Issuer Free Writing Prospectus

Relating to Preliminary Prospectus Supplement Filed Pursuant to Rule 424(b)(5)

Filed Pursuant to Rule 433

Registration No. 333-115467

July 31, 2006

JCP&L TRANSITION FUNDING II LLC

TERM SHEET

IMPORTANT NOTICE REGARDING THE CONDITIONS

FOR THIS OFFERING OF ASSET-BACKED SECURITIES

The asset-backed securities referred to in these materials are being offered when, as and if issued. In particular, you are advised that asset-backed securities, and the asset pools backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated), at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the securities having the characteristics described in these materials. If we determine that condition is not satisfied in any material respect, we will notify you, and neither the issuer nor the underwriter will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

STATEMENT REGARDING THIS FREE WRITING PROSPECTUS

JCP&L Transition Funding II LLC (the “Issuer”), a special purpose entity owned by the sponsor, Jersey Central Power & Light Company (“JCP&L”), has filed a registration statement (including a base prospectus, as supplemented by a preliminary prospectus supplement (the "Prospectus")) with the SEC for the offering to which this communication relates. Before you invest, you should read the Prospectus in that registration statement and other documents the Issuer has filed with the SEC for more complete information about the Issuer, JCP&L and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the Issuer or Goldman, Sachs & Co., the sole lead bookrunner for this offering, will arrange to send the Prospectus to you if you request it by calling toll-free 1-866-471-2526.

The registration statement referred to above (including the Prospectus) is incorporated in this free writing prospectus by reference and may be accessed by clicking on the following hyperlink:

IMPORTANT NOTICE RELATING TO AUTOMATICALLY

GENERATED EMAIL DISCLAIMERS

ANY LEGENDS, DISCLAIMERS OR OTHER NOTICES THAT MAY APPEAR AT THE BOTTOM OF THE E-MAIL COMMUNICATION TO WHICH THIS FREE WRITING PROSPECTUS IS ATTACHED RELATING TO (1) THESE MATERIALS NOT CONSTITUTING AN OFFER (OR A SOLICITATION OF AN OFFER), (2) NO REPRESENTATION THAT THESE MATERIALS ARE ACCURATE OR COMPLETE AND MAY NOT BE UPDATED OR (3) THESE MATERIALS POSSIBLY BEING CONFIDENTIAL, ARE NOT APPLICABLE TO THESE MATERIALS AND SHOULD BE DISREGARDED. SUCH LEGENDS, DISCLAIMERS OR OTHER NOTICES HAVE BEEN AUTOMATICALLY GENERATED AS A RESULT OF THESE MATERIALS HAVING BEEN SENT VIA BLOOMBERG OR ANOTHER SYSTEM.

July 31, 2006

Preliminary Term Sheet

JCP&L Transition Funding II LLC

$182,400,000 (approximate)

Transition Bonds, Series 2006-A

JCP&L Transition Funding II LLC (the "Issuer") is a Delaware limited liability company, wholly owned by Jersey Central Power & Light Company ("JCP&L"). The Issuer was formed principally to purchase the right to charge, collect and receive, and be paid from collections of, electricity consumption-based per-kilowatt-hour charges (also referred to as “Bondable Transition Property”) and to issue one or more series of transition bonds secured by that Bondable Transition Property pursuant to the Financing Order (defined below).

The above-captioned transition bonds (the "Bonds") will be offered pursuant to the Electric Discount and Energy Competition Act, enacted in the State of New Jersey in February 1999, and amended in September 2002 (the "Competition Act"). The Competition Act authorizes New Jersey electric public utilities to recover their basic generation service transition costs using transition bonds supported by irrevocable bondable stranded cost rate orders issued by the New Jersey Board of Public Utilities (the "BPU").

Pursuant to the BPU's irrevocable bondable stranded cost rate order of June 8, 2006 (the "Financing Order"), JCP&L has structured the Issuer as a bankruptcy-remote special purpose subsidiary to issue the Bonds. The Financing Order authorizes a non-bypassable charge (the "Transition Bond Charge") to be imposed on consumers of electricity within JCP&L's service territory (approximately 1.1 million residential, commercial, and industrial electricity consumers), to provide for the payment of principal of, interest on and expenses associated with the Bonds. JCP&L will collect the Transition Bond Charge on behalf of the Issuer and will remit those collections to the indenture trustee on a monthly or more frequent basis.

To enable the Bonds to be sold at the highest possible credit ratings and at the lowest possible cost for the benefit of the ratepayers, and to induce underwriters and investors to purchase the Bonds at such lowest cost, the BPU will take the specific actions set forth in the Financing Order, as expressly authorized by the Competition Act, to ensure the expected recovery of amounts sufficient to provide for timely payment of scheduled principal of and interest on the Bonds. The Transition Bond Charge will be adjusted at least annually (quarterly commencing May 1, 2020), to ensure the timely payment of scheduled principal of and interest on the Bonds.

The Bonds will not be an obligation of JCP&L or any of its affiliates (other than the Issuer). The Bonds will not be a debt or general obligation of the State of New Jersey, the BPU or any other governmental agency or instrumentality, and are not a charge on the full faith and credit or taxing power of the State of New Jersey.

Offered Classes | Approximate Principal Amount ($ Millions) | Expected Ratings (Moody’s/ S&P/ Fitch) | Fixed / Floating | Expected Weighted Average Life (years) | Expected Principal Amortization Period | Expected Final Maturity | Legal Final Maturity |

| A-1 | 55.9 | Aaa/AAA/AAA | Fixed | 3.0 yrs | 5.3 yrs | 6/5/2012 | 6/5/2014 |

| A-2 | 25.6 | Aaa/AAA/AAA | Fixed | 7.0 yrs | 2.3 yrs | 9/5/2014 | 9/5/2016 |

| A-3 | 49.3 | Aaa/AAA/AAA | Fixed | 10.0 yrs | 3.8 yrs | 6/5/2018 | 6/5/2020 |

| A-4 | 51.6 | Aaa/AAA/AAA | Fixed | 13.4 yrs | 3.0 yrs | 6/5/2021 | 6/5/2023 |

Assumptions used in the calculation of the above table include: 1) the series 2006-A transition bonds are issued on August 10, 2006; 2) payments on the series 2006-A transition bonds are made, with respect to each payment date, on the fifth day of each month in which a payment date occurs (or if such day is not a business day, on the following business day), commencing on March, 5, 2007; 3) the total annual servicing fee for the series 2006-A transition bonds equals 0.125% of the initial principal balance of the series 2006-A transition bonds; 4) there are no net earnings on amounts on deposit in the collection account; 5) operating expenses, including all fees, costs and charges of the issuer and the trustee, are paid in the amount of $76,000 in the aggregate for all classes on each payment date and that these amounts are payable in arrears; and 6) all transition bond charge collections are received in accordance with JCP&L’s forecasts and deposited in the collection account. For further details please see page S-9 of the Preliminary Prospectus Supplement.

Key Features: | | | |

Managers: | Goldman, Sachs & Co. (sole bookrunner) Morgan Stanley & Co. Incorporated Citigroup Global Markets Inc. Williams Capital Group, L.P. | Collateral: | Primarily Bondable Transition Property, which includes the irrevocable right to charge, collect and receive, and be paid from collections of, transition bond charges (“TBCs”) payable by all of JCP&L’s electric customers. The Bondable Transition Property was established by a financing order, dated June 8, 2006, issued by the New Jersey Board of Public Utilities (“BPU”) which is final, irrevocable and non-appealable |

Issuer: | JCP&L Transition Funding II LLC |

Servicer: | Jersey Central Power & Light Company (“JCP&L”), a subsidiary of FirstEnergy Corp. JCP&L provides retail electric service within a service territory located in northern, western and east central New Jersey having a population of approximately 2.5 million |

US Federal Income Tax Treatment: | The Transition Bonds will be treated as debt of JCP&L |

Structure: | Sinking fund amortization; sequential pay |

Delivery: | DTC |

Type of Offering: | SEC-Registered |

Clean-Up Call: | 5% clean-up call |

Indenture Trustee: | The Bank of New York | Series 2002-A: | In June 2002, JCP&L Transition Funding LLC issued $320 million of transition bonds, similar to those described herein, backed by a separate customer charge. There has been no principal repayment variability in Series 2002-A in the 14 payment dates to date |

ERISA Eligible: | Yes |

This material is for your information. This material is not to be construed as an offer to sell or the solicitation of any offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. The information contained in this material may not pertain to any securities that will actually be sold. The information contained in this material may be based on assumptions regarding market conditions and other matters as reflected in this material. We make no representations regarding the reasonableness of such assumptions or the likelihood that any of such assumptions will coincide with actual market conditions or events, and this material should not be relied upon for such purposes. We and our affiliates, officers, directors, partners and employees, including persons involved in the preparation or issuance of this material may, from time to time, have long or short positions in, and buy or sell, the securities mentioned in this material or derivatives of those securities (including options). Information contained in this material is current as of the date appearing on this material only and supersedes all prior information regarding the securities and assets referred to in this material. Goldman, Sachs & Co. does not provide accounting, tax or legal advice. In addition, subject to applicable law, you may disclose any and all aspects of any potential transaction or structure described herein that are necessary to support any U.S. federal income tax benefits, without Goldman, Sachs & Co. imposing any limitation of any kind.

July 31, 2006

Description of the Bonds | | |

Offered Bonds: | $182.4 million of bonds, consisting of 4 classes, issued by JCP&L Transition Funding II LLC, a Delaware limited liability company |

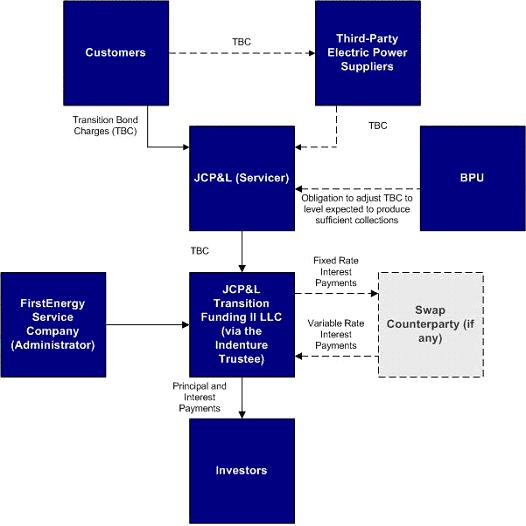

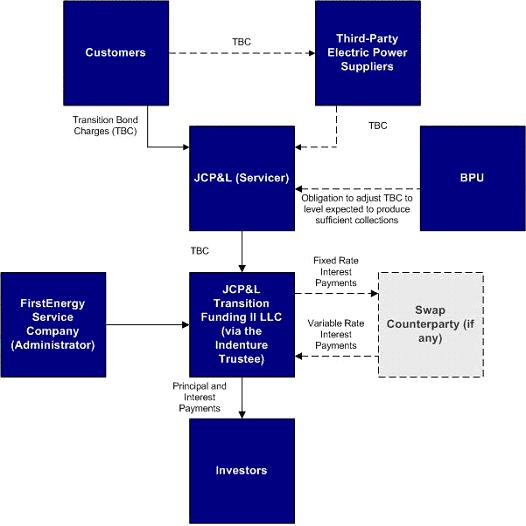

Transaction Parties: | For a summary of the transaction parties and their relationships, see Exhibit A hereto |

Collateral: | Primarily Bondable Transition Property, which includes the irrevocable right to charge, collect and receive, and be paid from the collections of, the TBC payable by electric customers |

Credit Enhancement: | n Mandatory true-ups effected through filings made with the BPU provide adjustments to the TBCs at least annually (quarterly commencing May 1, 2020) n Capital subaccount (0.50% of initial principal balance funded on the issuance date) n Reserve subaccount, which will hold any excess TBC collections |

State Pledge: | The State of New Jersey has pledged, among other things, that it will not take or permit any action that would impair the value of Bondable Transition Property, except as contemplated by the periodic adjustments to the TBC discussed above. No voter initiative or referendum process currently exists in New Jersey, and the financing order of the BPU is final, irrevocable and non-appealable |

Principal Payments: | Principal will be paid sequentially. No class will receive principal payments until all classes of a higher payment priority have been paid in full unless there is an acceleration of the series 2006-A transition bonds following an event of default in which case principal will be paid to all classes on a pro rata basis |

Payment Priority: | The indenture trustee will pay all amounts on deposit in the collection account and all investment earnings thereon, other than investment earnings on amounts held in the capital subaccount, generally in the order of priority set forth in the indenture |

Average Life Profile: | Principal cannot be repaid earlier than expected (except for 5% clean-up call applicable to Class A-4) unless the bonds are accelerated; any excess collections will be held in the reserve subaccount. The true-up mechanism is intended to provide, among other things, for the expected recovery of amounts sufficient to repay principal according to expected amortization schedule |

Payment Dates: | Each March 5, June 5, September 5 and December 5, commencing March 5, 2007 |

Interest Accrual: | Interest will accrue on a 30/360 basis |

Transition Bond Charges | Calculated to (a) generate expected TBC collections sufficient to pay expenses, interest and principal according to the expected amortization schedule and fund or replenish the capital subaccount to the required level and (b) reflect revised assumptions of electricity usage, write-offs and delinquencies For summary historical information regarding JCP&L’s electric sales and revenues and customers, see Table 1 attached hereto |

Minimum Denomination: | $1,000, except for one transition bond of each class which may be of a smaller denomination |

Risk Weighting: | If held by financial institutions subject to regulation in countries that have adopted the 1988 International Convergence of Capital Measurement and Capital Standards of the Basel Committee on Banking Supervision (“Basel Accord”), the Bonds may attract the same 20% risk weighting as "claims on" or "claims guaranteed by" non-central government bodies within those countries. However, no assurances can be given that the Bonds will attract this 20% risk weighting treatment under any national law, regulation or policy implementing the Basel Accord. Before acquiring any Bond, prospective investors that are banks or bank holding companies, particularly those that are organized under the laws of any country other than the United States, and prospective investors that are U.S. branches and agencies of foreign banks, should consult all applicable laws, regulations and policies, as well as appropriate regulatory bodies and legal counsel, to determine that an investment in the Bonds is permissible and in compliance with any applicable investment or other limits. |

This material is for your information. This material is not to be construed as an offer to sell or the solicitation of any offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. The information contained in this material may not pertain to any securities that will actually be sold. The information contained in this material may be based on assumptions regarding market conditions and other matters as reflected in this material. We make no representations regarding the reasonableness of such assumptions or the likelihood that any of such assumptions will coincide with actual market conditions or events, and this material should not be relied upon for such purposes. We and our affiliates, officers, directors, partners and employees, including persons involved in the preparation or issuance of this material may, from time to time, have long or short positions in, and buy or sell, the securities mentioned in this material or derivatives of those securities (including options). Information contained in this material is current as of the date appearing on this material only and supersedes all prior information regarding the securities and assets referred to in this material. Goldman, Sachs & Co. does not provide accounting, tax or legal advice. In addition, subject to applicable law, you may disclose any and all aspects of any potential transaction or structure described herein that are necessary to support any U.S. federal income tax benefits, without Goldman, Sachs & Co. imposing any limitation of any kind.

July 31, 2006

| | Parties to Transaction | Exhibit A |

The following diagram represents a general summary of the parties to the transaction underlying the offering of the Bonds, their roles and their various relationships to the other parties:

This material is for your information. This material is not to be construed as an offer to sell or the solicitation of any offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. The information contained in this material may not pertain to any securities that will actually be sold. The information contained in this material may be based on assumptions regarding market conditions and other matters as reflected in this material. We make no representations regarding the reasonableness of such assumptions or the likelihood that any of such assumptions will coincide with actual market conditions or events, and this material should not be relied upon for such purposes. We and our affiliates, officers, directors, partners and employees, including persons involved in the preparation or issuance of this material may, from time to time, have long or short positions in, and buy or sell, the securities mentioned in this material or derivatives of those securities (including options). Information contained in this material is current as of the date appearing on this material only and supersedes all prior information regarding the securities and assets referred to in this material. Goldman, Sachs & Co. does not provide accounting, tax or legal advice. In addition, subject to applicable law, you may disclose any and all aspects of any potential transaction or structure described herein that are necessary to support any U.S. federal income tax benefits, without Goldman, Sachs & Co. imposing any limitation of any kind.

July 31, 2006

Table 1

Historical JCP&L Electric Sales, Retail Electric Revenues and Retail Customer Statistics1

| | March 31, 2006 | 2005 | 2004 | 2003 | 2002 | 2001 |

| | | | | | | |

Billed Retail Revenues ($000s)2 | | | | | | |

| Residential | 247,277 | 1,156,044 | 975,436 | 968,121 | 988,713 | 919,207 |

| Commercial | 208,864 | 864,709 | 753,750 | 806,087 | 830,342 | 779,025 |

| Industrial | 33,280 | 140,802 | 136,310 | 202,104 | 246,560 | 242,894 |

| Other | 5,245 | 20,348 | 18,629 | 19,135 | 18,693 | 18,900 |

| Total | 494,666 | 2,181,903 | 1,884,125 | 1,995,447 | 2,084,308 | 1,960,025 |

| | | | | | | |

Average Number of Retail Customers | | | | | | |

| Residential | 952,455 | 946,379 | 935,692 | 928,251 | 918,089 | 904,390 |

| Commercial | 117,752 | 116,640 | 115,260 | 113,526 | 111,644 | 109,001 |

| Industrial | 2,634 | 2,651 | 2,680 | 2,730 | 2,778 | 2,811 |

| Other | 1,584 | 1,576 | 1,327 | 1,370 | 1,427 | 1,510 |

| Total | 1,074,426 | 1,067,246 | 1,054,959 | 1,045,877 | 1,033,938 | 1,017,712 |

| | | | | | | |

Billed Electric Consumption (gWh) | | | | | | |

| Residential | 2,254 | 10,064 | 9,349 | 9,122 | 8,990 | 8,403 |

| Commercial | 2,205 | 9,352 | 8,875 | 8,607 | 8,462 | 8,183 |

| Industrial | 690 | 3,057 | 3,078 | 3,045 | 3,142 | 3,165 |

| Other | 22 | 87 | 82 | 83 | 82 | 82 |

| Total | 5,171 | 22,560 | 21,384 | 20,857 | 20,677 | 19,833 |

| | | | | | | |

| | | | | | | |

| | | 2005 | 2004 | 2003 | 2002 | 2001 |

| Annual Variances for Billed Retail Energy Sales (gWh) |

| Forecast | | 22,075 | 21,392 | 20,709 | 20,198 | 19,802 |

| Actual | | 22,560 | 21,384 | 20,858 | 20,677 | 19,833 |

| Percent Variance | | 2.20% | -0.04% | 0.72% | 2.37% | 0.16% |

| | | | | | | |

Write-Offs | | | | | | |

| Gross Write-offs ($000s) | | 8,831 | 10,595 | 11,071 | 9,932 | 12,650 |

| Net Write-offs ($000s) | | 6,078 | 6,931 | 8,080 | 8,371 | 10,815 |

| Net Write-offs as % Billed Revenues | | 0.28% | 0.37% | 0.40% | 0.40% | 0.55% |

1 Numbers may not total due to rounding.

2 Revenue figures include revenue realized by JCP&L from basic generation service and delivery charges. Beginning in 2003, more of the larger industrial customers began to shop for generation in response to, among other things, a BPU decision to expose them to hourly pricing, which has resulted in a decrease in commodity revenues from such customers.

This material is for your information. This material is not to be construed as an offer to sell or the solicitation of any offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. The information contained in this material may not pertain to any securities that will actually be sold. The information contained in this material may be based on assumptions regarding market conditions and other matters as reflected in this material. We make no representations regarding the reasonableness of such assumptions or the likelihood that any of such assumptions will coincide with actual market conditions or events, and this material should not be relied upon for such purposes. We and our affiliates, officers, directors, partners and employees, including persons involved in the preparation or issuance of this material may, from time to time, have long or short positions in, and buy or sell, the securities mentioned in this material or derivatives of those securities (including options). Information contained in this material is current as of the date appearing on this material only and supersedes all prior information regarding the securities and assets referred to in this material. Goldman, Sachs & Co. does not provide accounting, tax or legal advice. In addition, subject to applicable law, you may disclose any and all aspects of any potential transaction or structure described herein that are necessary to support any U.S. federal income tax benefits, without Goldman, Sachs & Co. imposing any limitation of any kind.