Patrick Miller President & CEO Tim Trenary Chief Financial Officer & Treasurer Kirk Feiler VP Corporate Development & COMMERCIAL VEHICLE GROUP, INC. Investor Relations September 2019 Investor Presentation

Forward Looking Statements This presentation contains forward-looking statements that are subject to risks and uncertainties. These statements often include words such as “believe”, “anticipate”, “plan”, “expect”, “intend”, “will”, “should”, “could”, “would”, “project”, “continue”, “likely”, and similar expressions. In particular, this press release may contain forward-looking statements about Company expectations for future periods with respect to its plans to improve financial results and enhance the Company, the future of the Company’s end markets, including Class 8 and Class 5-7 North America truck build rates and performance of the global construction equipment business, expected cost savings, the Company’s initiatives to address customer needs, organic growth, the Company’s plans to focus on certain segments and markets and the Company’s financial position or other financial information. These statements are based on certain assumptions that the Company has made in light of its experience as well as its perspective on historical trends, current conditions, expected future developments and other factors it believes are appropriate under the circumstances. Actual results may differ materially from the anticipated results because of certain risks and uncertainties, including but not limited to: (i) general economic or business conditions affecting the markets in which the Company serves; (ii) the Company's ability to develop or successfully introduce new products; (iii) risks associated with conducting business in foreign countries and currencies; (iv) increased competition in the medium- and heavy-duty truck markets, construction, agriculture, aftermarket, military, bus and other markets; (v) the Company’s failure to complete or successfully integrate strategic acquisitions; (vi) the Company’s ability to recognize synergies from the reorganization of the segments; (vii) the Company’s failure to successfully manage any divestitures; (viii) the impact of changes in governmental regulations on the Company's customers or on its business; (ix) the loss of business from a major customer, a collection of smaller customers or the discontinuation of particular commercial vehicle platforms; (x) the Company’s ability to obtain future financing due to changes in the lending markets or its financial position; (xi) the Company’s ability to comply with the financial covenants in its debt facilities; (xii) fluctuation in interest rates relating to the Company’s debt facilities; (xiii) the Company’s ability to realize the benefits of its cost reduction and strategic initiatives and address rising labor and material costs; (xiv) a material weakness in our internal control over financial reporting which could, if not remediated, result in material misstatements in our financial statements; (xv) volatility and cyclicality in the commercial vehicle market adversely affecting us; (xvi) the geographic profile of our taxable income and changes in valuation of our deferred tax assets and liabilities impacting our effective tax rate; (xvii) changes to domestic manufacturing initiatives; and (xviii) implementation of tax or other changes, by the United States or other international jurisdictions, related to products manufactured in one or more jurisdictions where the Company does business; and (xix) various other risks as outlined under the heading "Risk Factors" in the Company's Annual Report on Form 10-K for fiscal year ending December 31, 2018. There can be no assurance that statements made in this presentation relating to future events will be achieved. The Company undertakes no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results over time. All subsequent written and oral forward-looking statements attributable to the Company or persons acting on behalf of the Company are expressly qualified in their entirety by such cautionary statements. Page | 2 COMMERCIAL VEHICLE GROUP, INC.

Investment Highlights Leading supplier of electrical wire harnesses, seating systems and a full range of cab related components to the global commercial vehicle industry Strong and growing global presence – 25 facilities across North America, Europe and Asia Pacific FY 2018 revenue $898 million, operating margin 7.4% and free cash flow $27 million Favorable industry and secular trends support growth potential Opportunities to expand into adjacent markets to diversify business and mitigate impact of cyclicality Realigned business structure to improve synergies and organic growth Solid balance sheet Page | 3 COMMERCIAL VEHICLE GROUP, INC.

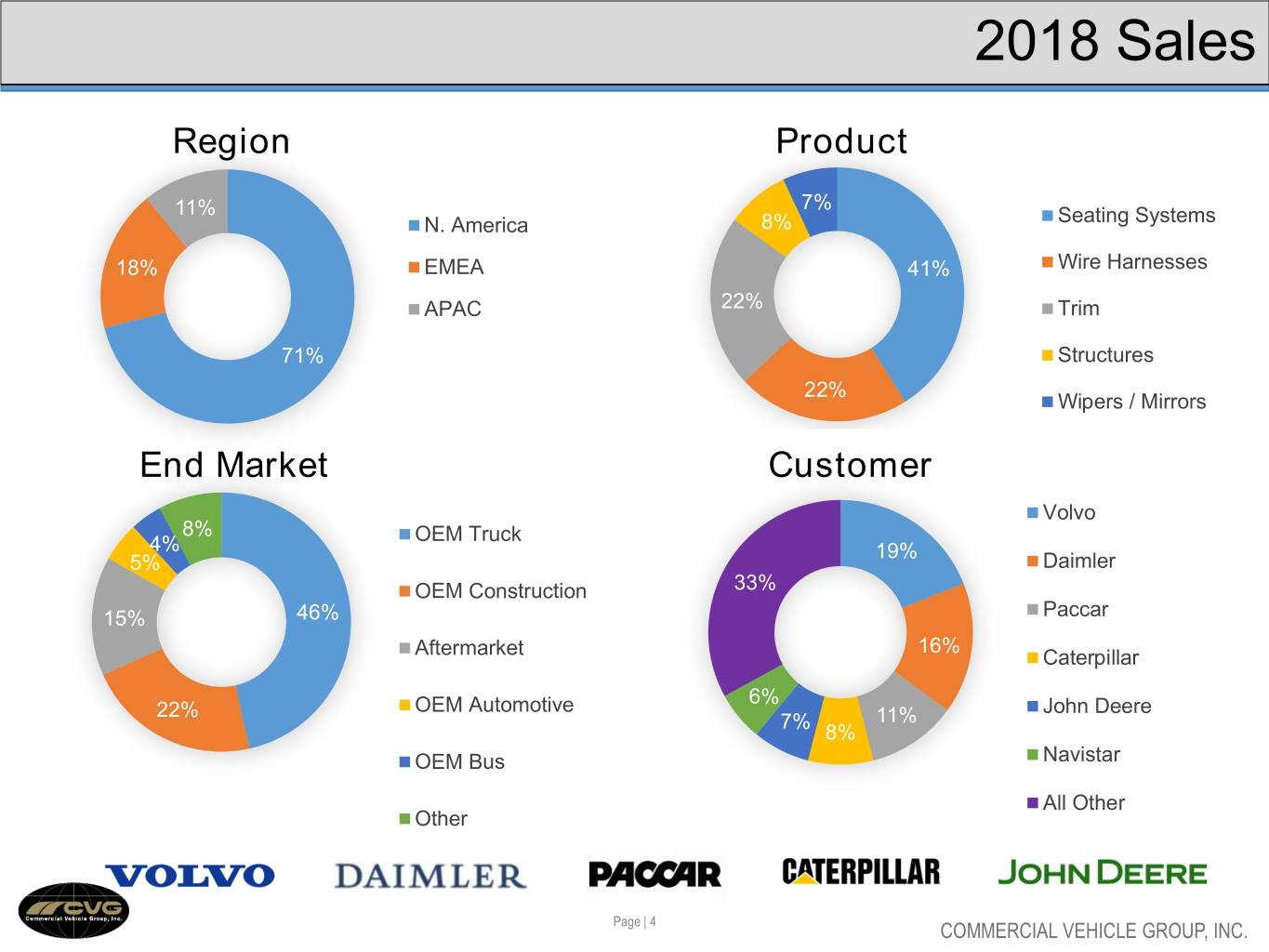

2018 Sales Region Product 11% 7% N. America 8% Seating Systems 18% EMEA 41% Wire Harnesses APAC 22% Trim 71% Structures 22% Wipers / Mirrors End Market Customer Volvo 8% OEM Truck 4% 19% 5% Daimler OEM Construction 33% 15% 46% Paccar 16% Aftermarket Caterpillar 6% 22% OEM Automotive John Deere 7% 11% 8% OEM Bus Navistar All Other Other Page | 4 COMMERCIAL VEHICLE GROUP, INC.

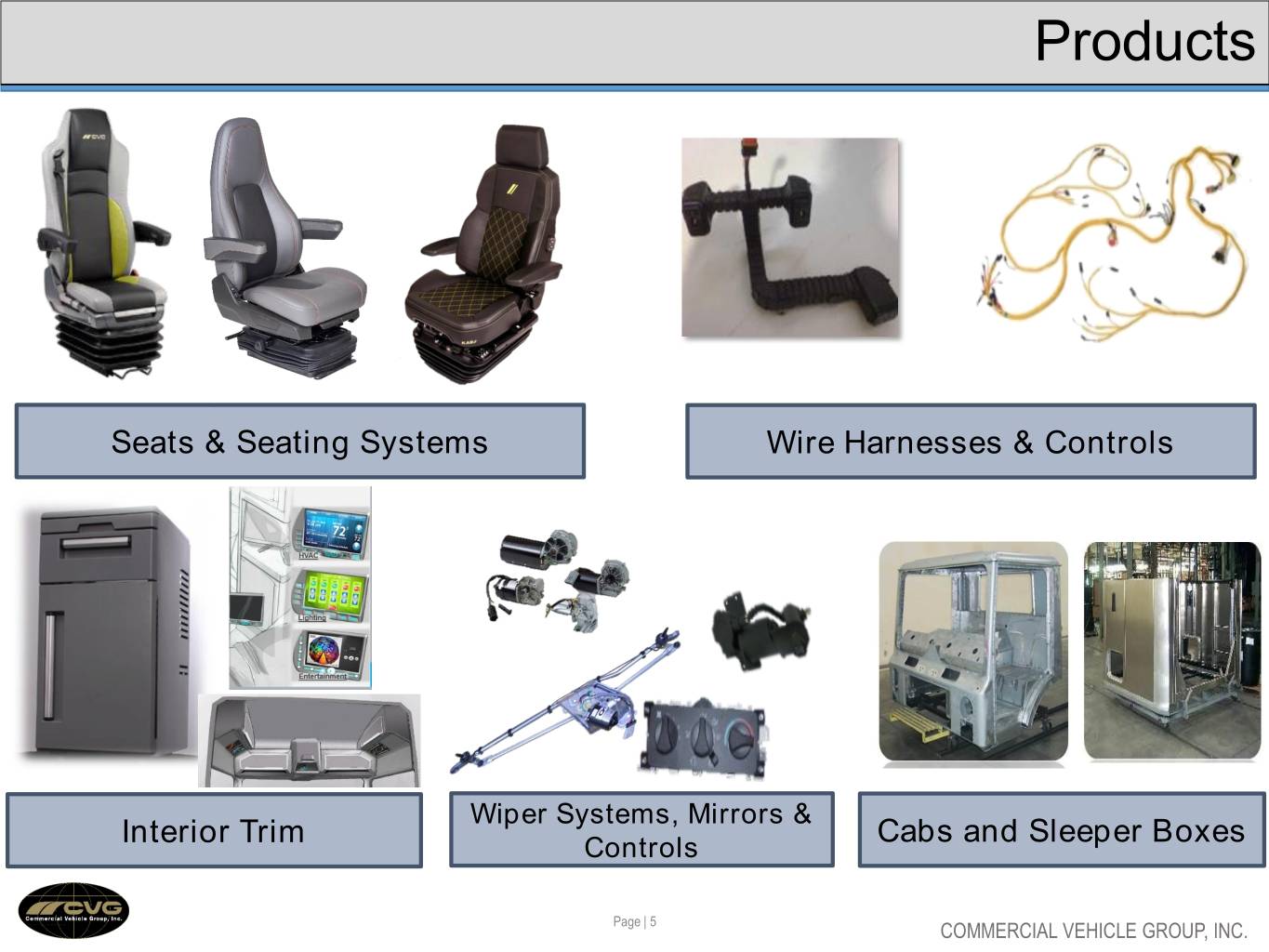

Products Seats & Seating Systems Wire Harnesses & Controls Wiper Systems, Mirrors & Interior Trim Cabs and Sleeper Boxes Controls Page | 5 COMMERCIAL VEHICLE GROUP, INC.

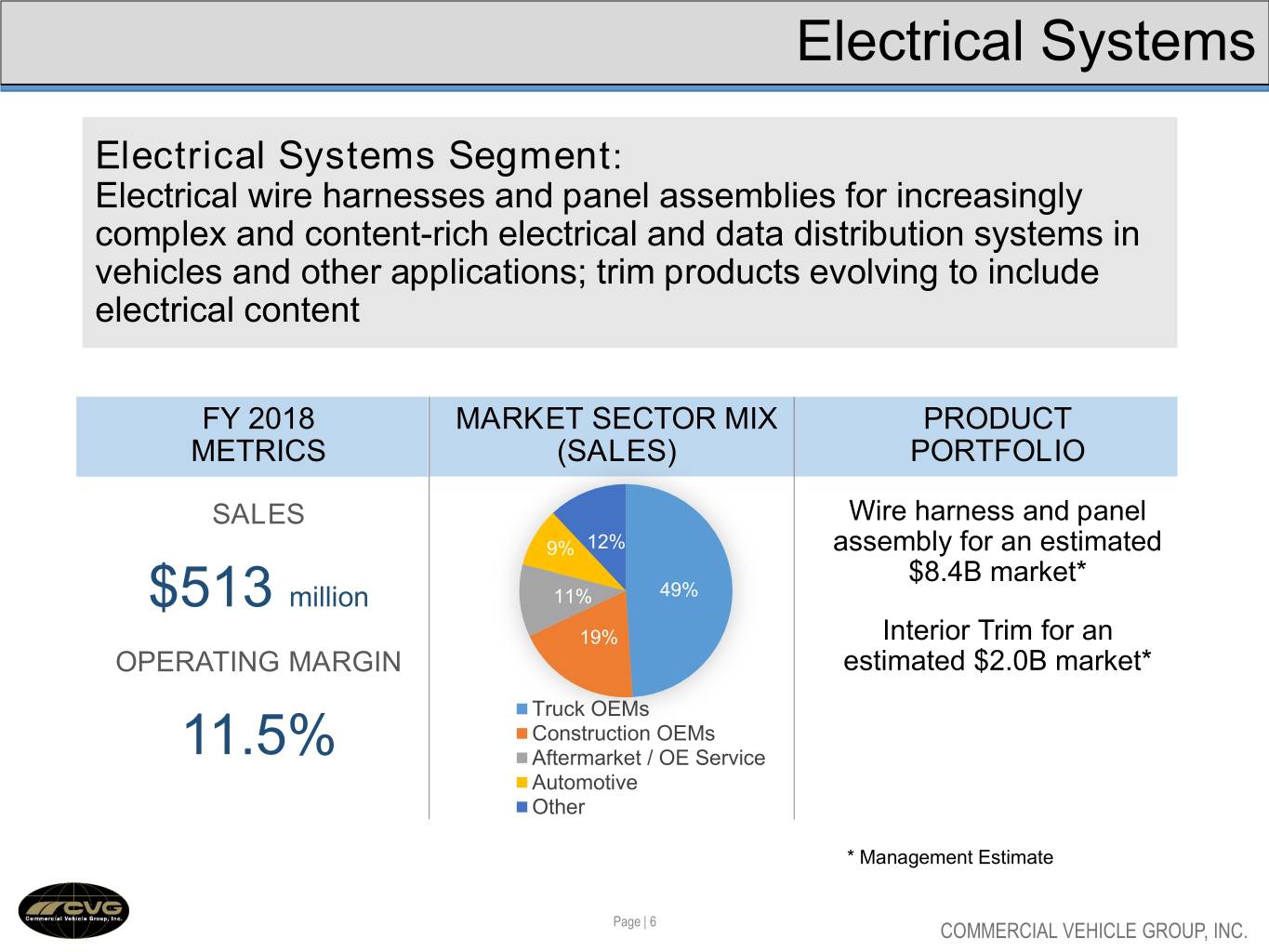

Electrical Systems Electrical Systems Segment: Electrical wire harnesses and panel assemblies for increasingly complex and content-rich electrical and data distribution systems in vehicles and other applications; trim products evolving to include electrical content FY 2018 MARKET SECTOR MIX PRODUCT METRICS (SALES) PORTFOLIO SALES Wire harness and panel 9% 12% assembly for an estimated $8.4B market* $513 million 11% 49% 19% Interior Trim for an OPERATING MARGIN estimated $2.0B market* Truck OEMs Construction OEMs 11.5% Aftermarket / OE Service Automotive Other * Management Estimate Page | 6 COMMERCIAL VEHICLE GROUP, INC.

Growth Drivers – Electrical Systems Macro Economic Trends - Global electrical distribution market expected to grow 6.5% CAGR through 2023* Diversification - Adjacent market penetration in truck powertrain, power generation, European off-road, and other industrial applications Digitalization and connectivity - Growth of electrification, power and data usage drives Next-Level harness content Performance Technology - Integrated sensor technology, active electronics, embedded software and other power and data applications for trim products Industry Trends - Continued increase in composite materials inside the vehicle and more focus on styling for commercial applications * Bishop Incorporated 2018 Annual Report Page | 7 COMMERCIAL VEHICLE GROUP, INC.

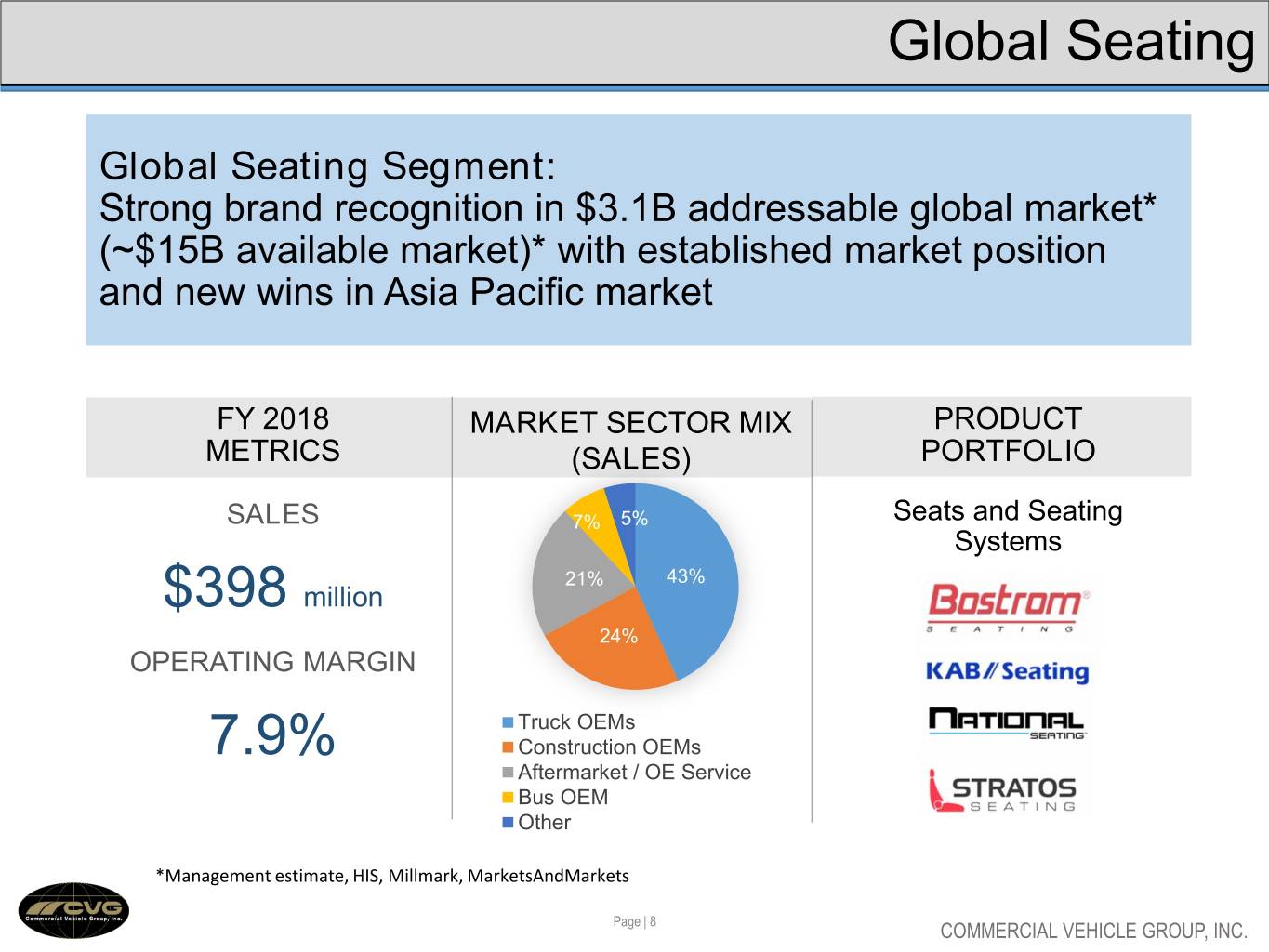

Global Seating Global Seating Segment: Strong brand recognition in $3.1B addressable global market* (~$15B available market)* with established market position and new wins in Asia Pacific market FY 2018 MARKET SECTOR MIX PRODUCT METRICS (SALES) PORTFOLIO SALES 7% 5% Seats and Seating Systems 21% 43% $398 million 24% OPERATING MARGIN Truck OEMs 7.9% Construction OEMs Aftermarket / OE Service Bus OEM Other *Management estimate, HIS, Millmark, MarketsAndMarkets Page | 8 COMMERCIAL VEHICLE GROUP, INC.

Growth Drivers – Global Seating Brand - Strong brand recognition Product Enhancements - New modular seat product leverages product engineering, design and manufacturing capabilities across end markets; maintains functionality and styling options while reducing complexity and cost Global Trends - Increasing trend towards Expand Global improved seating functionality, including style Presence and quality in Asia Pacific Increasing Market Share - Recent new customer wins and expanding customer relationships in Asia Pacific Footprint Expansion - New facility in Thailand Page | 9 COMMERCIAL VEHICLE GROUP, INC.

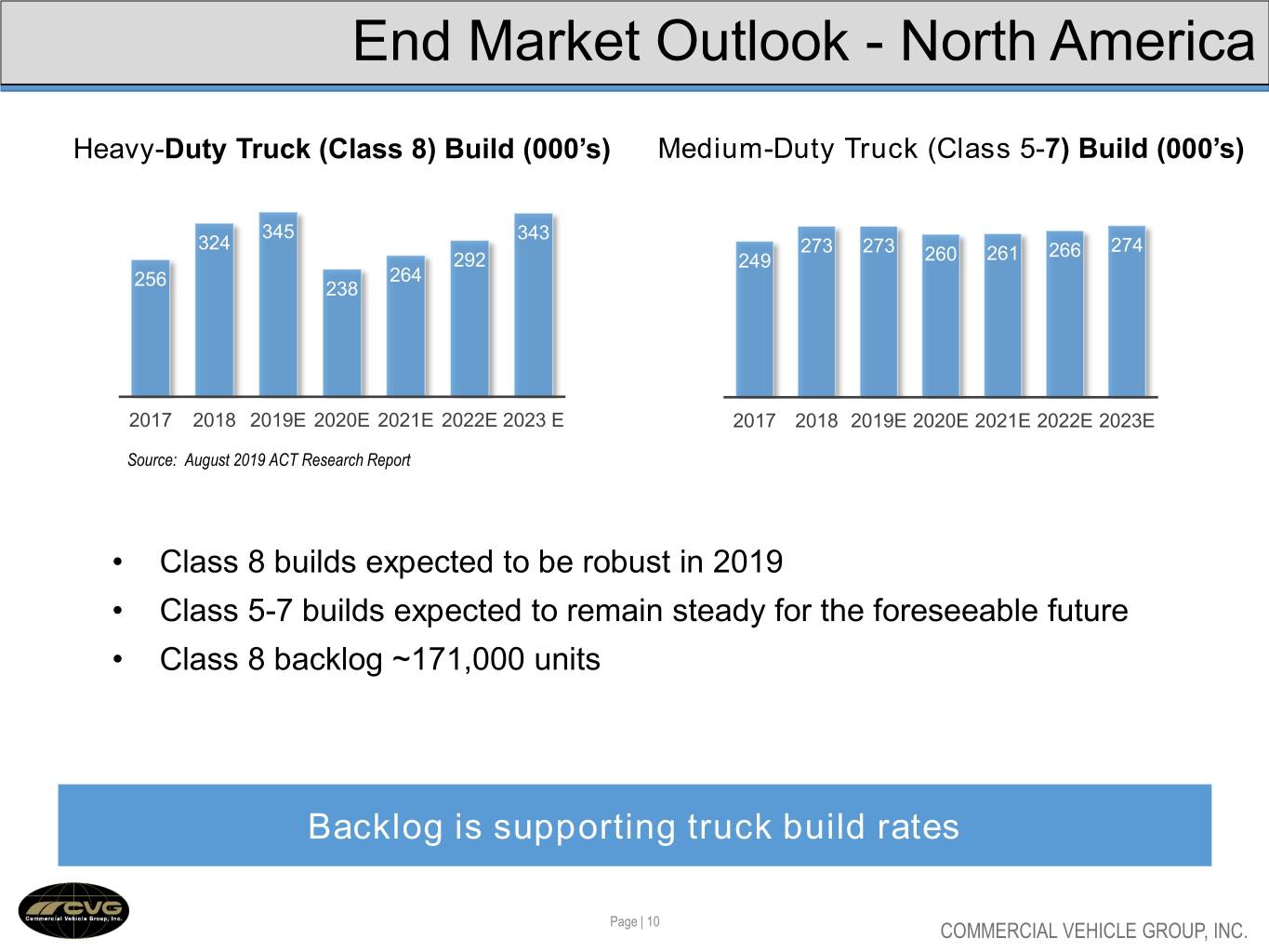

End Market Outlook - North America Heavy-Duty Truck (Class 8) Build (000’s) Medium-Duty Truck (Class 5-7) Build (000’s) 345 343 324 273 273 266 274 292 249 260 261 264 256 238 2017 2018 2019E 2020E 2021E 2022E 2023 E 2017 2018 2019E 2020E 2021E 2022E 2023E Source: August 2019 ACT Research Report • Class 8 builds expected to be robust in 2019 • Class 5-7 builds expected to remain steady for the foreseeable future • Class 8 backlog ~171,000 units Backlog is supporting truck build rates Page | 10 COMMERCIAL VEHICLE GROUP, INC.

End Market Outlook – Global Construction Equipment HD-MD Construction Machinery (000’s) Excavator Industry US/CAN* (6-40mt) (000’s) 1,216 1,121 32.5 32.8 1,019 29.9 896 24.7 2017 2018 2019E 2020E 2017 2018 2019E 2020E Source: Management estimates, Millmark, S&OP data *Global Excavator growth in line with US/CAN trends Global HD-MD construction machinery growth in 2019 driven by infrastructure and oil spending Backlogs have stabilized while rental utilization remains high Inventories are reaching target levels Excavators continue to gain popularity and grow as a percentage of total construction machinery; CVG seat leader on excavators Growth opportunities in Southeast Asia Page | 11 COMMERCIAL VEHICLE GROUP, INC.

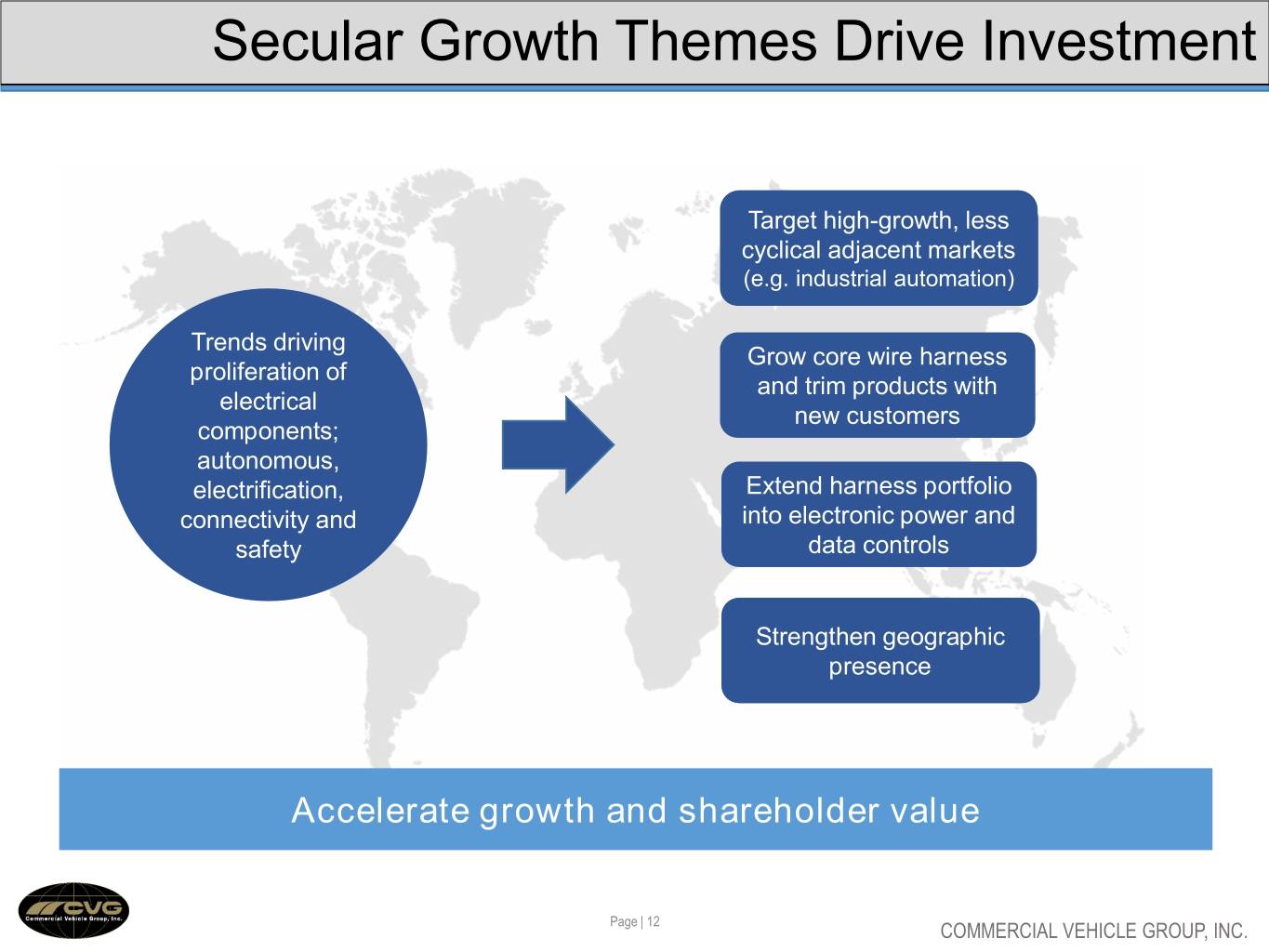

Secular Growth Themes Drive Investment Target high-growth, less cyclicalTarget highadjacent-growth, markets less (e.g. cyclicalindustrial markets automation) Trends driving Grow core wire harness proliferation of Deliver differentiated and trim products with electrical solutions new customers components; autonomous, Extend harness portfolio electrification, Strengthen geographical into electronic power and connectivity and presence safety data controls BuildStrengthen on wire geographic harness or trim productpresence categories Accelerate growth and shareholder value Page | 12 COMMERCIAL VEHICLE GROUP, INC.

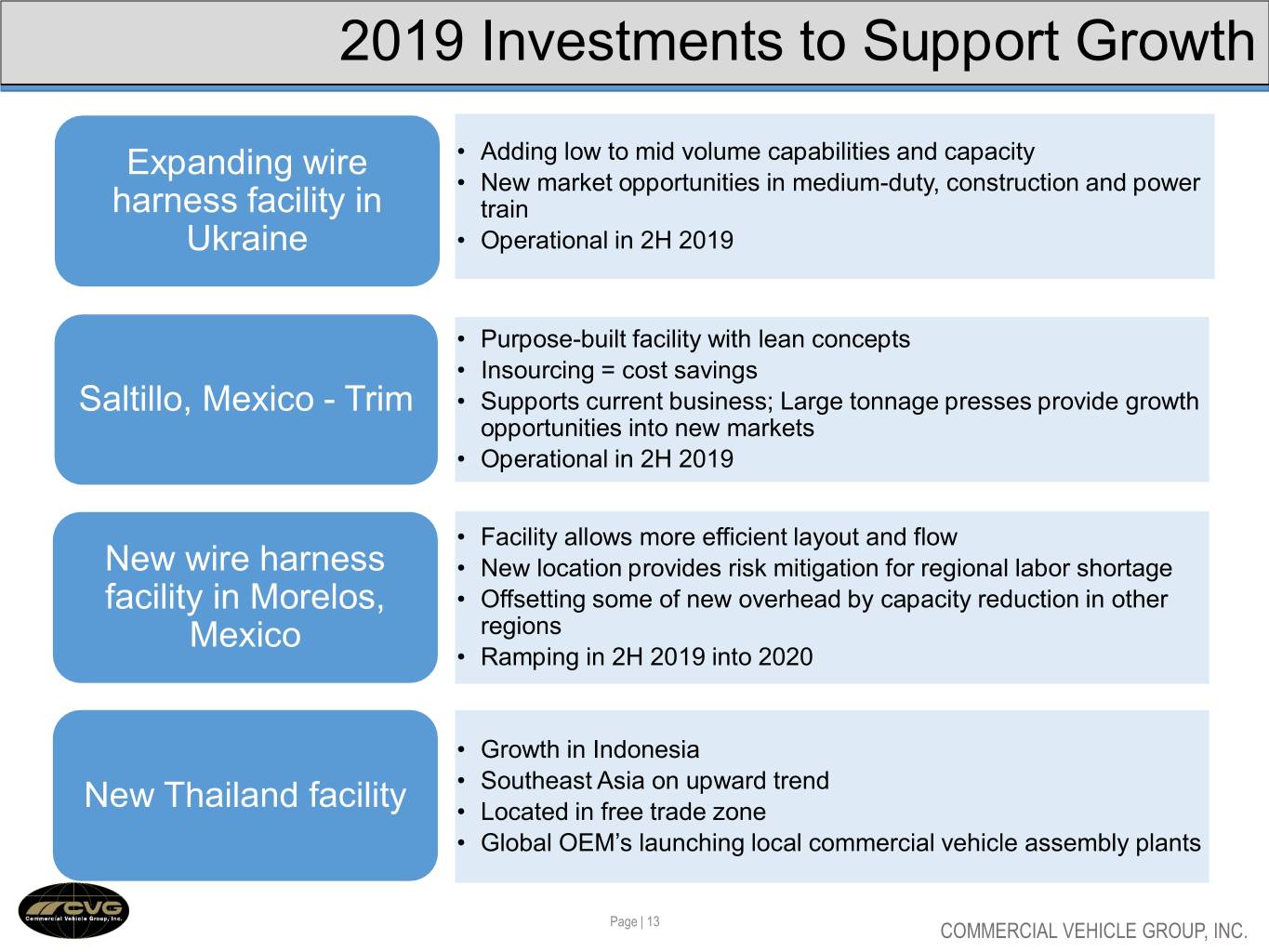

2019 Investments to Support Growth Expanding wire • Adding low to mid volume capabilities and capacity • New market opportunities in medium-duty, construction and power harness facility in train Ukraine • Operational in 2H 2019 • Purpose-built facility with lean concepts • Insourcing = cost savings Saltillo, Mexico - Trim • Supports current business; Large tonnage presses provide growth opportunities into new markets • Operational in 2H 2019 • Facility allows more efficient layout and flow New wire harness • New location provides risk mitigation for regional labor shortage facility in Morelos, • Offsetting some of new overhead by capacity reduction in other Mexico regions • Ramping in 2H 2019 into 2020 • Growth in Indonesia • Southeast Asia on upward trend New Thailand facility • Located in free trade zone • Global OEM’s launching local commercial vehicle assembly plants Page | 13 COMMERCIAL VEHICLE GROUP, INC.

Finance Update COMMERCIAL VEHICLE GROUP, INC.

Historical Performance Revenues (Millions) Operating Income (Millions) & Margin $898 7.4% $755 3.8% 4.1% $67 $662 $25 $31 2016 2017 2018 2016 2017 2018 Strong end-market performance Reflects benefit of margin enhancement actions Revenues up 36% from 2016 Restructuring Both segments contributing to growth Cost control/recovery Electrical Systems 37% Lean Manufacturing Global Seating 36% Operating income more than doubled from 2016; 360 bps improvement in operating margin from 2016 2018 free cash flow $27 million Page | 15 COMMERCIAL VEHICLE GROUP, INC.

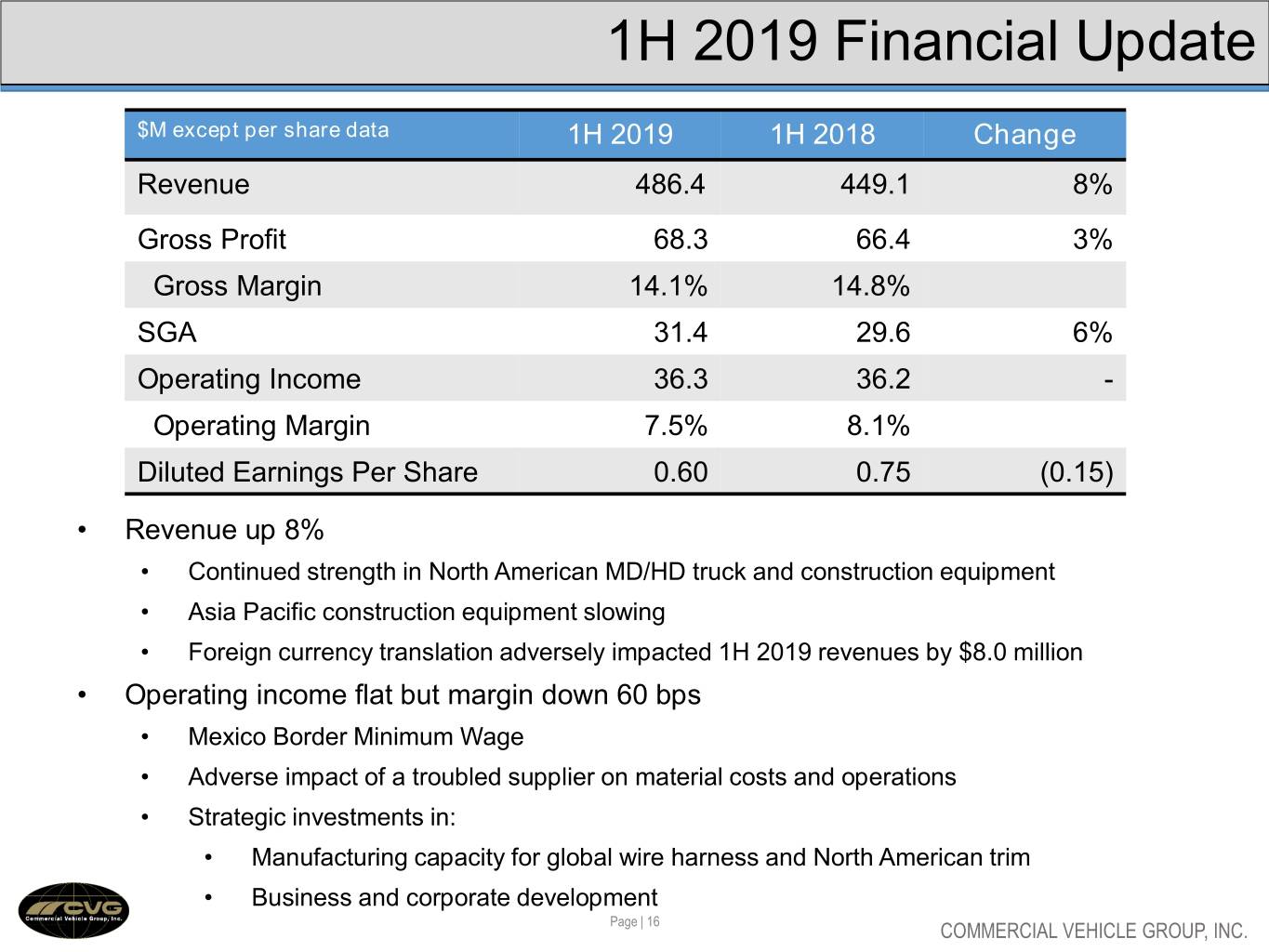

1H 2019 Financial Update $M except per share data 1H 2019 1H 2018 Change Revenue 486.4 449.1 8% Gross Profit 68.3 66.4 3% Gross Margin 14.1% 14.8% SGA 31.4 29.6 6% Operating Income 36.3 36.2 - Operating Margin 7.5% 8.1% Diluted Earnings Per Share 0.60 0.75 (0.15) • Revenue up 8% • Continued strength in North American MD/HD truck and construction equipment • Asia Pacific construction equipment slowing • Foreign currency translation adversely impacted 1H 2019 revenues by $8.0 million • Operating income flat but margin down 60 bps • Mexico Border Minimum Wage • Adverse impact of a troubled supplier on material costs and operations • Strategic investments in: • Manufacturing capacity for global wire harness and North American trim • Business and corporate development Page | 16 COMMERCIAL VEHICLE GROUP, INC.

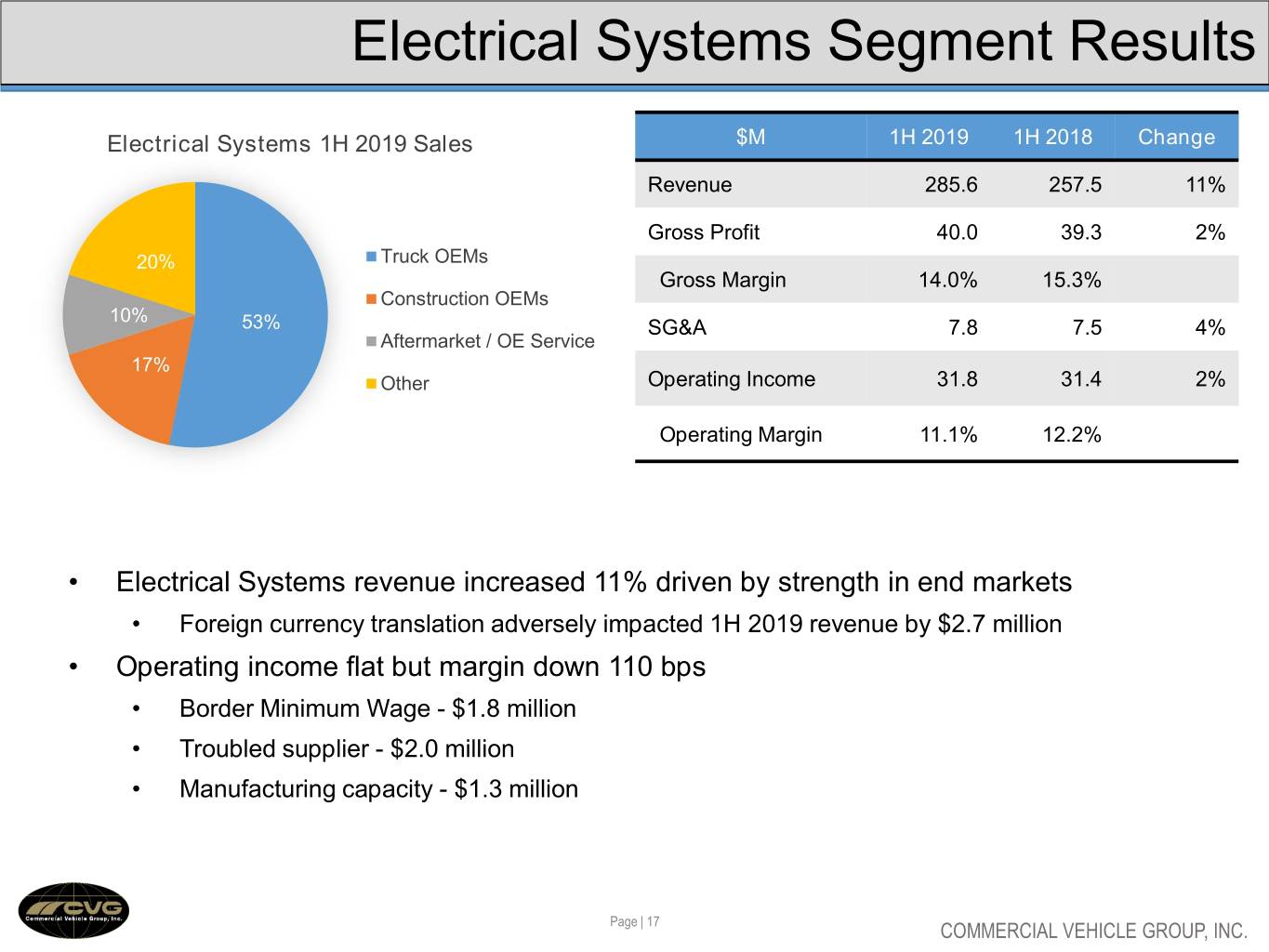

Electrical Systems Segment Results Electrical Systems 1H 2019 Sales $M 1H 2019 1H 2018 Change Revenue 285.6 257.5 11% Gross Profit 40.0 39.3 2% 20% Truck OEMs Gross Margin 14.0% 15.3% Construction OEMs 10% 53% SG&A 7.8 7.5 4% Aftermarket / OE Service 17% Other Operating Income 31.8 31.4 2% Operating Margin 11.1% 12.2% • Electrical Systems revenue increased 11% driven by strength in end markets • Foreign currency translation adversely impacted 1H 2019 revenue by $2.7 million • Operating income flat but margin down 110 bps • Border Minimum Wage - $1.8 million • Troubled supplier - $2.0 million • Manufacturing capacity - $1.3 million Page | 17 COMMERCIAL VEHICLE GROUP, INC.

Global Seating Segment Sales Global Seating 1H 2019 Sales $M 1H 2019 1H 2018 Change Revenue 209.3 197.3 6% Gross Profit 28.5 27.6 3% 11% Truck OEMs Gross Margin 13.6% 14.0% 20% Construction OEMs 48% Aftermarket / OE Service SG&A 10.5 11.2 (6)% Other 21% Operating Income 17.7 16.1 10% Operating Margin 8.4% 8.2% • Global Seating revenue increased 6% driven by strength in North America MD/HD truck, partially offset by softening in Asia Pacific Construction Equipment market • Foreign currency translation adversely impacted 1H 2019 revenue by $5.3 million • Operating income and margin up • SG&A down Page | 18 COMMERCIAL VEHICLE GROUP, INC.

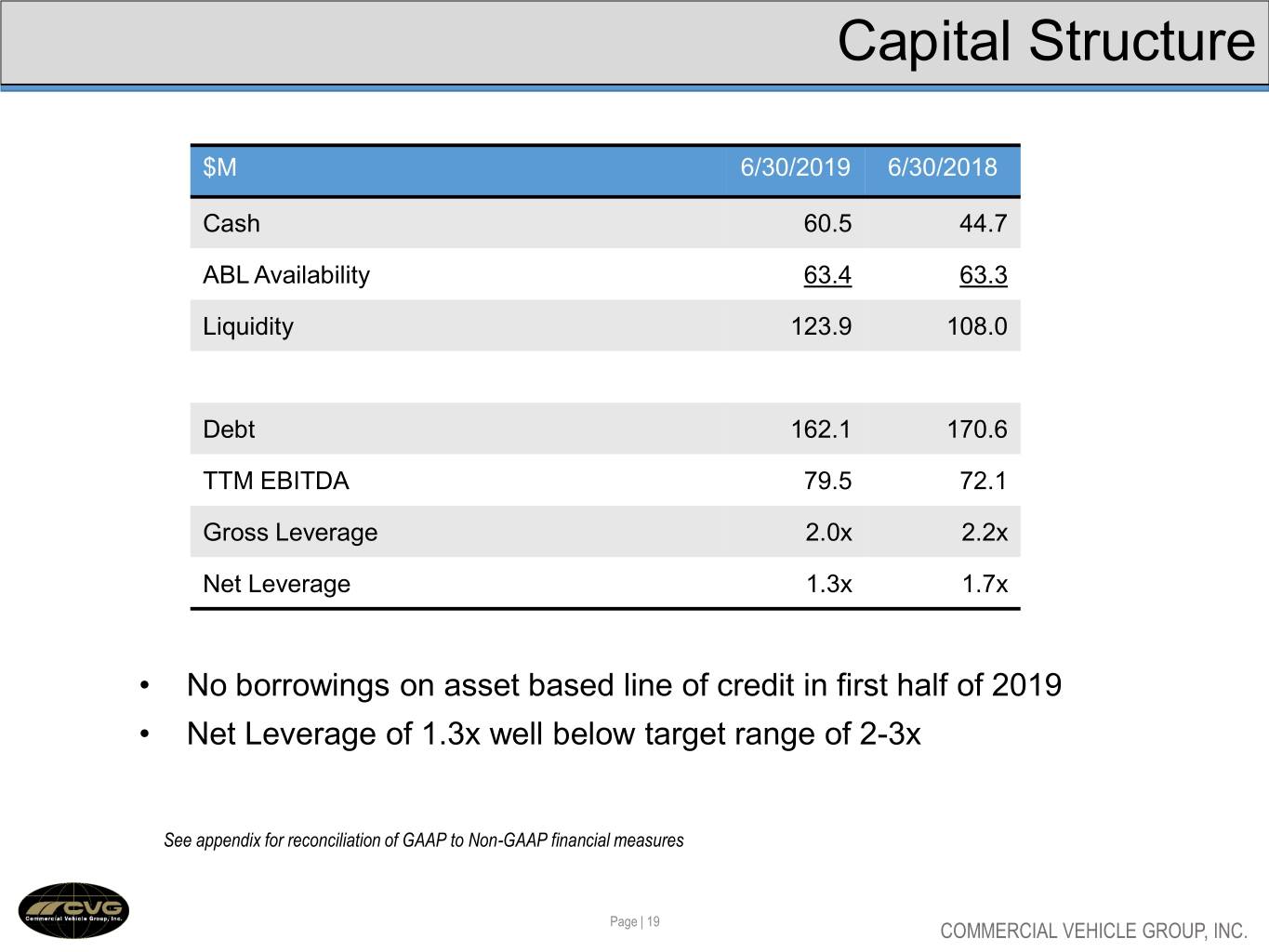

Capital Structure $M 6/30/2019 6/30/2018 Cash 60.5 44.7 ABL Availability 63.4 63.3 Liquidity 123.9 108.0 Debt 162.1 170.6 TTM EBITDA 79.5 72.1 Gross Leverage 2.0x 2.2x Net Leverage 1.3x 1.7x • No borrowings on asset based line of credit in first half of 2019 • Net Leverage of 1.3x well below target range of 2-3x See appendix for reconciliation of GAAP to Non-GAAP financial measures Page | 19 COMMERCIAL VEHICLE GROUP, INC.

Investment Highlights Leading supplier of electrical wire harnesses, seating systems and a full range of cab related components to the global commercial vehicle industry Strong and growing global presence – 25 facilities across North America, Europe and Asia Pacific FY 2018 revenue $898 million, operating margin 7.4% and free cash flow $27 million Favorable industry and secular trends support growth potential Opportunities to expand into adjacent markets to diversify business and mitigate impact of cyclicality Realigned business structure to improve synergies and organic growth Solid balance sheet Page | 20 COMMERCIAL VEHICLE GROUP, INC.

Appendix COMMERCIAL VEHICLE GROUP, INC.

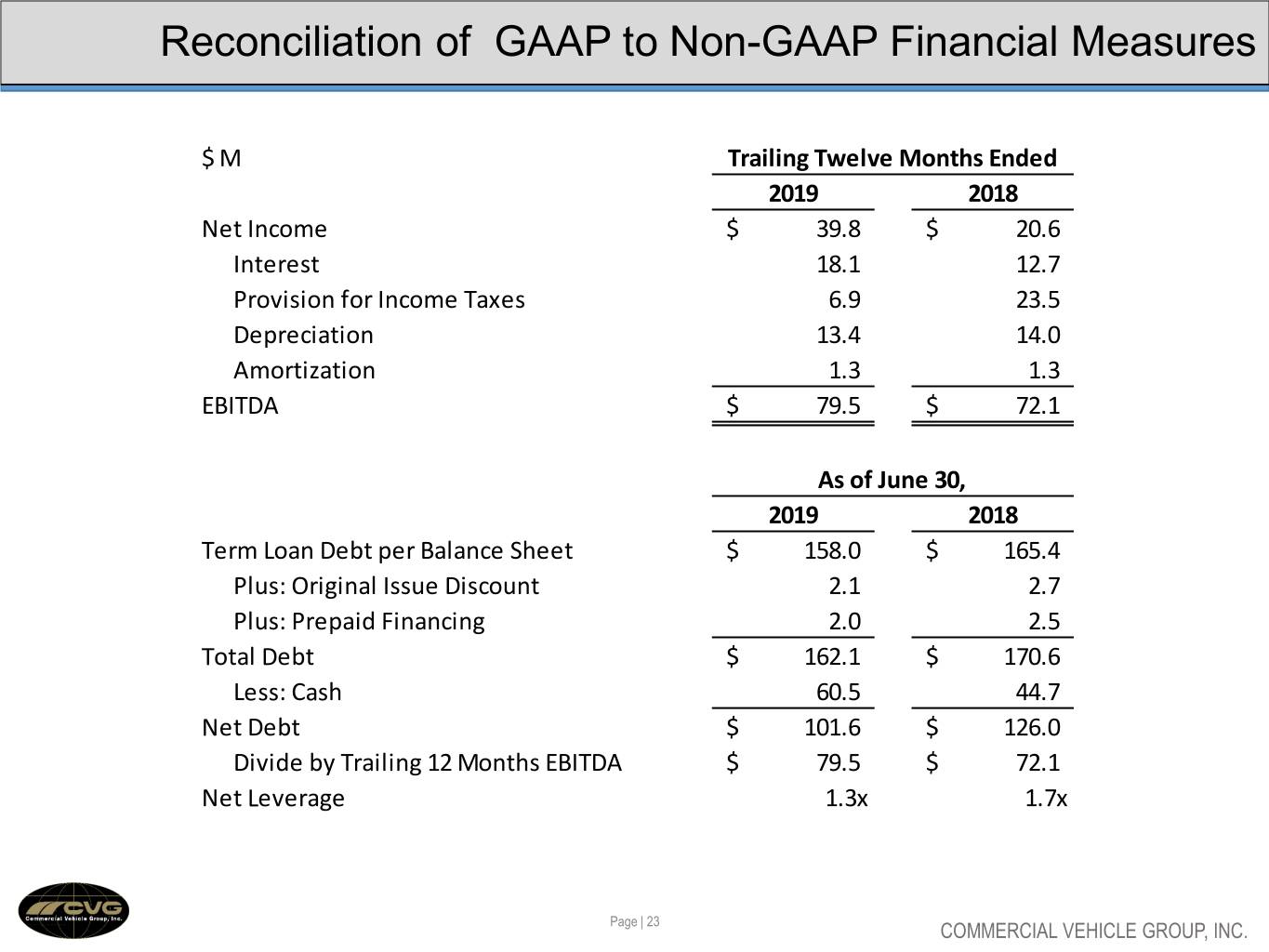

Use of Non-GAAP Measures This presentation contains financial measures that are not calculated in accordance with U.S. generally accepted accounting principles (“GAAP”). In general, the non-GAAP measures exclude items that (i) management believes reflect the Company’s multi-year corporate activities; or (ii) relate to activities or actions that may have occurred over multiple or in prior periods without predictable trends. Management uses these non-GAAP financial measures internally to evaluate the Company’s performance, engage in financial and operational planning and to determine incentive compensation. Management provides these non-GAAP financial measures to investors as supplemental metrics to assist readers in assessing the effects of items and events on the Company’s financial and operating results and in comparing the Company’s performance to that of its competitors and to comparable reporting periods. The non-GAAP financial measures used by the Company may be calculated differently from, and therefore may not be comparable to, similarly titled measures used by other companies. The non-GAAP financial measures disclosed by the Company should not be considered a substitute for, or superior to, financial measures calculated in accordance with GAAP. The financial results calculated in accordance with GAAP and reconciliations to those financial statements set forth above should be carefully evaluated. Page | 22 COMMERCIAL VEHICLE GROUP, INC.

Reconciliation of GAAP to Non-GAAP Financial Measures $ M Trailing Twelve Months Ended 2019 2018 Net Income $ 39.8 $ 20.6 Interest 18.1 12.7 Provision for Income Taxes 6.9 23.5 Depreciation 13.4 14.0 Amortization 1.3 1.3 EBITDA $ 79.5 $ 72.1 As of June 30, 2019 2018 Term Loan Debt per Balance Sheet $ 158.0 $ 165.4 Plus: Original Issue Discount 2.1 2.7 Plus: Prepaid Financing 2.0 2.5 Total Debt $ 162.1 $ 170.6 Less: Cash 60.5 44.7 Net Debt $ 101.6 $ 126.0 Divide by Trailing 12 Months EBITDA $ 79.5 $ 72.1 Net Leverage 1.3x 1.7x Page | 23 COMMERCIAL VEHICLE GROUP, INC.