MPC Corporation’s

Proposed Acquisition of

Gateway’s “Professional” Business Unit

John Yeros, CEO

MPC Corporation

Forward-looking Statements & Confidentiality

Any statements in this presentation, other than statements of historical fact, are forward-looking statements. Forward-looking

statements are based on current management expectations and assumptions. However, there is no assurance that such

expectations will occur or that the assumptions will prove accurate. Our actual future performance could differ materially from

the forward-looking statements. Forward-looking statements in this presentation include statements with respect to the

possible acquisition of Gateway's "Professional" Business Unit. MPC and Gateway have not signed an acquisition agreement

with respect to this proposed transaction, and it is possible that an acquisition agreement will not be signed under that

currently expected timeline or at all. If an acquisition agreement is signed, it may contain terms and conditions that differ

materially from the terms described in this presentation. Any acquisition agreement would be subject to a number of

conditions to closing that may never be satisfied or waived, including that MPC obtain the exercise for cash of outstanding

warrants and the conversion of outstanding convertible debt. Statements in this presentation with respect to possible future

performance of a combined company are also forward-looking statements. The combined company could fail to achieve

projected revenue, margin and other financial performance measures. A combined company would face significant risks and

uncertainties, including the ability to retain customers and employees, retention of vendor support in funding the

combined operation, the ability to transition product lines, the ability to effectively combine management teams, and the ability

to obtain required intellectual property licenses on terms acceptable to the combined company or at all. The interests of

current shareholders would be diluted in connection with the proposed transaction. MPC faces significant liquidity challenges,

and the combined company would continue to face such challenges. Investors are encouraged to carefully review MPC's risk

factors set forth in its most recent Form 10-KSB and Form 10-Q filed with the Securities and Exchange Commission. Except

as required by law, we are not obligated to provide or release publicly any revisions to these forward-looking statements that

might reflect events or circumstances occurring after the date of this presentation or those that might reflect the occurrence of

unanticipated events. The information in this presentation is provided under terms of a non-disclosure agreement. By

receiving this presentation, you confirm and agree that the terms of such non-disclosure agreement apply to the

presentation.

Overview of Proposed Combination

Profile of New Company

Customer Segments

Products

Operations

Pro-forma P&L and Balance Sheet

Pro-forma Valuation & Deal Structure

Agenda

Overview

MPC today is a $300 million PC company focused on government, education,

and commercial customers

Gateway today is a $4 billion PC company with three business units

Retail: focused on home users

Consumer Direct: focused on home users and small businesses (<100 employees)

Professional: focused on government, education and commercial customers

Gateway is interested in divesting the Professional business unit, as it no

longer considers this segment core to its strategy

MPC is negotiating with Gateway to acquire this business unit and integrate it

into its existing infrastructure

Gateway Snapshot (NYSE: GTW)

Market cap: $665 million

Shares outstanding: 371 million shares

Average daily volume: 4.9 million shares

Analyst coverage: Argus Research Morgan Stanley

Bear Stearns Needham & Co.

Citigroup Standard & Poors

FTN Midwest Securities Value Line

Goldman Sachs WR Hambrecht

Motley Fool commentary: “Gateway managed to tack on 310 basis

(5/9/07) points to last year’s Pro gross margin…”

“Gateway should forget retail and poach the

best corporate accounts from its largest

rivals…”

Profile of Combined Company (“MPC Pro”)

Combining MPC and Gateway’s Professional business unit creates a powerful

PC company that is large enough to be relevant in the industry

With sales of over $1.1B and 1,000 employees, it would rank among the top

five PC companies in the US serving the professional markets of government,

education and commercial

Balanced segment mix of commercial, government and education

Balanced product mix, including a higher-margin server/storage business of

over $40 million

A formidable sales force of 430 sales reps, with 300 inside reps in two call

centers and 130 field reps spread across the country

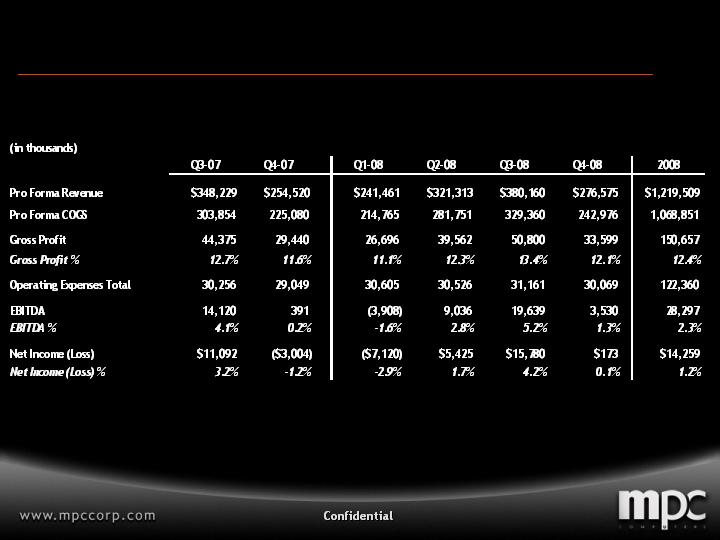

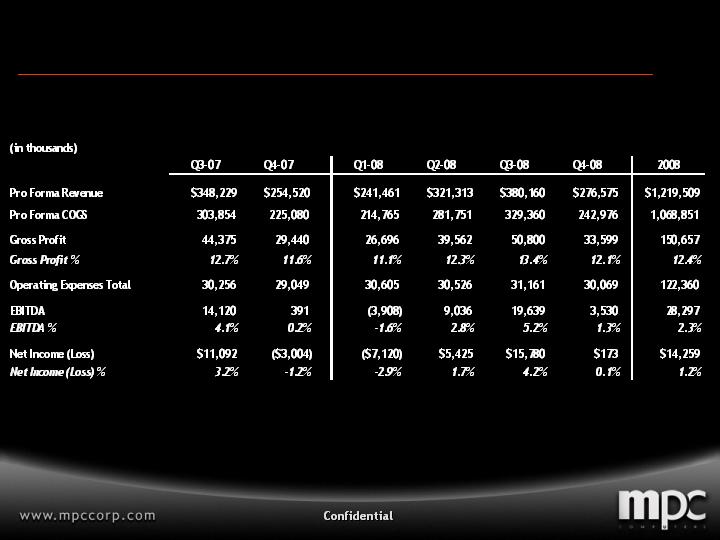

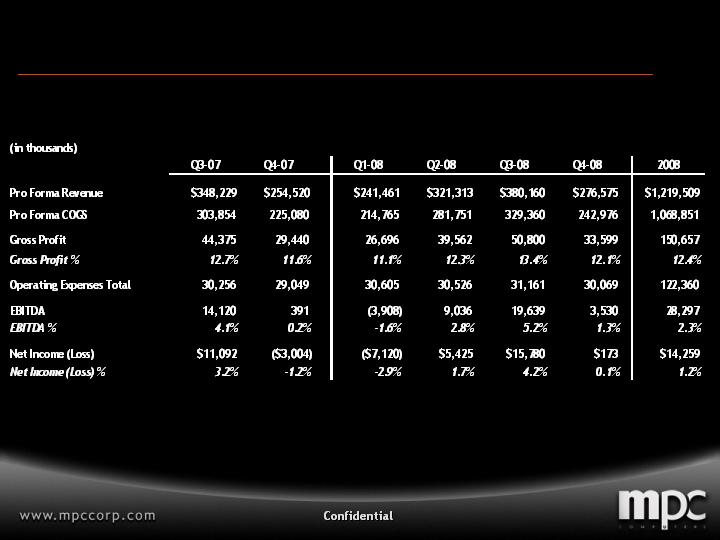

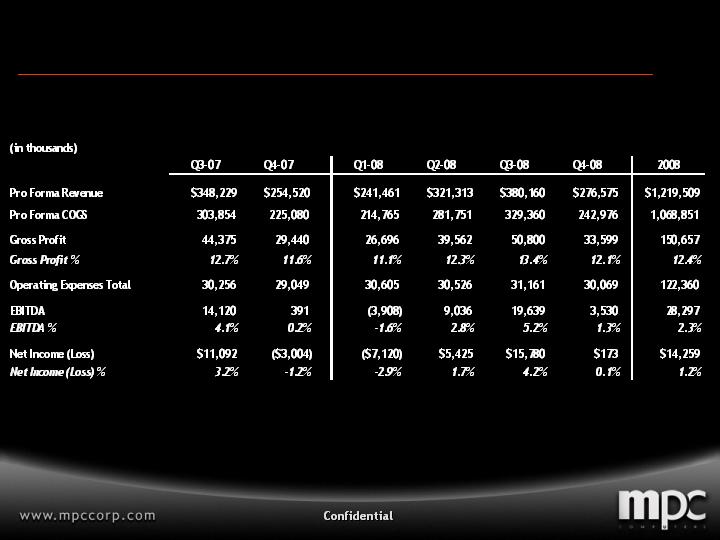

Pro Forma P&L

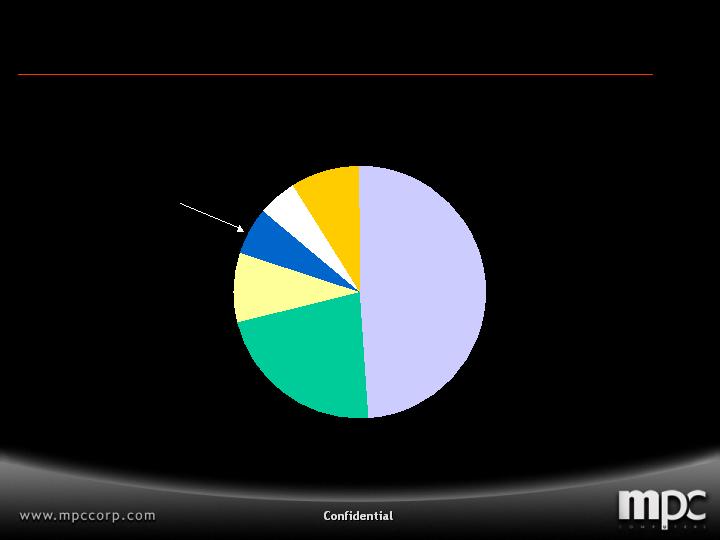

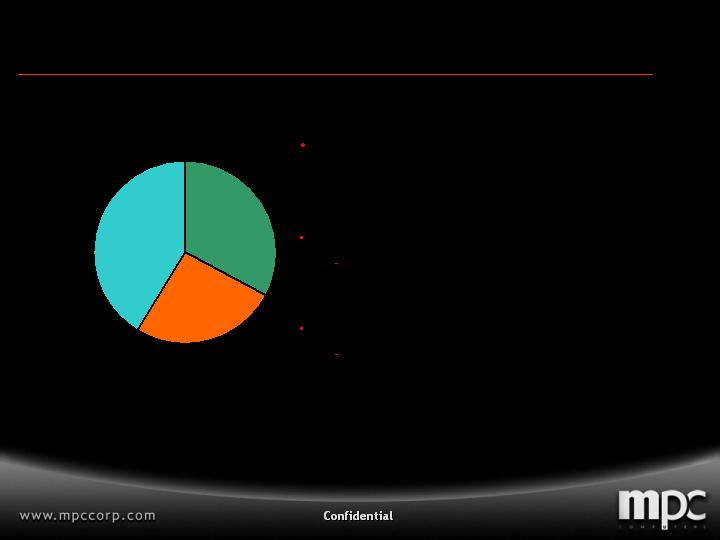

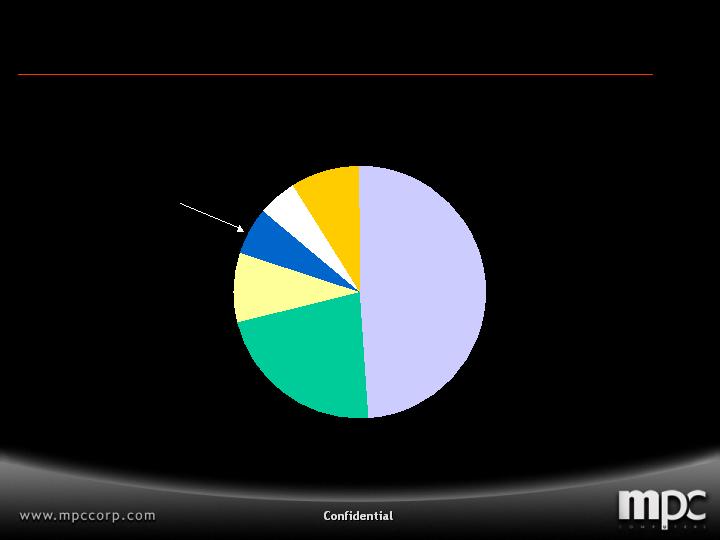

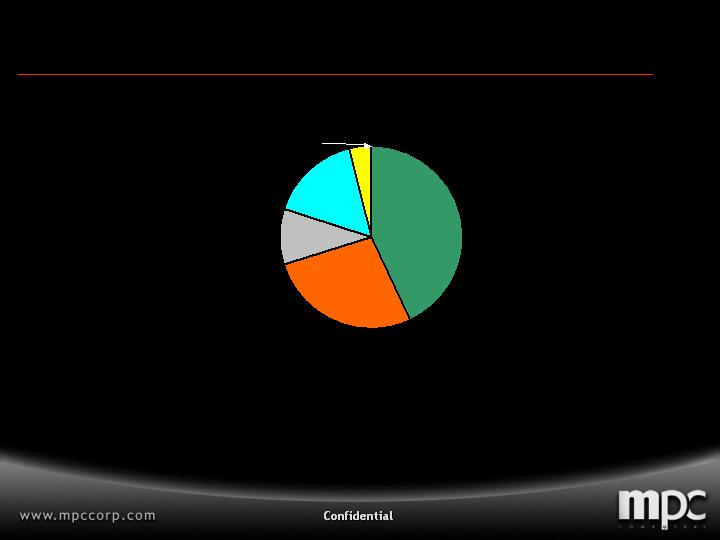

Relevant in Industry Market Share

Dell

49%

HP

22%

Lenovo

9%

Other

9%

MPC Pro

Market share

6%

Apple

5%

US PC vendor market share among government, education & commercial customers

Total market size is $20 B

Competitive Data Source: IDC Market Research, 2006

MPC Pro Data Source: MPC, Gateway Internal Projections

MPC Pro Value Proposition

Lower total cost of ownership for overall PC investment

US-based high-quality tech support

Dedicated account management

Custom configuration and software image loads

Responsiveness and flexibility

Understanding of IT needs in commercial, government and education

segments

Higher attention to “Pro” segment customers compared to Dell & HP

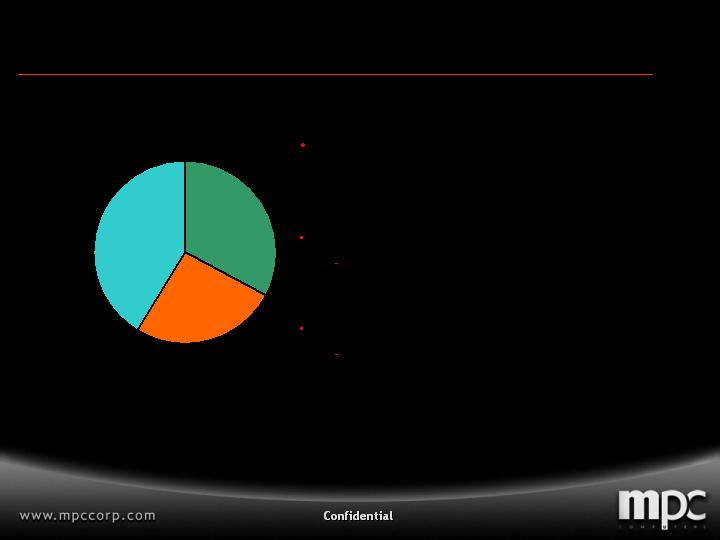

MPC Pro Customers

Mid-Size Enterprise (Commercial)

(Businesses with 100 - 5,000 employees)

Federal Government

Top agency customers include VA, Army,

Air Force, Coast Guard

State/Local Government & Education (SLE)

Ed includes both K-12 and higher ed

schools

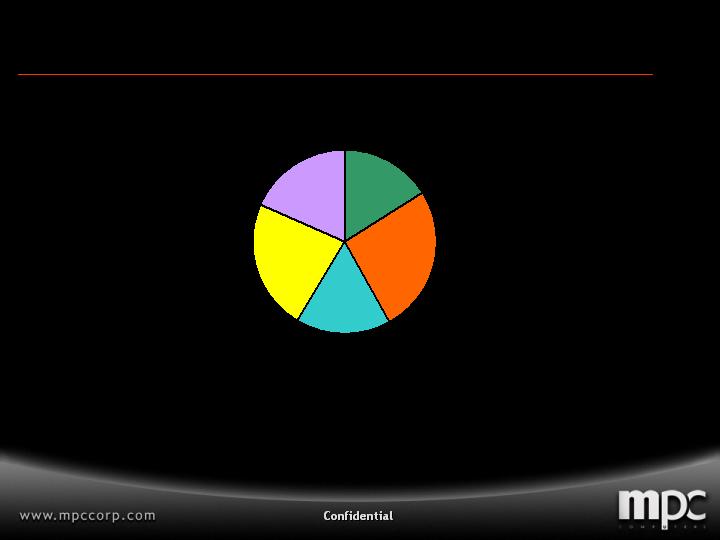

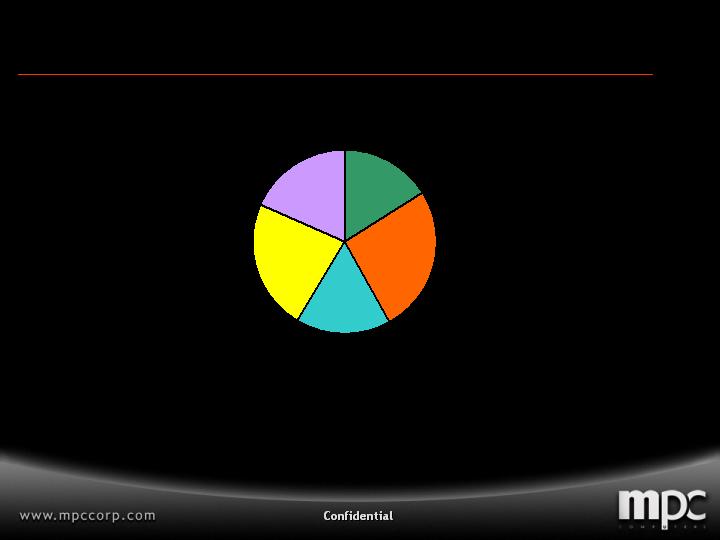

Government

33%

SMB

26%

Education

41%

MPC Pro Segment Mix Breakout

Federal

16%

Commercial

26%

K-12

23%

Higher Ed

18%

State/Local

17%

Diversification and balance of the combined entity is better

than either one as a stand-alone

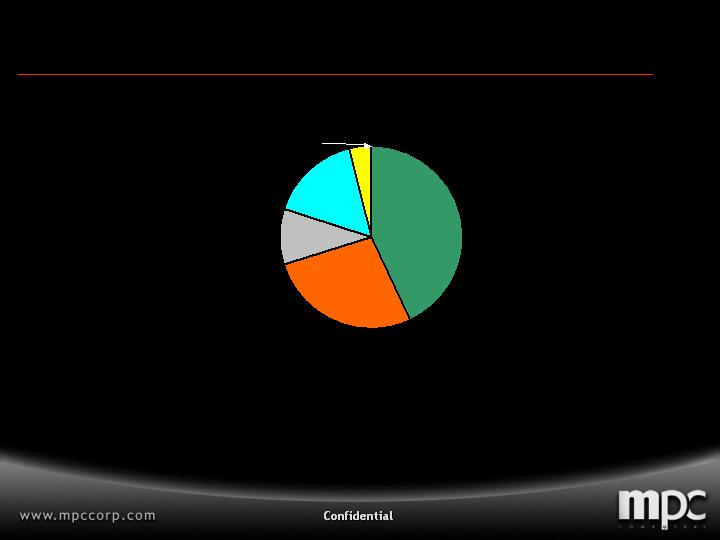

MPC Pro Product Mix

Desktops

43%

Notebooks

27%

Services

10%

3rd party

16%

Server/Storage

4%

Combined entity has a well-balanced product portfolio with growth

vectors in Services, 3 rd Party and Servers/Storage

MPC Pro Products

MPC Pro will sell both Gateway-branded and MPC-branded hardware

into the Gateway Pro customer base

Customers will want to keep platforms stable for the near-term and

transition to MPC-branded products over one year

MPC has one-year license to use Gateway brand

Overlapping product lines will merge over one year

Mainstream desktops

Mainstream notebooks (MPC will add Gateway suppliers)

Mainstream servers

For unique Gateway products such as tablets, MPC will assume supplier

relationships

Gateway Product & Service Awards

Technology Business Research: Corporate IT Buying Behavior

June 2006: #1 in Customer Satisfaction for Notebooks

Dec 2006: #1 in Customer Satisfaction for Desktops

[H]ardOCP (Dec 2006): Gateway is Best Tier-1 Integrator

PC Magazine (Dec 2006): E-100M Ultraportable Notebook

4.5 out of 5 Stars, Editors’ Rating “Very Good”

Network World (Nov 2006): E-100M Ultraportable Notebook

4.5 out of 5 Stars, Editors’ Rating “Very Good”

FOSE Government Trade Show (March 2007): E-9722R Server

Best of FOSE 2007: Enterprise Hardware Category

Sales Transition

MPC Pro will launch a comprehensive communications program to

educate and retain Gateway Pro sales and marketing people

Professional customer segment is now the entire business

MPC Pro management understands these segments and will position

the company for profitability and growth

Gateway Pro management will play key roles in the new company

No major reorganizations planned immediately

No changes to sales compensation model planned immediately

Customer Transition

MPC Pro will launch a comprehensive communications program to

educate and retain Gateway Pro customers

Reassuring and retaining Gateway Pro salespeople will be instrumental

in this effort

Customers should be reassured with a year-long product transition

plan

In addition to communications from sales, we will reach out to

customers directly

Letter from the CEO explaining the strategy behind this combination

and the benefits that they will see, including HP printers, IP SANs, and

additional all-in-one desktop form factors

MPC executive management will meet face-to-face with largest

customers

Valuation and Merger Consequences

Proposed Transaction Structure

Assets acquired

Identifiable Pro inventory (WIP and warranty)

Pro BU intangibles, including contracts, customer lists, workforce

FF&E and technology for GTW personnel

Liabilities assumed

Warranty liability (est. $56M)

Securities to be issued

Short-term note for approximately $10M

Equity in MPC (<20%)

MPC secures up to $10M of new capital from existing investors through

cash exercise of warrants, and secures conversion of outstanding

convertible notes

LOI Terms

Assumption of Warranty Liabilities $56,000,000

Working Capital Investment 10,000,000

Common stock in MPZ 9,300,000

Estimated fair value of warrants in MPZ 1,200,000

Preliminary Transaction Value $76,500,000

Notes: Assumes stock issued at $1.10 per share. Warranty liability is a preliminary estimate. Working

capital investment dependent on net inventory levels at closing. Does not include additional funding raised

by MPC for combined entity. Includes warrants issued at 19.9% of outstanding options and warrants at close.

Purchase price

1.

MPC converts all outstanding convertible notes and debentures

2.

MPC exchanges all outstanding $1.10 warrants for cash

3.

Gateway provides MPC with excess inventory tied to promissory note

4.

Gateway raises additional capital in the amount of at least $80mm

5.

Obtaining applicable regulatory approvals, including HSR, if applicable

6.

Consent from key ODM’s, including Quanta, to transfer GCC interest

Closing Conditions

MPC Current Cap Table

Conversion Cash ImpactCash Impact

Total Price Near-term Long-term

Common Stock 13,075,200

Stock options

MPZ outstanding options 589,417$3.52 $2,074,748

Restricted Stock Units (granted, subject to vesting) 2,069,100

Warrants

Warrants Outstanding pre-IPO 356,642$3.50 $1,248,247

Warrants issued to Investment Bankers in Merger 300,000$3.00 $900,000

IPO Warrants Outstanding 3,600,000$5.50 $19,800,000

IPO UW Warrants 270,000$3.03 $817,200

GTG PC Investments LLC - $5.50 Warrants 1,330,524$5.50 $7,317,882

MIC Holding Company LLC - $5.50 Warrants 1,325,212$5.50 $7,288,666

WFF Warrants ($3.00 and $5.50) 97,510$3.58 $349,066

Toibb Investments Warrants issued for Bridge 1,027,500$1.10$1,130,250

Crestview Capital Warrants issued for Bridge 342,500$1.10 $376,750

Maxim Warrants per Engagement Letter 120,000$1.60 $192,000

Warrants Issued in Private Placement (Tranche 1) 4,924,500$1.10$5,416,950

Warrants Issued to Maxim for Pvt Placement (Tr 1) 546,000$1.10 $600,600

Warrants Issued to Crestview for Consulting Agreement 360,000$1.10 $396,000

Warrants Issued in Private Placement (Tranche 2) 2,468,125$1.10$2,714,938

Warrants Issued to Maxim for Pvt Placement (Tr 2) 499,867$1.10 $549,854

Convertible Debt (Assumes 100% Conversion

Unconverted Bridge Loans 85,714

Bathgate $550,000 Note at Closing 165,000

Private Placement Tranche 1 13,132,000

Private Placement Tranche 2 6,581,667

Total shares (fully diluted) 53,266,478 $10,034,888$41,138,263

MPC Pro Cap Table (Post Closing)

Cash-In

Total Long-term

Common Shares

Common Stock 13,075,200

C/S - $1.10 Warrants 9,122,625

C/S – Note Conversions 19,964,381

Gateway Shares 10,430,608

Total common shares 52,592,814

Stock options

MPZ options 589,417 $2,074,700

MPZ RSUs 2,069,100

MPC Warrants 8,445,755 $39,064,435

Gateway Warrants 2,201,724

Total Options and Warrants 13,305,996

Pro Forma P&L

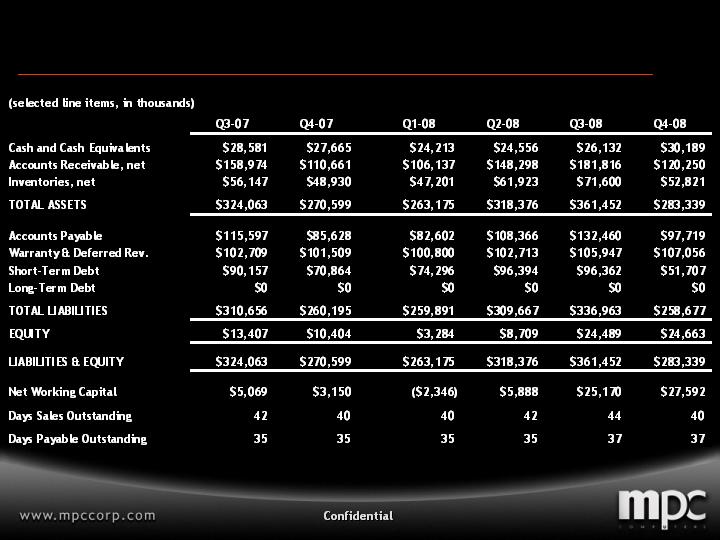

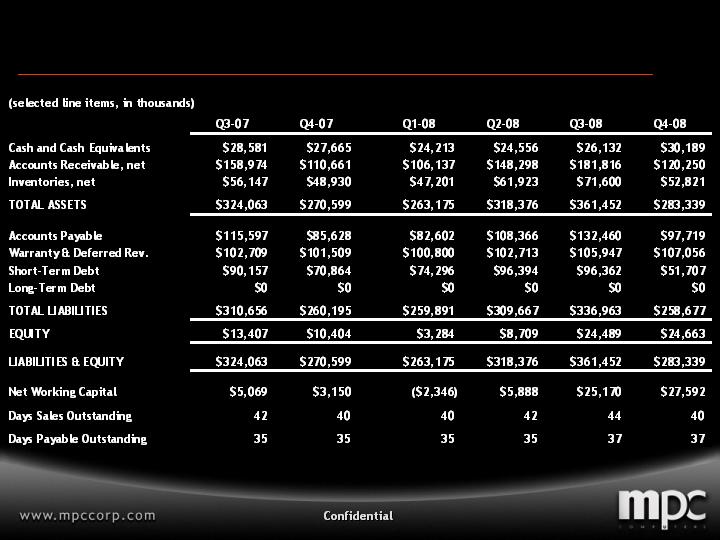

Pro Forma Balance Sheet

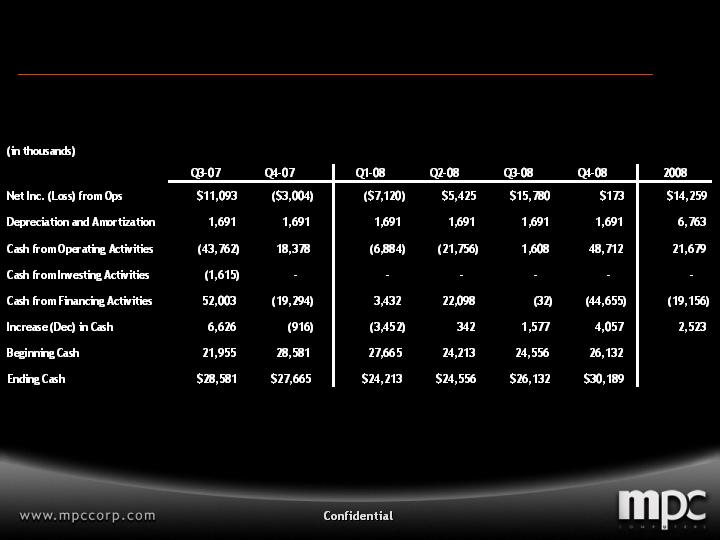

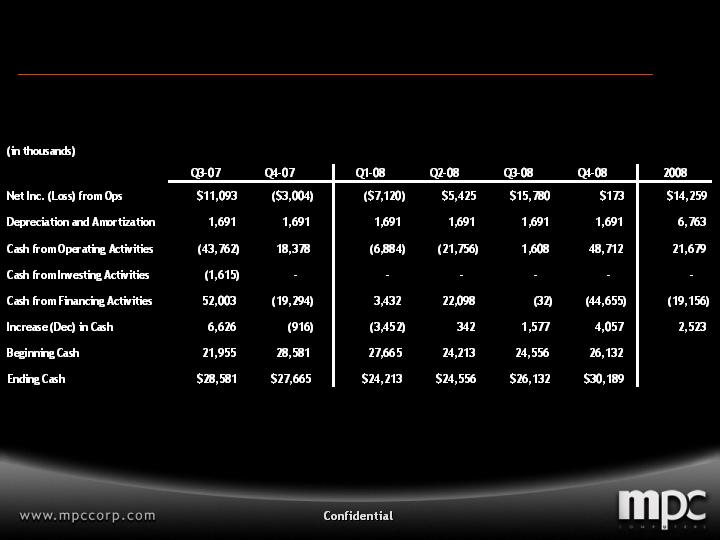

Pro-Forma Cash Flow

MPC Pro Modeling – Major Assumptions

Transaction/transition costs appr. $1M; cap ex <$2.0M

Combined entity achieves revenue growth and preserves

blended material margins

Pro forma cost adjustments of Pro reflect adequately the

cost burden to be replaced by MPC

Service and Support

Supply Chain Management

Vendor lines will provide a substantial portion of initial

funding to MPC Pro

Proposed Timeline

June 4 Signed Letter of Intent; attorneys begin drafting definitive agreement;

final due diligence list presented; investor meetings begin

June 11 Contact initiated with ODMs, suppliers and benefits providers

June 15 Investor meetings completed

June 22 Due diligence substantially completed; organizational charts completed;

transition and communications plans completed

June 29 Definitive agreement and lease agreements completed

June 30 Begin to execute transition and communications plans

July 13 Sign definitive agreements and public announcement

Q&A