Investor Presentation July 2023

2 Safe Harbor Statement Statements contained herein or in prior press releases which are not historical fact, such as statements regarding our future operating and financial performance, are forward-looking statements for purposes of the safe harbor provisions under the Private Securities Litigation Reform Act of 1995. These forward-looking statements involve risks and uncertainties that may cause our actual results to be materially different from the future results expressed or implied by such forward-looking statements. Factors that could cause actual results to differ materially from those expectations include, but are not limited to, our ability to manage wireless network rationalization to lower our costs without causing disruption of service to our customers; our ability to retain key management personnel and to attract and retain talent within the organization; the productivity of our sales organization and our ability to deliver effective customer support; our ability to identify potential acquisitions, consummate and successfully integrate such acquisitions, and achieve the expected benefits of such acquisitions; risks related to global health epidemics; economic conditions such as recessionary economic cycles, higher interest rates, inflation and higher levels of unemployment; competition for our services and products from new technologies or those offered and/or developed from firms that are substantially larger and have much greater financial and human capital resources; continuing decline in the number of paging units we have in service with customers, commensurate with a continuing decline in our wireless revenue; our ability to address changing market conditions with new or revised software solutions; undetected defects, bugs, or security vulnerabilities in our products; our dependence on the U.S. healthcare industry; the sales cycle of our software solutions and services can run from six to eighteen months, making it difficult to plan for and meet our sales objectives and bookings on a steady basis quarter-to-quarter and year-to-year; our reliance on third-party vendors to supply us with wireless paging equipment; our ability to maintain successful relationships with our channel partners; our ability to protect our rights in intellectual property that we own and develop and the potential for litigation claiming intellectual property infringement by us; our use of open source software, third-party software and other intellectual property; the reliability of our networks and servers and our ability to prevent cyber-attacks and other security issues and disruptions; unauthorized breaches or failures in cybersecurity measures adopted by us and/or included in our products and services; our ability to realize the benefits associated with our deferred income tax assets; future impairments of our long-lived assets, amortizable intangible assets or goodwill; risks related to data privacy and protection-related laws and regulation; and our ability to manage changes related to regulation, including laws and regulations affecting hospitals and the healthcare industry generally, as well as other risks described from time to time in our periodic reports and other filings with the Securities and Exchange Commission. Although Spok believes the expectations reflected in the forward-looking statements are based on reasonable assumptions, it can give no assurance that its expectations will be attained. Spok disclaims any intent or obligation to update any forward-looking statements.

Our Mission & Investment Highlights

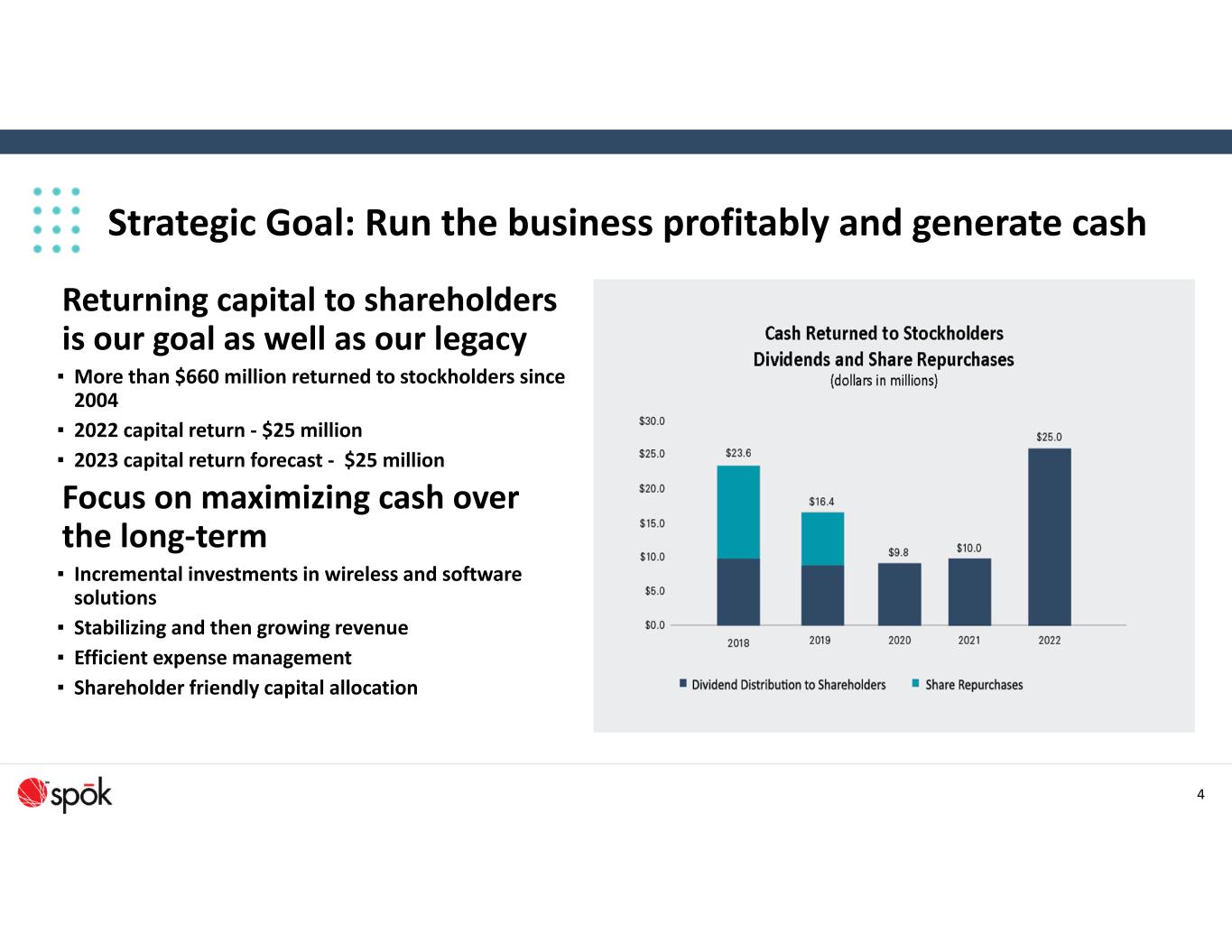

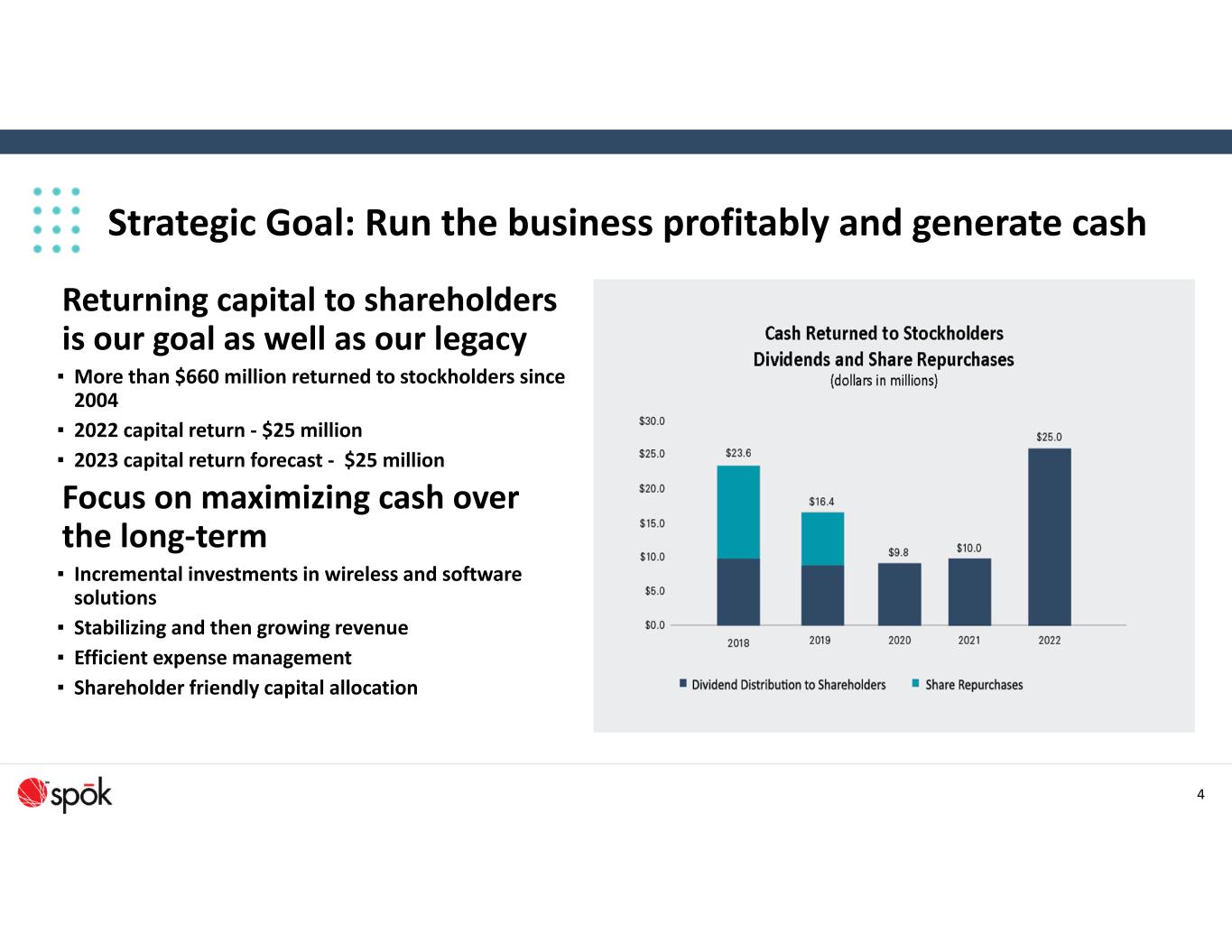

Strategic Goal: Run the business profitably and generate cash Returning capital to shareholders is our goal as well as our legacy ▪ More than $660 million returned to stockholders since 2004 ▪ 2022 capital return ‐ $25 million ▪ 2023 capital return forecast ‐ $25 million Focus on maximizing cash over the long‐term ▪ Incremental investments in wireless and software solutions ▪ Stabilizing and then growing revenue ▪ Efficient expense management ▪ Shareholder friendly capital allocation 4

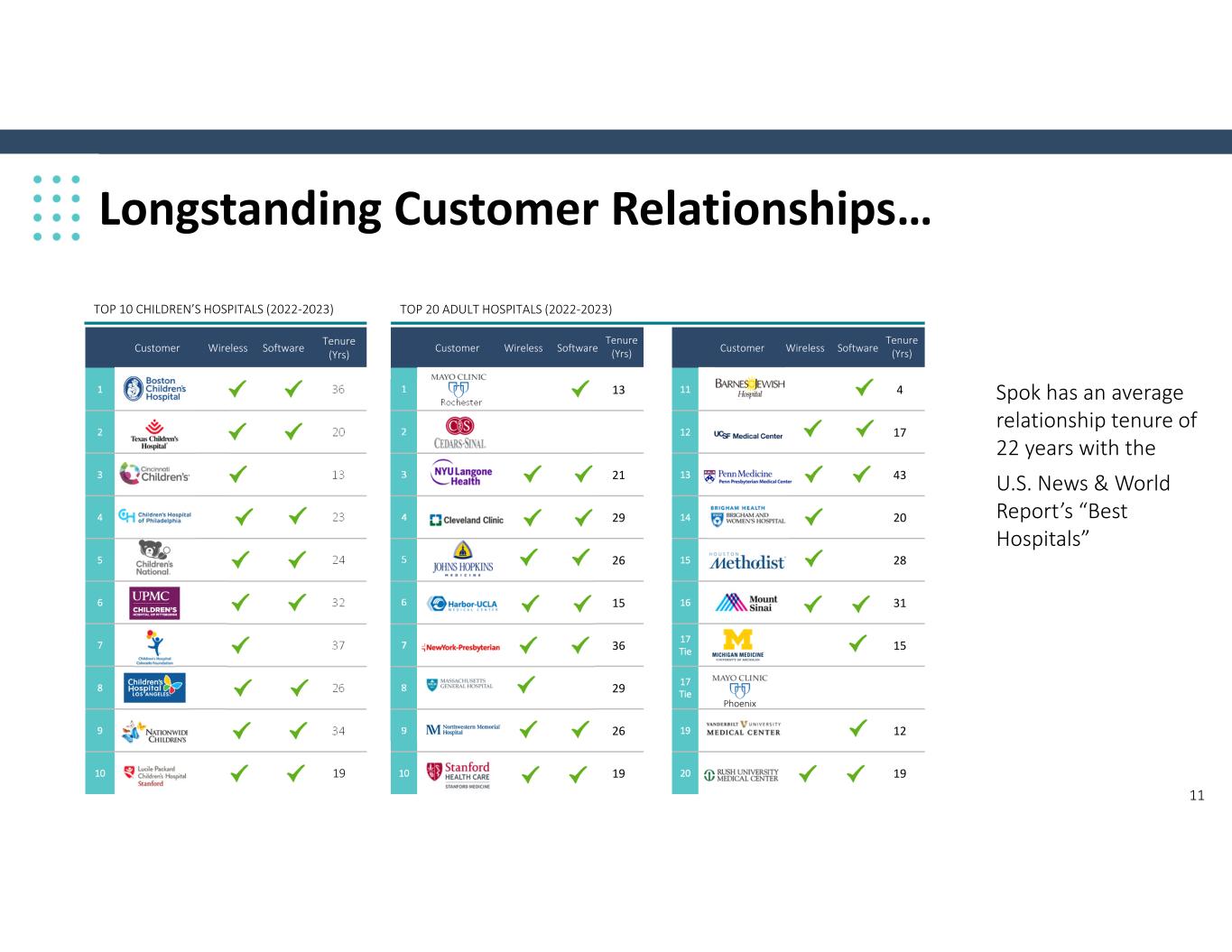

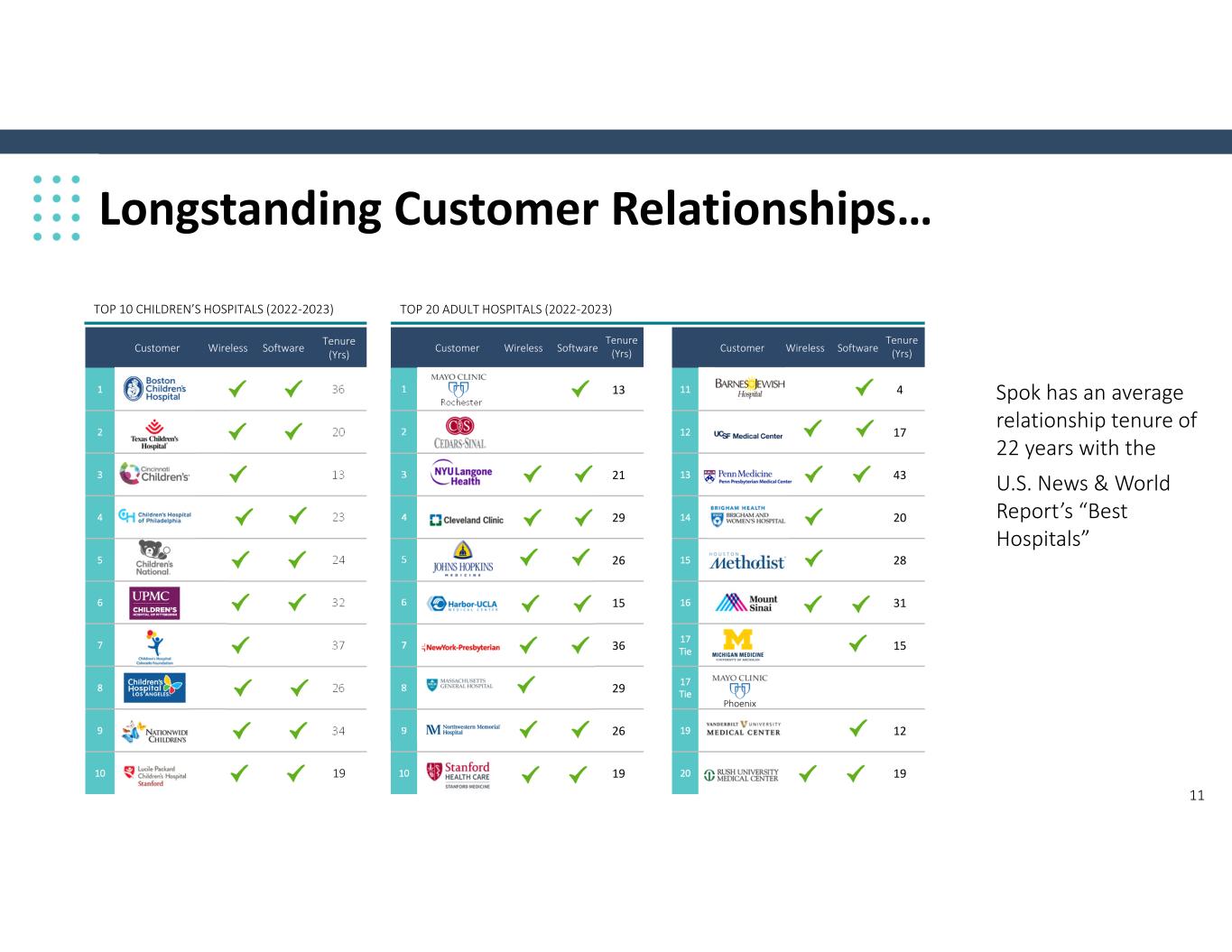

Key Investment Highlights Significant Annual Free Cash Flow Generation and Strong Balance Sheet Substantial cash flow being returned to shareholders through considerable quarterly dividend, no debt Software Operations Bookings Momentum, Large Identified Pipeline Expanding software pipeline converting to growth in sales Stable Re‐occurring Software Maintenance and Wireless Segment Revenue 80+% of Spok’s revenue is re‐occurring in nature due to maintenance revenue from contact center and wireless paging revenue Long‐standing Customer Relationships with the “Best Hospitals” All 10 U.S. News & World Report’s Top 10 Children’s Hospitals and 18 of Top 20 Adult Hospitals are Spok customers, with an average tenure of 22 years 5 2 3 1 Clear Roadmap Developed to Execute Strategy Multiple avenues of organic and inorganic growth across new and existing customers and product development 4 5

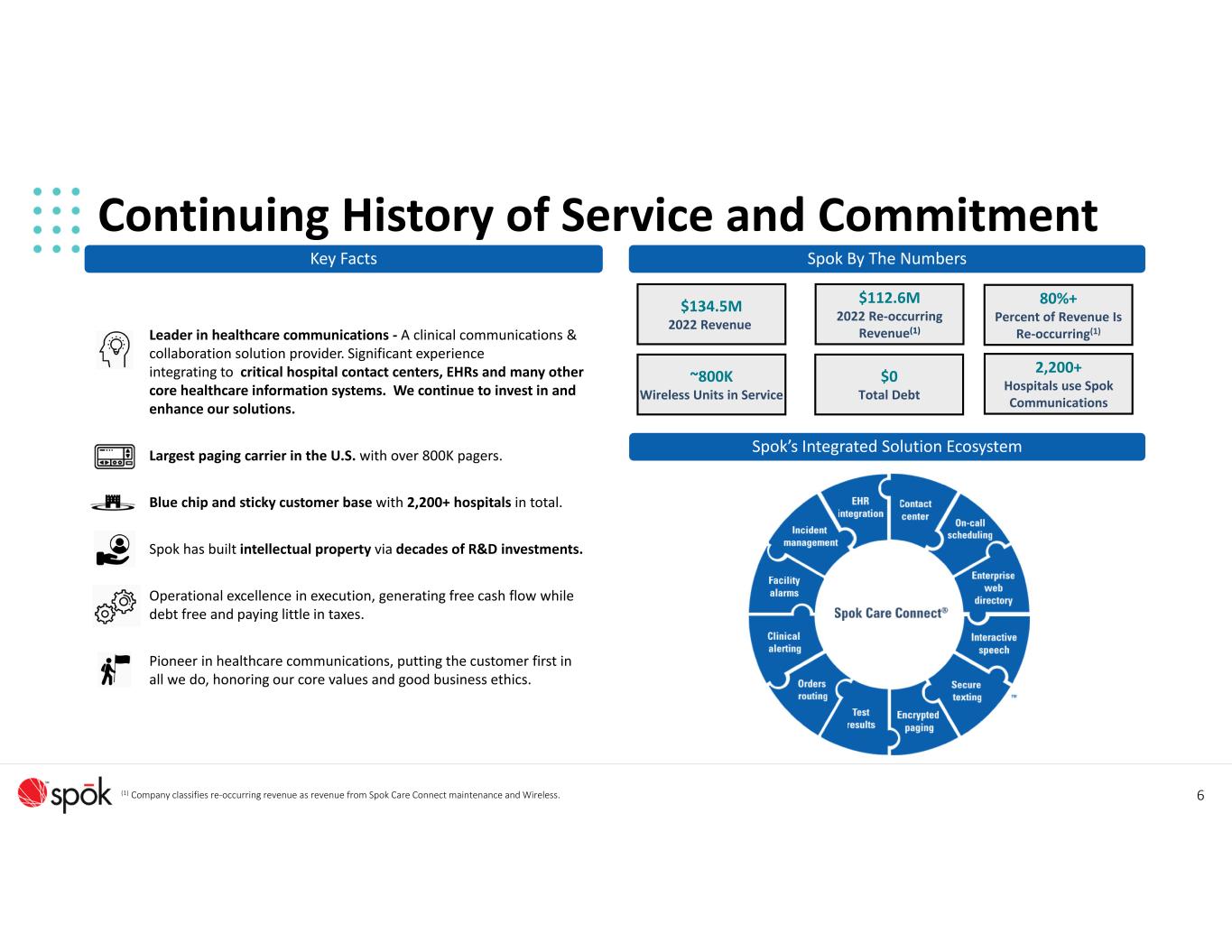

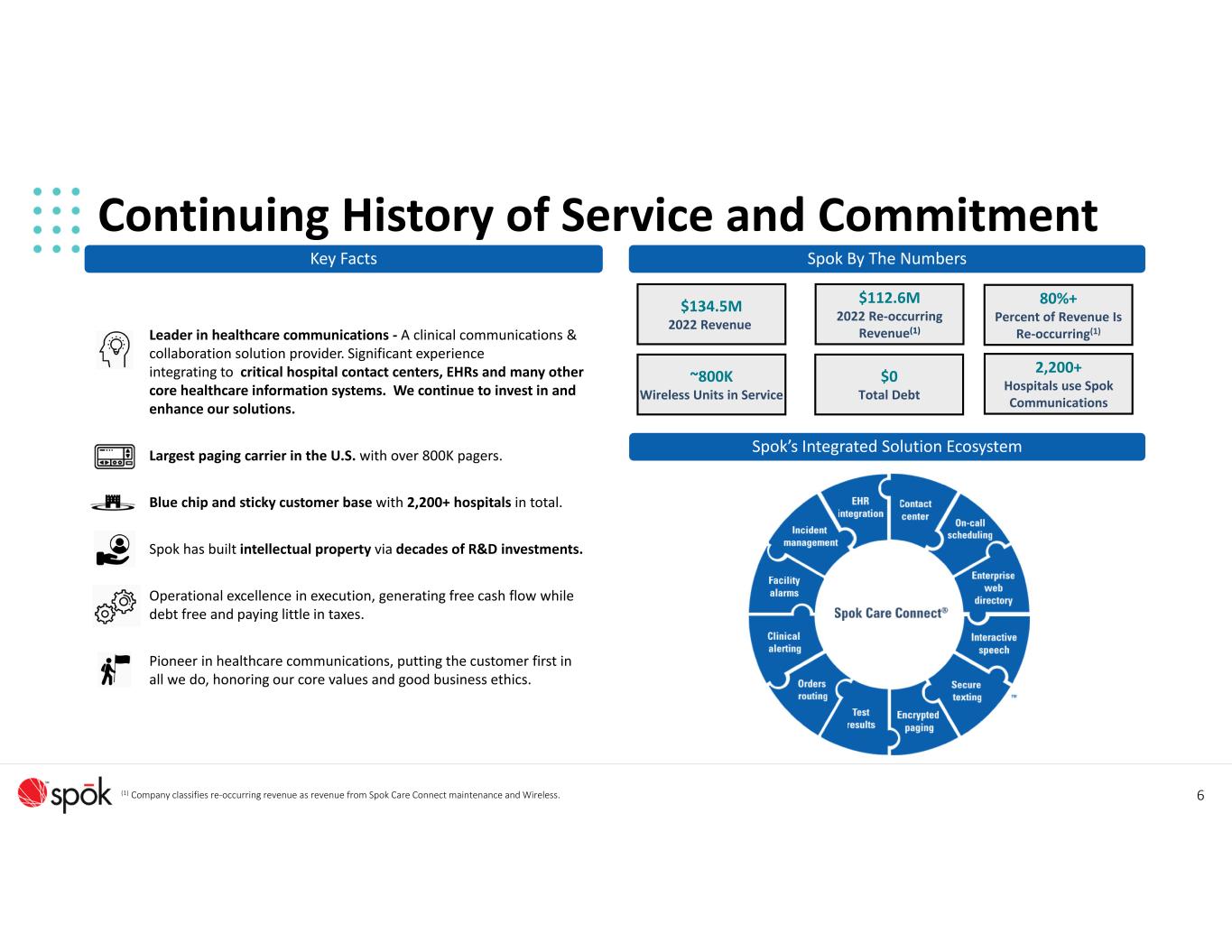

6 Continuing History of Service and Commitment Leader in healthcare communications ‐ A clinical communications & collaboration solution provider. Significant experience integrating to critical hospital contact centers, EHRs and many other core healthcare information systems. We continue to invest in and enhance our solutions. Largest paging carrier in the U.S. with over 800K pagers. Blue chip and sticky customer base with 2,200+ hospitals in total. Spok has built intellectual property via decades of R&D investments. Operational excellence in execution, generating free cash flow while debt free and paying little in taxes. Pioneer in healthcare communications, putting the customer first in all we do, honoring our core values and good business ethics. $134.5M 2022 Revenue $112.6M 2022 Re‐occurring Revenue(1) $0 Total Debt 80%+ Percent of Revenue Is Re‐occurring(1) 2,200+ Hospitals use Spok Communications ~800K Wireless Units in Service Key Facts Spok By The Numbers Spok’s Integrated Solution Ecosystem (1) Company classifies re‐occurring revenue as revenue from Spok Care Connect maintenance and Wireless.

Our Plan Growth in value and return of capital 7 Long‐term objective • Growing cash flow while stabilizing our top line with growth in software revenue Short‐term energy focus 1. Software Bookings: Achieve plan and show YoY growth 2. Product Roadmap Progress: Demonstrable benefit to the business and future sales 3. Wireless Revenue Stabilization: Positive UIS variance and positive ARPU a) Price increases b) GenA pager placements with related ARPU uplift

8 Healthcare responds to fiscal challenges Changes in economic conditions Fiscal alignment of healthcare IT strategy Staff Shortages (Nursing, IT and others) High Labor Costs Higher Capital Cost / Reduced Capital Spending High Inflation Economic Recession Thinner Margins Tighter IT Budgets Reduce, eliminate or postpone new IT initiatives Maintain existing information systems investments Maintain supported versions/prevent Cyber risks Maximize value of current assets/investments Implement unutilized capabilities/Improve ROI

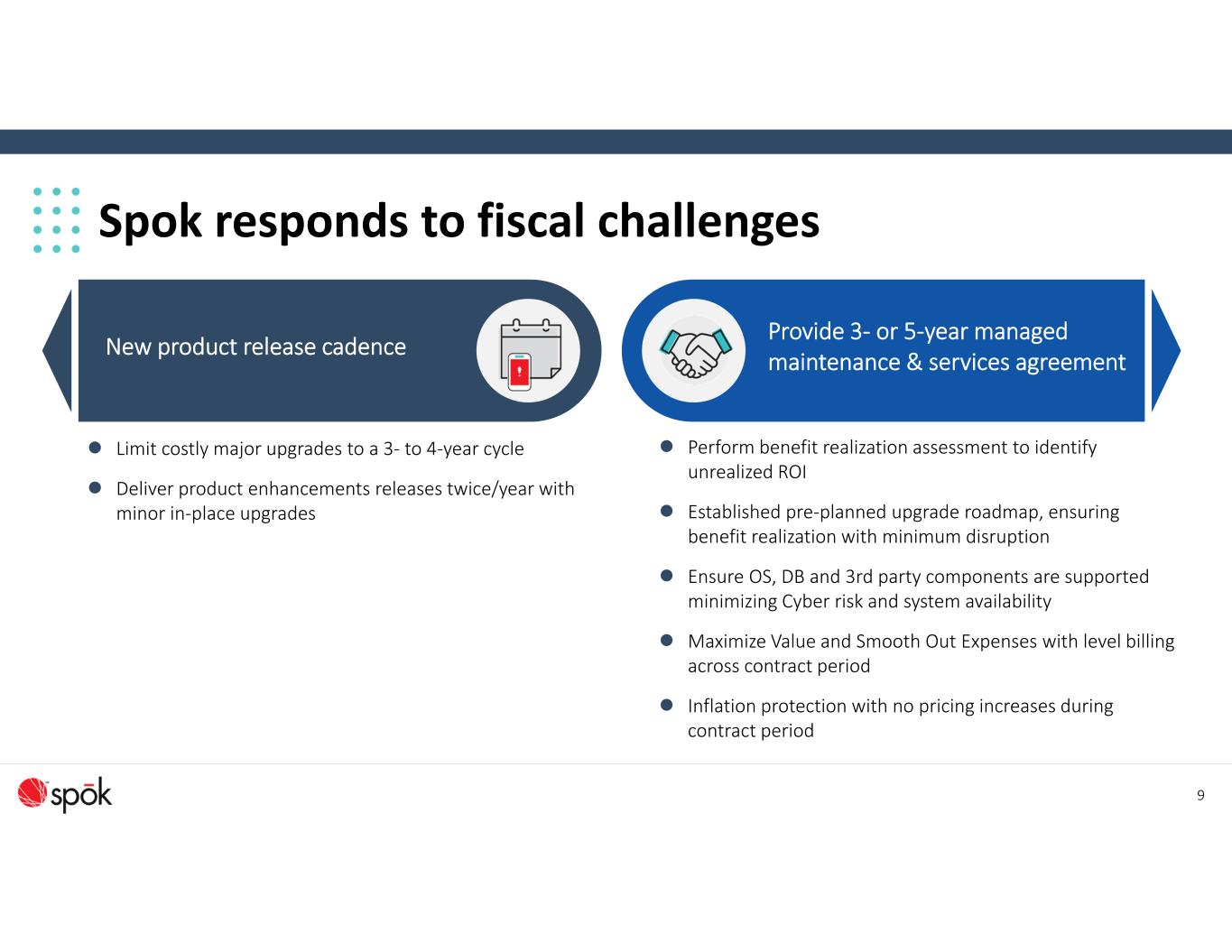

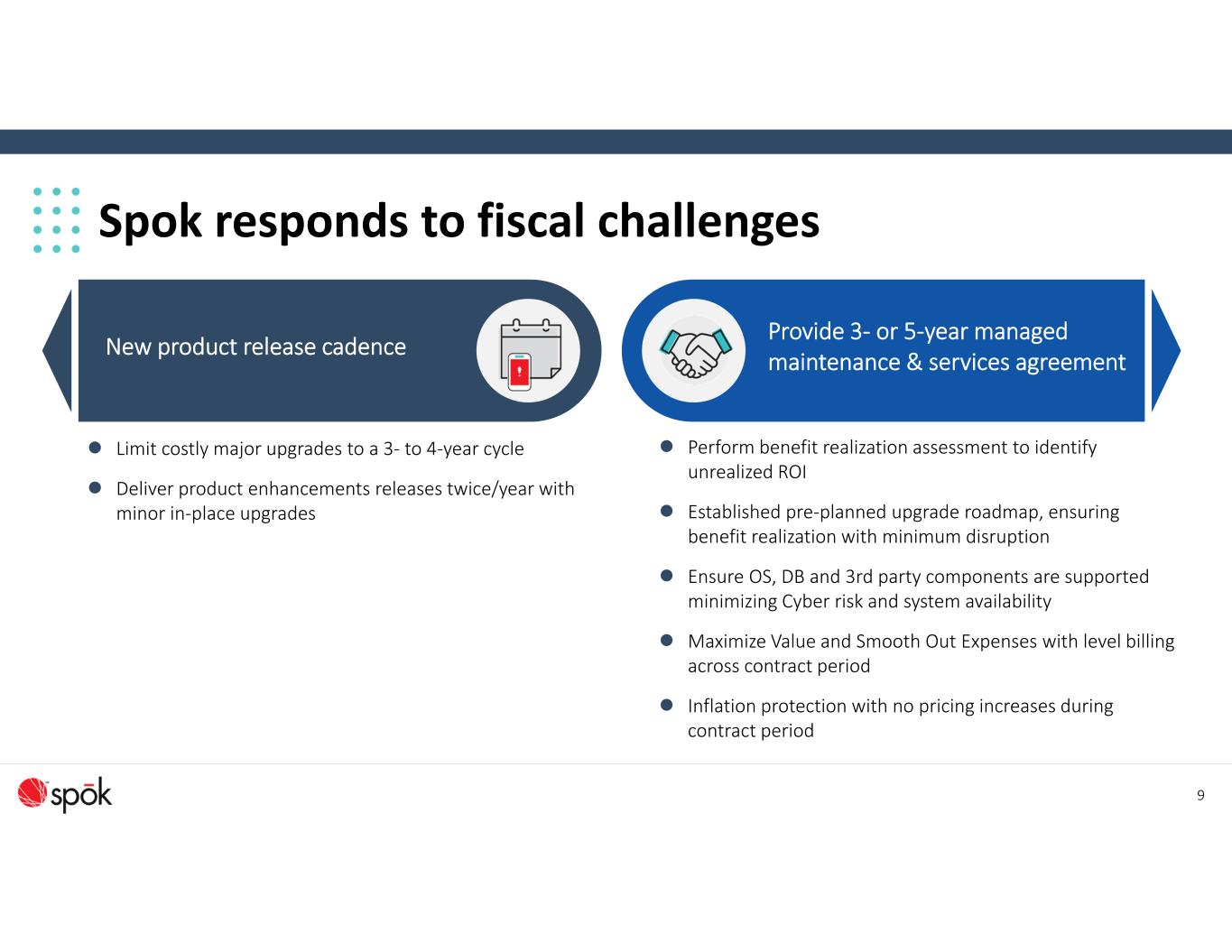

9 Spok responds to fiscal challenges New product release cadence Provide 3‐ or 5‐year managed maintenance & services agreement Limit costly major upgrades to a 3‐ to 4‐year cycle Deliver product enhancements releases twice/year with minor in‐place upgrades Perform benefit realization assessment to identify unrealized ROI Established pre‐planned upgrade roadmap, ensuring benefit realization with minimum disruption Ensure OS, DB and 3rd party components are supported minimizing Cyber risk and system availability Maximize Value and Smooth Out Expenses with level billing across contract period Inflation protection with no pricing increases during contract period

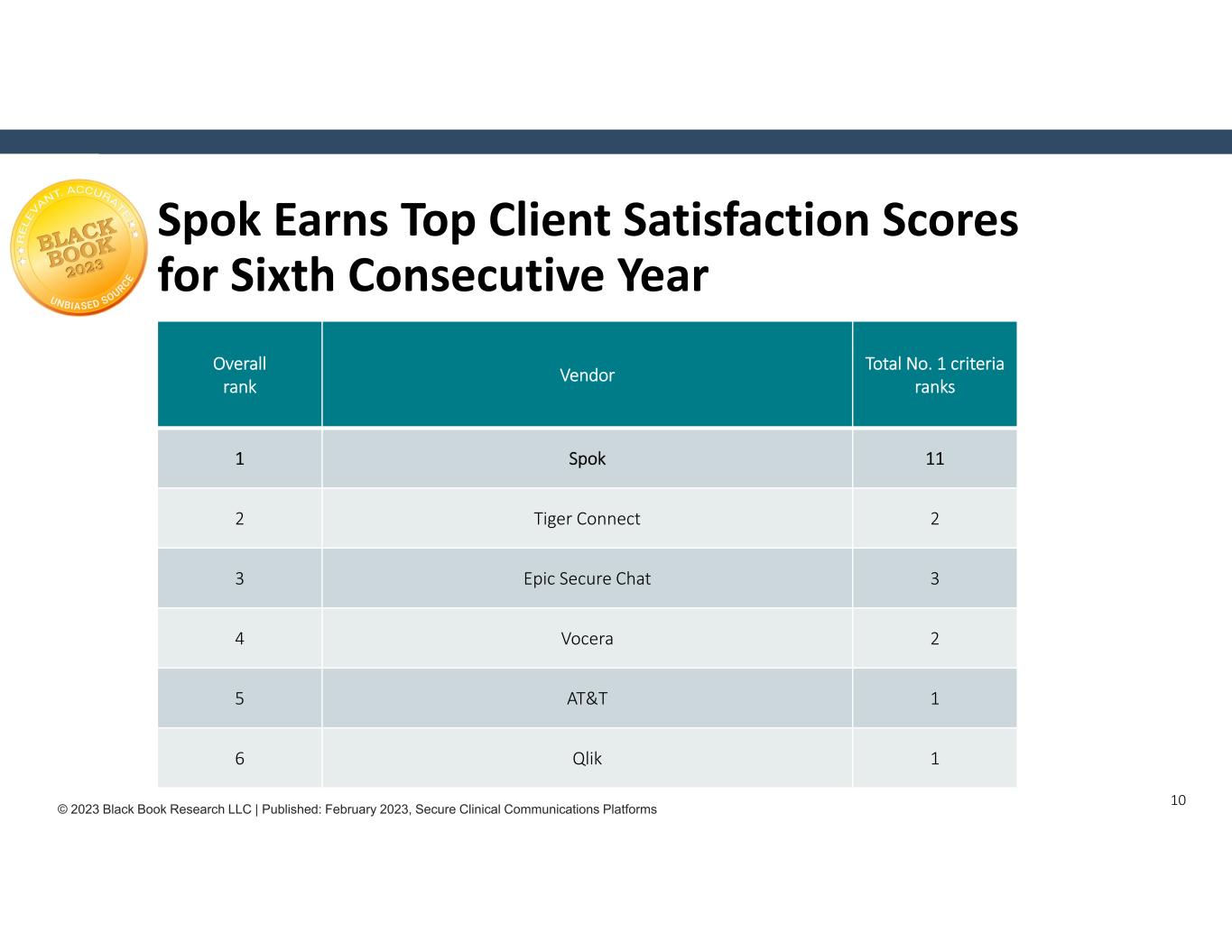

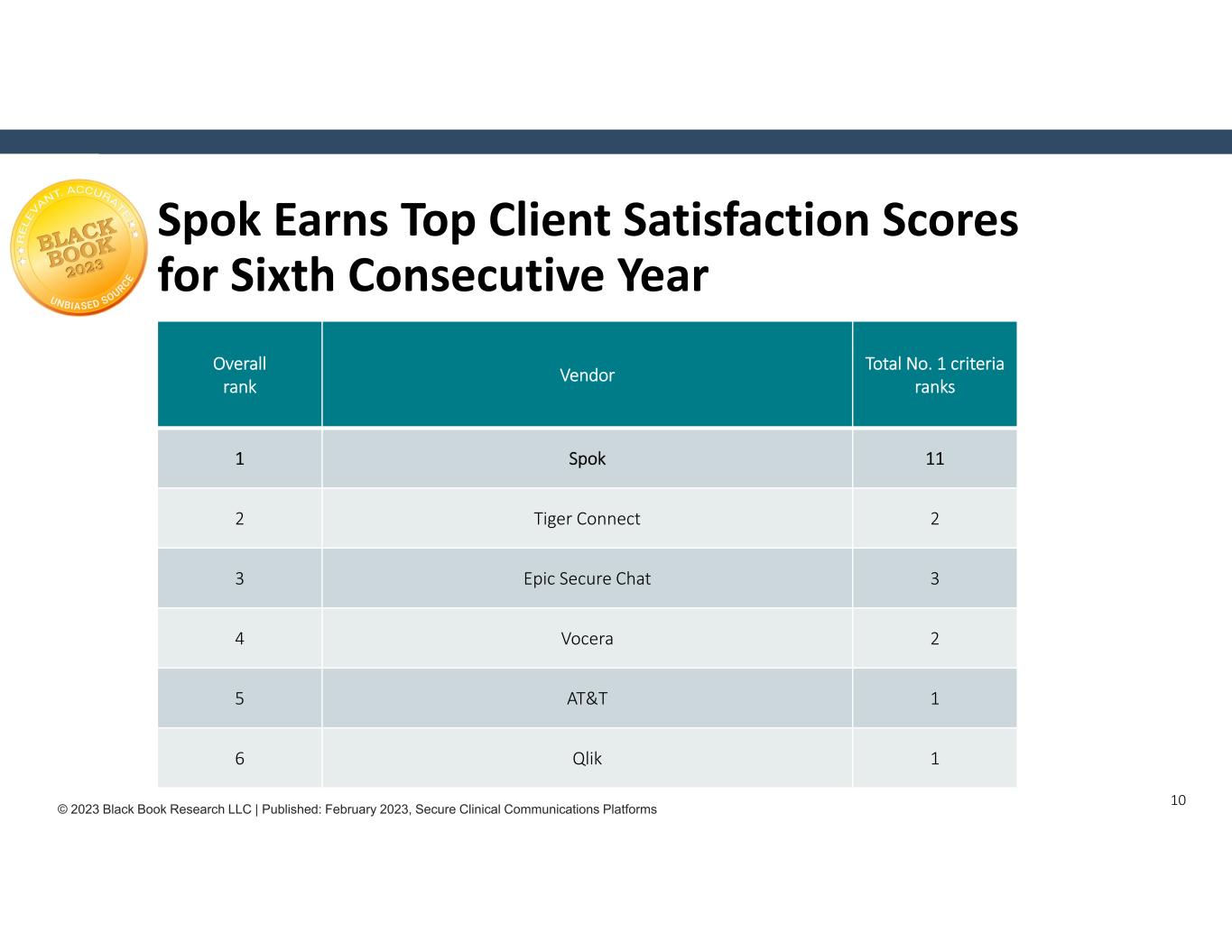

10 Spok Earns Top Client Satisfaction Scores for Sixth Consecutive Year Overall rank Vendor Total No. 1 criteria ranks 1 Spok 11 2 Tiger Connect 2 3 Epic Secure Chat 3 4 Vocera 2 5 AT&T 1 6 Qlik 1 © 2023 Black Book Research LLC | Published: February 2023, Secure Clinical Communications Platforms

Customer Wireless Software Tenure (Yrs) 1 36 2 20 3 13 4 23 5 24 6 32 7 37 8 26 9 34 10 19 1 13 2 3 21 4 29 5 26 6 15 7 36 8 29 9 26 10 19 11 4 12 17 13 43 14 20 15 28 16 31 17 Tie 15 17 Tie 19 12 20 19 TOP 10 CHILDREN’S HOSPITALS (2022‐2023) TOP 20 ADULT HOSPITALS (2022‐2023) Rochester Phoenix Wireless Software Wireless Software Longstanding Customer Relationships… Spok has an average relationship tenure of 22 years with the U.S. News & World Report’s “Best Hospitals” Customer Customer Tenure (Yrs) Tenure (Yrs) 11

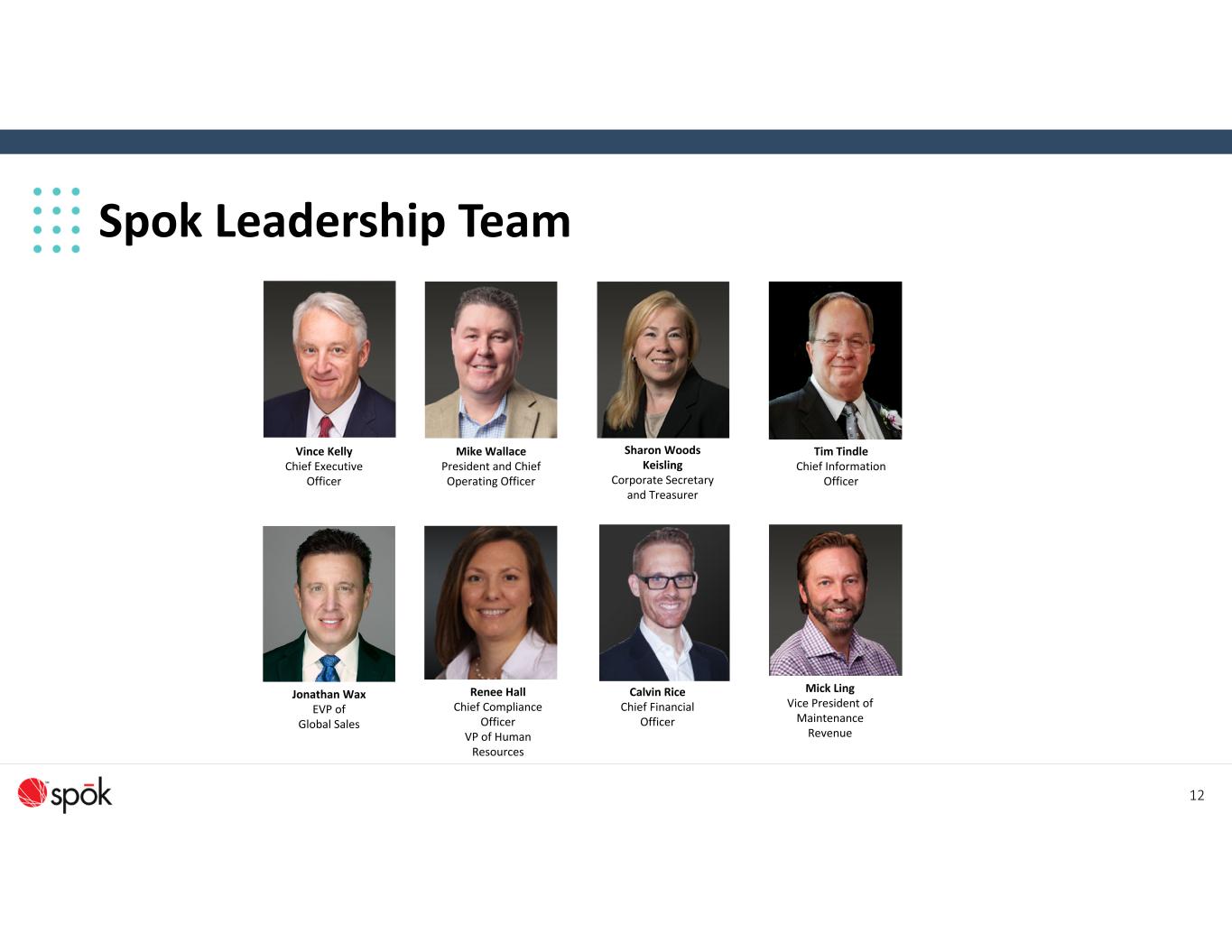

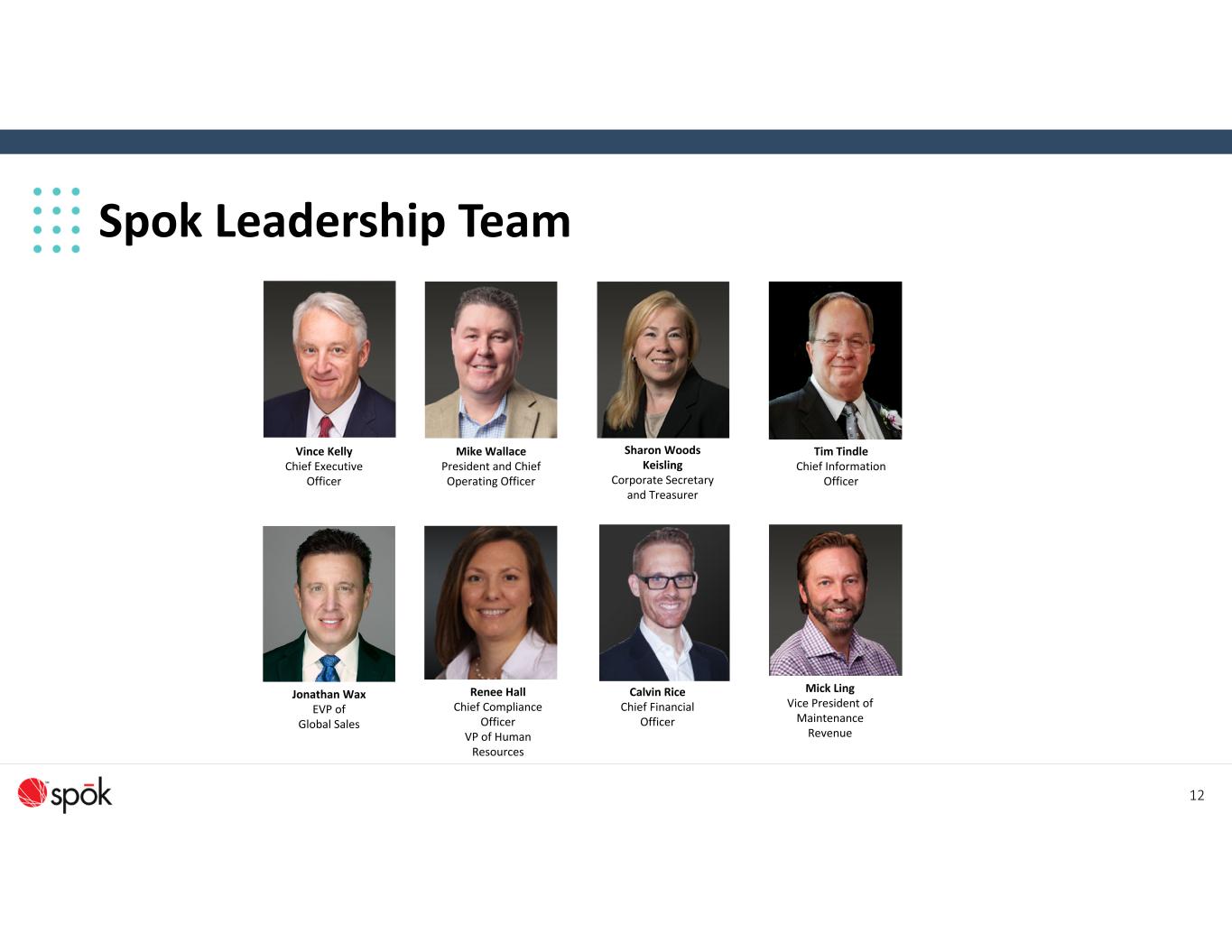

Spok Leadership Team Sharon Woods Keisling Corporate Secretary and Treasurer Renee Hall Chief Compliance Officer VP of Human Resources Tim Tindle Chief Information Officer Vince Kelly Chief Executive Officer Mike Wallace President and Chief Operating Officer Mick Ling Vice President of Maintenance Revenue Calvin Rice Chief Financial Officer Jonathan Wax EVP of Global Sales 12

Business Strategy

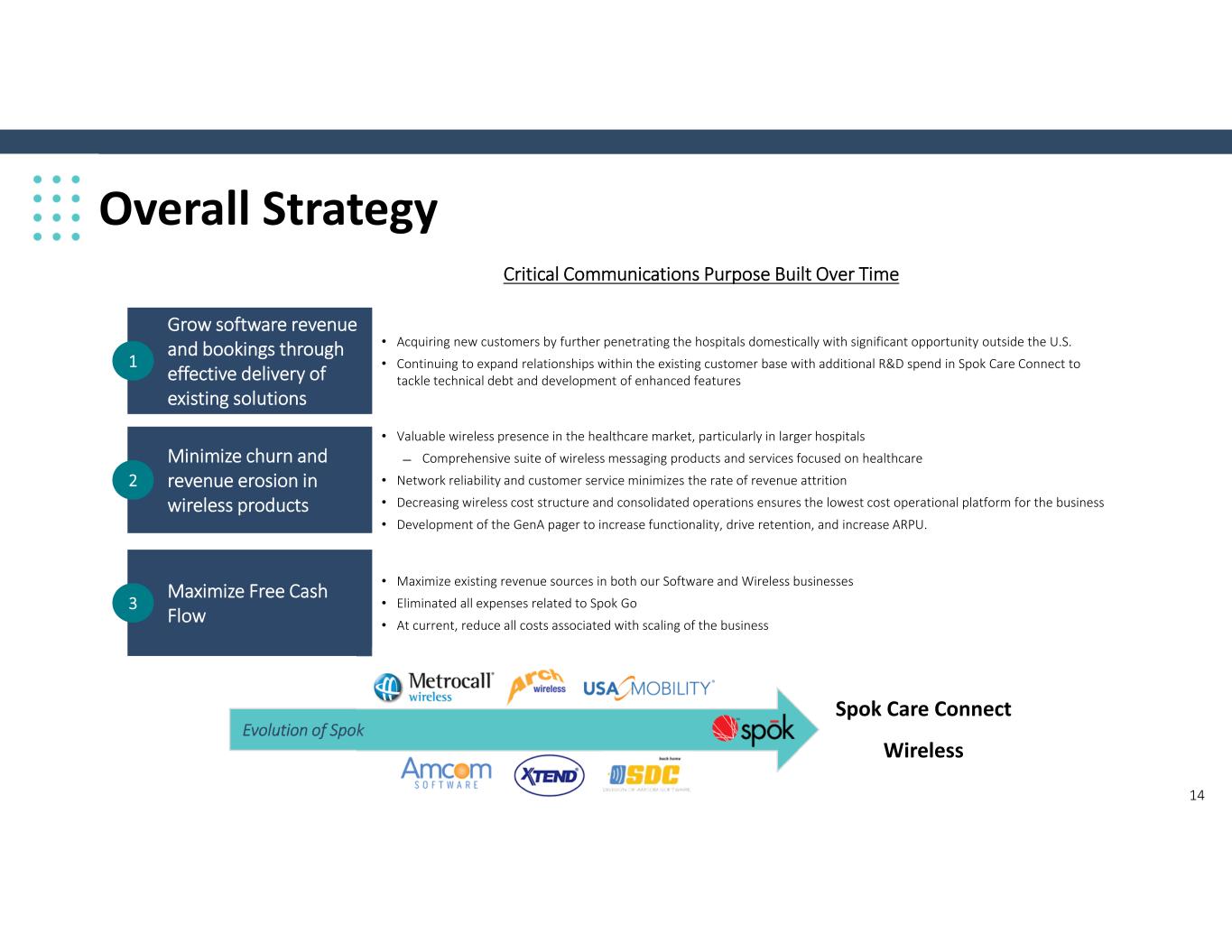

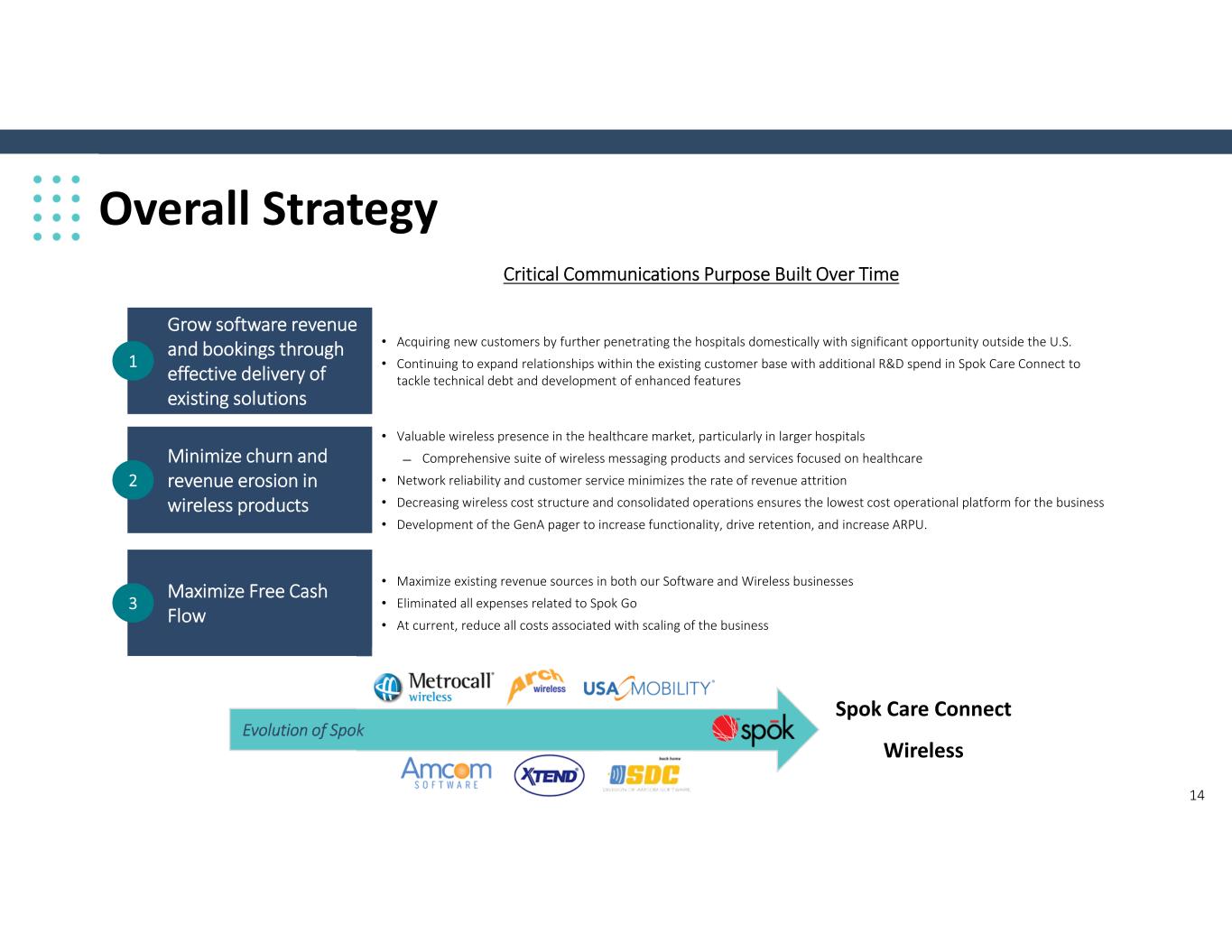

Overall Strategy Critical Communications Purpose Built Over Time Evolution of Spok • Acquiring new customers by further penetrating the hospitals domestically with significant opportunity outside the U.S. • Continuing to expand relationships within the existing customer base with additional R&D spend in Spok Care Connect to tackle technical debt and development of enhanced features Grow software revenue and bookings through effective delivery of existing solutions 1 Maximize Free Cash Flow 3 Minimize churn and revenue erosion in wireless products 2 • Maximize existing revenue sources in both our Software and Wireless businesses • Eliminated all expenses related to Spok Go • At current, reduce all costs associated with scaling of the business • Valuable wireless presence in the healthcare market, particularly in larger hospitals ̶ Comprehensive suite of wireless messaging products and services focused on healthcare • Network reliability and customer service minimizes the rate of revenue attrition • Decreasing wireless cost structure and consolidated operations ensures the lowest cost operational platform for the business • Development of the GenA pager to increase functionality, drive retention, and increase ARPU. Wireless Spok Care Connect 14

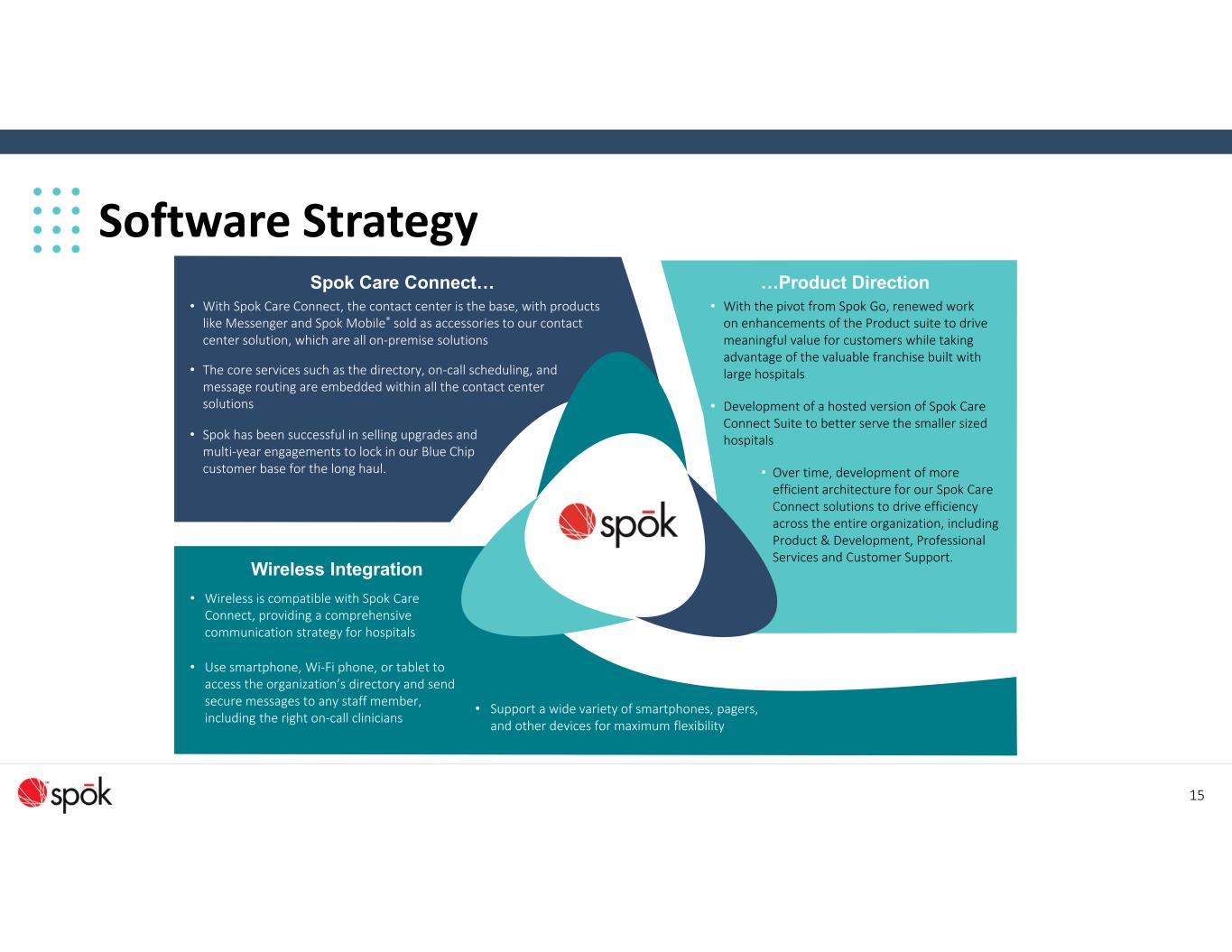

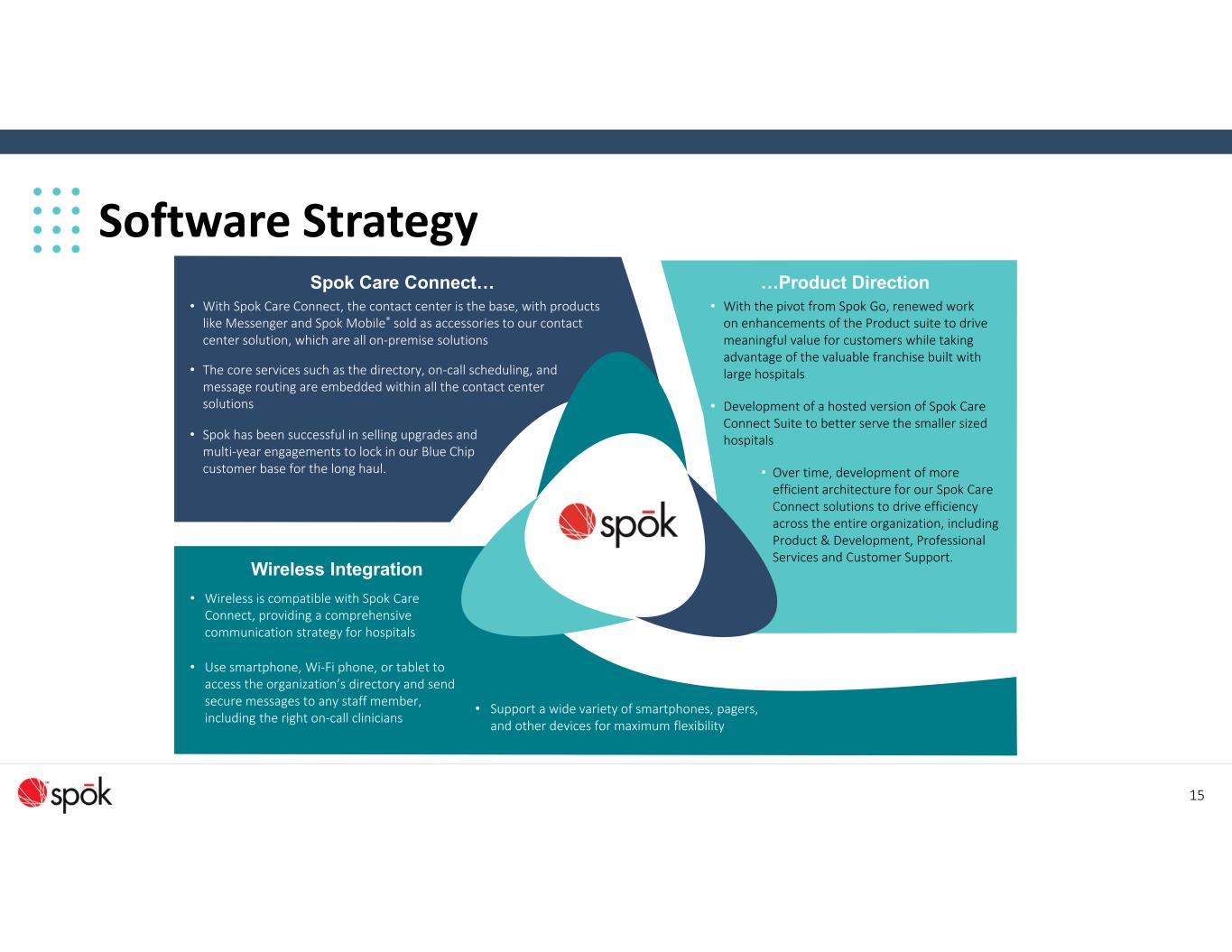

Software Strategy • With Spok Care Connect, the contact center is the base, with products like Messenger and Spok Mobile® sold as accessories to our contact center solution, which are all on‐premise solutions Wireless Integration Spok Care Connect… …Product Direction • With the pivot from Spok Go, renewed work on enhancements of the Product suite to drive meaningful value for customers while taking advantage of the valuable franchise built with large hospitals • Development of a hosted version of Spok Care Connect Suite to better serve the smaller sized hospitals • Over time, development of more efficient architecture for our Spok Care Connect solutions to drive efficiency across the entire organization, including Product & Development, Professional Services and Customer Support. • Wireless is compatible with Spok Care Connect, providing a comprehensive communication strategy for hospitals • Use smartphone, Wi‐Fi phone, or tablet to access the organization’s directory and send secure messages to any staff member, including the right on‐call clinicians • Support a wide variety of smartphones, pagers, and other devices for maximum flexibility • Spok has been successful in selling upgrades and multi‐year engagements to lock in our Blue Chip customer base for the long haul. • The core services such as the directory, on‐call scheduling, and message routing are embedded within all the contact center solutions 15

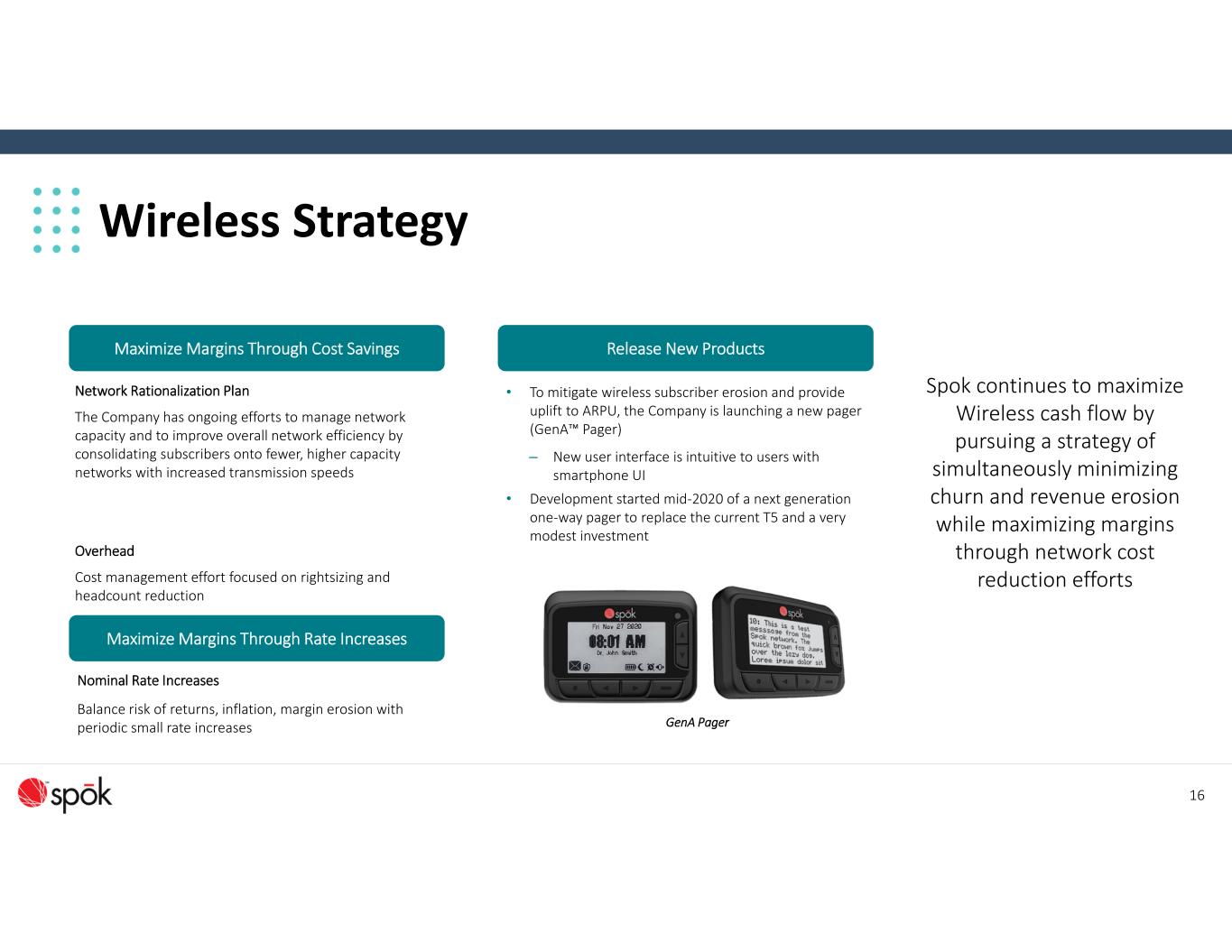

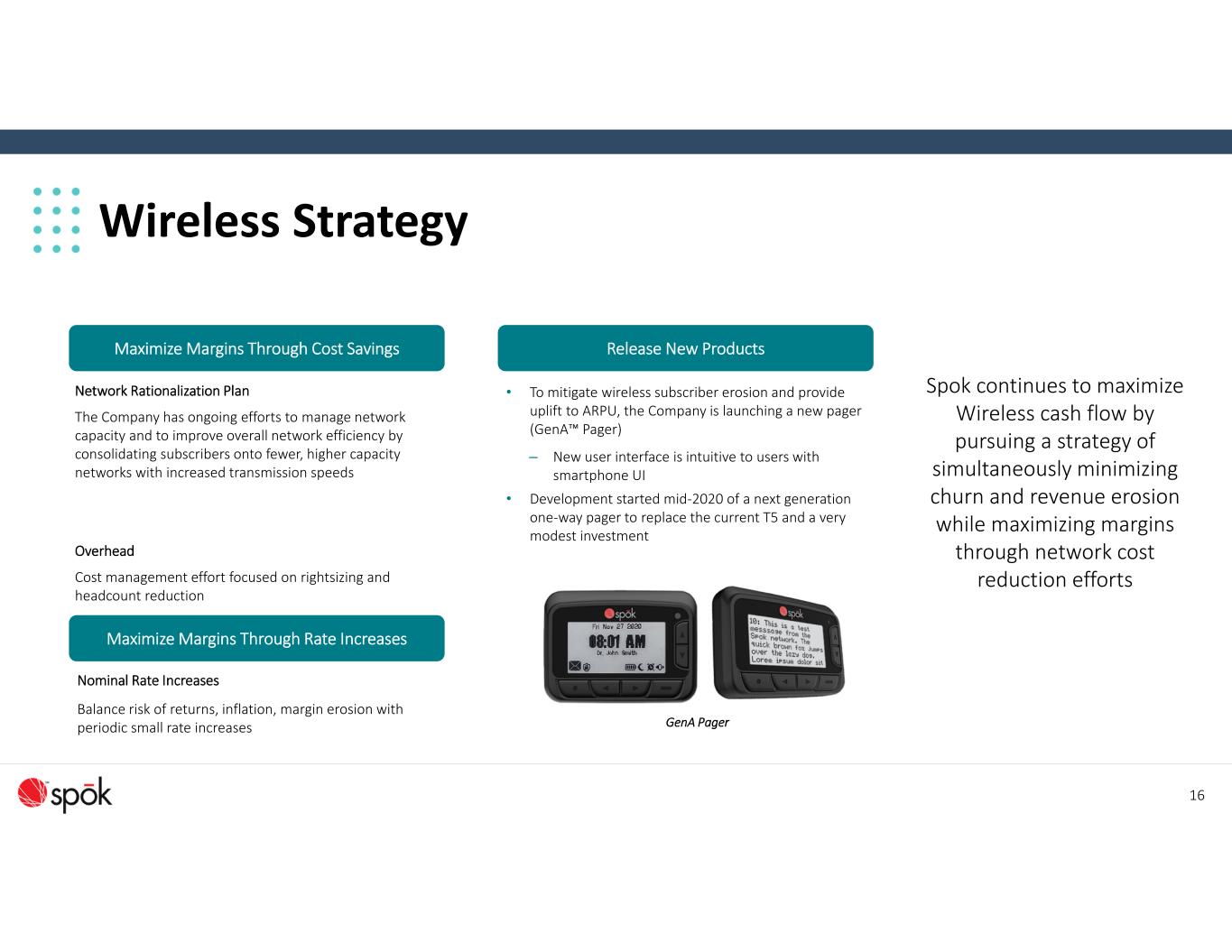

Wireless Strategy Spok continues to maximize Wireless cash flow by pursuing a strategy of simultaneously minimizing churn and revenue erosion while maximizing margins through network cost reduction efforts Network Rationalization Plan The Company has ongoing efforts to manage network capacity and to improve overall network efficiency by consolidating subscribers onto fewer, higher capacity networks with increased transmission speeds Overhead Cost management effort focused on rightsizing and headcount reduction Release New ProductsMaximize Margins Through Cost Savings • To mitigate wireless subscriber erosion and provide uplift to ARPU, the Company is launching a new pager (GenA™ Pager) – New user interface is intuitive to users with smartphone UI • Development started mid‐2020 of a next generation one‐way pager to replace the current T5 and a very modest investment GenA Pager Maximize Margins Through Rate Increases Nominal Rate Increases Balance risk of returns, inflation, margin erosion with periodic small rate increases 16

61% H e a l t h c a r e Other Large Enterprise Government 2012 17 Focus on Healthcare 85% H e a l t h c a r e Government Large Enterprise Other 2023 Percentage of revenue

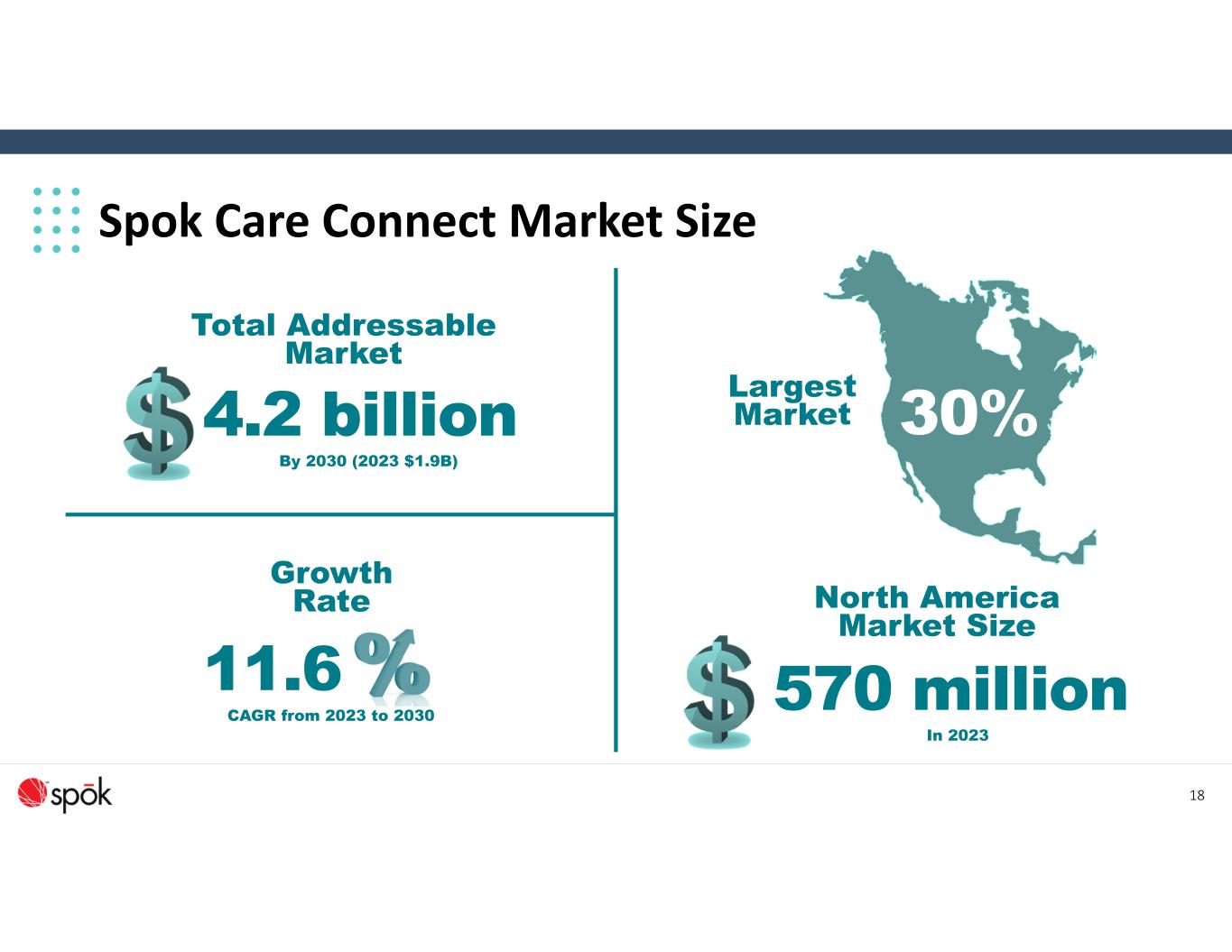

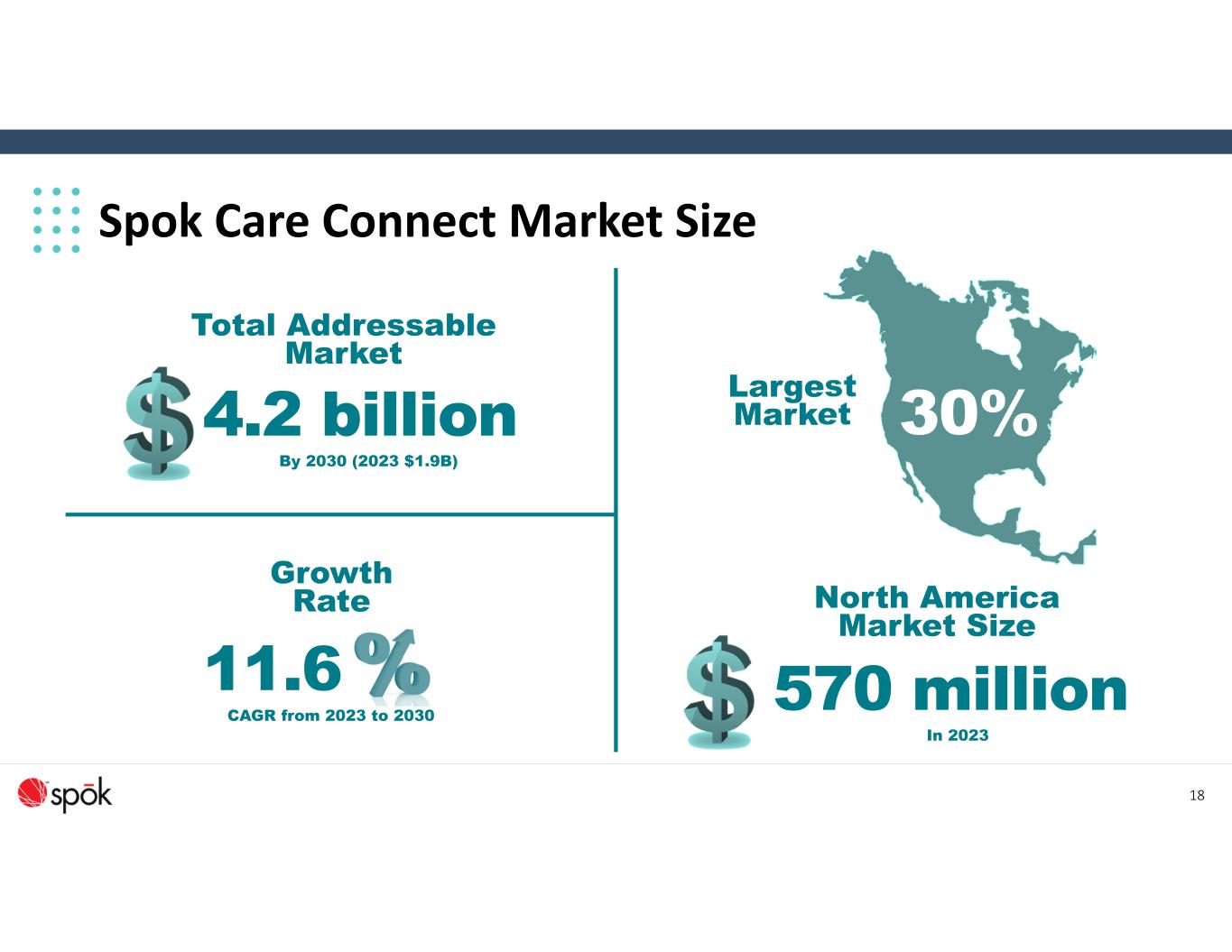

18 Spok Care Connect Market Size 4.2 billion By 2030 (2023 $1.9B) Total Addressable Market 11.6 CAGR from 2023 to 2030 Growth Rate Largest Market 30% 570 million In 2023 North America Market Size

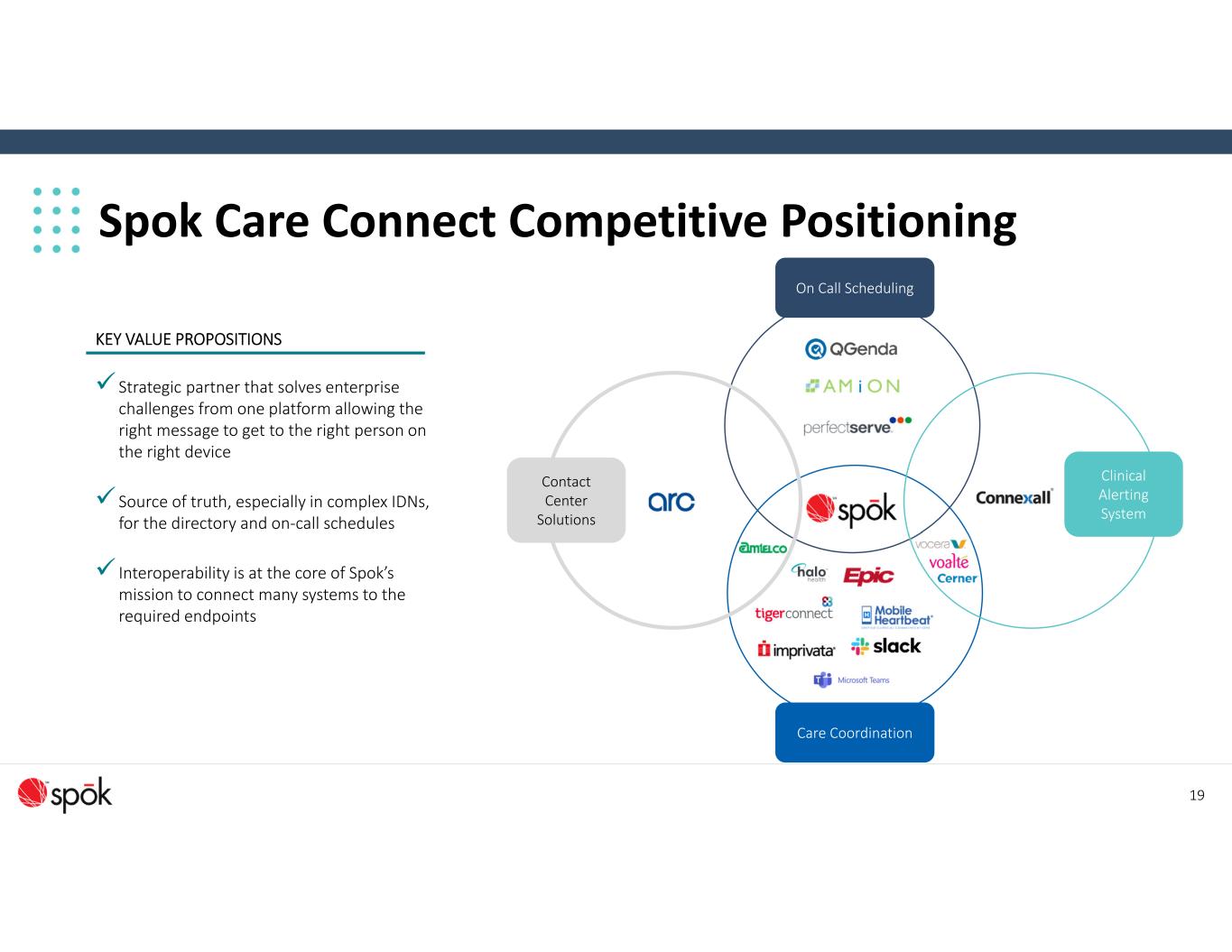

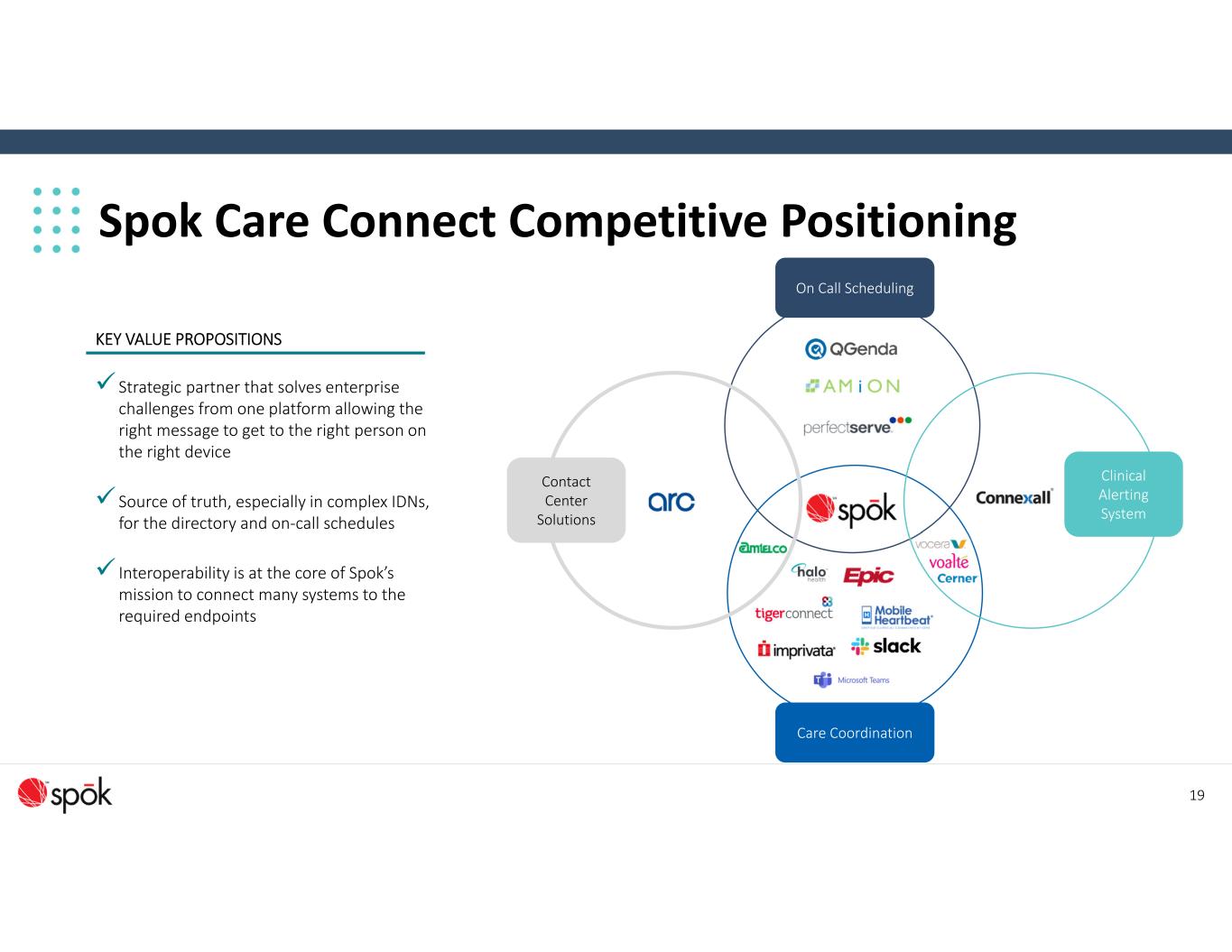

Spok Care Connect Competitive Positioning KEY VALUE PROPOSITIONS Strategic partner that solves enterprise challenges from one platform allowing the right message to get to the right person on the right device Source of truth, especially in complex IDNs, for the directory and on‐call schedules Interoperability is at the core of Spok’s mission to connect many systems to the required endpoints On Call Scheduling Clinical Alerting System Care Coordination Contact Center Solutions 19

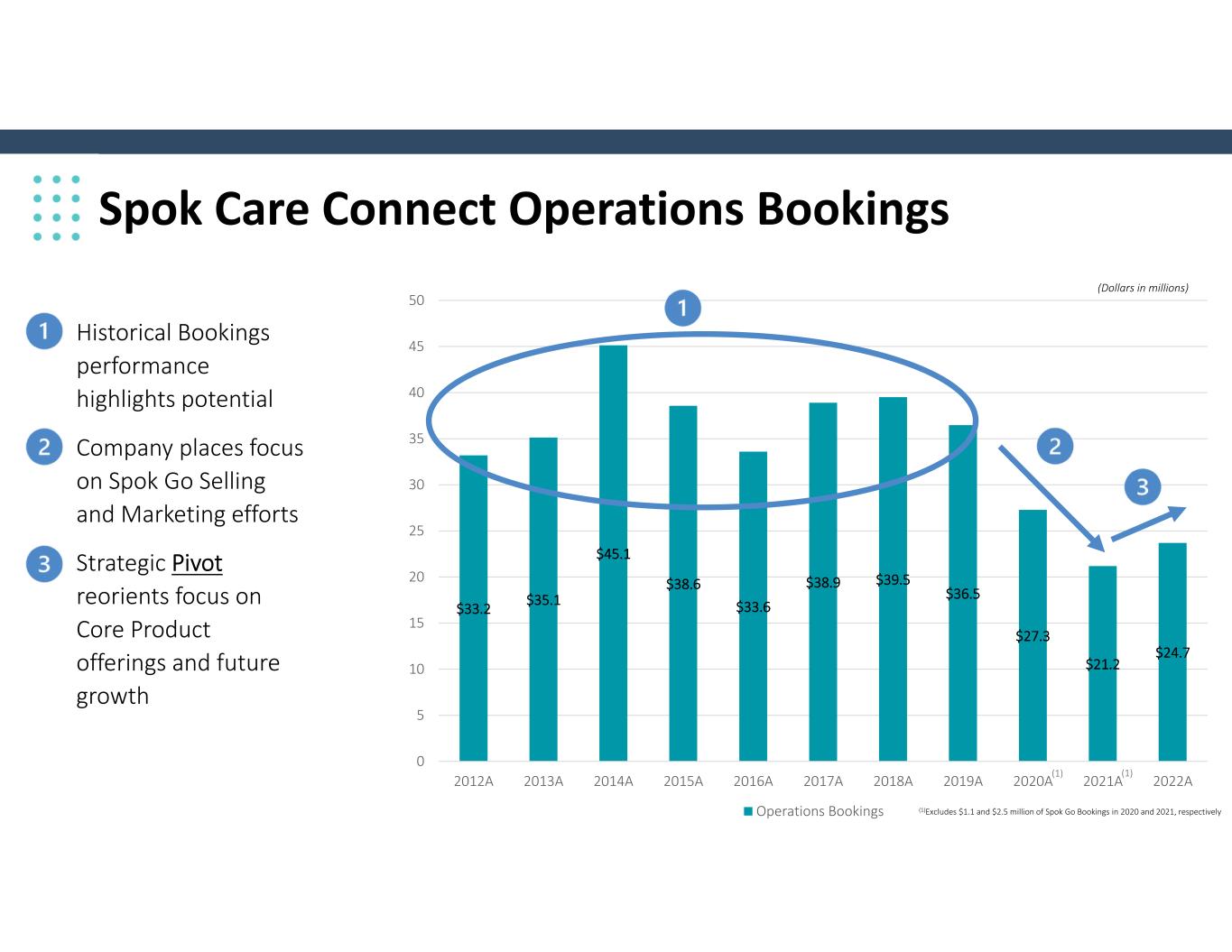

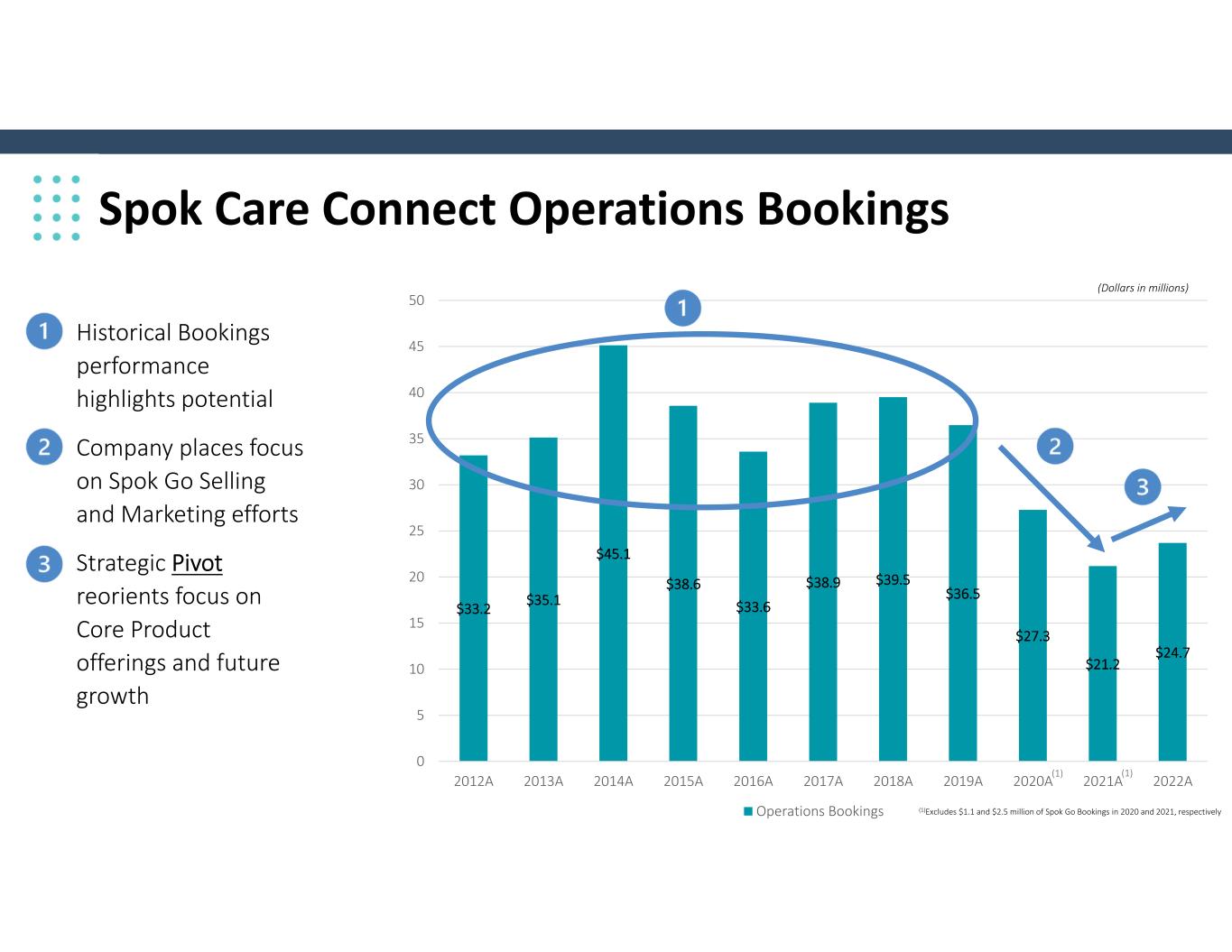

Spok Care Connect Operations Bookings Historical Bookings performance highlights potential Company places focus on Spok Go Selling and Marketing efforts Strategic Pivot reorients focus on Core Product offerings and future growth $33.2 $35.1 $45.1 $38.6 $33.6 $38.9 $39.5 $36.5 $27.3 $21.2 $24.7 0 5 10 15 20 25 30 35 40 45 50 2012A 2013A 2014A 2015A 2016A 2017A 2018A 2019A 2020A 2021A 2022A Operations Bookings (1)Excludes $1.1 and $2.5 million of Spok Go Bookings in 2020 and 2021, respectively (1) (1) (Dollars in millions)

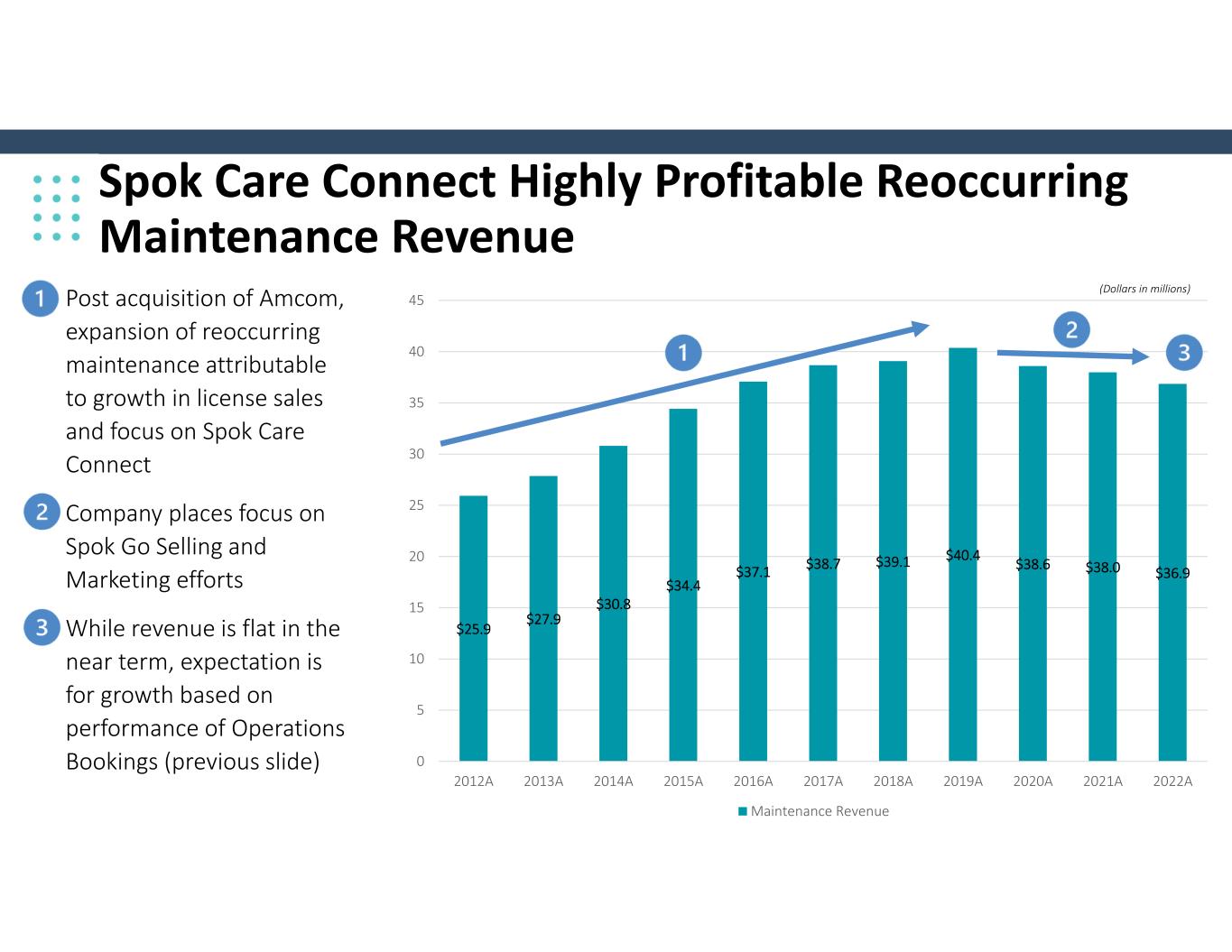

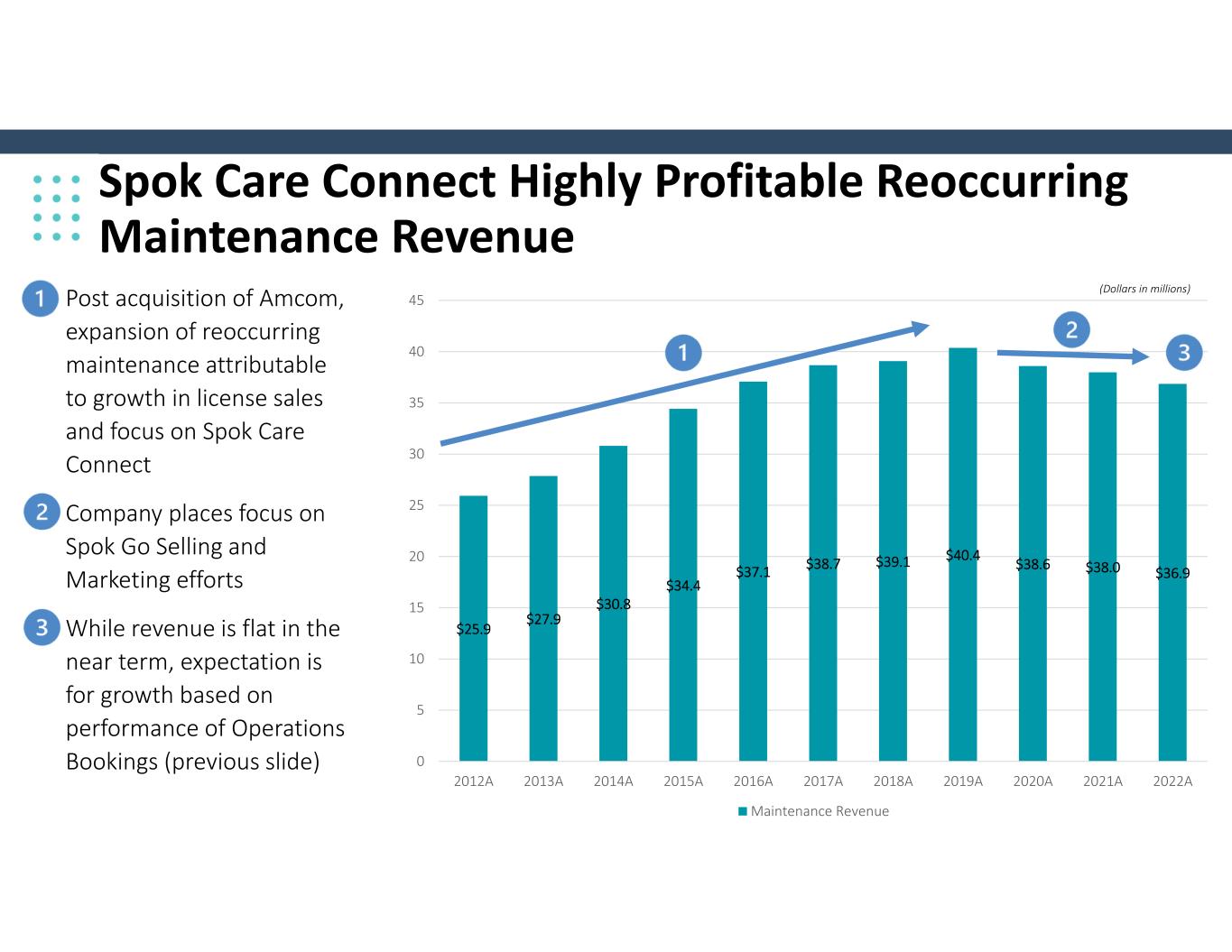

Spok Care Connect Highly Profitable Reoccurring Maintenance Revenue Post acquisition of Amcom, expansion of reoccurring maintenance attributable to growth in license sales and focus on Spok Care Connect Company places focus on Spok Go Selling and Marketing efforts While revenue is flat in the near term, expectation is for growth based on performance of Operations Bookings (previous slide) $25.9 $27.9 $30.8 $34.4 $37.1 $38.7 $39.1 $40.4 $38.6 $38.0 $36.9 0 5 10 15 20 25 30 35 40 45 2012A 2013A 2014A 2015A 2016A 2017A 2018A 2019A 2020A 2021A 2022A Maintenance Revenue (Dollars in millions)

Financials

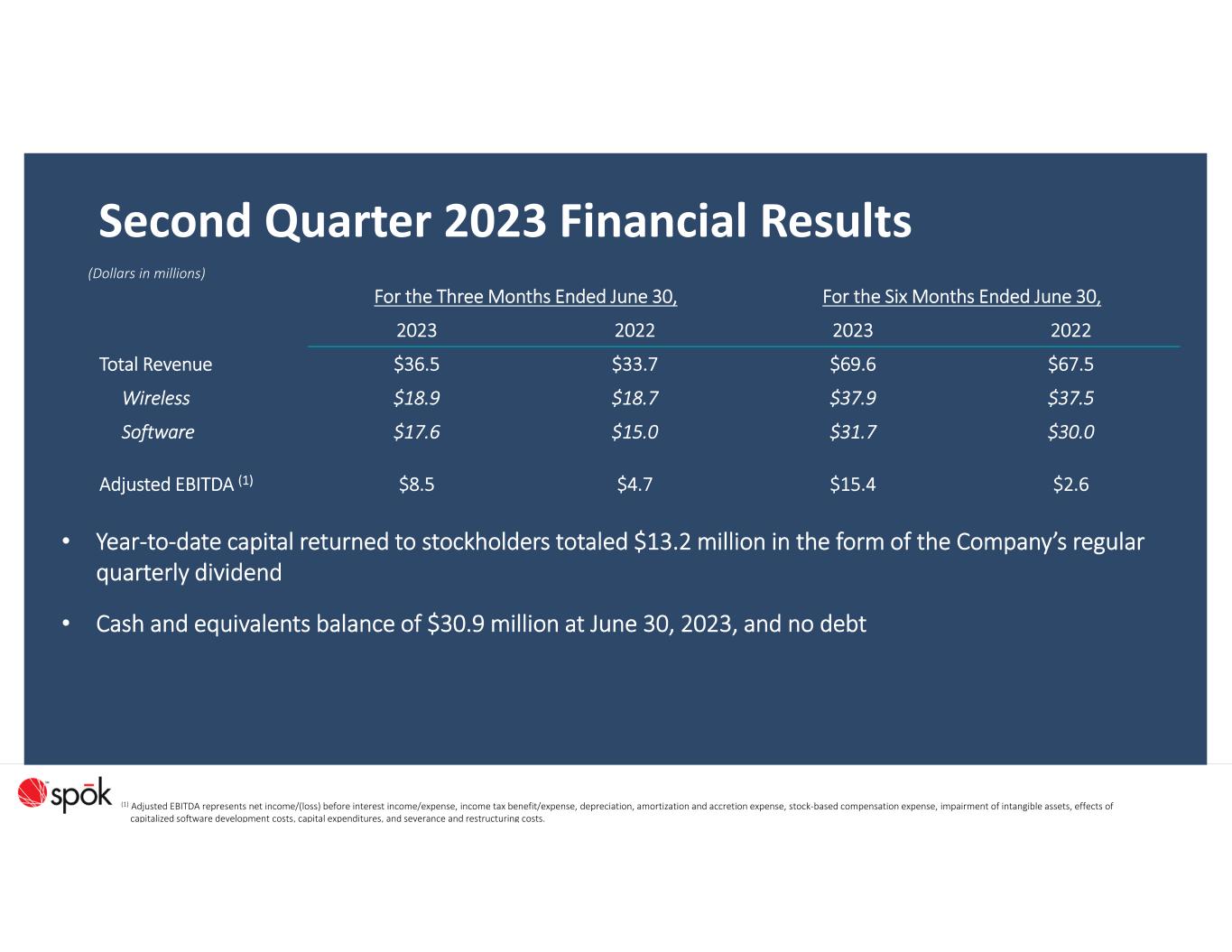

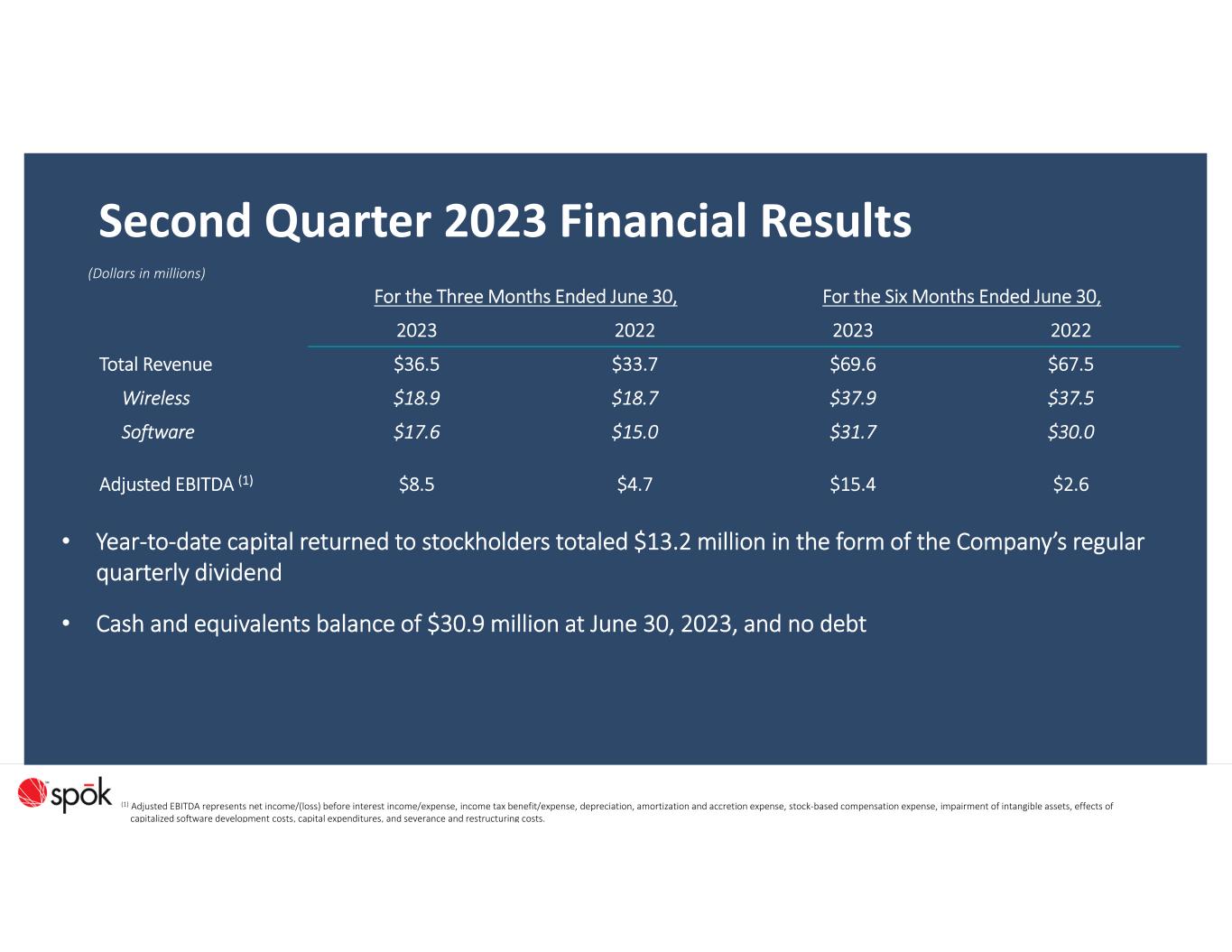

23 Second Quarter 2023 Financial Results For the Three Months Ended June 30, For the Six Months Ended June 30, 2023 2022 2023 2022 Total Revenue $36.5 $33.7 $69.6 $67.5 Wireless $18.9 $18.7 $37.9 $37.5 Software $17.6 $15.0 $31.7 $30.0 Adjusted EBITDA (1) $8.5 $4.7 $15.4 $2.6 • Year‐to‐date capital returned to stockholders totaled $13.2 million in the form of the Company’s regular quarterly dividend • Cash and equivalents balance of $30.9 million at June 30, 2023, and no debt (Dollars in millions) (1) Adjusted EBITDA represents net income/(loss) before interest income/expense, income tax benefit/expense, depreciation, amortization and accretion expense, stock‐based compensation expense, impairment of intangible assets, effects of capitalized software development costs, capital expenditures, and severance and restructuring costs.

Second Quarter 2023 Highlights • Company executing on strategic business plan generating $4.7 million of GAAP net income, and $8.5 million of adjusted EBITDA • Second Quarter software operations bookings increased 90% as momentum continued in the quarter • Software and Wireless revenue growth on a year‐ over‐year basis • Wireless average revenue per unit continues upward trends, up to $7.53, or 4.1%, with units in service down less than 1% on a sequential basis and only 3.5% from the prior year period 24

25 Balance Sheet • Exceptionally clean and simple balance sheet • No debt • Common stock only • $30.9 million of cash and equivalents • Significant deferred tax assets to shield income from taxes for many years

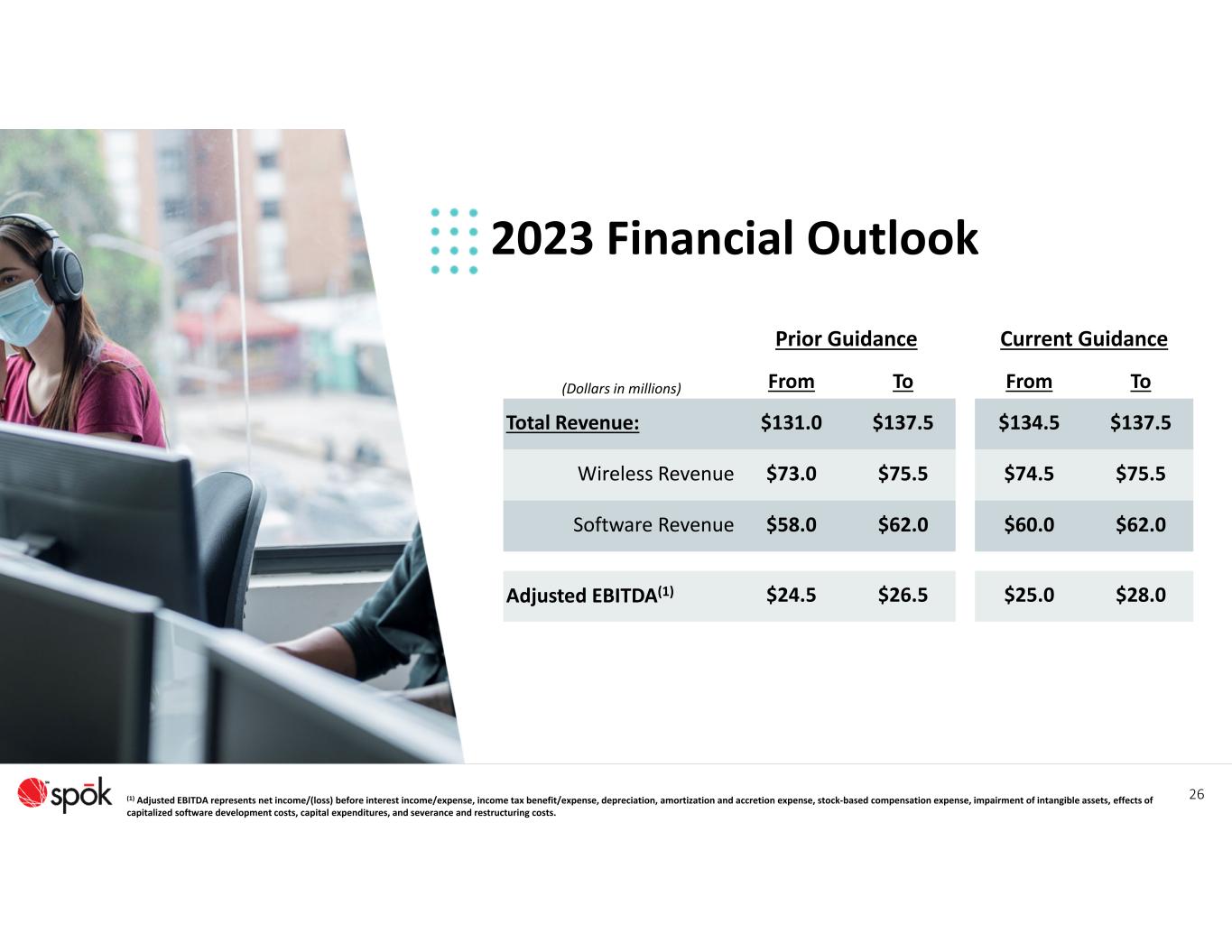

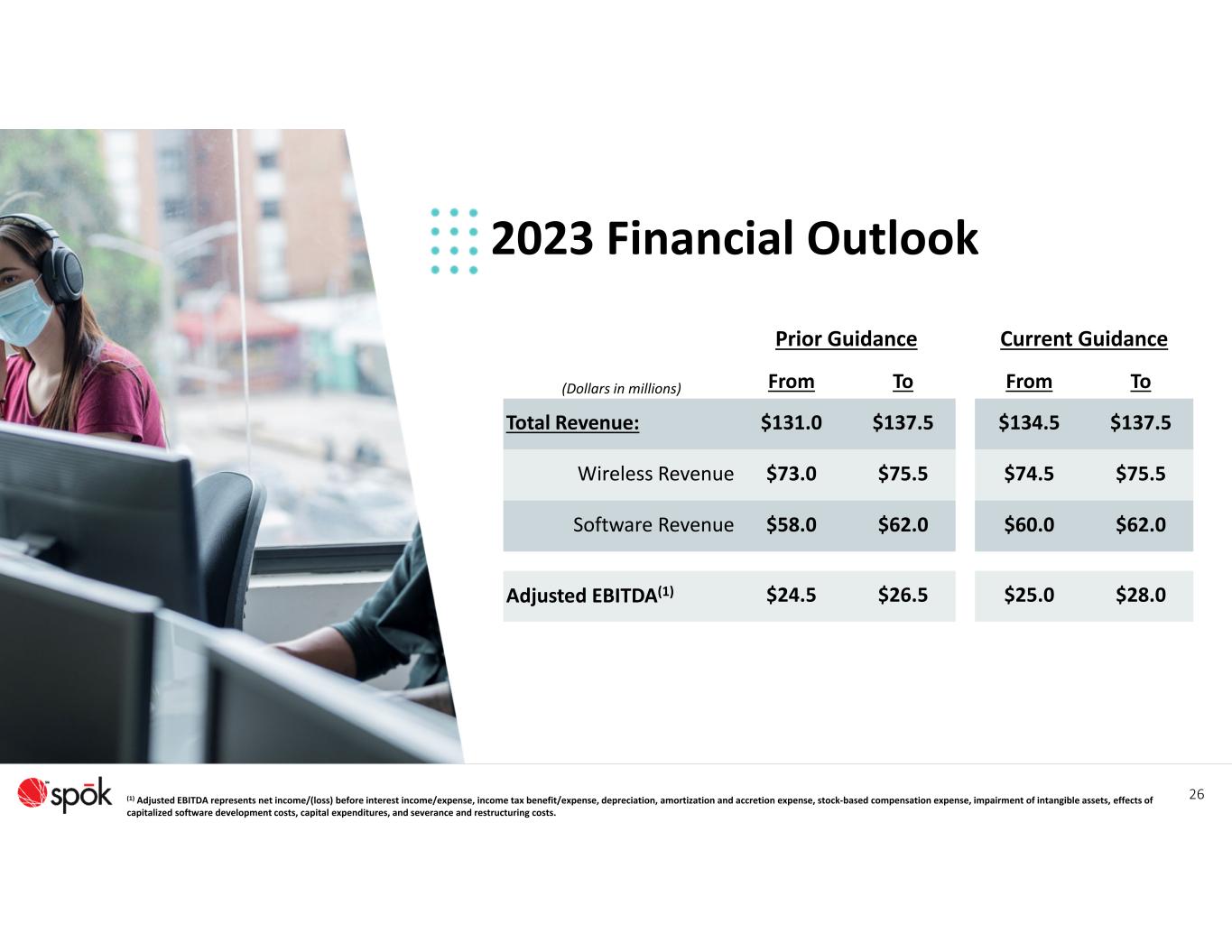

2023 Financial Outlook 26 Prior Guidance Current Guidance From To From To Total Revenue: $131.0 $137.5 $134.5 $137.5 Wireless Revenue $73.0 $75.5 $74.5 $75.5 Software Revenue $58.0 $62.0 $60.0 $62.0 Adjusted EBITDA(1) $24.5 $26.5 $25.0 $28.0 (Dollars in millions) (1) Adjusted EBITDA represents net income/(loss) before interest income/expense, income tax benefit/expense, depreciation, amortization and accretion expense, stock‐based compensation expense, impairment of intangible assets, effects of capitalized software development costs, capital expenditures, and severance and restructuring costs.

Capital Allocation

Capital Allocation Return of Capital • Higher $1.25 annual dividend since February 2022 • Opportunistic capital deployment for shareholder value via share repurchase authorization – current basket of $10.0 million M&A • Not a current focus/priority • Will be opportunistic for potential to leverage our cash flow prioritization strategy Internal Investment • Product innovation and technology expansion with our Spok Care Connect Suite to grow software revenue • Automation and efficiency initiatives

29 History of FCF generation and return of capital • Since the 2004 merger, Spok has generated over $1 billion in cumulative free cash flow. • Both our Wireless and Software businesses drive significant FCF and allow for the continued investment in our software business. 29 $1005.2 $545.7 $30.9 6/30/23 (in millions)

Wrap‐Up Enormous customer base and strong relationships with leading healthcare providers Largest wireless paging network in the country with 800,000+ units in service No debt, $30.9 mm cash balance, significant deferred tax assets, funding 85%+ of dividend from free cash flow, substantial dividend yield at current Stable re‐occurring wireless and software maintenance revenue with opportunities to grow total revenue 30

Thank you 31