UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): December 26, 2024 (December 19, 2024)

Commercial Vehicle Group, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-34365 | | 41-1990662 |

| (State or other jurisdiction | | (Commission | | (I.R.S. Employer |

| of incorporation) | | File Number) | | Identification No.) |

| | | | | | | | |

| | |

| 7800 Walton Parkway, New Albany, Ohio | | 43054 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: 614-289-5360

Not Applicable

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | CVGI | The NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| | | | | |

| Emerging growth company | ☐ |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ¨

|

Item 1.01. Entry into a Material Definitive Agreement.

Amendment to Credit Agreement

On December 19, 2024, Commercial Vehicle Group, Inc. (the “Company”) and certain of its subsidiaries entered into a fourth amendment (the “Amendment”) to its credit agreement (as so amended, the “Amended Credit Agreement”) between, among others, Bank of America, N.A. as administrative agent (the “Administrative Agent”) and other lenders party thereto (the “Lenders”) pursuant to which the Lenders reduced the existing term loan facility to $85 million in aggregate principal amount (the “Term Loan Facility”) and reduced the revolving credit facility commitments by $25 million to an aggregate of $125 million in revolving credit facility commitments (the “Revolving Credit Facility” and together with the Term Loan Facility, the “Credit Facilities”). Subject to the terms of the Amended Credit Agreement, the Revolving Credit Facility includes a $10 million swing line sublimit and a $10 million letter of credit sublimit. The Amended Credit Agreement provides for an incremental term facility agreement and/or an increase of the Revolving Credit Facility (together, the “Incremental Facilities”), in a maximum aggregate amount of $15 million. The Credit Facilities mature on May 12, 2027 (the “Maturity Date”).

Interest Rates and Fees

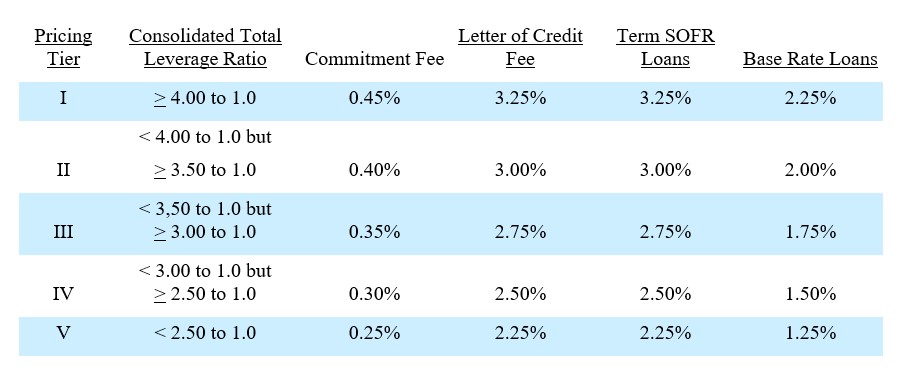

Amounts outstanding under the Credit Facilities and the commitment fee payable in connection with the Credit Facilities accrue interest at a per annum rate equal to (at the Company’s option) the base rate or the Term SOFR (including a credit spread adjustment) plus a rate which will vary according to the Consolidated Total Leverage Ratio as set forth in the most recent compliance certificate received by the Administrative Agent, as set out in the following table:

Guarantee and Security

All obligations under the Amended Credit Agreement and related documents are unconditionally guaranteed by each of the Company’s existing and future direct and indirect wholly owned material domestic subsidiaries, subject to certain exceptions (the “Guarantors”). All obligations of the Company under the Amended Credit Agreement and the guarantees of those obligations are secured by a first priority pledge of substantially all of the assets of the Company and of the Guarantors, subject to certain exceptions. The property pledged by the Company and the Guarantors includes a first priority pledge of all of the equity interests owned by the Company and the Guarantors in their respective domestic subsidiaries and a first priority pledge of the equity interests owned by the Company and the Guarantors in certain foreign subsidiaries, in each case, subject to certain exceptions.

Covenants and Other Terms

The Amended Credit Agreement contains customary restrictive covenants, including, without limitation, limitations on the ability of the Company and its subsidiaries to incur additional debt and guarantees; grant certain liens on assets; pay dividends or make certain other distributions; make certain investments or acquisitions; dispose of certain assets; make payments on certain indebtedness; merge, combine with any other person or liquidate; amend organizational documents; make material changes in accounting treatment or reporting practices; enter into certain restrictive agreements; enter into certain hedging agreements; engage in transactions with affiliates; enter into certain employee benefit plans; make acquisitions; and other matters customarily included in senior secured loan agreements.

The Amended Credit Agreement also contains customary reporting and other affirmative covenants, as well as customary events of default, including, without limitation, nonpayment of obligations under the Credit Facilities when due; material inaccuracy of representations and warranties; violation of covenants in the Amended Credit Agreement and certain other documents executed in connection therewith; breach or default of agreements related to material debt; revocation or attempted revocation of guarantees; denial of the validity or enforceability of the loan documents or failure of the loan documents to be in full force and effect; certain material judgments; certain events of bankruptcy or insolvency; certain Employee Retirement Income Securities Act events; and a change in control of the Company. Certain of the defaults are subject to exceptions, materiality qualifiers, grace periods and baskets customary for credit facilities of this type.

The Amended Credit Agreement includes (a) a minimum consolidated fixed charge coverage ratio of 1.20:1.0, and (b) a maximum consolidated total leverage ratio of 4.25:1.0 (which will be subject to step-downs to 3.75:1.0 at the end of the fiscal quarter ending September 30, 2025; and to 3.00:1.0 for each fiscal quarter thereafter).

Repayment and prepayment

The Amended Credit Agreement requires the Company to make quarterly amortization payments to the Term Loan Facility at an annualized rate of the loans under the Term Loan Facility for every year as follows: 5.0%, 7.5%, 10.0%, 12.5% and 15%. The Amended Credit Agreement also requires all outstanding amounts under the Credit Facilities to be repaid in full on the Maturity Date.

The Amended Credit Agreement requires mandatory prepayments from the receipt of proceeds of dispositions or debt issuance, subject to certain exceptions and ability to re-invest and use proceeds towards acquisitions permitted by the Amended Credit Agreement.

Voluntary prepayments of amounts outstanding under the Credit Facilities are permitted at any time, without premium or penalty.

The foregoing does not constitute a complete summary of the terms of the Amended Credit Agreement. A copy of the Amendment is attached hereto as Exhibit 10.1 and is incorporated herein by reference.

The Amended Credit Agreement contains customary representations and warranties by the Company, The representations and warranties contained in the Amended Credit Agreement were made only for purposes of such agreement and as of specific dates, were solely for the benefit of the parties to such agreement and may be subject to limitations agreed upon by the contracting parties.

Item 2.03. Creation of a Direct Financial Obligation or an Obligation Under an Off-Balance Sheet Arrangement of a Registrant.

The information set forth under Item 1.01 of this Current Report on Form 8-K is hereby incorporated by reference into this Item 2.03.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibit

| | | | | | | | |

| Exhibit No. | | Description |

| | Fourth Amendment dated December 19, 2024 to the Credit Agreement, dated as of April 30, 2021 between, among others, the Company, Bank of America, N.A. as administrative agent and other lenders party thereto. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | COMMERCIAL VEHICLE GROUP, INC. |

| | | |

| December 26, 2024 | | | | By: | | /s/ Andy Cheung |

| | | | Name: | | Chung Kin Cheung ("Andy Cheung") |

| | | | Title: | | Chief Financial Officer

(Principal Financial Officer) |