Table of Contents

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of Aug 2008

LG Display Co., Ltd.

(Translation of Registrant’s name into English)

20 Yoido-dong, Youngdungpo-gu, Seoul 150-721, The Republic of Korea

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F X Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submission to furnish a report or other document that the registration foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes No X

Table of Contents

SEMIANNUAL REPORT

(From January 1, 2008 to June 30, 2008)

THIS IS A TRANSLATION OF THE SEMIANNUAL REPORT ORIGINALLY PREPARED IN KOREAN AND IS IN SUCH FORM AS REQUIRED BY THE KOREAN FINANCIAL SUPERVISORY COMMISSION.

IN THE TRANSLATION PROCESS, SOME PARTS OF THE REPORT WERE REFORMATTED, REARRANGED OR SUMMARIZED FOR THE CONVENIENCE OF READERS.

UNLESS EXPRESSLY STATED OTHERWISE, ALL INFORMATION CONTAINED HEREIN IS PRESENTEDON A NON-CONSOLIDATED BASIS IN ACCORDANCE WITH ACCOUNTING PRINCIPLES GENERALLY ACCEPTED IN KOREA, OR KOREAN GAAP, WHICH DIFFER IN CERTAIN RESPECTS FROM GENERALLY ACCEPTED ACCOUNTING PRINCIPLES IN CERTAIN OTHER COUNTRIES, INCLUDING THE UNITED STATES. WE HAVE MADE NO ATTEMPT TO IDENTIFY OR QUANTIFY THE IMPACT OF THESE DIFFERENCES IN THIS DOCUMENT.

Contents

| 1. | Overview |

| A. | Industry |

| B. | Company |

| C. | Recent developments |

| 2. | Information Regarding Shares |

| A. | Change in capital stock |

| B. | Convertible bonds |

| C. | Shareholder list |

| D. | Voting rights |

| E. | Dividends |

| 3. | Major Products and Materials |

| A. | Major products in H1 2008 |

| B. | Average selling price trend of major products |

| C. | Major materials |

| D. | Price trend of major materials |

| 4. | Production & Equipment |

| A. | Production capacity and calculation |

| B. | Production performance and working ratio |

| C. | Investment plan |

| 5. | Sales |

| A. | Sales performance |

| B. | Sales route and sales method |

| 6. | Directors & Employees |

| A. | Members of the Board of Directors |

| B. | Committees of the Board of Directors |

| C. | Director & Officer Liability Insurance |

| D. | Employees |

| E. | Stock option |

| 7. | Financial Information |

| A. | Financial highlights |

| B. | R&D expense |

| C. | Domestic credit rating |

| D. | Remuneration for directors in H1 2008 |

| E. | Derivative contracts |

| F. | Status of equity investment |

Attachment: 1. Korean GAAP Non-consolidated Financial Statements

2. Korean GAAP Consolidated Financial Statements

3. U.S. GAAP Consolidated Financial Statements

Table of Contents

1. Overview

A. Industry

(1) Industry characteristics and growth potential

| • | TFT-LCD technology is one of the most widely used technologies in the manufacture of flat panel displays and the demand for flat panel displays is growing. The flat panel display industry is characterized by entry barriers due to rapidly evolving technology, capital-intensive characteristics, and the significant investments required to achieve economies of scale, among other factors. There is strong competition between a relatively small number of players within the industry and production capacity in the industry, including ours, is being continually increased. |

| • | The demand for LCD panels for notebook computers & monitors has been closely related to the IT industry cycle. The demand for LCD panels for TVs is growing with the start of HDTV broadcasting and as LCD TV has come to play an important role in the digital display market. There is competition between TFT-LCD and PDP technologies in the area of large flat TV products. In addition, markets for small- to medium-sized LCD panels, such as mobile phones, P-A/V, medical applications and automobile navigation systems, among others, are growing steadily. |

| • | The average selling prices of LCD panels have declined in general and are expected to continually decline with time irrespective of general business cycles as a result of, among other factors, technology advances and cost reductions. |

(2) Cyclicality

| • | The TFT-LCD business is highly cyclical as well as being capital-intensive. In spite of the increase in demand for products, this industry has experienced periodic volatility caused by imbalances between demand and supply due to capacity expansion within the industry. |

| • | Intense competition and expectations of demand growth may lead panel manufacturers to invest in manufacturing capacity on similar schedules, resulting in a surge in capacity when production is ramped up at new fabrication facilities. |

| • | During such surges in capacity growth, our customers can exert and have exerted strong downward pricing pressure, resulting in sharp declines in average selling prices and significant fluctuations in our gross margins. Conversely, demand surges and fluctuations in the supply chain can lead to price increases. |

(3) Competitiveness

| • | Our ability to compete successfully depends on factors both within and outside our control, including product pricing, performance and reliability, successful and timely investment and product development, success of our end-brand customers in marketing their brands and products, component and raw material supply costs, foreign exchange rate and general economic and industry conditions. |

Table of Contents

| • | Core competitiveness includes technology leadership, capability to design new products and premium products, timely investment in advanced fabs, cost leadership through application of large production lines, innovation of process and productivity, and collaborative customer relationships. |

| • | Most importantly, cost leadership and stable and long-term relationships with customers are critical to secure profit even in a buyer’s market. |

| • | A substantial portion of our sales is attributable to a limited group of end-brand customers and their designated system integrators. The loss of these end-brand customers, as a result of customers entering into strategic supplier arrangements with our competitors or otherwise, would thus result in reduced sales. |

| • | Developing new products and technologies that can be differentiated from those of our competitors is critical to the success of our business. We take active measures to protect our intellectual property internationally by obtaining patents and undertaking monitoring activities in our major markets. It is also necessary to recruit and retain the experienced key staffs and highly skilled line operators. |

(4) Sourcing material

| • | Key materials (including color filters) are sourced in-house as well as from domestic and overseas vendors. |

| • | The shortage of raw materials may arise temporarily due to the rapid increase in demand for raw materials resulting from capacity expansion in the TFT-LCD industry. |

| • | We have purchased, and expect to purchase, a substantial portion of our equipment from a limited number of qualified foreign and local suppliers. From time to time, increased demand for new equipment may cause lead times to extend beyond those normally required by the equipment vendors. |

(5) Others

| • | Most TFT-LCD panel makers are located in Asia. |

| a. | Korea: LG Display, Samsung Electronics (including a joint venture between Samsung Electronics and Sony Corporation), BOE-Hydis |

| b. | Taiwan: AU Optronics, Chi Mei Optoelectronics, CPT, etc. |

| c. | Japan: Sharp, IPS-Alpha, etc. |

| d. | China: SVA-NEC, BOE-OT, etc. |

B. Company

(1) Business overview

| • | Commercial production for our TFT-LCD business began in September 1995 at P1, which was then the first fabrication facility of LG Electronics. At the end of 1998, LG Electronics and LG Semicon transferred their respective TFT-LCD related businesses to LG Soft Co., Ltd (currently LG Display). It became a joint venture between LG Electronics and Philips Electronics in August 1999. In July 2004, we completed our initial public offering and listed our common stock on the Korea Exchange and our ADSs on the New York Stock Exchange. As of June 30, 2008, we operate seven fabrication facilities located in Gumi and Paju, Korea, and seven module facilities located in Gumi and Paju, Korea; Nanjing (3 factories) and Guangzhou, China; and Wroclaw, Poland. |

Table of Contents

| • | We became the first LCD maker in the world to commence commercial production at a 4th generation fab (P3) in July 2000 and at a 5th generation fab (P4) in March 2002, and we started mass production at our 6th generation fab (P6) in August 2004, which allows us to produce LCD panels for large TVs and monitors. With the commencement of mass production at our 7th generation fab (P7) in January 2006 and with our decision to invest in an 8th generation fab (P8) in October 2007, we are expanding our production capacity in line with the growing large-sized LCD TV market. In addition, in July 2007, we decided to make additional investments in our 6th generation fab (P6) to prepare for the growth of the TFT-LCD market. |

| • | Our non-consolidated sales increased by 40.5% from KRW 5,874 billion in the first half of 2007 to KRW 8,251 billion in the first half of 2008. We recorded non-consolidated operating income of KRW 1,779 billion in the first half of 2008 compared to non-consolidated operating loss of KRW 99 billion in the first half of 2007 and we recorded non-consolidated net income of KRW 1,492 billion in the first half of 2008 compared to non-consolidated net income of KRW 60 billion in the first half of 2007. (Our consolidated sales under Korean GAAP increased by approximately 35.7% from KRW 6,077 billion in the first half of 2007 to KRW 8,247 billion in the first half of 2008. We recorded consolidated operating income under Korean GAAP of KRW 1,770 billion in the first half of 2008 compared to consolidated operating loss of KRW 58 billion in the first half of 2007. In addition, we recorded consolidated net income of KRW 1,476 billion in the first half of 2008 compared to consolidated net income of KRW 60 billion in the first half of 2007.) |

| • | We reinforced our position as a leader in LCD technology by developing public displays such as the world’s largest 52-inch multi-touch screen panel and a 47-inch triple-view panel as well as the world’s largest 6-inch oval LCD panel, a 17.1-inch switchable 3D display which function allows for a 2D/3D conversion with ease, a 15-inch TFT LCD panel with a C/F board that applies the role printing method and a 15-inch AM OLED that uses the a-Si method. |

| • | Moreover, we formed strategic alliances or entered into long-term sales contracts with major global firms such as Dell, Hewlett Packard and Kodak of the United States and Japan’s Toshiba, among others, to secure customers and expand partnerships for technology development. |

(2) Market shares

| • | Our worldwide market share for large-size TFT-LCD panels (10-inch or large) based on revenue |

| 2008 H1 | 2007 | 2006 | |||||||

Panel for Notebook Computers | 30.1 | % | 28.5 | % | 26.2 | % | |||

Panel for Monitors | 15.9 | % | 15.6 | % | 15.6 | % | |||

Panel for TVs | 18.0 | % | 22.0 | % | 23.6 | % | |||

Total | 19.4 | % | 20.4 | % | 20.5 | % |

| * | Source: DisplaySearch Q3 2008 |

Table of Contents

(3) Market characteristics

| • | Due to the recent high growth in the display appliance market for the flat display format, the scale of the LCD market is growing at a rapid rate, resulting in expansion of the market centered mainly in America, Japan, Europe and China. |

(4) New business

| • | As of the end of the first half of 2008, P7 in our Paju Display Cluster reached an expanded production capacity of over 150 thousand sheets of glass substrates per month and we have commenced the construction of P8 (8th generation fab) in anticipation of growth in the large-sized TFT-LCD market. |

| • | In May 2006, we entered into an investment agreement with the Guangzhou Development District Administrative Committee to construct a module production plant in Guangzhou, China, and in June 2006, we established LG Display Guangzhou Co., Ltd. (f/k/a LG.Philips LCD Guangzhou Co., Ltd.). We commenced mass production at the new module production plant in December 2007 and we held an opening ceremony for the module production plant in April 2008. |

| • | In June 2008, we launched the OLED Business Unit in anticipation of future growth in the OLED business. In addition, we also plan to strengthen our market position in the future display technologies by accelerating the development of flexible display technologies and leading the LED back-light LCD market. |

| • | In order to facilitate a cooperative purchasing relationship with HannStar Display Corporation (HannStar), a company that manufactures TFT-LCD panels in Taiwan, we decided to purchase 180 million shares of preferred stock of HannStar at a purchase price of NT$3,170,250,000. We acquired the preferred shares in February 2008. The preferred shares mature in three years and are convertible into shares of common stock of HannStar. |

| • | We are making an effort to increase our competitiveness by forming cooperative relationships with our suppliers and purchasers of our products. As part of this effort, in June 2008 we purchased 2,037,204 shares of AVACO, which produces sputters, a core equipment for LCD production, and we purchased 1,008,875 shares of TLI Co., Ltd., which produces core LCD panel components such as “Timing Controllers” and “Drive ICs”. By promoting strategic relationships with equipments and parts suppliers which enables us to obtain a stable source of supply of equipments and parts at competitive prices, we have strengthened our competitive position in the LCD business. |

Table of Contents

| • | In July 2008, we and Skyworth RGB Electronics founded a R&D joint venture corporation with a registered capital of CNY 50 million in China. |

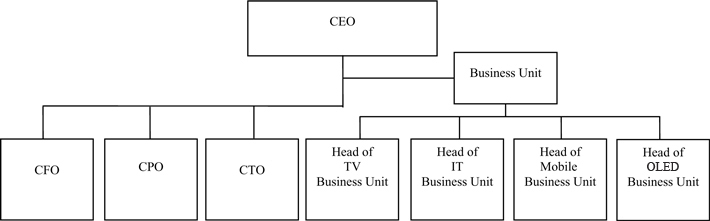

(5) Organization chart as of June 30, 2008

- CEO: Chief Executive Officer

- CFO: Chief Financial Officer

- CPO: Chief Production Officer

- CTO: Chief Technology Officer

C. Recent developments

(1) January 2008: Acquired OLED business from LG Electronics

(2) March 2008: Changed the name of the Company from LG.Philips LCD Co., Ltd. to LG Display Co., Ltd.

(3) Major contracts

| • | February 2008: Extended trademark license agreement with Philips Electronics |

(January 1, 2008 ~ June 30, 2008)

| • | February 2008: Extended trademark license agreement with LG Corp. |

(January 1, 2008 ~ December 31, 2010)

| • | April 2008: Entered into an agreement with Skyworth RGB Electronics to establish a research and development joint venture company |

| • | June 2008: Skyworth TV Holdings Limited purchased a 16% interest in LG Display Guangzhou Co., Ltd |

2. Information Regarding Shares

A. Change in Capital Stock

| (Unit: KRW, Share) | |||||||

Date | Descriptions | Change in number of common shares | Face amount per share | ||||

July 27, 2005 | Follow-on offering | * | 32,500,000 | 5,000 | |||

| * | ADSs offering: 32,500,000 shares (US$42.64 per share, US$21.32 per ADS) |

Table of Contents

B. Convertible Bonds

| (Unit: USD, Share) | ||||

Item | Content | |||

| Issuing date | April 18, 2007 | |||

Maturity (Redemption date after put option exercise) | April 18, 2012 (April 18, 2010) | |||

| Face Amount | USD550,000,000 | |||

| Offering method | Public offering | |||

| Conversion period | Convertible into shares of common stock during the period from April 19, 2008 to April 3, 2012 | |||

| Conversion price | KRW 48,760 per share* | |||

| Conversion status | Number of shares already converted | None | ||

| Number of convertible shares | 10,530,762 shares if all are converted* | |||

| Remarks | • Registered form • Listed on Singapore Exchange | |||

| * | Conversion price was adjusted from KRW 49,070 to KRW 48,760 and the number of convertible shares was adjusted from 10,464,234 to 10,530,762 following the approval by the stockholders, during the annual general meeting of stockholders on February 29, 2008, of a cash dividend of KRW 750 per share. |

C. Shareholder List

(1) Total shares issued and outstanding: 357,815,700 shares as of June 30, 2008

(2) Largest shareholder and related parties as of June 30, 2008

| (Unit: share) | ||||||||||

Name | Relationship | January 1, 2008 | Increase/Decrease | June 30, 2008 | ||||||

LG Electronics | Largest Shareholder | 135,625,000 (37.9 | %) | — | 135,625,000 (37.9 | %) | ||||

Young Soo Kwon | Related Party | 15,000 (0.0 | %) | 8,000 | 23,000 (0.0 | %) | ||||

Total | 135,640,000 (37.9 | %) | 8,000 | 135,648,000 (37.9 | %) | |||||

Table of Contents

(3) Shareholders who owned 5% or more of our shares as of December 31, 2007

| (Unit: share) | |||||||

Name | Type of stock | Number of shares | Ratio | ||||

LG Electronics | Common Stock | 135,625,000 | 37.9 | % | |||

Philips Electronics | Common Stock | 71,225,000 | 19.9 | %* | |||

Total | — | 206,850,000 | 57.8 | % | |||

| * | On March 17, 2008, Philips Electronics sold an additional 6.7% of our common stock (24 million shares of common stock). |

D. Voting rights as of June 30, 2008

| (Unit: share) | ||

Description | Number of shares | |

1. Shares with voting rights [A-B] | 357,815,700 | |

A. Total shares issued | 357,815,700 | |

B. Shares without voting rights | — | |

2. Shares with restricted voting rights | — | |

Total number of shares with voting rights [1-2] | 357,815,700 |

E. Dividends

On February 29, 2008, we declared a cash dividend of KRW 750 per share to our shareholders of record as of December 31, 2007 and distributed the cash dividend to such shareholders in March 2008.

Dividends during the recent 3 fiscal years

Description | 2008 H1 | 2007 | 2006 | ||||

Par value (Won) | 5,000 | 5,000 | 5,000 | ||||

Net income (loss) (Million Won) | 1,492,108 | 1,344,027 | (769,313 | ) | |||

Earnings (Loss) per share (Won) | 4,170 | 3,756 | (2,150 | ) | |||

Retained earning for dividends (Million Won) | 5,251,973 | 4,028,227 | 2,711,036 | ||||

Total cash dividend amount (Million Won) | — | 268,362 | — | ||||

Total stock dividend amount (Million Won) | — | — | — | ||||

Cash dividend payout ratio (%) | — | — | — | ||||

Cash dividend yield (%) | — | 1.6 | — | ||||

Stock dividend yield (%) | — | — | — | ||||

Cash dividend per share (Won) | — | 750 | — | ||||

Stock dividend per share (Won) | — | — | — |

| * | Earnings per share are calculated based on par value of 5,000 Won per share. |

Table of Contents

(As a result of a stock split, par value of our shares changed to Won 5,000 per share from Won 10,000 per share as of May 25, 2004.)

| * | Retained earning for dividends is the amount before dividends are paid. |

| * | Earnings per share is calculated by net income divided by weighted average number of common stock. |

3. Major Products and Materials

A. Major products in H1 2008

| (Unit: In billions of Won) | |||||||||||

Business | Sales types | Items (Market) | Specific use | Major trademark | Sales (%) | ||||||

TFT-LCD | Product/ Service/ Other Sales | TFT-LCD (Overseas) | Notebook Computer, Monitor, TV, Applications Panels, etc. | LG Display | 7,676 (93.0 | %) | |||||

TFT-LCD (Korea*) | Notebook Computer, Monitor, TV, Applications Panels, etc. | LG Display | 575 (7.0 | %) | |||||||

Total | 8,251 (100 | %) | |||||||||

| * | Including local export. |

| ** | Period: January 1, 2008 ~ June 30, 2008 |

| *** | Major products’ trademark has changed from LG. Philips LCD to LG Display |

B. Average selling price trend of major products

| (Unit: USD / m2) | ||||||||

Description | 2008 Q2 | 2008 Q1 | 2007 Q4 | 2007 Q3 | ||||

TFT-LCD panel | 1,274 | 1,339 | 1,375 | 1,364 | ||||

| * | Semi-finished products in the cell process have been excluded. |

| ** | Quarterly average selling price per square meter of net display area shipped |

| *** | On a consolidated basis |

C. Major materials

| (Unit: In billions of Won) | |||||||||||

Business area | Purchase types | Items | Specific use | Purchase amount (%) | Suppliers | ||||||

TFT-LCD | Materials | Glass | LCD panel manufacturing | 1,093 (26.5 | %) | Samsung Corning Precision Glass Co., Ltd., NEG, etc. | |||||

Back-Light | 1,028 (25.0 | %) | Heesung Electronics Ltd., etc. | ||||||||

Polarizer | 548 (13.3 | %) | LG Chem., etc. | ||||||||

| Others | 1,453 (35.2 | %) | — | ||||||||

| Total | 4,122 (100 | %) | — | ||||||||

| * | Period : January 1, 2008 ~ Jun 30, 2008 |

Table of Contents

D. Price trend of major materials

| • | Prices of major materials depend on fluctuations in supply and demand in the market as well as on change in size and quantity of raw materials according to the increased production of large-size panels. |

4. Production and Equipment

A. Production capacity and calculation

(1) Production capacity

| (Unit : 1,000 Glass sheets) | ||||||||||

Business area | Items | Business place | 2008 H1 | 2007 | 2006 | |||||

TFT-LCD | TFT-LCD | Gumi, Paju | 6,017 | 11,544 | 9,942 | |||||

| * | Glass size per each factory not considered. |

(2) Calculation of production capacity

a. Method

Assumptions for calculation

| • | Based on input glass |

‚ Calculation method of production capacity

| • | 2008 H1: Monthly maximum input capacity per each factory in the first half of 2008 |

× number of months (6 months).

| • | 2007: Monthly maximum input capacity per each factory in year 2007 |

× number of months (12 months).

| • | 2006: Monthly maximum input capacity per each factory for 4th quarter of 2006 |

× number of months (12 months).

b. Average working hours

| • | See 4.B(2) below. |

B. Production performance and working ratio

(1) Production performance

| (Unit: 1,000 Glass sheets) | ||||||||||

Business area | Items | Business place | 2008 H1 | 2007 | 2006 | |||||

TFT-LCD | TFT-LCD | Gumi, Paju | 5,719 | 10,182 | 9,052 | |||||

| * | Based on input glass |

Table of Contents

(2) Working Ratio *

| (Unit: Hours) | ||||||

Business place (area) | Available working hours of 2008 H1 | Real working hours of 2008 H1 | Average working ratio | |||

Gumi (TFT-LCD) | 4,368 (24 hours X 182 days) | 4,368 (24 hours X 182 days) | 100% | |||

Paju (TFT-LCD) | 4,368 (24 hours X 182 days) | 4,368 (24 hours X 182days) | 100% | |||

C. Investment plan

(1) Investment in progress

| (Unit: In billions of Won) | ||||||||||||||||

Business area | Description | Investment period | Investment assets | Investment effect | Total investment | Already invested | To be invested | Remarks | ||||||||

TFT-LCD | New / Expansion, etc. | Q4 ‘05~ | Building/ Machinery, etc. | New production facility | 4,400 | 1,163 | 3,237 | — | ||||||||

(2) Investment Plan (Consolidated basis)

| (Unit: In billions of Won) | ||||||||||||

| Expected yearly investment | ||||||||||||

Business area | Project | 2008 * | 2009 ** | 2010 ** | Investment effects | Remarks | ||||||

TFT-LCD | New / Expansion, etc. | 4,500 | — | — | Capacity Expansion, etc. | |||||||

| * | Expected investments in 2008 are subject to change depending on market environment. |

| ** | Expected investments in 2009 and in 2010 cannot be projected due to industry characteristics. |

5. Sales

A. Sales performance

| (Unit: In billions of Won) | ||||||||||||

Business area | Sales types | Items (Market) | 2008 H1 | 2007 H1 | 2007 | |||||||

TFT-LCD | Products, etc. | TFT-LCD | Overseas | 7,676 | 5,422 | 13,137 | ||||||

| Korea* | 575 | 452 | 1,026 | |||||||||

| Total | 8,251 | 5,874 | 14,163 | |||||||||

| * | Including local export. |

Table of Contents

B. Sales route and sales method

(1) Sales organization

| • | As of June 30, 2008, each of the IT Business Unit, TV Business Unit, Mobile Business Unit, and OLED Business Unit had individual sales and customer support functions. |

| • | Sales subsidiaries in America, Germany, Japan, Taiwan and China (Shanghai and Shenzhen) perform sales activities in overseas countries and provide technical support to customers. |

(2) Sales route

| • | LG Display HQg Overseas subsidiaries (USA/Germany/Japan/Taiwan/Shenzhen/Shanghai), etc. |

gSystem integrators, Branded customersg End users

| • | LG Display HQg System integrators, Branded customersg End users |

(3) Sales methods and conditions

| • | Direct sales & sales through overseas subsidiaries, etc. |

(4) Sales strategy

| • | To secure stable sales to major PC makers and the leading consumer electronics makers globally |

| • | To increase sales of premium notebook computer products, to strengthen sales of the larger size and high-end monitor segment and to lead the large and wide LCD TV market including in the category of full-HD 120Hz TV monitors |

| • | To diversify our market in the small- to medium-sized monitor segment, including products such as mobile phone, P-A/V, automobile navigation systems, aircraft instrumentation and medical diagnostic equipment, etc. |

6. Directors & Employees

A. Members of the Board of Directors

Name | Date of birth | Position | Business experience | |||

| Young Soo Kwon | February 6, 1957 | Representative Director, President and Chief Executive Officer | President and Chief Financial Officer of LG Electronics | |||

| James (Hoyoung) Jeong | November 2, 1961 | Director and Chief Financial Officer | Executive Vice President and Chief Financial Officer of LG Electronics | |||

| Simon (Shin Ik) Kang | May 10, 1954 | Director | Head of Digital Display Product Business Division of LG Electronics | |||

Table of Contents

| Paul Verhagen | February 2, 1962 | Director | Chief Financial Officer of Consumer Lifestyle Section, Philips Electronics | |||

| Ingoo Han | October 15, 1956 | Outside Director | Dean, Graduate School of Management, Korea Advanced Institute of Science and Technology | |||

| Dongwoo Chun | January 15, 1945 | Outside Director | Outside Director, Pixelplus | |||

| Bruce. I. Berkoff | August 13, 1960 | Outside Director | President of LCD TV Association | |||

| Yoshihide Nakamura | October 22, 1942 | Outside Director | President of ULDAGE, Inc. | |||

| William Y. Kim | June 6, 1956 | Outside Director | Partner of Ropes & Gray LLP | |||

B. Committees of the Board of Directors

Committees of the Board of Directors as of June 30, 2008

Committee | Member | |

| Audit Committee | Ingoo Han, Yoshihide Nakamura, William Y. Kim | |

| Remuneration Committee | Simon (Shin Ik) Kang, Paul Verhagen, Dongwoo Chun, Bruce I. Berkoff | |

| Outside Director Nomination and Corporate Governance Committee | Simon (Shin Ik) Kang, Paul Verhagen, Dongwoo Chun, William Y. Kim | |

C. Director & Officer Liability Insurance

(1) Overview of Director & Officer Liability Insurance (as of August 13, 2008)

| (Unit: USD) | ||||||

Name of insurance | Premium paid in 2008 | Limit of liability | Remarks | |||

Directors & Officers Liability Insurance | 1,984,000 | 100,000,000 | — | |||

| * | In July 2008, we renewed our director & officer liability insurance with coverage until July 2009. |

(2) The approval procedure for the Director & Officer Liability Insurance

| • | The limit for liability, coverage and premiums were approved by our internal regulation |

(3) The insured

| 1. | LG Display and its subsidiaries and their respective Directors and Officers |

| 2. | Duly elected or appointed Directors or Officers, past and new Directors and Officers during the policy period |

Table of Contents

| 3. | The estates and heirs of deceased Directors or Officers, and the legal representatives of Directors or Officers in the event of their incompetence, insolvency or bankruptcy (only if the Directors or Officers were employed at the time the acts were committed) |

(4) The Covered Risks

| 1. | The liability of a director or an officer for the Loss to shareholders or 3rd parties, arising from any alleged Wrongful Act of a director or officer of the Company in their respective capacities, provided that the director or officer duly discharged his or her fiduciary duties |

| a. | Wrongful Act means any breach of duty, neglect, error, misstatement, misleading statement, omission, or act by the Directors or Officers |

| b. | Loss includes damages, judgments, settlements and Defense Costs |

| 2. | Coverage for security holder derivative action & security claims |

The Loss arising out of any security holder derivative action is paid in accordance with the ‘Security Holder Derivative Action Inclusion Clause’. Securities Loss, incurred on account of a Securities Claim against the Directors, Officers and/or the Company, is covered (except for exclusions).

(5) Exclusions

| 1. | General Exclusions (any loss related to following items): |

| • | Any illegal gaining of personal profit through, dishonest or criminal act; |

| • | Remuneration payment to the Insureds without the previous approval of the stockholders, which payment was illegal; |

| • | Profits in fact made from the purchase or sale of securities of the Company using non public information in an illegal manner; |

| • | Payment of commissions, gratuities, benefits or any other favor provided to a political group, government official, director, officer, employee or any person having an ownership interest in any customers of the |

| • | Company or their agent(s), representative(s) or member(s) of their family or any other entity(ies) with which they are affiliated; |

| • | Wrongful Acts alleged in any claim which has been reported under any policy of which this policy is a renewal or replacement; |

| • | Any pending or prior litigation as of the inception date of this policy, or derived from the same facts as alleged in such pending or prior litigation, etc.; |

| • | Wrongful Act which Insured knew or should reasonably have foreseen at the inception date of this policy; |

| • | Pollutants, contamination; |

| • | Nuclear material, radioactive contamination; |

| • | Bodily injury, disease, death or emotional distress of any person, or damage to tangible property, loss of use of property, or injury from oral or written publication of a libel or slander, or material that violates a person’s right of privacy; |

Table of Contents

| • | Any alleged Wrongful Act of any Subsidiary of which the insured did not own more than 50% of stock either directly or indirectly through its Subsidiaries. |

| 2. | Special Exclusions (any loss related to following items) : |

| • | Punitive Damage |

| • | Nuclear Energy Liability |

| • | Mutual claim between Insureds |

| • | Claim of a large shareholder (one holding 15% or more of the outstanding shares) |

| • | Claim by a government entity |

| • | Professional Service liability |

| • | Section 16(b) of the Securities Exchange Act of 1934 or a similar law |

| • | ERISA(Employee Retirement Income Security Act) |

| • | The so called ‘Year 2000 Problem’ |

| • | War & Terrorism |

| • | Asbestos/Mould liability |

| • | Patent / Copyright liability, etc. |

D. Employees

| (as of June 30, 2008) | (Unit: person, in millions of Won) | |||||||||||||

| Details of Employees | Total Salary in 2008 H1 | Per Capita Salary | Average Service Year | |||||||||||

Sex | Office Worker | Line Worker | Others | Total | ||||||||||

Male | 5,396 | 6,397 | — | 11,793 | 314,526 | 28.3 | 5.1 | |||||||

Female | 414 | 4,634 | — | 5,048 | 96,639 | 19.4 | 3.1 | |||||||

Total | 5,810 | 11,031 | — | 16,841 | 411,165 | 25.5 | 4.5 | |||||||

| * | Directors and executive officers have been excluded. |

E. Stock option

The following table sets forth certain information regarding our stock options as of June 30, 2008.

Executive Officers | Grant Date | Exercise Period | Exercise Price | Number of Granted Options | Number of Exercised Options | Number of Exercisable Options* | ||||||||

| From | To | |||||||||||||

Ron H.Wirahadiraksa | April 7, 2005 | April 8, 2008 | April 7, 2012 | KRW 44,050 | 100,000 | 0 | 50,000 | |||||||

Duke M. Koo | April 7, 2005 | April 8, 2008 | April 7, 2012 | KRW 44,050 | 40,000 | 0 | 20,000 | |||||||

Sang Deog Yeo | April 7, 2005 | April 8, 2008 | April 7, 2012 | KRW 44,050 | 40,000 | 0 | 20,000 | |||||||

Jae Geol Ju | April 7, 2005 | April 8, 2008 | April 7, 2012 | KRW 44,050 | 40,000 | 0 | 20,000 | |||||||

Total | 220,000 | 110,000 | ||||||||||||

| * | When the increase rate of the Company’s share price is the same or less than the increase rate of the Korea Composite Stock Price Index (“KOSPI”) over the three-year period following the grant date, only 50% of the initially granted shares are exercisable. Since the increase rate of the Company’s share price was lower than the increase rate of KOSPI during the period from April 7, 2005 to April 7, 2008, only 50% of the 220,000 initially granted shares are exercisable. |

Table of Contents

7. Financial Information

A. Financial highlights (Based on Non-consolidated, Korean GAAP)

| (Unit: In millions of Won) | ||||||||||||

Description | 2008 H1 | 2007 | 2006 | 2005 | 2004 | |||||||

Current Assets | 7,843,293 | 5,644,253 | 2,731,656 | 3,196,934 | 2,638,616 | |||||||

Quick Assets | 6,650,057 | 4,963,657 | 1,996,280 | 2,725,169 | 2,170,617 | |||||||

Inventories | 1,193,236 | 680,596 | 735,376 | 471,765 | 467,999 | |||||||

Non-current Assets | 7,829,857 | 7,750,182 | 10,084,191 | 9,798,981 | 6,960,077 | |||||||

Investments | 769,314 | 489,114 | 361,558 | 213,984 | 168,055 | |||||||

Tangible Assets | 6,650,191 | 6,830,600 | 8,860,076 | 8,988,459 | 6,366,651 | |||||||

Intangible Assets | 169,947 | 111,530 | 114,182 | 149,894 | 183,471 | |||||||

Other Non-current Asset | 240,405 | 318,938 | 748,375 | 446,644 | 241,900 | |||||||

Total Assets | 15,673,150 | 13,394,435 | 12,815,847 | 12,995,915 | 9,598,693 | |||||||

Current Liabilities | 3,394,169 | 2,245,410 | 2,694,389 | 2,594,282 | 1,900,765 | |||||||

Non-current Liabilities | 2,702,169 | 2,859,652 | 3,231,782 | 2,726,036 | 1,925,286 | |||||||

Total Liabilities | 6,096,338 | 5,105,062 | 5,926,171 | 5,320,318 | 3,826,051 | |||||||

Capital Stock | 1,789,079 | 1,789,079 | 1,789,079 | 1,789,079 | 1,626,579 | |||||||

Capital Surplus | 2,311,071 | 2,311,071 | 2,275,172 | 2,279,250 | 1,012,271 | |||||||

Other Accumulated Comprehensive Income (Loss) | 69,516 | 5,823 | (13,948 | ) | (1,418 | ) | 42,118 | |||||

Retained Earnings | 5,407,146 | 4,183,400 | 2,839,373 | 3,608,686 | 3,091,674 | |||||||

Total Shareholder’s Equity | 9,576,812 | 8,289,373 | 6,889,676 | 7,675,597 | 5,772,642 | |||||||

Table of Contents

Description | 2008 H1 | 2007 | 2006 | 2005 | 2004 | ||||||

Sales Revenues | 8,251,154 | 14,163,131 | 10,200,660 | 8,890,155 | 8,079,891 | ||||||

Operating Income (Loss) | 1,779,499 | 1,491,135 | (945,208 | ) | 447,637 | 1,640,708 | |||||

Income (Loss) from continuing operation | 1,492,108 | 1,344,027 | (769,313 | ) | 517,012 | 1,655,445 | |||||

Net Income (Loss) | 1,492,108 | 1,344,027 | (769,313 | ) | 517,012 | 1,655,445 |

B. R&D Expense

(1) Summary

| (Unit: In millions of Won) | |||||||||||

Account | 2008 H1 | 2007 | 2006 | ||||||||

Material Cost | 125,206 | 246,577 | 291,714 | ||||||||

Labor Cost | 68,400 | 110,586 | 87,078 | ||||||||

Depreciation Expense | 10,352 | 22,516 | 20,671 | ||||||||

Others | 16,971 | 34,737 | 36,649 | ||||||||

Total R&D Expense | 220,929 | 414,416 | 436,112 | ||||||||

Accounting Treatment | Selling & Administrative Expenses | 68,416 | 106,082 | 82,635 | |||||||

Manufacturing Cost | 152,513 | 308,334 | 353,477 | ||||||||

R&D Expense / Sales Ratio [Total R&D Expense/Sales for the period×100] | 2.7 | % | 2.9 | % | 4.3 | % | |||||

(2) R&D achievements

[Achievements in 2004]

1) Development of 20.1-inch AMOLED

| • | Joint development of 20.1-inch AMOLED with LG Electronics |

| • | Development of world’s largest 20.1-inch wide AMOLED based on LTPS technology |

2) Development of copper bus line

| • | Next generation LCD technology to significantly improve brightness, definition and resolution, etc. |

3) Development and mass production of world’s largest TFT-LCD panel for full-HD TV (55-inch) in October 2004.

| • | Stitch Lithography and Segmented Circuit Driving to cope with large-size LCD Panel |

| • | Achievement of high contrast ratio and fast response time through new technologies |

| • | Application of innovative panel technology to solve the weak point (gravity/touch stains) of large size |

Table of Contents

4) Development of ultra high resolution product (30-inch)

| • | World’s first success in mass production of LCM applying Cu Line (source & gate area) |

| • | Achievement of ultra high resolution (2560x1600 : 101ppi) |

5) Development of the world’s lowest power-consumption, 32-inch wide LCD TV model

| • | Development of the world’s lowest power consumption, under 90W model (EEFL applied) |

| • | High contrast ratio, fast response time (DCR + ODC applied) |

[Achievements in 2005]

6) Development of high luminance and high color gamut 17-inch wide LCD panel for notebook computer

| • | World’s first 500nit luminance and 72% color gamut in 17-inch wide for notebook computer |

| • | Development of 6200nit luminance backlight |

7) Development of world’s largest 10.1-inch Flexible Display

| • | Joint development with E-ink Corporation |

8) 37-inch, 42-inch, 47-inch full-HD model development, applying low resistance line (copper bus line)

| • | World’s first mass production of copper bus line model |

| • | Realize full-HD Resolution (1920x1080) |

9) 37-inch wide LCD model development which is the world’s best in power consumption

| • | The lowest power consumption of below 120W (applying EEFL) |

| • | High contrast ratio, fast response time with DCR, ODC technology. |

[Achievements in 2006]

10) Development of high brightness/color gamut 17-inch wide slim LCD for notebook computer

| • | Slim model (10tg7t), featuring 500nit, NTSC 72% |

| • | Development of slim and high brightness backlight |

11) World’s largest size 100-inch TFT-LCD development

| • | High quality image without noise or signal distortion, applying low resistance copper bus line |

| • | High dignity picture for full-HD TV |

12) 32-inch/42-inch HCFL Scanning Backlight applied LCD TV model development

| • | Realization of MBR (Motion Blur Reduction) by application of Backlight Scanning technology |

| • | Lamp Quantity Reduction by HCFL (Hot Cathode Fluorescent Lamp) application |

13) World’s largest 20.1-inch TFT-LCD for notebook computer development

| • | S-IPS Mode, sRGB, Realization of DCR 3000:1 by backlight control, brightness 300nit |

14) Ultra-slim TFT-LCD development for mobile phones

| • | Realization of 1.3t by reducing light guide plate & glass thickness |

15) The fast response 2.0-inch TFT-LCD development for mobile phones

| • | Realization of high quality image by new liquid crystal development (25msg16ms) |

Table of Contents

16) Wide color gamut 30-inch wide TFT-LCD monitor development

| • | Realization of 92% high color gamut by application of WCG CCFL |

17) LGE Chassis integration model (Tornado) development (32-inch/37-inch/42-inch)

| • | Maximized cost reduction by co-design with LGE & LPL |

| • | Improved product competitiveness by thin & light design |

18) 32-inch 120Hz new-mode panel development

| • | Cost reduction & spec. upgrade by new-mode panel |

| • | MBR (Motion Blur Reduction) by 120Hz driving |

19) CI model development (new concept BL)

| • | Cost reduction and productivity improvement by new concept backlight |

[Achievements in 2007]

20) Development of first Poland model

| • | 32-inch HD model |

21) Development of socket type backlight model

| • | 42-inch FHD model |

| • | 47-inch HD/FHD model |

22) Development of new concept backlight model

| • | Development of 32-inch HD model |

| • | 42/47-inch model under development |

23) Development of interlace image sticking free technology and model

| • | Improvement of low picture quality caused by TV interlace signals |

24) Development of TFT-LCD with ODF (One Drop Filling) for mobile phone application

| • | Our first ODF model for mobile phone application (1.52 inch) |

25) Development of GIP (Gate in Panel) application model 15XGA

| • | Removed gate drive IC: 3eag 0ea |

| • | Reduction in net material costs and shortening of assembly process |

26) 24-inch TN (92%) monitor model development

| • | The world’s first large-size panel TN application |

| • | Realization of 92% high color gamut on the world’s largest TN panel |

27) 15.4-inch LED backlight applied model development

| • | The world’s first 15.4-inch wide LED-applied display panel for notebook computers |

| • | The world’s largest LED-applied panel for notebook computers |

28) Development of FHD 120Hz display panel

| • | 37- to 47-inch FHD model |

Table of Contents

29) Development of backlight localization model

| • | 32-inch HD model |

30) Development of enhanced Dynamic Contrast Ratio technology

| • | 32-inch HD model |

| • | Enhanced from 5000:1 to 10000:1 |

31) Development of technology that improves panel transmittance

| • | Expected to be applied to new models |

32) Development of THM (through-hole mounting) technology and model

| • | 37- to 47-inch model |

| • | Providing more mounting options to users |

33) Development of the world’s first DRD (Double Rate Driving) technology-applied model

| • | Source Drive IC reduction: 6eag 3ea |

| • | Reduction in net material costs and shortening of assembly process |

34) COG (Chip On Panel) applied model development

| • | Development of thin and light LCD panels made possible by flat type structure |

35) 26-inch/30-inch IPS 102% monitor model development

| • | Development of 26-inch/30-inch IPS model that can realize 102% wide color gamut |

36) 2.4-inch narrow bezel for Mobile Display

| • | The borders on the left and right sides of this 2.4-inch qVGA-resolution (240RGB×320) LCD panel measure just 1mm each. This is approximately 50% thinner than most a-Si TFT LCD panels currently produced, which generally have borders measuring closer to 2mm |

37) Development of 6-inch Electrophoretic Display Product (EDP) to be used in e-books. The first EPD product for LG Display

| • | The first EDP to be developed and launched for e-books, the 6-inch SVGA-resolution (800RGBX600) EDP will be supplied to SONY |

[Achievements in 2008]

38) 42FHD Ultra-Slim LCD TV development

| • | Development of ultra-slim (19.8mm in thickness) 42-inch TV panel |

39) 37FHD COF adoption LCD TV development

| • | Cost reduction with TCPg COF change: $2.4 (as of March 2008) |

40) Scanning Backlight Technology development

| • | Achieve 6ms MPRT from 8ms |

41) 24WUXGA monitor model development applying RGB LED backlight

| • | High color gamut (NTSC > 105%), color depth (10 bit) |

42) 13.3-inch notebook computer model development applying LED backlight

| • | Thin & Light model development applying LED backlight and COG technology (3.5mm in thickness, 275g in weight) |

Table of Contents

43) IPS GIP technology development

| • | Developed LCD industry’s first WUXGA GIP technology in wide view mode area (IPS, VA) |

| • | Comparative advantage in cost & transmittance over VA |

44) 17.1-inch notebook computer model development applying RGB LED backlight

| • | High color gamut (100%) notebook computer model development applied RGB LED backlight |

45) Free Form LCD development (Elliptical, Circle)

| • | Development of the world’s largest 6-inch elliptical and 1.4-inch circular-shaped LCD panels |

| • | Developing non-traditional shaped displays by applying (i) error-free, cutting-edge techniques to overcome technical limitations in making curved LCD panels, (ii) accumulated panel design knowledge and (iii) unique screen information processing algorithm |

| • | Potential applications of the elliptical-shaped LCD panels include digital photo frame, as well as instrument panels for automobiles and home electronics. The circular LCD panel is expected to make a huge impact in the design of small digital devices like mobile phones, watches and gaming devices. |

46) 42HD power consumption saving technology development

| • | Power consumption reduction using lamp mura coverage technology which reduces the number of lamps used for B/L from 18pcs(160W) to 9pcs(80W) in case of 42-inch HD LCD panels. |

47) New liquid crystal development

| • | CR: Up 5% compared with the MP level. |

| • | Material cost is same to the MP material. |

48) New AG Polarizer development:

| • | New Polarizer which has a low CR drop ratio under bright room condition |

| • | CR drop ratio under 1,500lux compared with dark room condition : 82%g 67% |

49) PSM (Potential Sharing Method) technology development

| • | (Improves the Yogore mura characteristics by applying a different electric circuit driving method) |

| • | The time for Yogore mura occurrence delayed by more than 50% |

: Black line 1level base, 552Hrs, 720Hrsg 1,392Hrs, 2,064Hrsh

50) LED backlight 47FHD TV model in development

| • | Development of next generation light source which enables realization of ultra slim LCD panels |

Table of Contents

C. Domestic Credit Rating

Subject | Month of rating | Credit rating | Rating agency (Rating range) | |||

Corporate Debenture | March 2005 | AA- | National Information & Credit Evaluation, Inc.

(AAA ~ D) | |||

| June 2005 | AA- | |||||

| June 2006 | AA- | |||||

| December 2006 | A+ | |||||

| June 2007 | A+ | |||||

| March 2005 | AA- | Korea Investors Service, Inc.

(AAA ~ D) | ||||

| June 2005 | AA- | |||||

| June 2006 | AA- | |||||

| January 2007 | A+ | |||||

| June 2007 | A+ | |||||

Commercial Paper | June 2005 | A1 | National Information & Credit Evaluation, Inc.

(A1 ~ D) | |||

| January 2006 | A1 | |||||

| June 2006 | A1 | |||||

| December 2006 | A1 | |||||

| June 2007 | A1 | |||||

| December 2007 | A1 | |||||

| June 2006 | A1 | Korea Investors Service, Inc.

(A1 ~ D) | ||||

| January 2007 | A1 | |||||

| June 2007 | A1 | |||||

| December 2007 | A1 | |||||

D. Remuneration for directors in 2008 H1

| (Unit: In millions of Won) | ||||||||

Classification | Salary paid | Approved salary at shareholders meeting | Per capita average salary paid | Remarks | ||||

Inside Directors (4 persons) | 1,540 | 13,400 | 385 | — | ||||

Outside Directors (5 persons) | 165 | 33 | — | |||||

| * | Period: January 1, 2008 ~ June 30, 2008 |

| * | Salary paid is calculated on the basis of actually paid salary except accrued salary and severance benefits. |

Table of Contents

E. Derivative contracts

(1) Foreign currency forward contracts

| (Unit: In millions) | ||||||||||||

Contracting party | Selling position | Buying position | Contract foreign | Maturity date | Purpose | |||||||

ABN AMRO Bank and others | US$ | 611 | KRW | 626,374 | KRW977.70 :US$1 ~ KRW1,053.40 :US$1 | July 1, 2008 ~ November 17, 2008 | Hedge of fair value | |||||

BNP Paribas and others | US$ | 94 | JPY | 10,000 | JPY 104.63 :US$1 ~ JPY 107.79:US$1 | July 14, 2008 ~ August 14, 2008 | Hedge of fair value | |||||

BNP Paribas and others | US$ | 785 | KRW | 774,609 | KRW 944.10 :US$1 ~ KRW 1,050.10:US$1 | July 1, 2008 ~ December 31, 2008 | Hedge of cash flow | |||||

CALYON Bank and others | KRW | 38,470 | JPY | 4,000 | 9.58: JPY1~ 9.65: JPY1 | July 14, 2008 ~ August 14, 2008 | Hedge of cash flow | |||||

(2) Cross Currency Interest Rate Swap

| (Unit: In millions) | |||||||||||

Contracting party | Contract amount | Contract interest rate | Maturity date | Purpose | |||||||

Kookmin Bank and others | Buying position | US$ | 150 | 3M LIBOR ~ 3M LIBOR +0.53% | August 29,2011 ~ January 31, 2012 | Hedge of fair value and cash flow | |||||

| Selling position | KRW | 143,269 | 4.54% ~ 5.35% | August 29,2011 ~ January 31, 2012 | Hedge of fair value and cash flow | ||||||

(3) Interest Rate Swap

| (Unit: In millions) | |||||||||||

Contracting party | Contract amount | Contract interest rate | Maturity date | Purpose | |||||||

Standard Chartered First Bank Korea | US$ | 150 | Floating Rate Receipt | 6 Month Libor | May 21, 2009 ~ May 24, 2010 | Hedge of cash flow | |||||

| Fixed Rate Payment | 5.375% ~ 5.644% | ||||||||||

Table of Contents

(4) Currency Option

| (Unit: In millions) | ||||||||||||

Contracting party | USD Put Option Buying Position | USD Call Option Selling Position | Strike Price | Maturity date | Purpose | |||||||

Citibank Korea and others | US$ | 330 | US$ | 330 | KRW 941.00:US$1 ~ KRW 999.10:US$1 | July 9, 2008 ~ September 29, 2008 | Hedge of fair value | |||||

F. Status of equity investment

| • | Status of equity investment as of June 30, 2008: |

Company | Total issued and outstanding shares | Number of shares owned by us | Ownership ratio | ||||

LG Display America, Inc. | 5,000,000 | 5,000,000 | 100 | % | |||

LG Display Japan Co., Ltd. | 1,900 | 1,900 | 100 | % | |||

LG Display Germany GmbH | 960,000 | 960,000 | 100 | % | |||

LG Display Taiwan Co., Ltd. | 11,550,000 | 11,550,000 | 100 | % | |||

LG Display Nanjing Co., Ltd. | * | * | 100 | % | |||

LG Display Hong Kong Co., Ltd. | 115,000 | 115,000 | 100 | % | |||

LG Display Shanghai Co., Ltd. | * | * | 100 | % | |||

LG Display Poland Sp. zo.o. | 5,110,710 | 4,103,277 | 80 | % | |||

LG Display Guangzhou Co., Ltd. | * | * | 84 | % | |||

LG Display Shenzhen Co., Ltd. | * | * | 100 | % | |||

Paju Electric Glass Co., Ltd. | 3,600,000 | 1,440,000 | 40 | % | |||

TLI Co., Ltd. | 7,760,575 | 1,008,875 | 13 | % | |||

AVACO Co., Ltd. | 10,237,204 | 2,037,204 | 20 | % |

| * | No shares have been issued in accordance with the local laws and regulations. |

Table of Contents

LG DISPLAY CO., LTD.

(Formerly, LG.Philips LCD Co., Ltd.)

Interim Non-Consolidated Financial Statements

(Unaudited)

June 30, 2008

(With Independent Accountants’ Review Report Thereon)

Table of Contents

| Page | ||

| 1 | ||

| 3 | ||

| 5 | ||

Interim Non-Consolidated Statements of Changes in Stockholders’ Equity | 6 | |

| 7 | ||

| 9 | ||

Table of Contents

LG DISPLAY CO., LTD. (formerly, LG.Philips LCD Co., Ltd.)

Notes to Interim Non-Consolidated Financial Statements

June 30, 2008

(Unaudited)

Independent Accountants’ Review Report

Based on a report originally issued in Korean

To the Stockholders and Board of Directors

LG Display Co., Ltd.:

We have reviewed the accompanying interim non-consolidated balance sheet of LG Display Co., Ltd. (formerly, LG.Philips LCD Co., Ltd.) (the “Company”) as of June 30, 2008, and the related interim non-consolidated statements of income for each of the three-month and six-month periods ended June 30, 2008, changes in stockholders’ equity and cash flows for the six-month period ended June 30, 2008. These interim non-consolidated financial statements are the responsibility of the Company’s management. Our responsibility is to issue a report on these interim financial statements based on our review. The accompanying interim non-consolidated statements of income for each of the three-month and six-month periods ended June 30, 2007, changes in stockholders’ equity and cash flows for the six-month period ended June 30, 2007, presented for comparative purposes, were reviewed by Samil PricewaterhouseCoopers, whose report thereon dated July 25, 2007, stated that nothing had come to their attention that caused them to believe that these interim non-consolidated financial statements reviewed by them were not presented fairly, in all material respects, in accordance with accounting principles generally accepted in the Republic of Korea.

We conducted our review in accordance with the Review Standards for Semiannual Financial Statements established by the Securities and Futures Commission of the Republic of Korea. These Standards require that we plan and perform the review to obtain moderate assurance as to whether the financial statements are free of material misstatement. A review consists principally of inquiries of company personnel and analytical procedures applied to financial data and, thus provides less assurance than an audit. We have not performed an audit and, accordingly, we do not express an audit opinion.

Based on our review, nothing has come to our attention that causes us to believe that the interim non-consolidated financial statements referred to above are not presented fairly, in all material respects, in accordance with accounting principles generally accepted in the Republic of Korea.

The non-consolidated balance sheet of the Company as of December 31, 2007 and the related non-consolidated statements of income, appropriation of retained earnings, changes in stockholders’ equity and cash flows for the year then ended were audited by Samil PricewaterhouseCoopers and their report thereon, dated February 15, 2008, expressed an unqualified opinion. The accompanying non-consolidated balance sheet of the Company as of December 31, 2007, presented for comparative purposes, is not different from the above-stated non-consolidated balance sheet in all material respects.

As discussed in Note 2 (b) to the interim non-consolidated financial statements, accounting principles and review standards and their application in practice vary among countries. The accompanying interim non-consolidated financial statements are not intended to present the financial position, results of operations, changes in stockholders’ equity and cash flows in accordance with accounting principles and practices generally accepted in countries other than the Republic of Korea. In addition, the procedures and practices utilized in the Republic of Korea to review such interim non-consolidated financial statements may differ from those generally accepted and applied in other countries. Accordingly, this report and the accompanying interim non-consolidated financial statements are for use by those knowledgeable about Korean accounting procedures and review standards and their application in practice.

1

Table of Contents

LG DISPLAY CO., LTD. (formerly, LG.Philips LCD Co., Ltd.)

Notes to Interim Non-Consolidated Financial Statements

June 30, 2008

(Unaudited)

| /s/ KPMG Samjong Accounting Corp. |

| Seoul, Korea |

| July 18, 2008 |

This report is effective as of July 18, 2008, the review report date. Certain subsequent events or circumstances, which may occur between the review report date and the time of reading this report, could have a material impact on the accompanying interim non-consolidated financial statements and notes thereto. Accordingly, the readers of the review report should understand that there is a possibility that the above review report may have to be revised to reflect the impact of such subsequent events or circumstances, if any.

2

Table of Contents

LG DISPLAY CO., LTD. (formerly, LG.Philips LCD Co., Ltd.)

Interim Non-Consolidated Balance Sheets

(Unaudited)

As at June 30, 2008 and December 31, 2007

| In millions of Won, except share data | Note | 2008 | 2007 | ||||

Assets | |||||||

Cash and cash equivalents | (Won) | 804,128 | 1,109,749 | ||||

Short-term financial instruments | 2,945,000 | 785,000 | |||||

Available-for-sale securities | 3 | 74 | 63 | ||||

Trade accounts and notes receivable, net | 4, 18 | 2,231,588 | 2,462,946 | ||||

Other accounts receivable, net | 4 | 56,899 | 121,687 | ||||

Accrued income, net | 4 | 58,662 | 14,044 | ||||

Advance payments, net | 4 | 1,317 | 2,743 | ||||

Prepaid expenses | 58,698 | 33,475 | |||||

Prepaid value added tax | 157,172 | 94,564 | |||||

Deferred income tax assets, net | 13 | 334,099 | 330,277 | ||||

Inventories, net | 5 | 1,193,236 | 680,596 | ||||

Other current assets | 2,420 | 9,109 | |||||

Total current assets | 7,843,293 | 5,644,253 | |||||

Long-term financial instruments | 13 | 13 | |||||

Equity-method investments | 6 | 644,481 | 489,101 | ||||

Available-for-sale securities | 3 | 114,386 | — | ||||

Long-term loans | 18 | 10,434 | — | ||||

Property, plant, and equipment, net | 7 | 6,650,191 | 6,830,600 | ||||

Intangible assets, net | 169,947 | 111,530 | |||||

Long-term other receivables, net | 4 | 273 | 364 | ||||

Long-term prepaid expenses | 162,480 | 155,584 | |||||

Deferred income tax assets, net | 13 | 25,920 | 134,055 | ||||

Non-current guarantee deposits | 38,491 | 28,935 | |||||

Other non-current assets | 13,241 | — | |||||

Total non-current assets | 7,829,857 | 7,750,182 | |||||

Total assets | (Won) | 15,673,150 | 13,394,435 | ||||

See accompanying notes to interim non-consolidated financial statements.

3

Table of Contents

LG DISPLAY CO., LTD. (formerly, LG.Philips LCD Co., Ltd.)

Interim Non-Consolidated Balance Sheets (continued)

(Unaudited)

As at June 30, 2008 and December 31, 2007

| In millions of Won, except share data | Note | 2008 | 2007 | ||||

Liabilities | |||||||

Trade accounts payable and notes payable | 18 | (Won) | 1,091,587 | 980,566 | |||

Other accounts payable | 1,098,669 | 554,920 | |||||

Advances received | 10,845 | 12,360 | |||||

Withholdings | 6,285 | 6,726 | |||||

Accrued expenses | 178,663 | 172,270 | |||||

Income tax payable | 298,230 | 72,342 | |||||

Warranty reserve | 51,357 | 49,295 | |||||

Current portion of long-term debt and debentures, net of discounts | 8, 9 | 560,096 | 350,281 | ||||

Other current liabilities | 98,437 | 46,650 | |||||

Total current liabilities | 3,394,169 | 2,245,410 | |||||

Debentures, net of current portion and discounts on debentures | 8 | 1,734,242 | 1,998,147 | ||||

Long-term debt, net of current portion | 9 | 865,768 | 807,510 | ||||

Long-term accrued expenses | 10 | — | 560 | ||||

Accrued severance benefits, net | 89,210 | 53,435 | |||||

Other non-current liabilities | 12,949 | — | |||||

Total non-current liabilities | 2,702,169 | 2,859,652 | |||||

Total liabilities | 6,096,338 | 5,105,062 | |||||

Stockholders’ equity | |||||||

Common stock, (Won)5,000 par value. Authorized 500,000,000 shares: issued and outstanding 357,815,700 shares in 2008 and 2007 | 1,789,079 | 1,789,079 | |||||

Capital surplus | 2,311,071 | 2,311,071 | |||||

Accumulated other comprehensive income | 69,516 | 5,823 | |||||

Retained earnings | 5,407,146 | 4,183,400 | |||||

Total stockholders’ equity | 9,576,812 | 8,289,373 | |||||

Commitments and contingencies | 11 | ||||||

Total liabilities and stockholders’ equity | (Won) | 15,673,150 | 13,394,435 | ||||

See accompanying notes to interim non-consolidated financial statements.

4

Table of Contents

LG DISPLAY CO., LTD. (formerly, LG.Philips LCD Co., Ltd.)

Interim Non-Consolidated Statements of Income

(Unaudited)

For the three-month and six-month periods ended June 30, 2008 and 2007

| In millions of Won, except earnings per share | Note | For the three-month periods ended June 30 | For the six-month periods ended June 30 | |||||||||||

| 2008 | 2007 | 2008 | 2007 | |||||||||||

Sales | 18, 19 | (Won) | 4,069,100 | 3,267,223 | (Won) | 8,251,154 | 5,873,586 | |||||||

Cost of sales | 15, 18 | 3,046,306 | 2,995,651 | 6,133,171 | 5,713,555 | |||||||||

Gross profit | 1,022,794 | 271,572 | 2,117,983 | 160,031 | ||||||||||

Selling and administrative expenses | 16, 18 | 191,579 | 132,892 | 338,484 | 258,644 | |||||||||

Operating income (loss) | 831,215 | 138,680 | 1,779,499 | (98,613 | ) | |||||||||

Interest income | 52,209 | 11,510 | 90,686 | 18,878 | ||||||||||

Rental income | 838 | 1,044 | 1,684 | 2,051 | ||||||||||

Foreign exchange gains | 524,564 | 18,902 | 740,381 | 42,543 | ||||||||||

Gain on foreign currency translation | — | 23,178 | 70,694 | 13,302 | ||||||||||

Equity income on investments | 28,010 | 19,291 | 49,842 | 28,279 | ||||||||||

Gain on disposal of property, plant and equipment | 1,450 | 626 | 1,727 | 2,127 | ||||||||||

Commission earned | 6,887 | 11,826 | 9,015 | 17,796 | ||||||||||

Gains on redemption of debentures | 8 | 172 | — | 188 | — | |||||||||

Other income | 18 | 2,490 | 1,702 | 9,070 | 3,982 | |||||||||

Non-operating income | 616,620 | 88,079 | 973,287 | 128,958 | ||||||||||

Interest expense | 28,860 | 49,653 | 62,000 | 93,939 | ||||||||||

Foreign exchange losses | 485,416 | 26,671 | 652,655 | 40,770 | ||||||||||

Loss on foreign currency translation | 32,272 | 10,332 | 141,685 | 10,332 | ||||||||||

Donations | 662 | 116 | 985 | 117 | ||||||||||

Loss on disposal of trade accounts and notes receivable | 4 | 5,913 | — | 8,714 | 1,805 | |||||||||

Equity losses on investments | 2,572 | 17,463 | 16,958 | 12,233 | ||||||||||

Loss on disposal of property, plant and equipment | 6 | 479 | 491 | 482 | ||||||||||

Impairment loss on property, plant and equipment | 83 | — | 83 | — | ||||||||||

Nagetive reversal of bad debt | 469 | — | — | — | ||||||||||

Loss on redemption of debentures | 8 | — | — | 13 | — | |||||||||

Other expense | — | 1 | — | 1 | ||||||||||

Non-operating expenses | 556,253 | 104,715 | 883,584 | 159,679 | ||||||||||

Income (loss) before income taxes | 891,582 | 122,044 | 1,869,202 | (129,334 | ) | |||||||||

Income tax expense (benefit) | 13 | 160,060 | (106,443 | ) | 377,094 | (189,222 | ) | |||||||

Net income | (Won) | 731,522 | 228,487 | (Won) | 1,492,108 | 59,888 | ||||||||

Earnings per share | 17 | |||||||||||||

Basic earnings per share | (Won) | 2,044 | 639 | (Won) | 4,170 | 167 | ||||||||

Diluted earnings per share | (Won) | 1,999 | 631 | (Won) | 4,076 | 167 | ||||||||

See accompanying notes to interim non-consolidated financial statements.

5

Table of Contents

LG DISPLAY CO., LTD. (formerly, LG.Philips LCD Co., Ltd.)

Interim Non-Consolidated Statements of Changes in Stockholders’ Equity

(Unaudited)

For the six-month periods ended June 30, 2008 and 2007

| In millions of Won | Note | Capital Stock | Capital Surplus | Accumulated other comprehensive income (loss) | Retained earnings | Total | ||||||||||

Balances at January 1, 2007 | (Won) | 1,789,079 | 2,275,172 | (13,948 | ) | 2,839,373 | 6,889,676 | |||||||||

Net income | — | — | — | 59,888 | 59,888 | |||||||||||

Change in equity arising from application of equity method | 14 | — | — | 9,181 | — | 9,181 | ||||||||||

Gain on valuation of cash flow hedges | 12, 14 | — | — | (12,094 | ) | — | (12,094 | ) | ||||||||

Loss on valuation of cash flow hedges | 12, 14 | — | — | 3,370 | — | 3,370 | ||||||||||

Change in consideration for conversion rights | — | 35,899 | — | — | 35,899 | |||||||||||

Balances at June 30, 2007 | 1,789,079 | 2,311,071 | (13,491 | ) | 2,899,261 | 6,985,920 | ||||||||||

Balances at January 1, 2008 | 1,789,079 | 2,311,071 | 5,823 | 4,183,400 | 8,289,373 | |||||||||||

Cash dividend | — | — | — | (268,362 | ) | (268,362 | ) | |||||||||

Net income | — | — | — | 1,492,108 | 1,492,108 | |||||||||||

Change in equity arising from application of equity method | 14 | — | — | 76,064 | — | 76,064 | ||||||||||

Change in fair value of available-for-sale securities | 3, 14 | — | — | 13,149 | — | 13,149 | ||||||||||

Gain on valuation of cash flow hedges | 12, 14 | — | — | (784 | ) | — | (784 | ) | ||||||||

Loss on valuation of cash flow hedges | 12, 14 | — | — | (24,736 | ) | — | (24,736 | ) | ||||||||

Balances at June 30, 2008 | (Won) | 1,789,079 | 2,311,071 | 69,516 | 5,407,146 | 9,576,812 | ||||||||||

See accompanying notes to interim non-consolidated financial statements.

6

Table of Contents

LG DISPLAY CO., LTD. (formerly, LG.Philips LCD Co., Ltd.)

Interim Non-Consolidated Statements of Cash Flows

(Unaudited)

For the six-month periods ended June 30, 2008 and 2007

| In millions of Won | Note | 2008 | 2007 | ||||||

Cash flows provided by operating activities: | |||||||||

Net income | (Won) | 1,492,108 | 59,888 | ||||||

Adjustments for: | |||||||||

Depreciation | 1,261,599 | 1,318,857 | |||||||

Amortization of intangible assets | 24,796 | 22,448 | |||||||

Gain on disposal of property, plant and equipment, net | (1,236 | ) | (1,645 | ) | |||||

Impairment loss on property, plant and equipment | 83 | — | |||||||

Loss on foreign currency translation, net | 70,992 | (3,559 | ) | ||||||

Amortization of discount on debentures, net | 15,387 | 21,983 | |||||||

Gain on redemption of debentures, net | (175 | ) | — | ||||||

Provision for warranty reserve | 41,761 | 28,945 | |||||||

Provision for severance benefits | 44,447 | 39,429 | |||||||

Equity income on investments, net | (32,884 | ) | (16,046 | ) | |||||

Stock compensation cost | (560 | ) | — | ||||||

| 1,424,210 | 1,410,412 | ||||||||

Changes in operating assets and liabilities: | |||||||||

Decrease (increase) in trade accounts receivable and notes receivable | 270,841 | (560,800 | ) | ||||||

Decrease (increase) in inventories | (512,640 | ) | (59,471 | ) | |||||

Decrease (increase) in other accounts receivable | 68,563 | (431 | ) | ||||||

Decrease (increase) in accrued income | (44,618 | ) | (2,941 | ) | |||||

Decrease (increase) in advance payments | 1,427 | 1,960 | |||||||

Decrease (increase) in prepaid expenses | (10,898 | ) | (29,317 | ) | |||||

Decrease (increase) in prepaid value added tax | (55,334 | ) | (2,568 | ) | |||||

Decrease (increase) in current deferred income tax | 5,857 | (267,947 | ) | ||||||

Decrease (increase) in other current assets | 22,231 | 9,463 | |||||||

Decrease (increase) in long-term prepaid expenses | (21,222 | ) | (45,835 | ) | |||||

Decrease (increase) in long-term other receivables | 91 | — | |||||||

Decrease (increase) in other non-current assets | (13,241 | ) | — | ||||||

Decrease (increase) in non-current deferred income tax | 66,237 | 78,726 | |||||||

Increase (decrease) in trade accounts and notes payable | 102,854 | 18,682 | |||||||

Increase (decrease) in other accounts payable | 105,067 | (33,290 | ) | ||||||

Increase (decrease) in advances received | (1,515 | ) | 6,596 | ||||||

Increase (decrease) in withholdings | (442 | ) | 2,629 | ||||||

Increase (decrease) in accrued expenses | 6,393 | 20,483 | |||||||

Increase (decrease) in income tax payable | 225,888 | — | |||||||

Increase (decrease) in warranty reserve | (30,035 | ) | (20,702 | ) | |||||

Increase (decrease) in other current liabilities | (20,617 | ) | (5,887 | ) | |||||

Accrued severance benefits transferred from affiliated company, net | 2,201 | 2,020 | |||||||

Payment of severance benefits | (14,362 | ) | (38,267 | ) | |||||

Decrease (increase) in severance insurance deposits | 3,455 | 8,573 | |||||||

Decrease (increase) in contribution to the National Pension Fund | 33 | 65 | |||||||

| 156,214 | (918,259 | ) | |||||||

Net cash provided by operating activities | (Won) | 3,072,532 | 552,041 | ||||||

See accompanying notes to interim non-consolidated financial statements.

7

Table of Contents

LG DISPLAY CO., LTD. (formerly, LG.Philips LCD Co., Ltd.)

Interim Non-Consolidated Statements of Cash Flows (continued)

(Unaudited)

For the six-month periods ended June 30, 2008 and 2007

| In millions of Won | Note | 2008 | 2007 | ||||||

Cash flows from investing activities: | |||||||||

Proceeds from maturity of short-term financial instruments | (Won) | 685,000 | — | ||||||

Acquisition of short-term financial instruments | (2,845,000 | ) | — | ||||||

Acquisition of available-for-sale securities | (96,260 | ) | — | ||||||

Cash dividend received | 10,725 | 1,440 | |||||||

Acquisition of equity method securities | (20,247 | ) | (102,230 | ) | |||||

Proceeds from disposal of property, plant and equipment | 5,774 | 19,548 | |||||||

Acquisition of property, plant and equipment | (680,760 | ) | (869,654 | ) | |||||

Acquisition of intangible assets | (52,986 | ) | (4,213 | ) | |||||

Refund of non-current guarantee deposits | 38 | 405 | |||||||

Long-term loans | (10,474 | ) | |||||||

Payment of non-current guarantee deposits | (9,593 | ) | (775 | ) | |||||

Government subsidy received | 354 | — | |||||||

Net cash used in investing activities | (3,013,429 | ) | (955,479 | ) | |||||

Cash flows from financing activities: | |||||||||

Proceeds from debentures | — | 508,997 | |||||||

Proceeds from long-term debt | — | 273,014 | |||||||

Repayment of current portion of long-term debt | (46,836 | ) | (25,211 | ) | |||||

Redemption of debentures | (49,526 | ) | — | ||||||

Payment of cash dividend | (268,362 | ) | — | ||||||

Net cash provided by (used in) financing activities | (364,724 | ) | 756,800 | ||||||

Net increase (decrease) in cash and cash equivalents | (305,621 | ) | 353,362 | ||||||

Cash and cash equivalents at beginning of period | 1,109,749 | 788,066 | |||||||

Cash and cash equivalents at end of period | (Won) | 804,128 | 1,141,428 | ||||||

See accompanying notes to interim non-consolidated financial statements.

8

Table of Contents

LG DISPLAY CO., LTD. (formerly, LG.Philips LCD Co., Ltd.)

Notes to Interim Non-Consolidated Financial Statements

June 30, 2008

(Unaudited)

| 1 | Organization and Description of Business |

LG Display Co., Ltd. (formerly, LG.Philips LCD Co., Ltd.) (the “Company”) was incorporated in 1985 under its original name of LG Soft, Ltd. as a wholly owned subsidiary of LG Electronics Inc. In 1998, LG Electronics Inc. and LG Semicon transferred their respective Thin Film Transistor Liquid Crystal Display (“TFT-LCD”) related business to the Company and its main business is to manufacture and sell TFT-LCD panels. In July 1999, LG Electronics Inc., and Koninklijke Philips Electronics N.V. (“Philips”) entered into a joint venture agreement. Pursuant to the agreement, the Company changed its name to LG.Philips LCD Co., Ltd. However, on February 29, 2008, the Company changed its name from LG.Philips LCD Co., Ltd. to LG Display Co., Ltd. based upon the approval of shareholders at the general shareholders’ meeting on the same date as a result of the decrease in Philips’ share interest in the Company and the possibility of its business expansion to Organic Light Emitting Diode (“OLED”) and Flexible Display products. As of June 30, 2008, the majority of shares in the Company are owned by LG Electronics Inc. and Philips, 37.9% (135,625 thousand shares) and 13.2% (47,225 thousand shares), respectively.

As of June 30, 2008, the Company’s LCD Research & Development Center is located in Anyang, TFT-LCD manufacturing plants are located in Gumi and Paju and OLED manufacturing plant is located in Gumi. The Company’s overseas subsidiaries are located in the United States of America, Europe and Asia.

| 2 | Summary of Significant Accounting Policies and Basis of Presenting Financial Statements |

| (a) | Significant Accounting Policies |

The significant accounting policies followed by the Company in the preparation of its interim non-consolidated financial statements are same as those followed by the Company in its preparation of annual non-consolidated financial statements as of December 31, 2007 except for the application of the Statements of Korea Accounting Standard No. 2, Interim Financial Reporting.

| (b) | Basis of Presenting Financial Statements |

The Company maintains its accounting records in Korean Won and prepares statutory financial statements in the Korean language (Hangul) in conformity with the accounting principles generally accepted in the Republic of Korea. Certain accounting principles applied by the Company that conform with financial accounting standards and accounting principles in the Republic of Korea may not conform with generally accepted accounting principles in other countries. Accordingly, these interim non-consolidated financial statements are intended for use only by those who are informed about Korean accounting principles and practices. The accompanying interim non-consolidated financial statements have been translated into English from the Korean language interim non-consolidated financial statements.

9

Table of Contents

LG DISPLAY CO., LTD. (formerly, LG.Philips LCD Co., Ltd.)

Notes to Interim Non-Consolidated Financial Statements

June 30, 2008

(Unaudited)

| 3 | Available-For-Sale Securities |

Available-for-sale securities as of June 30, 2008 and December 31, 2007 are as follows:

| In millions of Won | 2008 | ||||||||||||

| Acquisition cost | Unrealized gains(losses) | ||||||||||||

| Beginning balance | Changes in unrealized gains and losses, net | Realized gains on disposition | Net balance at end of period | Book value (fair value) | |||||||||

Current asset | |||||||||||||

Debt securities | |||||||||||||

Government bonds | (Won) | 74 | — | — | — | — | 74 | ||||||

Non-current asset | |||||||||||||

Equity securities | |||||||||||||

HannStar Display Corporation(*) | (Won) | 96,249 | — | 18,137 | — | 18,137 | 114,386 | ||||||

| (*) | The Company purchased 180 million shares of non-voting mandatorily redeemable convertible preferred stock. The preferred stocks are convertible into common stocks of HannStar Display Corporation at a ratio of 1:1 at the option of the Company from issue date (February 28, 2008) to maturity (February 28, 2011). |

The Company has a put option for total or partial cash redemption of convertible preferred stocks during the period between 18 months from issuance to 91 days prior to maturity and the issuer has a call option to repay, in cash, total preferred stocks during the period between 2 years from issuance to 90 days prior to maturity.

The abovementioned convertible preferred stocks have been privately issued under the Taiwanese Law, which restricts the sale of the preferred stocks (up to three years) and the stocks acquired through conversion are not to be traded in the Taiwanese stock exchange until the original maturity of the preferred stocks.

| In millions of Won | 2007 | ||||||||||||

| Acquisition cost | Unrealized gains(losses) | ||||||||||||

| Beginning balance | Changes in unrealized gains and losses, net | Realized gains on disposition | Net balance at end of period | Book value (fair value) | |||||||||

Current asset | |||||||||||||

Debt securities | |||||||||||||

Government bonds | (Won) | 63 | — | — | — | — | 63 | ||||||

10

Table of Contents