UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| x | Soliciting Material under §240.14a-12 |

| MACQUARIE INFRASTRUCTURE CORPORATION |

| (Name of Registrant as Specified In Its Charter) |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| Payment of Filing Fee (Check the appropriate box): |

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| | (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

| | (3) | Filing Party: |

| | (4) | Date Filed: |

Macquarie Infrastructure Corporation Investor Presentation – Sa le of Atlantic Aviation and MIC Hawaii July 19, 2021

PAGE 2 Important Information For Investors And Stockholders In connection with the proposed transactions, Macquarie Infrastructure Corporation (the “Company”) filed a proxy statement with the Securities and Exchange Commission (“SEC”) on July 15 , 2021 , the definitive version of which will be mailed to stockholders of the Company . INVESTORS AND SECURITY HOLDERS OF THE COMPANY ARE STRONGLY ENCOURAGED TO READ THE PROXY STATEMENT AND OTHER DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION . Investors and security holders are able to obtain free copies of the proxy statement and other documents filed with the SEC by the Company through the website maintained by the SEC at https : //www . sec . gov . Copies of the documents filed with the SEC by the Company will also be available free of charge on the Company website at www . macquarie . com/mic or by writing to us at 125 West 55 th Street, New York, New York 10019 , United States of America, Attention : Investor Relations . Certain Information Regarding Participants The Company and its directors and executive officers may be considered participants in the solicitation of proxies in connection with the proposed transactions . Information about the directors and executive officers of the Company is set forth in its Annual Report on Form 10 - K for the year ended December 31 , 2020 , which was filed with the SEC on February 17 , 2021 , and its definitive proxy statement for its 2021 annual meeting of stockholders, which was filed with the SEC on March 29 , 2021 . Other information regarding the participants of the Company in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement and other relevant materials to be filed with the SEC regarding the proposed transactions when they become available . Disclaimer on Forward Looking Statements This communication contains forward - looking statements . The Company may, in some cases, use words such as “project,” “believe,” “anticipate,” “plan,” “expect,” “estimate,” “intend,” “should,” “would,” “could,” “potentially” or “may” or other words that convey uncertainty of future events or outcomes to identify these forward - looking statements . Such statements include, among others, those concerning the Company’s expected financial performance and strategic and operational plans, statements regarding potential sales of the Company’s operating businesses (including the Company’s proposed reorganization) and the anticipated uses of any proceeds therefrom, statements regarding the anticipated specific and overall impacts of the COVID - 19 pandemic, as well as all assumptions, expectations, predictions, intentions or beliefs about future events . Forward - looking statements in this communication are subject to a number of risks and uncertainties, some of which are beyond the Company’s control, including, among other things : changes in general economic or business conditions ; the ongoing impact of the COVID - 19 pandemic ; the Company’s ability to complete the proposed transactions ; the Company’s ability to service, comply with the terms of and refinance debt ; its ability to retain or replace qualified employees ; in the absence of a sale or sales of its businesses, its ability to complete growth projects, deploy growth capital and manage growth, make and finance future acquisitions and implement its strategy ; the regulatory environment ; demographic trends ; the political environment ; the economy, tourism, construction and transportation costs ; air travel ; environmental costs and risks ; fuel and gas and other commodity costs ; the Company’s ability to recover increases in costs from customers ; cybersecurity risks ; work interruptions or other labor stoppages ; risks associated with acquisitions or dispositions ; litigation risks ; reliance on sole or limited source suppliers, risks or conflicts of interests involving the Company’s relationship with the Macquarie Group ; and changes in U . S . federal tax law . These and other risks and uncertainties are described under the caption “Risk Factors” in Item 1 A of the Company’s Annual Report on Form 10 - K for the year ended December 31 , 2020 and in its other reports filed from time to time with the SEC . The Company’s actual results, performance, prospects, or opportunities could differ materially from those expressed in or implied by the forward - looking statements . Additional risks of which the Company is not currently aware could also cause its actual results to differ . In light of these risks, uncertainties, and assumptions, you should not place undue reliance on any forward - looking statements . The forward - looking events discussed in this communication may not occur . These forward - looking statements are made as of the date of this communication . The Company undertakes no obligation to publicly update or revise any forward - looking statements, whether as a result of new information, future events or otherwise, except as required by law . Important Notice

PAGE 3 • Sale of MIC Hawaii to Argo Infrastructure for $514 million 1 – announced June 2021 • Transaction represents strong valuation 2 in challenging market environment and value enhancing outcome for shareholders • Sale of IMTT to affiliate of Riverstone Holdings for $2.685 billion – completed December 2020 • Largest pure play bulk liquid storage terminal in North America 1. Unitholders to receive $3.83 per unit at closing (or, if the transaction is consummated after July 1, 2022, $4.11 per unit at cl osing) 2. 12.9x 2021E EBITDA at the midpoint of MIC EBITDA guidance 3. Based on the 60 - day VWAP to October 31, 2019 Sales of Atlantic Aviation and MIC Hawaii Successfully Conclude MIC’s Strategic Alternatives Process • Sale of Atlantic Aviation to KKR for $4.475 billion – announced June 2021 • Industry record ~16.2x 2019A EBITDA 1 2 3 “Since 2018, our strategy has centered on enhancing the infrastructure characteristics of our businesses, improving their resilience and unlocking additional value for our shareholders. While COVID - 19 lengthened the timeframe to complete these efforts, we are now transferring our businesses to private owners who recognize their improved resilience and growth potential. Subject to the successful closing of our two agreed transactions, we have delivered on our commitments and will return net proceeds to shareholders of $52.18 per share, representing a 35% 3 premium to our share price prior to embarking on our pursuit of strategic alternatives.” — CHRISTOPHER FROST, CEO, MIC (June 14, 2021) x Atlantic Aviation and MIC Hawaii transactions together successfully conclude complex and robust strategic alternatives process started in October 2019 x Aggregate proceeds from sales of IMTT, Atlantic Aviation and MIC Hawaii expected to total $52.18 per share, representing approximately 35% 3 premium to share price prior to announcement of strategic alternatives process

PAGE 4 Sale of Atlantic Aviation Transaction multiple of 16.2x 2019A EBITDA is expected to be a record price for FBO industry • Valuation contains no discount for COVID - 19 and captures fundamental shift in risk perception of FBO business and resilient Atlantic Aviation portfolio • Compares to Signature Aviation transaction multiple of 15.6x 2019A EBITDA 1 ,and 12.9x 2019A EBITDA 2 adjusted for share - based payments and midpoint of announced cost - savings Rapid rebound of general aviation activity following the pandemic solidified value proposition • General aviation activity levels down ~70% following near - national shutdown in April 2020, but recovered to near pre - pandemic activity by April 2021 • Resiliency boosted by both existing users and new customers substituting from commercial travel • Higher relative volume to leisure destinations due to shut - down of metropolitan centers and greater work - from - home flexibility Shareholders compensated for the expected full recovery of Atlantic Aviation business and corresponding forecast • After receiving first round indications of interest, Atlantic Aviation was able to point to superior performance relative to budget and a positive demand response to improving macroeconomic conditions, with a corresponding increase in public EBITDA guidance ��� Continued improvements in short - term performance reinforced bidder conviction around the resiliency of the business and the robust long - term outlook Transaction concludes an extensive sale process prior to and following the onset of the COVID - 19 pandemic with multiple parallel processes including all permutations of MIC’s individual assets or a sale of the entire company • Initial outreach to 48 parties regarding a sale of Atlantic Aviation, plus additional pre - pandemic outreach to 29 parties in connection with the sale of the entire company, of which there was a strong interest in an Atlantic Aviation - only transaction • 28 acquisition NDAs executed; in 2021, received 9 first round offers, 3 final binding offers and 3 “best and final” offers 1. Excluding non - cash items as defined by management 2. Excluding non - cash items as defined by management; Represents pre - COVID 2019 EBITDA of $348.7mm adjusted for $8.6mm of share - based payment and illustrative cost savings of $75mm ( midpoint of $70mm - $80mm range)

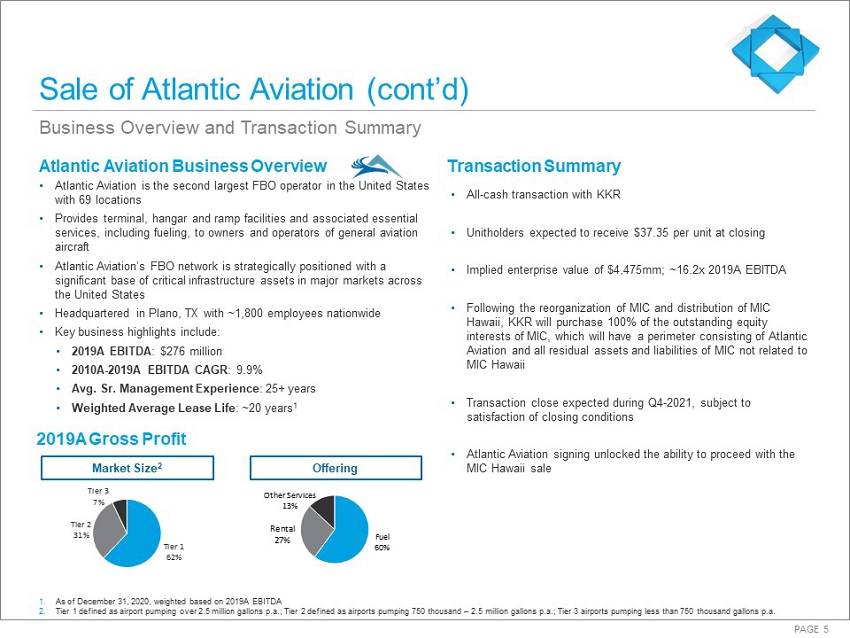

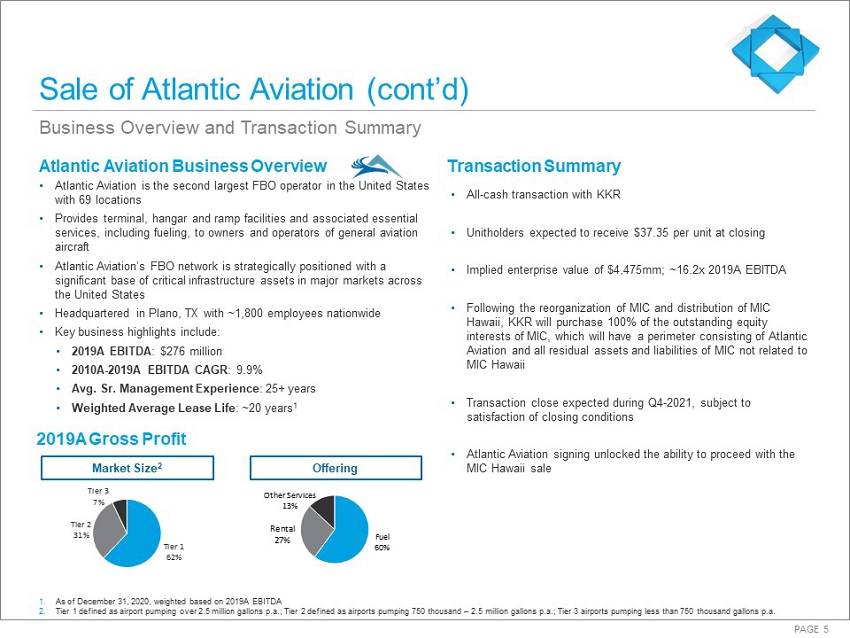

PAGE 5 Fuel 60% Rental 27% Other Services 13% Tier 1 62% Tier 2 31% Tier 3 7% 1. As of December 31, 2020, weighted based on 2019A EBITDA 2. Tier 1 defined as airport pumping over 2.5 million gallons p.a.; Tier 2 defined as airports pumping 750 thousand – 2.5 million g allons p.a.; Tier 3 airports pumping less than 750 thousand gallons p.a. Transaction Summary Atlantic Aviation Business Overview Sale of Atlantic Aviation (cont’d) • Atlantic Aviation is the second largest FBO operator in the United States with 69 locations • Provides terminal, hangar and ramp facilities and associated essential services, including fueling, to owners and operators of general aviation aircraft • Atlantic Aviation’s FBO network is strategically positioned with a significant base of critical infrastructure assets in major markets across the United States • Headquartered in Plano, TX with ~1,800 employees nationwide • Key business highlights include: • 2019A EBITDA : $276 million • 2010A - 2019A EBITDA CAGR : 9.9% • Avg. Sr. Management Experience : 25+ years • Weighted Average Lease Life : ~20 years 1 • All - cash transaction with KKR • Unitholders expected to receive $37.35 per unit at closing • Implied enterprise value of $4,475mm; ~16.2x 2019A EBITDA • Following the reorganization of MIC and distribution of MIC Hawaii, KKR will purchase 100% of the outstanding equity interests of MIC, which will have a perimeter consisting of Atlantic Aviation and all residual assets and liabilities of MIC not related to MIC Hawaii • Transaction close expected during Q4 - 2021, subject to satisfaction of closing conditions • Atlantic Aviation signing unlocked the ability to proceed with the MIC Hawaii sale Market Size 2 Offering Business Overview and Transaction Summary 2019A Gross Profit

PAGE 6 Sale of MIC Hawaii Attractive valuation despite fundamental and permanent shift in risk perception of MIC Hawaii business to unitholders and any potential buyer, with COVID - 19 demonstrating significant exposure to Hawaii tourism • Since April 2020, visitor numbers drastically declined, with 90%+ reductions vs. 2019A levels and MIC Hawaii total volumes sold decreasing 26% in 2020 • MIC Hawaii management projects recovery to 2019 volume levels post - 2024; economic forecasters cautious regarding pace of recovery as long - distance travel remains heavily dependent on public sentiment with respect to travel safety Effects sale transaction for a business that may be sub - scale for a public listing • MIC management estimates approximately $11 million of annual corporate costs as a standalone publicly listed company post sale of Atlantic Aviation and not previously captured within MIC Hawaii’s historic EBITDA results, severely impacting projected profitability and challenging any public equity story Transaction concludes a robust sale process with the goal of identifying a buyer with ( i ) the ability and commitment to pay an attractive valuation, and (ii) the necessary credentials to achieve a successful regulatory outcome • Initial outreach to 121 parties, including sponsors and strategics, with 40+ NDAs executed in connection with the sale of MIC Hawaii or the entire company • Public knowledge that MIC seeking buyers for this asset for over 18 months Installs new steward to support the business’ further alignment with the State of Hawaii’s energy goals 1. Excludes the ~$11m of ongoing listed costs Transaction multiple of 12.9x 1 2021E EBITDA and 12.2x 1 2022E EBITDA, superior to blended multiple of comparable companies of ~10.5x and ~9.6x for 2021E and 2022E, respectively

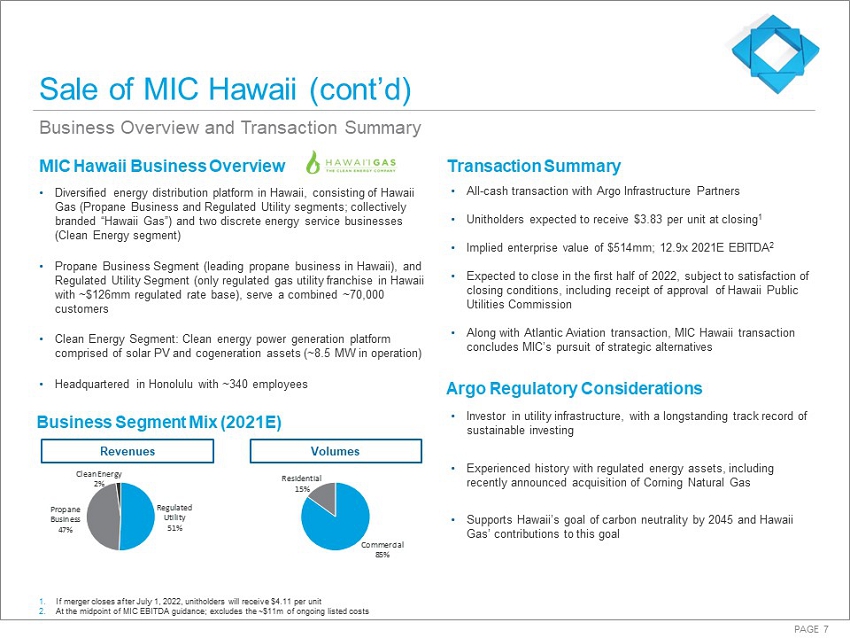

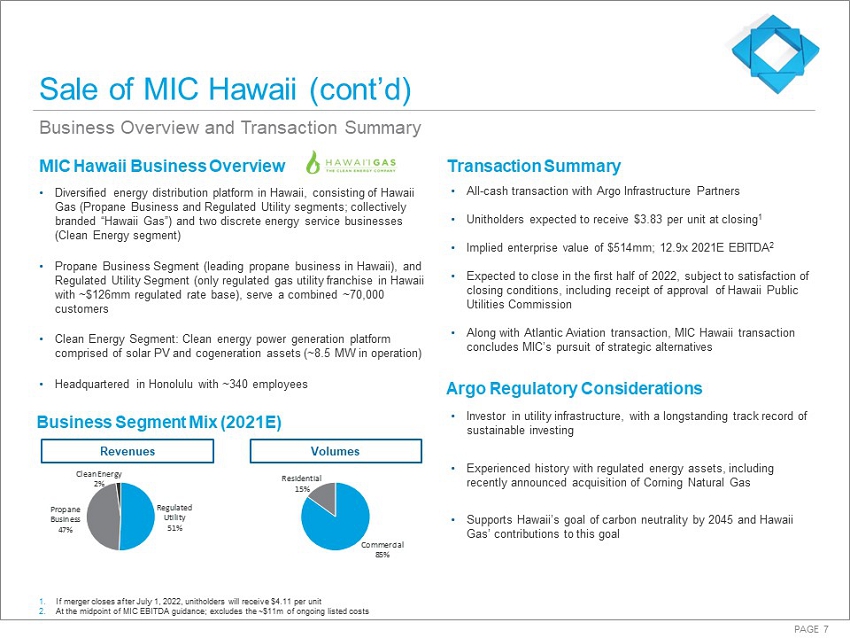

PAGE 7 Regulated Utility 51% Propane Business 47% Clean Energy 2% 1. If merger closes after July 1, 2022, unitholders will receive $4.11 per unit 2. At the midpoint of MIC EBITDA guidance; excludes the ~$11m of ongoing listed costs Transaction Summary MIC Hawaii Business Overview Sale of MIC Hawaii (cont’d) • Diversified energy distribution platform in Hawaii, consisting of Hawaii Gas (Propane Business and Regulated Utility segments; collectively branded “Hawaii Gas”) and two discrete energy service businesses (Clean Energy segment) • Propane Business Segment (leading propane business in Hawaii), and Regulated Utility Segment (only regulated gas utility franchise in Hawaii with ~$126mm regulated rate base), serve a combined ~70,000 customers • Clean Energy Segment: Clean energy power generation platform comprised of solar PV and cogeneration assets (~8.5 MW in operation) • Headquartered in Honolulu with ~340 employees • All - cash transaction with Argo Infrastructure Partners • Unitholders expected to receive $3.83 per unit at closing 1 • Implied enterprise value of $514mm; 12.9x 2021E EBITDA 2 • Expected to close in the first half of 2022, subject to satisfaction of closing conditions, including receipt of approval of Hawaii Public Utilities Commission • Along with Atlantic Aviation transaction, MIC Hawaii transaction concludes MIC’s pursuit of strategic alternatives Revenues Volumes Business Overview and Transaction Summary Business Segment Mix (2021E) Argo Regulatory Considerations • Investor in utility infrastructure, with a longstanding track record of sustainable investing • Experienced history with regulated energy assets, including recently announced acquisition of Corning Natural Gas • Supports Hawaii’s goal of carbon neutrality by 2045 and Hawaii Gas’ contributions to this goal Commercial 85% Residential 15%