Exhibit 99.1 |

Safe Harbor Statement This presentation may include forward-looking statements that are subject to risks and uncertainties relating to USA Mobility’s future financial and business performance. Such statements may include estimates of revenue, expenses, and income, as well as other predictive statements or plans which are dependent upon future events or conditions. These statements represent the Company’s estimates only on the date of this presentation and are not intended to give any assurance as to actual future results. USA Mobility’s actual results could differ materially from those anticipated in these forward-looking statements. Although these statements are based upon assumptions that the Company believes to be reasonable, based upon available information, they are subject to risks and uncertainties. Please review the risk factors section relating to our operations and the business environment in which we compete, contained in our 2011 Form 10-K and related Company documents filed with the Securities and Exchange Commission, for a description of these risks and uncertainties. Please note that USA Mobility assumes no obligation to update any forward-looking statements from past or present filings and conference calls. 2 |

2011 Strategic Assessment Wireless - business is extremely profitable, but continues to decline as paging users migrate to newer technologies – Cash flow margin once again expanded in 2011 – However, paging subscribers, revenue and cash flow declined – The rate of decline slowed, but the trajectory remains downward – Paging will throw off significant cash flow for years – Cash flow per share from paging will decline each year – We have large Deferred Tax Assets (DTAs) Software - repositioned for future growth with the Amcom acquisition – Attractive Software business model, focused on our core segments – Positive demographics, long term business potential – Unlocked significant value in our DTAs 3 |

Managing Our Wireless Business • Faced with declining subscribers and revenue, we have met enormous challenges with respect to managing the Wireless business creating efficiencies • For the past six years annual operating expenses have been reduced at a higher rate than our rate of annual revenue decline • We have produced significant free cash flow, expanded our margins EVERY year since 2005 and planned for the future 4 *Operating Cash Flow (OCF) excludes Depreciation, Amortization & Accretion; Goodwill Impairment; includes Capital Expense and transaction costs. **Operating Expense excludes Depreciation, Amortization & Accretion; Goodwill Impairment and includes transaction costs. Revenue Reduction Operating Expense** Reduction Operating Cash Flow* Revenue (Millions) |

Driving Solid Performance – 2011 Highlights 5 *Revenues include maintenance revenue write-down related to purchase accounting adjustments. **Operating Expenses exclude Depreciation, Amortization & Accretion and include transaction costs. 2011 (Millions) From To Results Revenues* Software 42.0 $ 48.0 $ 43.2 $ Wireless 193.0 200.0 199.7 Total 235.0 $ 248.0 $ 242.9 $ Operating Expenses** Software 40.0 $ 35.0 $ 38.6 $ Wireless 134.0 127.0 125.3 Total 174.0 $ 162.0 $ 163.9 $ Capital Expenditures Software 1.0 $ 0.5 $ 0.2 $ Wireless 8.0 6.0 7.8 Total 9.0 $ 6.5 $ 8.0 $ Guidance Range |

Driving Solid Performance – 2011 Highlights Wireless – Annual subscriber churn rate improved for second year in a row from 22.5% for 2009 to 13.4% for 2010 and 11.7% for 2011 – lowest in Company’s history – Year-over-year rate of revenue decline was 14.4% in 2011 compared to 19.5% in 2010 Software – On a pro forma full year comparable basis (excluding purchase accounting adjustments) revenue increased 11.2% in 2011 over 2010; $56.7 million vs. $51.0 million – Q4 Total Bookings (including Maintenance renewals) were the best of the year at $15.2 million – December Operations Bookings were the best month of the stub period at $3.8 million. Best single month in the history of the Software company 6 |

Driving Solid Performance – 2011 Highlights On a consolidated basis, 29 cents of every dollar of revenue generated in 2011 turned into profit generating sufficient cash flow to: 7 Return $22.1 million in capital to stockholders in the form of dividends; $1.00/share for the year Repay $23.7 million of the $51.9 million bank debt incurred for Amcom transaction End 2011 with $53.7 million cash in the bank Net debt free on a cash basis at YE 2011 (debt free currently) |

Repositioning for Future Growth Amcom Software Acquisition in March 2011 – Demonstrates our long-term commitment to new and existing customers – Provides a long-term revenue and cash flow stream for our shareholders – New product sales into our valuable market segments – Expansion via internal R&D – Select add-on acquisitions – Increased the future recoverability of the DTAs by $32.4 million in 2011 8 Capitalizes on our valuable franchise in core markets – Healthcare, Government, and Large Enterprise Creates a growth platform for continued value creation through: Unlocks more value of our existing DTAs |

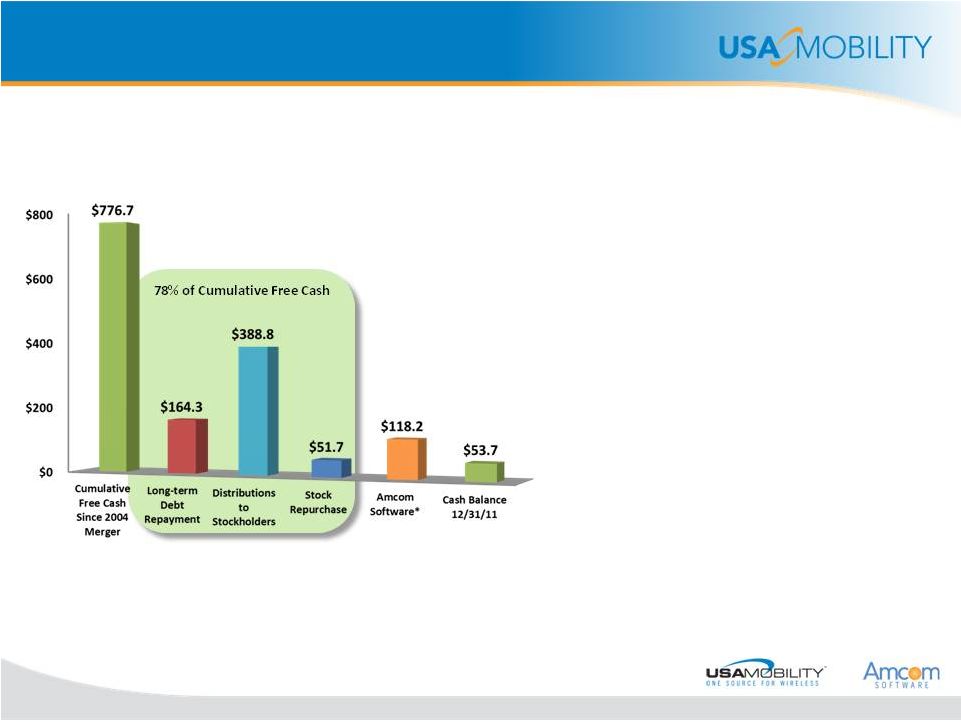

Achieving Solid Long-Term Performance • We delivered on our plan through 2011 • We have started the process to capitalize on our strengths to reposition for long-term growth with the Amcom acquisition • We will continue that process in 2012 which will require changes in approach but not in our continued goal to increase shareholder value 9 *Actual cash invested exclusive of debt. (Millions) Create long-term value & return excess capital to shareholders |

10 Long-Term Growth Strategy Cross sell + expand S&M resources Further Penetrate Existing Markets with New Product Development Expand International Presence Pursue Highly Targeted Acquisitions Market Expansion |

• • • • • 11 Our Changing Marketplace and Approach Our Changing Marketplace and Approach Cross-selling opportunities and collaboration create value for all stakeholders – Customers – the Company – Shareholders – and are integral to our sales strategy and execution Impact Achieves Results Increase new logo business Retain and grow base business Keep revenue “All in the Family” Path to Company growth and Long Term Shareholder Value |

12 Leads Sales Referrals, Key Account Manager Referrals, Webinar Registrants Collaboration among Sales orgs “At-bats” into sales pipeline Collaboration Driving Wireless Customers to Amcom |

13 • Includes tracking leads and passing to appropriate sales representatives Virtual Cross Selling Web Sites Direct Visitors Accordingly |

Hospitals Today: Communications Challenged 14 |

15 Hospitals Need Solutions to Improve Quality of Care and Patient Safety • Inadequate communication is the main cause of sentinel events in hospitals (1) • Amcom customer experiences illustrate need for rapid, more automated communications – Lack of coordinated response to patients in distress – Difficulty reaching the appropriate clinician – Inaccurate on-call schedules contribute to improper contacts – Slow caregiver response to aid requests Communications Patient Assessment Leadership Procedural Compliance Competency/Credentialing Environmental Safety/Security Orientation/Training Availability of Information Care Planning Organization Culture Staffing Continuum of Care % of Deaths and Serious Injuries Impacted by Issue 0% 20% 40% 60% 80% (1) Improving America’s Hospitals: The Joint Commission’s Annual Report on Quality and Safety 2007 |

Amcom Solutions Solve Critical Communications Challenges 16 Operator Console Console Web Directory, On Call, Hours Tracking Web Portal Smartphone & Tablet Messaging Amcom Mobile Connect Emergency Notification e.Notify Mobile Event Notification Amcom Messenger Speech Recognition Speech Solutions Call Center Quality Amcom Call Recording Call Accounting Eclipse E911 Enhanced 911 Solutions Connecting Correctly Amcom Care Connect |

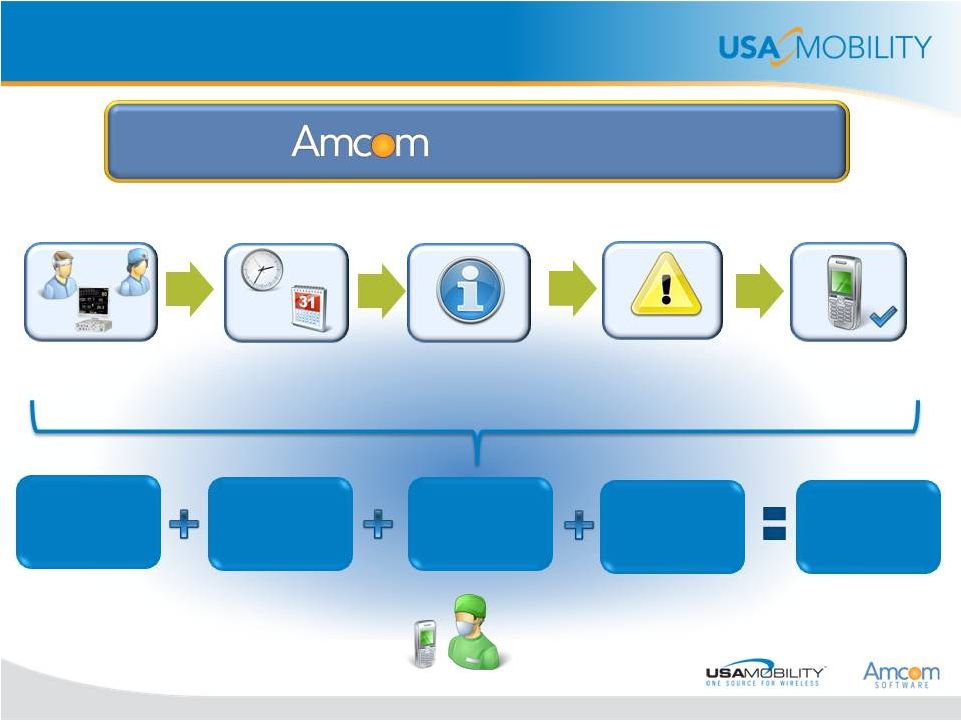

Care Connect Who wants to connect? Time of day Day of week What is the priority of the message? What is my Preferred device? What is my status? Why do they want to connect? Who: Dr. Elray For: Urgent Consult Request TOD / DOW: 8:50 AM, Wednesday Status: In Surgery Priority: Urgent (Urgent Consult Request) Preferred Communication: Mobile Call Giving physicians control over their communication process 17 |

Expand International Presence 18 • Offices in Australia, UK, Netherlands and Dubai (soon) • 16% of Software revenue in 2012 comes from outside of the U.S. – Strong presence in Australia – Growing presence in the Middle East, Europe and Asia • Pursuing international opportunities where they make sense given our existing resources and talent |

• Disciplined approach that focuses on targeted applications areas • We investigate potential acquisition targets where we believe that a buy is advantageous versus an internal build effort – Time to market – Reasonable valuation expectations – Domain and technology expertise • Based on these criteria we have identified a pipeline of possibilities that we are investigating for possible acquisitions • IMCO acquisition demonstrates execution of our M&A strategy – Addition of critical test results management enables us to offer more communication solutions in clinical settings, a focal point of our strategy M&A Strategy Approach 19 |

IMCO Acquisition = Amcom Critical Test Results • Acquisition allows faster time to market for vital clinical customer need at cost efficient investment • • Helps to address Joint Commission's National Patient Safety Goal Requirements regarding timely delivery of critical test results – This is the #2 on their list of patient safety goals – Speeds workflow, reduces litigation exposure and cost of regulatory compliance • We will integrate this solution with Amcom's suite of communication workflow solutions including smartphone messaging – Supports traceable, closed-loop test results information that empowers physicians to provide better care for their patients 20 |

Strategy Implementation – Capital Allocation Reviewing capital allocation based upon: – The realities of cash flow from our Wireless business – The need for strategic capital to grow our Software business – The ability to unlock further value from our DTAs Considerations: – Maintain a significant current yield on our common stock – Establish a revised dividend rate that is sustainable over several years – Provide strategic capital to pursue potential acquisitions – Continue review of our stock repurchase plan 21 |

|