UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| | | | | |

| ☑ | Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

or

| | | | | |

| ☐ | Transition report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

| | | | | | | | |

| For the fiscal year ended December 31, 2021 | | Commission file number: 001-34365 |

COMMERCIAL VEHICLE GROUP, INC.

(Exact name of Registrant as specified in its charter)

| | | | | | | | |

| Delaware | | 41-1990662 |

| (State of Incorporation) | | (I.R.S. Employer Identification No.) |

| | |

| 7800 Walton Parkway | | 43054 |

| New Albany, Ohio | | (Zip Code) |

| (Address of Principal Executive Offices) | | |

Registrant’s telephone number, including area code:

(614) 289-5360

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of Each Class | Trading Symbol | Name of exchange on which registered |

| Common Stock, par value $.01 per share | CVGI | The NASDAQ Global Select Market |

| | |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Schedule 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically, every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ¨ Accelerated filer þ Non-accelerated filer ¨ Smaller reporting company ☐ Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☑

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No þ

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold on June 30, 2021, was $335,586,432.

As of March 1, 2022, 32,879,150 shares of Common Stock of the Registrant were outstanding.

Documents Incorporated by Reference

Information required by Items 10, 11, 12, 13 and 14 of Part III of this Annual Report on Form 10-K is incorporated by reference from the Registrant’s Proxy Statement for its annual meeting to be held May 19, 2022 (the “2022 Proxy Statement”).

COMMERCIAL VEHICLE GROUP, INC.

Annual Report on Form 10-K

Table of Contents

| | | | | | | | |

| | | Page |

| PART I | |

| Item 1. | | |

| Item 1A. | | |

| Item 1B. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| |

| PART II | |

| Item 5. | | |

| Item 6. | | |

| Item 7. | | |

| Item 7A. | | |

| Item 8. | | |

| Item 9. | | |

| Item 9A. | | |

| Item 9B. | | |

| Item 9C. | | |

| |

| PART III | |

| Item 10. | | |

| Item 11. | | |

| Item 12. | | |

| Item 13. | | |

| Item 14. | | |

| |

| PART IV | |

| Item 15. | | |

| Item 16. | | |

| |

CERTAIN DEFINITIONS

All references in this Annual Report on Form 10-K to the “Company”, “Commercial Vehicle Group”, “CVG”, “we”, “us”, and “our” refer to Commercial Vehicle Group, Inc. and its consolidated subsidiaries (unless the context otherwise requires).

FORWARD-LOOKING INFORMATION

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended. For this purpose, any statements contained herein that are not statements of historical fact, including without limitation, certain statements under “Item 1 - Business” and “Item 7 - Management’s Discussion and Analysis of Financial Condition and Results of Operations” and located elsewhere herein regarding industry outlook, the Company’s expectations for future periods with respect to its plans to improve financial results, the future of the Company’s end markets, including the short-term and long-term impact of the COVID-19 pandemic on our business and the global supply chain, changes in the Class 8 and Class 5-7 North America truck build rates, performance of the global construction equipment business, the Company’s prospects in the wire harness, warehouse automation and electric vehicle markets, the Company’s initiatives to address customer needs, organic growth, the Company’s strategic plans and plans to focus on certain segments, competition faced by the Company, volatility in and disruption to the global economic environment, including inflation and labor shortages, financial covenant compliance, anticipated effects of acquisitions, production of new products, plans for capital expenditures and our results of operations or financial position and liquidity, may be deemed to be forward-looking statements. Without limiting the foregoing, the words “believe”, “anticipate”, “plan”, “expect”, “intend”, “will”, “should”, “could”, “would”, “project”, “continue”, “likely”, and similar expressions, as they relate to us, are intended to identify forward-looking statements. The important factors discussed in “Item 1A - Risk Factors”, among others, could cause actual results to differ materially from those indicated by forward-looking statements made herein and presented elsewhere by management from time to time. Such forward-looking statements represent management’s current expectations and are inherently uncertain. Investors are warned that actual results may differ from management’s expectations. Additionally, various economic and competitive factors could cause actual results to differ materially from those discussed in such forward-looking statements, including, but not limited to, factors which are outside our control.

Any forward-looking statement that we make in this report speaks only as of the date of such statement, and we undertake no obligation to update any forward-looking statement or to publicly announce the results of any revision to any of those statements to reflect future events or developments. Comparisons of results for current and any prior periods are not intended to express any future trends or indications of future performance, unless specifically expressed as such, and should only be viewed as historical data.

PART I

Item 1. Business

COMPANY OVERVIEW

CVG is a global provider of systems, assemblies and components to the global commercial vehicle market, the electric vehicle market, and the warehouse automation markets.

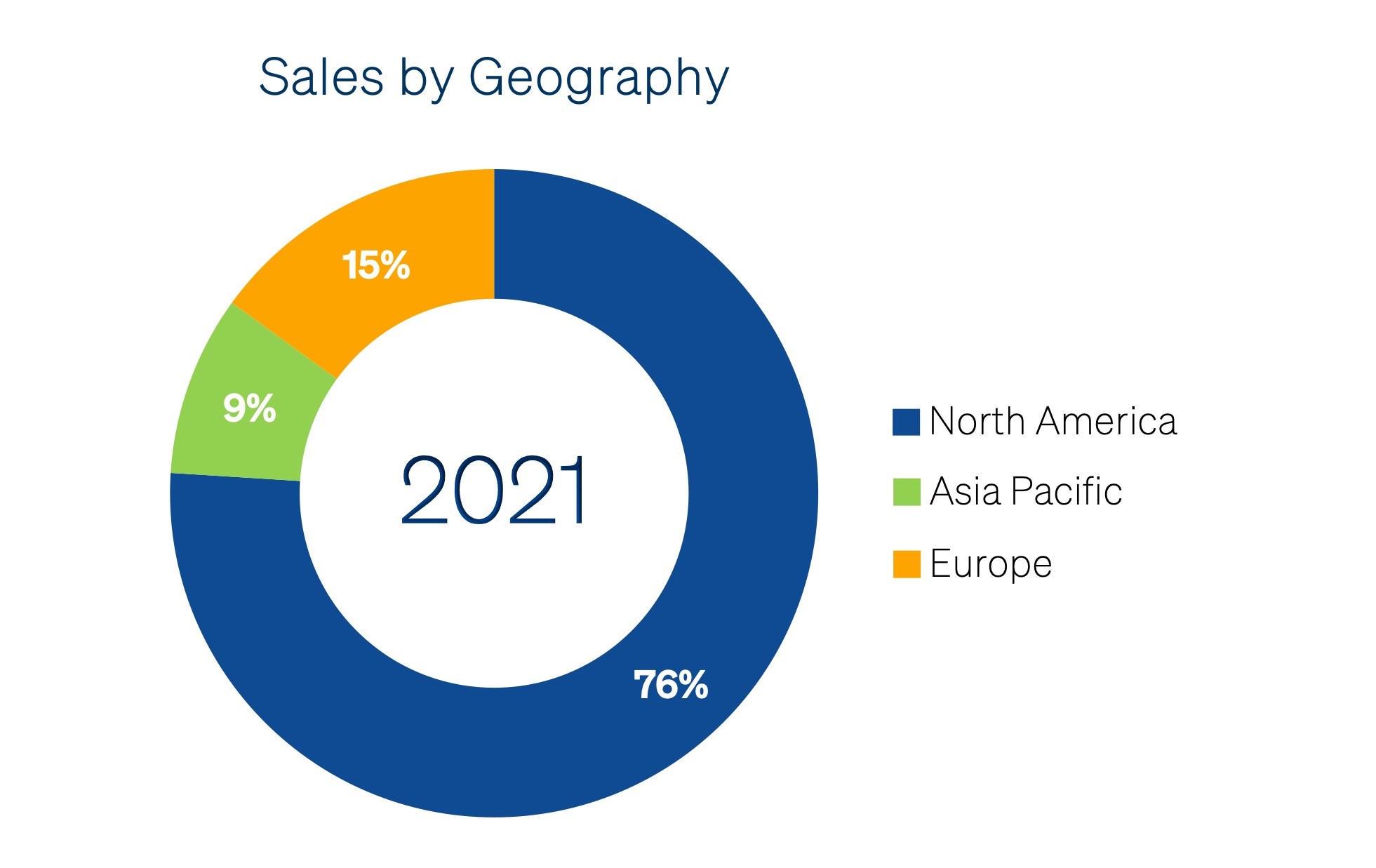

We have manufacturing operations in the United States, Mexico, China, United Kingdom, Belgium, Czech Republic, Ukraine, Thailand, India and Australia. Our products are primarily sold in North America, Europe, and the Asia-Pacific region.

We primarily manufacture customized products to meet the requirements of our customer. We believe our products are used by a majority of the North American Commercial Truck manufacturers, many construction vehicle original equipment manufacturers ("OEMs") and top e-commerce retailers.

Our Long-term Strategy

Refer to Item 7, Management's Discussion and Analysis of Financial Condition and Results of Operations.

SEGMENTS

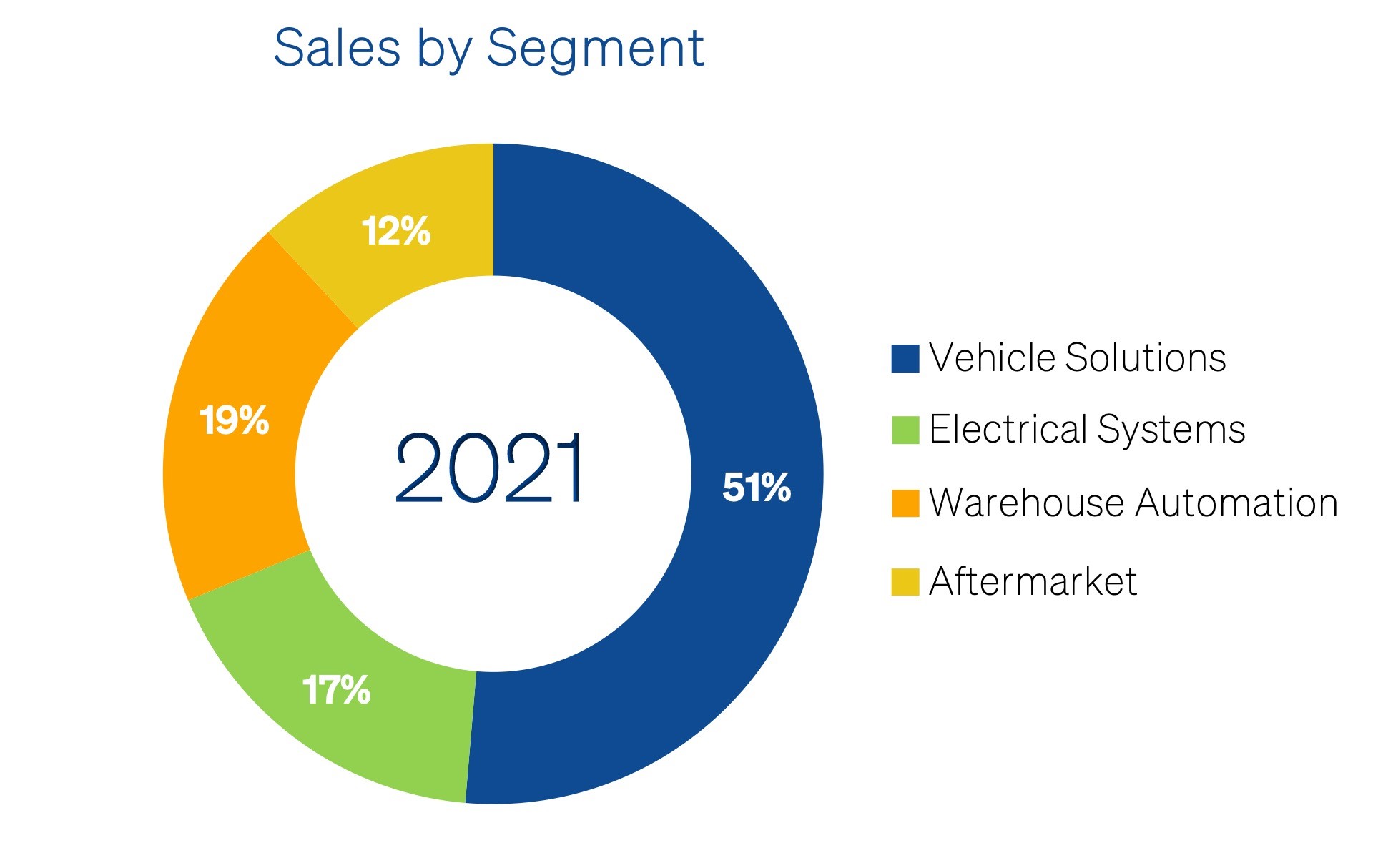

In the quarter ended December 31, 2021, we completed a strategic reorganization of our operations into four segments, Vehicle Solutions, Warehouse Automation, Electrical Systems and Aftermarket & Accessories. The reorganization will allow the Company to better focus on growth opportunities, capital allocation and enhancing shareholder value. As a result of the strategic reorganization, the prior period segment information has been reclassified to conform to the new organization structure. See Note 16, Segment Reporting, to our consolidated financial statements in Item 8 in this Annual Report on Form 10-K.

Our segments offer various products which are sold into many end markets such as internal combustion commercial vehicles, electric vehicles, construction equipment, warehouse automation and military. Certain of our facilities manufacture and sell products through multiple business segments. The products produced by each of our segments are more specifically described below.

The Vehicle Solutions segment designs, manufactures and sells the following products:

•Commercial vehicle seats for the global commercial vehicle markets including heavy duty trucks, medium duty trucks, last mile delivery trucks and vans, construction and agriculture equipment in North America, Europe and Asia-Pacific. This segment includes a portion of the company’s activities in the electric vehicle market;

•Plastic components ("Trim") primarily for the North America commercial vehicle market and recreational vehicle markets; and Cab structures for the North American medium-duty/heavy-duty ("MD/HD") truck market.

The Warehouse Automation segment designs, manufactures and sells the following products:

•Warehouse automation subsystems including control panels, electro-mechanical assemblies, cable assemblies, and power and communication solutions.

•The end markets for these products primarily include e-commerce, warehouse integration, transportation and the military/defense industry.

The Electrical Systems segment designs, manufactures and sells the following products:

•Cable and harness assemblies for both high and low voltage applications, control boxes, dashboard assemblies and design and engineering for these applications.

•The end markets for these products are construction, agricultural, industrial, automotive (both internal combustion and electric vehicles), truck, mining, rail and the military/ defense industries in North America, Europe and Asia-Pacific.

The Aftermarket & Accessories segment designs, manufactures and sells the following products:

•Seats and components sold into the commercial vehicle markets in North America, Europe and Asia-Pacific;

•Commercial vehicle accessories including wipers, mirrors, and sensors; and

•Office seats primarily in Europe and Asia-Pacific.

The charts below display CVG's net sales by segment and geography for the year ended December 31, 2021.

VEHICLE SOLUTIONS SEGMENT OVERVIEW

Vehicle Solutions Segment Products

Set forth below is a brief description of our products manufactured in the Vehicle Solutions Segment and their applications.

Seats and Seating Systems. We design, engineer and produce seats for MD/HD truck, bus, construction, agriculture and military markets. Our seats are primarily sold fully-assembled and ready for installation. We offer a wide range of seats that include mechanical and air suspension seats, static seats, bus seats and military seats. As a result of our product design and product technology, we believe we are a leader in designing seats with convenience and safety features. Our seats are designed to achieve a high level of operator comfort by adding a wide range of manual and power features such as lumbar support, cushion and back bolsters, and leg and thigh support. Our seats are built to meet customer requirements in low volumes and produced in numerous feature combinations to form a full-range product line with a wide level of price points.

Our seats are sold under multiple brands, including KAB Seating™, National Seating™, Bostrom Seating®, and Stratos™.

Plastic Assemblies and Components. We design, engineer and produce plastic components and assemblies for medium and heavy duty trucks, recreational vehicles, specialty vehicle applications, and diversified markets. We offer thermoformed products, injection molded products, reaction injection molded products (RIM), and decorated / hydrographic finished products. We also assemble components and fabrics to these formed plastic parts and deliver complete subassemblies. Our principal products in this category include:

Molded Products. Our molded products include both large and small parts. Specific components include vinyl or cloth-covered appliqués ranging from a traditional cut and sew approach to a contemporary molded styling theme, armrests, map pocket compartments, and sound-reducing insulation.

Instrument Panels. We produce and assemble instrument panels that can be integrated with the rest of the interior trim. The instrument panel is a complex system of coverings and foam, plastic and metal parts designed to house various components and act as a safety device for the vehicle occupant.

Plastics Decorating and Finishing. We offer customers a wide variety of cost-effective finishes in paint, ultra violet, hard coating and customized industrial hydrographic films (simulated appearance of wood grain, carbon fiber, brushed metal, marbles, camouflage and custom patterns), and other interior and exterior finishes.

Our plastic products are sold under several brand names including FinishTEK™ and AdvancTek™.

Cab Structures and Interior Parts. We design, engineer and produce complete cab structures and interior design components for commercial vehicles. Our principal products in this category include:

Cab Structures. We design, manufacture and assemble complete cab structures. Our cab structures, which are manufactured from both steel and aluminum, are delivered fully assembled and primed for paint.

Cab Interiors. We design, manufacture and provide a variety of interior design products including armrests, grab handles, storage systems, floor coverings, floor mats, sleeper bunks, headliners, wall panels, and privacy curtains that can be part of the overall cab structure or standalone assemblies depending on the customer application.

WAREHOUSE AUTOMATION SEGMENT OVERVIEW

Warehouse Automation Segment Products

Electrical Systems, Panel Assemblies, and Electro-Mechanical Assemblies. We offer a wide range of material handling equipment, electrical distribution systems, and related assemblies primarily for the e-commerce, warehouse integration, transportation and the military/ defense markets. Our principal products in this category include:

Panel Assemblies. We offer integrated assemblies and cabinets that are installed in a vehicle or unit of equipment and may be integrated with our wire harness assemblies. These components provide the user control over multiple operational functions and features.

Electro-Mechanical Assemblies. We offer electro-mechanical assemblies, including box builds, complex automated and robotic assemblies, and large multi-cabinet control cabinets with power distribution and cabling. Our service includes mechanical assembly, wire and cable routing, automated wire preparation capabilities, complex configurations, test and custom palletizing and crating solutions.

ELECTRICAL SYSTEMS SEGMENT OVERVIEW

Electrical Systems Segment Products

Wire Harness Assemblies. We design, engineer and produce a wide range of high and low voltage electrical wire systems for vehicles and subsystems, which include, Ethernet, battery cables and power distribution boxes. Our electrical wire harness assemblies function as the primary electric current carrying devices used to provide electrical interconnections for gauges, lights, control functions, power circuits, powertrain and transmission sensors, emissions systems and other electronic applications on commercial and other vehicles. Our wire harnesses are customized to fit specific end-user requirements and can be complex. Our production capabilities include low and high volume serial production with low and high volume circuitry, RIM (reaction injection molding) and specialized testing.

Cable Harness Assemblies. Our primary product offerings include engineering design for customized cable assemblies, control boxes, fuse boxes, dashboard assemblies in multiple sizes, complexity, and applications. Our engineering and production capabilities include virtual wiring boards, automatic plug insertion stations, system architecture and schematic development and prototyping.

Our electrical systems segment products are sold into the construction, agriculture, industrial, e-commerce and electric vehicles, traditional automotive, mining, rail and military end markets.

AFTERMARKET & ACCESSORIES SEGMENT OVERVIEW

Aftermarket & Accessories Segment Products

We design, manufacture, and provide a variety of seats, mirrors, wipers and wiper systems sold into the commercial MD/HD truck, military and specialty recreational vehicles, electric vehicle, office and home office markets. These products are sold under various brands including, Bostrom®, National Seating™, Moto Mirror®, KAB Seating™ (for both vehicles and Office markets), Sprague Devices® and RoadWatch®.

Our aftermarket products are primarily sold through the Original Equipment Service (OES) sales channel and direct into the retail aftermarket as replacements for original equipment in North America, Europe and Asia Pacific.

OUR CONSOLIDATED OPERATIONS

As a diverse global company, we are affected by economic and market developments around the world, supply chain disruptions, instability in certain regions, commodity prices, foreign currency volatility and policies regarding trade and imports. While we continue to operate, consistent with applicable government guidelines, we are experiencing, and may continue to experience, production slowdowns and/or shutdowns at our manufacturing facilities in North America, Europe and Asia Pacific as a result of government orders, our inability to obtain component parts from suppliers and/or unpredictable customer demand. In addition, many of our suppliers and customers are also experiencing, and may continue to experience, production slowdowns and/or shutdowns, which may further impact our business, sales and results of operation.

Primary Industries Served

Commercial Vehicle Market. Commercial vehicles are used in a wide variety of end markets, including local and long-haul commercial trucking, bus, construction, mining, agricultural, military, industrial, municipal, off-road recreational and specialty vehicle markets. The commercial vehicle supply industry can generally be separated into two categories: (1) sales to OEMs, in which products are sold in relatively large quantities directly for use by OEMs in new commercial and construction vehicles; and (2) aftermarket sales, in which products are sold as replacements to a wide range of original equipment service organizations, wholesalers, retailers and installers. Additionally, we are seeing a trend toward alternate fuel and electric vehicles, middle-mile and last-mile vehicle models.

North American Commercial Truck Market. Purchasers of commercial trucks include fleet operators, owner operators, governmental agencies and industrial end users. Commercial vehicles used for local and long-haul commercial trucking are generally classified by gross vehicle weight. Class 8 vehicles are trucks with gross vehicle weight in excess of 33,000 lbs. and Classes 5 through 7 vehicles are trucks with gross vehicle weight from 16,001 lbs. to 33,000 lbs. Separately, we are seeing changes in e-commerce behaviors that are driving increased demand for middle-mile and last-mile vehicles.

The following describes the major markets within the commercial vehicle market in which the Vehicle Solutions Segment competes:

Class 8 Truck Market. The global Class 8 ("Class 8" or "heavy-duty") truck manufacturing market is concentrated in three primary regions: North America, Europe and Asia-Pacific. The global Class 8 truck market is localized in nature due to the following factors: (1) the prohibitive costs of shipping components from one region to another, (2) the high degree of customization to meet the region-specific demands of end-users, and (3) the ability to meet just-in-time delivery requirements. New Class 8 truck demand is cyclical and is particularly sensitive to economic factors that generate a significant portion of the freight tonnage hauled by commercial vehicles.

Class 5-7 Truck Market. North American Class 5-7 ("Class 5-7" or "medium-duty") includes recreational vehicles, buses and medium-duty trucks. We primarily participate in the Class 6 and 7 portion of the medium-duty truck market. The medium-duty truck market is influenced by overall economic conditions but has historically been less cyclical than the North American Class 8 truck market.

Commercial Truck Aftermarket. Demand for aftermarket products is driven by the quality of OEM parts, the number of vehicles in operation, the average age of the vehicle fleet, the content and value per vehicle, vehicle usage and the average useful life of vehicle parts. Aftermarket sales tend to be at a higher margin. The recurring nature of aftermarket revenue can be expected to provide some insulation to the overall cyclical nature of the industry as it tends to provide a more stable stream of revenues. Brand equity and the extent of a company’s distribution network also contribute to the level of aftermarket sales. We believe CVG has a widely recognized brand portfolio and participates in most retail sales channels including original equipment dealer networks and independent distributors.

Construction Equipment Market. New vehicle demand in the global construction equipment market generally follows certain economic conditions including gross domestic product, infrastructure investment, housing starts, business investment, oil and energy investment and industrial production around the world. Within the construction market, there are two classes of construction equipment markets: the medium and heavy construction equipment market (weighing over 12 metric tons) and the light construction equipment market (weighing below 12 metric tons). We primarily supply OEMs with our wire harness and seating products. Our construction equipment products are primarily used in the medium and heavy construction equipment markets. The platforms that we generally participate in include: cranes, pavers, planers and profilers, dozers, loaders, graders, haulers, tractors, excavators, backhoes, material handling and compactors. Demand in the medium and heavy construction equipment market is typically related to the level of larger-scale infrastructure development projects such as highways, dams, harbors, hospitals, airports and industrial development as well as activity in the mining, forestry and other commodities industries.

Purchasers of medium and heavy construction equipment include construction companies, municipalities, local governments, rental fleet owners, quarrying and mining companies and forestry related industries. Purchasers of light construction equipment include contractors, rental fleet owners, landscapers, logistics companies and farmers.

Military Equipment Market. We supply products for heavy- and medium-payload tactical vehicles and complex military communications equipment over multiple product lines that are used by various defense customers. Military equipment production is particularly sensitive to political and governmental budgetary considerations.

Warehouse Automation Market. Shifting retailer behavior and consumer expectations are creating a significant need for incremental automation within warehouses. Given consumer demands for next-day (and same-day) delivery,

there has been a surge in demand for “last mile” urban fulfillment centers, which are typically supported by very large distribution centers located in the outer ring of a city. Additionally, increased throughput volume, a greater variety of order and package types, and more frequent product returns by end consumers, all support the rationale for continued investment in automated solutions by warehouse operators. We supply material handling subsystems incorporated into automated warehouses.

Our Customer Contracts, and Sales and Marketing

Our customers generally source business to us pursuant to written contracts, purchase orders or other commitments (“Commercial Arrangements”) with terms of price, quality, technology, and delivery. Awarded business generally covers the supply of all or a portion of a customer’s production and service requirements for a particular product program rather than the supply of a specific quantity of products. In general, these Commercial Arrangements provide that the customer can terminate them if we do not meet specified quality, delivery and cost requirements. Although these Commercial Arrangements may be terminated at any time by our customers (but generally not by us), such terminations have historically been minimal and have not had a material impact on our results of operations.

Our Commercial Arrangements with our OEM customers may provide for an annual prospective productivity price reduction. These productivity price reductions are generally calculated on an annual basis as a percentage of the previous year’s purchases by each customer. Historically, most of these price reductions have been offset by internal cost reductions and through the assistance of our supply base, although no assurances can be given that we will be able to achieve such reductions in the future. The cost reduction is achieved through engineering changes, material cost reductions, logistics savings, reductions in packaging cost, labor efficiencies and other productivity actions.

Our sales and marketing efforts are designed to create customer awareness of our engineering, design and manufacturing capabilities. Our sales and marketing staff work closely with our design and engineering personnel to prepare the materials used for bidding on new business, as well as to provide an interface between us and our key customers. We have sales and marketing personnel located in every major region in which we operate. From time to time, we participate in industry trade shows and advertise in industry publications.

Our Supply Agreements

Our supply agreements generally provide for fixed pricing but do not require us to purchase any specified quantities. Normally we do not carry inventories of raw materials or finished products in excess of what is reasonably required to meet production and shipping schedules, as well as service requirements. Steel, aluminum, petroleum-based products, copper, resin, foam, fabrics, wire and wire components comprise the most significant portion of our raw material costs. We typically purchase steel, copper and petroleum-based products at market prices that are fixed over varying periods of time. Due to the volatility in pricing, we use methods such as market index pricing and competitive bidding to assist in reducing our overall cost. The impact of the COVID-19 pandemic on raw materials has affected the supply and prices of certain of our products. We strive to align our customer pricing and material costs to minimize the impact of price fluctuations. Certain component purchases and suppliers are directed by our customers, so we generally will pass through directly to the customer cost changes from these components. We generally are not dependent on a single supplier or limited group of suppliers for our raw materials.

Competition

Within each of our principal product categories we compete with a variety of independent suppliers and with vertically integrated in-house operations, primarily on the basis of price, breadth of product offerings, product quality, technical expertise, development capability, product delivery and product service.

Manufacturing Processes

We utilize a wide range of manufacturing processes to produce our products. The end markets for our products can be highly specialized and our customers frequently request modified products in low volumes within an expedited delivery timeframe. As a result, we primarily utilize flexible manufacturing cells at our production facilities. Manufacturing cells are clusters of individual manufacturing operations and work stations. This provides flexibility by allowing efficient changes to the number of operations each operator performs. When compared to the more traditional, less flexible assembly line process, cell manufacturing allows us to better maintain our product output consistent with our OEM customers’ requirements and minimize the level of inventory.

We have systems in place that allow us to provide complete customized interior kits in returnable containers and disposable dunnage that are delivered in sequence. Several of our manufacturing facilities are strategically located near our customers’ assembly facilities, which facilitates this process and minimizes shipping costs.

We employ just-in-time manufacturing and sourcing in our operations to meet customer requirements for faster deliveries and to minimize our need to carry significant inventory levels. We utilize material systems to manage inventory levels and, in certain locations, we have inventory delivered as often as two times per day from a nearby facility based on the previous day’s order, which reduces the need to carry excess inventory at our facilities.

We strive to maintain a certain portion of temporary labor to improve our ability to flex our costs and throughput as required by fluctuating customer demand. We engage our core employees to assist in making our processes efficient.

Research and Development

Our research and development capabilities offer quality and technologically advanced products to our customers at competitive prices. We offer product styling, product design, specialized simulation and testing and evaluation services that are necessary in today’s global markets. Our capabilities in acoustics, thermal efficiency, benchmarking, multi-axis durability, biomechanics, comfort, prototyping and process prove-out allow us to provide complete integrated solutions.

We engage in global engineering, and research and development activities that improve the reliability, performance and cost-effectiveness of our existing products and support the design, development and testing of new products for existing and new applications. Generally, we work with our customers’ engineering and development teams at the beginning of the design process for new components and assemblies and systems, or the re-engineering process for existing components and assemblies, in order to leverage production efficiency and quality.

Research and development costs for the years ended December 31, 2021, 2020 and 2019 totaled $9.1 million, $6.4 million and $9.9 million, respectively.

Intellectual Property

Our major brands include CVG™, Sprague Devices®, Moto Mirror®, RoadWatch®, KAB Seating™, National Seating™, Bostrom Seating®, Stratos™, FinishTEK™ and AdvancTek™. We believe that our brands are valuable but that our business is not dependent on any one brand. We own U.S. federal trademark registrations for several of our product brands.

Environmental

The Company is subject to changing federal, state, and local laws and regulations governing the protection of the environment and occupational health and safety, including laws regulating air emissions, wastewater discharges, generation, storage, handling, use and transportation of hazardous materials; the emission and discharge of hazardous materials into the soil, ground or air; and the health and safety of our colleagues. Stringent fines and penalties may be imposed for noncompliance with these laws. In addition, environmental laws could impose liability for costs associated with investigating and remediating contamination at the Company’s facilities or at third-party facilities at which the Company may arrange for the disposal treatment of hazardous materials.

The Company believes it is in compliance in all material respects, with all applicable environmental laws and the Company is not aware of any noncompliance or obligation to investigate or remediate contamination that could reasonably be expected to result in a material liability. Several of our facilities are either certified as, or are in the process of being certified as ISO 9001, 14000, 14001 or TS16949 (the international environmental management standard) compliant or are developing similar environmental management systems. We have made, and will continue to make, capital and other expenditures to implement such environmental programs and comply with environmental requirements.

The environmental laws continue to be amended and revised to impose stricter obligations, and compliance with future additional environmental requirements could necessitate capital outlays. However, the Company does not believe that these expenditures will ultimately result in a material adverse effect on its financial position or results of operations. The Company cannot predict the precise effect such future requirements, if enacted, would have on the Company. The Company believes that such regulations would be enacted over time and would affect the industry as a whole.

Human Capital, Environmental, Social and Governance

As of December 31, 2021, we had approximately 7,600 employees of which 7,300 were permanent employees and 300 (4%) were temporary employees. 6,100 (81%) of the Company's employees are international and 1,500 (20%) of the Company's

employees are in the United States. It is customary for the company to employ temporary employees to both flex up / down to demand rates. Of our permanent workforce, approximately 1,000 (13%) were salaried and the remainder were hourly. As of December 31, 2021, all of the Company's U.S. employees were non-union and a majority of the Company's personnel in Mexico were unionized. Approximately 74% of our European, Asian and Australian operations were represented by some form of shop steward committees.

The Company is committed to establishing and developing a workforce to support our long term diversification and growth strategy through targeted external recruiting, and internal development and succession planning. We have developed leaders and emerging leaders for targeted training opportunities and have leveraged online learning platforms to make training more accessible for our workforce.

Compensation and Benefits - Our compensation programs reinforce a pay for performance philosophy with market-based compensation and benefits that are competitive for the manufacturing sector. Specific programs vary worldwide based on regional practices and benchmarks.

Diversity, Equity and Inclusion - The Company is intentional in its commitment to diversity, equity and inclusion including a diverse Board of Directors and executive leadership team. Approximately one fourth of our current Board is diverse by race or gender and one fourth of our current executive team is diverse by race or gender with others bringing diversity of experience, thought and perspective to their leadership roles. Among our global workforce, 44% is female, and among our domestic workforce, 27% is racially diverse.

The Company recognizes the importance of leveraging diversity, equity and inclusion in who we are and how we work. Our Executive Diversity & Inclusion Steering Committee continues to focus on expanding the diversity of our talent pipeline through our recruiting, development, communication, and retention. We will focus on the role our culture plays in creating the right environment for diverse thinking and inclusive approaches to work. During regular engagements with our leadership teams, we are highlighting how our organizational evolution benefits from a culture of diversity. We are also reestablishing the connection to the communities where our employees live and work, enabling our teams to grow both professionally and personally.

Safety - The safety of our workforce has always been a top priority and the Company is proud of our safety record, which includes three consecutive years of declining recordable incidents and five consecutive years of declining incident rates. Our 2021 full year incident rate of 0.63 is below the industry benchmarks and five of our global facilities were incident free in calendar year 2021.

The impact of the COVID-19 pandemic continues to require our focus and monitoring. We continued the evolution of safety practices and procedures to protect our employees, ensuring our work continuity as an essential manufacturing employer. During 2021, we maintained our prevention and mitigation strategies including minimal travel across borders where non-essential, visitor restrictions, and site screening protocols were in place. We continue to use safety programs in our largest facilities for rapid onsite antibody testing and high-capacity thermal scanners. As we see surges occur in local areas, our sites have adopted flexible programs regarding masks and social distancing as required. Some of our plants continue to operate with masking policies where we experience a surge in cases both in the facility or the larger community.

CVG is committed to operating in an ethical and sustainable manner that benefits all our stakeholders including customers, employees and the communities we serve. We have established company-wide environmental, human rights and labor rights policies that outline the Company’s standards for all business operations. More information on these policies can be found on our website under the caption “About Us - CVG Policies,” including highlights of our ongoing Environmental, Social and Governance (“ESG”) efforts related to safety, quality, environmental, community engagement and corporate governance.

AVAILABLE INFORMATION

We maintain a website on the Internet at www.cvgrp.com. We make available free of charge through our website, by way of a hyperlink to a third-party Securities Exchange Commission ("SEC") filing website, our Annual Reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, including exhibits and amendments to those reports electronically filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act of 1934. Such information is available as soon as such reports are filed with the SEC. Additionally, our Code of Ethics may be accessed within the Investor Relations section of our website. Information found on our website is not part of this Annual Report on Form 10-K or any other report filed with the SEC.

INFORMATION ABOUT OUR EXECUTIVE OFFICERS

See Item 10. Directors, Executive Officers and Corporate Governance" in Part III of this Annual Report on Form 10-K.

Item 1A.Risk Factors

You should carefully consider the risks described below before making an investment decision. These are not the only risks we face. If any of these risks and uncertainties were to actually occur, our business, financial condition or results of operations could be materially and adversely affected. In such case, the trading price of our common stock could decline and you may lose all or part of your investment.

Risks Related to COVID-19 Pandemic, health epidemics and Global Economy

Our financial condition and results of operations have been and will continue to be adversely affected by the coronavirus pandemic

The global spread of COVID-19 that was declared a pandemic by the World Health Organization and the preventative measures taken to contain or mitigate the outbreak have caused, and are continuing to cause, significant volatility and uncertainty and economic disruptions. The outbreak has resulted in governments around the world implementing increasingly stringent measures to contain or mitigate the spread of the virus, including quarantines, “shelter in place” and “stay at home” orders, travel restrictions, business curtailments, vaccine mandates and other measures. While we continue to operate, consistent with applicable government guidelines, we are experiencing, and may continue to experience, production slowdowns and/or shutdowns at our manufacturing facilities in North America, Europe and Asia Pacific as a result of government orders, our inability to obtain component parts from suppliers and/or unpredictable customer demand. In addition, many of our suppliers and customers are also experiencing, and may continue to experience, production slowdowns and/or shutdowns, which may further impact our business, sales and results of operation.

The resulting financial impact of COVID-19 has adversely affected our business, supply chain, sales, results of operations, financial condition and cash flows. Even after the COVID-19 pandemic subsides, we may experience adverse impacts to our business due to any resulting economic inflation, recession or depression that may continue to impact customer demand and the financial instability or operating viability of our suppliers and customers. Additionally, a significant outbreak of any other contagious diseases in the human population could result in a widespread health crisis that could adversely affect the economies and financial markets of many countries, resulting in an economic downturn that could affect demand for our products and adversely impact our operating results.

Volatility in and disruption to the global economic environment and changes in the regulatory and business environments in which we operate may have an adverse effect on our business, results of operations and financial condition.

The commercial vehicle industry as a whole has been more adversely affected by volatile economic conditions than many other industries, as the purchase or replacement of commercial vehicles, which are durable items, may be deferred for many reasons. Future changes in the regulatory and business environments in which we operate, including increased trade protectionism and tariffs, may adversely affect our ability to sell our products or source materials needed to manufacture our products. Furthermore, financial instability or bankruptcy at any of our suppliers or customers could disrupt our ability to manufacture our products and impair our ability to collect receivables, any or all of which may have an adverse effect on our business, results of operations and financial condition. In addition, some of our customers and suppliers may experience serious cash flow problems and, thus, may find it difficult to obtain financing, if financing is available at all. Any inability of customers to pay us for our products and services, or any demands by suppliers for different payment terms, or inability of our suppliers to supply us may adversely affect our results of operations and financial condition. Furthermore, our suppliers may not be successful in generating sufficient sales, restarting or ramping up production or securing alternate financing arrangements, and therefore may no longer be able to supply goods and services to us. In that event, we would need to find alternate sources for these goods and services, and there is no assurance we would be able to find such alternate sources on favorable terms, if at all. Disruption in our supply chain has had and could continue to have an adverse effect on our ability to manufacture and deliver our products on a timely basis, and thereby affect our results of operations.

Risks Related to Our Business and Industry

Our results of operations could be adversely affected by downturns in the U.S. and global economy which are naturally accompanied by related declines in new truck orders by fleets, freight tonnage hauled and in infrastructure development and other construction projects.

Our results of operations are directly impacted by changes in the U.S. and global economic conditions, which are accompanied by related declines in freight tonnage hauled and in infrastructure development and other construction projects because, among other things:

▪Demand for our MD/HD Truck products is generally dependent on the number of new MD/HD Truck commercial vehicles manufactured in North America. Historically, the demand for MD/HD Truck commercial vehicles has declined during periods of weakness in the North American economy.

▪Demand for our construction equipment products is dependent on vehicle demand for new commercial vehicles in the global construction equipment market.

▪Demand in the medium and heavy-construction vehicle market, which is where our products are primarily used, is typically related to the level of larger-scale infrastructure development projects.

If we experience periods of low demand for our products or there is volatility in the commercial vehicle market in the future, it could have an adverse effect on our revenues, operating results and financial position.

We may be unable to successfully implement our business strategy and, as a result, our businesses and financial position and results of operations could be adversely affected.

Our ability to achieve our business and financial objectives is subject to a variety of factors, many of which are beyond our control. For example, we may not be successful in implementing our strategy if unforeseen factors emerge diminishing the current levels or any future expected growth in the commercial vehicle, warehouse automation or electric vehicle markets we supply or expect to penetrate, or we experience increased pressure on our margins. Any failure to successfully implement our business strategy could have an adverse effect on our business, results of operations and growth potential.

We may be unable to complete strategic acquisitions, or we may encounter unforeseen difficulties in integrating acquisitions.

We may pursue acquisition targets that will allow us to continue to expand into new geographic markets, add new customers, provide new products, manufacturing and service capabilities and increase penetration with existing customers. However, we expect to face competition for acquisition candidates, which may limit the number of our acquisition opportunities and may lead to higher acquisition prices. Moreover, acquisition of businesses may require additional debt and/or equity financing, perhaps resulting in additional leverage and/or shareholder dilution. The covenants relating to our debt instruments may further limit our ability to complete acquisitions. There can be no assurance we will find attractive acquisition candidates or successfully integrate acquired businesses into our existing business. If the expected synergies from acquisitions do not materialize or we fail to successfully integrate such new businesses into our existing businesses, our results of operations could also be adversely affected.

Circumstances associated with our acquisition and divestiture strategy could adversely affect our results of operations and financial condition.

From time to time we evaluate the performance and strategic fit of our businesses and may decide to sell a business or product line based on such an evaluation. Any divestitures may result in significant write-offs, including those related to goodwill and other tangible and intangible assets, which could have an adverse effect on our results of operations and financial condition.

Our customer base is concentrated and the loss of business from a major customer or the discontinuation of particular commercial vehicle platforms could reduce our revenues.

Even though we may be selected as the supplier of a product by an OEM for a particular vehicle, our OEM customers issue blanket purchase orders, which generally provide for the supply of that customer’s annual requirements for that vehicle, rather than for a specific number of our products. If the OEM’s requirements are less than estimated, the number of products we sell to that OEM will be accordingly reduced. In addition, the OEM may terminate its purchase orders with us at any time. The loss of any of our large customers or the loss of significant business from any of these customers could have an adverse effect on our business, financial condition and results of operations.

On October 25, 2021, the Company provided notice to the Volvo Group (“Volvo”) of the Company’s intention to terminate its agreement with Volvo, with such termination to become effective twelve months from the date of notice, absent the parties reaching mutually agreeable terms upon which to continue their relationship. If no such agreement is reached, the loss of business from Volvo could have an adverse effect on our business, financial condition and results of operations as sales to Volvo represented more than 10% of reported consolidated net sales during each of the three most recent years.

Our profitability could be adversely affected if the actual production volumes for our customers’ vehicles are significantly lower than expected or our costs are higher than expected.

We incur costs and make capital expenditures based in part upon estimates of production volumes for our customers’ vehicles. While we attempt to establish a price for our components and systems that will compensate for variances in production volumes, if the actual production of these vehicles is significantly less than anticipated, our gross margin on these products would be adversely affected. Our OEM customers have historically had a significant amount of leverage over us. We enter into agreements with our customers at the beginning of a given platform’s life to supply products for that platform. Once we enter into such agreements, fulfillment of the supply requirements is our obligation for the entire production life of the platform, with terms generally ranging from five to seven years, and we have limited provisions to terminate such contracts. We may become committed to supplying products to our customers at selling prices that are not sufficient to cover the direct cost to produce such products, which may be as a result of inflation or increased employment costs as a result of current labor markets or other factors. We cannot predict our customers’ demands for our products. If customers representing a significant amount of our revenues were to purchase materially lower volumes than expected, or if we are unable to keep our commitment under the agreements, or if our costs are higher than anticipated, it would have an adverse effect on our business, financial condition and results of operations.

Additionally, we generally do not have clauses in our customer agreements that guarantee that we will recoup the design and development costs that we incurred to develop a product. In other cases, we share the design costs with the customer and thereby have some risk that not all the costs will be covered if the project does not go forward or if it is not as profitable as expected.

We may be unable to successfully implement price increases to offset inflation and, as a result, our businesses and financial position and results of operations could be adversely affected.

Our ability to implement customer price increases where margin on product is not meeting profitability targets is subject to a variety of factors, such as fluctuations in our material, freight and labor costs, inflation or other competitive conditions, which are beyond our control. For example, customers may refuse to pay increased prices that meet our profitability targets, resource from other suppliers, or not issue purchase orders to us with large volumes. Any failure to successfully implement price increases could have an adverse effect on our business, results of operations and growth potential.

Our inability to compete effectively in the highly competitive warehouse automation industry could result in loss of market share and reduced gross margins, which could have an adverse effect on our revenues and operating results.

The warehouse automation industry is highly competitive. Some of our competitors are companies that are larger and have greater financial and other resources than we do. Our products primarily compete on the basis of price, product quality, technical expertise, development capability, product delivery and product service. Increased competition may lead to price reductions or loss of business resulting in reduced gross margins and loss of market share.

We are subject to certain risks associated with our foreign operations.

We have operations in the Mexico, China, United Kingdom, Czech Republic, Ukraine, Belgium, Australia, India and Thailand, which collectively accounted for approximately 24% of our total revenues for the year ended December 31, 2021. There are certain risks inherent in our international business activities including, but not limited to:

•the difficulty of enforcing agreements and collecting receivables through certain foreign legal systems;

•foreign customers, who may have longer payment cycles than customers in the U.S.;

•foreign currency exchange rate fluctuations affecting our ability to match revenue received with costs;

•tax rates in certain foreign countries, which may exceed those in the U.S., withholding requirements or the imposition of tariffs, exchange controls or other restrictions, including restrictions on repatriation, of foreign earnings;

•intellectual property protection difficulties;

•general economic and political conditions, along with major differences in business culture and practices, including the challenges of dealing with business practices that may impact the company’s compliance efforts, in countries where we operate;

•exposure to local social unrest, including any acts of war, terrorism or similar events;

•exposure to local minimum wage requirements;

•the difficulties associated with managing a large organization spread throughout various countries; and

•complications in complying with a variety of laws and regulations related to doing business with and in foreign countries, some of which may conflict with U.S. law or may be vague or difficult to comply with.

Additionally, our international business activities are also subject to risks arising from violations of U.S. laws such as the U.S. Foreign Corrupt Practices Act and similar anti-bribery laws in other jurisdictions, and various export control and trade embargo laws and regulations, including those which may require licenses or other authorizations for transactions relating to certain countries and/or with certain individuals identified by the U.S. government. If we fail to comply with applicable laws and regulations, we could suffer civil and criminal penalties that could have an adverse effect on our results of operations and financial condition.

Recently, Russian troops invaded Ukraine. The invasion of Ukraine by Russia and the retaliatory measures taken by the U.S., NATO and other countries have created global security concerns and economic uncertainty that could have a lasting impact on regional and global economies. We cannot be certain that similar international tensions will not affect our facility in the Ukraine, including due to the Russian invasion of Ukraine, electrical outages, cyber-attacks and periodic battles with separatists closer to our facility. In addition, certain of our employees in Ukraine are routinely conscripted into the military and/or sent to fight in the ongoing conflict. Furthermore, most of our products manufactured in Ukraine are shipped across the border from Ukraine to the Czech Republic for further delivery to our customers. If that border crossing were to be closed or restricted for any reason, or if our customers decide to stop ordering from us or shift orders to our competitors, we would experience a loss of the use of our Ukrainian facility, which could have an adverse effect on our results of operations and financial condition.

Decreased availability or increased costs of materials could affect both our ability to produce products as well as the cost of producing our products.

We purchase raw materials, fabricated components, assemblies and services from a variety of suppliers. Steel, aluminum, petroleum-based products, copper, resin, foam, fabrics, wire and wire components, semiconductor chips, electronics and electrical components account for the most significant portion of our raw material costs. Although we currently maintain alternative sources for most raw materials, from time to time, however, the prices and availability of these materials fluctuate due to global market demands and other considerations, which could impair the Company's ability to procure necessary materials, or increase the cost of such materials. We may be assessed surcharges on certain purchases of steel, copper and other raw materials. There is currently a well-publicized global shortage of semiconductor chips and several of the raw materials we use that could impact the Company and our customers. Inflationary and other increases in costs or shortages of the various materials that are needed for us to produce our products are currently having an impact on our business which may continue for the foreseeable future. In addition, freight costs associated with shipping and receiving product are impacted by fluctuations in freight tonnage, freight hauler availability or capacity and the cost of oil and gas. We are currently experiencing difficulty purchasing and obtaining timely delivery of certain raw materials required for our operations, which is having an adverse effect on our results of operations. In addition, to the extent we are unable to pass on the increased costs of raw materials, freight and labor to our customers, it could adversely affect our results of operations and financial condition.

We have invested substantial resources in markets where we expect growth and we may be unable to timely alter our strategies should such expectations not be realized.

Our future growth is dependent in part on us making the right investments at the right time in people, technology, product development, manufacturing capacity, and to expand into new markets including in warehouse automation and electric vehicle markets. If we fail to realize expected rates of return on our investments, we may incur losses on such investments and be unable to timely redeploy the invested capital to take advantage of other markets, potentially resulting in lost market share to our competitors.

We cannot guarantee that we will be successful in leveraging our capabilities into new markets and thus, in meeting the needs of these new customers and competing favorably in these new markets.

Our inability to compete effectively in the highly competitive commercial vehicle component supply industry could result in lower prices for our products, loss of market share and reduced gross margins, which could have an adverse effect on our revenues and operating results.

The commercial vehicle component supply industry is highly competitive. Some of our competitors are companies that are larger and have greater financial and other resources than we do. In some cases, we compete with divisions of our OEM customers. Our products primarily compete on the basis of price, breadth of product offerings, product quality, technical expertise, development capability, product delivery and product service. Increased competition may lead to price reductions resulting in reduced gross margins and loss of market share.

We may be unable to successfully introduce new products and, as a result, our business, and financial condition and results of operations could be adversely affected.

Product innovations have been and will continue to be a part of our business strategy. We believe it is important we continue to meet our customers’ demands for product innovation, improvement and enhancement, including the continued development of new-generation products, and design improvements and innovations that improve the quality and efficiency of our products including manufacturing seats with airbags, seatbelts and other safety devices and improvements. However, such development will require us to continue to invest in research and development and sales and marketing. Such investments are subject to the risks generally associated with product development, including difficulty in gaining market acceptance, delays in product development and failure of products to operate properly. Additionally, we have exposure to excess costs as we are engaged in multiple development programs for new electric vehicles, each with unique designs and timelines. These electric vehicle programs require the use of a higher level of technical expertise with increased costs and the incremental cost is variable depending on the pace and success rate of the innovation process, the prototyping and mule build process, the production tooling process and then production ramp-up. In addition, our competitors may develop new products before us or may produce similar products that compete with our new products. We may, as a result of these factors, be unable to meaningfully focus on product innovation as a strategy and may therefore be unable to meet our customers’ demands for product innovation, which could have an adverse effect on our business, operating results and financial condition.

We rely on third parties for raw materials, parts, and components.

We may source a variety of systems, components, raw materials and parts, including but not limited to top covers, fabricated steel, semiconductor chips, chemicals, seat-foam, air bag, air bag inflators, seat belts, and other components from third parties. From time to time these third-party items may not meet the quality standards that we desire, which could harm our reputation, cause delays and cause us to incur significant costs. Furthermore, we may be unable to source third-party items in sufficient quantities or at acceptable prices. We are currently experiencing difficulty sourcing certain raw materials, parts and components required for our operations, which is having an adverse effect on our results of operations.

We could experience disruption in our supply or delivery chain, which could cause one or more of our customers to halt or delay production.

We, as with other component manufactures in the commercial vehicle industry, sometimes ship products to the customers throughout the world so they are delivered on a “just-in-time” basis in order to maintain low inventory levels. Our suppliers (external suppliers as well as our own production sites) also sometimes use a similar method. This just-in-time method makes the logistics supply chain in the industries we serve very complex and very vulnerable to disruptions.

The potential loss of one of our suppliers or our own production sites could be caused by a myriad of factors. Additionally, as we expand in growth markets, the risk for such disruptions is heightened. The lack of even a small single subcomponent necessary to manufacture one of our products, for whatever reason, could force us to cease production, possibly for a prolonged period. In the event of a reduction or stoppage in production at any of our facilities, even if only temporary, or if we experience delays as a result of events that are beyond our control, delivery times to our customers could be severely affected. Any significant delay in deliveries to our customers could lead to increased returns or cancellations. Similarly, a potential quality issue could force us to halt deliveries. Even where products are ready to be shipped or have been shipped, delays may arise before they reach our customer. Our customers may halt or delay their production for the same reason if one of their other suppliers fails to deliver necessary components. This may cause our customers to suspend their orders or instruct us to suspend delivery of our products, which may adversely affect our financial performance. When we cease timely deliveries, we have to absorb our own costs for identifying and solving the root cause problem as well as expeditiously producing replacement components or products. Generally, we must also carry the costs associated with “catching up,” such as overtime and premium freight.

Additionally, if we are the cause for a customer being forced to halt production the customer may seek to recoup all of its losses and expenses from us. These losses and expenses could include consequential losses such as lost profits. Thus, any supply chain disruption, however small, could potentially cause the complete shutdown of an assembly line of one of our customers, and any such shutdown could expose us to claims for compensation. Where a customer halts production because of another supplier failing to deliver on time, we may not be fully compensated, if at all, and therefore our business and financial results could be adversely affected.

If we are unable to recruit or retain senior management and other skilled personnel, our business, operating results and financial condition could be adversely affected.

Our operations depend to a large extent on the efforts of our senior management team as well as our ability to attract, train, integrate and retain highly skilled personnel. We seek to develop and retain an effective management team through the proper positioning of existing key employees and the addition of new management personnel where necessary. Retaining personnel with the right skills at competitive wages can be difficult in certain markets in which we are doing business, particularly those locations that are seeing much inbound investment and have highly mobile workforces. Additionally, attracting sufficiently well-educated and talented management, especially middle-management employees, in certain markets can be challenging.

We may not be able to retain our current senior management and other skilled personnel or retain similarly skilled personnel in the future. If we lose senior management or the services of our skilled workforce, or if we are unable to attract, train, integrate and retain the highly skilled personnel we need, our business, operating results and financial condition could be adversely affected.

We may be adversely impacted by labor strikes, work stoppages and other matters.

As of December 31, 2021, a majority of employees based in Mexico are unionized. In addition, approximately 74% of our employees of our European, Asian and Australian operations were represented by a shop steward committee, which may limit our flexibility in our relationship with these employees. We may encounter future unionization efforts or other types of conflicts with labor unions or our employees.

Many of our OEM customers and their suppliers also have unionized work forces. Work stoppages or slow-downs experienced by OEMs or their other suppliers could result in slow-downs or closures of assembly plants where our products are included in assembled commercial vehicles. In the event that one or more of our customers or their suppliers experience a material work stoppage, such work stoppage could have an adverse effect on our business.

Additionally, the rapid recovery of certain COVID-19-impacted markets and locales and the low unemployment rate is causing spot shortages of labor. The Company has exposure to cost premiums as we use temporary labor during demand ramp-ups which carries with it a temporary premium cost. The Company is currently at high levels of temporary labor which could have an adverse effect on our business.

Our earnings may be adversely affected by changes to the carrying values of our tangible and intangible assets as a result of recording any impairment charges deemed necessary.

We are required to perform impairment tests whenever events and circumstances indicate the carrying value of certain assets may not be recoverable. We cannot accurately predict the amount and timing of any impairment of assets. A significant amount of judgment is involved in determining if an indication of impairment exists. Factors that may be considered in assessing whether goodwill or other long-lived assets may not be recoverable include a decline in our stock price or market capitalization, reduced estimates of future cash flows, the general economic environment, changes or downturns in our industry as a whole, termination of any of our customer contracts, restructuring efforts and general workforce reductions. A continued decline in our stock price may trigger an evaluation of the recoverability of the recorded goodwill and other long-lived assets. Any charge for impairment could adversely affect our reported net income and our stockholders’ equity.

We have taken, are taking, and may take future restructuring actions to realign and resize our production capacity and cost structure to meet current and projected operational and market requirements. Charges related to these actions or any further restructuring actions may have an adverse effect on our results of operations and financial condition. There can be no assurance that any current or future restructuring will be completed as planned or achieve the desired results. The failure to complete restructuring as planned could have an adverse effect our results of operations.

We have established and may establish in the future valuation allowances on deferred tax assets. These changes may have an adverse effect on our results of operations and financial position.

Additionally, from time to time in the past, we have recorded asset impairment losses relating to specific plants and operations. Generally, we record asset impairment losses when we determine that our estimates of the future undiscounted cash flows from an operation will not be sufficient to recover the carrying value of that facility’s building, fixed assets and production tooling. There can be no assurance that we will not incur charges in the future as changes in economic or operating conditions impacting the estimates and assumptions could result in additional impairment. Any future impairments may adversely affect our results of operations.

Our inability to successfully achieve operational efficiencies could result in the incurrence of additional costs and expenses that could adversely affect our reported earnings.

As part of our business strategy, we continuously seek ways to lower costs, improve manufacturing efficiencies and increase productivity in our existing operations and intend to apply this strategy to those operations acquired through acquisitions. In addition, we incur restructuring charges periodically to close facilities, such as lease termination charges, severance charges and impairment charges of leasehold improvements and/or machinery and equipment, as we continue to evaluate our manufacturing footprint to improve our cost structure and remove excess, underperforming assets, or assets that no longer fit our goals. If we decide to close or consolidate facilities, we may face execution risks which could adversely affect our ability to serve our customers. Further, we may be unsuccessful in achieving these objectives which could adversely affect our operating results and financial condition.

The geographic profile of our taxable income could adversely impact our tax provision and therefore our results of operations.

Our future tax provision could be adversely affected by the geographic profile of our taxable income and by changes in the valuation of our deferred tax assets and liabilities. Our results could be adversely impacted by significant changes in our effective tax rate. Additionally, any changes to manufacturing activities could result in significant changes to our effective tax rate related to products manufactured either in the United States or in international jurisdictions. If the United States or another international jurisdiction implements a tax change related to products manufactured in a particular jurisdiction where we do business, our results could be adversely affected.

Exposure to currency exchange rate fluctuations on cross border transactions and translation of local currency results into United States dollars could adversely impact our results of operations.

Cross border transactions, both with external parties and intercompany relationships, result in increased exposure to foreign currency fluctuations. The strengthening or weakening of the United States dollar may result in favorable or unfavorable foreign currency translation effects in as much as the results of our foreign locations are translated into United States dollars. This could adversely impact our results of operations.

We have only limited protection for our proprietary rights in our intellectual property, which makes it difficult to prevent third parties from infringing upon our rights and our operations could be limited by the rights of others.

Our success depends to a certain degree on our ability to protect our intellectual property and to operate without infringing on the proprietary rights of third parties. While we have been issued patents and have registered trademarks with respect to many of our products, our competitors could independently develop similar or superior products or technologies, duplicate our designs, trademarks, processes or other intellectual property or design around any processes or designs on which we have or may obtain patents or trademark protection. In addition, it is possible third parties may have or acquire licenses for other technology or designs that we may use or desire to use, requiring us to acquire licenses to, or to contest the validity of, such patents or trademarks of third parties. Such licenses may not be made available to us on acceptable terms, if at all, or we may not prevail in contesting the validity of third party rights.

As we diversify and globalize our geographic footprint, we may encounter laws and practices in emerging markets that are not as stringent or enforceable as those present in developed markets, and thus incur a higher risk of intellectual property infringement, which could have an adverse effect on our results of operations.

Our products may be susceptible to claims by third parties that our products infringe upon their proprietary rights.

As the number of products in our target markets increases and the functionality of these products further overlaps, we may become increasingly subject to claims by a third party that our technology infringes such party’s proprietary rights. Regardless of their merit, any such claims could be time consuming and expensive to defend, may divert management’s attention and resources, could cause product shipment delays and could require us to enter into costly royalty or licensing agreements. If successful, a claim of infringement against us and our inability to license the infringed or similar technology and/or product could have an adverse effect on our business, operating results and financial condition.

We may be subject to product liability claims, recalls or warranty claims, which could be expensive, damage our reputation and result in a diversion of management resources.

As a supplier of products and systems, we face an inherent business risk of exposure to product liability claims in the event that our products, or the equipment into which our products are incorporated, malfunction and result in injury to person or property

or death. Product liability claims could result in significant losses as a result of expenses incurred in defending claims or the award of damages.

In addition, we may be required to participate in recalls involving systems or components sold by us if any prove to be defective, or we may or our customers may voluntarily initiate a recall and we have to make payments related to such recalls as a result of various industry or business practices, contractual obligations or the need to maintain good customer relationships. Such a recall would result in a diversion of management resources. While we maintain product liability insurance generally with a self-insured retention amount, we cannot assure you that it will be sufficient to cover all product liability claims, that such claims will not exceed our insurance coverage limits or that such insurance will continue to be available on commercially reasonable terms, if at all. Any product liability claim brought against us could have an adverse effect on our results of operations.

We warrant the workmanship and materials of many of our products under limited warranties and have entered into warranty agreements with certain customers that warranty certain of our products in the hands of customers of our customers, in some cases for many years. From time to time, we receive product warranty claims from our customers, pursuant to which we may be required to bear costs of repair or replacement of certain of our products. Accordingly, we are subject to risk of warranty claims in the event that our products do not conform to our customers’ specifications or, in some cases in the event that our products do not conform to their customers’ expectations. It is possible for warranty claims to result in costly product recalls, significant repair costs and damage to our reputation, all of which could adversely affect our results of operations.

Our businesses are subject to statutory environmental and safety regulations in multiple jurisdictions, and the impact of any changes in regulation and/or the violation of any applicable laws and regulations by our businesses could result in an adverse effect on our financial condition and results of operations.