125 West 55th Street

New York, NY 10019

USA

Media Release

ACQUISITIONS STRUCTURED AS EXPANDED DEAL FOR MERCURY AIR CENTERS

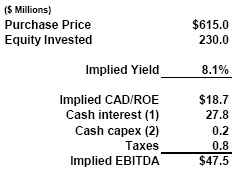

With the agreement to purchase SJJC Aviation Services, LLC, MIC will acquire a total of 26 FBOs in the Mercury transaction. The total purchase price, including all fees, expenses, debt service reserves and pre-funded integration costs, will be approximately $615.0 million. In addition, the Company expects to commit to an additional approximately $18.0 million of growth related capital expenditures for a new hangar. The transaction is expected to close in the third quarter of 2007.

“We are pleased to be able to add these facilities, including the San Jose Jet Center, one of the largest FBOs in the aviation industry, to our network of Atlantic Aviation branded sites”, said Peter Stokes, Chief Executive Officer of MIC. “The San Jose Jet Center and ACM Aviation are outstanding facilities serving the general aviation needs of the Silicon Valley and the San Francisco Bay area.”

MIC will fund a portion of the expanded acquisition with a two-year bridge facility of $80.0 million guaranteed by its airport services holding company, Macquarie FBO Holdings. The balance will be funded with proceeds from MIC’s existing acquisition-related revolving credit facility.

As a result of the increase in the size of the Mercury transaction, the Company now intends to raise approximately $230.0 million in a follow-on equity offering. The proceeds of the equity offering, along with those generated in a planned refinance of the Company’s airport services business, will be used to fund both the acquisition and the planned growth capital expenditures. Any equity offering will be made at management’s discretion, subject to market conditions being deemed favorable.

Macquarie Securities (USA) Inc. (“MSUSA”) is acting as financial advisor to MIC on the acquisition. MSUSA is a subsidiary of Macquarie Bank Limited, the parent company of MIC’s Manager.

IMPACT ON MACQUARIE INFRASTRUCTURE COMPANY

The Company believes that the transaction for SJJC Aviation Services, LLC will be immediately yield accretive. The table below summarizes the contribution to EBITDA and estimated cash available for distribution (“CAD”) that the Company expects will be generated in the first year following the closing of the expanded Mercury acquisition.

125 West 55th Street

New York, NY 10019

USA

| (1) | Cash interest assumes a refinance rate equal to rate (base plus margin) on the existing debt in the airport services business. |

| (2) | Cash capex reflects the planned debt funding of the maintenance capex related to the initial 24 Mercury FBOs ($170k per facility, per year) and the funding of maintenance capex at the San Jose Jet Center from operating cash flows ($200k per year). |

ABOUT MACQUARIE INFRASTRUCTURE COMPANY

MIC owns, operates and invests in a diversified group of infrastructure businesses, which provide basic, everyday services, to customers in the United States. Its businesses consist of an airport services business, an airport parking business, a district energy business, a gas production and distribution business, and a fifty percent indirect interest in a bulk liquid storage terminal business. The Company is managed by a wholly-owned subsidiary of Macquarie Bank Limited. For additional information, please visit the Macquarie Infrastructure Company website at www.macquarie.com/mic.

FORWARD LOOKING STATEMENTS

This earnings release contains forward-looking statements. We may, in some cases, use words such as "project”, "believe”, "anticipate”, "plan”, "expect”, "estimate”, "intend”, "should”, "would”, "could”, "potentially”, or "may” or other words that convey uncertainty of future events or outcomes to identify these forward-looking statements. Forward-looking statements in this presentation are subject to a number of risks and uncertainties, some of which are beyond our control including, among other things: our ability to successfully integrate and manage acquired businesses, manage growth, make and finance future acquisitions, service, comply with the terms of and refinance our debt, and implement our strategy, decisions made by persons who control our investments including the distribution of dividends, our regulatory environment, changes in air travel, automobile usage, fuel and gas prices, foreign exchange fluctuations, environmental risks and changes in U.S. federal tax law.

Our actual results, performance, prospects or opportunities could differ materially from those expressed in or implied by the forward-looking statements. Additional risks of which we are not currently aware could also cause our actual results to differ. In light of these risks, uncertainties and assumptions, you should not place undue reliance on any forward-looking statements. The forward-looking events discussed in this release may not occur. These forward-looking statements are made as of the date of this release. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. MIC-G

FOR FURTHER INFORMATION, PLEASE CONTACT:

Investor enquiries Jay A. Davis Investor Relations Macquarie Infrastructure Company (212) 231-1825 | Media enquiries Alex Doughty Corporate Communications Macquarie Infrastructure Company (212) 231-1710 |