Table of Contents

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2006

LG.Philips LCD Co., Ltd.

(Translation of Registrant’s name into English)

20 Yoido-dong, Youngdungpo-gu, Seoul 150-721, The Republic of Korea

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F X Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submission to furnish a report or other document that the registration foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes No X

Table of Contents

QUARTERLY REPORT

(From January 1, 2006 to September 30, 2006)

THIS IS A TRANSLATION OF THE QUARTERLY REPORT ORIGINALLY PREPARED IN KOREAN AND IS IN SUCH FORM AS REQUIRED BY THE KOREAN FINANCIAL SUPERVISORY COMMISSION.

IN THE TRANSLATION PROCESS, SOME PARTS OF THE REPORT WERE REFORMATTED, REARRANGED OR SUMMARIZED FOR THE CONVENIENCE OF READERS.

UNLESS EXPRESSLY STATED OTHERWISE, ALL INFORMATION CONTAINED HEREIN IS PRESENTEDON A NON-CONSOLIDATED BASIS IN ACCORDANCE WITH ACCOUNTING PRINCIPLES GENERALLY ACCEPTED IN KOREA, OR KOREAN GAAP, WHICH DIFFER IN CERTAIN RESPECTS FROM GENERALLY ACCEPTED ACCOUNTING PRINCIPLES IN CERTAIN OTHER COUNTRIES, INCLUDING THE UNITED STATES. WE HAVE MADE NO ATTEMPT TO IDENTIFY OR QUANTIFY THE IMPACT OF THESE DIFFERENCES.

(All information is presented on a non-consolidated Korean GAAP basis)

| 1. | Overview | 1 | ||

| 1 | ||||

| 3 | ||||

| 2. | Information Regarding Shares | 5 | ||

| 5 | ||||

| 6 | ||||

| 6 | ||||

| 7 | ||||

| 7 | ||||

| 3. | Major Products and Materials | 8 | ||

| 8 | ||||

| 8 | ||||

| 8 | ||||

| 8 | ||||

Table of Contents

| 4. | Production & Equipment | 9 | ||

| 9 | ||||

| 9 | ||||

| 10 | ||||

| 5. | Sales | 10 | ||

| 10 | ||||

| 10 | ||||

| 6. | Directors & Employees | 12 | ||

| 12 | ||||

| 13 | ||||

| 13 | ||||

| 15 | ||||

| 16 | ||||

| 7. | Financial Information | 17 | ||

| 17 | ||||

| 18 | ||||

| 20 | ||||

| 20 | ||||

| 21 | ||||

| 22 | ||||

| Attachment: | 1. Korean GAAP Non-consolidated Financial Statements | |

| 2. Korean GAAP Consolidated Financial Statements | ||

| 3. U.S. GAAP Consolidated Financial Statements |

Table of Contents

| 1. | Overview |

| A. | Industry |

| (1) | Industry characteristics and growth potential |

| - | TFT-LCD technology is one of the most widely used technologies in the manufacture of flat panel displays and the demand for flat panel displays is growing rapidly. The flat panel display industry is characterized by high entry barriers due to rapidly evolving technology, capital-intensive characteristics, and the significant investments required to achieve economies of scale, among other factors. There is strong competition between a limited number of players within the industry and production capacity in the industry, including ours, is being continually increased. |

| - | The demand for LCD panels for Notebook Computers & Monitors has been closely related to the IT industry cycle. The demand for LCD panels for TVs is growing with the start of HDTV broadcasting and as LCD TV is anticipated to play a key role in the digital display market. There is a competition between TFT-LCD and PDP technologies in the area of large flat TV products. In addition, LCD panel markets for applications, such as mobile phones, PDAs, medical applications and automobile navigation systems, among others, are growing steadily. |

| - | The average selling prices of our display panels have declined in general and are expected to continually decline with time irrespective of industry-wide fluctuations as a result of, among other factors, technology advances and cost reductions. |

| (2) | Cyclicality |

| - | The TFT-LCD business has high cyclicality as well as being a capital intensive business. In spite of the increase in demand for products, this industry has experienced periodic volatility caused by imbalances between demand and supply due to capacity expansion within the industry. |

| - | Intense competition and expectations of demand growth may lead panel manufacturers to invest in manufacturing capacity on similar schedules, resulting in a surge in capacity when production is ramped up at new fabrication facilities. |

| - | During such surges in capacity growth, our customers can exert and have exerted strong downward pricing pressure, resulting in sharp declines in average selling prices and significant fluctuations in our gross margins. Conversely, demand surges and fluctuations in the supply chain can lead to price increases. |

| (3) | Competitiveness |

| - | Our ability to compete successfully depends on factors both within and outside our control, including product pricing, performance and reliability, successful and timely investment and product development, success of our end-brand customers in marketing their brands and products, component and raw material supply costs, foreign exchange rate and general economic and industry conditions. |

1

Table of Contents

| - | Core competitiveness includes technology leadership, capability to design new products and premium products, timely investment in advanced fabs, cost leadership through application of large production lines, innovation of process and productivity, and collaborative customer relationships. |

| - | Most importantly, cost leadership and stable and long-term relationships with customers are critical to secure profit even in a buyer’s market. |

| - | A substantial portion of our sales is attributable to a limited group of end-brand customers and their designated system integrators. The loss of these end-brand customers, as a result of customers entering into strategic supplier arrangements with our competitors or otherwise, would thus result in reduced sales. |

| - | Developing new products and technologies that can be differentiated from those of our competitors is critical to the success of our business. We take active measures to protect our intellectual property internationally by obtaining patents and undertaking monitoring activities in our major markets. It is also necessary to recruit and retain the experienced key staffs and highly skilled line operators. |

| (4) | Sourcing material |

| - | Materials are sourced in-house (color filters) as well as from domestic and overseas vendors. Recently, the domestic portion has grown due to the active participation of domestic vendors. |

| - | The shortage of raw materials may arise temporarily due to the rapid increase in demand for raw materials resulting from capacity expansion in the TFT-LCD industry. |

| - | We have purchased, and expect to purchase, a substantial portion of our equipment from a limited number of qualified foreign and local suppliers. From time to time, increased demand for new equipment may cause lead times to extend beyond those normally required by the equipment vendors. |

| (5) | Others |

| - | Most TFT-LCD panel makers are located in Asia. |

a. Korea: LG.Philips LCD, Samsung Electronics (including Joint Venture between Samsung Electronics and Sony Corporation), BOE-Hydis

b. Taiwan: AU Optronics, Chi Mei Optoelectronics, CPT, QDI, etc.

c. Japan: Sharp, IPS-Alpha, etc.

d. China: SVA-NEC, BOE-OT, etc.

2

Table of Contents

| B. | Company |

| (1) | Business overview |

| - | We started the TFT-LCD business in 1998. We currently operate seven fabrication facilities located in Gumi and Paju, Korea and four module facilities located in Gumi & Paju, Korea and Nanjing, China. |

| - | We became the first LCD maker in the world which commenced commercial production at a 4th generation fab (P3) in July 2000 and at a 5th generation fab (P4) in March 2002, and we started mass production at our 6th generation fab (P6) in August 2004 , which allows us to produce LCD panels for large TVs and monitors. Following mass production at our 7th generation fab (P7) in January 2006, we became a panel maker who operates both 6th and 7th generation lines, which we believe will strengthen our position as a leader in the LCD TV market. |

| - | Non-consolidated sales revenue in the third quarter of 2006 increased by around 31% to KRW 2,730 billion compared to KRW 2,086 billion in the second quarter of 2006 and increased by 13% compared to KRW 2,416 billion in the third quarter of 2005. |

| - | Due to the continuous fall in product prices, we incurred a non-consolidated operating loss of KRW 384 billion in the third quarter of 2006 compared to a non-consolidated operating loss of KRW 445 billion in the second quarter of 2006. We also incurred a non-consolidated net loss of KRW 321 billion in the third quarter of 2006 compared to a non-consolidated net loss of KRW 322 billion in the second quarter of 2006. |

| - | Business area of the company for disclosure is limited to LCD business. |

| (2) | Market shares |

| - | World wide market share of large-size TFT-LCD panels (³ 10”) based on revenue |

| Q2 2006 | 2005 | 2004 | |||||||

Panel for Notebook Computer | 25.1 | % | 22.5 | % | 19.6 | % | |||

Panel for Monitor | 15.7 | % | 22.5 | % | 22.6 | % | |||

Panel for TV | 22.7 | % | 23.9 | % | 19.8 | % | |||

Total | 20.0 | % | 22.2 | % | 20.9 | % |

| * | Source: DisplaySearch Q3 2006 |

3

Table of Contents

| (3) | Market characteristics |

| - | Due to the recent high growth in the display appliance market for the flat display format, the scale of the LCD market is growing at a rapid rate, resulting in expansion of the market centered mainly in America, Japan, Europe and China. |

| (4) | New business |

| - | Due to our downward adjustment of 2006 capital expenditure, P7 is expected to reach a production capacity of 75,000 input glass sheets per month by the end of 2006. |

| - | We have commenced building construction of P8 at our Paju display cluster in Korea in anticipation of growth in the TFT-LCD market, and decided to invest in a multi-purpose generation 5.5 facility at P8 plant to meet our customer’s forthcoming needs, particularly in the expanding wide format notebook and high-end monitor segments. |

| - | In September 2005, we entered into an agreement to build a ‘back-end” module production plant in Wroclaw, Poland, becoming the first global LCD industry player to commence such a production facility in Europe. We broke ground on the plant in June 2006 and expect to begin production - during the first half of 2007. In October 2006, we formed a strategic alliance with Toshiba Corporation whereby Toshiba would take a 19.9% equity participation in our subsidiary, a LCD module plant, in Poland currently under construction in Wroclaw, Poland and LG.Philips LCD Poland Sp. z o.o. would supply Toshiba with a quantity of LCD TV panels produced in the plant in Poland. |

| - | In May 2006, we entered into an investment agreement with the Guangzhou Development District Administrative Committee to construct a module production plant in Guangzhou, China, and in August 2006, we established LG.Philips LCD Guangzhou Co., Ltd. which plant is under construction. |

4

Table of Contents

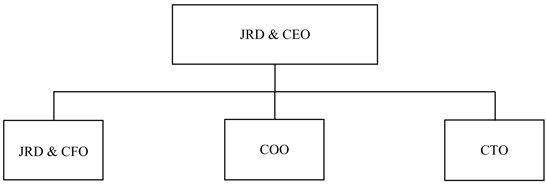

| (5) | Organization chart as of September 30, 2006 |

- JRD : Joint Representative Director

- CEO : Chief Executive Officer

- CFO : Chief Financial Officer

- COO : Chief Operating Officer

- CTO : Chief Technology Officer

| 2. | Information Regarding Shares |

| A. | Change in Capital Stock |

(Unit : KRW, Share)

Date | Descriptions | Change of Number of Common Shares | Face amount per share | |||

July 23, 2004 | Initial Public Offering* | 33,600,000 | 5,000 | |||

September 8, 2004 | Over-allotment Option** | 1,715,700 | 5,000 | |||

July 27, 2005 | Follow-on Offering*** | 32,500,000 | 5,000 |

| * | ADSs offering : 24,960,000 shares (US$30 per Share, US$15 per ADS) Offering of common stock : 8,640,000 shares (KRW34,500 per Share) |

| ** | Pursuant to underwriters’ exercise of over-allotment option (US$30 per Share, US$15 per ADS) |

| *** | ADSs offering (US$42.64 per Share, US$21.32 per ADS) |

5

Table of Contents

| B. | Convertible Bonds |

(Unit : USD, Share)

Item | Contents | |||

Issuing Date | April 19, 2005 | |||

Maturity (Redemption Date after Put Option Exercise) | April 19, 2010 (October 19, 2007) | |||

Face Amount | 475,000,000 | |||

Offering method | Public Offering | |||

Conversion period | Convertible into shares of common stock in the period from June 27, 2005 to April 4, 2010 | |||

Conversion price | KRW 58,251 per share* | |||

Conversion status | Number of shares already converted | None | ||

Number of convertible shares | 8,276,681 shares if all convertible bonds are converted* | |||

Remarks | - Registered form - Listed on Singapore Exchange | |||

| * | Conversion price was adjusted from KRW 58,435 to KRW 58,251 and the number of convertible shares was adjusted from 8,250,620 to 8,276,681 according to follow-on offering as of July 27, 2005. |

| C. | Shareholder List |

| (1) | Total shares issued : 357,815,700 shares as of September 30, 2006 |

| (2) | Largest shareholder and related parties as of September 30, 2006 |

(Unit: share)

Name | January 1, 2006 | Increase/Decrease | September 30, 2006 | |||||

LG Electronics | 135,625,000 (37.90) | % | — | 135,625,000 (37.90) | % | |||

Total | 135,625,000 (37.90) | % | — | 135,625,000 (37.90) | % |

| (3) | Shareholders who own 5% or more of our shares as of December 31, 2005 |

(Unit: share)

Name | Type of Stock | Number of shares | Ratio | ||||

LG Electronics | Common Stock | 135,625,000 | 37.90 | % | |||

Philips Electronics | Common Stock | 117,625,000 | 32.87 | % | |||

Citibank N.A.* | Common Stock | 36,518,569 | 10.21 | % | |||

Total | 289,768,569 | 80.98 | % |

| * | ADSs Depositary |

6

Table of Contents

| D. | Voting rights as of September 30, 2006 |

(Unit: share)

Description | Number of shares | |||

1. | Shares with voting rights [A-B] | 357,815,700 | ||

| A. Total shares issued | 357,815,700 | |||

| B. Shares without voting rights | — | |||

2. | Shares with restricted voting rights | — | ||

| Total number of shares with voting rights [1-2] | 357,815,700 | |||

| E. | Dividends |

| (1) | Dividends during the recent 3 fiscal years |

Description | 2006 (Q1 ~ Q3) | 2005 | 2004 | |||

Par value (Won) | 5,000 | 5,000 | 5,000 | |||

Net income (Million Won) | (-)594,968 | 517,012 | 1,655,445 | |||

Earnings per share (Won) | (-)1,663 | 1,523 | 5,420 | |||

Retained earning for dividends (Million Won) | 2,885,381 | 3,480,349 | 2,963,337 | |||

Total cash dividend amount (Million Won) | — | — | — | |||

Total stock dividend amount (Million Won) | — | — | — | |||

Cash dividend payout ratio (%) | — | — | — | |||

Cash dividend yield (%) | — | — | — | |||

Stock dividend yield (%) | — | — | — | |||

Cash dividend per share (Won) | — | — | — | |||

Stock dividend per share (Won) | — | — | — |

| * | Earnings per share are calculated based on par value of 5,000 Won. |

(Stock split was made from par value of 10,000 Won to par value of 5,000 Won per share as of May 25, 2004.)

| * | Retained earning for dividends is the amount before dividends are paid. |

| * | Earnings per share is calculated by net income divided by weighted average number of common stock. |

7

Table of Contents

| 3. | Major Products and Materials |

| A. | Major products in 2006 (Q1 ~ Q3) |

(Unit: In billions of Won)

Business area | Sales types | Items (Market) | Specific use | Major trademark | Sales (%) | ||||||

TFT- | Product/ Service/ Other Sales | TFT-LCD (Overseas) | Notebook Computer, Monitor, TV, Applications Panels, etc. | LG.Philips LCD | 6,589 | (91.1)% | |||||

| TFT-LCD (Korea*) | Notebook Computer, Monitor, TV, Applications Panels, etc. | LG.Philips LCD | 645 | (8.9)% | |||||||

Total | 7,234 | (100)% |

| * | Local export was included. |

| B. | Average selling price trend of major products |

| (Unit: USD / m2 | ) | ||||||

Description | 2006 Q3 | 2006 Q2 | 2006 Q1 | ||||

TFT-LCD panel | 1,430 | 1,598 | 1,953 |

| * | Half-finished products in cell format are excluded. |

| ** | Quarterly average selling price per square meter of net display area shipped |

| *** | Consolidated basis |

| C. | Major materials |

| (Unit: In billions of Won | ) | |||||||||||

Business area | Purchase types | Items | Specific use | Purchase amount (%) | Remarks | |||||||

TFT-LCD | Materials | Glass | LCD Panel Manufacturing | 944 (20.0) | % | Samsung Corning Precision Glass Co., Ltd., NEG, etc. | | |||||

| Back- Light | 1,345 (28.5) | % | Heesung Electronics Ltd., etc. | |||||||||

| Polarizer | 471 (10.0) | % | LG Chem., etc. | |||||||||

| Others | 1,966 (41.5) | % | ||||||||||

| Total | 4,726 (100.0) | % | ||||||||||

| D. | Price trend of major materials |

| - | Prices of major materials depend on fluctuations in supply and demand in the market as well as on change in size and quantity of raw materials according to the increased production of larger-size panels. |

8

Table of Contents

| 4. | Production and Equipment |

| A. | Production capacity and calculation |

| (1) | Production capacity |

| (Unit : 1,000 Glass sheets) | ||||||||||

Business area | Items | Business place | 2006 (Q1 ~ Q3) | 2005 | 2004 | |||||

TFT-LCD | TFT-LCD | Gumi, Paju | 7,260 | 8,128 | 6,644 | |||||

| (2) | Calculation of Capacity |

| a. | Method |

| | Assumptions for calculation |

| - | Based on input glass |

| ‚ | Calculation method |

| - | Input capacity of recent month x given periods (9 months) in case of 2006 (Q1 ~ Q3) |

| - | Average monthly input capacity for 4th quarter x given periods (12 months) in case of 2005 and 2004. |

| b. | Average working hours |

| - | Refer to B-(2) |

| B. | Production performance and working ratio |

| (1) | Production performance |

| (Unit: 1,000 Glass sheets) | ||||||||||

Business area | Items | Business place | 2006 (Q1 ~ Q3) | 2005 | 2004 | |||||

TFT-LCD | TFT-LCD | Gumi, Paju | 6,634 | 7,544 | 6,033 | |||||

| * | Based on input glass |

| (2) | Working Ratio * |

| (Unit: Hours | ) | ||||||

Business place (area) | Available working hours of 2006 (Q1 ~ Q3) | Real working hours of 2006 (Q1 ~ Q3) | Average working ratio | ||||

Gumi, Paju (TFT-LCD) | 6,552 (24 hours X 273 Days) | 6,552 (24 hours X 273 Days) | 100 | % | |||

| * | Working hours for R&D activities were included. |

9

Table of Contents

| C. | Investment plan |

| (1) | Investment in progress |

| (Unit: In billions of Won) | ||||||||||||||||

Business area | Description | Investment period | Investment Assets | Investment effect | Total investment | Already invested | To be invested | Remarks | ||||||||

TFT-LCD | New / Expansion, etc. | Q3 ‘04~ | Building/ Machinery, etc. | Capacity expansion | 7,050 | 5,160 | 1,890 | — | ||||||||

| (2) | Investment Plan (Consolidated basis) |

| (Unit: In billions of Won) | ||||||||||||

Business area | Project | Expected yearly investment | Investment effects | Remarks | ||||||||

| 2006 * | 2007 * | 2008 ** | ||||||||||

TFT-LCD | New / Expansion, etc. | 3,035 | 1,100 | — | Capacity Expansion, etc. | |||||||

| * | Expected investments in 2006 and in 2007 are subject to change depending on market environment. |

| ** | Expected investments in 2008 cannot be projected due to industry characteristics. |

| 5. | Sales |

| A. | Sales performance |

| (Unit: In billions of Won) | ||||||||||||

Business area | Sales types | Items (Market) | 2006 (Q1 ~ Q3) | 2005 (Q1 ~ Q3) | 2005 | |||||||

TFT-LCD | Products, etc. | TFT-LCD | Overseas | 6,589 | 5,659 | 8,114 | ||||||

| Korea* | 645 | 556 | 776 | |||||||||

| Total | 7,234 | 6,215 | 8,890 | |||||||||

| * | Local export was included. |

| B. | Sales route and sales method |

| (1) | Sales organization |

| - | As of September 30, 2006, each of IT business unit, TV business unit, and Small & Medium Displays business unit has individual sales and customer support function. |

| - | Sales subsidiaries in America, Germany, Japan, Taiwan and China (Hong Kong and Shanghai) perform sales activities in overseas countries and provide technical support to customers. |

10

Table of Contents

| (2) | Sales route |

| - | LG.Philips LCD HQ® Overseas subsidiaries (USA/Europe/Japan/Taiwan /Hong Kong/Shanghai), etc.® System integrators, Branded customers® End users |

| - | LG.Philips LCD HQ® System integrators, Branded customers® End users |

| (3) | Sales methods and conditions |

| - | Direct sales & sales through overseas subsidiaries, etc. |

| (4) | Sales strategy |

| - | To secure stable sales to major PC makers and the leading consumer electronics makers globally |

| - | To increase sales of premium Notebook Computer products, to strengthen sales of the larger size and high-end Monitor segment and to lead the large and wide LCD TV market |

| - | To diversify our market in the application segment, including products such as mobile phone, automobile navigation systems, aircraft instrumentation and medical diagnostic equipment, etc. |

11

Table of Contents

| 6. | Directors & Employees |

| A. | Members of Board of Directors as of September 30, 2006 |

Name | Date of Birth | Position | Principal Occupation | |||

| Bon Joon Koo | December 24, 1951 | Joint Representative Director, Vice-Chairman and Chief Executive Officer | — | |||

Ron H. Wirahadiraksa | June 10, 1960 | Joint Representative Director, President and Chief Financial Officer | — | |||

| Hee Gook Lee | March 19, 1952 | Director | President and Chief Technology Officer of LG Electronics | |||

| Rudy Provoost | October 16, 1959 | Director | Chief Executive Officer of Philips Consumer Electronics and Member of Philips Group Management Committee | |||

| Bongsung Oum | March 2, 1952 | Outside Director | Chairman, KIBNET Co., Ltd. | |||

| Bart van Halder | August 17, 1947 | Outside Director | Member of Boards of Directors of Cosun u.a. and Air Traffic Control in the Netherlands | |||

| Ingoo Han | October 15, 1956 | Outside Director | Professor, Graduate School of Management, Korea Advanced Institute of Science and Technology | |||

| Doug J. Dunn | May 5, 1944 | Outside Director | Member of Boards of Directors of ARM Holdings plc, STMicroelectronics N.V., Soitec Group, Optical Metrology Innovations and TomTom International BV | |||

| Dongwoo Chun | January 15, 1945 | Outside Director | Outside Director, Pixelplus | |||

12

Table of Contents

| B. | Committees of the Board of Directors |

Committee | Member | |

Audit Committee | Mr. Bongsung Oum, Mr. Bart van Halder, Mr. Ingoo Han | |

Remuneration Committee | Mr. Rudy Provoost, Mr. Hee Gook Lee, Mr. Doug J. Dunn, Mr. Dongwoo Chun | |

Outside Director Nomination and Corporate Governance Committee | Mr. Rudy Provoost, Mr. Hee Gook Lee, Mr. Bart van Halder, Mr. Dongwoo Chun |

| C. | Director & Officer Liability Insurance |

| (1) | Overview of Director & Officer Liability Insurance (as of September, 2006) |

(Unit: USD)

Name of insurance | Premium paid in Q3 2006 | Limit of liability | Remarks | |||

Directors & Officers Liability Insurance | 1,500,000 | 100,000,000 | — |

| * | In July 2006, LPL renewed director & officer liability insurance with coverage until July 2007. |

| (2) | The approval procedure for the Director & Officer Liability Insurance |

| - | Joint Representative Directors approved the limit for liability, coverage and premiums. |

| (3) | The insured |

| 1. | LG.Philips LCD Co., Ltd. and its subsidiaries and their respective Directors and Officers |

| 2. | Duly elected or appointed Directors or Officers, past and new Directors and Officers during the policy period |

| 3. | The estates and heirs of deceased Directors or Officers, and the legal representatives of Directors or Officers in the event of their incompetence, insolvency or bankruptcy (only if the Directors or Officers were employed at the time the acts were committed) |

13

Table of Contents

| (4) | The Covered Risks |

| 1. | The Loss for shareholders or 3rd party, arising from any alleged Wrongful Act of director or officer of the company in their respective capacities, in spite of their fiduciary duties |

| a. | Wrongful Act means any breach of duty, neglect, error, misstatement, misleading statement, omission, or act by the Directors or Officers |

| b. | Loss means damages, judgments, settlements and Defense Costs |

| 2. | Coverage for security holder derivative action & security claims |

The Loss arising out of any security holder derivative action is paid in accordance with ‘Security Holder Derivative Action Inclusion Clause’. Securities Loss, incurred on account of a Securities Claim against the Directors, Officers and/or the Company is covered. (Except for exclusions)

| (5) | Exclusions |

| 1. | General Exclusions (any loss related to following items) |

| - | Any illegal gaining of personal profit, dishonest or criminal act; |

| - | Remuneration payment to the Insureds without the previous approval of the stockholders, which payment was illegal; |

| - | Profits in fact made from the purchase or sale of securities of the Company using non- public information in an illegal manner; |

| - | Payment of commissions, gratuities, benefits or any other favor provided to political group, government official, director, officer, employee or any person having an ownership interest in any customers of the company or their agent(s), representative(s) or member(s) of their family or any other entity(ies) with which they are affiliated. |

| - | Wrongful Acts alleged in any claim which has been reported under any policy of which this policy is a renewal or replacement; |

| - | Any pending or prior litigation as of the inception date of this policy, or derived from the same facts as alleged in such pending or prior litigation, etc.; |

| - | Wrongful Act which Insured knew or should reasonably have foreseen at the inception date of this policy; |

| - | Pollutants, contamination; |

| - | Act or omission as directors or officers of any other entity other than the Company; |

| - | Nuclear material, radioactive contamination; |

| - | Bodily injury, disease, death or emotional distress of any person, or damage to tangible property, loss of use of property, or injury from oral or written publication of a libel or slander, or material that violates a person’s right of privacy ; |

| - | Any alleged Wrongful Act of any Subsidiary of which the insured did not own more than 50% of stock either directly or indirectly through its Subsidiaries. |

14

Table of Contents

| 2. | Special Exclusions (any loss related to following items) |

| - | Punitive Damage |

| - | Nuclear Energy Liability |

| - | Mutual claim between Insureds |

| - | Claim of 15% Closely Held entity |

| - | Claim of Regulator |

| - | Professional Service liability |

| - | SEC (Securities and Exchange Commission) – 16(b) |

| - | ERISA(Employee Retirement Income Security Act) |

| - | The so called ‘Year 2000 Problem’ |

| - | War & Terrorism |

| - | Asbestos/Mould liability |

| - | Patent / Copyright liability, etc. |

| D. | Employees |

(as of September 30, 2006) | (Unit: person, in millions of Won) |

Sex | Details of employees | Total Salary in 2006 (Q1 ~ Q3) | Per Capita Salary | Average Service Year | ||||||||||

Office Worker | Line Worker | Others | Total | |||||||||||

Male | 5,580 | 5,610 | 11,190 | 331,512 | 30 | 4.1 | ||||||||

Female | 459 | 5,150 | 5,609 | 118,814 | 21 | 2.2 | ||||||||

Total | 6,039 | 10,760 | 16,799 | 450,326 | 27 | 3.4 | ||||||||

| * | Directors and executive officers are excluded. |

15

Table of Contents

| E. | Stock Option |

The following table sets forth certain information regarding our stock option plan as of September 30, 2006.

Executive Officers | Grant Date | Exercise Period | Exercise Price | Number of Granted Options | Number of Exercised Options | Number of Exercisable Options | |||||||||

| From | To | ||||||||||||||

Ron H. Wirahadiraksa | April 7, 2005 | April 8, 2008 | April 7, 2012 | (Won) | 44,050 | 100,000 | 0 | 100,000 | |||||||

Ki Seon Park | April 7, 2005 | April 8, 2008 | April 7, 2012 | (Won) | 44,050 | 70,000 | 0 | 70,000 | |||||||

Duke M. Koo | April 7, 2005 | April 8, 2008 | April 7, 2012 | (Won) | 44,050 | 40,000 | 0 | 40,000 | |||||||

Budiman Sastra | April 7, 2005 | April 8, 2008 | April 7, 2012 | (Won) | 44,050 | 40,000 | 0 | 40,000 | |||||||

Won Wook Kim | April 7, 2005 | April 8, 2008 | April 7, 2012 | (Won) | 44,050 | 40,000 | 0 | 40,000 | |||||||

Woo Shik Kim | April 7, 2005 | April 8, 2008 | April 7, 2012 | (Won) | 44,050 | 40,000 | 0 | 40,000 | |||||||

Sang Deog Yeo | April 7, 2005 | April 8, 2008 | April 7, 2012 | (Won) | 44,050 | 40,000 | 0 | 40,000 | |||||||

Jae Geol Ju | April 7, 2005 | April 8, 2008 | April 7, 2012 | (Won) | 44,050 | 40,000 | 0 | 40,000 | |||||||

Total | 410,000 | 410,000 | |||||||||||||

16

Table of Contents

| 7. | Financial Information |

| A. | Financial Highlights (Based on Non-consolidated, Korean GAAP) |

(Unit: In millions of Won)

Description | 2006 (Q1 ~ Q3) | 2005 | 2004 | 2003 | 2002 | |||||

Current Assets | 2,641,140 | 3,196,934 | 2,638,616 | 1,918,329 | 806,156 | |||||

Quick Assets | 1,914,223 | 2,725,169 | 2,170,617 | 1,644,838 | 463,539 | |||||

Inventories | 726,917 | 471,765 | 467,999 | 273,491 | 342,617 | |||||

Fixed Assets | 10,325,876 | 9,798,981 | 6,960,077 | 4,295,753 | 3,613,748 | |||||

Investments | 1,012,131 | 660,628 | 409,955 | 203,343 | 147,832 | |||||

Tangible Assets | 9,142,075 | 8,988,459 | 6,366,651 | 3,874,428 | 3,210,884 | |||||

Intangible Assets | 171,670 | 149,894 | 183,471 | 217,982 | 255,032 | |||||

Total Assets | 12,967,016 | 12,995,915 | 9,598,693 | 6,214,082 | 4,419,904 | |||||

Current Liabilities | 2,168,009 | 2,594,282 | 1,900,765 | 2,044,005 | 1,117,066 | |||||

Non-current Liabilities | 3,727,446 | 2,726,036 | 1,925,286 | 1,276,045 | 1,436,775 | |||||

Total Liabilities | 5,895,455 | 5,320,318 | 3,826,051 | 3,320,050 | 2,553,841 | |||||

Capital Stock | 1,789,079 | 1,789,079 | 1,626,579 | 1,450,000 | 1,450,000 | |||||

Capital Surplus | 2,275,172 | 2,279,250 | 1,012,271 | |||||||

Retained Earnings | 3,013,718 | 3,608,686 | 3,091,674 | 1,436,229 | 417,129 | |||||

Capital Adjustment | (-)6,408 | (-)1,418 | 42,118 | 7,803 | (-)1,066 | |||||

Total Shareholder’s Equity | 7,071,561 | 7,675,597 | 5,772,642 | 2,894,032 | 1,866,063 | |||||

Sales Revenues | 7,233,521 | 8,890,155 | 8,079,891 | 6,031,261 | 3,518,289 | |||||

Operating Income | (-)794,370 | 447,637 | 1,640,708 | 1,086,517 | 215,724 | |||||

Ordinary Income | (-)816,570 | 367,281 | 1,683,067 | 1,009,731 | 293,249 | |||||

Net Income | (-)594,968 | 517,012 | 1,655,445 | 1,019,100 | 288,792 |

| * | For the purpose of comparison, Financial Statements for FY 2003 & 2002 were reclassified according to changes in the Statements of Korean Financial Accounting Standards. |

17

Table of Contents

| B. | R&D Expense |

| (1) | Summary |

(Unit: In millions of Won)

Account | 2006 (Q1 ~ Q3) | 2005 | 2004 | Remarks | |||||||||

| Direct Material Cost | 208,010 | 253,930 | 170,051 | ||||||||||

| Direct Labor Cost | 65,108 | 72,142 | 58,202 | ||||||||||

| Depreciation Expense | 14,987 | 11,710 | 11,078 | ||||||||||

| Others | 24,777 | 23,979 | 13,874 | ||||||||||

| R&D Expense Total | 312,882 | 361,761 | 253,205 | ||||||||||

Accounting Treatment | Selling & Administrative Expenses | 56,166 | 55,057 | 43,095 | |||||||||

| Manufacturing Cost | 256,716 | 306,704 | 210,110 | ||||||||||

R&D Expense / Sales Ratio [Total R&D Expense/Sales for the period×100] | 4.33 | % | 4.07 | % | 3.13 | % | |||||||

| * | Capex for R&D, Manufacturing Cost for R&D test run are excluded. |

| (2) | R&D achievements |

[Achievement in 2004]

| 1) | Development of 20.1-inch AMOLED |

| - | Joint development of 20.1-inch AMOLED with LG Electronics |

| - | Development of world’s largest 20.1-inch wide AMOLED based on LTPS technology |

| 2) | Development of copper bus line |

| - | Next generation LCD technology to significantly improve brightness, definition and resolution, etc. |

| 3) | Development and mass production of world’s largest TFT-LCD panel for Full-HD TV (55-inch) in October 2004. |

| - | Stitch Lithography and Segmented Circuit Driving to cope with large-size LCD Panel |

| - | Achievement of High Contrast Ratio and Fast Response Time through new technologies |

| - | Application of innovative panel technology to solve the weak point (gravity/touch stains) of large size |

| 4) | Development of Ultra High Resolution Product (30-inch) |

| - | World’s 1st success in mass production of LCM applying Cu Line(source & gate Area) |

| - | Achievement of Ultra High Resolution (2560x1600 : 101ppi) |

18

Table of Contents

| 5) | Development of the world’s lowest power-consumption, 32-inch Wide LCD TV Model |

| - | Development of the world’s lowest power consumption, under 90W model (EEFL applied) |

| - | High Contrast Ratio, Fast Response Time (DCR + ODC applied) |

[Achievement in 2005]

| 6) | Development of High Luminance and High Color Gamut 17-inch wide LCD Panel for Notebook Computer |

| - | World’s 1st 500nit luminance and 72% color gamut in 17-inch wide for Notebook Computer |

| - | Development of 6200nit luminance backlight |

| 7) | Development of world’s largest 10.1-inch Flexible Display |

| - | Joint development with E-ink Corporation |

| 8) | 37-inch, 42-inch, 47-inch Full-HD Model Development, applying Low Resistance Line (Copper bus Line) |

| - | World’s 1st mass production of copper bus line Model |

| - | Realize Full HD Resolution (1920x1080) |

| 9) | 37-inch wide LCD Model development which is world’s best in power consumption |

| - | The lowest power consumption of below 120W (applying EEFL) |

| - | High Contrast Ratio, Fast Response Time with DCR, ODC Technology. |

[Achievement in 2006]

| 10) | Development of High Brightness/Color gamut 17-inch wide slim LCD for Notebook Computer |

| - | Slim model (10t®7t), featuring 500nit, NTSC 72% |

| - | Development of Slim and High Brightness Backlight |

| 11) | World’s largest size 100-inch TFT-LCD development |

| - | High quality image without noise or signal distortion, applying low resistance copper bus line |

| - | High dignity picture for Full HDTV |

| 12) | 32-inch/42-inch HCFL Scanning Backlight applied LCD TV Model Development |

| - | Realization of MBR (Motion Blur Reduction) by application of Backlight Scanning Technology |

| - | Lamp Quantity Reduction by HCFL (Hot Cathode Fluorescent Lamp) Application |

| 13) | World’s largest 20.1-inch TFT-LCD for Notebook Computer Development |

| - | S-IPS Mode, sRGB, Realization of DCR 3000:1 by Backlight Control, Brightness 300nit |

| 14) | Ultra-slim TFT-LCD development for mobile phones |

| - | Realization of 1.3t by reducing light guide plate & glass thickness |

| 15) | The fast response 2.0” TFT-LCD development for mobile phones |

| - | Realization of high quality image by new liquid crystal development (25ms®16ms) |

| 16) | Wide Color Gamut 30” Wide TFT-LCD Monitor Development |

| - | Realization of 92% high color gamut by Application of WCG CCFL |

19

Table of Contents

| C. | Domestic Credit Rating |

Subject | Month of Rating | Credit Rating | Rating Agency (Rating range) | |||

| April 2004 | AA- | National Information & Credit Evaluation, Inc. (AAA ~ D) | ||||

| October 2004 | AA- | |||||

| March 2005 | AA- | |||||

| June 2005 | AA- | |||||

| Corporate | June 2006 | AA- | ||||

| Debenture | May 2004 | AA- | Korea Investors Service, Inc. (AAA ~ D) | |||

| October 2004 | AA- | |||||

| March 2005 | AA- | |||||

| June 2005 | AA- | |||||

| June 2006 | AA- | |||||

| Commercial Paper | April 2004 | A1 | ||||

| December 2004 | A1 | National Information & Credit Evaluation, Inc. (A1 ~ D) | ||||

| June 2005 | A1 | |||||

| January 2006 | A1 | |||||

| June 2006 | A1 | |||||

| May 2004 | A1 | Korea Investors Service, Inc. (A1 ~ D) | ||||

| October 2004 | A1 | |||||

| June 2006 | A1 |

| D. | Remuneration for directors in 2006 (Q1 ~ Q3) |

(Unit: In millions of Won)

Classification | Salary Paid | Approved Salary at Shareholders Meeting | Per Capita Average Salary Paid | Remarks | ||||

Inside Directors (4 persons) | 1,008 | 13,400 | 252 | |||||

Outside Directors (5 persons) | 210 | 42 | Audit committee consists of three outside directors. |

20

Table of Contents

| E. | Derivative contracts |

| (1) | Foreign currency forward contracts |

(Unit: In millions)

Contracting party | Selling position | Buying position | Contract foreign exchange rate | Maturity date | ||||||

HSBC and others | US$ | 2,467 | (Won) | 2,374,463 | (Won) 925.22:US$1 ~ (Won) 1,050.20:US$1 | October 2, 2006 ~ September 6, 2007 | ||||

SHINHAN BANK and others | EUR 210 | (Won) | 253,779 | (Won) 1,164.28:EUR1 ~ (Won) 1,277.94:EUR1 | October 11, 2006 ~ June 13, 2007 | |||||

HSBC and others | (Won) | 316,558 | JP¥ 37,100 | (Won) 8.153:JP¥1 ~ (Won) 9.362:JP¥1 | October 2, 2006 ~ June 12, 2007 | |||||

CITI and others | US$ | 82 | JP¥ 9,500 | JP¥114.00:US$1 ~ JP¥116.06:US$1 | October 16, 2006 ~ February 14, 2007 | |||||

| (2) | Cross Currency Swap |

(Unit: In millions )

Contracting party | Contract Amount | Contract interest rate | Maturity date | ||||||

| ABN AMRO and others | Buying position | US$ | 250 | 3 Month Libor | October 12, 2006 ~ | ||||

| Selling position | (Won) | 252,065 | 4.15% ~ 4.54% | August 29, 2011 | |||||

| (3) | Interest Rate Swap |

(Unit: In millions )

Contracting party | Contract Amount | Contract interest rate | Maturity date | ||||||

| Standard Chartered First Bank Korea | US$ | 150 | Floating Rate Receipt | 6 Month Libor | May 21, 2009 ~ | ||||

| Fixed Rate Payment | 5.375% ~ 5.644% | May 24, 2010 | |||||||

21

Table of Contents

| (4) | Currency Option |

(Unit: In millions )

Contracting party | USD Put Option Buying Position | USD Call Option Selling Position | Strike Price | Maturity date | |||||||

| Korea Development Bank and others | US$ | 50 | US$ | 100 | (Won) (Won) | 957.30:US$1 ~ 966.50:US$1 | May 21, 2007 ~ June 21, 2007 | ||||

| F. | Status of Equity Investment as of September 30, 2006 |

Company | Total issued and outstanding shares | Number of shares owned by us | Ownership ratio | ||||

LG.Philips LCD America, Inc. | 5,000,000 | 5,000,000 | 100 | % | |||

LG.Philips LCD Japan Co., Ltd. | 1,900 | 1,900 | 100 | % | |||

LG.Philips LCD Germany GmbH | 960,000 | 960,000 | 100 | % | |||

LG.Philips LCD Taiwan, Co., Ltd. | 11,549,994 | 11,549,994 | 100 | % | |||

LG.Philips LCD Nanjing Co., Ltd. | * | * | 100 | % | |||

LG.Philips LCD Hong Kong Co., Ltd. | 115,000 | 115,000 | 100 | % | |||

LG.Philips LCD Shanghai Co., Ltd. | * | * | 100 | % | |||

LG.Philips LCD Poland Sp. z o.o. ** | 769,040 | 769,040 | 100 | % | |||

LG.Philips LCD Guangzhou Co., Ltd. | * | * | 100 | % | |||

Paju Electric Glass Co., Ltd. | 3,600,000 | 1,440,000 | 40 | % |

| * | No shares have been issued in accordance with the local laws and regulations. |

| ** | On October 26, 2006, we injected the paid-in capital of US$ 18,000,000 into LG.Philips LCD Poland Sp. z o.o. and our ownership ratio thereafter remained 100%. |

22

Table of Contents

LG.Philips LCD Co., Ltd.

Interim Non-Consolidated Financial Statements

September 30, 2006 and 2005

Table of Contents

Index

September 30, 2006 and 2005

| Page(s) | ||

| 1 – 2 | ||

Non-Consolidated Financial Statements | ||

| 3 | ||

| 4 | ||

| 5 – 6 | ||

| 7 – 21 |

Table of Contents

Report of Independent Accountants

To the Board of Directors and Shareholders of

LG.Philips LCD Co., Ltd.

We have reviewed the accompanying non-consolidated balance sheet of LG.Philips LCD Co., Ltd. (the “Company”) as of September 30, 2006, and the related non-consolidated statements of operations and cash flows for the three-month and nine-month periods ended September 30, 2006 and 2005, expressed in Korean won. These interim financial statements are the responsibility of the Company’s management. Our responsibility is to issue a report on these interim financial statements based on our reviews.

We conducted our reviews in accordance with the quarterly review standards established by the Securities and Futures Commission of the Republic of Korea. These standards require that we plan and perform our review to obtain moderate assurance as to whether the financial statements are free of material misstatement. A review is limited primarily to inquiries of company personnel and analytical procedures applied to financial data and thus provides less assurance than an audit. We have not performed an audit and, accordingly, we do not express an audit opinion.

Based on our reviews, nothing has come to our attention that causes us to believe that the non-consolidated interim financial statements referred to above are not presented fairly, in all material respects, in accordance with accounting principles generally accepted in the Republic of Korea.

We have audited the non-consolidated balance sheet of LG.Philips LCD Co., Ltd. as of December 31, 2005, and the related non-consolidated statements of operations, appropriations of retained earnings and cash flows for the year then ended, in accordance with auditing standards generally accepted in the Republic of Korea. We expressed an unqualified opinion on those financial statements in our audit report dated January 20, 2006. These financial statements are not included in this review report. The non-consolidated balance sheet as of December 31, 2005, presented herein for comparative purposes, is consistent, in all material respects, with the above audited balance sheet as of December 31, 2005.

Samil Pricewaterhouse Cooper is the Korean member firm of PricewaterhouseCoopers. PricewaterhouseCoopers refer to the network of member firms of PricewaterhouseCoopers International Limited, each of which is a separate and independent legal entity.

1

Table of Contents

Accounting principles and review standards and their application in practice vary among countries. The accompanying financial statements are not intended to present the financial position, results of operations and cash flows in conformity with accounting principles and practices generally accepted in countries and jurisdictions other than the Republic of Korea. In addition, the procedures and practices used in the Republic of Korea to review such financial statements may differ from those generally accepted and applied in other countries. Accordingly, this report and the accompanying financial statements are for use by those who are informed about Korean accounting principles or review standards and their application in practice.

/s/ Samil PricewaterhouseCoopers

Seoul, Korea

October 27, 2006

This report is effective as of October 27, 2006, the review report date. Certain subsequent events or circumstances, which may occur between the review report date and the time of reading this report, could have a material impact on the accompanying financial statements and notes thereto. Accordingly, the readers of the review report should understand that there is a possibility that the above review report may have to be revised to reflect the impact of such subsequent events or circumstances, if any.

2

Table of Contents

LG.Philips LCD Co., Ltd.

Non-Consolidated Balance Sheets

September 30, 2006 and December 31, 2005

(Unaudited)

(in millions of Korean won)

| 2006 | 2005 | |||||||

Assets | ||||||||

Current assets | ||||||||

Cash and cash equivalents | (Won) | 333,690 | (Won) | 1,465,025 | ||||

Available-for-sale securities | 23 | 354 | ||||||

Trade accounts and notes receivable, net (Notes 8 and 11) | 1,370,920 | 1,034,196 | ||||||

Inventories, net (Note 4) | 726,917 | 471,765 | ||||||

Other accounts receivable, net (Note 11) | 20,181 | 15,751 | ||||||

Accrued income, net | 657 | 1,369 | ||||||

Advanced payments, net | 2,591 | 5,959 | ||||||

Prepaid expenses | 39,127 | 20,532 | ||||||

Prepaid value added tax | 42,319 | 102,094 | ||||||

Deferred income tax assets (Note 9) | 35,501 | 4,647 | ||||||

Others (Note 8) | 69,214 | 75,242 | ||||||

Total current assets | 2,641,140 | 3,196,934 | ||||||

Property, plant and equipment, net | 9,142,075 | 8,988,459 | ||||||

Long-term financial instruments (Note 3) | 16 | 16 | ||||||

Equity-method investments | 338,669 | 213,968 | ||||||

Non-current guarantee deposits | 17,333 | 24,000 | ||||||

Long-term prepaid expenses | 138,657 | 83,023 | ||||||

Deferred income tax assets (Note 9) | 517,456 | 339,621 | ||||||

Intangible assets, net | 171,670 | 149,894 | ||||||

Total assets | (Won) | 12,967,016 | (Won) | 12,995,915 | ||||

Liabilities and Shareholders’ Equity | ||||||||

Current liabilities | ||||||||

Trade accounts and notes payable (Note 11) | (Won) | 874,036 | (Won) | 563,874 | ||||

Other accounts payable (Note 11) | 869,734 | 1,445,471 | ||||||

Advances received | 852 | 609 | ||||||

Withholdings | 3,972 | 12,004 | ||||||

Accrued expenses | 116,848 | 73,772 | ||||||

Ramp up costs (Note 4) | — | 19,499 | ||||||

Warranty reserve | 21,958 | 16,023 | ||||||

Current maturities of debentures and long-term debts (Note 5) | 240,849 | 429,352 | ||||||

Others (Note 8) | 39,760 | 33,678 | ||||||

Total current liabilities | 2,168,009 | 2,594,282 | ||||||

Income (loss) before income tax benefit | ||||||||

Debentures, net of current maturities and discounts on debentures (Note 6) | 2,795,742 | 2,385,272 | ||||||

Income tax benefit | 860,218 | 297,577 | ||||||

Accrued severance benefits, net | 71,486 | 43,187 | ||||||

Total liabilities | 5,895,455 | 5,320,318 | ||||||

Commitments and contingencies (Note 8) | ||||||||

Shareholders’ equity | ||||||||

Capital stock | ||||||||

Common stock, (Won)5,000 par value per share ; 400 million shares authorized ; 358 million shares issued and outstanding | 1,789,079 | 1,789,079 | ||||||

Capital surplus | 2,275,172 | 2,279,250 | ||||||

Retained earnings | 3,013,718 | 3,608,686 | ||||||

Capital adjustments | (6,408 | ) | (1,418 | ) | ||||

Total shareholders’ equity | 7,071,561 | 7,675,597 | ||||||

Total liabilities and shareholders’ equity | (Won) | 12,967,016 | (Won) | 12,995,915 | ||||

The accompanying notes are an integral part of these non-consolidated financial statements.

See Report of Independent Accountants

3

Table of Contents

Non-Consolidated Statements of Operations

Three-Month and Nine-Month Periods Ended September 30, 2006 and 2005

(Unaudited)

(in millions of Korean won, except per share amounts)

For the three-month periods ended September 30, | For the nine-month periods ended September 30, | |||||||||||||||

| 2006 | 2005 | 2006 | 2005 | |||||||||||||

Sales (Notes 11 and 12) | (Won) | 2,729,486 | (Won) | 2,416,322 | (Won) | 7,233,521 | (Won) | 6,215,168 | ||||||||

Cost of sales (Note 11) | 3,017,868 | 2,069,988 | 7,684,498 | 5,837,207 | ||||||||||||

Gross profit (loss) | (288,382 | ) | 346,334 | (450,977 | ) | 377,961 | ||||||||||

Selling and administrative expenses | 96,065 | 103,586 | 343,393 | 268,725 | ||||||||||||

Operating income (loss) | (384,447 | ) | 242,748 | (794,370 | ) | 109,236 | ||||||||||

Non-operating income | ||||||||||||||||

Interest income | 4,586 | 15,085 | 21,876 | 35,639 | ||||||||||||

Rental income | 1,850 | 25 | 5,893 | 25 | ||||||||||||

Foreign exchange gain | 22,096 | 72,041 | 136,329 | 131,559 | ||||||||||||

Gain on foreign currency translation | 25,321 | 28,209 | 53,322 | 28,209 | ||||||||||||

Gain on valuation of equity method investments | 29,810 | 1,401 | 79,921 | 2,906 | ||||||||||||

Gain on disposal of property, plant and equipment | 396 | 16 | 486 | 2,012 | ||||||||||||

Others | 4,933 | 3,597 | 24,061 | 11,025 | ||||||||||||

| 88,992 | 120,374 | 321,888 | 211,375 | |||||||||||||

Non-operating expenses | ||||||||||||||||

Interest expenses | 39,563 | 25,866 | 110,599 | 73,124 | ||||||||||||

Foreign exchange losses | 23,657 | 63,524 | 174,255 | 138,931 | ||||||||||||

Loss on foreign currency translation | 26,090 | 36,446 | 26,120 | 31,700 | ||||||||||||

Donations | 288 | 750 | 1,542 | 843 | ||||||||||||

Loss on disposal of accounts receivable | 5,256 | 1,566 | 8,319 | 6,519 | ||||||||||||

Loss on disposal of available-for-sale securities | 118 | — | 153 | — | ||||||||||||

Loss on valuation of equity method investments | 35,525 | 13,680 | 4,006 | 10,309 | ||||||||||||

Loss on disposal of property, plant and equipment | — | 79 | 1,046 | 101 | ||||||||||||

Ramp up costs (Note 4) | — | 7,147 | 18,043 | 7,147 | ||||||||||||

Others | — | — | 5 | — | ||||||||||||

| 130,497 | 149,058 | 344,088 | 268,674 | |||||||||||||

Income (loss) before income tax benefit | (425,952 | ) | 214,064 | (816,570 | ) | 51,937 | ||||||||||

Income tax benefit | (104,986 | ) | (12,863 | ) | (221,602 | ) | (137,227 | ) | ||||||||

Net income (loss) | (Won) | (320,966 | ) | (Won) | 226,927 | (Won) | (594,968 | ) | (Won) | 189,164 | ||||||

Basic ordinary income (loss) per share (Note 10) | (Won) | (897 | ) | (Won) | 651 | (Won) | (1,663 | ) | (Won) | 568 | ||||||

Basic earnings (loss) per share (Note 10) | (Won) | (897 | ) | (Won) | 651 | (Won) | (1,663 | ) | (Won) | 568 | ||||||

Diluted ordinary income (loss) per share (Note 10) | (Won) | (897 | ) | (Won) | 649 | (Won) | (1,663 | ) | (Won) | 568 | ||||||

Diluted earnings (loss) per share (Note 10) | (Won) | (897 | ) | (Won) | 649 | (Won) | (1,663 | ) | (Won) | 568 | ||||||

The accompanying notes are an integral part of these non-consolidated financial statements.

See Report of Independent Accountants

4

Table of Contents

Non-Consolidated Statements of Cash Flows

Three-Month and Nine-Month Periods Ended September 30, 2006 and 2005

(Unaudited)

(in millions of Korean won)

For the three-month periods ended September 30, | For the nine-month periods ended September 30, | |||||||||||||||

| 2006 | 2005 | 2006 | 2005 | |||||||||||||

Cash flows from operating activities | ||||||||||||||||

Net income (loss) | (Won) | (320,966 | ) | (Won) | 226,927 | (Won) | (594,968 | ) | (Won) | 189,164 | ||||||

Adjustments to reconcile net income to net cash provided by operating activities | ||||||||||||||||

Depreciation | 638,832 | 429,051 | 1,830,776 | 1,226,943 | ||||||||||||

Amortization of intangible assets | 12,416 | 10,830 | 37,094 | 33,493 | ||||||||||||

Provision for severance benefits | 7,953 | 8,374 | 39,338 | 34,930 | ||||||||||||

Loss (gain) on foreign currency translation, net | 761 | 10,990 | (34,548 | ) | 7,563 | |||||||||||

Loss (gain) on disposal of property, plant and equipment, net | (395 | ) | 63 | 560 | (1,911 | ) | ||||||||||

Amortization of discount on debentures | 8,858 | 9,025 | 27,042 | 20,394 | ||||||||||||

Loss (gain) on valuation of investments using the equity-method of accounting, net | 5,715 | 12,279 | (75,915 | ) | 7,404 | |||||||||||

Stock compensation cost | — | (204 | ) | — | 35 | |||||||||||

Others | 8,821 | 3,802 | 21,429 | 8,628 | ||||||||||||

| 682,961 | 484,210 | 1,845,776 | 1,337,479 | |||||||||||||

Changes in operating assets and liabilities | ||||||||||||||||

Increase in trade accounts and notes receivable | (431,846 | ) | (81,592 | ) | (348,135 | ) | (402,864 | ) | ||||||||

Decrease (increase) in inventories | 102,959 | (34,827 | ) | (255,153 | ) | (24,410 | ) | |||||||||

(Increase) decrease in other accounts receivable | (8,520 | ) | 312 | (4,473 | ) | 1,145 | ||||||||||

Decrease in accrued income | 387 | 952 | 712 | 166 | ||||||||||||

Decrease in advance payments | 1,171 | 2,886 | 3,368 | 4,140 | ||||||||||||

Decrease (increase) in prepaid expenses | 32,680 | 16,588 | (2,412 | ) | 16,954 | |||||||||||

Decrease (increase) in prepaid value added tax | 22,036 | (8,298 | ) | 59,775 | (4,314 | ) | ||||||||||

Decrease in other current assets | 2,232 | 6,150 | 23,726 | 67,837 | ||||||||||||

Increase in long-term prepaid expenses | (29,172 | ) | (24,787 | ) | (71,816 | ) | (41,665 | ) | ||||||||

Increase in deferred income tax | (104,985 | ) | (18,624 | ) | (221,602 | ) | (142,989 | ) | ||||||||

Increase in trade accounts and notes payable | 340,725 | 74,934 | 315,223 | 118,641 | ||||||||||||

(Decrease) increase in other accounts payable | (45,474 | ) | 54,355 | (105,943 | ) | 67,344 | ||||||||||

(Decrease) increase in advances received | (2,688 | ) | 749 | 243 | 1,146 | |||||||||||

(Decrease) increase in withholdings | (2,626 | ) | (769 | ) | (8,033 | ) | 43 | |||||||||

Increase (decrease) in accrued expenses | 44,192 | 1,946 | 43,076 | (55,483 | ) | |||||||||||

Increase (decrease) in income taxes payable | — | 1,055 | (19,499 | ) | (73,525 | ) | ||||||||||

Decrease in product warranty | (5,119 | ) | (4,353 | ) | (15,340 | ) | (11,186 | ) | ||||||||

Decrease in other current liabilities | (29,378 | ) | (38,972 | ) | (5,289 | ) | (40,016 | ) | ||||||||

Accrued severance benefits transferred from affiliated company, net | — | 524 | 2,947 | 1,329 | ||||||||||||

Payments of severance benefits | (1,182 | ) | (5,910 | ) | (24,035 | ) | (14,861 | ) | ||||||||

Decrease in severance insurance deposit | 223 | 2,558 | 10,025 | 6,043 | ||||||||||||

(Increase) decrease in contribution to National Pension Fund | (13 | ) | 28 | 24 | 67 | |||||||||||

| (114,398 | ) | (55,095 | ) | (622,611 | ) | (526,458 | ) | |||||||||

Net cash provided by operating activities | 247,597 | 656,042 | 628,197 | 1,000,185 | ||||||||||||

5

Table of Contents

LG.Philips LCD Co., Ltd.

Non-Consolidated Statements of Cash Flows

Three-Month and Nine-Month Periods Ended September 30, 2006 and 2005

(Unaudited)

(in millions of Korean won)

For the three-month periods ended September 30, | For the nine-month periods ended September 30, | |||||||||||||||

| 2006 | 2005 | 2006 | 2005 | |||||||||||||

Cash flows from investing activities | ||||||||||||||||

Acquisition of equity-method investments | (Won) | (99,856 | ) | (Won) | (22,300 | ) | (Won) | (99,856 | ) | (Won) | (22,967 | ) | ||||

Acquisitions of available-for-sale securities | (8 | ) | (23 | ) | (53 | ) | (229 | ) | ||||||||

Proceeds from disposal of available-for-sale securities | — | — | 349 | — | ||||||||||||

Proceeds from non-current guarantee deposits | 461 | 2 | 11,183 | 27 | ||||||||||||

Payments of non-current guarantee deposits | (48 | ) | — | (4,633 | ) | (4,960 | ) | |||||||||

Acquisitions of property, plant and equipment | (739,430 | ) | (1,348,374 | ) | (2,502,760 | ) | (2,702,281 | ) | ||||||||

Proceeds from disposal of property, plant and equipment 926 | 245 | 1,710 | 2,722 | |||||||||||||

Acquisition of intangible assets | (1,478 | ) | (5,712 | ) | (5,363 | ) | (8,021 | ) | ||||||||

Dividends from equity-method investments | 37,643 | — | 37,643 | — | ||||||||||||

Net cash used in investing activities | (801,790 | ) | (1,376,162 | ) | (2,561,780 | ) | (2,735,709 | ) | ||||||||

Cash flows from financing activities | ||||||||||||||||

Repayment on current portion of long-term debts | (219,633 | ) | — | (229,417 | ) | — | ||||||||||

Proceeds from issuance of long-term debts | 387,616 | 59,843 | 632,065 | 161,743 | ||||||||||||

Proceeds from issuance of debentures | — | — | 399,600 | 873,684 | ||||||||||||

Proceeds from issuance of common stock | — | 1,401,179 | — | 1,401,179 | ||||||||||||

Net cash provided by financing activities | 167,983 | 1,461,022 | 802,248 | 2,436,606 | ||||||||||||

Net increase (decrease) in cash and cash equivalents | (386,210 | ) | 740,902 | (1,131,335 | ) | 701,082 | ||||||||||

Cash and cash equivalents | ||||||||||||||||

Beginning of the period | 719,900 | 1,235,169 | 1,465,025 | 1,274,989 | ||||||||||||

End of the period | (Won) | 333,690 | (Won) | 1,976,071 | (Won) | 333,690 | (Won) | 1,976,071 | ||||||||

The accompanying notes are an integral part of these non-consolidated financial statements.

See Report of Independent Accountants

6

Table of Contents

Notes to Non-Consolidated Financial Statements

September 30, 2006 and 2005

(Unaudited)

| 1. | The Company |

LG.Philips LCD Co., Ltd. (the “Company”) was incorporated in 1985 under the Commercial Code of the Republic of Korea and commenced the manufacturing and sale of Thin Film Transistor Liquid Crystal Display (“TFT LCD”) from 1999. On July 26, 1999, LG Electronics Inc., Koninklijke Philips Electronics N.V. (“Philips”) and the Company entered into a joint venture agreement. Pursuant to the agreement, the Company changed its name from LG LCD CO., Ltd. to LG.Philips LCD Co., Ltd. effective August 27, 1999, and on August 31, 1999, the Company issued new shares of common stock to Philips for proceeds of (Won)725,000 million.

In July 2004, pursuant to Securities Registration Statement filed on July 16, 2004, with the Korea Stock Exchange, the Company sold 8,640,000 shares of common stock for proceeds of (Won)298,080 million. Concurrently, pursuant to a Form F-1 registration statement filed on July 15, 2004 with the U.S. Securities and Exchange Commission, the Company sold 24,960,000 shares of common stock in the form of American Depositary Shares (“ADSs”) for proceeds of US$748,800,000.

| 2. | Summary of Significant Accounting Policies |

The significant accounting policies followed by the Company in the preparation of its interim non-consolidated financial statements are same as those followed by the Company in its preparation of annual non-consolidated financial statements and are summarized below:

Basis of Financial Statement Presentation

The Company maintains its accounting records in Korean won and prepares statutory financial statements in the Korean language (Hangul) in conformity with the accounting principles generally accepted in the Republic of Korea. Certain accounting principles applied by the Company that conform with financial accounting standards and accounting principles in the Republic of Korea may not conform with generally accepted accounting principles in other countries. Accordingly, these financial statements are intended for use by those who are informed about Korean accounting principles and practices. The accompanying financial statements have been condensed, restructured and translated into English from the Korean language non-consolidated financial statements. Certain information attached to the Korean language financial statements, but not required for a fair presentation of the Company’s financial position, results of operations, or cash flows, is not presented in the accompanying non-consolidated financial statements.

Accounting Estimates

The preparation of the financial statements requires management to make estimates and assumptions that affect amounts reported therein. Although these estimates are based on management’s best knowledge of current events and actions that the Company may undertake in the future, actual results may differ from those estimates.

See Report of Independent Accountants

7

Table of Contents

LG. Philips LCD Co., Ltd.

Notes to Non-Consolidated Financial Statements

September 30, 2006 and 2005

(Unaudited)

Application of the Statements of Korean Financial Accounting Standards

The Korean Accounting Standards Board has published a series of Statements of Korean Financial Accounting Standards (SKFAS), which will gradually replace the existing financial accounting standards established by the Korean Financial Supervisory Commission. As SKFAS Nos. 18 through 20 became applicable for the Company on January 1, 2006, the Company adopted these Standards in its financial statements covering periods beginning January 1, 2006.

| 3. | Financial Instruments |

As of September 30, 2006 and December 31, 2005, long-term financial instruments represent key money deposits required to maintain checking accounts and, accordingly, the withdrawal of such deposits is restricted.

| 4. | Inventories |

Inventories as of September 30, 2006 and December 31, 2005, consist of the following:

| (in millions of Korean won) | 2006 | 2005 | ||||||

Finished products | (Won) | 406,540 | (Won) | 191,918 | ||||

Work-in-process | 229,596 | 131,483 | ||||||

Raw materials | 137,316 | 124,999 | ||||||

Supplies | 90,618 | 59,750 | ||||||

| 864,070 | 508,150 | |||||||

Less : Valuation loss | (137,153 | ) | (36,385 | ) | ||||

| (Won) | 726,917 | (Won) | 471,765 | |||||

For the nine-month period ended September 30, 2006, the Company recorded ramp-up costs of (Won)18,043 million to counter the unusual low volume of production.

See Report of Independent Accountants

8

Table of Contents

LG. Philips LCD Co., Ltd.

Notes to Non-Consolidated Financial Statements

September 30, 2006 and 2005

(Unaudited)

| 5. | Current Maturities of Long-Term Debts |

Current maturities of long-term debts as of September 30, 2006 and December 31, 2005, consist of the following:

(in millions of Korean won)

Type of borrowing | Creditor | Annual interest rates (%) as of September 30, 2006 | 2006 | 2005 | ||||||||

Long-term | Korea Export- Import Bank | 5.9 - 6.1 | (Won) | 39,267 | (Won) | 29,417 | ||||||

Long-term | — | — | — | 200,000 | ||||||||

Long-term | The Korea Development Bank | 3M Libor + 1.0 | 7,087 | — | ||||||||

Long-term | Korea Export- Import Bank | 6M Libor + 1.2 | 5,668 | — | ||||||||

Long-term | Woori Bank | 3M Libor + 1.0 | 16,534 | 17,727 | ||||||||

Long-term 182.5 million | — | 3M Libor + 1.0 | 172,426 | 184,872 | ||||||||

| 240,982 | 432,016 | |||||||||||

Less : Discounts on debentures | (133 | ) | (2,664 | ) | ||||||||

| (Won) | 240,849 | (Won) | 429,352 | |||||||||

See Report of Independent Accountants

9

Table of Contents

LG. Philips LCD Co., Ltd.

Notes to Non-Consolidated Financial Statements

September 30, 2006 and 2005

(Unaudited)

| 6. | Long-Term Debts |

Long-term debts as of September 30, 2006 and December 31, 2005, consist of the following:

(in millions of Korean won)

Type of borrowing | Annual interest rates (%) as of September 30, 2006 | 2006 | 2005 | |||||||

Won currency debentures | ||||||||||

Non-guaranteed, payable through 2010 | 3.5 – 5.0 | (Won) | 1,550,000 | (Won) | 1,750,000 | |||||

Private debentures, payable through 2011 | 5.3 – 5.9 | 600,000 | 200,000 | |||||||

Less : Current maturities | — | (200,000 | ) | |||||||

Discounts on debentures | (21,695 | ) | (28,120 | ) | ||||||

| 2,128,305 | 1,721,880 | |||||||||

Foreign currency debentures | ||||||||||

Floating rate notes, payable through 2007 | 3M Libor + 0.6 - 3M Libor + 1.0 | 284,385 | 304,913 | |||||||

Term notes, payable through 2006 | 3M Libor +1.0 | 77,001 | 82,559 | |||||||

| 361,386 | 387,472 | |||||||||

Less : Current maturities | (172,426 | ) | (184,872 | ) | ||||||

Discount on debentures | (1,142 | ) | (1,960 | ) | ||||||

| 187,818 | 200,640 | |||||||||

Convertible bonds¹ | ||||||||||

US dollar-denominated bonds, payable through 2010 | — | 483,780 | 483,780 | |||||||

Add : Call premium | 84,613 | 84,613 | ||||||||

Less : Discount on debentures | (2,289 | ) | (2,724 | ) | ||||||

Conversion adjustment | (86,485 | ) | (102,917 | ) | ||||||

| 479,619 | 462,752 | |||||||||

Total debentures | (Won) | 2,795,742 | (Won) | 2,385,272 | ||||||

Won currency loans | ||||||||||

General loans | 3.5 – 6.1 | (Won) | 252,769 | (Won) | 126,420 | |||||

Less : Current maturities | (39,267 | ) | (29,417 | ) | ||||||

| 213,502 | 97,003 | |||||||||

Foreign currency loans | ||||||||||

General loans | 3M Libor+0.35, 3M Libor+0.47, 3M Libor+0.99, 3M Libor+1.0, 3M Libor+1.35, 6M Libor+0.41, 6M Libor+1.2 | 676,005 | 218,301 | |||||||

Less : Current maturities | (29,289 | ) | (17,727 | ) | ||||||

| 646,716 | 200,574 | |||||||||

Total long-term loans | (Won) | 860,218 | (Won) | 297,577 | ||||||

See Report of Independent Accountants

10

Table of Contents

LG. Philips LCD Co., Ltd.

Notes to Non-Consolidated Financial Statements

September 30, 2006 and 2005

(Unaudited)

¹On April 19, 2005, the Company issued US dollar-denominated convertible bonds totaling US$475 million, with a zero coupon rate. On or after June 27, 2005 through April 4, 2010, the bonds are convertible into common shares at a conversion price of (Won)58,251 per share of common stock, subject to adjustment based on certain events. The bonds will mature in five years from the issue date and will be repaid at 117.49 % of their principal amount at maturity. The bondholders have a put option to be repaid at 108.39 % of their principal amount on October 19, 2007. As of September 30, 2006, the number of non-converted common shares is 8,276,681.

As of September 30, 2006, foreign currency debentures denominated in U.S. dollars amount to US$ 383 million (December 31, 2005 : US$ 383 million) and foreign currency loans denominated in U.S. dollars amount to US$ 716 million (December 31, 2005 : US$ 215 million).

| 7. | Stock Appreciation Plan |

On April 7, 2005, the Company granted 450,000 shares of stock appreciations rights (“SARs”) for certain executives with the exercise price of (Won) 44,260 per share. Under the terms of this plan, executives, upon exercising their SARs, are entitled to receive cash equal to the excess of the market price of the Company’s common stock over the exercise price. The exercise price has been subsequently adjusted from (Won) 44,260 to (Won) 44,050 per share due to the additional issuance of common stock in 2005. These SARs are exercisable on or after April 8, 2008, through April 7, 2012. Additionally, when the increase rate of the Company’s share price is the same or less than the increase rate of the Korea Composite Stock Price Index (“KOSPI”) over the three-year period following the grant date, only 50% of the initially granted shares can be exercised.

The options activity under the SARs since April 7, 2005, is as follows:

Number of shares under SARs | |||

Option granted as of April, 7, 2005 | 450,000 | ||

Options canceled ¹ | 40,000 | ||

Balance, September 30, 2006 | 410,000 | ||

Exercise price per share | (Won) | 44,050 | |

¹Options canceled due to the retirement of an executive officer in 2005.

The Company did not recognize any compensation costs as market price is below the exercise price as of September 30, 2006.

See Report of Independent Accountants

11

Table of Contents

LG. Philips LCD Co., Ltd.

Notes to Non-Consolidated Financial Statements

September 30, 2006 and 2005

(Unaudited)

| 8. | Commitments and Contingencies |

As of September 30, 2006, the Company has bank overdraft agreements with various banks up to (Won)59,000 million.

As of September 30, 2006, the Company has revolving credit facility agreements with several banks totaling (Won)300,000 million and US$100 million (December 31, 2005 : (Won)450,000 million and US$100 million).

As of September 30, 2006, the Company has agreements with several banks for U.S. dollar denominated accounts receivable negotiating facilities for up to an aggregate of US$1,150 million. The Company has agreements with several banks in relation to the opening of letters of credit amounting to (Won) 90,000 million and US$145 million. The amount of negotiated foreign currency receivables outstanding as of September 30, 2006, is (Won)390,759 million (December 31, 2005 : (Won)303,904 million).

As of September 30, 2006, in relation to its TFT-LCD business, the Company has technical license agreements with Hitachi and others, and has trademark license agreements with LG Corporation and Philips Electronics.

The Company entered into foreign currency forward contracts to manage the exposure to changes in currency exchange rates in accordance with its foreign currency risk management policy. The use of foreign currency forward contracts allows the Company to reduce its exposure to the risk that the eventual Korean won cash outflows resulting from operating expenses, capital expenditures, purchasing of materials and debt service will be adversely affected by changes in exchange rates.

A summary of these contracts follows :

(in millions)

Contracting party | Selling position | Buying position | Contract foreign exchange rate | Maturity date | ||||

HSBC and others | US$ 2,467 | (Won)2,374,463 | (Won)925.22:US$1- (Won)1,050.20:US$1 | Oct 2, 2006 - Sep 6, 2007 | ||||

Shinhan Bank and others | EUR 210 | (Won)253,779 | (Won)1,164.28:EUR1- (Won)1,277.94:EUR1 | Oct 11, 2006 - June 13, 2007 | ||||

HSBC and others | (Won)316,558 | JP¥ 37,100 | (Won)8.1530:JP¥1- (Won)9.3620:JP¥1 | Oct 2, 2006 - June 12, 2007 | ||||

Citibank and others | US$ 82 | JP¥ 9,500 | JP¥114.00:US$1- JP¥116.06:US$1 | Oct 16, 2006 - Feb 14, 2007 |

See Report of Independent Accountants

12

Table of Contents

LG. Philips LCD Co., Ltd.

Notes to Non-Consolidated Financial Statements

September 30, 2006 and 2005

(Unaudited)

As of September 30, 2006, the Company recorded unrealized gains and losses on outstanding foreign currency forward contracts of (Won)54,869 million and (Won)20,834 million, respectively. Total unrealized gains and losses of (Won)2,379 million and (Won)2,835 million, respectively, were charged to operations for the nine-month period ended September 30, 2006, as these contracts did not meet the requirements for a cash flow hedge. Net unrealized gains and losses, net of related taxes, incurred relating to cash flow hedges from forecasted exports, were recorded as capital adjustments.

The forecasted hedged transactions are expected to occur on September 6, 2007. The aggregate amount of all deferred gains and losses of (Won)52,490 million and (Won)17,999 million, respectively, recorded net of tax under capital adjustments, are expected to be included in the determination of gain and loss within a year from September 30, 2006.

For the nine-month period ended September 30, 2006, the Company recorded realized gains of (Won)201,617 million (2005: (Won)85,384 million) on foreign currency forward contracts upon settlement, and realized losses of (Won)61,892 million (2005: (Won)56,250 million).

The Company entered into cross-currency swap contracts to manage the exposure to changes in currency exchange rates in accordance with its foreign currency risk management policy and to manage the exposure to changes in interest rates related to floating rate notes.

A summary of these contracts follows :

(in millions)

Contracting party | Buying position | Selling position | Contract foreign exchange rate | Maturity date | |||||

ABN AMRO and others | US$ 250 | — | 3M Libor | October 12, 2006 - August 29, 2011 | |||||

| — | (Won) | 252,065 | 4.15% - 4.54% | ||||||

As of September 30, 2006, unrealized losses of (Won)12,530 million were charged to loss on valuation.

For the nine-month period ended September 30, 2006, the Company recorded realized gains of (Won)(83) million (2005 : (Won)219 million) and realized losses of (Won)15,024 million (2005: (Won)9,473 million) on cross-currency swap contracts upon settlement.

The Company entered into option contracts to manage the exposure to changes in currency exchange rates in accordance with its foreign currency risk management policy. These transactions do not meet the requirements for hedge accounting for financial statement purposes. Therefore, the resulting realized and unrealized gains or losses, measured using quoted market prices, are recognized in current operations as gains or losses as the exchange rates change.

See Report of Independent Accountants

13

Table of Contents

LG. Philips LCD Co., Ltd.

Notes to Non-Consolidated Financial Statements

September 30, 2006 and 2005

(Unaudited)

A summary of these contracts follows :

(in millions)

Contracting party | USD Put buying | USD Call selling | Strike price | Maturity date | ||||

KDB and others | US$ 50 | US$ 100 | (Won) 957.30:US$1- (Won) 966.50:US$1 | May 21, 2007 - June 21, 2007 |

As of September 30, 2006, unrealized gains of (Won)708 million were charged to current operations, as these contracts do not fulfill the requirements for hedge accounting for financial statement purposes.

The Company entered into interest rate swap contracts to manage the exposure to changes in interest rates related to floating rate notes.

A summary of these contracts follows :

(in millions)

Contracting party | Contract Amount | Contract foreign exchange rate | Maturity date | |||||

SC First Bank | US$ 150 | Accept floating rate | 6M Libor | May 21, 2009 - May 24, 2010 | ||||

| Pay fix rate | 5.375% - 5.644% | |||||||

As of September 30, 2006, unrealized losses of (Won)2,554 million were charged to capital adjustments, as these contracts fulfill the requirements for hedge accounting for financial statement purposes.

The Company is facing several legal proceedings and claims arising from the ordinary course of business. In August 2002, the Company filed a complaint against Chunghwa Picture Tubes, Tatung Company and Tatung Co. of America, alleging patent infringement relating to liquid crystal displays and the manufacturing process for TFT-LCDs. Subsequently, the Company filed a complaint against the customers of Chunghwa Picture Tubes, including ViewSonic Corp., Jeans Co, Lite-On Technology Corp., Lite-On Technology International, Inc., TPV Technology and Invision Peripheral Inc. In June 2004, Chunghwa Picture Tubes filed a counter-claim against the Company in the United States District Court in Los Angeles, California for alleged infringement of certain patents and violation of U.S. antitrust laws. The Company also filed a complaint against Chunghwa Picture Tubes with the American Arbitration Association in connection with the ownership of certain patents. In June 2006, the American Arbitration Association decided in favor of the Company.

See Report of Independent Accountants

14

Table of Contents

LG. Philips LCD Co., Ltd.

Notes to Non-Consolidated Financial Statements

September 30, 2006 and 2005

(Unaudited)