S m a r t e r, fa s t e r c l i n i c a l c o m m u n i c a t i o n I n v e s t o r P r e s e n t a t i o n | D e c e m b e r 2 0 2 2

Safe harbor statement Statements contained in this presentation which are not historical fact, such as statements regarding Spok’s future operating and financial performance, and future dividend payments are forward-looking statements for purposes of the safe harbor provisions under the Private Securities Litigation Reform Act of 1995. These forward- looking statements involve risks and uncertainties that may cause Spok’s actual results to be materially different from the future results expressed or implied by such forward-looking statements. Factors that could cause actual results to differ materially from those expectations include, but are not limited to, risks related to Spok’s new strategic business plan, including its ability to maximize revenue and cash generation from its established businesses and return capital to shareholders, risks related to the COVID-19 pandemic and its effect on our business and the economy, other economic conditions such as recessionary economic cycles, higher interest rates, inflation and higher levels of unemployment, declining demand for paging products and services, continued demand for our software products and services, our dependence on the U.S. healthcare industry, our ability to develop additional software solutions for our customers and manage our development as a global organization, the ability to manage operating expenses, particularly third-party consulting services and research and development costs, future capital needs, competitive pricing pressures, competition from traditional paging services, other wireless communications services and other software providers, many of which are substantially larger and have much greater financial and human capital resources, changes in customer purchasing priorities or capital expenditures, government regulation of our products and services and the healthcare and health insurance industries, reliance upon third-party providers for certain equipment and services, unauthorized breaches or failures in cybersecurity measures adopted by us and/or included in our products and services, the effects of changes in accounting policies or practices, our ability to realize the benefits associated with our deferred tax assets, future impairments of our long-lived assets, amortizable intangible assets and goodwill, the effects of our limited- duration shareholder rights plan, as well as other risks described from time to time in our periodic reports and other filings with the Securities and Exchange Commission. Although Spok believes the expectations reflected in the forward-looking statements are based on reasonable assumptions, it can give no assurance that its expectations will be attained. Spok disclaims any intent or obligation to update any forward-looking statements.

Table of Contents Investment Highlights Business Strategy Spok Care Connect® Wireless Financials Wrap Up 1 2 4 5 6 3

Investment Highlights1

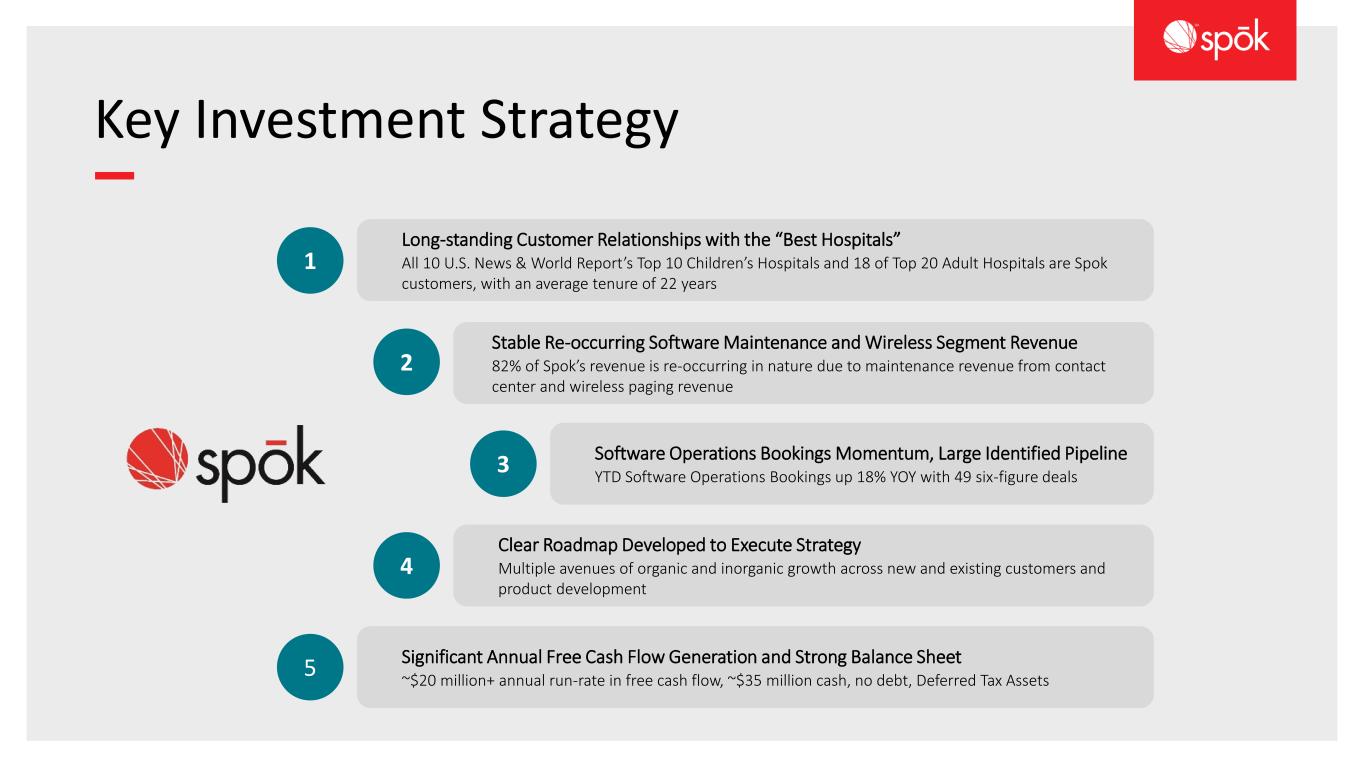

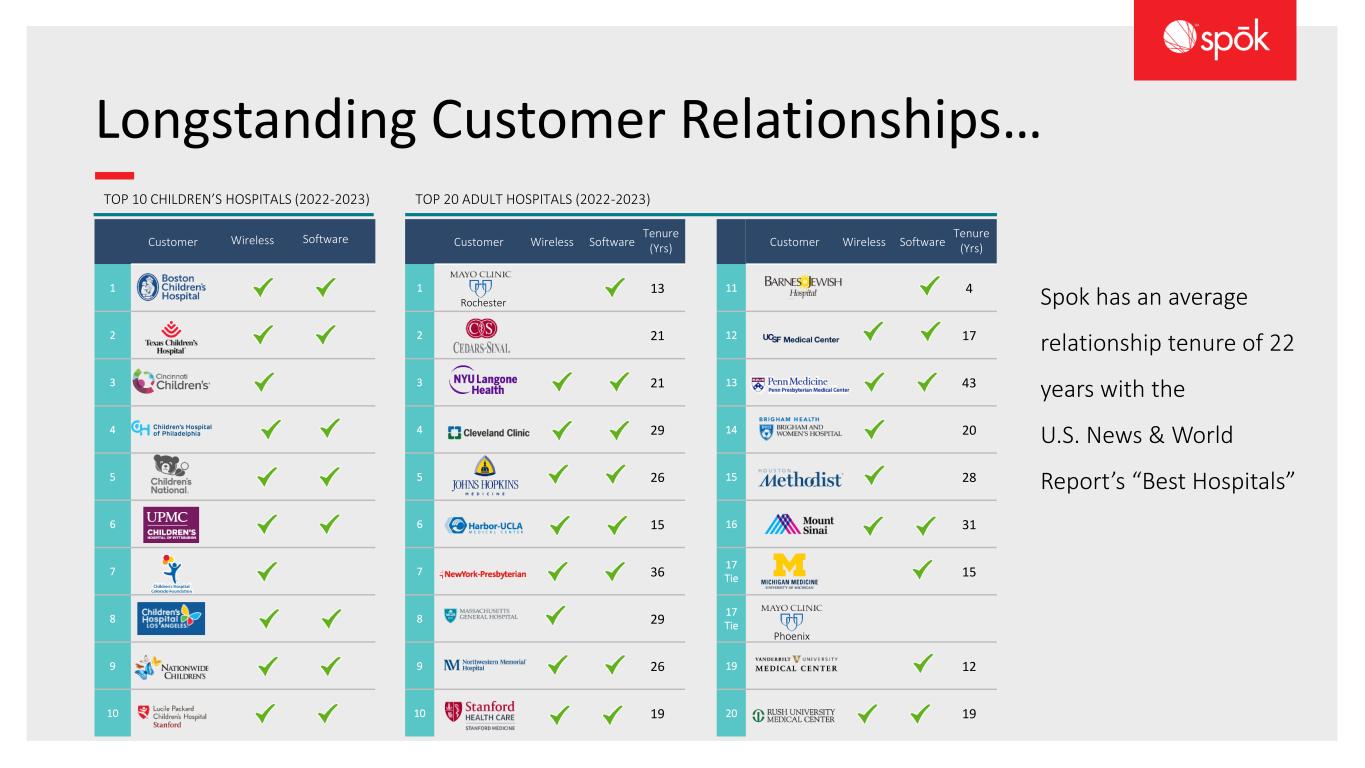

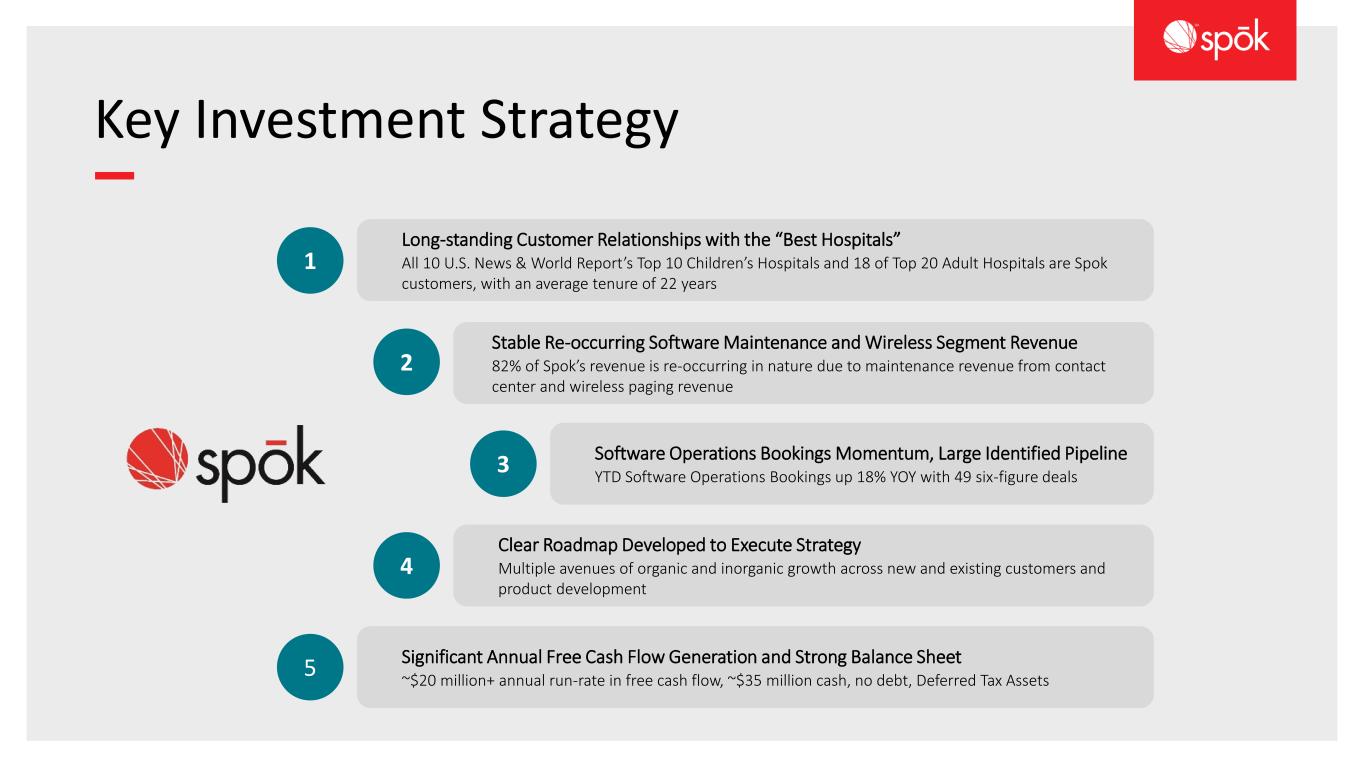

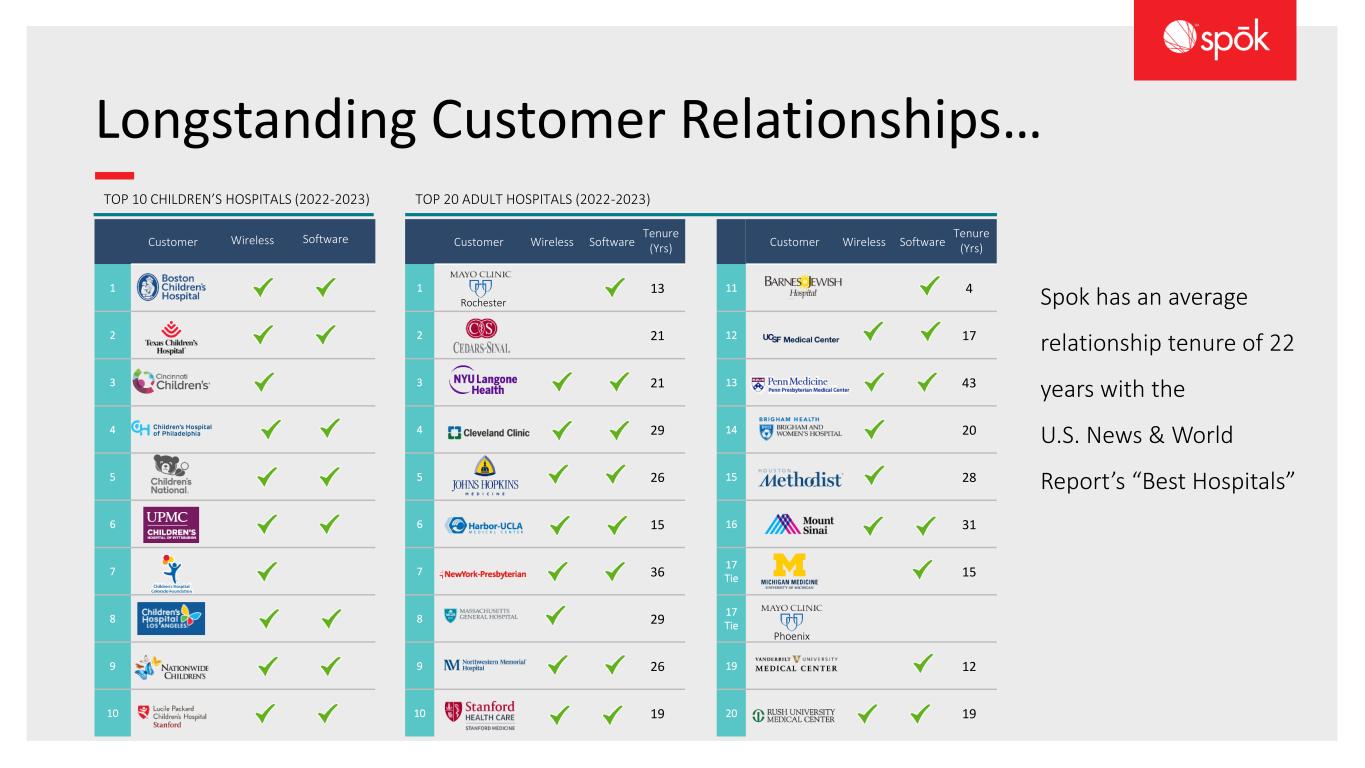

Key Investment Strategy Significant Annual Free Cash Flow Generation and Strong Balance Sheet ~$20 million+ annual run-rate in free cash flow, ~$35 million cash, no debt, Deferred Tax Assets Software Operations Bookings Momentum, Large Identified Pipeline YTD Software Operations Bookings up 18% YOY with 49 six-figure deals Stable Re-occurring Software Maintenance and Wireless Segment Revenue 82% of Spok’s revenue is re-occurring in nature due to maintenance revenue from contact center and wireless paging revenue Long-standing Customer Relationships with the “Best Hospitals” All 10 U.S. News & World Report’s Top 10 Children’s Hospitals and 18 of Top 20 Adult Hospitals are Spok customers, with an average tenure of 22 years 5 2 3 1 Clear Roadmap Developed to Execute Strategy Multiple avenues of organic and inorganic growth across new and existing customers and product development 4

Spok at a Glance Leader in healthcare communications - A clinical communications & collaboration solution provider. Significant experience integrating to critical hospital contact centers, EHRs and many other core healthcare information systems. We continue to invest in and enhance our solutions. Largest paging carrier in the U.S. with over 800K pagers Blue chip and sticky customer base including all Top 10 Children’s Hospitals and 18 of the Top 20 Adult Hospitals, with 2,200+ hospitals in total Spok has built intellectual property via decades of R&D investments Operational excellence in execution, generating free cash flow while debt free and paying little in taxes. Pioneer in healthcare communications, putting the customer first in all we do, honoring our core values and good business ethics. $134M 2022E Revenue $111M 2022E Re-occurring Revenue(1) 36% 2022E Contribution Margin 83% Percent of Revenue Is Re-occurring 2,200+ Hospitals use Spok Communications 79% 2022E Gross Margin Key Facts Spok By The Numbers Spok Integrated Solution Ecosystem Source: Company management. (1) Company classifies re-occurring revenue as revenue from Spok Care Connect maintenance, and Wireless.

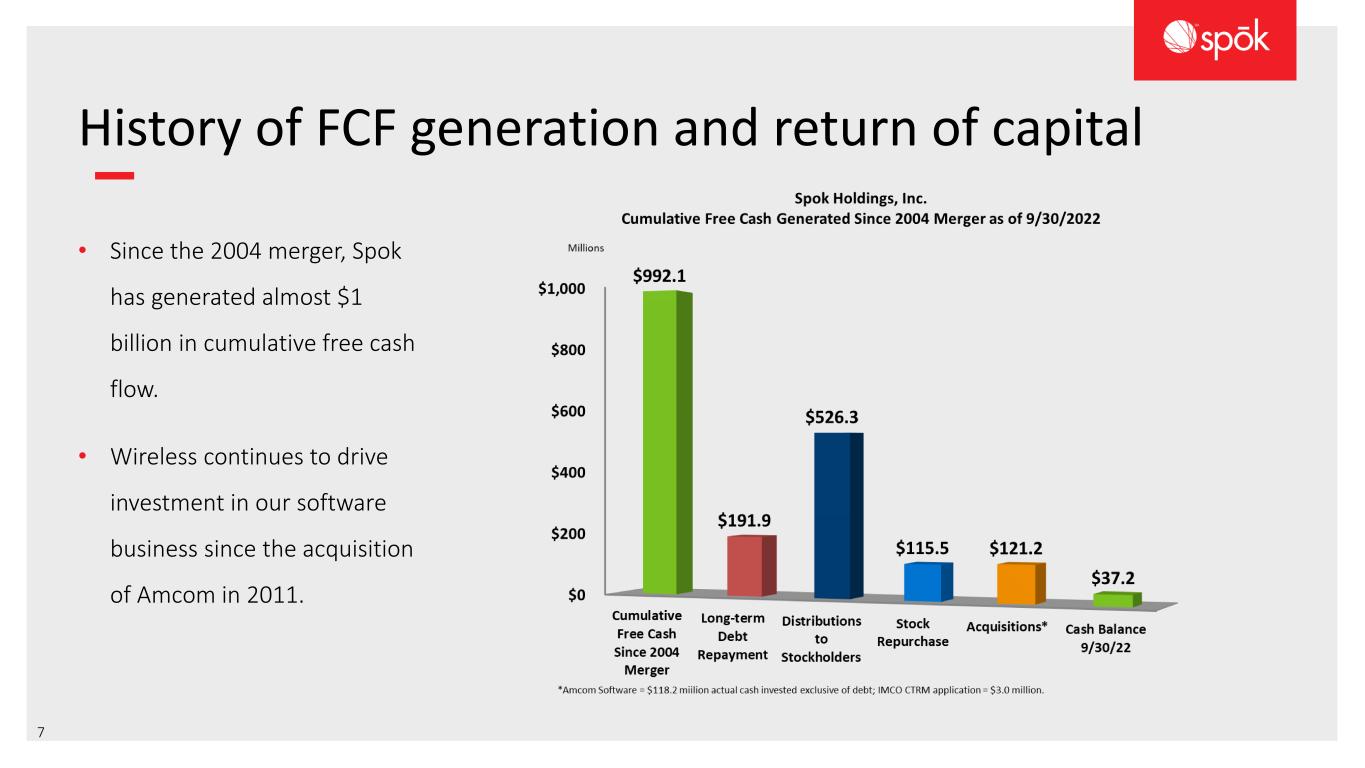

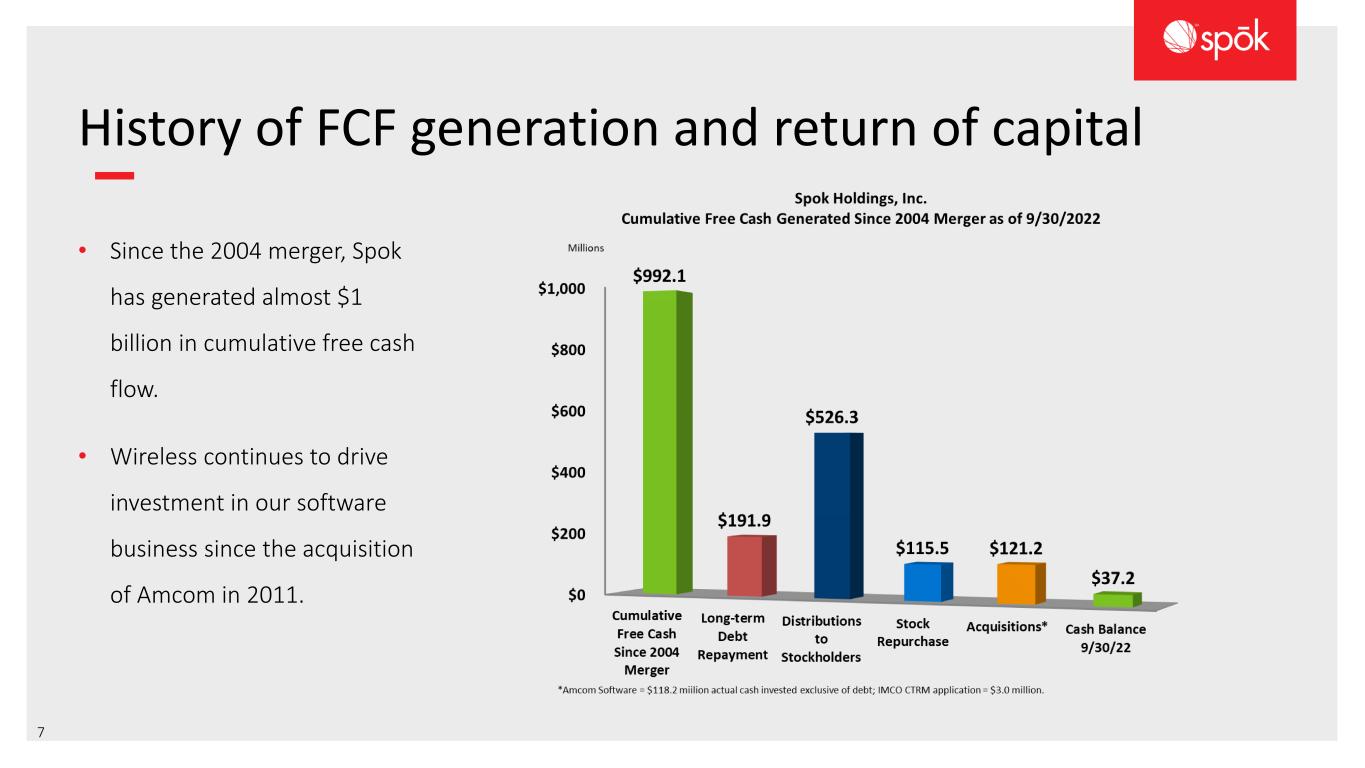

History of FCF generation and return of capital • Since the 2004 merger, Spok has generated almost $1 billion in cumulative free cash flow. • Wireless continues to drive investment in our software business since the acquisition of Amcom in 2011. 7

Spok Leadership Team Sharon Woods Keisling Corporate Secretary and Treasurer Renee Hall Chief Compliance Officer VP of Human Resources Tim Tindle Chief Information Officer Vince Kelly Chief Executive Officer Mike Wallace President and Chief Operating Officer Mick Ling Vice President of Maintenance Revenue Calvin Rice Chief Financial Officer Jonathan Wax EVP of Global Sales

Business Strategy2

10 Strategic business plan update 01 02 03 Strategic business plan prioritizing maximization of free cash flow and returning capital to shareholders officially implemented on Feb. 17, 2022 Significant business improvement in virtually all areas, including sales, product development, and overall execution 04 Completed rightsizing the company to focus on cash flow and stabilizing revenue in our core Spok Care Connect and Wireless service Lines $16.9 million of Proforma Free Cash Flow generated for 3Q YTD 2022 - $18.8 million in cumulative capital returned to shareholders since the implementation of the strategic business plan in the first quarter of 2022

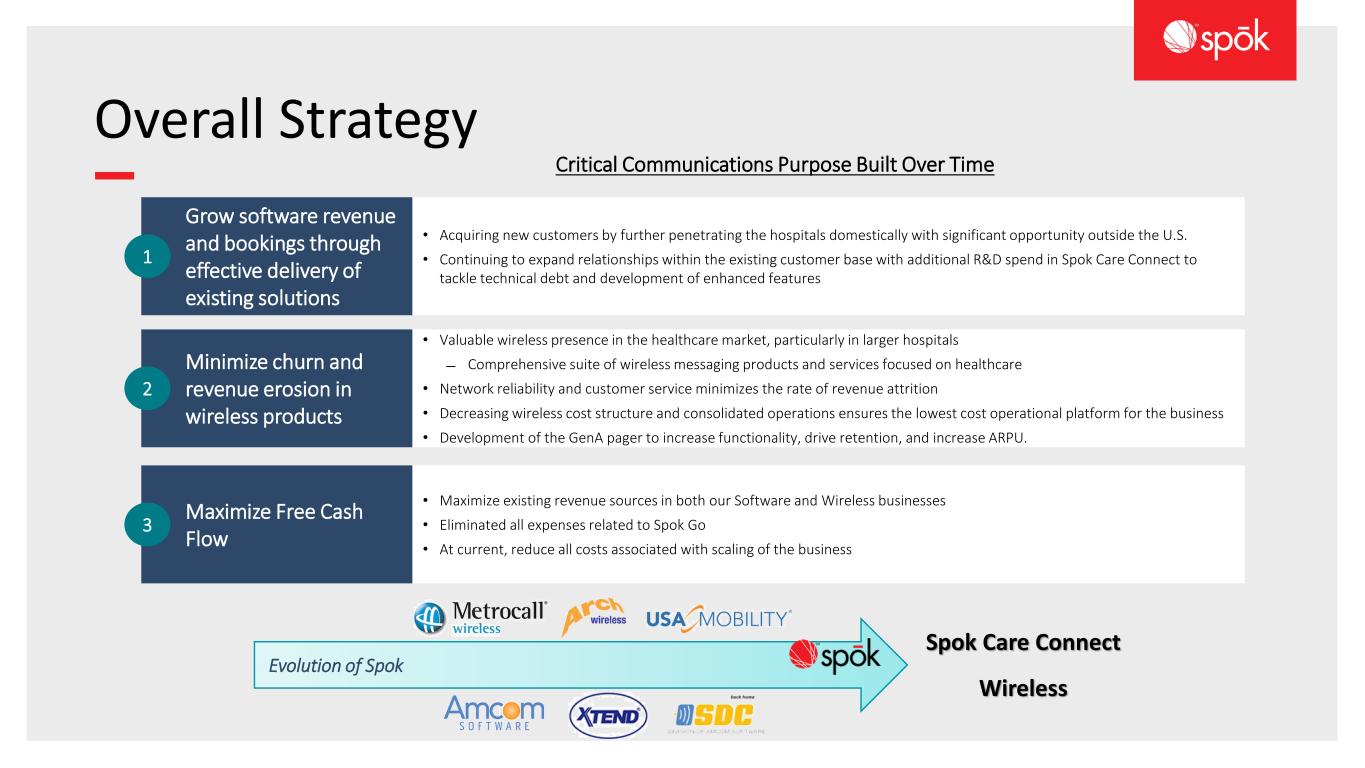

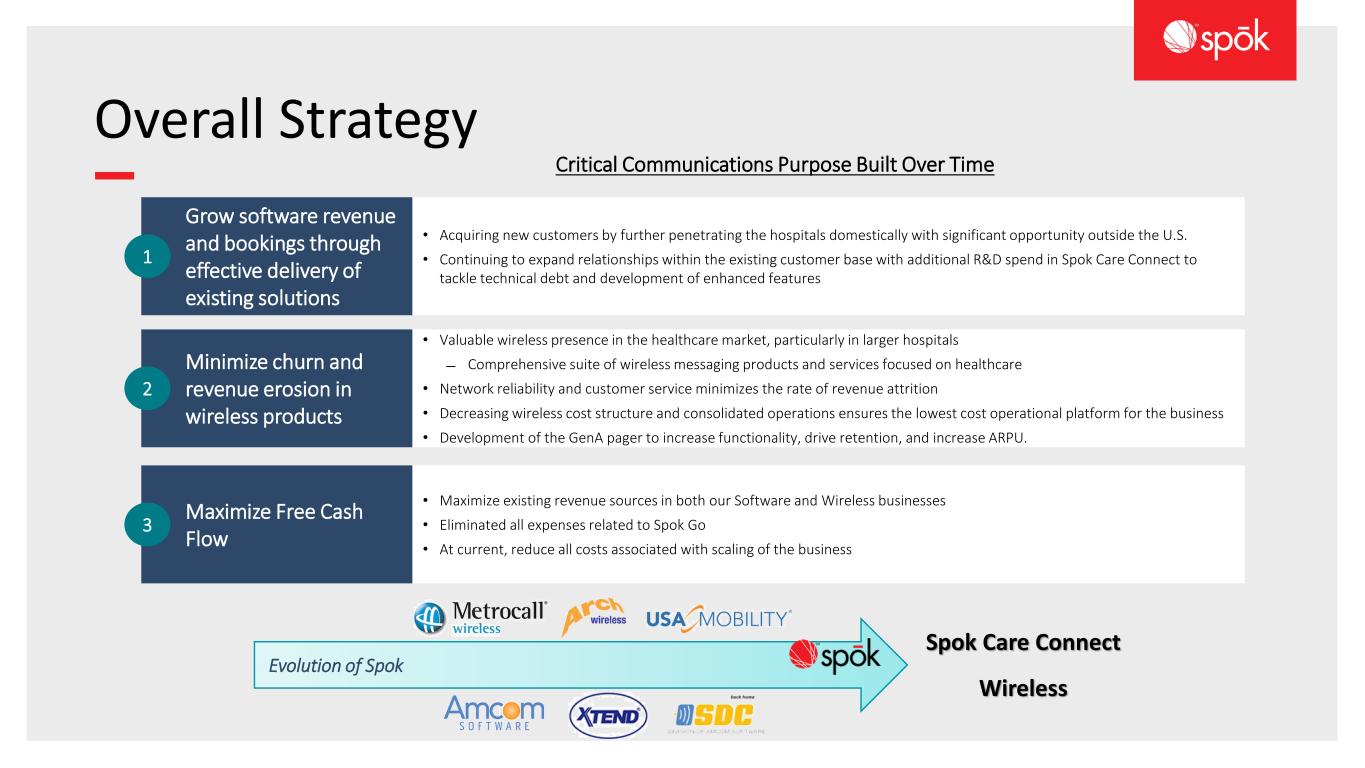

Overall Strategy Critical Communications Purpose Built Over Time Evolution of Spok • Acquiring new customers by further penetrating the hospitals domestically with significant opportunity outside the U.S. • Continuing to expand relationships within the existing customer base with additional R&D spend in Spok Care Connect to tackle technical debt and development of enhanced features Grow software revenue and bookings through effective delivery of existing solutions 1 Maximize Free Cash Flow 3 Minimize churn and revenue erosion in wireless products 2 • Maximize existing revenue sources in both our Software and Wireless businesses • Eliminated all expenses related to Spok Go • At current, reduce all costs associated with scaling of the business • Valuable wireless presence in the healthcare market, particularly in larger hospitals ̶ Comprehensive suite of wireless messaging products and services focused on healthcare • Network reliability and customer service minimizes the rate of revenue attrition • Decreasing wireless cost structure and consolidated operations ensures the lowest cost operational platform for the business • Development of the GenA pager to increase functionality, drive retention, and increase ARPU. Wireless Spok Care Connect

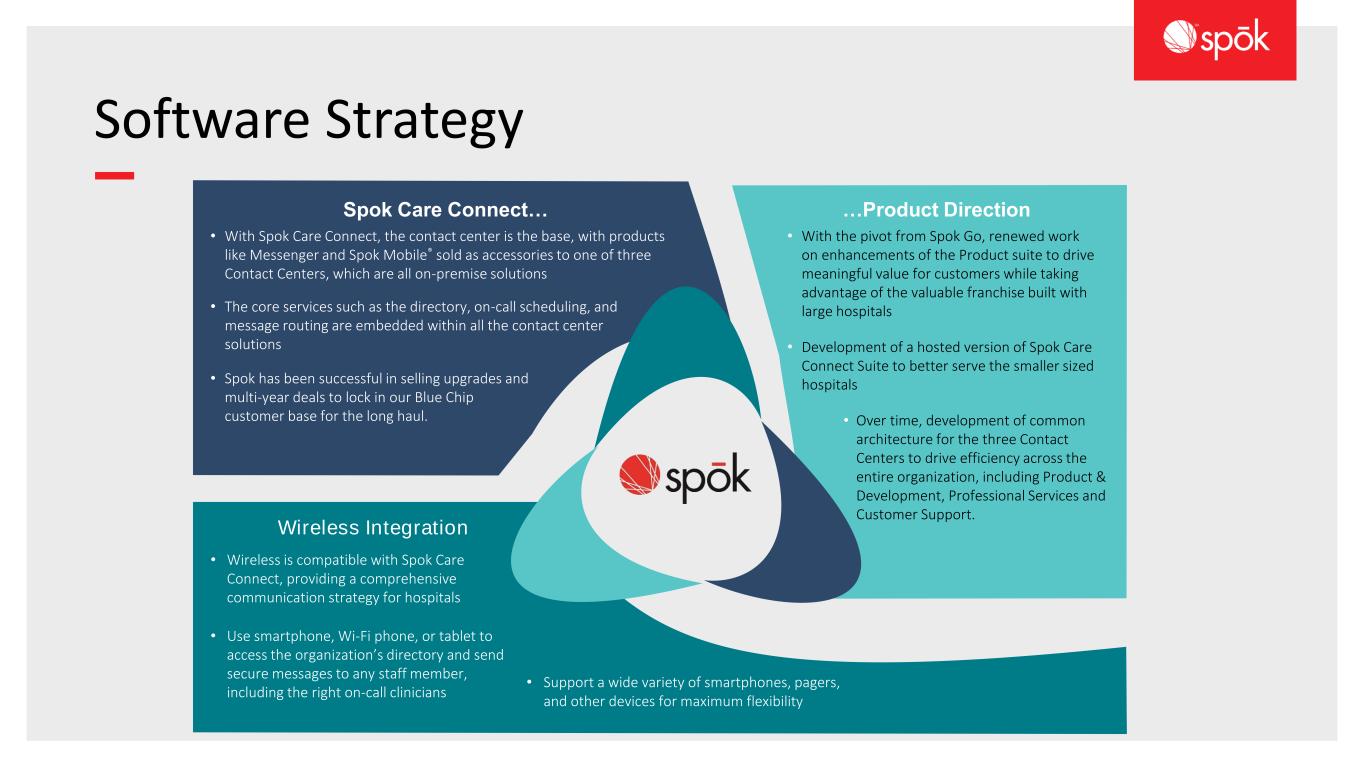

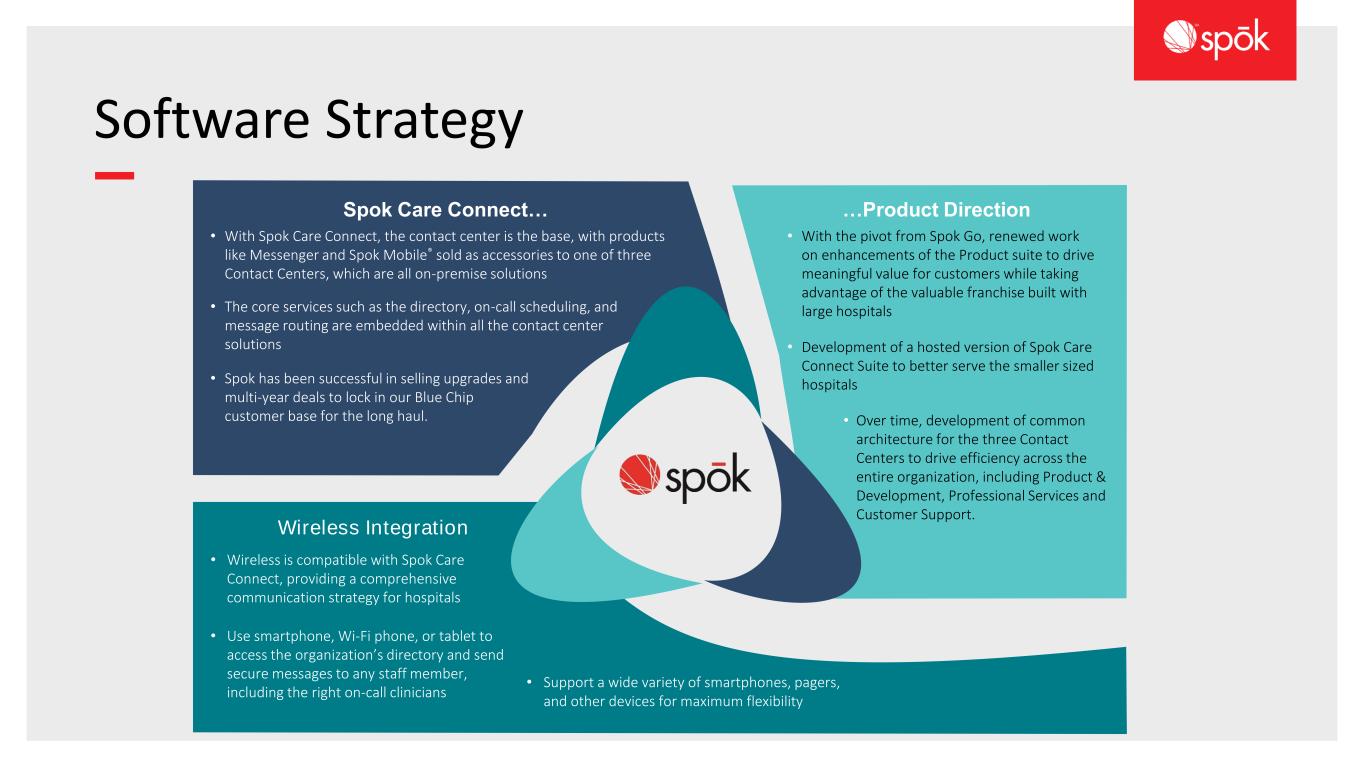

Software Strategy • With Spok Care Connect, the contact center is the base, with products like Messenger and Spok Mobile® sold as accessories to one of three Contact Centers, which are all on-premise solutions Wireless Integration Spok Care Connect… …Product Direction • With the pivot from Spok Go, renewed work on enhancements of the Product suite to drive meaningful value for customers while taking advantage of the valuable franchise built with large hospitals • Development of a hosted version of Spok Care Connect Suite to better serve the smaller sized hospitals • Over time, development of common architecture for the three Contact Centers to drive efficiency across the entire organization, including Product & Development, Professional Services and Customer Support. • Wireless is compatible with Spok Care Connect, providing a comprehensive communication strategy for hospitals • Use smartphone, Wi-Fi phone, or tablet to access the organization’s directory and send secure messages to any staff member, including the right on-call clinicians • Support a wide variety of smartphones, pagers, and other devices for maximum flexibility • Spok has been successful in selling upgrades and multi-year deals to lock in our Blue Chip customer base for the long haul. • The core services such as the directory, on-call scheduling, and message routing are embedded within all the contact center solutions

Wireless Strategy Spok continues to maximize Wireless cash flow by pursuing a strategy of simultaneously minimizing churn and revenue erosion while maximizing margins through network cost reduction efforts Network Rationalization Plan The Company has ongoing efforts to manage network capacity and to improve overall network efficiency by consolidating subscribers onto fewer, higher capacity networks with increased transmission speeds Overhead Cost management effort focused on rightsizing and headcount reduction Release New ProductsMaximize Margins Through Cost Savings • To mitigate wireless subscriber erosion and provide uplift to ARPU, the Company is launching a new pager (GenA™ Pager) – New user interface is intuitive to users with smartphone UI • Development started mid-2020 of a next generation one-way pager to replace the current T5 and a very modest investment GenA Pager Maximize Margins Through Rate Increases Nominal Rate Increases Balance risk of returns, inflation, margin erosion with periodic small rate increases

Spok Care Connect®3

61% H e a l t h c a r e Other Large Enterprise Government 2012 Focus on Healthcare 15 85% H e a l t h c a r e Government Large Enterprise Other 2022 Percentage of revenue

1 2 3 4 5 6 7 8 9 10 1 13 2 21 3 21 4 29 5 26 6 15 7 36 8 29 9 26 10 19 11 4 12 17 13 43 14 20 15 28 16 31 17 Tie 15 17 Tie 19 12 20 19 TOP 10 CHILDREN’S HOSPITALS (2022-2023) TOP 20 ADULT HOSPITALS (2022-2023) Rochester Phoenix Wireless Software Wireless Software Wireless Software Longstanding Customer Relationships… Spok has an average relationship tenure of 22 years with the U.S. News & World Report’s “Best Hospitals” Customer Customer Customer Tenure (Yrs) Tenure (Yrs)

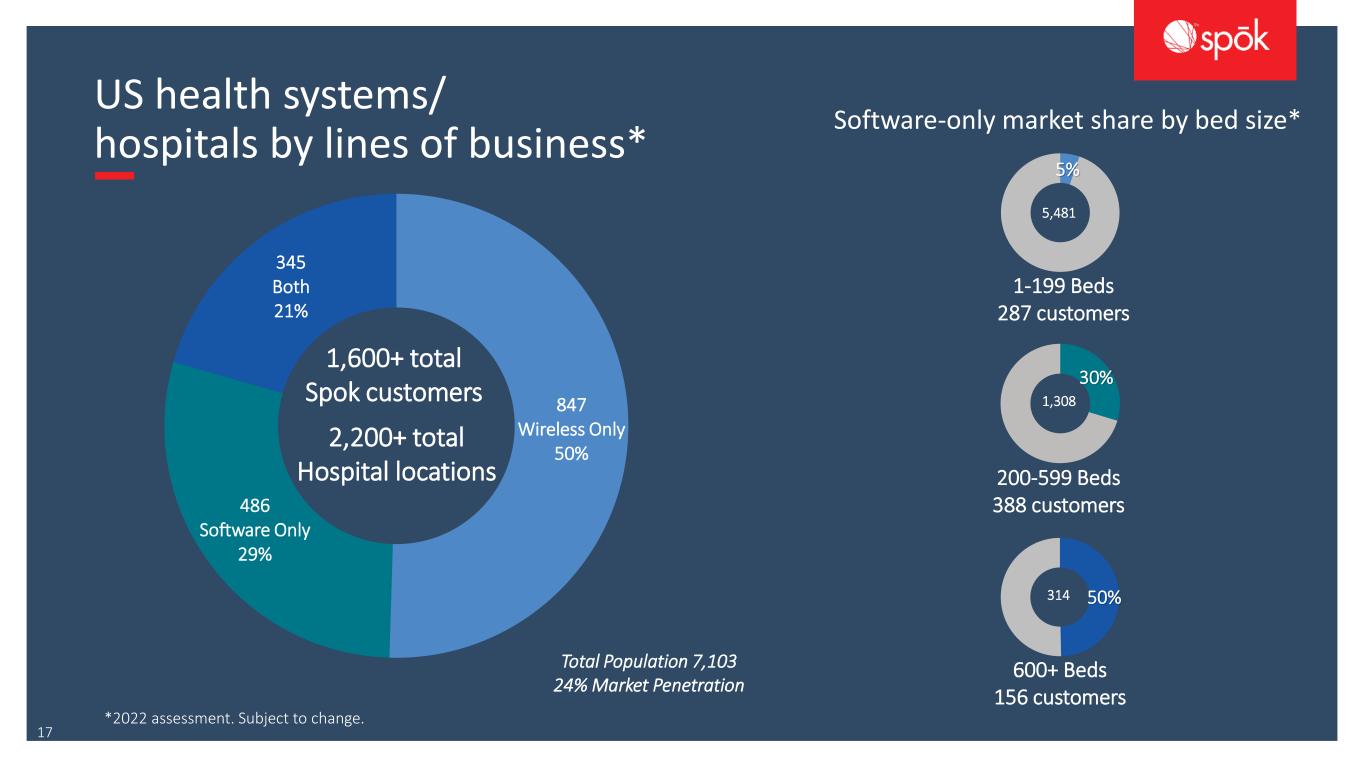

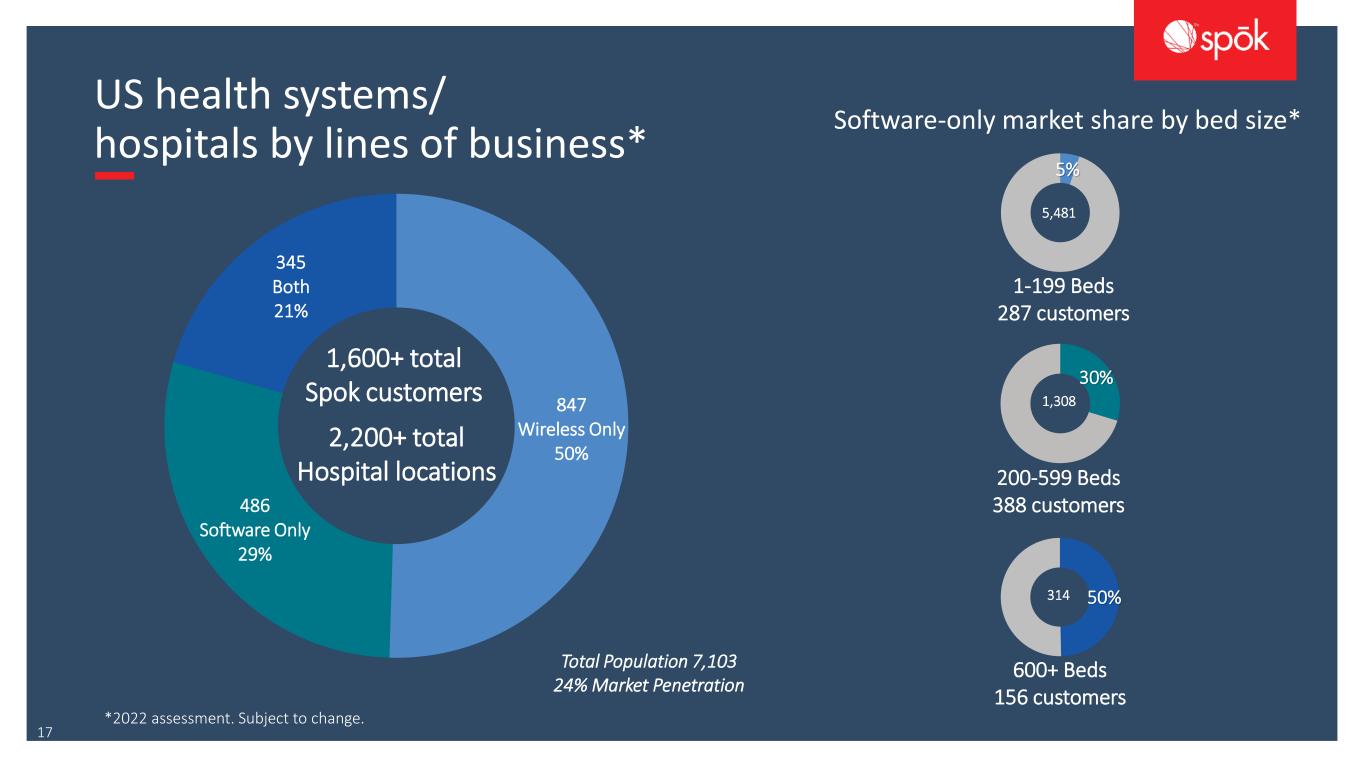

17 US health systems/ hospitals by lines of business* 847 Wireless Only 50% 486 Software Only 29% 345 Both 21% 1,600+ total Spok customers Total Population 7,103 24% Market Penetration 5% 30% 1-199 Beds 287 customers 50% 200-599 Beds 388 customers 600+ Beds 156 customers 5,481 1,308 314 Software-only market share by bed size* *2022 assessment. Subject to change. 2,200+ total Hospital locations

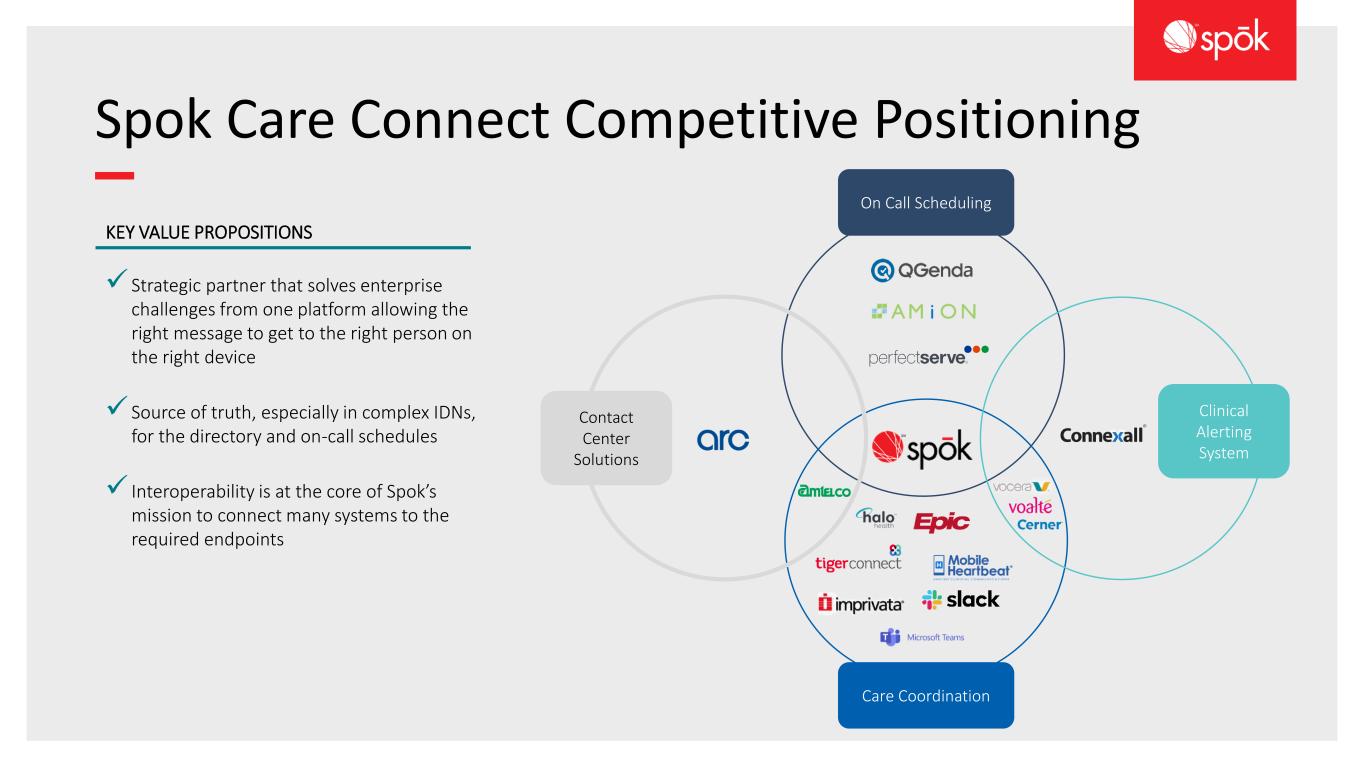

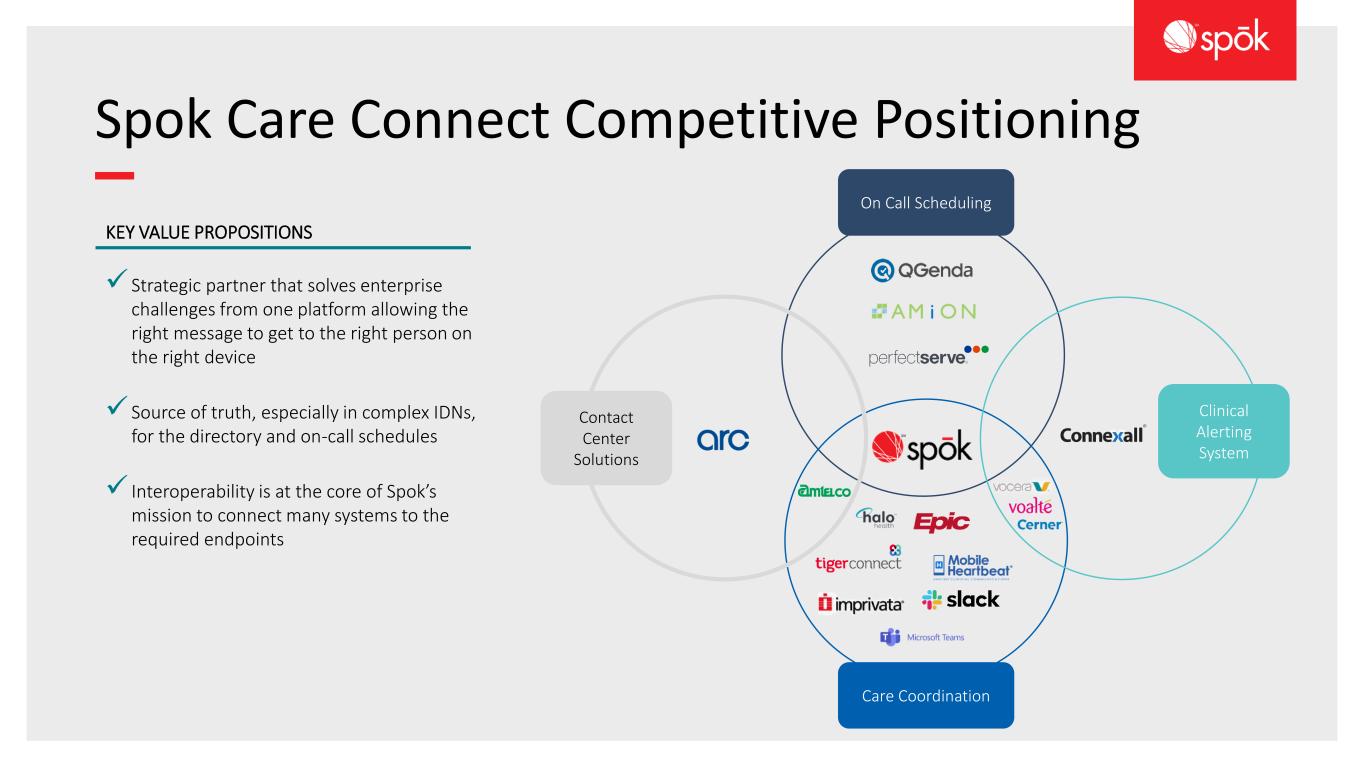

Spok Care Connect Competitive Positioning KEY VALUE PROPOSITIONS ✓ Strategic partner that solves enterprise challenges from one platform allowing the right message to get to the right person on the right device ✓ Source of truth, especially in complex IDNs, for the directory and on-call schedules ✓ Interoperability is at the core of Spok’s mission to connect many systems to the required endpoints On Call Scheduling Clinical Alerting System Care Coordination Contact Center Solutions

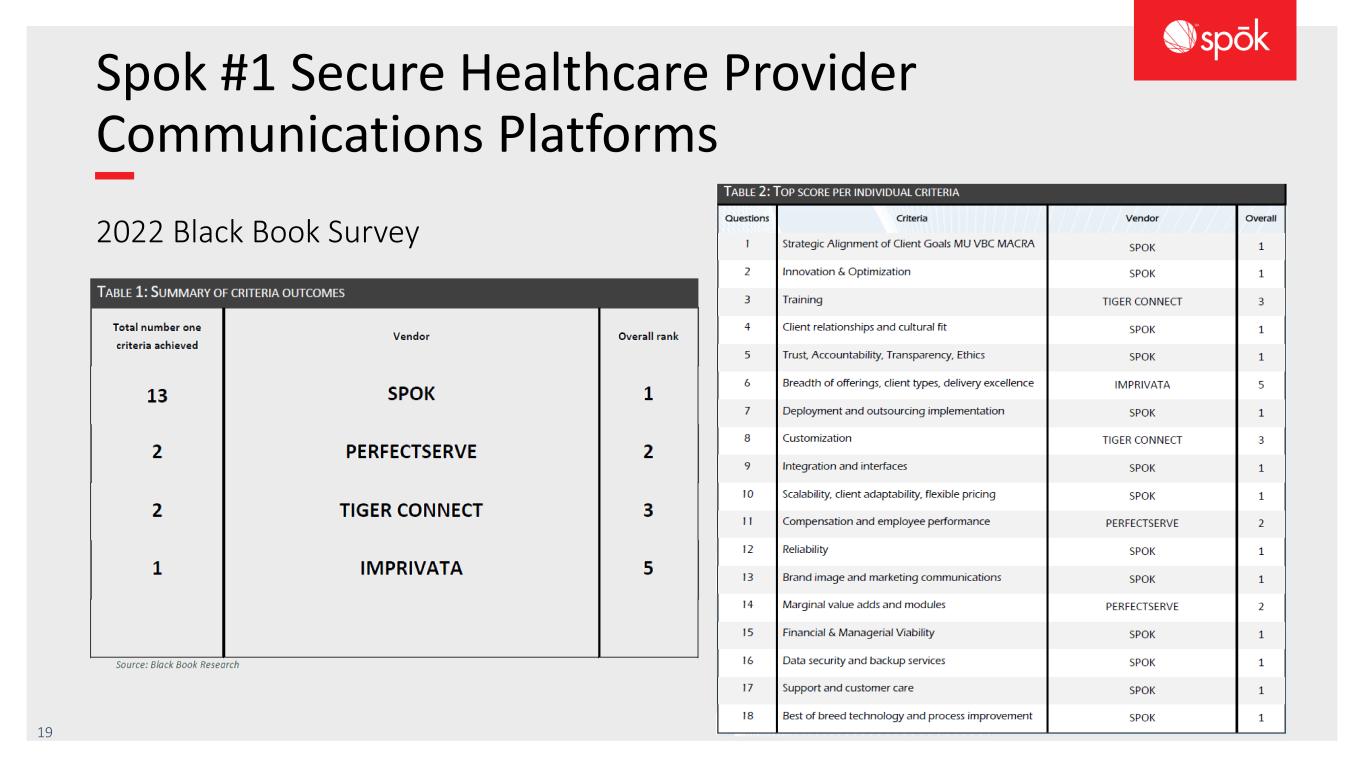

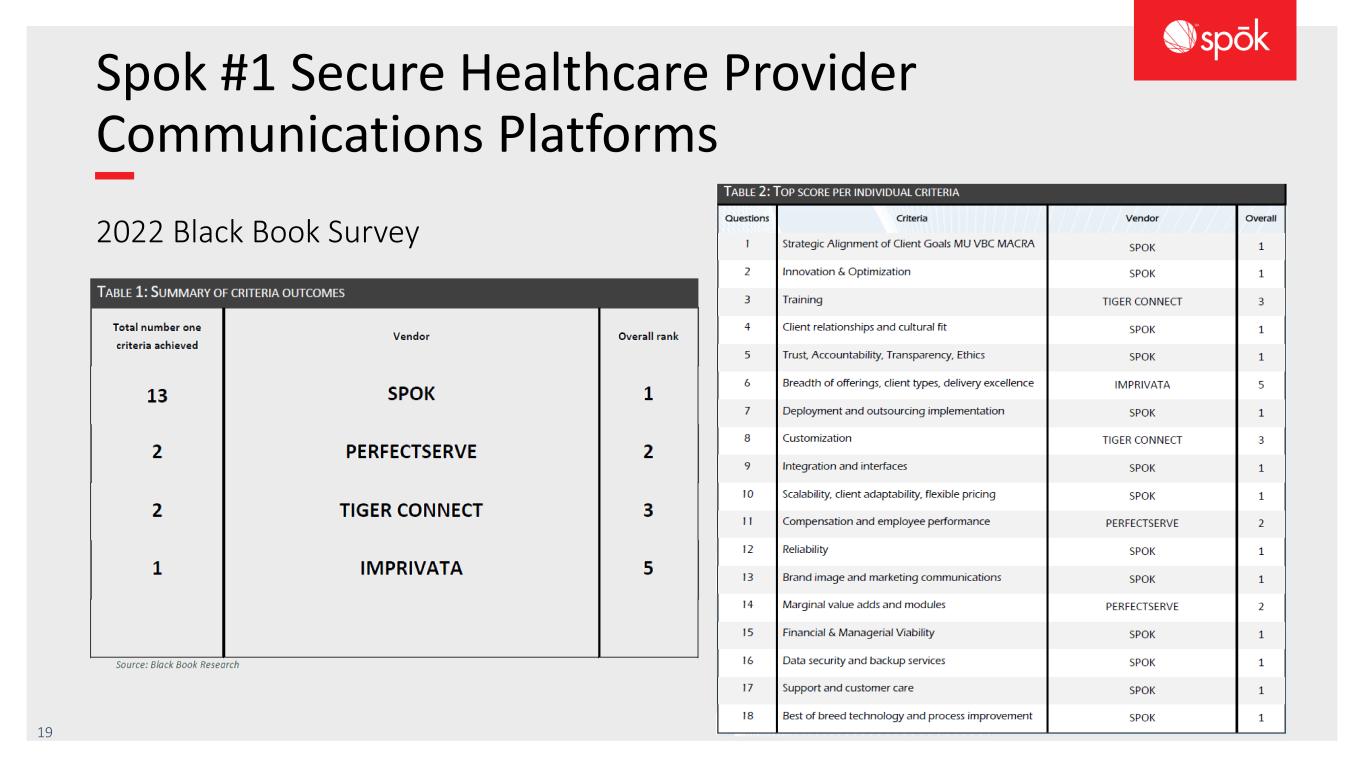

Spok #1 Secure Healthcare Provider Communications Platforms 2022 Black Book Survey 19

Spok Care Connect® Spok Operator Console Spok Mobile® Messenger e.Notify CTI Speech

Our value proposition Improve patient outcomes by connecting clinical teams with the people and information they need when and where it matters most. 21 C a r e t e a m c o m m u n i c a t i o n Provides clinician-to-clinician messaging and delivers real-time information from clinical systems to everyone on the care team E f f i c i e n t c l i n i c a l w o r k f l o w s Clinical alerting and alarm management with flexible routing and escalation of alerts to the right person E n t e r p r i s e c a l l p r o c e s s i n g Quickly help staff and patients, and directly support patient care by launching critical codes

22 How Spok Care Connect sets us apart? Enterprise platform for health systems, hospitals, & IDNs Extensive interoperability that supports existing workflows Powerful central directory Device-agnostic platform supports the right device for the right roleCan be accessed and updated in real time by all roles and departments Interoperable with 300+ hospital systems, including EHRs Supports a diverse device mix, including pagers Encompasses care collaboration among clinical and non- clinical staff and systems Security Comprehensive cybersecurity program

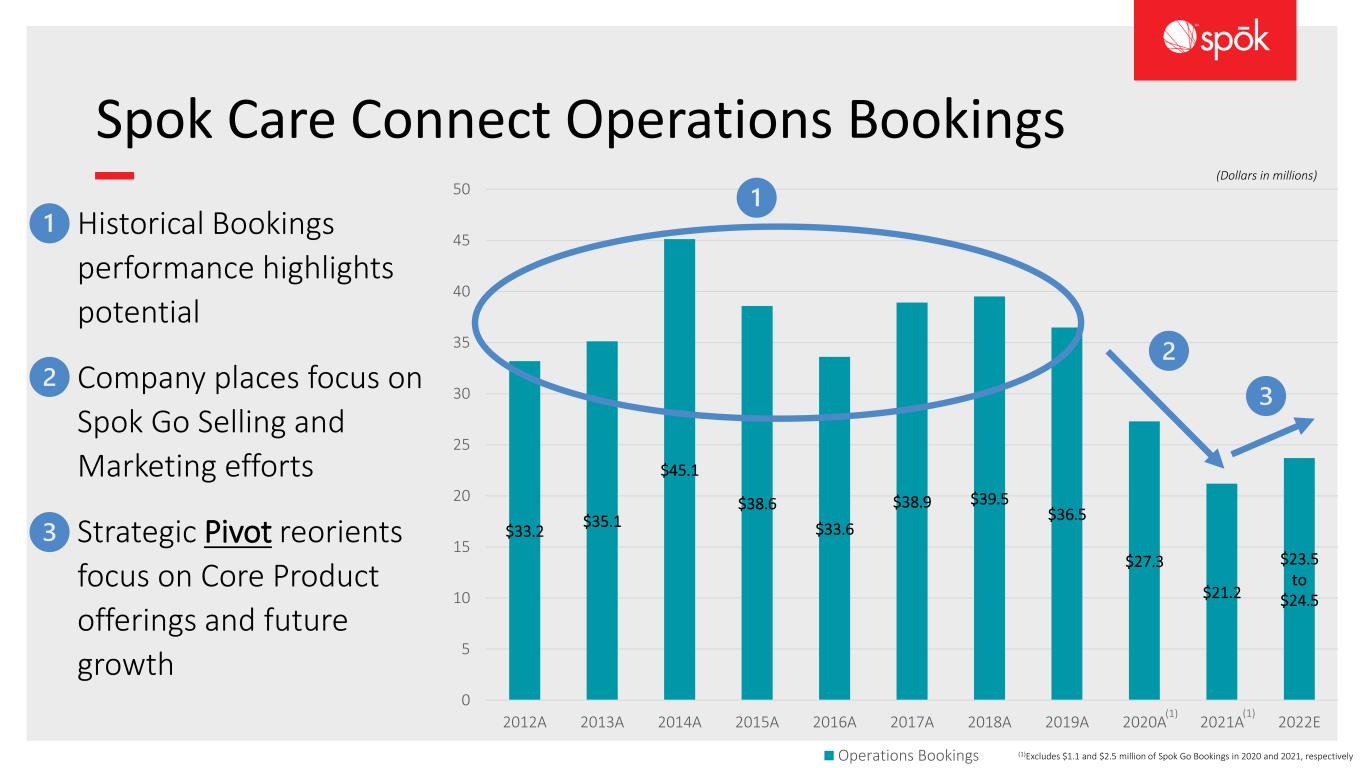

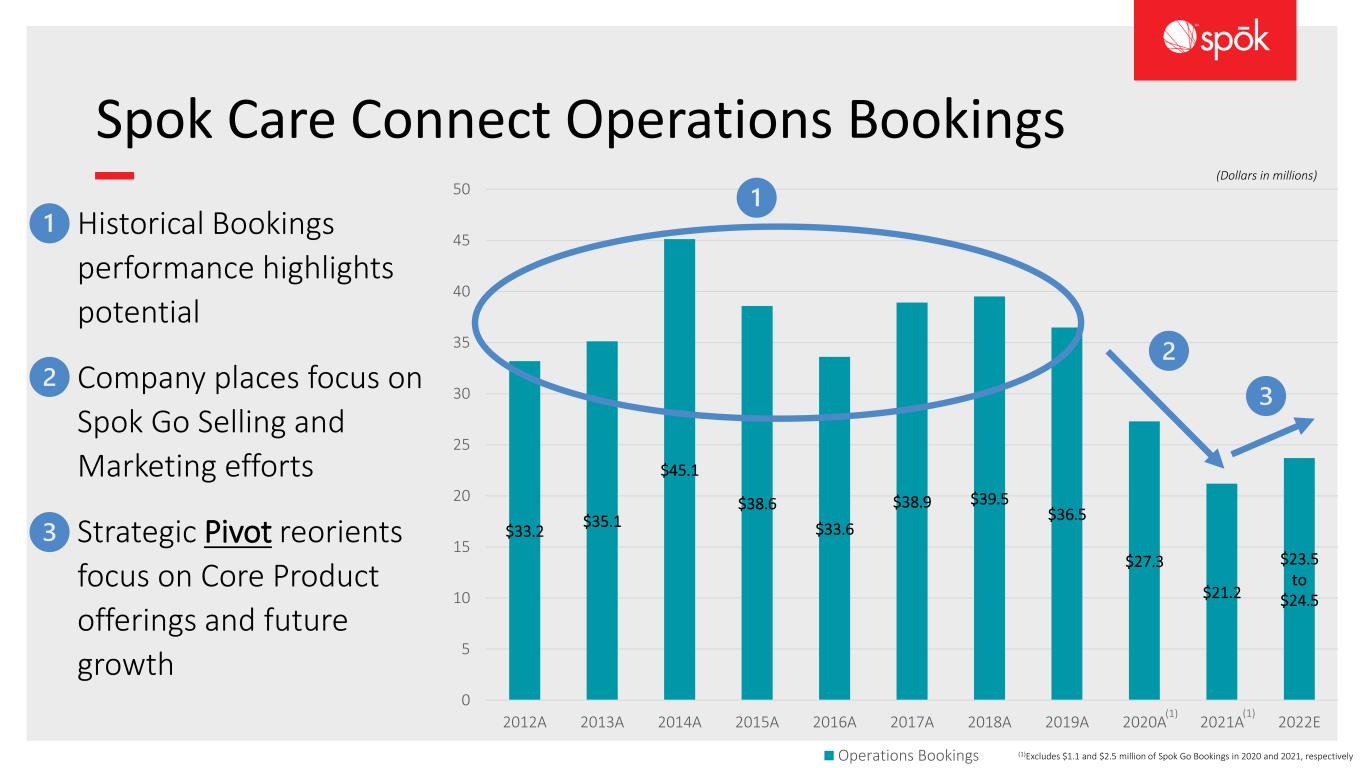

Spok Care Connect Operations Bookings Historical Bookings performance highlights potential Company places focus on Spok Go Selling and Marketing efforts Strategic Pivot reorients focus on Core Product offerings and future growth $33.2 $35.1 $45.1 $38.6 $33.6 $38.9 $39.5 $36.5 $27.3 $21.2 $23.5 to $24.5 0 5 10 15 20 25 30 35 40 45 50 2012A 2013A 2014A 2015A 2016A 2017A 2018A 2019A 2020A 2021A 2022E Operations Bookings (1)Excludes $1.1 and $2.5 million of Spok Go Bookings in 2020 and 2021, respectively (1) (1) (Dollars in millions)

Highly Profitable Reoccurring Maintenance Revenue Post acquisition of Amcom, expansion of reoccurring maintenance attributable to growth in license sales and focus on Spok Care Connect Company places focus on Spok Go Selling and Marketing efforts While revenue is flat in the near term, expectation is for growth based on performance of Operations Bookings (previous slide) $25.9 $27.9 $30.8 $34.4 $37.1 $38.7 $39.1 $40.4 $38.6 $38.0 $36.0 to $37.0 0 5 10 15 20 25 30 35 40 45 2012A 2013A 2014A 2015A 2016A 2017A 2018A 2019A 2020A 2021A 2022E Maintenance Revenue (Dollars in millions)

Wireless4

Nationwide Wireless Paging Network • Largest carrier in the U.S. • Over 100 million messages / month • Carrier-grade network with 99.92% availability • Secure nationwide network • Dominates the healthcare paging market and is part of a full critical communication platform with leading-edge software 26

Paging Remains Relevant Paging’s value remains high for critical messaging • Paging has facilitated hospital workflows and critical response • Pagers receive messages when cellular and Wi-Fi cannot • Paging’s survivable architecture provides advantages, especially in crisis and disaster scenarios • Reliability/cost still a factor – paging best low-cost solution • Role-based communication needs – not everyone needs a smartphone to do his/her job; budget constraints

Why healthcare organizations value pagers 28 Not everyone needs a smartphone to do their job Complements secure text messaging in workflows HIPAA compliance with encrypted paging Tried and true – and cost effective Works in disaster situations

Spok GenA™ Pager

GenA Importance and Strategy • Increase features, functions and benefits to improve retention Continue to Improve UIS Trends Increase ARPU Leverage Current Investments (Wireless / Software) • Increased feature, function and benefits to drive higher Monthly Recurring Revenue • Increase encrypted pager adoption GenA penetration to-date remains low at less than 10,000 units as we begin its rollout. At current though, we are seeing approximately $1.50 - $2.50 higher ARPU with GenA pagers.

Financials5

Third Quarter and YTD 2022 Financial Results 32 For the Three Months Ended September 30 For the Nine Months Ended September 30 2022 2021 2022 2021 Total Revenue $33.7 $35.9 $101.3 $107.6 Wireless $19.1 $19.6 $56.6 $59.6 Software $14.7 $16.2 $44.7 $48.0 Adjusted Operating Expenses(1) $27.9 $39.4 $95.0 $114.7 Capital Expenditures $(0.6) $(0.9) $(1.8) $(3.1) Adjusted EBITDA(2) $4.7 $(2.5) $(1.1) $(4.5) • Year-to-date capital returned to stockholders totaled $18.8 million in the form of the Company’s regular quarterly dividend • Cash, cash equivalents and short-term investments balance of $37.2 million at September 30, 2022, and no debt (Dollars in millions) (1) Adjusted Operating Expenses defined as operating expenses adjusted for depreciation, amortization, accretion, capitalized software development costs, and severance and restructuring costs (2) Adjusted EBITDA represents net income/(loss) before interest income/expense, income tax benefit/expense, depreciation, amortization and accretion expense, stock-based compensation expense, impairment of intangible assets, effects of capitalized software development costs, and capital expenditures.

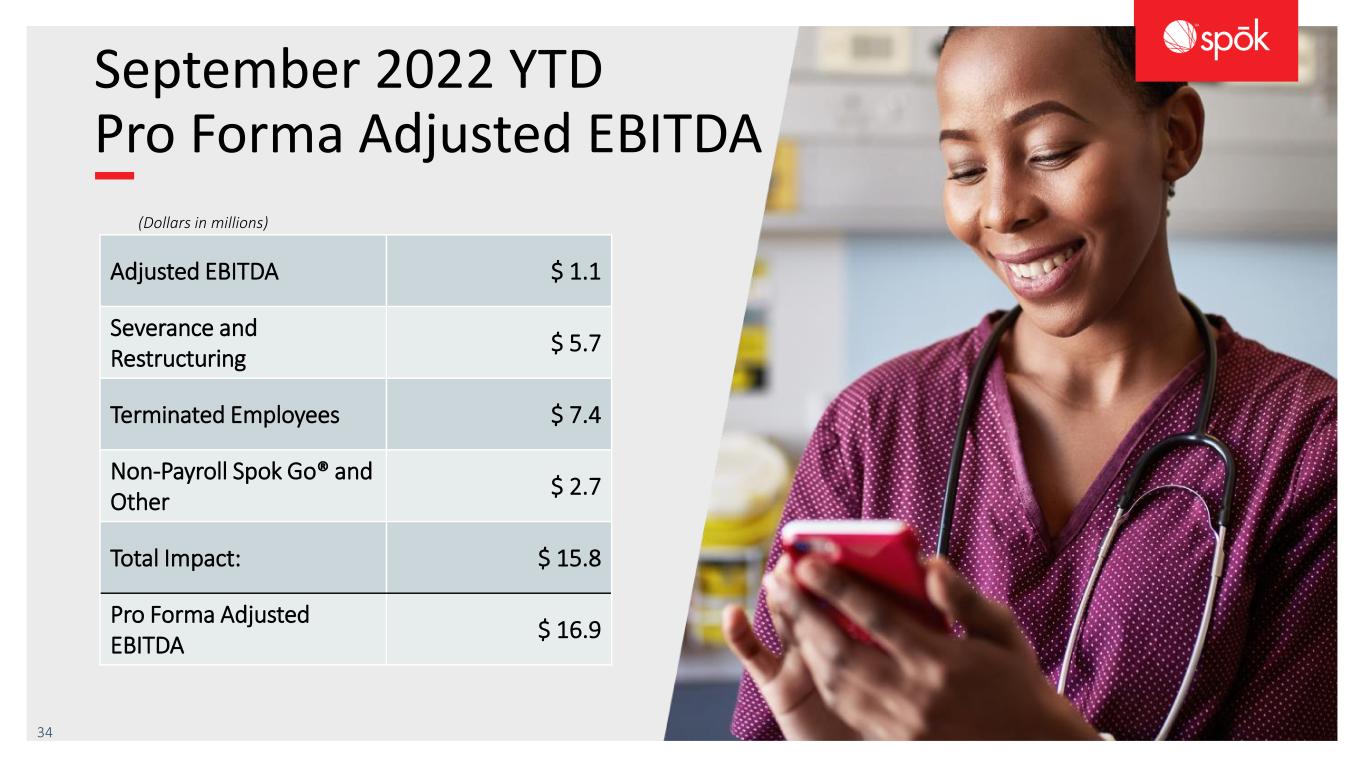

Third Quarter 2022 Highlights ⚫ Strategic business plan continued to progress in the third quarter as the Company generated $2.9 million of GAAP net income, and $4.7 million of adjusted EBITDA ⚫ Year-to-date proforma adjusted EBITDA of $16.9 million ⚫ Third quarter software operations bookings increased 26% as momentum continued in the quarter ⚫ Year-to-date software operations bookings increased 18% with 49 deals worth over six figures ⚫ Wireless average revenue per unit up to $7.40, or 1.5%, with units in service down only 3.4% 33

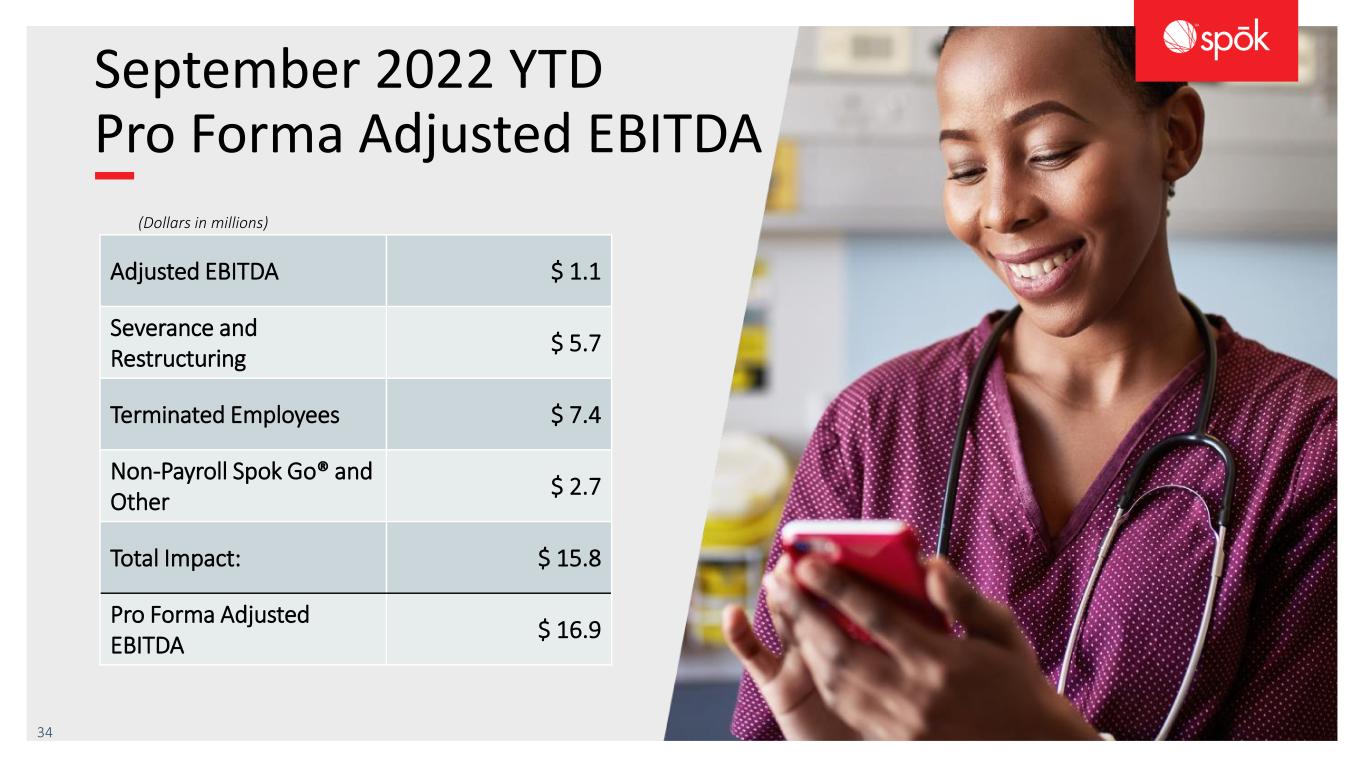

September 2022 YTD Pro Forma Adjusted EBITDA 34 Adjusted EBITDA $ 1.1 Severance and Restructuring $ 5.7 Terminated Employees $ 7.4 Non-Payroll Spok Go® and Other $ 2.7 Total Impact: $ 15.8 Pro Forma Adjusted EBITDA $ 16.9 (Dollars in millions)

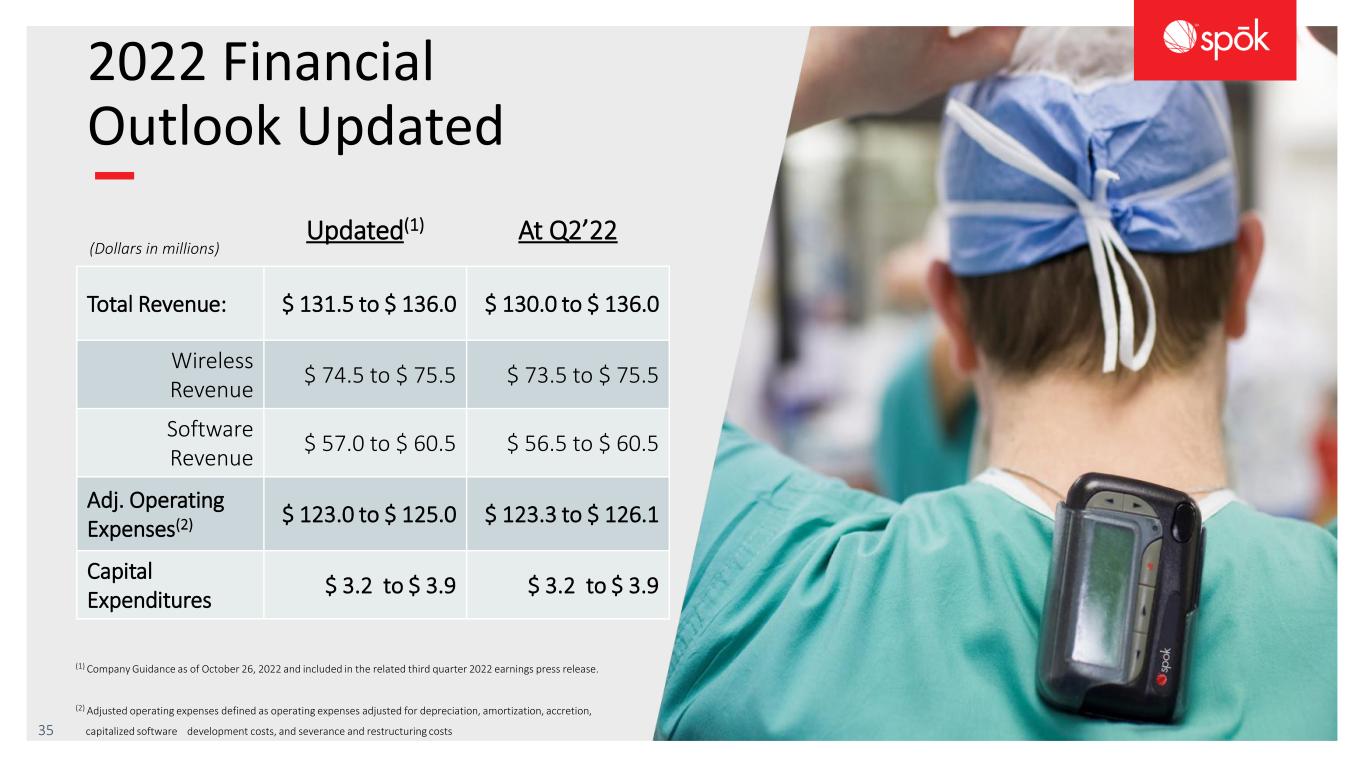

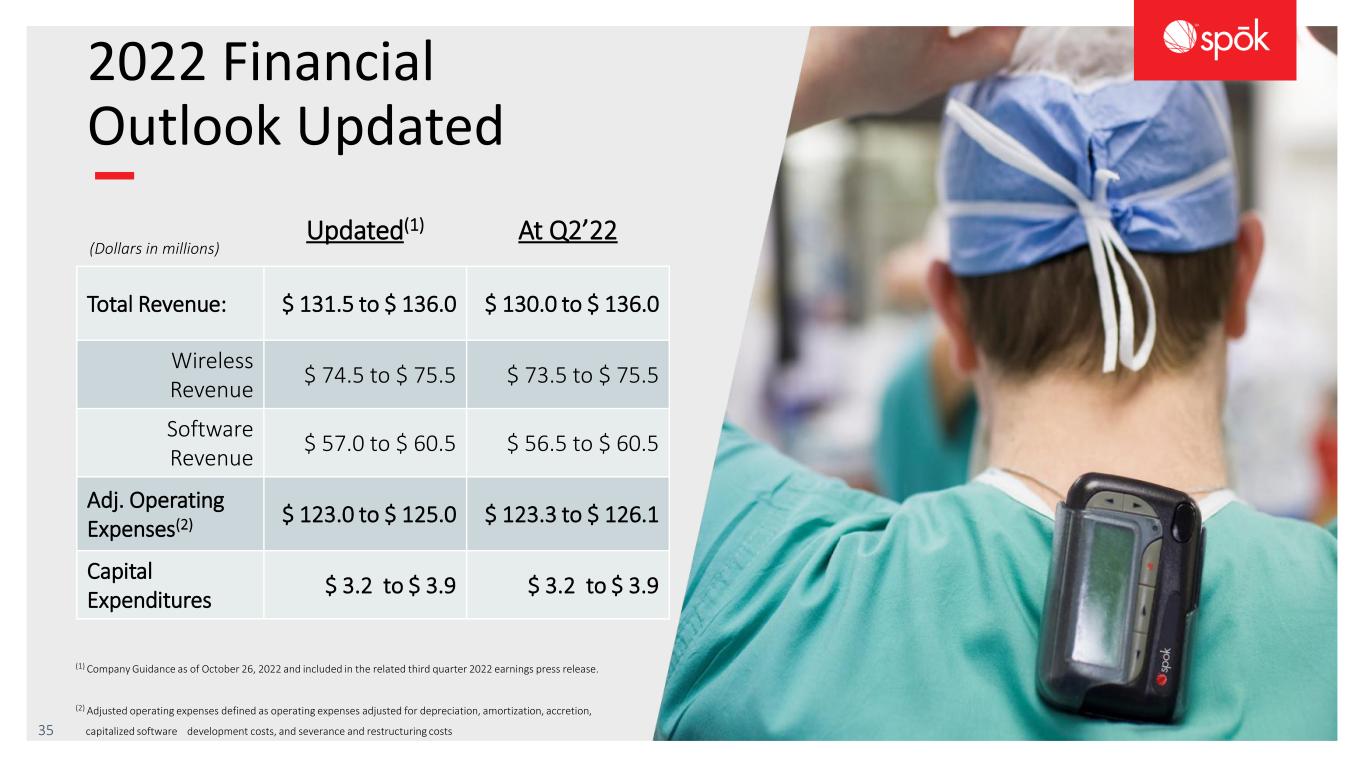

35 2022 Financial Outlook Updated Updated(1) At Q2’22 Total Revenue: $ 131.5 to $ 136.0 $ 130.0 to $ 136.0 Wireless Revenue $ 74.5 to $ 75.5 $ 73.5 to $ 75.5 Software Revenue $ 57.0 to $ 60.5 $ 56.5 to $ 60.5 Adj. Operating Expenses(2) $ 123.0 to $ 125.0 $ 123.3 to $ 126.1 Capital Expenditures $ 3.2 to $ 3.9 $ 3.2 to $ 3.9 (Dollars in millions) (1) Company Guidance as of October 26, 2022 and included in the related third quarter 2022 earnings press release. (2) Adjusted operating expenses defined as operating expenses adjusted for depreciation, amortization, accretion, capitalized software development costs, and severance and restructuring costs

Balance Sheet ⚫ Exceptionally clean and simple balance sheet ⚫ No debt ⚫ Common stock only ⚫ $35 million+ of cash and cash equivalents ⚫ Significant deferred tax assets to shield federal income taxes for many years to come 36

Wrap Up6

Spok Value Enormous customer base and strong relationships with leading healthcare providers Largest wireless paging network in the country with 800,000+ units in service No debt, $35mm+ cash balance, significant deferred tax assets, funding 80%+ of dividend from free cash flow, substantial dividend yield at current Stable re-occurring wireless and software maintenance revenue with opportunities to grow total revenue

Thank you S m a r t e r, fa s t e r c l i n i c a l c o m m u n i c at i o n 39

40 Contact Investor Relations Al Galgano + 1 (952) 224-6096 al.galgano@spok.com