Exhibit 99.1

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Searchable text section of graphics shown above

AMEX: HCO, HCO.WS

NIBA May 19 -20, 2005

[LOGO]

Forward-Looking Statements

The statements, other than statements of historical fact, included in this presentation are forward-looking statements. Forward-looking statements generally can be identified by the use of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “estimate,” “anticipate,” “plan,” “seek,” or “believe.” We believe that the expectations reflected in such forward-looking statements are accurate. However, we cannot be assured that such expectations will occur. Our actual future performance could differ materially from such statements. These forward-looking statements are subject to risks and uncertainties that could cause actual results and events to differ materially. These forward-looking statements apply only as of the date of this report; as such, they should not be unduly relied upon for current circumstances. Except as required by law, we are not obligated to release publicly any revisions to these forward-looking statements that might reflect events or circumstances occurring after the date of this report or those that might reflect the occurrence of unanticipated events.

[LOGO] | © 2005 HyperSpace Communications, Inc. | [LOGO] |

| Proprietary Information/Private and Confidential | |

2

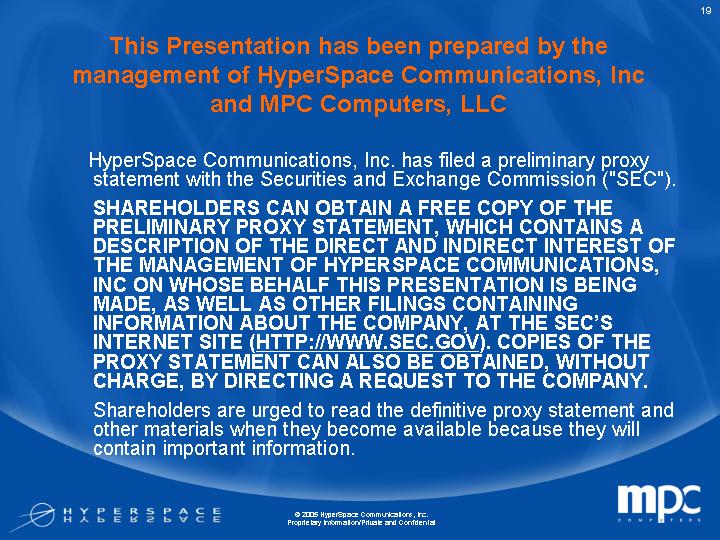

This Presentation has been prepared by the management of HyperSpace Communications, Inc and MPC Computers, LLC

HyperSpace Communications, Inc. has filed a preliminary proxy statement with the Securities and Exchange Commission (“SEC”).

SHAREHOLDERS CAN OBTAIN A FREE COPY OF THE PRELIMINARY PROXY STATEMENT, WHICH CONTAINS A DESCRIPTION OF THE DIRECT AND INDIRECT INTEREST OF THE MANAGEMENT OF HYPERSPACE COMMUNICATIONS, INC ON WHOSE BEHALF THIS PRESENTATION IS BEING MADE, AS WELL AS OTHER FILINGS CONTAINING INFORMATION ABOUT THE COMPANY, AT THE SEC’S INTERNET SITE (HTTP://WWW.SEC.GOV). COPIES OF THE PROXY STATEMENT CAN ALSO BE OBTAINED, WITHOUT CHARGE, BY DIRECTING A REQUEST TO THE COMPANY.

Shareholders are urged to read the definitive proxy statement and other materials when they become available because they will contain important information.

3

HyperSpace Standalone Capitalization

Initial Public Offering: | | October 1, 2004 | |

Issued: | | 1.8 million units | |

Units: | | 1 common and 2 warrants | |

Unit Price: | | $5.50 | |

Warrants Exercisable: | | $5.50 | |

Shares Outstanding: | | 3.7 million | |

| | | |

As of 5/17/2005: | | | |

Float: | | 2.2 million shares | |

Share Price: | | $3.70 | |

Warrant Price: | | $0.67 | |

Combined Unit Price: | | $4.37 | |

4

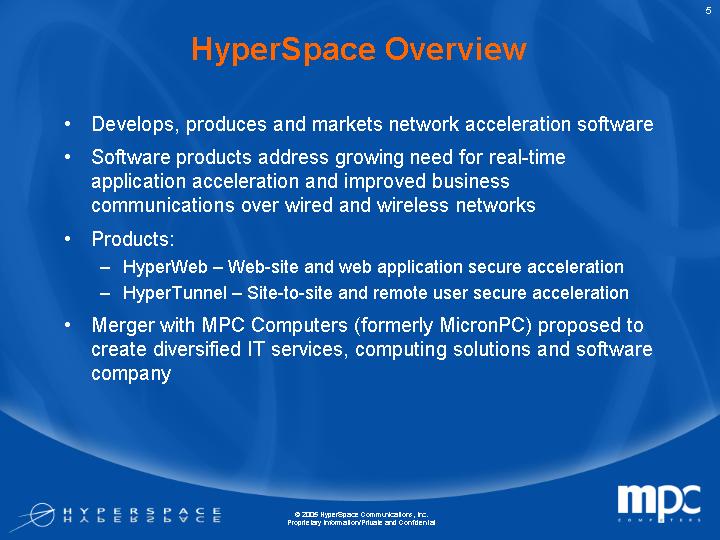

HyperSpace Overview

• Develops, produces and markets network acceleration software

• Software products address growing need for real-time application acceleration and improved business communications over wired and wireless networks

• Products:

• HyperWeb – Web-site and web application secure acceleration

• HyperTunnel – Site-to-site and remote user secure acceleration

• Merger with MPC Computers (formerly MicronPC) proposed to create diversified IT services, computing solutions and software company

5

HCO Customers

Americas and Canada

[LOGO]

Europe

[LOGO]

Asia and Australia

[LOGO]

6

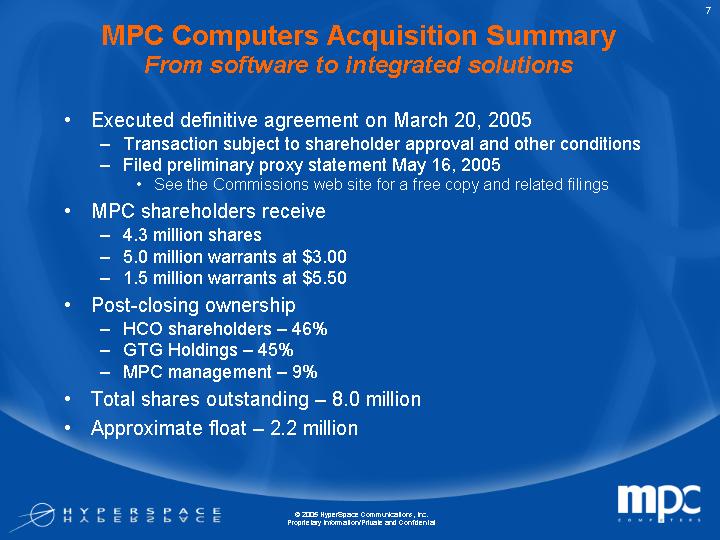

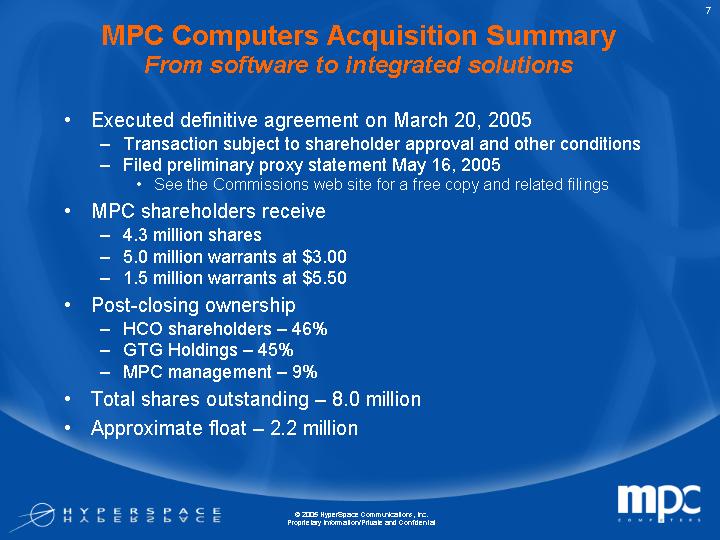

MPC Computers Acquisition Summary

From software to integrated solutions

• Executed definitive agreement on March 20, 2005

• Transaction subject to shareholder approval and other conditions

• Filed preliminary proxy statement May 16, 2005

• See the Commissions web site for a free copy and related filings

• MPC shareholders receive

• 4.3 million shares

• 5.0 million warrants at $3.00

• 1.5 million warrants at $5.50

• Post-closing ownership

• HCO shareholders – 46%

• GTG Holdings – 45%

• MPC management – 9%

• Total shares outstanding – 8.0 million

• Approximate float – 2.2 million

7

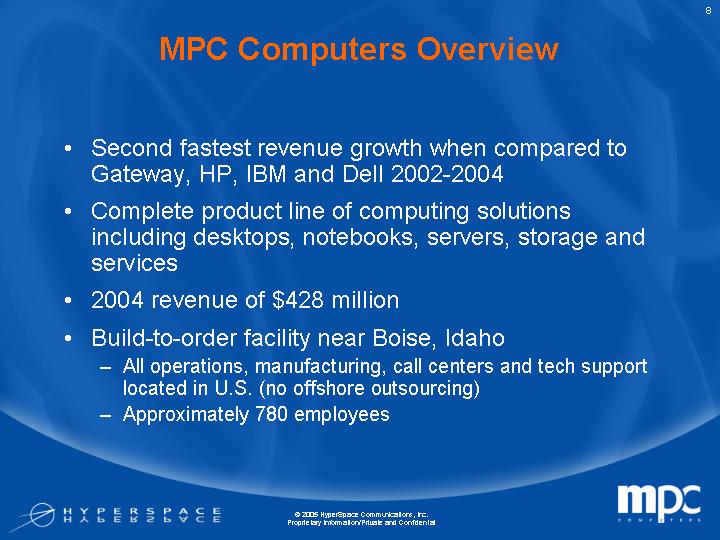

MPC Computers Overview

• Second fastest revenue growth when compared to Gateway, HP, IBM and Dell 2002-2004

• Complete product line of computing solutions including desktops, notebooks, servers, storage and services

• 2004 revenue of $428 million

• Build-to-order facility near Boise, Idaho

• All operations, manufacturing, call centers and tech support located in U.S. (no offshore outsourcing)

• Approximately 780 employees

8

Focused Customer-Base

Federal Government

• #3 hardware provider in the “Top 100 Federal Prime Contractors in IT”(1)

• #2 supplier to the Department of Veterans Affairs(2)

• #4 supplier to the U.S. Army(3)

• #1 supplier to the U.S. Coast Guard (4)

• #2 supplier to the U.S. Air Force(5)

State/Local Government & Education (SLE)

• 2004 inclusion in the WSCA contract for business in 23 states

Mid-Size Businesses (250 - 5,000 employees)

Sources:

(1) Washington Technology magazine ninth Annual Report: Top 100 Federal Prime Contractors in IT

(2) VA PCHS contract performance data

(3) U.S. Army ADMC-1 contract performance data

(4) U.S. Coast Guard procurement data

(5) U.S. Air Force AF-IT2 contract performance data

9

MPC’s View of Competitive Landscape

| | Primary Business Model | | | | |

| | Build-to-Order | | Direct Manuf. | | Target Markets | | Differentiator |

| | | | | | Domestic | | |

[LOGO] | | ý | | ý | | Federal, SLE, | | |

| | | | | | Mid-market | | Service |

| | | | | | enterprise | | |

| | | | | | | | |

| | | | | | | | Price, Product |

[LOGO] | | ý | | ý | | All | | Breadth |

| | | | | | | | |

| | | | | | Consumer, Retail | | Price, Product |

[LOGO] | | o | | o | | “Professional” | | Breadth |

| | | | | | | | |

| | | | | | Global, Channel, | | Product |

[LOGO] | | o | | o | | Fortune 1000 | | Breadth, Price |

| | | | | | | | |

| | | | | | Global, Channel, | | Professional |

[LOGO](1) | | o | | o | | Fortune 1000 | | services |

(1) IBM information does not include Lenovo data.

10

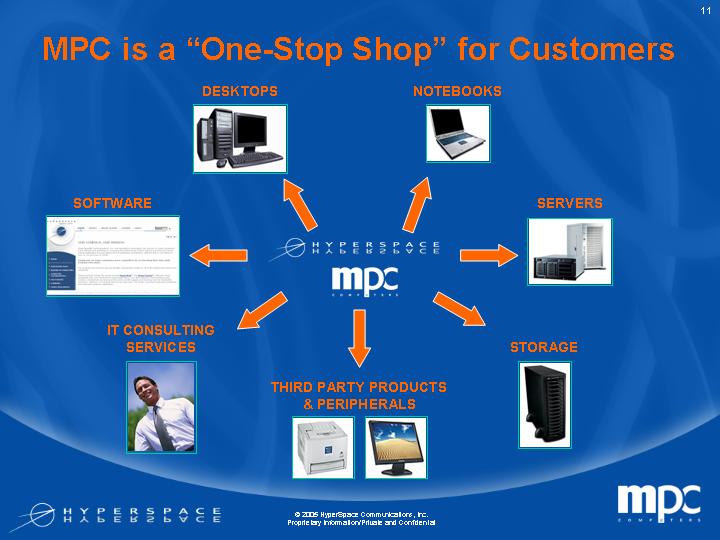

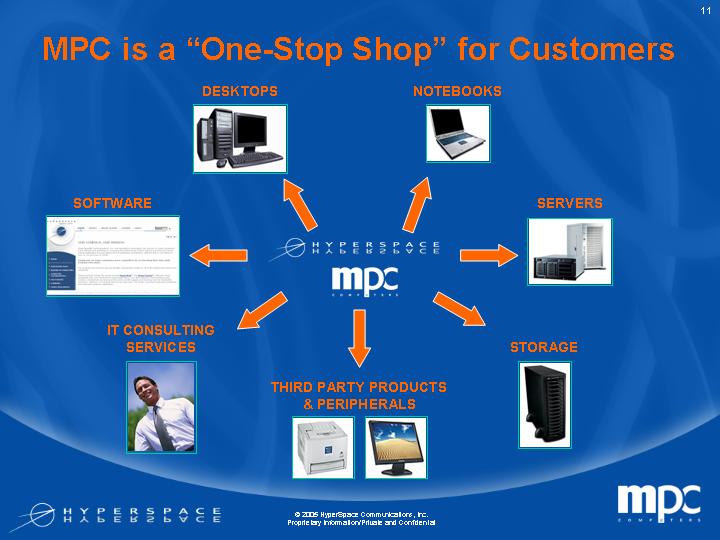

MPC is a “One-Stop Shop” for Customers

| DESKTOPS | NOTEBOOKS | |

| [GRAPHIC] | [GRAPHIC] | |

| | | |

SOFTWARE | | | SERVERS |

[GRAPHIC] | [LOGO] | [GRAPHIC] |

| | | |

| IT CONSULTING | | | | |

| SERVICES | | | STORAGE | |

| [GRAPHIC] | | | [GRAPHIC] | |

| | | |

THIRD PARTY PRODUCTS

& PERIPHERALS |

[GRAPHIC] |

| | | | | | | |

11

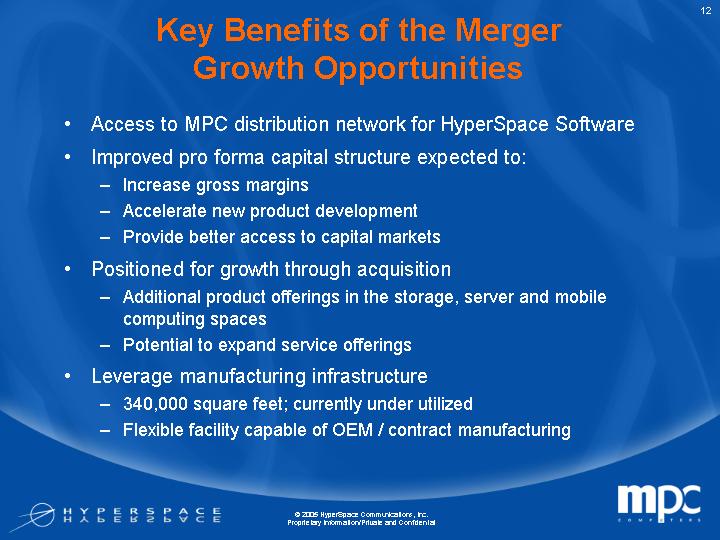

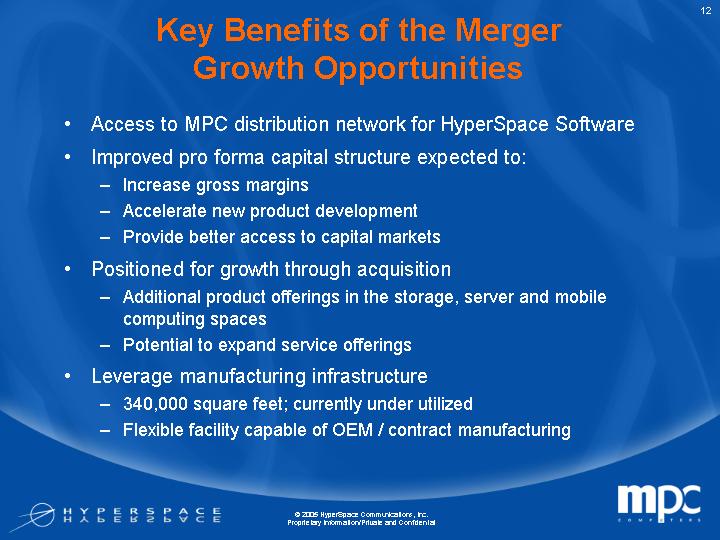

Key Benefits of the Merger Growth Opportunities

• Access to MPC distribution network for HyperSpace Software

• Improved pro forma capital structure expected to:

• Increase gross margins

• Accelerate new product development

• Provide better access to capital markets

• Positioned for growth through acquisition

• Additional product offerings in the storage, server and mobile computing spaces

• Potential to expand service offerings

• Leverage manufacturing infrastructure

• 340,000 square feet; currently under utilized

• Flexible facility capable of OEM / contract manufacturing

12

Management and Partnerships

• Management team

• HyperSpace team brings public company and software experience

• MPC management team remains in place

• Average MPC tenure of 8 years

• Diversified and experienced Board of Directors

• Strong relationships

• Gores Technology Group

• Friedman, Billings, Ramsey

13

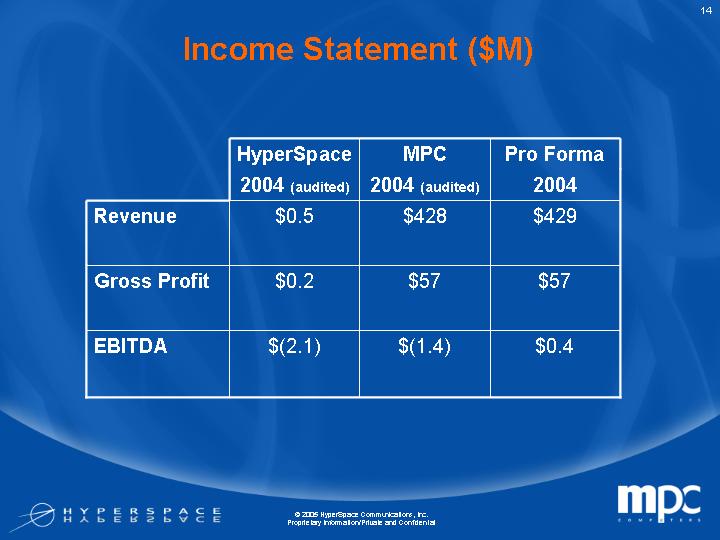

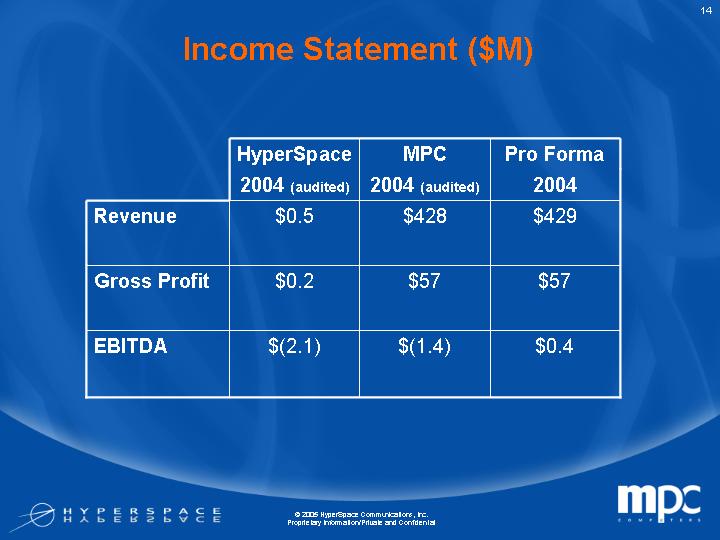

Income Statement ($M)

| | HyperSpace

2004 (audited) | | MPC

2004 (audited) | | Pro Forma

2004 | |

Revenue | | $ | 0.5 | | $ | 428 | | $ | 429 | |

| | | | | | | |

Gross Profit | | $ | 0.2 | | $ | 57 | | $ | 57 | |

| | | | | | | |

EBITDA | | $ | (2.1 | ) | $ | (1.4 | ) | $ | 0.4 | |

14

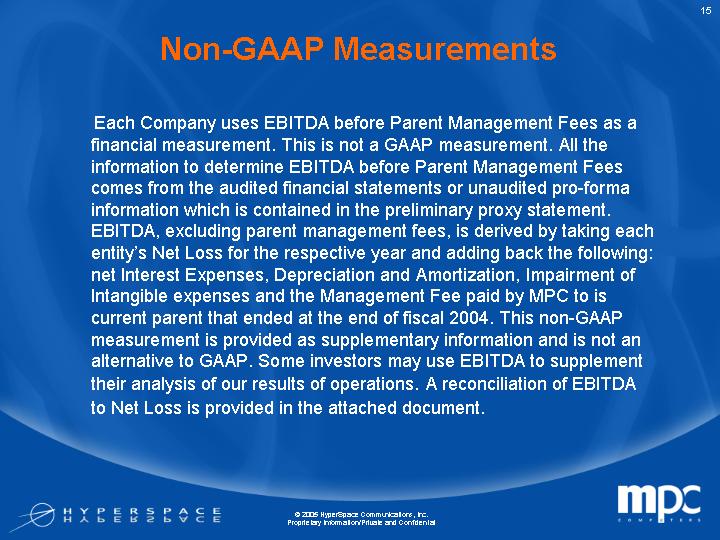

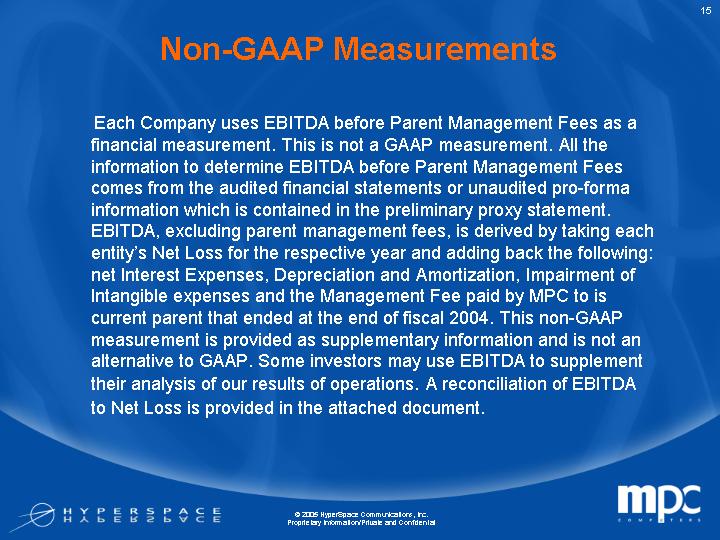

Non-GAAP Measurements

Each Company uses EBITDA before Parent Management Fees as a financial measurement. This is not a GAAP measurement. All the information to determine EBITDA before Parent Management Fees comes from the audited financial statements or unauditedpro-forma information which is contained in the preliminary proxy statement. EBITDA, excluding parent management fees, is derived by taking each entity’s Net Loss for the respective year and adding back the following: net Interest Expenses, Depreciation and Amortization, Impairmentof Intangible expenses and the Management Fee paid by MPC to is current parent that ended at the end of fiscal 2004. This non-GAAP measurement is provided as supplementary information and is not an alternative to GAAP. Some investors may use EBITDA to supplement their analysis of our results of operations. A reconciliation of EBITDA to Net Loss is provided in the attached document.

15

EBITDA RECONCILATION TO NET LOSS

EBITDA RECONCILIATION | | HCO

2003 | | HCO

2004 | | MPC

2003 | | MPC

2004 | | PRO-FORMA

2004 | |

| | | | | | | | | | | |

Net Loss as Reported | | $ | (1,838,909 | ) | $ | (3,120,854 | ) | $ | (8,561,000 | ) | $ | (6,175,000 | ) | $ | (10,481,000 | ) |

| | | | | | | | | | | |

Depreciation, Amortization & Impairment | | $ | 580,667 | | $ | 222,645 | | $ | 1,008,000 | | $ | 2,325,000 | | $ | 7,690,645 | |

| | | | | | | | | | | |

Management Fee Paid to Parent | | $ | — | | $ | — | | $ | 3,468,000 | | $ | 3,958,000 | | $ | — | |

| | | | | | | | | | | |

Net Interest Expense | | $ | 345,395 | | $ | 822,748 | | $ | 2,111,000 | | $ | 2,411,000 | | $ | 3,233,748 | |

| | | | | | | | | | | |

EBITDA | | $ | (912,847 | ) | $ | (2,075,461 | ) | $ | (1,974,000 | ) | $ | 2,519,000 | | $ | 443,393 | |

16

Balance Sheet ($M)

| | HyperSpace

2004 (audited) | | MPC

2004 (audited) | | Pro Forma

2004 | |

Cash & Equivalents | | $ | 5.9 | | $ | 2.2 | | $ | 8.1 | |

| | | | | | | |

Assets | | $ | 6.6 | | $ | 109 | | $ | 155.8 | |

| | | | | | | |

Liabilities | | $ | 1.6 | | $ | 129 | | $ | 131.6 | |

| | | | | | | |

Shareholders Equity | | $ | 5 | | $ | (20 | ) | $ | 24.2 | |

17

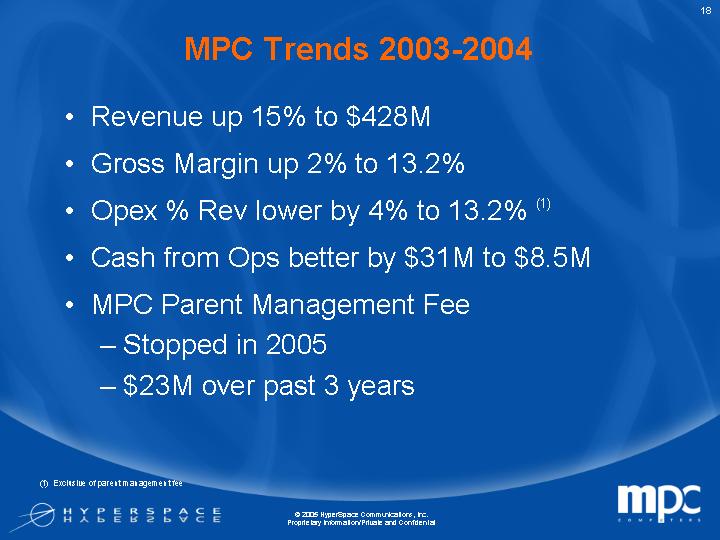

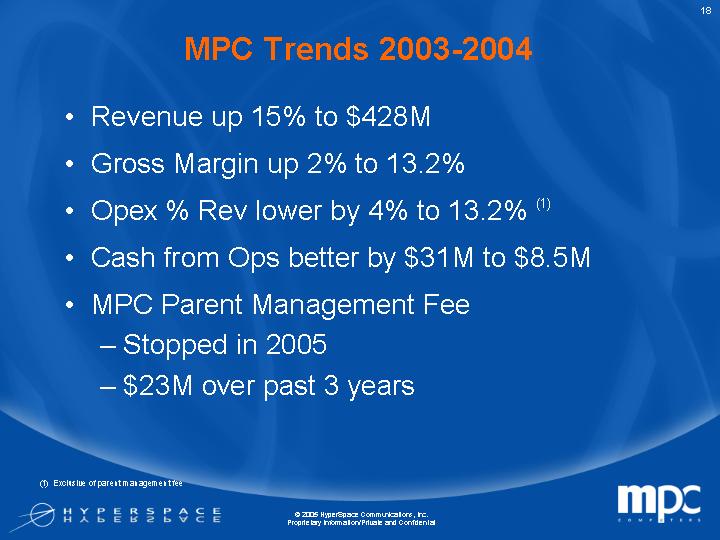

MPC Trends 2003-2004

• Revenue up 15% to $428M

• Gross Margin up 2% to 13.2%

• Opex % Rev lower by 4% to 13.2% (1)

• Cash from Ops better by $31M to $8.5M

• MPC Parent Management Fee

• Stopped in 2005

• $23M over past 3 years

(1) Exclusive of parent management fee

18

This Presentation has been prepared by the management of HyperSpace Communications, Inc and MPC Computers, LLC

HyperSpace Communications, Inc. has filed a preliminary proxy statement with the Securities and Exchange Commission (“SEC”).

SHAREHOLDERS CAN OBTAIN A FREE COPY OF THE PRELIMINARY PROXY STATEMENT, WHICH CONTAINS A DESCRIPTION OF THE DIRECT AND INDIRECT INTEREST OF THE MANAGEMENT OF HYPERSPACE COMMUNICATIONS, INC ON WHOSE BEHALF THIS PRESENTATION IS BEING MADE, AS WELL AS OTHER FILINGS CONTAINING INFORMATION ABOUT THE COMPANY, AT THE SEC’S INTERNET SITE (HTTP://WWW.SEC.GOV). COPIES OF THE PROXY STATEMENT CAN ALSO BE OBTAINED, WITHOUT CHARGE, BY DIRECTING A REQUEST TO THE COMPANY.

Shareholders are urged to read the definitive proxy statement and other materials when they become available because they will contain important information.

19