QuickLinks -- Click here to rapidly navigate through this document

As filed with the Securities and Exchange Commission on May 13, 2004

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-11

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

DASCO Medical Properties Trust

(Exact Name of Registrant as Specified in Governing Instruments)

3399 PGA Boulevard

Suite 240

Palm Beach Gardens, FL 33410

(561) 691-9900

(Address, Including Zip Code, and Telephone Number, Including Area Code,

of Registrant's Principal Executive Offices)

Malcolm S. Sina

DASCO Medical Properties Trust

3399 PGA Boulevard

Suite 240

Palm Beach Gardens, FL 33410

(561) 691-9900

(Name, Address, Including Zip Code, and Telephone Number,

Including Area Code, of Agent For Service)

Copies to: | ||

| J. Warren Gorrell, Jr., Esq. Stuart A. Barr, Esq. Mark L. Landis, Esq. HOGAN & HARTSON L.L.P. Columbia Square 555 Thirteenth Street, N.W. Washington, D.C. 20004-1109 (202) 637-5600 | Gilbert G. Menna, P. C. GOODWIN PROCTERLLP Exchange Place 53 State Street Boston, MA 02109-2804 (617) 570-1000 | |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this Registration Statement becomes effective.

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box. o

CALCULATION OF REGISTRATION FEE

| Title of Securities To Be Registered | Proposed Maximum Aggregate Offering Price (1) | Amount of Registration Fee | ||

|---|---|---|---|---|

| Common Shares, par value $0.01 per share | $160,000,000 | $20,272 | ||

- (1)

- Estimated solely for the purpose of calculating the registration fee.

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed or supplemented. We cannot sell any of the securities described in this prospectus until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell the securities, nor is it a solicitation of an offer to buy the securities, in any state where an offer or sale of the securities is not permitted.

Subject to Completion, dated May 13, 2004

PROSPECTUS

Shares

DASCO Medical Properties Trust

Common Shares

We are DASCO Medical Properties Trust. We focus on acquiring, developing, re-developing, owning, managing and leasing medical office buildings. We intend to operate so as to qualify as a real estate investment trust, or REIT, for federal income tax purposes. Our common shares are subject to transfer restrictions designed to preserve our status as a real estate investment trust, see "Description of Shares—Restrictions on Ownership and Transfer."

This is our initial public offering of our common shares. No public market currently exists for our common shares. We currently expect the public offering price to be between $ and $ per share. We intend to apply to have our common shares listed on the New York Stock Exchange under the symbol "DSC."

We expect to use approximately $ million of the proceeds of this offering to prepay debt of The DASCO Companies, L.L.C. to an affiliate of the lead underwriter of this offering, Lehman Brothers Inc., and to purchase a portion of the equity interests in The DASCO Companies and in certain related property-owning entities from an affiliate of Lehman Brothers Inc.

Investing in our common shares involves risks. See "Risk Factors" beginning on page 17 of this prospectus for some risks regarding an investment in our common shares, including:

- •

- If we fail to qualify or remain qualified as a REIT, our distributions will not be deductible by us, and our income will be subject to taxation, reducing our earnings available for distribution;

- •

- In connection with the formation transactions described in this prospectus, we will not obtain appraisals of the properties or other assets in which we will own an interest following this offering and the formation transactions, and the consideration given by us in exchange for them may exceed their fair market value;

- •

- Our portfolio consists exclusively of medical office buildings, making us more vulnerable to changes in economic and industry conditions than if our portfolio were more diversified across industry sectors;

- •

- Many of our ground leases and other agreements with hospitals effectively limit our control over various aspects of the operation of the applicable building, restrict our ability to transfer the building and allow the hospital to repurchase the building in specified circumstances;

- •

- We depend upon our relationships with healthcare systems for development and acquisition opportunities, and any adverse change in any of those relationships or in the financial condition or business strategy of any of those healthcare systems could harm our business and growth prospects; and

- •

- Our business would be harmed if we lose the services of key personnel with long-standing relationships with healthcare systems.

| | Per Share | Total | ||

|---|---|---|---|---|

| Public offering price | $ | $ | ||

| Underwriting discount | $ | $ | ||

| Proceeds, before expenses, to us | $ | $ |

The underwriters may also purchase up to common shares from us at the public offering price, less the underwriting discount, within 30 days after the date of this prospectus to cover over-allotments, if any.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Lehman Brothers expects to deliver the common shares on or about , 2004.

LEHMAN BROTHERS

, 2004

No dealer, salesperson or other individual has been authorized to give any information or make any representations not contained in this prospectus in connection with the offering made by this prospectus. If given or made, such information or representations must not be relied upon as having been authorized by us or any of the underwriters. This prospectus does not constitute an offer to sell, or a solicitation of an offer to buy, any of our securities in any jurisdiction in which such an offer or solicitation is not authorized or in which the person making such offer or solicitation is not qualified to do so, or to any person to whom it is unlawful to make such offer or solicitation. Neither the delivery of this prospectus nor any sale made hereunder shall, under any circumstances, create an implication that there has not been any change in the facts set forth in this prospectus or in the affairs of our company since the date hereof.

| | Page | ||

|---|---|---|---|

| SUMMARY | 1 | ||

| Overview | 1 | ||

| Our Competitive Strengths | 2 | ||

| Our Business and Growth Strategy | 4 | ||

| Market Opportunity | 4 | ||

| Structure and Formation of Our Company and Benefits to Related Parties | 5 | ||

| Summary Risk Factors | 9 | ||

| Our Properties | 10 | ||

| Properties Under Agreement | 11 | ||

| Restrictions on Ownership of Our Common Shares | 12 | ||

| Our Distribution Policy | 13 | ||

| Our Company History, Tax Status and Principal Office | 13 | ||

| The Offering | 14 | ||

| Summary Selected Financial Data | 15 | ||

| RISK FACTORS | 17 | ||

| Risks Related to Our Property/Business | 17 | ||

| Risks Related to Our Organization and Structure | 24 | ||

| Risks Related to this Offering | 27 | ||

| Risks Related to the Industry | 30 | ||

| Tax Risks | 32 | ||

| USE OF PROCEEDS | 34 | ||

| DISTRIBUTION POLICY | 36 | ||

| CAPITALIZATION | 39 | ||

| DILUTION | 40 | ||

| SELECTED FINANCIAL DATA | 41 | ||

| MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 43 | ||

| Overview | 43 | ||

| General Industry Trends Impacting Operating Results | 44 | ||

| Critical Accounting Policies | 45 | ||

| Results of Operations | 48 | ||

| Liquidity and Capital Resources | 50 | ||

| Inflation | 53 | ||

| Quantitative and Qualitative Disclosures About Market Risk | 53 | ||

| New Accounting Standards and Accounting Changes | 54 | ||

| OUR BUSINESS AND PROPERTIES | 55 | ||

ii

| Overview | 55 | ||

| Our Competitive Strengths | 56 | ||

| Business and Growth Strategy | 58 | ||

| Financing Strategy | 59 | ||

| Industry Background | 59 | ||

| Our Properties | 62 | ||

| Major Healthcare Systems | 68 | ||

| Ratings | 68 | ||

| Our Leases | 74 | ||

| Asset Selection Process | 74 | ||

| Development Projects on or Adjacent to Hospital Campuses | 75 | ||

| In-House Asset and Property Management | 76 | ||

| In-House Marketing and Leasing | 76 | ||

| Excluded Properties | 77 | ||

| Debt Outstanding After the Offering | 77 | ||

| Environmental Matters | 78 | ||

| Restrictions and Limitations in Our Ground Leases and Other Agreements With Hospitals | 79 | ||

| Cash Flow and Capital Proceeds Participation Arrangements With Hospitals | 80 | ||

| Insurance | 81 | ||

| Competition | 81 | ||

| Legal Proceedings | 82 | ||

| Offices | 82 | ||

| Employees | 82 | ||

| MANAGEMENT | 83 | ||

| Trustees and Executive Officers | 83 | ||

| Corporate Governance Profile | 85 | ||

| Committees of the Board of Trustees | 85 | ||

| Compensation of Trustees | 86 | ||

| Compensation Committee Interlocks and Insider Participation | 86 | ||

| Executive Compensation | 86 | ||

| Employment Agreements | 87 | ||

| Equity and Benefit Plans | 87 | ||

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | 88 | ||

| Formation Transactions | 88 | ||

| Other Benefits to Related Parties | 89 | ||

| STRUCTURE AND FORMATION OF OUR COMPANY | 90 | ||

| Our Operating Entities | 90 | ||

| Formation Transactions | 90 | ||

| Consequences of this Offering and the Formation Transactions | 91 | ||

| Benefits to Related Parties | 92 | ||

| Determination of Offering Price | 94 | ||

| STRUCTURE AND DESCRIPTION OF OPERATING PARTNERSHIP | 95 | ||

| Management | 95 | ||

| Management Liability and Indemnification | 95 | ||

| Fiduciary Responsibilities | 95 | ||

| Transfers | 96 | ||

| Distributions | 97 | ||

| Allocation of Net Income and Net Loss | 97 | ||

| Redemption | 97 | ||

| Issuance of Additional Partnership Interests | 98 | ||

iii

| Preemptive Rights | 99 | ||

| Amendment of Partnership Agreement | 99 | ||

| Tax Matters | 100 | ||

| Term | 100 | ||

| INVESTMENT POLICIES AND POLICIES WITH RESPECT TO CERTAIN ACTIVITIES | 101 | ||

| Investments in Real Estate or Interests in Real Estate | 101 | ||

| Investments in Mortgages | 102 | ||

| Investments in Securities of or Interests in Persons Primarily Engaged in Real Estate Activities and Other Issuers | 102 | ||

| Dispositions | 103 | ||

| Financing Policies | 103 | ||

| Lending Policies | 103 | ||

| Equity Capital Policies | 103 | ||

| Conflict of Interest Policy | 104 | ||

| Reporting Policies | 104 | ||

| PRINCIPAL SHAREHOLDERS | 105 | ||

| DESCRIPTION OF SHARES | 106 | ||

| General | 106 | ||

| Voting Rights of Common Shares | 106 | ||

| Dividends, Liquidation and Other Rights | 106 | ||

| Power to Reclassify Shares and Issue Additional Common Shares or Preferred Shares | 107 | ||

| Restrictions on Ownership and Transfer | 107 | ||

| Transfer Agent and Registrar | 108 | ||

| Certain Provisions of Maryland Law and Our Declaration of Trust and Bylaws | 108 | ||

| SHARES ELIGIBLE FOR FUTURE SALE | 114 | ||

| Rule 144 | 114 | ||

| Rule 701 | 114 | ||

| Sales of Restricted Shares | 114 | ||

| MATERIAL UNITED STATES FEDERAL INCOME TAX CONSIDERATIONS | 115 | ||

| Taxation of the Company as a REIT | 116 | ||

| Tax Aspects of Our Ownership of Interests in the Operating Partnership and other Partnerships and Limited Liability Companies | 125 | ||

| Taxation of Holders of Our Common Shares | 127 | ||

| Taxation of U.S. Shareholders | 127 | ||

| Taxation of Non-U.S. Shareholders | 129 | ||

| Taxation of Tax-Exempt Shareholders | 131 | ||

| Backup Withholding Tax and Information Reporting | 132 | ||

| Sunset of Tax Provisions | 133 | ||

| State and Local Taxes | 133 | ||

| Tax Shelter Reporting | 133 | ||

| Proposed Legislation | 134 | ||

| UNDERWRITING | 135 | ||

| Commissions and Expenses | 135 | ||

| Over-Allotment Option | 135 | ||

| Lock-Up Agreements | 136 | ||

| Indemnification | 136 | ||

| Listing | 136 | ||

| Offering Price Determination | 136 | ||

| Stabilization, Short Positions and Penalty Bids | 136 | ||

| Discretionary Sales | 137 | ||

iv

| Directed Share Program | 137 | ||

| Electronic Distribution | 137 | ||

| Notice to Canadian Residents | 138 | ||

| Stamp Taxes | 140 | ||

| Relationships | 140 | ||

| LEGAL MATTERS | 141 | ||

| EXPERTS | 141 | ||

| WHERE YOU CAN FIND MORE INFORMATION | 142 | ||

| INDEX TO FINANCIAL STATEMENTS | F-1 | ||

Until , 2004, 25 days after the date of this prospectus, all dealers that buy, sell or trade our common shares, whether or not participating in this offering, may be required to deliver a prospectus. This requirement is in addition to the dealers' obligation to deliver a prospectus when acting as underwriters and with respect to unsold allotments or subscriptions.

v

You should rely only on the information contained in this prospectus or to which we have referred you. We have not authorized anyone to provide you with different information. This prospectus may only be used where it is legal to sell these securities. The information in this prospectus may only be accurate on the date of this prospectus.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Some of the statements contained in "Summary," "Risk Factors," "Distribution Policy," "Management's Discussion and Analysis of Financial Condition and Results of Operations," "Our Business and Properties" and elsewhere in this prospectus constitute forward-looking statements. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. In some cases, you can identify forward-looking statements by terms such as "anticipate," "believe," "could," "estimate," "expect," "intend," "may," "plan," "potential," "should," "will" and "would" or the negative of these terms or other comparable terminology.

The forward-looking statements contained in this prospectus reflect our current views about future events and are subject to risks, uncertainties, assumptions and changes in circumstances that may cause our actual results to differ significantly from those expressed in any forward-looking statement. As such, readers are cautioned not to place undue reliance on any of these forward-looking statements. The factors that could cause actual results to differ significantly from expected results include, among others:

- •

- National, regional and local economic conditions;

- •

- The ability of tenants to pay rent;

- •

- The highly competitive environment in which we operate;

- •

- Financing risks;

- •

- Availability of suitable acquisition, development and/or re-development opportunities on favorable terms;

- •

- Acquisition, development, re-development and joint venture risks;

- •

- Potential environmental and other liabilities;

- •

- Changes in the reimbursement available to our tenants by government or private payors;

- •

- Other factors affecting the real estate and healthcare industries generally; and

- •

- Legislative/regulatory changes.

For more information regarding risks that may cause our actual results to differ materially from any forward-looking statements, see "Risk Factors" beginning on page 17. We do not intend and disclaim any duty or obligation to update or revise any industry information or forward-looking statements set forth in this prospectus to reflect new information, future events or otherwise.

vi

This is only a summary and does not contain all of the information that you should consider before investing in our common shares. You should read this entire prospectus, including "Risk Factors" and the financial statements and related notes appearing elsewhere in this prospectus, before deciding to invest in our common shares. Unless indicated otherwise, the information included in this prospectus assumes no exercise by the underwriters of the over-allotment option to purchase up to an additional common shares, that the common shares to be sold in this offering are sold at $ per share, which is the midpoint of the range indicated on the front cover of this prospectus, and that the initial value of an operating partnership unit is equal to the public offering price of the common shares as set forth on the front cover of this prospectus.

In this prospectus, unless the context suggests otherwise, references to "DASCO" mean The DASCO Companies, L.L.C., together with its predecessors and its predecessors' affiliates. References to the "DASCO group" mean DASCO, together with its principals and the property-owning entities in which DASCO or its principals currently own direct or indirect interests. References to "our company," "we," "us" and "our" mean DASCO Medical Properties Trust, DASCO Medical Properties L.P. and their subsidiaries, including their predecessor companies. References to the "Sponsors" mean an affiliate of the lead underwriter of this offering, Lehman Brothers Inc. and certain affiliates of James Heistand, as well as Malcolm Sina, James Galgano, Wayne Yetman and certain other members of our senior management team, each of whom owns interests in the property-owning entities and/or DASCO. References to the "completed buildings" mean those medical office buildings in which we will own an interest and developed by DASCO for which a certificate of occupancy for the shell of the building has been obtained and either more than one year has passed since it was obtained or a master lease is in place for 100% of the rentable square feet of the project. References to "sponsoring hospitals" mean the hospitals on whose campuses, or adjacent to whose campuses, many of our medical office buildings are located, and the hospitals that have entered into master leases with us.

Overview

We are a fully integrated, self-administered and self-managed real estate company focused primarily on the development, acquisition, re-development, ownership, management and leasing of medical office buildings throughout the United States. Upon the completion of this offering and the formation transactions described below, we will own interests in 28 medical office buildings in nine states that contain a total of approximately 1.4 million rentable square feet. Twenty-four of these medical office buildings, which represent the completed buildings and the acquired buildings, were 92.7% leased as of December 31, 2003. The remaining four medical office buildings, which are recently developed or currently under construction, were 73.0% leased as of December 31, 2003. The DASCO group has entered into agreements to develop five additional medical office buildings in which we will own an interest, and to acquire one additional medical office building. We expect these six additional medical office buildings, which will be located in six states, to contain a total of approximately 325,000 rentable square feet, although we cannot assure you that any of these transactions will be completed.

Our strategy is to generate stable and increasing cash flow and asset value by continuing and expanding the business of the DASCO group, which has been engaged in developing, acquiring, re-developing, owning, managing and leasing medical office buildings for more than ten years. We plan to focus our investments in the medical office building sector and will selectively pursue development and acquisition opportunities where we believe we can leverage our existing infrastructure and relationships to generate attractive risk-adjusted returns. We believe that our senior management team's existing relationships with healthcare systems, hospitals, lenders, general contractors, architects, real estate brokers, advisors and consultants will continue to be an important source of attractive development and acquisition opportunities in the future.

1

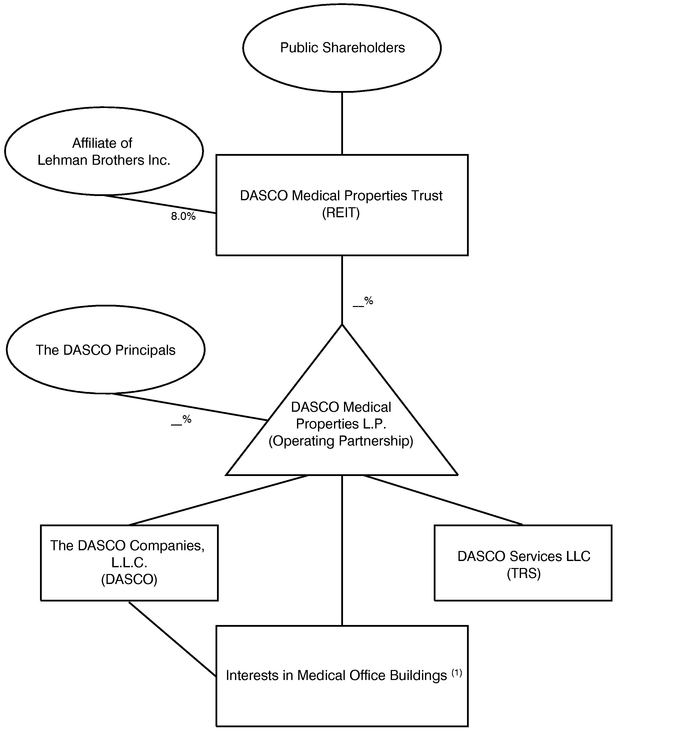

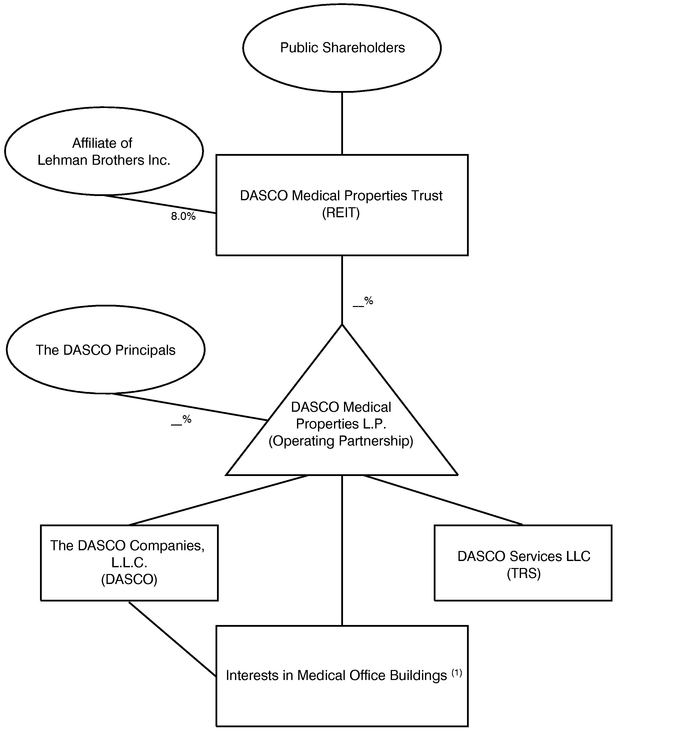

We are organized as a Maryland real estate investment trust and intend to elect to be taxed as a REIT for federal income tax purposes following completion of this offering. We will conduct substantially all of our business through DASCO Medical Properties L.P., our operating partnership, which we will control as general partner. This structure is commonly referred to as an UPREIT. Upon completion of this offering and the formation transactions described below, we will own an approximate % interest in our operating partnership. The other initial limited partners in our operating partnership will be members of the DASCO group, whom we refer to as the DASCO principals, who will contribute their direct and indirect interests in the property-owning entities and their interests in DASCO to our operating partnership in the formation transactions.

Our Competitive Strengths

We believe we distinguish ourselves from other medical real estate owners, operators and developers in a number of ways, and enjoy significant competitive strengths, because of our:

- •

- Medical Office Buildings Focus. Our entire portfolio consists of medical office buildings and our focus will continue to be on developing, acquiring, re-developing, owning, managing and leasing medical office buildings throughout the United States. Twenty-three of 28 buildings in our portfolio, and all six of the additional buildings under contract to be developed or acquired, are located on or adjacent to hospital campuses. Nineteen of the 28 buildings in our portfolio, as well as four of the five other buildings in our portfolio that are not located on or adjacent to hospital campuses, contain hospital ancillary and outpatient services to attract physicians and their patients. We believe that our management team's extensive experience with this specific asset class provides us with a significant competitive advantage. In addition, we believe that our portfolio of medical office buildings will enable us to generate stable cash flows over time, primarily because our buildings generally are recently developed or refurbished, typically are occupied by tenants with long-term leases and historically have experienced a high percentage of tenants renewing their leases.

- •

- Existing Relationships with Major Healthcare Systems. Our senior management team has existing relationships with a number of major not-for-profit and for-profit healthcare systems, including Catholic Health Initiatives (the fourth largest healthcare system in the U.S. based on total number of acute-care hospitals in 2002 according to aModern Healthcare report), Community Health Systems, Inc. (the fifth largest healthcare system in the U.S. based on total number of acute-care hospitals in 2002 according to that report), Ascension Health (the sixth largest healthcare system in the U.S. based on total number of acute-care hospitals in 2002 according to that report) and Health Management Associates, Inc. (the ninth largest healthcare system in the U.S. based on total number of acute-care hospitals in 2002 according to that report). We believe that our senior management team's existing relationships with major healthcare systems and some of their associated hospitals will continue to be an important source of attractive development and acquisition opportunities in the future.

- •

- Creative, Flexible Approach to Meeting Clients' Needs. Our management team uses a creative and flexible approach to meeting our clients' specific medical real estate needs, including the areas of medical office building design, financing, ownership structure, lease terms and lease incentives, as well as ongoing client influence on various aspects of the operations of the building. We believe that a creative, flexible approach is important for establishing and strengthening relationships with hospitals and healthcare systems, as each has its own unique needs and objectives.

- •

- Experienced Management Team. Our senior management team has an average of approximately 11 years in the business of developing, acquiring, re-developing, owning, managing and leasing medical office buildings and other healthcare real estate properties, as well as an average of

2

- •

- Fully Integrated, Full-Service Operations. We engage in a broad range of in-house development, acquisition, budgeting, facility design oversight, construction management, financial structuring, accounting, property management, marketing and leasing activities for medical office buildings in our portfolio. We currently have 56 employees across the country, including 14 property management personnel, nine leasing professionals and four corporate management personnel. We believe that hospitals and healthcare systems often prefer to sell medical office buildings to, or develop medical office buildings with, real estate companies that offer a broad range of fully integrated operations. This provides hospitals and healthcare systems with greater certainty about the nature and quality of services being provided to tenants, who typically consist of the hospital itself and its staff physicians. This also allows the hospital or healthcare system to work with only one real estate provider for its medical office building needs.

- •

- Geographic Diversification. Our 24 completed and acquired properties are located in 15 markets in nine states. In addition to our headquarters in Palm Beach Gardens, Florida, we have six regional offices located in: Dallas, Texas; Scottsdale, Arizona; Orlando, Florida; Jackson, Mississippi; Los Angeles, California; and Chicago, Illinois. Many of our healthcare system clients have geographically diversified portfolios of hospitals. We believe that our ability to consistently provide high quality services to major healthcare systems at their hospitals throughout the country is important for building and strengthening our relationships with them and for maximizing attractive development and acquisition opportunities across the country. In addition, we believe that our geographic diversification will lessen the impact on our overall portfolio if a specific market or region experiences adverse market conditions.

- •

- Diverse and Stable Tenant Base. No single tenant represents more than 7.7% of our annualized base rental revenue, based on leases in place at the completed and acquired medical office buildings as of December 31, 2003. In addition, as of December 31, 2003, the weighted average lease term for the completed and acquired buildings was approximately 10 years, with no more than 9.4% of our total base rent expiring in any single year through 2012. Moreover, we had only three tenant defaults in each of 2002 and 2003, which represented 0.6% and 0.4% of our annualized base rental revenues as of December 31, 2002 and 2003, respectively. In addition, we have experienced a high percentage of tenants renewing leases in our portfolio of medical office buildings, with average renewal rates in 2002 and 2003 of 83% (excluding tenants whose original leases had a term of two years or less, which tenants generally were pre-existing in acquired properties), although we cannot assure you that we will achieve a favorable lease renewal rate in the future. We believe that our diversity of tenants, staggered lease expiration schedule, long-term leases, low historical lease default rates and high average renewal rates will enable us to generate stable cash flows over time.

more than seven years with DASCO. Since 1994, DASCO has developed or acquired interests in 61 medical office buildings and other medical real estate properties, including 28 buildings in which we will own an interest following this offering and the formation transactions, which are described in more detail below. Those 61 buildings contained a total of approximately 3.4 million rentable square feet. Our senior management team's in-depth industry knowledge enables us to develop existing relationships with major healthcare systems that prefer to work with a fully integrated real estate company with extensive experience in developing, acquiring, re-developing, owning, managing and leasing medical office buildings.

3

Our Business and Growth Strategy

Our business strategy is to generate stable and increasing cash flow and asset value by developing, acquiring, re-developing, owning, managing and leasing a portfolio of well-positioned medical office buildings. Our business strategy consists of the following elements:

- •

- Pursuing Development Projects that We Believe Will Generate Attractive Returns. We will target development projects that offer attractive anticipated risk-adjusted yields as compared to comparable acquisitions. We expect that these development projects will often result from our existing relationships with healthcare systems. We generally require a minimum pre-leasing threshold of 50%-60% before commencing construction to reduce our lease-up risk. In some cases, a hospital will expedite the commencement of construction of a development project by entering into a master lease agreement with us to satisfy our minimum pre-leasing threshold. Under the master lease agreement, the hospital pays rent to us on specified amounts of space in the proposed medical office building until replacement tenants can be found.

- •

- Pursuing Acquisitions on Attractive Terms. We will pursue acquisitions of multi-tenant medical office buildings located on or near hospital campuses or outpatient services in expanding markets with competitive tenant lease terms. In addition, we will pursue acquisitions of high-quality medical office buildings in other attractive locations where demand for medical office space is expected to grow for the foreseeable future. Our senior management team's existing relationships with healthcare systems has been an important source of attractive acquisition opportunities in the past, and we expect this will continue in the future. We believe that our status as a publicly-traded UPREIT will enhance our ability to acquire medical office buildings through the use of units of beneficial ownership in our operating partnership, or OP units, as consideration, thereby providing sellers with liquidity and diversification while providing substantial deferral of income taxes that otherwise would be due as a result of a cash sale.

- •

- Building and Leveraging Our Relationships for Development and Acquisition Opportunities. A top priority in managing our business is developing and maintaining strong relationships with healthcare systems, general contractors, architects, real estate brokers, advisors and consultants. We believe that our senior management team's existing relationships will be an important source of attractive development and acquisition opportunities in the future. Our senior management team actively networks through existing clients, general contractors, architects, real estate brokers, advisors and others for introductions to hospitals and healthcare systems with well-positioned facilities across the country.

- •

- Maximizing Cash Flow by Continuing to Enhance the Operating Performance of Each Property. We manage our medical office buildings through centralized accounting and regional property management, which enables us to control and minimize operating expenses. We also aggressively lease available space, and space becoming available in the future, to our existing tenants and new tenants. In addition, the leases in place at the completed and acquired buildings and the recently-developed buildings generally provide for annual contractual rent increases.

Market Opportunity

According to a survey conducted by the Energy Information Administration, as of 1999, there were an estimated 98,000 clinic/outpatient buildings and doctor/dentist office buildings in the U.S., comprising a total of 921 million square feet of space. In addition,Modern Healthcare's annual Construction & Design Survey indicates that an estimated $0.9 billion was spent in the U.S. on the construction of new medical office buildings that were completed in 2003 and an estimated $1.4 billion was spent in the U.S. on the construction of freestanding outpatient facilities that were completed in 2003. According to a 2003 report by Real Capital Analytics on the medical office industry, approximately $1.4 billion of medical office buildings, each with a value of $5 million or more, were

4

sold in 2003. This represents a growth of 47% over the $0.9 billion sold in 2002, as stated in that report.

We believe that the demand for outpatient medical services in the United States is increasing as a result of the growth and aging of the population. Similarly, we believe that the demand for outpatient medical facilities and medical office buildings is increasing as a result of the growing demand for outpatient medical services as well as pressures being faced by healthcare providers to operate more efficiently and to control overhead costs. In addition, we believe that the demand for medical office buildings is increasing in those markets that are benefiting from shifts in the geographic concentration of the U.S. population.

Our experience indicates that the key factors to success in the medical office building industry include attractive locations on or adjacent to campuses of hospitals with strong market positions, proper positioning of the buildings relative to their tenant bases, existing relationships between the owners or developers of the buildings and the sponsoring hospitals and a diverse tenant mix throughout the portfolio.

Structure and Formation of Our Company and Benefits to Related Parties

Our Operating Partnership

Following the completion of this offering and the formation transactions, all of our assets will be held indirectly by, and substantially all of our operations will be conducted through, our operating partnership. We will contribute the net proceeds of this offering to our operating partnership in exchange for a number of OP units equal to the number of common shares issued in this offering. The DASCO principals will own the remaining OP units and be limited partners of our operating partnership. We will control the operating partnership as general partner and will own an approximate % interest in our operating partnership. Beginning on or after the first anniversary of the closing of this offering, limited partners of our operating partnership may redeem their OP units in exchange for cash in an amount equal to the market value of our common shares or, at our option, a number of our common shares equal to the number of OP units offered for redemption, adjusted as specified in the partnership agreement of our operating partnership to take into account prior share dividends or any subdivisions or combinations of our common shares.

The Sponsors who hold interests in DASCO will contribute those interests to the operating partnership. As a result of these contributions, DASCO will become a wholly owned subsidiary of our operating partnership.

Our Service Company

A subsidiary of our operating partnership, DASCO Services LLC, which we refer to as our taxable REIT subsidiary or TRS, will perform certain activities and hold certain assets that might jeopardize our status as a REIT if we performed the activities or held the assets directly.

Formation Transactions

Each property in which we will own an indirect interest at the completion of this offering and the formation transactions is currently owned by a partnership or limited liability company, which we refer to as a property-owning entity. The current direct or indirect investors in these property-owning entities include the Sponsors, hospitals, physicians and physician practice groups that are tenants in our buildings (and physicians that are principals in physician practice groups that are tenants in our buildings) and three private investors who are not affiliated with DASCO.

5

As part of our formation transactions:

- •

- Under a contribution and sale agreement, which we refer to as the contribution agreement, an affiliate of the lead underwriter of this offering, Lehman Brothers Inc., will contribute its direct and indirect interests in DASCO and the property-owning entities to our operating partnership in exchange for common shares, representing approximately 8.0% of our initial outstanding common shares (with an initial aggregate value of approximately $ million), and approximately $ million in cash, representing in part its accrued and unpaid preferred return in DASCO and in some of the property-owning entities.

- •

- Under the contribution agreement, the DASCO principals will contribute their direct or indirect interests in DASCO and the property-owning entities to our operating partnership in exchange for OP units (with an initial aggregate value of approximately $ million) and approximately $ million in cash.

- •

- We will sell common shares in this offering and an additional common shares if the underwriters exercise their over-allotment option in full, and we will contribute the net proceeds from this offering to our operating partnership in exchange for a like number of OP units.

- •

- Our operating partnership intends to enter into a revolving credit facility, which we refer to as our new revolving credit facility, at or shortly after the completion of this offering to be used primarily to finance future property development, acquisition and re-development activities.

- •

- We expect that our operating partnership will use a portion of the net proceeds of this offering to prepay approximately $101.9 million of existing debt and to pay approximately $0.2 million in related prepayment penalties.

- •

- The current employees of DASCO will become employees of our TRS and/or our company.

The following diagram depicts our expected ownership structure and the expected ownership structure of our operating partnership upon completion of this offering and the formation transactions:

6

OUR EXPECTED OWNERSHIP STRUCTURE

- (1)

- Described in more detail in "—Our Properties" below.

7

Based on the issuance of common shares in this offering, upon the completion of this offering and the formation transactions, we expect to own an approximate % interest in our operating partnership, and the DASCO principals will own an approximate % interest in our operating partnership. If the underwriters' over-allotment option is exercised in full, we expect to own an approximate % interest in our operating partnership and the DASCO principals will own an approximate % interest in our operating partnership.

Benefits to Related Parties

The Sponsors are parties to a contribution agreement with our operating partnership under which they will contribute their direct or indirect interests in the property-owning entities and DASCO to our operating partnership in exchange for common shares, OP units or cash. See "Structure and Formation of Our Company—Formation Transactions," beginning on page 90. The value of the OP units that we will issue in exchange for these contributed interests will increase or decrease if our common share price increases or decreases. The initial public offering price of our common shares will be determined in consultation with the underwriters.

Under the contribution agreement:

- •

- An affiliate of the lead underwriter of this offering, Lehman Brothers Inc., will receive common shares, representing 8.0% of our initial outstanding common shares (with an initial aggregate value of approximately $ million), approximately $ million in cash, representing in part its accrued and unpaid preferred return in DASCO and in some of the property-owning entities, and the right to nominate one trustee to our board of trustees so long as this affiliate owns at least 5% of our outstanding common shares;

- •

- Affiliates of Mr. James Heistand will receive OP units (with an initial value of approximately $ , representing an approximate % beneficial interest in our company on a fully diluted basis) and $ million in cash;

- •

- Mr. Malcolm Sina and related entities will receive OP units (with an initial value of approximately $ , representing an approximate % beneficial interest in our company on a fully diluted basis);

- •

- Mr. James Galgano and related entities will receive OP units (with an initial value of approximately $ , representing an approximate % beneficial interest in our company on a fully diluted basis);

- •

- Mr. Wayne Yetman will receive OP units (with an initial value of approximately $ , representing an approximate % beneficial interest in our company on a fully diluted basis); and

- •

- Other members of our senior management team will receive an aggregate of OP units (with an initial value of approximately $ , representing an approximate % beneficial interest in our company on a fully diluted basis).

An affiliate of the lead underwriter of this offering, Lehman Brothers Inc., will receive $2.9 million in cash in prepayment of its revolving credit loan and term loan to DASCO. In addition, James Heistand and some of his affiliates will receive approximately $0.4 million in cash in prepayment of its term loan to DASCO.

We expect to cause any personal guarantees previously made by the DASCO principals with respect to the properties in which we will own an interest following this offering and the formation transactions to be released concurrently with the completion of this offering. These personal guarantees relate to mortgage debt on our properties that will be repaid or remain in place following the formation transactions, as well as the revolving credit loan due to an affiliate of Lehman Brothers Inc.

8

These personal guarantees, which often are joint and several obligations of various of the DASCO principals, relate to a total principal amount of $37.8 million of debt at December 31, 2003. If we are unsuccessful in obtaining any such release, we will indemnify the DASCO principals with respect to any loss incurred under any of these personal guarantees.

We intend to enter into employment agreements with our chairman of the board of trustees and some of our other executive officers, which will provide for salary, bonus and other benefits, including severance upon termination of employment under specified circumstances.

Summary Risk Factors

You should carefully consider the matters discussed in the section "Risk Factors" beginning on page 17 prior to deciding whether to invest in our common shares. Some of these risks include:

- •

- If we fail to qualify or remain qualified as a REIT, our distributions will not be deductible by us, and our income will be subject to taxation, reducing our earnings available for distribution;

- •

- In connection with the formation transactions, we will not obtain appraisals of the properties or other assets in which we will own an interest following this offering and the formation transactions, and the consideration given by us in exchange for them may exceed their fair market value;

- •

- Our portfolio consists exclusively of medical office buildings, making us more vulnerable to changes in economic and industry conditions than if our portfolio were more diversified across industry sectors;

- •

- Many of our ground leases and other agreements with hospitals effectively limit our control over various aspects of the operation of the applicable building, restrict our ability to transfer the building and allow the hospital to repurchase the building in specified circumstances;

- •

- We depend upon our relationships with healthcare systems for development and acquisition opportunities, and any adverse change in any of those relationships or in the financial condition or business strategy of any of those healthcare systems could harm our business and growth prospects;

- •

- Our business would be harmed if we lost the services of key personnel with existing relationships with healthcare systems;

- •

- After this offering and the formation transactions, we expect to have approximately $75.0 million of debt, which may impede our operating performance and reduce our ability to incur additional debt to fund our growth;

- •

- Our organizational documents contain provisions that may discourage third parties from conducting a tender offer or pursuing other change of control transactions that could involve a premium price for our shares or otherwise benefit our shareholders;

- •

- Our management has no experience operating a REIT and limited experience operating a public company;

- •

- If you invest in this offering, you will experience immediate and substantial dilution in net tangible book value per common share;

- •

- We depend on external capital, which may not be available on favorable terms or at all;

- •

- All of our ground leases provide for the building to revert to the hospital for no consideration upon the expiration or earlier termination of the ground lease;

9

- •

- Properties with limited operating history may not achieve forecasted results, which could hinder our ability to make distributions to our shareholders;

- •

- We expect to continue to experience rapid growth and may not be able to adapt our management and operational systems to respond to the integration of additional properties without disruption or expense;

- •

- Adverse trends in healthcare provider operations may negatively affect our lease revenues and our ability to make distributions to our shareholders; and

- •

- Reductions in reimbursement from third-party payors, including Medicare and Medicaid, could adversely affect the profitability of our tenants and hinder their ability to make rent payments to us.

Our Properties

The following table contains information about our portfolio of medical office buildings as of December 31, 2003, which consists of 24 completed and acquired properties with an aggregate of approximately 1.1 million rentable square feet and four recently developed or under construction properties with an aggregate of approximately 0.3 million rentable square feet:

| Property (1) | Year Developed (D)/ Acquired (A)(2) | Year Built/ Renov. | % Owned by Our Company | Rentable Sq. Ft. | % Leased | Associated Healthcare System (3) | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Completed and Acquired Properties | |||||||||||||

Texarkana Professional Building Texarkana, TX | 2000 (A) | 1966 / 1978 | 47 | % | 77,700 | 100 | % | Christus Health Systems | |||||

Physician's East and Physician's West Lancaster, TX (Dallas MSA) | 2000 (A) | 1982 / 1992 | 70 | 54,900 | 94 | American MedTrust | |||||||

The Birth Place at Southwest General San Antonio, TX | 2000 (A) / 2002 (D) | 1994 / 2002 | 100 | 34,100 | 100 | IASIS | |||||||

McDowell Mountain Medical Scottsdale, AZ (Phoenix MSA) | 2001 (A) | 1999 | 100 | 85,900 | 88 | N/A | |||||||

Lake Granbury Medical Center Granbury, TX | 2001 (D) | 2001 | 100 | (4) | 33,800 | 93 | Community Health Systems | ||||||

630 N. Alvernon Tucson, AZ | 2001 (A) | 1986 / 1993 | 100 | 112,700 | 84 | Ascension Health | |||||||

The Medical Offices at Central Mississippi Medical Center Jackson, MS | 2002 (D) | 2002 | 100 | (4) | 44,500 | 100 | Health Management Associates | ||||||

Burns Professional Building Blue Ridge, GA | 2002 (D) | 2002 | 100 | (4) | 14,700 | 100 | Community Health Associates | ||||||

Baytown Plaza I and Plaza II Baytown, TX (Houston MSA) | 2002 (A) | 1979 / 1987 | 100 | 38,800 | 83 | N/A | |||||||

Oviedo Medical Center Oviedo, FL (Orlando MSA) | 2002 (A) | 1997 | 100 | 68,100 | 97 | Orlando Regional Healthcare | |||||||

South Seminole Medical Office Building II Longwood, FL (Orlando MSA) | 2002 (A) | 1987 | 100 | 35,300 | 96 | Orlando Regional Healthcare | |||||||

MedPlex B at Sandlake Commons Orlando, FL | 2002 (A) | 1988 | 100 | 32,100 | 100 | Orlando Regional Healthcare | |||||||

Orlando Professional Center II Orlando, FL | 2002 (A) | 1963 | 100 | 28,000 | 94 | Orlando Regional Healthcare | |||||||

South Seminole Medical Office Building III Longwood, FL (Orlando MSA) | 2002 (A) | 1993 | 100 | 23,100 | 100 | Orlando Regional Healthcare | |||||||

10

Orlando Professional Center I Orlando, FL | 2002 (A) | 1969 | 100 | % | 17,100 | 100 | % | Orlando Regional Healthcare | |||||

Sand Lake Physicians Office Building Orlando, FL | 2002 (A) | 1985 | 100 | 14,000 | 100 | Orlando Regional Healthcare | |||||||

St. Joseph's Medical Plaza Tucson, AZ | 2002 (A) | 1986 | 100 | 87,900 | 73 | Ascension Health | |||||||

Heartland Regional Medical Office Building Marion, IL | 2002 (D) | 2002 | 70 | 72,200 | 92 | Community Health Systems | |||||||

Santa Rosa Medical Office Building Milton, FL (Pensacola MSA) | 2003 (D) | 2003 | 100 | (4) | 36,700 | 100 | Health Management Associates | ||||||

River Oaks Professional Center Jackson, MS | 2003 (D) | 2003 | 100 | (4) | 45,700 | 100 | Health Management Associates | ||||||

Eagle Creek Medical Plaza Lexington, KY | 2003 (A) | 1982 / 1987 | 100 | 42,400 | 96 | Catholic Health Initiatives | |||||||

Elgin Medical Office Building II Elgin, IL (Chicago MSA) | 2003 (A) | 2001 | 100 | 45,900 | 91 | Provena Health | |||||||

Elgin Medical Office Building I Elgin, IL (Chicago MSA) | 2003 (A) | 1997 | 100 | 44,400 | 98 | Provena Health | |||||||

Provena Mercy Professional Office Building Aurora, IL (Chicago MSA) | 2003 (A) | 1985 | 100 | 26,800 | 96 | Provena Health | |||||||

Recently Developed/Under Construction Properties (5) | |||||||||||||

NASA Parkway Medical Office Building Nassau Bay, TX (Houston MSA) | Jun. 2003 (D) | 2003 | 88 | %(6) | 48,200 | 69 | % | Christus Health Systems | |||||

St. Joseph East Office Park Lexington, KY | Sept. 2003 (D) | 2003 | 95 | (6) | 73,600 | 68 | Catholic Health Initiatives | ||||||

Parker Adventist Professional Building Parker, CO (Denver MSA) | Jan. 2004 (D) | 2004 | 100 | (6) | 83,600 | 66 | Centura Health | ||||||

Brentwood Medical Center Walnut Creek, CA (San Francisco MSA) | Nov. 2004 (D)(7) | 2004 | 100 | (4)(6) | 104,500 | 85 | John Muir/Mt. Diablo Hospital System | ||||||

- (1)

- "MSA" means Metropolitan Statistical Area (source: U.S. Census Bureau, Population Division).

- (2)

- The properties are set forth on this table in chronological order. For properties we acquired, this is the year in which the acquisition closed. For properties we developed, this is the year in which a certificate of occupancy for the shell of the building was received or is expected to be received.

- (3)

- "Associated Healthcare System" refers to the healthcare system with which the sponsoring hospital is associated.

- (4)

- This property is subject to cash flow and/or capital proceeds participation arrangements with the hospital and/or our physician tenants. For a discussion of these arrangements, see "Our Business and Properties—Our Properties," beginning on page 62.

- (5)

- These buildings are currently under construction and have not received a certificate of occupancy or have had a certificate of occupancy for less than 12 months as of December 31, 2003.

- (6)

- Our current ownership interest in this property may be reduced as a result of the offering and sale of ownership interests in the property-owning entity to prospective physician tenants as an inducement to enter into long-term leases at the property or otherwise. For a more detailed discussion of this aspect of our leasing program, see "Our Business and Properties—Our Leases," beginning on page 74.

- (7)

- We cannot assure you that this project will be completed by November 2004.

Properties Under Agreement

DASCO has entered into agreements to develop five additional medical office buildings in which we will own an interest, and to acquire one additional medical office building, although we cannot

11

assure you that any of these transactions will be completed. The following table contains information about these medical office buildings as of May 12, 2004.

| Property Under Agreement (1) | Expected Year of Development (D)/ Acquisition (A)(2) | Year Built/ Renov. | On/Off Hospital Campus (3) | Estimated Rentable Sq. Ft. | Expected to be Subject to Ground Lease (4) | Associated Healthcare System (5) | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

Randall Road Carpentersville, IL (Chicago MSA) | 2004 (A) | 2000 | Off | 9,700 | N | Provena Health | ||||||

Lakeside Health Park (6) Omaha, NE | 2005 (D) | N/A | On | 97,000 | Y | Alegent Health | ||||||

Central Mississippi Medical Center II (7) Jackson, MS | 2005 (D) | N/A | On | 42,100 | Y | Health Management Associates | ||||||

Jefferson Regional Medical Center Pine Bluff, AR | 2005 (D) | N/A | On | 42,000 | Y | Jefferson Regional Medical Center | ||||||

St. Joseph Hospital (6) Towson, MD (Baltimore MSA) | 2005 (D) | N/A | On | 57,400 | Y | Catholic Health Initiatives | ||||||

Gateway Medical Center (6) Newburgh, IN | 2006 (D) | N/A | On | 76,800 | Y | Deaconess Health |

- (1)

- We cannot assure you that any of these transactions will be completed. "MSA" means Metropolitan Statistical Area (source: U.S. Census Bureau, Population Division).

- (2)

- The properties are set forth on this table in chronological order. For properties we acquired, this is the year the acquisition closed. For properties we developed, this is the year in which a certificate of occupancy for the shell of the building was received or is expected to be received.

- (3)

- "On hospital campus" includes buildings adjacent to a hospital campus.

- (4)

- For a description of various restrictions and limitations applicable to us that are contained in our ground leases with hospitals or healthcare systems, see "Our Business and Properties—Restrictions and Limitations in Our Ground Leases and Other Agreements with Hospitals," beginning on page 79.

- (5)

- "Associated Healthcare System" refers to the healthcare system with which the sponsoring hospital is associated.

- (6)

- In pre-leasing phase of development.

- (7)

- This property is 100% master leased by the sponsoring hospital for a 15-year term.

Restrictions on Ownership of Our Common Shares

Due to limitations on the concentration of ownership of REIT shares imposed by the Internal Revenue Code of 1986, which we refer to as the Internal Revenue Code, our declaration of trust generally prohibits any shareholder from actually or constructively owning more than 9.8% of our outstanding common shares. Our declaration of trust also prohibits other transfers and ownership of our shares if such transfer or ownership would otherwise jeopardize our status as a REIT under the Internal Revenue Code. Any purported acquisition of our common shares that, if effective, would result in a violation of this ownership limit or other ownership restrictions contained in our declaration of trust will be null and void and will result in automatic transfers of the affected common shares to a charitable trust and the prohibited transferee will not acquire any right or interest in the common shares transferred. Our board may, in its sole discretion, waive the ownership limits and restrictions with respect to a particular shareholder if, among other things, our board is presented with evidence satisfactory to it that the ownership will not then or in the future jeopardize our status as a REIT or subject us to tax.

12

Our Distribution Policy

To satisfy the requirements to qualify as a REIT, and to avoid paying tax on our income, we intend to make regular quarterly distributions of all, or substantially all, of our REIT taxable income (including capital gains) to holders of our common shares. Any future distributions we make will be at the discretion of our board of directors and will depend upon, among other things, our actual results of operations. See "Distribution Policy." Our actual results of operations and our ability to pay distributions will be affected by a number of factors, including our occupancy levels, the rental rates under our leases, the ability of our tenants to meet their rent payment obligations, our operating expenses, interest expense and unanticipated expenditures. For more information regarding risk factors that could have a materially adverse affect on our actual results of operations, see "Risk Factors," beginning on page 17.

Our Company History, Tax Status and Principal Office

We were formed as a Maryland real estate investment trust on March 8, 2004 to continue and expand the business of the DASCO group, which has been engaged in developing, acquiring, re-developing, owning, managing and leasing medical office buildings throughout the United States for more than ten years. Our principal executive office is located at 3399 PGA Boulevard, Suite 240, Palm Beach Gardens, FL 33410. Our telephone number is (561) 691-9900. Our web site address iswww.dascomed.com. The information on our web site does not constitute a part of this prospectus.

We intend to elect to be taxed as a REIT under the Internal Revenue Code in connection with the completion of this offering. Our qualification as a REIT depends upon our ability to meet on a continuing basis, through actual annual (or in some cases, quarterly) operating results, various complex requirements under the Internal Revenue Code relating to, among other things, the nature and sources of our gross income, the composition and values of our assets, our distribution levels and the diversity of ownership of our shares. We believe that we will be organized in conformity with the requirements for qualification and taxation as a REIT under the Internal Revenue Code, and that our intended manner of operation will enable our company to meet the requirements for taxation as a REIT for federal income tax purposes. In connection with our election to be taxed as a REIT, we anticipate we will have a fiscal year ending on December 31.

As a REIT, we generally will not be subject to federal income tax on REIT taxable income that we distribute currently to our shareholders. If we fail to qualify as a REIT in any taxable year, we will be subject to federal income tax at regular corporate rates. Even if we qualify for taxation as a REIT, we may be subject to some federal, state and local taxes on our income and property, and our taxable REIT subsidiaries will be subject to federal, state and local income tax.

13

Common shares offered | ||||

Common shares outstanding after this offering | (1) | |||

Common shares and operating partnership units outstanding after this offering | (1)(2) | |||

Use of proceeds | We estimate that our net cash proceeds from this offering will be approximately $ million based on an assumed initial public offering price of $ per share. We intend to use these net proceeds primarily: | |||

• | To purchase a portion of the interests of an affiliate of the lead underwriter of this offering, Lehman Brothers Inc., in DASCO and the property-owning entities, including the affiliate's accrued and unpaid preferred return on its investments in the properties; | |||

• | To prepay outstanding debt, including debt held by an affiliate of Lehman Brothers Inc. and an affiliate of James Heistand, and to pay related prepayment fees; | |||

• | To purchase a portion of the interests of affiliates of James Heistand in DASCO and the property-owning entities; | |||

• | To purchase one property that is under contract; and | |||

• | For general working capital purposes, including the development, acquisition and re-development of medical office buildings. | |||

Risk Factors | See "Risk Factors" beginning on page 17 and other information included in this prospectus for a discussion of factors that you should consider before investing in our common shares. | |||

Proposed New York Stock Exchange symbol | "DSC" | |||

- (1)

- Excludes common shares issuable upon exercise of the underwriters' over-allotment option.

- (2)

- Includes OP units expected to be issued in connection with our formation transactions that may, subject to specified limitations, be exchanged for cash or, at our option, our common shares on a one-for-one basis.

14

SUMMARY SELECTED FINANCIAL DATA

The following table sets forth certain financial data on a pro forma basis and on a historical combined basis for our predecessor. Pro forma operating data are presented for the year ended December 31, 2003 as if this offering and formation transactions had occurred on January 1, 2003, and pro forma balance sheet data are presented as if this offering and formation transactions had occurred on December 31, 2003. The pro forma data do not purport to represent what our actual financial position or results of operations would have been as of or for the period indicated, nor do they purport to represent any future financial position or results of operations for any future period.

Historical operating results, including net loss, may not be comparable to future operating results because of the historically greater leverage of our predecessor.

The following selected historical financial data as of December 31, 2003 and 2002 and for each of the years in the three-year period ended December 31, 2003 were derived from our audited financial statements contained elsewhere in this prospectus which have been audited by Ernst & Young LLP.

You should read the information below together with all of the financial statements and related notes and "Management's Discussion and Analysis of Financial Conditions and Results of Operations" included elsewhere in this prospectus.

| | Year Ended December 31, | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Pro forma 2003 | 2003 | 2002 | 2001 | |||||||||

| Operating Information: | |||||||||||||

| Revenue: | |||||||||||||

| Rental revenues | $ | 16,249,129 | $ | 14,628,947 | $ | 8,741,830 | $ | 2,932,705 | |||||

| Tenant reimbursements | 3,329,292 | 3,329,292 | 1,910,019 | 564,251 | |||||||||

| Other | 180,905 | 160,905 | 428,511 | 1,880,437 | |||||||||

| Total revenue | 19,759,326 | 18,119,144 | 11,080,360 | 5,377,393 | |||||||||

Expenses: | |||||||||||||

| Property operating expenses | 5,349,589 | 4,819,643 | 2,828,260 | 820,407 | |||||||||

| Operating income | 14,409,737 | 13,299,501 | 8,252,100 | 4,556,986 | |||||||||

General and administrative | 8,301,743 | 6,584,743 | 4,677,660 | 2,702,407 | |||||||||

| Depreciation and amortization | 5,285,010 | 4,015,354 | 2,236,786 | 828,022 | |||||||||

| Interest expense | 2,687,281 | 4,748,720 | 3,403,544 | 1,943,873 | |||||||||

Gain on sale of real estate properties | 90,915 | 90,915 | 218,887 | — | |||||||||

Deficit distributions to minority partners | (156,216 | ) | (156,216 | ) | — | — | |||||||

Minority interests | 426,441 | (70,614 | ) | (106,323 | ) | (157,913 | ) | ||||||

| Loss from continuing operations | $ | (1,503,157 | ) | (2,185,231 | ) | (1,953,326 | ) | (1,075,229 | ) | ||||

| Discontinued operations | 1,957,159 | (78,733 | ) | (35,111 | ) | ||||||||

| Net loss | $ | (228,072 | ) | $ | (2,032,059 | ) | $ | (1,110,340 | ) | ||||

| Basic loss per share | $ | (0.22 | ) | ||||||||||

| Diluted loss per share | $ | (0.22 | ) | ||||||||||

15

| | As of or for the Year Ended December 31, | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Pro forma 2003 | 2003 | 2002 | 2001 | ||||||||||

| Balance Sheet Information: | ||||||||||||||

| Real estate properties, net | $ | 120,215,646 | $ | 117,515,646 | $ | 78,680,904 | $ | 36,817,817 | ||||||

| Cash and cash equivalents(1) | 51,226,221 | 9,802,450 | 6,505,335 | 7,630,989 | ||||||||||

| Total assets | 189,898,227 | 147,697,188 | 105,698,242 | 56,499,977 | ||||||||||

| Mortgage notes payable | 71,543,594 | 118,291,108 | 74,268,395 | 35,978,471 | ||||||||||

| Total liabilities | 83,085,121 | 141,350,268 | 95,032,451 | 52,704,348 | ||||||||||

| Minority interests | 25,829,797 | 1,496,733 | 1,562,209 | 18,593 | ||||||||||

| Shareholders' equity/owners' equity | 80,983,309 | 4,850,187 | 9,103,582 | 3,777,036 | ||||||||||

| Total liabilities and shareholders' equity/owners' equity | $ | 189,898,227 | $ | 147,697,188 | $ | 105,698,242 | $ | 56,499,977 | ||||||

| Other Information: | ||||||||||||||

| Cash flow: | ||||||||||||||

| Provided by (used in) operating activities | $ | 755,148 | $ | (4,064,060 | ) | $ | 5,789,245 | |||||||

| Used in investing activities | (37,233,568 | ) | (41,986,916 | ) | (28,857,318 | ) | ||||||||

| Provided by financing activities | 36,758,170 | 49,190,666 | 24,999,183 | |||||||||||

| Funds From Operations(2) | $ | 2,043,567 | 1,089,040 | (508,351 | ) | (668,179 | ) | |||||||

| Operating properties at end of year: | ||||||||||||||

| Number of properties | 27 | 26 | 20 | 7 | ||||||||||

| Rentable square feet | 1,248,000 | 1,238,600 | 951,900 | 411,500 | ||||||||||

| Properties under development at end of year: | ||||||||||||||

| Number of properties | 2 | 2 | 4 | 3 | ||||||||||

| Rentable square feet | 188,100 | 188,100 | 204,200 | 131,400 | ||||||||||

- (1)

- Includes restricted cash.

- (2)

- Funds from Operations, which we refer to as FFO, is a widely used performance measure for real estate companies and is provided here as a supplemental measure of operating performance. We calculate FFO in accordance with the best practices described in the April 2002 National Policy Bulletin of the National Association of Real Estate Investment Trusts, which we refer to as NAREIT. This National Policy Bulletin, which we refer to as the White Paper, defines FFO as net income (computed in accordance with generally accepted accounting principles, or GAAP), excluding gains (or losses) from sales of property, plus depreciation and amortization, and after adjustments for unconsolidated partnerships and joint ventures.

Given the nature of our business as a real estate owner, developer and operator, we believe that FFO is helpful to investors as a starting point in measuring our operational performance because it excludes various items included in net income that do not relate to or are not indicative of our operating performance such as gains (or losses) from sales of property and depreciation and amortization, which can make periodic and peer analyses of operating performance more difficult. FFO should not be considered as an alternative to net income (determined in accordance with GAAP) as an indicator of our financial performance, is not an alternative to cash flow from operating activities (determined in accordance with GAAP) as a measure of our liquidity, and is not indicative of funds available to fund our cash needs, including our ability to make distributions to shareholders. Our computation of FFO may not be comparable to FFO reported by other REITs that do not define the term in accordance with the current NAREIT definition or that interpret the current NAREIT definition differently than we do. The following table presents a reconciliation of our net loss to our FFO for the periods presented:

| | Year Ended December 31, | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Pro forma 2003 | 2003 | 2002 | 2001 | ||||||||||

| Reconciliation of FFO | ||||||||||||||

| Net loss | $ | (1,503,157 | ) | $ | (228,072 | ) | $ | (2,032,059 | ) | $ | (1,110,340 | ) | ||

| Plus depreciation | 2,749,283 | 2,422,763 | 1,286,264 | 411,091 | ||||||||||

| Plus amortization of intangible tenant origination costs | 888,356 | 732,568 | 414,469 | — | ||||||||||

| Plus depreciation of unconsolidated subsidiaries | — | 52,134 | 8,715 | — | ||||||||||

| Less gains from sales of real estate properties | (90,915 | ) | (1,958,904 | ) | (218,887 | ) | — | |||||||

| Plus depreciation included in discontinued operations | — | 68,551 | 33,147 | 31,070 | ||||||||||

| FFO | $ | 2,043,567 | $ | 1,089,040 | $ | (508,351 | ) | $ | (668,179 | ) | ||||

16

Before you invest in our securities, you should carefully consider the following risks, together with the other information included in this prospectus. If any of the following risks actually occur, our business, financial condition or results of operations may suffer. As a result, the trading price of our common shares could decline, and you may lose all or part of your investment.

Risks Relating to Our Property/Business

Our portfolio consists exclusively of medical office buildings, making us more vulnerable to changes in economic and industry conditions than if our portfolio were more diversified across industry sectors.

Following this offering and the formation transactions, our portfolio will consist exclusively of medical office buildings. After this offering, we will continue to focus on developing, acquiring, re-developing, owning, managing and leasing medical office buildings. Our focus on medical office buildings subjects us to the risk of a downturn in the medical office industry, in the commercial real estate industry generally or in the healthcare industry generally. A downturn in the medical office industry or the commercial real estate industry generally could significantly and adversely affect the value of our buildings. In addition, a downturn in the healthcare industry could affect our tenants' ability to make lease payments to us or cause the failure of one or more hospitals or the medical practice of some of their staff physicians who lease space in our medical office buildings, which might result in increased vacancies in our buildings. These events, in turn, might adversely affect our ability to make distributions to our shareholders.

As leases expire, we may be unable to renew them or re-let the space without significant capital improvements or at all, which could harm our business and operating results.

Most of our income will be derived from rent payments from our tenants which will provide us the cash to make distributions to our shareholders. We cannot predict whether existing leases in our medical office buildings will be renewed at the end of their lease terms. If these leases are not renewed, we will need to find other tenants for that space.

In addition, failure on the part of a tenant to comply with its lease obligations, including the failure to make rent payments, generally would give us the right to terminate the lease, repossess the applicable space and enforce the payment obligations under the lease. However, we would then be required to find other tenants for that space.

We cannot assure you that we will be able to renew leases or re-let space on terms favorable to us or at all. Failure to renew leases or re-let space on favorable terms could harm our business and operating results. In many cases, we are not permitted under our agreements with a sponsoring hospital, except in very limited circumstances, to lease space in a medical office building to tenants other than physicians who are members in good standing of the hospital's staff, who must use the space for their medical practices. Because many of our medical office buildings are located on or adjacent to hospital campuses, even if we are permitted to re-let space to other types of tenants, we cannot assure you that general office tenants or other tenants would be interested in leasing the space on terms favorable to us or at all. Further, we may be required to make significant capital expenditures to renovate or re-configure space to attract new tenants. Undertaking significant capital expenditures could harm our operating results.

Many of our ground leases and other agreements with hospitals effectively limit our control over various aspects of the operation of the applicable building, restrict our ability to transfer the building and allow the hospital to repurchase the building in specified circumstances.

We often develop or acquire medical office buildings subject to restrictions or limitations contained in ground leases or other agreements with hospitals, and we intend to continue to do so in the future.

17

In many cases, we are not permitted under these agreements, except in very limited circumstances, to lease space in the medical office building to tenants other than physicians and in many cases, to tenants other than physicians who are members in good standing of that hospital's staff, for their medical practices. In many of these agreements, the types of permitted medical practices are restricted to those that do not compete with the hospital, and in some cases, further restricted to those that do not violate specified religious standards. In addition, in most cases, we cannot, except in very limited circumstances, transfer our interests in the medical office building without the consent of the hospital. Moreover, in some cases, the hospital has the right to acquire our interests in the medical office building or our existing ground leases in specified circumstances, such as if we elect to seek the hospital's consent to a transfer of our interests in the building to a third party. Further, in some cases, the hospital has a right to repurchase the medical office building on or after specified dates, or in specified circumstances, at its then current fair market value. In the case of our Brentwood property, when the hospital first has the right to repurchase the building, the purchase price is a fixed price that may be below fair market value at that time. These provisions limit our ability to control and transfer our interests in the building.

We face significant competition for the development and acquisition of medical office buildings, which may impede our ability to develop or acquire medical office buildings in the future or may increase the cost of these transactions.

We encounter significant competition for developments and acquisitions of medical office buildings from private investors, healthcare providers (including physicians and physician practice groups), healthcare-related REITs, real estate partnerships, and numerous local, regional and national developers, owners and financial institutions. Many of our competitors may have substantially greater financial and other resources than we have, and some may have stronger relationships than we have with healthcare systems, hospitals, lenders, general contractors, architects, real estate brokers, advisors and consultants. We intend to adhere to our development and acquisition strategies and criteria. However, increased competition, including from other publicly-traded REITs, may adversely affect our ability to develop or acquire medical office buildings and may increase the price we are required to pay for acquisitions or the concessions we are required to grant to secure development opportunities, which may in turn have an adverse affect on our revenues and earnings.

Our medical office buildings, their sponsoring hospitals and our tenants may be unable to compete successfully.