SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of January 2007

LG.Philips LCD Co., Ltd.

(Translation of Registrant’s name into English)

20 Yoido-dong, Youngdungpo-gu, Seoul 150-721, The Republic of Korea

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F X Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submission to furnish a report or other document that the registration foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes No X

Q4 06 Earnings Results

| I. | Performance in Q4 2006 – Korean GAAP Consolidated Financial Data |

(Unit: KRW B)

Item | Q4 06 | Q3 06 | Q4 05 | QoQ | YoY | |||||||

Quarterly Results | ||||||||||||

Revenues | 3,065 | 2,773 | 2,963 | 10.5 | % | 3.4 | % | |||||

Operating Income | -177 | -382 | 334 | — | — | |||||||

Ordinary Income | -212 | -422 | 309 | — | — | |||||||

Net Income | -174 | -321 | 328 | — | — |

| II. | IR Event of Q4 2006 Earnings Results |

1. Provider of Information: | IR Communication team | |

2. Participants: | Institutional investors, securities analysts, etc. | |

3. Purpose: | To present Q4 06 Earnings Results of LG.Philips LCD | |

4. Date & Time: | 4:30 p.m. (Korea Time) on January 16, 2007 in Korean 10:00 p.m. (Korea Time) on January 16, 2007 in English | |

5. Venue & Method: | 1) Earnings release conference in Korean: | |

| - International conference room, 1st floor, Korea Exchange New Building, Seoul | ||

| 2) Conference call in English: | ||

| - Please refer to IR homepage of LG.Philips LCD Co., Ltd. at www.lgphilips-lcd.com | ||

| 6. Contact Information | ||

1) Head of Disclosure: Dong Joo Kim, Vice President, Finance & Risk Management Department (82-2-3777-0702) | ||

2) Main Contact for Disclosure-related Matters: | ||

Kanghee Kim, Assistant, Financing Team (82-2-3777-1665) | ||

3) Relevant Team: IR Communication team (82-2-3777-1010) | ||

2

| III. | Remarks |

| 1. | Please note that the presentation material for Q4 06 Earnings Results is attached as an appendix and accessible on IR homepage of LG.Philips LCD Co., Ltd. at www.lgphilips-lcd.com. |

| 2. | Please note that the financial data included in the investor presentation and press release are prepared on a consolidated Korean GAAP basis only (US GAAP consolidated and Korean GAAP non-consolidated information are stated below). |

| 3. | Financial data for Q4 06 are unaudited. They are provided for the convenience of investors and can be subject to change. |

| The following US GAAP consolidated information and Korean GAAP non-consolidated information are included for the convenience of investors. |

US GAAP consolidated information

(Unit: KRW B)

Item | Q4 06 | Q3 06 | Q4 05 | QoQ | YoY | |||||||

Quarterly Results | ||||||||||||

Revenues | 3,065 | 2,773 | 2,963 | 10.5 | % | 3.5 | % | |||||

Operating Income | -172 | -378 | 328 | — | — | |||||||

Ordinary Income | -186 | -408 | 334 | — | — | |||||||

Net Income | -145 | -307 | 360 | — | — |

Korean GAAP non-consolidated information

(Unit: KRW B)

Item | Q4 06 | Q3 06 | Q4 05 | QoQ | YoY | |||||||

Quarterly Results | ||||||||||||

Revenues | 2,967 | 2,730 | 2,675 | 8.7 | % | 10.9 | % | |||||

Operating Income | -151 | -384 | 339 | — | — | |||||||

Ordinary Income | -207 | -426 | 315 | — | — | |||||||

Net Income | -174 | -321 | 328 | — | — |

Attached: 1) Press Release

2) Presentation Material

3

Attachment 1. Press Release

LG.PHILIPS LCD REPORTS FOURTH QUARTER 2006 RESULTS

SEOUL, Korea – January 16, 2007 – LG.Philips LCD [NYSE: LPL, KRX: 034220],one of the world’s leading TFT-LCD manufacturers, today reported unaudited earnings results based on consolidated Korean GAAP for the three-month period ended December 31, 2006. Amounts in Korean Won (KRW) are translated into US dollars (USD) at the noon buying rate in effect on December 29, 2006, which was KRW 930.00 per US dollar.

| • | Sales in the fourth quarter of 2006 increased by 11% to KRW 3,065 billion (USD 3,296 million) from sales of KRW 2,773 billion (USD 2,982 million) in the third quarter of 2006 and increased 3% compared to KRW 2,963 billion (USD 3,186 million) in the fourth quarter of 2005. |

| • | Operating loss in the fourth quarter of 2006 was KRW 177 billion (USD 190 million) compared to an operating loss of KRW 382 billion (USD 411 million) in the third quarter of 2006, and an operating profit of KRW 334 billion (USD 359 million) in the fourth quarter of 2005. |

| • | EBITDA in the fourth quarter of 2006 was KRW 559 billion (USD 601 million), an increase of 89% from KRW 295 billion (USD 317 million) in the third quarter of 2006 and a year-over-year decline of 32% from KRW 824 billion (USD 886 million) in the fourth quarter of 2005. |

| • | Net income in the fourth quarter of 2006 was a loss of KRW 174 billion (USD 187 million) compared to a loss of KRW 321 billion (USD 345 million) in the third quarter of 2006 and a profit of KRW 328 billion (USD 353 million) in the fourth quarter of 2005. |

Ron Wirahadiraksa, CFO of LG.Philips LCD, said, “We are encouraged by our performance this quarter and the results of the enhanced cost reduction initiatives we are implementing. During the fourth quarter, we were able to reduce our COGS per square meter in KRW by 10% sequentially. In addition, we maintained finished goods inventory levels at slightly under three weeks at the end of the quarter. Further, the increasing number of long-term supply agreements we have secured, reflects our continued focus on closer customer collaboration as we head into a challenging market environment in 2007.”

“Responding to the needs of our customers and a rapidly evolving global business environment remains a key focus of LG.Philips LCD,” Mr. Wirahadiraksa continued. “We believe our strategy is strong and that the new leadership team, announced in late December, will further enhance the Company’s global standing and business capabilities.”

4

Fourth Quarter Financial Review

Revenue and Cost

Revenue in the three-month period ended December 31, 2006, increased by 3% to KRW 3,065 billion (USD 3,296 million) from KRW 2,963 billion (USD 3,186 million) in the corresponding period of 2005. TFT-LCD panels for TVs, desktop monitors, notebook computers and other applications accounted for 48%, 27%, 21% and 4%, respectively, on a revenue basis in the fourth quarter of 2006.

Overall, the Company shipped a total of 2.3 million square meters of net display area in the fourth quarter of 2006, a 14% increase quarter-on-quarter, with an average selling price per square meter of USD 1,414. This represents a decrease in the average selling price per square meter of net display area of approximately 3% compared to the end of the third quarter of 2006 and an average decrease of 1% from the third quarter of 2006.

The total cost of goods sold increased 2% sequentially to KRW 3,090 billion (USD 3,323 million), and increased 26% year-over-year driven by shipment growth. The cost of goods sold per square meter of net display area shipped was KRW 1.4 million (USD 1,460) for the fourth quarter of 2006, down 10% from the third quarter of 2006.

Liquidity

As of December 31, 2006, LG.Philips LCD had KRW 954 billion (USD 1,026 million) of cash and cash equivalents. Total debt was KRW 4,121 billion (USD 4,431 million), and the net debt-to-equity ratio was 46% as of December 31, 2006, compared to 57% as of September 30, 2006.

Capital Spending

Capital expenditures in the fourth quarter of 2006 were KRW 324 billion (USD 348 million) compared to KRW 1,396 billion (USD 1,501 million) in the fourth quarter of 2005, and were primarily invested in Gen 5.5, the Poland module plant, the enhancement of production efficiency, and the maintenance of existing facilities.

Utilization and Capacity

Total input capacity on an area basis increased approximately 17% sequentially in the fourth quarter, mainly attributable to the ramp up of P7, which currently averages 78,000 input sheets per month.

Outlook

The following expectations are based on current information as of January 16, 2007. The Company does not expect to update its expectations until next quarter’s earnings announcement. However, the Company may update its full business outlook, or any portion thereof, at any time for any reason.

“For the first quarter of 2007, we anticipate a mid-single digit decrease percentage in total area shipments sequentially, where TV decreases by a high-teens and IT increases by a mid-single digit percentage,” commented Mr. Wirahadiraksa. “We anticipate both the ASP per square meter at the end of the first quarter of 2007 as well as the average ASP during the quarter to decline by a low-teens percentage, which is the same for both TV and IT.”

5

Mr. Wirahadiraksa continued, “Our COGS reduction per square meter is expected to be a mid-single digit percentage in the first quarter. Accordingly, our EBITDA margin for the first quarter of 2007 is expected to be a mid-teens percentage. Looking forward to 2007, we anticipate continued progress in our cost reduction efforts and expect that these strategies will reduce costs by 25 to 30 percent.”

“Our CAPEX guidance for 2007 remains at approximately KRW 1 trillion. Our 2007 CAPEX will be utilized for future production facilities, production efficiency enhancement and existing facility maintenance, thereby providing us with more operational flexibility,” Mr. Wirahadiraksa concluded.

Earnings Conference and Conference Call

LG.Philips LCD will hold a Korean language earnings conference on January 16, 2007, at 4:30 p.m. Korea Standard Time on the 1st floor, in the International Conference Room of the Korea Exchange Building (KRX). An English language conference call will follow at 10:00 p.m. Korea Standard Time, 8:00 a.m. EST and 1:00 p.m. GMT. The call-in number is +82 (0)31-810-3001 for both callers in Korea and callers outside of Korea. The confirmation number is 3777. Corresponding slides will be available at the Investor Relations section of the LG.Philips LCD web site:http://www.lgphilips-lcd.com

Investors can listen to the conference call via the Internet athttp://www.lgphilips-lcd.com. To listen to the live call, please go to the Investor Relations section of the web site at least 15 minutes prior to the call to register and install any necessary audio software.

For those who are unable to participate in the call, a replay will be available for 30 days after the call. The call-in number is 031-810-3100 for callers in Korea and +82-31-810-3100 for callers outside of Korea. The confirmation number for the replay is 76999#.

6

About LG.Philips LCD

LG.Philips LCD Co., Ltd [NYSE: LPL, KRX: 034220] is a leading manufacturer and supplier of thin-film transistor liquid crystal display (TFT-LCD) panels. The Company manufactures TFT-LCD panels in a wide range of sizes and specifications for use in TVs, monitors, notebook PCs, and various applications. LG.Philips LCD currently operates seven fabrication facilities and four back-end assembly facilities in Korea, China and Poland. In addition, LG.Philips LCD has sales and representative offices in ten countries and has approximately 21,000 employees globally. Please visithttp://www.lgphilips-lcd.com for more information.

Forward-Looking Statement Disclaimer

This press release contains forward-looking statements. Statements that are not historical facts, including statements about our beliefs and expectations, are forward-looking statements. These statements are based on current plans, estimates and projections, and therefore you should not place undue reliance on them. Forward-looking statements speak only as of the date they are made, and we undertake no obligation to update publicly any of them in light of new information or future events. Forward-looking statements involve inherent risks and uncertainties. We caution you that a number of important factors could cause actual results to differ materially from those contained in any forward-looking statement. Additional information as to factors that may cause actual results to differ materially from our forward-looking statements can be found in our filings with the United States Securities and Exchange Commission.

| Investor Relations Contacts: | ||

| C.H. Lee [Korea] | Joshua Hochberg [USA] | |

| LG.Philips LCD | Sloane & Company | |

| Tel: +822-3777-1010 | Tel: +1-212-446-1892 | |

| Email:ch.lee@lgphilips-lcd.com | Email:jhochberg@sloanepr.com | |

| Media Contacts: | ||

| Elliot Sloane [USA] | Sue Kim [Korea] | |

| Sloane & Company | LG.Philips LCD | |

| Tel: +1-212-446-1860 | Tel: +822-3777-0970 | |

| Email:ESloane@sloanepr.com | Email:sue.kim@lgphilips-lcd.com | |

7

LG.Philips LCD

CONSOLIDATED STATEMENTS OF INCOME

( In millions of KRW)

(The financial statements are based on unaudited Korean GAAP)

| 2006 | 2005 | |||||||||||||||||||||||

Three months ended Dec 31 | Twelve months ended Dec 31 | Three months ended Dec 31 | Twelve months ended Dec 31 | |||||||||||||||||||||

REVENUES | 3,065,294 | 100 | % | 10,624,200 | 100 | % | 2,962,697 | 100 | % | 10,075,580 | 100 | % | ||||||||||||

Cost of goods sold | (3,090,235 | ) | -101 | % | (10,932,316 | ) | -103 | % | (2,456,670 | ) | -83 | % | (9,094,711 | ) | -90 | % | ||||||||

GROSS PROFIT | (24,941 | ) | -1 | % | (308,116 | ) | -3 | % | 506,027 | 17 | % | 980,869 | 10 | % | ||||||||||

Selling, general & administrative | (151,647 | ) | -5 | % | (570,922 | ) | -5 | % | (171,643 | ) | -6 | % | (511,172 | ) | -5 | % | ||||||||

OPERATING INCOME | (176,588 | ) | -6 | % | (879,038 | ) | -8 | % | 334,384 | 11 | % | 469,697 | 5 | % | ||||||||||

Interest income | 5,773 | 0 | % | 29,309 | 0 | % | 14,135 | 0 | % | 50,622 | 1 | % | ||||||||||||

Interest expense | (53,440 | ) | -2 | % | (179,199 | ) | -2 | % | (26,253 | ) | -1 | % | (104,928 | ) | -1 | % | ||||||||

Foreign exchange gain (loss),net | 4,469 | 0 | % | 3,426 | 0 | % | (9,461 | ) | 0 | % | (30,500 | ) | 0 | % | ||||||||||

Others, net | 7,947 | 0 | % | 4,026 | 0 | % | (4,253 | ) | 0 | % | (16,196 | ) | 0 | % | ||||||||||

Total other income (expense) | (35,251 | ) | -1 | % | (142,438 | ) | -1 | % | (25,832 | ) | -1 | % | (101,002 | ) | -1 | % | ||||||||

INCOME BEFORE TAX | (211,839 | ) | -7 | % | (1,021,476 | ) | -10 | % | 308,552 | 10 | % | 368,695 | 4 | % | ||||||||||

Income tax (expense) benefit | 37,494 | 1 | % | 252,163 | 2 | % | 19,274 | 1 | % | 148,317 | 1 | % | ||||||||||||

NET INCOME(LOSS) | (174,345 | ) | -6 | % | (769,313 | ) | -7 | % | 327,826 | 11 | % | 517,012 | 5 | % | ||||||||||

- These financial statements are provided for informational purposes only.

LG.Philips LCD

CONSOLIDATED BALANCE SHEET

( In millions of KRW)

(The financial statements are based on unaudited Korean GAAP)

| 2006 | 2005 | |||||||||||||||||||||||

| Dec 31 | Sep 30 | Dec 31 | Sep 30 | |||||||||||||||||||||

ASSETS | ||||||||||||||||||||||||

Current assets: | ||||||||||||||||||||||||

Cash and cash equivalents | 954,362 | 7 | % | 471,747 | 3 | % | 1,579,452 | 12 | % | 2,129,456 | 16 | % | ||||||||||||

Trade accounts and notes receivable | 859,300 | 6 | % | 1,330,539 | 10 | % | 1,266,899 | 9 | % | 1,307,958 | 10 | % | ||||||||||||

Inventories | 1,052,705 | 8 | % | 1,148,286 | 8 | % | 690,785 | 5 | % | 724,954 | 5 | % | ||||||||||||

Other current assets | 288,260 | 2 | % | 320,707 | 2 | % | 308,932 | 2 | % | 248,701 | 2 | % | ||||||||||||

Total current assets | 3,154,627 | 23 | % | 3,271,279 | 24 | % | 3,846,068 | 28 | % | 4,411,069 | 33 | % | ||||||||||||

Investments and other non-current assets | 781,287 | 6 | % | 703,452 | 5 | % | 469,109 | 3 | % | 413,959 | 3 | % | ||||||||||||

Property, plant and equipment, net | 9,428,048 | 70 | % | 9,578,309 | 70 | % | 9,199,599 | 67 | % | 8,548,527 | 63 | % | ||||||||||||

Intangible assets, net | 123,825 | 1 | % | 181,576 | 1 | % | 159,306 | 1 | % | 167,933 | 1 | % | ||||||||||||

Total assets | 13,487,787 | 100 | % | 13,734,616 | 100 | % | 13,674,082 | 100 | % | 13,541,488 | 100 | % | ||||||||||||

LIABILITIES AND SHAREHOLDERS’ EQUITY | ||||||||||||||||||||||||

Current liabilities: | ||||||||||||||||||||||||

Short-term debt | 813,735 | 6 | % | 672,720 | 5 | % | 749,809 | 5 | % | 794,504 | 6 | % | ||||||||||||

Trade accounts and notes payable | 949,436 | 7 | % | 881,443 | 6 | % | 693,588 | 5 | % | 730,003 | 5 | % | ||||||||||||

Other payables and accrued liabilities | 1,445,618 | 11 | % | 1,230,405 | 9 | % | 1,695,439 | 12 | % | 1,816,328 | 13 | % | ||||||||||||

Total current liabilities | 3,208,789 | 24 | % | 2,784,568 | 20 | % | 3,138,836 | 23 | % | 3,340,835 | 25 | % | ||||||||||||

Long-term debt | 3,306,988 | 25 | % | 3,806,675 | 28 | % | 2,815,969 | 21 | % | 2,822,930 | 21 | % | ||||||||||||

Other non-current liabilities | 82,334 | 1 | % | 71,812 | 1 | % | 43,681 | 0 | % | 59,528 | 0 | % | ||||||||||||

Total liabilities | 6,598,111 | 49 | % | 6,663,055 | 49 | % | 5,998,486 | 44 | % | 6,223,293 | 46 | % | ||||||||||||

Common stock and additional paid-in capital | 4,064,250 | 30 | % | 4,064,250 | 30 | % | 4,068,328 | 30 | % | 4,069,499 | 30 | % | ||||||||||||

Retained earnings | 2,839,373 | 21 | % | 3,013,718 | 22 | % | 3,608,686 | 26 | % | 3,280,838 | 24 | % | ||||||||||||

Capital adjustment | (13,947 | ) | 0 | % | (6,407 | ) | 0 | % | (1,418 | ) | 0 | % | (32,142 | ) | 0 | % | ||||||||

Shareholders’ equity | 6,889,676 | 51 | % | 7,071,561 | 51 | % | 7,675,596 | 56 | % | 7,318,195 | 54 | % | ||||||||||||

Total liabilities and shareholders’ equity | 13,487,787 | 100 | % | 13,734,616 | 100 | % | 13,674,082 | 100 | % | 13,541,488 | 100 | % | ||||||||||||

- These financial statements are provided for informational purposes only.

LG.Philips LCD

CONSOLIDATED STATEMENTS OF CASH FLOW

(In millions of KRW)

(The financial statements are based on unaudited Korean GAAP)

| 2006 | 2005 | |||||||||||

| Three months ended Dec 31 | Twelve months ended Dec 31 | Three months ended Dec 31 | Twelve months ended Dec 31 | |||||||||

Net Income | (174,345 | ) | (769,313 | ) | 327,826 | 517,012 | ||||||

Depreciation | 715,314 | 2,593,439 | 492,179 | 1,746,901 | ||||||||

Amortization | 7,456 | 45,410 | 11,196 | 45,421 | ||||||||

Others | 24,518 | 80,253 | (9,512 | ) | 68,877 | |||||||

Operating Cash Flow | 572,943 | 1,949,789 | 821,689 | 2,378,211 | ||||||||

Net Change in Working Capital | 598,922 | (84,289 | ) | 67,569 | (269,795 | ) | ||||||

Change in accounts receivable | 483,584 | 409,123 | 5,807 | (398,445 | ) | |||||||

Change in inventory | 95,582 | (361,919 | ) | 34,097 | 114,503 | |||||||

Change in accounts payable | 63,038 | 256,642 | (27,506 | ) | 122,926 | |||||||

Change in others | (43,282 | ) | (388,135 | ) | 55,171 | (108,779 | ) | |||||

Cash Flow from Operation | 1,171,865 | 1,865,500 | 889,258 | 2,108,416 | ||||||||

Capital Expenditures | (324,404 | ) | (3,067,195 | ) | (1,396,205 | ) | (4,197,874 | ) | ||||

Acquisition of property, plant and equipment | (330,887 | ) | (3,075,985 | ) | (1,379,631 | ) | (4,166,151 | ) | ||||

(Delivery) | (521,337 | ) | (2,833,983 | ) | (1,141,287 | ) | (4,419,223 | ) | ||||

(Other account payables) | 190,450 | (242,002 | ) | (238,344 | ) | 253,072 | ||||||

Intangible assets investment | (2,888 | ) | (8,251 | ) | (2,557 | ) | (12,704 | ) | ||||

Others | 9,371 | 17,041 | (14,017 | ) | (19,019 | ) | ||||||

Cash Flow before Financing | 847,461 | (1,201,695 | ) | (506,947 | ) | (2,089,458 | ) | |||||

Cash Flow from Financing Activities | (364,846 | ) | 576,605 | (43,219 | ) | 906,329 | ||||||

Proceeds from Issuance of common stock | 0 | 0 | 162 | 1,401,342 | ||||||||

Net Cash Flow | 482,615 | (625,090 | ) | (550,004 | ) | 218,213 | ||||||

- These financial statements are provided for informational purposes only.

LG.Philips LCD

CONSOLIDATED STATEMENTS OF INCOME

(In millions of KRW)

(The financial statements are based on unaudited US GAAP)

| 2006 | 2005 | |||||||||||||||||||||||

Three months ended Dec 31 | Twelve months ended Dec 31 | Three months ended Dec 31 | Twelve months ended Dec 31 | |||||||||||||||||||||

REVENUES | 3,065,294 | 100 | % | 10,624,200 | 100 | % | 2,962,697 | 100 | % | 10,075,580 | 100 | % | ||||||||||||

Cost of goods sold | (3,076,094 | ) | -100 | % | (10,910,267 | ) | -103 | % | (2,456,269 | ) | -83 | % | (9,069,848 | ) | -90 | % | ||||||||

GROSS PROFIT | (10,800 | ) | 0 | % | (286,067 | ) | -3 | % | 506,428 | 17 | % | 1,005,732 | 10 | % | ||||||||||

Selling, general & administrative | (160,921 | ) | -5 | % | (595,781 | ) | -6 | % | (178,037 | ) | -6 | % | (528,084 | ) | -5 | % | ||||||||

OPERATING INCOME | (171,721 | ) | -6 | % | (881,848 | ) | -8 | % | 328,391 | 11 | % | 477,648 | 5 | % | ||||||||||

Interest income | 5,773 | 0 | % | 29,309 | 14,135 | 0 | % | 50,622 | 1 | % | ||||||||||||||

Interest expense | (51,926 | ) | -2 | % | (169,598 | ) | -2 | % | (26,391 | ) | -1 | % | (107,540 | ) | -1 | % | ||||||||

Foreign exchange gain (loss), net | 16,699 | 1 | % | 52,400 | 0 | % | 9,409 | 0 | % | (23,607 | ) | 0 | % | |||||||||||

Others, net | 14,988 | 0 | % | 34,855 | 0 | % | 8,334 | 0 | % | 7,807 | 0 | % | ||||||||||||

Total other income (expense) | (14,466 | ) | 0 | % | (53,034 | ) | 0 | % | 5,487 | 0 | % | (72,718 | ) | -1 | % | |||||||||

INCOME BEFORE TAX | (186,187 | ) | -6 | % | (934,882 | ) | -9 | % | 333,878 | 11 | % | 404,930 | 4 | % | ||||||||||

Income tax (expense) benefit | 41,426 | 1 | % | 242,103 | 2 | % | 25,837 | 1 | % | 136,719 | 1 | % | ||||||||||||

NET INCOME(LOSS) | (144,761 | ) | -5 | % | (692,779 | ) | -7 | % | 359,715 | 12 | % | 541,649 | 5 | % | ||||||||||

- These financial statements are provided for informational purposes only.

LG.Philips LCD

CONSOLIDATED BALANCE SHEETS

(In millions of KRW)

(The financial statements are based on unaudited US GAAP)

| 2006 | 2005 | |||||||||||||||||||||||

| Dec 31 | Sep 30 | Dec 31 | Sep 30 | |||||||||||||||||||||

ASSETS | ||||||||||||||||||||||||

Current assets: | ||||||||||||||||||||||||

Cash and cash equivalents | 954,362 | 7 | % | 471,747 | 3 | % | 1,579,452 | 12 | % | 2,129,456 | 16 | % | ||||||||||||

Trade accounts and notes receivable | 859,300 | 6 | % | 1,330,539 | 10 | % | 1,266,899 | 9 | % | 1,307,957 | 10 | % | ||||||||||||

Inventories | 1,051,590 | 8 | % | 1,147,575 | 8 | % | 689,577 | 5 | % | 723,917 | 5 | % | ||||||||||||

Other current assets | 289,050 | 2 | % | 326,424 | 2 | % | 310,837 | 2 | % | 248,029 | 2 | % | ||||||||||||

Total current assets | 3,154,302 | 23 | % | 3,276,285 | 24 | % | 3,846,765 | 28 | % | 4,409,359 | 33 | % | ||||||||||||

Investments and other non-current assets | 794,998 | 6 | % | 710,701 | 5 | % | 492,311 | 4 | % | 434,719 | 3 | % | ||||||||||||

Property, plant and equipment, net | 9,485,148 | 70 | % | 9,663,242 | 71 | % | 9,234,104 | 68 | % | 8,578,817 | 64 | % | ||||||||||||

Intangible assets, net | 61,911 | 0 | % | 45,380 | 0 | % | 43,374 | 0 | % | 42,341 | 0 | % | ||||||||||||

Total assets | 13,496,359 | 100 | % | 13,695,608 | 100 | % | 13,616,554 | 100 | % | 13,465,236 | 100 | % | ||||||||||||

LIABILITIES AND SHAREHOLDERS’ EQUITY | ||||||||||||||||||||||||

Current liabilities: | ||||||||||||||||||||||||

Short-term debt | 814,776 | 6 | % | 672,853 | 5 | % | 751,109 | 6 | % | 794,690 | 6 | % | ||||||||||||

Trade accounts and notes payable | 949,436 | 7 | % | 881,443 | 6 | % | 733,588 | 5 | % | 730,003 | 5 | % | ||||||||||||

Other payables and accrued liabilities | 1,482,955 | 11 | % | 1,236,235 | 9 | % | 1,660,262 | 12 | % | 1,820,553 | 14 | % | ||||||||||||

Total current liabilities | 3,247,167 | 24 | % | 2,790,531 | 20 | % | 3,144,959 | 23 | % | 3,345,246 | 25 | % | ||||||||||||

Long-term debt | 3,291,065 | 24 | % | 3,801,984 | 28 | % | 2,851,353 | 21 | % | 2,875,674 | 21 | % | ||||||||||||

Other non-current liabilities | 84,557 | 1 | % | 75,560 | 1 | % | 46,040 | 0 | % | 61,138 | 0 | % | ||||||||||||

Total liabilities | 6,622,789 | 49 | % | 6,668,075 | 49 | % | 6,042,352 | 44 | % | 6,282,058 | 47 | % | ||||||||||||

Common stock and additional paid-in capital | 4,036,025 | 30 | % | 4,035,331 | 29 | % | 4,032,878 | 30 | % | 4,032,294 | 30 | % | ||||||||||||

Retained earnings | 2,849,913 | 21 | % | 2,994,673 | 22 | % | 3,542,691 | 26 | % | 3,182,976 | 24 | % | ||||||||||||

Capital adjustment | (12,368 | ) | 0 | % | (2,471 | ) | 0 | % | (1,367 | ) | 0 | % | (32,092 | ) | 0 | % | ||||||||

Shareholders’ equity | 6,873,570 | 51 | % | 7,027,533 | 51 | % | 7,574,202 | 56 | % | 7,183,178 | 53 | % | ||||||||||||

Total liabilities and shareholders’ equity | 13,496,359 | 100 | % | 13,695,608 | 100 | % | 13,616,554 | 100 | % | 13,465,236 | 100 | % | ||||||||||||

- These financial statements are provided for informational purposes only.

LG.Philips LCD

CONSOLIDATED STATEMENTS OF CASH FLOW

(In millions of KRW)

(The financial statements are based on unaudited US GAAP)

| 2006 | 2005 | |||||||||||

| Three months ended Dec 31 | Twelve months ended Dec 31 | Three months ended Dec 31 | Twelve months ended Dec 31 | |||||||||

Net Income | (144,761 | ) | (692,779 | ) | 359,715 | 541,649 | ||||||

Depreciation | 710,783 | 2,597,479 | 492,550 | 1,748,385 | ||||||||

Amortization | 1,788 | 6,766 | 1,536 | 6,778 | ||||||||

Others | 17,499 | 19,560 | (27,868 | ) | 81,442 | |||||||

Operating Cash Flow | 585,309 | 1,931,026 | 825,933 | 2,378,254 | ||||||||

Net Change in Working Capital | 586,556 | (65,526 | ) | 63,325 | (269,838 | ) | ||||||

Change in accounts receivable | 483,584 | 409,123 | 56,108 | (400,838 | ) | |||||||

Change in inventory | 95,985 | (362,013 | ) | 34,267 | 114,540 | |||||||

Change in accounts payable | 83,188 | 256,642 | (27,506 | ) | 121,391 | |||||||

Change in others | (76,201 | ) | (369,278 | ) | 456 | (104,931 | ) | |||||

Cash Flow from Operation | 1,171,865 | 1,865,500 | 889,258 | 2,108,416 | ||||||||

Capital Expenditures | (324,404 | ) | (3,067,195 | ) | (1,396,205 | ) | (4,197,874 | ) | ||||

Acquisition of property, plant and equipment | (330,887 | ) | (3,075,985 | ) | (1,379,631 | ) | (4,166,151 | ) | ||||

(Delivery) | (521,337 | ) | (2,833,983 | ) | (1,141,287 | ) | (4,419,223 | ) | ||||

(Other account payables) | 190,450 | (242,002 | ) | (238,344 | ) | 253,072 | ||||||

Intangible assets investment | (2,888 | ) | (8,251 | ) | (2,557 | ) | (12,704 | ) | ||||

Others | 9,371 | 17,041 | (14,017 | ) | (19,019 | ) | ||||||

Cash Flow before Financing | 847,461 | (1,201,695 | ) | (506,947 | ) | (2,089,458 | ) | |||||

Cash Flow from Financing Activities | (364,846 | ) | 576,605 | (43,219 | ) | 906,329 | ||||||

Proceeds from Issuance of common stock | 0 | 0 | 162 | 1,401,342 | ||||||||

Net Cash Flow | 482,615 | (625,090 | ) | (550,004 | ) | 218,213 | ||||||

- These financial statements are provided for informational purposes only.

LG.Philips LCD

Net Income Reconciliation to US GAAP

(In millions of KRW)

| 2006 | ||||||

| Q4 | Q3 | |||||

Net Income under K GAAP | (174,345 | ) | (320,966 | ) | ||

US GAAP Adjustments | 29,584 | 13,475 | ||||

Depreciation of PP&E | (655 | ) | (655 | ) | ||

Amortization of IPR | 9,399 | 9,510 | ||||

Adjustment of AR discount loss | (1,408 | ) | 1,670 | |||

Capitalization of financial interests | 2,121 | 2,767 | ||||

Pension expense | 2,268 | 509 | ||||

Income tax effect of US GAAP Adjustments | 3,965 | (573 | ) | |||

ESOP | (694 | ) | (694 | ) | ||

Convertible bonds (including FX valuation) | 9,293 | 5,467 | ||||

Stock appreciation right | 1,533 | (322 | ) | |||

Cash flow hedge | 2,355 | (3,884 | ) | |||

Others | 1,407 | (320 | ) | |||

Net Income under US GAAP | (144,761 | ) | (307,491 | ) | ||

- These financial statements are provided for informational purposes only (Unaudited).

1 Q4 06 Q4 06 Earnings Results Earnings Results January 16, 2007 Attachment 2. Presentation Material |

2 Disclaimer Disclaimer This presentation contains forward-looking statements. We may also make written or oral forward-looking statements in our periodic reports to the United States Securities and Exchange Commission and the Korean Financial Supervisory Service, in our annual report to shareholders, in our proxy statements, in our offering circulars and prospectuses, in press releases and other written materials and in oral statements made by our officers, directors or employees to third parties. Statements that are not historical facts, including statements about our beliefs and expectations, are forward-looking statements. These statements are based on current plans, estimates and projections, and therefore you should not place undue reliance on them. Forward-looking statements speak only as of the date they are made, and we undertake no obligation to update publicly any of them in light of new information or future events. Forward-looking statements involve inherent risks and uncertainties. We caution you that a number of important factors could cause actual results to differ materially from those contained in any forward-looking statement. Such factors include, but are not limited to: our highly competitive environment; the cyclical nature of our industry; our ability to introduce new products on a timely basis; our dependence on growth in the demand for our products; our ability to successfully execute our expansion strategy; our dependence on key personnel; and general economic and political conditions, including those related to the TFT-LCD industry; possible disruptions in business activities caused by natural and human-induced disasters, including terrorist activity and armed conflict; and fluctuations in foreign currency exchange rates. Additional information as to these and other factors that may cause actual results to differ materially from our forward-looking statements can be found in our filings with the Securities and Exchange Commission. This presentation also includes information regarding our historical financial performance through December 31, 2006, and our expectations regarding future performance as reflected in certain non-GAAP financial measures as defined by United States Securities and Exchange Commission rules. As required by such rules, we have provided a reconciliation of those measures to the most directly comparable GAAP measures, which is available on our investor relations website at http://www.lgphilips-lcd.com under the file name Q4 06 Earnings Presentation. |

3 Agenda Agenda Q4 06 Earnings Results Performance Highlights Outlook Gen 5.5 located in P8 47”W 32”W 37”W 42”W |

4 Q4 06 Earnings Results Q4 06 Earnings Results |

5 Q4 06 Earnings Results Q4 06 Earnings Results |

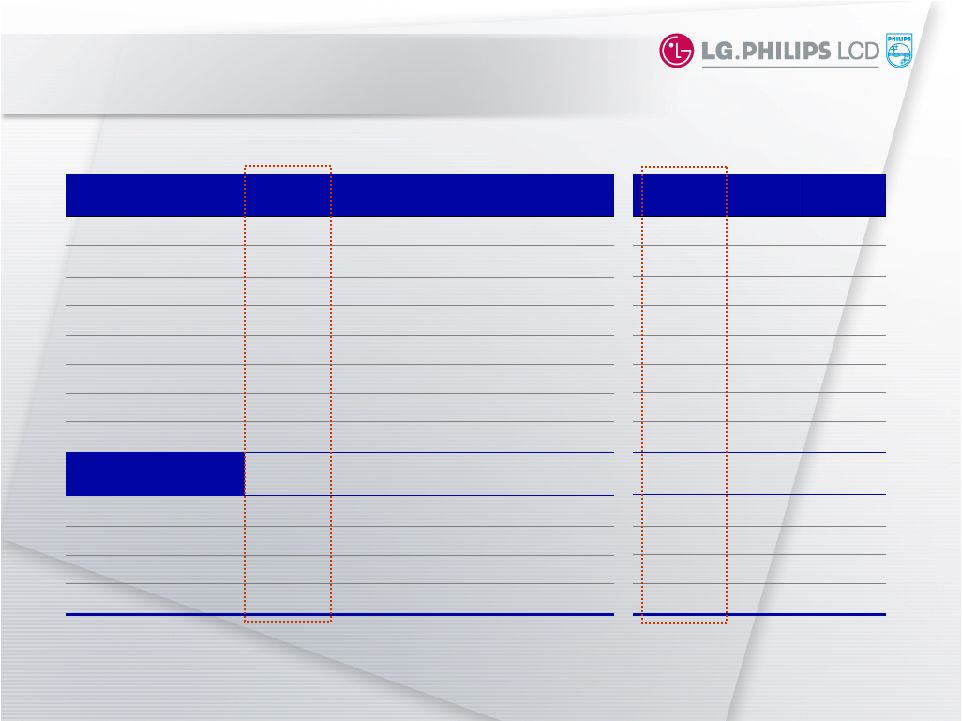

6 Income Statement Income Statement Margin (%) Q4 06 Q3 06 QoQ Q4 05 YoY KRW b Revenue COGS Gross profit Operating income EBITDA Income before tax Net income 3% 26% NA NA (32%) NA NA 11% 2% NA NA 89% NA NA Gross margin Operating margin EBITDA margin Net margin Source: Unaudited, Company financials K GAAP (Consolidated) (18) (17) (10) (17) 8 8 7 6 17 11 28 11 (1) (6) 18 (6) 2,773 3,019 (246) (382) 295 (422) (321) 3,065 3,090 (25) (177) 559 (212) (174) 2,963 2,457 506 334 824 309 328 (9) (14) 11 (12) YoY 2005 2006 5% 20% NA NA (20%) NA NA (13) (13) (5) (12) 10 5 22 5 10,624 10,932 (308) (879) 1,767 (1,021) (769) 10,076 9,095 981 470 2,215 369 517 (3) (8) 17 (7) |

7 Balance Sheet Balance Sheet Q4 06 Q3 06 QoQ Q4 05 YoY KRW b Assets Cash and cash equivalents Inventory Liabilities Short-term debt Long-term debt Shareholders’ equity Net debt to equity ratio (%) (1%) (40%) 52% 10% 9% 17% (10%) 20 (2%) 102% (8%) (1%) 21% (13%) (3%) (11) K GAAP (Consolidated) Source: Unaudited, Company financials 13,488 954 1,053 6,598 814 3,307 6,890 46 13,674 1,579 691 5,998 750 2,816 7,676 26 13,735 472 1,148 6,663 673 3,807 7,072 57 |

8 Cash Flow Cash Flow Q4 06 Q3 06 QoQ Q4 05 YoY KRW b Net income Depreciation & Amortization Others Net change in working capital Cash flow from operations CAPEX Cash flow before financing Financing activities Proceeds from issuance of common stock Net change in cash K GAAP (Consolidated) Source: Unaudited, Company financials (321) 672 5 (34) 322 (908) (586) 279 0 (307) 328 503 (10) 68 889 (1,396) (507) (43) 0 (550) 147 50 20 633 850 584 1,434 (645) 0 789 (502) 219 35 531 283 1,072 1,355 (323) 0 1,032 (174) 722 25 599 1,172 (324) 848 (366) 0 482 2005 YoY 2006 517 1,792 69 (270) 2,108 (4,198) (2,090) 907 1,401 218 (1,286) 846 12 186 (242) 1,131 889 (331) (1,401) (843) (769) 81 (84) 1,866 (3,067) (1,201) 576 0 (625) |

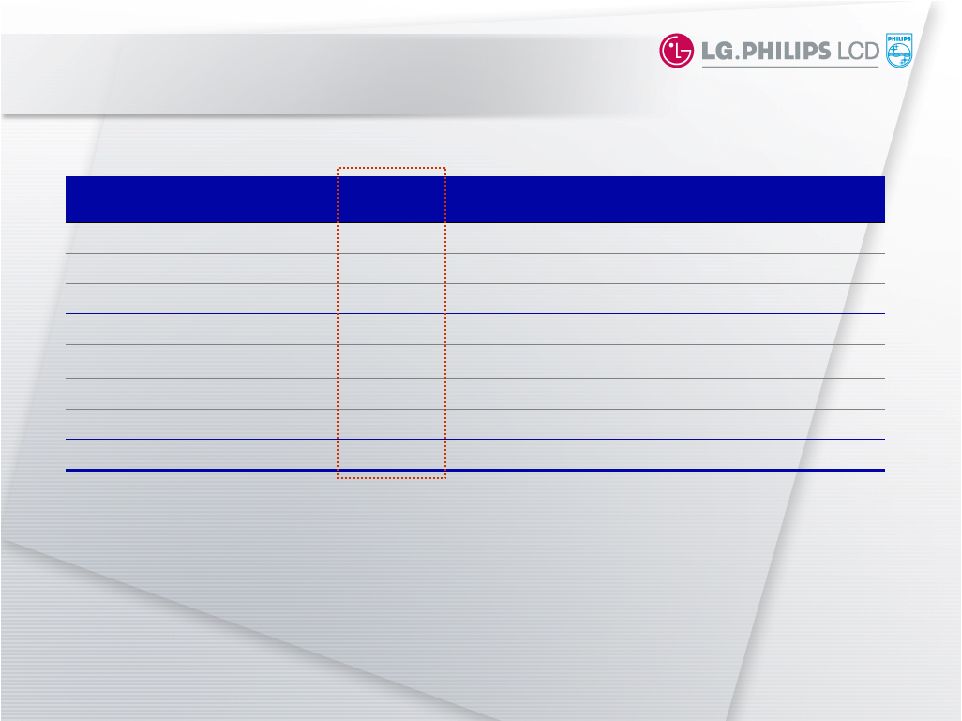

9 Performance Highlights Performance Highlights |

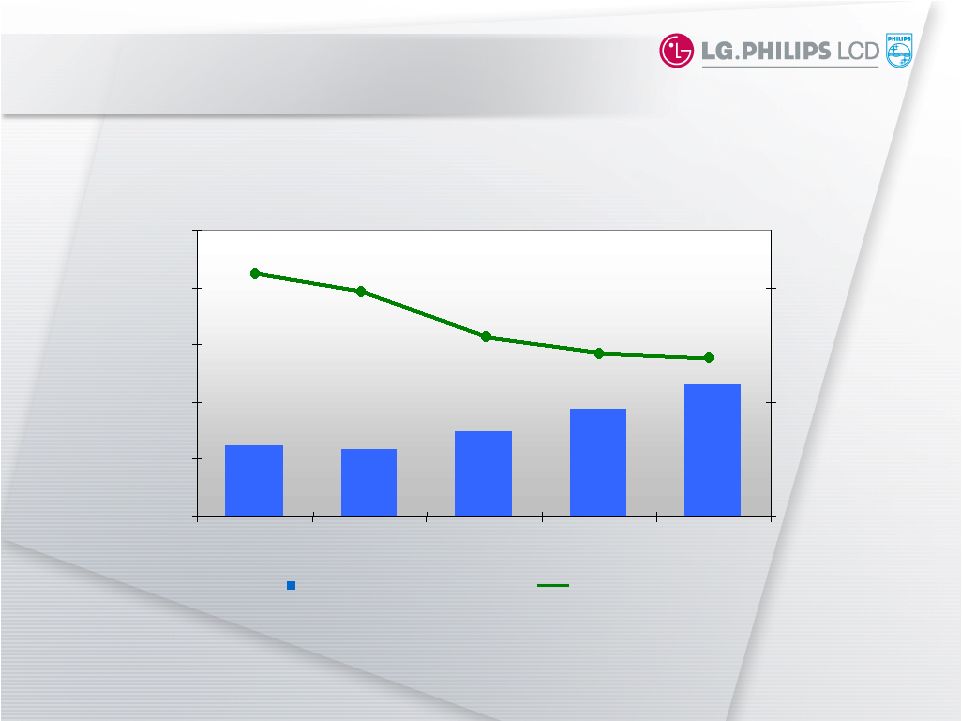

10 Shipments and ASP Shipments and ASP Total K m² * ASP**/m² (USD) Source: Company financials * Net display area shipped ** Quarterly average selling price per square meter of net display area shipped Display area shipment in K m² ASP per m² (USD) 1,343 1,274 1,485 1,993 2,275 $2,112 $1,953 $1,598 $1,430 $1,414 0 1,000 2,000 3,000 4,000 5,000 Q4 05 Q1 06 Q2 Q3 Q4 $0 $1,000 $2,000 |

11 Q4 05 Q3 06 Q4 06 Revenue: Product Mix Revenue: Product Mix Source: Company financials (Based on USD) Notebooks Monitors TVs Applications 34% 48% 38% 26% 21% 24% 4% 5% 48% 27% 21% 4% |

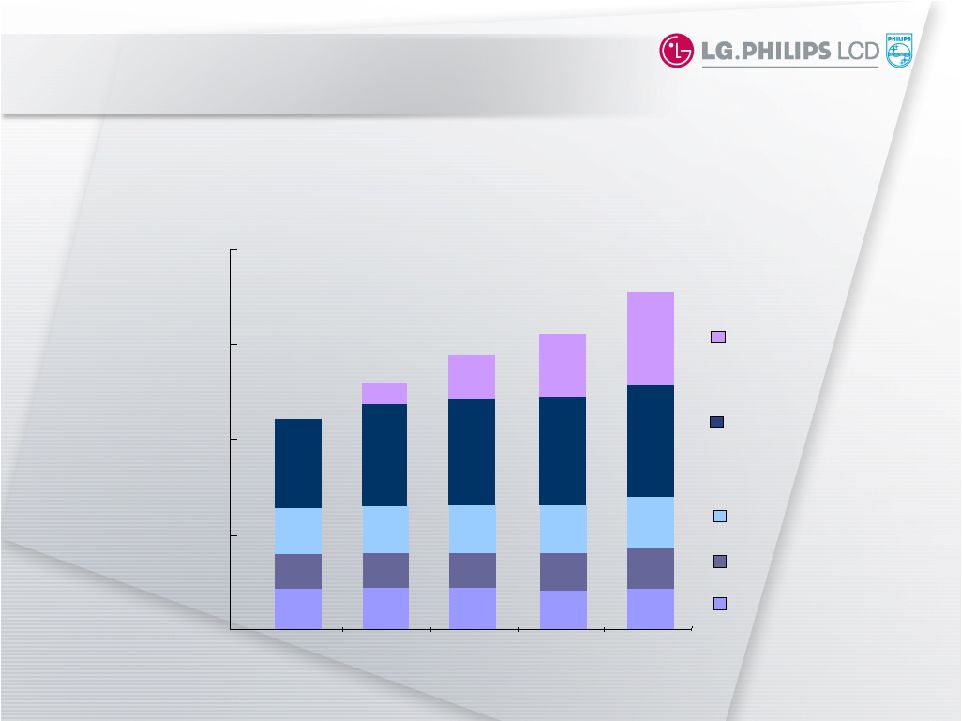

Q4 06 Capacity Update Q4 06 Capacity Update P7 has achieved an average of 78K input sheets per month for the quarter Source: Company financials Unit: Quarterly input capacity by Area (K m² ) P1-P3 P4 P5 P6 P7 0 1,000 2,000 3,000 Q4 05 Q1 06 Q2 Q3 Q4 412 424 421 409 368 367 359 389 490 487 494 507 929 1,082 1,082 1,092 216 452 682 2,199 2,576 2,808 3,079 412 418 534 1,211 1,032 3,607 4,000 12 |

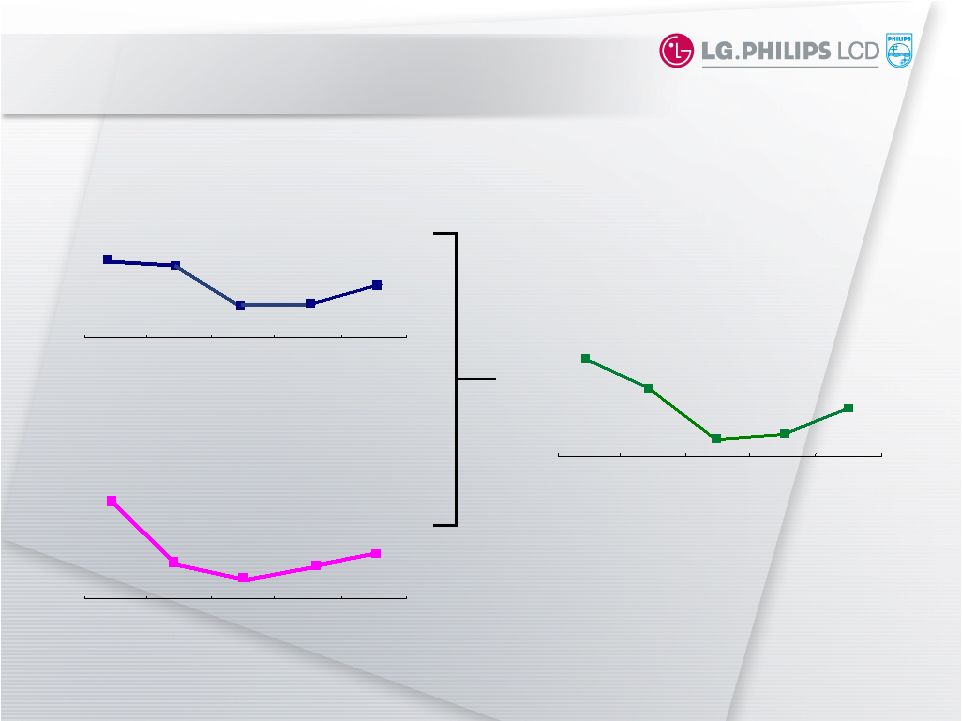

13 Cash ROIC Cash ROIC Source: Unaudited, Company financials * IC (Invested Capital) equals average of net debt and equity for the designated period; Quarterly ratios are annualized K GAAP (Consolidated) EBITDA margin Sales / IC* Cash ROIC 18% 28% 142% 124% 23% 39% Q4 05 Q1 06 Q2 27% 112% 30% Q3 10% 98% 10% Q4 05 Q1 06 Q2 Q3 Q4 11% 112% 12% Q4 Q4 05 Q1 06 Q2 Q3 Q4 |

14 Outlook Outlook |

Outlook Outlook Source: Company financials, delivery base Capex Schedule (KRW b) Capex Schedule (KRW b) 549 1,064 1,221 2006 2007 Others P7 Future production facilities 2,834 566 197 252 1,015 15 Total Shipments in m² Q1 07 vs. Q4 06 : Mid-single digit (%) ASP per m² shipped End of Q1 07 vs. End of Q4 06, Average Q1 07 vs. Average Q4 06 : Low teens (%) – TV: Low teens (%) – IT: Low teens (%) COGS per m² Q1 07 : Mid-single digit (%) 2007 : 25 to 30% EBITDA Margin Q1 07 : Mid teens (%) CAPEX 2007 : Approximately KRW 1 trillion |

16 Questions and Answers Questions and Answers |

17 Appendix Appendix |

18 US GAAP Income Statement US GAAP Income Statement Margin (%) Q4 06 Q3 06 QoQ Q4 05 YoY KRW b Revenue COGS Gross profit Operating income EBITDA Income before tax Net income 3% 25% NA NA (65%) NA NA 11% 2% NA NA 93% NA NA Gross margin Operating margin EBITDA margin Net margin Source: Unaudited, Company financials (17) (17) (9) (17) 9 8 8 6 17 11 28 12 (0) (6) 19 (5) 2,773 3,009 (236) (378) 297 (408) (307) 3,065 3,076 (11) (172) 574 (186) (145) 2,963 2,457 506 328 841 334 360 (9) (14) 11 (11) YoY 2005 2006 5% 20% NA NA (18%) NA NA (13) (13) (5) (12) 10 5 22 5 10,624 10,910 (286) (882) 1,814 (935) (693) 10,076 9,070 1,006 478 2,223 405 542 (3) (8) 17 (7) |

19 US GAAP Balance Sheet US GAAP Balance Sheet Q4 06 Q3 06 QoQ Q4 05 YoY KRW b Assets Cash and cash equivalents Inventory Liabilities Short-term debt Long-term debt Shareholders’ equity Net debt to equity ratio (%) (1%) 102% (8%) (1%) 21% (13%) (2%) (11) Source: Unaudited, Company financials 13,496 954 1,052 6,623 815 3,291 6,873 46 13,616 1,579 690 6,042 751 2,851 7,574 27 13,696 472 1,148 6,668 673 3,802 7,028 57 (1%) (40%) 52% 10% 8% 15% (9%) 19 |

20 US GAAP Cash Flow US GAAP Cash Flow Q4 06 Q3 06 QoQ Q4 05 YoY KRW b Net income Depreciation & Amortization Others Net change in working capital Cash flow from operations CAPEX Cash flow before financing Other financing activities Proceeds from issuance of common stock Net change in cash Source: Unaudited, Company financials (307) 664 1 (36) 322 (908) (586) 279 0 (307) 360 494 (28) 63 889 (1,396) (507) (43) 0 (550) 162 49 16 623 850 584 1,434 (645) 0 789 (505) 219 45 524 283 1,072 1,355 (323) 0 1,032 (145) 713 17 587 1,172 (324) 848 (366) 0 482 2005 YoY 2006 542 1,755 81 (270) 2,108 (4,198) (2,090) 907 1,401 218 (1,235) 849 (60) 204 (242) 1,131 889 (331) (1,401) (843) (693) 2,604 21 (66) 1,866 (3,067) (1,201) 576 0 (625) |

21 Net Income Reconciliation to US GAAP Net Income Reconciliation to US GAAP Source: Unaudited, Company financials 2005 2006 Cash flow hedge Others Convertible bonds (including FX valuation) Stock appreciation right ESOP Pension expense Income tax effect of US GAAP Adjustments Amortization of IPR Depreciation of PP&E Capitalization of financial interests Adjustment of AR discount loss Net Income under K GAAP US GAAP Adjustments Net Income under US GAAP Q4 06 Q3 06 KRW b (174) 29 (1) 9 (1) 2 2 4 (1) 9 2 2 2 (145) (321) 14 (1) 10 2 3 1 (1) (1) 6 0 (4) (1) (307) (769) 76 (3) 38 0 7 1 (10) (3) 47 1 (2) 0 (693) 517 25 (3) 40 0 1 (1) (12) (3) 6 (2) 0 (1) 542 |

22 EBITDA Reconciliation EBITDA Reconciliation 2,215 0 45 1,747 (148) (51) 105 517 2005 824 0 11 492 (19) (14) 26 328 Q4 05 295 0 13 659 (101) (5) 50 (321) Q3 06 (448) 0 0 846 (104) 22 74 (1,286) YoY 1,767 0 45 2,593 (252) (29) 179 (769) 2006 559 0 7 715 (38) (5) 54 (174) Q4 06 (265) 0 (4) 223 (19) 9 28 (502) YoY 264 0 (6) 56 63 0 4 147 QoQ EBITDA(1+2+3+4+5+6+7) 2. Interest Expense 5. Depreciation of PP&E 4. Provision (benefit) for Income Taxes 7. Amortization of Debt Issuance Cost 6. Amortization of Intangible Asset 1. Net Income 3. Interest Income K GAAP (KRW bn) 2,223 6 7 1,748 (137) (51) 108 542 2005 841 1 2 492 (26) (14) 26 360 Q4 05 297 1 2 662 (100) (5) 44 (307) Q3 06 (409) (1) 0 849 (105) 22 61 (1,235) YoY 1,814 5 7 2,597 (242) (29) 169 (693) 2006 574 1 2 711 (41) (5) 51 (145) Q4 06 (267) 0 0 219 (15) 9 25 (505) YoY 277 0 0 49 59 0 7 162 QoQ EBITDA(1+2+3+4+5+6+7) 2. Interest Expense 5. Depreciation of PP&E 4. Provision (benefit) for Income Taxes 7. Amortization of Debt Issuance Cost 6. Amortization of Intangible Asset 1. Net Income 3. Interest Income US GAAP (KRW bn) |

23 EBITDA Reconciliation (Continued) EBITDA Reconciliation (Continued) EBITDA is defined as net income (loss) plus: interest income (expense); provision (benefit) for income taxes; depreciation of property, plant and equipment; amortization of intangible assets; and amortization of debt issuance cost. EBITDA is a key financial measure used by our senior management to internally evaluate the performance of our business and for other required or discretionary purposes. Specifically, our significant capital assets are in different stages of depreciation, and because we do not have separate operating divisions, our senior management uses EBITDA internally to measure the performance of these assets on a comparable basis. We also believe that the presentation of EBITDA will enhance an investor’s understanding of our operating performance as we believe it is commonly reported and widely used by analysts and investors in our industry. It also provides useful information for comparison on a more comparable basis of our operating performance and those of our competitors, who follow different accounting policies. For example, depreciation on most of our equipment is made based on a four-year useful life while most of our competitors use different depreciation schedules from our own. EBITDA is not a measure determined in accordance with U.S. GAAP. EBITDA should not be considered as an alternative to operating income, cash flows from operating activities or net income, as determined in accordance with U.S. GAAP. Our calculation of EBITDA may not be comparable to similarly titled measures reported by other companies. |

24 LG.Philips LCD makes Technology you can see! |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| LG.Philips LCD Co., Ltd. | ||||

| (Registrant) | ||||

Date: January 16, 2007 | By: | /s/ Ron H. Wirahadiraksa | ||

| (Signature) | ||||

| Name: | Ron H. Wirahadiraksa | |||

| Title: | Joint Representative Director/ | |||

| President & Chief Financial Officer | ||||