OMB APPROVAL

OMB Number: 3235-0570

Expires: July 31, 2022

Estimated average burden hours per response...20.3

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21582

Madison Covered Call & Equity Strategy Fund

(Exact name of registrant as specified in charter)

550 Science Drive, Madison, WI 53711

(Address of principal executive offices)(Zip code)

Steven J. Fredricks

Madison Legal and Compliance Department

550 Science Drive

Madison, WI 53711

(Name and address of agent for service)

Registrant's telephone number, including area code: 608-274-0300

Date of fiscal year end: December 31

Date of reporting period: December 31, 2022

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. s 3507.

Item 1. Report to Shareholders.

| | MADISON COVERED CALL & EQUITY STRATEGY FUND (MCN) |

| | |

| | Active Equity Management combined |

| | with a Covered Call Option Strategy |

MCN | Madison Covered Call & Equity Strategy Fund | December 31, 2022

Table of Contents

MCN | Madison Covered Call & Equity Strategy Fund | Management’s Discussion of Fund Performance - continued | December 31, 2022

Management’s Discussion of Fund Performance (unaudited)

Covered Call strategies, by their nature, are defensive. They are structured to knowingly sacrifice a portion of upside growth potential in order to provide additional downside protection. The Madison Covered Call & Equity Strategy Fund pursues these strategies by owning a very high quality portfolio of individual equities and selling equity call options on the portfolio holdings. The Fund provides a total return platform which seeks capital appreciation and a high distribution rate which is primarily sourced from selling call options and realizing capital gains on the underlying portfolio. It is a relatively concentrated, actively managed portfolio providing a defensive way to participate in U.S. equity markets.

Port in a Storm

By most measures, 2022 was an extremely stormy year for investors. U.S. stocks were hammered to the tune of -18.1% on the S&P 500© index while the technology-laden NASDAQ Composite Index fell 32%. Bonds were not much better with the return on the U.S. 10 year Treasury coming in at -16.5%, its worst return in almost a century. As a result, a 60/40 portfolio (S&P 500/ 10-year Treasury) carded a -17.5% return, worst since 1931. It wasn’t pretty and there were very few places to hide. We are extremely proud to have been one of those few ports in the storm. The Madison Covered Call & Equity Strategy Fund not only offered protection but gained ground on both a net asset value (NAV) basis and market value basis.

Overall, areas of relative strength were few and far between in 2022. Most agricultural commodities were higher during the year. Many industrial metals were also higher, although copper and aluminum fell sharply in the second half as China aggressively shut down on Covid concerns. Gold was flat while the U.S. dollar was a beacon of strength, rising 8% against a basket of major currencies. Oil (WTI) was up 7% but swung wildly, starting the year at $75 per barrel, rising above $123 following the Russian invasion of Ukraine and then settling back to $80 at end the year. Within the S&P 500, the Energy sector was the star, rising 65% while the only other positive sector was Utilities, up 1.6%. The Technology, Consumer Discretionary and Communication Services sectors fell 28.2%, 37% and 39.9%, respectively. These lagging sectors typified the weakness of the prior leaders, mega-cap growth stocks. The NYSE Fang+ Index which houses these titans fell 40%. Also, several bubbles deflated in 2022 including money supply growth, crypto currencies, SPACs and used car prices with more likely to come in 2023.

The focus in 2022 for investors was rising inflation and rising interest rates. The X factor is whether the Fed can combat inflation by raising rates without plunging the economy into a deep recession. During the year, the Fed raised rates 7 times, moving the rate on reserve balances from 0.1% to 4.4% … the most aggressive move since the early 1980’s. The average 30-year fixed mortgage rate rose above 7% for the 1st time in over 20 years before retreating at year end to 6.4%. Housing affordability is at record lows and if mortgage rates remain elevated, house prices are likely to correct. The yield on the 10-year treasury bond rose from 1.5% to 3.9% and was a catalyst for significant price to earnings multiple contraction throughout the year in equity markets.

Back in 2021, the S&P 500’s top performing sector was Energy with a 54.4% return in a very robust overall market. In 2022, with the market in decline, the Energy sector led again with an even higher return. The performance differential between Energy and the worst performing sector, Communication Services which includes Alphabet, Meta (Facebook), Disney, Verizon etc, was an astounding 105%. We have been over-weighted in the Energy sector for many years and did suffer when large cap growth companies led the market. However, our patience has been rewarded over the past two years. Our view has not wavered. Demand for petroleum products will continue to grow even if we have a recession unless it is a very severe one. Supply growth will remain curtailed globally as companies maintain capital discipline and fewer meaningful discoveries occur. The industry has suffered from

MCN | Madison Covered Call & Equity Strategy Fund | Management’s Discussion of Fund Performance - continued | December 31, 2022

underinvestment for many years and will struggle to meet continued global demand growth. Companies within the sector exhibit many of the qualities that we like such as high free cashflow generation, strong balance sheets, increasing dividends and stock buybacks. Even if oil prices don’t move higher, companies are extremely profitable in the current environment and barring a very deep recession or another Covid-like experience which eliminated demand, prices, while volatile, are more likely to rise than fall.

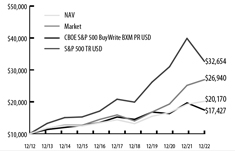

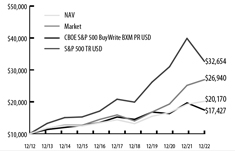

Cumulative Performance of $10,000 Investment

| Average Annual Total Return (%) through December 31, 2022* |

| | | 1 yr | | | 5 yr | | | 10 yr | |

| NAV | | | 4.90 | % | | | 7.00 | % | | | 7.27 | % |

| Market | | | 7.12 | % | | | 11.14 | % | | | 10.42 | % |

| S&P 500 TR USD | | | -18.11 | % | | | 9.42 | % | | | 12.56 | % |

| CBOE S&P 500 BuyWrite BXM PR USD | | | -11.37 | % | | | 2.73 | % | | | 5.71 | % |

| *The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the sale of fund shares. Past performance is not predictive of future results. |

Corporate earnings continue to remain on thin ice. The massive money supply growth post-Covid ramped up inflation which showed up in corporate revenue growth and companies with good operating leverage succeeded in growing earnings impressively. We are now on the other side of that phenomenon with money supply growth that has shrunk in record fashion. Corporate revenue growth is now faltering and with inflation remaining sticky, profit margins are getting hit. Cost cutting efforts are now in full swing as we see large layoff announcements on an almost daily basis. In our estimation, S&P 500 earnings estimates are still too high despite trending lower in the 2nd half of the year. Over the coming quarters, we should get more clarity on the potential depth of a coming recession. For over a year, our view has been that we are at risk of a significant earnings decline and recession and now that view has become the consensus view. That concerns us as we are never very comfortable being part of the consensus. A comforting factor is that when we took this stance, the consensus wasn’t with us. Now it appears that where the consensus is likely to be wrong is in its underestimation of the depth of a recession. As such, we lean to continue to be very defensive and watch our energy exposure very closely.

We believe that remaining in port is still the most comfortable place to be. The storm hasn’t fully passed on …. we may not have even seen the worst of it yet.

How did the Fund perform given the marketplace conditions during 2022?

With most of the market decline occurring in the first half of the year, the second half performance was flattish but notably volatile, rising on hopes of a Federal Reserve pivot and falling as those hopes waned. In the 4th quarter, the market rallied early but sold off in December. The Fund outperformed the S&P 500 and the CBOE S&P 500 Buy-Write Index (BXM) in each quarter. Over the full year, the Fund NAV gained 4. 90% and on a stock price basis, the Fund rose 7.12% compared to the S&P 500’s -18.1% decline and the BXM’s -11.4% fall. The market declined immediately after the year began and continued lower through the first half of the year with only a minor attempt at recovering in late March. Over this period, the Fund consistently outperformed as the market moved lower. Through the July to mid-August period, the market attempted to rebound on hopes that the Federal Reserve would pivot from its rate hiking and quantitative tightening stance, thus potentially fueling a new bull market. During this short market bounce, the Fund underperformed. Once it became evident that the Fed was steadfast in its inflation fighting stance, the market resumed its downturn and the Fund returned to outperforming. The fourth quarter of the year began with a strong rally in October which lasted through mid-December but unlike a similar

MCN | Madison Covered Call & Equity Strategy Fund | Management’s Discussion of Fund Performance - continued | December 31, 2022

year-end rally in 2021 which was dominated by mega cap growth stocks, this rally was led by cyclical companies including those in the Energy sector. Mega cap growth stocks continued to lag despite the strong move upward in the overall market. As the Fund has been underweighted in the mega cap area, it was able to strongly outperform the S&P 500™ despite its upward momentum.

Over the full year, stock selection was the primary driver of the Fund’s excellent returns while sector allocation was also positive. The Fund’s cash allocation and call option coverage were also very additive to returns given the downward trend of the market. The Fund came into the year with a tilt toward cyclical and commodity-based companies and less exposure to the higher flying and expensive Technology and Communication Services sectors. This gave the Fund a decidedly value oriented tilt which benefited from the very strong outperformance of value stocks relative to growth stocks. We expect this trend to continue into 2023 but we are prepared to move to a more balanced approach once the market environment allows. The Fund remained very defensively postured throughout the year with high call option coverage and elevated cash levels. Cash acts as an added downward hedge and is redeployed on an opportunistic basis.

As noted above, stock selection over the full year was a very strong positive contributor to overall performance. Over the full period, 54% of the Fund’s holdings managed positive returns in a severely down-trending market. Clearly, with the Energy sector up over 60%, the Fund enjoyed very strong results from its individual energy holdings led by Apache, Transocean, EOG Resources and Range Resources. However, despite the weakness in the overall market, many non-energy companies also contributed strongly. Among the larger contributors were T-Mobile, Las Vegas Sands, Archer Daniels and Midland, Air Products and Chemicals and utility companies. Weaker performers included Medtronic, PayPal, CME Group, and Newmont Mining.

Sector allocation was accretive to performance relative to the S&P 500. The most significant positive was our continued overweighting of the Energy sector which remains a favored area given the strong fundamentals of the commodity and the historically strong fundamentals of many of the companies within the sector. Underweighting the Consumer Discretionary sector was also a positive contributor as the sector declined 37% during the year. The Fund was underweighted in defensive sectors such as Consumer Staples and Health Care as high valuation levels made it difficult to find attractive defensive companies at reasonable prices.

Describe the fund’s portfolio equity and option structure:

As of December 31, 2022, the Fund held 35 equity securities, an Electronic Exchange Traded Fund (ETF), and unexpired covered call options had been written against 82.6% of the Fund’s stock holdings. It is the strategy of the Fund to write “out-of-the-money” call options, and, as of December 31, 95% of the Fund’s call options (36 of 38 different options) remained “out-of-the-money”. (Out-of-the-money means the stock price is below the strike price at which the shares could be called away by the option holder.) On average, the call options in the Fund were 9.4% out-of-the-money at year end with an average time to expiration of 39.4 days.

Which sectors are prevalent in the fund?

From a sector perspective, MCN’s largest exposure as of December 31, 2022 was to the Information Technology sector, followed by Energy, Health Care and Financials. The most significant divergences from the sector weightings of the S&P 500 were over-weightings in the Energy and Materials sectors and under-weightings in the Information Technology, Industrials, Health Care and Consumer Staples sectors.

MCN | Madison Covered Call & Equity Strategy Fund | Management’s Discussion of Fund Performance - continued | December 31, 2022

| ALLOCATION AS A PERCENTAGE OF TOTAL INVESTMENTS AS OF 12/31/22 | | | |

| Communication Services | | | 6.1 | % |

| Consumer Discretionary | | | 7.6 | % |

| Consumer Staples | | | 2.3 | % |

| Energy | | | 14.1 | % |

| Exchange Traded Funds | | | 0.9 | % |

| Financials | | | 9.0 | % |

| Health Care | | | 9.3 | % |

| Industrials | | | 2.6 | % |

| Information Technology | | | 18.8 | % |

| Materials | | | 4.2 | % |

| Real Estate | | | 2.5 | % |

| Short Term Investment | | | 21.1 | % |

| Utilities | | | 1.5 | % |

Discuss the fund’s security and option selection process:

The Fund is managed by primarily focusing on active stock selection before adding the call option overlay utilizing individual equity call options rather than index options. We use fundamental analysis to select solid companies with good growth prospects and attractive valuations. We then seek attractive call options to write on those stocks. It is our belief that this partnership of active management of the equity and option strategies provides investors with an innovative, risk-moderated approach to equity investing. The fund’s portfolio managers seek to invest in a portfolio of common stocks that have favorable “PEG” ratios (Price-Earnings ratio to Growth rate) as well as financial strength and industry leadership. As bottom-up investors, we focus on the fundamental businesses of our companies. Our stock selection philosophy strays away from the “beat the street” mentality, as we seek companies that have sustainable competitive advantages, predictable cash flows, solid balance sheets and high-quality management teams. By concentrating on long-term prospects and circumventing the “instant gratification” school of thought, we believe we bring elements of consistency, stability and predictability to our shareholders.

Once we have selected attractive and solid names for the fund, we employ our call writing strategy. This procedure entails selling calls that are primarily out-of the-money, meaning that the strike price is higher than the common stock price, so that the fund can participate in some stock appreciation. By receiving option premiums, the fund receives a high level of investment income and adds an element of downside protection. Call options may be written over a number of time periods and at differing strike prices in an effort to maximize the protective value to the strategy and spread income evenly throughout the year.

Discuss how risk is managed through the fund’s investment process:

Risk management is a critical component of the investment manager’s overall philosophy and investment process. The primary means for managing risk are as follows:

1. Focus on the underlying security. The manager’s bottom-up stock selection process is geared toward investing in companies with very strong fundamentals including market leadership, balance sheet strength, attractive growth prospects, sustainable competitive advantages, predictable cash flows, and high-quality management teams. Purchasing such companies at attractive valuations is vital to providing an added margin of safety and the manager’s “growth-at-a-reasonable-price” (GARP) philosophy is specifically tuned to such valuation discipline.

2. Active covered call writing. The manager actively sells (writes) individual equity call options on equities that are owned by the fund. The specific characteristics of the call options ( strike price, expiration, degree of coverage) are dependent on the manager’s outlook on the underlying equity and/or general market conditions. If equity prices appear over-valued due to individual company strength or surging markets, the manager may choose to become more defensive with the fund’s option strategy by selling call options that are closer to the current equity market

MCN | Madison Covered Call & Equity Strategy Fund | Management’s Discussion of Fund Performance - continued | December 31, 2022

price, generating larger option premiums which would help defend against a market reversal. The manager may also sell call options on a greater percentage of the portfolio in an effort to provide for more downside protection. Following a market downturn, the manager may sell options further out of the money in order to allow the fund to benefit from a market recovery. In such an environment, the manager may also determine that a lesser percentage of the portfolio be covered by call options in order to more fully participate in market upside.

3. Cash management and timing. Generally, the manager believes that the fund should be fully invested under normal market conditions. A covered call strategy is rather unique relative to most equity portfolios as the short term nature of call options can lead to the assignment or sale of underlying stock positions on a fairly regular basis. As a result, the fund’s cash levels are likely to frequently fluctuate based on the characteristics of the call options and the market conditions. The thoughtful reinvestment of cash levels adds a layer of risk management to the investment process. This is most evident following a strong surge in equity prices above the strike prices of call options written against individual stocks in the fund (call options move in-the-money). This could lead to a larger than normal wave of stock sales via call option assignment which would increase the fund’s cash position following a period of very strong stock. Given the manager’s disciplined focus on purchasing underlying securities at appropriate valuation levels, the immediate reinvestment of cash may be delayed until market conditions and valuations become more attractive. If market conditions continue to surge for a period of time, the fund may underperform due to higher than normal cash levels, however, it is the manager’s belief that maintaining a strong valuation discipline will provide greater downside protection over a full market cycle.

What is the management’s outlook for the market and fund in 2023?

Historically, it is rare that the S&P 500 declines two years in succession. Since the Great Depression, it has only occurred 3 times, 1939-41, 1973-74 and 2000-03. It’s a little early to handicap 2023 with much precision but the path forward at least holds the potential for another down year ahead. Global PMI’s (Purchasing Managers Index) are leading indicators and very highly corelated to equity trends. They are weak and getting weaker. Central bank monetary tightening is still in place and likely getting tighter … interest rates higher for longer and the F ed is deleveraging its balance sheet. Banks are aggressively tightening lending standards. With Congress in gridlock, no major fiscal stimulus is coming to the rescue. The impact of this tightening has a lagged effect on the economy and should continue to weigh on markets and economic activity for the immediate future. It is likely as the economy weakens , unemployment will rise and the housing market will suffer. Only when housing bottoms can we truly see the embers of the next bull market. Corporate earnings estimates are very likely to revise lower and the environment is not conducive to valuations expanding.

While we hope for the best, we are tasked with preparing for the worst. We hope for better markets ahead but it likely will take longer than many currently expect for the storm clouds to clear. Until then, we will remain defensive and protect capital to the best of our ability. We accomplished that extremely well in 2022 and we remain focused on doing so in the future.

| TOP TEN EQUITY HOLDINGS AS OF 12/31/22 | | | |

| | | % of Total Investments | |

| Fiserv, Inc. | | | 4.2 | % |

| Las Vegas Sands Corp. | | | 4.0 | % |

| APA Corp. | | | 3.6 | % |

| Baker Hughes Co. | | | 3.4 | % |

| CVS Health Corp. | | | 3.0 | % |

| T-Mobile U.S., Inc. | | | 3.0 | % |

| Transocean Ltd. | | | 2.9 | % |

| JPMorgan Chase & Co. | | | 2.8 | % |

| Stryker Corp. | | | 2.8 | % |

| Visa, Inc. | | | 2.8 | % |

MCN | Madison Covered Call & Equity Strategy Fund | December 31, 2022

Portfolio of Investments

| | | Shares | | | Value (Note 2,3) | |

| COMMON STOCKS - 79.0% | | | | | | | | |

| Communication Services - 6.1% | | | | | | | | |

| Alphabet, Inc., Class C * (A) | | | 32,000 | | | $ | 2,839,360 | |

| Comcast Corp., Class A | | | 31,500 | | | | 1,101,555 | |

| Lumen Technologies, Inc. | | | 124,000 | | | | 647,280 | |

| T-Mobile U.S., Inc. * (A) | | | 32,000 | | | | 4,480,000 | |

| | | | | | | | 9,068,195 | |

| | | | | | | | | |

| Consumer Discretionary - 7.7% | | | | | | | | |

| Amazon.com, Inc. * (A) | | | 34,000 | | | | 2,856,000 | |

| Las Vegas Sands Corp. * (A) | | | 124,000 | | | | 5,960,680 | |

| Nordstrom, Inc. (A) (B) | | | 156,000 | | | | 2,517,840 | |

| | | | | | | | 11,334,520 | |

| | | | | | | | | |

| Consumer Staples - 2.4% | | | | | | | | |

| Constellation Brands, Inc., Class A (A) | | | 15,000 | | | | 3,476,250 | |

| | | | | | | | | |

| Energy - 14.3% | | | | | | | | |

| APA Corp. (A) | | | 117,000 | | | | 5,461,560 | |

| Baker Hughes Co. (A) | | | 171,000 | | | | 5,049,630 | |

| Diamondback Energy, Inc. (A) | | | 20,500 | | | | 2,803,990 | |

| EOG Resources, Inc. (A) | | | 16,000 | | | | 2,072,320 | |

| EQT Corp. (A) | | | 45,000 | | | | 1,522,350 | |

| Transocean Ltd. * | | | 940,000 | | | | 4,286,400 | |

| | | | | | | | 21,196,250 | |

| | | | | | | | | |

| Financials - 9.1% | | | | | | | | |

| BlackRock, Inc. (A) | | | 5,700 | | | | 4,039,191 | |

| CME Group, Inc. (A) | | | 18,000 | | | | 3,026,880 | |

| JPMorgan Chase & Co. (A) | | | 31,700 | | | | 4,250,970 | |

| Morgan Stanley (A) | | | 26,000 | | | | 2,210,520 | |

| | | | | | | | 13,527,561 | |

| | | | | | | | | |

| Health Care - 9.4% | | | | | | | | |

| CVS Health Corp. (A) | | | 48,500 | | | | 4,519,715 | |

| Danaher Corp. (A) | | | 9,000 | | | | 2,388,780 | |

| Medtronic PLC (A) | | | 37,300 | | | | 2,898,956 | |

| Stryker Corp. (A) | | | 17,000 | | | | 4,156,330 | |

| | | | | | | | 13,963,781 | |

| | | | | | | | | |

| Industrials - 2.6% | | | | | | | | |

| 3M Co. (A) | | | 12,500 | | | | 1,499,000 | |

| FedEx Corp. (A) | | | 13,700 | | | | 2,372,840 | |

| | | | | | | | 3,871,840 | |

| | | | | | | | | |

| Information Technology - 19.0% | | | | | | | | |

| Adobe, Inc. * (A) | | | 12,100 | | | | 4,072,013 | |

| Analog Devices, Inc. (A) | | | 23,000 | | | | 3,772,690 | |

| Ciena Corp. * (A) | | | 47,000 | | | | 2,396,060 | |

| Fiserv, Inc. * (A) | | | 62,000 | | | | 6,266,340 | |

| Microsoft Corp. (A) | | | 15,000 | | | | 3,597,300 | |

| PayPal Holdings, Inc. * | | | 53,800 | | | | 3,831,636 | |

| Visa, Inc., Class A (A) | | | 20,500 | | | | 4,259,080 | |

| | | | | | | | 28,195,119 | |

| | | | | | | | | |

| Materials - 4.2% | | | | | | | | |

| Barrick Gold Corp. | | | 233,500 | | | | 4,011,530 | |

| Newmont Corp. (A) | | | 47,000 | | | | 2,218,400 | |

| | | | | | | | 6,229,930 | |

| | | Shares | | | Value (Note 2,3) | |

| Real Estate - 2.6% | | | | | | | | |

| American Tower Corp., REIT (A) | | | 18,000 | | | $ | 3,813,480 | |

| | | | | | | | | |

| Utilities - 1.6% | | | | | | | | |

| AES Corp. (A) | | | 80,000 | | | | 2,300,800 | |

| | | | | | | | | |

| Total Common Stocks | | | | | | | | |

| ( Cost $142,187,195 ) | | | | | | | 116,977,726 | |

| | | | | | | | | |

| EXCHANGE TRADED FUNDS- 0.9% | | | | | | | | |

| | | | | | | | | |

| VanEck Gold Miners ETF (B) | | | 46,900 | | | | 1,344,154 | |

| | | | | | | | | |

| Total Exchange Traded Funds | | | | | | | | |

| ( Cost $1,833,807 ) | | | | | | | 1,344,154 | |

| | | | | | | | | |

| SHORT-TERM INVESTMENTS - 21.3% | | | | | | | | |

| State Street Institutional U.S. | | | | | | | | |

| Government Money Market Fund, | | | | | | | | |

| Premier Class, (D), 4.11% | | | 31,480,003 | | | | 31,480,003 | |

| | | | | | | | | |

| State Street Navigator Securities | | | | | | | | |

| Lending Government Money Market | | | | | | | | |

| Portfolio, (C) (D), 4.34% | | | 118,000 | | | | 118,000 | |

| | | | | | | | | |

| Total Short-Term Investments | | | | | | | | |

| ( Cost $31,598,003 ) | | | | | | | 31,598,003 | |

| | | | | | | | | |

| TOTAL INVESTMENTS - 101.2% | | | | | | | | |

| (Cost $175,619,005** ) | | | | | | | 149,919,883 | |

| | | | | | | | | |

| TOTAL OPTIONS WRITTEN - (1.2%) | | | | | | | (1,742,440 | ) |

| | | | | | | | | |

| NET OTHER ASSETS AND LIABILITIES – (0.0)% | | | | | | | (21,421 | ) |

| | | | | | | | | |

| TOTAL NET ASSETS - 100.0% | | | | | | $ | 148,156,022 | |

| * | | Non-income producing. |

| | | |

| ** | | Aggregate cost for Federal tax purposes was $176,124,515. |

| | | |

| (A) | | All or a portion of these securities’ positions, with a value of $103,099,325, represent covers (directly or through conversion rights) for outstanding options written. |

| | | |

| (B) | | All or a portion of these securities, with an aggregate fair value of $792,673, are on loan as part of a securities lending program. See footnote (C) and Note 5 for details on the securities lending program. |

| | | |

| (C) | | Represents investments of cash collateral received in connection with securities lending. |

| | | |

| (D) | | 7-day yield. |

| | | |

| ETF | | Exchange Traded Fund. |

| | | |

| PLC | | Public Limited Company. |

| | | |

| REIT | | Real Estate Investment Trust. |

See accompanying Notes to Financial Statements.

MCN | Madison Covered Call & Equity Strategy Fund | Portfolio of Investments - concluded | December 31, 2022

Written Option Contracts Outstanding at December 31, 2022

| Description | | Exercise

Price | | | Expiration

Date | | Number

of

Contracts | | | Notional

Amount | | | Market

Value | | | Premiums

Paid

(Received) | | | Unrealized

Appreciation

(Depreciation) | |

| Call Options Written | | | | | | | | | | | | | | | | | | | | |

| 3M Co. | | $ | 130.00 | | | 1/20/23 | | | (125 | ) | | $ | (1,625,000 | ) | | $ | (3,437 | ) | | $ | (31,876 | ) | | $ | 28,439 | |

| Adobe, Inc. | | | 355.00 | | | 1/20/23 | | | (121 | ) | | | (4,295,500 | ) | | | (57,173 | ) | | | (117,259 | ) | | | 60,086 | |

| AES Corp. | | | 30.00 | | | 2/17/23 | | | (800 | ) | | | (2,400,000 | ) | | | (54,000 | ) | | | (59,200 | ) | | | 5,200 | |

| Alphabet, Inc., Class C | | | 100.00 | | | 2/17/23 | | | (320 | ) | | | (3,200,000 | ) | | | (44,320 | ) | | | (57,570 | ) | | | 13,250 | |

| Amazon.com, Inc. | | | 100.00 | | | 2/17/23 | | | (340 | ) | | | (3,400,000 | ) | | | (46,920 | ) | | | (73,709 | ) | | | 26,789 | |

| American Tower Corp., REIT | | | 230.00 | | | 1/20/23 | | | (140 | ) | | | (3,220,000 | ) | | | (12,950 | ) | | | (68,947 | ) | | | 55,997 | |

| American Tower Corp., REIT | | | 220.00 | | | 2/17/23 | | | (40 | ) | | | (880,000 | ) | | | (26,600 | ) | | | (21,559 | ) | | | (5,041 | ) |

| Analog Devices, Inc. | | | 175.00 | | | 2/17/23 | | | (230 | ) | | | (4,025,000 | ) | | | (90,850 | ) | | | (111,953 | ) | | | 21,103 | |

| APA Corp. | | | 52.50 | | | 1/20/23 | | | (585 | ) | | | (3,071,250 | ) | | | (23,985 | ) | | | (105,667 | ) | | | 81,682 | |

| APA Corp. | | | 52.50 | | | 2/17/23 | | | (585 | ) | | | (3,071,250 | ) | | | (81,023 | ) | | | (72,528 | ) | | | (8,495 | ) |

| Baker Hughes Co. | | | 32.00 | | | 1/20/23 | | | (59 | ) | | | (188,800 | ) | | | (1,622 | ) | | | (7,315 | ) | | | 5,693 | |

| Baker Hughes Co. | | | 35.00 | | | 1/20/23 | | | (855 | ) | | | (2,992,500 | ) | | | — | | | | (74,703 | ) | | | 74,703 | |

| BlackRock, Inc. | | | 750.00 | | | 2/17/23 | | | (57 | ) | | | (4,275,000 | ) | | | (105,735 | ) | | | (108,255 | ) | | | 2,520 | |

| Ciena Corp. | | | 50.00 | | | 1/20/23 | | | (250 | ) | | | (1,250,000 | ) | | | (52,500 | ) | | | (28,492 | ) | | | (24,008 | ) |

| Ciena Corp. | | | 50.00 | | | 2/17/23 | | | (220 | ) | | | (1,100,000 | ) | | | (70,400 | ) | | | (44,879 | ) | | | (25,521 | ) |

| CME Group, Inc. | | | 185.00 | | | 1/20/23 | | | (17 | ) | | | (314,500 | ) | | | (297 | ) | | | (3,723 | ) | | | 3,426 | |

| CME Group, Inc. | | | 180.00 | | | 3/17/23 | | | (163 | ) | | | (2,934,000 | ) | | | (48,085 | ) | | | (41,980 | ) | | | (6,105 | ) |

| Constellation Brands, Inc. | | | 240.00 | | | 1/20/23 | | | (150 | ) | | | (3,600,000 | ) | | | (39,375 | ) | | | (74,845 | ) | | | 35,470 | |

| CVS Health Corp. | | | 100.00 | | | 2/17/23 | | | (485 | ) | | | (4,850,000 | ) | | | (47,530 | ) | | | (98,921 | ) | | | 51,391 | |

| Danaher Corp. | | | 270.00 | | | 2/17/23 | | | (90 | ) | | | (2,430,000 | ) | | | (99,900 | ) | | | (67,409 | ) | | | (32,491 | ) |

| Diamondback Energy, Inc. | | | 145.00 | | | 2/17/23 | | | (205 | ) | | | (2,972,500 | ) | | | (98,400 | ) | | | (104,091 | ) | | | 5,691 | |

| EOG Resources, Inc. | | | 150.20 | | | 1/20/23 | | | (160 | ) | | | (2,403,200 | ) | | | (2,800 | ) | | | (80,241 | ) | | | 77,441 | |

| EQT Corp. | | | 40.00 | | | 2/17/23 | | | (450 | ) | | | (1,800,000 | ) | | | (33,750 | ) | | | (53,540 | ) | | | 19,790 | |

| FedEx Corp. | | | 185.00 | | | 1/20/23 | | | (137 | ) | | | (2,534,500 | ) | | | (18,906 | ) | | | (62,730 | ) | | | 43,824 | |

| Fiserv, Inc. | | | 110.00 | | | 2/17/23 | | | (446 | ) | | | (4,906,000 | ) | | | (62,440 | ) | | | (103,103 | ) | | | 40,663 | |

| Fiserv, Inc. | | | 110.00 | | | 3/17/23 | | | (174 | ) | | | (1,914,000 | ) | | | (39,150 | ) | | | (34,665 | ) | | | (4,485 | ) |

| JPMorgan Chase & Co. | | | 135.00 | | | 1/20/23 | | | (157 | ) | | | (2,119,500 | ) | | | (47,807 | ) | | | (55,585 | ) | | | 7,778 | |

| JPMorgan Chase & Co. | | | 140.00 | | | 1/20/23 | | | (160 | ) | | | (2,240,000 | ) | | | (20,160 | ) | | | (38,556 | ) | | | 18,396 | |

| Las Vegas Sands Corp. | | | 55.00 | | | 1/20/23 | | | (620 | ) | | | (3,410,000 | ) | | | (12,400 | ) | | | (68,193 | ) | | | 55,793 | |

| Las Vegas Sands Corp. | | | 55.00 | | | 3/17/23 | | | (620 | ) | | | (3,410,000 | ) | | | (103,540 | ) | | | (90,699 | ) | | | (12,841 | ) |

| Medtronic PLC | | | 82.50 | | | 3/17/23 | | | (190 | ) | | | (1,567,500 | ) | | | (39,615 | ) | | | (35,999 | ) | | | (3,616 | ) |

| Microsoft Corp. | | | 255.00 | | | 2/17/23 | | | (150 | ) | | | (3,825,000 | ) | | | (88,125 | ) | | | (114,595 | ) | | | 26,470 | |

| Morgan Stanley | | | 90.00 | | | 2/17/23 | | | (260 | ) | | | (2,340,000 | ) | | | (46,930 | ) | | | (58,819 | ) | | | 11,889 | |

| Newmont Corp. | | | 50.00 | | | 1/20/23 | | | (470 | ) | | | (2,350,000 | ) | | | (28,200 | ) | | | (66,335 | ) | | | 38,135 | |

| Nordstrom, Inc. | | | 25.00 | | | 1/20/23 | | | (565 | ) | | | (1,412,500 | ) | | | — | | | | (67,223 | ) | | | 67,223 | |

| Stryker Corp. | | | 250.00 | | | 1/20/23 | | | (170 | ) | | | (4,250,000 | ) | | | (68,000 | ) | | | (77,904 | ) | | | 9,904 | |

| T-Mobile U.S., Inc. | | | 150.00 | | | 2/17/23 | | | (320 | ) | | | (4,800,000 | ) | | | (81,440 | ) | | | (100,472 | ) | | | 19,032 | |

| Visa, Inc., Class A | | | 215.00 | | | 1/20/23 | | | (205 | ) | | | (4,407,500 | ) | | | (44,075 | ) | | | (60,164 | ) | | | 16,089 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total Call Options Written | | | | | | | | | | | | | | | | $ | (1,742,440 | ) | | $ | (2,543,704 | ) | | $ | 801,264 | |

| Total Options Written, at Value | | | | | | | | | | | | | | | | $ | (1,742,440 | ) | | $ | (2,543,704 | ) | | $ | 801,264 | |

See accompanying Notes to Financial Statements.

MCN | Madison Covered Call & Equity Strategy Fund | December 31, 2022

Statement of Assets and Liabilities as of December 31, 2022

| Assets: | | | |

| Investments in unaffiliated securities, at fair value†§ | | $ | 149,919,883 | |

| Receivables: | | | | |

| Fund shares issued for reinvestment | | | 65,767 | |

| Dividends and Interest | | | 165,198 | |

| Total assets | | | 150,150,848 | |

| Liabilities: | | | | |

| Payables: | | | | |

| Upon return of securities loaned | | | 118,000 | |

| Advisory agreement fees | | | 101,420 | |

| Administrative services agreement fees | | | 32,966 | |

| Options written, at value (premium received $2,543,704) | | | 1,742,440 | |

| Total liabilities | | | 1,994,826 | |

| Net assets | | $ | 148,156,022 | |

| | | | | |

| Net assets consist of: | | | | |

| Common Stock/Shares: | | | | |

| Paid-in capital in excess of par | | $ | 173,538,098 | |

| Accumulated distributable earnings (loss) | | | (25,382,076 | ) |

| Net Assets | | $ | 148,156,022 | |

| | | | | |

| Capital Shares Issued and Outstanding (Note 9) | | | 21,016,506 | |

| Net Asset Value per share | | $ | 7.05 | |

| | | | | |

| † Cost of Investments in unaffiliated securities | | $ | 175,619,005 | |

| § Fair Value of securities on loan | | $ | 792,673 | |

See accompanying Notes to Financial Statements.

MCN | Madison Covered Call & Equity Strategy Fund | December 31, 2022

Statement of Operations for the year ended December 31, 2022

| Investment Income: | | | |

| Interest | | $ | 381,884 | |

| Dividends | | | | |

| Unaffiliated issuers | | | 2,425,083 | |

| Less: Foreign taxes withheld/reclaimed | | | (22,804 | ) |

| Income from securities lending | | | 366 | |

| Total investment income | | | 2,784,529 | |

| Expenses (Note 4): | | | | |

| Advisory agreement fees | | | 1,197,831 | |

| Administrative services agreement fees | | | 389,295 | |

| Trustee fees | | | 37,000 | |

| Other expenses | | | 187 | |

| Total expenses | | | 1,624,313 | |

| Net Investment Income | | | 1,160,216 | |

| Net Realized and Unrealized Gain (loss) on Investments | | | | |

| Net realized gain (loss) on investments (including net realized gain (loss) on foreign currency related transactions) | | | | |

| Options purchased | | | 1,843,097 | |

| Options written | | | 6,446,380 | |

| Unaffiliated issuers | | | 5,036,089 | |

| Net change in unrealized appreciation (depreciation) on investments (including net unrealized appreciation (depreciation) on foreign currency related transactions) | | | | |

| Options purchased | | | 1,863,005 | |

| Options written | | | 68,936 | |

| Unaffiliated issuers | | | (9,609,853 | ) |

| Net Realized and Unrealized Gain on Investments | | | 5,647,654 | |

| Net Increase in Net Assets from Operations | | $ | 6,807,870 | |

See accompanying Notes to Financial Statements.

MCN | Madison Covered Call & Equity Strategy Fund | December 31, 2022

Statements of Changes in Net Assets

| Year Ended December 31, | | 2022 | | | 2021 | |

| Net Assets at beginning of period | | $ | 156,219,786 | | | $ | 148,475,062 | |

| Increase (decrease) in net assets from operations: | | | | | | | | |

| Net investment income | | | 1,160,216 | | | | 254,814 | |

| Net realized gain | | | 13,325,566 | | | | 13,277,772 | |

| Net change in unrealized appreciation (depreciation) | | | (7,677,912 | ) | | | 9,040,542 | |

| Net increase in net assets from operations | | | 6,807,870 | | | | 22,573,128 | |

| Distributions to shareholders from: | | | | | | | | |

| Accumulated earnings (combined net investment income and net realized gains) | | | (15,115,784 | ) | | | (12,559,719 | ) |

| Return of capital | | | – | | | | (2,532,497 | ) |

| Total distributions | | | (15,115,784 | ) | | | (15,092,216 | ) |

| Capital Stock transactions: | | | | | | | | |

| Newly issued to shareholders in reinvestment of distributions | | | 244,150 | | | | 263,812 | |

| Increase from capital stock transactions | | | 244,150 | | | | 263,812 | |

| Total increase (decrease) in net assets | | | (8,063,764 | ) | | | 7,744,724 | |

| Net Assets at end of period | | $ | 148,156,022 | | | $ | 156,219,786 | |

| | | | | | | | | |

| Capital Share transactions: | | | | | | | | |

| Newly issued shares reinvested | | | 34,956 | | | | 34,626 | |

| Increase from capital shares transactions | | | 34,956 | | | | 34,626 | |

See accompanying Notes to Financial Statements.

MCN | Madison Covered Call & Equity Strategy Fund | December 31, 2022

Financial Highlights for a Share of Beneficial Interest Outstanding

| | | Year Ended December 31, | |

| | | 2022 | | | 2021 | | | 2020 | | | 2019 | | | 2018 | |

| Net Asset Value at beginning of period | | $ | 7.45 | | | $ | 7.09 | | | $ | 7.35 | | | $ | 6.91 | | | $ | 8.27 | |

| Income from Investment Operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.06 | | | | 0.01 | | | | 0.04 | | | | 0.08 | | | | 0.10 | |

| Net realized and unrealized gain (loss) on investments | | | 0.26 | | | | 1.07 | | | | 0.42 | | | | 1.08 | | | | (0.74 | ) |

| Total from investment operations | | | 0.32 | | | | 1.08 | | | | 0.46 | | | | 1.16 | | | | (0.64 | ) |

| Less Distributions From: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.65 | ) | | | (0.60 | ) | | | (0.50 | ) | | | (0.47 | ) | | | (0.51 | ) |

Capital gains | | | (0.07 | ) | | | - | | | | - | | | | - | | | | - | |

| Return of Capital | | | – | | | | (0.12 | ) | | | (0.22 | ) | | | (0.25 | ) | | | (0.21 | ) |

| Total distributions | | | (0.72 | ) | | | (0.72 | ) | | | (0.72 | ) | | | (0.72 | ) | | | (0.72 | ) |

| Net increase (decrease) in net asset value | | | (0.40 | ) | | | 0.36 | | | | (0.26 | ) | | | 0.44 | | | | (1.36 | ) |

| Net Asset Value at end of period | | $ | 7.05 | | | $ | 7.45 | | | $ | 7.09 | | | $ | 7.35 | | | $ | 6.91 | |

| Market Value at end of period | | $ | 7.75 | | | $ | 8.02 | | | $ | 6.75 | | | $ | 6.63 | | | $ | 6.16 | |

| Total Return | | | | | | | | | | | | | | | | | | | | |

| Net asset value (%)1 | | | 4.90 | | | | 15.36 | | | | 7.72 | | | | 17.39 | | | | (8.37 | ) |

| Market value (%)2 | | | 7.12 | | | | 30.44 | | | | 15.22 | | | | 19.83 | | | | (11.79 | ) |

| Ratios/Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

| Net Assets at end of period (in 000‘s) | | $ | 148,156 | | | $ | 156,220 | | | $ | 148,475 | | | $ | 153,963 | | | $ | 144,686 | |

| Ratios of expenses to average net assets (%) | | | 1.08 | | | | 1.08 | | | | 1.07 | | | | 1.073 | | | | 1.173 | |

| Ratio of net investment income to average net assets (%) | | | 0.77 | | | | 0.16 | | | | 0.61 | | | | 1.15 | | | | 0.75 | |

| Portfolio turnover (%) | | | 104 | | | | 178 | | | | 128 | | | | 114 | | | | 114 | |

1 Total net asset value return is calculated based on changes in the net asset value per share for the year reported on. Dividends and distributions, if any, are assumed, for purposes of this calculation, to be reinvested at the net asset value amount on the date of the distribution.

2 Total market value return is calculated assuming a purchase of a share of common stock at the market price on the first day and a sale of a share of common stock at the market price on the last day of each period reported. Dividends and distributions, if any, are assumed, for purposes of this calculation, to be reinvested at prices obtained under the dividend reinvestment plan. Total market value return does not reflect brokerage commissions or sales charges in connection with the purchase or sale of Fund stock.

3 Includes Board-approved expenses related to special and annual meetings that took place during the year.

See accompanying Notes to Financial Statements.

MCN | Madison Covered Call & Equity Strategy Fund | December 31, 2022

Notes to Financial Statements

1. ORGANIZATION

Madison Covered Call & Equity Strategy Fund (the “Fund”) was organized as a Delaware statutory trust on May 6, 2004. The Fund is registered as a diversified, closed-end management investment company under the Investment Company Act of 1940 (“1940 Act”), as amended, and the Securities Act of 1933, as amended. The Fund’s primary investment objective is to provide a high level of current income and current gains, with a secondary objective of long-term capital appreciation. The Fund will pursue its investment objectives by investing primarily in large and mid-capitalization common stocks that are, in the view of Madison Asset Management, LLC, the Fund’s investment adviser (the “Adviser”), selling at a reasonable price in relation to their long-term earnings growth rates. Under normal market conditions, the Fund will seek to generate current earnings from option premiums by writing (selling) covered call options on a substantial portion of its portfolio securities. There can be no assurance that the Fund will achieve its investment objectives. The Fund’s investment objectives are considered fundamental and may not be changed without shareholder approval.

2. SIGNIFICANT ACCOUNTING POLICIES

The Fund is an investment company that applies the accounting and reporting guidance in the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946, Financial Services - Investment Companies (ASC 946). The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements.

Use of Estimates: The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions. Such estimates affect the reported amounts of assets and liabilities and reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

Portfolio Valuation: Securities traded on a national securities exchange are valued at their closing sale price, except for securities traded on the National Association of Securities Dealers Automated Quotation System (“NASDAQ”), which are valued at the NASDAQ official closing price (“NOCP”). If no sale occurs, equities traded on a U.S. exchange or on NASDAQ are valued at the bid price. Options are valued at the mean between the best bid and best ask price across all option exchanges. Debt securities having maturities of 60 days or less are valued at amortized cost, which approximates market value. Debt securities having longer maturities are valued on the basis of the last available bid prices or current market quotations provided by dealers or pricing services approved by the Fund. Mutual funds are valued at their net asset value (“NAV”). Securities for which market quotations are not readily available are valued at their fair value as determined in good faith under procedures approved by the Board of Trustees.

At times, the Fund maintains cash balances at financial institutions in excess of federally insured limits. The Fund monitors this credit risk and has not experienced any losses related to this risk.

Investment Transactions and Investment Income: Investment transactions are recorded on a trade date basis. The cost of investments sold is determined on the identified cost basis for financial statement and federal income tax purposes. Dividend income is recorded on the ex-dividend date and interest income is recorded on an accrual basis.

MCN | Madison Covered Call & Equity Strategy Fund | Notes to the Financial Statements - continued | December 31, 2022

Covered Call and Put Options: An option on a security is a contract that gives the holder of the option, in return for a premium, the right to buy from (in the case of a call) or sell to (in the case of a put) the writer of the option the security underlying the option at a specified exercise or “strike” price. The writer of an option on a security has an obligation upon exercise of the option to deliver the underlying security upon payment of the exercise price (in the case of a call) or pay the exercise price upon delivery of the underlying security (in the case of a put).

The number of call options the Fund can write (sell) is limited by the amount of equity securities the Fund holds in its portfolio. The Fund will not write (sell) “naked” or uncovered call options. The Fund seeks to produce a high level of current income and gains generated from option writing premiums and, to a lesser extent, from dividends.

Options on securities indices are designed to reflect price fluctuations in a group of securities or segment of the securities market rather than price fluctuations in a single security and are similar to options on single securities, except that the exercise of securities index options requires cash settlement payments and does not involve the actual purchase or sale of securities.

When an option is written, a liability is recorded equal to the premium received. This liability for options written is marked-to-market on a daily basis to reflect the current market value of the option written. These liabilities are reflected as options written in the Statement of Assets and Liabilities. Premiums received from writing options that expire unexercised are recorded on the expiration date as a realized gain. The difference between the premium received and the amount paid on effecting a closing purchase transaction, including brokerage commissions, is also treated as a realized gain, or if the premium is less than the amount paid for the closing purchase transactions, as a realized loss. If a call option is exercised, the premium is added to the proceeds from the sale of the underlying security in determining whether there has been a realized gain or loss.

Distributions to Shareholders: The Fund declares and pays quarterly distributions to shareholders. Distributions to shareholders are recorded on the ex-dividend date. The amount and timing of distributions are determined in accordance with federal income tax regulations, which may differ from Generally Accepted Accounting Principles (“GAAP”). These distributions consist of investment company taxable income, which generally includes qualified dividend income, ordinary income and short-term capital gains, including premiums received on written options. Distributions may also include a return of capital. Any net realized long-term capital gains are distributed annually to shareholders. The character of the distributions are determined annually in accordance with federal income tax regulations.

Recently Issued Accounting Pronouncements: On December 3, 2020, the Securities and Exchange Commission (SEC) adopted new rule 2a-5 (Valuation Rule) under the Investment Company Act of 1940, establishing an updated regulatory framework for fund valuation. The Valuation Rule, in part, provides a framework for good faith fair value determination and permits a Board to designate fair value determinations to a fund’s investment adviser. Further, the SEC is rescinded previously issued guidance on related issues. The Valuation Rule became effective on March 8, 2021, with a compliance date of September 8, 2022. The Trust approved new pricing and valuation procedure to comply with the Valuation Rule as of the compliance date.

3. FAIR VALUE MEASUREMENTS

The Fund has adopted FASB applicable guidance on fair value measurements. Fair value is defined as the price that the Fund would receive upon selling an investment in a timely transaction to an independent buyer in the principal or most advantageous market of the investment. A three-tier hierarchy is used to maximize the use of observable market data “inputs” and minimize the use of unobservable “inputs” and to establish classification of fair value measurements for disclosure purposes. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk (for example, the risk inherent in a

MCN | Madison Covered Call & Equity Strategy Fund | Notes to the Financial Statements - continued | December 31, 2022

particular valuation technique used to measure fair value including such a pricing model and/or the risk inherent in the inputs to the valuation technique). Inputs may be observable or unobservable.

Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available under the circumstances. The three-tier hierarchy of inputs is summarized in the three broad Levels listed below:

| • | Level 1 - unadjusted quoted prices in active markets for identical investments |

| • | Level 2 - other significant observable inputs (including quoted prices for similar investments, interest rate volatilities, prepayment speeds, credit risk, benchmark yields, transactions, bids, offers, new issues, spreads and other relationships observed in the markets among comparable securities, underlying equity of the issuer; and proprietary pricing models such as yield measures calculated using factors such as cash flows, financial or collateral performance and other reference data, etc.) |

| • | Level 3 - significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments). |

The valuation techniques used by the Fund to measure fair value for the year ended December 31, 2022, maximized the use of observable inputs and minimized the use of unobservable inputs.

There were no transfers between classifications levels during the year ended December 31, 2022. As of and during the period ended December 31, 2022, the Fund did not hold securities deemed as a Level 3.

The following is a summary of the inputs used as of December 31, 2022, in valuing the Fund’s investments carried at fair value:

| Description | | Level 1 | | | Level 2 | | | Level 3 | | | Value at 12/31/22 | |

| Assets:1 | | | | | | | | | | | | | | | | |

| Common Stocks | | $ | 116,977,726 | | | $ | — | | | $ | — | | | $ | 116,977,726 | |

| Exchange Traded Funds | | | 1,344,154 | | | | — | | | | — | | | | 1,344,154 | |

| Short-Term Investments | | | 31,598,003 | | | | — | | | | — | | | | 31,598,003 | |

| | | $ | 149,919,883 | | | $ | — | | | $ | — | | | $ | 149,919,883 | |

| Liabilities:1 | | | | | | | | | | | | | | | | |

| Options Written | | $ | (1,742,440 | ) | | $ | — | | | $ | — | | | $ | (1,742,440 | ) |

1 Please see the Portfolio of Investments for a listing of all securities within each category.

4. ADVISORY, ADMINISTRATIVE SERVICES AND OTHER EXPENSES

Pursuant to an Investment Advisory Agreement with the Fund, the Adviser, under the supervision of the Fund’s Board of Trustees, provides a continuous investment program for the Fund’s portfolio; provides investment research and makes and executes recommendations for the purchase and sale of securities; and provides certain facilities and personnel, including officers required for the Fund’s administrative management and compensation of all officers and interested trustees of the Fund. For these services, the Fund pays the Adviser an advisory fee, payable monthly, in an amount equal to an annualized rate of 0.80% of the Fund’s average daily net assets.

Under a separate Administrative Services Agreement, the Adviser also provides or arranges to have a third party provide the Fund with such services as it may require in the ordinary course of its business. Services to the Fund include: compliance services, custodial services, Fund administration services, Fund accounting services, and such other services necessary to conduct the Fund’s business. In addition, the Adviser shall arrange and pay for

MCN | Madison Covered Call & Equity Strategy Fund | Notes to the Financial Statements - continued | December 31, 2022

independent public accounting services for audit and tax purposes, legal services, a fidelity bond, and directors and officers/errors and omissions insurance. In exchange for these services, the Fund pays the Adviser a service fee, payable monthly, equal to an annualized rate of 0.26% of the Fund’s average daily net assets. Not included in this fee and, therefore, the responsibility of the Fund are “excluded expenses” and “transitional expenses.” Excluded expenses consist of (i) any fees and expenses relating to portfolio holdings (e.g., brokerage commissions, interest on loans, etc.); (ii) extraordinary and non-recurring fees and expenses (e.g., costs relating to any borrowing costs, overdrafts or taxes the Fund may owe, etc.); (iii) the costs associated with investment by the Fund in other investment companies (i.e., acquired fund fees and expenses); and (iv) Independent Trustees compensation, including Lead Independent Trustee compensation.

Certain officers and Trustees of the Fund may also be officers, directors and/or employees of the Adviser or its affiliates. The Fund does not compensate its officers or Trustees who are officers, directors and/or employees of the Adviser or its affiliates.

5. SECURITIES LENDING:

The Board of Trustees has authorized the Fund to engage in securities lending with State Street Bank and Trust Company as securities lending agent pursuant to a Securities Lending Authorization Agreement (the “Agreement”) and subject to the Fund’s securities lending policies and procedures. Under the terms of the Agreement, and subject to the policies and procedures, the Fund may lend portfolio securities to qualified borrowers in order to generate additional income, while managing risk associated with the securities lending program. The Agreement requires that loans are collateralized at all times by cash or U.S.government securities, initially equal to at least 102% of the value of the domestic securities and 105% of non-domestic securities, based upon the prior days market value for securities loaned. The loaned securities and collateral are marked to market daily to maintain collateral at 102% of the total loaned portfolio. Amounts earned as interest on investments of cash collateral, net of rebates and fees, if any, are included in the Statement of Operations. The primary risk associated with securities lending is loss associated with investment of cash and non-cash collateral. A secondary risk is if the borrower defaults on its obligation to return the securities loaned because of insolvency or other reasons. The Fund could experience delays and costs in recovering securities loaned or in gaining access to the collateral. Under the Agreement, the securities lending agent has provided a limited indemnification in the event of a borrower default. The Fund does not have a master netting agreement.

As of December 31, 2022, the aggregate fair value of securities on loan for the Trust was $ 792,673. Cash collateral received for such loans is reinvested into the State Street Navigator Securities Lending Government Money Market Portfolio. Non-cash collateral is comprised of U.S. treasuries or government securities. See below for fair value on loan and collateral breakout for each fund and each respective fund’s portfolio of investments for individual securities identified on loan.

| Fund | | Fair Value on Loan | | | Cash Collateral* | | | Non-Cash Collateral* | |

| Conservative Allocation | | $ | 792,673 | | | $ | 118,000 | | | $ | 695,542 | |

* Collateral represents minimum 102% of the value of domestic securities and 105% of non-domestic securities on loan, based upon the prior days market value for securities loaned.

The following table provides increased transparency about the types of collateral pledged for securities lending transactions that are accounted for as secured borrowing. Non-cash collateral is not reflected in the table because the funds cannot repledge or resell this collateral.

MCN | Madison Covered Call & Equity Strategy Fund | Notes to the Financial Statements - continued | December 31, 2022

| | | Remaining Contractual Maturity of the Agreements

As of December 31, 2022 | |

| | | Overnight and

Continuous | | | <30 days | | | Between

30 & 90 days | | | >90 days | | | Total | |

| Securities Lending Transactions(1) | | | | | | | | | | | | | | | | | | | | |

| Conservative Allocation | | | | | | | | | | | | | | | | | | | | |

| Government Money Market | | $ | 118,000 | | | $ | — | | | $ | — | | | $ | — | | | $ | 118,000 | |

| Total Borrowings | | $ | 118,000 | | | $ | — | | | $ | — | | | $ | — | | | $ | 118,000 | |

| Gross amount of recognized liabilities for securities lending transactions | | | | | | | | | | | $ | 118,000 | |

6. Derivatives:

The FASB issued guidance intended to enhance financial statement disclosure for derivative instruments and enable investors to understand: a) how and why a fund uses derivative investments, b) how derivative instruments are accounted for, and c) how derivative instruments affect a fund’s financial position, and results of operations.

In addition, in November 2020, the SEC adopted Rule 18f-4 under the 1940 Act to govern the use of derivatives and certain related instruments by registered investment companies. Rule 18f-4, which had a compliance date of August 19, 2022, replaced existing SEC and staff guidance with a new framework for the use of derivatives by registered investment companies. Unless a fund qualifies as a “limited derivatives user,” as defined in Rule 18f-4, Rule 18f-4 requires registered investment companies that trade derivatives and other instruments that create future payment or delivery obligations to adopt a value at-risk leverage limit and implement a derivatives risk management program. Because the Fund’s strategy involves investing in derivatives, and the Fund’s use of such derivatives does not meet the conditions applicable to the “limited user exception” in Rule 18f-4, the Fund has adopted a derivatives program that complies with the requirements of the rule. As part of this, certain officers of the Investment Adviser and the Fund serve as the “derivatives risk manager” for the Fund.

The following table presents the types of derivatives in the fund by location and as presented on the Statement of Assets and Liabilities as of December 31, 2022.

| | | Statement of Asset & Liability Presentation of Fair Values of Derivative Instruments | |

| | | Asset Derivatives | | | Liability Derivatives | |

| Underlying Risk | | Statement of Assets and Liabilities

Location | | Fair Value | | | Statement of Assets and Liabilities

Location | | Fair Value | |

| Equity | | Options purchased | | $ | - | | | Options written | | $ | (1,742,440 | ) |

The following table presents the effect of derivative instruments on the Statement of Operations for the year ended December 31, 2022.

| Statement of Operations | | Underlying Risk | | Realized Gain

(Loss) on Derivatives | | | Change in Unrealized Appreciation

(Depreciation) on Derivatives | |

| Options Purchased | | Equity | | $ | 1,843,097 | | | $ | 1,863,005 | |

| Options Written | | Equity | | | 6,446,380 | | | | 68,936 | |

| | | | | $ | 8,289,477 | | | $ | 1,931,941 | |

The average volume (based on the open positions at each month-end) of derivative activity during the year ended December 31, 2022.

| | | Options Purchased Contracts(1) | | | Options Written Contracts(1) | |

| Madison Covered Call & Equity Strategy Fund | | | 70 | | | | 10,964 | |

(1) Number of Contracts

MCN | Madison Covered Call & Equity Strategy Fund | Notes to the Financial Statements - continued | December 31, 2022

7. FEDERAL INCOME TAX INFORMATION

No provision is made for federal income taxes since it is the intention of the Fund to comply with the provisions of Subchapter M of the Internal Revenue Code of 1986 as amended, applicable to regulated investment companies and to make the requisite distribution to shareholders of taxable income, which will be sufficient to relieve it from all or substantially all federal income taxes. Due to inherent differences in the recognition of income, expenses, and realized gains/losses under GAAP and federal income tax purposes, permanent differences between book and tax basis reporting have been identified and appropriately reclassified on the Statement of Assets and Liabilities. At December 31, 2022, the aggregate gross unrealized appreciation (depreciation) and net unrealized depreciation for all securities, as computed on a federal income tax basis for the fund, were as follows:

| Cost | | $ | 176,124,515 | |

| Gross appreciation | | | 1,606,016 | |

| Gross depreciation | | | (27,009,384 | ) |

| Net depreciation | | $ | (25,403,368 | ) |

Net realized gains or losses may differ for financial reporting and tax purposes primarily as a result of the deferral of losses relating to wash sale transactions and certain market-to-market investments. For the years ended December 31, 2022, and 2021, the tax character of distributions paid to shareholders was $13,560,297 ordinary income and $1,555,487 for long-term capital gain for 2022 and $12,559,719 ordinary income and $2,532,497 for return on capital for 2021.

As of December 31, 2022, the components of distributable earnings on a tax basis were as follows:

| Fund | | Ordinary

Income | | | Long-Term

Capital Gain | | | Tax Exempt

Income | |

| Covered Call Equity Strategy | | $ | 21,292 | | | $ | - | | | $ | - | |

For all open tax years and all major jurisdictions, management of the Fund has concluded that there are no significant uncertain tax positions that would require recognition in the financial statements. Uncertain tax positions are tax positions taken or expected to be taken in the course of preparing the Fund’s tax returns that would not meet a more-likely-than not threshold of being sustained by the applicable tax authority and would be recorded as a tax expense in the current year. Open tax years are those that are open for examination by taxing authorities (i.e., generally the last four tax year ends). Furthermore, management of the Fund is also not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months. It is the Fund’s policy to recognize accrued interest and penalties related to uncertain tax benefits in income taxes, as appropriate.

8. INVESTMENT TRANSACTIONS

During the year ended December 31, 2022, the cost of purchases and proceeds from sales of investments, excluding short-term investments, were $128,039,249 and $128,899,939 respectively. No long-term U.S. government securities were purchased or sold during the year.

9. CAPITAL

The Fund has an unlimited amount of common shares, $0.01 par value, authorized and 21,016,506 shares issued and outstanding as of December 31, 2022. During the years ended December 31, 2022 and December 31, 2021, 34,956 shares and 34,626 shares were issued and reinvested, respectively, per the Dividend Reinvestment Plan, since the Fund was trading at a premium.

MCN | Madison Covered Call & Equity Strategy Fund | Notes to the Financial Statements - continued | December 31, 2022

10. INDEMNIFICATIONS

In the normal course of business, the Fund enters into contracts that provide general indemnifications. The Fund’s maximum exposure under these arrangements is dependent upon claims that may be made against the Fund in the future and therefore cannot be estimated; however, the Fund considers the risk of material loss from such claims as remote.

11. DISCUSSION OF RISKS

Equity Risk: The value of the securities held by the Fund may decline due to general market and economic conditions, perceptions regarding the industries in which the issuers of securities held by the Fund participate, or factors relating to specific companies in which the Fund invests.

Option Risk: There are several risks associated with transactions in options on securities. For example, there are significant differences between the securities and options markets that could result in an imperfect correlation between these markets, causing a given transaction not to achieve its objectives. A decision as to whether, when and how to use options involves the exercise of skill and judgment, and even a well-conceived transaction may be unsuccessful to some degree because of market behavior or unexpected events.

As the writer of a covered call option, the Fund forgoes, during the option’s life, the opportunity to profit from increases in the market value of the security covering the call option above the sum of the premium and the strike price of the call, but retains the risk of loss should the price of the underlying security decline. The writer of an option has no control over the time when it may be required to fulfill its obligation as a writer of the option. Once an option writer has received an exercise notice, it cannot effect a closing purchase transaction in order to terminate its obligation under the option and must deliver the underlying security at the exercise price.

When the Fund writes covered put options, it bears the risk of loss if the value of the underlying stock declines below the exercise price. If the option is exercised, the Fund could incur a loss if it is required to purchase the stock underlying the put option at a price greater than the market price of the stock at the time of exercise. While the Fund’s potential gain in writing a covered put option is limited to the interest earned on the liquid assets securing the put option plus the premium received from the purchaser of the put option, the Fund risks a loss equal to the entire value of the stock.

Derivatives Risk: The risk that loss may result from investments in options, forwards, futures, swaps and other derivatives instruments. These instruments may be illiquid, difficult to price and leveraged so that small changes in the value of the underlying instruments may produce disproportionate losses to the fund. Derivatives are also subject to counterparty risk, which is the risk that the other party to the transaction will not fulfill its contractual obligations.

Industry Concentration Risk: To the extent that the Fund makes substantial investments in a single industry, the Fund will be more susceptible to adverse economic or regulatory occurrences affecting those sectors.

Fund Distribution Risk: In order to make regular quarterly distributions on its common shares, the Fund may have to sell a portion of its investment portfolio at a time when independent investment judgment may not dictate such action. In addition, the Fund’s ability to make distributions more frequently than annually from any net realized capital gains by the Fund is subject to the Fund obtaining exemptive relief from the SEC, which cannot be assured. To the extent the total quarterly distributions for a year exceed the Fund’s net investment company income and net realized capital gain for that year, the excess will generally constitute a return of the Fund’s capital to its common shareholders. Such return of capital distributions generally are tax-free up to the amount of a

MCN | Madison Covered Call & Equity Strategy Fund | Notes to the Financial Statements - continued | December 31, 2022

common shareholder’s tax basis in the common shares (generally, the amount paid for the common shares). In addition, such excess distributions will decrease the Fund’s total assets and may increase the Fund’s expense ratio.

Cybersecurity Risk: The Fund is also subject to cybersecurity risk, which includes the risks associated with computer systems, networks and devices to carry out routine business operations. These systems, networks and devices employ a variety of protections that are designed to prevent cyberattacks. Despite the various cyber protections utilized by the Fund, the Adviser, and other service providers, their systems, networks, or devices could potentially be breached. The Fund, its shareholders, and the Adviser could be negatively impacted as a result of a cybersecurity breach. The Fund cannot control the cybersecurity plans and systems put in place by service providers or any other third parties whose operations may affect the Fund.

Foreign Investment Risk: Investing in non-U.S. issuers may involve unique risks such as currency, political, and economic risks, as well as lower market liquidity, generally greater market volatility and less complete financial information than for U.S. issuers.

Mid-Cap Company Risk: Mid-cap companies often are newer or less established companies than larger companies. Investments in mid-cap companies carry additional risks because earnings of these companies tend to be less predictable; they often have limited product lines, markets, distribution channels or financial resources; and the management of such companies may be dependent upon one or a few key people. The market movements of equity securities of mid-cap companies may be more abrupt or erratic than the market movements of equity securities of larger, more established companies or the stock market in general.

Financial Leverage Risk: The Fund is authorized to utilize leverage through the issuance of preferred shares and/ or the Fund may borrow or issue debt securities for financial leveraging purposes and for temporary purposes such as settlement of transactions. Although the use of any financial leverage by the Fund may create an opportunity for increased net income, gains and capital appreciation for common shares, it also results in additional risks and can magnify the effect of any losses. If the income and gains earned on securities purchased with financial leverage proceeds are greater than the cost of financial leverage, the Fund’s return will be greater than if financial leverage had not been used. Conversely, if the income or gain from the securities purchased with such proceeds does not cover the cost of financial leverage, the return to the Fund will be less than if financial leverage had not been used. Financial leverage also increases the likelihood of greater volatility of the NAV and market price of, and dividends on, the common shares than a comparable portfolio without leverage.

U.S. and international markets have experienced and may continue to experience significant periods of volatility in recent years and months due to a number of economic, political and global macro factors including rising inflation, uncertainty regarding central banks’ interest rate increases, the possibility of a national or global recession, trade tensions, political events, the war between Russia and Ukraine and the impact of the coronavirus (COVID-19) global pandemic. As a result of continuing political tensions and armed conflicts, including the war between Ukraine and Russia, the U.S. and the European Union imposed sanctions on certain Russian individuals and companies, including certain financial institutions, and have limited certain exports and imports to and from Russia. These developments, as well as other events, could result in further market volatility and negatively affect financial asset prices, the liquidity of certain securities and the normal operations of securities exchanges and other markets, despite government efforts to address market disruptions.

Additional Risks: While investments in securities have been keystones in wealth building and management, at times these investments have produced surprises. Those who enjoyed growth and income of their investments generally were rewarded for the risks they took by investing in the markets. Although the Adviser seeks to

MCN | Madison Covered Call & Equity Strategy Fund | December 31, 2022

appropriately address and manage the risks identified and disclosed to you in connection with the management of the securities in the Fund, you should understand that the very nature of the securities markets includes the possibility that there may be additional risks of which we are not aware. We certainly seek to identify all applicable risks and then appropriately address them, take appropriate action to reasonably manage them and to make you aware of them so you can determine if they exceed your risk tolerance. Nevertheless, the often volatile nature of the securities markets and the global economy in which we work suggests that the risk of the unknown is something to consider in connection with an investment in securities. Unforeseen events could under certain circumstances produce a material loss of the value of some or all of the securities we manage for you in the Fund.

12. SUBSEQUENT EVENTS

Management has evaluated all subsequent events through the date the financial statements were issued. No events have taken place that meet the definition of a subsequent event that requires adjustment to, or disclosure in the financial statements.

MCN | Madison Covered Call & Equity Strategy Fund | December 31, 2022

Audit Opinion

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the shareholders and the Board of Trustees of Madison Covered Call & Equity Strategy Fund:

Opinion on the Financial Statements and Financial Highlights

We have audited the accompanying statement of assets and liabilities of Madison Covered Call & Equity Strategy Fund (the “Fund”), including the portfolio of investments as of December 31, 2022, the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, the financial highlights for each of the five years in the period then ended, and the related notes. In our opinion, the financial statements and financial highlights present fairly, in all material respects, the financial position of the Fund as of December 31, 2022, and the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements and financial highlights based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.