $ | 80.6 | |

2010 | | $ | 106.6 | |

2011 | | $ | 216.3 | |

2012 | | $ | 15.4 | |

| |

Total | | $ | 470.6 | |

Exhibit 2, Sheet 1

Brokerage - CMPL

Reported Loss

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Development | |

| AY | | 2 | | | 5 | | | 8 | | | 11 | | | 14 | | | 17 | | | 20 | | | 23 | | | 26 | | | 29 | | | 32 | |

Prior | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 3,444,413 | | | | 3,627,484 | | | | 3,907,424 | |

1999 | | | — | | | | — | | | | — | | | | — | | | | 2,549,557 | | | | 2,873,882 | | | | 3,585,929 | | | | 4,085,124 | | | | 4,640,454 | | | | 5,088,978 | | | | 5,456,720 | |

2000 | | | 87,895 | | | | 795,209 | | | | 1,535,865 | | | | 2,647,467 | | | | 3,635,581 | | | | 4,557,574 | | | | 5,086,788 | | | | 5,478,877 | | | | 5,477,060 | | | | 5,722,933 | | | | 6,642,078 | |

2001 | | | 259,136 | | | | 1,567,800 | | | | 2,517,830 | | | | 4,151,511 | | | | 5,058,894 | | | | 7,156,194 | | | | 7,963,764 | | | | 8,702,467 | | | | 8,944,831 | | | | 12,011,346 | | | | 12,619,929 | |

2002 | | | 134,294 | | | | 874,675 | | | | 2,164,487 | | | | 3,829,898 | | | | 6,115,589 | | | | 8,085,375 | | | | 9,145,975 | | | | 10,906,869 | | | | 11,364,428 | | | | 11,657,915 | | | | 12,721,772 | |

2003 | | | 416,734 | | | | 1,930,389 | | | | 3,888,883 | | | | 6,813,046 | | | | 8,398,441 | | | | 9,927,773 | | | | 12,273,386 | | | | 13,749,480 | | | | 14,794,302 | | | | 16,098,080 | | | | 16,613,484 | |

2004 | | | 629,398 | | | | 2,431,966 | | | | 5,464,035 | | | | 8,936,669 | | | | 12,027,524 | | | | 15,169,222 | | | | 16,924,469 | | | | 20,253,675 | | | | 21,838,041 | | | | 22,767,867 | | | | 23,695,236 | |

2005 | | | 779,379 | | | | 3,557,346 | | | | 6,651,098 | | | | 10,583,258 | | | | 15,640,078 | | | | 18,798,958 | | | | 21,110,914 | | | | 23,581,350 | | | | 27,486,620 | | | | 28,810,096 | | | | 30,894,518 | |

2006 | | | 797,582 | | | | 3,477,912 | | | | 8,025,971 | | | | 12,556,507 | | | | 18,958,071 | | | | 24,408,243 | | | | 27,610,611 | | | | 31,806,105 | | | | 34,721,092 | | | | 37,113,861 | | | | 39,354,774 | |

2007 | | | 1,210,922 | | | | 4,973,082 | | | | 10,389,646 | | | | 18,362,808 | | | | 26,366,128 | | | | 31,829,727 | | | | 35,848,876 | | | | 37,961,055 | | | | 38,741,156 | | | | 42,935,279 | | | | 45,664,655 | |

2008 | | | 1,328,325 | | | | 6,980,455 | | | | 14,413,665 | | | | 22,427,108 | | | | 30,648,467 | | | | 38,279,669 | | | | 45,241,131 | | | | 50,975,676 | | | | 56,311,754 | | | | 59,410,168 | | | | 60,820,372 | |

2009 | | | 2,985,503 | | | | 9,304,484 | | | | 19,226,718 | | | | 29,757,094 | | | | 41,417,163 | | | | 50,507,956 | | | | 55,999,548 | | | | 61,227,651 | | | | 65,377,300 | | | | 69,933,499 | | | | 74,159,156 | |

2010 | | | 1,754,586 | | | | 9,216,245 | | | | 17,314,995 | | | | 25,202,806 | | | | 33,514,880 | | | | 41,478,731 | | | | 51,072,099 | | | | 56,099,265 | | | | 63,820,923 | | | | 66,461,537 | | | | 69,353,619 | |

2011 | | | 2,625,224 | | | | 10,191,840 | | | | 18,351,489 | | | | 26,961,975 | | | | 37,091,502 | | | | 42,442,513 | | | | 45,060,469 | | | | 48,128,258 | | | | 52,985,435 | | | | 57,998,251 | | | | — | |

2012 | | | 1,284,040 | | | | 5,186,331 | | | | 9,516,911 | | | | 15,995,281 | | | | 23,267,670 | | | | 27,521,714 | | | | — | | | | — | | | | — | | | | — | | | | — | |

2013 | | | 1,470,190 | | | | 5,577,133 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

|

| Age-to Age | |

| AY | | 2 - 5 | | | 5 - 8 | | | 8 - 11 | | | 11 - 14 | | | 14 - 17 | | | 17 - 20 | | | 20 - 23 | | | 23 - 26 | | | 26 - 29 | | | 29 - 32 | | | 32 - 35 | |

Prior | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 1.053 | | | | 1.077 | | | | 1.037 | |

1999 | | | | | | | | | | | | | | | | | | | 1.127 | | | | 1.248 | | | | 1.139 | | | | 1.136 | | | | 1.097 | | | | 1.072 | | | | 1.111 | |

2000 | | | 9.047 | | | | 1.931 | | | | 1.724 | | | | 1.373 | | | | 1.254 | | | | 1.116 | | | | 1.077 | | | | 1.000 | | | | 1.045 | | | | 1.161 | | | | 1.044 | |

2001 | | | 6.050 | | | | 1.606 | | | | 1.649 | | | | 1.219 | | | | 1.415 | | | | 1.113 | | | | 1.093 | | | | 1.028 | | | | 1.343 | | | | 1.051 | | | | 1.059 | |

2002 | | | 6.513 | | | | 2.475 | | | | 1.769 | | | | 1.597 | | | | 1.322 | | | | 1.131 | | | | 1.193 | | | | 1.042 | | | | 1.026 | | | | 1.091 | | | | 1.036 | |

2003 | | | 4.632 | | | | 2.015 | | | | 1.752 | | | | 1.233 | | | | 1.182 | | | | 1.236 | | | | 1.120 | | | | 1.076 | | | | 1.088 | | | | 1.032 | | | | 1.046 | |

2004 | | | 3.864 | | | | 2.247 | | | | 1.636 | | | | 1.346 | | | | 1.261 | | | | 1.116 | | | | 1.197 | | | | 1.078 | | | | 1.043 | | | | 1.041 | | | | 1.012 | |

2005 | | | 4.564 | | | | 1.870 | | | | 1.591 | | | | 1.478 | | | | 1.202 | | | | 1.123 | | | | 1.117 | | | | 1.166 | | | | 1.048 | | | | 1.072 | | | | 1.087 | |

2006 | | | 4.361 | | | | 2.308 | | | | 1.564 | | | | 1.510 | | | | 1.287 | | | | 1.131 | | | | 1.152 | | | | 1.092 | | | | 1.069 | | | | 1.060 | | | | 1.032 | |

2007 | | | 4.107 | | | | 2.089 | | | | 1.767 | | | | 1.436 | | | | 1.207 | | | | 1.126 | | | | 1.059 | | | | 1.021 | | | | 1.108 | | | | 1.064 | | | | 1.024 | |

2008 | | | 5.255 | | | | 2.065 | | | | 1.556 | | | | 1.367 | | | | 1.249 | | | | 1.182 | | | | 1.127 | | | | 1.105 | | | | 1.055 | | | | 1.024 | | | | 1.026 | |

2009 | | | 3.117 | | | | 2.066 | | | | 1.548 | | | | 1.392 | | | | 1.219 | | | | 1.109 | | | | 1.093 | | | | 1.068 | | | | 1.070 | | | | 1.060 | | | | 1.065 | |

2010 | | | 5.253 | | | | 1.879 | | | | 1.456 | | | | 1.330 | | | | 1.238 | | | | 1.231 | | | | 1.098 | | | | 1.138 | | | | 1.041 | | | | 1.044 | | | | 1.026 | |

2011 | | | 3.882 | | | | 1.801 | | | | 1.469 | | | | 1.376 | | | | 1.144 | | | | 1.062 | | | | 1.068 | | | | 1.101 | | | | 1.095 | | | | — | | | | | |

2012 | | | 4.039 | | | | 1.835 | | | | 1.681 | | | | 1.455 | | | | 1.183 | | | | — | | | | | | | | | | | | | | | | | | | | | |

2013 | | | 3.793 | | | | — | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Exhibit 2, Sheet 2

Brokerage - CMPL

Reported Loss

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Development | |

| AY | | 35 | | | 38 | | | 41 | | | 44 | | | 47 | | | 50 | | | 53 | | | 56 | | | 59 | | | 62 | |

Prior | | | 4,052,905 | | | | 8,262,045 | | | | 8,650,313 | | | | 9,313,283 | | | | 9,964,128 | | | | 10,049,198 | | | | 10,073,071 | | | | 10,560,967 | | | | 10,317,658 | | | | 9,926,791 | |

1999 | | | 6,062,014 | | | | 6,224,520 | | | | 6,644,627 | | | | 7,193,582 | | | | 6,767,377 | | | | 6,711,277 | | | | 6,527,227 | | | | 6,646,825 | | | | 6,747,824 | | | | 6,718,522 | |

2000 | | | 6,936,111 | | | | 7,461,901 | | | | 8,244,635 | | | | 8,417,900 | | | | 8,387,278 | | | | 8,394,612 | | | | 8,292,973 | | | | 8,246,420 | | | | 8,135,874 | | | | 8,028,400 | |

2001 | | | 13,360,888 | | | | 13,476,372 | | | | 13,848,729 | | | | 13,843,768 | | | | 13,610,484 | | | | 13,752,626 | | | | 13,326,274 | | | | 13,364,871 | | | | 13,778,273 | | | | 13,612,271 | |

2002 | | | 13,175,125 | | | | 13,885,452 | | | | 14,196,166 | | | | 14,574,378 | | | | 14,514,341 | | | | 14,800,175 | | | | 15,593,001 | | | | 18,065,757 | | | | 18,256,238 | | | | 18,211,846 | |

2003 | | | 17,371,313 | | | | 17,792,741 | | | | 18,367,740 | | | | 18,908,971 | | | | 18,760,607 | | | | 19,078,917 | | | | 18,844,787 | | | | 19,344,432 | | | | 19,893,341 | | | | 20,062,067 | |

2004 | | | 23,982,092 | | | | 24,855,917 | | | | 24,588,665 | | | | 24,956,053 | | | | 25,146,832 | | | | 25,544,776 | | | | 27,364,638 | | | | 27,505,482 | | | | 27,294,587 | | | | 26,683,839 | |

2005 | | | 33,590,809 | | | | 35,247,595 | | | | 37,726,018 | | | | 38,453,013 | | | | 39,423,861 | | | | 38,735,945 | | | | 39,016,309 | | | | 38,722,037 | | | | 38,706,538 | | | | 38,618,834 | |

2006 | | | 40,597,120 | | | | 41,505,864 | | | | 43,321,510 | | | | 43,562,134 | | | | 44,634,670 | | | | 44,777,640 | | | | 44,651,915 | | | | 44,404,671 | | | | 44,222,047 | | | | 44,154,525 | |

2007 | | | 46,739,315 | | | | 47,072,263 | | | | 48,696,009 | | | | 47,715,117 | | | | 47,798,163 | | | | 47,924,722 | | | | 47,570,854 | | | | 48,850,605 | | | | 49,854,294 | | | | 51,551,888 | |

2008 | | | 62,391,448 | | | | 63,981,406 | | | | 66,250,514 | | | | 68,996,800 | | | | 72,083,355 | | | | 74,376,673 | | | | 74,543,583 | | | | 75,401,856 | | | | 75,995,993 | | | | 78,384,084 | |

2009 | | | 78,960,773 | | | | 86,657,537 | | | | 84,524,298 | | | | 85,393,623 | | | | 82,588,677 | | | | 87,663,092 | | | | 91,040,610 | | | | — | | | | — | | | | — | |

2010 | | | 71,155,530 | | | | 76,182,959 | | | | 79,534,066 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

2011 | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

2012 | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

2013 | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

|

| Age-to Age | |

| AY | | 35 - 38 | | | 38 - 41 | | | 41 - 44 | | | 44 - 47 | | | 47 - 50 | | | 50 - 53 | | | 53 - 56 | | | 56 - 59 | | | 59 - 62 | | | 62 - 65 | |

Prior | | | 2.039 | | | | 1.047 | | | | 1.077 | | | | 1.070 | | | | 1.009 | | | | 1.002 | | | | 1.048 | | | | 0.977 | | | | 0.962 | | | | 1.058 | |

1999 | | | 1.027 | | | | 1.067 | | | | 1.083 | | | | 0.941 | | | | 0.992 | | | | 0.973 | | | | 1.018 | | | | 1.015 | | | | 0.996 | | | | 1.005 | |

2000 | | | 1.076 | | | | 1.105 | | | | 1.021 | | | | 0.996 | | | | 1.001 | | | | 0.988 | | | | 0.994 | | | | 0.987 | | | | 0.987 | | | | 0.988 | |

2001 | | | 1.009 | | | | 1.028 | | | | 1.000 | | | | 0.983 | | | | 1.010 | | | | 0.969 | | | | 1.003 | | | | 1.031 | | | | 0.988 | | | | 1.094 | |

2002 | | | 1.054 | | | | 1.022 | | | | 1.027 | | | | 0.996 | | | | 1.020 | | | | 1.054 | | | | 1.159 | | | | 1.011 | | | | 0.998 | | | | 0.989 | |

2003 | | | 1.024 | | | | 1.032 | | | | 1.029 | | | | 0.992 | | | | 1.017 | | | | 0.988 | | | | 1.027 | | | | 1.028 | | | | 1.008 | | | | 1.034 | |

2004 | | | 1.036 | | | | 0.989 | | | | 1.015 | | | | 1.008 | | | | 1.016 | | | | 1.071 | | | | 1.005 | | | | 0.992 | | | | 0.978 | | | | 1.006 | |

2005 | | | 1.049 | | | | 1.070 | | | | 1.019 | | | | 1.025 | | | | 0.983 | | | | 1.007 | | | | 0.992 | | | | 1.000 | | | | 0.998 | | | | 1.010 | |

2006 | | | 1.022 | | | | 1.044 | | | | 1.006 | | | | 1.025 | | | | 1.003 | | | | 0.997 | | | | 0.994 | | | | 0.996 | | | | 0.998 | | | | 1.016 | |

2007 | | | 1.007 | | | | 1.034 | | | | 0.980 | | | | 1.002 | | | | 1.003 | | | | 0.993 | | | | 1.027 | | | | 1.021 | | | | 1.034 | | | | 0.981 | |

2008 | | | 1.025 | | | | 1.035 | | | | 1.041 | | | | 1.045 | | | | 1.032 | | | | 1.002 | | | | 1.012 | | | | 1.008 | | | | 1.031 | | | | 1.040 | |

2009 | | | 1.097 | | | | 0.975 | | | | 1.010 | | | | 0.967 | | | | 1.061 | | | | 1.039 | | | | — | | | | | | | | | | | | | |

2010 | | | 1.071 | | | | 1.044 | | | | — | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

2011 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

2012 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

2013 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |