Commercial Vehicle Group, Inc. Bank of America Merrill Lynch 2016 Leveraged Finance Conference November 29, 2016 Patrick Miller President and CEO Tim Trenary Chief Financial Officer Terry Hammett Treasurer and VP Investor Relations

Forward Looking Statement This presentation contains forward-looking statements that are subject to risks and uncertainties. These statements often include words such as "believe," "expect," "anticipate," "intend," "plan," "estimate," or similar expressions. In particular, this press release may contain forward- looking statements about Company expectations for future periods with respect to its plans to improve financial results and enhance the Company, the future of the Company’s end markets, Class 8 North America build rates, performance of the global construction equipment business, expected cost savings, enhanced shareholder value and other economic benefits of the consulting services, the Company’s initiatives to address customer needs, organic growth, the Company’s economic growth plans to focus on certain segments and markets and the Company’s financial position or other financial information. These statements are based on certain assumptions that the Company has made in light of its experience in the industry as well as its perspective on historical trends, current conditions, expected future developments and other factors it believes are appropriate under the circumstances. Actual results may differ materially from the anticipated results because of certain risks and uncertainties, including but not limited to: (i) general economic or business conditions affecting the markets in which the Company serves; (ii) the Company's ability to develop or successfully introduce new products; (iii) risks associated with conducting business in foreign countries and currencies; (iv) increased competition in the medium and heavy-duty truck, construction, aftermarket, military, bus, agriculture and other markets; (v) the Company’s failure to complete or successfully integrate strategic acquisitions; (vi) the impact of changes in governmental regulations on the Company's customers or on its business; (vii) the loss of business from a major customer or the discontinuation of particular commercial vehicle platforms; (viii) the Company’s ability to obtain future financing due to changes in the lending markets or its financial position; (ix) the Company’s ability to comply with the financial covenants in its revolving credit facility; (x) the Company’s ability to realize the benefits of its cost reduction and strategic initiatives; (xi) a material weakness in our internal control over financial reporting which could, if not remediated, result in material misstatements in our financial statements; (xii) volatility and cyclicality in the commercial vehicle market adversely affecting us; and (xiii) various other risks as outlined under the heading "Risk Factors" in the Company's Annual Report on Form 10- K for fiscal year ending December 31, 2015. There can be no assurance that statements made in this presentation relating to future events will be achieved. The Company undertakes no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results over time. All subsequent written and oral forward-looking statements attributable to the Company or persons acting on behalf of the Company are expressly qualified in their entirety by such cautionary statements. pg | 1

22 Facilities 9 Countries 2015 sales $825M NASDAQ CVGI Global Presence pg | 1 North America 11 facilities Europe 5 facilities Asia Pacific 6 Facilities

Products Seats & Seating Systems Cabs and Sleeper BoxesWiper Systems, Mirrors & Controls Wire Harnesses & Controls Interior Trim pg | 3

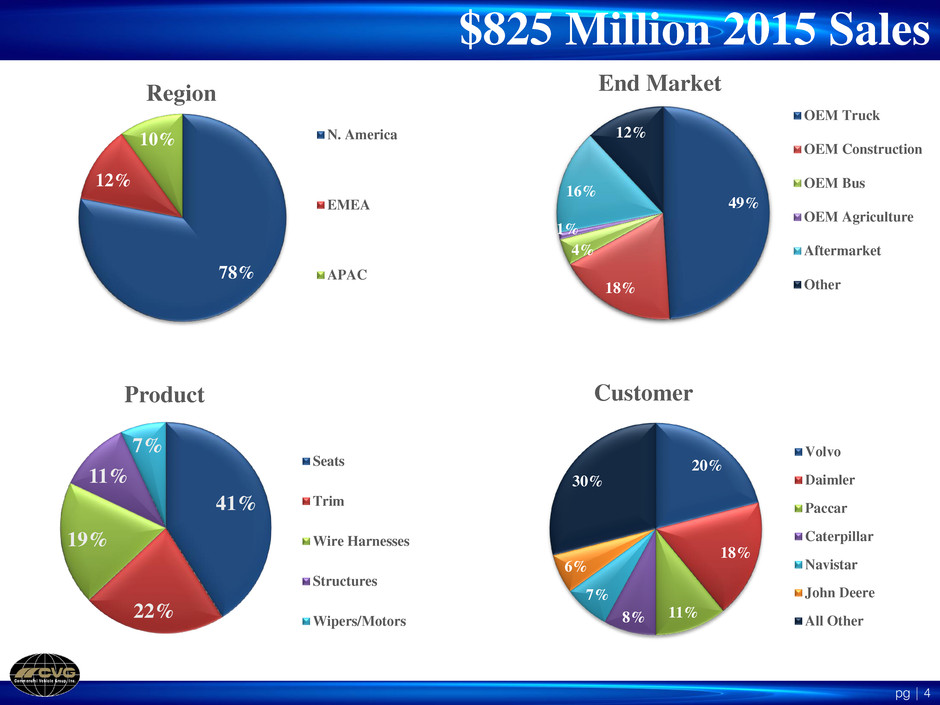

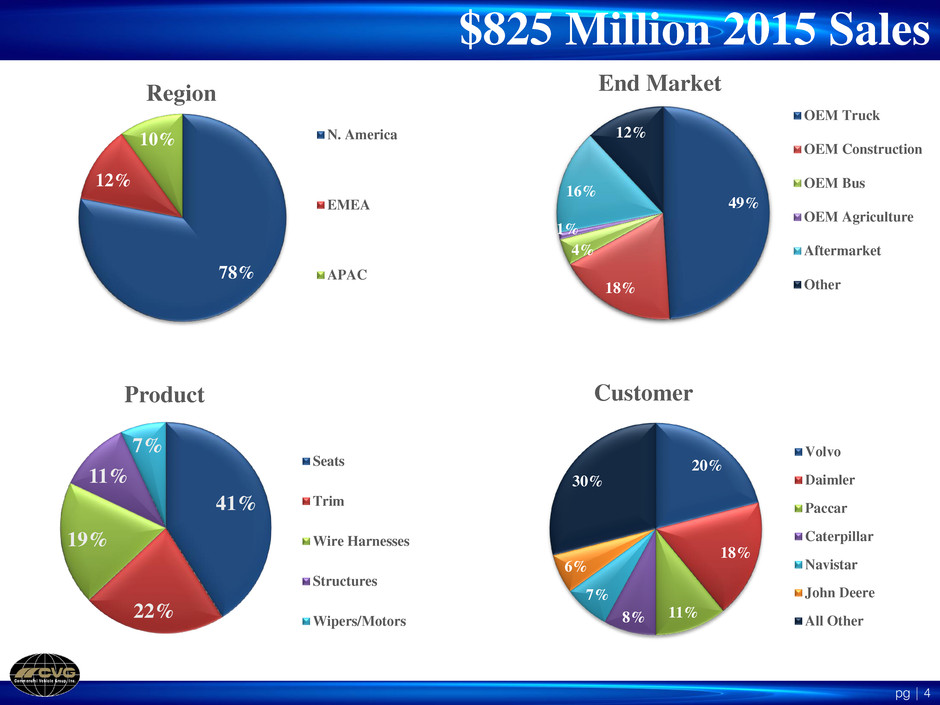

$825 Million 2015 Sales pg | 4 78% 12% 10% Region N. America EMEA APAC 49% 18% 4% 1% 16% 12% End Market OEM Truck OEM Construction OEM Bus OEM Agriculture Aftermarket Other 41% 22% 19% 11% 7% Product Seats Trim Wire Harnesses Structures Wipers/Motors 20% 18% 11%8% 7% 6% 30% Customer Volvo Daimler Paccar Caterpillar Navistar John Deere All Other

2015 Business Segment Sales¹ 70% 15% 6% 2% 7% Global Truck and Bus $565 Million MD/HD Truck OEM Aftermarket/OES Bus OEMs Construction OEMs Other 52% 16% 14% 5% 3% 3% 7% Global Construction and Agriculture $272 Million Construction Aftermarket/OES Auto Truck Agriculture Military Other pg | 5 1. Before intercompany sales eliminations

Strategies to Improve the Core Operational Improvement Margin Impact 18% Fewer Sales pg | 6 Restructuring Update Executive leadership realigned Major changes announced – on target for completion by the end of 2017 Supply Chain - Leveraging globally, increasing standardization, and localizing supply Lean/Six Sigma driving cost out 2016 goal 400 belts To date, 549 belts granted Process investments Interior trim in North America More efficient seat assembly lines in US and UK 18% Fewer Sales See appendix for reconciliation of GAAP to non-GAAP financial measures 18% Fewer Sales 20-25% Historical Pull through Operational Improvement Q3 YTD 2016 Adjusted OIM Q3 YTD 2015 Adjusted OIM 5.3% 4.3% 3.8% 4.8%

pg | 7 Targets for Growth New off-road seating product lines Construction and Ag seats debut in Nov 2016. Includes light duty equipment applications Global Ag market Wire harness, interior trim, and seats. Potential addressable market ~ $900M Wire harnesses – Europe and North America Winning in new segments – agriculture, truck (powertrain), and power generation. Exploring extension into digital components. Global Truck and Bus Major launch activities in North America. Targeting seat growth in domestic India and China. Interior trim and wiper options in Europe. Open to M&A options that could facilitate our targets for growth

FINANCIAL UPDATE

(Dollars in millions) 2016 2015 Sales 153.6 202.7 Reflects end markets Gross Profit 18.9 27.9 Margin 12.3 % 13.8 % SG&A 14.1 17.6 Down $3.5 million Operating Income 4.5 9.9 Margin 2.9 % 4.9 % Adjusted Operating Income 6.0 10.3 Margin 3.9 % 5.1 % Good margin protection N.A. Class 8 Production (000's) 53,754 83,005 Down 35% N.A. Class 5 - 7 Production (000's) 52,555 60,935 Three months ended September 30, Financial Results pg | 9 ACT outlook for medium and heavy duty truck production (000’s)* Class 8 Class 5-7 * Source: ACT Research See appendix for reconciliation of GAAP to non-GAAP financial measures

Business Segments¹ pg | 10 1. Before intercompany sales eliminations See appendix for reconciliation of GAAP to non-GAAP financial measures (Dollars in millions) Global Truck & Bus Global Construction & Agriculture Sales 96.0 59.4 Gross Profit 10.8 8.5 Margin 11.2 % 14.4 % SG&A 5.3 4.6 Operating Income 5.1 3.9 Margin 5.4 % 6.6 % Adjusted Operating Income 6.5 4.1 Margin 6.7 % 6.9 % Three Months Ended September 30, 2016

See appendix for reconciliation of GAAP to non-GAAP financial measures Capital Structure pg | 11 Capital Allocation: 1.) liquidity 2.) growth 3.) de-leverage 4.) return capital to shareholders (Dollars in millions) 2013 2014 2015 LTM Q3 2016 Principal Balance 235 Debt 250 250 235 235 Interest 7.875% Cash 73 70 92 137 Due April 2019 Net Debt 177 180 143 98 April 2016 Redemption 102% April 2017 Redemption 100% Adjusted EBITDA 34 54 58 48 Leverage: Debt / Adj. EBITDA 7.4 X 4.6 X 4.1 X 4.9 X Commitment 40 Net Debt / Adj. EBITDA 5.2 X 3.3 X 2.5 X 2.0 X Availability 37 Letters of Credit 3 Liquidity: Accordion 35 Cash 137 ABL 40 Less: LOC (3) Moody's B2 / Stable S&P B / Stable Total 174 Senior Secured Notes Asset Based Credit Facility Agency Ratings

GAAP to Non-GAAP Reconciliation APPENDIX

GAAP to Non-GAAP Reconciliation Adjusted Operating Income Reconciliation pg | 13 2015 2016 (Dollars in millions) YTD Q3 YTD Q3 Sales 640.6 512.2 Cost of Sales 554.2 443.2 Gross Profit 86.4 69.0 SG&A 52.7 46.5 Amortization 1.0 1.0 Operating Income 32.7 21.5 Margin 5.1 % 4.2 % Special Items: Restructuring 1.5 2.9 Adjusted Operating Income 34.2 24.4 Margin 5.3 % 4.8 %

EBITDA Reconciliation GAAP to Non-GAAP Reconciliation pg | 14 Q4 Q1 Q2 Q3 LTM (Dollars in millions) 2013 2014 2015 2015 2016 2016 2016 Q3 2016 Net Income (12.5) 7.6 7.1 (2.3) 2.6 2.7 1.1 4.1 Interest 21.1 20.7 21.4 5.9 4.9 4.9 5.0 20.6 Income Tax (2.3) 5.1 9.8 1.7 1.2 0.8 (1.5) 2.1 Depreciation 19.0 16.7 16.4 4.1 4.1 3.7 3.8 15.7 Amortization 1.6 1.5 1.3 0.3 0.3 0.3 0.3 1.3 BITDA 26.9 51.7 55.9 9.7 13.0 12.4 8.8 43.9 Restructuring 7.1 1.3 2.3 0.8 0.3 0.5 1.5 3.1 Impaired Asset - 0.8 - - 0.6 - - 0.6 Adjusted EBITDA 34.0 53.8 58.2 10.5 13.9 12.9 10.3 47.6

GAAP to Non-GAAP Reconciliation Business Segment Adjusted Operating Income Reconciliation pg | 15 Three Months Ended September 30, 2016 (Dollars in millions) Global Truck & Bus Global Construction & Agriculture Operating Income 5.1 3.9 Special Items Restructuring 1.4 0.2 Adjusted Operating Income 6.5 4.1 Margin 6.7 % 6.9%